Detailed Analysis of Costs and Revenues for Decision Making

VerifiedAdded on 2020/10/22

|18

|4722

|421

Report

AI Summary

This report provides a comprehensive analysis of cost and revenue management within an organization. It begins by outlining the purpose of internal reporting and the relationships between different costing systems, including marginal, absorption, standard, and historical costing. The report then delves into responsibility centers, cost classifications, and the differences between marginal and absorption costing. Task 2 focuses on recording and analyzing cost information for materials, labor, and expenses, alongside inventory valuation methods (FIFO, LIFO, and weighted average) and cost behavior (fixed, variable, semi-variable). Overhead cost allocation, absorption rates, and variance adjustments are discussed in Task 3. Task 4 examines the comparison of budgeted and actual costs, variance analysis for management reports, and the formulation of management reports. Finally, Task 5 explores estimates of future income and costs, the effect of changing activity levels on unit costs, and factors affecting short-term and long-term decision-making. The report concludes with an overview of the key concepts and findings, emphasizing their importance in financial management.

Costs and Revenues

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Purpose of internal reporting and providing accurate information to management:............1

1.2 Relationship between various costing systems within an organisation:...............................1

1.3 Responsibility centres, cost centres, profit centres and investment centres within an

organisation:................................................................................................................................2

1.4 Characteristics of different types of cost classifications and their use in costing:................2

1.5 Differences between marginal and absorption costing:........................................................3

TASK 2............................................................................................................................................4

2.1 Record of cost information for material, labour and expenses:............................................4

2.2 Analysis of cost information for material, labour and expenses:..........................................4

2.3 Various stages of Inventory:.................................................................................................5

2.4 Valuation of inventories:.......................................................................................................5

2.5 behaviour of these costs:.......................................................................................................7

2.6 Record of cost information using different costing systems:................................................7

TASK 3............................................................................................................................................8

3.1 Attribution of overhead cost to production and service cost centres:...................................8

3.2 Calculation of overhead absorption rate:..............................................................................8

3.3 adjustment for under and over recovered overhead cost:......................................................9

Overhead rate per machine hours: -............................................................................................9

Over and under absorption: -.......................................................................................................9

3.4 Methods of allocation, apportionment and absorption at regular intervals:........................10

3.5 Communication with staff to resolve queries related to overhead cost data.......................10

TASK 4..........................................................................................................................................10

4.1 Comparison of budgeted and actual costs noting any variances.........................................10

4.2 Analysis of variances for management reports...................................................................11

4.3 Information for budget holders of any significant variances:.............................................11

4.4 Formulation of management reports in an appropriate format...........................................12

TASK 5..........................................................................................................................................12

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Purpose of internal reporting and providing accurate information to management:............1

1.2 Relationship between various costing systems within an organisation:...............................1

1.3 Responsibility centres, cost centres, profit centres and investment centres within an

organisation:................................................................................................................................2

1.4 Characteristics of different types of cost classifications and their use in costing:................2

1.5 Differences between marginal and absorption costing:........................................................3

TASK 2............................................................................................................................................4

2.1 Record of cost information for material, labour and expenses:............................................4

2.2 Analysis of cost information for material, labour and expenses:..........................................4

2.3 Various stages of Inventory:.................................................................................................5

2.4 Valuation of inventories:.......................................................................................................5

2.5 behaviour of these costs:.......................................................................................................7

2.6 Record of cost information using different costing systems:................................................7

TASK 3............................................................................................................................................8

3.1 Attribution of overhead cost to production and service cost centres:...................................8

3.2 Calculation of overhead absorption rate:..............................................................................8

3.3 adjustment for under and over recovered overhead cost:......................................................9

Overhead rate per machine hours: -............................................................................................9

Over and under absorption: -.......................................................................................................9

3.4 Methods of allocation, apportionment and absorption at regular intervals:........................10

3.5 Communication with staff to resolve queries related to overhead cost data.......................10

TASK 4..........................................................................................................................................10

4.1 Comparison of budgeted and actual costs noting any variances.........................................10

4.2 Analysis of variances for management reports...................................................................11

4.3 Information for budget holders of any significant variances:.............................................11

4.4 Formulation of management reports in an appropriate format...........................................12

TASK 5..........................................................................................................................................12

5.1 Estimates of future income and costs for decision making................................................12

5.2 Effect of changing activity levels on unit costs..................................................................13

5.3 The effect of changing activity levels on unit costs............................................................13

5.4 Factors affecting short-term and long-term decision making.............................................14

CONCLUSION .............................................................................................................................14

Books and journals....................................................................................................................15

5.2 Effect of changing activity levels on unit costs..................................................................13

5.3 The effect of changing activity levels on unit costs............................................................13

5.4 Factors affecting short-term and long-term decision making.............................................14

CONCLUSION .............................................................................................................................14

Books and journals....................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Cost and revenues can be termed as a total cost of manufacturing and delivering a

product. In simple words, cost can be said as what is spent where revenue as what is earned. It is

found in the annual accounting statement of a company. Cost and revenues include expenses like

wages, administration cost, marketing and advertising costs, etc. In this report the discussion is

all about nature and role of costing system within an organisation, recording and analysing cost

information. Also, apportion costs according to organisational requirements, analysing deviations

from budget and reporting these to management and use of collected information from costing

system to assist decision-making (Burchell and Listokin, 2012).

TASK 1

1.1 Purpose of internal reporting and providing accurate information to management:

Internal management reporting system is the part of management control system which

provides necessary business information and financial outcomes. The main purpose of internal

reporting is to improve decision making ability with responsiveness to subjective issue. It also

helps to find out the problems in an organisation with there best alternative solutions (Terpstra

and Verbeeten, 2014).

1.2 Relationship between various costing systems within an organisation:

There are different types of costing systems which can be implemented by an

organisation according to the nature of entity which are as follows:

Marginal costing: It is a costing technique wherein the marginal cost, i.e. variable

cost is charged to unit of cost, while fixed cost for the period is completely written

off against the contribution.

Absorption costing: Absorption Costing is a method of costing a product in which

all fixed cost and variable cost are calculated to cost centre where they are

accounted for using absorption rates.

Standard costing: It is the method of costing, where certain standard rates are set

to compare with actual cost for determining causes of variance so corrective

measures can be taken for enhancement.

1

Cost and revenues can be termed as a total cost of manufacturing and delivering a

product. In simple words, cost can be said as what is spent where revenue as what is earned. It is

found in the annual accounting statement of a company. Cost and revenues include expenses like

wages, administration cost, marketing and advertising costs, etc. In this report the discussion is

all about nature and role of costing system within an organisation, recording and analysing cost

information. Also, apportion costs according to organisational requirements, analysing deviations

from budget and reporting these to management and use of collected information from costing

system to assist decision-making (Burchell and Listokin, 2012).

TASK 1

1.1 Purpose of internal reporting and providing accurate information to management:

Internal management reporting system is the part of management control system which

provides necessary business information and financial outcomes. The main purpose of internal

reporting is to improve decision making ability with responsiveness to subjective issue. It also

helps to find out the problems in an organisation with there best alternative solutions (Terpstra

and Verbeeten, 2014).

1.2 Relationship between various costing systems within an organisation:

There are different types of costing systems which can be implemented by an

organisation according to the nature of entity which are as follows:

Marginal costing: It is a costing technique wherein the marginal cost, i.e. variable

cost is charged to unit of cost, while fixed cost for the period is completely written

off against the contribution.

Absorption costing: Absorption Costing is a method of costing a product in which

all fixed cost and variable cost are calculated to cost centre where they are

accounted for using absorption rates.

Standard costing: It is the method of costing, where certain standard rates are set

to compare with actual cost for determining causes of variance so corrective

measures can be taken for enhancement.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Historical costing: In this method of costing, determination of cost are obtained

from actual cost only once it is incurred. As a result, every organisation adopts

this method of costing for better result (Graham, 2013).

In context of B&M, the company uses the absorption costing and historical costing where

they observe previous cost for analyses and absorption costing for net profit after including all

expenses related to fixed and variable cost, where they have a relation which shows how to

increase organisation's profit.

1.3 Responsibility centres, cost centres, profit centres and investment centres within an

organisation:

Responsibility Centre: It is an organisational unit directed by manager, who have

supreme authority for managing activities. In responsibility centre, all information

related to revenues and cost are collected. In terms of B&M, manager have the

responsibility to manage issue relating revenues and cost.

Cost centres: It is the department within a organisation to determine cost but

which do not add direct profit. Some of the departments of cost centre are R&D

department, Marketing department, etc. In context of B&M, different department

have been made who is responsible for all works related to cost centre and any

issue regarding various department of cost centre (da Cruz, Simões and Marques,

2012).

Profit centres: This centres are included in the part of business to make

appreciable contribution in the organisation's profit. The manager of profit centre

are held accountable for asset and liability.

Investment centres: It is the department in which the responsibility to control

revenues and associated costs, assets and liabilities. The performance of

investment centre is judged on return on investment (ROI) incurred.

1.4 Characteristics of different types of cost classifications and their use in costing:

The different characteristics of cost classifications and their use in costing are as under:

2

from actual cost only once it is incurred. As a result, every organisation adopts

this method of costing for better result (Graham, 2013).

In context of B&M, the company uses the absorption costing and historical costing where

they observe previous cost for analyses and absorption costing for net profit after including all

expenses related to fixed and variable cost, where they have a relation which shows how to

increase organisation's profit.

1.3 Responsibility centres, cost centres, profit centres and investment centres within an

organisation:

Responsibility Centre: It is an organisational unit directed by manager, who have

supreme authority for managing activities. In responsibility centre, all information

related to revenues and cost are collected. In terms of B&M, manager have the

responsibility to manage issue relating revenues and cost.

Cost centres: It is the department within a organisation to determine cost but

which do not add direct profit. Some of the departments of cost centre are R&D

department, Marketing department, etc. In context of B&M, different department

have been made who is responsible for all works related to cost centre and any

issue regarding various department of cost centre (da Cruz, Simões and Marques,

2012).

Profit centres: This centres are included in the part of business to make

appreciable contribution in the organisation's profit. The manager of profit centre

are held accountable for asset and liability.

Investment centres: It is the department in which the responsibility to control

revenues and associated costs, assets and liabilities. The performance of

investment centre is judged on return on investment (ROI) incurred.

1.4 Characteristics of different types of cost classifications and their use in costing:

The different characteristics of cost classifications and their use in costing are as under:

2

Nature of Expenses: In terms of expenses cost can be classified into labour and

material. In this type of cost B & M have categorised their expenses according to

different classes of labour (Raisman, 2013).

Relation to Cost object: The classification is done on the basis of direct cost and

indirect cost. In context of B & M, they have defined duties to their employee's

how they will calculate all the expenses related to direct and indirect cost.

Function/ Activities: In this cost have been categorised into group, such as

production, administration, finance, etc.

The behaviour of Costs: The behaviour of cost changes in accordance with change

in input volume. The different types of behaviour cost are fixed cost, variable

cost, and semi- variable cost.

The purpose of decision-making by management: For selecting best decision for

maximum out with extra profit cost can be classified as opportunity cost, marginal

cost, sunk cost, etc. and many more.

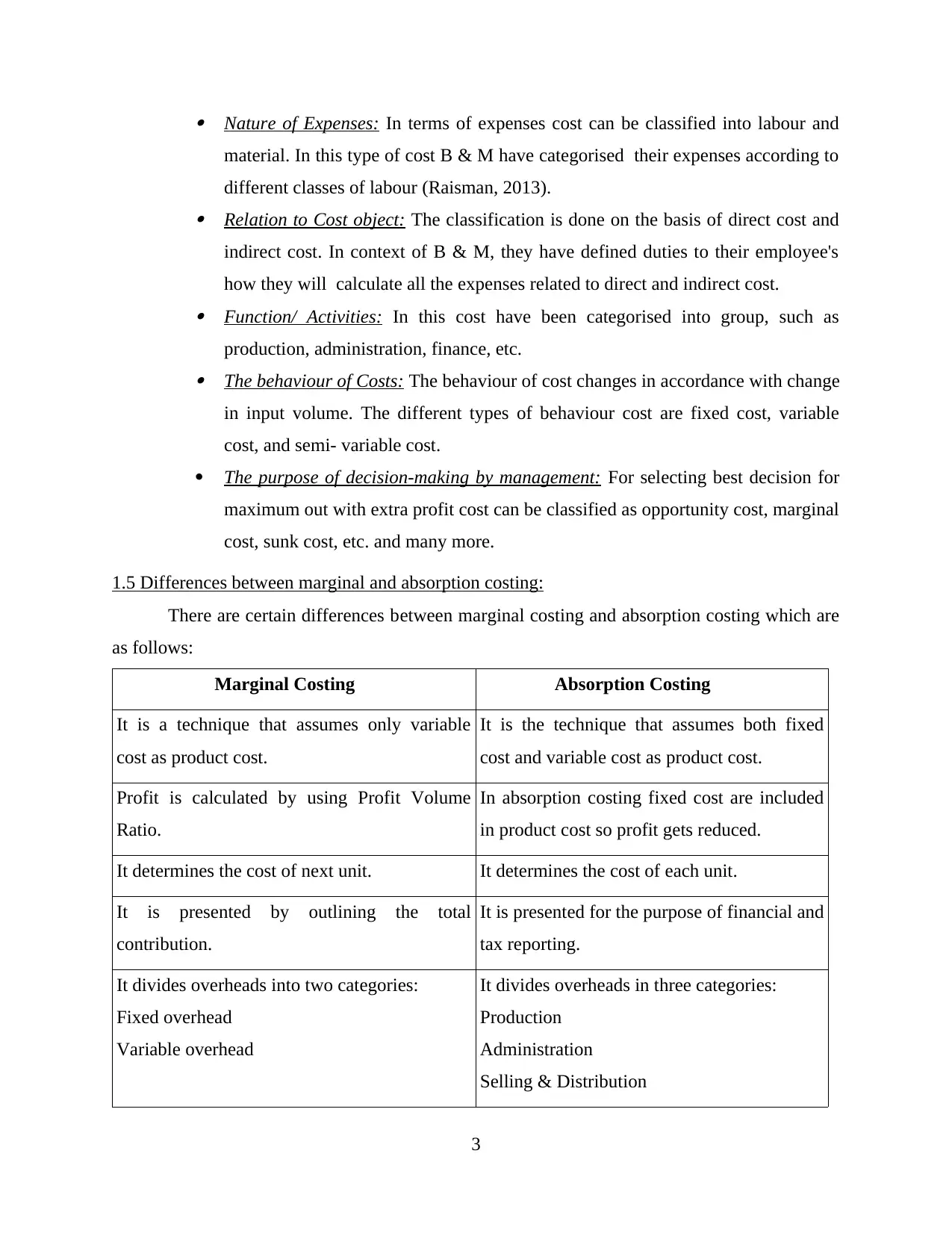

1.5 Differences between marginal and absorption costing:

There are certain differences between marginal costing and absorption costing which are

as follows:

Marginal Costing Absorption Costing

It is a technique that assumes only variable

cost as product cost.

It is the technique that assumes both fixed

cost and variable cost as product cost.

Profit is calculated by using Profit Volume

Ratio.

In absorption costing fixed cost are included

in product cost so profit gets reduced.

It determines the cost of next unit. It determines the cost of each unit.

It is presented by outlining the total

contribution.

It is presented for the purpose of financial and

tax reporting.

It divides overheads into two categories:

Fixed overhead

Variable overhead

It divides overheads in three categories:

Production

Administration

Selling & Distribution

3

material. In this type of cost B & M have categorised their expenses according to

different classes of labour (Raisman, 2013).

Relation to Cost object: The classification is done on the basis of direct cost and

indirect cost. In context of B & M, they have defined duties to their employee's

how they will calculate all the expenses related to direct and indirect cost.

Function/ Activities: In this cost have been categorised into group, such as

production, administration, finance, etc.

The behaviour of Costs: The behaviour of cost changes in accordance with change

in input volume. The different types of behaviour cost are fixed cost, variable

cost, and semi- variable cost.

The purpose of decision-making by management: For selecting best decision for

maximum out with extra profit cost can be classified as opportunity cost, marginal

cost, sunk cost, etc. and many more.

1.5 Differences between marginal and absorption costing:

There are certain differences between marginal costing and absorption costing which are

as follows:

Marginal Costing Absorption Costing

It is a technique that assumes only variable

cost as product cost.

It is the technique that assumes both fixed

cost and variable cost as product cost.

Profit is calculated by using Profit Volume

Ratio.

In absorption costing fixed cost are included

in product cost so profit gets reduced.

It determines the cost of next unit. It determines the cost of each unit.

It is presented by outlining the total

contribution.

It is presented for the purpose of financial and

tax reporting.

It divides overheads into two categories:

Fixed overhead

Variable overhead

It divides overheads in three categories:

Production

Administration

Selling & Distribution

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In context of B & M, they uses Absorption costing to find accurate result as it includes

all fixed and variable cost to its cost centre so accurate net profit can be obtained.

TASK 2

2.1 Record of cost information for material, labour and expenses:

Costing procedure implemented in any organisation defines as an activity of recording

costs in appropriate accounts so that actual cost can be calculated for manufacturing process as

an individual basis and for whole manufacturing process. In any organisation, there are various

kind of costs that are incurred due to business operations (Gensler, Leeflang and Skier, 2012).

These are material, labour and expenses.

Material cost:

It includes cost of raw materials that are purchased by the organisation from the market to

produce output. Material cost vary according to the output level but it remains same per unit of

output.

Labour Cost:

Labours are the workers of an entity that is engaged in producing the output and entity

gives wages to them. These wages are called labour cost, this cost is same per unit of output but

it changes if output level increases as a whole.

Expenses:

There are two types of expenses which is direct expenses and indirect expenses, direct

expenses incurred directly on a particular product. On the other hand, indirect expenses are

incurred on as a whole for the organisation (Kirkham, 2014).

2.2 Analysis of cost information for material, labour and expenses:

After recording the various kind of cost such as material labour and direct expenses and

so on, the next step is to analysis these costs, which are as follows:

Material cost:

In analysis part of material cost, company shall analysis the current material cost with

previously incurred cost in same period of time. By doing so, an entity can evaluate its current

performances and will take corrective action for any variances results form comparison between

actual and previously incurred material cost (Tallon, 2013).

Labour cost:

4

all fixed and variable cost to its cost centre so accurate net profit can be obtained.

TASK 2

2.1 Record of cost information for material, labour and expenses:

Costing procedure implemented in any organisation defines as an activity of recording

costs in appropriate accounts so that actual cost can be calculated for manufacturing process as

an individual basis and for whole manufacturing process. In any organisation, there are various

kind of costs that are incurred due to business operations (Gensler, Leeflang and Skier, 2012).

These are material, labour and expenses.

Material cost:

It includes cost of raw materials that are purchased by the organisation from the market to

produce output. Material cost vary according to the output level but it remains same per unit of

output.

Labour Cost:

Labours are the workers of an entity that is engaged in producing the output and entity

gives wages to them. These wages are called labour cost, this cost is same per unit of output but

it changes if output level increases as a whole.

Expenses:

There are two types of expenses which is direct expenses and indirect expenses, direct

expenses incurred directly on a particular product. On the other hand, indirect expenses are

incurred on as a whole for the organisation (Kirkham, 2014).

2.2 Analysis of cost information for material, labour and expenses:

After recording the various kind of cost such as material labour and direct expenses and

so on, the next step is to analysis these costs, which are as follows:

Material cost:

In analysis part of material cost, company shall analysis the current material cost with

previously incurred cost in same period of time. By doing so, an entity can evaluate its current

performances and will take corrective action for any variances results form comparison between

actual and previously incurred material cost (Tallon, 2013).

Labour cost:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

By setting the budget for current period, an entity can asses its current labour cost with

budget. It helps the company to assess the efficiency and effectiveness of the labours and

accordingly take corrective action (Cassell, Dreher and Myers, 2013).

Expenses:

It includes the evaluation of current period cost with standard so that company can

identify the weak areas where it has to work to improve them and accordingly increase the

profitability of company.

2.3 Various stages of Inventory:

Inventory is the very important for an organisation, which need to be take care from

various threats to save the company from losses. There is requirement of valuation of inventories

in an entity to show the correct balance of the inventories in the financial statements. There are

mainly three types (stages) of inventory in an manufacturing organisation which are as follows:

Raw Material: It is the first stage of inventory and it is purchased from outside the

organisation from the market. There is need to take care its inventory because this shall

be used in the manufacturing process to make final product.

Work in Progress: When a raw material is processed by the organisation but it is not yet

completed, then in such situation inventory is neither raw material nor it is a final product

because it is in process not completed. This inventory is called as work in progress

because process which is stared on this in not yet completed that's why it is called as

work in progress (Oum and Yu, 2012).

Finished Goods:

This is the last stage in which a raw material is finally converted into the product of

company which company wants to sale to its target customer. This is a new product which is

completely different from its original shape and nature.

2.4 Valuation of inventories:

There are various methods to calculate the value of closing inventory of an organisation,

out of three methods of valuation are as follows:

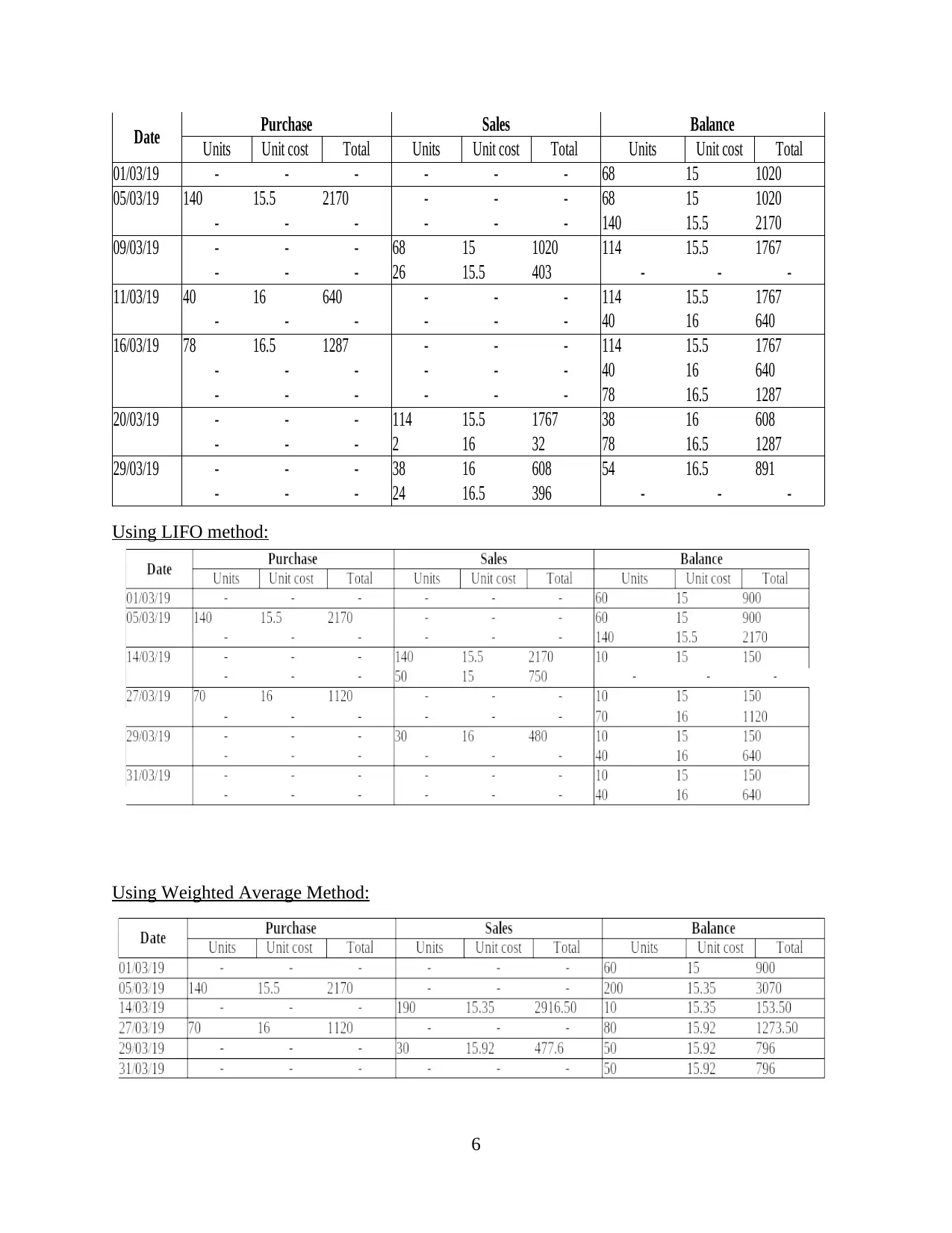

Using FIFO method:

5

budget. It helps the company to assess the efficiency and effectiveness of the labours and

accordingly take corrective action (Cassell, Dreher and Myers, 2013).

Expenses:

It includes the evaluation of current period cost with standard so that company can

identify the weak areas where it has to work to improve them and accordingly increase the

profitability of company.

2.3 Various stages of Inventory:

Inventory is the very important for an organisation, which need to be take care from

various threats to save the company from losses. There is requirement of valuation of inventories

in an entity to show the correct balance of the inventories in the financial statements. There are

mainly three types (stages) of inventory in an manufacturing organisation which are as follows:

Raw Material: It is the first stage of inventory and it is purchased from outside the

organisation from the market. There is need to take care its inventory because this shall

be used in the manufacturing process to make final product.

Work in Progress: When a raw material is processed by the organisation but it is not yet

completed, then in such situation inventory is neither raw material nor it is a final product

because it is in process not completed. This inventory is called as work in progress

because process which is stared on this in not yet completed that's why it is called as

work in progress (Oum and Yu, 2012).

Finished Goods:

This is the last stage in which a raw material is finally converted into the product of

company which company wants to sale to its target customer. This is a new product which is

completely different from its original shape and nature.

2.4 Valuation of inventories:

There are various methods to calculate the value of closing inventory of an organisation,

out of three methods of valuation are as follows:

Using FIFO method:

5

Date Purchase Sales Balance

Units Unit cost Total Units Unit cost Total Units Unit cost Total

01/03/19 - - - - - - 68 15 1020

05/03/19 140 15.5 2170 - - - 68 15 1020

- - - - - - 140 15.5 2170

09/03/19 - - - 68 15 1020 114 15.5 1767

- - - 26 15.5 403 - - -

11/03/19 40 16 640 - - - 114 15.5 1767

- - - - - - 40 16 640

16/03/19 78 16.5 1287 - - - 114 15.5 1767

- - - - - - 40 16 640

- - - - - - 78 16.5 1287

20/03/19 - - - 114 15.5 1767 38 16 608

- - - 2 16 32 78 16.5 1287

29/03/19 - - - 38 16 608 54 16.5 891

- - - 24 16.5 396 - - -

Using LIFO method:

Using Weighted Average Method:

6

Units Unit cost Total Units Unit cost Total Units Unit cost Total

01/03/19 - - - - - - 68 15 1020

05/03/19 140 15.5 2170 - - - 68 15 1020

- - - - - - 140 15.5 2170

09/03/19 - - - 68 15 1020 114 15.5 1767

- - - 26 15.5 403 - - -

11/03/19 40 16 640 - - - 114 15.5 1767

- - - - - - 40 16 640

16/03/19 78 16.5 1287 - - - 114 15.5 1767

- - - - - - 40 16 640

- - - - - - 78 16.5 1287

20/03/19 - - - 114 15.5 1767 38 16 608

- - - 2 16 32 78 16.5 1287

29/03/19 - - - 38 16 608 54 16.5 891

- - - 24 16.5 396 - - -

Using LIFO method:

Using Weighted Average Method:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.5 behaviour of these costs:

There are various cost which is completely different from each other in nature which are

as follows:

Fixed cost:

It is a cost which remains same in every situation whether level of output increases,

decreases or remain same. It is a cost which is either incurred in past time or which is to be

incurred in future but obligation for this cost is determined in past time (Gillen and Mantin,

2014).

Variable cost:

It is a cost which is continuously changes at a uniform rate when there level of outputs

increases or decreases. But variable cost is remained same at per unit if output of an entity.

Semi-variable cost:

It is a cost which is remained same for particular boundaries of output but it changes if

particular range of output changes at a uniform rate. Semi-variable cost remains same for

particular range of output.

Stepped Cost:

It is a fixed cost with some certain boundaries when the limit is crossed then it will get

changed. It is an additional investment which is required to increase the production.

2.6 Record of cost information using different costing systems:

There various costing systems available for an organisation and it may choose any one of

them as per nature of its business operations, which are as follows:

Job:

In job costing method, cost is recognised as per each and every job assignment. Managers

may get detailed information of expenses that have taken place for each job that are performed

by the individual worker.

Batch:

This method is used to take homogeneous products as cost unit for organisation. In this

costing technique a batch includes a particular number of items or articles. For example: if a

company which produces soaps for the target customers then it may use batch costing for

calculation of cost of its products.

7

There are various cost which is completely different from each other in nature which are

as follows:

Fixed cost:

It is a cost which remains same in every situation whether level of output increases,

decreases or remain same. It is a cost which is either incurred in past time or which is to be

incurred in future but obligation for this cost is determined in past time (Gillen and Mantin,

2014).

Variable cost:

It is a cost which is continuously changes at a uniform rate when there level of outputs

increases or decreases. But variable cost is remained same at per unit if output of an entity.

Semi-variable cost:

It is a cost which is remained same for particular boundaries of output but it changes if

particular range of output changes at a uniform rate. Semi-variable cost remains same for

particular range of output.

Stepped Cost:

It is a fixed cost with some certain boundaries when the limit is crossed then it will get

changed. It is an additional investment which is required to increase the production.

2.6 Record of cost information using different costing systems:

There various costing systems available for an organisation and it may choose any one of

them as per nature of its business operations, which are as follows:

Job:

In job costing method, cost is recognised as per each and every job assignment. Managers

may get detailed information of expenses that have taken place for each job that are performed

by the individual worker.

Batch:

This method is used to take homogeneous products as cost unit for organisation. In this

costing technique a batch includes a particular number of items or articles. For example: if a

company which produces soaps for the target customers then it may use batch costing for

calculation of cost of its products.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Unit:

In this system cost that has taken place for manufacturing a specific unit of product is

recorded. All fixed and variable expenses related to one item is considered in this method.

Process:

Costs related to production process is recorded in this method. It is mainly used in those

companies which manufactures products in large quantities.

Service:

In this costing technique expenses related to each service rendered by a company is

recorded. It is mainly used in hospitality industry, transport industry and schools ,universities and

so on.

TASK 3

3.1 Attribution of overhead cost to production and service cost centres:

There are two main types of attribution of overhead costs. Both of them are described

below:

Direct:

It is the most popular method of cost attribution. Main purpose of this technique top allot

costs to all production departments that are related to service division.

Step Down:

In this method only some specific costs are considered such as those expenses that are

incurred by human resource and maintenance department of the organisation. It is responsible to

provide rank to service divisions according to their performance.

3.2 Calculation of overhead absorption rate:

The calculation these are as under:

Machine Hours : -

Overhead absorption rate = Estimated Factory Overheads / Estimated machine hours * 100

= $150000 / 25000 * 100

= 600 % of direct material

Absorption of overheads based on direct material = Overhead absorption rate * actual material

cost of job

600% * $ 240 = $1440

8

In this system cost that has taken place for manufacturing a specific unit of product is

recorded. All fixed and variable expenses related to one item is considered in this method.

Process:

Costs related to production process is recorded in this method. It is mainly used in those

companies which manufactures products in large quantities.

Service:

In this costing technique expenses related to each service rendered by a company is

recorded. It is mainly used in hospitality industry, transport industry and schools ,universities and

so on.

TASK 3

3.1 Attribution of overhead cost to production and service cost centres:

There are two main types of attribution of overhead costs. Both of them are described

below:

Direct:

It is the most popular method of cost attribution. Main purpose of this technique top allot

costs to all production departments that are related to service division.

Step Down:

In this method only some specific costs are considered such as those expenses that are

incurred by human resource and maintenance department of the organisation. It is responsible to

provide rank to service divisions according to their performance.

3.2 Calculation of overhead absorption rate:

The calculation these are as under:

Machine Hours : -

Overhead absorption rate = Estimated Factory Overheads / Estimated machine hours * 100

= $150000 / 25000 * 100

= 600 % of direct material

Absorption of overheads based on direct material = Overhead absorption rate * actual material

cost of job

600% * $ 240 = $1440

8

Labour Hours : -

Overhead absorption rate = Estimated Factory Overheads / Estimated labour hours * 100

= $150000 / 30000 * 100

= 500 % of direct labour cost

Absorption of overheads based on direct labour cost = Overhead absorption rate * actual labour

cost of job

= $ 200 * 500% = $ 1000

3.3 adjustment for under and over recovered overhead cost:

Calculation for showing under and over recovered overhead cost are as under:

Overhead rate per machine hours: -

Normal working hours = No of machines * No of working hour per week * No of work per week

= 28 * 42 * 48

= 56448 hours

Loss of hours on maintenance = No of machines * No of hour loss on maintenance per week

*No. of work per week

= 28*5*48

= 6720 hours

Annual effective working hours = Normal working hours - Loss of hours on maintenance

= 56448 - 6720

= 49728 hours

Machine hours = Estimated annual overhead / Estimated working hours

= 124320 / 49728

= £2.5 per hours.

Over and under absorption: -

Over absorption = Machine hours produce – Overhead incurred

= (4200*2.5) – £10200

= £10500-£10200

= £300

Under absorption = Wages absorption – Wages incurred

= (28*42*4 @ £1.50) - £7400

= £7056 – £7400

9

Overhead absorption rate = Estimated Factory Overheads / Estimated labour hours * 100

= $150000 / 30000 * 100

= 500 % of direct labour cost

Absorption of overheads based on direct labour cost = Overhead absorption rate * actual labour

cost of job

= $ 200 * 500% = $ 1000

3.3 adjustment for under and over recovered overhead cost:

Calculation for showing under and over recovered overhead cost are as under:

Overhead rate per machine hours: -

Normal working hours = No of machines * No of working hour per week * No of work per week

= 28 * 42 * 48

= 56448 hours

Loss of hours on maintenance = No of machines * No of hour loss on maintenance per week

*No. of work per week

= 28*5*48

= 6720 hours

Annual effective working hours = Normal working hours - Loss of hours on maintenance

= 56448 - 6720

= 49728 hours

Machine hours = Estimated annual overhead / Estimated working hours

= 124320 / 49728

= £2.5 per hours.

Over and under absorption: -

Over absorption = Machine hours produce – Overhead incurred

= (4200*2.5) – £10200

= £10500-£10200

= £300

Under absorption = Wages absorption – Wages incurred

= (28*42*4 @ £1.50) - £7400

= £7056 – £7400

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.