BAP53 Corporate Finance Project Report: Bega Cheese Analysis

VerifiedAdded on 2023/06/09

|8

|1702

|495

Project

AI Summary

This project report provides a comprehensive financial analysis of Bega Cheese's proposed project, focusing on the yogurt range. The report begins with the calculation of the company's Weighted Average Cost of Capital (WACC), which is determined to be 14%, with 13.7% being the cost of equity and 0.10% being the cost of debt. The analysis then proceeds to evaluate the project's Net Present Value (NPV), revealing a negative NPV of -$2,185,611.58, indicating that the project is not financially viable. The report further examines the best and worst-case scenarios, both of which also yield negative NPVs, solidifying the recommendation against the investment. The financial analyst recommends that Bega Cheese should not invest in the yogurt range because the project would lead to significant losses. The report includes detailed calculations of cash inflows, along with the NPV calculations for all scenarios. The report recommends against investing in the project, as the financial analysis indicates that it is not likely to generate sufficient returns. The project's failure to generate positive returns is consistent across different scenarios and is not recommended for investment.

Project Report: Corporate Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Part A: WACC CALCULATIONS..................................................................................3

Part B: Proposed project analysis.....................................................................................4

Part C: Best and Worst case scenario...............................................................................4

Part D: Recommendation..................................................................................................5

References.........................................................................................................................6

Appendix...........................................................................................................................7

Part A: WACC CALCULATIONS..................................................................................3

Part B: Proposed project analysis.....................................................................................4

Part C: Best and Worst case scenario...............................................................................4

Part D: Recommendation..................................................................................................5

References.........................................................................................................................6

Appendix...........................................................................................................................7

Part A: WACC CALCULATIONS

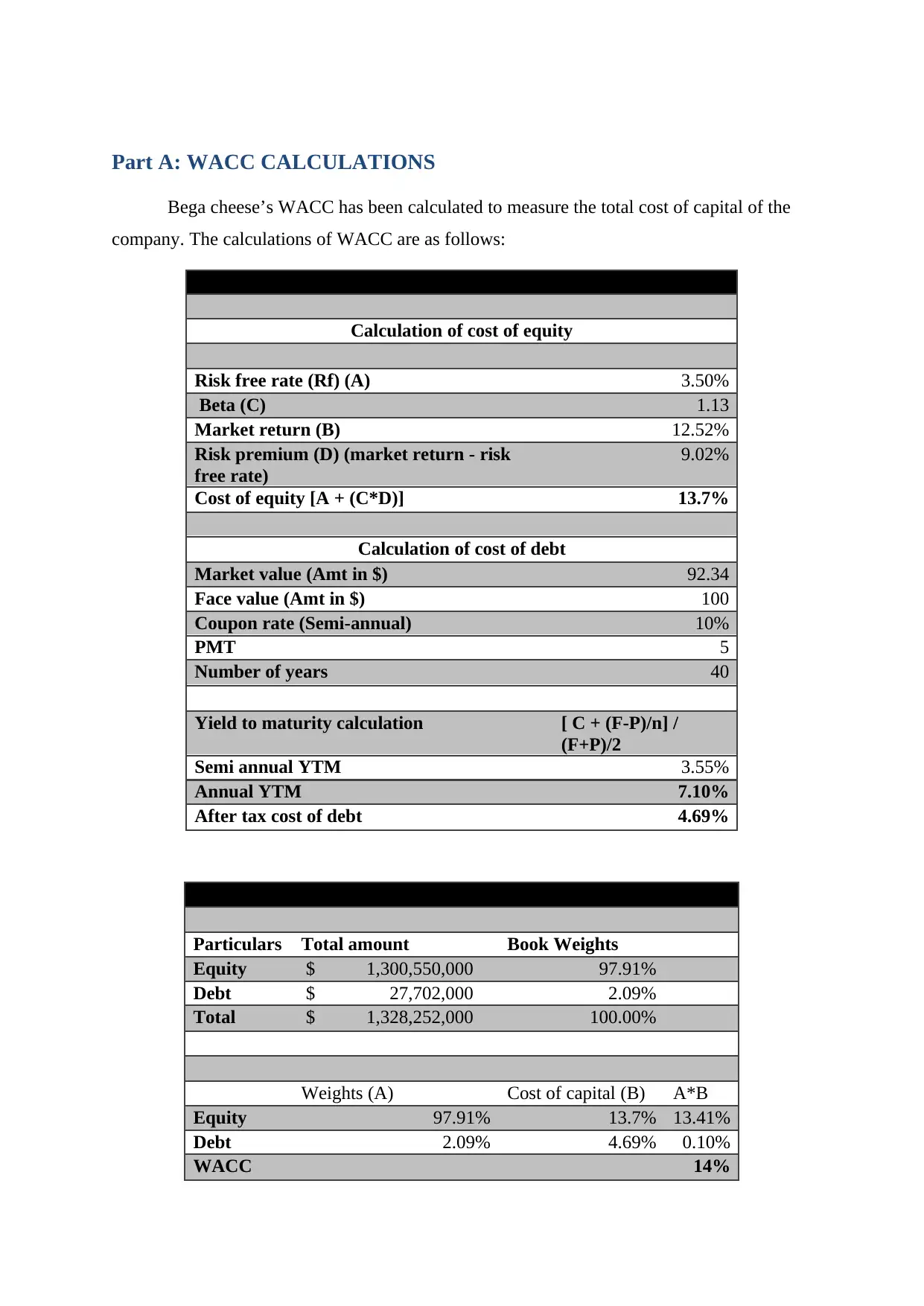

Bega cheese’s WACC has been calculated to measure the total cost of capital of the

company. The calculations of WACC are as follows:

Calculation of WACC

Calculation of cost of equity

Risk free rate (Rf) (A) 3.50%

Beta (C) 1.13

Market return (B) 12.52%

Risk premium (D) (market return - risk

free rate)

9.02%

Cost of equity [A + (C*D)] 13.7%

Calculation of cost of debt

Market value (Amt in $) 92.34

Face value (Amt in $) 100

Coupon rate (Semi-annual) 10%

PMT 5

Number of years 40

Yield to maturity calculation [ C + (F-P)/n] /

(F+P)/2

Semi annual YTM 3.55%

Annual YTM 7.10%

After tax cost of debt 4.69%

Calculation of WACC

Particulars Total amount Book Weights

Equity $ 1,300,550,000 97.91%

Debt $ 27,702,000 2.09%

Total $ 1,328,252,000 100.00%

Weights (A) Cost of capital (B) A*B

Equity 97.91% 13.7% 13.41%

Debt 2.09% 4.69% 0.10%

WACC 14%

Bega cheese’s WACC has been calculated to measure the total cost of capital of the

company. The calculations of WACC are as follows:

Calculation of WACC

Calculation of cost of equity

Risk free rate (Rf) (A) 3.50%

Beta (C) 1.13

Market return (B) 12.52%

Risk premium (D) (market return - risk

free rate)

9.02%

Cost of equity [A + (C*D)] 13.7%

Calculation of cost of debt

Market value (Amt in $) 92.34

Face value (Amt in $) 100

Coupon rate (Semi-annual) 10%

PMT 5

Number of years 40

Yield to maturity calculation [ C + (F-P)/n] /

(F+P)/2

Semi annual YTM 3.55%

Annual YTM 7.10%

After tax cost of debt 4.69%

Calculation of WACC

Particulars Total amount Book Weights

Equity $ 1,300,550,000 97.91%

Debt $ 27,702,000 2.09%

Total $ 1,328,252,000 100.00%

Weights (A) Cost of capital (B) A*B

Equity 97.91% 13.7% 13.41%

Debt 2.09% 4.69% 0.10%

WACC 14%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

(Lumby and Jones, 2007)

It explains that the WACC of the company is 14% out of which 13.7% is the cost of

equity along with the 97.91% in the total capital of the company and 0.10% is the cost of debt

along with the 2.09% in the total capital of the company.

Part B: Proposed project analysis:

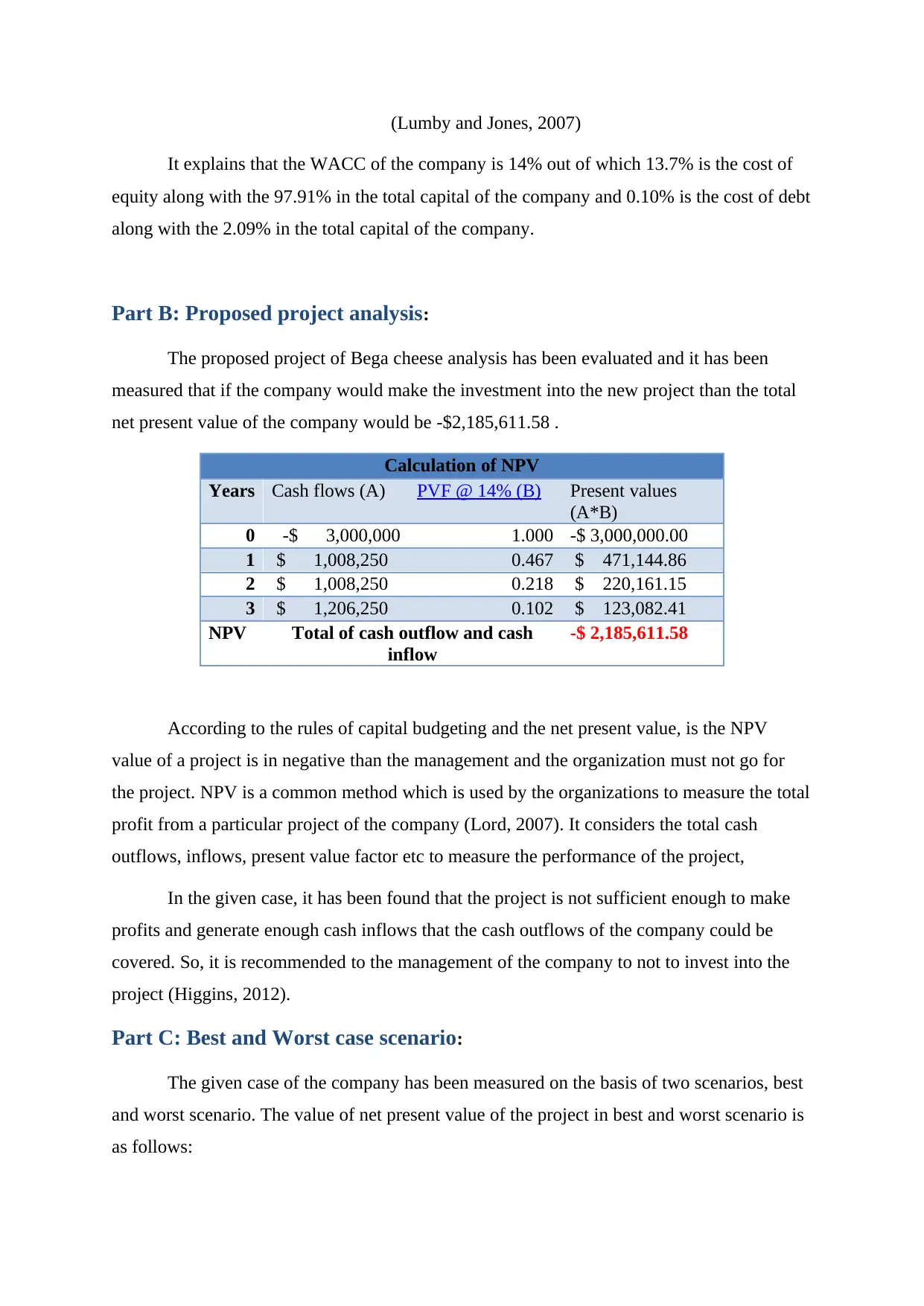

The proposed project of Bega cheese analysis has been evaluated and it has been

measured that if the company would make the investment into the new project than the total

net present value of the company would be -$2,185,611.58 .

Calculation of NPV

Years Cash flows (A) PVF @ 14% (B) Present values

(A*B)

0 -$ 3,000,000 1.000 -$ 3,000,000.00

1 $ 1,008,250 0.467 $ 471,144.86

2 $ 1,008,250 0.218 $ 220,161.15

3 $ 1,206,250 0.102 $ 123,082.41

NPV Total of cash outflow and cash

inflow

-$ 2,185,611.58

According to the rules of capital budgeting and the net present value, is the NPV

value of a project is in negative than the management and the organization must not go for

the project. NPV is a common method which is used by the organizations to measure the total

profit from a particular project of the company (Lord, 2007). It considers the total cash

outflows, inflows, present value factor etc to measure the performance of the project,

In the given case, it has been found that the project is not sufficient enough to make

profits and generate enough cash inflows that the cash outflows of the company could be

covered. So, it is recommended to the management of the company to not to invest into the

project (Higgins, 2012).

Part C: Best and Worst case scenario:

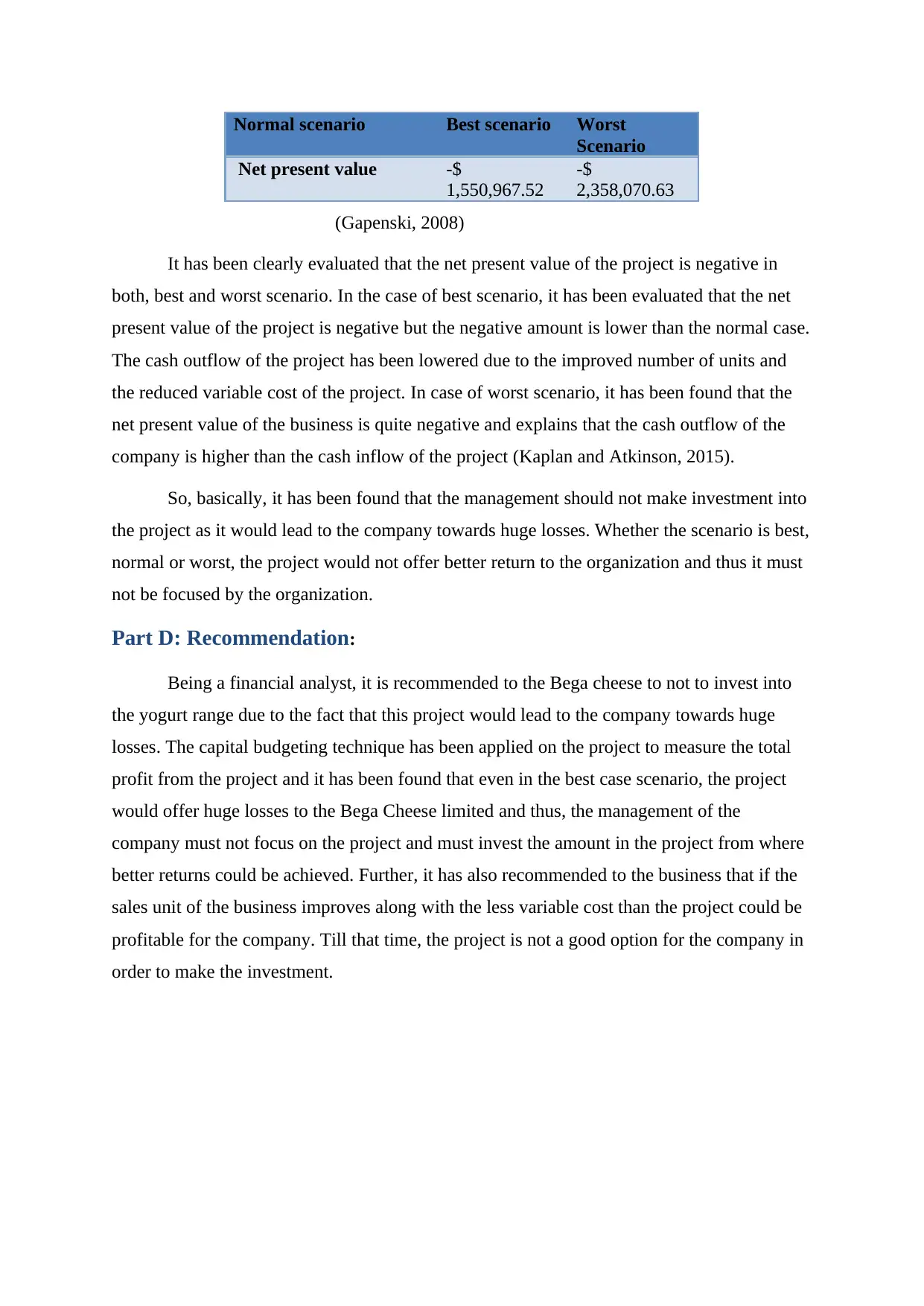

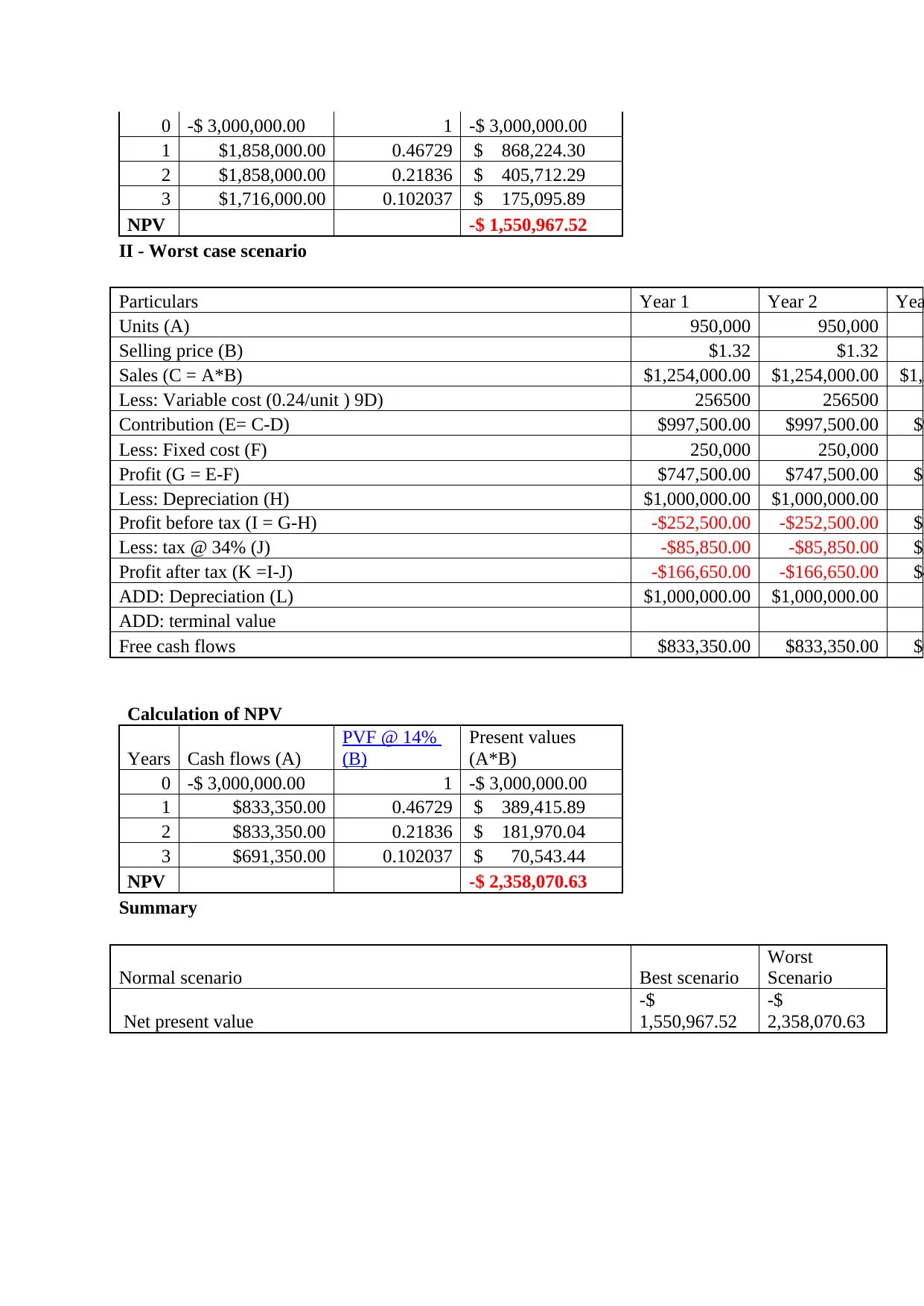

The given case of the company has been measured on the basis of two scenarios, best

and worst scenario. The value of net present value of the project in best and worst scenario is

as follows:

It explains that the WACC of the company is 14% out of which 13.7% is the cost of

equity along with the 97.91% in the total capital of the company and 0.10% is the cost of debt

along with the 2.09% in the total capital of the company.

Part B: Proposed project analysis:

The proposed project of Bega cheese analysis has been evaluated and it has been

measured that if the company would make the investment into the new project than the total

net present value of the company would be -$2,185,611.58 .

Calculation of NPV

Years Cash flows (A) PVF @ 14% (B) Present values

(A*B)

0 -$ 3,000,000 1.000 -$ 3,000,000.00

1 $ 1,008,250 0.467 $ 471,144.86

2 $ 1,008,250 0.218 $ 220,161.15

3 $ 1,206,250 0.102 $ 123,082.41

NPV Total of cash outflow and cash

inflow

-$ 2,185,611.58

According to the rules of capital budgeting and the net present value, is the NPV

value of a project is in negative than the management and the organization must not go for

the project. NPV is a common method which is used by the organizations to measure the total

profit from a particular project of the company (Lord, 2007). It considers the total cash

outflows, inflows, present value factor etc to measure the performance of the project,

In the given case, it has been found that the project is not sufficient enough to make

profits and generate enough cash inflows that the cash outflows of the company could be

covered. So, it is recommended to the management of the company to not to invest into the

project (Higgins, 2012).

Part C: Best and Worst case scenario:

The given case of the company has been measured on the basis of two scenarios, best

and worst scenario. The value of net present value of the project in best and worst scenario is

as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Normal scenario Best scenario Worst

Scenario

Net present value -$

1,550,967.52

-$

2,358,070.63

(Gapenski, 2008)

It has been clearly evaluated that the net present value of the project is negative in

both, best and worst scenario. In the case of best scenario, it has been evaluated that the net

present value of the project is negative but the negative amount is lower than the normal case.

The cash outflow of the project has been lowered due to the improved number of units and

the reduced variable cost of the project. In case of worst scenario, it has been found that the

net present value of the business is quite negative and explains that the cash outflow of the

company is higher than the cash inflow of the project (Kaplan and Atkinson, 2015).

So, basically, it has been found that the management should not make investment into

the project as it would lead to the company towards huge losses. Whether the scenario is best,

normal or worst, the project would not offer better return to the organization and thus it must

not be focused by the organization.

Part D: Recommendation:

Being a financial analyst, it is recommended to the Bega cheese to not to invest into

the yogurt range due to the fact that this project would lead to the company towards huge

losses. The capital budgeting technique has been applied on the project to measure the total

profit from the project and it has been found that even in the best case scenario, the project

would offer huge losses to the Bega Cheese limited and thus, the management of the

company must not focus on the project and must invest the amount in the project from where

better returns could be achieved. Further, it has also recommended to the business that if the

sales unit of the business improves along with the less variable cost than the project could be

profitable for the company. Till that time, the project is not a good option for the company in

order to make the investment.

Scenario

Net present value -$

1,550,967.52

-$

2,358,070.63

(Gapenski, 2008)

It has been clearly evaluated that the net present value of the project is negative in

both, best and worst scenario. In the case of best scenario, it has been evaluated that the net

present value of the project is negative but the negative amount is lower than the normal case.

The cash outflow of the project has been lowered due to the improved number of units and

the reduced variable cost of the project. In case of worst scenario, it has been found that the

net present value of the business is quite negative and explains that the cash outflow of the

company is higher than the cash inflow of the project (Kaplan and Atkinson, 2015).

So, basically, it has been found that the management should not make investment into

the project as it would lead to the company towards huge losses. Whether the scenario is best,

normal or worst, the project would not offer better return to the organization and thus it must

not be focused by the organization.

Part D: Recommendation:

Being a financial analyst, it is recommended to the Bega cheese to not to invest into

the yogurt range due to the fact that this project would lead to the company towards huge

losses. The capital budgeting technique has been applied on the project to measure the total

profit from the project and it has been found that even in the best case scenario, the project

would offer huge losses to the Bega Cheese limited and thus, the management of the

company must not focus on the project and must invest the amount in the project from where

better returns could be achieved. Further, it has also recommended to the business that if the

sales unit of the business improves along with the less variable cost than the project could be

profitable for the company. Till that time, the project is not a good option for the company in

order to make the investment.

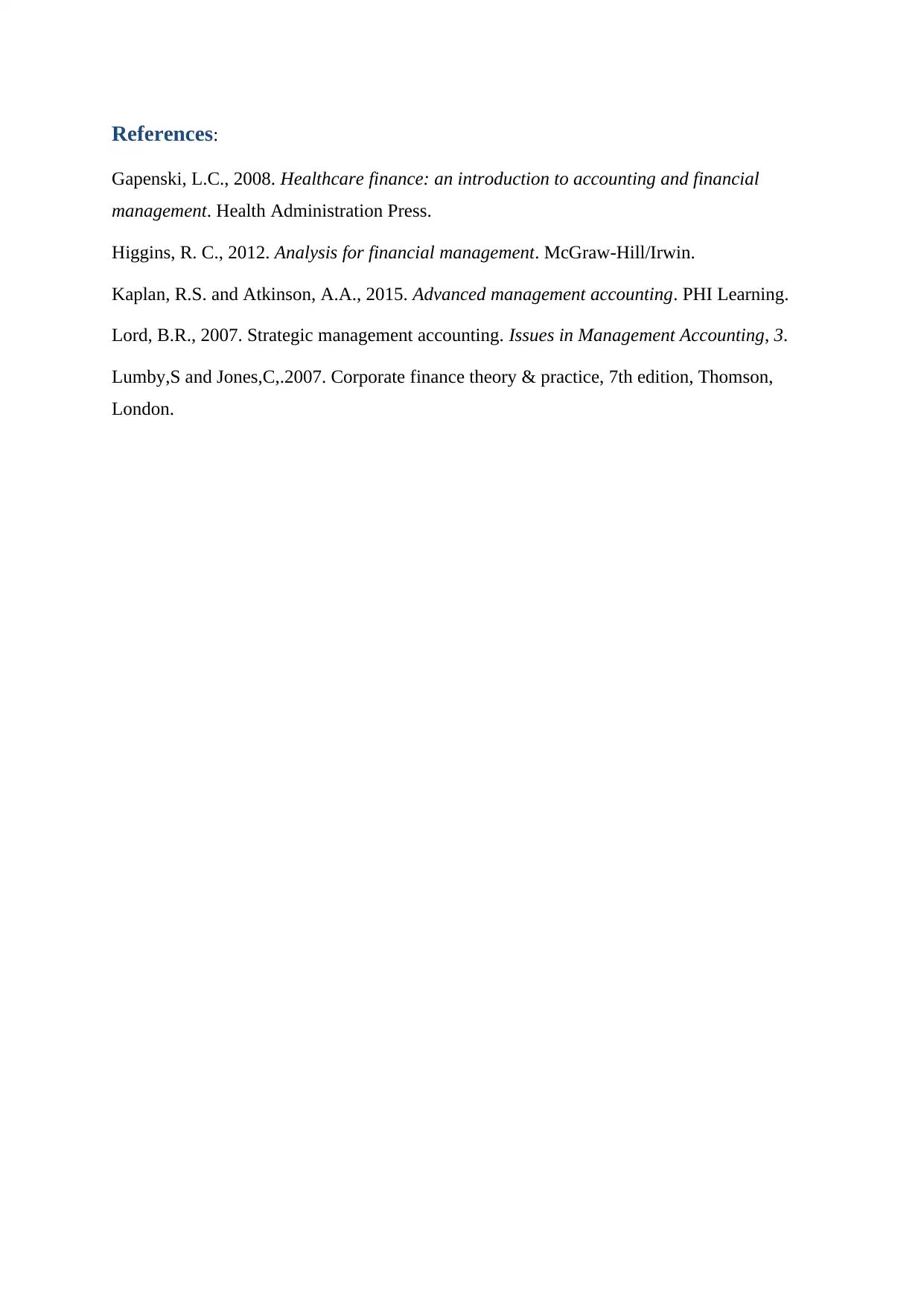

References:

Gapenski, L.C., 2008. Healthcare finance: an introduction to accounting and financial

management. Health Administration Press.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3.

Lumby,S and Jones,C,.2007. Corporate finance theory & practice, 7th edition, Thomson,

London.

Gapenski, L.C., 2008. Healthcare finance: an introduction to accounting and financial

management. Health Administration Press.

Higgins, R. C., 2012. Analysis for financial management. McGraw-Hill/Irwin.

Kaplan, R.S. and Atkinson, A.A., 2015. Advanced management accounting. PHI Learning.

Lord, B.R., 2007. Strategic management accounting. Issues in Management Accounting, 3.

Lumby,S and Jones,C,.2007. Corporate finance theory & practice, 7th edition, Thomson,

London.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

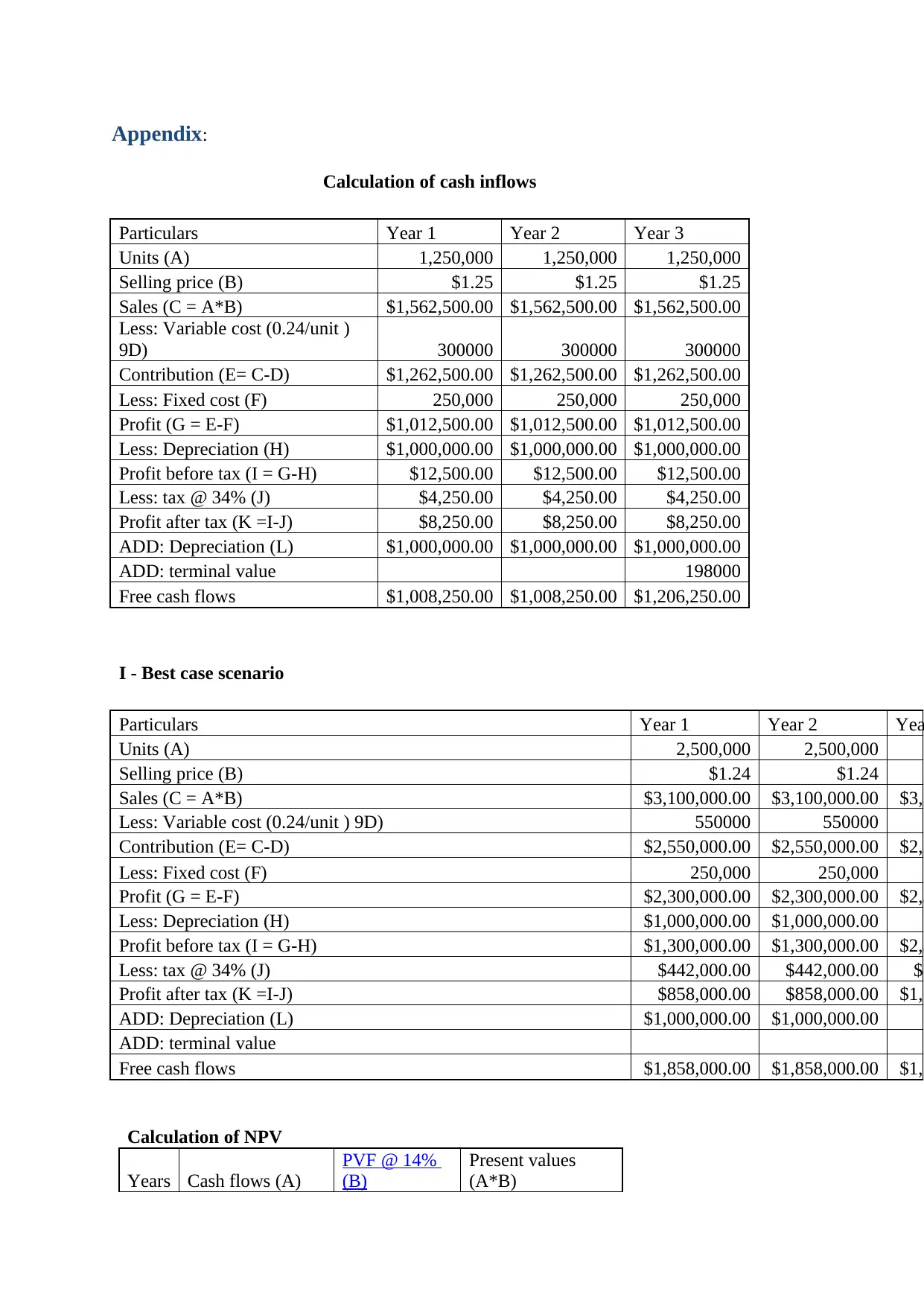

Appendix:

Calculation of cash inflows

Particulars Year 1 Year 2 Year 3

Units (A) 1,250,000 1,250,000 1,250,000

Selling price (B) $1.25 $1.25 $1.25

Sales (C = A*B) $1,562,500.00 $1,562,500.00 $1,562,500.00

Less: Variable cost (0.24/unit )

9D) 300000 300000 300000

Contribution (E= C-D) $1,262,500.00 $1,262,500.00 $1,262,500.00

Less: Fixed cost (F) 250,000 250,000 250,000

Profit (G = E-F) $1,012,500.00 $1,012,500.00 $1,012,500.00

Less: Depreciation (H) $1,000,000.00 $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) $12,500.00 $12,500.00 $12,500.00

Less: tax @ 34% (J) $4,250.00 $4,250.00 $4,250.00

Profit after tax (K =I-J) $8,250.00 $8,250.00 $8,250.00

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00 $1,000,000.00

ADD: terminal value 198000

Free cash flows $1,008,250.00 $1,008,250.00 $1,206,250.00

I - Best case scenario

Particulars Year 1 Year 2 Yea

Units (A) 2,500,000 2,500,000

Selling price (B) $1.24 $1.24

Sales (C = A*B) $3,100,000.00 $3,100,000.00 $3,1

Less: Variable cost (0.24/unit ) 9D) 550000 550000

Contribution (E= C-D) $2,550,000.00 $2,550,000.00 $2,5

Less: Fixed cost (F) 250,000 250,000

Profit (G = E-F) $2,300,000.00 $2,300,000.00 $2,3

Less: Depreciation (H) $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) $1,300,000.00 $1,300,000.00 $2,3

Less: tax @ 34% (J) $442,000.00 $442,000.00 $7

Profit after tax (K =I-J) $858,000.00 $858,000.00 $1,5

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00

ADD: terminal value

Free cash flows $1,858,000.00 $1,858,000.00 $1,7

Calculation of NPV

Years Cash flows (A)

PVF @ 14%

(B)

Present values

(A*B)

Calculation of cash inflows

Particulars Year 1 Year 2 Year 3

Units (A) 1,250,000 1,250,000 1,250,000

Selling price (B) $1.25 $1.25 $1.25

Sales (C = A*B) $1,562,500.00 $1,562,500.00 $1,562,500.00

Less: Variable cost (0.24/unit )

9D) 300000 300000 300000

Contribution (E= C-D) $1,262,500.00 $1,262,500.00 $1,262,500.00

Less: Fixed cost (F) 250,000 250,000 250,000

Profit (G = E-F) $1,012,500.00 $1,012,500.00 $1,012,500.00

Less: Depreciation (H) $1,000,000.00 $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) $12,500.00 $12,500.00 $12,500.00

Less: tax @ 34% (J) $4,250.00 $4,250.00 $4,250.00

Profit after tax (K =I-J) $8,250.00 $8,250.00 $8,250.00

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00 $1,000,000.00

ADD: terminal value 198000

Free cash flows $1,008,250.00 $1,008,250.00 $1,206,250.00

I - Best case scenario

Particulars Year 1 Year 2 Yea

Units (A) 2,500,000 2,500,000

Selling price (B) $1.24 $1.24

Sales (C = A*B) $3,100,000.00 $3,100,000.00 $3,1

Less: Variable cost (0.24/unit ) 9D) 550000 550000

Contribution (E= C-D) $2,550,000.00 $2,550,000.00 $2,5

Less: Fixed cost (F) 250,000 250,000

Profit (G = E-F) $2,300,000.00 $2,300,000.00 $2,3

Less: Depreciation (H) $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) $1,300,000.00 $1,300,000.00 $2,3

Less: tax @ 34% (J) $442,000.00 $442,000.00 $7

Profit after tax (K =I-J) $858,000.00 $858,000.00 $1,5

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00

ADD: terminal value

Free cash flows $1,858,000.00 $1,858,000.00 $1,7

Calculation of NPV

Years Cash flows (A)

PVF @ 14%

(B)

Present values

(A*B)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0 -$ 3,000,000.00 1 -$ 3,000,000.00

1 $1,858,000.00 0.46729 $ 868,224.30

2 $1,858,000.00 0.21836 $ 405,712.29

3 $1,716,000.00 0.102037 $ 175,095.89

NPV -$ 1,550,967.52

II - Worst case scenario

Particulars Year 1 Year 2 Yea

Units (A) 950,000 950,000

Selling price (B) $1.32 $1.32

Sales (C = A*B) $1,254,000.00 $1,254,000.00 $1,2

Less: Variable cost (0.24/unit ) 9D) 256500 256500

Contribution (E= C-D) $997,500.00 $997,500.00 $9

Less: Fixed cost (F) 250,000 250,000

Profit (G = E-F) $747,500.00 $747,500.00 $7

Less: Depreciation (H) $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) -$252,500.00 -$252,500.00 $7

Less: tax @ 34% (J) -$85,850.00 -$85,850.00 $2

Profit after tax (K =I-J) -$166,650.00 -$166,650.00 $4

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00

ADD: terminal value

Free cash flows $833,350.00 $833,350.00 $6

Calculation of NPV

Years Cash flows (A)

PVF @ 14%

(B)

Present values

(A*B)

0 -$ 3,000,000.00 1 -$ 3,000,000.00

1 $833,350.00 0.46729 $ 389,415.89

2 $833,350.00 0.21836 $ 181,970.04

3 $691,350.00 0.102037 $ 70,543.44

NPV -$ 2,358,070.63

Summary

Normal scenario Best scenario

Worst

Scenario

Net present value

-$

1,550,967.52

-$

2,358,070.63

1 $1,858,000.00 0.46729 $ 868,224.30

2 $1,858,000.00 0.21836 $ 405,712.29

3 $1,716,000.00 0.102037 $ 175,095.89

NPV -$ 1,550,967.52

II - Worst case scenario

Particulars Year 1 Year 2 Yea

Units (A) 950,000 950,000

Selling price (B) $1.32 $1.32

Sales (C = A*B) $1,254,000.00 $1,254,000.00 $1,2

Less: Variable cost (0.24/unit ) 9D) 256500 256500

Contribution (E= C-D) $997,500.00 $997,500.00 $9

Less: Fixed cost (F) 250,000 250,000

Profit (G = E-F) $747,500.00 $747,500.00 $7

Less: Depreciation (H) $1,000,000.00 $1,000,000.00

Profit before tax (I = G-H) -$252,500.00 -$252,500.00 $7

Less: tax @ 34% (J) -$85,850.00 -$85,850.00 $2

Profit after tax (K =I-J) -$166,650.00 -$166,650.00 $4

ADD: Depreciation (L) $1,000,000.00 $1,000,000.00

ADD: terminal value

Free cash flows $833,350.00 $833,350.00 $6

Calculation of NPV

Years Cash flows (A)

PVF @ 14%

(B)

Present values

(A*B)

0 -$ 3,000,000.00 1 -$ 3,000,000.00

1 $833,350.00 0.46729 $ 389,415.89

2 $833,350.00 0.21836 $ 181,970.04

3 $691,350.00 0.102037 $ 70,543.44

NPV -$ 2,358,070.63

Summary

Normal scenario Best scenario

Worst

Scenario

Net present value

-$

1,550,967.52

-$

2,358,070.63

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.