Assessing the Importance of Corporate Governance on Firm Performance

VerifiedAdded on 2023/04/24

|20

|5370

|52

Report

AI Summary

This report investigates the critical importance of corporate governance on a firm's performance, addressing key research objectives and questions. It explores how corporate governance practices, including shareholder rights, internal control mechanisms, and board structures, directly influence a company's financial outcomes and overall success. The literature review delves into various aspects of corporate governance, such as the role of the board of directors, ownership structures, and the impact of agency problems. The report highlights the significance of effective corporate governance in fostering transparency, accountability, and investor confidence, ultimately leading to improved financial performance and sustainable competitiveness. The study also examines the impact of risk management and the importance of establishing committees for monitoring financial performance. By analyzing these elements, the report aims to provide a comprehensive understanding of the relationship between corporate governance and firm success, supported by existing research and industry insights.

Running Head: IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S

PERFORMANCE

IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

Name of the Student

Name of the University

Author Note

PERFORMANCE

IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

Table of Contents

Research Objectives...................................................................................................................2

Research Questions....................................................................................................................2

Literature Review.......................................................................................................................3

Research Methods....................................................................................................................14

Conclusion................................................................................................................................14

Reference..................................................................................................................................16

Table of Contents

Research Objectives...................................................................................................................2

Research Questions....................................................................................................................2

Literature Review.......................................................................................................................3

Research Methods....................................................................................................................14

Conclusion................................................................................................................................14

Reference..................................................................................................................................16

2IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

Research Objectives

The research on the importance of corporate governance on firm’s performance is

conducted for achieving the objectives, which includes following:

For measuring the impact or importance of the practices of the corporate governance

on the company’s financial performance. Implementations of the standards of the

corporate governance improve the financial performance of the firm as well as it

positively influences the internal efficiency of firms (Tricker, 2015).

For measuring the degree to which the corporate governance influences the business

organization’sperformance. Corporate governance helps in affecting the performance

of business, creating sustainable competitiveness as well as feasible business

environment for the investments and growth for the corporate as well as national

economy (McCahery, Sautner &Starks, 2016).

For taking into considerations, the best practices in relation to corporate governance

in the business organizations,which can influences the firm’s performance. The

practices of the corporate governance help in increasing the performance of the

company (Krechovská & Procházková, 2014).

Research Questions

The development of the research can be donewith the objective of answering certain

questions, which is mentioned below:

1. How the different aspects of the corporate governance do creates the positive impact

on the company’s performance?

2. What are the reasons for which the firm’s performance is influenced by the corporate

governance?

Research Objectives

The research on the importance of corporate governance on firm’s performance is

conducted for achieving the objectives, which includes following:

For measuring the impact or importance of the practices of the corporate governance

on the company’s financial performance. Implementations of the standards of the

corporate governance improve the financial performance of the firm as well as it

positively influences the internal efficiency of firms (Tricker, 2015).

For measuring the degree to which the corporate governance influences the business

organization’sperformance. Corporate governance helps in affecting the performance

of business, creating sustainable competitiveness as well as feasible business

environment for the investments and growth for the corporate as well as national

economy (McCahery, Sautner &Starks, 2016).

For taking into considerations, the best practices in relation to corporate governance

in the business organizations,which can influences the firm’s performance. The

practices of the corporate governance help in increasing the performance of the

company (Krechovská & Procházková, 2014).

Research Questions

The development of the research can be donewith the objective of answering certain

questions, which is mentioned below:

1. How the different aspects of the corporate governance do creates the positive impact

on the company’s performance?

2. What are the reasons for which the firm’s performance is influenced by the corporate

governance?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

3. Why it is necessary for the firms for developing and implementing effective

mechanism for corporate governance for their effective performance?

Literature Review

The concept of the corporate governance provides the deep insights about the various

aspects of the code of conduct that has to be followed by the business organizations. Hence,

because of this reason, the corporate governance has become the practices and process which

governs the business activities of the firm. The system helps in managing and controlling the

business organizations. As per many views, corporate governance is considered one of the

major means for the creation of long-run value of the business organization (McCahery,

Sautner & Starks, 2016). The principles of corporate governance help in the management and

controlling of the different operations of the business. There are certain element such as

rights of the shareholders, their equitable treatments, stakeholder’s role in corporate

governance, maintaining of the transparency by disclosure of various information,

responsibility of the members of the board of directors and the others.All these aspects have

to be taken into considerations by the management for the development of the corporate

governance mechanism (Chan, Watson &Woodliff, 2014). The presence of the effective

mechanism of corporate governance helps in the management of the company for

establishment of the effective internal control over the accounting and financial related tasks.

The strong presence of the internal control within the organization helps in reducing the

possibility of the corporate failures because of corporate frauds and errors. The reason behind

this failures and scandal was due to the lack of the practices of the corporate governance (Al-

Najjar, 2014). This has affected the economy of the world; this has started the measures for

the implementation of the corporate governance in the organizations. Acknowledgement of

the corporate governance has helped in reducing the risk of the shareholders. This helps in

ensuring that the shareholders get the return on the investments. This has emphasized for

3. Why it is necessary for the firms for developing and implementing effective

mechanism for corporate governance for their effective performance?

Literature Review

The concept of the corporate governance provides the deep insights about the various

aspects of the code of conduct that has to be followed by the business organizations. Hence,

because of this reason, the corporate governance has become the practices and process which

governs the business activities of the firm. The system helps in managing and controlling the

business organizations. As per many views, corporate governance is considered one of the

major means for the creation of long-run value of the business organization (McCahery,

Sautner & Starks, 2016). The principles of corporate governance help in the management and

controlling of the different operations of the business. There are certain element such as

rights of the shareholders, their equitable treatments, stakeholder’s role in corporate

governance, maintaining of the transparency by disclosure of various information,

responsibility of the members of the board of directors and the others.All these aspects have

to be taken into considerations by the management for the development of the corporate

governance mechanism (Chan, Watson &Woodliff, 2014). The presence of the effective

mechanism of corporate governance helps in the management of the company for

establishment of the effective internal control over the accounting and financial related tasks.

The strong presence of the internal control within the organization helps in reducing the

possibility of the corporate failures because of corporate frauds and errors. The reason behind

this failures and scandal was due to the lack of the practices of the corporate governance (Al-

Najjar, 2014). This has affected the economy of the world; this has started the measures for

the implementation of the corporate governance in the organizations. Acknowledgement of

the corporate governance has helped in reducing the risk of the shareholders. This helps in

ensuring that the shareholders get the return on the investments. This has emphasized for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

determining the concept of agency for motivating the managers for increasing the return of

the shareholders. Payment such as bonuses and different facilities is provided to the managers

for increasing the return on the investments (Abdallah & Ismail, 2017).

A different aspect of the corporate governance in the organizations has major

importance in the firm’s performance. The mechanism of the corporate governance in the

business in the organization has outfitted for bringing the modifications or changes in the

decisions of investment such as changes in the policies in compensation management,

altering the policies of accounting, board decisions related to different financial aspects.

Hence, it becomes easier for the companies to monitor and implement different aspects of the

financial performances (McCahery, Sautner & Starks, 2016). At the same time, the presence

of the mechanism of the effective corporate governance assists in the establishment of the

certain committees for monitoring of the firm’s financial performance such as remuneration

committee, audit committee and others. Effective corporate governance helps in assisting the

management of the company by making the correct investment decisions regarding the

financial projects so that the company becomes profitable and beneficial from them. The

firm’s members have the responsibility for reviewing the mechanism for implemented

reporting with the objective for accelerating their financial performances. In addition to this,

all of these aspects help in ensuring the effective shareholder’s return (Aguilera &Crespi-

Cladera, 2016).

The healthy operating performance of the company is facilitates superior corporate

governance. The company that has inferior rating on the part of corporate governance

produces the less return in comparison to the superior governance. The risk of the company

plays the important role in the performance of the company because if the company takes

greater risk than the return is expected to be higher (Mishra &Mohanty, 2014). Hence, due to

the volatility of its nature, the firm specific risk hinders the policy makers of the firm and the

determining the concept of agency for motivating the managers for increasing the return of

the shareholders. Payment such as bonuses and different facilities is provided to the managers

for increasing the return on the investments (Abdallah & Ismail, 2017).

A different aspect of the corporate governance in the organizations has major

importance in the firm’s performance. The mechanism of the corporate governance in the

business in the organization has outfitted for bringing the modifications or changes in the

decisions of investment such as changes in the policies in compensation management,

altering the policies of accounting, board decisions related to different financial aspects.

Hence, it becomes easier for the companies to monitor and implement different aspects of the

financial performances (McCahery, Sautner & Starks, 2016). At the same time, the presence

of the mechanism of the effective corporate governance assists in the establishment of the

certain committees for monitoring of the firm’s financial performance such as remuneration

committee, audit committee and others. Effective corporate governance helps in assisting the

management of the company by making the correct investment decisions regarding the

financial projects so that the company becomes profitable and beneficial from them. The

firm’s members have the responsibility for reviewing the mechanism for implemented

reporting with the objective for accelerating their financial performances. In addition to this,

all of these aspects help in ensuring the effective shareholder’s return (Aguilera &Crespi-

Cladera, 2016).

The healthy operating performance of the company is facilitates superior corporate

governance. The company that has inferior rating on the part of corporate governance

produces the less return in comparison to the superior governance. The risk of the company

plays the important role in the performance of the company because if the company takes

greater risk than the return is expected to be higher (Mishra &Mohanty, 2014). Hence, due to

the volatility of its nature, the firm specific risk hinders the policy makers of the firm and the

5IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

ability of the planning departments for forecasting and planning their related activities and

their cash flows and so on. Generally, these risks ae related to the return on the stock of the

company. However, the risk of the firm specific is related directly to the company’s

performance (Arora & Sharma, 2016). Hence, the corporate governance is the important area

in the research that deals with the many arrangements of the governance that is used for the

control of the corporation that includes the objectives of maximizing the wealth of the

shareholders. The effectiveness of the corporate governance helps in guaranteeing the value

of the shareholders and bestpossible uses of thefirm’s resources that allows the access to the

capital and improving the confidence of the investors (Francis, Hasan & Wu, 2015).

In the stability of macroeconomics, corporate governance plays the important role

because it provides the environment that is suitable for the society welfare as well as growth

of the economy. The corporate governance is defined as the set of the relationship that exists

between the management of the company, their board, shareholders and the other

stakeholders (Dalwai, Basiruddin &Abdul Rasid, 2015). Corporate governance helps in

providing the structure by which the companies set the objectives, means of achieving the

objectives and provides the way of monitoring the performances is determined. If the

corporate governance is good then it helps in allocating the proper motivation to the board as

well as the management of the company for following the objectives that is in the company’s

interests and shareholder’s interest.In addition, it also facilitates the effectiveness of

monitoring in such a way that it boosts the company for using the resources of the company

more efficiently (Chang, Yu & Hung, 2015).

As per the past evidences, it has been observed that whether it is developed or under

developed country, the corporate governance has helped in increasing the financial

performances. Results of the past has also showed that the presence of the outside directors

have abnormal return on the investments (El-Chaarani, 2014).

ability of the planning departments for forecasting and planning their related activities and

their cash flows and so on. Generally, these risks ae related to the return on the stock of the

company. However, the risk of the firm specific is related directly to the company’s

performance (Arora & Sharma, 2016). Hence, the corporate governance is the important area

in the research that deals with the many arrangements of the governance that is used for the

control of the corporation that includes the objectives of maximizing the wealth of the

shareholders. The effectiveness of the corporate governance helps in guaranteeing the value

of the shareholders and bestpossible uses of thefirm’s resources that allows the access to the

capital and improving the confidence of the investors (Francis, Hasan & Wu, 2015).

In the stability of macroeconomics, corporate governance plays the important role

because it provides the environment that is suitable for the society welfare as well as growth

of the economy. The corporate governance is defined as the set of the relationship that exists

between the management of the company, their board, shareholders and the other

stakeholders (Dalwai, Basiruddin &Abdul Rasid, 2015). Corporate governance helps in

providing the structure by which the companies set the objectives, means of achieving the

objectives and provides the way of monitoring the performances is determined. If the

corporate governance is good then it helps in allocating the proper motivation to the board as

well as the management of the company for following the objectives that is in the company’s

interests and shareholder’s interest.In addition, it also facilitates the effectiveness of

monitoring in such a way that it boosts the company for using the resources of the company

more efficiently (Chang, Yu & Hung, 2015).

As per the past evidences, it has been observed that whether it is developed or under

developed country, the corporate governance has helped in increasing the financial

performances. Results of the past has also showed that the presence of the outside directors

have abnormal return on the investments (El-Chaarani, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

According to Jun-Koo Kang, the examination has been done on the role of the

mechanism of corporate governance during the turnover of the top executive in the Japanese

corporation. The research has been find that it is consistent with the evidence of the data of

US, that the likelihood of the turnover of the non-routine is significantly in relation to the

industry adjusted negative operating income, excess stock returns and return on the assets.

The sensitivity of the turnover of the non-routineexecutive to the performance of the earnings

for the firms that ties to the main bank is higher than the firms without ties (Amba, 2014).

The relationship that exists between the board of directors and financial performance

of the company has helped in the setting of the rules for the corporate board that leads to the

overall performance of the company. As per past studies, it has been find that, the

measurement of the corporate governance can be done by the different variables such as

board ownership, board effectiveness, size of board, composition of board, compensation of

board, duality of CEO, independence of the directors and experience and education of the

CEO of the board (Zagorchev& Gao, 2015). Detailed literature on these variables is shown

below:

Ownership of Board

The board ownership aspect of the company is the encouraging aspects of the

members of board. The personal interest of the board is merged in the matters of the company

which results in the taking the better decisions that is beneficial for the others stakeholders.

Moreover, there is positive relationship exists between the ownership of the board and

financial performance of the company. As per Fama and Jensen, this aspect is known as

“two-edged knife” that have optimal and maximum benefit in the enhancement of the

financial performance of the company. According to Sanjana S Gaur, the lack of the

concentration of the ownership leads to the problems of agency that result in the inferior

According to Jun-Koo Kang, the examination has been done on the role of the

mechanism of corporate governance during the turnover of the top executive in the Japanese

corporation. The research has been find that it is consistent with the evidence of the data of

US, that the likelihood of the turnover of the non-routine is significantly in relation to the

industry adjusted negative operating income, excess stock returns and return on the assets.

The sensitivity of the turnover of the non-routineexecutive to the performance of the earnings

for the firms that ties to the main bank is higher than the firms without ties (Amba, 2014).

The relationship that exists between the board of directors and financial performance

of the company has helped in the setting of the rules for the corporate board that leads to the

overall performance of the company. As per past studies, it has been find that, the

measurement of the corporate governance can be done by the different variables such as

board ownership, board effectiveness, size of board, composition of board, compensation of

board, duality of CEO, independence of the directors and experience and education of the

CEO of the board (Zagorchev& Gao, 2015). Detailed literature on these variables is shown

below:

Ownership of Board

The board ownership aspect of the company is the encouraging aspects of the

members of board. The personal interest of the board is merged in the matters of the company

which results in the taking the better decisions that is beneficial for the others stakeholders.

Moreover, there is positive relationship exists between the ownership of the board and

financial performance of the company. As per Fama and Jensen, this aspect is known as

“two-edged knife” that have optimal and maximum benefit in the enhancement of the

financial performance of the company. According to Sanjana S Gaur, the lack of the

concentration of the ownership leads to the problems of agency that result in the inferior

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

performances. Apart from this, the positive effect on the independence of the board on the

performances of the company reduces in the company that has higher concentration of

ownership. In addition to this, higher concentration of the ownership reduces the positive

effects of the board competence and its size (Kilic et al., 2015).

Composition of Board

The existence of the outside members of the board has positive relationship with the

performance of the company. The board is responsible for the development of the mission,

values, policies and tracking overall for the organization. People with the distinct opinions,

values as well as the relationship with the different communities and people that comprises

with the board of directors as well as it follows that the characteristics of the individual

people who are responsible for serving the board that influences the missions, policies and

the overall directions of the company. Hence, the representatives of the diversified

populations on the board of the directors have the impact directly on the policies, missions as

well as directions of the overall organizations (Baldenius, Melumad&Meng, 2014).

Board Effectiveness

The corporate governance of the company provides the way of dealing the problems

of agency and it cost. Hence, it can be said that the effective corporate governance can

resolve that agency problems. The objectives of the board and management are not same.

However, it depends upon the total compensation given by the board and company to the

management for meeting the interest of the shareholders. This compensation helps in solving

the problems between the management and shareholders and ultimately it results in boosting

the confidence of the shareholders. Agency cost is reduced by the presence of the board

(Conheady et al., 2015).

Board size and structure

performances. Apart from this, the positive effect on the independence of the board on the

performances of the company reduces in the company that has higher concentration of

ownership. In addition to this, higher concentration of the ownership reduces the positive

effects of the board competence and its size (Kilic et al., 2015).

Composition of Board

The existence of the outside members of the board has positive relationship with the

performance of the company. The board is responsible for the development of the mission,

values, policies and tracking overall for the organization. People with the distinct opinions,

values as well as the relationship with the different communities and people that comprises

with the board of directors as well as it follows that the characteristics of the individual

people who are responsible for serving the board that influences the missions, policies and

the overall directions of the company. Hence, the representatives of the diversified

populations on the board of the directors have the impact directly on the policies, missions as

well as directions of the overall organizations (Baldenius, Melumad&Meng, 2014).

Board Effectiveness

The corporate governance of the company provides the way of dealing the problems

of agency and it cost. Hence, it can be said that the effective corporate governance can

resolve that agency problems. The objectives of the board and management are not same.

However, it depends upon the total compensation given by the board and company to the

management for meeting the interest of the shareholders. This compensation helps in solving

the problems between the management and shareholders and ultimately it results in boosting

the confidence of the shareholders. Agency cost is reduced by the presence of the board

(Conheady et al., 2015).

Board size and structure

8IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

The board’ structure and size of the company is considered to the important factor.

The size of the company should not be that much large that it adds to the cost of the

organizations and results in the huge financial burden that is higher than the cost of agency.

The size of the board should not be too less that; it leads to the decisions, which is weak and

biased(Chen, 2015). The non-executive directors of the company make the efforts as well as

measures for ensuring that the effective running of the organizationsand monitors the

management’s performance foe retaining the reputation of the company in the market.

Moreover, in case of size of board, there are two thoughts. One thoughts is that, the board,

which is smaller contributes in the organization’sbest interest. However, there is the second

thought that, the larger the board size, the better result is expected for improving the

organization’s performances (Chen, 2015).

Compensation of Board

The shareholders of the company should have to attach the financial benefits to the

compensations for which have to paid by the management of the company. If the behavior of

the management is not favorable then the compensation becomes the mechanism of the

corporate governance for encouraging the management for running the company in the

shareholder’s interests. The issues of the agency that exist between the management and the

shareholdersare solved by the board compensation and ultimately it contribute to the

performances of the company (Mishra &Mohanty, 2014).

Board Independence

The most important aspect of the corporate governance is the independence of board.

If the board is independent, there is less chances of financial pressure and unbiased decisions.

The decisions of the company will be enhanced by its objectivity and credibility if the board

consists of large number of independent directors. The system of independent directors will

The board’ structure and size of the company is considered to the important factor.

The size of the company should not be that much large that it adds to the cost of the

organizations and results in the huge financial burden that is higher than the cost of agency.

The size of the board should not be too less that; it leads to the decisions, which is weak and

biased(Chen, 2015). The non-executive directors of the company make the efforts as well as

measures for ensuring that the effective running of the organizationsand monitors the

management’s performance foe retaining the reputation of the company in the market.

Moreover, in case of size of board, there are two thoughts. One thoughts is that, the board,

which is smaller contributes in the organization’sbest interest. However, there is the second

thought that, the larger the board size, the better result is expected for improving the

organization’s performances (Chen, 2015).

Compensation of Board

The shareholders of the company should have to attach the financial benefits to the

compensations for which have to paid by the management of the company. If the behavior of

the management is not favorable then the compensation becomes the mechanism of the

corporate governance for encouraging the management for running the company in the

shareholder’s interests. The issues of the agency that exist between the management and the

shareholdersare solved by the board compensation and ultimately it contribute to the

performances of the company (Mishra &Mohanty, 2014).

Board Independence

The most important aspect of the corporate governance is the independence of board.

If the board is independent, there is less chances of financial pressure and unbiased decisions.

The decisions of the company will be enhanced by its objectivity and credibility if the board

consists of large number of independent directors. The system of independent directors will

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

bring transparency in the value and financial statements. The board’s transparency also

enhances protection and supervision of increase in the shareholders equity. Moreover, the

independent directors are also responsible for supervision of the of the management hierarchy

in the unbiased and better way(Liu et al., 2015). The performance of the company increases if

the independent members are higher than that of the dependent member. On the board of the

directors, the non-executive directors of the company, performs on the part of the

shareholders who are external are expected for monitoring the strategy as well as the decision

making process of the organization. According to the Taher Hamza, there is negative as well

as significant relationship between the independence of board and return of the equity. As per

his suggestion, if the company is appointing directors that are more independentthen there is

failure in the enhancement of the return of stock. Moreover, the company with the

committees of independent audit exhibits the higher returns of the equity (Liu et al., 2015).

Duality of CEO

The duality of the CEO is defined as if one person has the responsibility of CEO as

well as Chairman of the Board. This duality leads to monopoly of the decisions and highly

biased decisions that lacks the board members performance and reductions of the company’s

performance. This creates the imbalances of power in the company and the one person’s

influence in all the matters of the firm results in ineffective decisions and highly biasedness.

Therefore, by keeping in mind this aspect of the duality, the companies moved from the

structure of duality to the non-duality and do the separation of CEO and Chairman of Board

(Yang & Zhao, 2014).

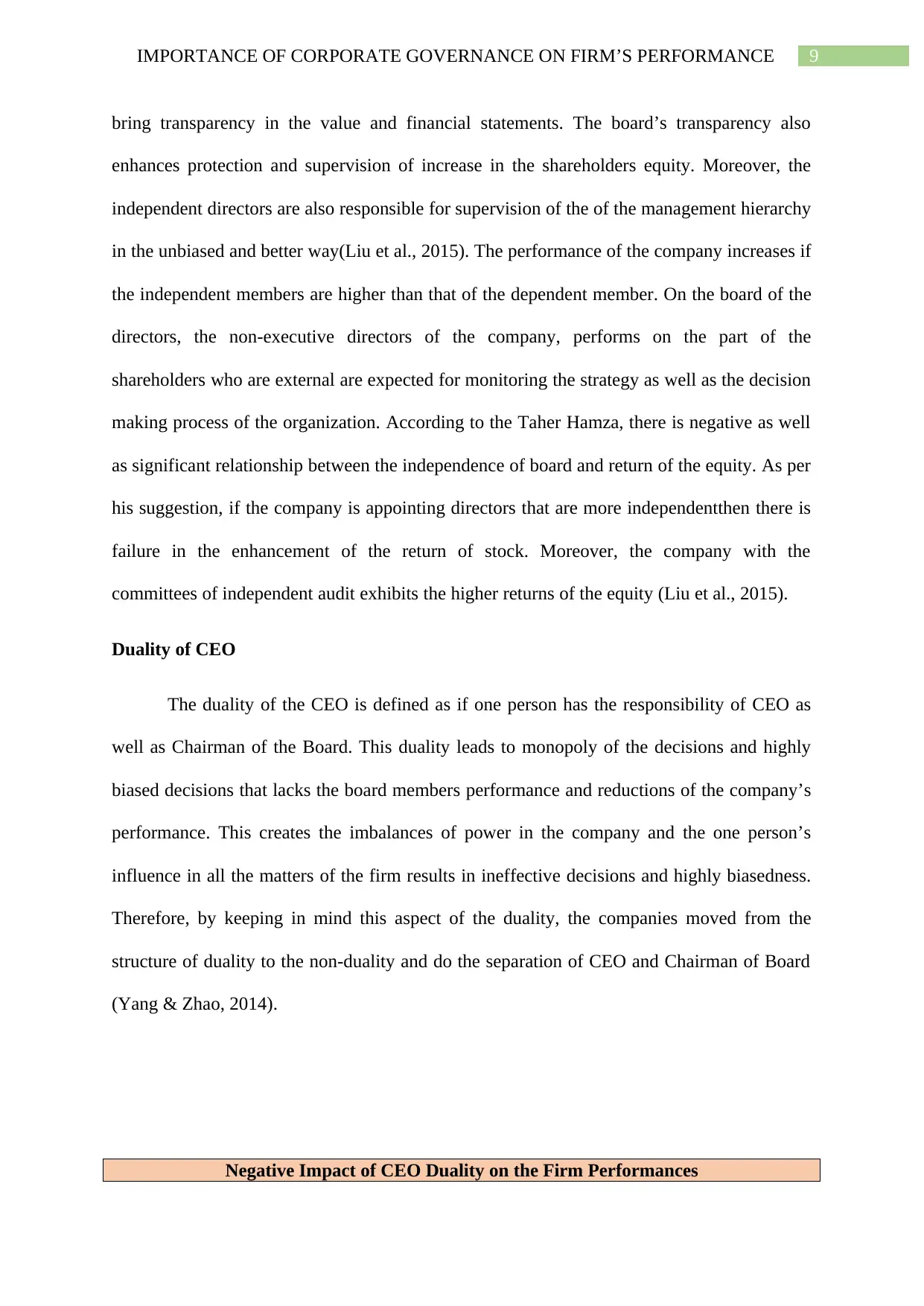

Negative Impact of CEO Duality on the Firm Performances

bring transparency in the value and financial statements. The board’s transparency also

enhances protection and supervision of increase in the shareholders equity. Moreover, the

independent directors are also responsible for supervision of the of the management hierarchy

in the unbiased and better way(Liu et al., 2015). The performance of the company increases if

the independent members are higher than that of the dependent member. On the board of the

directors, the non-executive directors of the company, performs on the part of the

shareholders who are external are expected for monitoring the strategy as well as the decision

making process of the organization. According to the Taher Hamza, there is negative as well

as significant relationship between the independence of board and return of the equity. As per

his suggestion, if the company is appointing directors that are more independentthen there is

failure in the enhancement of the return of stock. Moreover, the company with the

committees of independent audit exhibits the higher returns of the equity (Liu et al., 2015).

Duality of CEO

The duality of the CEO is defined as if one person has the responsibility of CEO as

well as Chairman of the Board. This duality leads to monopoly of the decisions and highly

biased decisions that lacks the board members performance and reductions of the company’s

performance. This creates the imbalances of power in the company and the one person’s

influence in all the matters of the firm results in ineffective decisions and highly biasedness.

Therefore, by keeping in mind this aspect of the duality, the companies moved from the

structure of duality to the non-duality and do the separation of CEO and Chairman of Board

(Yang & Zhao, 2014).

Negative Impact of CEO Duality on the Firm Performances

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

Frequency Percent Valid Percent Cumulative

Percent

Valid Strongly

Agree

14 23.3 23.3 23.3

Agree 25 41.7 41.7 65.0

Partially

Agree

11 18.3 18.3 83.3

Disagree 9 15.0 15.0 98.3

Strongly

Disagree

1 1.7 1.7 100.0

Total 60 100.0 100.0

Figure 1: Frequency Table of CEO duality (Peni, 2014)

Frequency Percent Valid Percent Cumulative

Percent

Valid Strongly

Agree

14 23.3 23.3 23.3

Agree 25 41.7 41.7 65.0

Partially

Agree

11 18.3 18.3 83.3

Disagree 9 15.0 15.0 98.3

Strongly

Disagree

1 1.7 1.7 100.0

Total 60 100.0 100.0

Figure 1: Frequency Table of CEO duality (Peni, 2014)

11IMPORTANCE OF CORPORATE GOVERNANCE ON FIRM’S PERFORMANCE

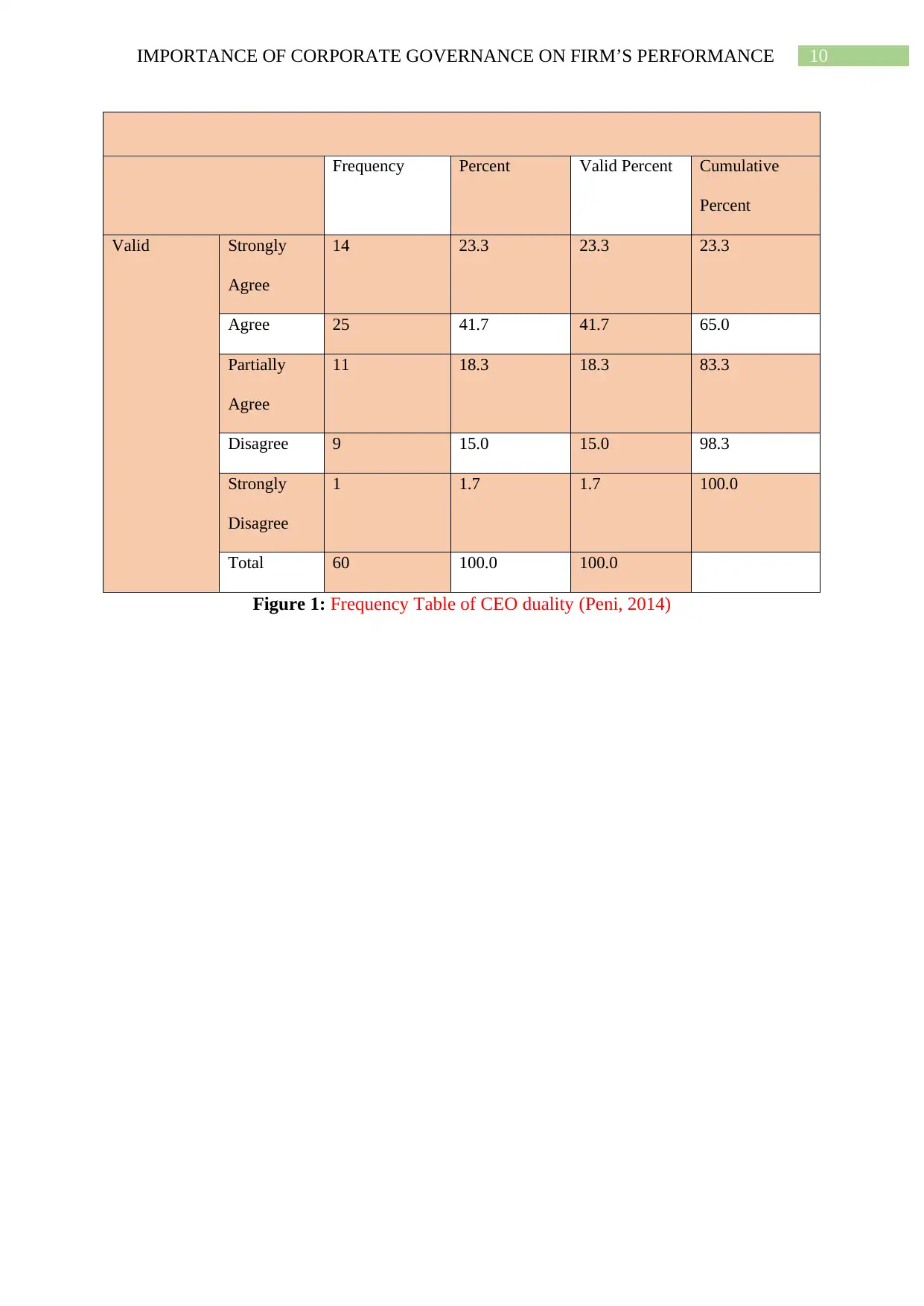

Figure 2: Graph of CEO duality (Peni, 2014)

Education and Experience of Board

The backbone of the company is its board of directors. They are responsible for the

monitoring of the business operations and safeguarding the interests of the shareholders.

They are also responsible for the evaluation of the management and taking the decisions that

is helpful for the organizations. Hence, for this the board must have good education and

experience level, so that they could inspect the currently prevailing situation very effectively

for taking decisions and measures accordingly. The basic role and responsibility of the board

is the firm’s internal corporate governance (Hassan, Marimuthu &Johl, 2015). Hence, each of

the board member should be equipped with the knowledge of the management such as

accounting, finance, marketing, legal issues, information’s systems as well as other areas that

is interrelated. The requirement of this suggests that each of the members of the board should

Figure 2: Graph of CEO duality (Peni, 2014)

Education and Experience of Board

The backbone of the company is its board of directors. They are responsible for the

monitoring of the business operations and safeguarding the interests of the shareholders.

They are also responsible for the evaluation of the management and taking the decisions that

is helpful for the organizations. Hence, for this the board must have good education and

experience level, so that they could inspect the currently prevailing situation very effectively

for taking decisions and measures accordingly. The basic role and responsibility of the board

is the firm’s internal corporate governance (Hassan, Marimuthu &Johl, 2015). Hence, each of

the board member should be equipped with the knowledge of the management such as

accounting, finance, marketing, legal issues, information’s systems as well as other areas that

is interrelated. The requirement of this suggests that each of the members of the board should

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.