Corporate and Financial Accounting: Equity and Debt Analysis Report

VerifiedAdded on 2020/05/16

|15

|3338

|107

Report

AI Summary

This report provides a comprehensive analysis of corporate and financial accounting, focusing on the regulation of financial reporting and the roles of the Australian Accounting Standards Board (AASB) and the International Financial Reporting Standards (IFRS). It examines the debate over voluntary versus regulated financial disclosure, arguing for the necessity of regulation. The report then delves into the financial performance of four public limited companies listed on the Australian Securities Exchange (ASX): Acacia Coal Limited, Aura Energy Limited, Amour Energy Limited, and Adx Energy Limited. It analyzes their equity positions, including issued capital, reserves, and accumulated losses, over the period from 2014 to 2017. The analysis reveals trends in equity components and the impact of operational losses on accumulated losses. The report also discusses the reasons behind changes in the items of equity and provides a comparative analysis of the debt and equity positions of the four firms, drawing conclusions based on the research findings.

CORPORATE AND FINANCIAL ACCOUNTING 1

CORPORATE AND FINANCIAL ACCOUNTING

By (Name)

Name of the Course

Professor

Name of University

City and State

Date

Word Count: 2838

CORPORATE AND FINANCIAL ACCOUNTING

By (Name)

Name of the Course

Professor

Name of University

City and State

Date

Word Count: 2838

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE AND FINANCIAL ACCOUNTING 2

Executive Summary

According to research, it has been found out that financial accounting and reporting

should be regulated. Managers must not be let to disclose financial accounting voluntarily. It has

also been established from research that there are a number of ways in which the Australian

Accounting Standards Board (AASB) participates in setting the global standards of accounting.

These have been discussed in detail in the sections below.

Four public limited companies which are listed on the Australian Securities Exchange

(ASX) that are in the same industry have been researched. These companies are Acacia Coal

Limited, Aura Energy Limited, Amour Energy Limited and Adx Energy Limited. The research

findings indicate that the four firms have a favorable debt and equity position since they have

used more of equity financing in funding most of their business operations. Furthermore, there

are various changes in their items of equity such as issued/contributed capital, reserves and

accumulated losses. However, it has been noted that for the Financial Years 2014 all through

2017, the four firms have been making operational losses, which have consequentially translated

into increasingly huge accumulated losses. The analysis has been provided in the various

sections below.

Executive Summary

According to research, it has been found out that financial accounting and reporting

should be regulated. Managers must not be let to disclose financial accounting voluntarily. It has

also been established from research that there are a number of ways in which the Australian

Accounting Standards Board (AASB) participates in setting the global standards of accounting.

These have been discussed in detail in the sections below.

Four public limited companies which are listed on the Australian Securities Exchange

(ASX) that are in the same industry have been researched. These companies are Acacia Coal

Limited, Aura Energy Limited, Amour Energy Limited and Adx Energy Limited. The research

findings indicate that the four firms have a favorable debt and equity position since they have

used more of equity financing in funding most of their business operations. Furthermore, there

are various changes in their items of equity such as issued/contributed capital, reserves and

accumulated losses. However, it has been noted that for the Financial Years 2014 all through

2017, the four firms have been making operational losses, which have consequentially translated

into increasingly huge accumulated losses. The analysis has been provided in the various

sections below.

CORPORATE AND FINANCIAL ACCOUNTING 3

TABLE OF CONTENTS

CONTENT PAGE

Introduction....................................................................................................................................................4

Corporate governance....................................................................................................................................4

i. Whether Financial Accounting and Reporting Should be Regulated……………………………...4

Setting of accounting standards..............................................................................................................…...6

i. How AASB participates in setting of Global standards of accounting…………………………….6

ii. The reasons why the IFRS Established by IASB Are not mandatory for its member countries......7

Owners’ equity...............................................................................................................................................7

i. Items of Equity..................................................................................................................................7

Issued Capital………....………………………………….…………………..8

Reserves……………………………………………………………..……….8

Retained earnings and Accumulated losses…….………..…………………..8

ii. Changes in items of equity and reasons for changes.......……………………………………….....9

iii. Comparative analysis of the debt and equity position of the four firms……...…………………..10

Conclusion...................................................................................................................................................12

References....................................................................................................................................................13

TABLE OF CONTENTS

CONTENT PAGE

Introduction....................................................................................................................................................4

Corporate governance....................................................................................................................................4

i. Whether Financial Accounting and Reporting Should be Regulated……………………………...4

Setting of accounting standards..............................................................................................................…...6

i. How AASB participates in setting of Global standards of accounting…………………………….6

ii. The reasons why the IFRS Established by IASB Are not mandatory for its member countries......7

Owners’ equity...............................................................................................................................................7

i. Items of Equity..................................................................................................................................7

Issued Capital………....………………………………….…………………..8

Reserves……………………………………………………………..……….8

Retained earnings and Accumulated losses…….………..…………………..8

ii. Changes in items of equity and reasons for changes.......……………………………………….....9

iii. Comparative analysis of the debt and equity position of the four firms……...…………………..10

Conclusion...................................................................................................................................................12

References....................................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE AND FINANCIAL ACCOUNTING 4

Introduction

The main purpose of this paper is do carry out a research and discuss if the financial

accounting and reporting should be regulated or a manager should be allowed to disclose

financial accounting information voluntarily (Vernimmen, Quiry, Dallocchio, Le Fur and Salvi

2014, pp. 22). The paper also gives an explanation on how the Australian Accounting Standards

Board (AASB) participates in the setting process of global accounting standards and why the

IFRS set by IASB is not regarded mandatory for IASB member countries. This paper also

chooses four public limited companies that are listed on the Australian Securities Exchange and

discusses their annual financial reports for the last four years with regard to items of equity as

well as debt and equity positions.

A. Corporate Regulation

i. Whether Financial Accounting and Reporting Should be Regulated

After conducting research, it has been established that financial accounting and reporting

should be regulated. Managers must not be let to disclose financial accounting voluntarily. This

proposition is supported by a number of arguments, as found in the research. In the absence of

financial accounting reporting regulation, optimal levels of disclosure would not be generated in

the financial markets as a result of the interplaying forces. Financial instrument providers are

faced with stiff competition in the capital and financial markets which are mainly populated by

numerous investors with various interests and objectives (Whittington 2008, pp. 495). Firms

whose main concern is to maximize their shareholder value often establish attractive incentives

and consider it necessary make disclosures of all information which is available to them, for

purposes of obtaining higher prices than those of their competitors. This is done mainly because

Introduction

The main purpose of this paper is do carry out a research and discuss if the financial

accounting and reporting should be regulated or a manager should be allowed to disclose

financial accounting information voluntarily (Vernimmen, Quiry, Dallocchio, Le Fur and Salvi

2014, pp. 22). The paper also gives an explanation on how the Australian Accounting Standards

Board (AASB) participates in the setting process of global accounting standards and why the

IFRS set by IASB is not regarded mandatory for IASB member countries. This paper also

chooses four public limited companies that are listed on the Australian Securities Exchange and

discusses their annual financial reports for the last four years with regard to items of equity as

well as debt and equity positions.

A. Corporate Regulation

i. Whether Financial Accounting and Reporting Should be Regulated

After conducting research, it has been established that financial accounting and reporting

should be regulated. Managers must not be let to disclose financial accounting voluntarily. This

proposition is supported by a number of arguments, as found in the research. In the absence of

financial accounting reporting regulation, optimal levels of disclosure would not be generated in

the financial markets as a result of the interplaying forces. Financial instrument providers are

faced with stiff competition in the capital and financial markets which are mainly populated by

numerous investors with various interests and objectives (Whittington 2008, pp. 495). Firms

whose main concern is to maximize their shareholder value often establish attractive incentives

and consider it necessary make disclosures of all information which is available to them, for

purposes of obtaining higher prices than those of their competitors. This is done mainly because

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE AND FINANCIAL ACCOUNTING 5

firms are aware that the investors would think otherwise and make the worst assumptions

regarding the company if the disclosures are not made (Vernimmen, Quiry, Dallocchio, Le Fur

and Salvi 2014, pp. 22). This means that a firm does not disclose its financial information

adequately, then interested and potential investors would end up assuming that there is some bad

news or reports which are being hidden from the public. The share price of the firm would

therefore be bid down and would consequentially lose value in comparison with that of the

competing firms (Zeff 2012, pp. 807).

In addition, this proposition is supported by the fact that regulation of disclosure of

financial information yields benefits which are both specific to the firm itself and the financial

market as a whole. It has been found out that most firms may not be willing to make voluntary

disclosures of their financial accounting information since this may be in favor of their

competitive advantage as information which is proprietary might be let known to their primary

competitors. Such a decision of not making the disclosure are beneficial to the firm itself but is

not good for the public in general since it does not have benefits which are economy-wide

(Whittington 2008, pp. 495).

In conclusion, it is agreed that managers of firms must not be allowed to voluntarily

disclose financial information since they may be unwilling to make disclosures regarding some

key aspects which are crucial for decision making by investors and the public at large. Instead,

the disclosure requirement must be highly regulated by the concerned financial reporting

agencies and bodies. This enables capital allocation to the projects which has the greatest yields,

and enhances competition among firms thus promoting improvements in productivity as well as

competition in terms of prices. For instance, making disclosures may help in revealing

significant information regarding other firms within the industry, although the firm making the

firms are aware that the investors would think otherwise and make the worst assumptions

regarding the company if the disclosures are not made (Vernimmen, Quiry, Dallocchio, Le Fur

and Salvi 2014, pp. 22). This means that a firm does not disclose its financial information

adequately, then interested and potential investors would end up assuming that there is some bad

news or reports which are being hidden from the public. The share price of the firm would

therefore be bid down and would consequentially lose value in comparison with that of the

competing firms (Zeff 2012, pp. 807).

In addition, this proposition is supported by the fact that regulation of disclosure of

financial information yields benefits which are both specific to the firm itself and the financial

market as a whole. It has been found out that most firms may not be willing to make voluntary

disclosures of their financial accounting information since this may be in favor of their

competitive advantage as information which is proprietary might be let known to their primary

competitors. Such a decision of not making the disclosure are beneficial to the firm itself but is

not good for the public in general since it does not have benefits which are economy-wide

(Whittington 2008, pp. 495).

In conclusion, it is agreed that managers of firms must not be allowed to voluntarily

disclose financial information since they may be unwilling to make disclosures regarding some

key aspects which are crucial for decision making by investors and the public at large. Instead,

the disclosure requirement must be highly regulated by the concerned financial reporting

agencies and bodies. This enables capital allocation to the projects which has the greatest yields,

and enhances competition among firms thus promoting improvements in productivity as well as

competition in terms of prices. For instance, making disclosures may help in revealing

significant information regarding other firms within the industry, although the firm making the

CORPORATE AND FINANCIAL ACCOUNTING 6

disclosure may not gain any benefits from the transfer of information. This can lead to under-

production of information by firms (Whittington 2008, pp. 496). In addition to this, when firms

disclose their financial adequately, financial markets or capital markets do not need to make any

efforts in collecting the information since it has been provided. Therefore, regulation of

disclosure would assist in preventing duplication of efforts to collect the financial information by

capital markets for provision to investors and other key financial decision makers (Georgiou

2010, pp. 101).

ii. Setting of Accounting Standards

i. How AASB Participates in Setting of Global Standards of Accounting

According to research, there are a number of ways in which the Australian Accounting

Standards Board (AASB) participates in setting the global standards of accounting. Since the

AASB aims primarily at developing and maintaining financial reporting standards of high quality

for all Australian economy sectors, it works in collaboration in various ways which enables it to

participate in the setting of the IFRS (Whittington 2008, pp. 495). For instance, AASB is

engaged in issuance of documents which seek to incorporate the discussion papers and exposure

drafts of IASB with a view to encouraging all constituents in Australia to take part in the process

by providing the board with useful information which can be recommended to IASB for the

purpose of setting IFRS (Georgiou 2010, pp. 103).

AASB also participates in setting of IFRS by making sure that the various changes made

to IFRS by IASB are appropriately processed and adequate communication is made to all

constituents in Australia. The board is also engaged in implementation of the new differential

framework of reporting as adopted by the IFRS established by IASB. Furthermore, AASB seeks

disclosure may not gain any benefits from the transfer of information. This can lead to under-

production of information by firms (Whittington 2008, pp. 496). In addition to this, when firms

disclose their financial adequately, financial markets or capital markets do not need to make any

efforts in collecting the information since it has been provided. Therefore, regulation of

disclosure would assist in preventing duplication of efforts to collect the financial information by

capital markets for provision to investors and other key financial decision makers (Georgiou

2010, pp. 101).

ii. Setting of Accounting Standards

i. How AASB Participates in Setting of Global Standards of Accounting

According to research, there are a number of ways in which the Australian Accounting

Standards Board (AASB) participates in setting the global standards of accounting. Since the

AASB aims primarily at developing and maintaining financial reporting standards of high quality

for all Australian economy sectors, it works in collaboration in various ways which enables it to

participate in the setting of the IFRS (Whittington 2008, pp. 495). For instance, AASB is

engaged in issuance of documents which seek to incorporate the discussion papers and exposure

drafts of IASB with a view to encouraging all constituents in Australia to take part in the process

by providing the board with useful information which can be recommended to IASB for the

purpose of setting IFRS (Georgiou 2010, pp. 103).

AASB also participates in setting of IFRS by making sure that the various changes made

to IFRS by IASB are appropriately processed and adequate communication is made to all

constituents in Australia. The board is also engaged in implementation of the new differential

framework of reporting as adopted by the IFRS established by IASB. Furthermore, AASB seeks

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE AND FINANCIAL ACCOUNTING 7

to make an active participation in the ongoing IASB’s process of setting global standards of

accounting, and making sure that the output of the standards is promoted and improved

appropriately (Ghosh 2011, pp. 109).

ii. The Reasons Why the IFRS Established by IASB are Not Mandatory For Its

Member Countries

There are various reasons why the IFRS established by IASB are not considered

mandatory for its member states or countries. For instance, companies that have foreign

subsidiaries in various countries and locations over the world would find it quite difficult to

adopt the IFRS established by IASB (Morais and Curto 2008, pp. 103). This is because there are

varying accounting standards and regulations that are adopted in various states. Therefore, IASB

does not give a compulsory requirement to its member countries to adopt the IFRS. In addition to

this, different member countries have different regulating bodies and therefore making a

compulsory requirement for IASB member countries to adopt IFRS may be very detrimental to

adoption of the state regulations (Georgiou 2010, pp. 102).

iii. Owner’s Equity

For the purpose of this section, four public limited companies which are listed on the

Australian Securities Exchange (ASX) that are in the same industry have been researched. These

companies are Acacia Coal Limited, Aura Energy Limited, Amour Energy Limited and Adx

Energy Limited. The annual reports of these companies for the last four years have been

analyzed and discussed with regard to items of equity as well as debt and equity position, in the

below sections (Whittington 2008, pp. 499).

i. Items of Equity

to make an active participation in the ongoing IASB’s process of setting global standards of

accounting, and making sure that the output of the standards is promoted and improved

appropriately (Ghosh 2011, pp. 109).

ii. The Reasons Why the IFRS Established by IASB are Not Mandatory For Its

Member Countries

There are various reasons why the IFRS established by IASB are not considered

mandatory for its member states or countries. For instance, companies that have foreign

subsidiaries in various countries and locations over the world would find it quite difficult to

adopt the IFRS established by IASB (Morais and Curto 2008, pp. 103). This is because there are

varying accounting standards and regulations that are adopted in various states. Therefore, IASB

does not give a compulsory requirement to its member countries to adopt the IFRS. In addition to

this, different member countries have different regulating bodies and therefore making a

compulsory requirement for IASB member countries to adopt IFRS may be very detrimental to

adoption of the state regulations (Georgiou 2010, pp. 102).

iii. Owner’s Equity

For the purpose of this section, four public limited companies which are listed on the

Australian Securities Exchange (ASX) that are in the same industry have been researched. These

companies are Acacia Coal Limited, Aura Energy Limited, Amour Energy Limited and Adx

Energy Limited. The annual reports of these companies for the last four years have been

analyzed and discussed with regard to items of equity as well as debt and equity position, in the

below sections (Whittington 2008, pp. 499).

i. Items of Equity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE AND FINANCIAL ACCOUNTING 8

The main items of equity for each of the above mentioned four firms are issued capital,

reserves and retained earnings or accumulated losses. Each of these has been further discussed

below (Tirole 2010, pp. 31).

Issued Capital

This is the number of company shares which have been issued to shareholders of

a company. They are shares which have been allotted and are therefore

subsequently entitled to shareholders. Issued capital forms a significant part of a

company’s authorized capital (Schroeder, Clark and Cathey 2009, pp. 78).

Reserves

These are assets held by a company which are highly liquid or easily convertible

into cash for purposes of meeting future payments of the company and other

emergencies as they come up (Maynard 2017, pp. 13).

Retained Earnings and Accumulated losses

Retained earnings is the aggregate net income which has been accumulated by a

company from the time it was incepted or established up to the current date of

financial reporting, less any amounts of dividends which have been distributed by

the company over time (Lee 2009, pp. 140).

Accumulated losses or deficit, on the other hand, represents retained earnings

which are negative. In other words, they are losses which have been cumulatively

incurred by the company since its inception (Deegan 2013, pp. 114).

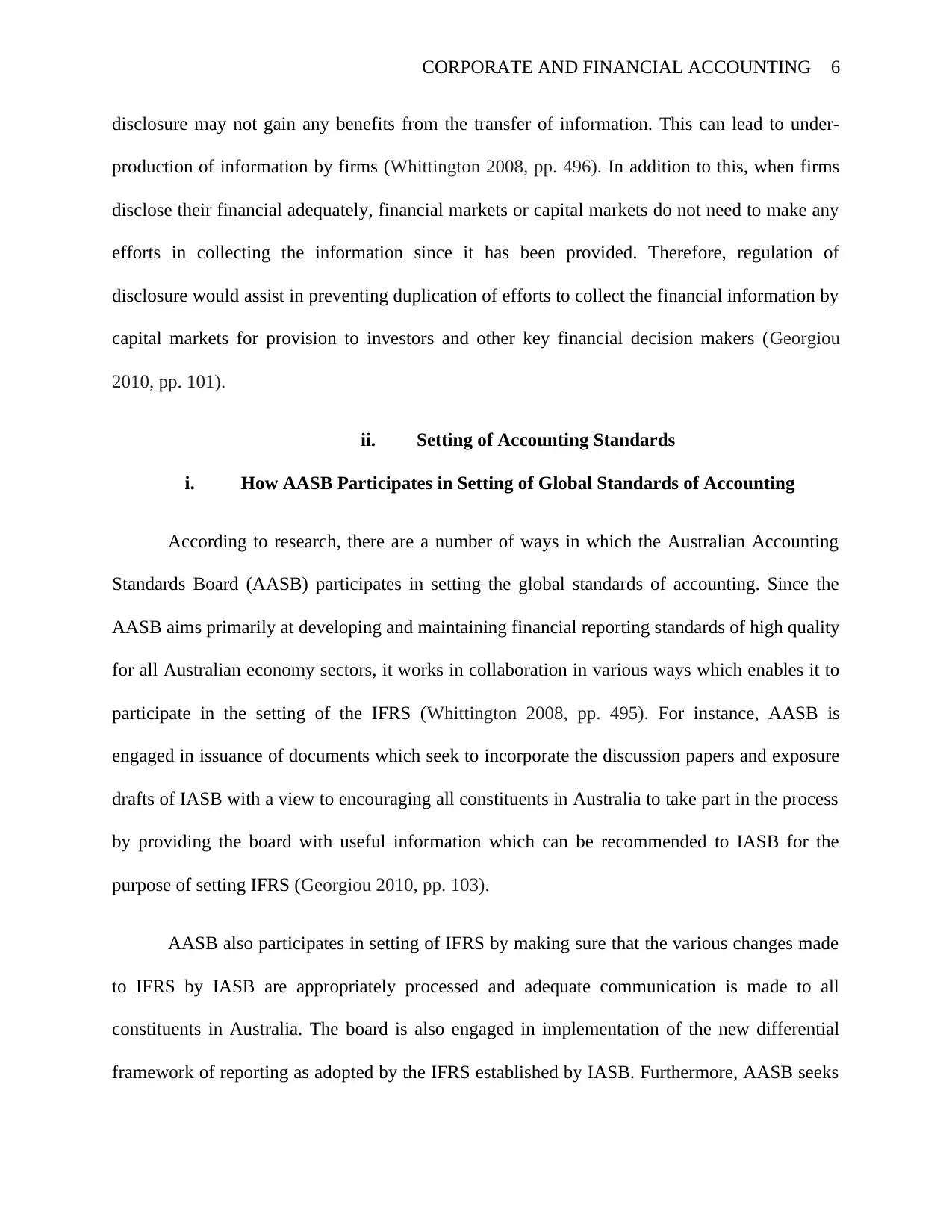

The following are the main changes that have been observed in each item of equity of the four

companies over the last four years from FY 2014 to FY 2017. These have been summarized in

the table below.

The main items of equity for each of the above mentioned four firms are issued capital,

reserves and retained earnings or accumulated losses. Each of these has been further discussed

below (Tirole 2010, pp. 31).

Issued Capital

This is the number of company shares which have been issued to shareholders of

a company. They are shares which have been allotted and are therefore

subsequently entitled to shareholders. Issued capital forms a significant part of a

company’s authorized capital (Schroeder, Clark and Cathey 2009, pp. 78).

Reserves

These are assets held by a company which are highly liquid or easily convertible

into cash for purposes of meeting future payments of the company and other

emergencies as they come up (Maynard 2017, pp. 13).

Retained Earnings and Accumulated losses

Retained earnings is the aggregate net income which has been accumulated by a

company from the time it was incepted or established up to the current date of

financial reporting, less any amounts of dividends which have been distributed by

the company over time (Lee 2009, pp. 140).

Accumulated losses or deficit, on the other hand, represents retained earnings

which are negative. In other words, they are losses which have been cumulatively

incurred by the company since its inception (Deegan 2013, pp. 114).

The following are the main changes that have been observed in each item of equity of the four

companies over the last four years from FY 2014 to FY 2017. These have been summarized in

the table below.

CORPORATE AND FINANCIAL ACCOUNTING 9

I. Changes in items of Equity

a. Aura Energy

Limited

Item 2017 2016 2015 2014

Issued Capital

$

39,558,943

$

32,784,203

$

31,311,388

$

27,935,558

Reserves

$

841,671

$

1,029,542

$

901,252

$

1,238,119

Accumulated Losses

$

(23,503,501)

$

(19,973,039)

$

(18,451,415)

$

(16,474,803)

b. Acacia Coal

Limited

Item 2017 2016 2015 2014

Contributed Capital

$

40,412,015

$

38,492,606

$

38,492,606

$

38,492,606

Reserves

$

3,198,599

$

3,059,055

$

2,954,258

$

2,822,378

Accumulated Losses

$

(42,058,420)

$

(39,587,441)

$

(29,610,551)

$

(29,396,989)

c. Armour Coal

Limited

Item 2017 2016 2015 2014

Issued Capital

$

91,301,423

$

87,435,000

$

83,880,979

$

83,709,877

Reserves

$

5,188,617

$

(638,474)

$

571,896

$

1,520,269

Accumulated Losses

$

(47,439,025)

$

(35,964,333)

$

(17,090,406)

$

(10,515,331)

I. Changes in items of Equity

a. Aura Energy

Limited

Item 2017 2016 2015 2014

Issued Capital

$

39,558,943

$

32,784,203

$

31,311,388

$

27,935,558

Reserves

$

841,671

$

1,029,542

$

901,252

$

1,238,119

Accumulated Losses

$

(23,503,501)

$

(19,973,039)

$

(18,451,415)

$

(16,474,803)

b. Acacia Coal

Limited

Item 2017 2016 2015 2014

Contributed Capital

$

40,412,015

$

38,492,606

$

38,492,606

$

38,492,606

Reserves

$

3,198,599

$

3,059,055

$

2,954,258

$

2,822,378

Accumulated Losses

$

(42,058,420)

$

(39,587,441)

$

(29,610,551)

$

(29,396,989)

c. Armour Coal

Limited

Item 2017 2016 2015 2014

Issued Capital

$

91,301,423

$

87,435,000

$

83,880,979

$

83,709,877

Reserves

$

5,188,617

$

(638,474)

$

571,896

$

1,520,269

Accumulated Losses

$

(47,439,025)

$

(35,964,333)

$

(17,090,406)

$

(10,515,331)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE AND FINANCIAL ACCOUNTING 10

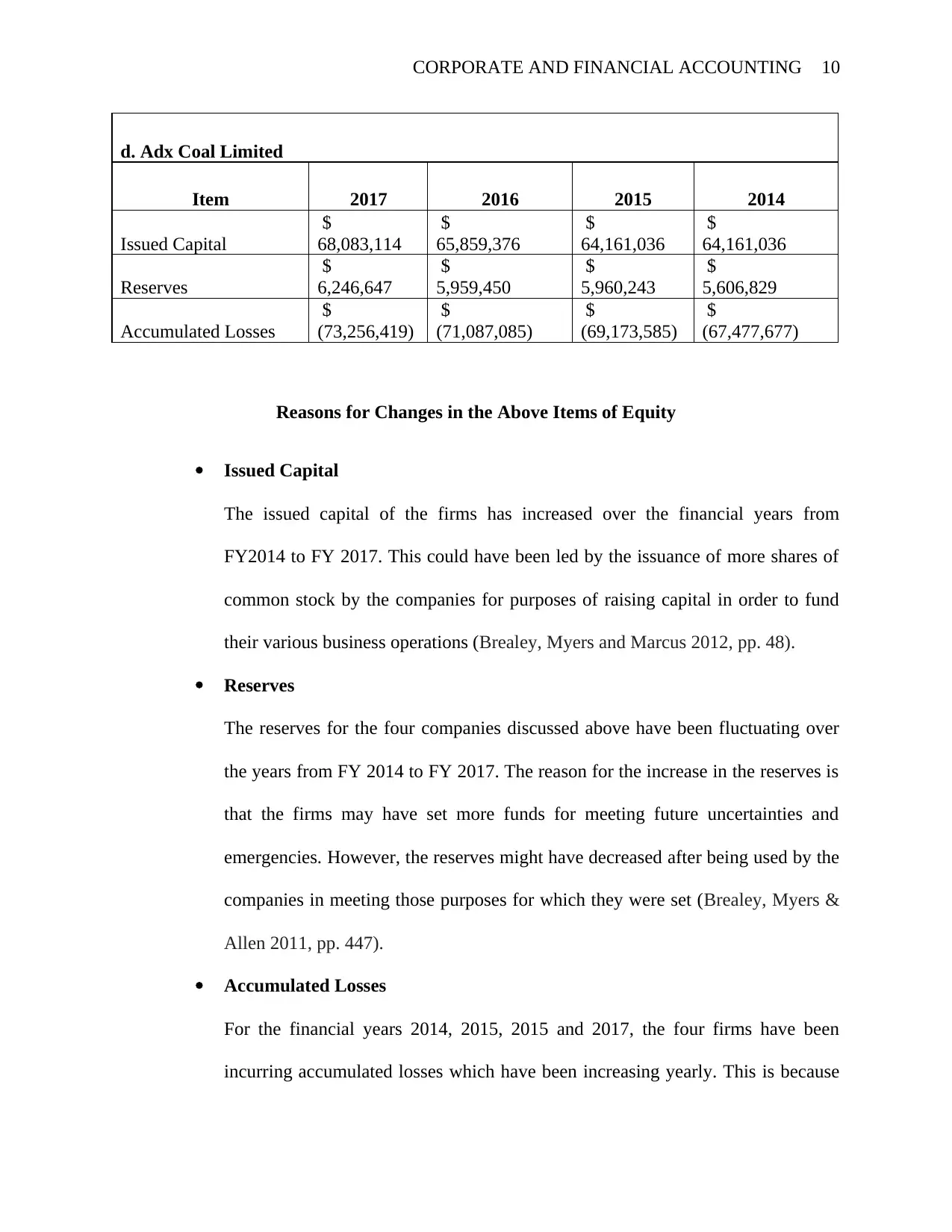

d. Adx Coal Limited

Item 2017 2016 2015 2014

Issued Capital

$

68,083,114

$

65,859,376

$

64,161,036

$

64,161,036

Reserves

$

6,246,647

$

5,959,450

$

5,960,243

$

5,606,829

Accumulated Losses

$

(73,256,419)

$

(71,087,085)

$

(69,173,585)

$

(67,477,677)

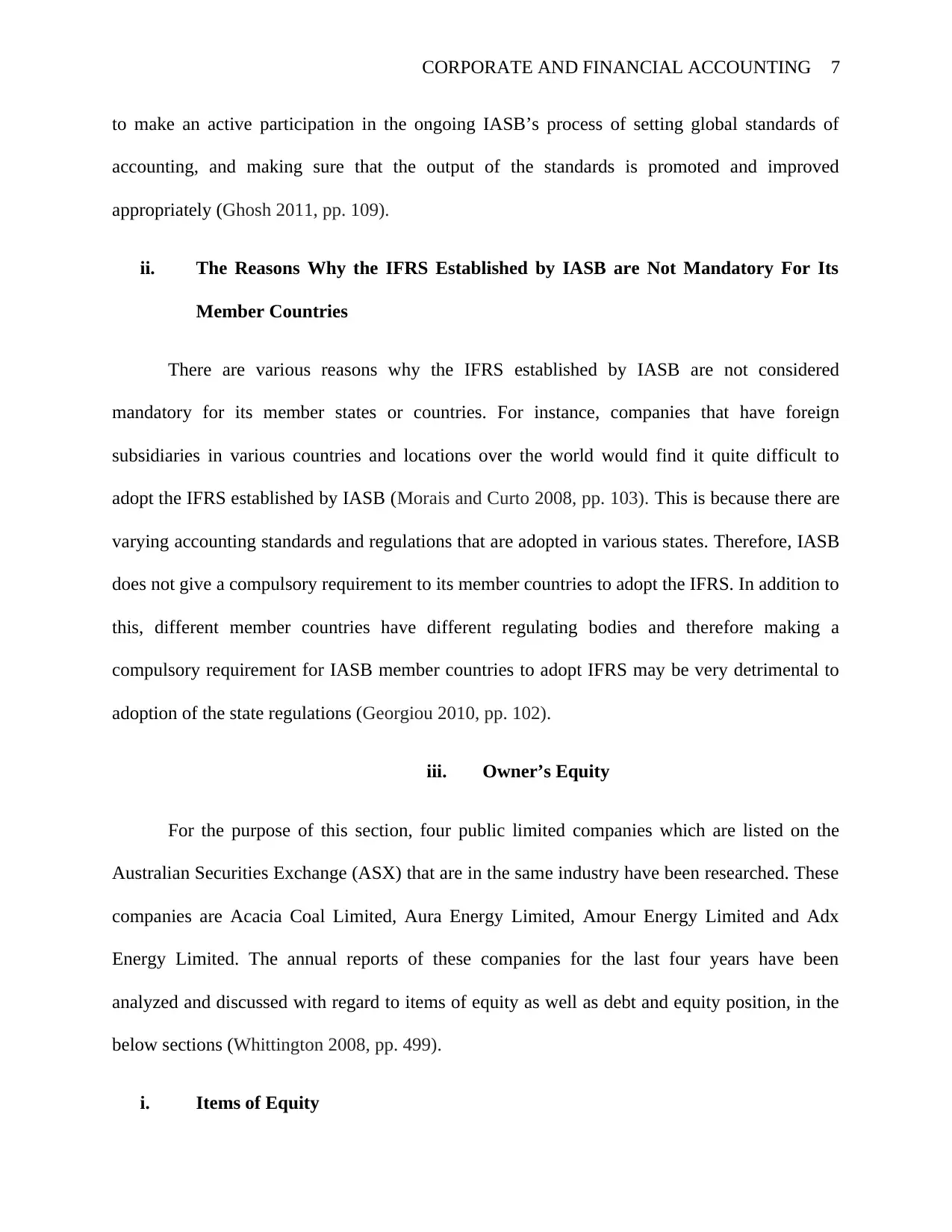

Reasons for Changes in the Above Items of Equity

Issued Capital

The issued capital of the firms has increased over the financial years from

FY2014 to FY 2017. This could have been led by the issuance of more shares of

common stock by the companies for purposes of raising capital in order to fund

their various business operations (Brealey, Myers and Marcus 2012, pp. 48).

Reserves

The reserves for the four companies discussed above have been fluctuating over

the years from FY 2014 to FY 2017. The reason for the increase in the reserves is

that the firms may have set more funds for meeting future uncertainties and

emergencies. However, the reserves might have decreased after being used by the

companies in meeting those purposes for which they were set (Brealey, Myers &

Allen 2011, pp. 447).

Accumulated Losses

For the financial years 2014, 2015, 2015 and 2017, the four firms have been

incurring accumulated losses which have been increasing yearly. This is because

d. Adx Coal Limited

Item 2017 2016 2015 2014

Issued Capital

$

68,083,114

$

65,859,376

$

64,161,036

$

64,161,036

Reserves

$

6,246,647

$

5,959,450

$

5,960,243

$

5,606,829

Accumulated Losses

$

(73,256,419)

$

(71,087,085)

$

(69,173,585)

$

(67,477,677)

Reasons for Changes in the Above Items of Equity

Issued Capital

The issued capital of the firms has increased over the financial years from

FY2014 to FY 2017. This could have been led by the issuance of more shares of

common stock by the companies for purposes of raising capital in order to fund

their various business operations (Brealey, Myers and Marcus 2012, pp. 48).

Reserves

The reserves for the four companies discussed above have been fluctuating over

the years from FY 2014 to FY 2017. The reason for the increase in the reserves is

that the firms may have set more funds for meeting future uncertainties and

emergencies. However, the reserves might have decreased after being used by the

companies in meeting those purposes for which they were set (Brealey, Myers &

Allen 2011, pp. 447).

Accumulated Losses

For the financial years 2014, 2015, 2015 and 2017, the four firms have been

incurring accumulated losses which have been increasing yearly. This is because

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE AND FINANCIAL ACCOUNTING 11

the companies have been making loses or negative operational net profits, thus

translating into accumulated losses over the years (Baker, Singleton and Veit

2011, pp. 12).

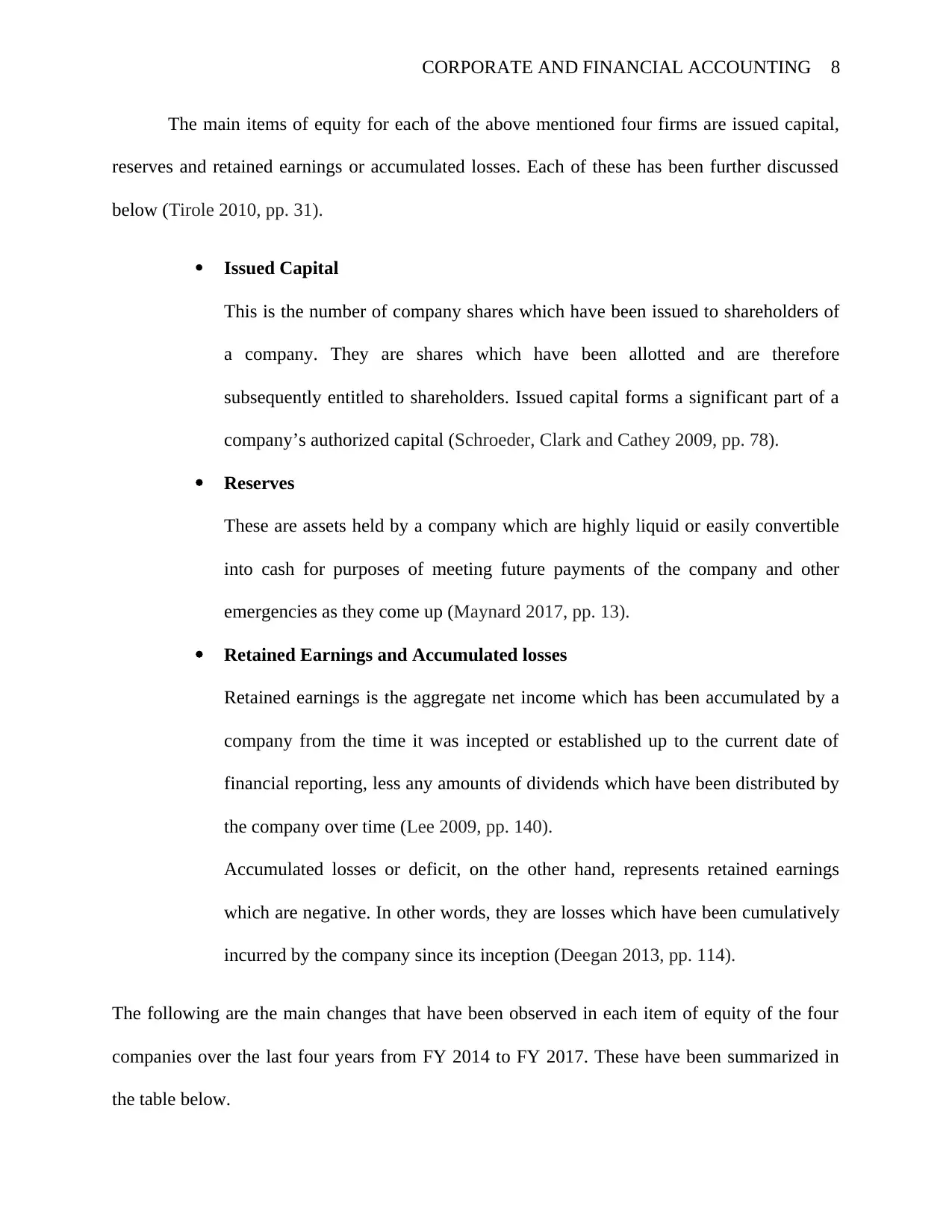

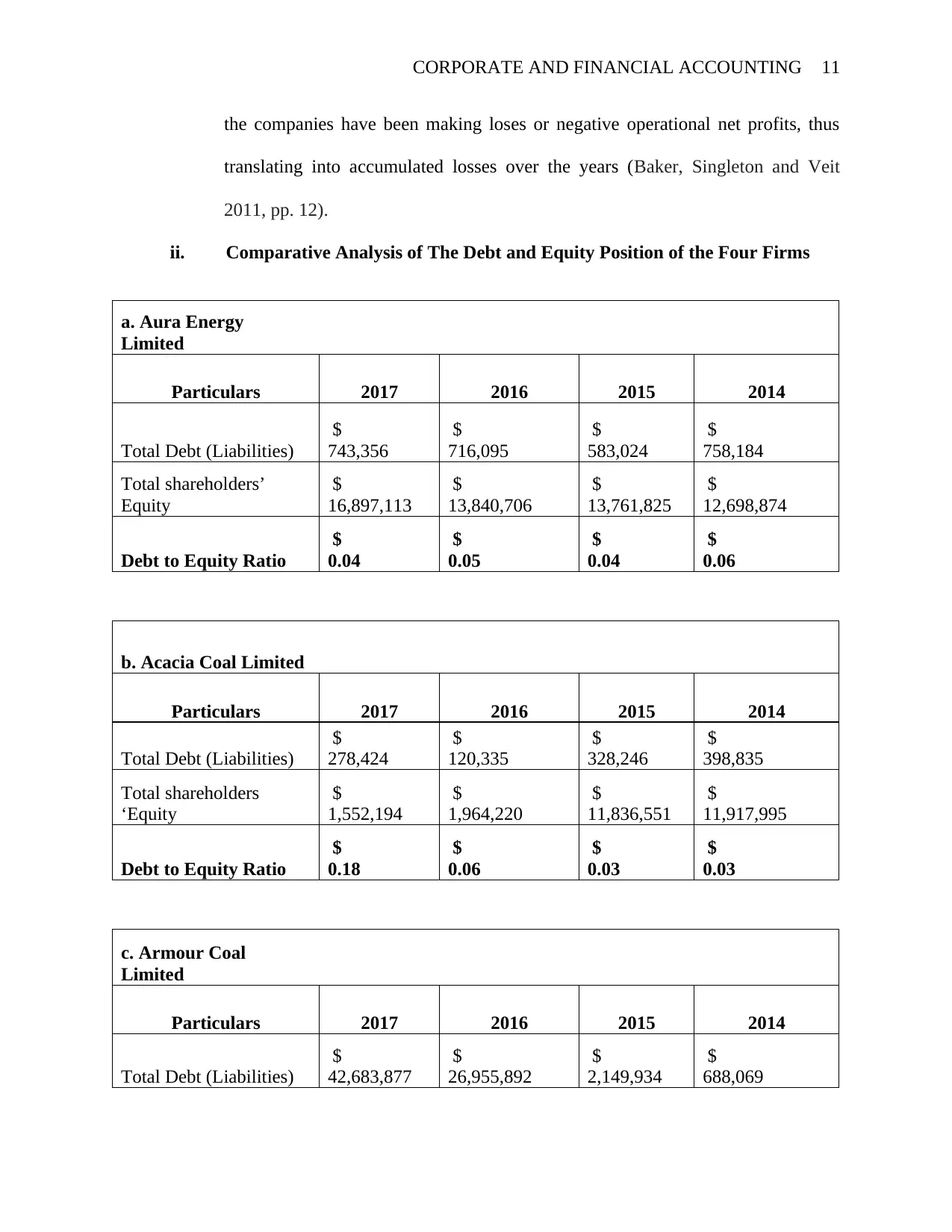

ii. Comparative Analysis of The Debt and Equity Position of the Four Firms

a. Aura Energy

Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

743,356

$

716,095

$

583,024

$

758,184

Total shareholders’

Equity

$

16,897,113

$

13,840,706

$

13,761,825

$

12,698,874

Debt to Equity Ratio

$

0.04

$

0.05

$

0.04

$

0.06

b. Acacia Coal Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

278,424

$

120,335

$

328,246

$

398,835

Total shareholders

‘Equity

$

1,552,194

$

1,964,220

$

11,836,551

$

11,917,995

Debt to Equity Ratio

$

0.18

$

0.06

$

0.03

$

0.03

c. Armour Coal

Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

42,683,877

$

26,955,892

$

2,149,934

$

688,069

the companies have been making loses or negative operational net profits, thus

translating into accumulated losses over the years (Baker, Singleton and Veit

2011, pp. 12).

ii. Comparative Analysis of The Debt and Equity Position of the Four Firms

a. Aura Energy

Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

743,356

$

716,095

$

583,024

$

758,184

Total shareholders’

Equity

$

16,897,113

$

13,840,706

$

13,761,825

$

12,698,874

Debt to Equity Ratio

$

0.04

$

0.05

$

0.04

$

0.06

b. Acacia Coal Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

278,424

$

120,335

$

328,246

$

398,835

Total shareholders

‘Equity

$

1,552,194

$

1,964,220

$

11,836,551

$

11,917,995

Debt to Equity Ratio

$

0.18

$

0.06

$

0.03

$

0.03

c. Armour Coal

Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

42,683,877

$

26,955,892

$

2,149,934

$

688,069

CORPORATE AND FINANCIAL ACCOUNTING 12

Total shareholders’

Equity

$

49,051,015

$

50,832,193

$

67,362,469

$

74,714,814

Debt to Equity Ratio

$

0.87

$

0.53

$

0.03

$

0.01

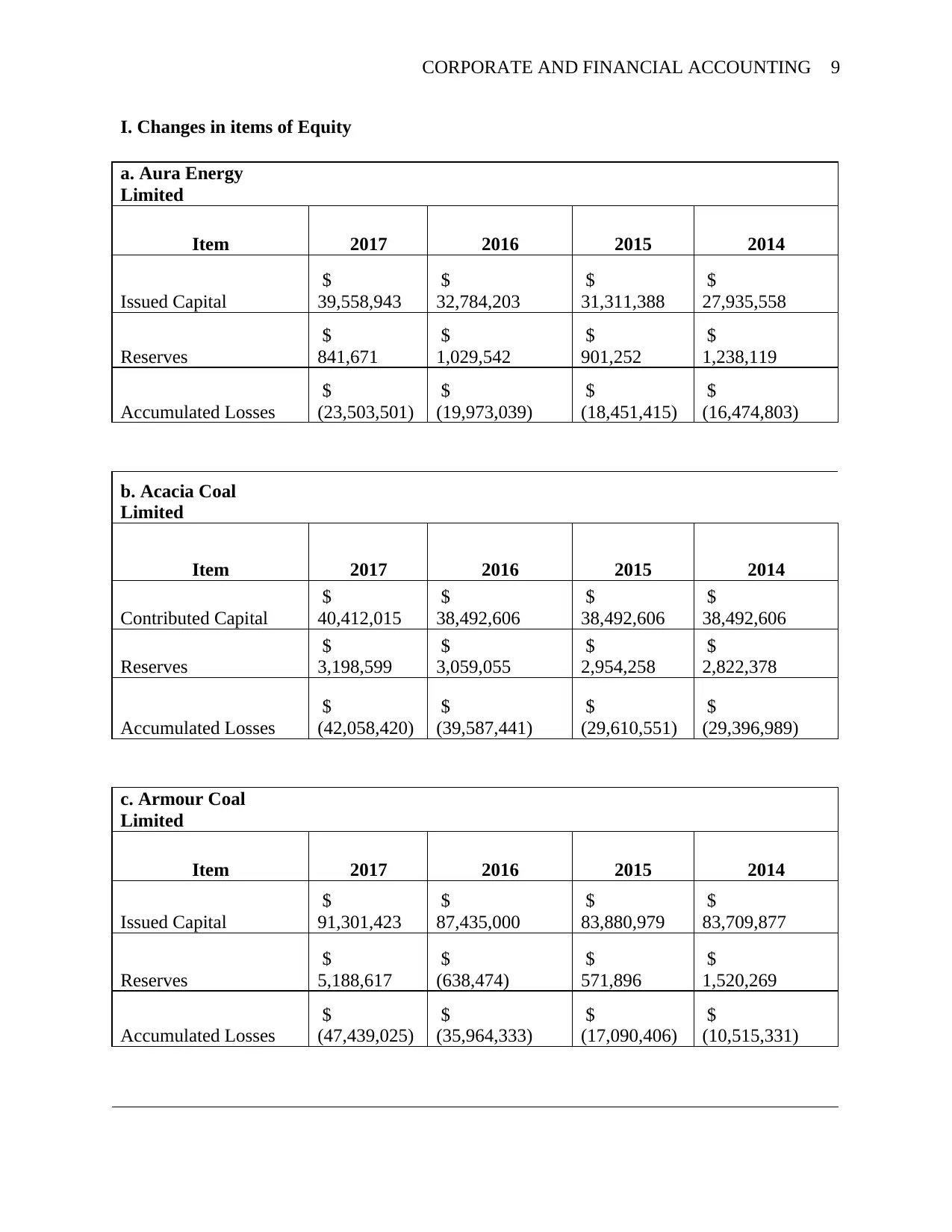

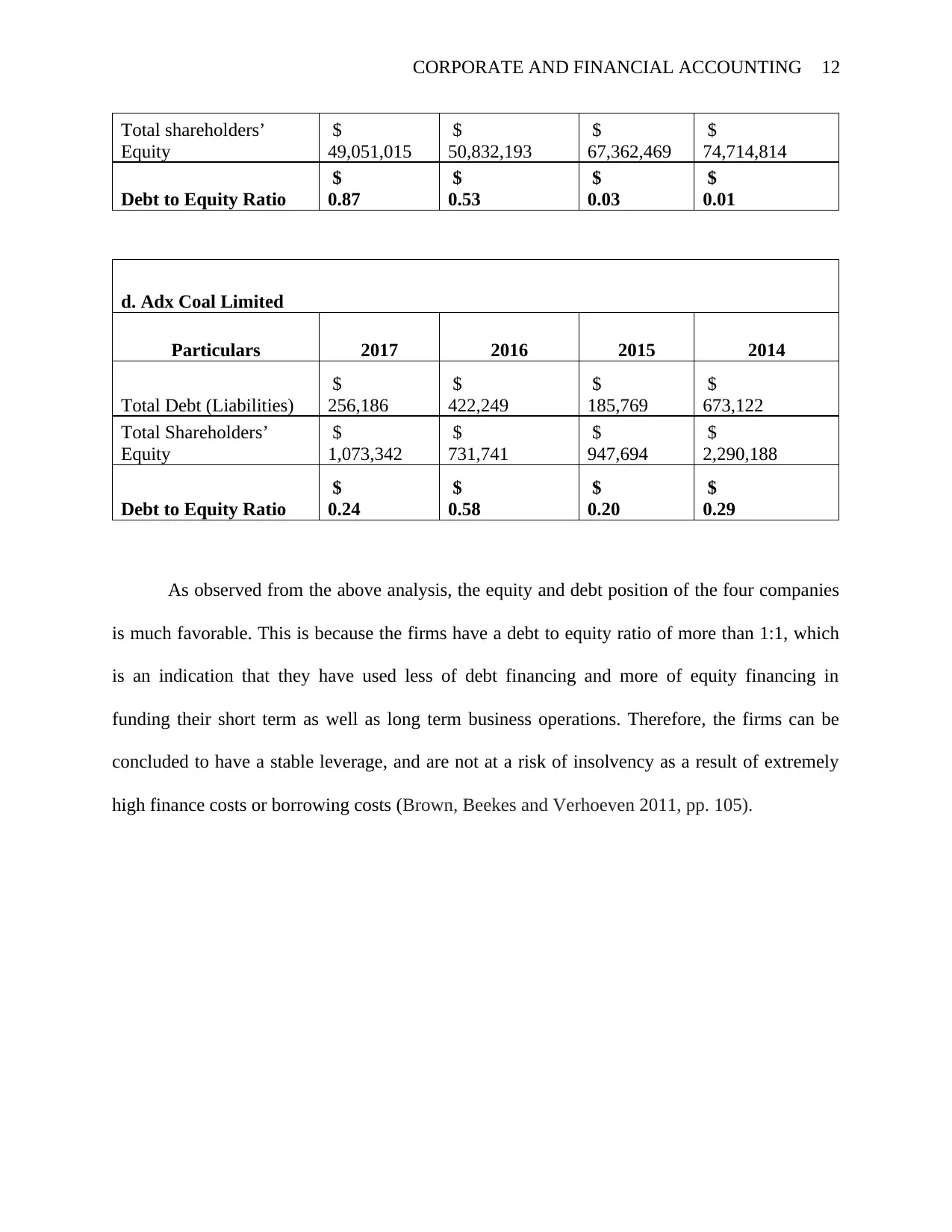

d. Adx Coal Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

256,186

$

422,249

$

185,769

$

673,122

Total Shareholders’

Equity

$

1,073,342

$

731,741

$

947,694

$

2,290,188

Debt to Equity Ratio

$

0.24

$

0.58

$

0.20

$

0.29

As observed from the above analysis, the equity and debt position of the four companies

is much favorable. This is because the firms have a debt to equity ratio of more than 1:1, which

is an indication that they have used less of debt financing and more of equity financing in

funding their short term as well as long term business operations. Therefore, the firms can be

concluded to have a stable leverage, and are not at a risk of insolvency as a result of extremely

high finance costs or borrowing costs (Brown, Beekes and Verhoeven 2011, pp. 105).

Total shareholders’

Equity

$

49,051,015

$

50,832,193

$

67,362,469

$

74,714,814

Debt to Equity Ratio

$

0.87

$

0.53

$

0.03

$

0.01

d. Adx Coal Limited

Particulars 2017 2016 2015 2014

Total Debt (Liabilities)

$

256,186

$

422,249

$

185,769

$

673,122

Total Shareholders’

Equity

$

1,073,342

$

731,741

$

947,694

$

2,290,188

Debt to Equity Ratio

$

0.24

$

0.58

$

0.20

$

0.29

As observed from the above analysis, the equity and debt position of the four companies

is much favorable. This is because the firms have a debt to equity ratio of more than 1:1, which

is an indication that they have used less of debt financing and more of equity financing in

funding their short term as well as long term business operations. Therefore, the firms can be

concluded to have a stable leverage, and are not at a risk of insolvency as a result of extremely

high finance costs or borrowing costs (Brown, Beekes and Verhoeven 2011, pp. 105).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.