Management Accounting Project: Cost Control and Analysis

VerifiedAdded on 2023/06/14

|28

|2831

|303

Report

AI Summary

This management accounting project report addresses key concepts such as panopticism in cost control, functions of management accounting, and the use of checklists for control. It includes practical exercises involving the preparation of a manufacturing statement and income statement for Tendulkar Manufacturing Co., analysis of labor costs, material control accounts, and accrued payroll accounts. Furthermore, the report delves into payroll entries, activity-based costing, and service department cost allocation using direct, step, and reciprocal methods. The report provides detailed calculations and journal entries, offering a comprehensive overview of management accounting principles and their application in real-world scenarios. This resource can be found on Desklib, a platform offering a wide range of study tools and solved assignments for students.

Running Head: Management Accounting

1

Project Report: Management Accounting for cost and control

1

Project Report: Management Accounting for cost and control

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting

2

Contents

Question 1: Panopticism...................................................................................................3

Question 2: Control...........................................................................................................3

Question 3: Checklist........................................................................................................4

Question 4: Manufacturing statement and income statement...........................................4

Question 5: Labour cost concept......................................................................................9

Question 6: Material control account.............................................................................10

Question 7: Accrued payroll account.............................................................................11

Question 8: Payroll entries..............................................................................................13

Question 9:Activity based costing..................................................................................21

Question 10: Service department cost allocation............................................................21

References.......................................................................................................................26

2

Contents

Question 1: Panopticism...................................................................................................3

Question 2: Control...........................................................................................................3

Question 3: Checklist........................................................................................................4

Question 4: Manufacturing statement and income statement...........................................4

Question 5: Labour cost concept......................................................................................9

Question 6: Material control account.............................................................................10

Question 7: Accrued payroll account.............................................................................11

Question 8: Payroll entries..............................................................................................13

Question 9:Activity based costing..................................................................................21

Question 10: Service department cost allocation............................................................21

References.......................................................................................................................26

Management Accounting

3

Question 1: Panopticism

Panopticism is a hypothetical jail which has been projected by Jeremy Bentham. It

have round tires of cell adjacent a central surveillance tower. Panopticism is a process of

panopticon in which cost are controlled and reduced by the companies to maintain the

performance and the position of the company in the industry. Panopticism requires less staff

and the main motto of this process is to set the goals and achieve the goals in no cost. It

explains that the virtual and hypothetical control should be there in the organization to

maintain the performance of the staff and it would make a control over all the cost of the

company due to hypothetical perseverance (Garrison et al, 2010). Panopticism process

controls and monitors the activity of a business to manage the entire activities of the

company. It enhances the overall business and the management of the company to reduce and

manage the cost of the company.

Question 2: Control

Controlling is a significant part of business which extends the performance and the

management of an organization. The way toward controlling includes supervising, proposing,

monitoring and analyzing corrections in the business activity and the process of the company.

The administration bookkeeping framework controls the business procedures and exercises in

order to guarantee that the business goals are accomplished. For instance, the exception

reporting and variance analysis is gotten through the management accounting framework,

which help administration in assessing the slip by at the workplace. Further, the controls are

likewise set down to decrease the wastage and in this way, the general cost of manufacturing

(Ittner, Lanen & Larcker, 2002). The variance analysis assists in finding the reasons for

rebelliousness and shatter of controls, alongside giving answer for the same. Along these,

management accounting assists the administration in giving the controlling capacity in the

association, which is significant for the accomplishment of the gaols.

3

Question 1: Panopticism

Panopticism is a hypothetical jail which has been projected by Jeremy Bentham. It

have round tires of cell adjacent a central surveillance tower. Panopticism is a process of

panopticon in which cost are controlled and reduced by the companies to maintain the

performance and the position of the company in the industry. Panopticism requires less staff

and the main motto of this process is to set the goals and achieve the goals in no cost. It

explains that the virtual and hypothetical control should be there in the organization to

maintain the performance of the staff and it would make a control over all the cost of the

company due to hypothetical perseverance (Garrison et al, 2010). Panopticism process

controls and monitors the activity of a business to manage the entire activities of the

company. It enhances the overall business and the management of the company to reduce and

manage the cost of the company.

Question 2: Control

Controlling is a significant part of business which extends the performance and the

management of an organization. The way toward controlling includes supervising, proposing,

monitoring and analyzing corrections in the business activity and the process of the company.

The administration bookkeeping framework controls the business procedures and exercises in

order to guarantee that the business goals are accomplished. For instance, the exception

reporting and variance analysis is gotten through the management accounting framework,

which help administration in assessing the slip by at the workplace. Further, the controls are

likewise set down to decrease the wastage and in this way, the general cost of manufacturing

(Ittner, Lanen & Larcker, 2002). The variance analysis assists in finding the reasons for

rebelliousness and shatter of controls, alongside giving answer for the same. Along these,

management accounting assists the administration in giving the controlling capacity in the

association, which is significant for the accomplishment of the gaols.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management Accounting

4

Question 3: Checklist

Checklist is a list of total items and things which are required to done the things or the

points which are required to be considered and used as a reminder. It is a type of job aid

which is used by the companies and the individuals to reduce the failure through

compensating the potential limits of attention and human memory. Van Halen’s checklist

theory explains that the band has been successful due to their checklist. The bank always used

to maintain a checklist before any concert so that the things could be managed and

performance could be at its best. It is quite tough for a band to manage such as big

equipments in smaller place but it used to easier for Van Halen’s due to their policy and the

checklist management (Weygandt, Kimmel & Kieso, 2015). However, it has also been found

that a checklist is only successful when it is properly followed.

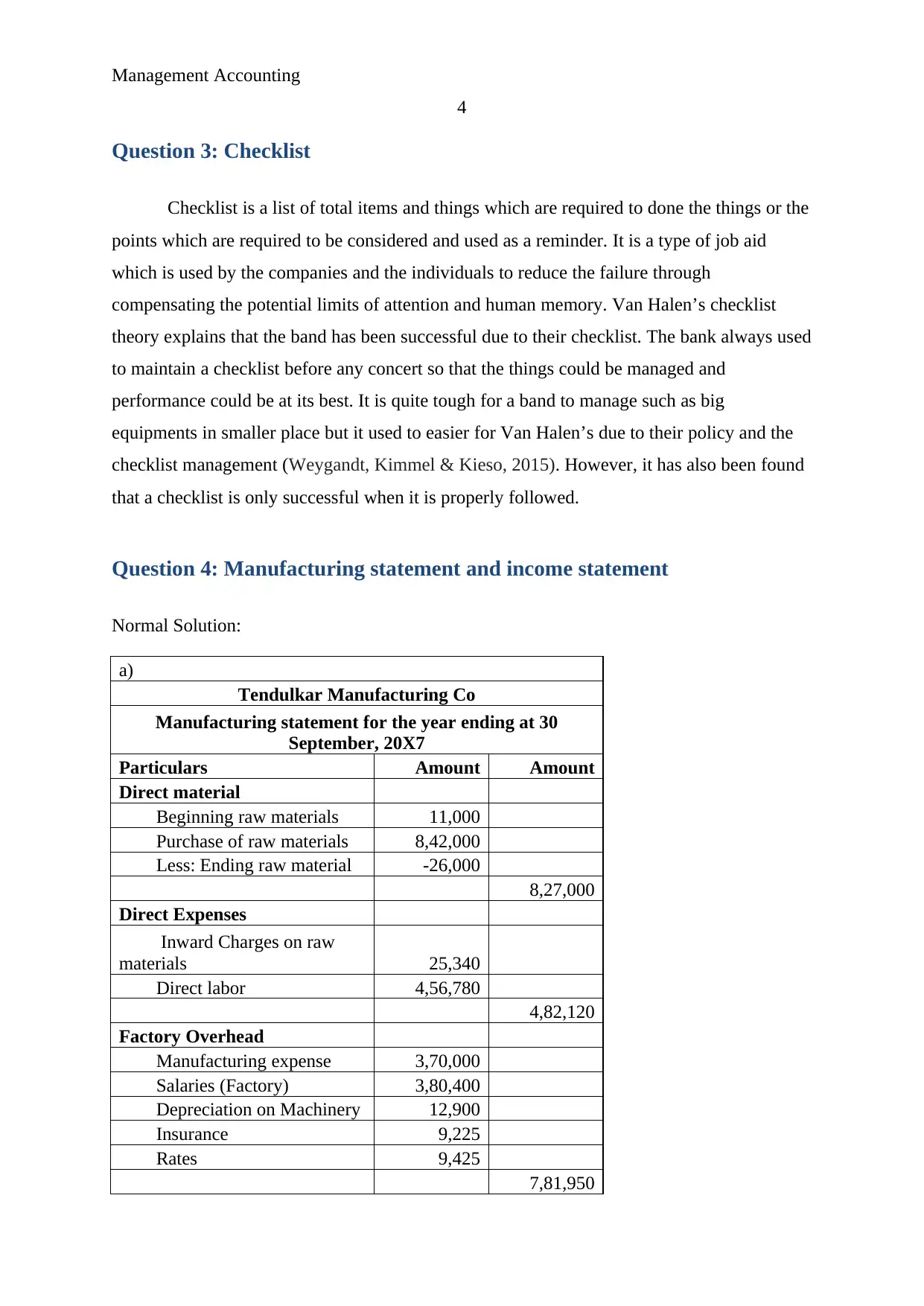

Question 4: Manufacturing statement and income statement

Normal Solution:

a)

Tendulkar Manufacturing Co

Manufacturing statement for the year ending at 30

September, 20X7

Particulars Amount Amount

Direct material

Beginning raw materials 11,000

Purchase of raw materials 8,42,000

Less: Ending raw material -26,000

8,27,000

Direct Expenses

Inward Charges on raw

materials 25,340

Direct labor 4,56,780

4,82,120

Factory Overhead

Manufacturing expense 3,70,000

Salaries (Factory) 3,80,400

Depreciation on Machinery 12,900

Insurance 9,225

Rates 9,425

7,81,950

4

Question 3: Checklist

Checklist is a list of total items and things which are required to done the things or the

points which are required to be considered and used as a reminder. It is a type of job aid

which is used by the companies and the individuals to reduce the failure through

compensating the potential limits of attention and human memory. Van Halen’s checklist

theory explains that the band has been successful due to their checklist. The bank always used

to maintain a checklist before any concert so that the things could be managed and

performance could be at its best. It is quite tough for a band to manage such as big

equipments in smaller place but it used to easier for Van Halen’s due to their policy and the

checklist management (Weygandt, Kimmel & Kieso, 2015). However, it has also been found

that a checklist is only successful when it is properly followed.

Question 4: Manufacturing statement and income statement

Normal Solution:

a)

Tendulkar Manufacturing Co

Manufacturing statement for the year ending at 30

September, 20X7

Particulars Amount Amount

Direct material

Beginning raw materials 11,000

Purchase of raw materials 8,42,000

Less: Ending raw material -26,000

8,27,000

Direct Expenses

Inward Charges on raw

materials 25,340

Direct labor 4,56,780

4,82,120

Factory Overhead

Manufacturing expense 3,70,000

Salaries (Factory) 3,80,400

Depreciation on Machinery 12,900

Insurance 9,225

Rates 9,425

7,81,950

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting

5

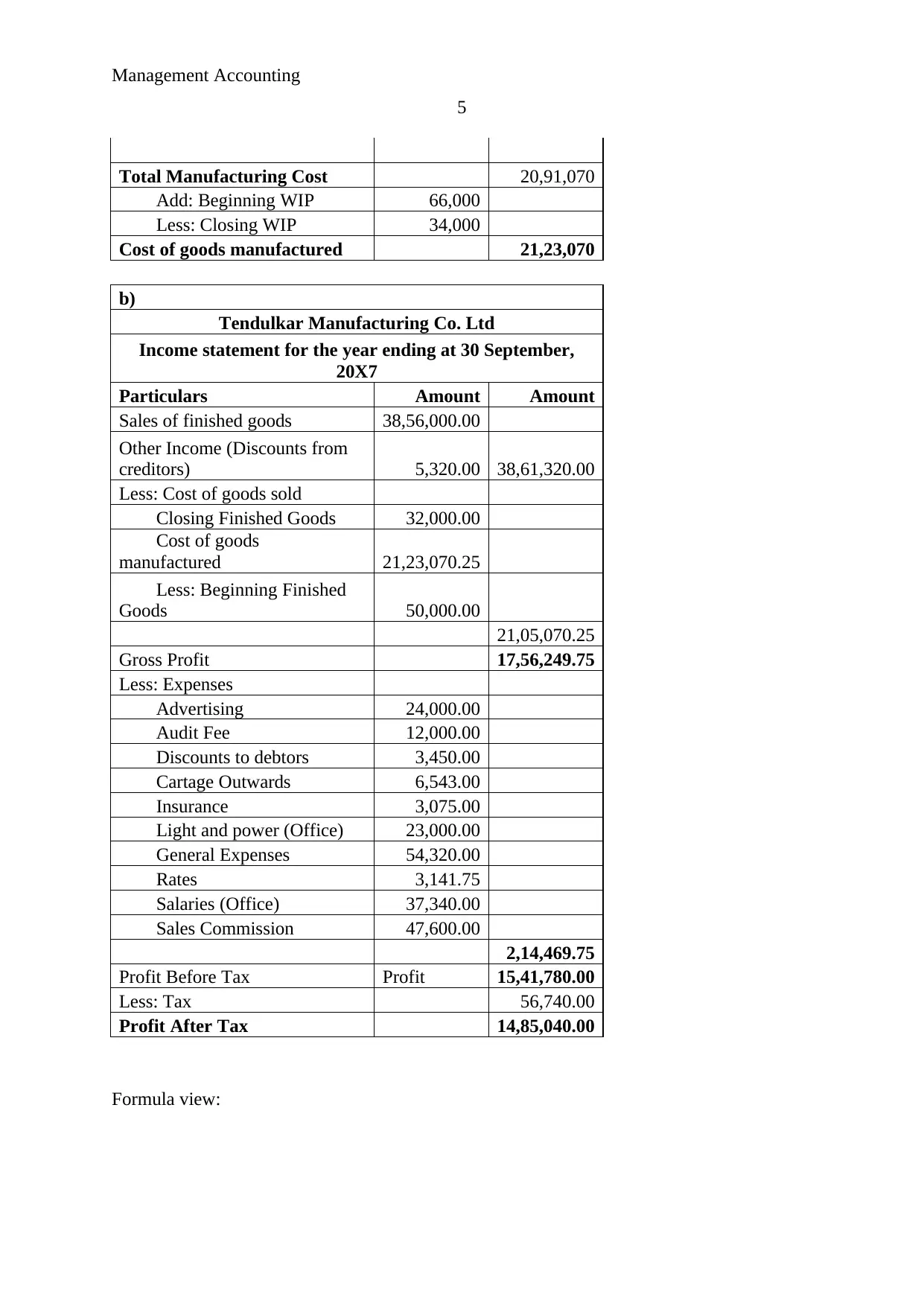

Total Manufacturing Cost 20,91,070

Add: Beginning WIP 66,000

Less: Closing WIP 34,000

Cost of goods manufactured 21,23,070

b)

Tendulkar Manufacturing Co. Ltd

Income statement for the year ending at 30 September,

20X7

Particulars Amount Amount

Sales of finished goods 38,56,000.00

Other Income (Discounts from

creditors) 5,320.00 38,61,320.00

Less: Cost of goods sold

Closing Finished Goods 32,000.00

Cost of goods

manufactured 21,23,070.25

Less: Beginning Finished

Goods 50,000.00

21,05,070.25

Gross Profit 17,56,249.75

Less: Expenses

Advertising 24,000.00

Audit Fee 12,000.00

Discounts to debtors 3,450.00

Cartage Outwards 6,543.00

Insurance 3,075.00

Light and power (Office) 23,000.00

General Expenses 54,320.00

Rates 3,141.75

Salaries (Office) 37,340.00

Sales Commission 47,600.00

2,14,469.75

Profit Before Tax Profit 15,41,780.00

Less: Tax 56,740.00

Profit After Tax 14,85,040.00

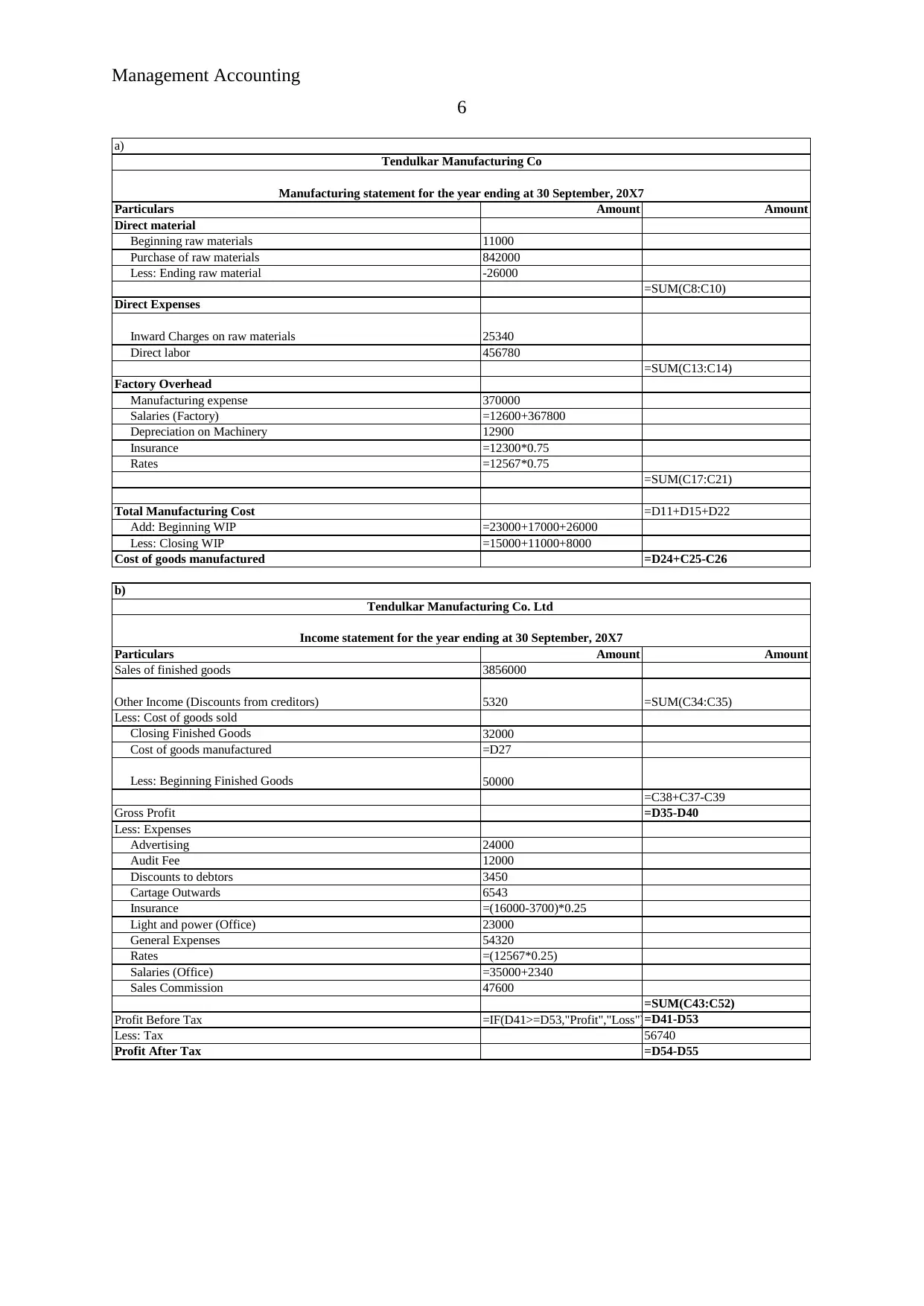

Formula view:

5

Total Manufacturing Cost 20,91,070

Add: Beginning WIP 66,000

Less: Closing WIP 34,000

Cost of goods manufactured 21,23,070

b)

Tendulkar Manufacturing Co. Ltd

Income statement for the year ending at 30 September,

20X7

Particulars Amount Amount

Sales of finished goods 38,56,000.00

Other Income (Discounts from

creditors) 5,320.00 38,61,320.00

Less: Cost of goods sold

Closing Finished Goods 32,000.00

Cost of goods

manufactured 21,23,070.25

Less: Beginning Finished

Goods 50,000.00

21,05,070.25

Gross Profit 17,56,249.75

Less: Expenses

Advertising 24,000.00

Audit Fee 12,000.00

Discounts to debtors 3,450.00

Cartage Outwards 6,543.00

Insurance 3,075.00

Light and power (Office) 23,000.00

General Expenses 54,320.00

Rates 3,141.75

Salaries (Office) 37,340.00

Sales Commission 47,600.00

2,14,469.75

Profit Before Tax Profit 15,41,780.00

Less: Tax 56,740.00

Profit After Tax 14,85,040.00

Formula view:

Management Accounting

6

Particulars Amount Amount

Direct material

Beginning raw materials 11000

Purchase of raw materials 842000

Less: Ending raw material -26000

=SUM(C8:C10)

Direct Expenses

Inward Charges on raw materials 25340

Direct labor 456780

=SUM(C13:C14)

Factory Overhead

Manufacturing expense 370000

Salaries (Factory) =12600+367800

Depreciation on Machinery 12900

Insurance =12300*0.75

Rates =12567*0.75

=SUM(C17:C21)

Total Manufacturing Cost =D11+D15+D22

Add: Beginning WIP =23000+17000+26000

Less: Closing WIP =15000+11000+8000

Cost of goods manufactured =D24+C25-C26

Particulars Amount Amount

Sales of finished goods 3856000

Other Income (Discounts from creditors) 5320 =SUM(C34:C35)

Less: Cost of goods sold

Closing Finished Goods 32000

Cost of goods manufactured =D27

Less: Beginning Finished Goods 50000

=C38+C37-C39

Gross Profit =D35-D40

Less: Expenses

Advertising 24000

Audit Fee 12000

Discounts to debtors 3450

Cartage Outwards 6543

Insurance =(16000-3700)*0.25

Light and power (Office) 23000

General Expenses 54320

Rates =(12567*0.25)

Salaries (Office) =35000+2340

Sales Commission 47600

=SUM(C43:C52)

Profit Before Tax =IF(D41>=D53,"Profit","Loss")=D41-D53

Less: Tax 56740

Profit After Tax =D54-D55

Tendulkar Manufacturing Co

Manufacturing statement for the year ending at 30 September, 20X7

Tendulkar Manufacturing Co. Ltd

Income statement for the year ending at 30 September, 20X7

a)

b)

6

Particulars Amount Amount

Direct material

Beginning raw materials 11000

Purchase of raw materials 842000

Less: Ending raw material -26000

=SUM(C8:C10)

Direct Expenses

Inward Charges on raw materials 25340

Direct labor 456780

=SUM(C13:C14)

Factory Overhead

Manufacturing expense 370000

Salaries (Factory) =12600+367800

Depreciation on Machinery 12900

Insurance =12300*0.75

Rates =12567*0.75

=SUM(C17:C21)

Total Manufacturing Cost =D11+D15+D22

Add: Beginning WIP =23000+17000+26000

Less: Closing WIP =15000+11000+8000

Cost of goods manufactured =D24+C25-C26

Particulars Amount Amount

Sales of finished goods 3856000

Other Income (Discounts from creditors) 5320 =SUM(C34:C35)

Less: Cost of goods sold

Closing Finished Goods 32000

Cost of goods manufactured =D27

Less: Beginning Finished Goods 50000

=C38+C37-C39

Gross Profit =D35-D40

Less: Expenses

Advertising 24000

Audit Fee 12000

Discounts to debtors 3450

Cartage Outwards 6543

Insurance =(16000-3700)*0.25

Light and power (Office) 23000

General Expenses 54320

Rates =(12567*0.25)

Salaries (Office) =35000+2340

Sales Commission 47600

=SUM(C43:C52)

Profit Before Tax =IF(D41>=D53,"Profit","Loss")=D41-D53

Less: Tax 56740

Profit After Tax =D54-D55

Tendulkar Manufacturing Co

Manufacturing statement for the year ending at 30 September, 20X7

Tendulkar Manufacturing Co. Ltd

Income statement for the year ending at 30 September, 20X7

a)

b)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management Accounting

7

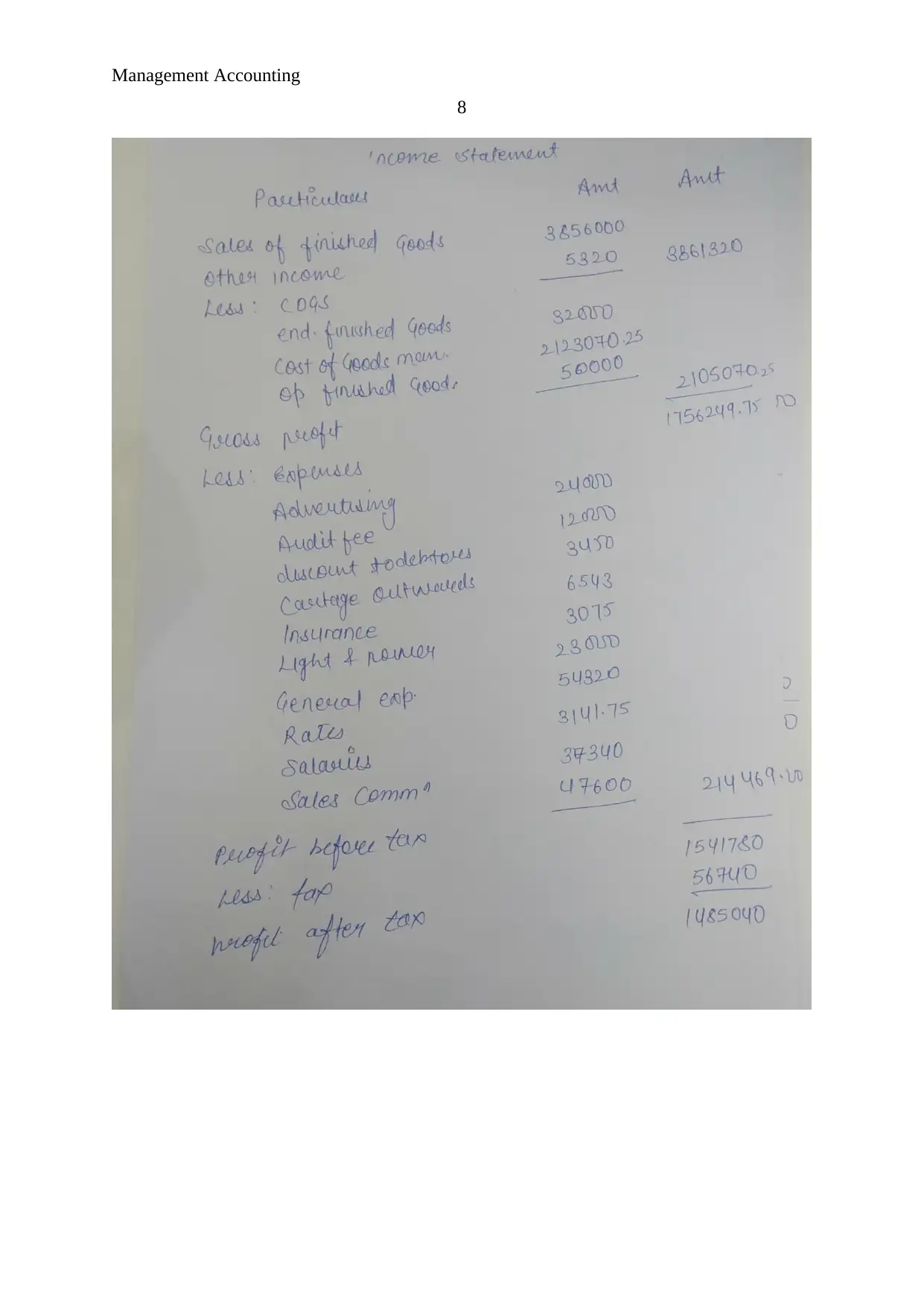

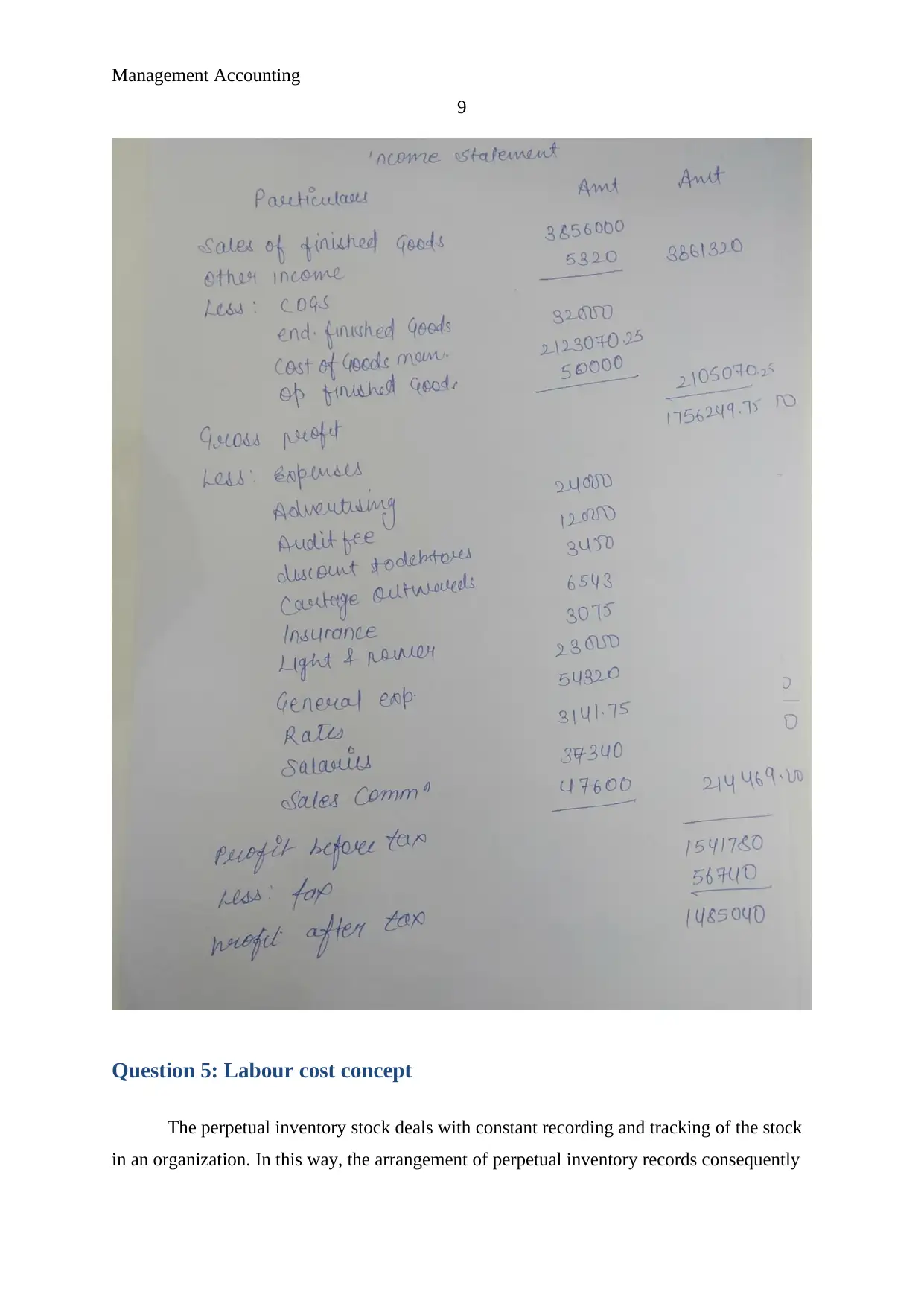

Manual:

7

Manual:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting

8

8

Management Accounting

9

Question 5: Labour cost concept

The perpetual inventory stock deals with constant recording and tracking of the stock

in an organization. In this way, the arrangement of perpetual inventory records consequently

9

Question 5: Labour cost concept

The perpetual inventory stock deals with constant recording and tracking of the stock

in an organization. In this way, the arrangement of perpetual inventory records consequently

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management Accounting

10

inventory and update the inventory system of the company. Since, the stock evidences are

reorganized on continuous premise, accordingly, it is required for the companies to update

and tally the inventory system to manage the performance of the company. It epxlians about

the cost of goods sold of the company (Coper and Kaplan, 2012).

Further, it explains that the overtime payment should be treated as overhead as this

cost could be controlled by the company.

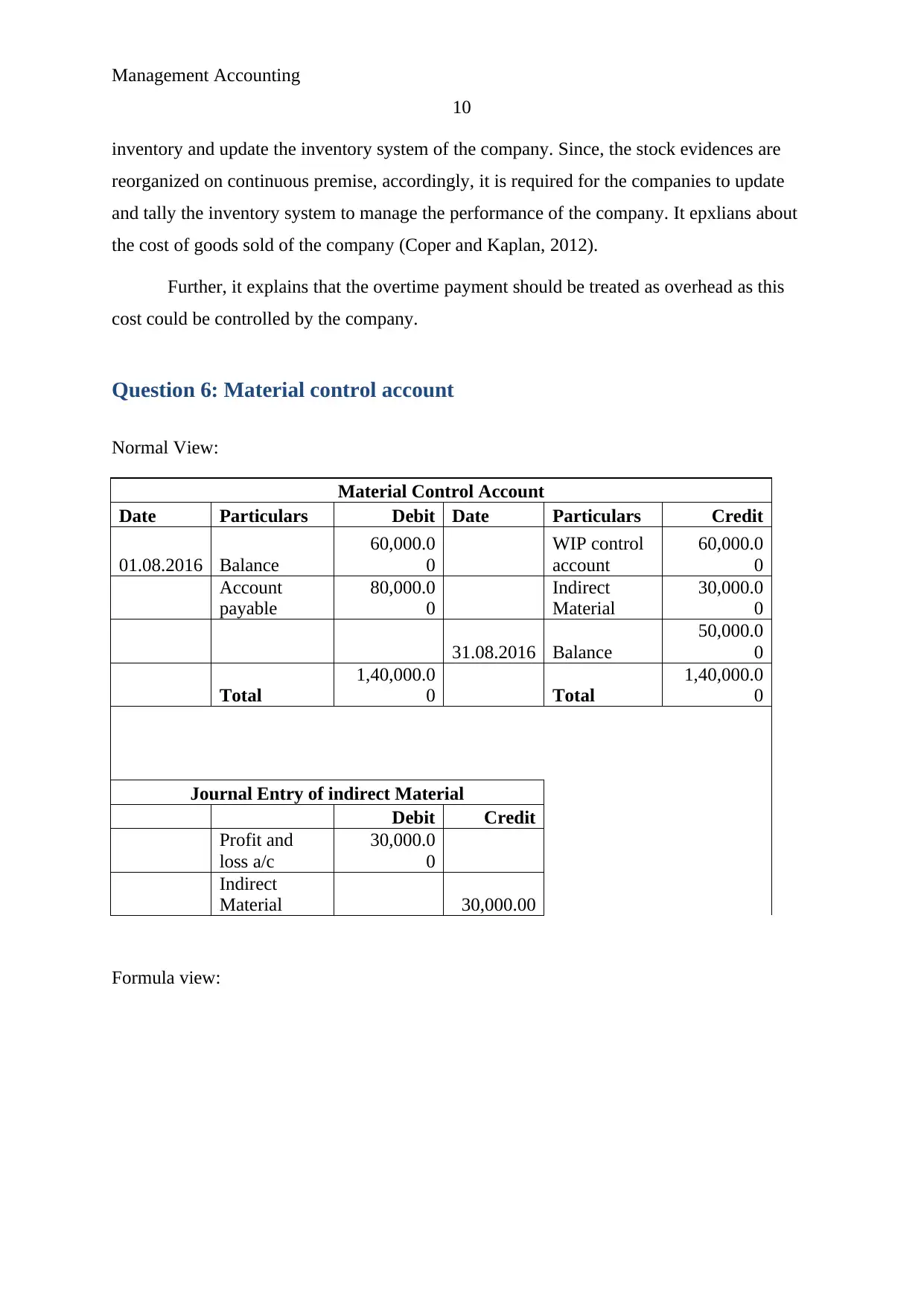

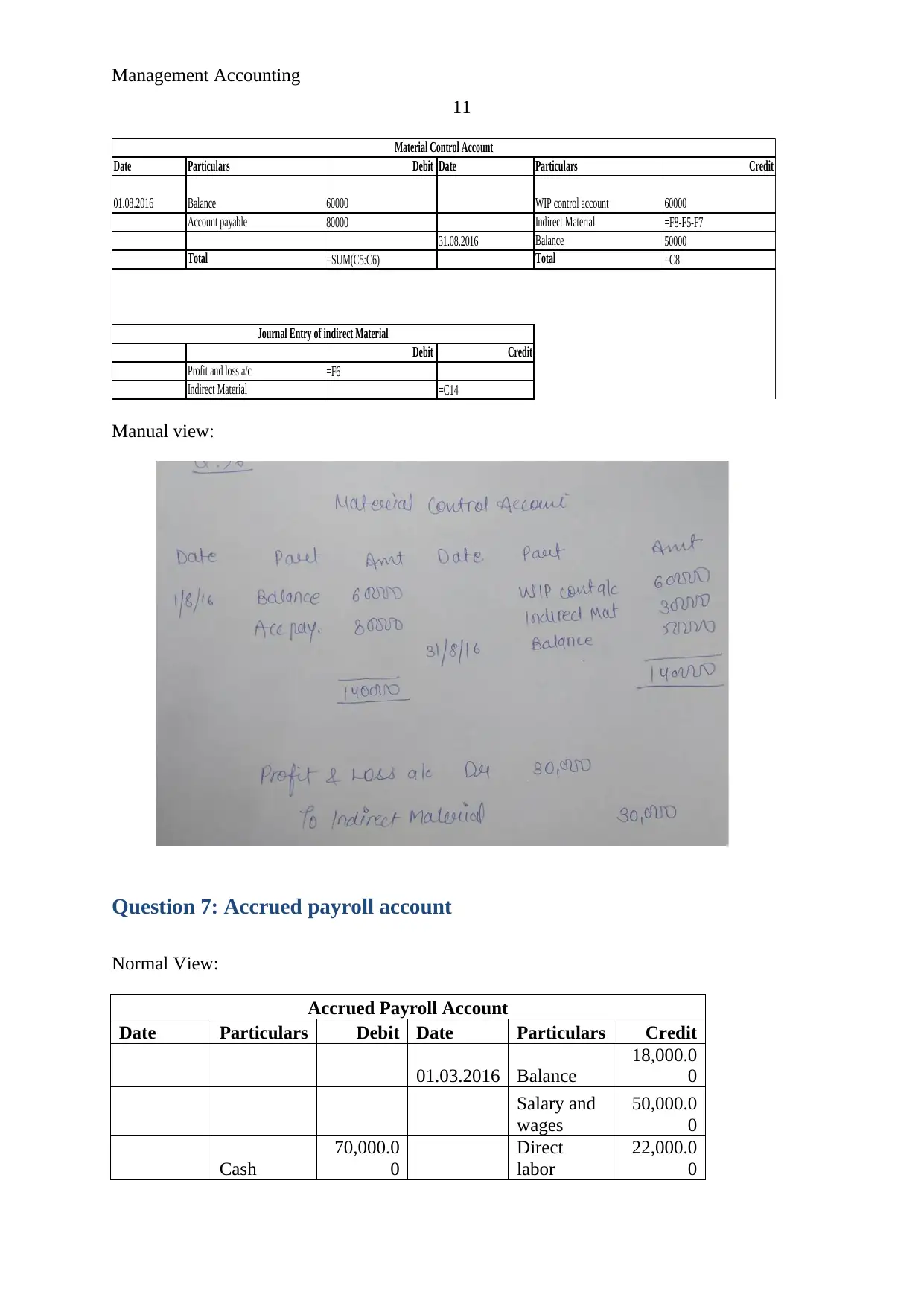

Question 6: Material control account

Normal View:

Material Control Account

Date Particulars Debit Date Particulars Credit

01.08.2016 Balance

60,000.0

0

WIP control

account

60,000.0

0

Account

payable

80,000.0

0

Indirect

Material

30,000.0

0

31.08.2016 Balance

50,000.0

0

Total

1,40,000.0

0 Total

1,40,000.0

0

Journal Entry of indirect Material

Debit Credit

Profit and

loss a/c

30,000.0

0

Indirect

Material 30,000.00

Formula view:

10

inventory and update the inventory system of the company. Since, the stock evidences are

reorganized on continuous premise, accordingly, it is required for the companies to update

and tally the inventory system to manage the performance of the company. It epxlians about

the cost of goods sold of the company (Coper and Kaplan, 2012).

Further, it explains that the overtime payment should be treated as overhead as this

cost could be controlled by the company.

Question 6: Material control account

Normal View:

Material Control Account

Date Particulars Debit Date Particulars Credit

01.08.2016 Balance

60,000.0

0

WIP control

account

60,000.0

0

Account

payable

80,000.0

0

Indirect

Material

30,000.0

0

31.08.2016 Balance

50,000.0

0

Total

1,40,000.0

0 Total

1,40,000.0

0

Journal Entry of indirect Material

Debit Credit

Profit and

loss a/c

30,000.0

0

Indirect

Material 30,000.00

Formula view:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting

11

Date Particulars Debit Date Particulars Credit

01.08.2016 Balance 60000 WIP control account 60000

Account payable 80000 Indirect Material =F8-F5-F7

31.08.2016 Balance 50000

Total =SUM(C5:C6) Total =C8

Debit Credit

Profit and loss a/c =F6

Indirect Material =C14

Material Control Account

Journal Entry of indirect Material

Manual view:

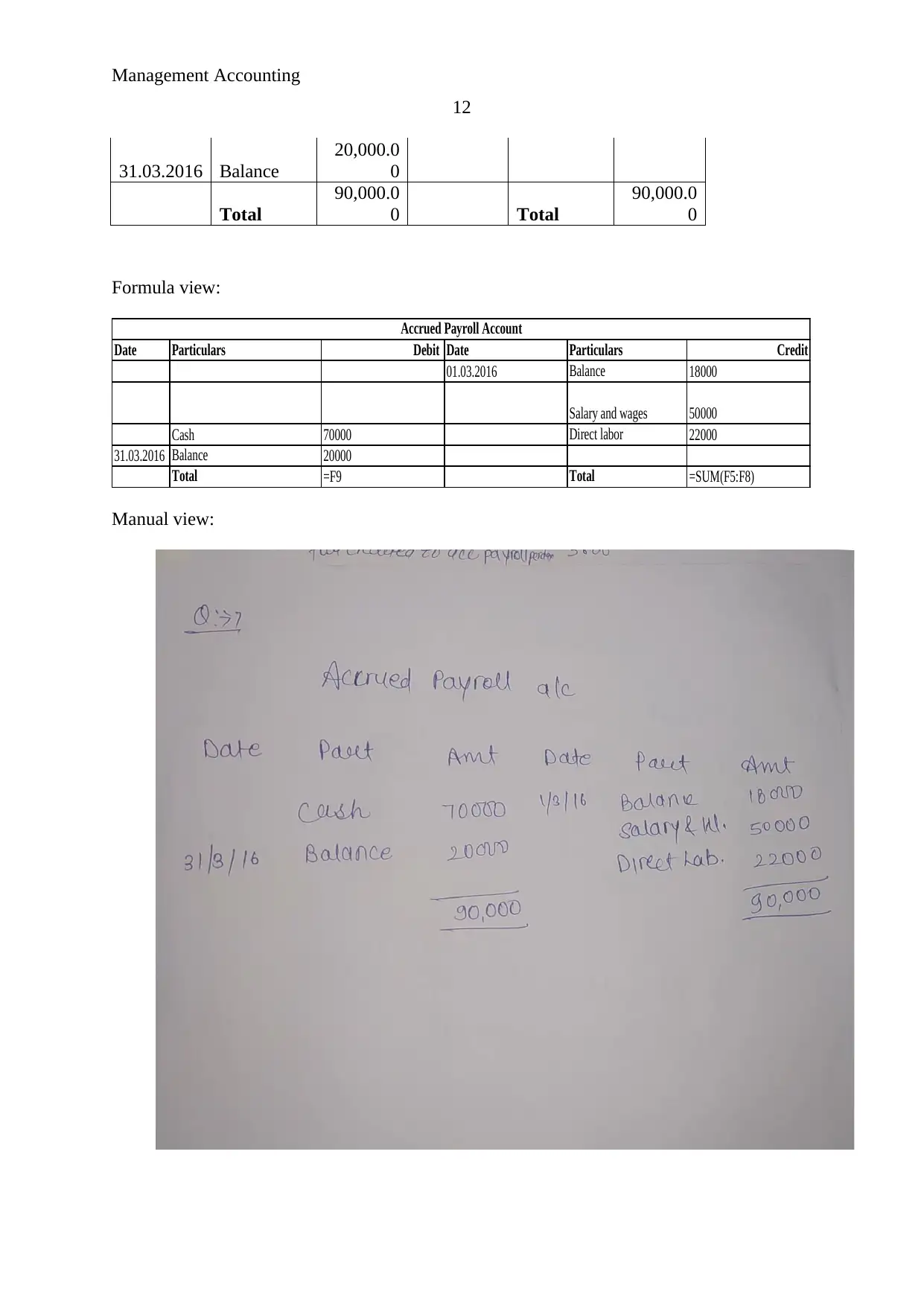

Question 7: Accrued payroll account

Normal View:

Accrued Payroll Account

Date Particulars Debit Date Particulars Credit

01.03.2016 Balance

18,000.0

0

Salary and

wages

50,000.0

0

Cash

70,000.0

0

Direct

labor

22,000.0

0

11

Date Particulars Debit Date Particulars Credit

01.08.2016 Balance 60000 WIP control account 60000

Account payable 80000 Indirect Material =F8-F5-F7

31.08.2016 Balance 50000

Total =SUM(C5:C6) Total =C8

Debit Credit

Profit and loss a/c =F6

Indirect Material =C14

Material Control Account

Journal Entry of indirect Material

Manual view:

Question 7: Accrued payroll account

Normal View:

Accrued Payroll Account

Date Particulars Debit Date Particulars Credit

01.03.2016 Balance

18,000.0

0

Salary and

wages

50,000.0

0

Cash

70,000.0

0

Direct

labor

22,000.0

0

Management Accounting

12

31.03.2016 Balance

20,000.0

0

Total

90,000.0

0 Total

90,000.0

0

Formula view:

Date Particulars Debit Date Particulars Credit

01.03.2016 Balance 18000

Salary and wages 50000

Cash 70000 Direct labor 22000

31.03.2016 Balance 20000

Total =F9 Total =SUM(F5:F8)

Accrued Payroll Account

Manual view:

12

31.03.2016 Balance

20,000.0

0

Total

90,000.0

0 Total

90,000.0

0

Formula view:

Date Particulars Debit Date Particulars Credit

01.03.2016 Balance 18000

Salary and wages 50000

Cash 70000 Direct labor 22000

31.03.2016 Balance 20000

Total =F9 Total =SUM(F5:F8)

Accrued Payroll Account

Manual view:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.