Corporate Finance Assignment: Portfolio Analysis and Capital Budgeting

VerifiedAdded on 2021/11/09

|6

|1035

|24

Homework Assignment

AI Summary

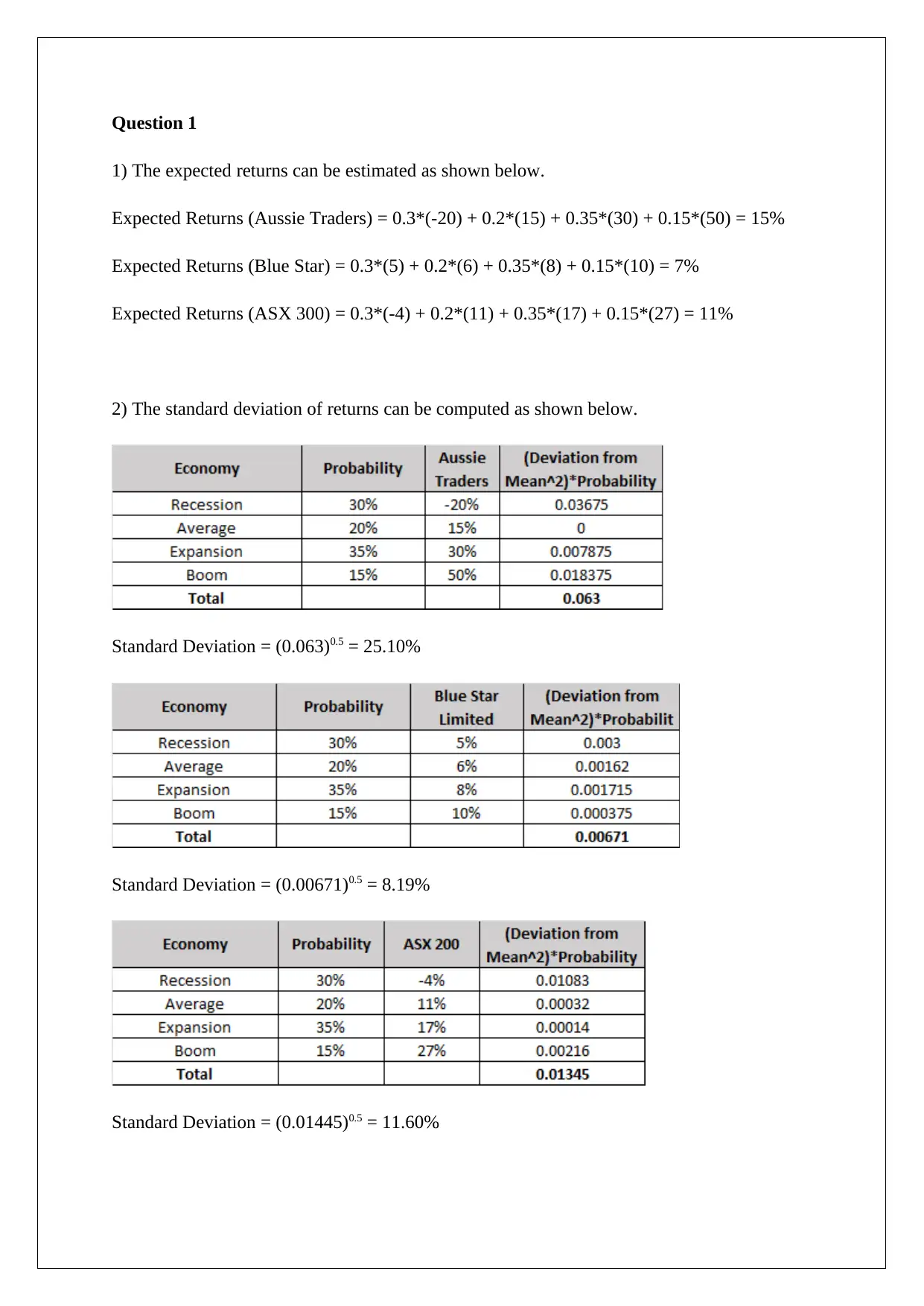

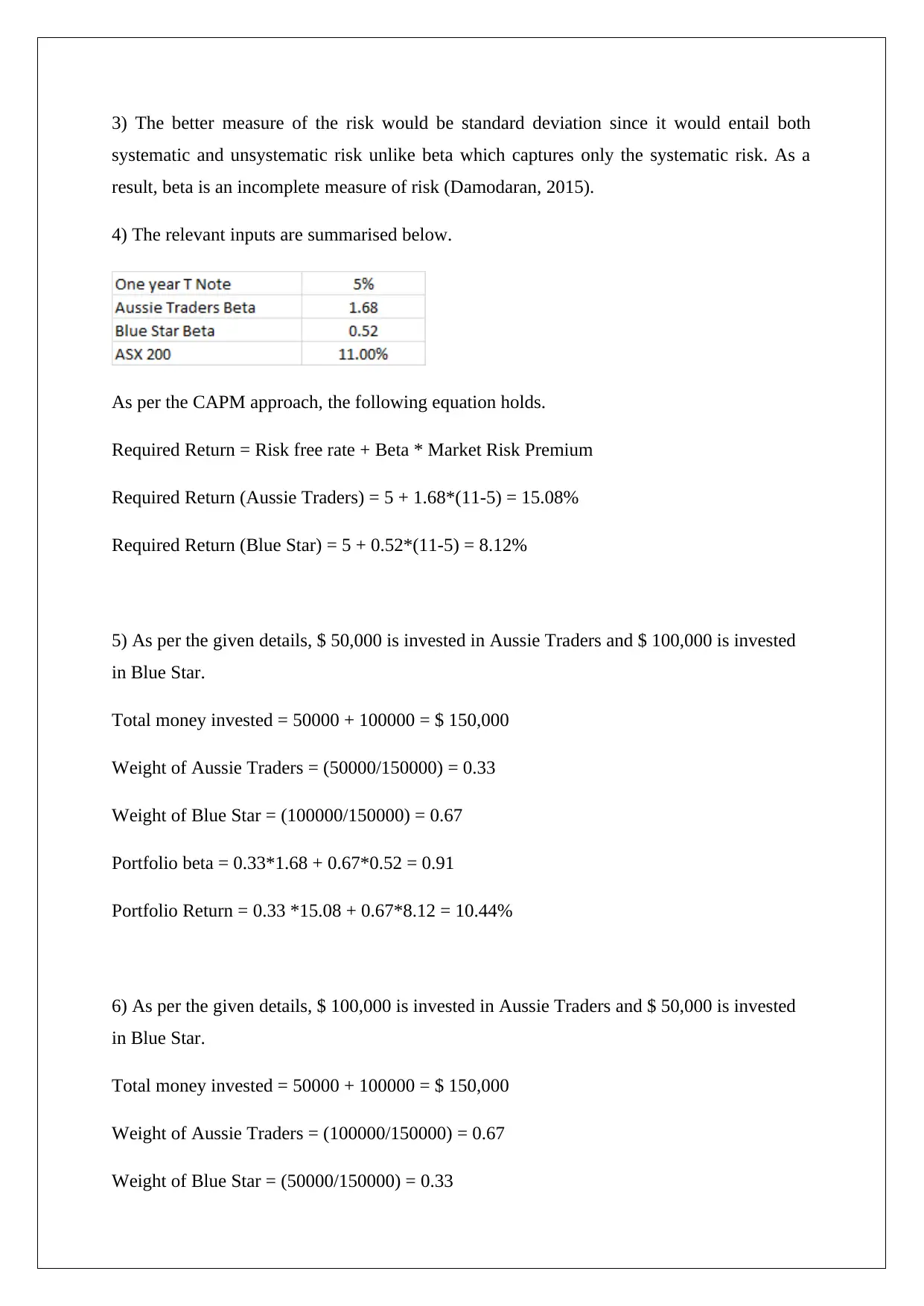

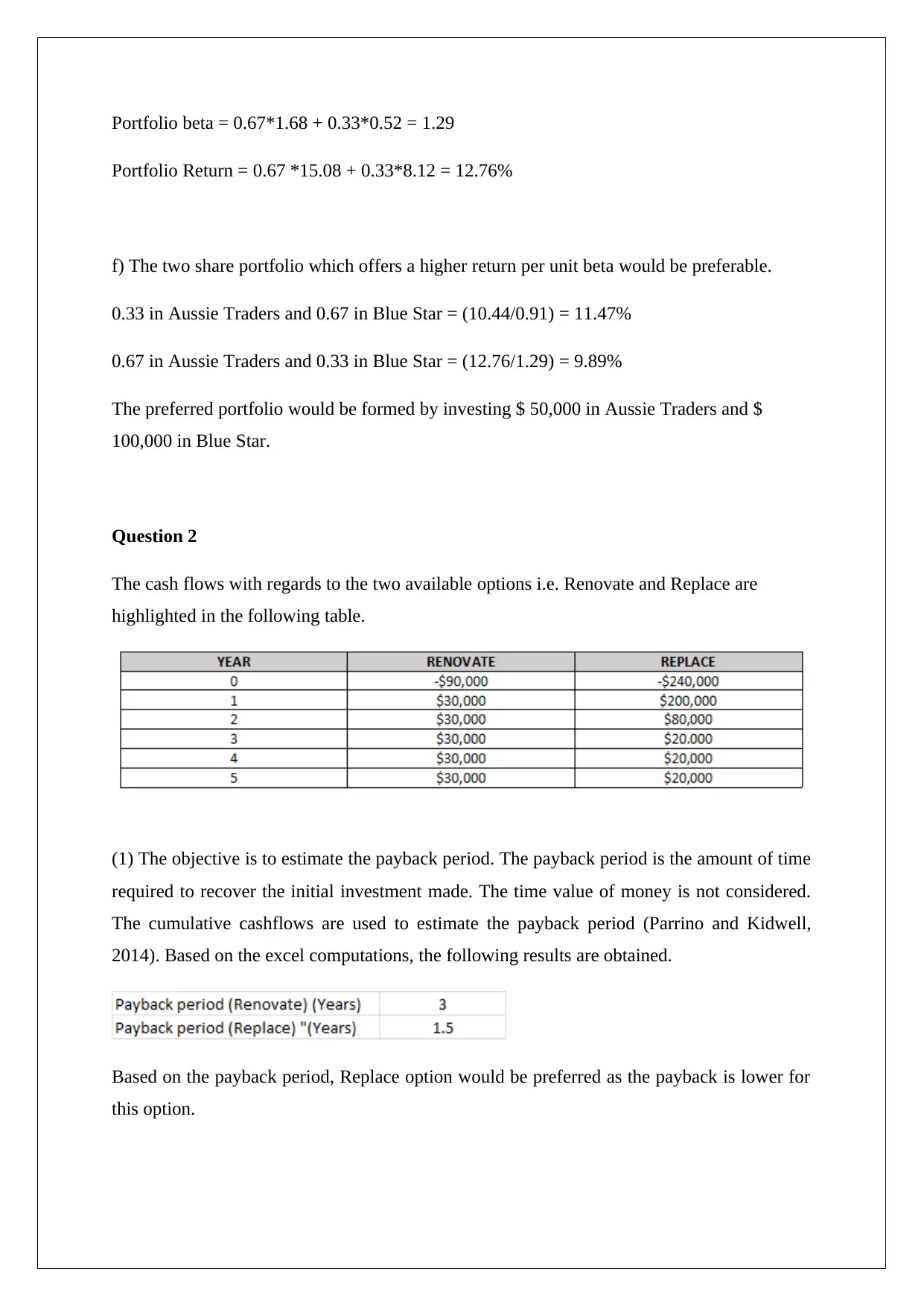

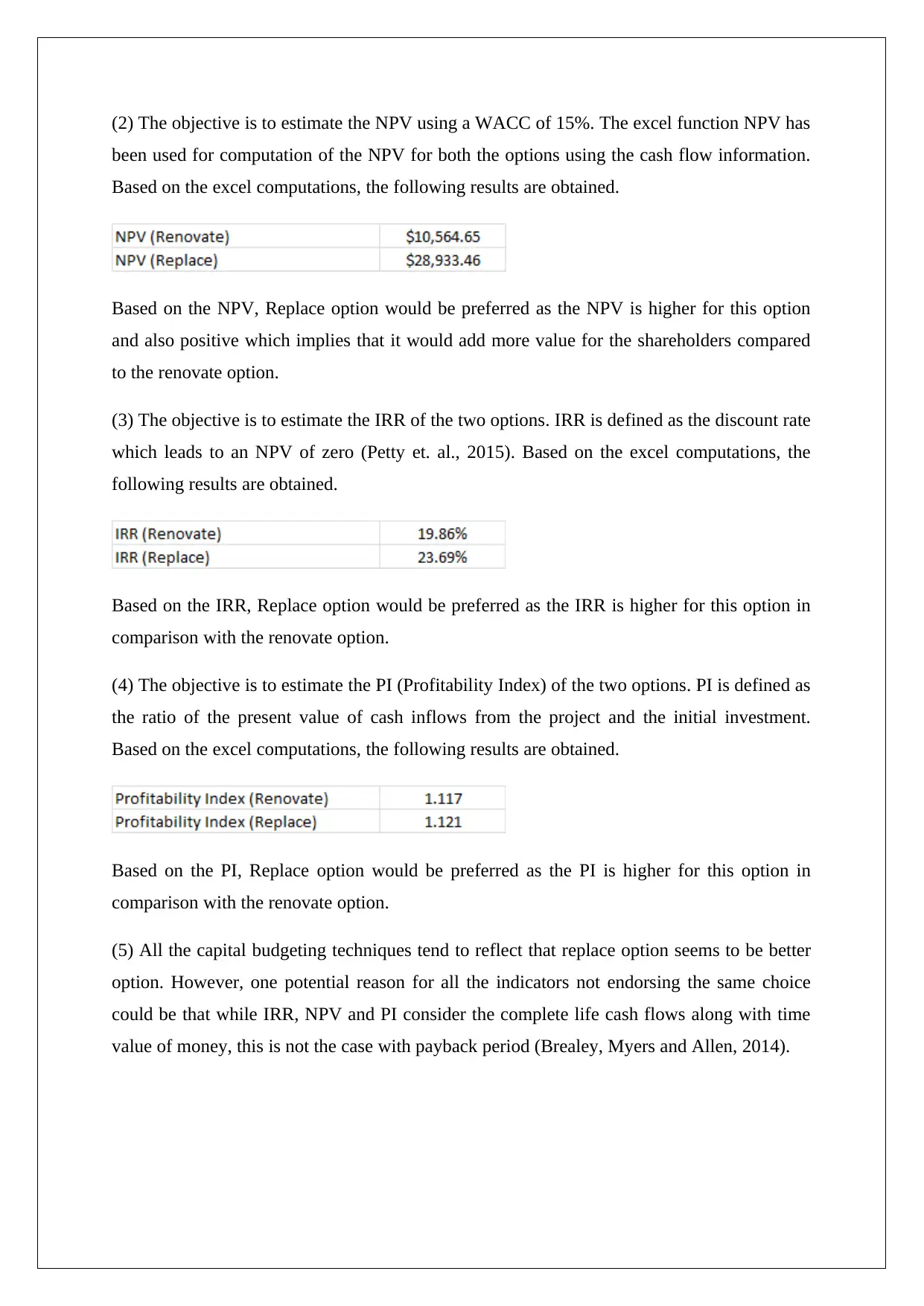

This corporate finance assignment solution analyzes portfolio performance and capital budgeting techniques. Question 1 calculates expected returns, standard deviation, and portfolio beta for different investment scenarios, comparing the risk and return profiles of Aussie Traders and Blue Star. It also applies the Capital Asset Pricing Model (CAPM) to determine required returns and portfolio returns for varying investment weights. Question 2 evaluates two options, Renovate and Replace, using payback period, Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Index (PI) to determine the most financially viable choice. The solution provides detailed calculations, comparisons of the two options, and references key corporate finance texts like Brealey, Myers, and Allen (2014), Damodaran (2015), Parrino and Kidwell (2014), and Petty et al. (2015).

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)