University Corporate Finance Assignment: Bond Valuation and WACC

VerifiedAdded on 2022/10/17

|11

|1890

|9

Homework Assignment

AI Summary

This document provides a comprehensive solution to a corporate finance assignment, addressing key concepts such as bond valuation, yield to maturity, and the weighted average cost of capital (WACC). The assignment calculates bond prices and yields, analyzes investment returns, and determines the cost of equity using the Capital Asset Pricing Model (CAPM) and Dividend Discount Model (DDM). The solution includes calculations for WACC, considering both equity and debt, and explores the impact of tax rates. Furthermore, the assignment delves into the agency problem, illustrating it with a case study of the Punjab National Bank fraud, and discussing the role of corporate governance in mitigating such issues. The analysis incorporates relevant financial data and academic references to support the findings. This assignment helps students understand and apply core corporate finance principles to real-world scenarios.

RUNNING HEAD: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Table of Contents

Question 1........................................................................................................................................2

Part A...........................................................................................................................................2

Part B...........................................................................................................................................2

Question 2........................................................................................................................................3

Question 3........................................................................................................................................5

References........................................................................................................................................8

Table of Contents

Question 1........................................................................................................................................2

Part A...........................................................................................................................................2

Part B...........................................................................................................................................2

Question 2........................................................................................................................................3

Question 3........................................................................................................................................5

References........................................................................................................................................8

2CORPORATE FINANCE

Question 1

Part A

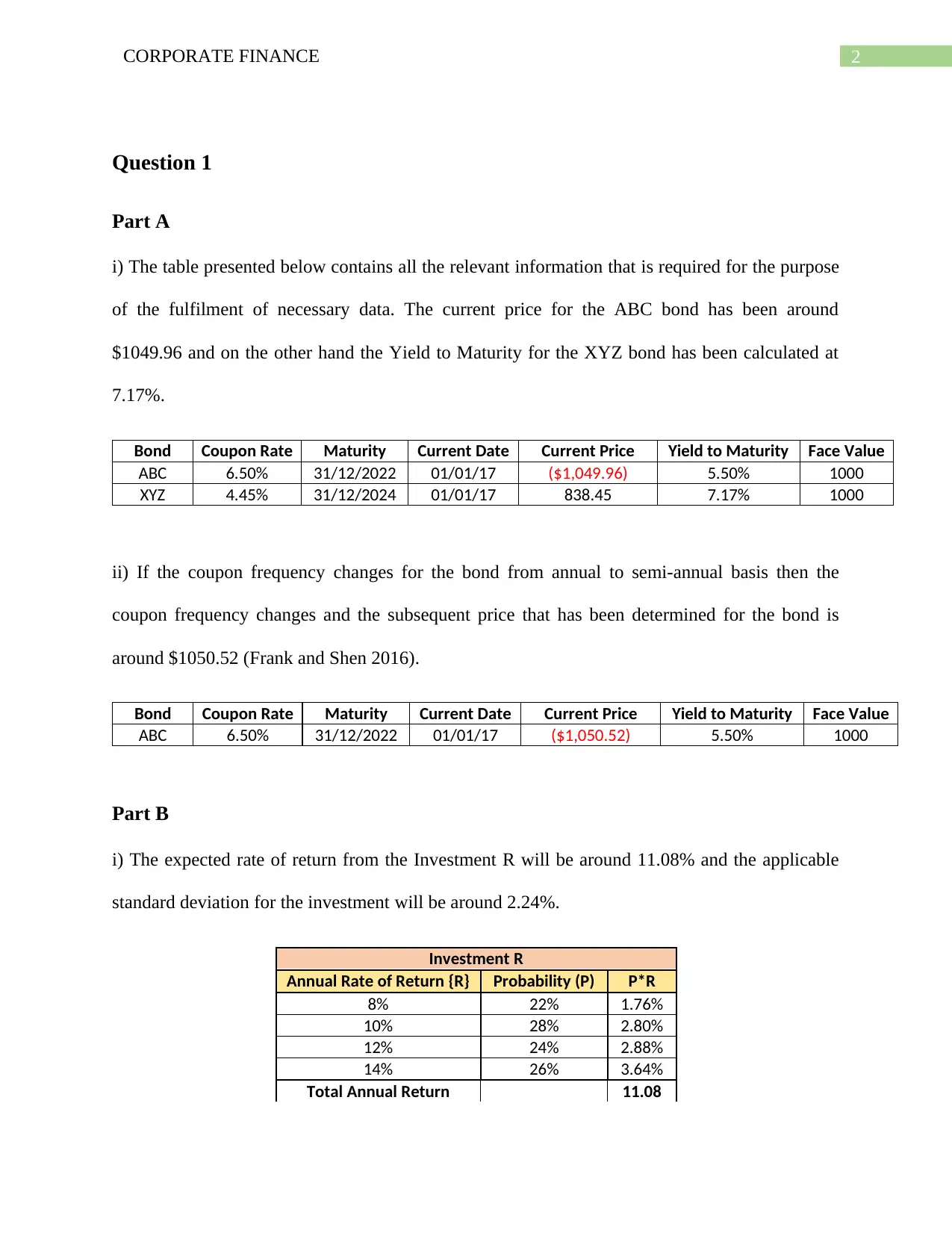

i) The table presented below contains all the relevant information that is required for the purpose

of the fulfilment of necessary data. The current price for the ABC bond has been around

$1049.96 and on the other hand the Yield to Maturity for the XYZ bond has been calculated at

7.17%.

Bond Coupon Rate Maturity Current Date Current Price Yield to Maturity Face Value

ABC 6.50% 31/12/2022 01/01/17 ($1,049.96) 5.50% 1000

XYZ 4.45% 31/12/2024 01/01/17 838.45 7.17% 1000

ii) If the coupon frequency changes for the bond from annual to semi-annual basis then the

coupon frequency changes and the subsequent price that has been determined for the bond is

around $1050.52 (Frank and Shen 2016).

Bond Coupon Rate Maturity Current Date Current Price Yield to Maturity Face Value

ABC 6.50% 31/12/2022 01/01/17 ($1,050.52) 5.50% 1000

Part B

i) The expected rate of return from the Investment R will be around 11.08% and the applicable

standard deviation for the investment will be around 2.24%.

Investment R

Annual Rate of Return {R} Probability (P) P*R

8% 22% 1.76%

10% 28% 2.80%

12% 24% 2.88%

14% 26% 3.64%

Total Annual Return 11.08

Question 1

Part A

i) The table presented below contains all the relevant information that is required for the purpose

of the fulfilment of necessary data. The current price for the ABC bond has been around

$1049.96 and on the other hand the Yield to Maturity for the XYZ bond has been calculated at

7.17%.

Bond Coupon Rate Maturity Current Date Current Price Yield to Maturity Face Value

ABC 6.50% 31/12/2022 01/01/17 ($1,049.96) 5.50% 1000

XYZ 4.45% 31/12/2024 01/01/17 838.45 7.17% 1000

ii) If the coupon frequency changes for the bond from annual to semi-annual basis then the

coupon frequency changes and the subsequent price that has been determined for the bond is

around $1050.52 (Frank and Shen 2016).

Bond Coupon Rate Maturity Current Date Current Price Yield to Maturity Face Value

ABC 6.50% 31/12/2022 01/01/17 ($1,050.52) 5.50% 1000

Part B

i) The expected rate of return from the Investment R will be around 11.08% and the applicable

standard deviation for the investment will be around 2.24%.

Investment R

Annual Rate of Return {R} Probability (P) P*R

8% 22% 1.76%

10% 28% 2.80%

12% 24% 2.88%

14% 26% 3.64%

Total Annual Return 11.08

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

%

Standard Deviation 2.24%

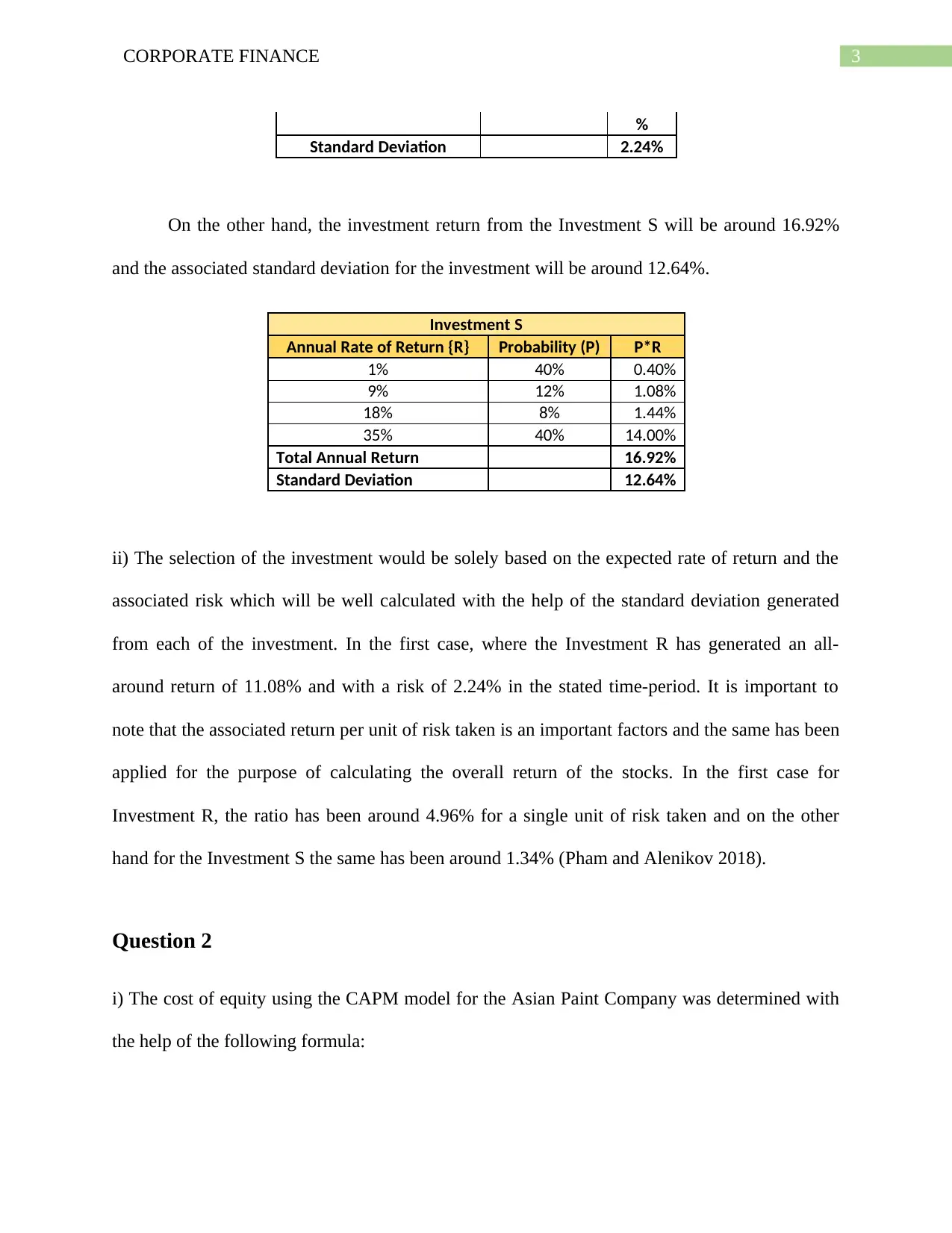

On the other hand, the investment return from the Investment S will be around 16.92%

and the associated standard deviation for the investment will be around 12.64%.

Investment S

Annual Rate of Return {R} Probability (P) P*R

1% 40% 0.40%

9% 12% 1.08%

18% 8% 1.44%

35% 40% 14.00%

Total Annual Return 16.92%

Standard Deviation 12.64%

ii) The selection of the investment would be solely based on the expected rate of return and the

associated risk which will be well calculated with the help of the standard deviation generated

from each of the investment. In the first case, where the Investment R has generated an all-

around return of 11.08% and with a risk of 2.24% in the stated time-period. It is important to

note that the associated return per unit of risk taken is an important factors and the same has been

applied for the purpose of calculating the overall return of the stocks. In the first case for

Investment R, the ratio has been around 4.96% for a single unit of risk taken and on the other

hand for the Investment S the same has been around 1.34% (Pham and Alenikov 2018).

Question 2

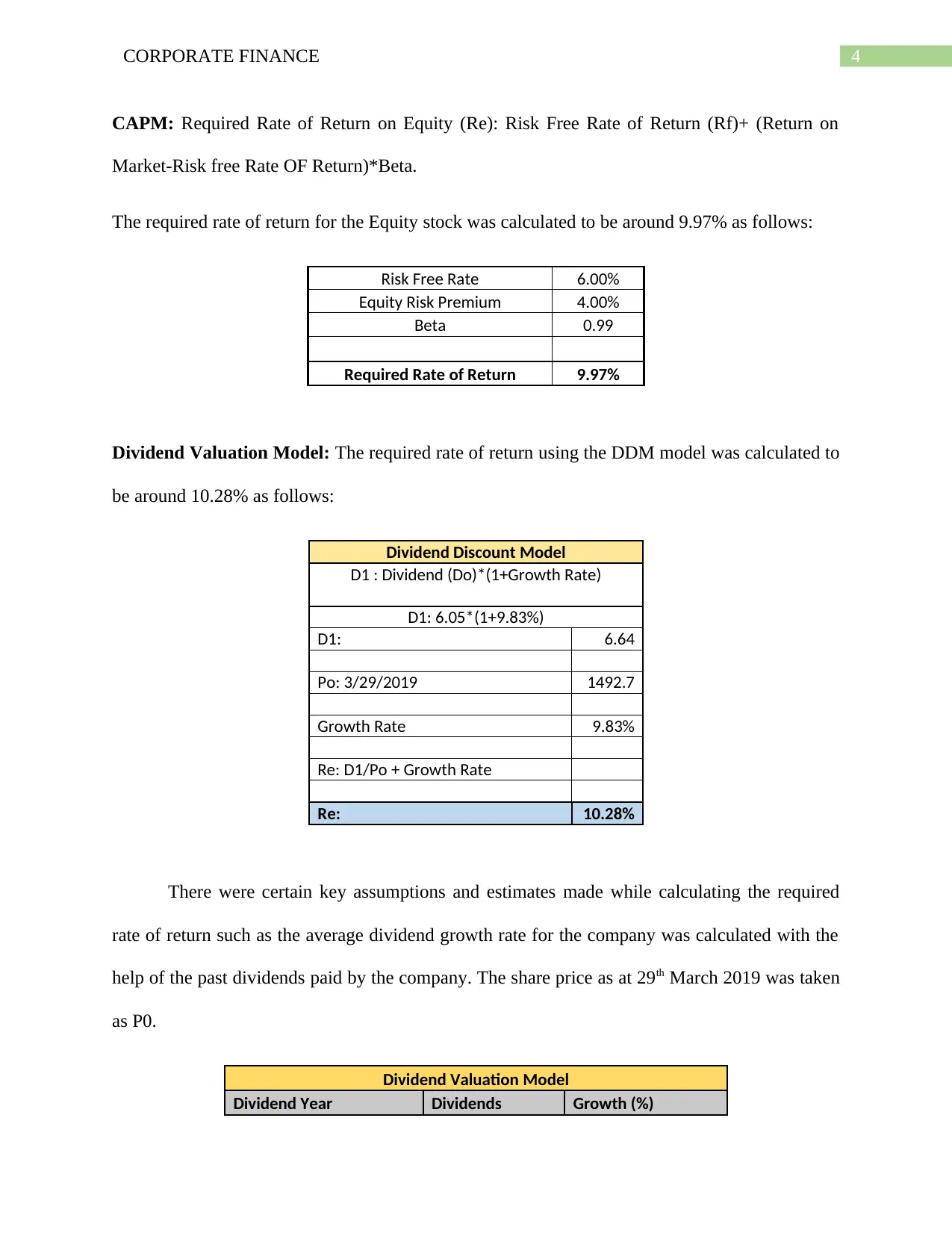

i) The cost of equity using the CAPM model for the Asian Paint Company was determined with

the help of the following formula:

%

Standard Deviation 2.24%

On the other hand, the investment return from the Investment S will be around 16.92%

and the associated standard deviation for the investment will be around 12.64%.

Investment S

Annual Rate of Return {R} Probability (P) P*R

1% 40% 0.40%

9% 12% 1.08%

18% 8% 1.44%

35% 40% 14.00%

Total Annual Return 16.92%

Standard Deviation 12.64%

ii) The selection of the investment would be solely based on the expected rate of return and the

associated risk which will be well calculated with the help of the standard deviation generated

from each of the investment. In the first case, where the Investment R has generated an all-

around return of 11.08% and with a risk of 2.24% in the stated time-period. It is important to

note that the associated return per unit of risk taken is an important factors and the same has been

applied for the purpose of calculating the overall return of the stocks. In the first case for

Investment R, the ratio has been around 4.96% for a single unit of risk taken and on the other

hand for the Investment S the same has been around 1.34% (Pham and Alenikov 2018).

Question 2

i) The cost of equity using the CAPM model for the Asian Paint Company was determined with

the help of the following formula:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCE

CAPM: Required Rate of Return on Equity (Re): Risk Free Rate of Return (Rf)+ (Return on

Market-Risk free Rate OF Return)*Beta.

The required rate of return for the Equity stock was calculated to be around 9.97% as follows:

Risk Free Rate 6.00%

Equity Risk Premium 4.00%

Beta 0.99

Required Rate of Return 9.97%

Dividend Valuation Model: The required rate of return using the DDM model was calculated to

be around 10.28% as follows:

Dividend Discount Model

D1 : Dividend (Do)*(1+Growth Rate)

D1: 6.05*(1+9.83%)

D1: 6.64

Po: 3/29/2019 1492.7

Growth Rate 9.83%

Re: D1/Po + Growth Rate

Re: 10.28%

There were certain key assumptions and estimates made while calculating the required

rate of return such as the average dividend growth rate for the company was calculated with the

help of the past dividends paid by the company. The share price as at 29th March 2019 was taken

as P0.

Dividend Valuation Model

Dividend Year Dividends Growth (%)

CAPM: Required Rate of Return on Equity (Re): Risk Free Rate of Return (Rf)+ (Return on

Market-Risk free Rate OF Return)*Beta.

The required rate of return for the Equity stock was calculated to be around 9.97% as follows:

Risk Free Rate 6.00%

Equity Risk Premium 4.00%

Beta 0.99

Required Rate of Return 9.97%

Dividend Valuation Model: The required rate of return using the DDM model was calculated to

be around 10.28% as follows:

Dividend Discount Model

D1 : Dividend (Do)*(1+Growth Rate)

D1: 6.05*(1+9.83%)

D1: 6.64

Po: 3/29/2019 1492.7

Growth Rate 9.83%

Re: D1/Po + Growth Rate

Re: 10.28%

There were certain key assumptions and estimates made while calculating the required

rate of return such as the average dividend growth rate for the company was calculated with the

help of the past dividends paid by the company. The share price as at 29th March 2019 was taken

as P0.

Dividend Valuation Model

Dividend Year Dividends Growth (%)

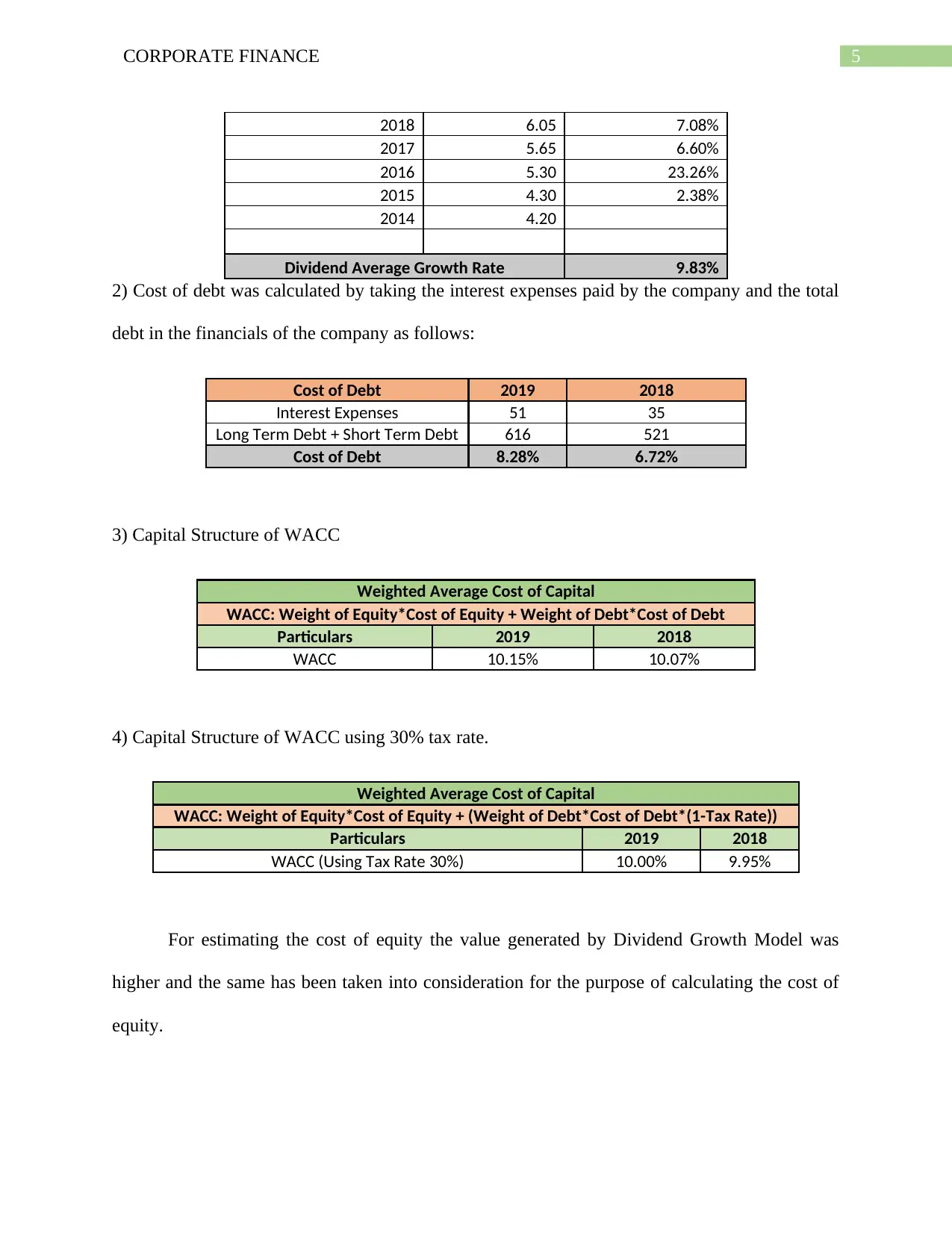

5CORPORATE FINANCE

2018 6.05 7.08%

2017 5.65 6.60%

2016 5.30 23.26%

2015 4.30 2.38%

2014 4.20

Dividend Average Growth Rate 9.83%

2) Cost of debt was calculated by taking the interest expenses paid by the company and the total

debt in the financials of the company as follows:

Cost of Debt 2019 2018

Interest Expenses 51 35

Long Term Debt + Short Term Debt 616 521

Cost of Debt 8.28% 6.72%

3) Capital Structure of WACC

Weighted Average Cost of Capital

WACC: Weight of Equity*Cost of Equity + Weight of Debt*Cost of Debt

Particulars 2019 2018

WACC 10.15% 10.07%

4) Capital Structure of WACC using 30% tax rate.

Weighted Average Cost of Capital

WACC: Weight of Equity*Cost of Equity + (Weight of Debt*Cost of Debt*(1-Tax Rate))

Particulars 2019 2018

WACC (Using Tax Rate 30%) 10.00% 9.95%

For estimating the cost of equity the value generated by Dividend Growth Model was

higher and the same has been taken into consideration for the purpose of calculating the cost of

equity.

2018 6.05 7.08%

2017 5.65 6.60%

2016 5.30 23.26%

2015 4.30 2.38%

2014 4.20

Dividend Average Growth Rate 9.83%

2) Cost of debt was calculated by taking the interest expenses paid by the company and the total

debt in the financials of the company as follows:

Cost of Debt 2019 2018

Interest Expenses 51 35

Long Term Debt + Short Term Debt 616 521

Cost of Debt 8.28% 6.72%

3) Capital Structure of WACC

Weighted Average Cost of Capital

WACC: Weight of Equity*Cost of Equity + Weight of Debt*Cost of Debt

Particulars 2019 2018

WACC 10.15% 10.07%

4) Capital Structure of WACC using 30% tax rate.

Weighted Average Cost of Capital

WACC: Weight of Equity*Cost of Equity + (Weight of Debt*Cost of Debt*(1-Tax Rate))

Particulars 2019 2018

WACC (Using Tax Rate 30%) 10.00% 9.95%

For estimating the cost of equity the value generated by Dividend Growth Model was

higher and the same has been taken into consideration for the purpose of calculating the cost of

equity.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCE

Question 3

The agency problem states the conflict of interest that usually arises from a relationship

whereby, one party is expected to act in another’s best interest. In terms of corporate finance the

same can be well and better explained with the help of the following problem whereby the

company would be acting for a purpose or reason that may not be in the best interest of the

various stakeholders that are associated with the company (Zee Business 2018). In the above

case study analysed whereby the fraudulent activity took place in India between a group of

people, companies and the public sector bank (Punjab National Bank). The agency problem can

be well related with the mentioned case whereby there was a conflict with the shareholders and

the company itself where due to fraudulent activities carried on by one of the customers of the

banks ultimately affected the company and the reported profitability and the financial position of

the company The (Better India 2018). The effect resulted in the wealth destruction of the

shareholders of the company and the overall brand image of the bank.

Corporate Governance is a key combination of rules, processes, law that enables or helps

the business operations in a proper and effective way so that various functions and work can be

better controlled or regulated (NEWS and News 2018). The term Corporate Governance

encompasses the various internal and external factors of the company and the same can be in the

field of key stakeholders, customers, suppliers, government regulators and the management of

the company. The absence of proper corporate governance policies like in the case of Punjab

National Bank could be affected merely by absence of proper rules and guidance in the

organization that could affect the overall operations of the company and ethical principle upon

which the business should operate (NEWS and News 2018).

Question 3

The agency problem states the conflict of interest that usually arises from a relationship

whereby, one party is expected to act in another’s best interest. In terms of corporate finance the

same can be well and better explained with the help of the following problem whereby the

company would be acting for a purpose or reason that may not be in the best interest of the

various stakeholders that are associated with the company (Zee Business 2018). In the above

case study analysed whereby the fraudulent activity took place in India between a group of

people, companies and the public sector bank (Punjab National Bank). The agency problem can

be well related with the mentioned case whereby there was a conflict with the shareholders and

the company itself where due to fraudulent activities carried on by one of the customers of the

banks ultimately affected the company and the reported profitability and the financial position of

the company The (Better India 2018). The effect resulted in the wealth destruction of the

shareholders of the company and the overall brand image of the bank.

Corporate Governance is a key combination of rules, processes, law that enables or helps

the business operations in a proper and effective way so that various functions and work can be

better controlled or regulated (NEWS and News 2018). The term Corporate Governance

encompasses the various internal and external factors of the company and the same can be in the

field of key stakeholders, customers, suppliers, government regulators and the management of

the company. The absence of proper corporate governance policies like in the case of Punjab

National Bank could be affected merely by absence of proper rules and guidance in the

organization that could affect the overall operations of the company and ethical principle upon

which the business should operate (NEWS and News 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE FINANCE

The Punjab National Bank, which is the second largest Indian Public Sector Bank, gave a

shock to the financial sector whereby the bank announced that it has discovered an fraud in the

operations of the bank that is around Rs 11,400 Crore making it to around $1.8 billion. The crime

came into limelight when the PNB bank filled a complaint with the Federal Investigative Agency

that it has been scammed by three major companies and a group of people. The key people

included Nirav Modi, a billionaire jeweller, his brother Neeshal and his maternal uncle Mehul

Choksi, who is acting as the Managing Director of Gitanjali Gems, who were claimed for the

scam and thereby making a total loss of around 2.8 billion dollars ($43 million). The bank has

also alleged that two of the employees who were employed in the Brady Branch in Mumbai has

issued fraudulent “Letter of Undertaking” whereby the bank was acting as the key undertaker in

the loan application. The key thing that came into light was that the Public sector banks were not

having any kind of backing up with the credit mortgage from the associated group of people. The

key settlement leaded the bank end up in a huge loss whereby the company was having a huge

loss when it ended up settling with foreign banks and by recovering some of the assets of Nirav

Modi. The bank also claimed that the LOU’s iisued by the Brady Branch were done without any

margin money and approved Credit Limit, which ultimately increased the credit risk that was

associated with the bank affecting the overall operations and the financial risk associated with

the bank.

From the above case it can be well understood that corporate governance plays a huge

role in the workings and operations of the company whereby the ethical principles and rules,

binds the operations of an entity. It is important that the management of the bank undertakes

various actions for the purpose of improving the agency theory problem that occurred. It should

also undertakes strategies and initiatives that benefits all the stakeholders of the company.

The Punjab National Bank, which is the second largest Indian Public Sector Bank, gave a

shock to the financial sector whereby the bank announced that it has discovered an fraud in the

operations of the bank that is around Rs 11,400 Crore making it to around $1.8 billion. The crime

came into limelight when the PNB bank filled a complaint with the Federal Investigative Agency

that it has been scammed by three major companies and a group of people. The key people

included Nirav Modi, a billionaire jeweller, his brother Neeshal and his maternal uncle Mehul

Choksi, who is acting as the Managing Director of Gitanjali Gems, who were claimed for the

scam and thereby making a total loss of around 2.8 billion dollars ($43 million). The bank has

also alleged that two of the employees who were employed in the Brady Branch in Mumbai has

issued fraudulent “Letter of Undertaking” whereby the bank was acting as the key undertaker in

the loan application. The key thing that came into light was that the Public sector banks were not

having any kind of backing up with the credit mortgage from the associated group of people. The

key settlement leaded the bank end up in a huge loss whereby the company was having a huge

loss when it ended up settling with foreign banks and by recovering some of the assets of Nirav

Modi. The bank also claimed that the LOU’s iisued by the Brady Branch were done without any

margin money and approved Credit Limit, which ultimately increased the credit risk that was

associated with the bank affecting the overall operations and the financial risk associated with

the bank.

From the above case it can be well understood that corporate governance plays a huge

role in the workings and operations of the company whereby the ethical principles and rules,

binds the operations of an entity. It is important that the management of the bank undertakes

various actions for the purpose of improving the agency theory problem that occurred. It should

also undertakes strategies and initiatives that benefits all the stakeholders of the company.

8CORPORATE FINANCE

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE FINANCE

References

Frank, M.Z. and Shen, T., 2016. Investment and the weighted average cost of capital. Journal of

Financial Economics, 119(2), pp.300-315.

NEWS, B. and News, I. 2018. PNB fraud: All that has happened so far - Times of India. [online]

The Times of India. Available at:

https://timesofindia.indiatimes.com/business/india-business/pnb-fraud-all-that-has-happened-so-

far/articleshow/62945221.cms [Accessed 23 Sep. 2019].

Pham, T.N.B. and Alenikov, T., 2018. The importance of Weighted Average Cost of Capital in

investment decision-making for investors of corporations in the healthcare industry.

The Better India. 2018. Nirav Modi-PNB Fraud: The 7 Agencies Probing India's Biggest

Banking Scam!. [online] Available at: https://www.thebetterindia.com/131764/nirav-modi-pnb-

fraud-7-agencies-banking-scam/ [Accessed 23 Sep. 2019].

The Economic Times. 2018. Wanted in PNB scam, Mehul Choksi tells CBI that it's impossible to

return to India. [online] Available at: https://economictimes.indiatimes.com/news/politics-and-

nation/wanted-in-pnb-scam-mehul-choksi-tells-cbi-that-its-impossible-to-return-to-india/

articleshow/63215819.cms?from=mdr [Accessed 23 Sep. 2019].

Zee Business. 2018. What is PNB fraud? How Punjab National Bank scam happened; blow by

blow account. [online] Available at: https://www.zeebiz.com/companies/news-what-is-pnb-

fraud-how-punjab-national-bank-scam-happened-blow-by-blow-account-37874 [Accessed 23

Sep. 2019].

References

Frank, M.Z. and Shen, T., 2016. Investment and the weighted average cost of capital. Journal of

Financial Economics, 119(2), pp.300-315.

NEWS, B. and News, I. 2018. PNB fraud: All that has happened so far - Times of India. [online]

The Times of India. Available at:

https://timesofindia.indiatimes.com/business/india-business/pnb-fraud-all-that-has-happened-so-

far/articleshow/62945221.cms [Accessed 23 Sep. 2019].

Pham, T.N.B. and Alenikov, T., 2018. The importance of Weighted Average Cost of Capital in

investment decision-making for investors of corporations in the healthcare industry.

The Better India. 2018. Nirav Modi-PNB Fraud: The 7 Agencies Probing India's Biggest

Banking Scam!. [online] Available at: https://www.thebetterindia.com/131764/nirav-modi-pnb-

fraud-7-agencies-banking-scam/ [Accessed 23 Sep. 2019].

The Economic Times. 2018. Wanted in PNB scam, Mehul Choksi tells CBI that it's impossible to

return to India. [online] Available at: https://economictimes.indiatimes.com/news/politics-and-

nation/wanted-in-pnb-scam-mehul-choksi-tells-cbi-that-its-impossible-to-return-to-india/

articleshow/63215819.cms?from=mdr [Accessed 23 Sep. 2019].

Zee Business. 2018. What is PNB fraud? How Punjab National Bank scam happened; blow by

blow account. [online] Available at: https://www.zeebiz.com/companies/news-what-is-pnb-

fraud-how-punjab-national-bank-scam-happened-blow-by-blow-account-37874 [Accessed 23

Sep. 2019].

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE FINANCE

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.