HI5020 Corporate Accounting Report: Mining Industry Analysis

VerifiedAdded on 2023/04/21

|43

|5039

|237

Report

AI Summary

This report offers a detailed financial analysis of three Australian mining companies: Rio Tinto, Altura Mining, and BHP Billiton. The analysis covers key aspects of corporate accounting, including equity and liabilities, with a comparative examination of share capital, reserves, retained earnings, borrowings, trade payables, and provisions. The report delves into the cash flow statements, examining operating, investing, and financing activities, followed by a comparative analysis to highlight financial trends. It further explores the other comprehensive income statements, identifying items not recognized under the income statement and reasons for their exclusion. The report concludes with an in-depth examination of accounting for corporate income tax, including tax expenses, effective tax rates, deferred tax assets and liabilities, and cash tax calculations. The comparative analysis across the three companies provides insights into their financial structures, leverage positions, and overall financial health, drawing from the companies' financial statements to support the analysis.

Running head: CORPORATE ACCOUNTING

Corporate accounting

Name of the student

Name of the university

Student ID

Author note

Corporate accounting

Name of the student

Name of the university

Student ID

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

Executive summary

Purpose of the report is to analyse various financial aspects of 3 companies from mining

industry of Australia that is Rio Tinto, Altura Mining and BHP Billiton. It will focus on

equities and liabilities reported by the entities and changes in the amount thereon. It will

further highlight the capital structure of the companies and will also analyse the other

comprehensive income statement and cash flow statement. Moreover the report will focus on

accounting aspects of corporate income tax.

Executive summary

Purpose of the report is to analyse various financial aspects of 3 companies from mining

industry of Australia that is Rio Tinto, Altura Mining and BHP Billiton. It will focus on

equities and liabilities reported by the entities and changes in the amount thereon. It will

further highlight the capital structure of the companies and will also analyse the other

comprehensive income statement and cash flow statement. Moreover the report will focus on

accounting aspects of corporate income tax.

2CORPORATE ACCOUNTING

Table of Contents

Introduction................................................................................................................................4

Equity and liabilities..................................................................................................................5

(i) Items of equity.............................................................................................................5

(ii) Items of liabilities........................................................................................................7

(iii) Comparative analysis of debt and equity...................................................................11

Cash flow statements................................................................................................................12

(iv) Items listed under cash flow statement......................................................................12

(v) Comparative analysis.................................................................................................13

(vi) Comparative analysis for explaining insights............................................................16

Other comprehensive income statement..................................................................................16

(vii) Items reported in other comprehensive income (OCI) statement..............................16

(viii) Reasons why the items not recognised under income statement...........................18

(ix) Comparative analysis.................................................................................................18

(x) Inclusion of comprehensive income for evaluation of manager’s performance.......18

Accounting for corporate income tax.......................................................................................19

(xi) Tax expenses.............................................................................................................19

(xii) Effective tax rate........................................................................................................19

(xiii) Deferred tax assets or liabilities.............................................................................19

(xiv) Increase or decrease in the deferred tax assets or liabilities..................................20

Table of Contents

Introduction................................................................................................................................4

Equity and liabilities..................................................................................................................5

(i) Items of equity.............................................................................................................5

(ii) Items of liabilities........................................................................................................7

(iii) Comparative analysis of debt and equity...................................................................11

Cash flow statements................................................................................................................12

(iv) Items listed under cash flow statement......................................................................12

(v) Comparative analysis.................................................................................................13

(vi) Comparative analysis for explaining insights............................................................16

Other comprehensive income statement..................................................................................16

(vii) Items reported in other comprehensive income (OCI) statement..............................16

(viii) Reasons why the items not recognised under income statement...........................18

(ix) Comparative analysis.................................................................................................18

(x) Inclusion of comprehensive income for evaluation of manager’s performance.......18

Accounting for corporate income tax.......................................................................................19

(xi) Tax expenses.............................................................................................................19

(xii) Effective tax rate........................................................................................................19

(xiii) Deferred tax assets or liabilities.............................................................................19

(xiv) Increase or decrease in the deferred tax assets or liabilities..................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING

(xv) Cash tax.....................................................................................................................20

(xvi) Cash tax rate...........................................................................................................20

(xvii) Difference among book tax rate and cash tax rate.................................................21

Conclusion................................................................................................................................21

References................................................................................................................................22

Appendix..................................................................................................................................24

(xv) Cash tax.....................................................................................................................20

(xvi) Cash tax rate...........................................................................................................20

(xvii) Difference among book tax rate and cash tax rate.................................................21

Conclusion................................................................................................................................21

References................................................................................................................................22

Appendix..................................................................................................................................24

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

Introduction

Rio Tinto Plc. That was incorporated on 30th March 1962 is the leading metals and

mining entity in Australia. The major business of the entity is finding, processing and mining

of the mineral resources. Various segments of the entity includes Aluminium, Iron Ore,

Diamonds and copper, minerals and energy and different other operations. Materials from the

company are essential for making the modern life work and their economies assist the

communities to prosper and economies to grow. Further, through various innovations and

researches they help to meet the requirements of the society in changing as well as growing

the world. Moreover, they bring benefits to the people, to the communities under which it

operates and beyond (Riotinto.com 2018).

Altura Mining is the key player in the global market for lithium that is based in

Perth, Australia. It is leveraging the growing demand for the raw materials to manufacture

lithium ion batteries used in electric vehicles and for static usages. The entity is further

engaged in development and exploration activities and its segments include exploration

services, coal mining and exploration of minerals. Coal mining sector of the company is

involved in selling of coal. Further, the company is focussed on development and

construction of Pilgangoora Lithium project that is 100% owned by it and situated in Pilbara

region of Western Australia. Moreover, the company delivers drilling services to the

exploration and mining companies (Alturamining.com 2018).

BHP Billiton that was established in 2001 with the merger of Broken Hill, Proprietary

(BHP) and Billiton is one of the largest global resources and mining company that has more

than 100,000 employees in more than 25 nations. Headquarter of the company is in

Melbourne, Australia. It is among the largest producers for copper, aluminium, iron ore,

manganese, nickel, titanium, silver and uranium. Further, it is the 7th largest aluminium

Introduction

Rio Tinto Plc. That was incorporated on 30th March 1962 is the leading metals and

mining entity in Australia. The major business of the entity is finding, processing and mining

of the mineral resources. Various segments of the entity includes Aluminium, Iron Ore,

Diamonds and copper, minerals and energy and different other operations. Materials from the

company are essential for making the modern life work and their economies assist the

communities to prosper and economies to grow. Further, through various innovations and

researches they help to meet the requirements of the society in changing as well as growing

the world. Moreover, they bring benefits to the people, to the communities under which it

operates and beyond (Riotinto.com 2018).

Altura Mining is the key player in the global market for lithium that is based in

Perth, Australia. It is leveraging the growing demand for the raw materials to manufacture

lithium ion batteries used in electric vehicles and for static usages. The entity is further

engaged in development and exploration activities and its segments include exploration

services, coal mining and exploration of minerals. Coal mining sector of the company is

involved in selling of coal. Further, the company is focussed on development and

construction of Pilgangoora Lithium project that is 100% owned by it and situated in Pilbara

region of Western Australia. Moreover, the company delivers drilling services to the

exploration and mining companies (Alturamining.com 2018).

BHP Billiton that was established in 2001 with the merger of Broken Hill, Proprietary

(BHP) and Billiton is one of the largest global resources and mining company that has more

than 100,000 employees in more than 25 nations. Headquarter of the company is in

Melbourne, Australia. It is among the largest producers for copper, aluminium, iron ore,

manganese, nickel, titanium, silver and uranium. Further, it is the 7th largest aluminium

5CORPORATE ACCOUNTING

producer in the world. Aluminium portfolio of the entity includes bauxite refining for

producing alumina, bauxite production and smelting of the aluminium metal (BHP 2018).

Equity and liabilities

(i) Items of equity

Rio Tinto – listed equity items for the entity are as follows –

Share capital – share capital is the fund that is raised by issuing shares for cash or

consideration. It is the long-term source for finance. Shareholders get share of

ownership in the company in return of their share holdings

Share premium – it is the amount that is subscribed to for the new issue of shares

over and above its par value. It can be used only for specific purposes mentioned in

the bylaws of the entity (Marshall 2016).

Other reserves – other reserves is the part of equity that excludes the basic share

capital part. Generally the other reserves includes specified part of the surplus fund

generated through various other sources like selling the shares at premium or upward

revaluation of fixed asset

Retained earnings – it is the profit available with the company at the balance sheet

date and is decreased by the amount of any distribution made to the the stockholders

as a means of dividend. However, the amounts of retained earnings are also re-

invested in business or are maintained as reserve for particular purposes (Melloni, Lai

and Stacchezzini 2018).

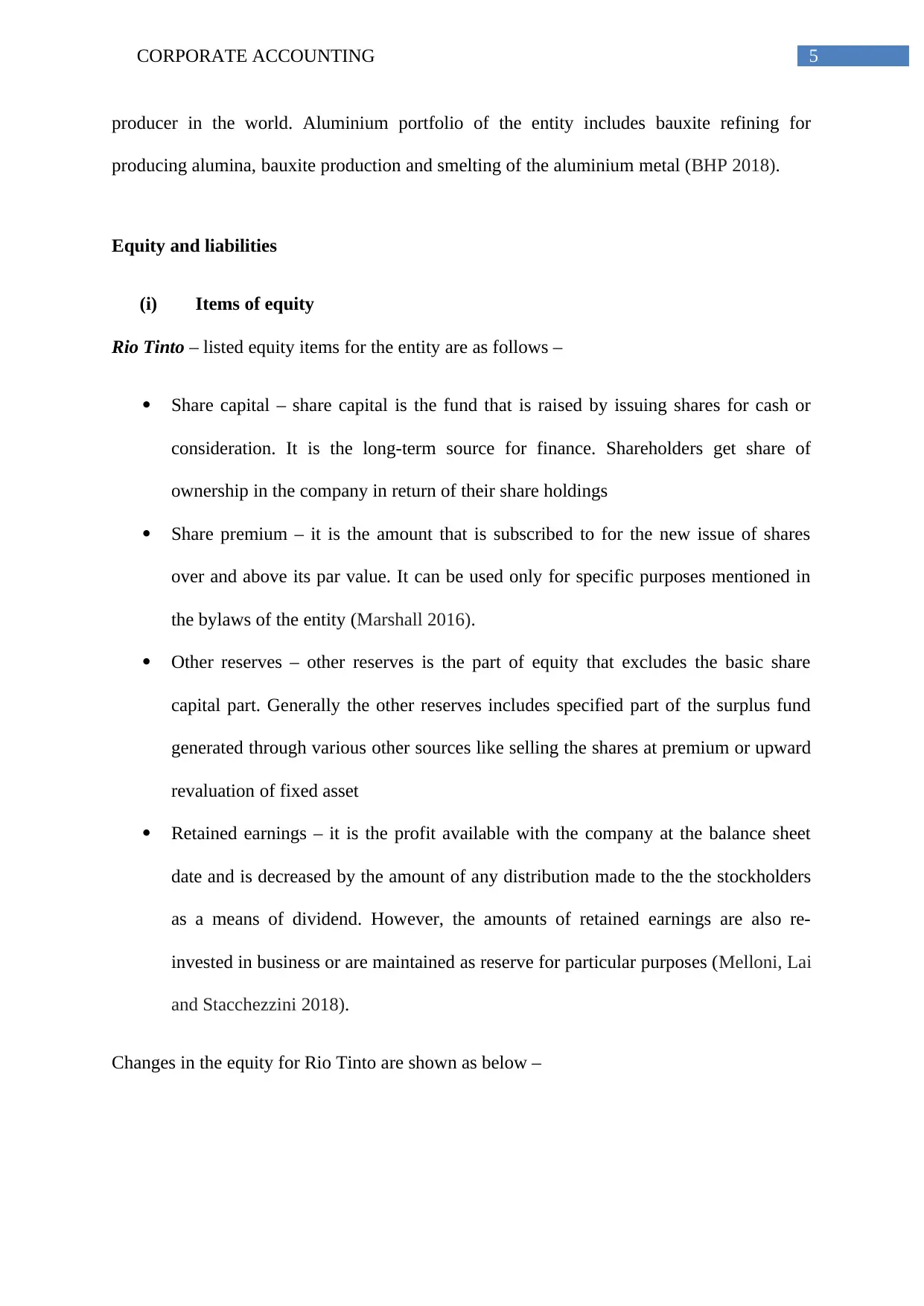

Changes in the equity for Rio Tinto are shown as below –

producer in the world. Aluminium portfolio of the entity includes bauxite refining for

producing alumina, bauxite production and smelting of the aluminium metal (BHP 2018).

Equity and liabilities

(i) Items of equity

Rio Tinto – listed equity items for the entity are as follows –

Share capital – share capital is the fund that is raised by issuing shares for cash or

consideration. It is the long-term source for finance. Shareholders get share of

ownership in the company in return of their share holdings

Share premium – it is the amount that is subscribed to for the new issue of shares

over and above its par value. It can be used only for specific purposes mentioned in

the bylaws of the entity (Marshall 2016).

Other reserves – other reserves is the part of equity that excludes the basic share

capital part. Generally the other reserves includes specified part of the surplus fund

generated through various other sources like selling the shares at premium or upward

revaluation of fixed asset

Retained earnings – it is the profit available with the company at the balance sheet

date and is decreased by the amount of any distribution made to the the stockholders

as a means of dividend. However, the amounts of retained earnings are also re-

invested in business or are maintained as reserve for particular purposes (Melloni, Lai

and Stacchezzini 2018).

Changes in the equity for Rio Tinto are shown as below –

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

Retained earnings of the company have been changed owing to buyback of the shares

and payment of dividend from this amount. Share capital amount has been changed due to

share buyback.

Altura Mining – listed equity items for the entity are as follows –

Contributed equity – contributed equity or the paid in capital is element of total equity

amount reported by the entity. However, it can be segregated as the separate account

under stockholder’s equity segment of balance sheet. In other words, it is the amount

contributed by the stockholders in return of ownership stake (Sarfaty 2015).

Reserves – As described for Rio Tinto above

Accumulated loss – retained earnings amount usually represent the credit balance

generated from the income accumulated over the specified time period. However, the

amounts of retained earnings are impacted by the amount of dividend distribution. If

the accumulated amount earning is in negative it decreases the amount of retained

earnings and make it negative which is also known as accumulated deficit or loss

(Reid and Myddelton 2017).

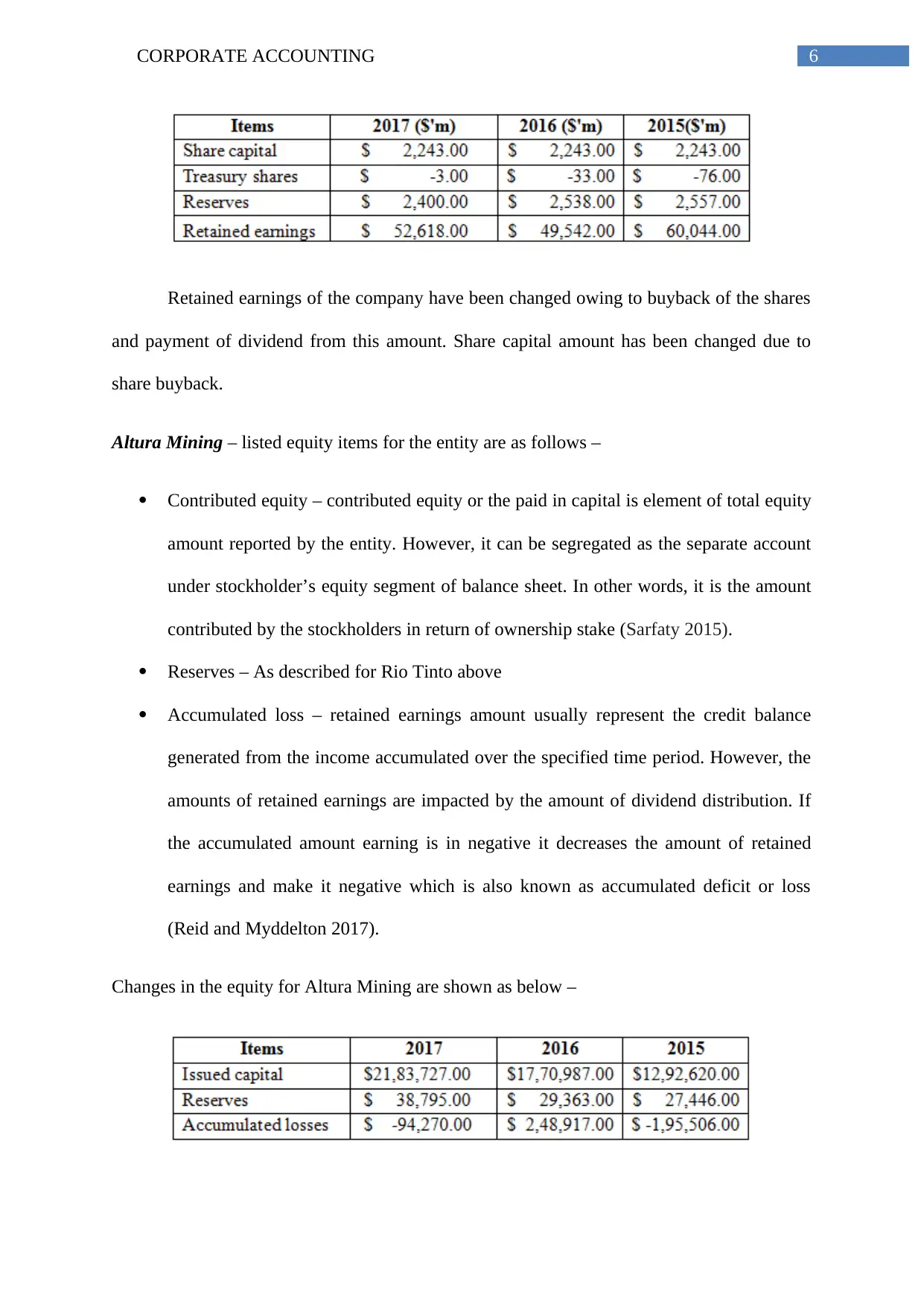

Changes in the equity for Altura Mining are shown as below –

Retained earnings of the company have been changed owing to buyback of the shares

and payment of dividend from this amount. Share capital amount has been changed due to

share buyback.

Altura Mining – listed equity items for the entity are as follows –

Contributed equity – contributed equity or the paid in capital is element of total equity

amount reported by the entity. However, it can be segregated as the separate account

under stockholder’s equity segment of balance sheet. In other words, it is the amount

contributed by the stockholders in return of ownership stake (Sarfaty 2015).

Reserves – As described for Rio Tinto above

Accumulated loss – retained earnings amount usually represent the credit balance

generated from the income accumulated over the specified time period. However, the

amounts of retained earnings are impacted by the amount of dividend distribution. If

the accumulated amount earning is in negative it decreases the amount of retained

earnings and make it negative which is also known as accumulated deficit or loss

(Reid and Myddelton 2017).

Changes in the equity for Altura Mining are shown as below –

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

As shown above, amount of the issued capital has been increased due to equity

contribution and accumulated loss was due to dividend distribution made from retained

earnings.

BHP Billiton – listed equity items for the entity are as follows –

Share capital – As described for Rio Tinto above

Treasury shares – it is the share that is bought back by the company already issued

before. It lessens the outstanding shares of the entity in the open market. However,

there is no dividend right on the treasury shares and does not have any voting rights

(Sethi 2016).

Reserves – As described for Rio Tinto above

Retained earnings – As described for Rio Tinto above

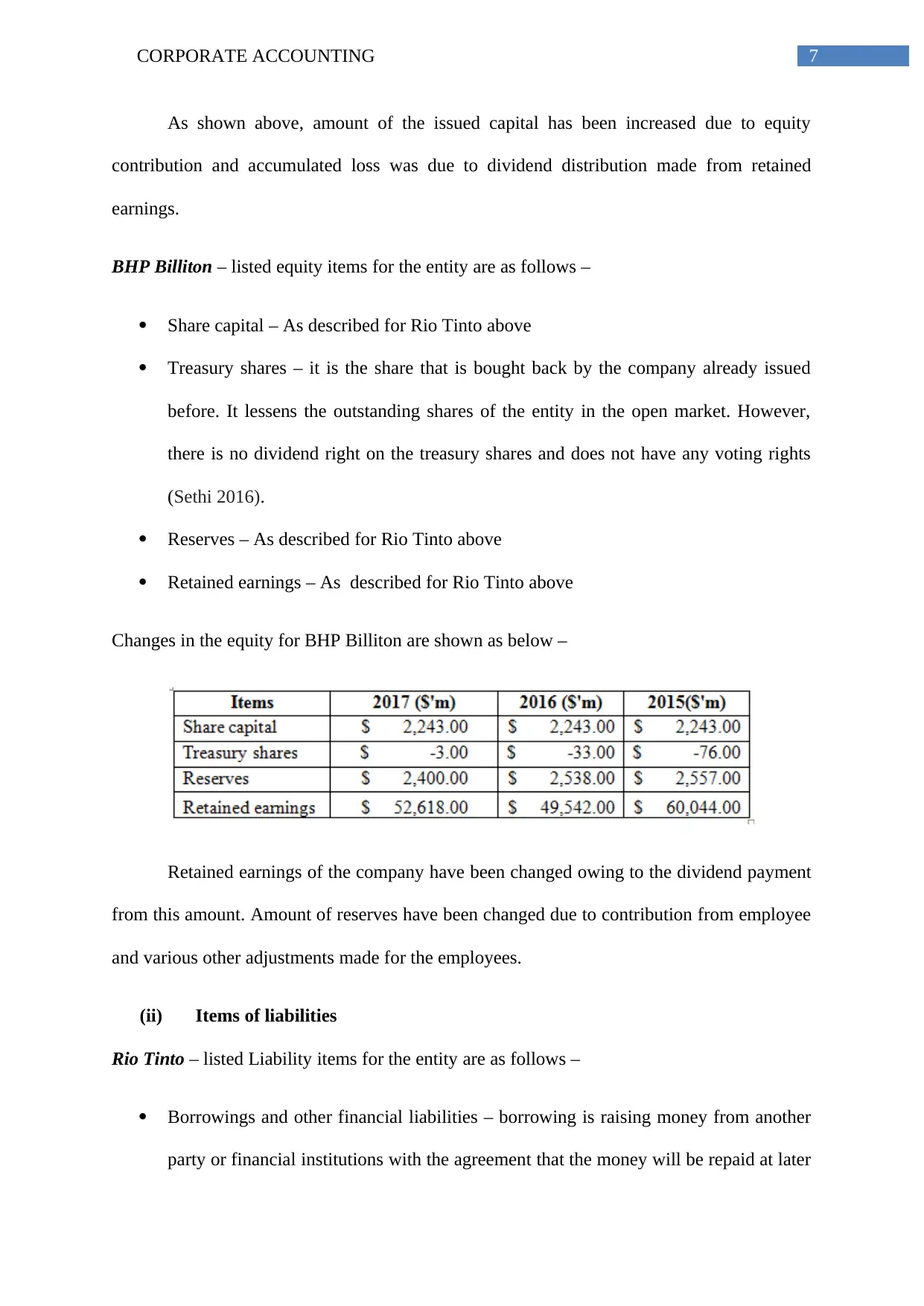

Changes in the equity for BHP Billiton are shown as below –

Retained earnings of the company have been changed owing to the dividend payment

from this amount. Amount of reserves have been changed due to contribution from employee

and various other adjustments made for the employees.

(ii) Items of liabilities

Rio Tinto – listed Liability items for the entity are as follows –

Borrowings and other financial liabilities – borrowing is raising money from another

party or financial institutions with the agreement that the money will be repaid at later

As shown above, amount of the issued capital has been increased due to equity

contribution and accumulated loss was due to dividend distribution made from retained

earnings.

BHP Billiton – listed equity items for the entity are as follows –

Share capital – As described for Rio Tinto above

Treasury shares – it is the share that is bought back by the company already issued

before. It lessens the outstanding shares of the entity in the open market. However,

there is no dividend right on the treasury shares and does not have any voting rights

(Sethi 2016).

Reserves – As described for Rio Tinto above

Retained earnings – As described for Rio Tinto above

Changes in the equity for BHP Billiton are shown as below –

Retained earnings of the company have been changed owing to the dividend payment

from this amount. Amount of reserves have been changed due to contribution from employee

and various other adjustments made for the employees.

(ii) Items of liabilities

Rio Tinto – listed Liability items for the entity are as follows –

Borrowings and other financial liabilities – borrowing is raising money from another

party or financial institutions with the agreement that the money will be repaid at later

8CORPORATE ACCOUNTING

date along with interest. Generally borrowings have specified maturity date based on

which it is classified as short term or long term.

Trade and other payables – it is the amount billed to any entity by the suppliers for the

goods delivered or for the services consumed by it during the ordinary business

course (Titman, Keown and Martin 2017).

Tax payable – it is the account recorded under current liabilities segment of the

balance sheet. It comprised of the taxes due to government within one year period of

time.

Deferred tax liabilities – it is the tax assessed or due for current period but has not yet

been paid. It is recorded in the balance sheet if the company ensures that in future the

entity will pay more amount of of tax for any transaction taken place in the current

period.

Provisions for post retirement benefits – it is related to the defined pension benefit and

various other post retirement benefits including the welfare and healthcare plans. It is

primarily based on the years of services provided by the employee and the

compensation he is entitled to (Waddock 2017).

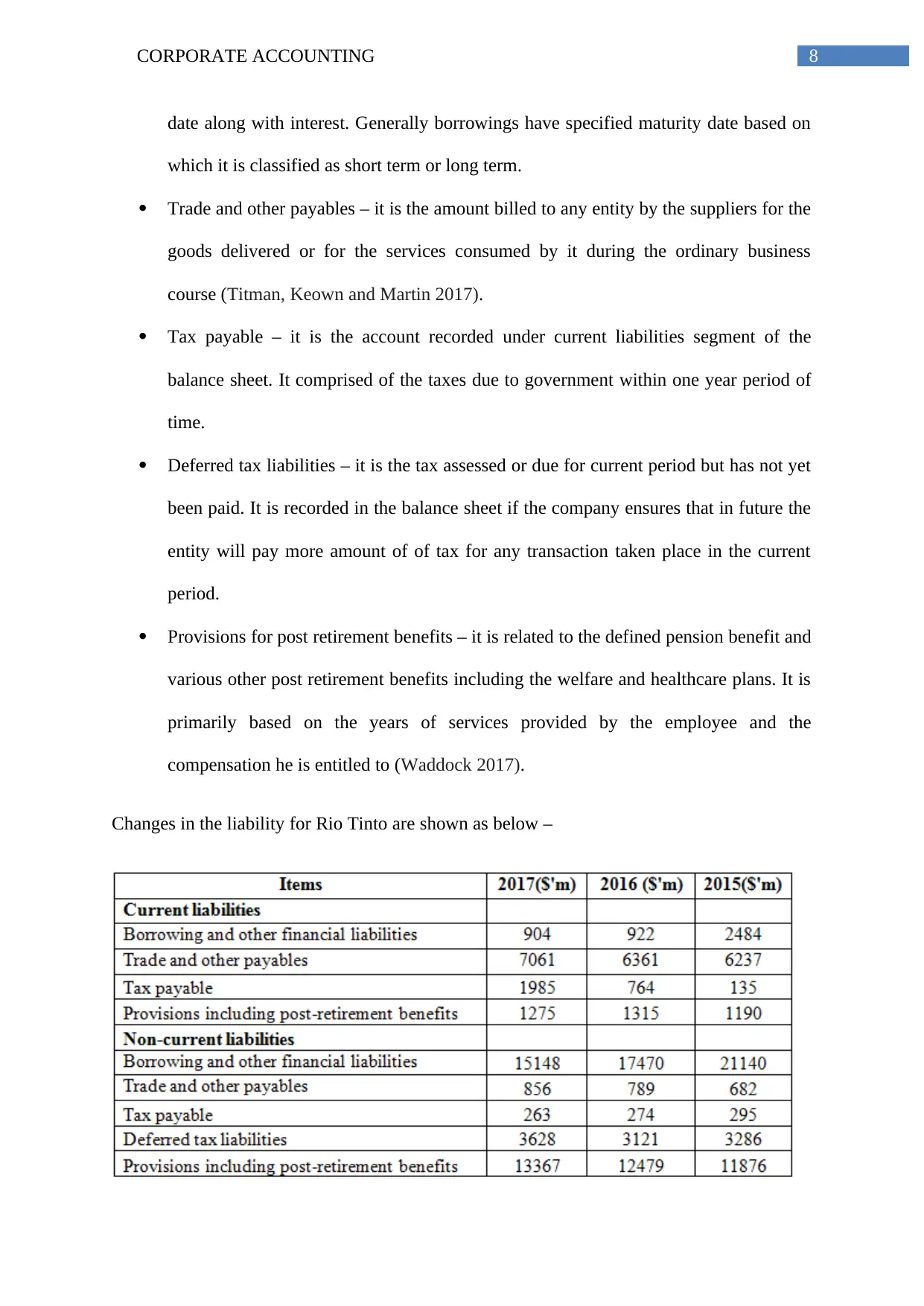

Changes in the liability for Rio Tinto are shown as below –

date along with interest. Generally borrowings have specified maturity date based on

which it is classified as short term or long term.

Trade and other payables – it is the amount billed to any entity by the suppliers for the

goods delivered or for the services consumed by it during the ordinary business

course (Titman, Keown and Martin 2017).

Tax payable – it is the account recorded under current liabilities segment of the

balance sheet. It comprised of the taxes due to government within one year period of

time.

Deferred tax liabilities – it is the tax assessed or due for current period but has not yet

been paid. It is recorded in the balance sheet if the company ensures that in future the

entity will pay more amount of of tax for any transaction taken place in the current

period.

Provisions for post retirement benefits – it is related to the defined pension benefit and

various other post retirement benefits including the welfare and healthcare plans. It is

primarily based on the years of services provided by the employee and the

compensation he is entitled to (Waddock 2017).

Changes in the liability for Rio Tinto are shown as below –

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE ACCOUNTING

Borrowings have been reduced due to repayment of the amount and trade payables

amount have been changed due to payment of current portion of payables and accruals of

new payables. Further, provisions for the post retirement benefits have been increased due to

adjustments of currency translation and changes in the estimates.

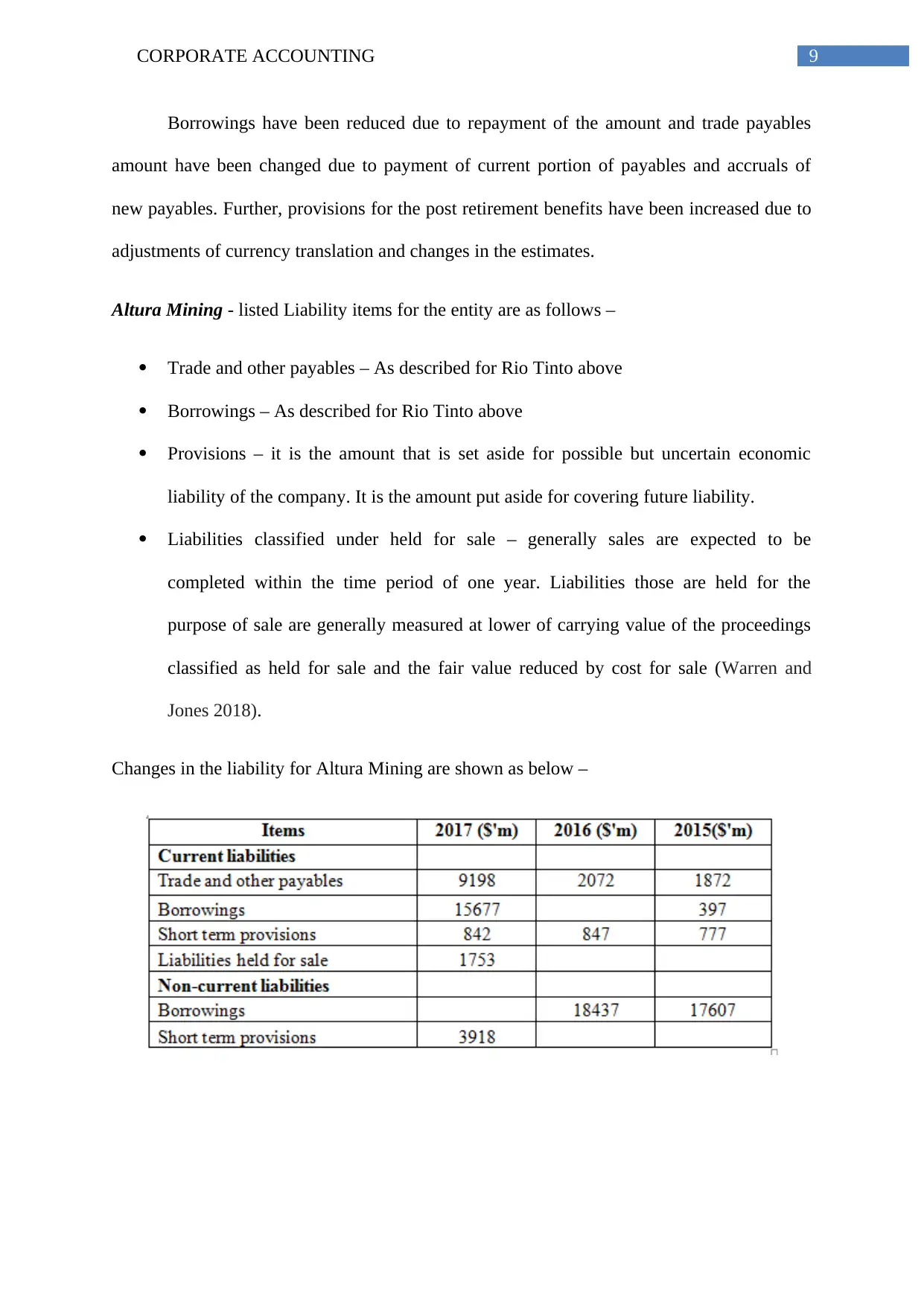

Altura Mining - listed Liability items for the entity are as follows –

Trade and other payables – As described for Rio Tinto above

Borrowings – As described for Rio Tinto above

Provisions – it is the amount that is set aside for possible but uncertain economic

liability of the company. It is the amount put aside for covering future liability.

Liabilities classified under held for sale – generally sales are expected to be

completed within the time period of one year. Liabilities those are held for the

purpose of sale are generally measured at lower of carrying value of the proceedings

classified as held for sale and the fair value reduced by cost for sale (Warren and

Jones 2018).

Changes in the liability for Altura Mining are shown as below –

Borrowings have been reduced due to repayment of the amount and trade payables

amount have been changed due to payment of current portion of payables and accruals of

new payables. Further, provisions for the post retirement benefits have been increased due to

adjustments of currency translation and changes in the estimates.

Altura Mining - listed Liability items for the entity are as follows –

Trade and other payables – As described for Rio Tinto above

Borrowings – As described for Rio Tinto above

Provisions – it is the amount that is set aside for possible but uncertain economic

liability of the company. It is the amount put aside for covering future liability.

Liabilities classified under held for sale – generally sales are expected to be

completed within the time period of one year. Liabilities those are held for the

purpose of sale are generally measured at lower of carrying value of the proceedings

classified as held for sale and the fair value reduced by cost for sale (Warren and

Jones 2018).

Changes in the liability for Altura Mining are shown as below –

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE ACCOUNTING

Trade payables amount have been changed due to payment of current portion of

payables and accruals of new payables and borrowings have been reduced due to repayment

of the amount.

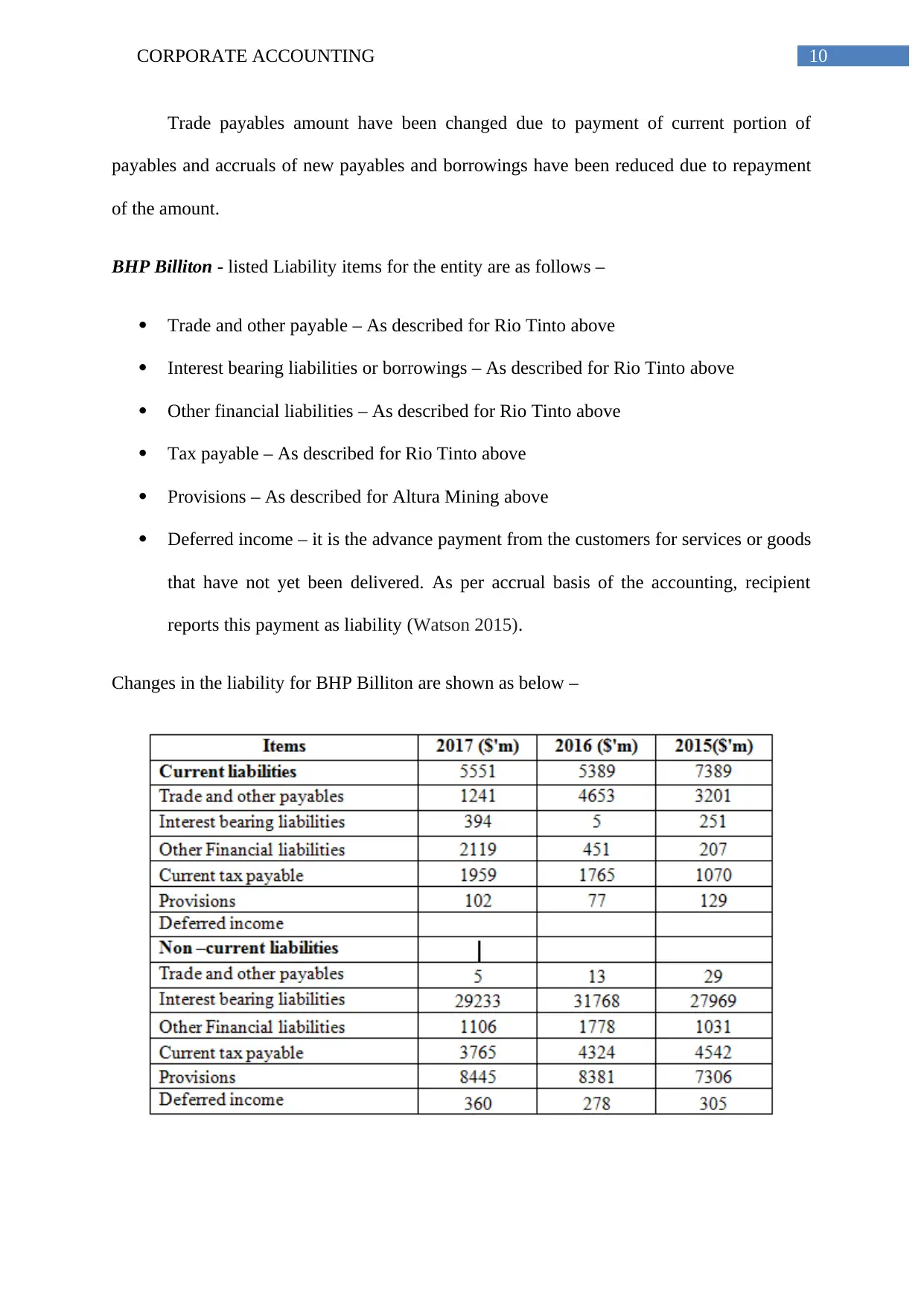

BHP Billiton - listed Liability items for the entity are as follows –

Trade and other payable – As described for Rio Tinto above

Interest bearing liabilities or borrowings – As described for Rio Tinto above

Other financial liabilities – As described for Rio Tinto above

Tax payable – As described for Rio Tinto above

Provisions – As described for Altura Mining above

Deferred income – it is the advance payment from the customers for services or goods

that have not yet been delivered. As per accrual basis of the accounting, recipient

reports this payment as liability (Watson 2015).

Changes in the liability for BHP Billiton are shown as below –

Trade payables amount have been changed due to payment of current portion of

payables and accruals of new payables and borrowings have been reduced due to repayment

of the amount.

BHP Billiton - listed Liability items for the entity are as follows –

Trade and other payable – As described for Rio Tinto above

Interest bearing liabilities or borrowings – As described for Rio Tinto above

Other financial liabilities – As described for Rio Tinto above

Tax payable – As described for Rio Tinto above

Provisions – As described for Altura Mining above

Deferred income – it is the advance payment from the customers for services or goods

that have not yet been delivered. As per accrual basis of the accounting, recipient

reports this payment as liability (Watson 2015).

Changes in the liability for BHP Billiton are shown as below –

11CORPORATE ACCOUNTING

Trade payables amount have been changed due to payment of current portion of

payables and accruals of new payables and borrowings have been reduced due to repayment

of the amount. Current tax payable has been increased due to increase in tax rate and

recognition of tax assets those were unrecognised during the previous year.

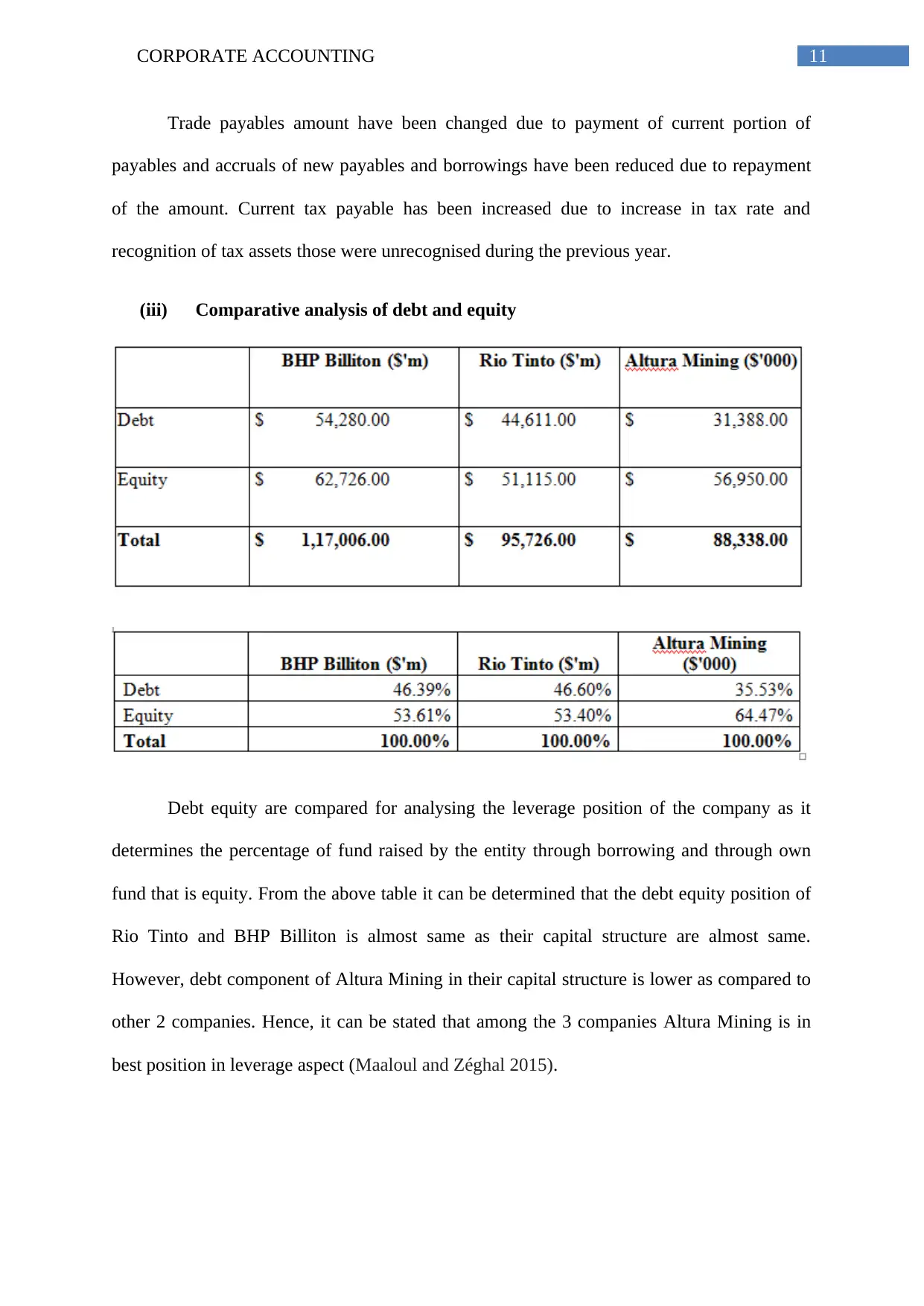

(iii) Comparative analysis of debt and equity

Debt equity are compared for analysing the leverage position of the company as it

determines the percentage of fund raised by the entity through borrowing and through own

fund that is equity. From the above table it can be determined that the debt equity position of

Rio Tinto and BHP Billiton is almost same as their capital structure are almost same.

However, debt component of Altura Mining in their capital structure is lower as compared to

other 2 companies. Hence, it can be stated that among the 3 companies Altura Mining is in

best position in leverage aspect (Maaloul and Zéghal 2015).

Trade payables amount have been changed due to payment of current portion of

payables and accruals of new payables and borrowings have been reduced due to repayment

of the amount. Current tax payable has been increased due to increase in tax rate and

recognition of tax assets those were unrecognised during the previous year.

(iii) Comparative analysis of debt and equity

Debt equity are compared for analysing the leverage position of the company as it

determines the percentage of fund raised by the entity through borrowing and through own

fund that is equity. From the above table it can be determined that the debt equity position of

Rio Tinto and BHP Billiton is almost same as their capital structure are almost same.

However, debt component of Altura Mining in their capital structure is lower as compared to

other 2 companies. Hence, it can be stated that among the 3 companies Altura Mining is in

best position in leverage aspect (Maaloul and Zéghal 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 43

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.