Corporate Accounting and Reporting: AASB 16 Lease Standards Review

VerifiedAdded on 2022/05/20

|9

|1385

|22

Report

AI Summary

This report provides a comprehensive overview of corporate accounting and reporting, with a specific focus on the application of AASB 16, the new lease accounting standard. The report begins with an introduction to the standard, highlighting its impact on how lessees account for operating leases, effectively removing the distinction between operating and finance leases. It then delves into a discussion of lease classification, emphasizing the risks and rewards associated with asset ownership, differentiating between finance and operating leases. The report elaborates on the commencement and period of leases, minimum lease payments, and fair values. It also examines the accounting principles for lessors under AASB 117, including financial lease recognition, fiscal proceeds, and the treatment of assets held for operating leases. The report further explains the amendments to the standard regarding initial direct costs and the treatment of sale-and-leaseback transactions. Finally, it highlights the disclosure requirements for lessors under AASB 16, including qualitative and quantitative data, risk management, and the nature of leasing activities. The report concludes by summarizing the key aspects of lease accounting and its application in financial reporting.

Running head: CORPORATE ACCOUNTING AND REPORTING

Corporate Accounting and Reporting

Name of the Student:

Name of the University:

Author Note:

Corporate Accounting and Reporting

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

Table of Contents

Part A............................................................................................................................2

Part B............................................................................................................................6

References...................................................................................................................8

Table of Contents

Part A............................................................................................................................2

Part B............................................................................................................................6

References...................................................................................................................8

2CORPORATE ACCOUNTING

Part A

Introduction

AASB 16 states that leases basically alter the monetary reporting background

for in what way lessees account for operating leases. As soon as new standards

come in effect it removes the classification regarding the operating leases as well as

the requirement on the part of all lessees in order to reflect it as a liability lease along

with the corresponding right to use the asset. The company is required to conclude

the necessary actions to be taken in order to finalise the preparation of financial

statement as per the applicability of new accounting standard. The modification

could be complex that effect could be outside the treatment level of accounting. As

the selections completed will disturb the approach the presentation of the

commercial is restrained and stated, it is energetic to deliberate not simply the

profitable and appliedproblems, but correspondingly the tax consequences of these

variations.

Part A

Introduction

AASB 16 states that leases basically alter the monetary reporting background

for in what way lessees account for operating leases. As soon as new standards

come in effect it removes the classification regarding the operating leases as well as

the requirement on the part of all lessees in order to reflect it as a liability lease along

with the corresponding right to use the asset. The company is required to conclude

the necessary actions to be taken in order to finalise the preparation of financial

statement as per the applicability of new accounting standard. The modification

could be complex that effect could be outside the treatment level of accounting. As

the selections completed will disturb the approach the presentation of the

commercial is restrained and stated, it is energetic to deliberate not simply the

profitable and appliedproblems, but correspondingly the tax consequences of these

variations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING

Discussion

The grouped of leases accepted in the Standard is constructed on the scope

to that risks as well as the rewards that are incidental to possession of constructed

assets to with the lessor. Risks comprise the potentials of lessees from idle capacity

or technical uselessness and of dissimilarities in reappearance due to altering

economic situations. A lease is classified as business lease if it assignment

significantly all the hazards and plunders occurrence to possession. An operating

lease is occupancy further than a finance lease. The lease is only termed as non-

cancellable lease at the occurrence of some isolated eventuality, if the lessor gives

the permission for cancellation, or there is new lease agreement related to similar

asset among other lessor and upon the imbursement made by the lessee of a

supplementary quantity such that, at beginning, continuance of the occupancy is

sensibly convinced (Aasb.gov.au 2019).

The commencement of the lease is the previous day of the lease contract or

of a assurance by the gatherings to the main requirements of the lease. The lease

period is the non-cancellable period for that the lease has measured to occupy the

asset collected with several additional relationships for associating the lesser has the

possibility to endure to tenancy of the assets with or deprived of additional

disbursement, which selection at the beginning of the occupancy it is rationally

convinced that the occupant will work out. Least possible lease expenditures are the

expenses over the occupancy period that the occupant is, or be able to be

compulsory, to brand exclusive of depending payment, prices for facilities and duties

to be remunerated by and refunded to the lessor. Fair price is the sum for which an

asset might be swapped or accountability established, amongst experienced, within

gatherings in an armrest’s measurement deal (Kilshaw 2013).

Discussion

The grouped of leases accepted in the Standard is constructed on the scope

to that risks as well as the rewards that are incidental to possession of constructed

assets to with the lessor. Risks comprise the potentials of lessees from idle capacity

or technical uselessness and of dissimilarities in reappearance due to altering

economic situations. A lease is classified as business lease if it assignment

significantly all the hazards and plunders occurrence to possession. An operating

lease is occupancy further than a finance lease. The lease is only termed as non-

cancellable lease at the occurrence of some isolated eventuality, if the lessor gives

the permission for cancellation, or there is new lease agreement related to similar

asset among other lessor and upon the imbursement made by the lessee of a

supplementary quantity such that, at beginning, continuance of the occupancy is

sensibly convinced (Aasb.gov.au 2019).

The commencement of the lease is the previous day of the lease contract or

of a assurance by the gatherings to the main requirements of the lease. The lease

period is the non-cancellable period for that the lease has measured to occupy the

asset collected with several additional relationships for associating the lesser has the

possibility to endure to tenancy of the assets with or deprived of additional

disbursement, which selection at the beginning of the occupancy it is rationally

convinced that the occupant will work out. Least possible lease expenditures are the

expenses over the occupancy period that the occupant is, or be able to be

compulsory, to brand exclusive of depending payment, prices for facilities and duties

to be remunerated by and refunded to the lessor. Fair price is the sum for which an

asset might be swapped or accountability established, amongst experienced, within

gatherings in an armrest’s measurement deal (Kilshaw 2013).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

As per AASB 117, the below stated are the principles that is been applied in

the case of fiscal statement of lessors.

As soon as the term of lease commence, the lessor is responsible to record

the monetary lease on the balance sheet under receivables that the amount is

equivalent to net investment in the lease.

The lessor is liable to identify fiscal proceeds that are based on an outline that

is reflecting a continuous timely rate of return on the lessor’s net investment

that is being outstanding in reference of the fiscal lease.

Assets apprehended for operating leases ought to be accessible in the

balance sheet of the lessor rendering to the feature of the asset. [IAS 17.49]

Lease income must be documented over the tenancy period on a traditional-

line base, except additional methodical base is more illustrative of the period

arrangement in which use advantage is resultant from the rented asset is

moderated (Aasb.gov.au 2019).

As per AASB 117, Manufacturers or dealer lessors ought to comprise sales

income or loss in the similar dated as they would for an absolute sale. If in sincerely

low-slung charges of attention are charged, retailing revenue must be limited to that

which would put on if a profitable percentage of interest were charged. After the

standard has been amended the incremental cost as well as initial direct cost that is

incurred by lessor for negotiating the leases it shall be identified over the term of

lease. That might no longer to record under expenses as on when it is incurred. This

treatment is not applicable for lessors dealing in manufacturing and dealing purposes

as those cost identification under expense as soon as the selling profit is identified.

As per AASB 117, the below stated are the principles that is been applied in

the case of fiscal statement of lessors.

As soon as the term of lease commence, the lessor is responsible to record

the monetary lease on the balance sheet under receivables that the amount is

equivalent to net investment in the lease.

The lessor is liable to identify fiscal proceeds that are based on an outline that

is reflecting a continuous timely rate of return on the lessor’s net investment

that is being outstanding in reference of the fiscal lease.

Assets apprehended for operating leases ought to be accessible in the

balance sheet of the lessor rendering to the feature of the asset. [IAS 17.49]

Lease income must be documented over the tenancy period on a traditional-

line base, except additional methodical base is more illustrative of the period

arrangement in which use advantage is resultant from the rented asset is

moderated (Aasb.gov.au 2019).

As per AASB 117, Manufacturers or dealer lessors ought to comprise sales

income or loss in the similar dated as they would for an absolute sale. If in sincerely

low-slung charges of attention are charged, retailing revenue must be limited to that

which would put on if a profitable percentage of interest were charged. After the

standard has been amended the incremental cost as well as initial direct cost that is

incurred by lessor for negotiating the leases it shall be identified over the term of

lease. That might no longer to record under expenses as on when it is incurred. This

treatment is not applicable for lessors dealing in manufacturing and dealing purposes

as those cost identification under expense as soon as the selling profit is identified.

5CORPORATE ACCOUNTING

The auction of an asset correspondingly its subsequent leasing by the

previous proprietor must be accounted for in a method replicating the material of the

communications when understood as a set. The real secretarial action will be

contingent upon the kind of lease complicated. If an auction as well as leaseback

business outcomes in a finance lease, several surplus of auctions in comes

concluded the carrying sum ought to be delayed and pay back in excess of the lease

period. An operating lease in addition is recognised at fair price, any revenue or loss

ought to be accredited instantly (Aasb.gov.au 2019).

According to AASB 16, a lessor will disclose all the qualitative as well as

quantitative data regarding the leasing activities so as to meet the essential

requirement of the standard. The additional data is inclusive of but is not complete to

data that helps in assessing the statement to its users. The risk management done

by the lessor is also retaining the right that is being possessed through asset. The

feature of leasing is also depended. In specific, a lessor will reveal its risk

organisation plan for the privileges it recalls in fundamental possessions, counting

any incomes by which the lessor decreases that risk. Such incomes may comprise,

for instance, buyback contracts, outstanding value assurances or adjustable lease

expenditures for usage in extra of quantified restrictions (Moussaly and Wang 2014).

The auction of an asset correspondingly its subsequent leasing by the

previous proprietor must be accounted for in a method replicating the material of the

communications when understood as a set. The real secretarial action will be

contingent upon the kind of lease complicated. If an auction as well as leaseback

business outcomes in a finance lease, several surplus of auctions in comes

concluded the carrying sum ought to be delayed and pay back in excess of the lease

period. An operating lease in addition is recognised at fair price, any revenue or loss

ought to be accredited instantly (Aasb.gov.au 2019).

According to AASB 16, a lessor will disclose all the qualitative as well as

quantitative data regarding the leasing activities so as to meet the essential

requirement of the standard. The additional data is inclusive of but is not complete to

data that helps in assessing the statement to its users. The risk management done

by the lessor is also retaining the right that is being possessed through asset. The

feature of leasing is also depended. In specific, a lessor will reveal its risk

organisation plan for the privileges it recalls in fundamental possessions, counting

any incomes by which the lessor decreases that risk. Such incomes may comprise,

for instance, buyback contracts, outstanding value assurances or adjustable lease

expenditures for usage in extra of quantified restrictions (Moussaly and Wang 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

Conclusion

Accounting in case of leases applies to the contracts that give the right for

using an asset straight however considerable facilities by the lessor might be called

for in adaptation with the process or preservation of such assets. This standard is not

applicable to those agreements that are contracts for facilities that shall not handover

the right to use assets from another party to the other.

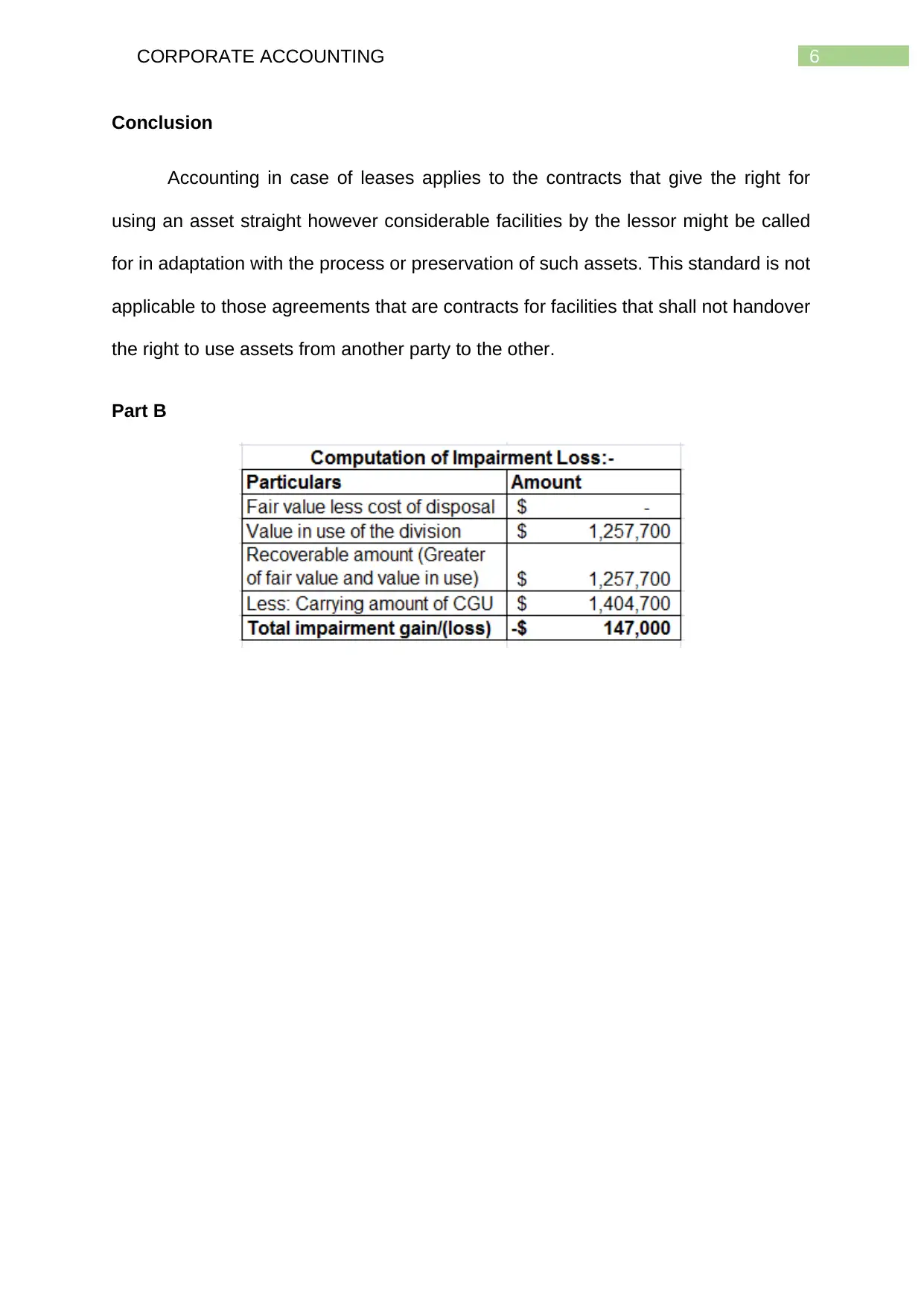

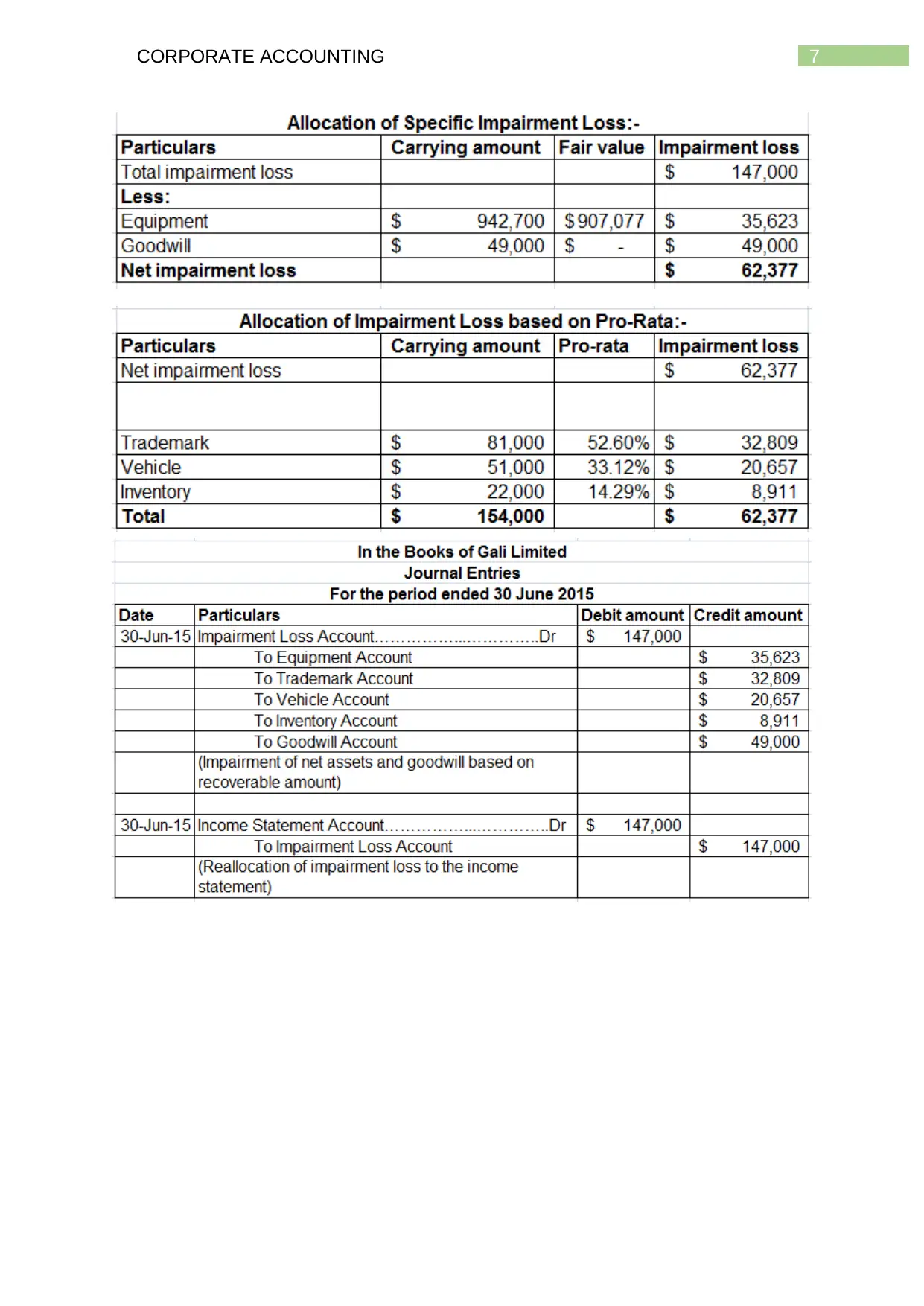

Part B

Conclusion

Accounting in case of leases applies to the contracts that give the right for

using an asset straight however considerable facilities by the lessor might be called

for in adaptation with the process or preservation of such assets. This standard is not

applicable to those agreements that are contracts for facilities that shall not handover

the right to use assets from another party to the other.

Part B

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

8CORPORATE ACCOUNTING

References

Aasb.gov.au. (2019). [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf [Accessed 25

Jan. 2019].

Islam, M.A., Islam, M.R. and Siddiqui, M.H., 2014. Lease financing of Bangladesh: A

descriptive analysis. International Journal of Economics, Finance and Management

Sciences, (1), p.2.

Kilshaw, R.J., 2013. System for enabling consumers to evaluate automobile leases.

U.S. Patent 8,392,280.

Kolpak, E.P., Gorynya, E.V., Shaposhnikova, A.I., Khasenova, K.E. and

Zemlyakova, N.S., 2016. Special aspects of leasing activities and its meaning in

conditions of enterprise competitiveness. International Review of Management and

Marketing, 6(6S), pp.126-133.

Moussaly, K. and Wang, W., 2014. The Impact of Leased and Rented Assets on

Industry Productivity Measurement. Statistics Canada= Statistique Canada.

Treasury.nsw.gov.au., 2019. [online] Available at:

https://www.treasury.nsw.gov.au/sites/default/files/2017-04/Guidance%20for

%20AASB%2016%20Leases%20-%20New%20Lease%20Standards.pdf [Accessed

25 Jan. 2019].

Wong, K. and Joshi, M., 2015. The impact of lease capitalisation on financial

statements and key ratios: Evidence from Australia. Australasian Accounting,

Business and Finance Journal, 9(3), pp.27-44.

References

Aasb.gov.au. (2019). [online] Available at:

https://www.aasb.gov.au/admin/file/content105/c9/AASB16_02-16.pdf [Accessed 25

Jan. 2019].

Islam, M.A., Islam, M.R. and Siddiqui, M.H., 2014. Lease financing of Bangladesh: A

descriptive analysis. International Journal of Economics, Finance and Management

Sciences, (1), p.2.

Kilshaw, R.J., 2013. System for enabling consumers to evaluate automobile leases.

U.S. Patent 8,392,280.

Kolpak, E.P., Gorynya, E.V., Shaposhnikova, A.I., Khasenova, K.E. and

Zemlyakova, N.S., 2016. Special aspects of leasing activities and its meaning in

conditions of enterprise competitiveness. International Review of Management and

Marketing, 6(6S), pp.126-133.

Moussaly, K. and Wang, W., 2014. The Impact of Leased and Rented Assets on

Industry Productivity Measurement. Statistics Canada= Statistique Canada.

Treasury.nsw.gov.au., 2019. [online] Available at:

https://www.treasury.nsw.gov.au/sites/default/files/2017-04/Guidance%20for

%20AASB%2016%20Leases%20-%20New%20Lease%20Standards.pdf [Accessed

25 Jan. 2019].

Wong, K. and Joshi, M., 2015. The impact of lease capitalisation on financial

statements and key ratios: Evidence from Australia. Australasian Accounting,

Business and Finance Journal, 9(3), pp.27-44.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.