Cost Accounting: Principles, Techniques, Investment Appraisal

VerifiedAdded on 2023/06/11

|16

|3645

|273

Homework Assignment

AI Summary

This document presents a solved assignment on cost accounting, covering a range of principles, concepts, and techniques. It includes multiple-choice questions addressing topics such as predetermined overhead rates, budgeting, overhead absorption, equivalent units, cost classification, management accounting systems, flexible budgets, capital investment appraisal methods, variance analysis, and inventory valuation. The assignment further explores practical applications, including calculating operatives' wages, identifying cost objects, and applying FIFO valuation. Additionally, it delves into cost-volume-profit analysis, pricing strategies, and the preparation of budgets. The second part focuses on cost accounting techniques, specifically computing and analyzing the payback period for different contracts, and discussing the features, pros, and cons of investment appraisal techniques like the Internal Rate of Return (IRR). Desklib provides access to similar solved assignments and study resources for students.

Cost Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Part 1 – Cost accounting principles, concepts and techniques...................................................3

Part 2 – Cost Accounting Techniques......................................................................................12

31. a) Compute the payback for both the Edinburgh and Newcastle upon Tyne contracts. 12

31. b) Critically analyse the payback technique...................................................................13

31. c) Define the features of investment appraisal techniques, pros and cons of IRR.........13

REFERENCES.........................................................................................................................16

Part 1 – Cost accounting principles, concepts and techniques...................................................3

Part 2 – Cost Accounting Techniques......................................................................................12

31. a) Compute the payback for both the Edinburgh and Newcastle upon Tyne contracts. 12

31. b) Critically analyse the payback technique...................................................................13

31. c) Define the features of investment appraisal techniques, pros and cons of IRR.........13

REFERENCES.........................................................................................................................16

Part 1 – Cost accounting principles, concepts and techniques

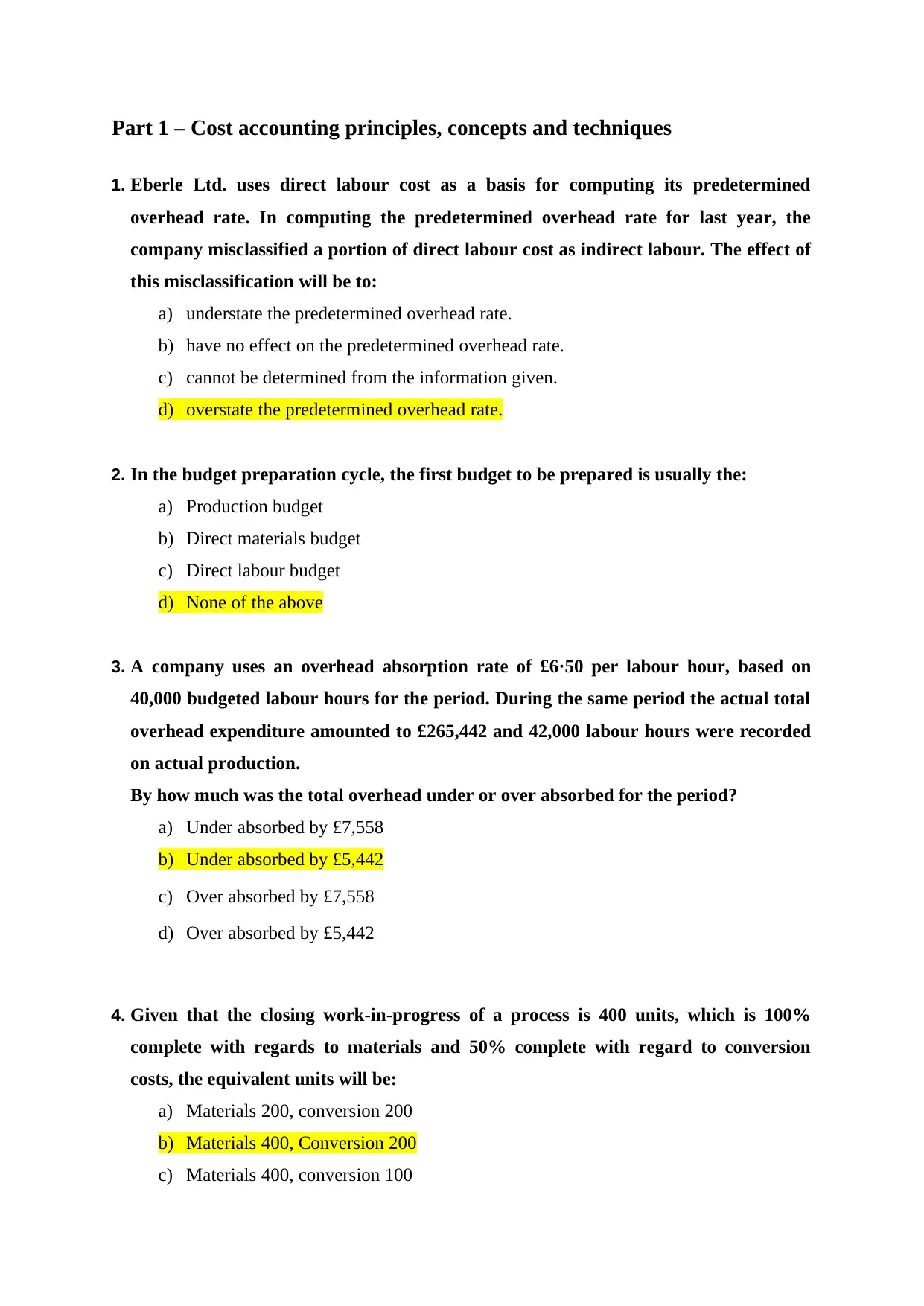

1. Eberle Ltd. uses direct labour cost as a basis for computing its predetermined

overhead rate. In computing the predetermined overhead rate for last year, the

company misclassified a portion of direct labour cost as indirect labour. The effect of

this misclassification will be to:

a) understate the predetermined overhead rate.

b) have no effect on the predetermined overhead rate.

c) cannot be determined from the information given.

d) overstate the predetermined overhead rate.

2. In the budget preparation cycle, the first budget to be prepared is usually the:

a) Production budget

b) Direct materials budget

c) Direct labour budget

d) None of the above

3. A company uses an overhead absorption rate of £6·50 per labour hour, based on

40,000 budgeted labour hours for the period. During the same period the actual total

overhead expenditure amounted to £265,442 and 42,000 labour hours were recorded

on actual production.

By how much was the total overhead under or over absorbed for the period?

a) Under absorbed by £7,558

b) Under absorbed by £5,442

c) Over absorbed by £7,558

d) Over absorbed by £5,442

4. Given that the closing work-in-progress of a process is 400 units, which is 100%

complete with regards to materials and 50% complete with regard to conversion

costs, the equivalent units will be:

a) Materials 200, conversion 200

b) Materials 400, Conversion 200

c) Materials 400, conversion 100

1. Eberle Ltd. uses direct labour cost as a basis for computing its predetermined

overhead rate. In computing the predetermined overhead rate for last year, the

company misclassified a portion of direct labour cost as indirect labour. The effect of

this misclassification will be to:

a) understate the predetermined overhead rate.

b) have no effect on the predetermined overhead rate.

c) cannot be determined from the information given.

d) overstate the predetermined overhead rate.

2. In the budget preparation cycle, the first budget to be prepared is usually the:

a) Production budget

b) Direct materials budget

c) Direct labour budget

d) None of the above

3. A company uses an overhead absorption rate of £6·50 per labour hour, based on

40,000 budgeted labour hours for the period. During the same period the actual total

overhead expenditure amounted to £265,442 and 42,000 labour hours were recorded

on actual production.

By how much was the total overhead under or over absorbed for the period?

a) Under absorbed by £7,558

b) Under absorbed by £5,442

c) Over absorbed by £7,558

d) Over absorbed by £5,442

4. Given that the closing work-in-progress of a process is 400 units, which is 100%

complete with regards to materials and 50% complete with regard to conversion

costs, the equivalent units will be:

a) Materials 200, conversion 200

b) Materials 400, Conversion 200

c) Materials 400, conversion 100

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

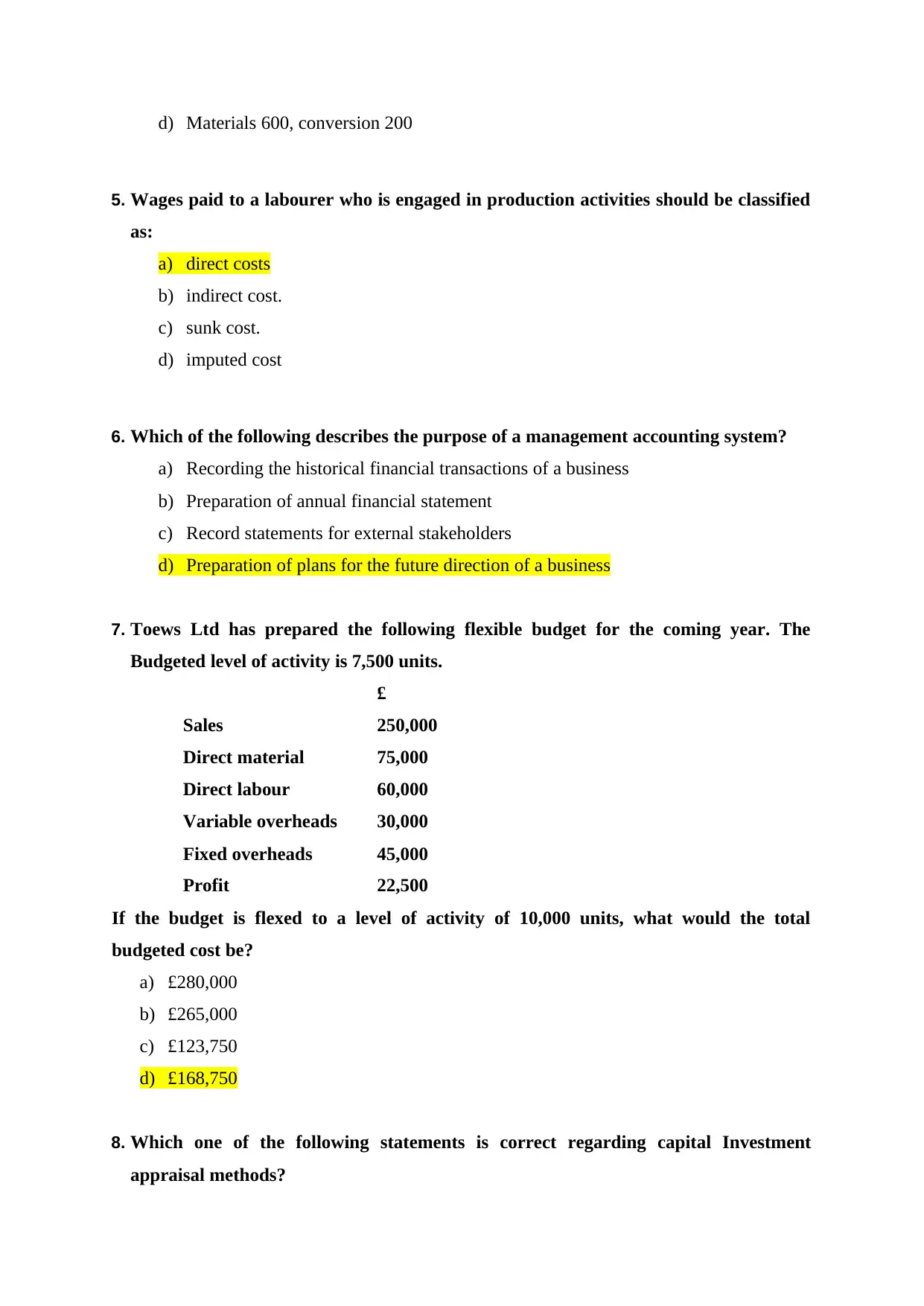

d) Materials 600, conversion 200

5. Wages paid to a labourer who is engaged in production activities should be classified

as:

a) direct costs

b) indirect cost.

c) sunk cost.

d) imputed cost

6. Which of the following describes the purpose of a management accounting system?

a) Recording the historical financial transactions of a business

b) Preparation of annual financial statement

c) Record statements for external stakeholders

d) Preparation of plans for the future direction of a business

7. Toews Ltd has prepared the following flexible budget for the coming year. The

Budgeted level of activity is 7,500 units.

£

Sales 250,000

Direct material 75,000

Direct labour 60,000

Variable overheads 30,000

Fixed overheads 45,000

Profit 22,500

If the budget is flexed to a level of activity of 10,000 units, what would the total

budgeted cost be?

a) £280,000

b) £265,000

c) £123,750

d) £168,750

8. Which one of the following statements is correct regarding capital Investment

appraisal methods?

5. Wages paid to a labourer who is engaged in production activities should be classified

as:

a) direct costs

b) indirect cost.

c) sunk cost.

d) imputed cost

6. Which of the following describes the purpose of a management accounting system?

a) Recording the historical financial transactions of a business

b) Preparation of annual financial statement

c) Record statements for external stakeholders

d) Preparation of plans for the future direction of a business

7. Toews Ltd has prepared the following flexible budget for the coming year. The

Budgeted level of activity is 7,500 units.

£

Sales 250,000

Direct material 75,000

Direct labour 60,000

Variable overheads 30,000

Fixed overheads 45,000

Profit 22,500

If the budget is flexed to a level of activity of 10,000 units, what would the total

budgeted cost be?

a) £280,000

b) £265,000

c) £123,750

d) £168,750

8. Which one of the following statements is correct regarding capital Investment

appraisal methods?

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

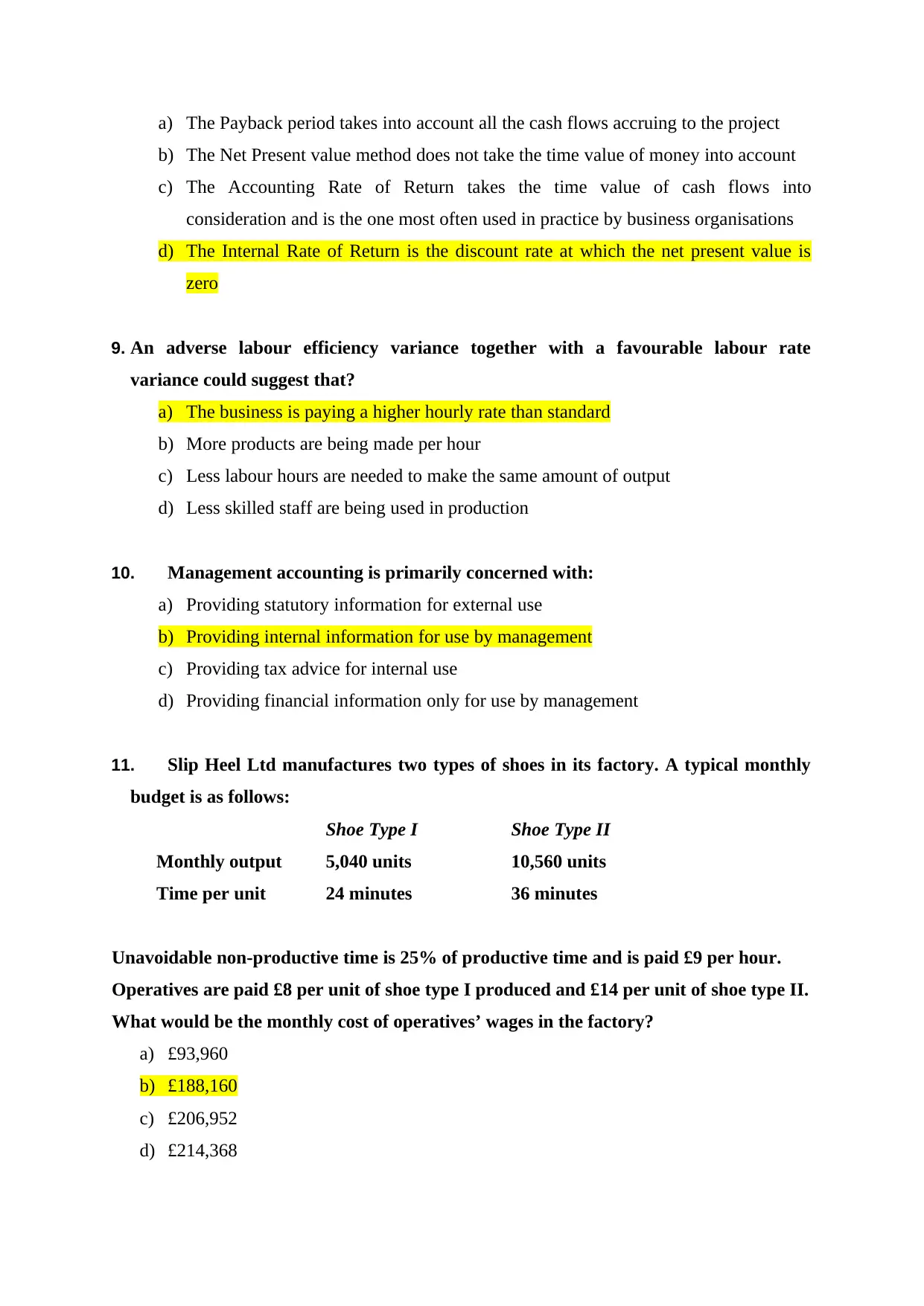

a) The Payback period takes into account all the cash flows accruing to the project

b) The Net Present value method does not take the time value of money into account

c) The Accounting Rate of Return takes the time value of cash flows into

consideration and is the one most often used in practice by business organisations

d) The Internal Rate of Return is the discount rate at which the net present value is

zero

9. An adverse labour efficiency variance together with a favourable labour rate

variance could suggest that?

a) The business is paying a higher hourly rate than standard

b) More products are being made per hour

c) Less labour hours are needed to make the same amount of output

d) Less skilled staff are being used in production

10. Management accounting is primarily concerned with:

a) Providing statutory information for external use

b) Providing internal information for use by management

c) Providing tax advice for internal use

d) Providing financial information only for use by management

11. Slip Heel Ltd manufactures two types of shoes in its factory. A typical monthly

budget is as follows:

Shoe Type I Shoe Type II

Monthly output 5,040 units 10,560 units

Time per unit 24 minutes 36 minutes

Unavoidable non-productive time is 25% of productive time and is paid £9 per hour.

Operatives are paid £8 per unit of shoe type I produced and £14 per unit of shoe type II.

What would be the monthly cost of operatives’ wages in the factory?

a) £93,960

b) £188,160

c) £206,952

d) £214,368

b) The Net Present value method does not take the time value of money into account

c) The Accounting Rate of Return takes the time value of cash flows into

consideration and is the one most often used in practice by business organisations

d) The Internal Rate of Return is the discount rate at which the net present value is

zero

9. An adverse labour efficiency variance together with a favourable labour rate

variance could suggest that?

a) The business is paying a higher hourly rate than standard

b) More products are being made per hour

c) Less labour hours are needed to make the same amount of output

d) Less skilled staff are being used in production

10. Management accounting is primarily concerned with:

a) Providing statutory information for external use

b) Providing internal information for use by management

c) Providing tax advice for internal use

d) Providing financial information only for use by management

11. Slip Heel Ltd manufactures two types of shoes in its factory. A typical monthly

budget is as follows:

Shoe Type I Shoe Type II

Monthly output 5,040 units 10,560 units

Time per unit 24 minutes 36 minutes

Unavoidable non-productive time is 25% of productive time and is paid £9 per hour.

Operatives are paid £8 per unit of shoe type I produced and £14 per unit of shoe type II.

What would be the monthly cost of operatives’ wages in the factory?

a) £93,960

b) £188,160

c) £206,952

d) £214,368

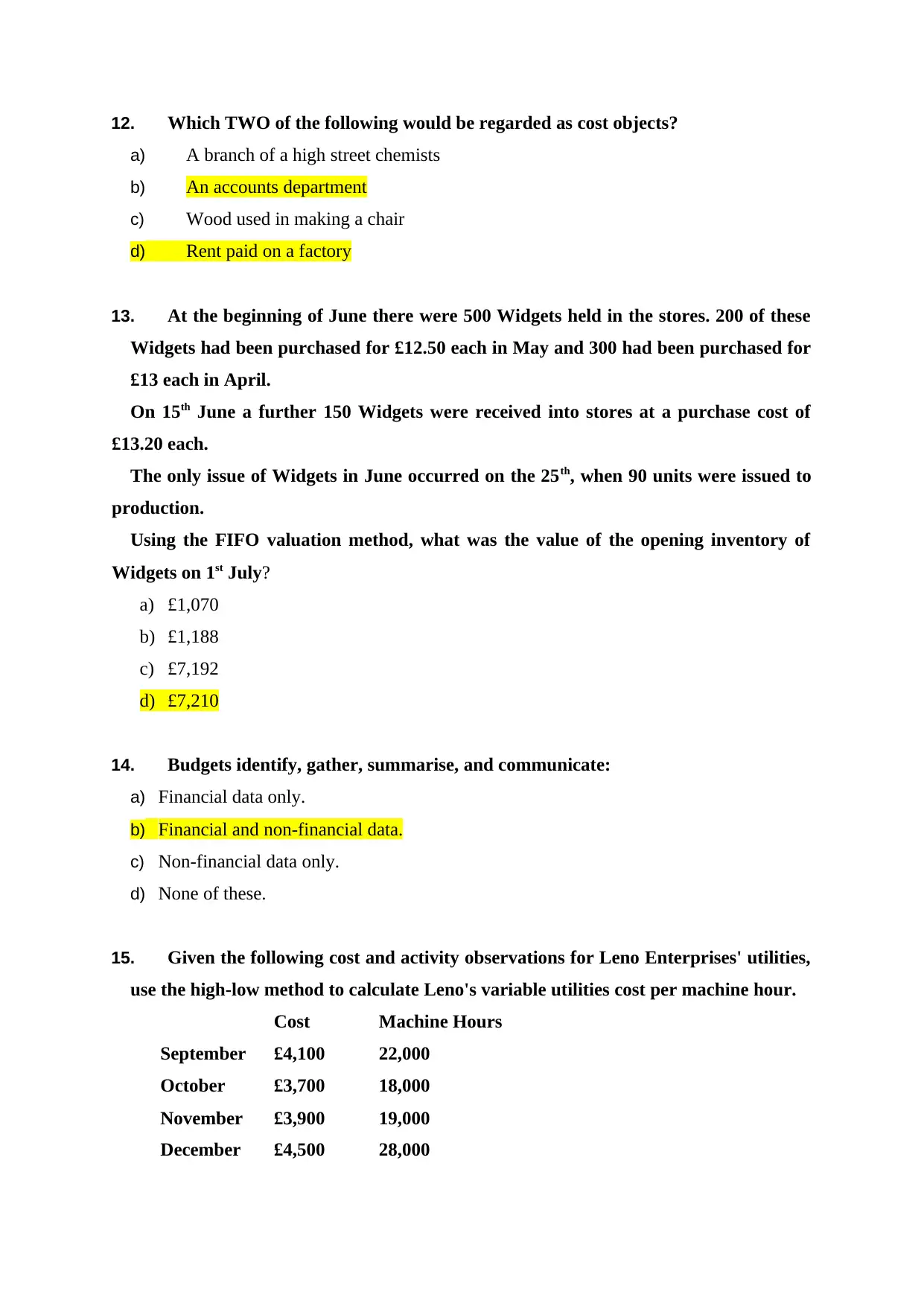

12. Which TWO of the following would be regarded as cost objects?

a) A branch of a high street chemists

b) An accounts department

c) Wood used in making a chair

d) Rent paid on a factory

13. At the beginning of June there were 500 Widgets held in the stores. 200 of these

Widgets had been purchased for £12.50 each in May and 300 had been purchased for

£13 each in April.

On 15th June a further 150 Widgets were received into stores at a purchase cost of

£13.20 each.

The only issue of Widgets in June occurred on the 25th, when 90 units were issued to

production.

Using the FIFO valuation method, what was the value of the opening inventory of

Widgets on 1st July?

a) £1,070

b) £1,188

c) £7,192

d) £7,210

14. Budgets identify, gather, summarise, and communicate:

a) Financial data only.

b) Financial and non-financial data.

c) Non-financial data only.

d) None of these.

15. Given the following cost and activity observations for Leno Enterprises' utilities,

use the high-low method to calculate Leno's variable utilities cost per machine hour.

Cost Machine Hours

September £4,100 22,000

October £3,700 18,000

November £3,900 19,000

December £4,500 28,000

a) A branch of a high street chemists

b) An accounts department

c) Wood used in making a chair

d) Rent paid on a factory

13. At the beginning of June there were 500 Widgets held in the stores. 200 of these

Widgets had been purchased for £12.50 each in May and 300 had been purchased for

£13 each in April.

On 15th June a further 150 Widgets were received into stores at a purchase cost of

£13.20 each.

The only issue of Widgets in June occurred on the 25th, when 90 units were issued to

production.

Using the FIFO valuation method, what was the value of the opening inventory of

Widgets on 1st July?

a) £1,070

b) £1,188

c) £7,192

d) £7,210

14. Budgets identify, gather, summarise, and communicate:

a) Financial data only.

b) Financial and non-financial data.

c) Non-financial data only.

d) None of these.

15. Given the following cost and activity observations for Leno Enterprises' utilities,

use the high-low method to calculate Leno's variable utilities cost per machine hour.

Cost Machine Hours

September £4,100 22,000

October £3,700 18,000

November £3,900 19,000

December £4,500 28,000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

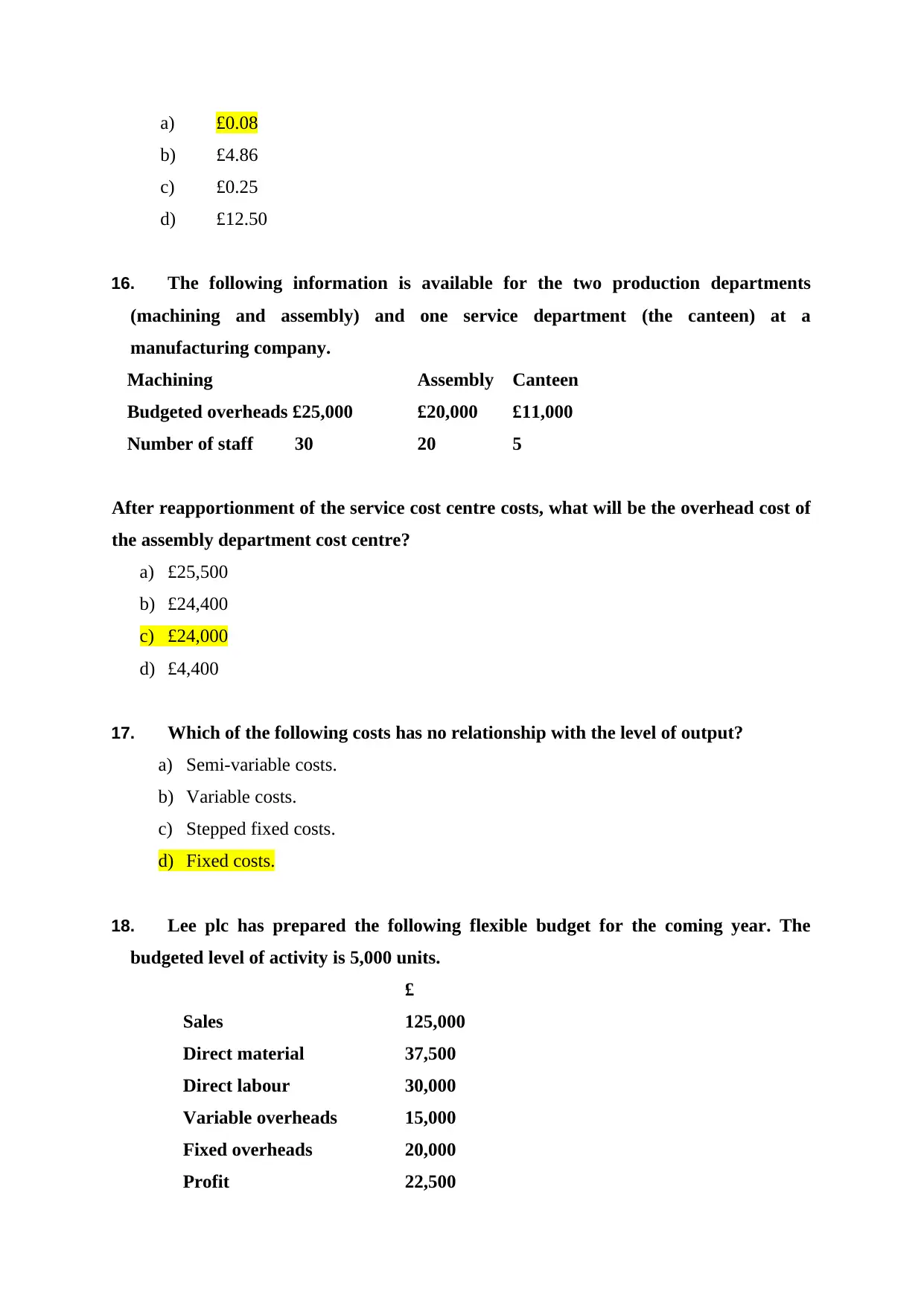

a) £0.08

b) £4.86

c) £0.25

d) £12.50

16. The following information is available for the two production departments

(machining and assembly) and one service department (the canteen) at a

manufacturing company.

Machining Assembly Canteen

Budgeted overheads £25,000 £20,000 £11,000

Number of staff 30 20 5

After reapportionment of the service cost centre costs, what will be the overhead cost of

the assembly department cost centre?

a) £25,500

b) £24,400

c) £24,000

d) £4,400

17. Which of the following costs has no relationship with the level of output?

a) Semi-variable costs.

b) Variable costs.

c) Stepped fixed costs.

d) Fixed costs.

18. Lee plc has prepared the following flexible budget for the coming year. The

budgeted level of activity is 5,000 units.

£

Sales 125,000

Direct material 37,500

Direct labour 30,000

Variable overheads 15,000

Fixed overheads 20,000

Profit 22,500

b) £4.86

c) £0.25

d) £12.50

16. The following information is available for the two production departments

(machining and assembly) and one service department (the canteen) at a

manufacturing company.

Machining Assembly Canteen

Budgeted overheads £25,000 £20,000 £11,000

Number of staff 30 20 5

After reapportionment of the service cost centre costs, what will be the overhead cost of

the assembly department cost centre?

a) £25,500

b) £24,400

c) £24,000

d) £4,400

17. Which of the following costs has no relationship with the level of output?

a) Semi-variable costs.

b) Variable costs.

c) Stepped fixed costs.

d) Fixed costs.

18. Lee plc has prepared the following flexible budget for the coming year. The

budgeted level of activity is 5,000 units.

£

Sales 125,000

Direct material 37,500

Direct labour 30,000

Variable overheads 15,000

Fixed overheads 20,000

Profit 22,500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

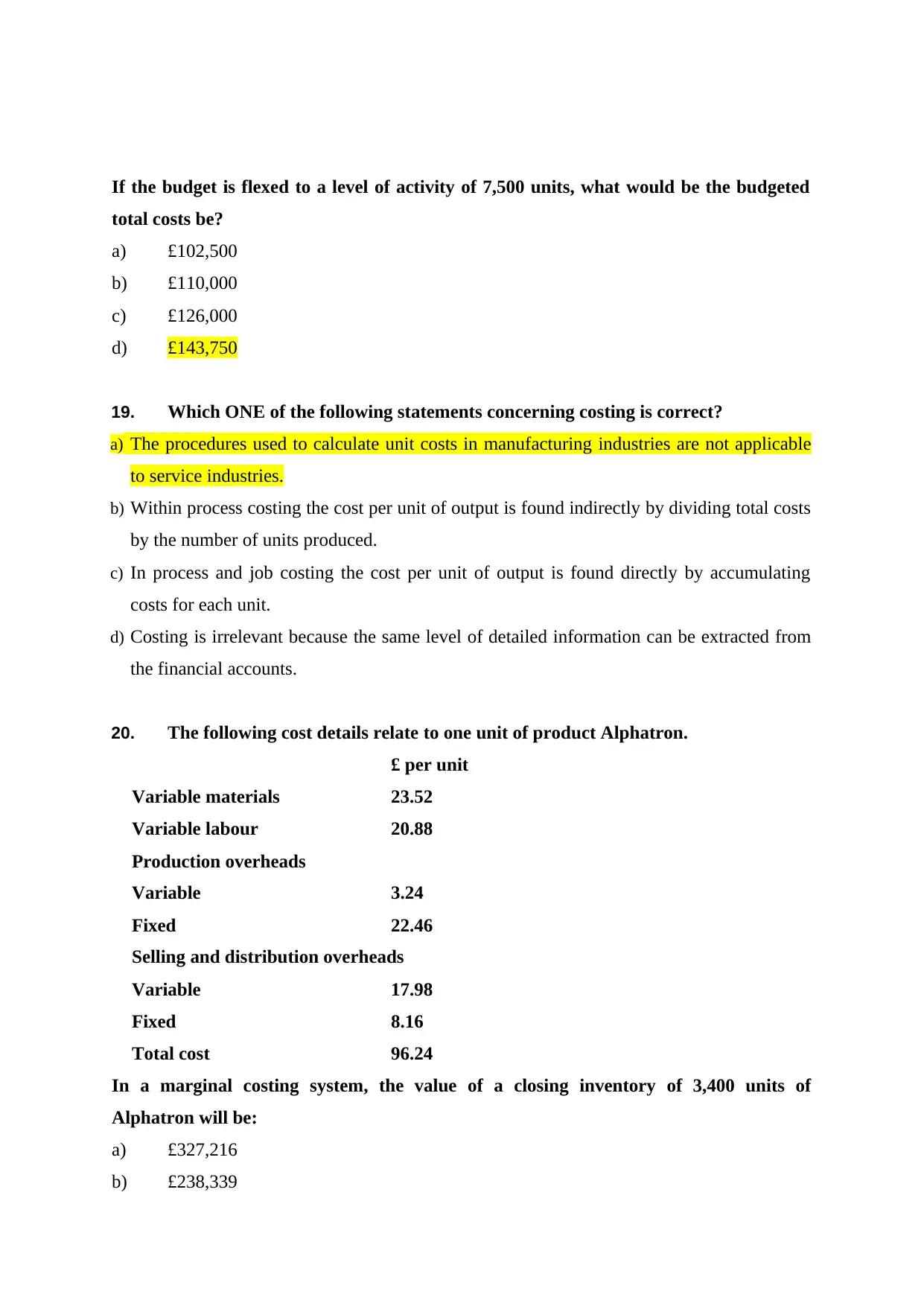

If the budget is flexed to a level of activity of 7,500 units, what would be the budgeted

total costs be?

a) £102,500

b) £110,000

c) £126,000

d) £143,750

19. Which ONE of the following statements concerning costing is correct?

a) The procedures used to calculate unit costs in manufacturing industries are not applicable

to service industries.

b) Within process costing the cost per unit of output is found indirectly by dividing total costs

by the number of units produced.

c) In process and job costing the cost per unit of output is found directly by accumulating

costs for each unit.

d) Costing is irrelevant because the same level of detailed information can be extracted from

the financial accounts.

20. The following cost details relate to one unit of product Alphatron.

Variable materials

£ per unit

23.52

Variable labour 20.88

Production overheads

Variable 3.24

Fixed 22.46

Selling and distribution overheads

Variable 17.98

Fixed 8.16

Total cost 96.24

In a marginal costing system, the value of a closing inventory of 3,400 units of

Alphatron will be:

a) £327,216

b) £238,339

total costs be?

a) £102,500

b) £110,000

c) £126,000

d) £143,750

19. Which ONE of the following statements concerning costing is correct?

a) The procedures used to calculate unit costs in manufacturing industries are not applicable

to service industries.

b) Within process costing the cost per unit of output is found indirectly by dividing total costs

by the number of units produced.

c) In process and job costing the cost per unit of output is found directly by accumulating

costs for each unit.

d) Costing is irrelevant because the same level of detailed information can be extracted from

the financial accounts.

20. The following cost details relate to one unit of product Alphatron.

Variable materials

£ per unit

23.52

Variable labour 20.88

Production overheads

Variable 3.24

Fixed 22.46

Selling and distribution overheads

Variable 17.98

Fixed 8.16

Total cost 96.24

In a marginal costing system, the value of a closing inventory of 3,400 units of

Alphatron will be:

a) £327,216

b) £238,339

c) £223,107

d) £161,976

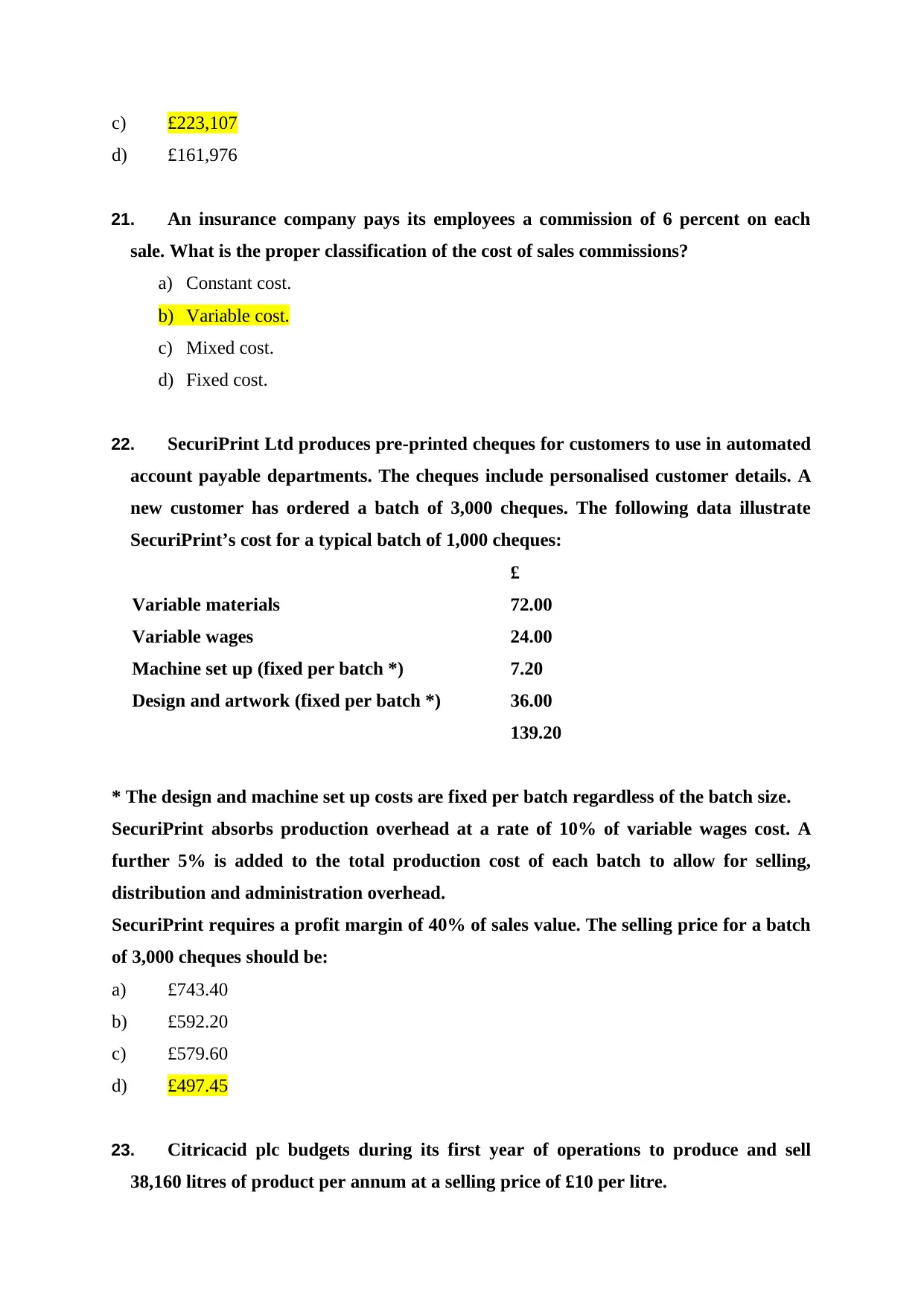

21. An insurance company pays its employees a commission of 6 percent on each

sale. What is the proper classification of the cost of sales commissions?

a) Constant cost.

b) Variable cost.

c) Mixed cost.

d) Fixed cost.

22. SecuriPrint Ltd produces pre-printed cheques for customers to use in automated

account payable departments. The cheques include personalised customer details. A

new customer has ordered a batch of 3,000 cheques. The following data illustrate

SecuriPrint’s cost for a typical batch of 1,000 cheques:

£

Variable materials 72.00

Variable wages 24.00

Machine set up (fixed per batch *) 7.20

Design and artwork (fixed per batch *) 36.00

139.20

* The design and machine set up costs are fixed per batch regardless of the batch size.

SecuriPrint absorbs production overhead at a rate of 10% of variable wages cost. A

further 5% is added to the total production cost of each batch to allow for selling,

distribution and administration overhead.

SecuriPrint requires a profit margin of 40% of sales value. The selling price for a batch

of 3,000 cheques should be:

a) £743.40

b) £592.20

c) £579.60

d) £497.45

23. Citricacid plc budgets during its first year of operations to produce and sell

38,160 litres of product per annum at a selling price of £10 per litre.

d) £161,976

21. An insurance company pays its employees a commission of 6 percent on each

sale. What is the proper classification of the cost of sales commissions?

a) Constant cost.

b) Variable cost.

c) Mixed cost.

d) Fixed cost.

22. SecuriPrint Ltd produces pre-printed cheques for customers to use in automated

account payable departments. The cheques include personalised customer details. A

new customer has ordered a batch of 3,000 cheques. The following data illustrate

SecuriPrint’s cost for a typical batch of 1,000 cheques:

£

Variable materials 72.00

Variable wages 24.00

Machine set up (fixed per batch *) 7.20

Design and artwork (fixed per batch *) 36.00

139.20

* The design and machine set up costs are fixed per batch regardless of the batch size.

SecuriPrint absorbs production overhead at a rate of 10% of variable wages cost. A

further 5% is added to the total production cost of each batch to allow for selling,

distribution and administration overhead.

SecuriPrint requires a profit margin of 40% of sales value. The selling price for a batch

of 3,000 cheques should be:

a) £743.40

b) £592.20

c) £579.60

d) £497.45

23. Citricacid plc budgets during its first year of operations to produce and sell

38,160 litres of product per annum at a selling price of £10 per litre.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

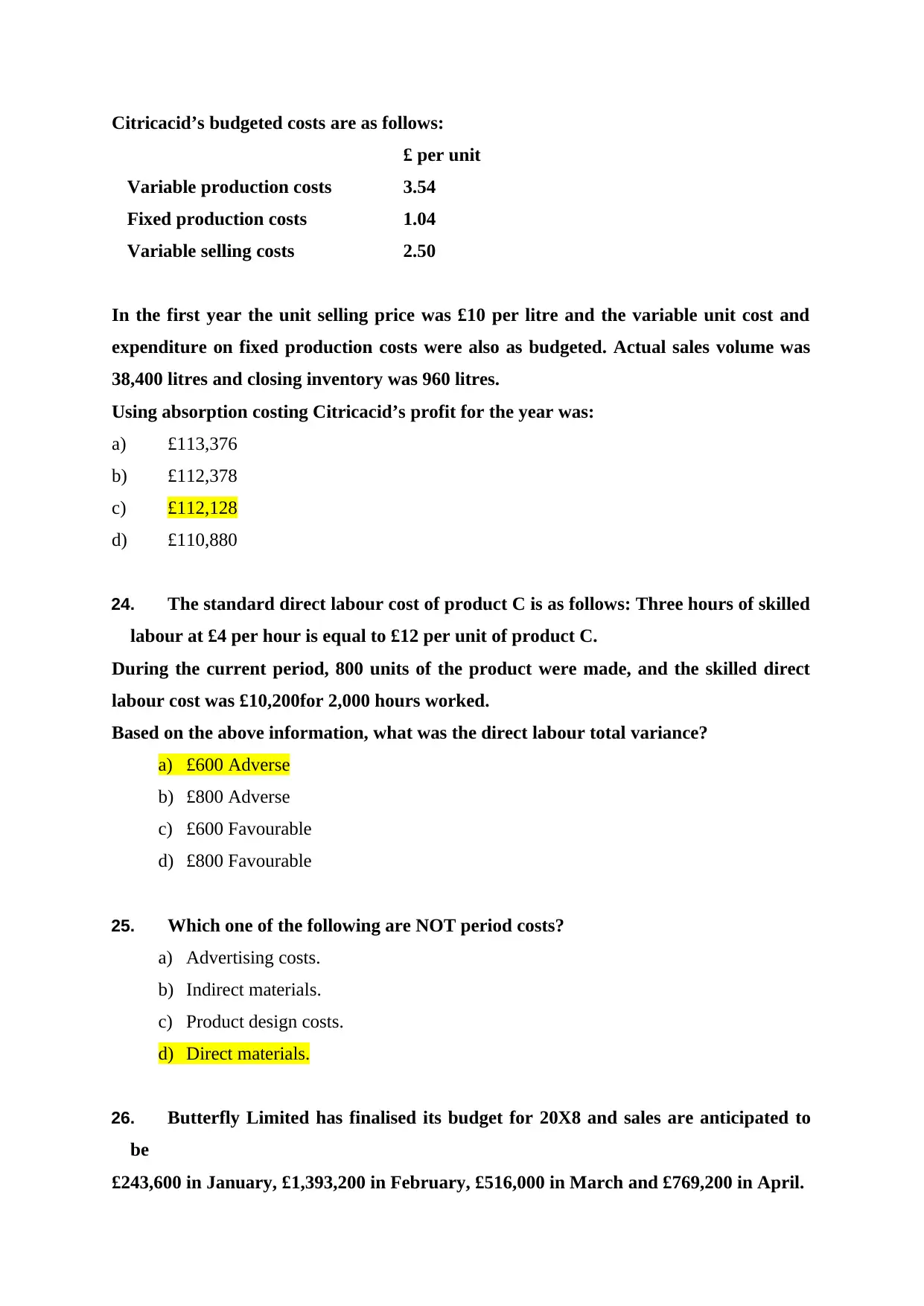

Citricacid’s budgeted costs are as follows:

£ per unit

Variable production costs 3.54

Fixed production costs 1.04

Variable selling costs 2.50

In the first year the unit selling price was £10 per litre and the variable unit cost and

expenditure on fixed production costs were also as budgeted. Actual sales volume was

38,400 litres and closing inventory was 960 litres.

Using absorption costing Citricacid’s profit for the year was:

a) £113,376

b) £112,378

c) £112,128

d) £110,880

24. The standard direct labour cost of product C is as follows: Three hours of skilled

labour at £4 per hour is equal to £12 per unit of product C.

During the current period, 800 units of the product were made, and the skilled direct

labour cost was £10,200for 2,000 hours worked.

Based on the above information, what was the direct labour total variance?

a) £600 Adverse

b) £800 Adverse

c) £600 Favourable

d) £800 Favourable

25. Which one of the following are NOT period costs?

a) Advertising costs.

b) Indirect materials.

c) Product design costs.

d) Direct materials.

26. Butterfly Limited has finalised its budget for 20X8 and sales are anticipated to

be

£243,600 in January, £1,393,200 in February, £516,000 in March and £769,200 in April.

£ per unit

Variable production costs 3.54

Fixed production costs 1.04

Variable selling costs 2.50

In the first year the unit selling price was £10 per litre and the variable unit cost and

expenditure on fixed production costs were also as budgeted. Actual sales volume was

38,400 litres and closing inventory was 960 litres.

Using absorption costing Citricacid’s profit for the year was:

a) £113,376

b) £112,378

c) £112,128

d) £110,880

24. The standard direct labour cost of product C is as follows: Three hours of skilled

labour at £4 per hour is equal to £12 per unit of product C.

During the current period, 800 units of the product were made, and the skilled direct

labour cost was £10,200for 2,000 hours worked.

Based on the above information, what was the direct labour total variance?

a) £600 Adverse

b) £800 Adverse

c) £600 Favourable

d) £800 Favourable

25. Which one of the following are NOT period costs?

a) Advertising costs.

b) Indirect materials.

c) Product design costs.

d) Direct materials.

26. Butterfly Limited has finalised its budget for 20X8 and sales are anticipated to

be

£243,600 in January, £1,393,200 in February, £516,000 in March and £769,200 in April.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Butterfly is budgeting that 50% of sales will be cash and the other 50% will be on credit

when 80% of receivables are expected to pay in the month after sale, 15% in the second

month after sale, while the remaining 5% are expected to be bad debts.

Credit customers who pay in the month of sale can claim a 5% cash settlement discount.

What level of sales receipts should be shown in the cash budget for March 20X8?

a) £820,650

b) £833,550

c) £1,425,432

d) £1,438,332

27. A combined set of operational budgets and a set of financial budgets for the

entire organisation is known as a:

a) Master budget.

b) Flexible budget.

c) Month-to-month budget.

d) Continuous budget.

28. Which of the following best describes a Joint-Product?

a) It is the expected loss in the efficient production of products.

b) It is that part of the output of a process which produces one or more products which

have relatively low sales values.

c) It is that part of the output of a process where two or more products are produced

which have substantial sales value to a business.

d) It is what happens when production is less efficient than expected and the actual

loss is greater than expected.

29. Financial budgets include:

a) Pro forma statements, a sales budget, and a cost of goods manufactured budget.

b) A budgeted income statement and budgeted balance sheet only.

c) A budgeted income statement, budgeted balance sheet, and cash budget.

d) Pro forma statements, a capital expenditures budget, and a cash budget.

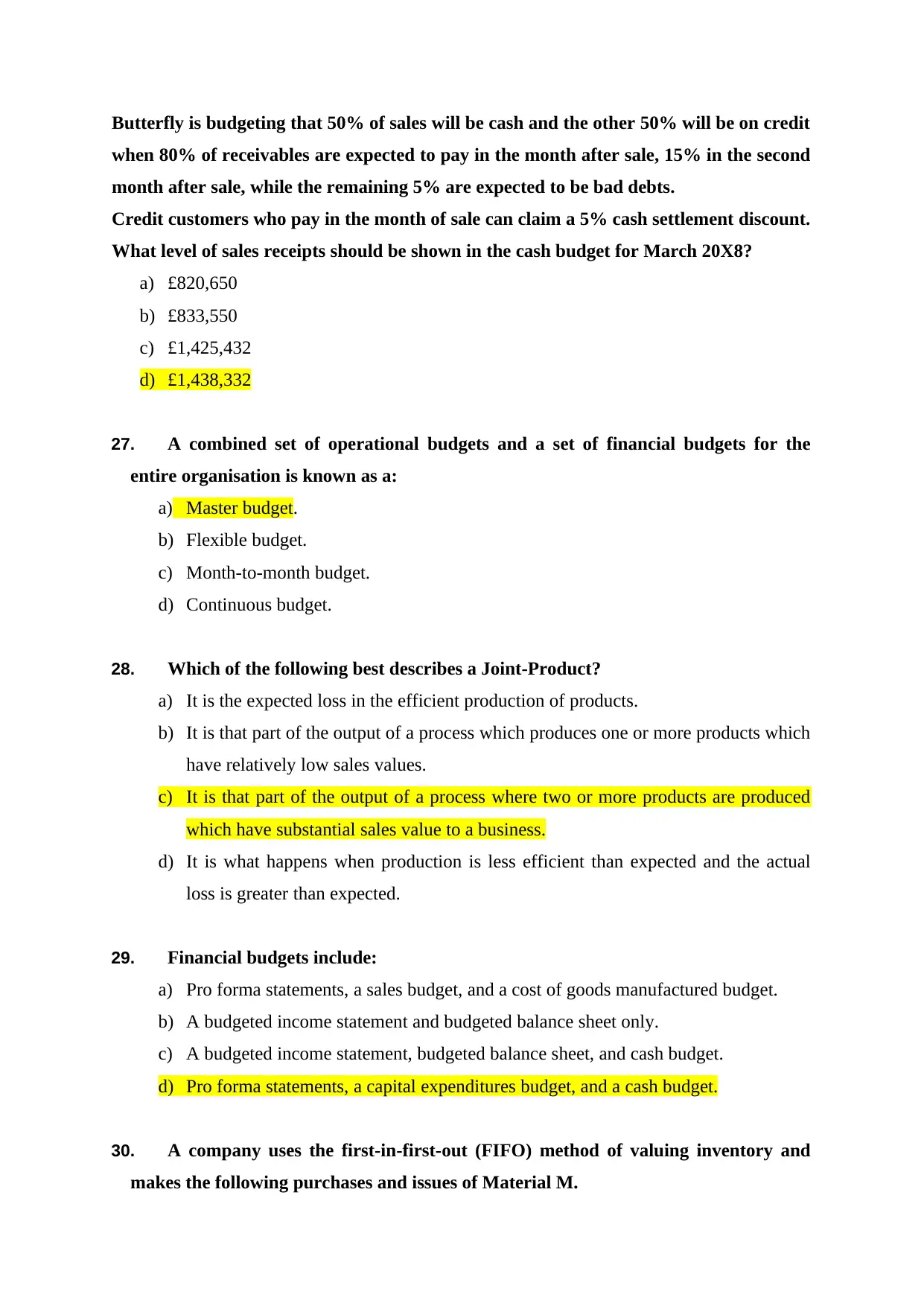

30. A company uses the first-in-first-out (FIFO) method of valuing inventory and

makes the following purchases and issues of Material M.

when 80% of receivables are expected to pay in the month after sale, 15% in the second

month after sale, while the remaining 5% are expected to be bad debts.

Credit customers who pay in the month of sale can claim a 5% cash settlement discount.

What level of sales receipts should be shown in the cash budget for March 20X8?

a) £820,650

b) £833,550

c) £1,425,432

d) £1,438,332

27. A combined set of operational budgets and a set of financial budgets for the

entire organisation is known as a:

a) Master budget.

b) Flexible budget.

c) Month-to-month budget.

d) Continuous budget.

28. Which of the following best describes a Joint-Product?

a) It is the expected loss in the efficient production of products.

b) It is that part of the output of a process which produces one or more products which

have relatively low sales values.

c) It is that part of the output of a process where two or more products are produced

which have substantial sales value to a business.

d) It is what happens when production is less efficient than expected and the actual

loss is greater than expected.

29. Financial budgets include:

a) Pro forma statements, a sales budget, and a cost of goods manufactured budget.

b) A budgeted income statement and budgeted balance sheet only.

c) A budgeted income statement, budgeted balance sheet, and cash budget.

d) Pro forma statements, a capital expenditures budget, and a cash budget.

30. A company uses the first-in-first-out (FIFO) method of valuing inventory and

makes the following purchases and issues of Material M.

Date Units

1 July purchase 400

8 July purchase 750

12 July purchase 700

22 July issue 950

30 July issue 400

The inventory valuation of Material M on July 31 is:

a) £1,190

b) £1,215

c) £1,225

d) £1,200

Part 2 – Cost Accounting Techniques

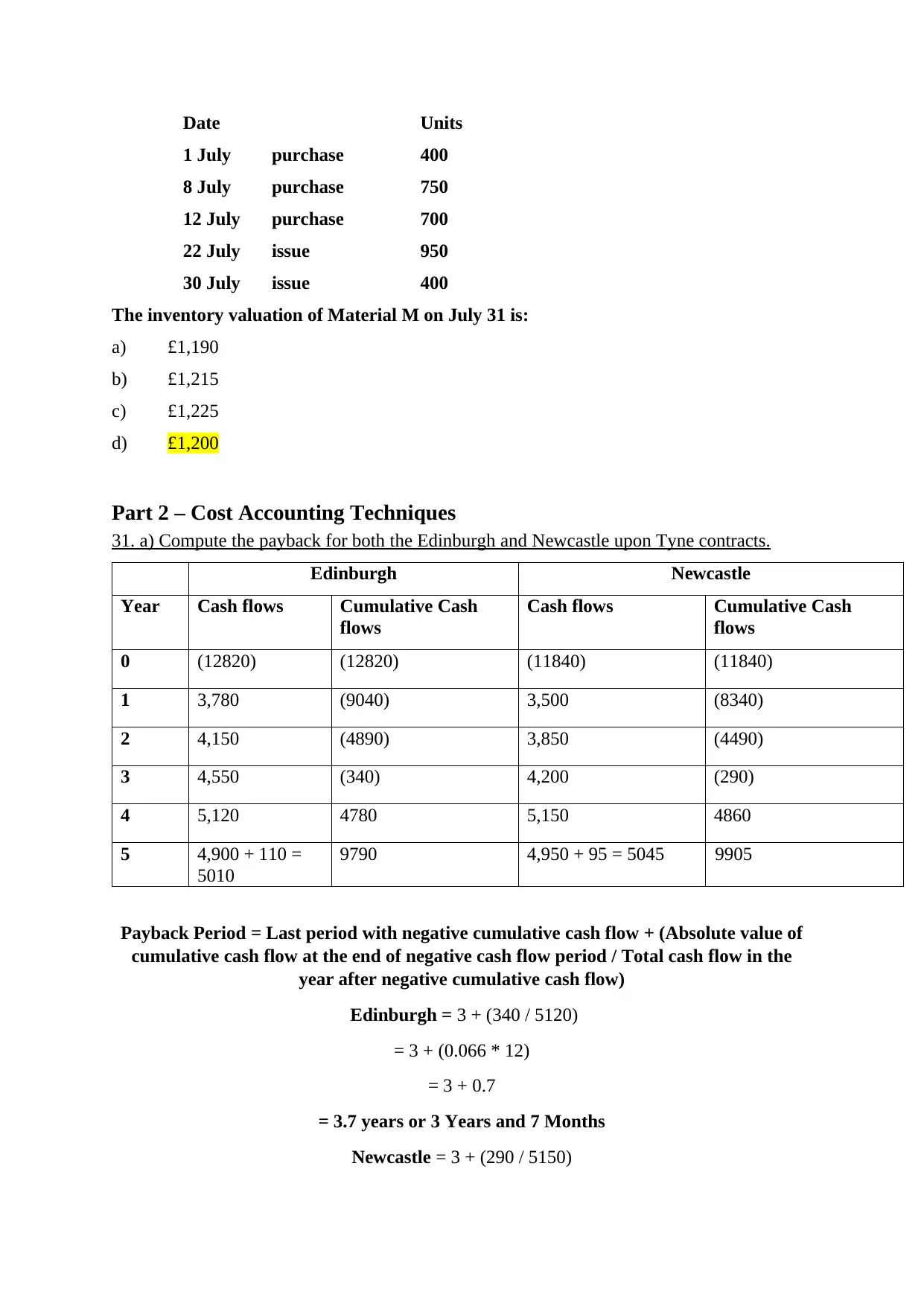

31. a) Compute the payback for both the Edinburgh and Newcastle upon Tyne contracts.

Edinburgh Newcastle

Year Cash flows Cumulative Cash

flows

Cash flows Cumulative Cash

flows

0 (12820) (12820) (11840) (11840)

1 3,780 (9040) 3,500 (8340)

2 4,150 (4890) 3,850 (4490)

3 4,550 (340) 4,200 (290)

4 5,120 4780 5,150 4860

5 4,900 + 110 =

5010

9790 4,950 + 95 = 5045 9905

Payback Period = Last period with negative cumulative cash flow + (Absolute value of

cumulative cash flow at the end of negative cash flow period / Total cash flow in the

year after negative cumulative cash flow)

Edinburgh = 3 + (340 / 5120)

= 3 + (0.066 * 12)

= 3 + 0.7

= 3.7 years or 3 Years and 7 Months

Newcastle = 3 + (290 / 5150)

1 July purchase 400

8 July purchase 750

12 July purchase 700

22 July issue 950

30 July issue 400

The inventory valuation of Material M on July 31 is:

a) £1,190

b) £1,215

c) £1,225

d) £1,200

Part 2 – Cost Accounting Techniques

31. a) Compute the payback for both the Edinburgh and Newcastle upon Tyne contracts.

Edinburgh Newcastle

Year Cash flows Cumulative Cash

flows

Cash flows Cumulative Cash

flows

0 (12820) (12820) (11840) (11840)

1 3,780 (9040) 3,500 (8340)

2 4,150 (4890) 3,850 (4490)

3 4,550 (340) 4,200 (290)

4 5,120 4780 5,150 4860

5 4,900 + 110 =

5010

9790 4,950 + 95 = 5045 9905

Payback Period = Last period with negative cumulative cash flow + (Absolute value of

cumulative cash flow at the end of negative cash flow period / Total cash flow in the

year after negative cumulative cash flow)

Edinburgh = 3 + (340 / 5120)

= 3 + (0.066 * 12)

= 3 + 0.7

= 3.7 years or 3 Years and 7 Months

Newcastle = 3 + (290 / 5150)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.