Corporate Finance: Bega Cheese Ltd Project Analysis Report

VerifiedAdded on 2023/06/09

|9

|1874

|116

Report

AI Summary

This report provides a comprehensive corporate finance analysis, focusing on evaluating a proposed project for Bega Cheese Ltd. The report begins with the calculation of the Weighted Average Cost of Capital (WACC), followed by an analysis of the project under normal, best-case, and worst-case scenarios. Key financial metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR) are computed for each scenario to determine the project's financial viability. The analysis considers sales volume, selling price, variable costs, fixed costs, and tax rates to determine net cash inflows. The results show that the project is only viable under the best-case scenario, and the report concludes with an investment decision recommendation based on the financial analysis. The report emphasizes the importance of considering different scenarios when making investment decisions and highlights the role of financial analysis in assessing project profitability and risk. The findings suggest that the management should decline the project under normal and worst-case scenarios.

Running head: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE FINANCE

Table of Contents

Weighted Average Cost of Capital..................................................................................................2

Analysis of the Proposed Project.....................................................................................................2

Best Case Scenario..........................................................................................................................4

Worst Case Scenario........................................................................................................................6

Investment Decisions.......................................................................................................................7

Reference.........................................................................................................................................8

CORPORATE FINANCE

Table of Contents

Weighted Average Cost of Capital..................................................................................................2

Analysis of the Proposed Project.....................................................................................................2

Best Case Scenario..........................................................................................................................4

Worst Case Scenario........................................................................................................................6

Investment Decisions.......................................................................................................................7

Reference.........................................................................................................................................8

2

CORPORATE FINANCE

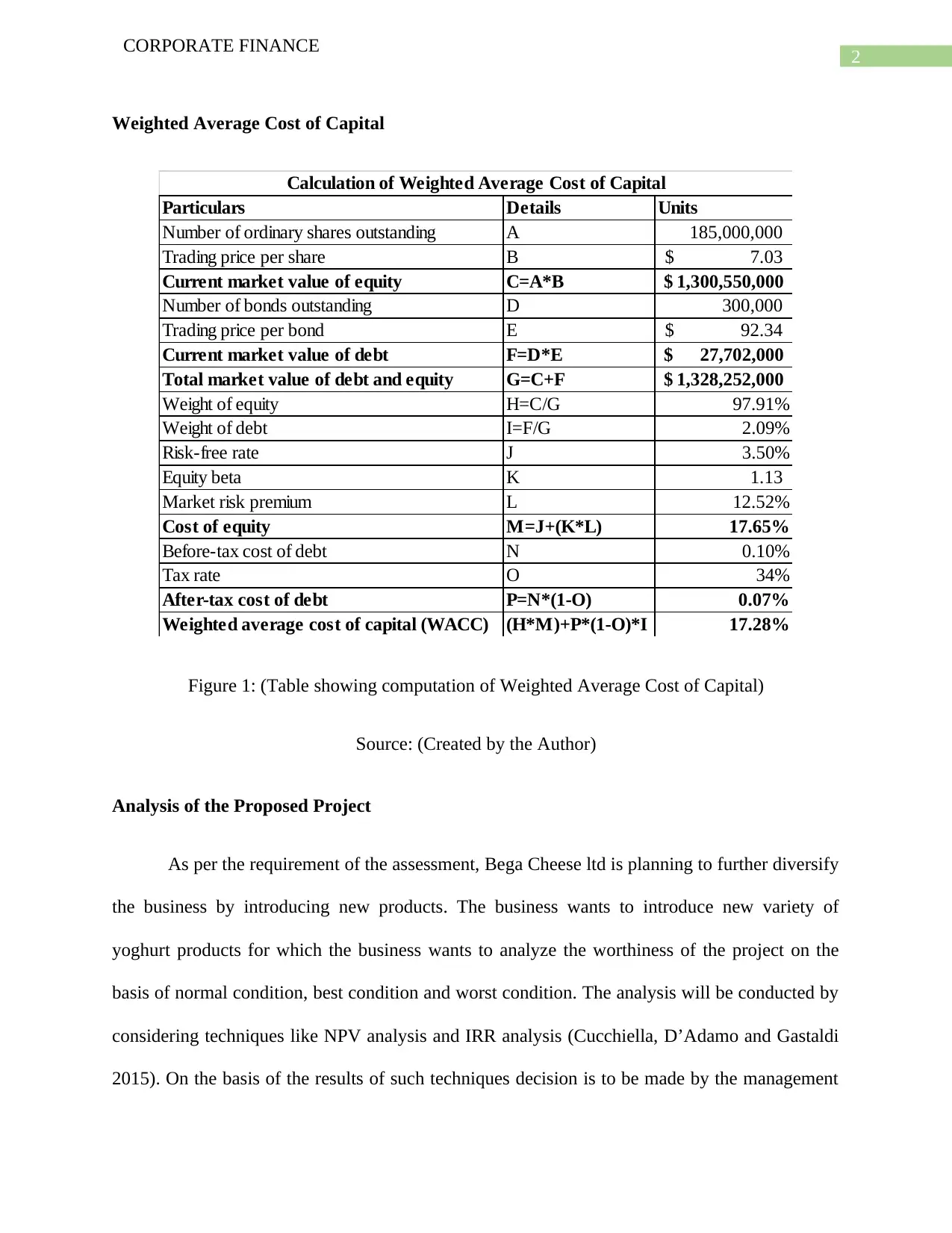

Weighted Average Cost of Capital

Particulars Details Units

Number of ordinary shares outstanding A 185,000,000

Trading price per share B 7.03$

Current market value of equity C=A*B 1,300,550,000$

Number of bonds outstanding D 300,000

Trading price per bond E 92.34$

Current market value of debt F=D*E 27,702,000$

Total market value of debt and equity G=C+F 1,328,252,000$

Weight of equity H=C/G 97.91%

Weight of debt I=F/G 2.09%

Risk-free rate J 3.50%

Equity beta K 1.13

Market risk premium L 12.52%

Cost of equity M=J+(K*L) 17.65%

Before-tax cost of debt N 0.10%

Tax rate O 34%

After-tax cost of debt P=N*(1-O) 0.07%

Weighted average cost of capital (WACC) (H*M)+P*(1-O)*I 17.28%

Calculation of Weighted Average Cost of Capital

Figure 1: (Table showing computation of Weighted Average Cost of Capital)

Source: (Created by the Author)

Analysis of the Proposed Project

As per the requirement of the assessment, Bega Cheese ltd is planning to further diversify

the business by introducing new products. The business wants to introduce new variety of

yoghurt products for which the business wants to analyze the worthiness of the project on the

basis of normal condition, best condition and worst condition. The analysis will be conducted by

considering techniques like NPV analysis and IRR analysis (Cucchiella, D’Adamo and Gastaldi

2015). On the basis of the results of such techniques decision is to be made by the management

CORPORATE FINANCE

Weighted Average Cost of Capital

Particulars Details Units

Number of ordinary shares outstanding A 185,000,000

Trading price per share B 7.03$

Current market value of equity C=A*B 1,300,550,000$

Number of bonds outstanding D 300,000

Trading price per bond E 92.34$

Current market value of debt F=D*E 27,702,000$

Total market value of debt and equity G=C+F 1,328,252,000$

Weight of equity H=C/G 97.91%

Weight of debt I=F/G 2.09%

Risk-free rate J 3.50%

Equity beta K 1.13

Market risk premium L 12.52%

Cost of equity M=J+(K*L) 17.65%

Before-tax cost of debt N 0.10%

Tax rate O 34%

After-tax cost of debt P=N*(1-O) 0.07%

Weighted average cost of capital (WACC) (H*M)+P*(1-O)*I 17.28%

Calculation of Weighted Average Cost of Capital

Figure 1: (Table showing computation of Weighted Average Cost of Capital)

Source: (Created by the Author)

Analysis of the Proposed Project

As per the requirement of the assessment, Bega Cheese ltd is planning to further diversify

the business by introducing new products. The business wants to introduce new variety of

yoghurt products for which the business wants to analyze the worthiness of the project on the

basis of normal condition, best condition and worst condition. The analysis will be conducted by

considering techniques like NPV analysis and IRR analysis (Cucchiella, D’Adamo and Gastaldi

2015). On the basis of the results of such techniques decision is to be made by the management

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CORPORATE FINANCE

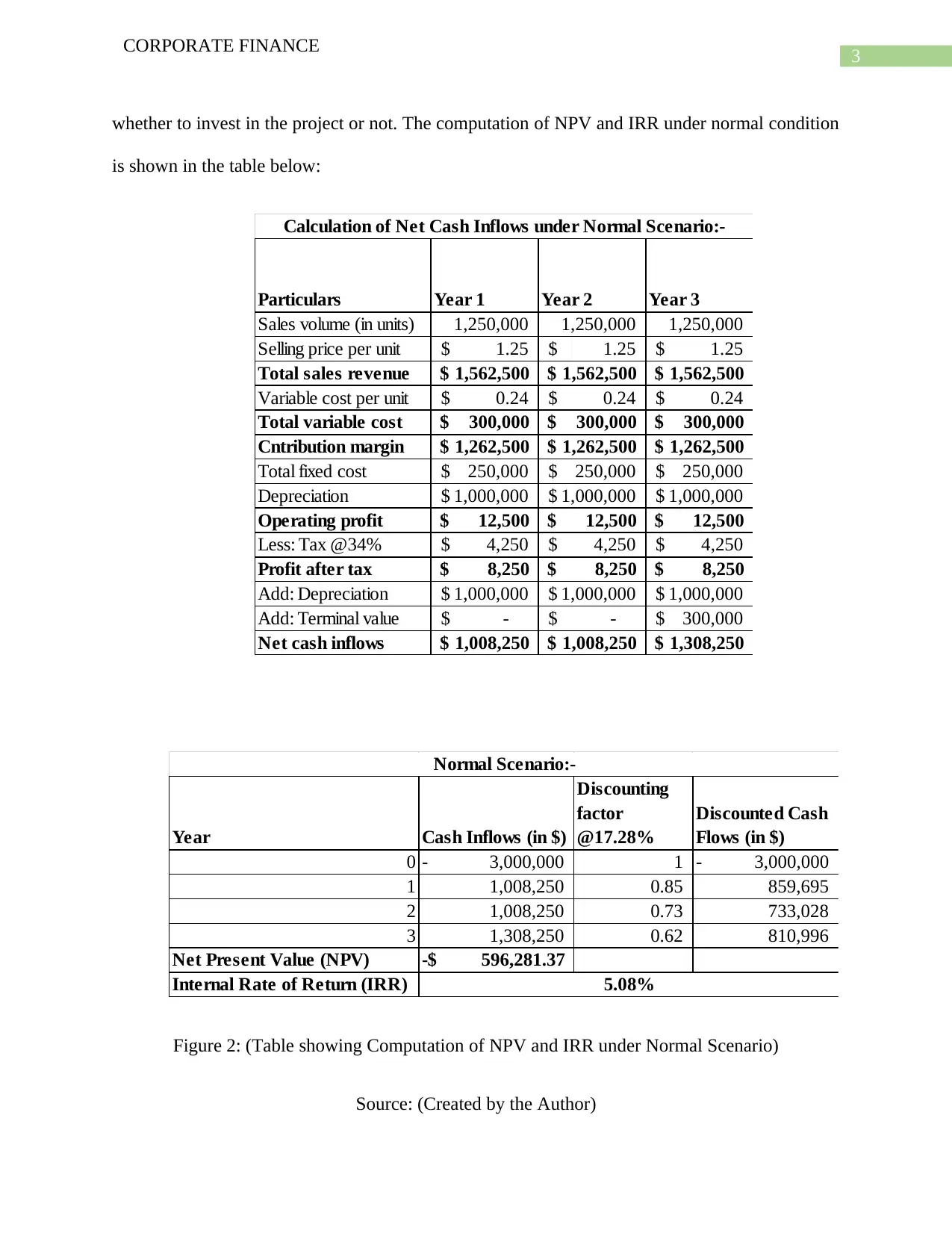

whether to invest in the project or not. The computation of NPV and IRR under normal condition

is shown in the table below:

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 1,250,000 1,250,000 1,250,000

Selling price per unit 1.25$ 1.25$ 1.25$

Total sales revenue 1,562,500$ 1,562,500$ 1,562,500$

Variable cost per unit 0.24$ 0.24$ 0.24$

Total variable cost 300,000$ 300,000$ 300,000$

Cntribution margin 1,262,500$ 1,262,500$ 1,262,500$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 12,500$ 12,500$ 12,500$

Less: Tax @34% 4,250$ 4,250$ 4,250$

Profit after tax 8,250$ 8,250$ 8,250$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 1,008,250$ 1,008,250$ 1,308,250$

Calculation of Net Cash Inflows under Normal Scenario:-

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 1,008,250 0.85 859,695

2 1,008,250 0.73 733,028

3 1,308,250 0.62 810,996

Net Present Value (NPV) 596,281.37-$

Internal Rate of Return (IRR) 5.08%

Normal Scenario:-

Figure 2: (Table showing Computation of NPV and IRR under Normal Scenario)

Source: (Created by the Author)

CORPORATE FINANCE

whether to invest in the project or not. The computation of NPV and IRR under normal condition

is shown in the table below:

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 1,250,000 1,250,000 1,250,000

Selling price per unit 1.25$ 1.25$ 1.25$

Total sales revenue 1,562,500$ 1,562,500$ 1,562,500$

Variable cost per unit 0.24$ 0.24$ 0.24$

Total variable cost 300,000$ 300,000$ 300,000$

Cntribution margin 1,262,500$ 1,262,500$ 1,262,500$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 12,500$ 12,500$ 12,500$

Less: Tax @34% 4,250$ 4,250$ 4,250$

Profit after tax 8,250$ 8,250$ 8,250$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 1,008,250$ 1,008,250$ 1,308,250$

Calculation of Net Cash Inflows under Normal Scenario:-

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 1,008,250 0.85 859,695

2 1,008,250 0.73 733,028

3 1,308,250 0.62 810,996

Net Present Value (NPV) 596,281.37-$

Internal Rate of Return (IRR) 5.08%

Normal Scenario:-

Figure 2: (Table showing Computation of NPV and IRR under Normal Scenario)

Source: (Created by the Author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE FINANCE

As shown in the above table, the cash flows are considered for computing the NPV of the

project considering the discounting factor which is shown in the above table. The NPV of the

project is shown to be in negative which suggests that the outflow which is related with the

project will be more than the estimated inflows which can be expected from the project. In case,

the business undertakes the project under normal scenario, the business will be taking a risky

gamble and will be earning losses for the same (Bas 2013). Moreover, the IRR which is

computed is shown to be 5.08% which is also not favorable and will not be able to meet the

expectations of the shareholders of the business (Pasqual, Padilla and Jadotte 2013). Therefore,

under normal case scenario, the business should not proceed with the proposal of diversifies the

variety of yoghurts which are offered by the business. The management should decline the

project.

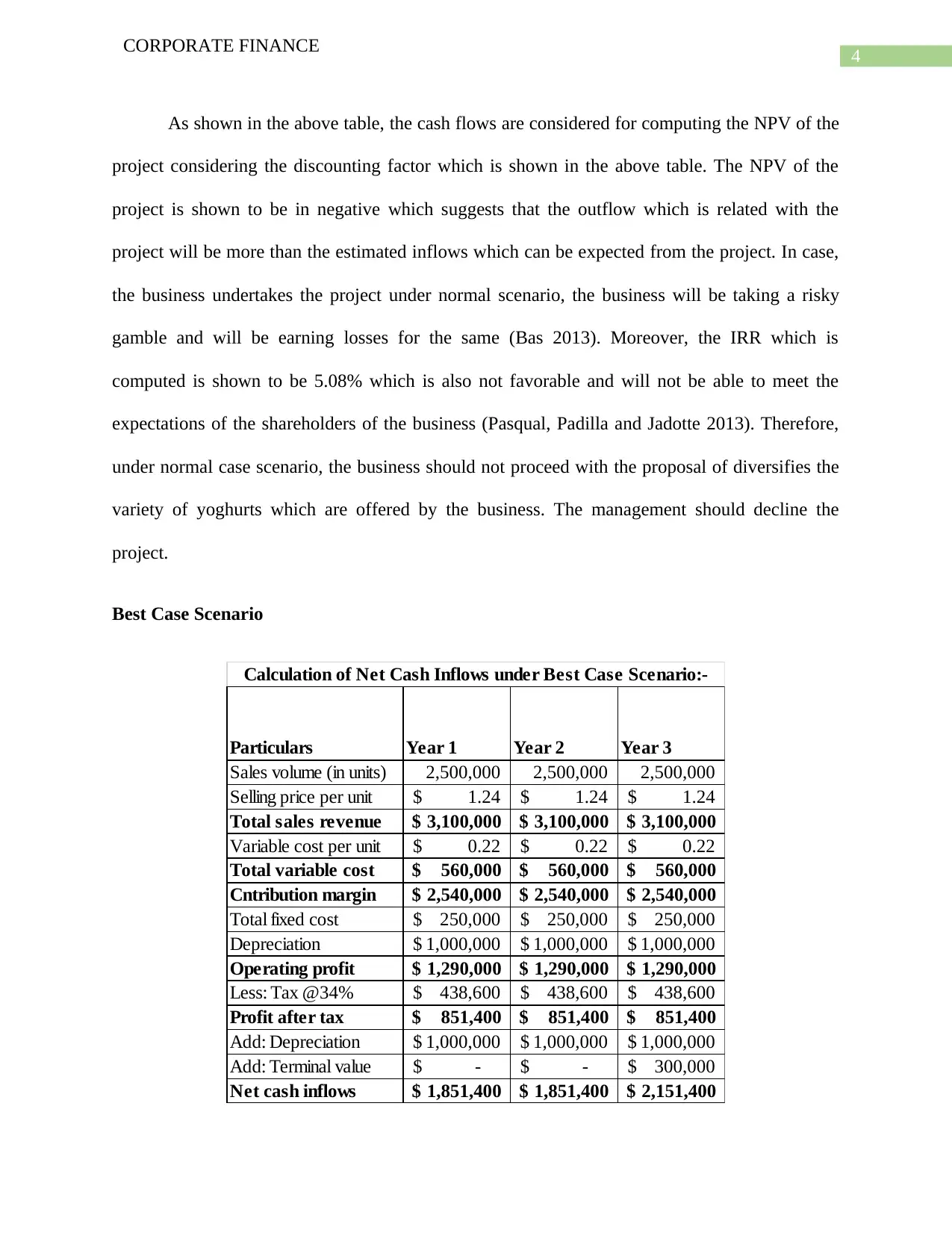

Best Case Scenario

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 2,500,000 2,500,000 2,500,000

Selling price per unit 1.24$ 1.24$ 1.24$

Total sales revenue 3,100,000$ 3,100,000$ 3,100,000$

Variable cost per unit 0.22$ 0.22$ 0.22$

Total variable cost 560,000$ 560,000$ 560,000$

Cntribution margin 2,540,000$ 2,540,000$ 2,540,000$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 1,290,000$ 1,290,000$ 1,290,000$

Less: Tax @34% 438,600$ 438,600$ 438,600$

Profit after tax 851,400$ 851,400$ 851,400$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 1,851,400$ 1,851,400$ 2,151,400$

Calculation of Net Cash Inflows under Best Case Scenario:-

CORPORATE FINANCE

As shown in the above table, the cash flows are considered for computing the NPV of the

project considering the discounting factor which is shown in the above table. The NPV of the

project is shown to be in negative which suggests that the outflow which is related with the

project will be more than the estimated inflows which can be expected from the project. In case,

the business undertakes the project under normal scenario, the business will be taking a risky

gamble and will be earning losses for the same (Bas 2013). Moreover, the IRR which is

computed is shown to be 5.08% which is also not favorable and will not be able to meet the

expectations of the shareholders of the business (Pasqual, Padilla and Jadotte 2013). Therefore,

under normal case scenario, the business should not proceed with the proposal of diversifies the

variety of yoghurts which are offered by the business. The management should decline the

project.

Best Case Scenario

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 2,500,000 2,500,000 2,500,000

Selling price per unit 1.24$ 1.24$ 1.24$

Total sales revenue 3,100,000$ 3,100,000$ 3,100,000$

Variable cost per unit 0.22$ 0.22$ 0.22$

Total variable cost 560,000$ 560,000$ 560,000$

Cntribution margin 2,540,000$ 2,540,000$ 2,540,000$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 1,290,000$ 1,290,000$ 1,290,000$

Less: Tax @34% 438,600$ 438,600$ 438,600$

Profit after tax 851,400$ 851,400$ 851,400$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 1,851,400$ 1,851,400$ 2,151,400$

Calculation of Net Cash Inflows under Best Case Scenario:-

5

CORPORATE FINANCE

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 1,851,400 0.85 1,578,615

2 1,851,400 0.73 1,346,023

3 2,151,400 0.62 1,333,673

Net Present Value (NPV) 1,258,310.65$

Internal Rate of Return (IRR)

Best Case Scenario:-

41.30%

Figure 3: (Table showing Computation of NPV and IRR under Best Scenario)

Source: (Created by the Author)

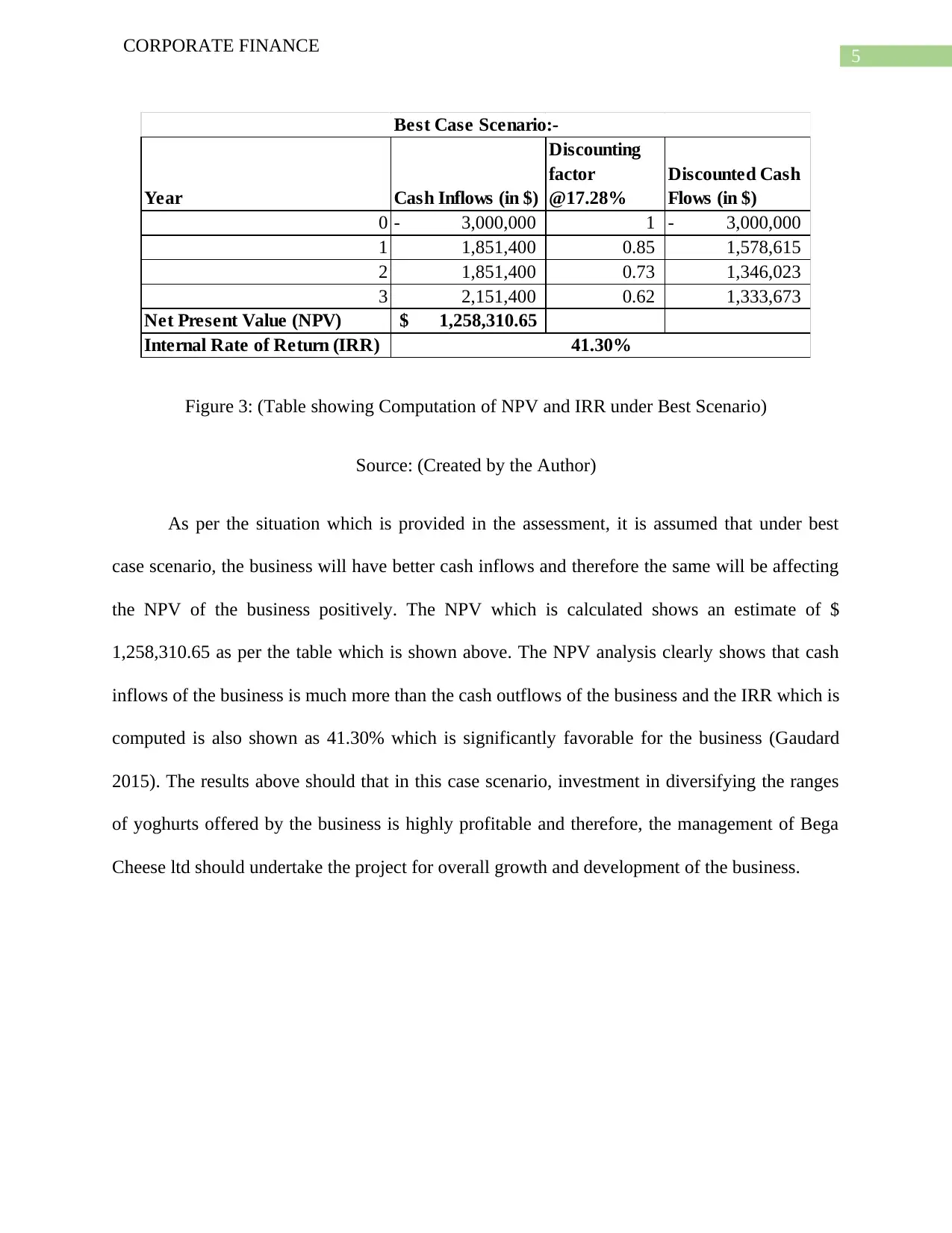

As per the situation which is provided in the assessment, it is assumed that under best

case scenario, the business will have better cash inflows and therefore the same will be affecting

the NPV of the business positively. The NPV which is calculated shows an estimate of $

1,258,310.65 as per the table which is shown above. The NPV analysis clearly shows that cash

inflows of the business is much more than the cash outflows of the business and the IRR which is

computed is also shown as 41.30% which is significantly favorable for the business (Gaudard

2015). The results above should that in this case scenario, investment in diversifying the ranges

of yoghurts offered by the business is highly profitable and therefore, the management of Bega

Cheese ltd should undertake the project for overall growth and development of the business.

CORPORATE FINANCE

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 1,851,400 0.85 1,578,615

2 1,851,400 0.73 1,346,023

3 2,151,400 0.62 1,333,673

Net Present Value (NPV) 1,258,310.65$

Internal Rate of Return (IRR)

Best Case Scenario:-

41.30%

Figure 3: (Table showing Computation of NPV and IRR under Best Scenario)

Source: (Created by the Author)

As per the situation which is provided in the assessment, it is assumed that under best

case scenario, the business will have better cash inflows and therefore the same will be affecting

the NPV of the business positively. The NPV which is calculated shows an estimate of $

1,258,310.65 as per the table which is shown above. The NPV analysis clearly shows that cash

inflows of the business is much more than the cash outflows of the business and the IRR which is

computed is also shown as 41.30% which is significantly favorable for the business (Gaudard

2015). The results above should that in this case scenario, investment in diversifying the ranges

of yoghurts offered by the business is highly profitable and therefore, the management of Bega

Cheese ltd should undertake the project for overall growth and development of the business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CORPORATE FINANCE

Worst Case Scenario

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 950,000 950,000 950,000

Selling price per unit 1.32$ 1.32$ 1.32$

Total sales revenue 1,254,000$ 1,254,000$ 1,254,000$

Variable cost per unit 0.22$ 0.22$ 0.22$

Total variable cost 212,800$ 212,800$ 212,800$

Cntribution margin 1,041,200$ 1,041,200$ 1,041,200$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 208,800-$ 208,800-$ 208,800-$

Less: Tax @34% 70,992-$ 70,992-$ 70,992-$

Profit after tax 137,808-$ 137,808-$ 137,808-$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 862,192$ 862,192$ 1,162,192$

Calculation of Net Cash Inflows under Worst Case Scenario:-

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 862,192 0.85 735,157

2 862,192 0.73 626,839

3 1,162,192 0.62 720,454

Net Present Value (NPV) 917,550.43-$

Internal Rate of Return (IRR)

Worst Case Scenario:-

-1.81%

Figure 4: (Table showing Computation of NPV and IRR under Worst Scenario)

Source: (Created by the Author)

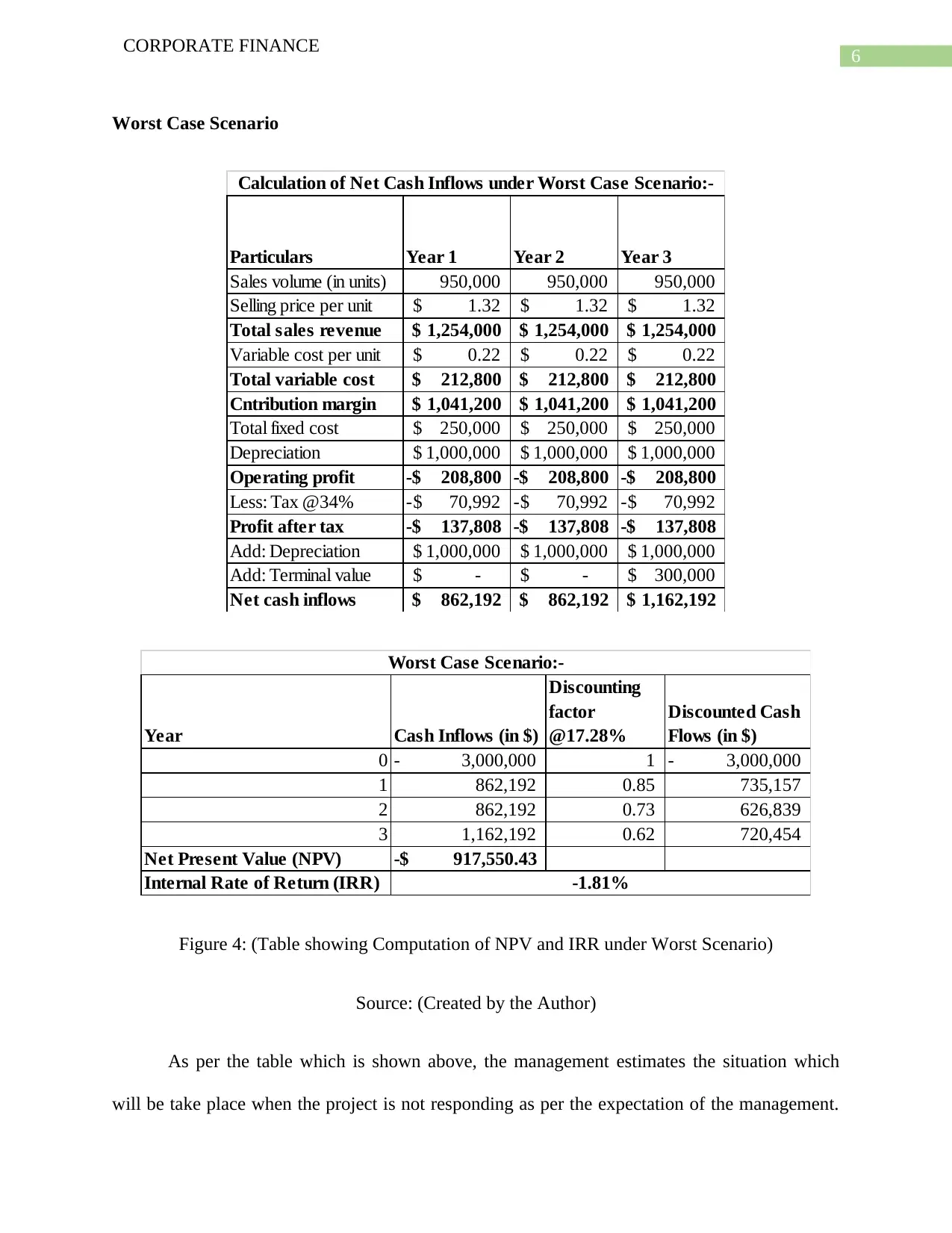

As per the table which is shown above, the management estimates the situation which

will be take place when the project is not responding as per the expectation of the management.

CORPORATE FINANCE

Worst Case Scenario

Particulars Year 1 Year 2 Year 3

Sales volume (in units) 950,000 950,000 950,000

Selling price per unit 1.32$ 1.32$ 1.32$

Total sales revenue 1,254,000$ 1,254,000$ 1,254,000$

Variable cost per unit 0.22$ 0.22$ 0.22$

Total variable cost 212,800$ 212,800$ 212,800$

Cntribution margin 1,041,200$ 1,041,200$ 1,041,200$

Total fixed cost 250,000$ 250,000$ 250,000$

Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Operating profit 208,800-$ 208,800-$ 208,800-$

Less: Tax @34% 70,992-$ 70,992-$ 70,992-$

Profit after tax 137,808-$ 137,808-$ 137,808-$

Add: Depreciation 1,000,000$ 1,000,000$ 1,000,000$

Add: Terminal value -$ -$ 300,000$

Net cash inflows 862,192$ 862,192$ 1,162,192$

Calculation of Net Cash Inflows under Worst Case Scenario:-

Year Cash Inflows (in $)

Discounting

factor

@17.28%

Discounted Cash

Flows (in $)

0 3,000,000- 1 3,000,000-

1 862,192 0.85 735,157

2 862,192 0.73 626,839

3 1,162,192 0.62 720,454

Net Present Value (NPV) 917,550.43-$

Internal Rate of Return (IRR)

Worst Case Scenario:-

-1.81%

Figure 4: (Table showing Computation of NPV and IRR under Worst Scenario)

Source: (Created by the Author)

As per the table which is shown above, the management estimates the situation which

will be take place when the project is not responding as per the expectation of the management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE FINANCE

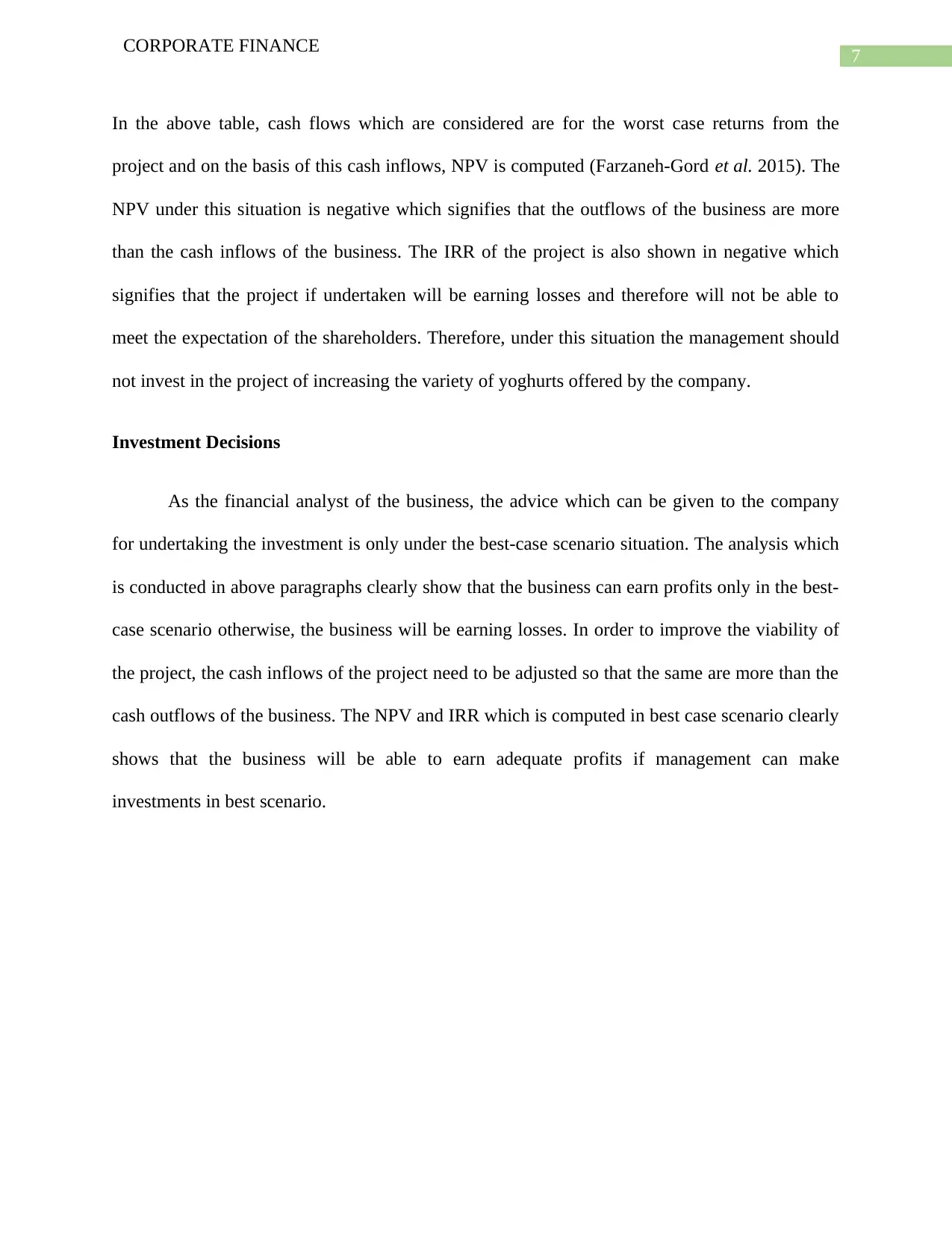

In the above table, cash flows which are considered are for the worst case returns from the

project and on the basis of this cash inflows, NPV is computed (Farzaneh-Gord et al. 2015). The

NPV under this situation is negative which signifies that the outflows of the business are more

than the cash inflows of the business. The IRR of the project is also shown in negative which

signifies that the project if undertaken will be earning losses and therefore will not be able to

meet the expectation of the shareholders. Therefore, under this situation the management should

not invest in the project of increasing the variety of yoghurts offered by the company.

Investment Decisions

As the financial analyst of the business, the advice which can be given to the company

for undertaking the investment is only under the best-case scenario situation. The analysis which

is conducted in above paragraphs clearly show that the business can earn profits only in the best-

case scenario otherwise, the business will be earning losses. In order to improve the viability of

the project, the cash inflows of the project need to be adjusted so that the same are more than the

cash outflows of the business. The NPV and IRR which is computed in best case scenario clearly

shows that the business will be able to earn adequate profits if management can make

investments in best scenario.

CORPORATE FINANCE

In the above table, cash flows which are considered are for the worst case returns from the

project and on the basis of this cash inflows, NPV is computed (Farzaneh-Gord et al. 2015). The

NPV under this situation is negative which signifies that the outflows of the business are more

than the cash inflows of the business. The IRR of the project is also shown in negative which

signifies that the project if undertaken will be earning losses and therefore will not be able to

meet the expectation of the shareholders. Therefore, under this situation the management should

not invest in the project of increasing the variety of yoghurts offered by the company.

Investment Decisions

As the financial analyst of the business, the advice which can be given to the company

for undertaking the investment is only under the best-case scenario situation. The analysis which

is conducted in above paragraphs clearly show that the business can earn profits only in the best-

case scenario otherwise, the business will be earning losses. In order to improve the viability of

the project, the cash inflows of the project need to be adjusted so that the same are more than the

cash outflows of the business. The NPV and IRR which is computed in best case scenario clearly

shows that the business will be able to earn adequate profits if management can make

investments in best scenario.

8

CORPORATE FINANCE

Reference

Bas, E., 2013. A robust approach to the decision rules of NPV and IRR for simple

projects. Applied Mathematics and Computation, 219(11), pp.5901-5908.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental Policy, 17(4),

pp.887-904.

Farzaneh-Gord, M., Ghezelbash, R., Arabkoohsar, A., Pilevari, L., Machado, L. and Koury,

R.N.N., 2015. Employing geothermal heat exchanger in natural gas pressure drop station in order

to decrease fuel consumption. Energy, 83, pp.164-176.

Gaudard, L., 2015. Pumped-storage project: A short to long term investment analysis including

climate change. Renewable and Sustainable Energy Reviews, 49, pp.91-99.

Pasqual, J., Padilla, E. and Jadotte, E., 2013. Equivalence of different profitability criteria with

the net present value. International Journal of Production Economics, 142(1), pp.205-210.

CORPORATE FINANCE

Reference

Bas, E., 2013. A robust approach to the decision rules of NPV and IRR for simple

projects. Applied Mathematics and Computation, 219(11), pp.5901-5908.

Cucchiella, F., D’Adamo, I. and Gastaldi, M., 2015. Financial analysis for investment and policy

decisions in the renewable energy sector. Clean Technologies and Environmental Policy, 17(4),

pp.887-904.

Farzaneh-Gord, M., Ghezelbash, R., Arabkoohsar, A., Pilevari, L., Machado, L. and Koury,

R.N.N., 2015. Employing geothermal heat exchanger in natural gas pressure drop station in order

to decrease fuel consumption. Energy, 83, pp.164-176.

Gaudard, L., 2015. Pumped-storage project: A short to long term investment analysis including

climate change. Renewable and Sustainable Energy Reviews, 49, pp.91-99.

Pasqual, J., Padilla, E. and Jadotte, E., 2013. Equivalence of different profitability criteria with

the net present value. International Journal of Production Economics, 142(1), pp.205-210.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.