Cost and Revenue Analysis: Financial Reporting and Accounting

VerifiedAdded on 2020/10/22

|16

|3585

|293

Report

AI Summary

This report provides a comprehensive analysis of cost and revenue, covering key aspects of financial reporting and accounting. It begins with an introduction to cost and revenue, emphasizing the importance of internal reporting for effective management decision-making. The report then explores different costing systems, including job costing and process costing, and their connections. It delves into responsibility centers, cost centers, profit centers, and investment centers within an organization, clarifying their roles and responsibilities. The report also classifies various types of costs, such as direct and indirect costs, variable and fixed costs, and examines the differences between marginal and absorption costing. Furthermore, it analyzes cost information related to material, labor, and other expenses, including the different stages of inventory and inventory valuation methods. The report also addresses overhead costs, including the calculation of absorption rates, adjustments for over or under-recovered overhead, and methods of absorption, allocation, and apportionment. The report concludes with a comparison of actual and budget costs, variance analysis, and a management report, along with an examination of the impact of changing activity levels on unit costs and factors influencing short-term and long-term decision-making.

Cost and Revenues

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Aim of internal reporting to deliver the exact information to manager................................1

1.2 connection between different costing system.......................................................................1

1.3 Responsibility, cost, profit and investment centre within an organisation...........................2

1.4 Features of various Kind of cost classification. ...................................................................2

1.5 Difference between marginal and absorption costing...........................................................3

TASK 2............................................................................................................................................3

2.1 Cost information of material, labour and other expenses.....................................................3

2.2 Analyse of cost information..................................................................................................4

2.3 different stages of inventory..................................................................................................4

2.4 Valuation of inventory..........................................................................................................4

2.5 Nature of fixed, variable and semi variable cost...................................................................6

2.6 Analysis the cost information by costing method.................................................................7

TASK 3............................................................................................................................................8

3.1 Overhead cost of production and services............................................................................8

3.2 Calculation of various types of absorption rate.....................................................................8

3.3 Adjustments of over or under recovered overhead...............................................................8

3.4 Methods of absorption, allocation and apportionment..........................................................9

3.5 Resolve queries related to overhead cost data ....................................................................10

TASK 4..........................................................................................................................................10

4.1 Compare the actual and budget cost. ..................................................................................10

4.2 Variance for the management report...................................................................................10

4.4 Management report.............................................................................................................10

TASK 5..........................................................................................................................................11

5.1 Presentation of estimated future income and costs for decision making:..........................11

5.2 Examining the effect of changing activity levels on unit costs...........................................11

5.3 Evaluation of both the effect of changing activity levels on unit costs..............................12

5.4 Identifying factors that influences short-term and long term decision making..................12

INTRODUCTION ..........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Aim of internal reporting to deliver the exact information to manager................................1

1.2 connection between different costing system.......................................................................1

1.3 Responsibility, cost, profit and investment centre within an organisation...........................2

1.4 Features of various Kind of cost classification. ...................................................................2

1.5 Difference between marginal and absorption costing...........................................................3

TASK 2............................................................................................................................................3

2.1 Cost information of material, labour and other expenses.....................................................3

2.2 Analyse of cost information..................................................................................................4

2.3 different stages of inventory..................................................................................................4

2.4 Valuation of inventory..........................................................................................................4

2.5 Nature of fixed, variable and semi variable cost...................................................................6

2.6 Analysis the cost information by costing method.................................................................7

TASK 3............................................................................................................................................8

3.1 Overhead cost of production and services............................................................................8

3.2 Calculation of various types of absorption rate.....................................................................8

3.3 Adjustments of over or under recovered overhead...............................................................8

3.4 Methods of absorption, allocation and apportionment..........................................................9

3.5 Resolve queries related to overhead cost data ....................................................................10

TASK 4..........................................................................................................................................10

4.1 Compare the actual and budget cost. ..................................................................................10

4.2 Variance for the management report...................................................................................10

4.4 Management report.............................................................................................................10

TASK 5..........................................................................................................................................11

5.1 Presentation of estimated future income and costs for decision making:..........................11

5.2 Examining the effect of changing activity levels on unit costs...........................................11

5.3 Evaluation of both the effect of changing activity levels on unit costs..............................12

5.4 Identifying factors that influences short-term and long term decision making..................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

REFERENCES..............................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Cost is defined as the amount paid by a buyer to buy a particular product or use a

service. In business, world cost also known as expenses is defined as the total monetary value

that is spent by company in order to produce something (Ahmed and et. al., 2013). Revenue are

defined the amount earn by companies by selling goods and services to customer. In general,

revenues and cost are important part of cost account, so its is significant for company to reduce

cost and increase revenue, which help growth and generating sufficient profit.

In this report, different concept of cost and revenues are discussed like, main purpose of

internal reporting and the important role of costing system. This shows various stages of

inventory management and approaches and connection of costing between. Project report also

discuss the different kind of cost that are incurred by companies during production of good.

TASK 1

1.1 Aim of internal reporting to deliver the exact information to manager.

The concept of internal reporting is the process of collection of accurate financial and

operating information on the regular basis, that help in improving the performance of employees

and operations. Manager prepare internal report and includes various kind of information such

as, sales data, expenses, employees turnover (Internal reporting, 2017). They also makes sure

that these report are not shared with anyone inside or outside the company. The basic purpose of

internal reporting is to have a precious information with top authority, that help them in making

right decision and formulation of strategies. With the help internal reporting process

management can control cost and enhance the revenues during an accounting year. Thus it can be

ascertain that reporting is helpful in determining and relegating project for future.

1.2 Connection between different costing system.

Companies spend a specific amount fro producing goods and services that is known as

cost. In accounting, the different costing system have different important role that are

implemented by management of company at various level such as production of product and

making of services (Bazaraa, Sherali and Shetty, 2013). Some system are, job costing system that

is implemented by every firm weather small or big that help in determining the total cost

incurred on particular individual job. Job costing system help to keep a detail record of different

cost material such as labour,material and other overhead expenses. The costing system is also

1

Cost is defined as the amount paid by a buyer to buy a particular product or use a

service. In business, world cost also known as expenses is defined as the total monetary value

that is spent by company in order to produce something (Ahmed and et. al., 2013). Revenue are

defined the amount earn by companies by selling goods and services to customer. In general,

revenues and cost are important part of cost account, so its is significant for company to reduce

cost and increase revenue, which help growth and generating sufficient profit.

In this report, different concept of cost and revenues are discussed like, main purpose of

internal reporting and the important role of costing system. This shows various stages of

inventory management and approaches and connection of costing between. Project report also

discuss the different kind of cost that are incurred by companies during production of good.

TASK 1

1.1 Aim of internal reporting to deliver the exact information to manager.

The concept of internal reporting is the process of collection of accurate financial and

operating information on the regular basis, that help in improving the performance of employees

and operations. Manager prepare internal report and includes various kind of information such

as, sales data, expenses, employees turnover (Internal reporting, 2017). They also makes sure

that these report are not shared with anyone inside or outside the company. The basic purpose of

internal reporting is to have a precious information with top authority, that help them in making

right decision and formulation of strategies. With the help internal reporting process

management can control cost and enhance the revenues during an accounting year. Thus it can be

ascertain that reporting is helpful in determining and relegating project for future.

1.2 Connection between different costing system.

Companies spend a specific amount fro producing goods and services that is known as

cost. In accounting, the different costing system have different important role that are

implemented by management of company at various level such as production of product and

making of services (Bazaraa, Sherali and Shetty, 2013). Some system are, job costing system that

is implemented by every firm weather small or big that help in determining the total cost

incurred on particular individual job. Job costing system help to keep a detail record of different

cost material such as labour,material and other overhead expenses. The costing system is also

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

related to process costing system that is also useful in maintaining detail record of cost involved

on material, labour etc. Thus it means that costing system are connected to other system also that

have the same cost component.

1.3 Responsibility, cost, profit and investment centre within an organisation.

Responsibility Centre: It is one of the department within a business firm that help in

management of operation and employees. In large companies management divide the business in

various smaller group and assign task accordingly. This support in smooth functioning and

completing of project on time. Company appoint manager for each group those are libel to

handle and manage operation activity.

Cost centre: The function of cost centre is to manage the total cost incurred on business

activities of companies. The manager of different project are liable to incur required cost on

production and control unnecessary expenses.

Profit centre: The main responsibility of manager is to handle and manage profit centre.

With the help of profit centre they are able to generate income and control expenses spend of

different sub group of companies.

Investment centre: The different division requires equivalent balance of investment.

Thus manager take decision about the total investment of capital required by each unit of

company.

1.4 Features of various Kind of cost classification.

In business there are various kind of cost that are incurred by companies that are

described below:

Direct labour: The cost that are related to the production process and have a direct effect

on the production level. For instance, cost of labour, material and labour etc.

Indirect cost: These are cost that do not have a direct effect on the production level.

Indirect cost are also known as common cost or joint cost that are incurred during the

production of product. Such as, expenses related to rent, bill payment of telephone,

electricity etc. and other factory overheads (Burchell and Listokin, 2012).

Variable cost: These cost are those that are spend in order to produce an additional unit of

input. Variable cost keeps on changing depending upon the activity level of company.

For example, cost of direct labour, commission on sales etc.

2

on material, labour etc. Thus it means that costing system are connected to other system also that

have the same cost component.

1.3 Responsibility, cost, profit and investment centre within an organisation.

Responsibility Centre: It is one of the department within a business firm that help in

management of operation and employees. In large companies management divide the business in

various smaller group and assign task accordingly. This support in smooth functioning and

completing of project on time. Company appoint manager for each group those are libel to

handle and manage operation activity.

Cost centre: The function of cost centre is to manage the total cost incurred on business

activities of companies. The manager of different project are liable to incur required cost on

production and control unnecessary expenses.

Profit centre: The main responsibility of manager is to handle and manage profit centre.

With the help of profit centre they are able to generate income and control expenses spend of

different sub group of companies.

Investment centre: The different division requires equivalent balance of investment.

Thus manager take decision about the total investment of capital required by each unit of

company.

1.4 Features of various Kind of cost classification.

In business there are various kind of cost that are incurred by companies that are

described below:

Direct labour: The cost that are related to the production process and have a direct effect

on the production level. For instance, cost of labour, material and labour etc.

Indirect cost: These are cost that do not have a direct effect on the production level.

Indirect cost are also known as common cost or joint cost that are incurred during the

production of product. Such as, expenses related to rent, bill payment of telephone,

electricity etc. and other factory overheads (Burchell and Listokin, 2012).

Variable cost: These cost are those that are spend in order to produce an additional unit of

input. Variable cost keeps on changing depending upon the activity level of company.

For example, cost of direct labour, commission on sales etc.

2

Fixed cost: These do not change and remain constant throughout the production process.

Some of the fixed are also applicable for companies even if the production process is

completed. For instance, depreciation, rent expenses etc.

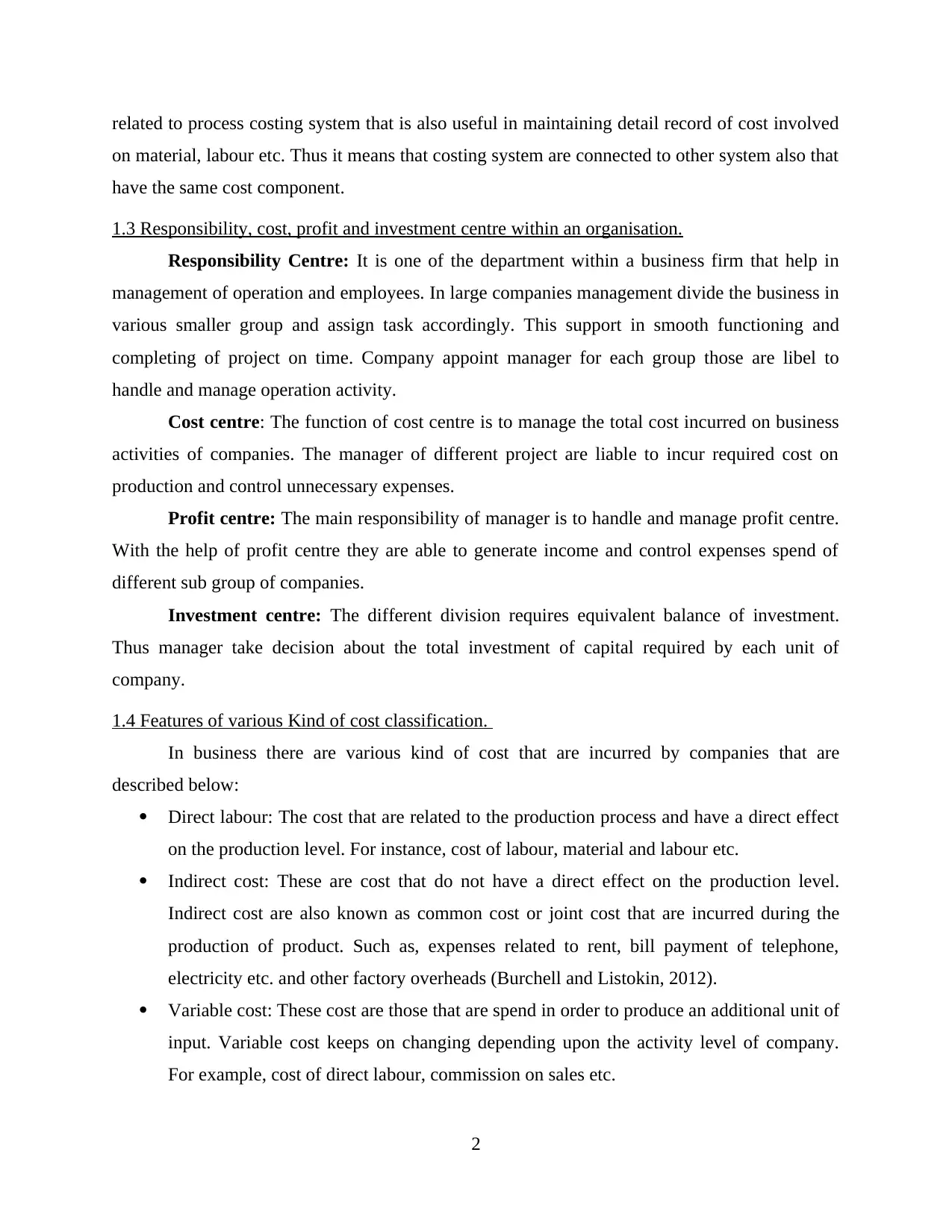

1.5 Difference between marginal and absorption costing.

Both types of cost are involved in the production of a goods and services. The basic

difference between them are discussed below:

Marginal costing Absorption costing

This cost is related to the expenses occur on

producing the additional unit of output.

These are all expenses associated with

producing a particular product such as, wages,

utility cost etc.

It includes only variable cost for product

costing and valuation of inventory.

Absorption costing includes all fixed and

variable cost that are send on product costing

and stock valuation.

This method gives higher profitability of all

individual units.

On the other side the profitability of individual

unit is lower.

The process of determining the profit uses the

contribution margin.

The process of measuring profit with

absorption costing includes.

TASK 2

2.1 Cost information of material, labour and other expenses.

The costing system includes all direct cost that are used to calculate gross profit margin at

the first stage. Direct cost includes cost of labour,material and other overheads. The indirect

expenses are calculated to determine the profit for company during a specific period. Some of

these are discussed below:

Direct labour cost: The cost that are incurred on labour during production process such as

wages etc.

Direct material cost: Those cost that are involved on buying specific material that is required to

produce a product or provide a service.

Direct expenses: All other expenses that are spend by company on producing the product.

3

Some of the fixed are also applicable for companies even if the production process is

completed. For instance, depreciation, rent expenses etc.

1.5 Difference between marginal and absorption costing.

Both types of cost are involved in the production of a goods and services. The basic

difference between them are discussed below:

Marginal costing Absorption costing

This cost is related to the expenses occur on

producing the additional unit of output.

These are all expenses associated with

producing a particular product such as, wages,

utility cost etc.

It includes only variable cost for product

costing and valuation of inventory.

Absorption costing includes all fixed and

variable cost that are send on product costing

and stock valuation.

This method gives higher profitability of all

individual units.

On the other side the profitability of individual

unit is lower.

The process of determining the profit uses the

contribution margin.

The process of measuring profit with

absorption costing includes.

TASK 2

2.1 Cost information of material, labour and other expenses.

The costing system includes all direct cost that are used to calculate gross profit margin at

the first stage. Direct cost includes cost of labour,material and other overheads. The indirect

expenses are calculated to determine the profit for company during a specific period. Some of

these are discussed below:

Direct labour cost: The cost that are incurred on labour during production process such as

wages etc.

Direct material cost: Those cost that are involved on buying specific material that is required to

produce a product or provide a service.

Direct expenses: All other expenses that are spend by company on producing the product.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.2 Analyse of cost information.

The cost involved on buying raw material is $11000, direct labour $9000 and other

expenses are $15000. All this record shows company want to low their cost of production,but

company needs to control cost of labour and cost spent of other overheads. This process help in

maintaining suitable profit during by producing and selling more product (Gudeman, 2013).

2.3 different stages of inventory.

The process of making a suitable product from the available raw material involves

different stages. These are describe below:

Raw material: The first stage is related to transferring of raw material into valuable

finished goods. For example, a furniture manufacturing company, at its first stage require woods

that help in making of valuable wooden product.

Work in progress: This stage is related to putting of raw material into production

process, it involves different effective methods and system that are used by companies to convert

raw material.

Finished goods: The last stage is related to the formation of finished good that is fit for

use to customer.

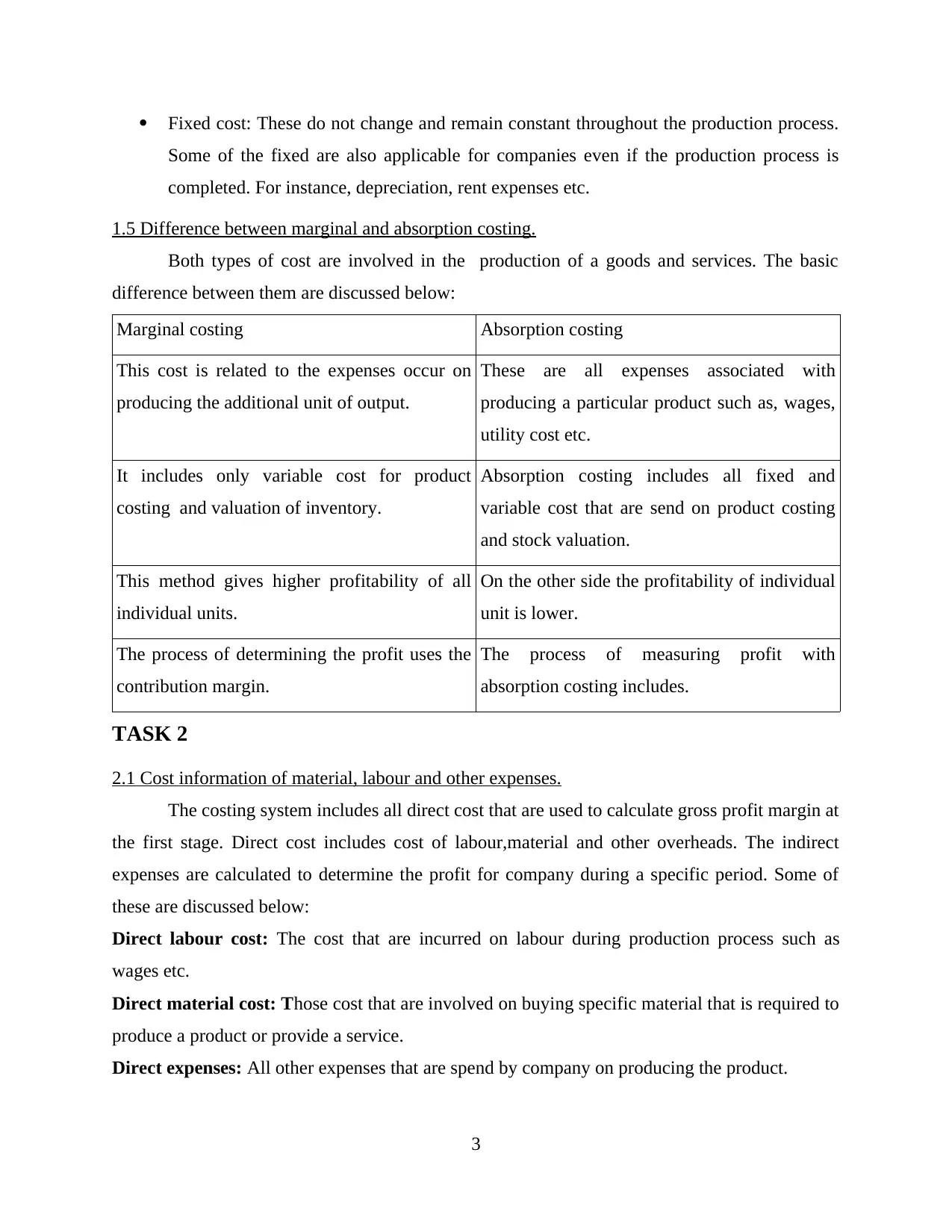

2.4 Valuation of inventory.

FIFO

Receipts Issue Balance

Date quantit

y

unit

cost

amount£ quantity Unit

cost

Amount£ quantity Unit

cost

amount

£

01/0

3/01

68 15 1020 68 15 1020

05/0

3/18

140 15.5 2170 140 15.5 2170

09/0

3/18

68 15 1020

26 15.5 430

4

The cost involved on buying raw material is $11000, direct labour $9000 and other

expenses are $15000. All this record shows company want to low their cost of production,but

company needs to control cost of labour and cost spent of other overheads. This process help in

maintaining suitable profit during by producing and selling more product (Gudeman, 2013).

2.3 different stages of inventory.

The process of making a suitable product from the available raw material involves

different stages. These are describe below:

Raw material: The first stage is related to transferring of raw material into valuable

finished goods. For example, a furniture manufacturing company, at its first stage require woods

that help in making of valuable wooden product.

Work in progress: This stage is related to putting of raw material into production

process, it involves different effective methods and system that are used by companies to convert

raw material.

Finished goods: The last stage is related to the formation of finished good that is fit for

use to customer.

2.4 Valuation of inventory.

FIFO

Receipts Issue Balance

Date quantit

y

unit

cost

amount£ quantity Unit

cost

Amount£ quantity Unit

cost

amount

£

01/0

3/01

68 15 1020 68 15 1020

05/0

3/18

140 15.5 2170 140 15.5 2170

09/0

3/18

68 15 1020

26 15.5 430

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11/0

3/18

40 16 640 114 15.5 1767

40 16 640

16/0

3/18

78 16.5 1287 114 15.5 1767

40 16 640

78 16.5 1287

20/0

3/18

114 15.5 1767 38 16 608

2 16 32 78 16.5 1287

29/0

3/18

38 16 608

31/0

3/18

24 16.5 396 54 16.5 891

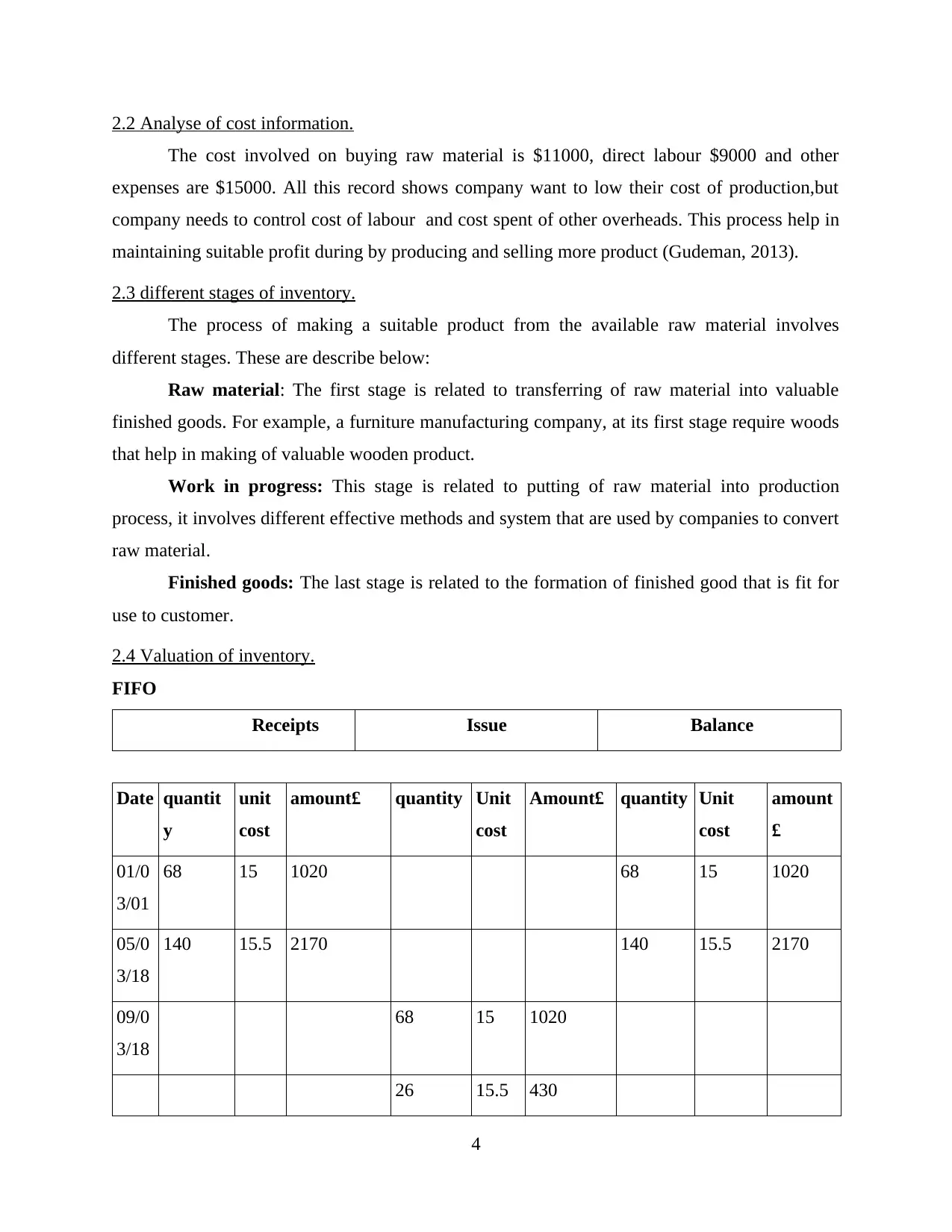

Working note-

Units Available for sale =78+140+40+68 =326

Units Sold = 62+ 94+116 = 272

Balance units = 326-272 = 54

Last In First Out (LIFO)

Receipts issued Balance

Date quantit

y

Unit

cost

amount quantit

y

Unit

cost

amount quantit

y

Unit

cost

amount

01/03/1

8

60 15 240 60 15 240

05/03/1 140 15.5 2170 140 15.5 2170

5

3/18

40 16 640 114 15.5 1767

40 16 640

16/0

3/18

78 16.5 1287 114 15.5 1767

40 16 640

78 16.5 1287

20/0

3/18

114 15.5 1767 38 16 608

2 16 32 78 16.5 1287

29/0

3/18

38 16 608

31/0

3/18

24 16.5 396 54 16.5 891

Working note-

Units Available for sale =78+140+40+68 =326

Units Sold = 62+ 94+116 = 272

Balance units = 326-272 = 54

Last In First Out (LIFO)

Receipts issued Balance

Date quantit

y

Unit

cost

amount quantit

y

Unit

cost

amount quantit

y

Unit

cost

amount

01/03/1

8

60 15 240 60 15 240

05/03/1 140 15.5 2170 140 15.5 2170

5

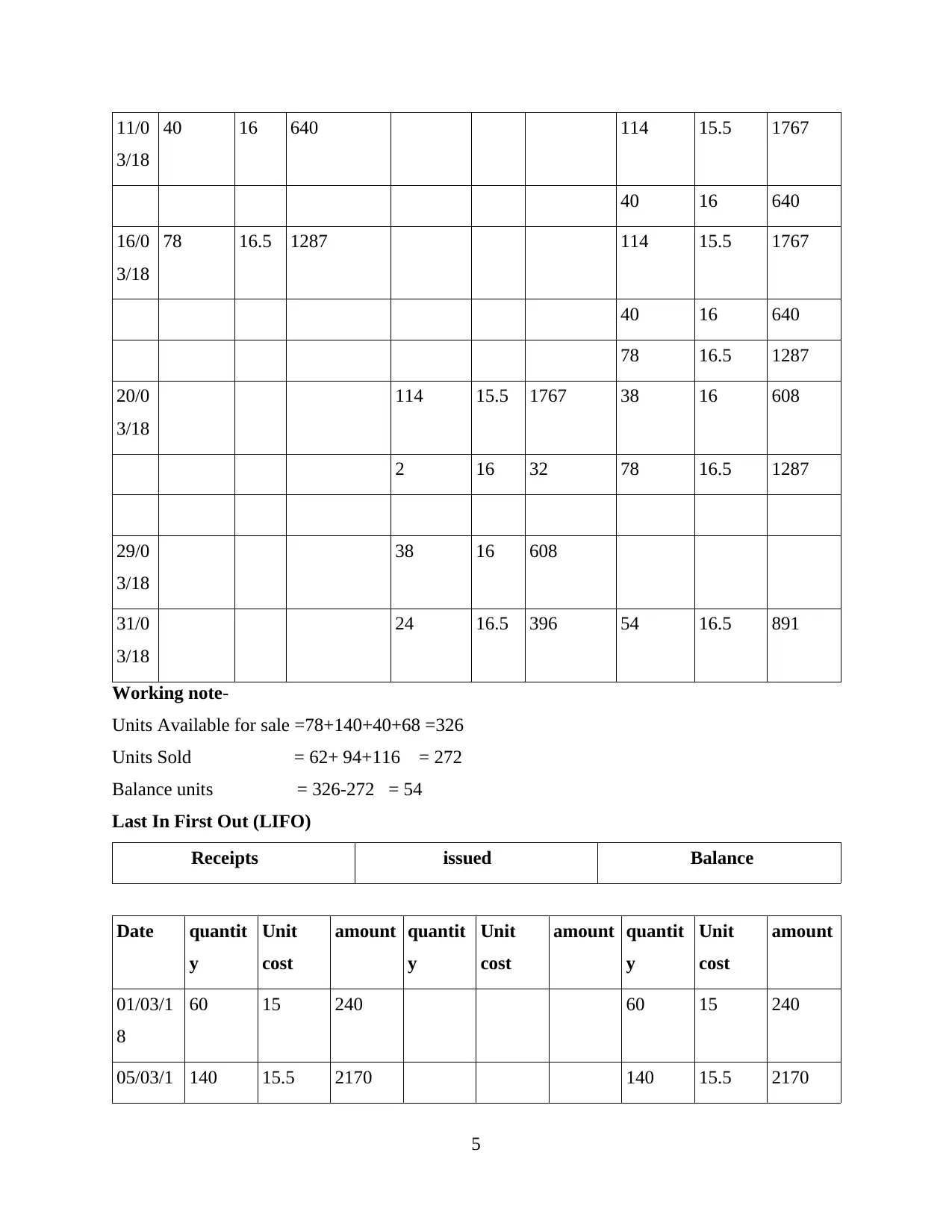

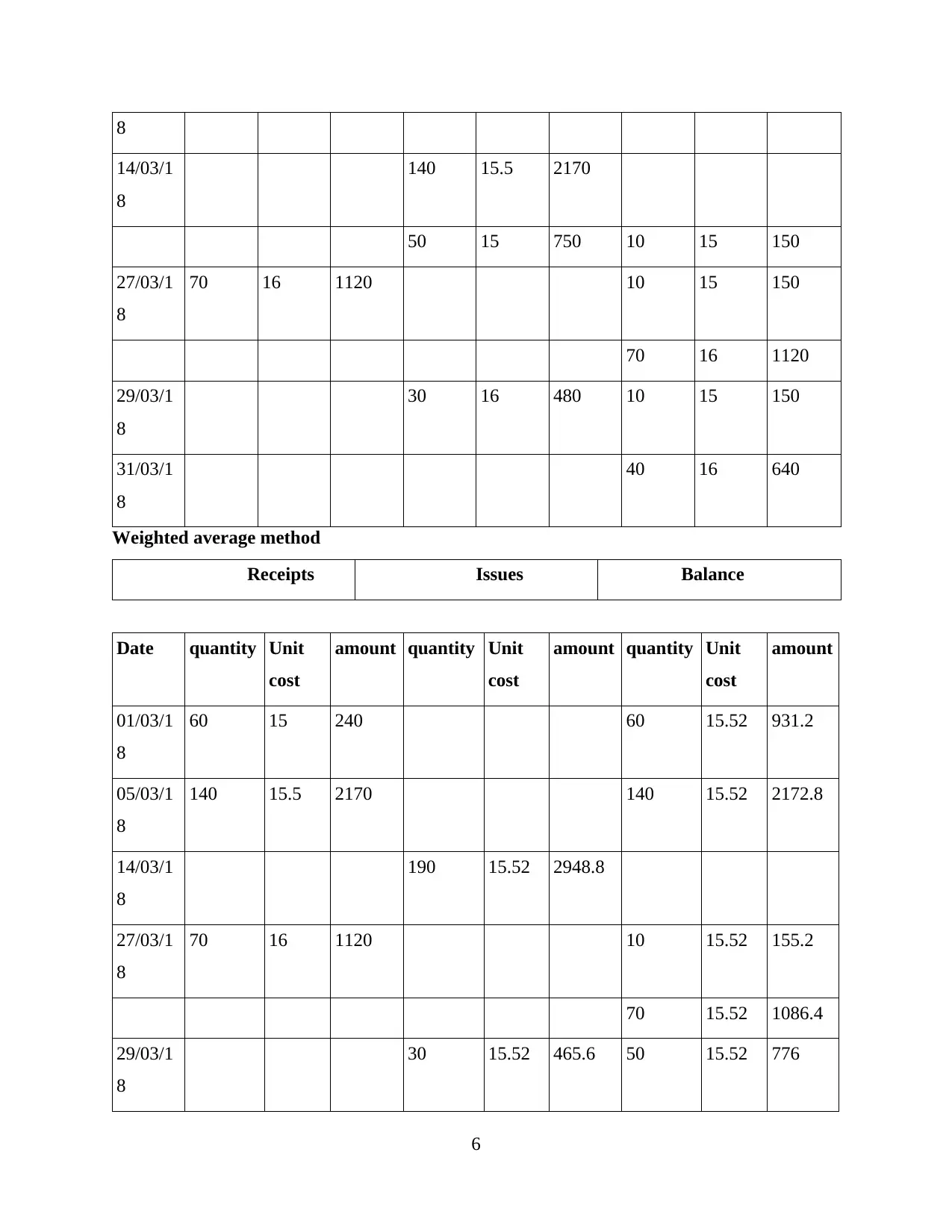

8

14/03/1

8

140 15.5 2170

50 15 750 10 15 150

27/03/1

8

70 16 1120 10 15 150

70 16 1120

29/03/1

8

30 16 480 10 15 150

31/03/1

8

40 16 640

Weighted average method

Receipts Issues Balance

Date quantity Unit

cost

amount quantity Unit

cost

amount quantity Unit

cost

amount

01/03/1

8

60 15 240 60 15.52 931.2

05/03/1

8

140 15.5 2170 140 15.52 2172.8

14/03/1

8

190 15.52 2948.8

27/03/1

8

70 16 1120 10 15.52 155.2

70 15.52 1086.4

29/03/1

8

30 15.52 465.6 50 15.52 776

6

14/03/1

8

140 15.5 2170

50 15 750 10 15 150

27/03/1

8

70 16 1120 10 15 150

70 16 1120

29/03/1

8

30 16 480 10 15 150

31/03/1

8

40 16 640

Weighted average method

Receipts Issues Balance

Date quantity Unit

cost

amount quantity Unit

cost

amount quantity Unit

cost

amount

01/03/1

8

60 15 240 60 15.52 931.2

05/03/1

8

140 15.5 2170 140 15.52 2172.8

14/03/1

8

190 15.52 2948.8

27/03/1

8

70 16 1120 10 15.52 155.2

70 15.52 1086.4

29/03/1

8

30 15.52 465.6 50 15.52 776

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

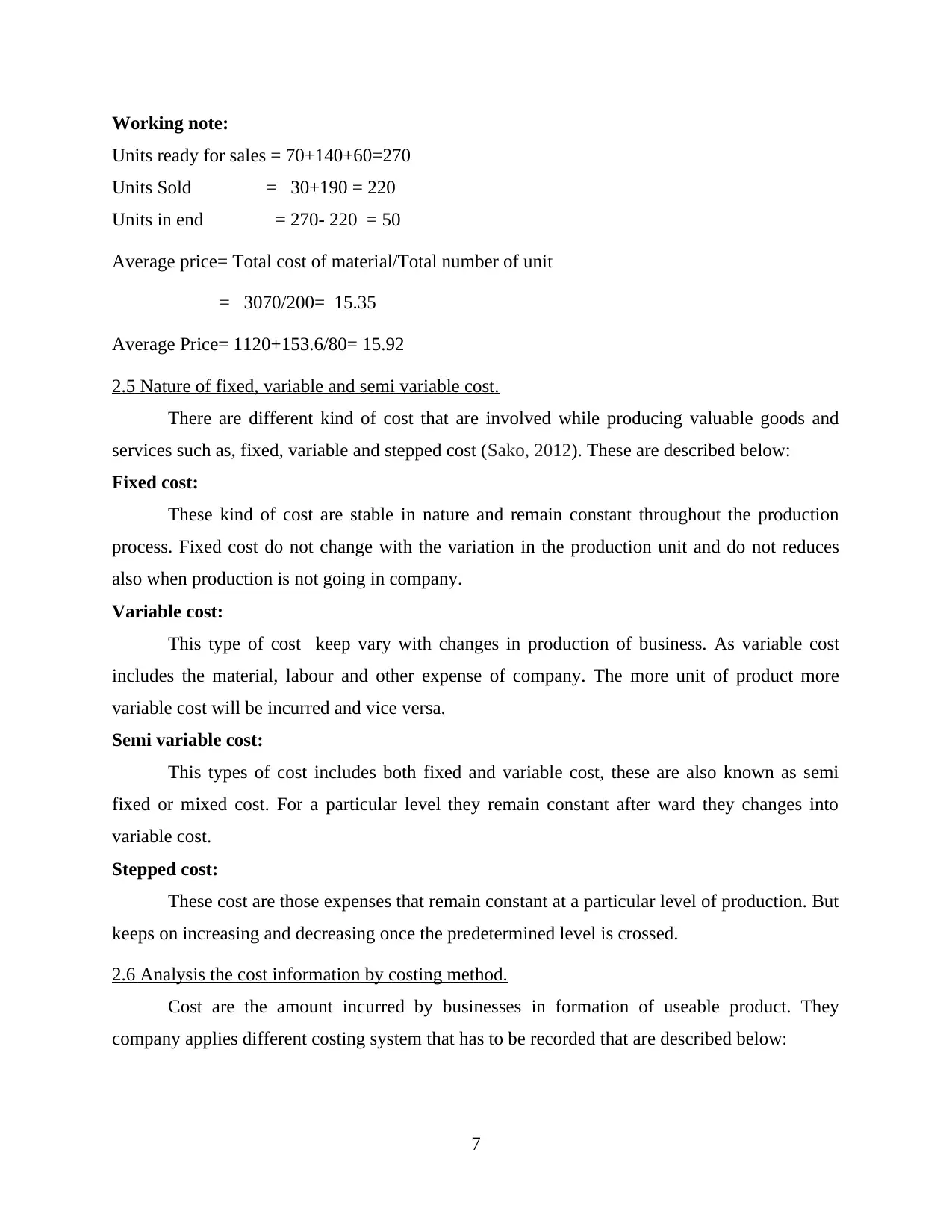

Working note:

Units ready for sales = 70+140+60=270

Units Sold = 30+190 = 220

Units in end = 270- 220 = 50

Average price= Total cost of material/Total number of unit

= 3070/200= 15.35

Average Price= 1120+153.6/80= 15.92

2.5 Nature of fixed, variable and semi variable cost.

There are different kind of cost that are involved while producing valuable goods and

services such as, fixed, variable and stepped cost (Sako, 2012). These are described below:

Fixed cost:

These kind of cost are stable in nature and remain constant throughout the production

process. Fixed cost do not change with the variation in the production unit and do not reduces

also when production is not going in company.

Variable cost:

This type of cost keep vary with changes in production of business. As variable cost

includes the material, labour and other expense of company. The more unit of product more

variable cost will be incurred and vice versa.

Semi variable cost:

This types of cost includes both fixed and variable cost, these are also known as semi

fixed or mixed cost. For a particular level they remain constant after ward they changes into

variable cost.

Stepped cost:

These cost are those expenses that remain constant at a particular level of production. But

keeps on increasing and decreasing once the predetermined level is crossed.

2.6 Analysis the cost information by costing method.

Cost are the amount incurred by businesses in formation of useable product. They

company applies different costing system that has to be recorded that are described below:

7

Units ready for sales = 70+140+60=270

Units Sold = 30+190 = 220

Units in end = 270- 220 = 50

Average price= Total cost of material/Total number of unit

= 3070/200= 15.35

Average Price= 1120+153.6/80= 15.92

2.5 Nature of fixed, variable and semi variable cost.

There are different kind of cost that are involved while producing valuable goods and

services such as, fixed, variable and stepped cost (Sako, 2012). These are described below:

Fixed cost:

These kind of cost are stable in nature and remain constant throughout the production

process. Fixed cost do not change with the variation in the production unit and do not reduces

also when production is not going in company.

Variable cost:

This type of cost keep vary with changes in production of business. As variable cost

includes the material, labour and other expense of company. The more unit of product more

variable cost will be incurred and vice versa.

Semi variable cost:

This types of cost includes both fixed and variable cost, these are also known as semi

fixed or mixed cost. For a particular level they remain constant after ward they changes into

variable cost.

Stepped cost:

These cost are those expenses that remain constant at a particular level of production. But

keeps on increasing and decreasing once the predetermined level is crossed.

2.6 Analysis the cost information by costing method.

Cost are the amount incurred by businesses in formation of useable product. They

company applies different costing system that has to be recorded that are described below:

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Job system: This system is used by producer to provide an effective job according to the

job required to complete a project. As there are various types of cost that are incurred such as

fixed and variable.

Batch: This is a kind of certain order costing that is similar to job costing. All batch is a

individually classifiable cost unit which is given a collection figure in the same way that each job

is given a amount.

Unit: This is related to the cost incurred on producing a single unit of a specific product.

Unit cost includes all fixed and variable cost that is utilize by management during production

process.

Process costing: This method is related to assigning the cost to product that are produced

by companies at large quantity. Process costing is used to determine the cost of product.

Services: This kind of cost are related to the expense incurred by companies in producing

and delivering valuable services to customer (Schosser and Wittmer, 2015).

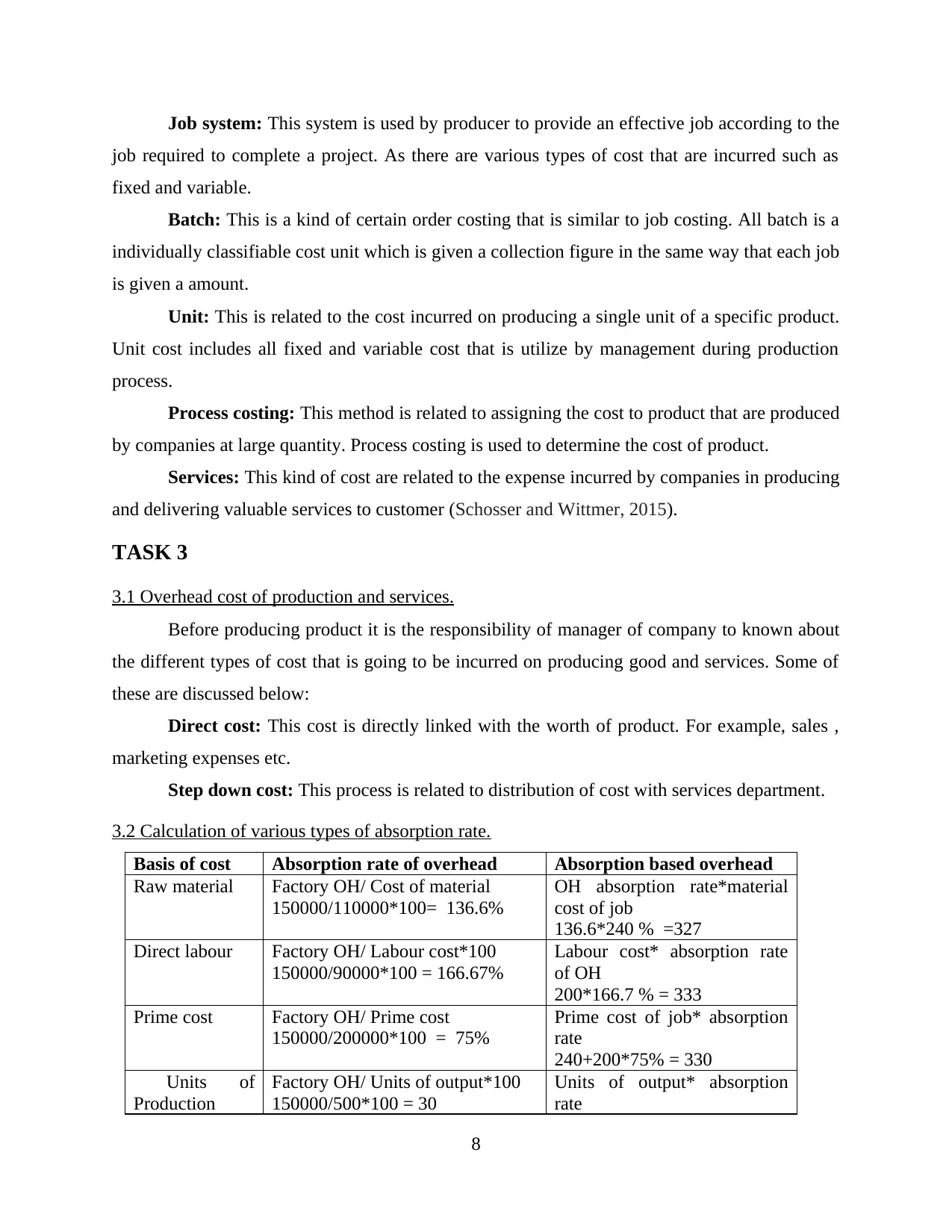

TASK 3

3.1 Overhead cost of production and services.

Before producing product it is the responsibility of manager of company to known about

the different types of cost that is going to be incurred on producing good and services. Some of

these are discussed below:

Direct cost: This cost is directly linked with the worth of product. For example, sales ,

marketing expenses etc.

Step down cost: This process is related to distribution of cost with services department.

3.2 Calculation of various types of absorption rate.

Basis of cost Absorption rate of overhead Absorption based overhead

Raw material Factory OH/ Cost of material

150000/110000*100= 136.6%

OH absorption rate*material

cost of job

136.6*240 % =327

Direct labour Factory OH/ Labour cost*100

150000/90000*100 = 166.67%

Labour cost* absorption rate

of OH

200*166.7 % = 333

Prime cost Factory OH/ Prime cost

150000/200000*100 = 75%

Prime cost of job* absorption

rate

240+200*75% = 330

Units of

Production

Factory OH/ Units of output*100

150000/500*100 = 30

Units of output* absorption

rate

8

job required to complete a project. As there are various types of cost that are incurred such as

fixed and variable.

Batch: This is a kind of certain order costing that is similar to job costing. All batch is a

individually classifiable cost unit which is given a collection figure in the same way that each job

is given a amount.

Unit: This is related to the cost incurred on producing a single unit of a specific product.

Unit cost includes all fixed and variable cost that is utilize by management during production

process.

Process costing: This method is related to assigning the cost to product that are produced

by companies at large quantity. Process costing is used to determine the cost of product.

Services: This kind of cost are related to the expense incurred by companies in producing

and delivering valuable services to customer (Schosser and Wittmer, 2015).

TASK 3

3.1 Overhead cost of production and services.

Before producing product it is the responsibility of manager of company to known about

the different types of cost that is going to be incurred on producing good and services. Some of

these are discussed below:

Direct cost: This cost is directly linked with the worth of product. For example, sales ,

marketing expenses etc.

Step down cost: This process is related to distribution of cost with services department.

3.2 Calculation of various types of absorption rate.

Basis of cost Absorption rate of overhead Absorption based overhead

Raw material Factory OH/ Cost of material

150000/110000*100= 136.6%

OH absorption rate*material

cost of job

136.6*240 % =327

Direct labour Factory OH/ Labour cost*100

150000/90000*100 = 166.67%

Labour cost* absorption rate

of OH

200*166.7 % = 333

Prime cost Factory OH/ Prime cost

150000/200000*100 = 75%

Prime cost of job* absorption

rate

240+200*75% = 330

Units of

Production

Factory OH/ Units of output*100

150000/500*100 = 30

Units of output* absorption

rate

8

10*30 = 300

Direct labour

basis

Factort OH/ Labour rate*100

150000/30000*100 =5

Labours hours* Absorption

rate of OH

63*5 = 315

Machine hour

basis

Factory OH/machine hours*100

150000/25000*100 =6

Machine hours for job* OH

absorption rate

44*6 = 264

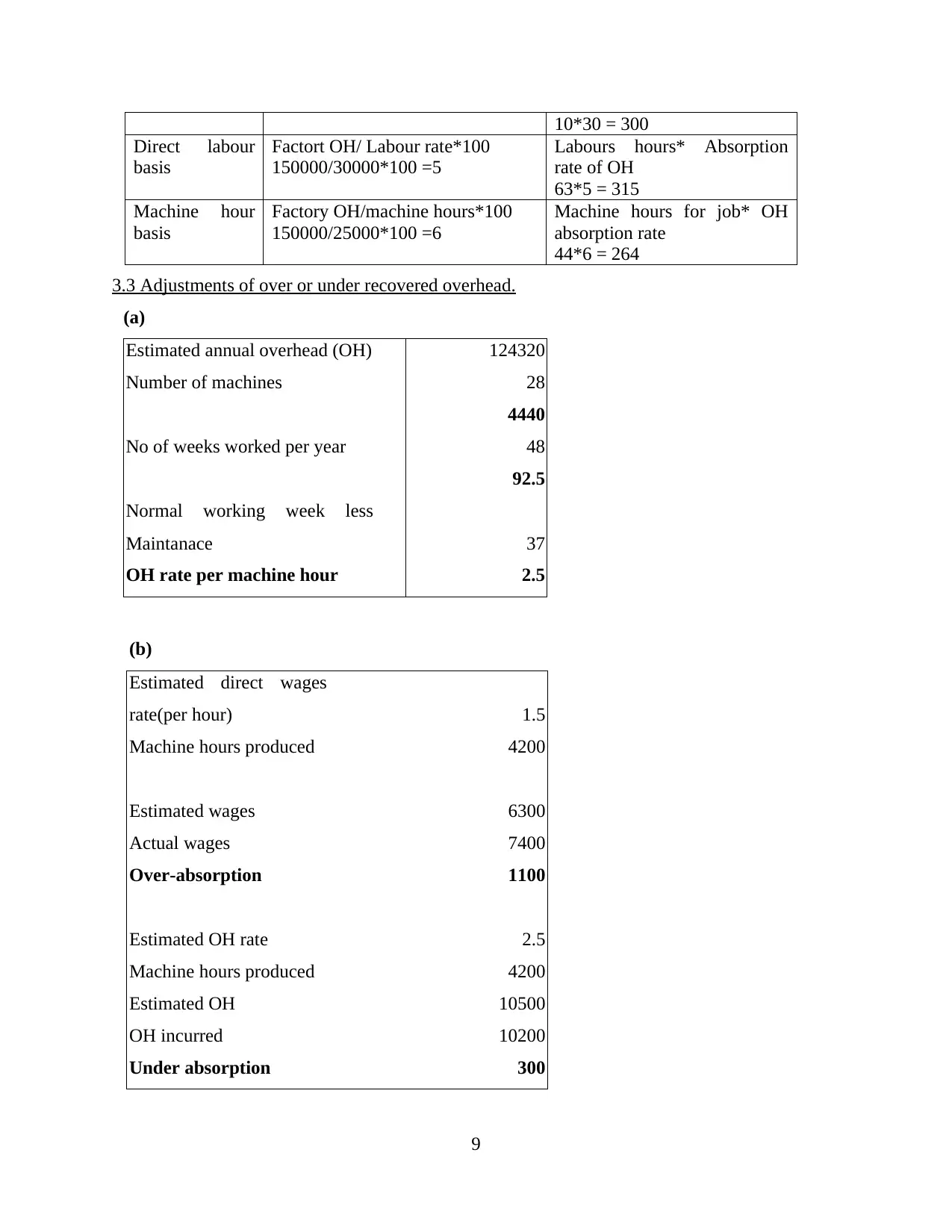

3.3 Adjustments of over or under recovered overhead.

(a)

Estimated annual overhead (OH) 124320

Number of machines 28

4440

No of weeks worked per year 48

92.5

Normal working week less

Maintanace 37

OH rate per machine hour 2.5

(b)

Estimated direct wages

rate(per hour) 1.5

Machine hours produced 4200

Estimated wages 6300

Actual wages 7400

Over-absorption 1100

Estimated OH rate 2.5

Machine hours produced 4200

Estimated OH 10500

OH incurred 10200

Under absorption 300

9

Direct labour

basis

Factort OH/ Labour rate*100

150000/30000*100 =5

Labours hours* Absorption

rate of OH

63*5 = 315

Machine hour

basis

Factory OH/machine hours*100

150000/25000*100 =6

Machine hours for job* OH

absorption rate

44*6 = 264

3.3 Adjustments of over or under recovered overhead.

(a)

Estimated annual overhead (OH) 124320

Number of machines 28

4440

No of weeks worked per year 48

92.5

Normal working week less

Maintanace 37

OH rate per machine hour 2.5

(b)

Estimated direct wages

rate(per hour) 1.5

Machine hours produced 4200

Estimated wages 6300

Actual wages 7400

Over-absorption 1100

Estimated OH rate 2.5

Machine hours produced 4200

Estimated OH 10500

OH incurred 10200

Under absorption 300

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.