FNSACC517 Cost Production Report & Activity Based Costing Analysis

VerifiedAdded on 2023/06/18

|5

|797

|372

Homework Assignment

AI Summary

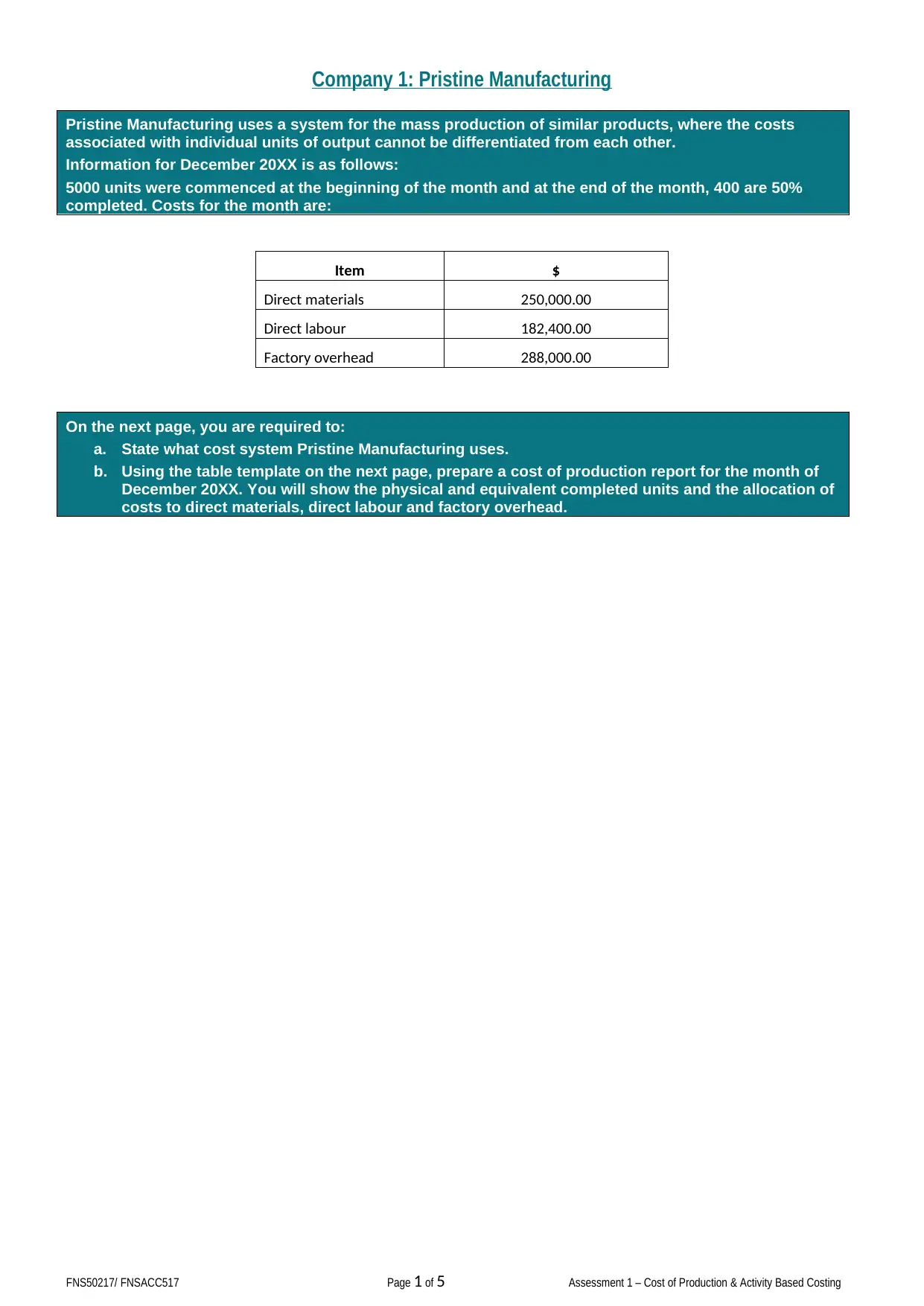

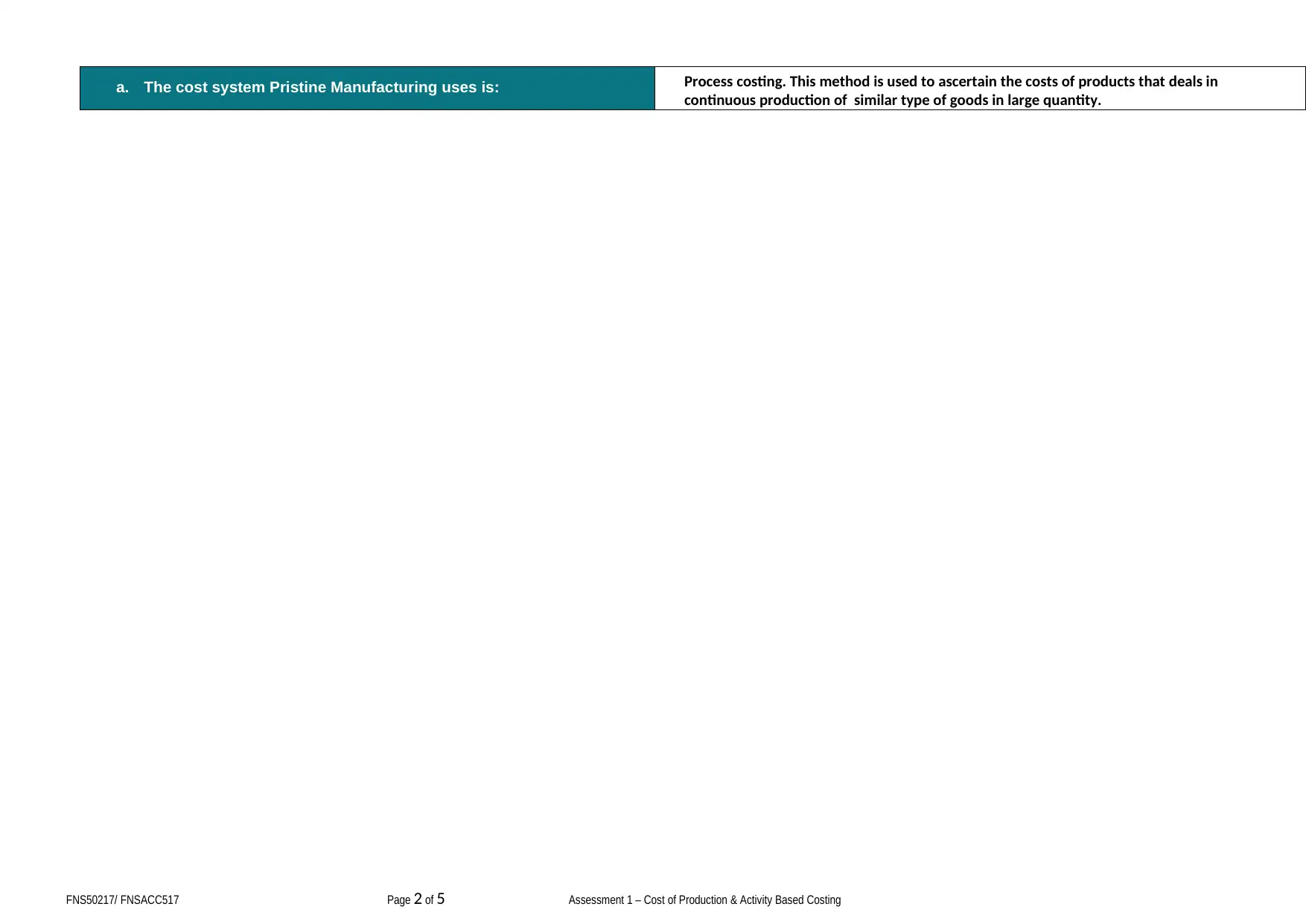

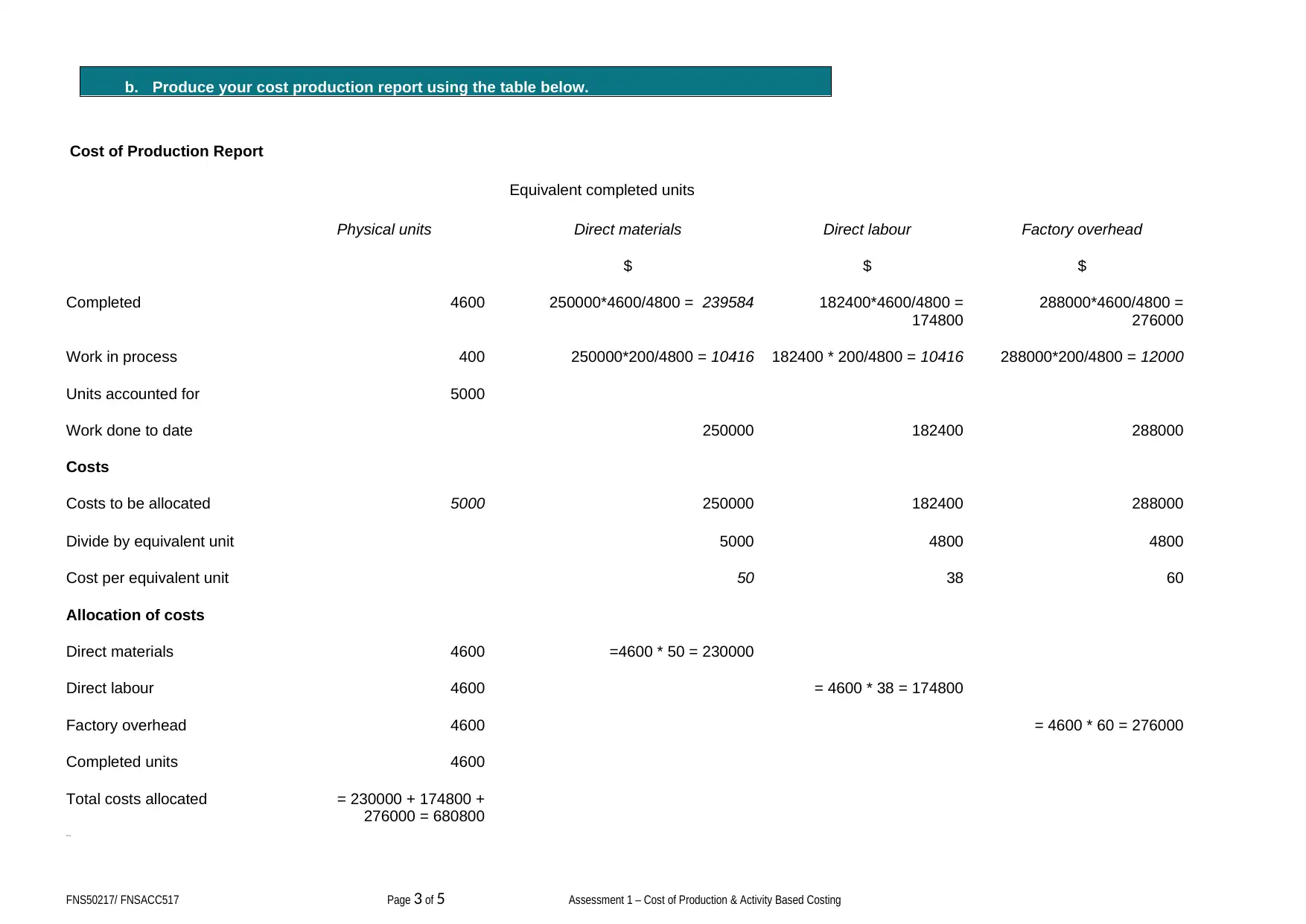

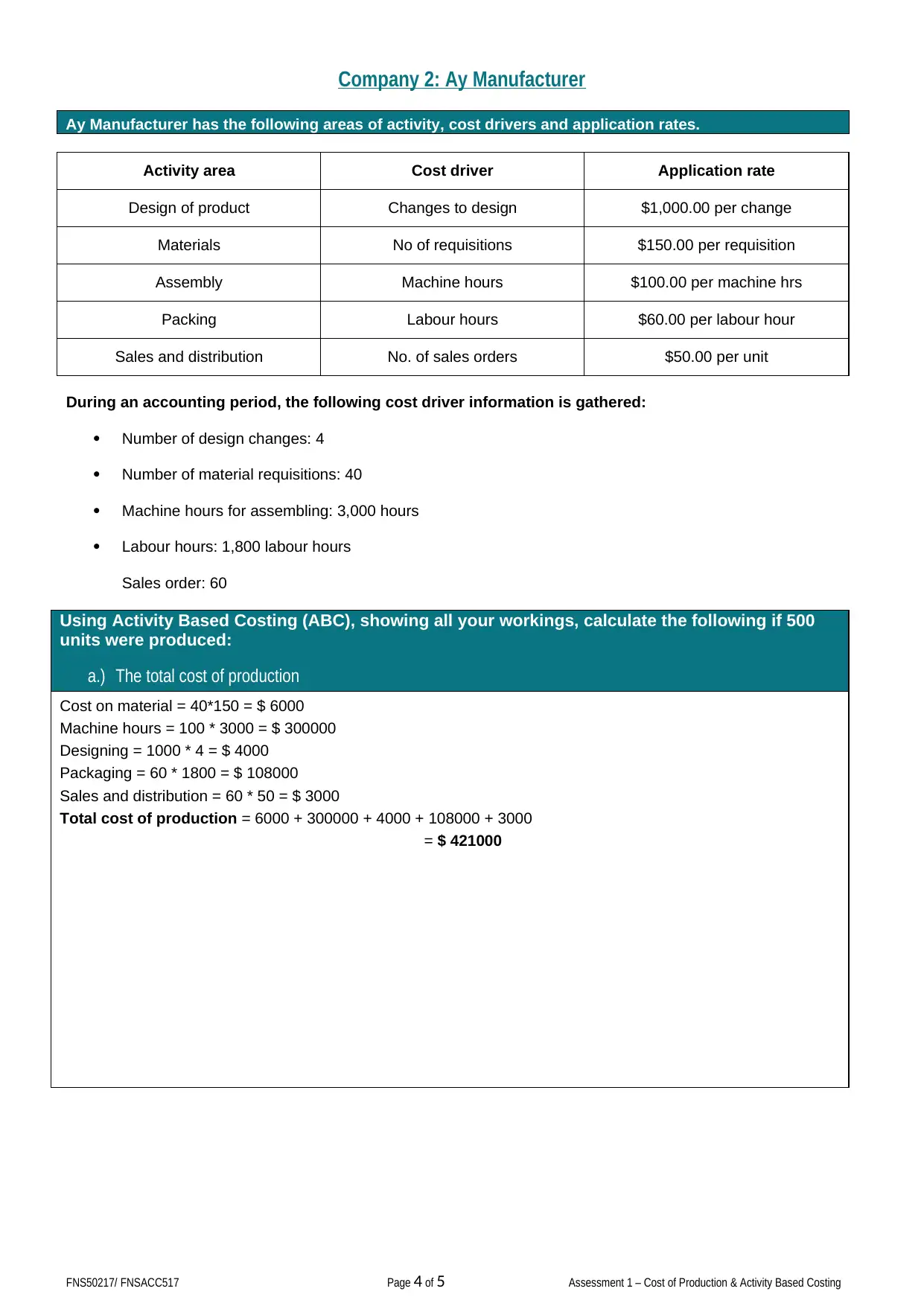

This assignment solution demonstrates the application of process costing and activity-based costing (ABC) in a manufacturing context. It begins with Company 1, Pristine Manufacturing, which uses process costing for its mass production. The solution provides a cost of production report for December 20XX, detailing the calculation of equivalent units, allocation of direct materials, direct labor, and factory overhead costs. The report includes completed units and work-in-process. For Company 2, Ay Manufacturer, the assignment applies ABC to calculate the total cost of production and cost per unit based on various activities such as product design, materials requisition, assembly, packing, and sales distribution. The solution breaks down the direct manufacturing costs, indirect costs, and overall cost per unit, providing a comprehensive understanding of cost drivers and their impact on production costs. Desklib offers a wide range of similar solved assignments and study resources for students.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)