Corporate Accounting Report: Debenhams Plc. Capital Structure

VerifiedAdded on 2023/06/05

|19

|5122

|69

Report

AI Summary

This report provides a comprehensive analysis of Debenhams Plc.'s corporate accounting practices, focusing on shareholder wealth maximization versus other objectives like risk minimization and stakeholder models. It explores the company's external financing sources, including equity and debt, and examines the factors influencing these choices. The report delves into Debenhams Plc.'s financial performance, presenting key metrics and capital structure details. It also covers the concept of the weighted average cost of capital (WACC) and its application to the company, including a discussion of relevant factors and practical considerations. The report concludes with recommendations regarding the company's capital structure and overall financial strategy.

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

EXECUTIVE SUMMARY

The current report is focused with certain different objectives that are assumed by a

company whenever its goals are discussed. These objectives may lie on several models being

shareholder wealth maximisation model, risk minimisation model, stakeholder model, and

etc. the later sections of report highlight the need of outside sources which the entity may

have while sourcing the finance. But the need satiated from outside sources depend upon the

different factors. These factors may lie within the management control or outside the control

of management.

The current report is focused with certain different objectives that are assumed by a

company whenever its goals are discussed. These objectives may lie on several models being

shareholder wealth maximisation model, risk minimisation model, stakeholder model, and

etc. the later sections of report highlight the need of outside sources which the entity may

have while sourcing the finance. But the need satiated from outside sources depend upon the

different factors. These factors may lie within the management control or outside the control

of management.

Table of Contents

EXECUTIVE SUMMARY..............................................................................................1

1. INTRODUCTION....................................................................................................3

2. Maximizing shareholders wealth vs other objectives.............................................3

MAXIMISATION OF SHAREHOLDERS’ WEALTH..................................................3

OTHER IMPORTANT OBJECTIVES..........................................................................4

4. EXTERNAL SOURCES OF FINANCE AVAILABLE TO THE COMPANY............5

5. Background of selected company..........................................................................6

6. External long term funds used by Debenhams Plc................................................7

7. Possible key factors considered by Debenhams Plc.............................................8

8. Computation of WEIGHTED AVERAGE COST OF CAPITAL of Debenhams Plc....9

9. Conclusion and recommendation of capital structure for Debenhams Plc..........13

10. REFERENCES...................................................................................................14

11. Bibliography......................................................................................................16

12. Appendix...........................................................................................................16

EXECUTIVE SUMMARY..............................................................................................1

1. INTRODUCTION....................................................................................................3

2. Maximizing shareholders wealth vs other objectives.............................................3

MAXIMISATION OF SHAREHOLDERS’ WEALTH..................................................3

OTHER IMPORTANT OBJECTIVES..........................................................................4

4. EXTERNAL SOURCES OF FINANCE AVAILABLE TO THE COMPANY............5

5. Background of selected company..........................................................................6

6. External long term funds used by Debenhams Plc................................................7

7. Possible key factors considered by Debenhams Plc.............................................8

8. Computation of WEIGHTED AVERAGE COST OF CAPITAL of Debenhams Plc....9

9. Conclusion and recommendation of capital structure for Debenhams Plc..........13

10. REFERENCES...................................................................................................14

11. Bibliography......................................................................................................16

12. Appendix...........................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. INTRODUCTION

Debenhams Plc. operates as a multinational organisation in the international market.

The company is British based. The operation of the entity is carried out in from of several

departmental stores and franchisee model throughout the United Kingdom. Multi-fold client

provisioning has resulted in enormous success for the company in recent years. The current

report has laid out the goals except wealth maximisation that can be prioritised for the

organisation. An analysis is made into the capital structure of the company to figure out the

various sources that the company is funding its requirements from. The management motive

behind the company’s selection of the certain external financing sources has been tried to be

understood. A study of the concept of the weighted average cost of capital is made to gather

knowledge regarding the different problems that the company might have faced while using

the costing model. However, the industry of entity’s operations also affects the operating and

financing pattern that the entity follows. No matter what kind of external financing the firm

resorts to, there is always a weighted average capital cost computed for the company. The

report is summed up with a theoretical discussion of the weighted average cost of capital and

the practical conditions that revolve while applying the model. The company chosen for the

preparation of report is Debenhams Plc. Various complex topics are conceptualised in a

smooth manner with the use of the given company. The capital structure is the main key point

for determining the cost of capital and financial leverage of business (Debenhams Plc., 2018).

2. Maximizing shareholders wealth vs other objectives

MAXIMISATION OF SHAREHOLDERS’ WEALTH

The aim behind adoption of this model is to increase value that the shareholders shall receive.

The increment in the value shall be made only when the market capitalisation increases. The

increase in the market capitalisation can be achieved when the market price of the shares can

be incremented. As per this model all the decisions should be taken by the management with

a view to increase the return that the shareholders shall get. This maximization of

shareholders value is increased when company align the interest of the stakeholder’s with the

organization development (Smith, Russell, and Tennent, 2017). The justification of this

model is that the shareholders signify the real owners that the company have. They shall add

to the investment which can sustain the company in the longer run. To keep the investors stay

Debenhams Plc. operates as a multinational organisation in the international market.

The company is British based. The operation of the entity is carried out in from of several

departmental stores and franchisee model throughout the United Kingdom. Multi-fold client

provisioning has resulted in enormous success for the company in recent years. The current

report has laid out the goals except wealth maximisation that can be prioritised for the

organisation. An analysis is made into the capital structure of the company to figure out the

various sources that the company is funding its requirements from. The management motive

behind the company’s selection of the certain external financing sources has been tried to be

understood. A study of the concept of the weighted average cost of capital is made to gather

knowledge regarding the different problems that the company might have faced while using

the costing model. However, the industry of entity’s operations also affects the operating and

financing pattern that the entity follows. No matter what kind of external financing the firm

resorts to, there is always a weighted average capital cost computed for the company. The

report is summed up with a theoretical discussion of the weighted average cost of capital and

the practical conditions that revolve while applying the model. The company chosen for the

preparation of report is Debenhams Plc. Various complex topics are conceptualised in a

smooth manner with the use of the given company. The capital structure is the main key point

for determining the cost of capital and financial leverage of business (Debenhams Plc., 2018).

2. Maximizing shareholders wealth vs other objectives

MAXIMISATION OF SHAREHOLDERS’ WEALTH

The aim behind adoption of this model is to increase value that the shareholders shall receive.

The increment in the value shall be made only when the market capitalisation increases. The

increase in the market capitalisation can be achieved when the market price of the shares can

be incremented. As per this model all the decisions should be taken by the management with

a view to increase the return that the shareholders shall get. This maximization of

shareholders value is increased when company align the interest of the stakeholder’s with the

organization development (Smith, Russell, and Tennent, 2017). The justification of this

model is that the shareholders signify the real owners that the company have. They shall add

to the investment which can sustain the company in the longer run. To keep the investors stay

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

in the entity and add their investments it’s important to add to the value that they shall receive

(Kilroy, and Schneider, 2017).

OTHER IMPORTANT OBJECTIVES

1. RISK MINIMISATION MODEL:

This model asks for providing the shareholders with certain and reasonable return but does

not strive for some maximum return. The aim is to make such investments that provide the

entity with certain and stable cash flows. The risk is the main thing to be eliminated from the

business transactions and outcomes (Delen, Kuzey, and Uyar, 2013). This model can be

placed in priority to all the other models as the focus of this model is to balance out different

factors. Along with returns the risk is also strived to be managed. The sustainability of

business strengthening in future is tried to be worked on (Nyeland, Laursen, and Callréusc,

2107).

2. STAKEHOLDER MODEL

The business does not run only for the benefit of shareholders. The needs of all the

stakeholders need to be kept in mind and ultimately fulfilled. These stakeholders are

necessary to be satisfied if the company wants to get successful in the longer run and sustain

the roots of success. The stakeholder models strengthen the business value and align the

business values with the stakeholder’s interest (Robb, and Robinson, 2014). The model can

be debated to be prioritised over the wealth maximisation model because for having

successful in a social placement, the entity is legitimately required to fulfil the needs of all

the stakeholders that include, society; government; employees, and etc. (Smith, Russell, and

Tennent, 2017).

These are the certain objectives that help the company in laying its vision and objectives for

the longer run. To set its roots stably in the environment the entity has to adopt them and

keep them in mind as the time passes (Yan, 2017).

3. PROBLEM OF RECONCILING THE TWO MODELS

There comes a serious problem in reconciling these models as the stakeholders

demand good quality services at a lower price, while the shareholders seek for

increasing profits by charging higher prices. This amounts to an expectation gap

between the two parties. However, the bigger picture suggests settlement of

stakeholder demand that shall ultimately satisfy the shareholders.

(Kilroy, and Schneider, 2017).

OTHER IMPORTANT OBJECTIVES

1. RISK MINIMISATION MODEL:

This model asks for providing the shareholders with certain and reasonable return but does

not strive for some maximum return. The aim is to make such investments that provide the

entity with certain and stable cash flows. The risk is the main thing to be eliminated from the

business transactions and outcomes (Delen, Kuzey, and Uyar, 2013). This model can be

placed in priority to all the other models as the focus of this model is to balance out different

factors. Along with returns the risk is also strived to be managed. The sustainability of

business strengthening in future is tried to be worked on (Nyeland, Laursen, and Callréusc,

2107).

2. STAKEHOLDER MODEL

The business does not run only for the benefit of shareholders. The needs of all the

stakeholders need to be kept in mind and ultimately fulfilled. These stakeholders are

necessary to be satisfied if the company wants to get successful in the longer run and sustain

the roots of success. The stakeholder models strengthen the business value and align the

business values with the stakeholder’s interest (Robb, and Robinson, 2014). The model can

be debated to be prioritised over the wealth maximisation model because for having

successful in a social placement, the entity is legitimately required to fulfil the needs of all

the stakeholders that include, society; government; employees, and etc. (Smith, Russell, and

Tennent, 2017).

These are the certain objectives that help the company in laying its vision and objectives for

the longer run. To set its roots stably in the environment the entity has to adopt them and

keep them in mind as the time passes (Yan, 2017).

3. PROBLEM OF RECONCILING THE TWO MODELS

There comes a serious problem in reconciling these models as the stakeholders

demand good quality services at a lower price, while the shareholders seek for

increasing profits by charging higher prices. This amounts to an expectation gap

between the two parties. However, the bigger picture suggests settlement of

stakeholder demand that shall ultimately satisfy the shareholders.

4. EXTERNAL SOURCES OF FINANCE AVAILABLE TO THE

COMPANY

Debenhams Plc. has raised money for its operations from some external sources. It is

practically not possible for the company to use completely retained funds and grow the

business. The different sources from which the company has raised funds externally include

the following (Ehiedu, V.C., (2014) such as Issue of common stock, short term borrowings,

long term debt through debenture (Debenhams Plc., 2018).

The explanation of these different sources has been laid as follows:

EXTERNAL EQUITY FUNDS

ISSUE OF COMMON STOCK: this is the most common way to raise funds by any

organisation. Herein the company raises funds and make the fund providers real owners of

the entity by providing them with ownership share in proportion with shareholding pattern

they have. These fund providers get voting rights in the company’s general meetings. The

return that is provided to the shareholders in this financing form is the value addition when

the market price rises and any dividend if declared by the company. However, it is not

necessary for the company to pay dividends regularly; however a regular dividend payment

consolidates faith in shareholders’ minds. This is less risky for the company’s part in

comparison with the debentures (Lashgari. 2015).

RIGHTS ISSUES: this is the way in which the company invites the existing shareholders to

purchase new shares that the company is issuing in the ratio they already hold shares. This is

mandatory to be followed by the company to provide the existing shareholders at the same

position and least impacted by further issue (Ogada, and Kalunda, 2017). It is the primitive

right of the shareholders which allow existing shareholders to buy more shares of the

company.

EXTERNAL DEBT FUND

SHORT TERM BORROWINGS: This debt borrowing includes short term financing tools

such as trade payables, notes payable, and bank overdraft. This genre of funding is required

to meet the fund requirements that are generated in day to day operations of the entity. The

working capital requirements are fulfilled by this borrowing technique.

DEBENTURES: Debenture borrowing is a long term fund raising technique which is

pertaining to be the most popular nowadays. The debentures are issues in the public market

and potential holders are invited to buy them. The holders of debentures get interest on a

COMPANY

Debenhams Plc. has raised money for its operations from some external sources. It is

practically not possible for the company to use completely retained funds and grow the

business. The different sources from which the company has raised funds externally include

the following (Ehiedu, V.C., (2014) such as Issue of common stock, short term borrowings,

long term debt through debenture (Debenhams Plc., 2018).

The explanation of these different sources has been laid as follows:

EXTERNAL EQUITY FUNDS

ISSUE OF COMMON STOCK: this is the most common way to raise funds by any

organisation. Herein the company raises funds and make the fund providers real owners of

the entity by providing them with ownership share in proportion with shareholding pattern

they have. These fund providers get voting rights in the company’s general meetings. The

return that is provided to the shareholders in this financing form is the value addition when

the market price rises and any dividend if declared by the company. However, it is not

necessary for the company to pay dividends regularly; however a regular dividend payment

consolidates faith in shareholders’ minds. This is less risky for the company’s part in

comparison with the debentures (Lashgari. 2015).

RIGHTS ISSUES: this is the way in which the company invites the existing shareholders to

purchase new shares that the company is issuing in the ratio they already hold shares. This is

mandatory to be followed by the company to provide the existing shareholders at the same

position and least impacted by further issue (Ogada, and Kalunda, 2017). It is the primitive

right of the shareholders which allow existing shareholders to buy more shares of the

company.

EXTERNAL DEBT FUND

SHORT TERM BORROWINGS: This debt borrowing includes short term financing tools

such as trade payables, notes payable, and bank overdraft. This genre of funding is required

to meet the fund requirements that are generated in day to day operations of the entity. The

working capital requirements are fulfilled by this borrowing technique.

DEBENTURES: Debenture borrowing is a long term fund raising technique which is

pertaining to be the most popular nowadays. The debentures are issues in the public market

and potential holders are invited to buy them. The holders of debentures get interest on a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

periodic basis which acts as a financing burden for the entity. But this pattern of borrowing is

somehow secure as far the view of the holders is concerned. For the company a regular

burden is fixed for the payment of interests. These debentures are issued at fixed interest rate.

Organizations which have low financial leverage must issue debentures. This will help

organization to raise capital at cheapest cost and strengthen the business outcomes.

LOAN STOCK: This comprises of fixed interest bearing bonds that are unsecured and

cannot be transferred.

REDEEMABLE PREFERENCE SHARES: these are those preference shares that have

been issued by the company with a certainty to get redeemed or repaid after a certain fixed

term.

BASIC DISTINCTION

The main area of difference between both kinds of external fund raising areas is depicted

here. When funds are raised through issuance of common stock or right shares, the fund

gathered is counted as company’s owned fund as the fund providers are considered to be the

actual owners of the company. Whereas, when debt funds are rescued by, the funds are

always borrowed and charge company with a periodic interest for the loaned amount. There

is no ownership and it has to be returned in priority in case the company falls in the clutches

of liquidation.

Further, the debt holders get no right to take part in the controlling operations of the

organisation. While when the shareholders of common stock are considered they all get to

have power to vote and take controlling positions. The tax benefit is not offered on the

dividend which is paid to the owners, but the interest payment made as the financing cost is

mostly the operating expense and the company is offered with tax benefit for the same.

Further, the investors that invest in the company’s common stock do not directly ask for any

security, which in the case of debt fund is collateral. The investors just look for the

company’s financial position to take the investment decision (Baker, and Wurgler, 2015).

5. Background of selected company

COMPANY’S PROFILE

Debenhams Plc. as discussed is a multinational brand having retail business across United

Kingdom. The company shows a vibrant profile of profiteering and is working well. The

revenues of the company are filling well in the company’s objectives. The revenues have

shown a stark rise of 12% as compared to the statistics of company’s presented for last three

somehow secure as far the view of the holders is concerned. For the company a regular

burden is fixed for the payment of interests. These debentures are issued at fixed interest rate.

Organizations which have low financial leverage must issue debentures. This will help

organization to raise capital at cheapest cost and strengthen the business outcomes.

LOAN STOCK: This comprises of fixed interest bearing bonds that are unsecured and

cannot be transferred.

REDEEMABLE PREFERENCE SHARES: these are those preference shares that have

been issued by the company with a certainty to get redeemed or repaid after a certain fixed

term.

BASIC DISTINCTION

The main area of difference between both kinds of external fund raising areas is depicted

here. When funds are raised through issuance of common stock or right shares, the fund

gathered is counted as company’s owned fund as the fund providers are considered to be the

actual owners of the company. Whereas, when debt funds are rescued by, the funds are

always borrowed and charge company with a periodic interest for the loaned amount. There

is no ownership and it has to be returned in priority in case the company falls in the clutches

of liquidation.

Further, the debt holders get no right to take part in the controlling operations of the

organisation. While when the shareholders of common stock are considered they all get to

have power to vote and take controlling positions. The tax benefit is not offered on the

dividend which is paid to the owners, but the interest payment made as the financing cost is

mostly the operating expense and the company is offered with tax benefit for the same.

Further, the investors that invest in the company’s common stock do not directly ask for any

security, which in the case of debt fund is collateral. The investors just look for the

company’s financial position to take the investment decision (Baker, and Wurgler, 2015).

5. Background of selected company

COMPANY’S PROFILE

Debenhams Plc. as discussed is a multinational brand having retail business across United

Kingdom. The company shows a vibrant profile of profiteering and is working well. The

revenues of the company are filling well in the company’s objectives. The revenues have

shown a stark rise of 12% as compared to the statistics of company’s presented for last three

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

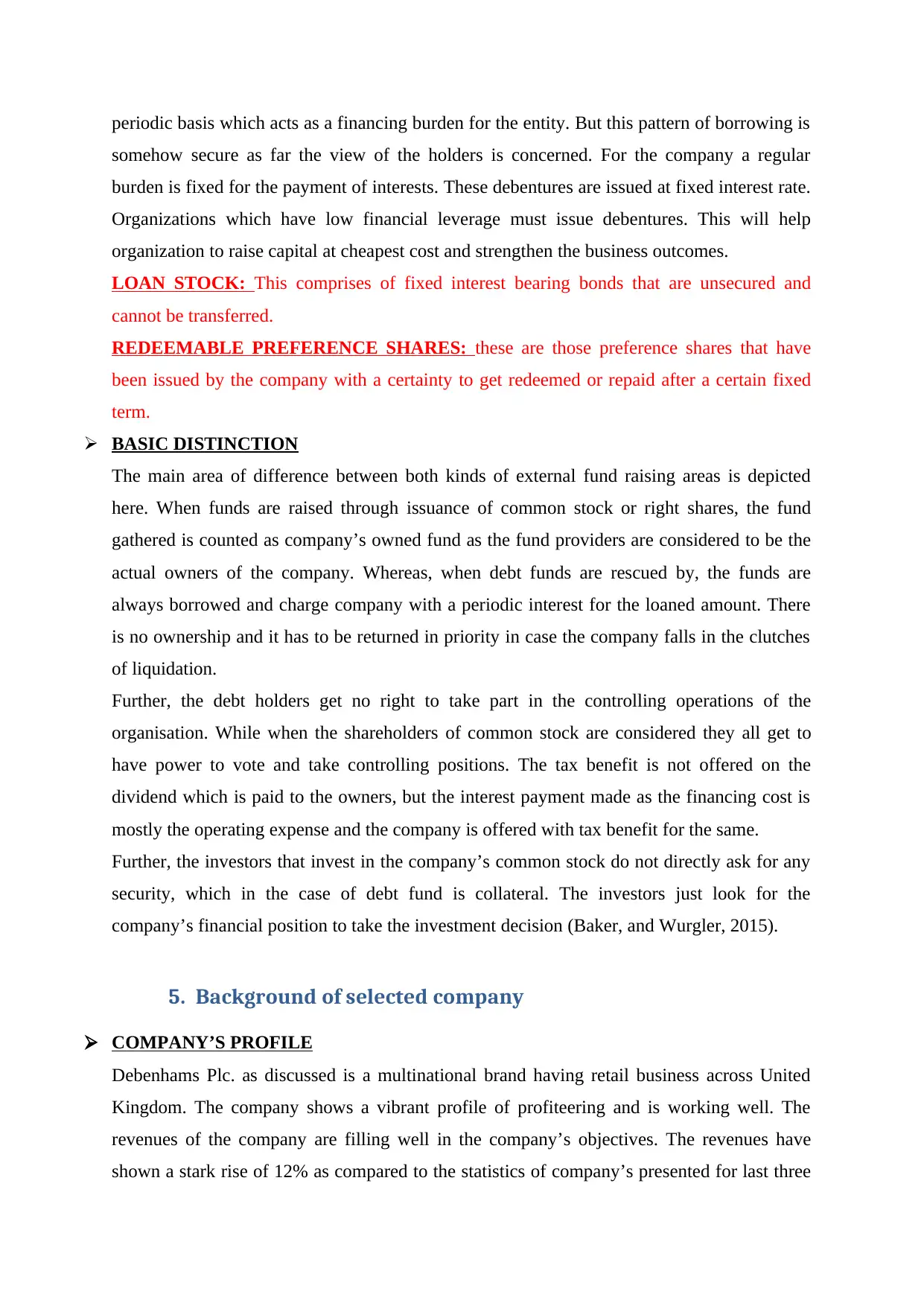

years. The company works in diversified product range since its establishment. The company

product category includes a wide range of products from widely famous brands and some of

the company’s owned brands. The company’s performance statistic is presented below:

Particulars Formula DEBENHAMS PLC ADR (DBHSY)

2013-

08

2014-

08

2015-

08

2016-

08

2017-

08

Net profit Margin

Net profit

revenues 6% 4% 4% 4% 2%

Return on equity

Net profit

Equity 17% 11% 11% 10% 5%

Earnings per

share

Net profit

Share

outstanding 0.50 0.25 .1.5 0.65 0.45

The increased business profitability and high return on capital employed is the positive

indicator for the future growth of the organization. Since last three years, the profitability

have gone down and resulted to high risk for the business sustainability.

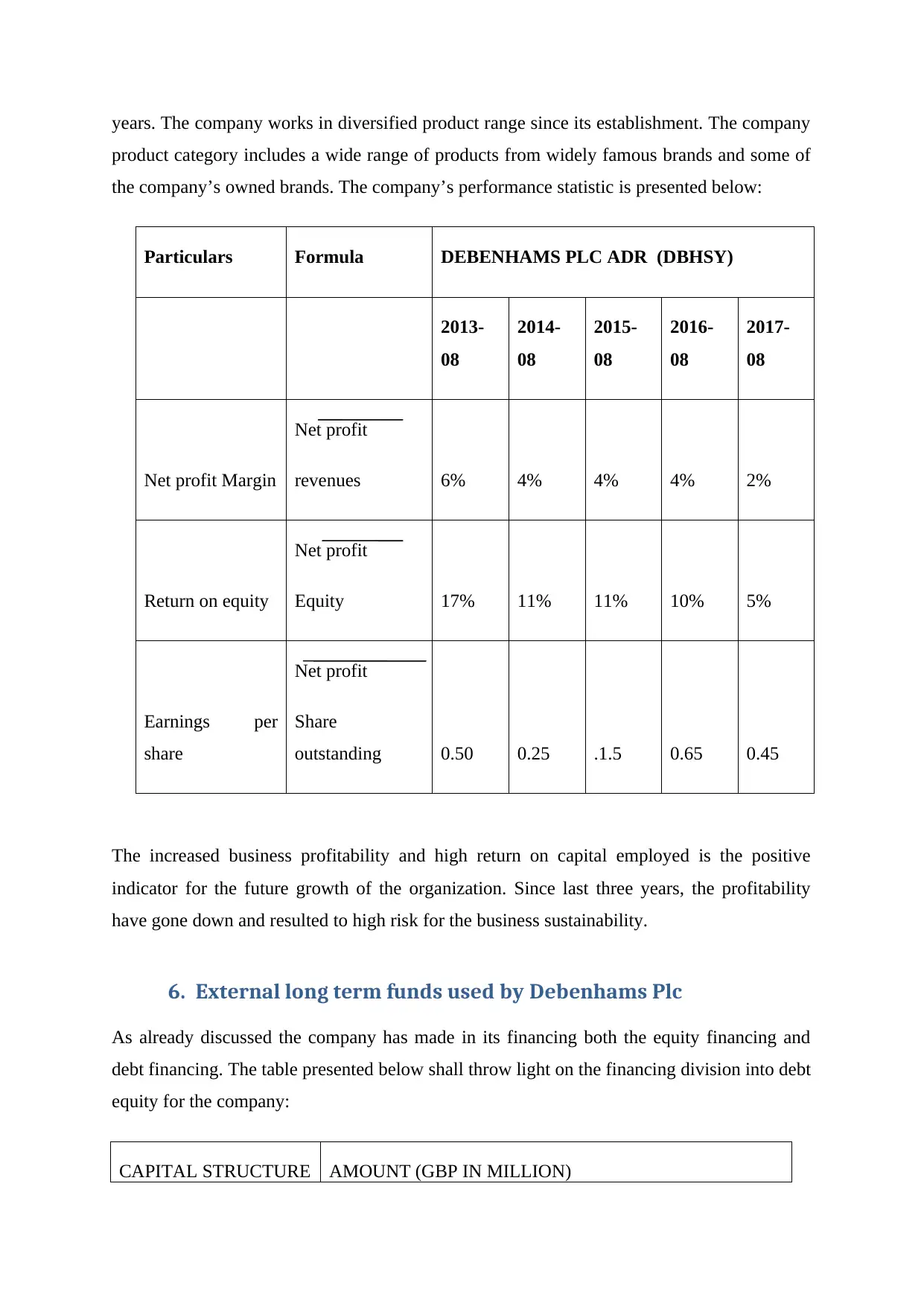

6. External long term funds used by Debenhams Plc

As already discussed the company has made in its financing both the equity financing and

debt financing. The table presented below shall throw light on the financing division into debt

equity for the company:

CAPITAL STRUCTURE AMOUNT (GBP IN MILLION)

product category includes a wide range of products from widely famous brands and some of

the company’s owned brands. The company’s performance statistic is presented below:

Particulars Formula DEBENHAMS PLC ADR (DBHSY)

2013-

08

2014-

08

2015-

08

2016-

08

2017-

08

Net profit Margin

Net profit

revenues 6% 4% 4% 4% 2%

Return on equity

Net profit

Equity 17% 11% 11% 10% 5%

Earnings per

share

Net profit

Share

outstanding 0.50 0.25 .1.5 0.65 0.45

The increased business profitability and high return on capital employed is the positive

indicator for the future growth of the organization. Since last three years, the profitability

have gone down and resulted to high risk for the business sustainability.

6. External long term funds used by Debenhams Plc

As already discussed the company has made in its financing both the equity financing and

debt financing. The table presented below shall throw light on the financing division into debt

equity for the company:

CAPITAL STRUCTURE AMOUNT (GBP IN MILLION)

2013 2014 2015 2016 2017

Equity 744 767 853 884 918

Debt 1388 1381 1289 1307 1,292

Total capital 2133 2148 2143 2191 2,210

The above table shows the clear inclination of the company towards the equity funds as

compared to the debt funds. A close look and study of the balance sheet tells that the main

rise for inclination comes to be the rise in the retained earnings for the company.

7. Possible key factors considered by Debenhams Plc

These factors are determined on the basis of the internal and external factors which may

directly and indirectly influence the cost of capital and return on capital employed of the

company. The underlying factors that have motivated the company to choose the external

financing pattern in the manner depicting above are explained as follows:

1. INTERNAL FACTORS

Fulfilment of debt covenants relating to existing debt: The most important internal factor that

might have laid the company to finance with the help of more equity is the already taken debt

by the company. The debt providers might have laid certain restrictions on the company to

prevent from raising further debt and may require fulfilment of certain other requirements to

get the new debt raised (Debenhams Plc., 2018).

Historical performance: Before raising the level of either of debt or equity the company needs

to look into the way it has performed in the near past. A trend analysis is required to be made

to analyse whether the company is able to successfully exploit the benefits of using larger

debt in its capital structure, or whether it has just been adding to the cost of the company.

Equity 744 767 853 884 918

Debt 1388 1381 1289 1307 1,292

Total capital 2133 2148 2143 2191 2,210

The above table shows the clear inclination of the company towards the equity funds as

compared to the debt funds. A close look and study of the balance sheet tells that the main

rise for inclination comes to be the rise in the retained earnings for the company.

7. Possible key factors considered by Debenhams Plc

These factors are determined on the basis of the internal and external factors which may

directly and indirectly influence the cost of capital and return on capital employed of the

company. The underlying factors that have motivated the company to choose the external

financing pattern in the manner depicting above are explained as follows:

1. INTERNAL FACTORS

Fulfilment of debt covenants relating to existing debt: The most important internal factor that

might have laid the company to finance with the help of more equity is the already taken debt

by the company. The debt providers might have laid certain restrictions on the company to

prevent from raising further debt and may require fulfilment of certain other requirements to

get the new debt raised (Debenhams Plc., 2018).

Historical performance: Before raising the level of either of debt or equity the company needs

to look into the way it has performed in the near past. A trend analysis is required to be made

to analyse whether the company is able to successfully exploit the benefits of using larger

debt in its capital structure, or whether it has just been adding to the cost of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Maintenance of certain working ratios: The trend analysis that the company performs may

require it to maintain a certain gearing level or keep the debt equity ratio to a certain point, or

to work out some other ratios relating to capital structure within acceptable limit. To fulfil

that certain requirement a selection between either debt or equity can be made by the

company (Öztekin, 2015).

2. EXTERNAL FACTORS

Economic conditions of market: sometimes the market scenario proves to be the prominent

factor that affects the choice of external finance. The market may at times show a boom that

makes the company require urgent funds to cater the business operations. The fund is not that

readily available when it comes to equity borrowing as the formalities are bit more as

compared to raising debt. This way the company may end up choosing debt.

Interest rate effect: if the interest rate on debt is such that the company is offered with more

benefits in terms of tax reductions and increased overall return on capital employed, the

company must choose debt over equity.

Movement in tax rates: the tax rate fluctuations are a major area to be analysed. Higher rate

of tax can promote debt financing as it shall help the company to take the benefit of reduction

of tax amount with the help of interest expense. Vice versa can be observed in case when the

tax rates are low (Graham, Harvey, and Puri, 2015).

8. Computation of WEIGHTED AVERAGE COST OF CAPITAL of Debenhams Plc

MEANING: weighted average cost of capital (WACC) helps the company to compute the

minimum and reasonable rate that its investor should expect out of any investment that the

company wants to invest their money into. This rate is calculated as an average cost rate that

averages the cost rate for both equity and debt. Any investment project whose rate of return is

analysed needs a comparison to be made with the weighted average cost of capital (Frank,

and Shen, 2016).

FORMULA: The WACC can be calculated in the following manner:

WACC = ((E/V) * Re) + [((D/V) * Rd) * (1-T)]

Where,

E = company’s equity market value

D = company’s debt market value

require it to maintain a certain gearing level or keep the debt equity ratio to a certain point, or

to work out some other ratios relating to capital structure within acceptable limit. To fulfil

that certain requirement a selection between either debt or equity can be made by the

company (Öztekin, 2015).

2. EXTERNAL FACTORS

Economic conditions of market: sometimes the market scenario proves to be the prominent

factor that affects the choice of external finance. The market may at times show a boom that

makes the company require urgent funds to cater the business operations. The fund is not that

readily available when it comes to equity borrowing as the formalities are bit more as

compared to raising debt. This way the company may end up choosing debt.

Interest rate effect: if the interest rate on debt is such that the company is offered with more

benefits in terms of tax reductions and increased overall return on capital employed, the

company must choose debt over equity.

Movement in tax rates: the tax rate fluctuations are a major area to be analysed. Higher rate

of tax can promote debt financing as it shall help the company to take the benefit of reduction

of tax amount with the help of interest expense. Vice versa can be observed in case when the

tax rates are low (Graham, Harvey, and Puri, 2015).

8. Computation of WEIGHTED AVERAGE COST OF CAPITAL of Debenhams Plc

MEANING: weighted average cost of capital (WACC) helps the company to compute the

minimum and reasonable rate that its investor should expect out of any investment that the

company wants to invest their money into. This rate is calculated as an average cost rate that

averages the cost rate for both equity and debt. Any investment project whose rate of return is

analysed needs a comparison to be made with the weighted average cost of capital (Frank,

and Shen, 2016).

FORMULA: The WACC can be calculated in the following manner:

WACC = ((E/V) * Re) + [((D/V) * Rd) * (1-T)]

Where,

E = company’s equity market value

D = company’s debt market value

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

V = overall market value of both debt and equity

Re = Cost of Equity

Rd = Cost of Debt

T = prevailing Tax Rate

Process to compute the WACCC by using the CAPM model

Step-1

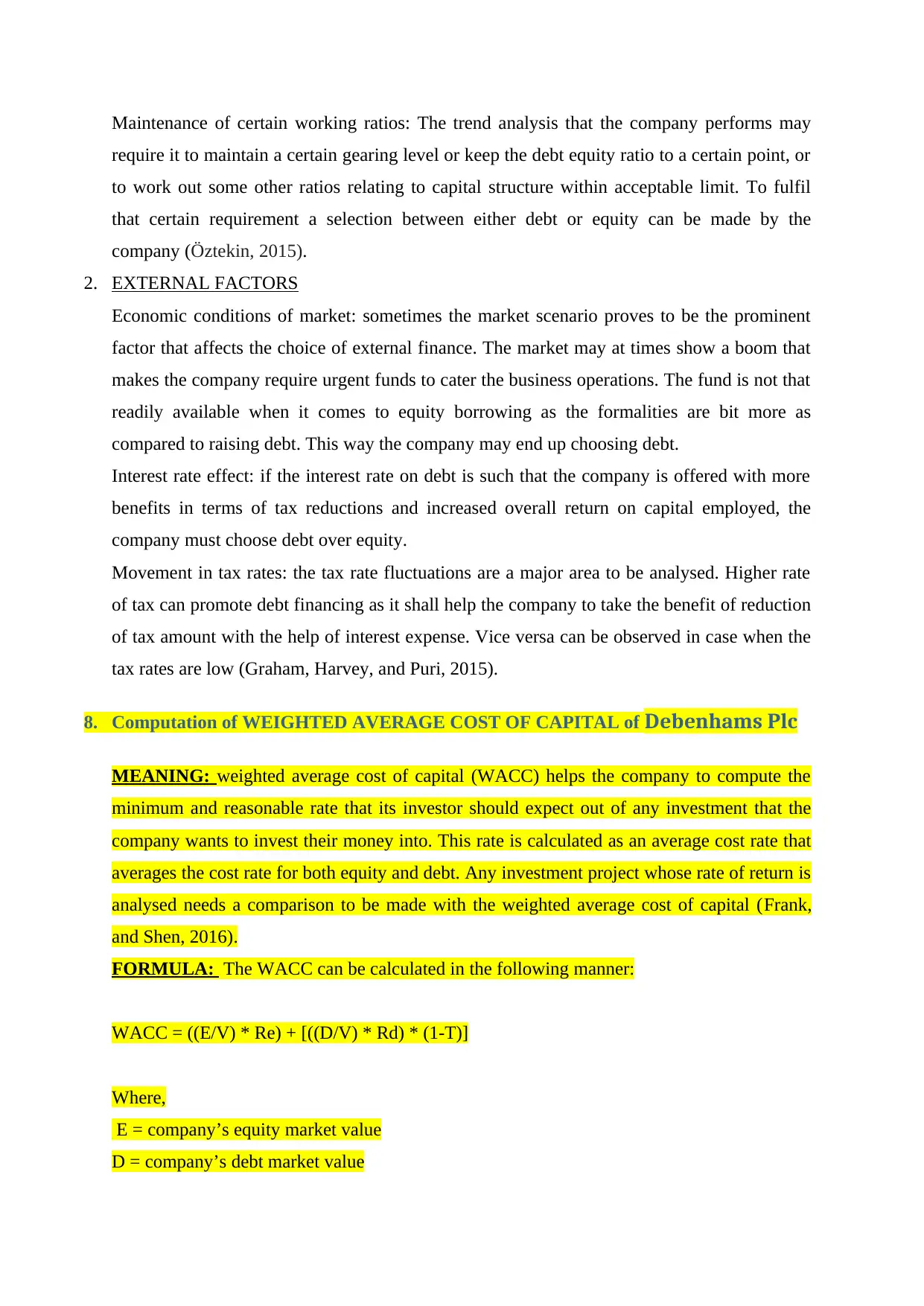

By using the CAPM model, beta firstly would be computed by using the regression analysis.

df SS MS F

Significan

ce F

Regressi

on 1 0.005802

0.0058

02

4.9196

88

0.037185

44

Residual 22 0.025944

0.0011

79

Total 23 0.031746

Coefficien

ts

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercep

t

-

0.008492

084 0.007562

-

1.1229

3

0.2735

71

-

0.024175

555

0.0071

91 -0.02418 0.007191

X

Variable

1

-

0.130042

533 0.05863

-

2.2180

4

0.0371

85

-

0.251632

8

-

0.0084

5 -0.25163 -0.00845

Beta= -.013 (Debenhams Plc., 2018).

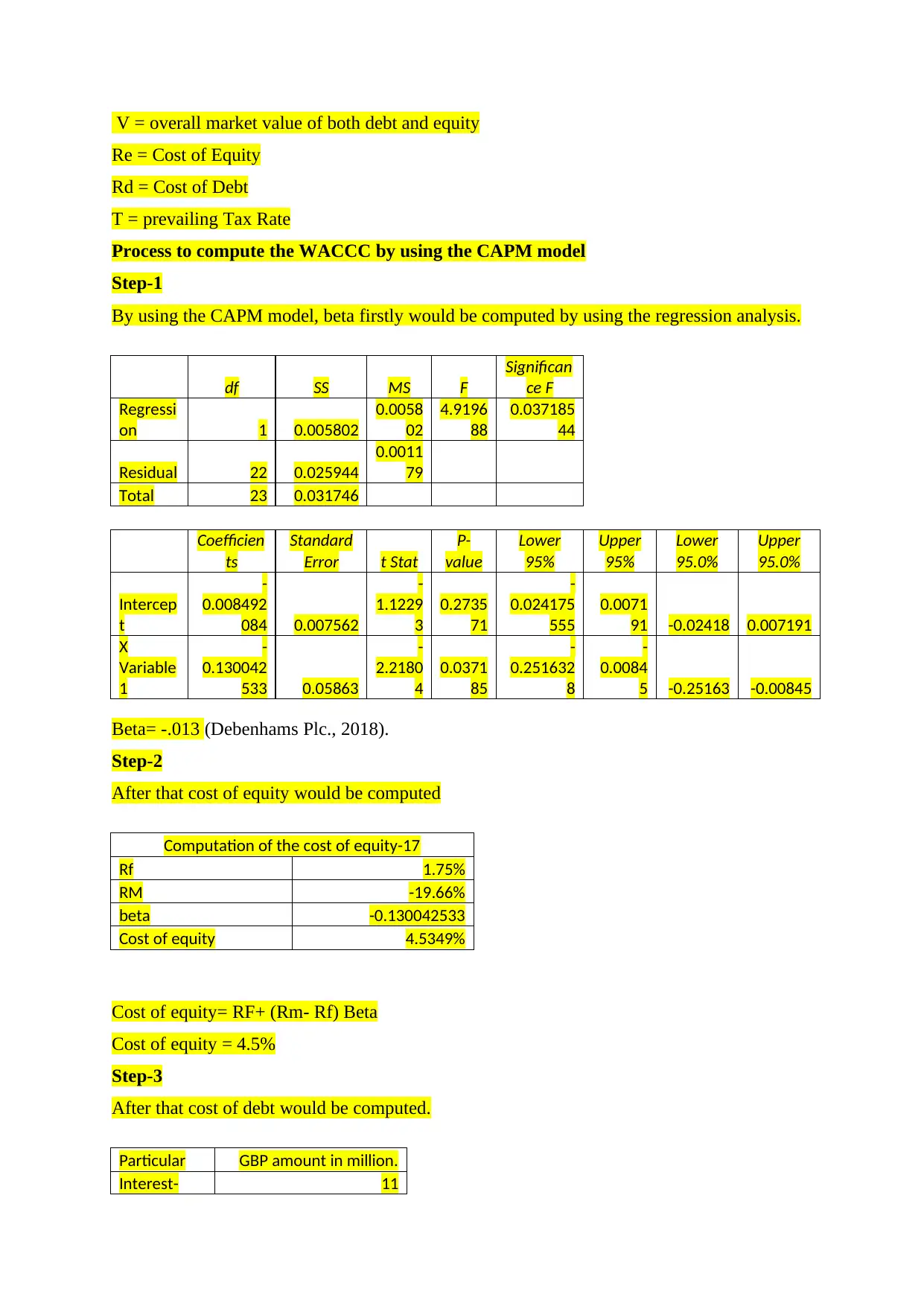

Step-2

After that cost of equity would be computed

Computation of the cost of equity-17

Rf 1.75%

RM -19.66%

beta -0.130042533

Cost of equity 4.5349%

Cost of equity= RF+ (Rm- Rf) Beta

Cost of equity = 4.5%

Step-3

After that cost of debt would be computed.

Particular GBP amount in million.

Interest- 11

Re = Cost of Equity

Rd = Cost of Debt

T = prevailing Tax Rate

Process to compute the WACCC by using the CAPM model

Step-1

By using the CAPM model, beta firstly would be computed by using the regression analysis.

df SS MS F

Significan

ce F

Regressi

on 1 0.005802

0.0058

02

4.9196

88

0.037185

44

Residual 22 0.025944

0.0011

79

Total 23 0.031746

Coefficien

ts

Standard

Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercep

t

-

0.008492

084 0.007562

-

1.1229

3

0.2735

71

-

0.024175

555

0.0071

91 -0.02418 0.007191

X

Variable

1

-

0.130042

533 0.05863

-

2.2180

4

0.0371

85

-

0.251632

8

-

0.0084

5 -0.25163 -0.00845

Beta= -.013 (Debenhams Plc., 2018).

Step-2

After that cost of equity would be computed

Computation of the cost of equity-17

Rf 1.75%

RM -19.66%

beta -0.130042533

Cost of equity 4.5349%

Cost of equity= RF+ (Rm- Rf) Beta

Cost of equity = 4.5%

Step-3

After that cost of debt would be computed.

Particular GBP amount in million.

Interest- 11

2017

Cost of debt 0.85%

tax 30%

KD 0.60%

The weighted average cost of capital is used to determine the cost of capital and the payment

which would be paid by the company to pay off the amount of investment taken by it from

the investors (Debenhams Plc., 2018).

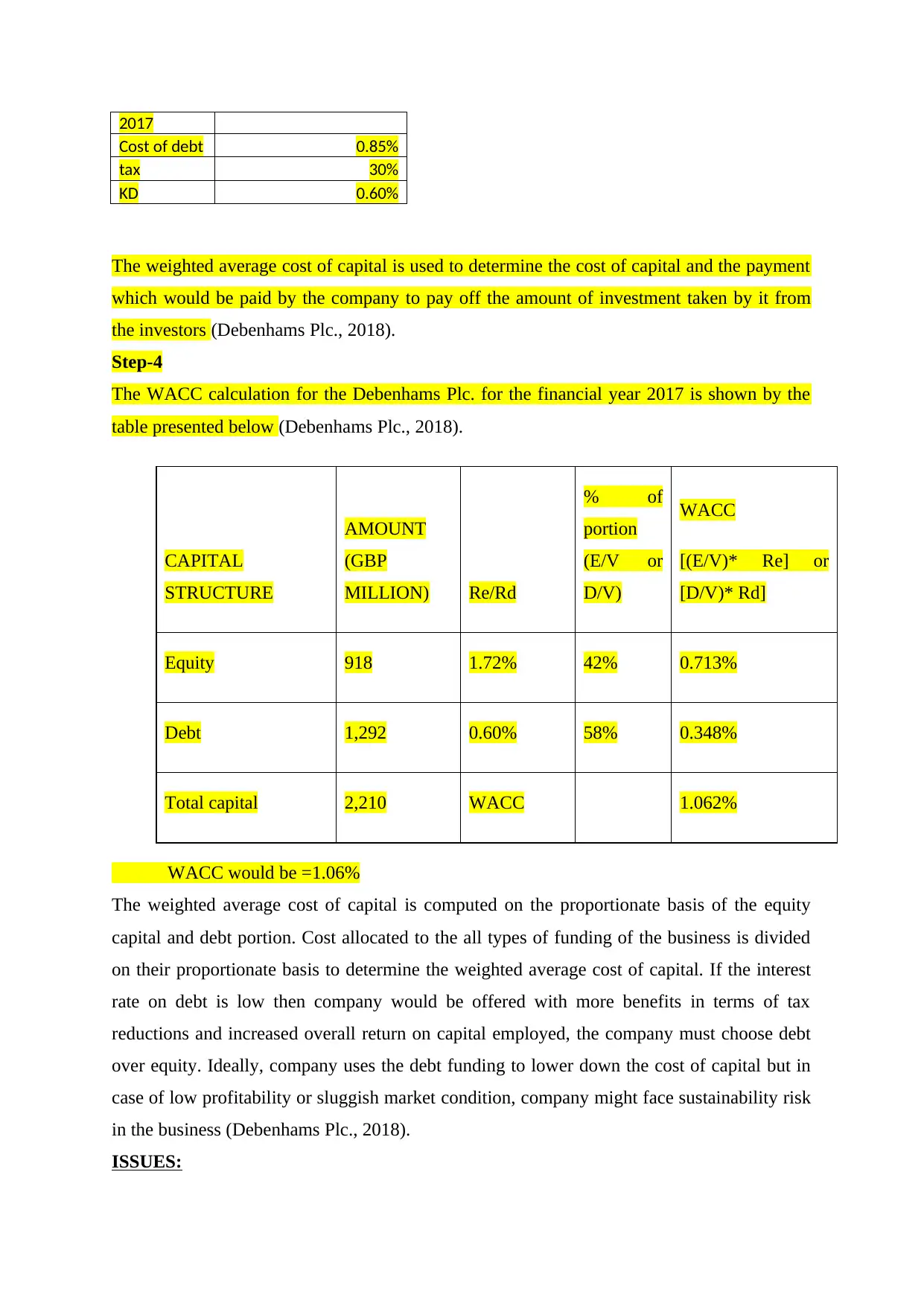

Step-4

The WACC calculation for the Debenhams Plc. for the financial year 2017 is shown by the

table presented below (Debenhams Plc., 2018).

CAPITAL

STRUCTURE

AMOUNT

(GBP

MILLION) Re/Rd

% of

portion

(E/V or

D/V)

WACC

[(E/V)* Re] or

[D/V)* Rd]

Equity 918 1.72% 42% 0.713%

Debt 1,292 0.60% 58% 0.348%

Total capital 2,210 WACC 1.062%

WACC would be =1.06%

The weighted average cost of capital is computed on the proportionate basis of the equity

capital and debt portion. Cost allocated to the all types of funding of the business is divided

on their proportionate basis to determine the weighted average cost of capital. If the interest

rate on debt is low then company would be offered with more benefits in terms of tax

reductions and increased overall return on capital employed, the company must choose debt

over equity. Ideally, company uses the debt funding to lower down the cost of capital but in

case of low profitability or sluggish market condition, company might face sustainability risk

in the business (Debenhams Plc., 2018).

ISSUES:

Cost of debt 0.85%

tax 30%

KD 0.60%

The weighted average cost of capital is used to determine the cost of capital and the payment

which would be paid by the company to pay off the amount of investment taken by it from

the investors (Debenhams Plc., 2018).

Step-4

The WACC calculation for the Debenhams Plc. for the financial year 2017 is shown by the

table presented below (Debenhams Plc., 2018).

CAPITAL

STRUCTURE

AMOUNT

(GBP

MILLION) Re/Rd

% of

portion

(E/V or

D/V)

WACC

[(E/V)* Re] or

[D/V)* Rd]

Equity 918 1.72% 42% 0.713%

Debt 1,292 0.60% 58% 0.348%

Total capital 2,210 WACC 1.062%

WACC would be =1.06%

The weighted average cost of capital is computed on the proportionate basis of the equity

capital and debt portion. Cost allocated to the all types of funding of the business is divided

on their proportionate basis to determine the weighted average cost of capital. If the interest

rate on debt is low then company would be offered with more benefits in terms of tax

reductions and increased overall return on capital employed, the company must choose debt

over equity. Ideally, company uses the debt funding to lower down the cost of capital but in

case of low profitability or sluggish market condition, company might face sustainability risk

in the business (Debenhams Plc., 2018).

ISSUES:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.