Management Accounting: Cost Analysis, Budgeting and Financial Issues

VerifiedAdded on 2023/06/18

|18

|4604

|60

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its application within Iceland Manufacturing, a UK-based frozen products company. It discusses various management accounting systems like inventory administration, cost accounting, and job costing, detailing their benefits and applications. The report also covers different methods of management accounting reporting, including performance reports, budget reports, inventory and manufacturing reports, and accounts receivable reports. It further analyzes cost using marginal and absorption costing techniques, presenting income statements prepared under both methods. The document also examines the benefits and drawbacks of budgetary planning tools and compares different approaches to adopting financial accounting systems in response to financial challenges. This student-contributed assignment is available on Desklib, offering valuable insights and solved examples for students studying finance and management accounting.

5-Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1) Discuss management accounting & also elaborate various types of systems used for

management accounting..............................................................................................................3

P2) Methods of management accounting reporting.....................................................................5

M1) Elaborate advantages of management accounting system along with their application in

context of organization................................................................................................................6

TASK 2............................................................................................................................................7

P3) Determine cost by applying suitable techniques of cost analysis and also prepare income

statement by absorption & marginal cost....................................................................................7

M2) Apply different techniques of management accounting & also formulate suitable financial

documents..................................................................................................................................10

PART 2..........................................................................................................................................10

TASK 3..........................................................................................................................................10

P4) Discuss benefits & drawbacks of various planning tools which are used for the purpose of

budgetary control.......................................................................................................................10

M3) Analyze various planning tools along with their application in preparation of budgets. . .12

TASK 4..........................................................................................................................................12

P5) Devise comparison in the way in which management accounting system is adopted for

dealing with different financial issues.......................................................................................12

M4) Evaluate how in response of financial problems, management accounting can lead

company towards sustainable success.......................................................................................14

CONCLUSION..............................................................................................................................15

REFERNCES.................................................................................................................................16

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1) Discuss management accounting & also elaborate various types of systems used for

management accounting..............................................................................................................3

P2) Methods of management accounting reporting.....................................................................5

M1) Elaborate advantages of management accounting system along with their application in

context of organization................................................................................................................6

TASK 2............................................................................................................................................7

P3) Determine cost by applying suitable techniques of cost analysis and also prepare income

statement by absorption & marginal cost....................................................................................7

M2) Apply different techniques of management accounting & also formulate suitable financial

documents..................................................................................................................................10

PART 2..........................................................................................................................................10

TASK 3..........................................................................................................................................10

P4) Discuss benefits & drawbacks of various planning tools which are used for the purpose of

budgetary control.......................................................................................................................10

M3) Analyze various planning tools along with their application in preparation of budgets. . .12

TASK 4..........................................................................................................................................12

P5) Devise comparison in the way in which management accounting system is adopted for

dealing with different financial issues.......................................................................................12

M4) Evaluate how in response of financial problems, management accounting can lead

company towards sustainable success.......................................................................................14

CONCLUSION..............................................................................................................................15

REFERNCES.................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting refers to a process wherein financial data & information is

analyzed, interpreted as well as communicated to relevant parties so that they can take necessary

business decisions in timely manner. It deals with numeric information & data with an aim to

prepare appropriate financial statements which further guide financial managers to take suitable

decisions for embarking growth within company. In addition to this, management accounting is

concern with presenting data & information in such a manner by which uncertainties can predict

in an efficient manner so that efficient & productive decisions can be made for success of

business entity (Caglio, 2018). Besides this, management accounting also assist business manager

in making business forecast so that uncertainties can eliminated & efficient decisions can be made

for future growth & success. In current report, Iceland manufacturing is considered that is a well

known manufacturing organization of UK and deals in frozen products. The report covers various

management accounting techniques which are applied by company for preparation of financial

documents. Different reporting methods of financial management accounting along with

necessary techniques of cost analysis have also included in the report. Further, benefits &

drawbacks of budgetary planning, comparison between the ways of adopting financial accounting

system have also covered in the following report.

TASK 1

P1) Discuss management accounting & also elaborate various types of systems used for

management accounting

Management accounting:

It is widely used approach which is concern with analysis, interpretation of financial

documents so that necessary information can imparted to managers for taking suitable business

related decisions (Wells, 2018). Here, data & information is present through financial documents

by which managers are able to analyze current financial position of organization which will

further assist in terms of eliminating uncertainties & making the most of business opportunities.

With this, liquidity within firm is also managed in order to ensure adequate amount of funds for

Management accounting refers to a process wherein financial data & information is

analyzed, interpreted as well as communicated to relevant parties so that they can take necessary

business decisions in timely manner. It deals with numeric information & data with an aim to

prepare appropriate financial statements which further guide financial managers to take suitable

decisions for embarking growth within company. In addition to this, management accounting is

concern with presenting data & information in such a manner by which uncertainties can predict

in an efficient manner so that efficient & productive decisions can be made for success of

business entity (Caglio, 2018). Besides this, management accounting also assist business manager

in making business forecast so that uncertainties can eliminated & efficient decisions can be made

for future growth & success. In current report, Iceland manufacturing is considered that is a well

known manufacturing organization of UK and deals in frozen products. The report covers various

management accounting techniques which are applied by company for preparation of financial

documents. Different reporting methods of financial management accounting along with

necessary techniques of cost analysis have also included in the report. Further, benefits &

drawbacks of budgetary planning, comparison between the ways of adopting financial accounting

system have also covered in the following report.

TASK 1

P1) Discuss management accounting & also elaborate various types of systems used for

management accounting

Management accounting:

It is widely used approach which is concern with analysis, interpretation of financial

documents so that necessary information can imparted to managers for taking suitable business

related decisions (Wells, 2018). Here, data & information is present through financial documents

by which managers are able to analyze current financial position of organization which will

further assist in terms of eliminating uncertainties & making the most of business opportunities.

With this, liquidity within firm is also managed in order to ensure adequate amount of funds for

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

meeting with predefined objectives. By this, appropriate decisions are taken which further help in

maximizing wealth of organization in an efficient manner.

Management accounting system:

Management accounting is concern with maintaining & controlling financial performance

of company. In this regard, different accounting systems are applied in Iceland which are given

underneath:

Inventory administration system: This system is concern with maintaining sufficient

level of inventory of inventory so that production process can be continue without any disruption.

Main emphasis of this approach is to keep an adequate level of inventory so that, it is easy to meet

with market demand in an efficient manner. In this, managers keep a track over inventory level &

determine a re-order level for avoiding the situations of surplus & deficiency. If, there is no

sufficient level of inventory then it disrupts of production process which hinder goodwill of

organization in marker place (Mio, 2016). On other side, surplus of stock enhances overall cost by

generating additional expenses of warehouse & more. For avoiding the situations of surplus &

deficiency, Iceland uses appropriate techniques with an aim to keep a track over inventory level.

With this, they are able to maintain consistency in production process wherein, they are able to

offer necessary goods & services to customers for fulfilling market demand in best possible way.

In this regard, certain approaches of inventory control are mentioned below:

LIFO: It is based on last in first out where the units which are included in stock at last

are used first during production.

FIFO: Here, concept of first in first out is followed under which the units which are

initially included in stock also used first during production process.

Cost accounting system: This system of management accounting aims to keep an

appropriate control over cost of production so that products & services can be manufactured

within minimum possible expenditure. Direct as well as indirect costs are crucial part of

production process (Aslanertik and Yardımcı, 2019). Direct cost is part of direct production such

cost of raw material, labor & more. On other side, indirect cost is not directly link with production

yet significantly contributes in overall cost of production. For earning significant amount of

maximizing wealth of organization in an efficient manner.

Management accounting system:

Management accounting is concern with maintaining & controlling financial performance

of company. In this regard, different accounting systems are applied in Iceland which are given

underneath:

Inventory administration system: This system is concern with maintaining sufficient

level of inventory of inventory so that production process can be continue without any disruption.

Main emphasis of this approach is to keep an adequate level of inventory so that, it is easy to meet

with market demand in an efficient manner. In this, managers keep a track over inventory level &

determine a re-order level for avoiding the situations of surplus & deficiency. If, there is no

sufficient level of inventory then it disrupts of production process which hinder goodwill of

organization in marker place (Mio, 2016). On other side, surplus of stock enhances overall cost by

generating additional expenses of warehouse & more. For avoiding the situations of surplus &

deficiency, Iceland uses appropriate techniques with an aim to keep a track over inventory level.

With this, they are able to maintain consistency in production process wherein, they are able to

offer necessary goods & services to customers for fulfilling market demand in best possible way.

In this regard, certain approaches of inventory control are mentioned below:

LIFO: It is based on last in first out where the units which are included in stock at last

are used first during production.

FIFO: Here, concept of first in first out is followed under which the units which are

initially included in stock also used first during production process.

Cost accounting system: This system of management accounting aims to keep an

appropriate control over cost of production so that products & services can be manufactured

within minimum possible expenditure. Direct as well as indirect costs are crucial part of

production process (Aslanertik and Yardımcı, 2019). Direct cost is part of direct production such

cost of raw material, labor & more. On other side, indirect cost is not directly link with production

yet significantly contributes in overall cost of production. For earning significant amount of

profit, it is essential to keep control over cost. In reference of Iceland, they adopt effective cost

accounting management system which allows them in order to keep the production cost at

minimum level for managing sufficient level of profit margin.

Job costing system: Here, cost of a particular work is determined with an aim to identify

the contribution of each & every job in completion of whole task. Generally, this method is

applied when separate jobs need to perform for fulfilling a specific task. Here, performance of

each job is analyzed in detailed manner which further help to identify contribution of each job. By

this, managers can keep control on overall cost by eliminating unnecessary jobs which are not

profitable (Kajüter and Schröder, 2017). Implementation of this system is helpful in order to make

maximum use of available resources. In context of Iceland, they use job costing with an intention

to evaluate performance of each job separately which will help in order to take effective decisions

for further betterment.

P2) Methods of management accounting reporting

Reports are constructed for assisting managers to take meaningful decisions for

betterment of company. In this regard, reports related to management accounting are used for the

purpose of planning, evaluating and measuring the performance of organization. These reports

include financial statements such as balance sheet, income statements and more. Management

accountant reports are likely to prepare by management team having proficiency as well as

competencies in preparation of these reports. In context of Iceland, they prepare appropriate

reports of management accounting by following particular methods which is mentioned as under:

Performance report: Individuals having different competencies, skills & abilities are

likely to work together within an organization (Meiryani, Susanto and Warganegara, 2019). They

perform different roles and responsibilities and also play a crucial role in overall success of

organization. Hence, it is required to keep a track over performance of employees on regular

basis. For meeting with this purpose, appropriate performance reports are constructed by

manager in different intervals. Through these reports, managers compare the actual performance

of employees with standards that further assist them in order to take corrective actions. In

reference of Iceland, they also analyze performance of subordinates on regular basis. With this

assessment, they arrange suitable training and learning programs for improving the performance

level of workforce.

accounting management system which allows them in order to keep the production cost at

minimum level for managing sufficient level of profit margin.

Job costing system: Here, cost of a particular work is determined with an aim to identify

the contribution of each & every job in completion of whole task. Generally, this method is

applied when separate jobs need to perform for fulfilling a specific task. Here, performance of

each job is analyzed in detailed manner which further help to identify contribution of each job. By

this, managers can keep control on overall cost by eliminating unnecessary jobs which are not

profitable (Kajüter and Schröder, 2017). Implementation of this system is helpful in order to make

maximum use of available resources. In context of Iceland, they use job costing with an intention

to evaluate performance of each job separately which will help in order to take effective decisions

for further betterment.

P2) Methods of management accounting reporting

Reports are constructed for assisting managers to take meaningful decisions for

betterment of company. In this regard, reports related to management accounting are used for the

purpose of planning, evaluating and measuring the performance of organization. These reports

include financial statements such as balance sheet, income statements and more. Management

accountant reports are likely to prepare by management team having proficiency as well as

competencies in preparation of these reports. In context of Iceland, they prepare appropriate

reports of management accounting by following particular methods which is mentioned as under:

Performance report: Individuals having different competencies, skills & abilities are

likely to work together within an organization (Meiryani, Susanto and Warganegara, 2019). They

perform different roles and responsibilities and also play a crucial role in overall success of

organization. Hence, it is required to keep a track over performance of employees on regular

basis. For meeting with this purpose, appropriate performance reports are constructed by

manager in different intervals. Through these reports, managers compare the actual performance

of employees with standards that further assist them in order to take corrective actions. In

reference of Iceland, they also analyze performance of subordinates on regular basis. With this

assessment, they arrange suitable training and learning programs for improving the performance

level of workforce.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Budget report: It is a kind of report wherein financial analysis is performed for a specific

accounting period. Here, managers make forecast about the expenses and also lookout for

necessary sources of income in future period of time. By this information suitable budgets are

constructed so that company can maintain and meet requirements of business in significant

manner. In reference of Iceland, they also prepared an appropriate budget after making detailed

forecasting regarding future expenses and income which will further help in meeting with

various requirements of business significantly.

Inventory and manufacturing report: Inventory is a crucial part of each & every

business as it helps in meeting with market demand in timely manner. For this purpose, reports

related to inventory and manufacturing so that necessary level of inventory can be maintained

with an organization throughout the manufacturing process. Main aim of this report is to avoid

disruption in production process which can occur due to inadequate level of inventory. By

preparing this report, manager can avoid the future situations such as surplus and deficiency of

inventory which will also help in o keeping cost of production at minimum level (Miles, 2019).

Apart from this, it is also helpful in maintaining positive image of organization in marketplace by

ensuring a proper balance between market demand and supply. In reference of Iceland, managers

formulate inventory & manufacturing reports after analyzing current level of inventory and

future market requirements. With this, they are able to cater the needs of customer’s timely

manner.

Account receivable report: This report is prepared for getting back the due payment from

creditors. It is stated that in business, goods are also sold on credit. Account receivable report is

prepared for keeping a record of money which needs to collect from creditors. This report depicts

the amount of credit along with necessary dates. Higher balance of accounting receivable shows

the inefficiency of organization to recover debt money. Hence, accounting receivable reports are

prepared so that organization can recover funds from creditors.

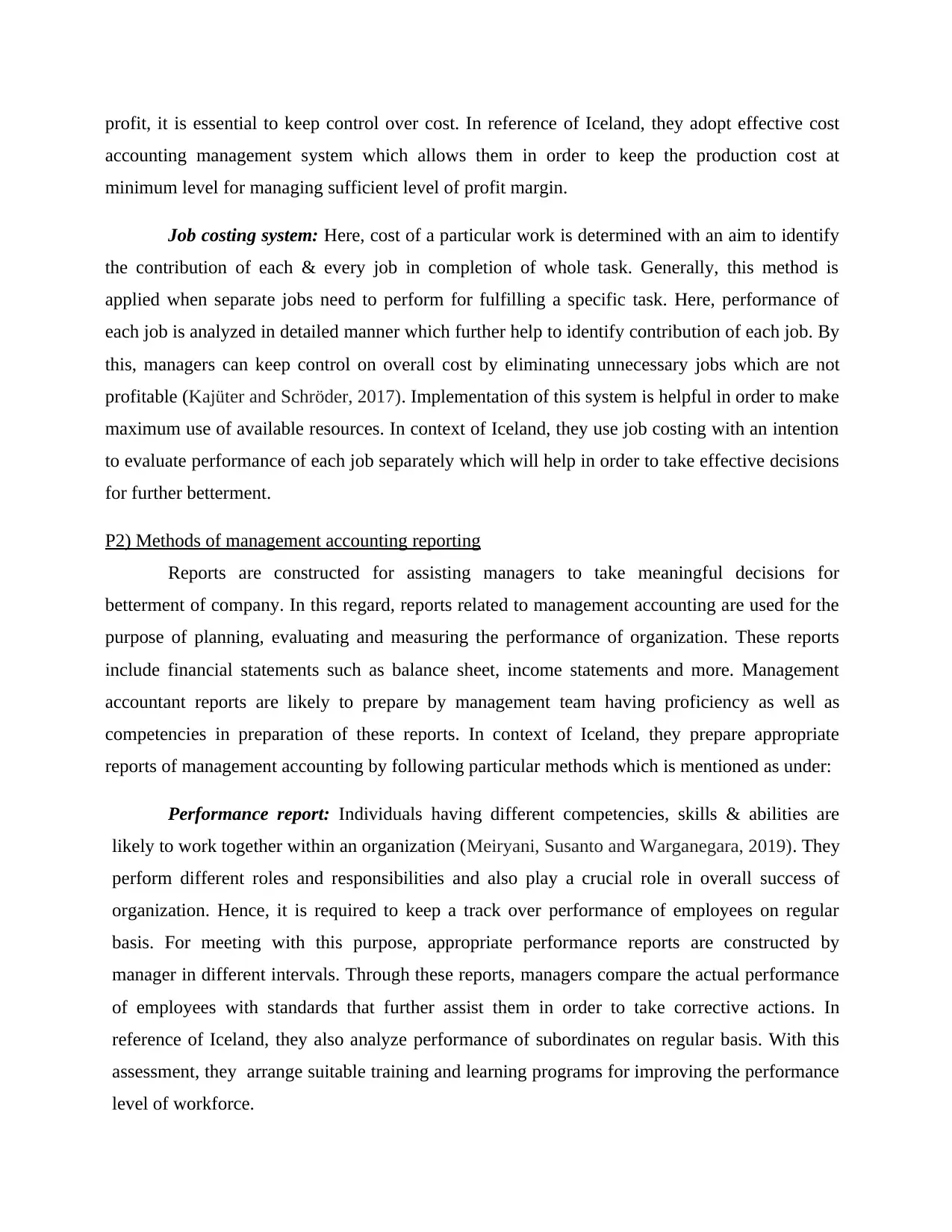

M1) Elaborate advantages of management accounting system along with their application in

context of organization

Accounting system Advantages

Inventory management system Benefit: This system is useful in order to maintain adequate

accounting period. Here, managers make forecast about the expenses and also lookout for

necessary sources of income in future period of time. By this information suitable budgets are

constructed so that company can maintain and meet requirements of business in significant

manner. In reference of Iceland, they also prepared an appropriate budget after making detailed

forecasting regarding future expenses and income which will further help in meeting with

various requirements of business significantly.

Inventory and manufacturing report: Inventory is a crucial part of each & every

business as it helps in meeting with market demand in timely manner. For this purpose, reports

related to inventory and manufacturing so that necessary level of inventory can be maintained

with an organization throughout the manufacturing process. Main aim of this report is to avoid

disruption in production process which can occur due to inadequate level of inventory. By

preparing this report, manager can avoid the future situations such as surplus and deficiency of

inventory which will also help in o keeping cost of production at minimum level (Miles, 2019).

Apart from this, it is also helpful in maintaining positive image of organization in marketplace by

ensuring a proper balance between market demand and supply. In reference of Iceland, managers

formulate inventory & manufacturing reports after analyzing current level of inventory and

future market requirements. With this, they are able to cater the needs of customer’s timely

manner.

Account receivable report: This report is prepared for getting back the due payment from

creditors. It is stated that in business, goods are also sold on credit. Account receivable report is

prepared for keeping a record of money which needs to collect from creditors. This report depicts

the amount of credit along with necessary dates. Higher balance of accounting receivable shows

the inefficiency of organization to recover debt money. Hence, accounting receivable reports are

prepared so that organization can recover funds from creditors.

M1) Elaborate advantages of management accounting system along with their application in

context of organization

Accounting system Advantages

Inventory management system Benefit: This system is useful in order to maintain adequate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

llevel of inventory within organization for meeting with

demands emerge in market place in timely manner.

Application: It is used in order to keep suitable control over

cost of production & make efficient use of available

resources.

Cost accounting system Benefits: It assists managers in producing goods & services

within minimum cost so that they can earn significant amount

of profit.

Application: Cost accounting is applied for reducing down

cost of production & earning higher amount of profit margin.

Job order costing system Benefits: This system is helpful in terms of evaluating

performance of each & every job so that company can further

continue with profitable jobs & eliminates in-effective tasks

from overall production process (Brown and et. al., 2020).

Application: It is applied for knowing cost of each product

which helps to identity profitable products from overall

product portfolio. It is useful while company is engaged in

producing different range of products.

TASK 2

P3) Determine cost by applying suitable techniques of cost analysis and also prepare income

statement by absorption & marginal cost

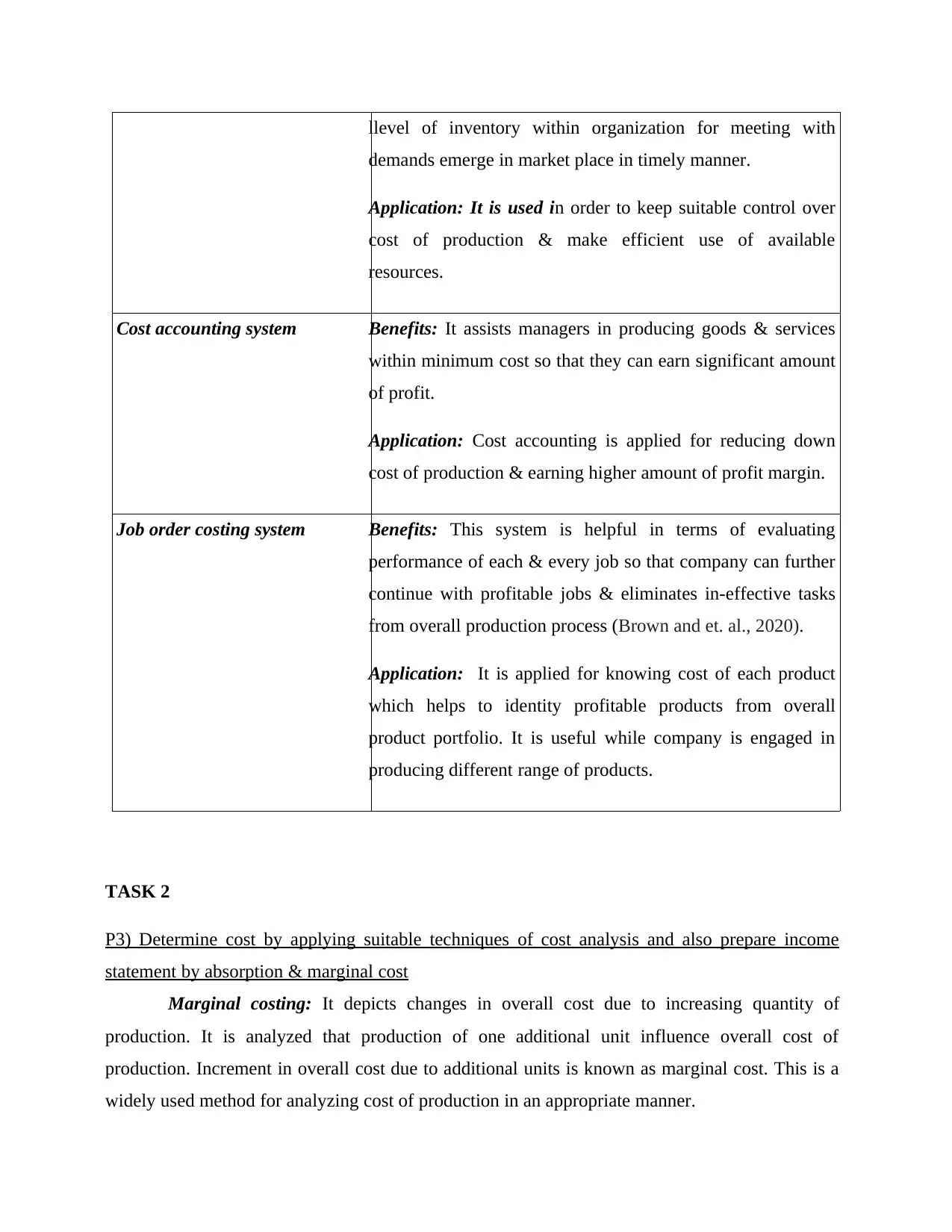

Marginal costing: It depicts changes in overall cost due to increasing quantity of

production. It is analyzed that production of one additional unit influence overall cost of

production. Increment in overall cost due to additional units is known as marginal cost. This is a

widely used method for analyzing cost of production in an appropriate manner.

demands emerge in market place in timely manner.

Application: It is used in order to keep suitable control over

cost of production & make efficient use of available

resources.

Cost accounting system Benefits: It assists managers in producing goods & services

within minimum cost so that they can earn significant amount

of profit.

Application: Cost accounting is applied for reducing down

cost of production & earning higher amount of profit margin.

Job order costing system Benefits: This system is helpful in terms of evaluating

performance of each & every job so that company can further

continue with profitable jobs & eliminates in-effective tasks

from overall production process (Brown and et. al., 2020).

Application: It is applied for knowing cost of each product

which helps to identity profitable products from overall

product portfolio. It is useful while company is engaged in

producing different range of products.

TASK 2

P3) Determine cost by applying suitable techniques of cost analysis and also prepare income

statement by absorption & marginal cost

Marginal costing: It depicts changes in overall cost due to increasing quantity of

production. It is analyzed that production of one additional unit influence overall cost of

production. Increment in overall cost due to additional units is known as marginal cost. This is a

widely used method for analyzing cost of production in an appropriate manner.

Income statement by using marginal cost method

Particular November (£)

Sales 50 500000

Less: Cost of Sales

Direct Material cost 18 -180000

Direct labor cost 4 -40000

Variable production overhead 3 -30000

Contribution 250000

Less:

Variable Selling

overhead(10% on sale value)

10000* 5 -50000

Fixed Selling expenses 14000

Fixed Administration

Overheads

26000

Fixed Production Overhead 99000

Net Profit 61000

Particular December (£)

Sales 50 600000

Less: Cost of Sales

Direct Material cost 18 -216000

Direct labor cost 4 -48000

Variable production overhead 3 -36000

Contribution 300000

Less:

Variable Selling

overhead(10% on sale value)

12000* 5 -60000

Fixed Selling expenses 14000

Particular November (£)

Sales 50 500000

Less: Cost of Sales

Direct Material cost 18 -180000

Direct labor cost 4 -40000

Variable production overhead 3 -30000

Contribution 250000

Less:

Variable Selling

overhead(10% on sale value)

10000* 5 -50000

Fixed Selling expenses 14000

Fixed Administration

Overheads

26000

Fixed Production Overhead 99000

Net Profit 61000

Particular December (£)

Sales 50 600000

Less: Cost of Sales

Direct Material cost 18 -216000

Direct labor cost 4 -48000

Variable production overhead 3 -36000

Contribution 300000

Less:

Variable Selling

overhead(10% on sale value)

12000* 5 -60000

Fixed Selling expenses 14000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

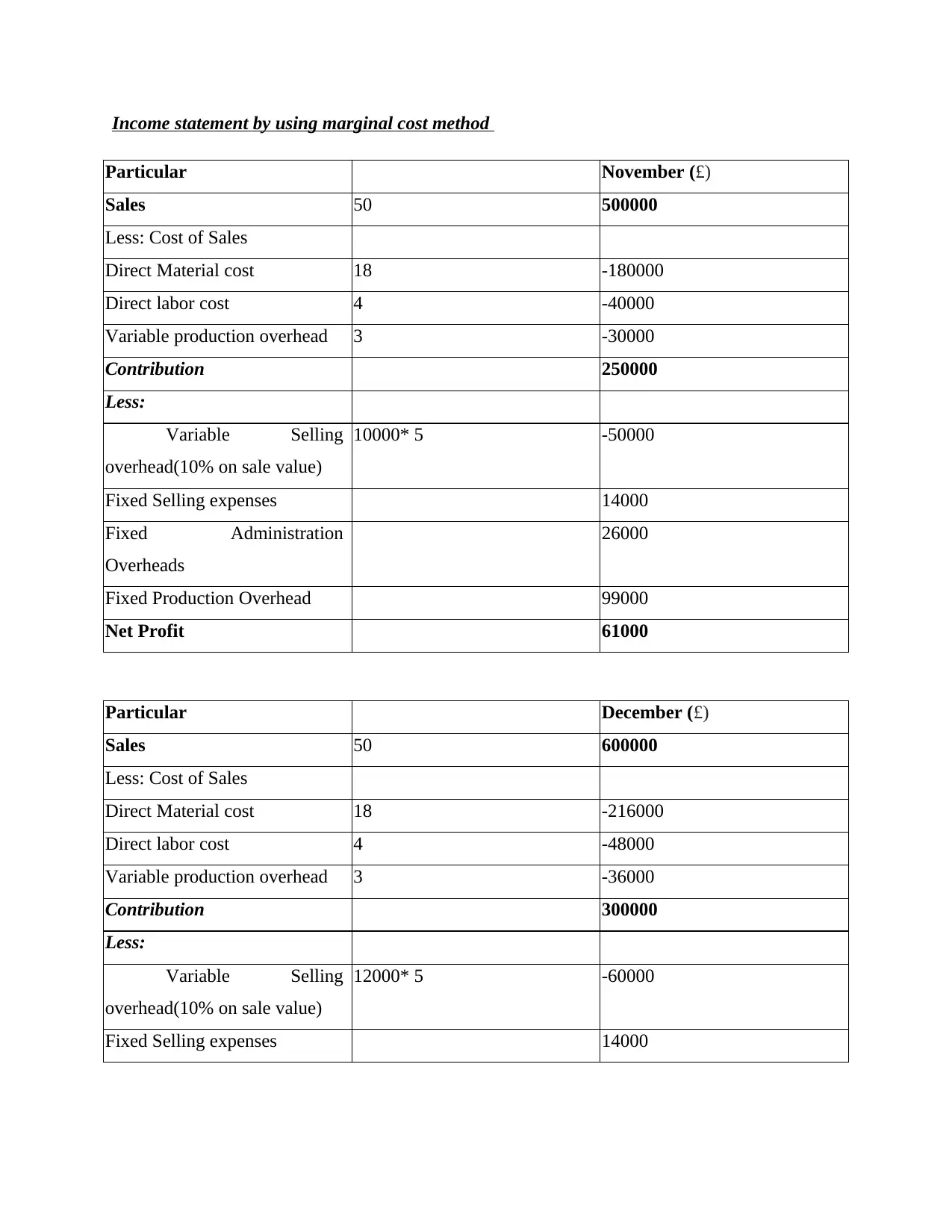

Fixed Administration

Overheads

26000

Fixed Production Overhead 99000

Net Profit 101000

Absorption cost: Under this, different expenditures which occur during production

process are taken into consideration (Narayanan and Boyce, 2019). So, it is also known as full

costing wherein all the necessary expenses are considered while determining cost of production.

Expenses such as direct, indirect, overheads are consolidated for accounting appropriate cost.

Income statement by using absorption cost method

Particular November(£)

Sales 50 500000

Less: Cost of Sales -340000

Gross Profit 160000

Variable selling overhead( 10%

of sales)

10000* 5 -50000

Fixed Selling expenses 14000

Fixed Administration

Overheads

26000

Under/ Over absorbed

production expenses

9000

Net Profit 79000

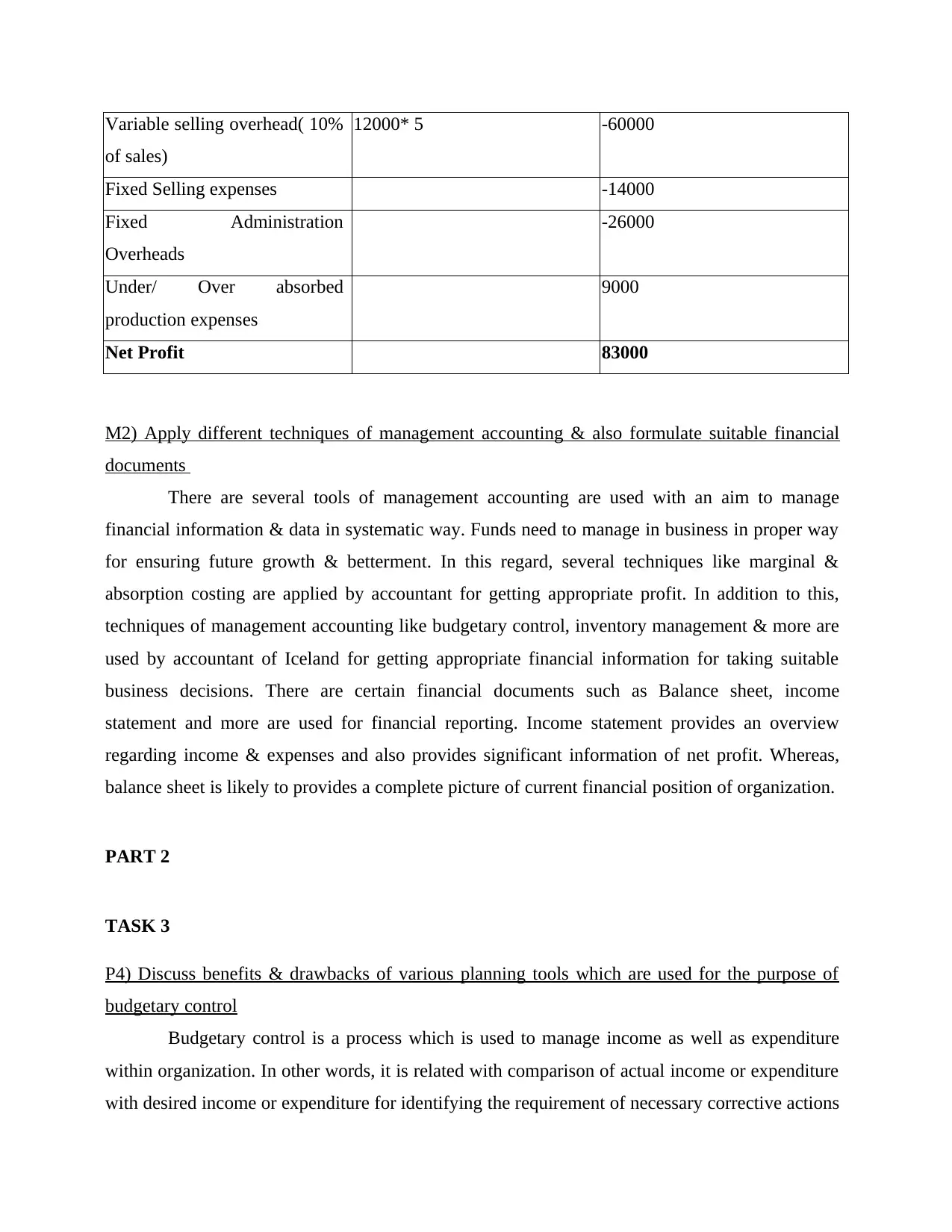

Particular December(£)

Sales 50 600000

Less: Cost of Sales -408000

Gross Profit 192000

Overheads

26000

Fixed Production Overhead 99000

Net Profit 101000

Absorption cost: Under this, different expenditures which occur during production

process are taken into consideration (Narayanan and Boyce, 2019). So, it is also known as full

costing wherein all the necessary expenses are considered while determining cost of production.

Expenses such as direct, indirect, overheads are consolidated for accounting appropriate cost.

Income statement by using absorption cost method

Particular November(£)

Sales 50 500000

Less: Cost of Sales -340000

Gross Profit 160000

Variable selling overhead( 10%

of sales)

10000* 5 -50000

Fixed Selling expenses 14000

Fixed Administration

Overheads

26000

Under/ Over absorbed

production expenses

9000

Net Profit 79000

Particular December(£)

Sales 50 600000

Less: Cost of Sales -408000

Gross Profit 192000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

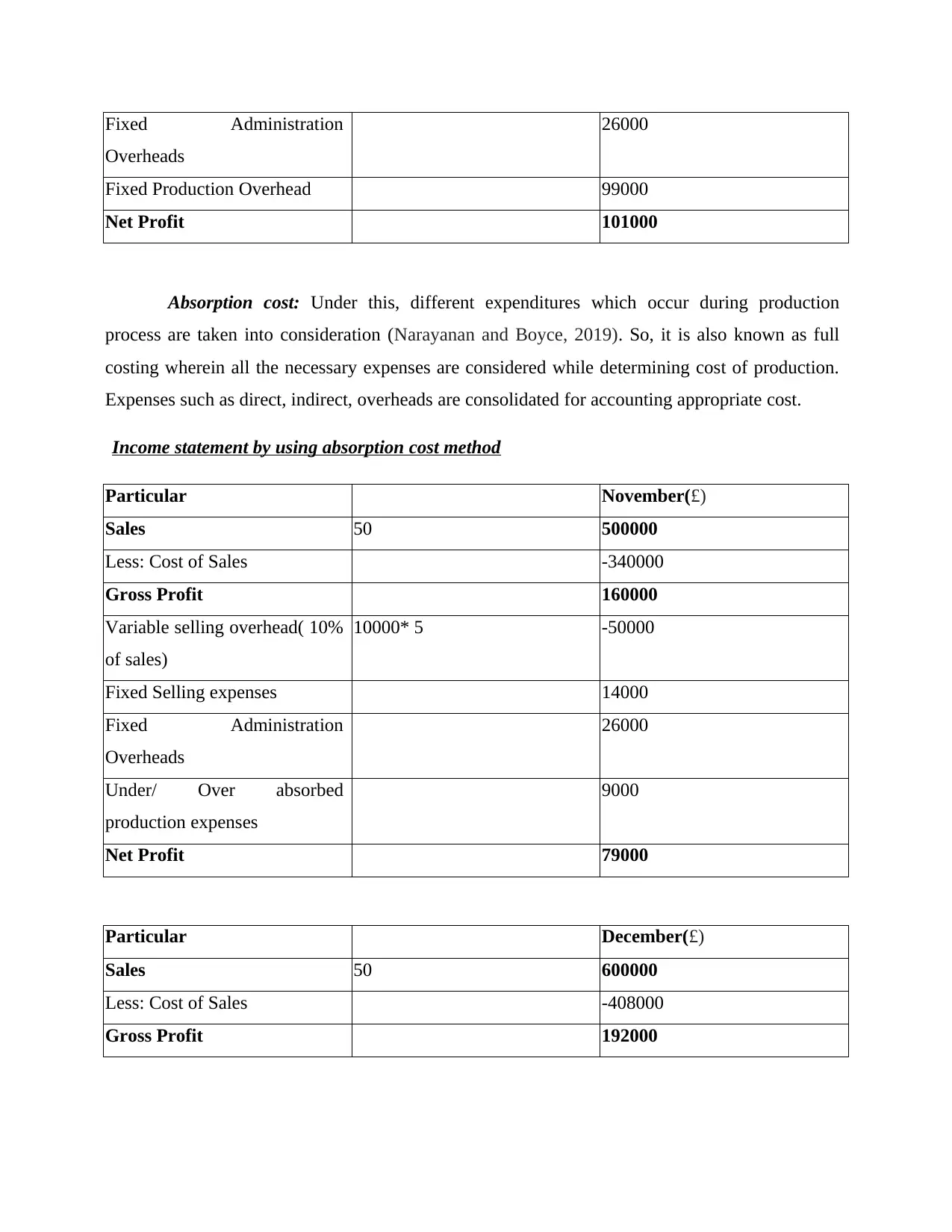

Variable selling overhead( 10%

of sales)

12000* 5 -60000

Fixed Selling expenses -14000

Fixed Administration

Overheads

-26000

Under/ Over absorbed

production expenses

9000

Net Profit 83000

M2) Apply different techniques of management accounting & also formulate suitable financial

documents

There are several tools of management accounting are used with an aim to manage

financial information & data in systematic way. Funds need to manage in business in proper way

for ensuring future growth & betterment. In this regard, several techniques like marginal &

absorption costing are applied by accountant for getting appropriate profit. In addition to this,

techniques of management accounting like budgetary control, inventory management & more are

used by accountant of Iceland for getting appropriate financial information for taking suitable

business decisions. There are certain financial documents such as Balance sheet, income

statement and more are used for financial reporting. Income statement provides an overview

regarding income & expenses and also provides significant information of net profit. Whereas,

balance sheet is likely to provides a complete picture of current financial position of organization.

PART 2

TASK 3

P4) Discuss benefits & drawbacks of various planning tools which are used for the purpose of

budgetary control

Budgetary control is a process which is used to manage income as well as expenditure

within organization. In other words, it is related with comparison of actual income or expenditure

with desired income or expenditure for identifying the requirement of necessary corrective actions

of sales)

12000* 5 -60000

Fixed Selling expenses -14000

Fixed Administration

Overheads

-26000

Under/ Over absorbed

production expenses

9000

Net Profit 83000

M2) Apply different techniques of management accounting & also formulate suitable financial

documents

There are several tools of management accounting are used with an aim to manage

financial information & data in systematic way. Funds need to manage in business in proper way

for ensuring future growth & betterment. In this regard, several techniques like marginal &

absorption costing are applied by accountant for getting appropriate profit. In addition to this,

techniques of management accounting like budgetary control, inventory management & more are

used by accountant of Iceland for getting appropriate financial information for taking suitable

business decisions. There are certain financial documents such as Balance sheet, income

statement and more are used for financial reporting. Income statement provides an overview

regarding income & expenses and also provides significant information of net profit. Whereas,

balance sheet is likely to provides a complete picture of current financial position of organization.

PART 2

TASK 3

P4) Discuss benefits & drawbacks of various planning tools which are used for the purpose of

budgetary control

Budgetary control is a process which is used to manage income as well as expenditure

within organization. In other words, it is related with comparison of actual income or expenditure

with desired income or expenditure for identifying the requirement of necessary corrective actions

(Merino and Aucock, 2017). For preparing budget, it is required to collect a lot of data and

information. In business, different kinds of budget like research, sales, marketing and production

are prepared for fulfilling requirements of different departments. For Iceland, different tools of

budgetary control are given below:

Variance analysis: It is a crucial tool which is often used for the purpose of budgetary

control where actual performance is compared with estimated figures. Main aim of this

comparison is to identify the gap between actual and standard performance so that appropriate

corrective actions can be taken (Riley and Yen, 2019). Variances are of two types which are

favorable and unfavorable variances. In case of unfavorable variance there is requirement to take

corrective action whereas favorable variances are likely to put positive impact over performance

of organization.

Advantages: Variance analysis makes an organization proactive so that they can achieve

predefine business goals by mitigating potential risk and future uncertainties. In addition

to this, it also renders necessary guidance to team members so that they can provide

efficient results.

Disadvantages: In variance analysis, there is requirement to set standards and then need to

perform necessary comparison which is a lengthy and burdensome process and also

requires huge cost as well as time.

Responsibility accounting: It is regarded as an effective technique of budgetary control

where accountability of employees are fixed and their performance is measured for taking

appropriate decisions regarding promotion and demotion for future period of time. This technique

is based an employee performance and helps manager in taking decisions of promotion and

demotion of employees

Advantages: It improves performance level of employees by assigning the responsibility

and providing necessary control over business process. Besides this, responsibility

accounting is also helpful in decision making as employees are allowed to participate in

decision making (Sofyan, Putra and Aprayuda, 2020).

Disadvantages: Due to responsibility accounting, inter departmental conflicts arise as

employees have necessary authority & power to take charge of their own work.

information. In business, different kinds of budget like research, sales, marketing and production

are prepared for fulfilling requirements of different departments. For Iceland, different tools of

budgetary control are given below:

Variance analysis: It is a crucial tool which is often used for the purpose of budgetary

control where actual performance is compared with estimated figures. Main aim of this

comparison is to identify the gap between actual and standard performance so that appropriate

corrective actions can be taken (Riley and Yen, 2019). Variances are of two types which are

favorable and unfavorable variances. In case of unfavorable variance there is requirement to take

corrective action whereas favorable variances are likely to put positive impact over performance

of organization.

Advantages: Variance analysis makes an organization proactive so that they can achieve

predefine business goals by mitigating potential risk and future uncertainties. In addition

to this, it also renders necessary guidance to team members so that they can provide

efficient results.

Disadvantages: In variance analysis, there is requirement to set standards and then need to

perform necessary comparison which is a lengthy and burdensome process and also

requires huge cost as well as time.

Responsibility accounting: It is regarded as an effective technique of budgetary control

where accountability of employees are fixed and their performance is measured for taking

appropriate decisions regarding promotion and demotion for future period of time. This technique

is based an employee performance and helps manager in taking decisions of promotion and

demotion of employees

Advantages: It improves performance level of employees by assigning the responsibility

and providing necessary control over business process. Besides this, responsibility

accounting is also helpful in decision making as employees are allowed to participate in

decision making (Sofyan, Putra and Aprayuda, 2020).

Disadvantages: Due to responsibility accounting, inter departmental conflicts arise as

employees have necessary authority & power to take charge of their own work.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.