Detailed Corporate Accounting Analysis of Grain Corp. Ltd's Financials

VerifiedAdded on 2020/10/22

|10

|2572

|406

Report

AI Summary

This report presents a comprehensive analysis of Grain Corp. Ltd's financial performance over a three-year period, focusing on cash flow statements, other comprehensive income statements, and corporate income tax accounting. The cash flow analysis examines customer receipts, payments to suppliers and employees, proceeds from borrowings, interest, and income tax paid, revealing trends in operating, investing, and financing activities. The other comprehensive income section details items not reclassified and reclassified to the profit and loss account, along with their respective income tax implications. The report also assesses Grain Corp. Ltd's corporate income tax, including tax expenses, tax rates, deferred tax assets and liabilities, current tax assets, and the relationship between income tax expense and income tax paid. The analysis highlights key financial metrics, providing insights into the company's financial health and accounting practices.

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

CASH FLOWS STATEMENT.......................................................................................................1

1. Items of cash flow statement..............................................................................................1

2. Cash flows attained in previous years................................................................................3

OTHER COMPREHENSIVE INCOME STATEMENT................................................................3

3. Items of other comprehensive income statement of past years..........................................3

4. Explaining each items of statement....................................................................................4

5. Analysing the reasons behind not including several items in income statement...............5

ACCOUNTING FOR CORPORATE INCOME TAX....................................................................5

6. Ascertaining the latest tax expenses of Grain Corp. Ltd....................................................5

7. Similarity between the tax rate times of Grain Corp. Ltd..................................................5

8. Commentary based on deferred tax assets/ liabilities reported in balance sheet................6

9. Presenting current tax assets or income tax payable reported by firm...............................6

10. Is the income tax expense and income tax paid are similar.............................................6

11. Treatment of tax of Grain Corp Ltd.................................................................................6

CONCLUSION ...............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION...........................................................................................................................1

CASH FLOWS STATEMENT.......................................................................................................1

1. Items of cash flow statement..............................................................................................1

2. Cash flows attained in previous years................................................................................3

OTHER COMPREHENSIVE INCOME STATEMENT................................................................3

3. Items of other comprehensive income statement of past years..........................................3

4. Explaining each items of statement....................................................................................4

5. Analysing the reasons behind not including several items in income statement...............5

ACCOUNTING FOR CORPORATE INCOME TAX....................................................................5

6. Ascertaining the latest tax expenses of Grain Corp. Ltd....................................................5

7. Similarity between the tax rate times of Grain Corp. Ltd..................................................5

8. Commentary based on deferred tax assets/ liabilities reported in balance sheet................6

9. Presenting current tax assets or income tax payable reported by firm...............................6

10. Is the income tax expense and income tax paid are similar.............................................6

11. Treatment of tax of Grain Corp Ltd.................................................................................6

CONCLUSION ...............................................................................................................................7

REFERENCES................................................................................................................................8

INTRODUCTION

Managing the business accounts in the most prominent ways which will be effective and

efficiency for the business as to have satisfactory rise in the income and operational viabilities of

firm. Moreover, in the present report there will be discussion based on analysing the financial

health of Grain Corp. Ltd. Over the period. The financial data set of this business will be

analysed as well as studies in terms of reaching to the concrete solutions.

CASH FLOWS STATEMENT

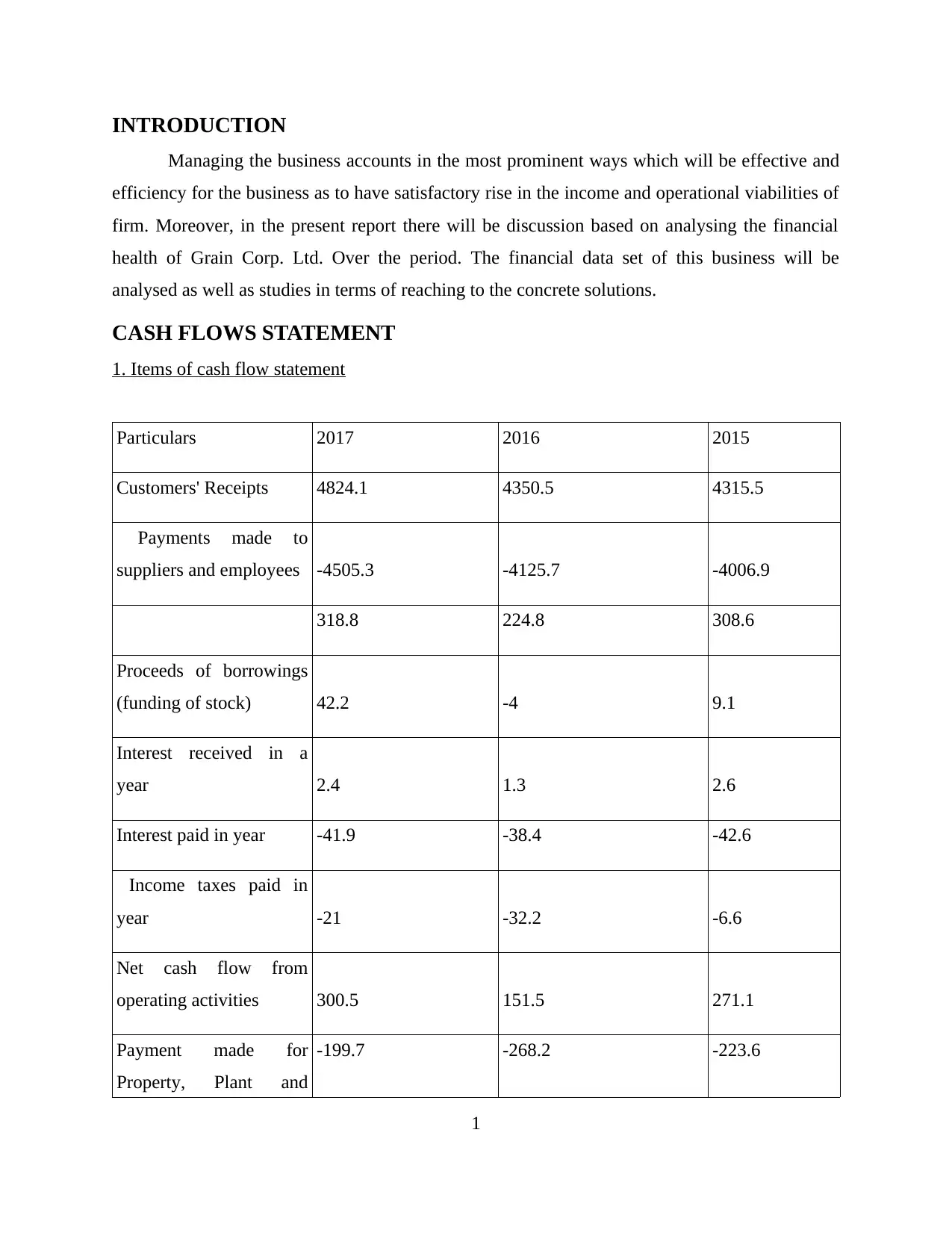

1. Items of cash flow statement

Particulars 2017 2016 2015

Customers' Receipts 4824.1 4350.5 4315.5

Payments made to

suppliers and employees -4505.3 -4125.7 -4006.9

318.8 224.8 308.6

Proceeds of borrowings

(funding of stock) 42.2 -4 9.1

Interest received in a

year 2.4 1.3 2.6

Interest paid in year -41.9 -38.4 -42.6

Income taxes paid in

year -21 -32.2 -6.6

Net cash flow from

operating activities 300.5 151.5 271.1

Payment made for

Property, Plant and

-199.7 -268.2 -223.6

1

Managing the business accounts in the most prominent ways which will be effective and

efficiency for the business as to have satisfactory rise in the income and operational viabilities of

firm. Moreover, in the present report there will be discussion based on analysing the financial

health of Grain Corp. Ltd. Over the period. The financial data set of this business will be

analysed as well as studies in terms of reaching to the concrete solutions.

CASH FLOWS STATEMENT

1. Items of cash flow statement

Particulars 2017 2016 2015

Customers' Receipts 4824.1 4350.5 4315.5

Payments made to

suppliers and employees -4505.3 -4125.7 -4006.9

318.8 224.8 308.6

Proceeds of borrowings

(funding of stock) 42.2 -4 9.1

Interest received in a

year 2.4 1.3 2.6

Interest paid in year -41.9 -38.4 -42.6

Income taxes paid in

year -21 -32.2 -6.6

Net cash flow from

operating activities 300.5 151.5 271.1

Payment made for

Property, Plant and

-199.7 -268.2 -223.6

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

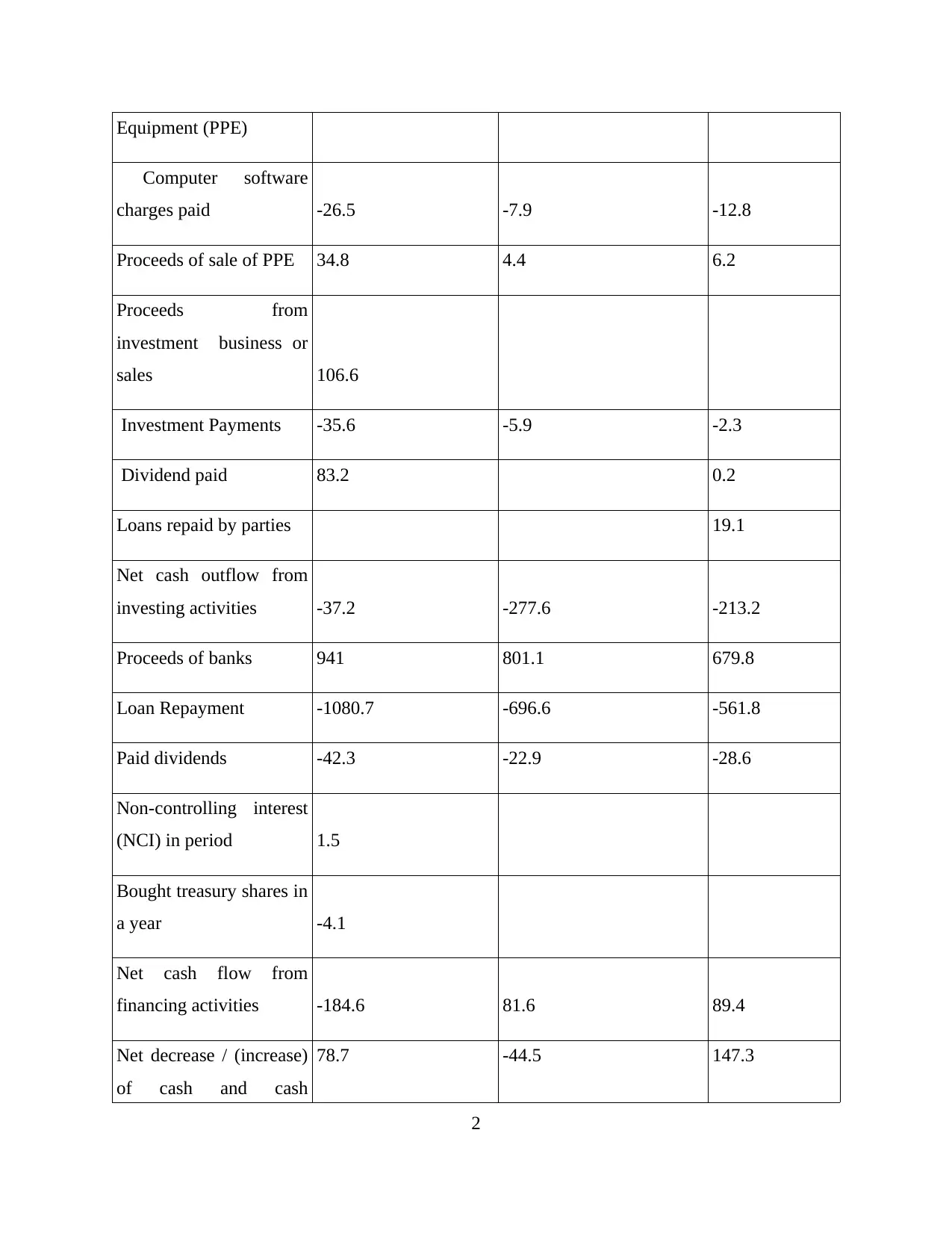

Equipment (PPE)

Computer software

charges paid -26.5 -7.9 -12.8

Proceeds of sale of PPE 34.8 4.4 6.2

Proceeds from

investment business or

sales 106.6

Investment Payments -35.6 -5.9 -2.3

Dividend paid 83.2 0.2

Loans repaid by parties 19.1

Net cash outflow from

investing activities -37.2 -277.6 -213.2

Proceeds of banks 941 801.1 679.8

Loan Repayment -1080.7 -696.6 -561.8

Paid dividends -42.3 -22.9 -28.6

Non-controlling interest

(NCI) in period 1.5

Bought treasury shares in

a year -4.1

Net cash flow from

financing activities -184.6 81.6 89.4

Net decrease / (increase)

of cash and cash

78.7 -44.5 147.3

2

Computer software

charges paid -26.5 -7.9 -12.8

Proceeds of sale of PPE 34.8 4.4 6.2

Proceeds from

investment business or

sales 106.6

Investment Payments -35.6 -5.9 -2.3

Dividend paid 83.2 0.2

Loans repaid by parties 19.1

Net cash outflow from

investing activities -37.2 -277.6 -213.2

Proceeds of banks 941 801.1 679.8

Loan Repayment -1080.7 -696.6 -561.8

Paid dividends -42.3 -22.9 -28.6

Non-controlling interest

(NCI) in period 1.5

Bought treasury shares in

a year -4.1

Net cash flow from

financing activities -184.6 81.6 89.4

Net decrease / (increase)

of cash and cash

78.7 -44.5 147.3

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

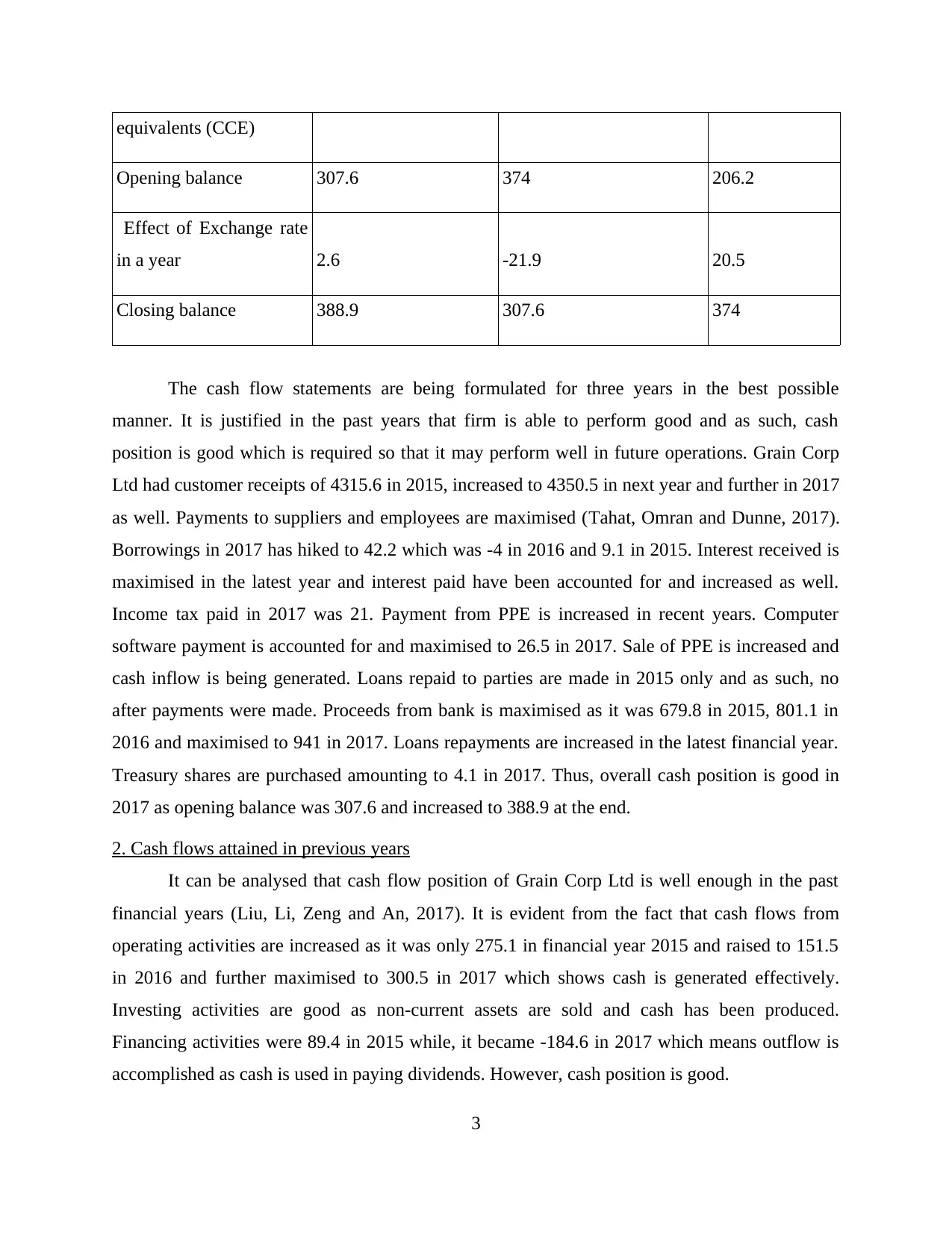

equivalents (CCE)

Opening balance 307.6 374 206.2

Effect of Exchange rate

in a year 2.6 -21.9 20.5

Closing balance 388.9 307.6 374

The cash flow statements are being formulated for three years in the best possible

manner. It is justified in the past years that firm is able to perform good and as such, cash

position is good which is required so that it may perform well in future operations. Grain Corp

Ltd had customer receipts of 4315.6 in 2015, increased to 4350.5 in next year and further in 2017

as well. Payments to suppliers and employees are maximised (Tahat, Omran and Dunne, 2017).

Borrowings in 2017 has hiked to 42.2 which was -4 in 2016 and 9.1 in 2015. Interest received is

maximised in the latest year and interest paid have been accounted for and increased as well.

Income tax paid in 2017 was 21. Payment from PPE is increased in recent years. Computer

software payment is accounted for and maximised to 26.5 in 2017. Sale of PPE is increased and

cash inflow is being generated. Loans repaid to parties are made in 2015 only and as such, no

after payments were made. Proceeds from bank is maximised as it was 679.8 in 2015, 801.1 in

2016 and maximised to 941 in 2017. Loans repayments are increased in the latest financial year.

Treasury shares are purchased amounting to 4.1 in 2017. Thus, overall cash position is good in

2017 as opening balance was 307.6 and increased to 388.9 at the end.

2. Cash flows attained in previous years

It can be analysed that cash flow position of Grain Corp Ltd is well enough in the past

financial years (Liu, Li, Zeng and An, 2017). It is evident from the fact that cash flows from

operating activities are increased as it was only 275.1 in financial year 2015 and raised to 151.5

in 2016 and further maximised to 300.5 in 2017 which shows cash is generated effectively.

Investing activities are good as non-current assets are sold and cash has been produced.

Financing activities were 89.4 in 2015 while, it became -184.6 in 2017 which means outflow is

accomplished as cash is used in paying dividends. However, cash position is good.

3

Opening balance 307.6 374 206.2

Effect of Exchange rate

in a year 2.6 -21.9 20.5

Closing balance 388.9 307.6 374

The cash flow statements are being formulated for three years in the best possible

manner. It is justified in the past years that firm is able to perform good and as such, cash

position is good which is required so that it may perform well in future operations. Grain Corp

Ltd had customer receipts of 4315.6 in 2015, increased to 4350.5 in next year and further in 2017

as well. Payments to suppliers and employees are maximised (Tahat, Omran and Dunne, 2017).

Borrowings in 2017 has hiked to 42.2 which was -4 in 2016 and 9.1 in 2015. Interest received is

maximised in the latest year and interest paid have been accounted for and increased as well.

Income tax paid in 2017 was 21. Payment from PPE is increased in recent years. Computer

software payment is accounted for and maximised to 26.5 in 2017. Sale of PPE is increased and

cash inflow is being generated. Loans repaid to parties are made in 2015 only and as such, no

after payments were made. Proceeds from bank is maximised as it was 679.8 in 2015, 801.1 in

2016 and maximised to 941 in 2017. Loans repayments are increased in the latest financial year.

Treasury shares are purchased amounting to 4.1 in 2017. Thus, overall cash position is good in

2017 as opening balance was 307.6 and increased to 388.9 at the end.

2. Cash flows attained in previous years

It can be analysed that cash flow position of Grain Corp Ltd is well enough in the past

financial years (Liu, Li, Zeng and An, 2017). It is evident from the fact that cash flows from

operating activities are increased as it was only 275.1 in financial year 2015 and raised to 151.5

in 2016 and further maximised to 300.5 in 2017 which shows cash is generated effectively.

Investing activities are good as non-current assets are sold and cash has been produced.

Financing activities were 89.4 in 2015 while, it became -184.6 in 2017 which means outflow is

accomplished as cash is used in paying dividends. However, cash position is good.

3

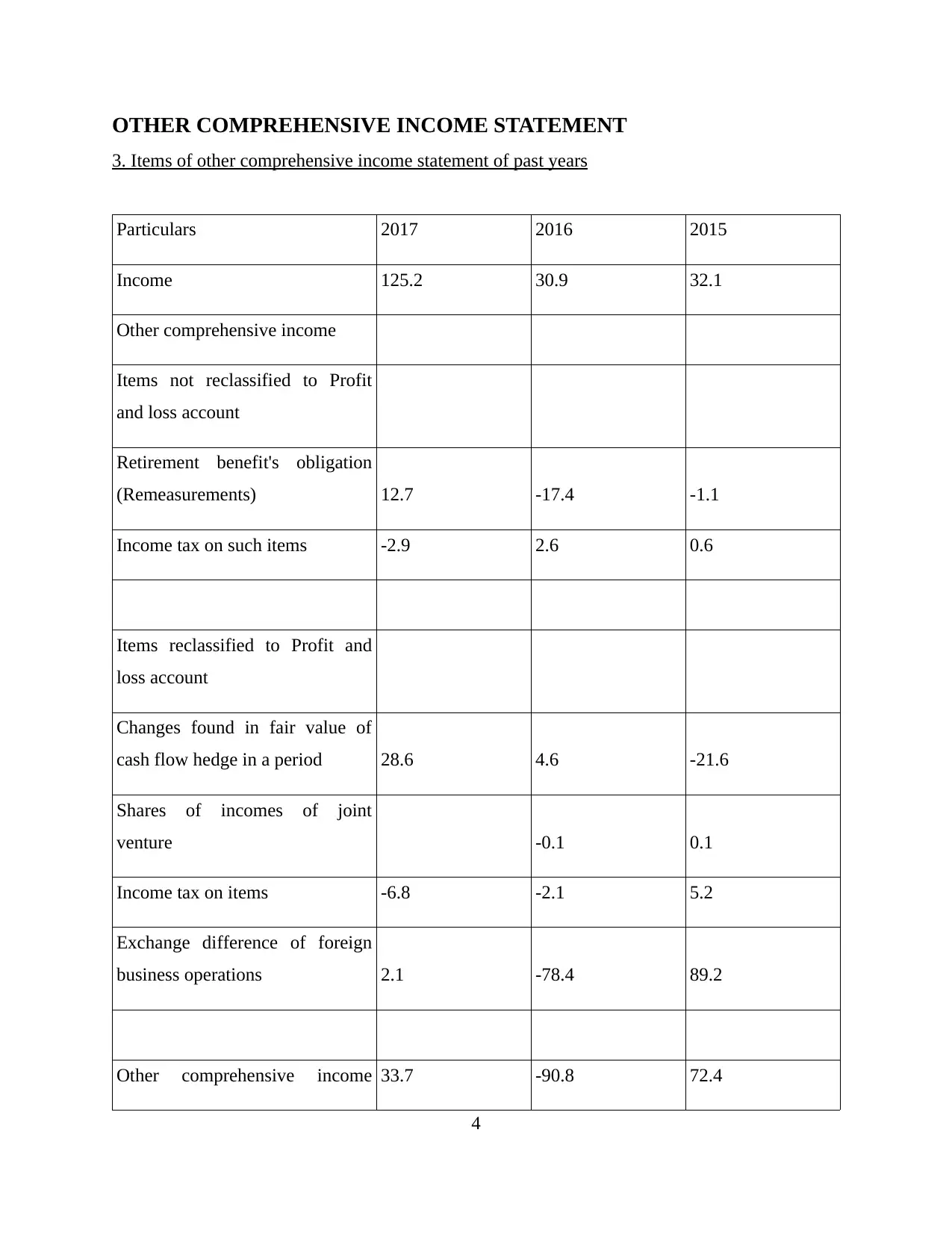

OTHER COMPREHENSIVE INCOME STATEMENT

3. Items of other comprehensive income statement of past years

Particulars 2017 2016 2015

Income 125.2 30.9 32.1

Other comprehensive income

Items not reclassified to Profit

and loss account

Retirement benefit's obligation

(Remeasurements) 12.7 -17.4 -1.1

Income tax on such items -2.9 2.6 0.6

Items reclassified to Profit and

loss account

Changes found in fair value of

cash flow hedge in a period 28.6 4.6 -21.6

Shares of incomes of joint

venture -0.1 0.1

Income tax on items -6.8 -2.1 5.2

Exchange difference of foreign

business operations 2.1 -78.4 89.2

Other comprehensive income 33.7 -90.8 72.4

4

3. Items of other comprehensive income statement of past years

Particulars 2017 2016 2015

Income 125.2 30.9 32.1

Other comprehensive income

Items not reclassified to Profit

and loss account

Retirement benefit's obligation

(Remeasurements) 12.7 -17.4 -1.1

Income tax on such items -2.9 2.6 0.6

Items reclassified to Profit and

loss account

Changes found in fair value of

cash flow hedge in a period 28.6 4.6 -21.6

Shares of incomes of joint

venture -0.1 0.1

Income tax on items -6.8 -2.1 5.2

Exchange difference of foreign

business operations 2.1 -78.4 89.2

Other comprehensive income 33.7 -90.8 72.4

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

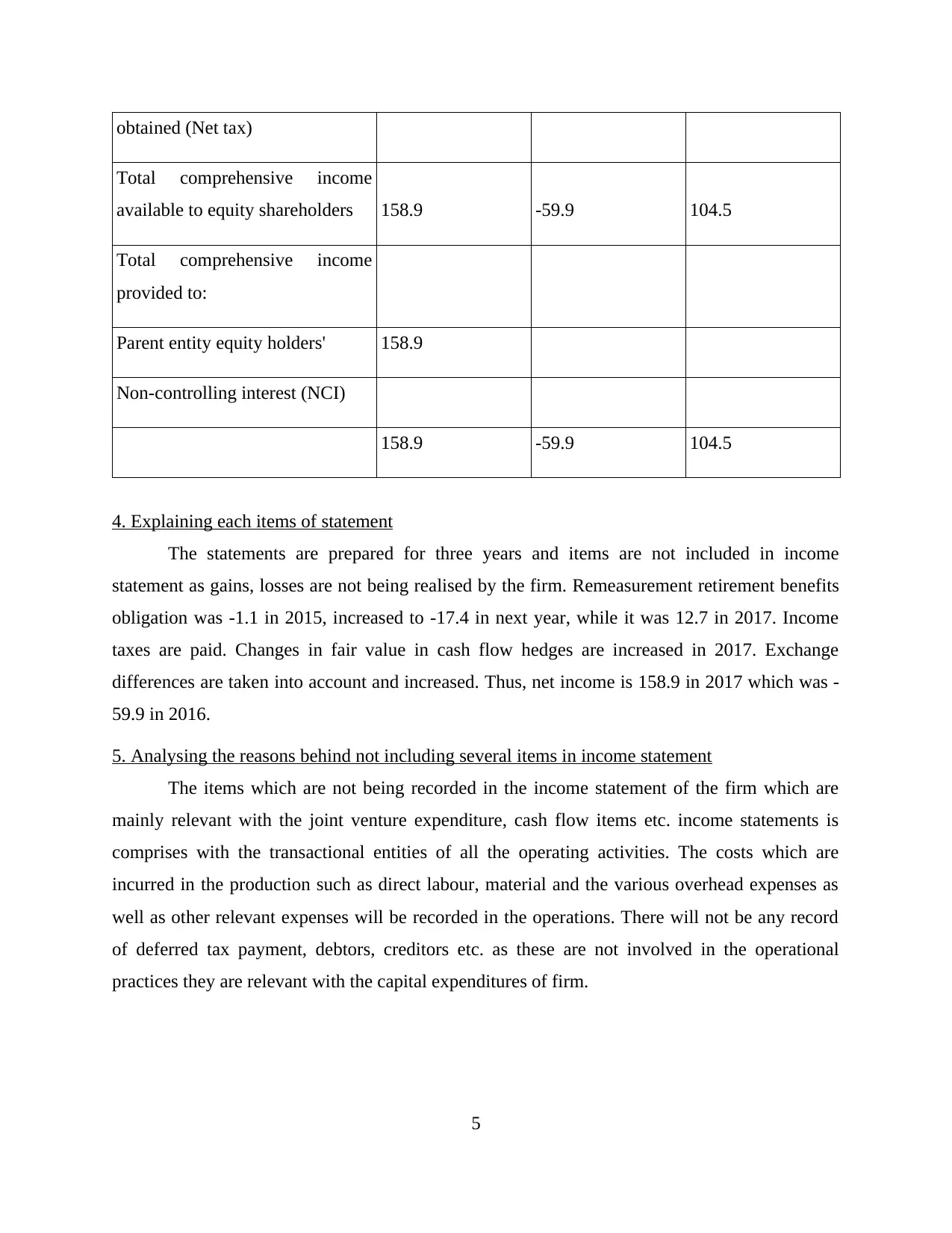

obtained (Net tax)

Total comprehensive income

available to equity shareholders 158.9 -59.9 104.5

Total comprehensive income

provided to:

Parent entity equity holders' 158.9

Non-controlling interest (NCI)

158.9 -59.9 104.5

4. Explaining each items of statement

The statements are prepared for three years and items are not included in income

statement as gains, losses are not being realised by the firm. Remeasurement retirement benefits

obligation was -1.1 in 2015, increased to -17.4 in next year, while it was 12.7 in 2017. Income

taxes are paid. Changes in fair value in cash flow hedges are increased in 2017. Exchange

differences are taken into account and increased. Thus, net income is 158.9 in 2017 which was -

59.9 in 2016.

5. Analysing the reasons behind not including several items in income statement

The items which are not being recorded in the income statement of the firm which are

mainly relevant with the joint venture expenditure, cash flow items etc. income statements is

comprises with the transactional entities of all the operating activities. The costs which are

incurred in the production such as direct labour, material and the various overhead expenses as

well as other relevant expenses will be recorded in the operations. There will not be any record

of deferred tax payment, debtors, creditors etc. as these are not involved in the operational

practices they are relevant with the capital expenditures of firm.

5

Total comprehensive income

available to equity shareholders 158.9 -59.9 104.5

Total comprehensive income

provided to:

Parent entity equity holders' 158.9

Non-controlling interest (NCI)

158.9 -59.9 104.5

4. Explaining each items of statement

The statements are prepared for three years and items are not included in income

statement as gains, losses are not being realised by the firm. Remeasurement retirement benefits

obligation was -1.1 in 2015, increased to -17.4 in next year, while it was 12.7 in 2017. Income

taxes are paid. Changes in fair value in cash flow hedges are increased in 2017. Exchange

differences are taken into account and increased. Thus, net income is 158.9 in 2017 which was -

59.9 in 2016.

5. Analysing the reasons behind not including several items in income statement

The items which are not being recorded in the income statement of the firm which are

mainly relevant with the joint venture expenditure, cash flow items etc. income statements is

comprises with the transactional entities of all the operating activities. The costs which are

incurred in the production such as direct labour, material and the various overhead expenses as

well as other relevant expenses will be recorded in the operations. There will not be any record

of deferred tax payment, debtors, creditors etc. as these are not involved in the operational

practices they are relevant with the capital expenditures of firm.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

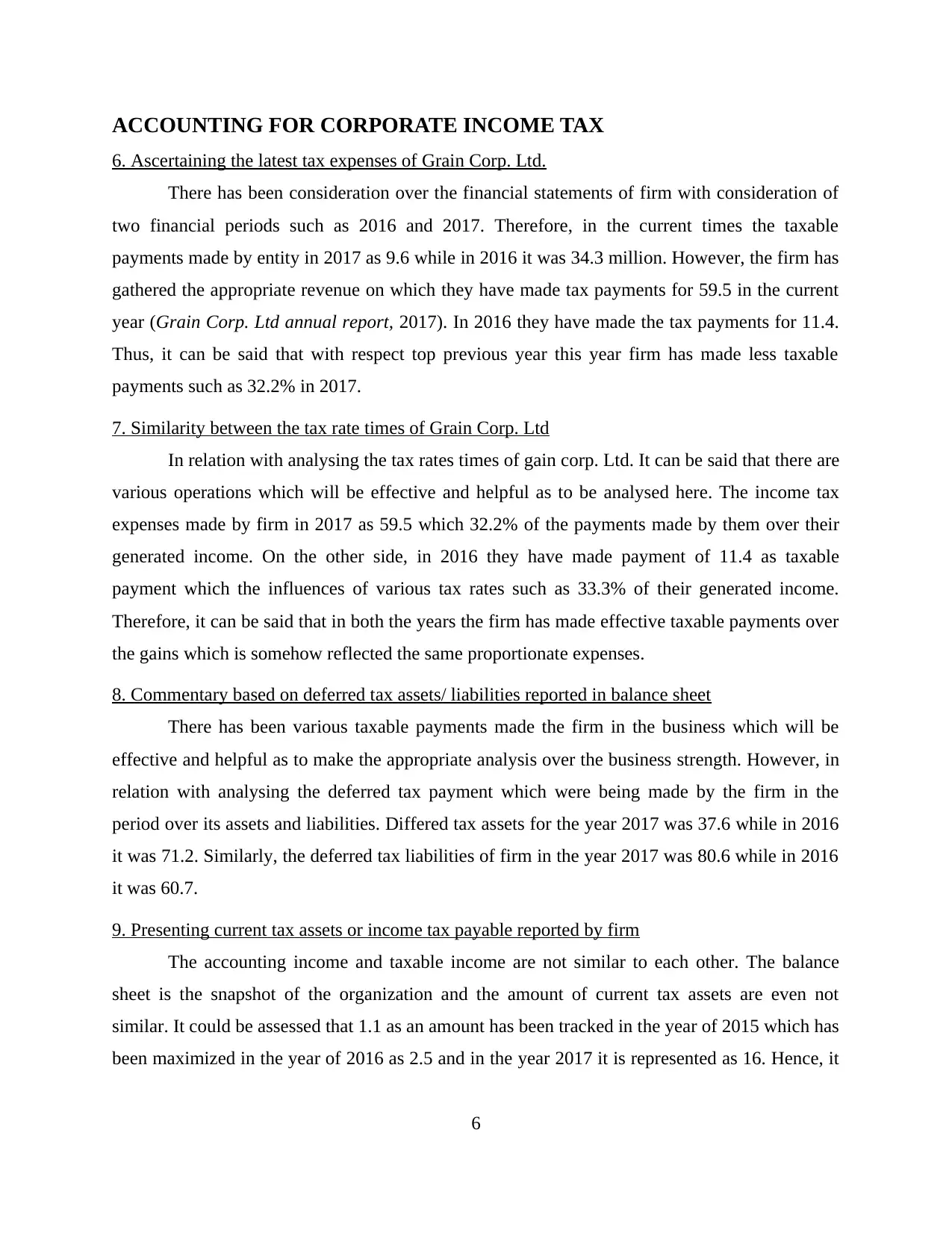

ACCOUNTING FOR CORPORATE INCOME TAX

6. Ascertaining the latest tax expenses of Grain Corp. Ltd.

There has been consideration over the financial statements of firm with consideration of

two financial periods such as 2016 and 2017. Therefore, in the current times the taxable

payments made by entity in 2017 as 9.6 while in 2016 it was 34.3 million. However, the firm has

gathered the appropriate revenue on which they have made tax payments for 59.5 in the current

year (Grain Corp. Ltd annual report, 2017). In 2016 they have made the tax payments for 11.4.

Thus, it can be said that with respect top previous year this year firm has made less taxable

payments such as 32.2% in 2017.

7. Similarity between the tax rate times of Grain Corp. Ltd

In relation with analysing the tax rates times of gain corp. Ltd. It can be said that there are

various operations which will be effective and helpful as to be analysed here. The income tax

expenses made by firm in 2017 as 59.5 which 32.2% of the payments made by them over their

generated income. On the other side, in 2016 they have made payment of 11.4 as taxable

payment which the influences of various tax rates such as 33.3% of their generated income.

Therefore, it can be said that in both the years the firm has made effective taxable payments over

the gains which is somehow reflected the same proportionate expenses.

8. Commentary based on deferred tax assets/ liabilities reported in balance sheet

There has been various taxable payments made the firm in the business which will be

effective and helpful as to make the appropriate analysis over the business strength. However, in

relation with analysing the deferred tax payment which were being made by the firm in the

period over its assets and liabilities. Differed tax assets for the year 2017 was 37.6 while in 2016

it was 71.2. Similarly, the deferred tax liabilities of firm in the year 2017 was 80.6 while in 2016

it was 60.7.

9. Presenting current tax assets or income tax payable reported by firm

The accounting income and taxable income are not similar to each other. The balance

sheet is the snapshot of the organization and the amount of current tax assets are even not

similar. It could be assessed that 1.1 as an amount has been tracked in the year of 2015 which has

been maximized in the year of 2016 as 2.5 and in the year 2017 it is represented as 16. Hence, it

6

6. Ascertaining the latest tax expenses of Grain Corp. Ltd.

There has been consideration over the financial statements of firm with consideration of

two financial periods such as 2016 and 2017. Therefore, in the current times the taxable

payments made by entity in 2017 as 9.6 while in 2016 it was 34.3 million. However, the firm has

gathered the appropriate revenue on which they have made tax payments for 59.5 in the current

year (Grain Corp. Ltd annual report, 2017). In 2016 they have made the tax payments for 11.4.

Thus, it can be said that with respect top previous year this year firm has made less taxable

payments such as 32.2% in 2017.

7. Similarity between the tax rate times of Grain Corp. Ltd

In relation with analysing the tax rates times of gain corp. Ltd. It can be said that there are

various operations which will be effective and helpful as to be analysed here. The income tax

expenses made by firm in 2017 as 59.5 which 32.2% of the payments made by them over their

generated income. On the other side, in 2016 they have made payment of 11.4 as taxable

payment which the influences of various tax rates such as 33.3% of their generated income.

Therefore, it can be said that in both the years the firm has made effective taxable payments over

the gains which is somehow reflected the same proportionate expenses.

8. Commentary based on deferred tax assets/ liabilities reported in balance sheet

There has been various taxable payments made the firm in the business which will be

effective and helpful as to make the appropriate analysis over the business strength. However, in

relation with analysing the deferred tax payment which were being made by the firm in the

period over its assets and liabilities. Differed tax assets for the year 2017 was 37.6 while in 2016

it was 71.2. Similarly, the deferred tax liabilities of firm in the year 2017 was 80.6 while in 2016

it was 60.7.

9. Presenting current tax assets or income tax payable reported by firm

The accounting income and taxable income are not similar to each other. The balance

sheet is the snapshot of the organization and the amount of current tax assets are even not

similar. It could be assessed that 1.1 as an amount has been tracked in the year of 2015 which has

been maximized in the year of 2016 as 2.5 and in the year 2017 it is represented as 16. Hence, it

6

has been clearly analyzed that liability of income tax will be raising in future as there is

maximization is current tax assets (Ijiri, 2018).

10. Is the income tax expense and income tax paid are similar

The reported income tax expense in the income statement is not similar to the paid

income tax which has been listed in cash flow statement. The variations are due to accounting

regulations and rules with perspective of financial reporting and it is distinguished when

computation of tax has been done and along with this, figures which are obtained are not similar

to each other. The amount of tax which is finalized can be attained and it should be payable on

profits which varies from the actual tax bills. It can be clearly depicted from the financial

statements that 59.5 is stated as income tax expense in the income statement. On its contrary,

Grain Corp Ltd has paid income tax in year 2017 is of 21 which varies from other and it can be

said that they are not similar.

11. Treatment of tax of Grain Corp Ltd

According to the accounting policies and rules which are adopted by various

organization, tax has been treated very differently (Duru and et.al., 2018). It has performed

proper analysis of Grain Corp Ltd, that different tax has been computed for the current financial

year. Straight line method has been selected by the organization and according to it fixed assets

are depreciated. Current liability which has been paid in the present year is income tax. 30% tax

rate has been applied, as it is according to rate of Australian government. Deferred tax is not

applied on the items where determining assets and liabilities and goodwill will be not having any

impact on the income of Grain Corp Ltd. Hence, consolidated tax group is purely headed by

presence of agreement in tax so by summing up the treatment of tax of this company is very

interesting to understand (Harris and Stahlin, 2018).

CONCLUSION

From the above report it can be concluded that for enhancing decisions financial

statements are properly utilized by each and every party. Scrutinizing financial gives major

benefit to external users of management and accounting information related to Grain Corp Ltd.

Further it has been concluded that expense of income tax always differs from the corporate tax

rate times the accounting income. Hence, they create the better opportunity for taking better

decisions which also leads to creating effectual opportunity.

7

maximization is current tax assets (Ijiri, 2018).

10. Is the income tax expense and income tax paid are similar

The reported income tax expense in the income statement is not similar to the paid

income tax which has been listed in cash flow statement. The variations are due to accounting

regulations and rules with perspective of financial reporting and it is distinguished when

computation of tax has been done and along with this, figures which are obtained are not similar

to each other. The amount of tax which is finalized can be attained and it should be payable on

profits which varies from the actual tax bills. It can be clearly depicted from the financial

statements that 59.5 is stated as income tax expense in the income statement. On its contrary,

Grain Corp Ltd has paid income tax in year 2017 is of 21 which varies from other and it can be

said that they are not similar.

11. Treatment of tax of Grain Corp Ltd

According to the accounting policies and rules which are adopted by various

organization, tax has been treated very differently (Duru and et.al., 2018). It has performed

proper analysis of Grain Corp Ltd, that different tax has been computed for the current financial

year. Straight line method has been selected by the organization and according to it fixed assets

are depreciated. Current liability which has been paid in the present year is income tax. 30% tax

rate has been applied, as it is according to rate of Australian government. Deferred tax is not

applied on the items where determining assets and liabilities and goodwill will be not having any

impact on the income of Grain Corp Ltd. Hence, consolidated tax group is purely headed by

presence of agreement in tax so by summing up the treatment of tax of this company is very

interesting to understand (Harris and Stahlin, 2018).

CONCLUSION

From the above report it can be concluded that for enhancing decisions financial

statements are properly utilized by each and every party. Scrutinizing financial gives major

benefit to external users of management and accounting information related to Grain Corp Ltd.

Further it has been concluded that expense of income tax always differs from the corporate tax

rate times the accounting income. Hence, they create the better opportunity for taking better

decisions which also leads to creating effectual opportunity.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

REFERENCES

Books and Journals

Duru, A., and et.al., 2018. Bank accounting regulations, enforcement mechanisms, and financial

statement informativeness: cross-country evidence. Accounting and Business Research.

pp.1-35.

Harris, P. and Stahlin, W., 2018. GAAP to IFRS Income Conversion Case Study: An

Examination of SEC Noted Accounting Differences. The Accounting Educators'

Journal. 27(1).

Ijiri, Y., 2018. An Introduction to Corporate Accounting Standards: A Review. Accounting,

Economics, and Law: A Convivium. 8(1).

8

Books and Journals

Duru, A., and et.al., 2018. Bank accounting regulations, enforcement mechanisms, and financial

statement informativeness: cross-country evidence. Accounting and Business Research.

pp.1-35.

Harris, P. and Stahlin, W., 2018. GAAP to IFRS Income Conversion Case Study: An

Examination of SEC Noted Accounting Differences. The Accounting Educators'

Journal. 27(1).

Ijiri, Y., 2018. An Introduction to Corporate Accounting Standards: A Review. Accounting,

Economics, and Law: A Convivium. 8(1).

8

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.