BAO2203 Corporate Accounting Assignment: Consolidation and Impairment

VerifiedAdded on 2022/11/13

|14

|1943

|180

Homework Assignment

AI Summary

This assignment solution addresses corporate accounting principles, specifically focusing on the consolidation of financial statements and the impairment of assets. Part I delves into the acquisition of Range Pty Ltd and Swift Works Ltd by Ezy Manufacturing Ltd, including journal entries for share acquisitions, dividend income, and the calculation of goodwill. It also includes detailed acquisition analyses, fair value adjustments, and elimination of intercompany transactions. Part II examines asset impairment, discussing impairment testing, its effects on financial statements, and the impact of discount rates. The solution references the Myer Holdings Limited 2018 Annual Report to illustrate impairment practices and provides insights into the prohibition of impairment reversals. The assignment covers various accounting standards and principles, including AASB 3 and IAS 36, providing a comprehensive understanding of consolidation and impairment accounting.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

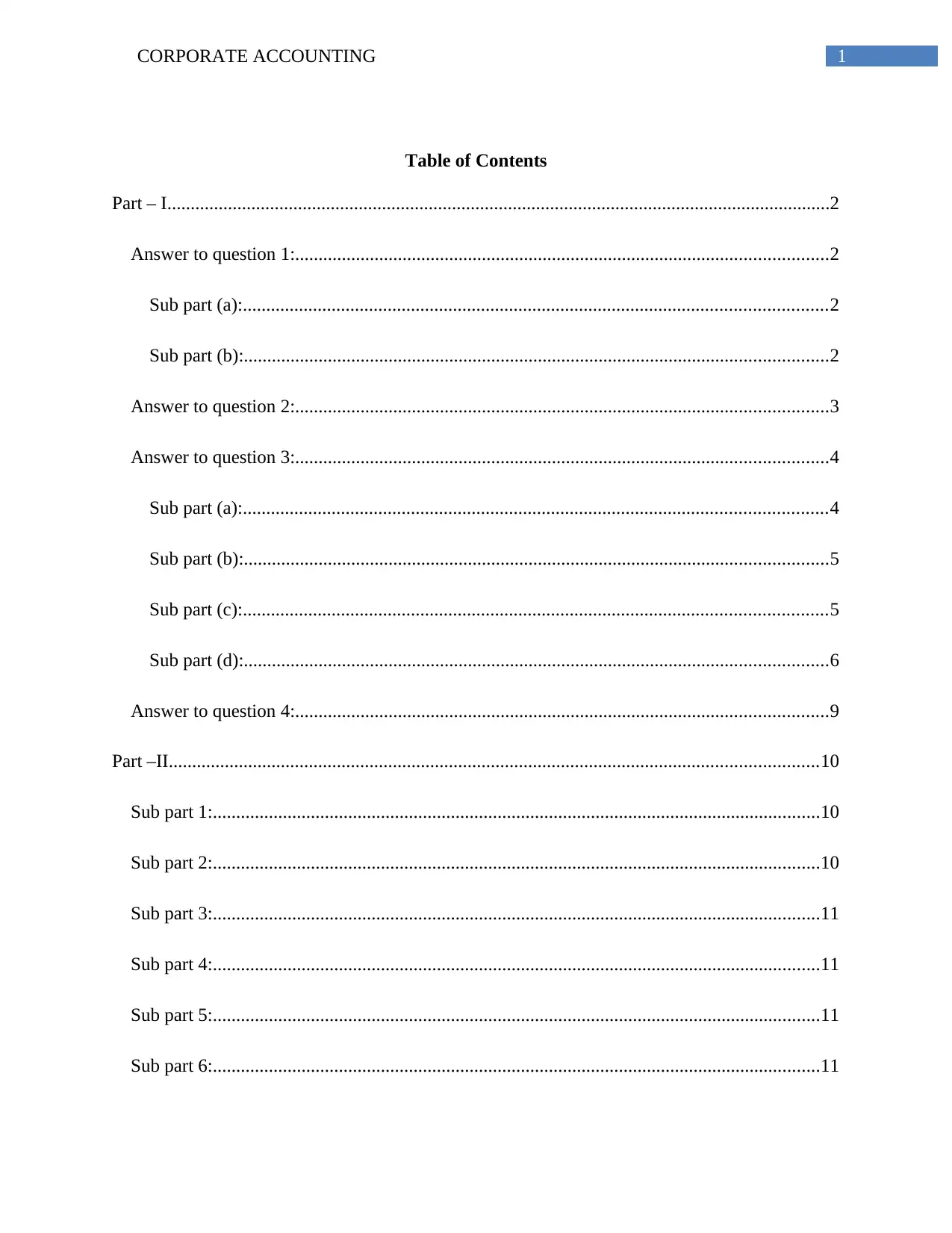

Table of Contents

Part – I..............................................................................................................................................2

Answer to question 1:..................................................................................................................2

Sub part (a):.............................................................................................................................2

Sub part (b):.............................................................................................................................2

Answer to question 2:..................................................................................................................3

Answer to question 3:..................................................................................................................4

Sub part (a):.............................................................................................................................4

Sub part (b):.............................................................................................................................5

Sub part (c):.............................................................................................................................5

Sub part (d):.............................................................................................................................6

Answer to question 4:..................................................................................................................9

Part –II...........................................................................................................................................10

Sub part 1:..................................................................................................................................10

Sub part 2:..................................................................................................................................10

Sub part 3:..................................................................................................................................11

Sub part 4:..................................................................................................................................11

Sub part 5:..................................................................................................................................11

Sub part 6:..................................................................................................................................11

Table of Contents

Part – I..............................................................................................................................................2

Answer to question 1:..................................................................................................................2

Sub part (a):.............................................................................................................................2

Sub part (b):.............................................................................................................................2

Answer to question 2:..................................................................................................................3

Answer to question 3:..................................................................................................................4

Sub part (a):.............................................................................................................................4

Sub part (b):.............................................................................................................................5

Sub part (c):.............................................................................................................................5

Sub part (d):.............................................................................................................................6

Answer to question 4:..................................................................................................................9

Part –II...........................................................................................................................................10

Sub part 1:..................................................................................................................................10

Sub part 2:..................................................................................................................................10

Sub part 3:..................................................................................................................................11

Sub part 4:..................................................................................................................................11

Sub part 5:..................................................................................................................................11

Sub part 6:..................................................................................................................................11

2CORPORATE ACCOUNTING

References and bibliography:........................................................................................................12

Part – I

Answer to question 1:

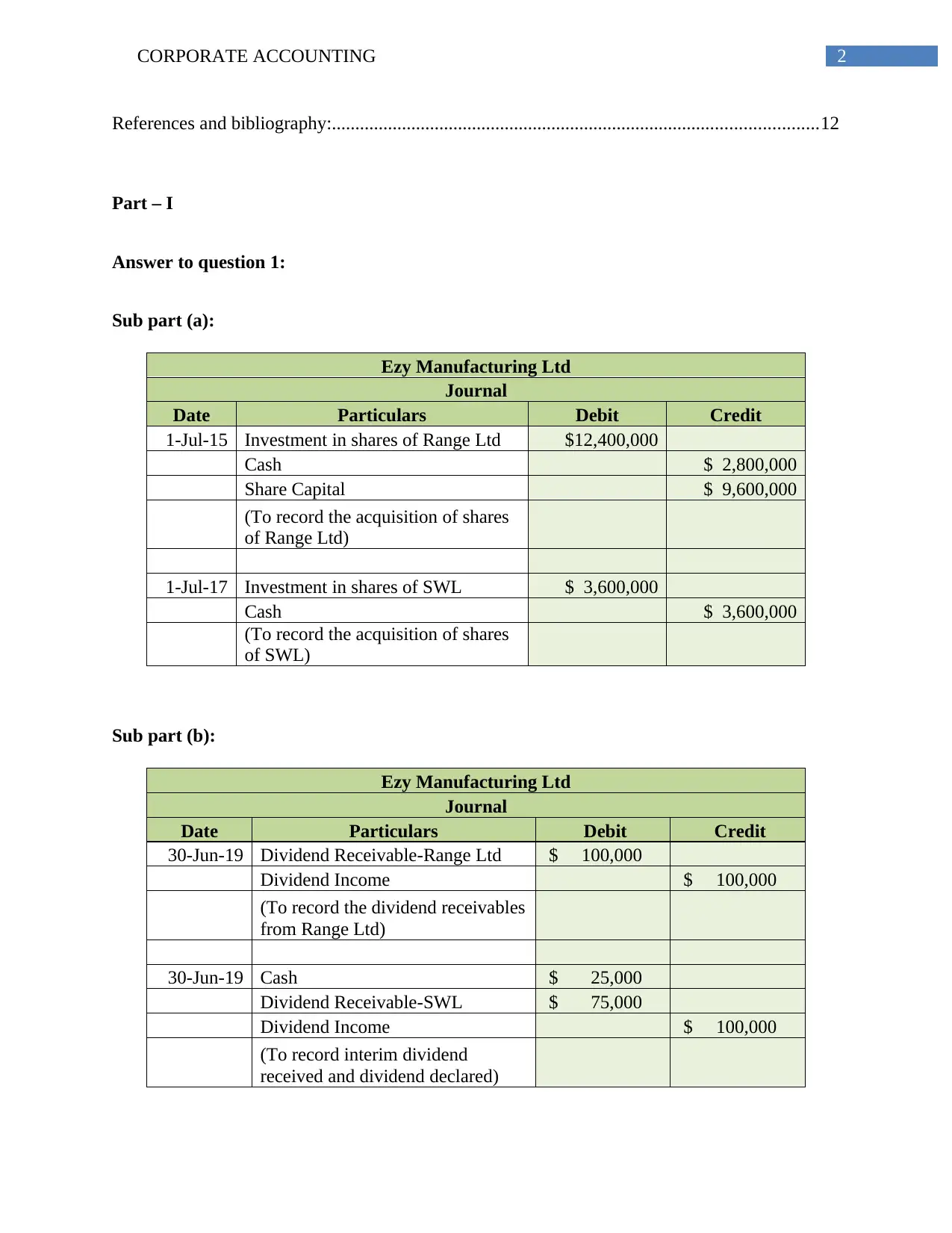

Sub part (a):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

1-Jul-15 Investment in shares of Range Ltd $12,400,000

Cash $ 2,800,000

Share Capital $ 9,600,000

(To record the acquisition of shares

of Range Ltd)

1-Jul-17 Investment in shares of SWL $ 3,600,000

Cash $ 3,600,000

(To record the acquisition of shares

of SWL)

Sub part (b):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

30-Jun-19 Dividend Receivable-Range Ltd $ 100,000

Dividend Income $ 100,000

(To record the dividend receivables

from Range Ltd)

30-Jun-19 Cash $ 25,000

Dividend Receivable-SWL $ 75,000

Dividend Income $ 100,000

(To record interim dividend

received and dividend declared)

References and bibliography:........................................................................................................12

Part – I

Answer to question 1:

Sub part (a):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

1-Jul-15 Investment in shares of Range Ltd $12,400,000

Cash $ 2,800,000

Share Capital $ 9,600,000

(To record the acquisition of shares

of Range Ltd)

1-Jul-17 Investment in shares of SWL $ 3,600,000

Cash $ 3,600,000

(To record the acquisition of shares

of SWL)

Sub part (b):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

30-Jun-19 Dividend Receivable-Range Ltd $ 100,000

Dividend Income $ 100,000

(To record the dividend receivables

from Range Ltd)

30-Jun-19 Cash $ 25,000

Dividend Receivable-SWL $ 75,000

Dividend Income $ 100,000

(To record interim dividend

received and dividend declared)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

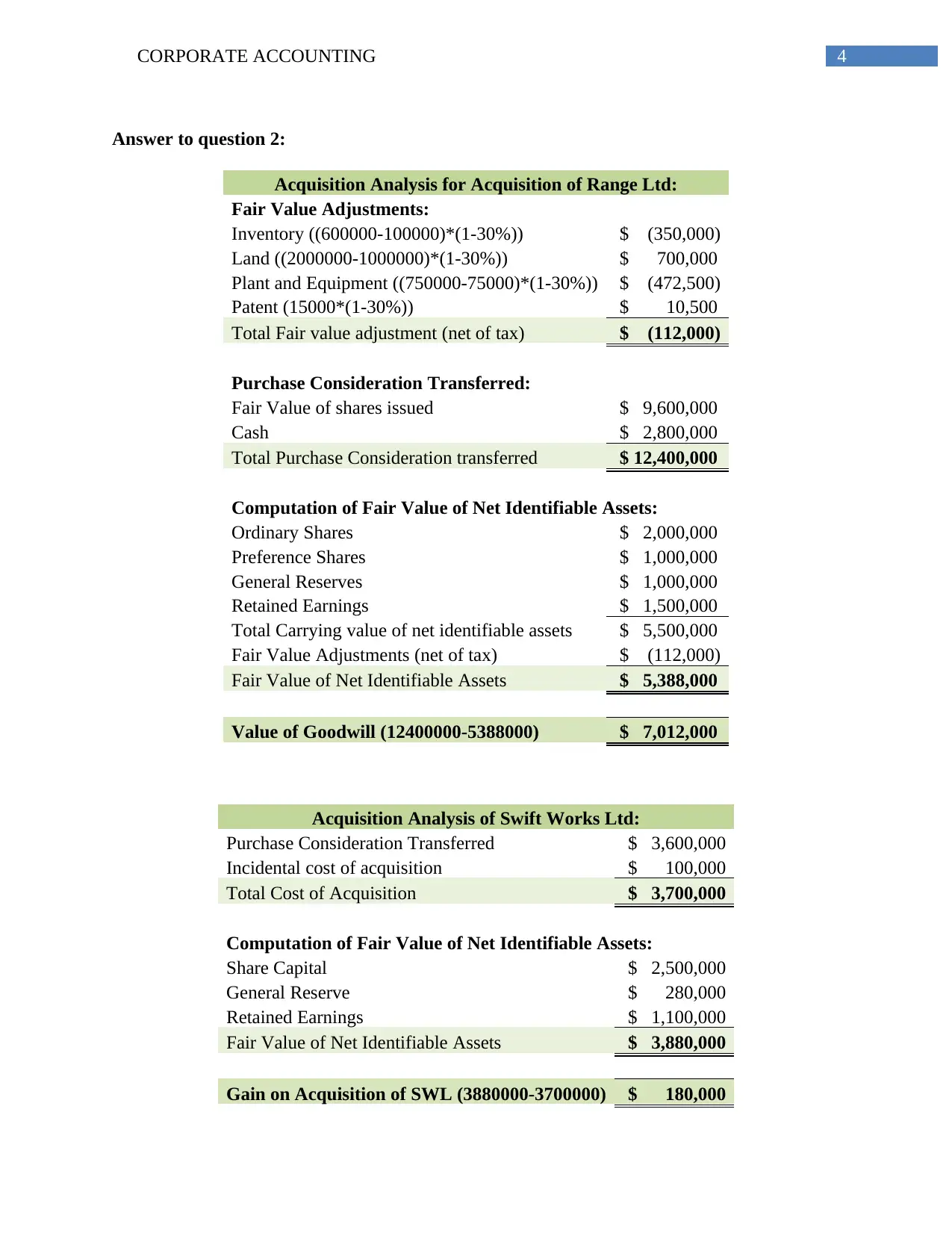

Answer to question 2:

Acquisition Analysis for Acquisition of Range Ltd:

Fair Value Adjustments:

Inventory ((600000-100000)*(1-30%)) $ (350,000)

Land ((2000000-1000000)*(1-30%)) $ 700,000

Plant and Equipment ((750000-75000)*(1-30%)) $ (472,500)

Patent (15000*(1-30%)) $ 10,500

Total Fair value adjustment (net of tax) $ (112,000)

Purchase Consideration Transferred:

Fair Value of shares issued $ 9,600,000

Cash $ 2,800,000

Total Purchase Consideration transferred $ 12,400,000

Computation of Fair Value of Net Identifiable Assets:

Ordinary Shares $ 2,000,000

Preference Shares $ 1,000,000

General Reserves $ 1,000,000

Retained Earnings $ 1,500,000

Total Carrying value of net identifiable assets $ 5,500,000

Fair Value Adjustments (net of tax) $ (112,000)

Fair Value of Net Identifiable Assets $ 5,388,000

Value of Goodwill (12400000-5388000) $ 7,012,000

Acquisition Analysis of Swift Works Ltd:

Purchase Consideration Transferred $ 3,600,000

Incidental cost of acquisition $ 100,000

Total Cost of Acquisition $ 3,700,000

Computation of Fair Value of Net Identifiable Assets:

Share Capital $ 2,500,000

General Reserve $ 280,000

Retained Earnings $ 1,100,000

Fair Value of Net Identifiable Assets $ 3,880,000

Gain on Acquisition of SWL (3880000-3700000) $ 180,000

Answer to question 2:

Acquisition Analysis for Acquisition of Range Ltd:

Fair Value Adjustments:

Inventory ((600000-100000)*(1-30%)) $ (350,000)

Land ((2000000-1000000)*(1-30%)) $ 700,000

Plant and Equipment ((750000-75000)*(1-30%)) $ (472,500)

Patent (15000*(1-30%)) $ 10,500

Total Fair value adjustment (net of tax) $ (112,000)

Purchase Consideration Transferred:

Fair Value of shares issued $ 9,600,000

Cash $ 2,800,000

Total Purchase Consideration transferred $ 12,400,000

Computation of Fair Value of Net Identifiable Assets:

Ordinary Shares $ 2,000,000

Preference Shares $ 1,000,000

General Reserves $ 1,000,000

Retained Earnings $ 1,500,000

Total Carrying value of net identifiable assets $ 5,500,000

Fair Value Adjustments (net of tax) $ (112,000)

Fair Value of Net Identifiable Assets $ 5,388,000

Value of Goodwill (12400000-5388000) $ 7,012,000

Acquisition Analysis of Swift Works Ltd:

Purchase Consideration Transferred $ 3,600,000

Incidental cost of acquisition $ 100,000

Total Cost of Acquisition $ 3,700,000

Computation of Fair Value of Net Identifiable Assets:

Share Capital $ 2,500,000

General Reserve $ 280,000

Retained Earnings $ 1,100,000

Fair Value of Net Identifiable Assets $ 3,880,000

Gain on Acquisition of SWL (3880000-3700000) $ 180,000

5CORPORATE ACCOUNTING

Answer to question 3:

Sub part (a):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Business Combination Valuation Reserve $ 350,000

Deferred tax Assets $ 150,000

Inventory $ 500,000

(To record the fair value adjustment for

Inventory)

Land $ 1,000,000

Business Combination Valuation Reserve $ 700,000

Deferred Tax Liability $ 300,000

(To record the fair value of land)

Business Combination Valuation Reserve $ 472,500

Deferred Tax Assets $ 202,500

Property, Plant and Equipment (750000-

75000) $ 675,000

(To record the fair value of property plant

and equipment)

Patent $ 15,000

Deferred tax liability $ 4,500

Business Combination Valuation Reserve $ 10,500

(To record the unrecorded patent)

Answer to question 3:

Sub part (a):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Business Combination Valuation Reserve $ 350,000

Deferred tax Assets $ 150,000

Inventory $ 500,000

(To record the fair value adjustment for

Inventory)

Land $ 1,000,000

Business Combination Valuation Reserve $ 700,000

Deferred Tax Liability $ 300,000

(To record the fair value of land)

Business Combination Valuation Reserve $ 472,500

Deferred Tax Assets $ 202,500

Property, Plant and Equipment (750000-

75000) $ 675,000

(To record the fair value of property plant

and equipment)

Patent $ 15,000

Deferred tax liability $ 4,500

Business Combination Valuation Reserve $ 10,500

(To record the unrecorded patent)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

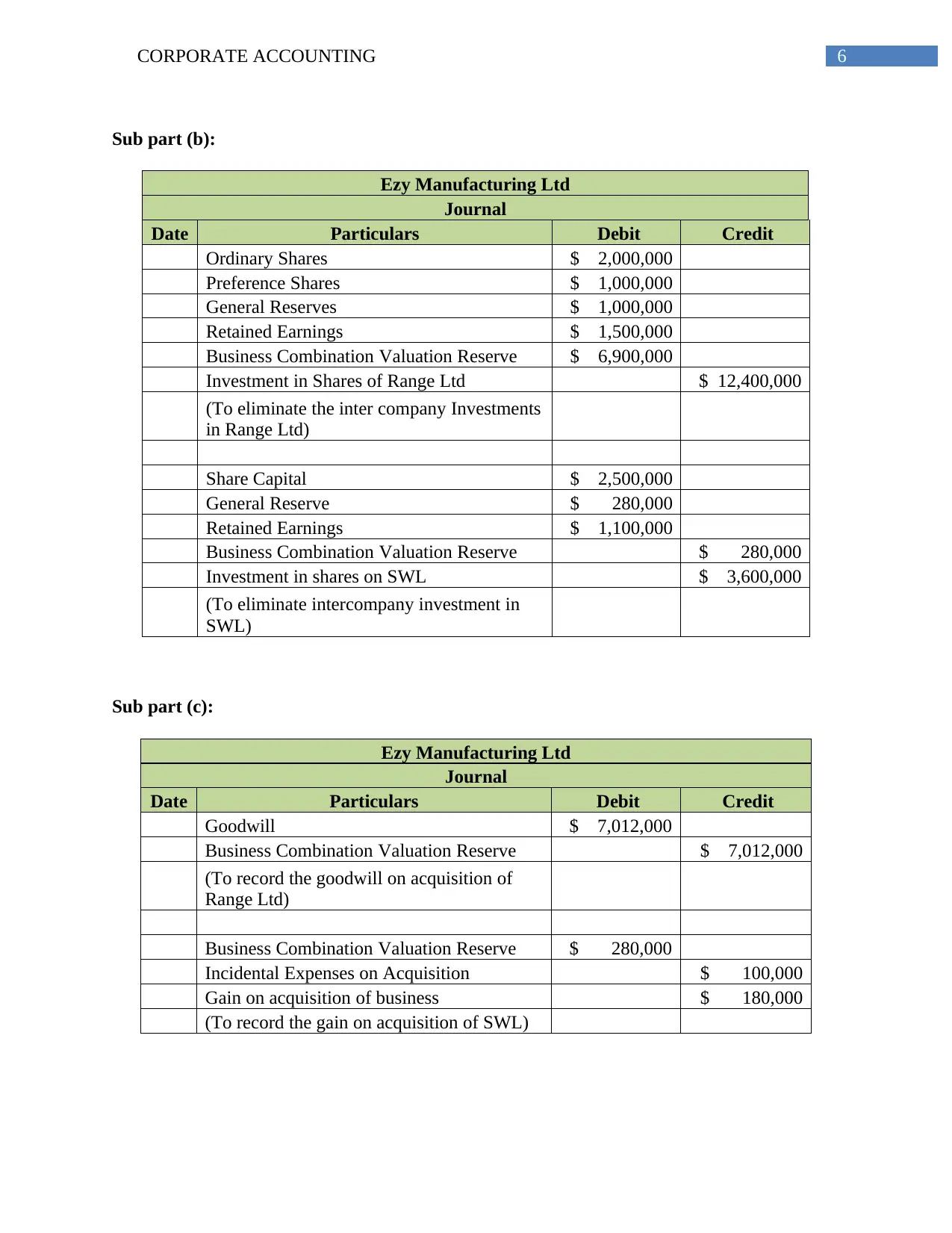

Sub part (b):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Ordinary Shares $ 2,000,000

Preference Shares $ 1,000,000

General Reserves $ 1,000,000

Retained Earnings $ 1,500,000

Business Combination Valuation Reserve $ 6,900,000

Investment in Shares of Range Ltd $ 12,400,000

(To eliminate the inter company Investments

in Range Ltd)

Share Capital $ 2,500,000

General Reserve $ 280,000

Retained Earnings $ 1,100,000

Business Combination Valuation Reserve $ 280,000

Investment in shares on SWL $ 3,600,000

(To eliminate intercompany investment in

SWL)

Sub part (c):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Goodwill $ 7,012,000

Business Combination Valuation Reserve $ 7,012,000

(To record the goodwill on acquisition of

Range Ltd)

Business Combination Valuation Reserve $ 280,000

Incidental Expenses on Acquisition $ 100,000

Gain on acquisition of business $ 180,000

(To record the gain on acquisition of SWL)

Sub part (b):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Ordinary Shares $ 2,000,000

Preference Shares $ 1,000,000

General Reserves $ 1,000,000

Retained Earnings $ 1,500,000

Business Combination Valuation Reserve $ 6,900,000

Investment in Shares of Range Ltd $ 12,400,000

(To eliminate the inter company Investments

in Range Ltd)

Share Capital $ 2,500,000

General Reserve $ 280,000

Retained Earnings $ 1,100,000

Business Combination Valuation Reserve $ 280,000

Investment in shares on SWL $ 3,600,000

(To eliminate intercompany investment in

SWL)

Sub part (c):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Goodwill $ 7,012,000

Business Combination Valuation Reserve $ 7,012,000

(To record the goodwill on acquisition of

Range Ltd)

Business Combination Valuation Reserve $ 280,000

Incidental Expenses on Acquisition $ 100,000

Gain on acquisition of business $ 180,000

(To record the gain on acquisition of SWL)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

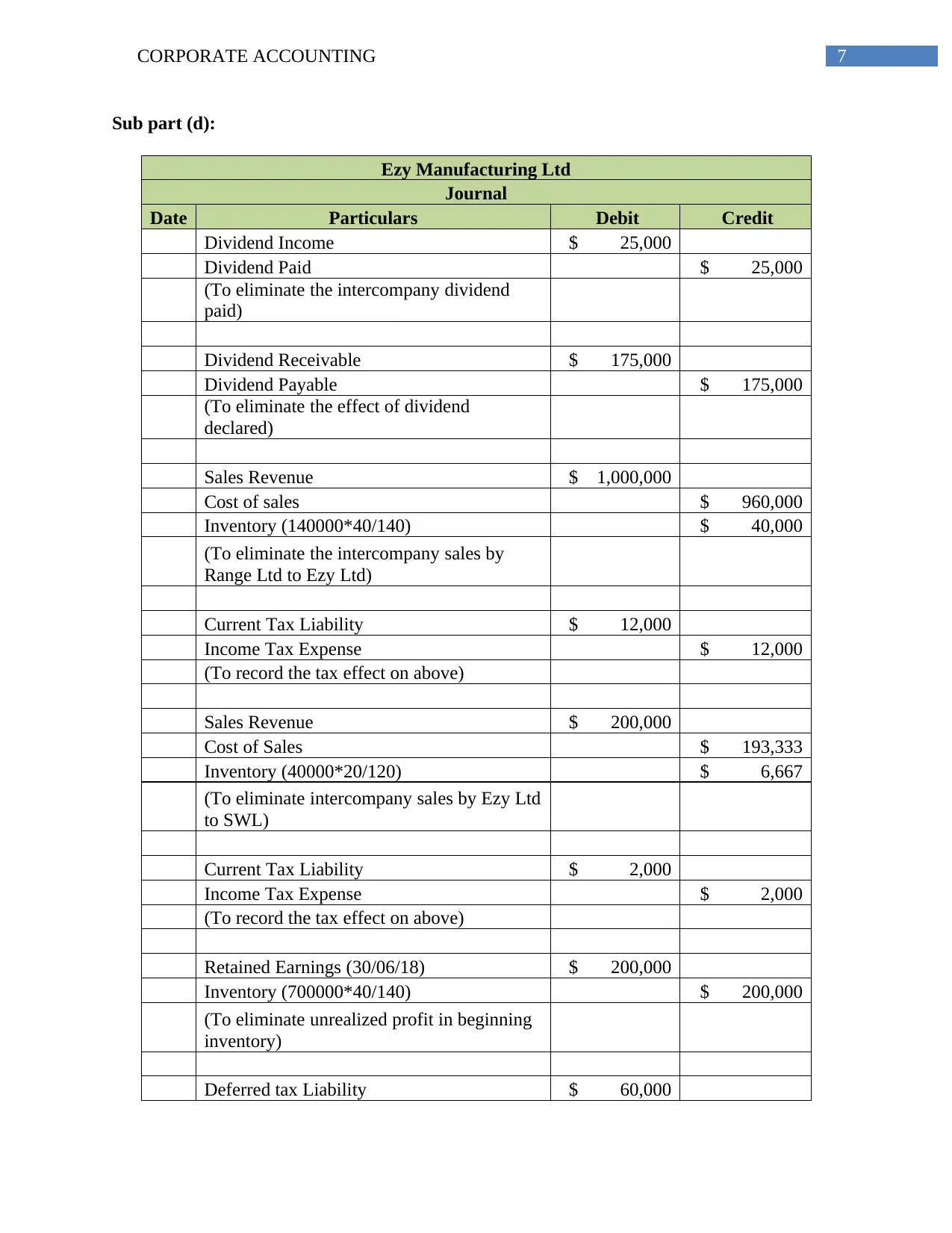

Sub part (d):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Dividend Income $ 25,000

Dividend Paid $ 25,000

(To eliminate the intercompany dividend

paid)

Dividend Receivable $ 175,000

Dividend Payable $ 175,000

(To eliminate the effect of dividend

declared)

Sales Revenue $ 1,000,000

Cost of sales $ 960,000

Inventory (140000*40/140) $ 40,000

(To eliminate the intercompany sales by

Range Ltd to Ezy Ltd)

Current Tax Liability $ 12,000

Income Tax Expense $ 12,000

(To record the tax effect on above)

Sales Revenue $ 200,000

Cost of Sales $ 193,333

Inventory (40000*20/120) $ 6,667

(To eliminate intercompany sales by Ezy Ltd

to SWL)

Current Tax Liability $ 2,000

Income Tax Expense $ 2,000

(To record the tax effect on above)

Retained Earnings (30/06/18) $ 200,000

Inventory (700000*40/140) $ 200,000

(To eliminate unrealized profit in beginning

inventory)

Deferred tax Liability $ 60,000

Sub part (d):

Ezy Manufacturing Ltd

Journal

Date Particulars Debit Credit

Dividend Income $ 25,000

Dividend Paid $ 25,000

(To eliminate the intercompany dividend

paid)

Dividend Receivable $ 175,000

Dividend Payable $ 175,000

(To eliminate the effect of dividend

declared)

Sales Revenue $ 1,000,000

Cost of sales $ 960,000

Inventory (140000*40/140) $ 40,000

(To eliminate the intercompany sales by

Range Ltd to Ezy Ltd)

Current Tax Liability $ 12,000

Income Tax Expense $ 12,000

(To record the tax effect on above)

Sales Revenue $ 200,000

Cost of Sales $ 193,333

Inventory (40000*20/120) $ 6,667

(To eliminate intercompany sales by Ezy Ltd

to SWL)

Current Tax Liability $ 2,000

Income Tax Expense $ 2,000

(To record the tax effect on above)

Retained Earnings (30/06/18) $ 200,000

Inventory (700000*40/140) $ 200,000

(To eliminate unrealized profit in beginning

inventory)

Deferred tax Liability $ 60,000

8CORPORATE ACCOUNTING

Retained Earnings (30/06/18) $ 60,000

(To record tax effect on above)

Accumulated Depreciation $ 250,000

Retained Earnings (30/06/18) (975000-

(1000000-250000)) $ 225,000

Machinery 1 $ 475,000

(To eliminate gain on intercompany sale of

machinery)

Deferred tax Liability $ 67,500

Retained Earnings $ 67,500

(To record tax effect on above)

Accumulated Depreciation (475000/10) $ 47,500

Retained Earnings (30/06/18) $ 47,500

(To adjust the recorded accumulated

depreciation)

Retained Earnings (30/06/18) $ 14,250

Deferred Tax Liability $ 14,250

(To record tax effect on above)

Accumulated Depreciation $ 47,500

Depreciation Expenses $ 47,500

(To adjust the accumulated depreciation in

the current year)

Income Tax Expense $ 14,250

Current tax Liability $ 14,250

(To record tax effect on above)

Accumulated Depreciation $ 200,000

Retained Earnings (1040000-(1000000-

200000)) $ 240,000

Machinery 2 $ 440,000

(To eliminate profit on intercompany sale of

machinery)

Deferred tax Liability $ 72,000

Retained Earnings $ 72,000

Retained Earnings (30/06/18) $ 60,000

(To record tax effect on above)

Accumulated Depreciation $ 250,000

Retained Earnings (30/06/18) (975000-

(1000000-250000)) $ 225,000

Machinery 1 $ 475,000

(To eliminate gain on intercompany sale of

machinery)

Deferred tax Liability $ 67,500

Retained Earnings $ 67,500

(To record tax effect on above)

Accumulated Depreciation (475000/10) $ 47,500

Retained Earnings (30/06/18) $ 47,500

(To adjust the recorded accumulated

depreciation)

Retained Earnings (30/06/18) $ 14,250

Deferred Tax Liability $ 14,250

(To record tax effect on above)

Accumulated Depreciation $ 47,500

Depreciation Expenses $ 47,500

(To adjust the accumulated depreciation in

the current year)

Income Tax Expense $ 14,250

Current tax Liability $ 14,250

(To record tax effect on above)

Accumulated Depreciation $ 200,000

Retained Earnings (1040000-(1000000-

200000)) $ 240,000

Machinery 2 $ 440,000

(To eliminate profit on intercompany sale of

machinery)

Deferred tax Liability $ 72,000

Retained Earnings $ 72,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE ACCOUNTING

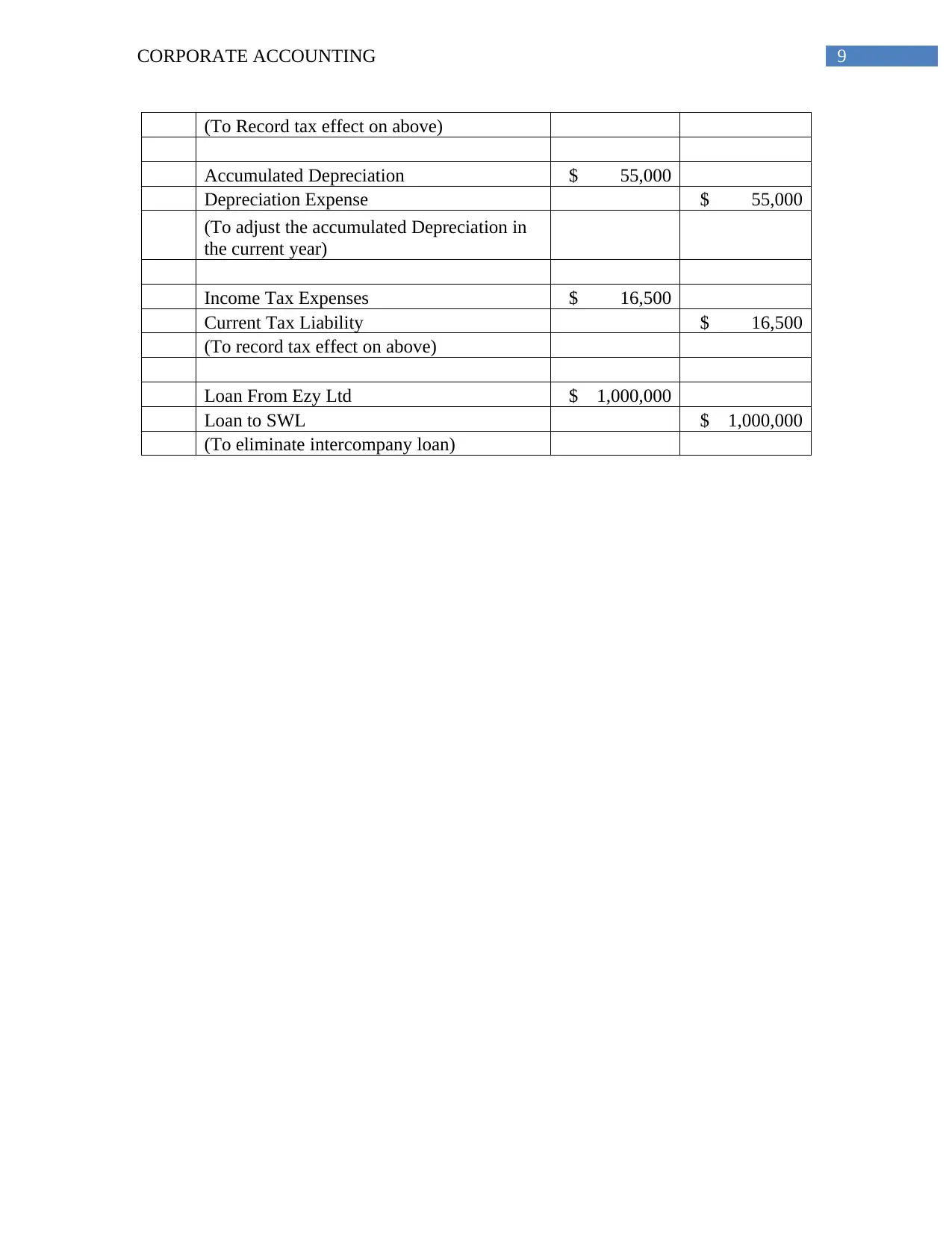

(To Record tax effect on above)

Accumulated Depreciation $ 55,000

Depreciation Expense $ 55,000

(To adjust the accumulated Depreciation in

the current year)

Income Tax Expenses $ 16,500

Current Tax Liability $ 16,500

(To record tax effect on above)

Loan From Ezy Ltd $ 1,000,000

Loan to SWL $ 1,000,000

(To eliminate intercompany loan)

(To Record tax effect on above)

Accumulated Depreciation $ 55,000

Depreciation Expense $ 55,000

(To adjust the accumulated Depreciation in

the current year)

Income Tax Expenses $ 16,500

Current Tax Liability $ 16,500

(To record tax effect on above)

Loan From Ezy Ltd $ 1,000,000

Loan to SWL $ 1,000,000

(To eliminate intercompany loan)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE ACCOUNTING

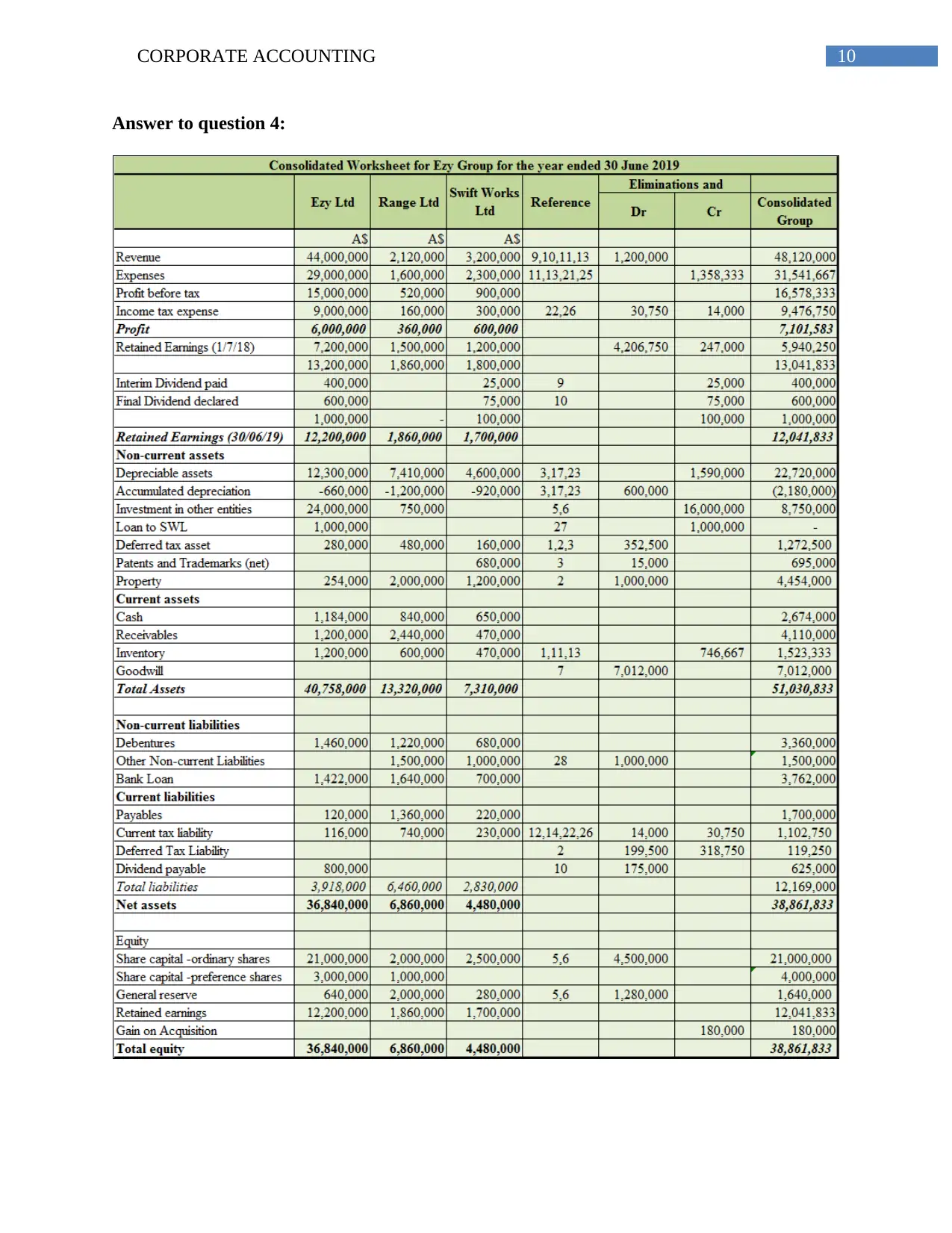

Answer to question 4:

Answer to question 4:

11CORPORATE ACCOUNTING

Part –II

Sub part 1:

Impairment test is the valuation of intangible and intangible assets. Tangible and

intangible assets are carried on in the books of accounts at its historical costs. After a certain

period of time the value of the assets or the net realizable value of the assets may not be the as it

is being carried forward in the books of accounts. Therefore, to show the actual value of the

assets and the true financial position of the business it is necessary to conduct the impairment test

for assets and revalue those assets to their fair value or the net realizable value (Devalle and

Rizzato 2017).

Sub part 2:

Impairment testing is conducted to ascertain the net realizable value of assets or the fair

value of assets. The fair value of assets so ascertained might be more than the carrying value or it

might be lesser than the carrying value of the respective assets. If the fair value of assets so

determined by the impairment testing is higher than the carrying value of the assets, then, the

difference amount is recognized as a gain on valuation of assets, it affects the income in profit

and loss account, and the value of assets is restated to its fair value in the balance sheet. On the

other hand, if the fair value so ascertained is less than the carrying value of the assets, then the

difference is recognized as a fair value loss and recognized as a loss in the profit and loss

account, and in the same way the value of assets is restated in the balance sheet. Hence, the

impairment testing is having effect in both the profit and loss account and the balance sheet

(Bond Govendir and Wells 2016).

Part –II

Sub part 1:

Impairment test is the valuation of intangible and intangible assets. Tangible and

intangible assets are carried on in the books of accounts at its historical costs. After a certain

period of time the value of the assets or the net realizable value of the assets may not be the as it

is being carried forward in the books of accounts. Therefore, to show the actual value of the

assets and the true financial position of the business it is necessary to conduct the impairment test

for assets and revalue those assets to their fair value or the net realizable value (Devalle and

Rizzato 2017).

Sub part 2:

Impairment testing is conducted to ascertain the net realizable value of assets or the fair

value of assets. The fair value of assets so ascertained might be more than the carrying value or it

might be lesser than the carrying value of the respective assets. If the fair value of assets so

determined by the impairment testing is higher than the carrying value of the assets, then, the

difference amount is recognized as a gain on valuation of assets, it affects the income in profit

and loss account, and the value of assets is restated to its fair value in the balance sheet. On the

other hand, if the fair value so ascertained is less than the carrying value of the assets, then the

difference is recognized as a fair value loss and recognized as a loss in the profit and loss

account, and in the same way the value of assets is restated in the balance sheet. Hence, the

impairment testing is having effect in both the profit and loss account and the balance sheet

(Bond Govendir and Wells 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.