Corporate Finance Report: Analyzing Lease versus Purchase Decisions

VerifiedAdded on 2022/09/08

|6

|632

|17

Report

AI Summary

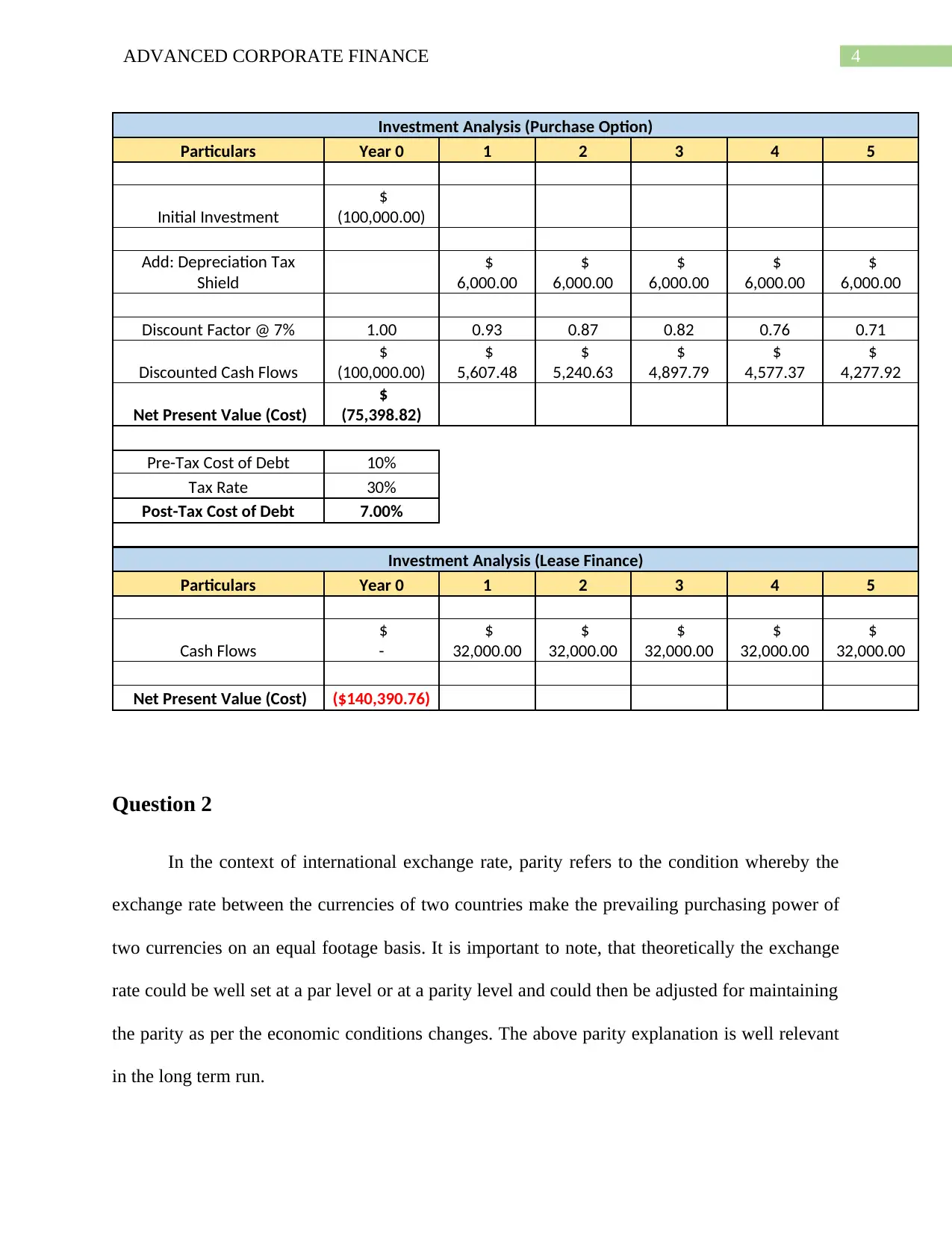

This report presents a corporate finance analysis comparing the financial implications of leasing versus purchasing an asset. The analysis involves calculating the present value of costs and benefits for both options, considering factors like initial investment, depreciation tax shields, and discount rates. The report recommends purchasing the asset over leasing based on a lower net present value cost. Additionally, the report touches upon international exchange rate parity, explaining its relevance in the long run. The report includes detailed calculations for investment analysis, including pre-tax and post-tax costs of debt, and provides a bibliography of cited sources. This student assignment is a valuable resource for understanding key corporate finance concepts and decision-making processes.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)