HI5020 Corporate Accounting: Comparative Analysis of AGL & Beach

VerifiedAdded on 2023/06/04

|12

|788

|243

Report

AI Summary

This report provides a comprehensive analysis of AGL Energy Limited and Beach Energy Limited, focusing on key corporate accounting aspects. It examines the owner's equity, compares comprehensive income statements, and analyzes tax expenses, effective tax rates, and deferred tax assets and liabilities for both companies. The report uses data from the companies' annual reports to evaluate their financial positions and changes in their financial performance between 2016 and 2017. The analysis helps in understanding the financial health and tax strategies of AGL Energy and Beach Energy, providing insights into their corporate accounting practices. This document is available on Desklib, a platform offering a range of study tools and solved assignments for students.

Corporate

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of contents

• Introduction

• Description of owner’s equity for AGL and Beach

Energy Limited

• Comprehensive Income Statement Comparison

• Tax Expenses

• Effective tax rate

• Deferred tax assets and liabilities

• Conclusion

• References

• Introduction

• Description of owner’s equity for AGL and Beach

Energy Limited

• Comprehensive Income Statement Comparison

• Tax Expenses

• Effective tax rate

• Deferred tax assets and liabilities

• Conclusion

• References

Introduction

• The report explains about the various corporate

accounting aspects which are been taken into

consideration by the individuals in context of AGL

Energy Limited and Beach Energy Limited.

• The aspects of the other comprehensive income

statement are also depicted and with the

understanding of the corporate taxes are also

provided throughout the report by calculating the

effective tax rates.

• The report explains about the various corporate

accounting aspects which are been taken into

consideration by the individuals in context of AGL

Energy Limited and Beach Energy Limited.

• The aspects of the other comprehensive income

statement are also depicted and with the

understanding of the corporate taxes are also

provided throughout the report by calculating the

effective tax rates.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Description of owner’s equity of Beach and

AGL Energy Limited

• In AGL Energy constrained the obligation has demonstrated

the immense increment which can be uncovered that the

sum in 2016 was $6678 which has expanded to $6884 and

the value sum has been diminished from $7926 to $7574.

• In Beach Energy Limited it has been seen that the measure

of obligation has been diminished from 2016 to 2017 that is

it was $149 and which diminished to $126 which is great

sign for the association (Beach Energy Limited, 2018). The

measure of the value has been expanded that is in 2016 it

was $1074 which expanded to $1402.

AGL Energy Limited

• In AGL Energy constrained the obligation has demonstrated

the immense increment which can be uncovered that the

sum in 2016 was $6678 which has expanded to $6884 and

the value sum has been diminished from $7926 to $7574.

• In Beach Energy Limited it has been seen that the measure

of obligation has been diminished from 2016 to 2017 that is

it was $149 and which diminished to $126 which is great

sign for the association (Beach Energy Limited, 2018). The

measure of the value has been expanded that is in 2016 it

was $1074 which expanded to $1402.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Statement Comparison (AGL

Energy Limited)

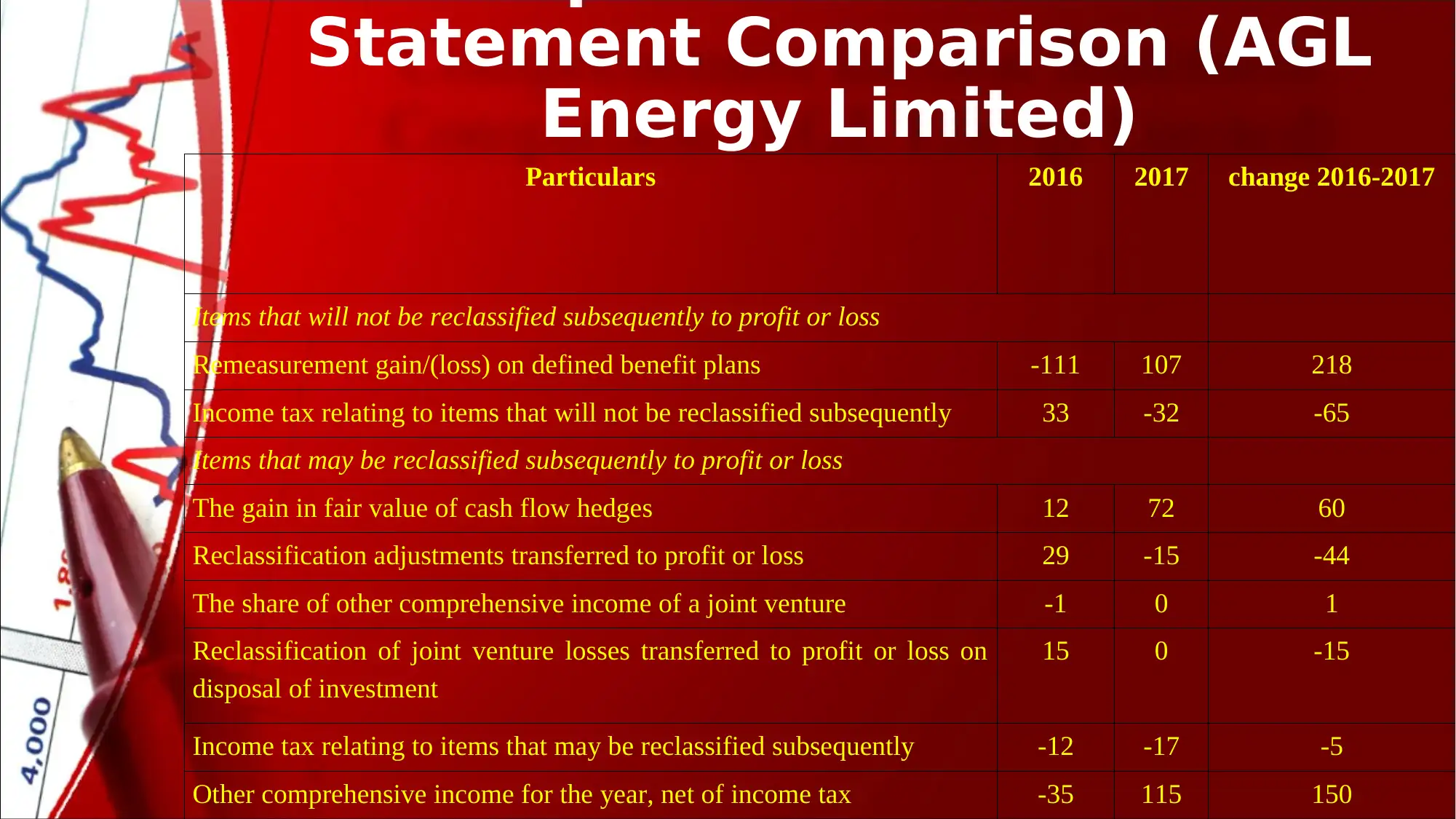

Particulars 2016 2017 change 2016-2017

Items that will not be reclassified subsequently to profit or loss

Remeasurement gain/(loss) on defined benefit plans -111 107 218

Income tax relating to items that will not be reclassified subsequently 33 -32 -65

Items that may be reclassified subsequently to profit or loss

The gain in fair value of cash flow hedges 12 72 60

Reclassification adjustments transferred to profit or loss 29 -15 -44

The share of other comprehensive income of a joint venture -1 0 1

Reclassification of joint venture losses transferred to profit or loss on

disposal of investment

15 0 -15

Income tax relating to items that may be reclassified subsequently -12 -17 -5

Other comprehensive income for the year, net of income tax -35 115 150

Energy Limited)

Particulars 2016 2017 change 2016-2017

Items that will not be reclassified subsequently to profit or loss

Remeasurement gain/(loss) on defined benefit plans -111 107 218

Income tax relating to items that will not be reclassified subsequently 33 -32 -65

Items that may be reclassified subsequently to profit or loss

The gain in fair value of cash flow hedges 12 72 60

Reclassification adjustments transferred to profit or loss 29 -15 -44

The share of other comprehensive income of a joint venture -1 0 1

Reclassification of joint venture losses transferred to profit or loss on

disposal of investment

15 0 -15

Income tax relating to items that may be reclassified subsequently -12 -17 -5

Other comprehensive income for the year, net of income tax -35 115 150

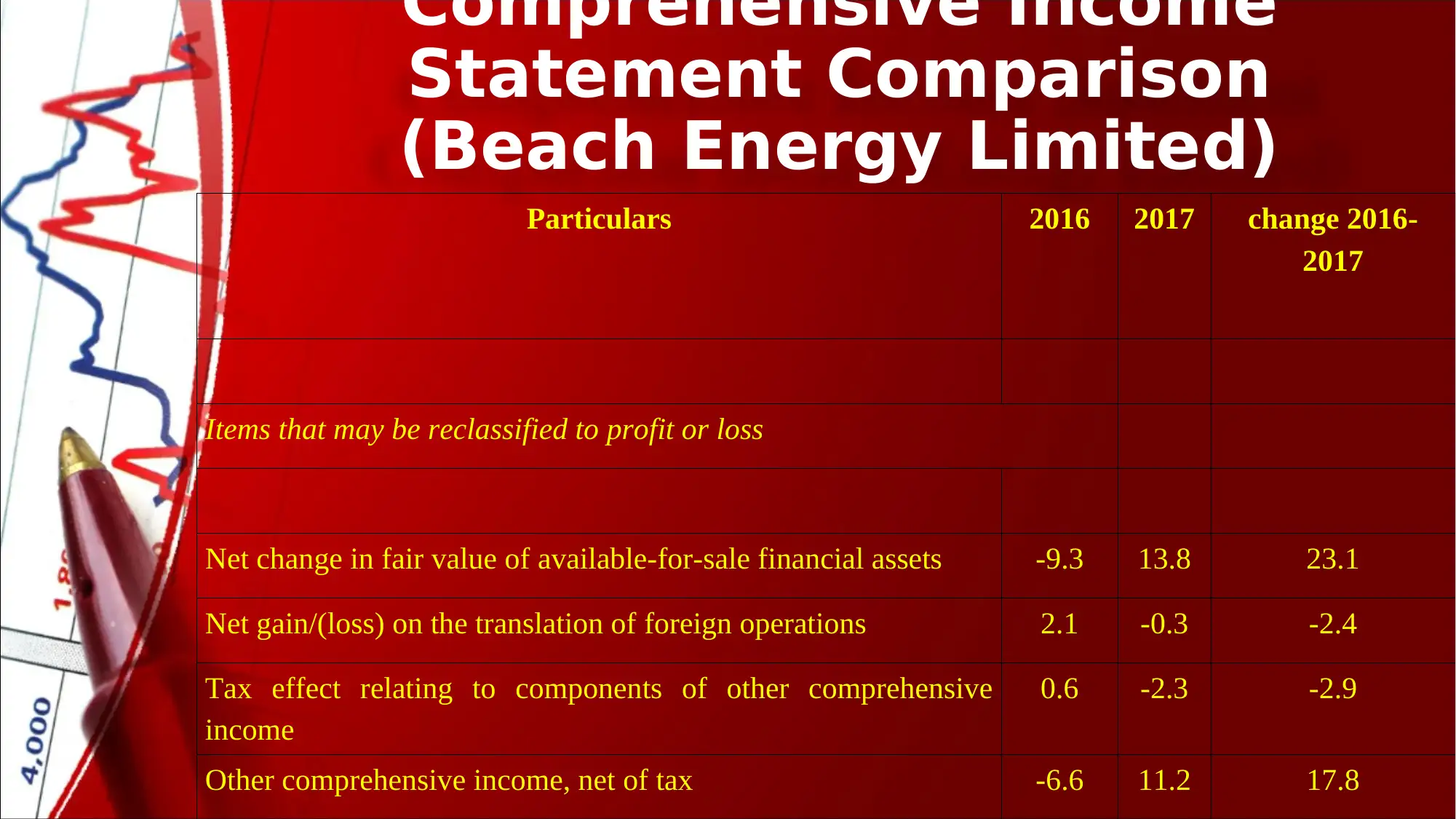

Comprehensive Income

Statement Comparison

(Beach Energy Limited)

Particulars 2016 2017 change 2016-

2017

Items that may be reclassified to profit or loss

Net change in fair value of available-for-sale financial assets -9.3 13.8 23.1

Net gain/(loss) on the translation of foreign operations 2.1 -0.3 -2.4

Tax effect relating to components of other comprehensive

income

0.6 -2.3 -2.9

Other comprehensive income, net of tax -6.6 11.2 17.8

Statement Comparison

(Beach Energy Limited)

Particulars 2016 2017 change 2016-

2017

Items that may be reclassified to profit or loss

Net change in fair value of available-for-sale financial assets -9.3 13.8 23.1

Net gain/(loss) on the translation of foreign operations 2.1 -0.3 -2.4

Tax effect relating to components of other comprehensive

income

0.6 -2.3 -2.9

Other comprehensive income, net of tax -6.6 11.2 17.8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

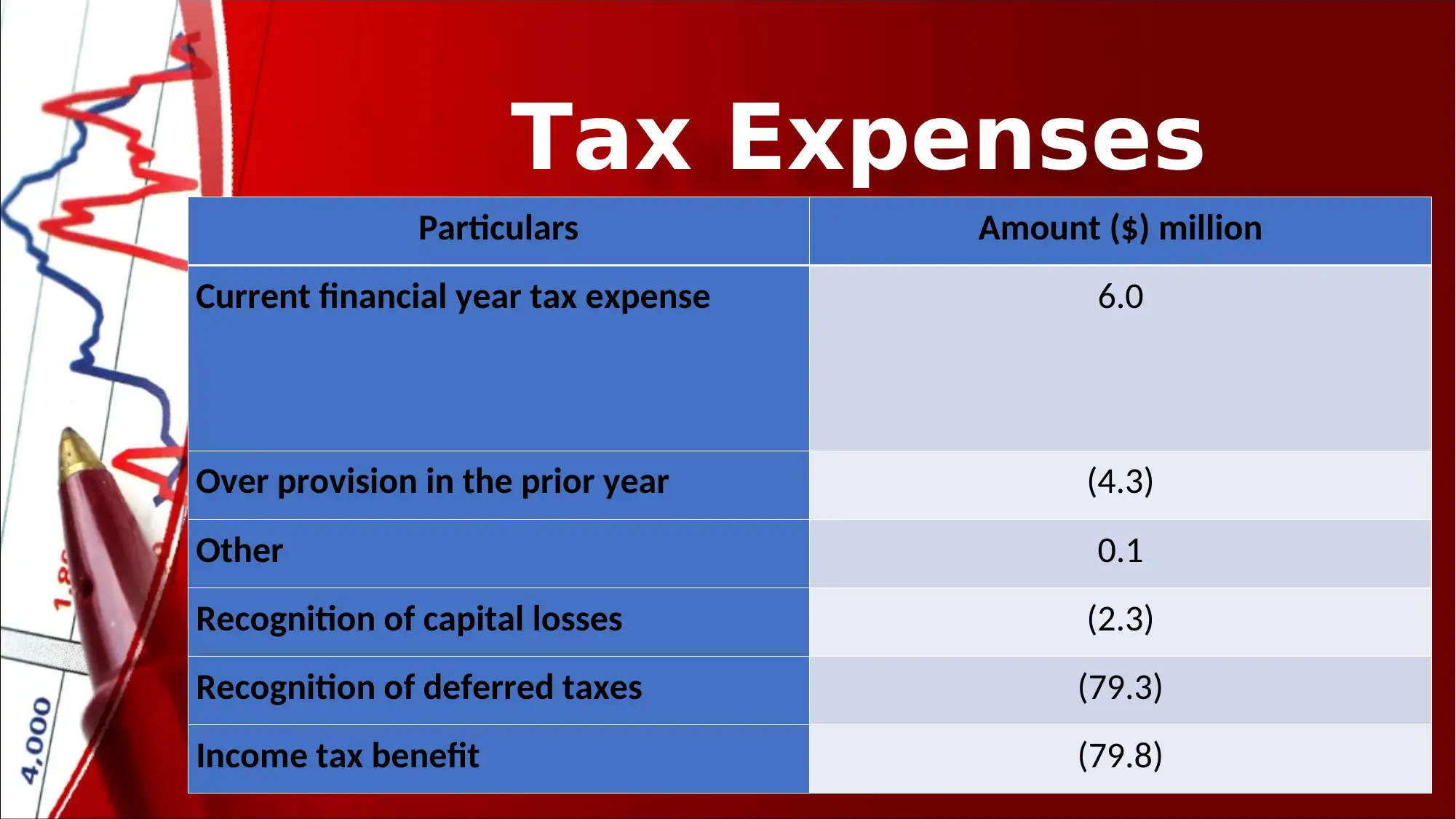

Tax Expenses

Particulars Amount ($) million

Current financial year tax expense 6.0

Over provision in the prior year (4.3)

Other 0.1

Recognition of capital losses (2.3)

Recognition of deferred taxes (79.3)

Income tax benefit (79.8)

Particulars Amount ($) million

Current financial year tax expense 6.0

Over provision in the prior year (4.3)

Other 0.1

Recognition of capital losses (2.3)

Recognition of deferred taxes (79.3)

Income tax benefit (79.8)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

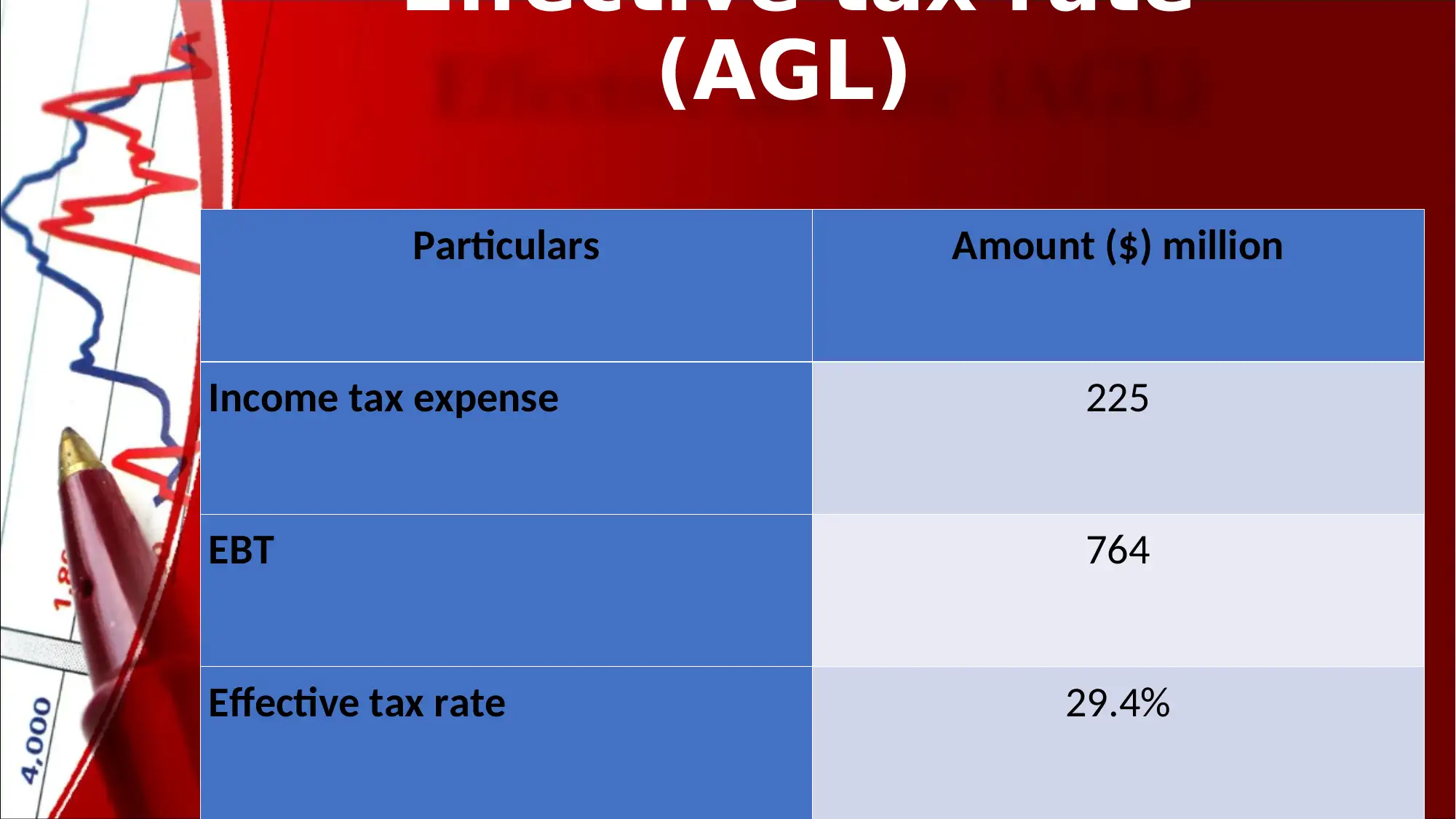

Effective tax rate

(AGL)

Particulars Amount ($) million

Income tax expense 225

EBT 764

Effective tax rate 29.4%

(AGL)

Particulars Amount ($) million

Income tax expense 225

EBT 764

Effective tax rate 29.4%

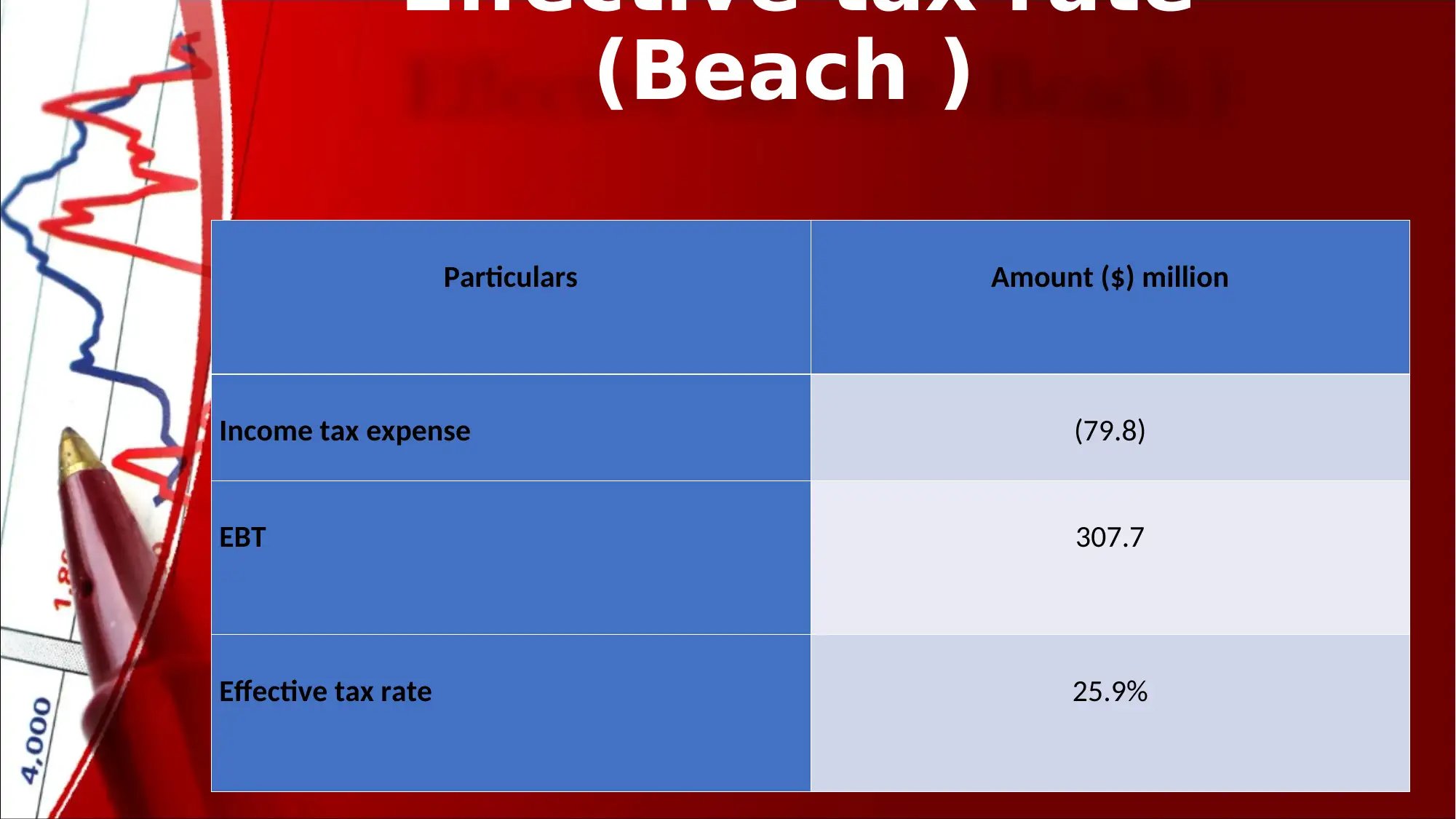

Effective tax rate

(Beach )

Particulars Amount ($) million

Income tax expense (79.8)

EBT 307.7

Effective tax rate 25.9%

(Beach )

Particulars Amount ($) million

Income tax expense (79.8)

EBT 307.7

Effective tax rate 25.9%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Deferred tax assets

and liabilities

• It has been observed that in the financial

statements of the Beach Energy Limited there is

$79.3 million which is reported as the deferred tax

assets.

• The Deferred tax assets in the event of AGL Energy

constrained is $792 million which is identifying with

impose misfortunes perceived amid the earlier

years and whose advantage will be gotten in the

present assessment year. The

and liabilities

• It has been observed that in the financial

statements of the Beach Energy Limited there is

$79.3 million which is reported as the deferred tax

assets.

• The Deferred tax assets in the event of AGL Energy

constrained is $792 million which is identifying with

impose misfortunes perceived amid the earlier

years and whose advantage will be gotten in the

present assessment year. The

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Conclusion

• From the overall discussion it can be concluded that

financial statements are necessary as they help in

examining the financial position of organization.

• The comparisons are also evaluated so that the

reason for change can be determined and accordingly

the actions for future growth can be taken.

• The tax rates will helps in analysing the amounts that

needs to be paid by the organization in the form of

tax.

• From the overall discussion it can be concluded that

financial statements are necessary as they help in

examining the financial position of organization.

• The comparisons are also evaluated so that the

reason for change can be determined and accordingly

the actions for future growth can be taken.

• The tax rates will helps in analysing the amounts that

needs to be paid by the organization in the form of

tax.

References

AGL Energy Limited. (2017). Annual report. [Online]. Retrieved from:

https://www.agl.com.au/-/media/aglmedia/documents/about-agl/investors

/annual-reports/170825-agl-207-annual-report-asx.pdf?

la=en&hash=7DAB19CD5A9A948AA9ACCF3D0B5C4D19E6402AE4

Beach Energy Limited. (2016). Annual report. [Online]. Retrieved from:

http://www.beachenergy.com.au/irm/PDF/6288_0/2016BeachEnergyLtdAn

nualReport Beach Energy Limited. (2017). Annual report. [Online]. Retrieved

from:

http://www.beachenergy.com.au/irm/PDF/6793_0/2017annualreport?

IncludeUnapproved=83324855

Crane, A. and Matten, D., (2016). Business ethics: Managing corporate

citizenship and sustainability in the age of globalization. UK: Oxford

University Press.

AGL Energy Limited. (2017). Annual report. [Online]. Retrieved from:

https://www.agl.com.au/-/media/aglmedia/documents/about-agl/investors

/annual-reports/170825-agl-207-annual-report-asx.pdf?

la=en&hash=7DAB19CD5A9A948AA9ACCF3D0B5C4D19E6402AE4

Beach Energy Limited. (2016). Annual report. [Online]. Retrieved from:

http://www.beachenergy.com.au/irm/PDF/6288_0/2016BeachEnergyLtdAn

nualReport Beach Energy Limited. (2017). Annual report. [Online]. Retrieved

from:

http://www.beachenergy.com.au/irm/PDF/6793_0/2017annualreport?

IncludeUnapproved=83324855

Crane, A. and Matten, D., (2016). Business ethics: Managing corporate

citizenship and sustainability in the age of globalization. UK: Oxford

University Press.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.