Comprehensive Cost Accounting and Financial Analysis Project

VerifiedAdded on 2019/09/23

|6

|523

|209

Project

AI Summary

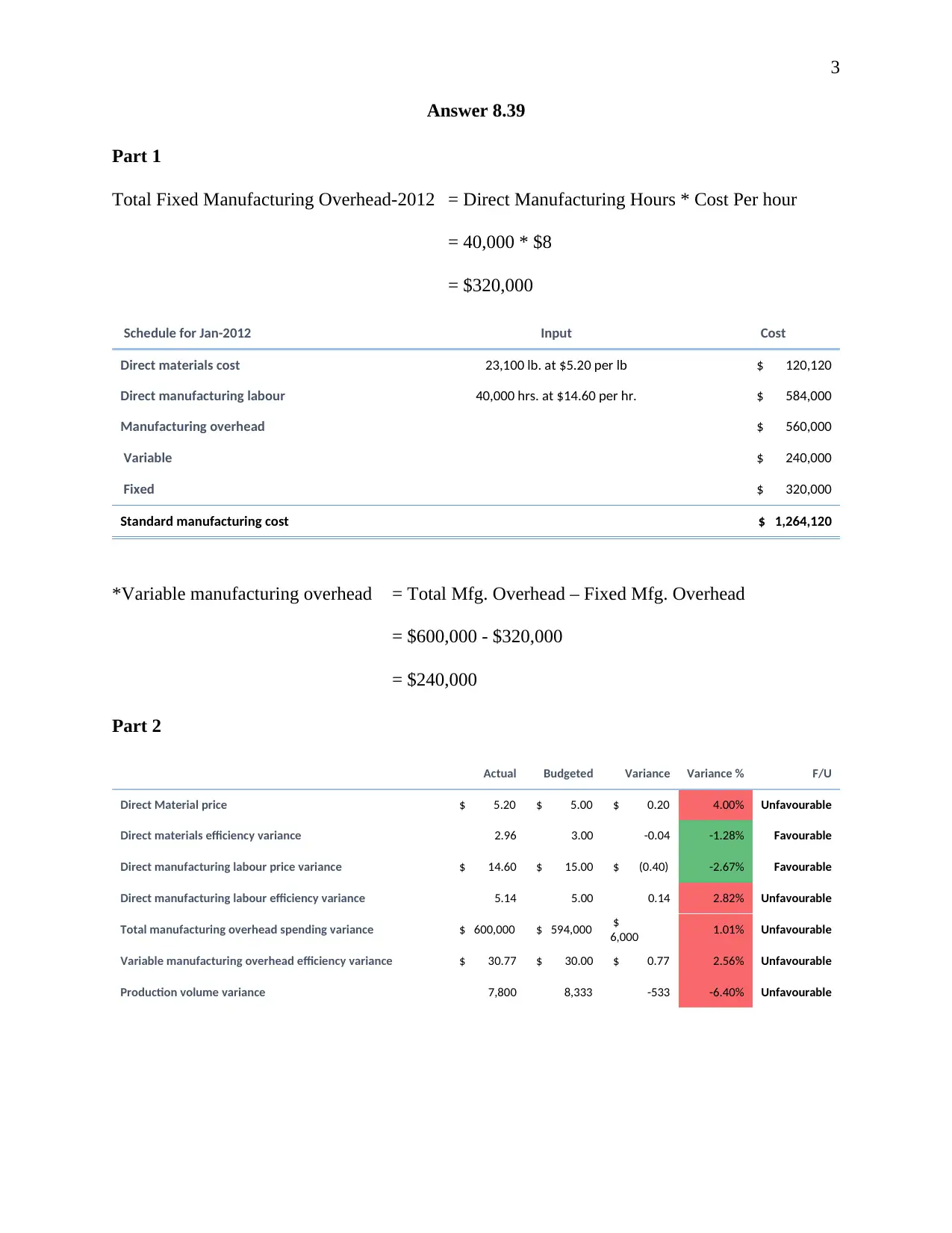

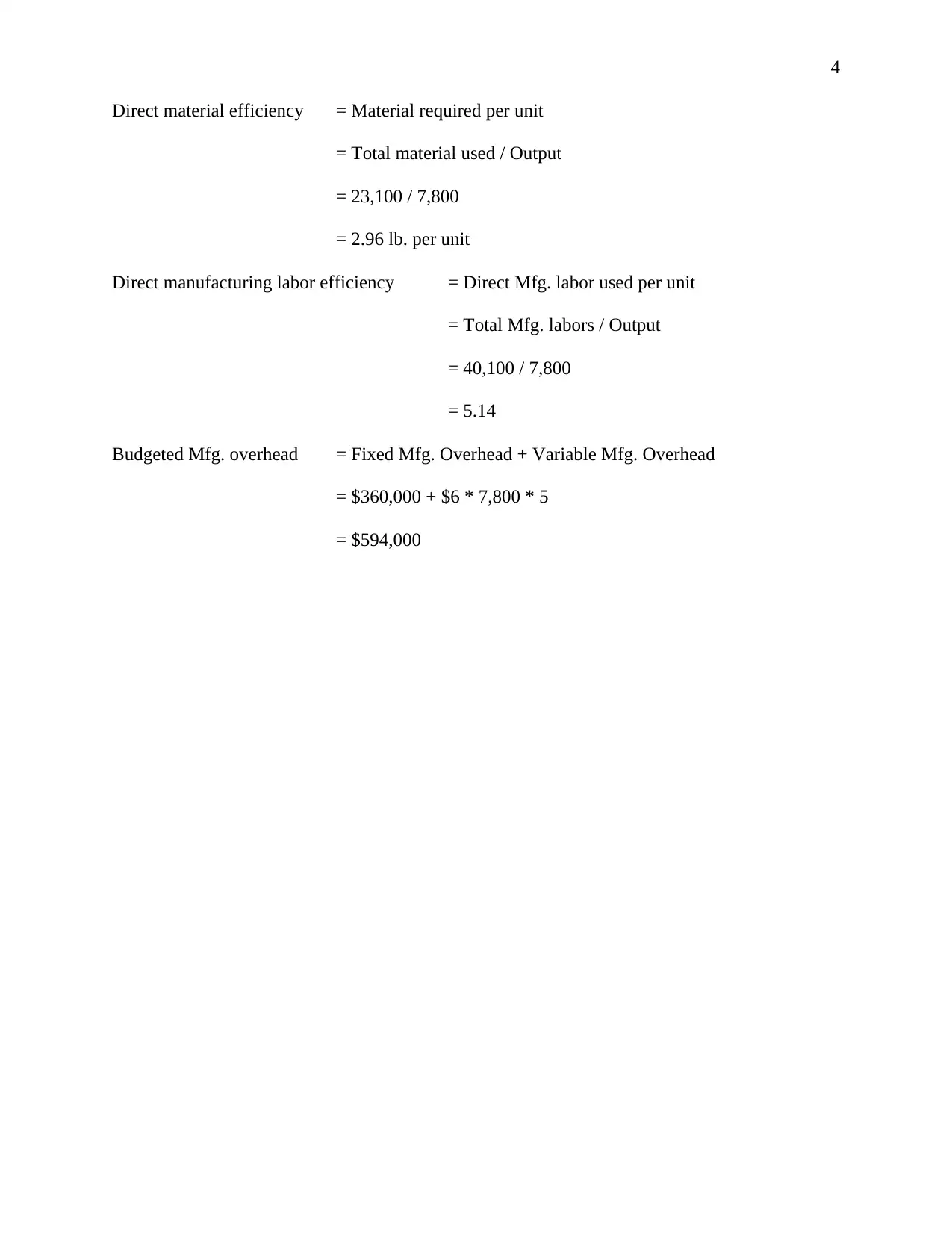

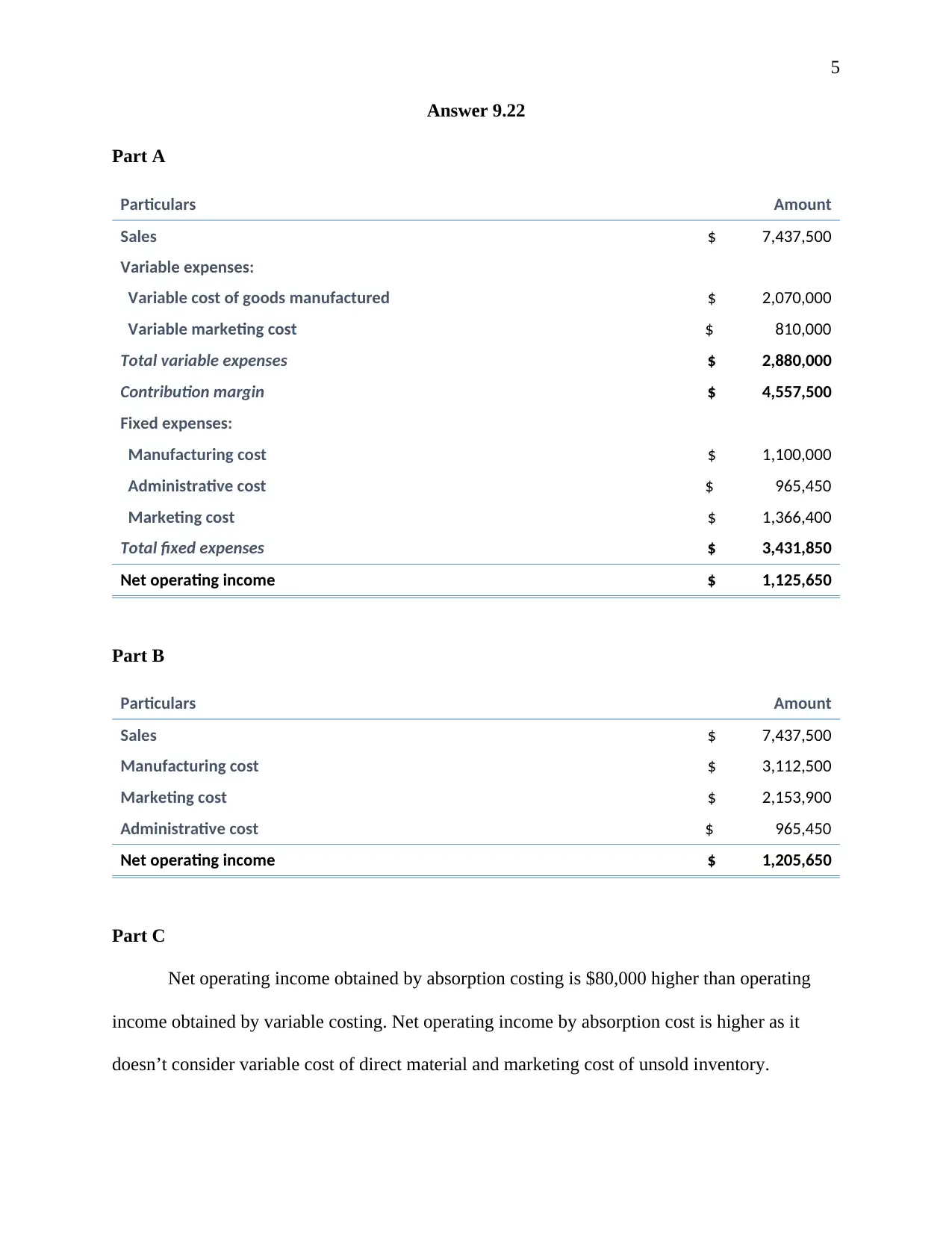

This project delves into cost accounting and financial analysis, covering key aspects like variance analysis, profitability, and costing methods. Part 1 examines total fixed manufacturing overhead and provides a schedule for input costs including direct materials, direct manufacturing labor, and manufacturing overhead. Part 2 analyzes variances in direct material prices, labor costs, and manufacturing overhead. Answer 9.22 explores variable and absorption costing, calculating net operating income under both methods and explaining the differences, as well as the impact on supervisor bonuses. The analysis includes detailed calculations, variance percentages, and explanations of the effects of different costing approaches on financial statements and management decisions. The project aims to demonstrate a comprehensive understanding of cost accounting principles and their practical application in financial analysis.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)