Corporate Accounting: AASB 136 and Impairment of Assets Analysis

VerifiedAdded on 2021/06/17

|8

|1586

|18

Homework Assignment

AI Summary

This assignment provides a comprehensive analysis of AASB 136, focusing on the impairment of assets in corporate accounting. The assignment begins with an overview of the standard, explaining its applicability to reporting entities and its objective of ensuring that the carrying amount of an asset does not exceed its recoverable amount. It details the conditions under which impairment losses may occur, distinguishing between external and internal sources of information. The core of the assignment explains the concept of recoverable amount, which is defined as the higher of fair value less costs of disposal and value in use. The calculation of both fair value and value in use are elaborated, including the steps involved in estimating future cash flows and applying an appropriate discount rate. The assignment then moves on to provide the journal entries for impairment loss, along with the working notes showing the computation of the impairment loss and its allocation to different assets like copyright, machinery, inventory and equipment. The assignment concludes with a list of relevant references.

Corporate accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Part A...............................................................................................................................................3

Part B...............................................................................................................................................6

References........................................................................................................................................7

Part A...............................................................................................................................................3

Part B...............................................................................................................................................6

References........................................................................................................................................7

Part A

Accounting standard of AASB 136 Impairment of assets is applicable to every enterprise needed

to prepare financial statements according to the part 2M.3 of the Corporations Act which is said

to be a reporting entity. Further, the standard targets on ensuring that carrying the amount of

asset must not surpass the recoverable amount while laying the process that an enterprise applies

to make sure that the carrying amount of asset is not more than the recoverable amount (Huikku,

Mouritsen and Silvola, 2017). Impairment of asset is done when the carried amount of the same

surpasses recoverable amount.

Paragraphs 12–14 of the standard (AASB 136), depicts certain conditions stating that an

impairment loss may have incurred. Such indication is considered under two sources which are

external and internal sources of information.

Recoverable amount is a term based on financial accounting; it is referred to the larger part of an

asset’s value offered to the corporate of presently being used. The notion of recoverable amount

is generally used in terms of identifying the impairment testing of fixed assets such as plant,

property or equipment (Barker and Schulte, 2017). The further recoverable amount is the greater

of the fair value of an asset from which cost of sell and value in use as well as discounted cash

flow determination is deducted. Moreover, an enterprise shall test goodwill and some other

intangibles for impairment on an annual basis.

In case the disposal costs are said to negligible, then the asset’s recoverable amount is closer or

greater as compared to the revaluated amount. In such situation, after applying the revaluation

requirements, it is not likely that there is impairment of revalued assets and there is no

requirement of estimating recoverable amount.

In case the disposal costs are not said to negligible, then the fair value minus cost of disposal is

comparatively less than its fair value (Sellhorn and Stier, 2017). Thus, impairing of the revalued

asset will be done if the VIU is lesser than the revalued amount. In such situation, after applying

the revaluation requirements, this standard is applied by the enterprise to identify whether the

asset might be impaired.

Below is presented the calculation for recoverable computing amount:

Accounting standard of AASB 136 Impairment of assets is applicable to every enterprise needed

to prepare financial statements according to the part 2M.3 of the Corporations Act which is said

to be a reporting entity. Further, the standard targets on ensuring that carrying the amount of

asset must not surpass the recoverable amount while laying the process that an enterprise applies

to make sure that the carrying amount of asset is not more than the recoverable amount (Huikku,

Mouritsen and Silvola, 2017). Impairment of asset is done when the carried amount of the same

surpasses recoverable amount.

Paragraphs 12–14 of the standard (AASB 136), depicts certain conditions stating that an

impairment loss may have incurred. Such indication is considered under two sources which are

external and internal sources of information.

Recoverable amount is a term based on financial accounting; it is referred to the larger part of an

asset’s value offered to the corporate of presently being used. The notion of recoverable amount

is generally used in terms of identifying the impairment testing of fixed assets such as plant,

property or equipment (Barker and Schulte, 2017). The further recoverable amount is the greater

of the fair value of an asset from which cost of sell and value in use as well as discounted cash

flow determination is deducted. Moreover, an enterprise shall test goodwill and some other

intangibles for impairment on an annual basis.

In case the disposal costs are said to negligible, then the asset’s recoverable amount is closer or

greater as compared to the revaluated amount. In such situation, after applying the revaluation

requirements, it is not likely that there is impairment of revalued assets and there is no

requirement of estimating recoverable amount.

In case the disposal costs are not said to negligible, then the fair value minus cost of disposal is

comparatively less than its fair value (Sellhorn and Stier, 2017). Thus, impairing of the revalued

asset will be done if the VIU is lesser than the revalued amount. In such situation, after applying

the revaluation requirements, this standard is applied by the enterprise to identify whether the

asset might be impaired.

Below is presented the calculation for recoverable computing amount:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The asset’s recoverable amount is the higher of the two key calculations; recoverable amount

equals to fair value less cost of disposal, and recoverable amount equals to value in use. By

considering this aspect, fair value is the price that will be gained while the asset is sold, whereas

the cost of disposal is the additional expenditure attributed directly to the alleviation of the asset.

IAS 36 has provided guidelines to financial users and accountant on this current topic as, if the

fair value of asset minus the cost of disposal is not able to be identified, wherein the recoverable

amount is equivalent to the value in use (Goncharov, Riedl and Sellhorn, 2014). In a situation

where a company aims to sell the asset, then the recoverable amount is equivalent to the fair

value of the same asset from which cost of disposal will be deducted.

Recoverable amount is the larger of the fair value of asset minus cost of disposal often known as

selling price and its value in use.

Fair value refers to the price that would be obtained by selling an asset or paying in order to

transfer a liability on an orderly transactional basis amongst market contestants during

measurement date (Whittington, 2015).

The value in use means the current value of the future cash flows likely to be obtained from an

asset or CGU. As per AASB 136 Value in use, is a crucial figure in considering whether an

impairment loss will take place while determining the value in use of the asset (Badia and et al.,

2017).

To estimate the VIU, there are some steps to be followed; initially, it is essential to estimate the

cash inflows and outflows of future basis which are to be derived from constant use and disposal

of an asset after that suitable discount rate is to be applied to the same future cash flows.

In order to determine recoverable amount, in a scenario where fair value minus cost of disposal

or VIU is greater as compared to the carrying amount, it is not required to compute the another

amount, it is because the asset is not assessed to be impaired under IAS 36.19 (Magnan, Menini

and Parbonetti, 2015). In case, it is not possible to determine the fair value minus cost of capital;

the recoverable amount is said to be the VIU as per the IAS 36.20. For the disposal of the assets,

the recoverable amount is assessed as a fair value from which cost of capital is deducted

according to IAS 36.21.

equals to fair value less cost of disposal, and recoverable amount equals to value in use. By

considering this aspect, fair value is the price that will be gained while the asset is sold, whereas

the cost of disposal is the additional expenditure attributed directly to the alleviation of the asset.

IAS 36 has provided guidelines to financial users and accountant on this current topic as, if the

fair value of asset minus the cost of disposal is not able to be identified, wherein the recoverable

amount is equivalent to the value in use (Goncharov, Riedl and Sellhorn, 2014). In a situation

where a company aims to sell the asset, then the recoverable amount is equivalent to the fair

value of the same asset from which cost of disposal will be deducted.

Recoverable amount is the larger of the fair value of asset minus cost of disposal often known as

selling price and its value in use.

Fair value refers to the price that would be obtained by selling an asset or paying in order to

transfer a liability on an orderly transactional basis amongst market contestants during

measurement date (Whittington, 2015).

The value in use means the current value of the future cash flows likely to be obtained from an

asset or CGU. As per AASB 136 Value in use, is a crucial figure in considering whether an

impairment loss will take place while determining the value in use of the asset (Badia and et al.,

2017).

To estimate the VIU, there are some steps to be followed; initially, it is essential to estimate the

cash inflows and outflows of future basis which are to be derived from constant use and disposal

of an asset after that suitable discount rate is to be applied to the same future cash flows.

In order to determine recoverable amount, in a scenario where fair value minus cost of disposal

or VIU is greater as compared to the carrying amount, it is not required to compute the another

amount, it is because the asset is not assessed to be impaired under IAS 36.19 (Magnan, Menini

and Parbonetti, 2015). In case, it is not possible to determine the fair value minus cost of capital;

the recoverable amount is said to be the VIU as per the IAS 36.20. For the disposal of the assets,

the recoverable amount is assessed as a fair value from which cost of capital is deducted

according to IAS 36.21.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

For determining the fair value less cost of capital; fair value is identified by considering and

complying with the IFRS 13 Fair Value Measurement. Furthermore, the cost of disposal is only

directly added costs, nor current cost neither overhead costs as per IAS 36.28.

According to AASB, the calculation of the value in use shall showcase the components

represented as below:

A prediction of the cash flows based on future, probably derived from the asset as expected by

the entity.

Expectations regarding the potential variation in the duration or amount of future cash flow.

The theory of time value of money, stated by the existing market risk-free rate of interest.

The price for tolerating risks and uncertainty associated with the asset.

Other related factors like illiquidity that the market contestants would state while pricing the

future cash flows, probably derived from the asset as expected by the entity (Hull and White,

2014).

From the above study, it can be concluded that the recoverable amount can be calculated by

deducting the cost of disposal from fair value, and also the value in use also equals to

recoverable amount. The fair value is held when the asset is sold, or payment is made on liability

transfer, while the value is used is calculated when the future cash flows are estimated gained

from the continuing use and disposal asset.

complying with the IFRS 13 Fair Value Measurement. Furthermore, the cost of disposal is only

directly added costs, nor current cost neither overhead costs as per IAS 36.28.

According to AASB, the calculation of the value in use shall showcase the components

represented as below:

A prediction of the cash flows based on future, probably derived from the asset as expected by

the entity.

Expectations regarding the potential variation in the duration or amount of future cash flow.

The theory of time value of money, stated by the existing market risk-free rate of interest.

The price for tolerating risks and uncertainty associated with the asset.

Other related factors like illiquidity that the market contestants would state while pricing the

future cash flows, probably derived from the asset as expected by the entity (Hull and White,

2014).

From the above study, it can be concluded that the recoverable amount can be calculated by

deducting the cost of disposal from fair value, and also the value in use also equals to

recoverable amount. The fair value is held when the asset is sold, or payment is made on liability

transfer, while the value is used is calculated when the future cash flows are estimated gained

from the continuing use and disposal asset.

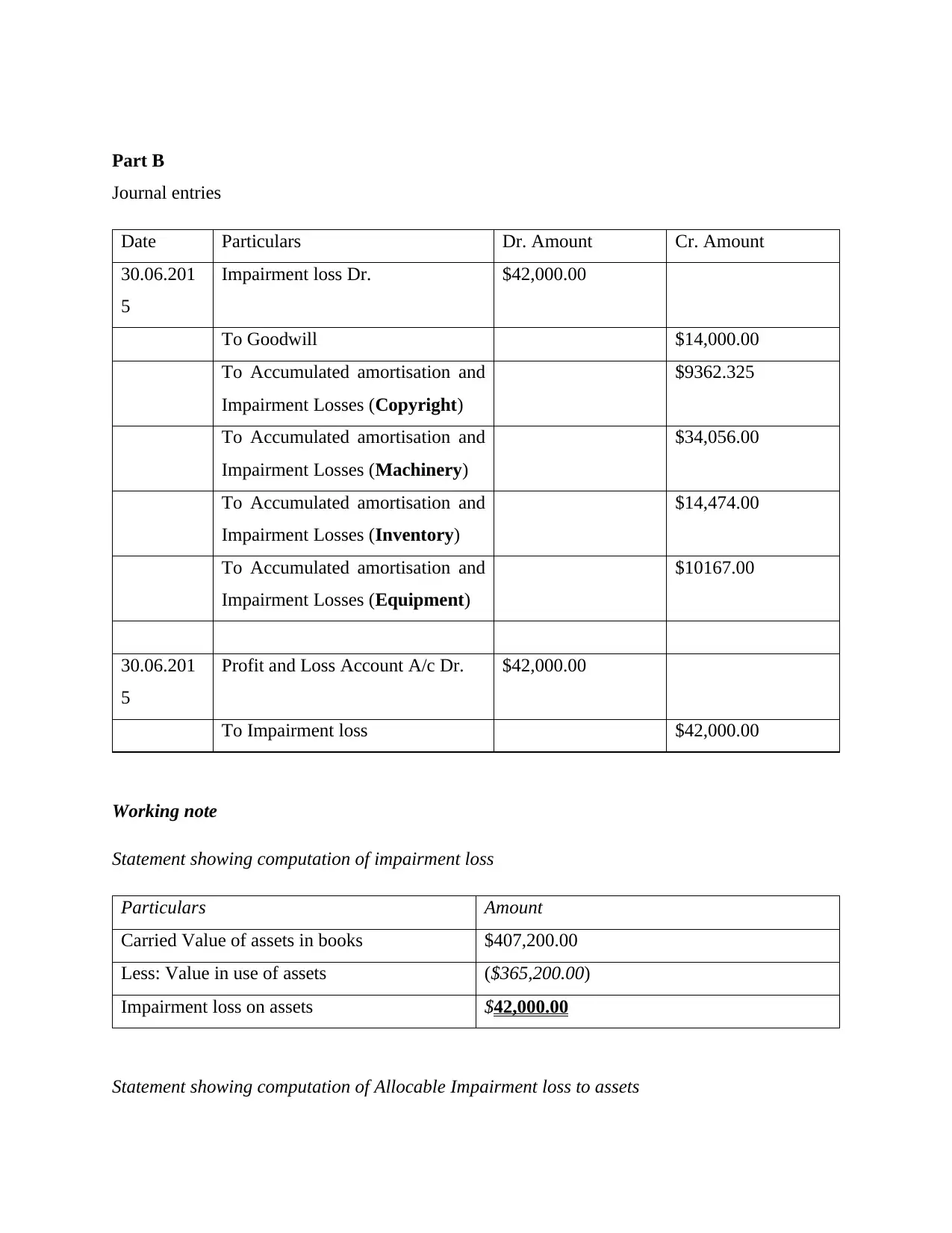

Part B

Journal entries

Date Particulars Dr. Amount Cr. Amount

30.06.201

5

Impairment loss Dr. $42,000.00

To Goodwill $14,000.00

To Accumulated amortisation and

Impairment Losses (Copyright)

$9362.325

To Accumulated amortisation and

Impairment Losses (Machinery)

$34,056.00

To Accumulated amortisation and

Impairment Losses (Inventory)

$14,474.00

To Accumulated amortisation and

Impairment Losses (Equipment)

$10167.00

30.06.201

5

Profit and Loss Account A/c Dr. $42,000.00

To Impairment loss $42,000.00

Working note

Statement showing computation of impairment loss

Particulars Amount

Carried Value of assets in books $407,200.00

Less: Value in use of assets ($365,200.00)

Impairment loss on assets $42,000.00

Statement showing computation of Allocable Impairment loss to assets

Journal entries

Date Particulars Dr. Amount Cr. Amount

30.06.201

5

Impairment loss Dr. $42,000.00

To Goodwill $14,000.00

To Accumulated amortisation and

Impairment Losses (Copyright)

$9362.325

To Accumulated amortisation and

Impairment Losses (Machinery)

$34,056.00

To Accumulated amortisation and

Impairment Losses (Inventory)

$14,474.00

To Accumulated amortisation and

Impairment Losses (Equipment)

$10167.00

30.06.201

5

Profit and Loss Account A/c Dr. $42,000.00

To Impairment loss $42,000.00

Working note

Statement showing computation of impairment loss

Particulars Amount

Carried Value of assets in books $407,200.00

Less: Value in use of assets ($365,200.00)

Impairment loss on assets $42,000.00

Statement showing computation of Allocable Impairment loss to assets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

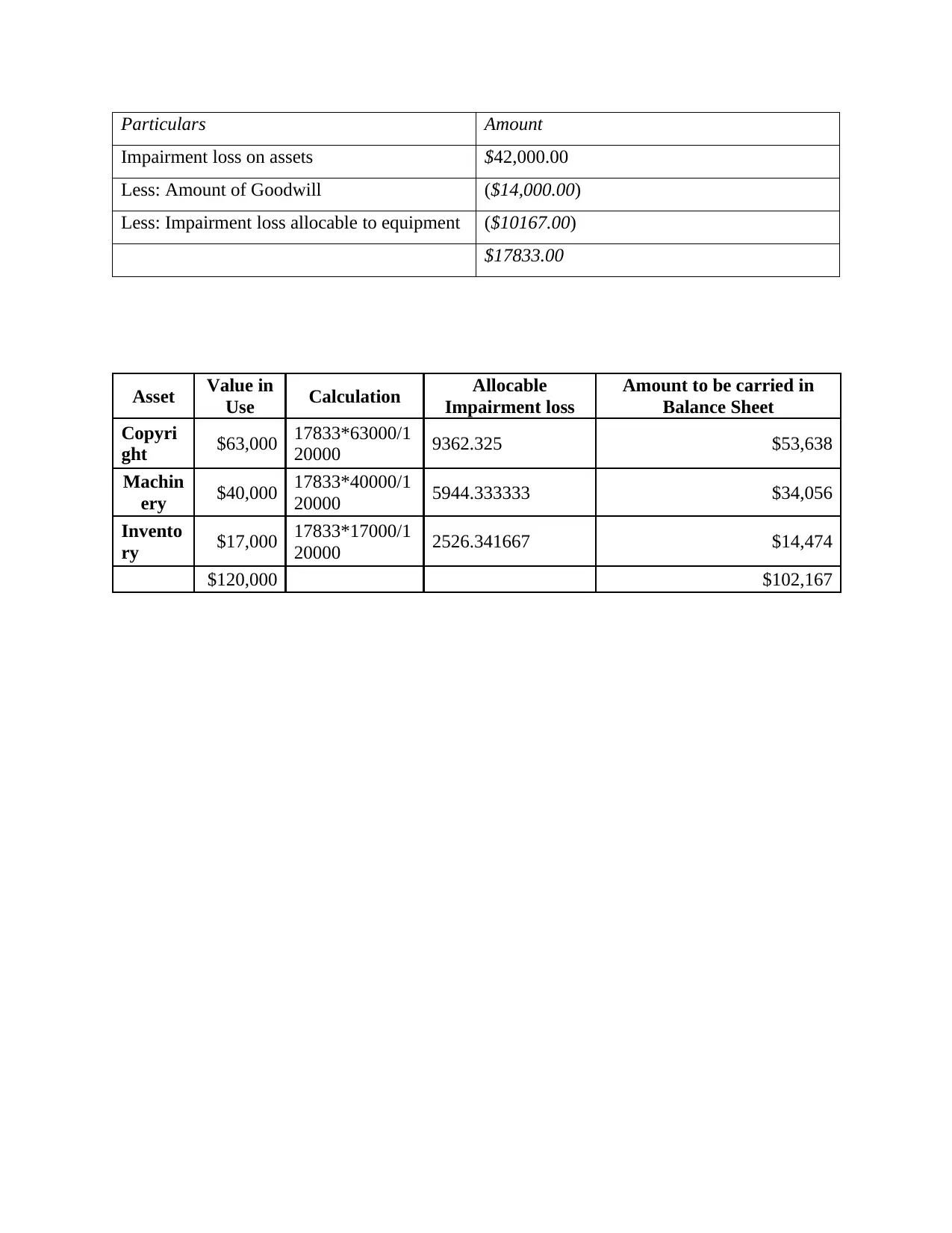

Particulars Amount

Impairment loss on assets $42,000.00

Less: Amount of Goodwill ($14,000.00)

Less: Impairment loss allocable to equipment ($10167.00)

$17833.00

Asset Value in

Use Calculation Allocable

Impairment loss

Amount to be carried in

Balance Sheet

Copyri

ght $63,000 17833*63000/1

20000 9362.325 $53,638

Machin

ery $40,000 17833*40000/1

20000 5944.333333 $34,056

Invento

ry $17,000 17833*17000/1

20000 2526.341667 $14,474

$120,000 $102,167

Impairment loss on assets $42,000.00

Less: Amount of Goodwill ($14,000.00)

Less: Impairment loss allocable to equipment ($10167.00)

$17833.00

Asset Value in

Use Calculation Allocable

Impairment loss

Amount to be carried in

Balance Sheet

Copyri

ght $63,000 17833*63000/1

20000 9362.325 $53,638

Machin

ery $40,000 17833*40000/1

20000 5944.333333 $34,056

Invento

ry $17,000 17833*17000/1

20000 2526.341667 $14,474

$120,000 $102,167

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Badia, M., Duro, M., Penalva, F. and Ryan, S., 2017. Conditionally conservative fair value

measurements. Journal of Accounting and Economics, 63(1), pp.75-98.

Barker, R. and Schulte, S., 2017. Representing the market perspective: Fair value measurement

for non-financial assets. Accounting, Organizations and Society, 56, pp.55-67.

Goncharov, I., Riedl, E.J. and Sellhorn, T., 2014. Fair value and audit fees. Review of

Accounting Studies, 19(1), pp.210-241.

Huikku, J., Mouritsen, J. and Silvola, H., 2017. Relative reliability and the recognisable firm:

Calculating goodwill impairment value. Accounting, Organizations and Society, 56, pp.68-83.

Hull, J. and White, A., 2014. Valuing derivatives: Funding value adjustments and fair

value. Financial Analysts Journal, 70(3), pp.46-56.

Magnan, M., Menini, A. and Parbonetti, A., 2015. Fair value accounting: information or

confusion for financial markets?. Review of Accounting Studies, 20(1), pp.559-591.

Sellhorn, T. and Stier, C., 2017. Fair Value Measurement for Long-Lived Operating Assets:

Research Evidence.

Whittington, G., 2015. Fair value and IFRS. The Routledge Companion to Financial Accounting

Theory, pp.217-235.

Badia, M., Duro, M., Penalva, F. and Ryan, S., 2017. Conditionally conservative fair value

measurements. Journal of Accounting and Economics, 63(1), pp.75-98.

Barker, R. and Schulte, S., 2017. Representing the market perspective: Fair value measurement

for non-financial assets. Accounting, Organizations and Society, 56, pp.55-67.

Goncharov, I., Riedl, E.J. and Sellhorn, T., 2014. Fair value and audit fees. Review of

Accounting Studies, 19(1), pp.210-241.

Huikku, J., Mouritsen, J. and Silvola, H., 2017. Relative reliability and the recognisable firm:

Calculating goodwill impairment value. Accounting, Organizations and Society, 56, pp.68-83.

Hull, J. and White, A., 2014. Valuing derivatives: Funding value adjustments and fair

value. Financial Analysts Journal, 70(3), pp.46-56.

Magnan, M., Menini, A. and Parbonetti, A., 2015. Fair value accounting: information or

confusion for financial markets?. Review of Accounting Studies, 20(1), pp.559-591.

Sellhorn, T. and Stier, C., 2017. Fair Value Measurement for Long-Lived Operating Assets:

Research Evidence.

Whittington, G., 2015. Fair value and IFRS. The Routledge Companion to Financial Accounting

Theory, pp.217-235.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.