Corporate Finance: Investment Appraisal, WACC and Stock Valuation

VerifiedAdded on 2023/05/29

|6

|1081

|461

Homework Assignment

AI Summary

This corporate finance assignment covers several key areas including present value calculations for annuities, analysis of simple and compound interest on bonds, and the computation of the Weighted Average Cost of Capital (WACC). It assesses the feasibility of projects using Net Present Value (NPV) analysis, comparing mutually exclusive projects to determine the most financially viable option. Furthermore, the assignment explores stock valuation methods, contrasting market value with intrinsic value using techniques like the Gordon dividend approach. It also differentiates between technical and fundamental analysis in the context of stock investment decisions, providing a comprehensive overview of corporate finance principles and their practical applications. Desklib offers a wealth of similar solved assignments and past papers to aid students in their studies.

CORPORATE FINANCE

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

PART A

The formula for present value of annuity is indicated as follows (Damodaran, 2015).

Based on the given information, P = $3,600, r= 12% p.a but owing to monthly compounding

1% per month, n = 24 months

Hence, PV of annuity = 3600*(1-1.01-24)/0.01 = $ 76,476.19

PART B

The relevant details about the bonds issues are highlighted below.

Face value = $ 10,000

Time to maturity = 12 years

Interest rate = 10% p.a.

a) If simple interest is charged, then the interest paid would be same every year

Hence, interest paid over 12 years = P*R*T = 10000*10%*12 = $ 12,000

b) If compound interest is charted, then the interest paid would keep increasing every year.

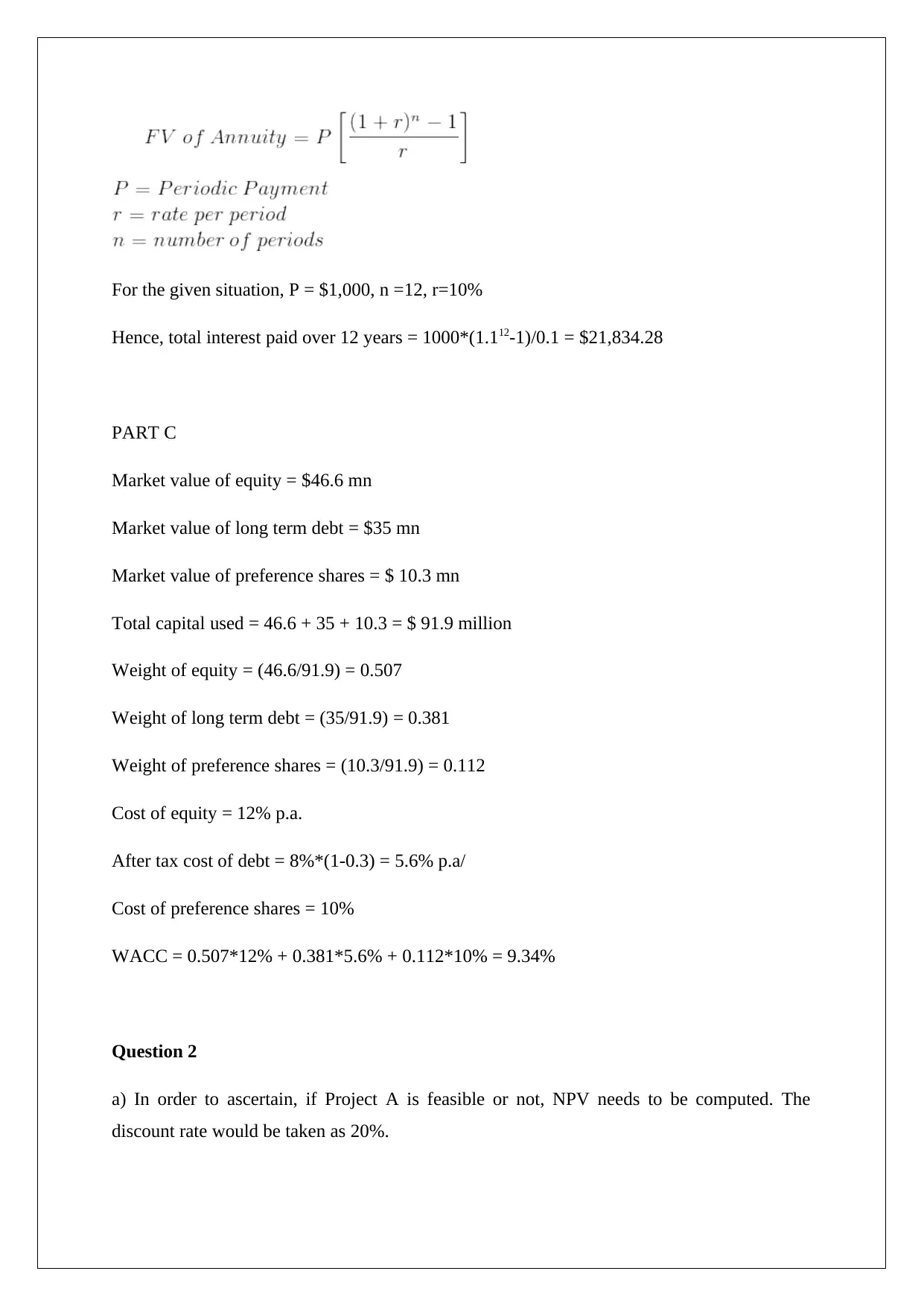

Thus, the future value of a annuity paying $ 1,000 every year for 12 years needs to be

computed. The relevant formula is indicated.

PART A

The formula for present value of annuity is indicated as follows (Damodaran, 2015).

Based on the given information, P = $3,600, r= 12% p.a but owing to monthly compounding

1% per month, n = 24 months

Hence, PV of annuity = 3600*(1-1.01-24)/0.01 = $ 76,476.19

PART B

The relevant details about the bonds issues are highlighted below.

Face value = $ 10,000

Time to maturity = 12 years

Interest rate = 10% p.a.

a) If simple interest is charged, then the interest paid would be same every year

Hence, interest paid over 12 years = P*R*T = 10000*10%*12 = $ 12,000

b) If compound interest is charted, then the interest paid would keep increasing every year.

Thus, the future value of a annuity paying $ 1,000 every year for 12 years needs to be

computed. The relevant formula is indicated.

For the given situation, P = $1,000, n =12, r=10%

Hence, total interest paid over 12 years = 1000*(1.112-1)/0.1 = $21,834.28

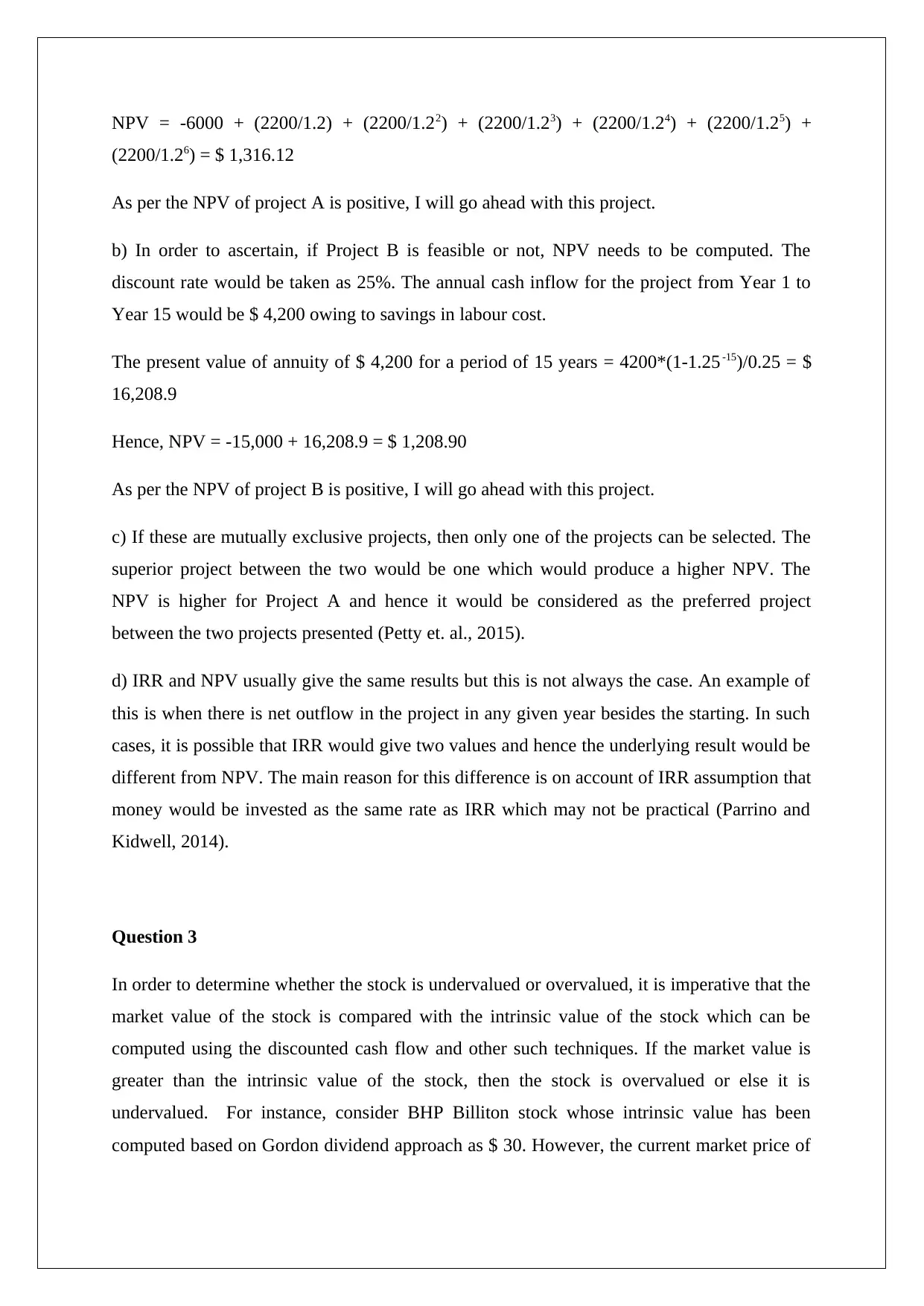

PART C

Market value of equity = $46.6 mn

Market value of long term debt = $35 mn

Market value of preference shares = $ 10.3 mn

Total capital used = 46.6 + 35 + 10.3 = $ 91.9 million

Weight of equity = (46.6/91.9) = 0.507

Weight of long term debt = (35/91.9) = 0.381

Weight of preference shares = (10.3/91.9) = 0.112

Cost of equity = 12% p.a.

After tax cost of debt = 8%*(1-0.3) = 5.6% p.a/

Cost of preference shares = 10%

WACC = 0.507*12% + 0.381*5.6% + 0.112*10% = 9.34%

Question 2

a) In order to ascertain, if Project A is feasible or not, NPV needs to be computed. The

discount rate would be taken as 20%.

Hence, total interest paid over 12 years = 1000*(1.112-1)/0.1 = $21,834.28

PART C

Market value of equity = $46.6 mn

Market value of long term debt = $35 mn

Market value of preference shares = $ 10.3 mn

Total capital used = 46.6 + 35 + 10.3 = $ 91.9 million

Weight of equity = (46.6/91.9) = 0.507

Weight of long term debt = (35/91.9) = 0.381

Weight of preference shares = (10.3/91.9) = 0.112

Cost of equity = 12% p.a.

After tax cost of debt = 8%*(1-0.3) = 5.6% p.a/

Cost of preference shares = 10%

WACC = 0.507*12% + 0.381*5.6% + 0.112*10% = 9.34%

Question 2

a) In order to ascertain, if Project A is feasible or not, NPV needs to be computed. The

discount rate would be taken as 20%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

NPV = -6000 + (2200/1.2) + (2200/1.22) + (2200/1.23) + (2200/1.24) + (2200/1.25) +

(2200/1.26) = $ 1,316.12

As per the NPV of project A is positive, I will go ahead with this project.

b) In order to ascertain, if Project B is feasible or not, NPV needs to be computed. The

discount rate would be taken as 25%. The annual cash inflow for the project from Year 1 to

Year 15 would be $ 4,200 owing to savings in labour cost.

The present value of annuity of $ 4,200 for a period of 15 years = 4200*(1-1.25-15)/0.25 = $

16,208.9

Hence, NPV = -15,000 + 16,208.9 = $ 1,208.90

As per the NPV of project B is positive, I will go ahead with this project.

c) If these are mutually exclusive projects, then only one of the projects can be selected. The

superior project between the two would be one which would produce a higher NPV. The

NPV is higher for Project A and hence it would be considered as the preferred project

between the two projects presented (Petty et. al., 2015).

d) IRR and NPV usually give the same results but this is not always the case. An example of

this is when there is net outflow in the project in any given year besides the starting. In such

cases, it is possible that IRR would give two values and hence the underlying result would be

different from NPV. The main reason for this difference is on account of IRR assumption that

money would be invested as the same rate as IRR which may not be practical (Parrino and

Kidwell, 2014).

Question 3

In order to determine whether the stock is undervalued or overvalued, it is imperative that the

market value of the stock is compared with the intrinsic value of the stock which can be

computed using the discounted cash flow and other such techniques. If the market value is

greater than the intrinsic value of the stock, then the stock is overvalued or else it is

undervalued. For instance, consider BHP Billiton stock whose intrinsic value has been

computed based on Gordon dividend approach as $ 30. However, the current market price of

(2200/1.26) = $ 1,316.12

As per the NPV of project A is positive, I will go ahead with this project.

b) In order to ascertain, if Project B is feasible or not, NPV needs to be computed. The

discount rate would be taken as 25%. The annual cash inflow for the project from Year 1 to

Year 15 would be $ 4,200 owing to savings in labour cost.

The present value of annuity of $ 4,200 for a period of 15 years = 4200*(1-1.25-15)/0.25 = $

16,208.9

Hence, NPV = -15,000 + 16,208.9 = $ 1,208.90

As per the NPV of project B is positive, I will go ahead with this project.

c) If these are mutually exclusive projects, then only one of the projects can be selected. The

superior project between the two would be one which would produce a higher NPV. The

NPV is higher for Project A and hence it would be considered as the preferred project

between the two projects presented (Petty et. al., 2015).

d) IRR and NPV usually give the same results but this is not always the case. An example of

this is when there is net outflow in the project in any given year besides the starting. In such

cases, it is possible that IRR would give two values and hence the underlying result would be

different from NPV. The main reason for this difference is on account of IRR assumption that

money would be invested as the same rate as IRR which may not be practical (Parrino and

Kidwell, 2014).

Question 3

In order to determine whether the stock is undervalued or overvalued, it is imperative that the

market value of the stock is compared with the intrinsic value of the stock which can be

computed using the discounted cash flow and other such techniques. If the market value is

greater than the intrinsic value of the stock, then the stock is overvalued or else it is

undervalued. For instance, consider BHP Billiton stock whose intrinsic value has been

computed based on Gordon dividend approach as $ 30. However, the current market price of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

BHP stock is $ 27 which would imply that the stock is undervalued as the fair value is larger

than the current market price (Brealey, Myers and Allen, 2014).

The technical analysis is based on the premise the future stock movements tend to have some

definite patterns and hence in technique levels these key levels are defined as support and

resistance for the stock and form the basis for taking decisions in the market (Damodaran,

2015). Technical analysis essentially provides estimates fo short term movement in the stock

based on the pattern since it is every changing. The fundamental analysis is based on

analysing the fundamentals of the company, underlying business model, financial

performance so as to determine if superior returns can be earned on the underlying stock

(Petty et. al., 2015).

than the current market price (Brealey, Myers and Allen, 2014).

The technical analysis is based on the premise the future stock movements tend to have some

definite patterns and hence in technique levels these key levels are defined as support and

resistance for the stock and form the basis for taking decisions in the market (Damodaran,

2015). Technical analysis essentially provides estimates fo short term movement in the stock

based on the pattern since it is every changing. The fundamental analysis is based on

analysing the fundamentals of the company, underlying business model, financial

performance so as to determine if superior returns can be earned on the underlying stock

(Petty et. al., 2015).

References

Brealey, R. A., Myers, S. C. and Allen, F. (2014) Principles of corporate finance, 6th ed. New

York: McGraw-Hill Publications

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. and Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M. and Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

Brealey, R. A., Myers, S. C. and Allen, F. (2014) Principles of corporate finance, 6th ed. New

York: McGraw-Hill Publications

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Parrino, R. and Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M. and Nguyen, H. (2015).

Financial Management, Principles and Applications, 6th ed.. NSW: Pearson Education, French

Forest Australia

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.