Corporate Finance Assignment Solution - Financial Analysis & Valuation

VerifiedAdded on 2023/06/07

|6

|1023

|70

Homework Assignment

AI Summary

This document presents a comprehensive solution to a corporate finance assignment. The solution addresses key concepts including the present value of an annuity, bond valuation, and the weighted average cost of capital (WACC). It calculates the present value of annuity payments and analyzes bond characteristics with both simple and compound interest. The assignment further delves into project feasibility analysis using Net Present Value (NPV) and Internal Rate of Return (IRR), comparing mutually exclusive projects and discussing situations where NPV and IRR may yield different results. Finally, it explores stock valuation techniques, differentiating between fundamental and technical analysis, and explaining how market participants determine if a stock is undervalued or overvalued, using the example of Rio Tinto. The document references several key finance textbooks to support its analysis.

CORPORATE FINANCE

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

PART A

The objective is to compute the present value of the annuity payment for which the formula

stated below can be used.

Present value of annuity = P(1-(1+r)-n)/r

The inputs for the above formula are as follows.

Hence, present value = (3600*(1-1.01-24)/0.01)

Solving the above, we get present value = $ 76,476.19

PART B

The bonds issued by the company have the following characteristics.

Par value is $ 10,000 with interest rate applicable being 10% p.a. and a maturity period of 12

years.

a) The simple interest does not change and is the same for each of the 12 years.

Hence, interest paid by the company till maturity = 10000*10%*12 = $ 12,000

b) Now considering the interest being compounded, the total amount paid as interest would

be the equivalent of the future value of interest annuity payments at the time of maturity. This

can be computed using the following computation based on the given inputs.

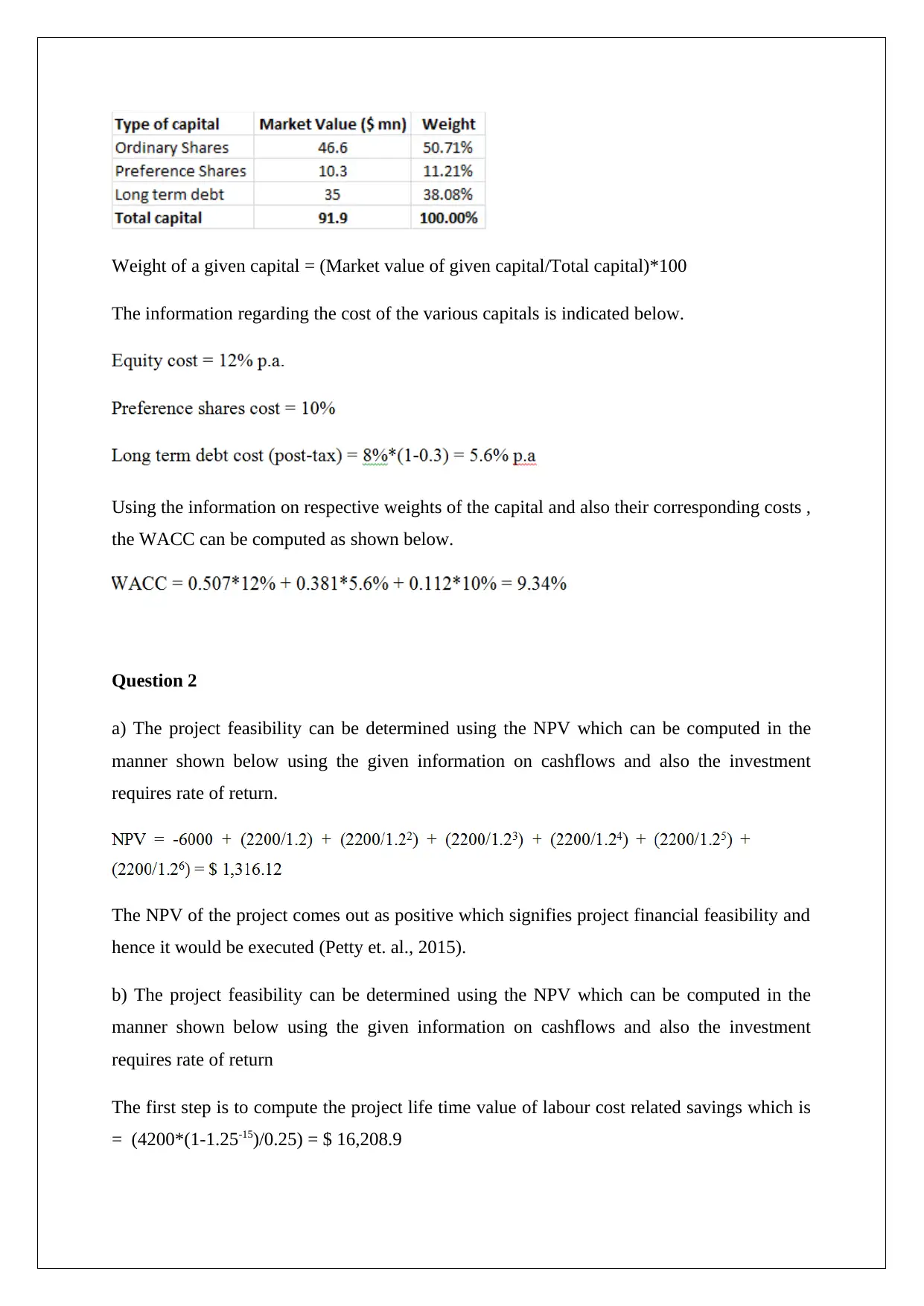

PART C

The weight of the three sources of capital to the firm is computed as shown below in the

tabular format.

PART A

The objective is to compute the present value of the annuity payment for which the formula

stated below can be used.

Present value of annuity = P(1-(1+r)-n)/r

The inputs for the above formula are as follows.

Hence, present value = (3600*(1-1.01-24)/0.01)

Solving the above, we get present value = $ 76,476.19

PART B

The bonds issued by the company have the following characteristics.

Par value is $ 10,000 with interest rate applicable being 10% p.a. and a maturity period of 12

years.

a) The simple interest does not change and is the same for each of the 12 years.

Hence, interest paid by the company till maturity = 10000*10%*12 = $ 12,000

b) Now considering the interest being compounded, the total amount paid as interest would

be the equivalent of the future value of interest annuity payments at the time of maturity. This

can be computed using the following computation based on the given inputs.

PART C

The weight of the three sources of capital to the firm is computed as shown below in the

tabular format.

Weight of a given capital = (Market value of given capital/Total capital)*100

The information regarding the cost of the various capitals is indicated below.

Using the information on respective weights of the capital and also their corresponding costs ,

the WACC can be computed as shown below.

Question 2

a) The project feasibility can be determined using the NPV which can be computed in the

manner shown below using the given information on cashflows and also the investment

requires rate of return.

The NPV of the project comes out as positive which signifies project financial feasibility and

hence it would be executed (Petty et. al., 2015).

b) The project feasibility can be determined using the NPV which can be computed in the

manner shown below using the given information on cashflows and also the investment

requires rate of return

The first step is to compute the project life time value of labour cost related savings which is

= (4200*(1-1.25-15)/0.25) = $ 16,208.9

The information regarding the cost of the various capitals is indicated below.

Using the information on respective weights of the capital and also their corresponding costs ,

the WACC can be computed as shown below.

Question 2

a) The project feasibility can be determined using the NPV which can be computed in the

manner shown below using the given information on cashflows and also the investment

requires rate of return.

The NPV of the project comes out as positive which signifies project financial feasibility and

hence it would be executed (Petty et. al., 2015).

b) The project feasibility can be determined using the NPV which can be computed in the

manner shown below using the given information on cashflows and also the investment

requires rate of return

The first step is to compute the project life time value of labour cost related savings which is

= (4200*(1-1.25-15)/0.25) = $ 16,208.9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The NPV of the project comes out as positive which signifies project financial feasibility and

hence it would be executed (Damodaran, 2015).

c) If the two projects highlighted above are mutually exclusive, then the superior project

ought to be identified which would be chosen. In order to enable the same, the NPV of

project A and project B has been compared which clearly highlights that the former has a

higher value of NPV making project A the appropriate choice (Brealey, Myers and Allen,

2014).

d) It is not true that same results are obtained from NPV and IRR for every project. In certain

cases the results may differ. A noticeable example in this regards would be projects involving

net cash inflow in any year after the project starts producing revenue. In such a case, it is

likely that IRR would produce multiple values and hence the underlying decision would not

match with that indicated by NPV (Parrino and Kidwell, 2014).

Question 3

Market participants make attempt to outline if a given stock is undervalued or overvalued.

This is achieved only when the fair value or intrinsic value of the stock is computed on the

basis of the present information and future estimates. Stock is termed as undervalued if the

fair value computed is higher than the prevailing market value of the stock or if the fair value

is lower than the prevailing market value of the stock, then the stock is termed as overvalued.

Consider for instance the stock of the mining giant Rio Tinto. Assume that the market price is

$23 but the fair price through valuation technique comes out as $ 32. In such situation, the

Rio Tinto stock would be termed as undervalued and therefore buying can be done (Parrino

and Kidwell, 2014).

The technical analysis is a process which aims to estimate the future stock movement based

on the respective past movements under the assumption that future stock movements tend to

be impacted by the past stock movements. Thus, technical analysis aims to facilitate the

market participants in taking calls related to trading in stocks by considering the trends,

support and resistance (Damodaran, 2015). The fundamental analysis in sharp contrast aims

to determine the fair value of the share considering the present performance and estimating

hence it would be executed (Damodaran, 2015).

c) If the two projects highlighted above are mutually exclusive, then the superior project

ought to be identified which would be chosen. In order to enable the same, the NPV of

project A and project B has been compared which clearly highlights that the former has a

higher value of NPV making project A the appropriate choice (Brealey, Myers and Allen,

2014).

d) It is not true that same results are obtained from NPV and IRR for every project. In certain

cases the results may differ. A noticeable example in this regards would be projects involving

net cash inflow in any year after the project starts producing revenue. In such a case, it is

likely that IRR would produce multiple values and hence the underlying decision would not

match with that indicated by NPV (Parrino and Kidwell, 2014).

Question 3

Market participants make attempt to outline if a given stock is undervalued or overvalued.

This is achieved only when the fair value or intrinsic value of the stock is computed on the

basis of the present information and future estimates. Stock is termed as undervalued if the

fair value computed is higher than the prevailing market value of the stock or if the fair value

is lower than the prevailing market value of the stock, then the stock is termed as overvalued.

Consider for instance the stock of the mining giant Rio Tinto. Assume that the market price is

$23 but the fair price through valuation technique comes out as $ 32. In such situation, the

Rio Tinto stock would be termed as undervalued and therefore buying can be done (Parrino

and Kidwell, 2014).

The technical analysis is a process which aims to estimate the future stock movement based

on the respective past movements under the assumption that future stock movements tend to

be impacted by the past stock movements. Thus, technical analysis aims to facilitate the

market participants in taking calls related to trading in stocks by considering the trends,

support and resistance (Damodaran, 2015). The fundamental analysis in sharp contrast aims

to determine the fair value of the share considering the present performance and estimating

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the financial performance based on the estimated external and internal factors. The final

decision by the market participants to buy the share or not is taken on the basis of comparison

between the market price and the fair value which would highlight if at the prevailing price it

is undervalued or overvalued (Brealey, Myers and Allen, 2014).

decision by the market participants to buy the share or not is taken on the basis of comparison

between the market price and the fair value which would highlight if at the prevailing price it

is undervalued or overvalued (Brealey, Myers and Allen, 2014).

References

Brealey, R. A., Myers, S. C. and Allen, F. (2014) Principles of corporate finance, 6th ed. New

York: McGraw-Hill Publications

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. and Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M. and Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

Brealey, R. A., Myers, S. C. and Allen, F. (2014) Principles of corporate finance, 6th ed. New

York: McGraw-Hill Publications

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. and Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M. and Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.