Comprehensive Cost and Revenue Analysis for Marks and Spencer

VerifiedAdded on 2020/12/24

|19

|4300

|341

Report

AI Summary

This report provides a detailed analysis of cost and revenue management within Marks & Spencer (M&S), a major UK-based retail enterprise. It examines internal reporting purposes, different costing systems, and the relationships between responsibility, cost, and investment centers. The report explores various cost classifications, including manufacturing, non-manufacturing, direct, and indirect costs, and differentiates between marginal and absorption costing methods. It covers costing procedures for materials, labor, and expenses, along with inventory stages and valuation using FIFO. The report delves into cost behavior, overhead allocation, and the calculation of overhead absorption rates based on machine and labor hours. Furthermore, it addresses variance analysis, budgeting, and provides insights into future income and cost estimations, including the effects of changing activity levels on unit costs and factors affecting short-term and long-term decision-making within M&S.

Costs and revenues

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.1 Purpose of internal reporting and giving accurate information.............................................1

1.2 Relationship among various costing systems within M&S..................................................1

1.3 Responsibility centres, cost centres and investment centres within organisation..................2

1.4 Characteristics of different cost classifications and their usage............................................2

1.5 Difference between marginal and absorption costing............................................................3

2.1 Record Cost information for material, labour and expenses in accordance with the costing

procedures of M&S......................................................................................................................3

2.2 Analyse cost information for material, labour and expenses in accordance with the costing

procedures of M&S......................................................................................................................3

2.3 Different stages of inventory.................................................................................................4

2.4 Value inventory using............................................................................................................4

2.5 Behaviour of costs..................................................................................................................7

2.6 Recording cost information....................................................................................................8

3.1 Attribute overhead costs to service and production costs......................................................8

3.2 Overhead absorption rate.......................................................................................................8

3.3 ................................................................................................................................................9

3.4 Reviewing allocation, apportionment and absorption methods...........................................10

3.5 Resolving queries in overhead cost......................................................................................10

4.1 comparison of actual costs with budget costs......................................................................10

4.2 Analyzing the variances.......................................................................................................10

4.3 Providing information to budget holders of any variances and remedial actions................11

4.4 Management report..............................................................................................................12

5.1 Future income and costs estimates.......................................................................................13

5.2 Effects of changing activity levels on unit costs..................................................................14

5.3 calculating the effects of changing activity levels on unit cost...........................................14

5.4 Factors affecting long-term and short-term decision making..............................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

1.1 Purpose of internal reporting and giving accurate information.............................................1

1.2 Relationship among various costing systems within M&S..................................................1

1.3 Responsibility centres, cost centres and investment centres within organisation..................2

1.4 Characteristics of different cost classifications and their usage............................................2

1.5 Difference between marginal and absorption costing............................................................3

2.1 Record Cost information for material, labour and expenses in accordance with the costing

procedures of M&S......................................................................................................................3

2.2 Analyse cost information for material, labour and expenses in accordance with the costing

procedures of M&S......................................................................................................................3

2.3 Different stages of inventory.................................................................................................4

2.4 Value inventory using............................................................................................................4

2.5 Behaviour of costs..................................................................................................................7

2.6 Recording cost information....................................................................................................8

3.1 Attribute overhead costs to service and production costs......................................................8

3.2 Overhead absorption rate.......................................................................................................8

3.3 ................................................................................................................................................9

3.4 Reviewing allocation, apportionment and absorption methods...........................................10

3.5 Resolving queries in overhead cost......................................................................................10

4.1 comparison of actual costs with budget costs......................................................................10

4.2 Analyzing the variances.......................................................................................................10

4.3 Providing information to budget holders of any variances and remedial actions................11

4.4 Management report..............................................................................................................12

5.1 Future income and costs estimates.......................................................................................13

5.2 Effects of changing activity levels on unit costs..................................................................14

5.3 calculating the effects of changing activity levels on unit cost...........................................14

5.4 Factors affecting long-term and short-term decision making..............................................14

CONCLUSION..............................................................................................................................15

REFERENCES .............................................................................................................................16

INTRODUCTION

Costing and revenue generation are two major and key aspects within an organisation that

will support the effective management of financial conditions within a firm. It helps the

organisations to monitor and manage their monetary based operations and handling different

inventories. It is also important to control the expenses that are been carried out within a firm.

The report is based on inventory and cost management of UK based retail enterprise, Marks and

Spencer. It is one of the largest retail enterprise in world with an effective management of large

number of inventories.

The assessment carries the assessment of internal reporting and providing accurate

information with different costing systems. The responsibility centre, profit centre with

evaluation of investment centres and classification of different costs. Also, the costing

procedures and expense management is been performed with various stages of an inventory and

management of different behaviours also the cost information is been evaluated. The overhead

costs will be analysed and measures of allocation, appointment and absorption is taken with

resolving of queries art cost data. Budgeting and management reports are presented with

assessment of various information for decision making and effects of changing activity levels.

MAIN BODY

1.1 Purpose of internal reporting and giving accurate information

Within an organisation, in order to have a good accessibility and management of their

cost operations and inventories, the internal reporting of various operations is very essential. This

process is carried out by almost all the organisation in order to have a significant control over

their operations and management of all sort of expenses.

It helps to monitor data redundancy, predicting future trends, identifying the resource

values and reduce chances of errors. This is vital for suitable decision making and carrying out of

different inventory management operations (Yang and Chen, 2018). The delivery of accurate

information helps to improve decision making and increase efficiency of an organisation's

management to deliver their services.

1.2 Relationship among various costing systems within M&S

Different costing systems are taken within the organisation that helps the firm to improve

the quality of services and improve the quality of services and maintain their expenses within an

organisation. The Unit costing measures the production of an individual unit of a commodity,

Costing and revenue generation are two major and key aspects within an organisation that

will support the effective management of financial conditions within a firm. It helps the

organisations to monitor and manage their monetary based operations and handling different

inventories. It is also important to control the expenses that are been carried out within a firm.

The report is based on inventory and cost management of UK based retail enterprise, Marks and

Spencer. It is one of the largest retail enterprise in world with an effective management of large

number of inventories.

The assessment carries the assessment of internal reporting and providing accurate

information with different costing systems. The responsibility centre, profit centre with

evaluation of investment centres and classification of different costs. Also, the costing

procedures and expense management is been performed with various stages of an inventory and

management of different behaviours also the cost information is been evaluated. The overhead

costs will be analysed and measures of allocation, appointment and absorption is taken with

resolving of queries art cost data. Budgeting and management reports are presented with

assessment of various information for decision making and effects of changing activity levels.

MAIN BODY

1.1 Purpose of internal reporting and giving accurate information

Within an organisation, in order to have a good accessibility and management of their

cost operations and inventories, the internal reporting of various operations is very essential. This

process is carried out by almost all the organisation in order to have a significant control over

their operations and management of all sort of expenses.

It helps to monitor data redundancy, predicting future trends, identifying the resource

values and reduce chances of errors. This is vital for suitable decision making and carrying out of

different inventory management operations (Yang and Chen, 2018). The delivery of accurate

information helps to improve decision making and increase efficiency of an organisation's

management to deliver their services.

1.2 Relationship among various costing systems within M&S

Different costing systems are taken within the organisation that helps the firm to improve

the quality of services and improve the quality of services and maintain their expenses within an

organisation. The Unit costing measures the production of an individual unit of a commodity,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

using it the batch costing is been estimated. Job and Contract costing will be analyses with

process costing in order to identify the expense of producing a product or services. Other than

this, the service costing and composite costing will help in improving the qualities and services

related top the production or manufacturing and helping to evaluate the proper inventory

maintaining of the firm.

1.3 Responsibility centres, cost centres and investment centres within organisation

The responsibility centres are the section of an organisation which are looked after to

handle any sort of responsibilities within organisation and thus facilitates an effective decision

making authorities and individual managers (Weisbach, Hemel and Nou, 2018). In Cost centres,

the financial operations are undertaken by managers and are responsible for the cost management

but not the revenue generation of the firm.

Investment centres, on the other hand, are responsible for both profit or revenue

generation and resources that are invested as an asset within an organisation. It also helps in

management of different inventories and facilitates buying, selling and using divisional assets

within an organisation.

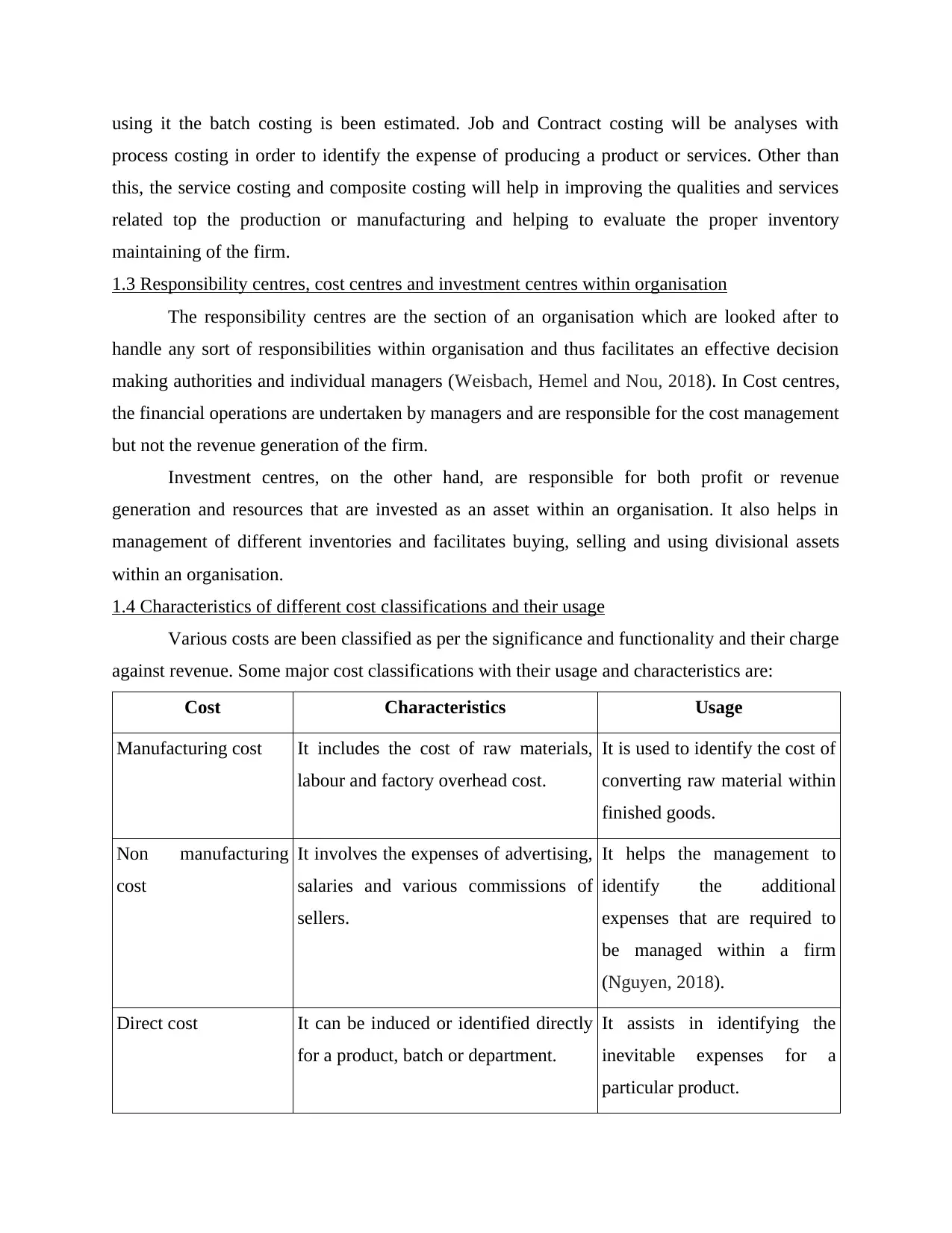

1.4 Characteristics of different cost classifications and their usage

Various costs are been classified as per the significance and functionality and their charge

against revenue. Some major cost classifications with their usage and characteristics are:

Cost Characteristics Usage

Manufacturing cost It includes the cost of raw materials,

labour and factory overhead cost.

It is used to identify the cost of

converting raw material within

finished goods.

Non manufacturing

cost

It involves the expenses of advertising,

salaries and various commissions of

sellers.

It helps the management to

identify the additional

expenses that are required to

be managed within a firm

(Nguyen, 2018).

Direct cost It can be induced or identified directly

for a product, batch or department.

It assists in identifying the

inevitable expenses for a

particular product.

process costing in order to identify the expense of producing a product or services. Other than

this, the service costing and composite costing will help in improving the qualities and services

related top the production or manufacturing and helping to evaluate the proper inventory

maintaining of the firm.

1.3 Responsibility centres, cost centres and investment centres within organisation

The responsibility centres are the section of an organisation which are looked after to

handle any sort of responsibilities within organisation and thus facilitates an effective decision

making authorities and individual managers (Weisbach, Hemel and Nou, 2018). In Cost centres,

the financial operations are undertaken by managers and are responsible for the cost management

but not the revenue generation of the firm.

Investment centres, on the other hand, are responsible for both profit or revenue

generation and resources that are invested as an asset within an organisation. It also helps in

management of different inventories and facilitates buying, selling and using divisional assets

within an organisation.

1.4 Characteristics of different cost classifications and their usage

Various costs are been classified as per the significance and functionality and their charge

against revenue. Some major cost classifications with their usage and characteristics are:

Cost Characteristics Usage

Manufacturing cost It includes the cost of raw materials,

labour and factory overhead cost.

It is used to identify the cost of

converting raw material within

finished goods.

Non manufacturing

cost

It involves the expenses of advertising,

salaries and various commissions of

sellers.

It helps the management to

identify the additional

expenses that are required to

be managed within a firm

(Nguyen, 2018).

Direct cost It can be induced or identified directly

for a product, batch or department.

It assists in identifying the

inevitable expenses for a

particular product.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Indirect cost It cannot be traced for a particular

object of costing. They are also known

as common or joint cost.

They assist in identifying the

overhead cost and operating

expenses.

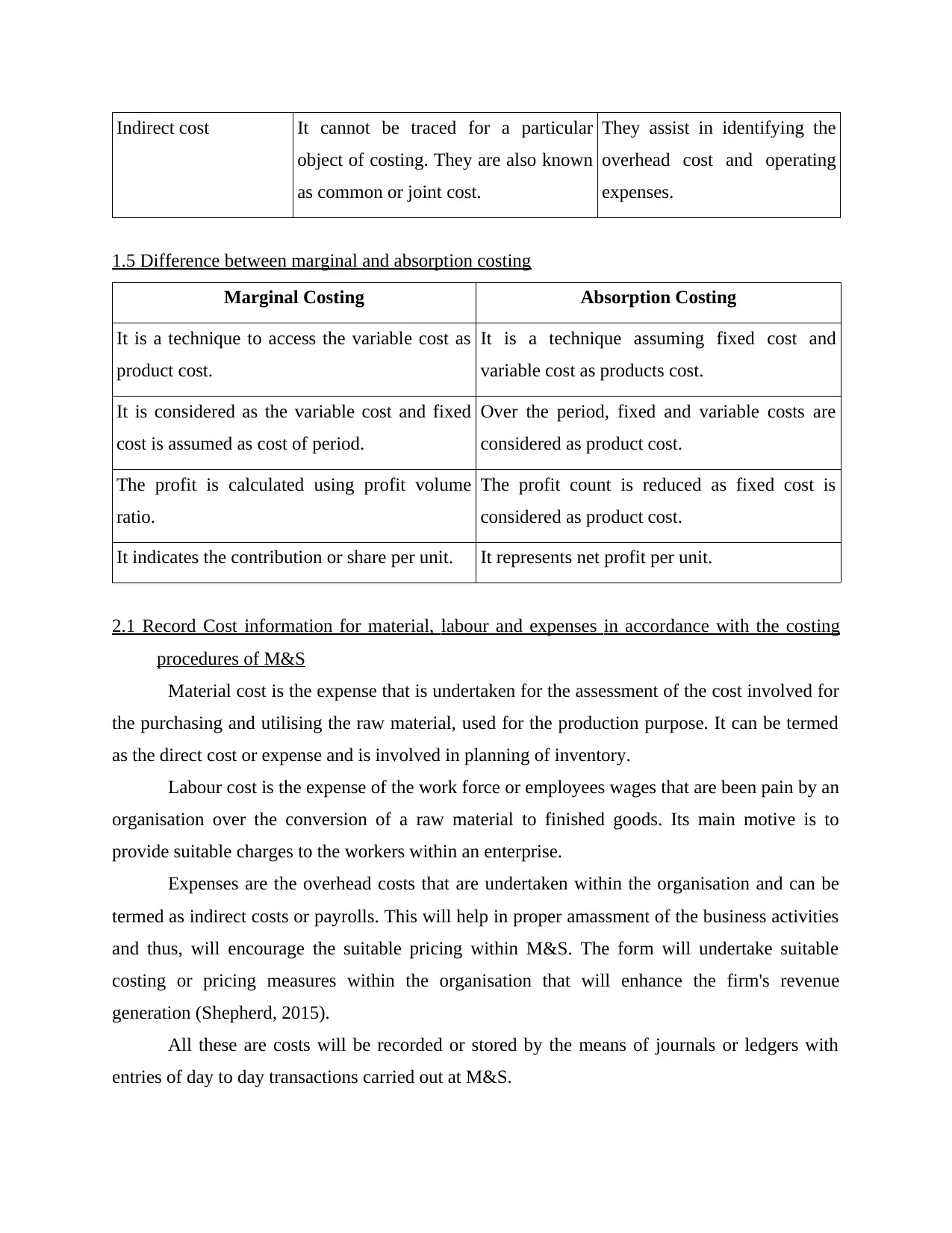

1.5 Difference between marginal and absorption costing

Marginal Costing Absorption Costing

It is a technique to access the variable cost as

product cost.

It is a technique assuming fixed cost and

variable cost as products cost.

It is considered as the variable cost and fixed

cost is assumed as cost of period.

Over the period, fixed and variable costs are

considered as product cost.

The profit is calculated using profit volume

ratio.

The profit count is reduced as fixed cost is

considered as product cost.

It indicates the contribution or share per unit. It represents net profit per unit.

2.1 Record Cost information for material, labour and expenses in accordance with the costing

procedures of M&S

Material cost is the expense that is undertaken for the assessment of the cost involved for

the purchasing and utilising the raw material, used for the production purpose. It can be termed

as the direct cost or expense and is involved in planning of inventory.

Labour cost is the expense of the work force or employees wages that are been pain by an

organisation over the conversion of a raw material to finished goods. Its main motive is to

provide suitable charges to the workers within an enterprise.

Expenses are the overhead costs that are undertaken within the organisation and can be

termed as indirect costs or payrolls. This will help in proper amassment of the business activities

and thus, will encourage the suitable pricing within M&S. The form will undertake suitable

costing or pricing measures within the organisation that will enhance the firm's revenue

generation (Shepherd, 2015).

All these are costs will be recorded or stored by the means of journals or ledgers with

entries of day to day transactions carried out at M&S.

object of costing. They are also known

as common or joint cost.

They assist in identifying the

overhead cost and operating

expenses.

1.5 Difference between marginal and absorption costing

Marginal Costing Absorption Costing

It is a technique to access the variable cost as

product cost.

It is a technique assuming fixed cost and

variable cost as products cost.

It is considered as the variable cost and fixed

cost is assumed as cost of period.

Over the period, fixed and variable costs are

considered as product cost.

The profit is calculated using profit volume

ratio.

The profit count is reduced as fixed cost is

considered as product cost.

It indicates the contribution or share per unit. It represents net profit per unit.

2.1 Record Cost information for material, labour and expenses in accordance with the costing

procedures of M&S

Material cost is the expense that is undertaken for the assessment of the cost involved for

the purchasing and utilising the raw material, used for the production purpose. It can be termed

as the direct cost or expense and is involved in planning of inventory.

Labour cost is the expense of the work force or employees wages that are been pain by an

organisation over the conversion of a raw material to finished goods. Its main motive is to

provide suitable charges to the workers within an enterprise.

Expenses are the overhead costs that are undertaken within the organisation and can be

termed as indirect costs or payrolls. This will help in proper amassment of the business activities

and thus, will encourage the suitable pricing within M&S. The form will undertake suitable

costing or pricing measures within the organisation that will enhance the firm's revenue

generation (Shepherd, 2015).

All these are costs will be recorded or stored by the means of journals or ledgers with

entries of day to day transactions carried out at M&S.

2.2 Analyse cost information for material, labour and expenses in accordance with the costing

procedures of M&S

The labour cost, material expense and other expenses that are been carried around within

the organisation that will help in identifying the suitable part of the operations and thus will

encourage the overall operations of the organisation that will help ion placing of the operations

and thus, will encourage the management of the organisation to enhance the quality of services

and thus will meet the operational needs of the organisation. The journals or ledgers that are

created for the recording and analysis purpose that will help in suitable planning of the business

operations and meeting the evaluation of cost or expenses within the firm.

2.3 Different stages of inventory

Different stages of inventory are been placed within the organisation that help in proper

assessment of the business expenses of M&S and thus will help in proper assessment of the

expenses carried within the organisation. The four major stages of inventory are:

Raw material: It involves all the resources and raw material that is been required to

produce a good and consists of the basic material such as cotton, wood, grains, milk etc.

Work in process: this involves the proper assesses of the manufacturing and production

process that is been carried out within the organisation. It also involves the assessment of

the inventory and material cost, including the overhead and also include the resource

allocation process (Ghiyasi, 2017).

Finished goods: it is the final product or service that is been taken in consideration by

the firm like M&S. This stage involves the stocking or storing process that is carried out

by firm. This stage is susceptible to theft, falling down of prices and decrease in market

demands.

Cost of sold goods: This is the represented as the income statement of the firm and

involves the cost of good s or products that is been sold by M&S to the customer.

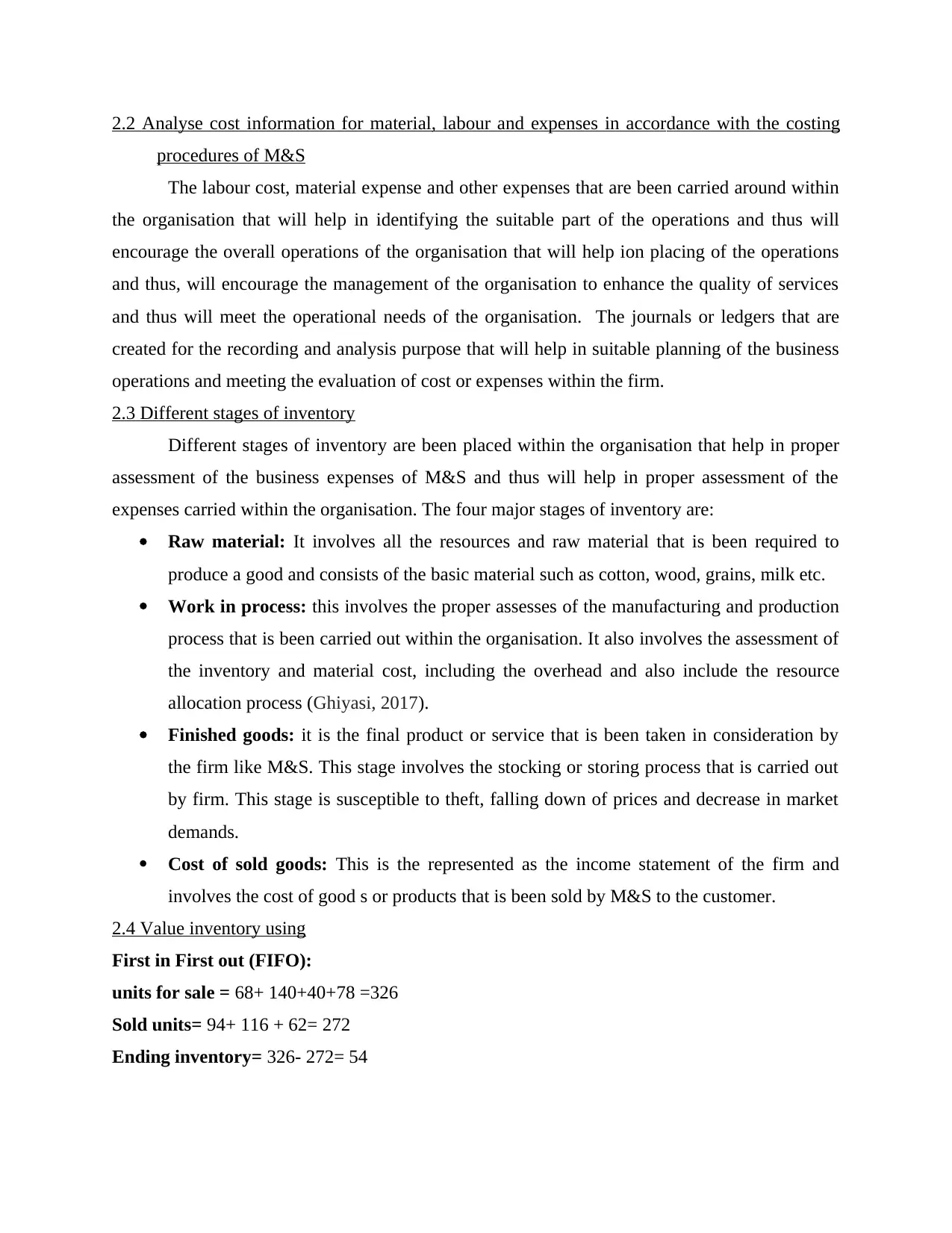

2.4 Value inventory using

First in First out (FIFO):

units for sale = 68+ 140+40+78 =326

Sold units= 94+ 116 + 62= 272

Ending inventory= 326- 272= 54

procedures of M&S

The labour cost, material expense and other expenses that are been carried around within

the organisation that will help in identifying the suitable part of the operations and thus will

encourage the overall operations of the organisation that will help ion placing of the operations

and thus, will encourage the management of the organisation to enhance the quality of services

and thus will meet the operational needs of the organisation. The journals or ledgers that are

created for the recording and analysis purpose that will help in suitable planning of the business

operations and meeting the evaluation of cost or expenses within the firm.

2.3 Different stages of inventory

Different stages of inventory are been placed within the organisation that help in proper

assessment of the business expenses of M&S and thus will help in proper assessment of the

expenses carried within the organisation. The four major stages of inventory are:

Raw material: It involves all the resources and raw material that is been required to

produce a good and consists of the basic material such as cotton, wood, grains, milk etc.

Work in process: this involves the proper assesses of the manufacturing and production

process that is been carried out within the organisation. It also involves the assessment of

the inventory and material cost, including the overhead and also include the resource

allocation process (Ghiyasi, 2017).

Finished goods: it is the final product or service that is been taken in consideration by

the firm like M&S. This stage involves the stocking or storing process that is carried out

by firm. This stage is susceptible to theft, falling down of prices and decrease in market

demands.

Cost of sold goods: This is the represented as the income statement of the firm and

involves the cost of good s or products that is been sold by M&S to the customer.

2.4 Value inventory using

First in First out (FIFO):

units for sale = 68+ 140+40+78 =326

Sold units= 94+ 116 + 62= 272

Ending inventory= 326- 272= 54

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Sold goods Cost Units Unit cost Total

Sales from march 1 68 $15 $1020

Sales from march 5 140 $15.50 $2170

Sales from march 11 40 $16 $640

Sales from march 16 24 $16.50 $396

Total 272 $4226

Ending inventory

Ending inventory units Unit cost Total

Inventory from purchase on mar 16 54 $16.50 $891

Perpetual

date Purchase Sales balance

March units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 140 $15.50 $2170 68 $15.50 $1020

9 68

26

$15.50

$15.50

$1020

$403

114 $15.50 $1767

11 40 $16 $640 114

40

$15.50

$16.00

$1767

$640

16 78 $16.50 $1287 114

40

78

$15.50

$16.00

$16.50

$1767

$640

$1287

20 114

2

$15.50

$16

$1767

$32

38

78

$16

$16.50

$608

$1287

29 38

24

$16

$16.50

$608

$396

54 $16.50 $891

Sales from march 1 68 $15 $1020

Sales from march 5 140 $15.50 $2170

Sales from march 11 40 $16 $640

Sales from march 16 24 $16.50 $396

Total 272 $4226

Ending inventory

Ending inventory units Unit cost Total

Inventory from purchase on mar 16 54 $16.50 $891

Perpetual

date Purchase Sales balance

March units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 140 $15.50 $2170 68 $15.50 $1020

9 68

26

$15.50

$15.50

$1020

$403

114 $15.50 $1767

11 40 $16 $640 114

40

$15.50

$16.00

$1767

$640

16 78 $16.50 $1287 114

40

78

$15.50

$16.00

$16.50

$1767

$640

$1287

20 114

2

$15.50

$16

$1767

$32

38

78

$16

$16.50

$608

$1287

29 38

24

$16

$16.50

$608

$396

54 $16.50 $891

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

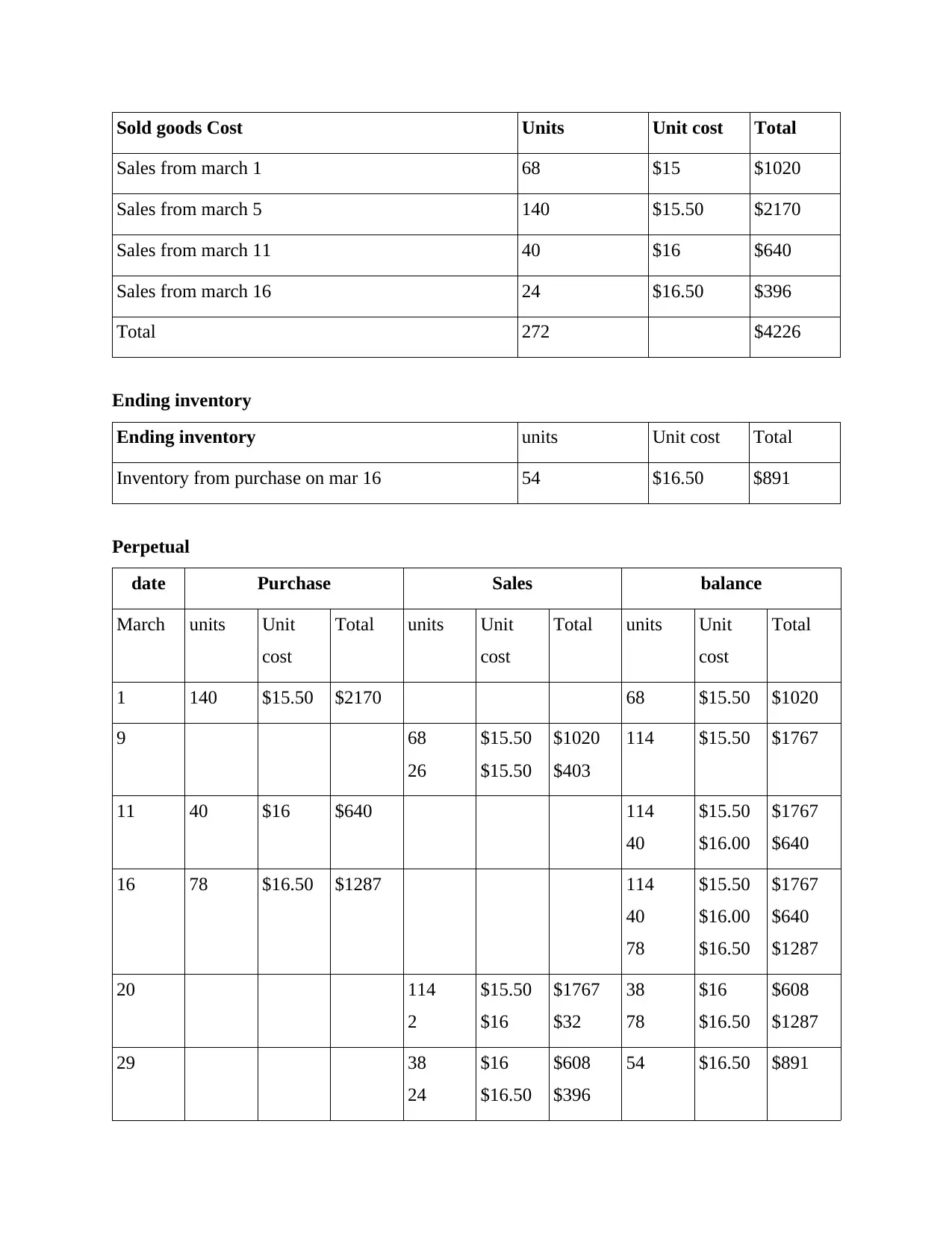

Last in first out (LIFO):

units for sale= 60+140+70= 270

Sold units= 190+30= 220

Ending inventory= 270-220=50

Sold goods Cost Units Unit cost Total

Sales on mar 27 70 $16 $1220

Sales on mar 5 140 $15.50 $2170

Sales on mar 1 10 $15 $150

220 $3440

Ending Inventory unit Unit cost total

Inventory on purchase on 27 50 $15 $750

Perpetual

Date Purchase Sales balance

March units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 60 $15 $900

5 140 $15.50 $2170 60

140

$15

$15.50

$900

$2170

14 140

50

$15.50

$15

$2170

$750

10 $15 $150

27 70 $16 $1190 10

70

$15

$16

$150

$1120

29 30 $16 $480 10 $15 $150

units for sale= 60+140+70= 270

Sold units= 190+30= 220

Ending inventory= 270-220=50

Sold goods Cost Units Unit cost Total

Sales on mar 27 70 $16 $1220

Sales on mar 5 140 $15.50 $2170

Sales on mar 1 10 $15 $150

220 $3440

Ending Inventory unit Unit cost total

Inventory on purchase on 27 50 $15 $750

Perpetual

Date Purchase Sales balance

March units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 60 $15 $900

5 140 $15.50 $2170 60

140

$15

$15.50

$900

$2170

14 140

50

$15.50

$15

$2170

$750

10 $15 $150

27 70 $16 $1190 10

70

$15

$16

$150

$1120

29 30 $16 $480 10 $15 $150

40 $16 $640

31 10

40

$15

$16

$150

$640

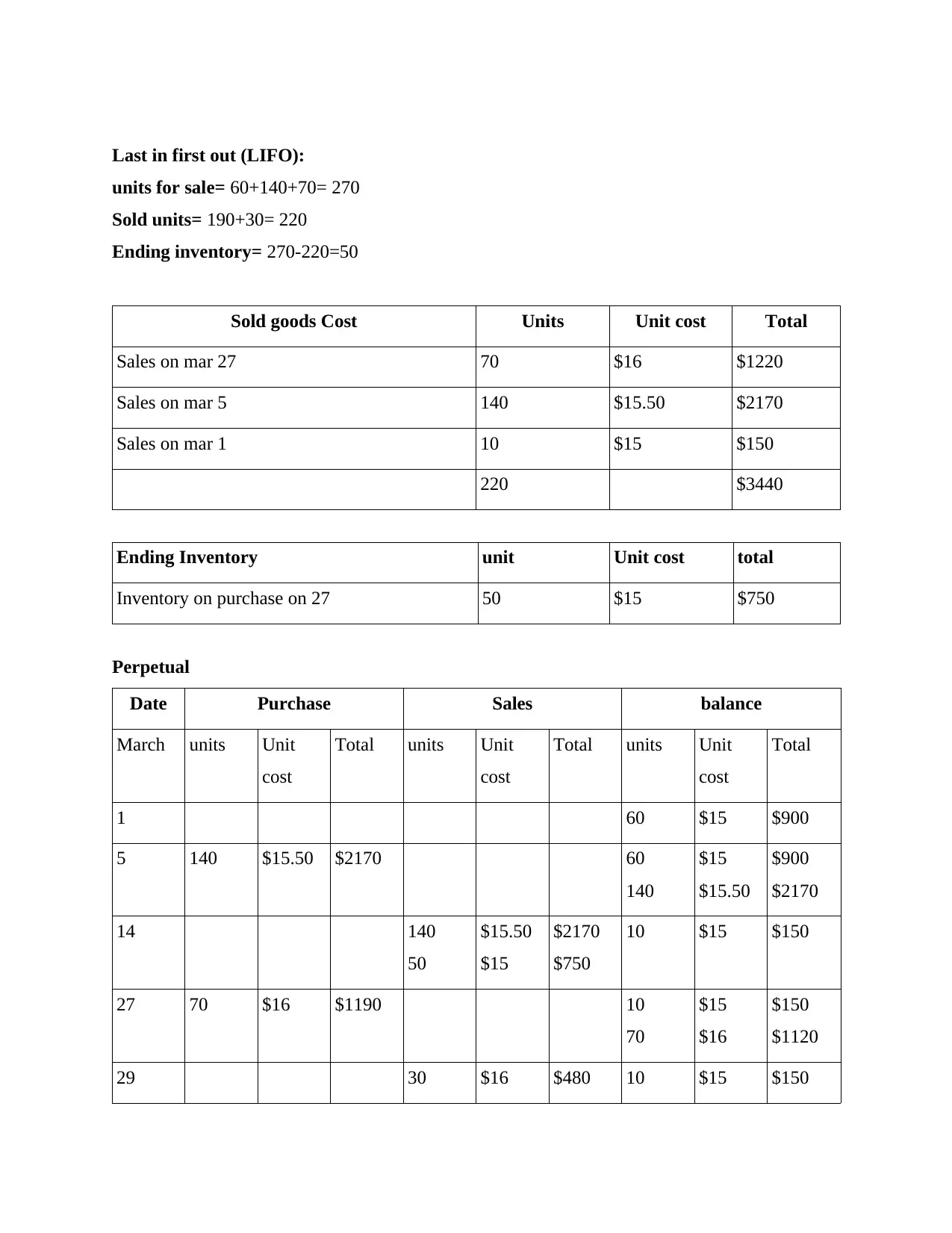

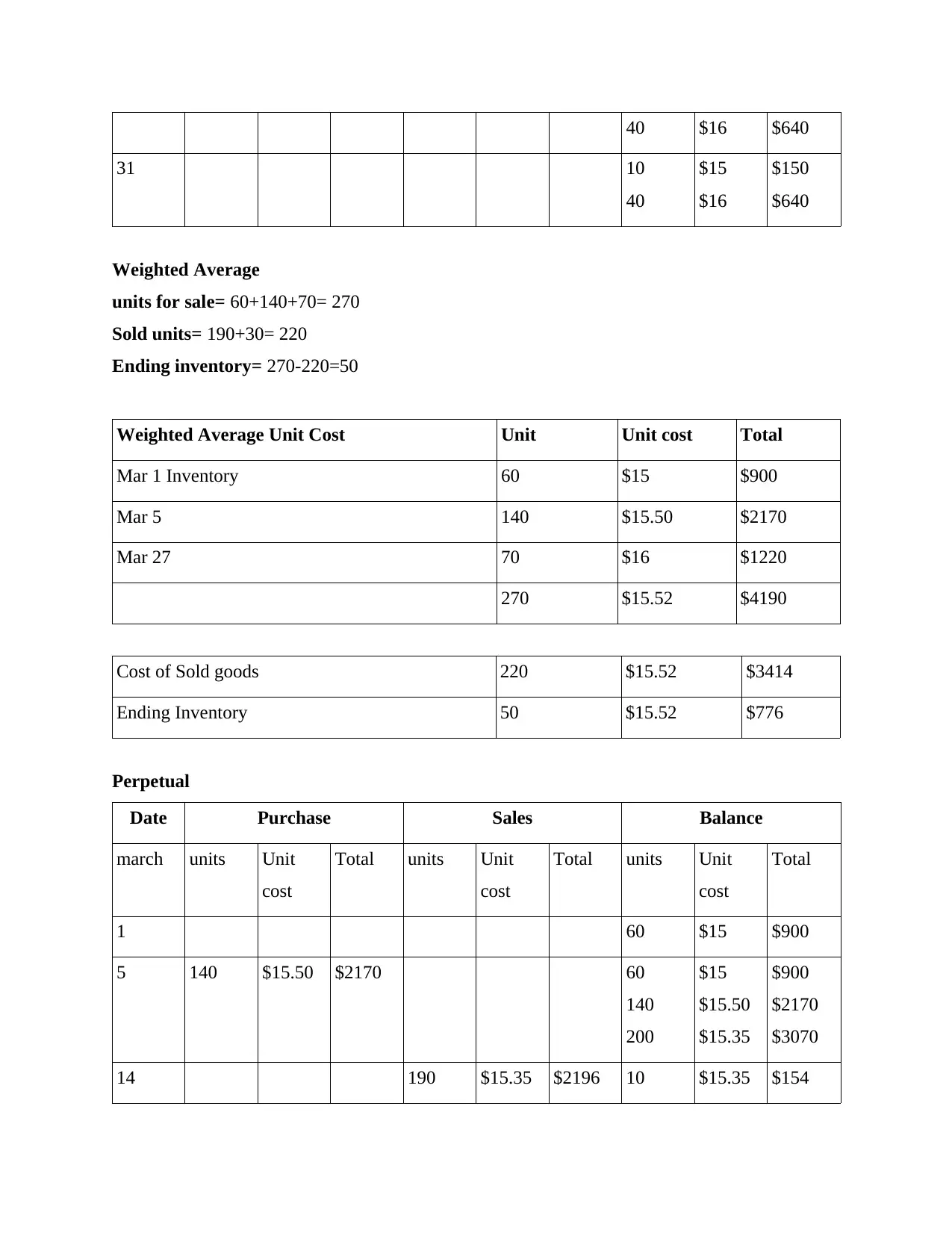

Weighted Average

units for sale= 60+140+70= 270

Sold units= 190+30= 220

Ending inventory= 270-220=50

Weighted Average Unit Cost Unit Unit cost Total

Mar 1 Inventory 60 $15 $900

Mar 5 140 $15.50 $2170

Mar 27 70 $16 $1220

270 $15.52 $4190

Cost of Sold goods 220 $15.52 $3414

Ending Inventory 50 $15.52 $776

Perpetual

Date Purchase Sales Balance

march units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 60 $15 $900

5 140 $15.50 $2170 60

140

200

$15

$15.50

$15.35

$900

$2170

$3070

14 190 $15.35 $2196 10 $15.35 $154

31 10

40

$15

$16

$150

$640

Weighted Average

units for sale= 60+140+70= 270

Sold units= 190+30= 220

Ending inventory= 270-220=50

Weighted Average Unit Cost Unit Unit cost Total

Mar 1 Inventory 60 $15 $900

Mar 5 140 $15.50 $2170

Mar 27 70 $16 $1220

270 $15.52 $4190

Cost of Sold goods 220 $15.52 $3414

Ending Inventory 50 $15.52 $776

Perpetual

Date Purchase Sales Balance

march units Unit

cost

Total units Unit

cost

Total units Unit

cost

Total

1 60 $15 $900

5 140 $15.50 $2170 60

140

200

$15

$15.50

$15.35

$900

$2170

$3070

14 190 $15.35 $2196 10 $15.35 $154

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

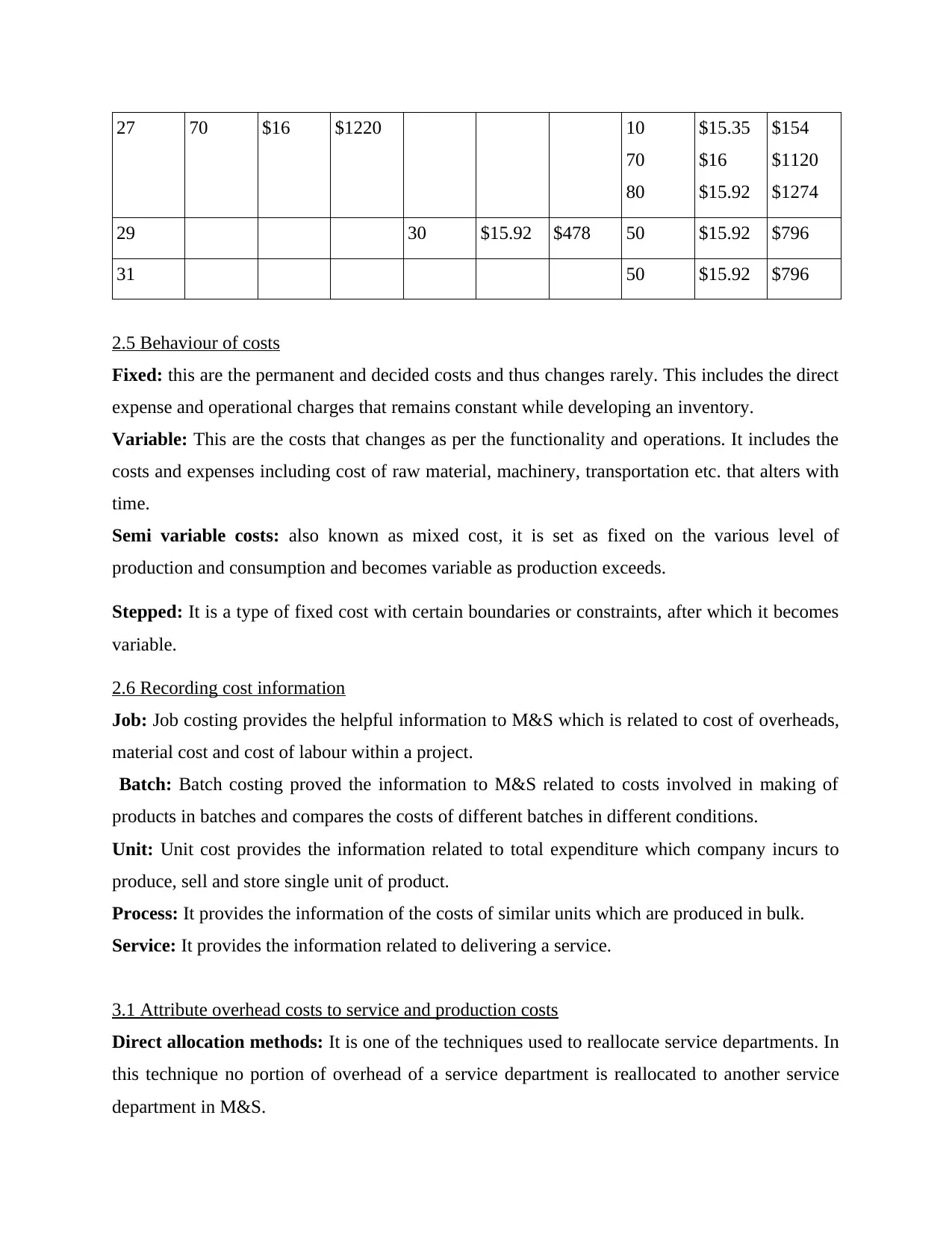

27 70 $16 $1220 10

70

80

$15.35

$16

$15.92

$154

$1120

$1274

29 30 $15.92 $478 50 $15.92 $796

31 50 $15.92 $796

2.5 Behaviour of costs

Fixed: this are the permanent and decided costs and thus changes rarely. This includes the direct

expense and operational charges that remains constant while developing an inventory.

Variable: This are the costs that changes as per the functionality and operations. It includes the

costs and expenses including cost of raw material, machinery, transportation etc. that alters with

time.

Semi variable costs: also known as mixed cost, it is set as fixed on the various level of

production and consumption and becomes variable as production exceeds.

Stepped: It is a type of fixed cost with certain boundaries or constraints, after which it becomes

variable.

2.6 Recording cost information

Job: Job costing provides the helpful information to M&S which is related to cost of overheads,

material cost and cost of labour within a project.

Batch: Batch costing proved the information to M&S related to costs involved in making of

products in batches and compares the costs of different batches in different conditions.

Unit: Unit cost provides the information related to total expenditure which company incurs to

produce, sell and store single unit of product.

Process: It provides the information of the costs of similar units which are produced in bulk.

Service: It provides the information related to delivering a service.

3.1 Attribute overhead costs to service and production costs

Direct allocation methods: It is one of the techniques used to reallocate service departments. In

this technique no portion of overhead of a service department is reallocated to another service

department in M&S.

70

80

$15.35

$16

$15.92

$154

$1120

$1274

29 30 $15.92 $478 50 $15.92 $796

31 50 $15.92 $796

2.5 Behaviour of costs

Fixed: this are the permanent and decided costs and thus changes rarely. This includes the direct

expense and operational charges that remains constant while developing an inventory.

Variable: This are the costs that changes as per the functionality and operations. It includes the

costs and expenses including cost of raw material, machinery, transportation etc. that alters with

time.

Semi variable costs: also known as mixed cost, it is set as fixed on the various level of

production and consumption and becomes variable as production exceeds.

Stepped: It is a type of fixed cost with certain boundaries or constraints, after which it becomes

variable.

2.6 Recording cost information

Job: Job costing provides the helpful information to M&S which is related to cost of overheads,

material cost and cost of labour within a project.

Batch: Batch costing proved the information to M&S related to costs involved in making of

products in batches and compares the costs of different batches in different conditions.

Unit: Unit cost provides the information related to total expenditure which company incurs to

produce, sell and store single unit of product.

Process: It provides the information of the costs of similar units which are produced in bulk.

Service: It provides the information related to delivering a service.

3.1 Attribute overhead costs to service and production costs

Direct allocation methods: It is one of the techniques used to reallocate service departments. In

this technique no portion of overhead of a service department is reallocated to another service

department in M&S.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

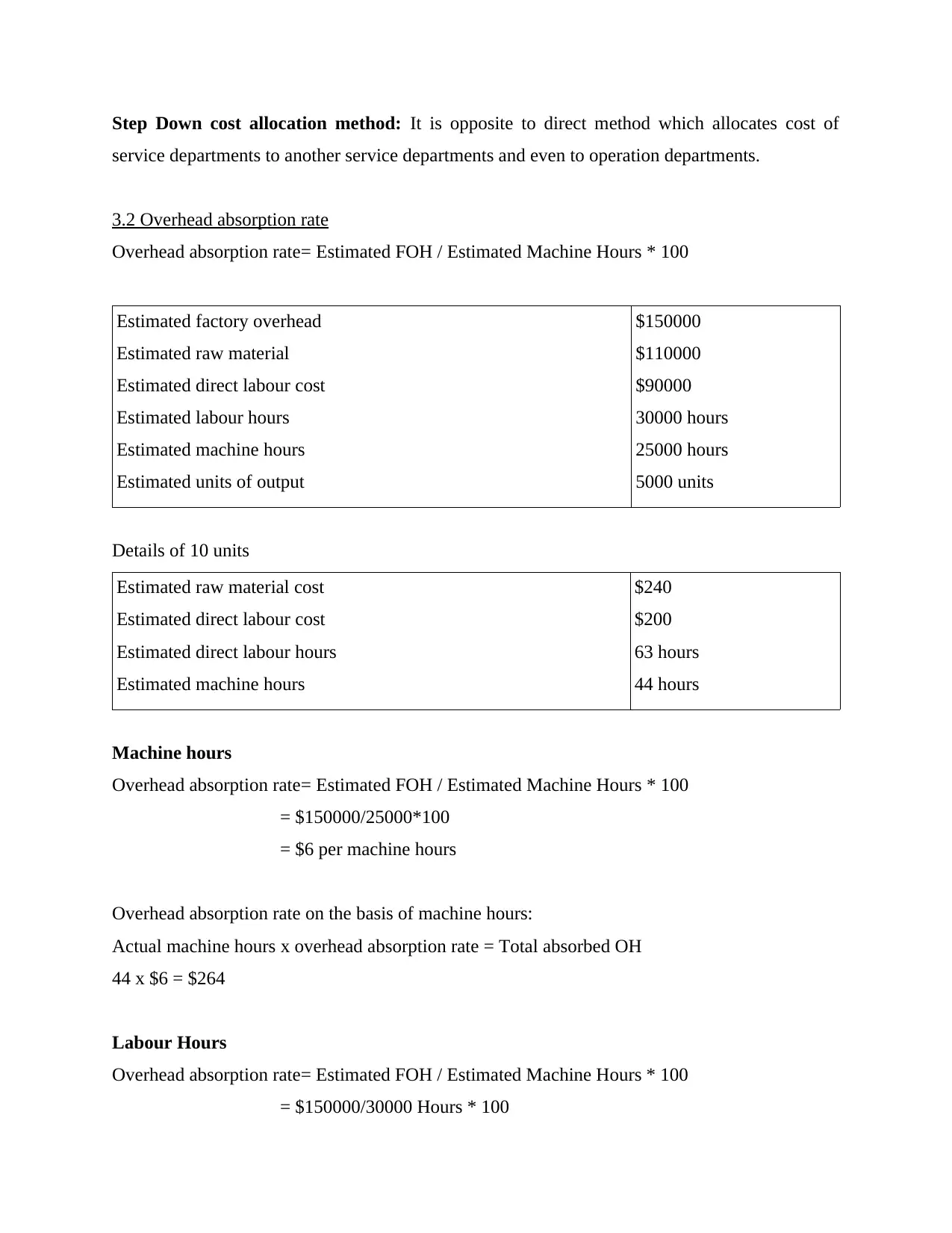

Step Down cost allocation method: It is opposite to direct method which allocates cost of

service departments to another service departments and even to operation departments.

3.2 Overhead absorption rate

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

Estimated factory overhead

Estimated raw material

Estimated direct labour cost

Estimated labour hours

Estimated machine hours

Estimated units of output

$150000

$110000

$90000

30000 hours

25000 hours

5000 units

Details of 10 units

Estimated raw material cost

Estimated direct labour cost

Estimated direct labour hours

Estimated machine hours

$240

$200

63 hours

44 hours

Machine hours

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

= $150000/25000*100

= $6 per machine hours

Overhead absorption rate on the basis of machine hours:

Actual machine hours x overhead absorption rate = Total absorbed OH

44 x $6 = $264

Labour Hours

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

= $150000/30000 Hours * 100

service departments to another service departments and even to operation departments.

3.2 Overhead absorption rate

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

Estimated factory overhead

Estimated raw material

Estimated direct labour cost

Estimated labour hours

Estimated machine hours

Estimated units of output

$150000

$110000

$90000

30000 hours

25000 hours

5000 units

Details of 10 units

Estimated raw material cost

Estimated direct labour cost

Estimated direct labour hours

Estimated machine hours

$240

$200

63 hours

44 hours

Machine hours

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

= $150000/25000*100

= $6 per machine hours

Overhead absorption rate on the basis of machine hours:

Actual machine hours x overhead absorption rate = Total absorbed OH

44 x $6 = $264

Labour Hours

Overhead absorption rate= Estimated FOH / Estimated Machine Hours * 100

= $150000/30000 Hours * 100

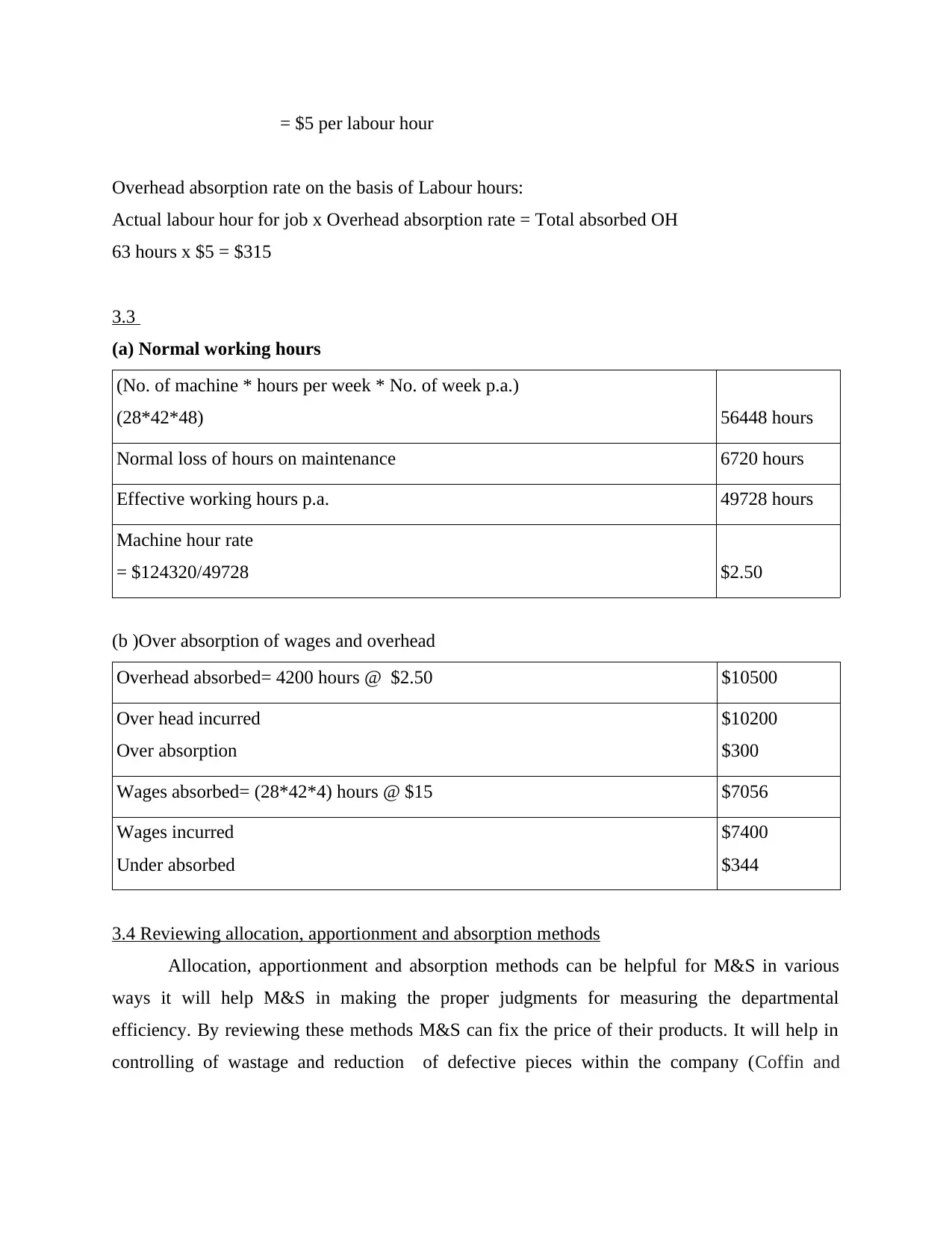

= $5 per labour hour

Overhead absorption rate on the basis of Labour hours:

Actual labour hour for job x Overhead absorption rate = Total absorbed OH

63 hours x $5 = $315

3.3

(a) Normal working hours

(No. of machine * hours per week * No. of week p.a.)

(28*42*48) 56448 hours

Normal loss of hours on maintenance 6720 hours

Effective working hours p.a. 49728 hours

Machine hour rate

= $124320/49728 $2.50

(b )Over absorption of wages and overhead

Overhead absorbed= 4200 hours @ $2.50 $10500

Over head incurred

Over absorption

$10200

$300

Wages absorbed= (28*42*4) hours @ $15 $7056

Wages incurred

Under absorbed

$7400

$344

3.4 Reviewing allocation, apportionment and absorption methods

Allocation, apportionment and absorption methods can be helpful for M&S in various

ways it will help M&S in making the proper judgments for measuring the departmental

efficiency. By reviewing these methods M&S can fix the price of their products. It will help in

controlling of wastage and reduction of defective pieces within the company (Coffin and

Overhead absorption rate on the basis of Labour hours:

Actual labour hour for job x Overhead absorption rate = Total absorbed OH

63 hours x $5 = $315

3.3

(a) Normal working hours

(No. of machine * hours per week * No. of week p.a.)

(28*42*48) 56448 hours

Normal loss of hours on maintenance 6720 hours

Effective working hours p.a. 49728 hours

Machine hour rate

= $124320/49728 $2.50

(b )Over absorption of wages and overhead

Overhead absorbed= 4200 hours @ $2.50 $10500

Over head incurred

Over absorption

$10200

$300

Wages absorbed= (28*42*4) hours @ $15 $7056

Wages incurred

Under absorbed

$7400

$344

3.4 Reviewing allocation, apportionment and absorption methods

Allocation, apportionment and absorption methods can be helpful for M&S in various

ways it will help M&S in making the proper judgments for measuring the departmental

efficiency. By reviewing these methods M&S can fix the price of their products. It will help in

controlling of wastage and reduction of defective pieces within the company (Coffin and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.