Management Accounting Report: Costing, Budgeting & Variance Analysis

VerifiedAdded on 2023/06/18

|19

|4234

|466

Report

AI Summary

This management accounting report provides a comprehensive analysis of Plaistead Plc and Crawford Plc, covering various aspects of costing, budgeting, and variance analysis. It includes calculations for contribution per unit, break-even sales revenue, margin of safety, and profit estimation for Plaistead Plc under different scenarios. The report also explores the impact of adopting a new pricing strategy. For Crawford Plc, the report details the allocation of costs to different departments using appropriate ratios and calculates overhead recovery rates. Furthermore, it determines the full job cost and product cost for a special product. Finally, the report discusses the estimations of budgets and variances for Jayrod Plc's PK65 product, offering insights into management accounting principles and their practical application. Desklib provides access to this and many other solved assignments to help students.

Introduction to

management accounting

management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents................................................................................................................................................2

Part 1.....................................................................................................................................................3

Question 2: Plaistead Plc..................................................................................................................3

Part 2.....................................................................................................................................................8

Question 3: Crawford Plc.................................................................................................................8

Part 3.....................................................................................................................................................3

Question 4:........................................................................................................................................3

REFERENCES.....................................................................................................................................9

Contents................................................................................................................................................2

Part 1.....................................................................................................................................................3

Question 2: Plaistead Plc..................................................................................................................3

Part 2.....................................................................................................................................................8

Question 3: Crawford Plc.................................................................................................................8

Part 3.....................................................................................................................................................3

Question 4:........................................................................................................................................3

REFERENCES.....................................................................................................................................9

Part 1

Question 2: Plaistead Plc.

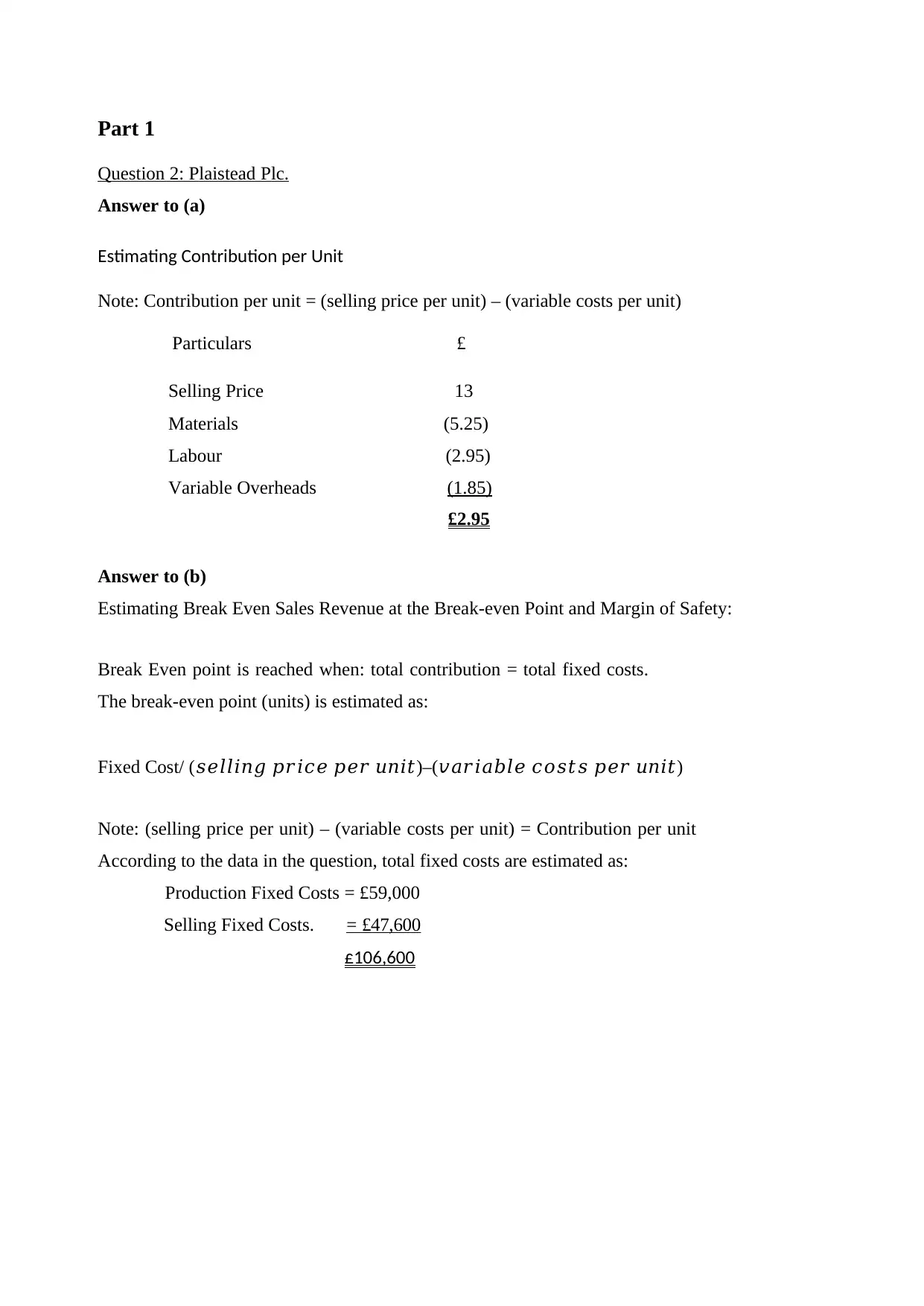

Answer to (a)

Estimating Contribution per Unit

Note: Contribution per unit = (selling price per unit) – (variable costs per unit)

Particulars £

Selling Price 13

Materials (5.25)

Labour (2.95)

Variable Overheads (1.85)

£2.95

Answer to (b)

Estimating Break Even Sales Revenue at the Break-even Point and Margin of Safety:

Break Even point is reached when: total contribution = total fixed costs.

The break-even point (units) is estimated as:

Fixed Cost/ (𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)–(𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡𝑠 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)

Note: (selling price per unit) – (variable costs per unit) = Contribution per unit

According to the data in the question, total fixed costs are estimated as:

Production Fixed Costs = £59,000

Selling Fixed Costs. = £47,600

£106,600

Question 2: Plaistead Plc.

Answer to (a)

Estimating Contribution per Unit

Note: Contribution per unit = (selling price per unit) – (variable costs per unit)

Particulars £

Selling Price 13

Materials (5.25)

Labour (2.95)

Variable Overheads (1.85)

£2.95

Answer to (b)

Estimating Break Even Sales Revenue at the Break-even Point and Margin of Safety:

Break Even point is reached when: total contribution = total fixed costs.

The break-even point (units) is estimated as:

Fixed Cost/ (𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)–(𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡𝑠 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)

Note: (selling price per unit) – (variable costs per unit) = Contribution per unit

According to the data in the question, total fixed costs are estimated as:

Production Fixed Costs = £59,000

Selling Fixed Costs. = £47,600

£106,600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

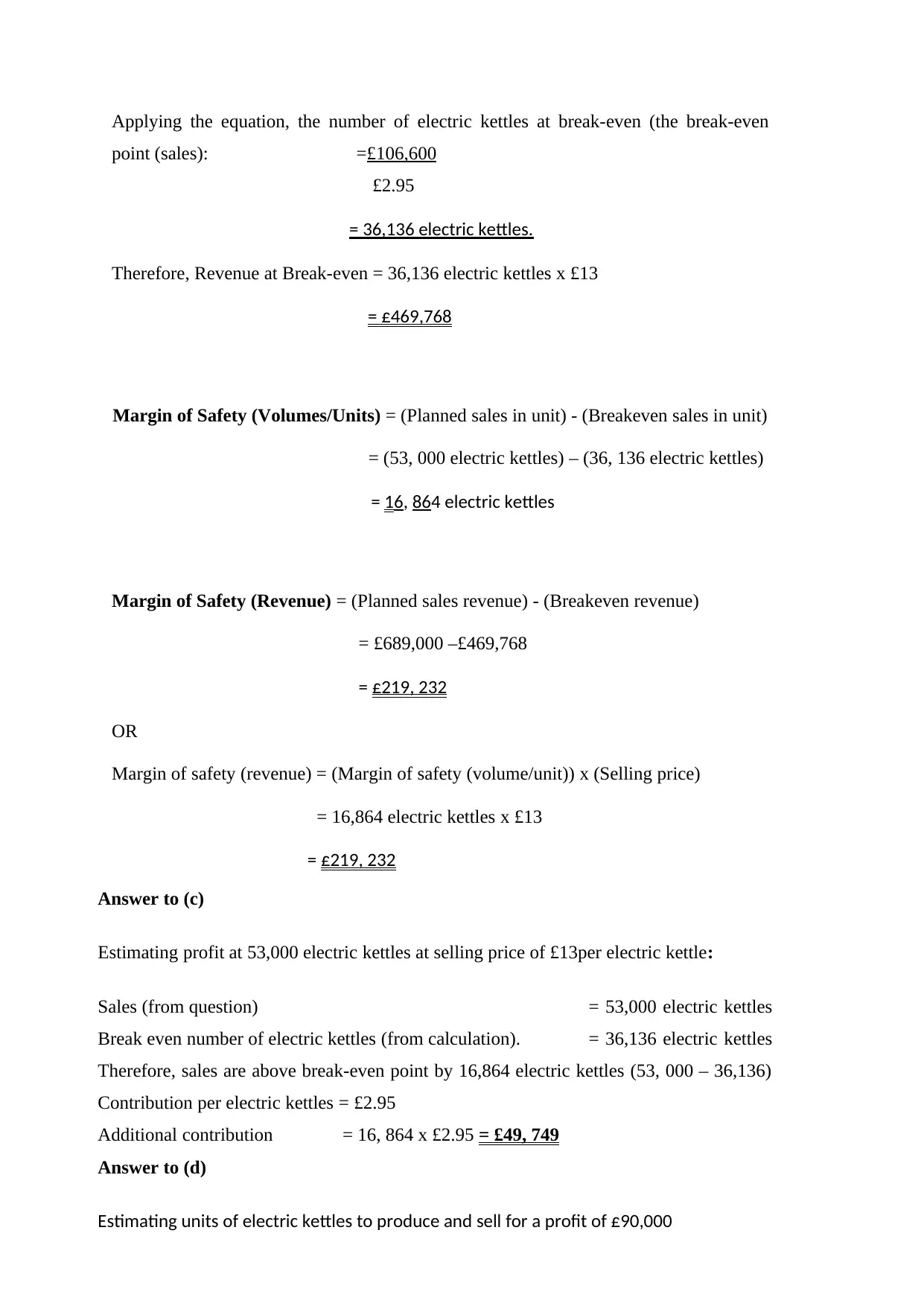

Applying the equation, the number of electric kettles at break-even (the break-even

point (sales): =£106,600

£2.95

= 36,136 electric kettles.

Therefore, Revenue at Break-even = 36,136 electric kettles x £13

= £469,768

Margin of Safety (Volumes/Units) = (Planned sales in unit) - (Breakeven sales in unit)

= (53, 000 electric kettles) – (36, 136 electric kettles)

= 16, 864 electric kettles

Margin of Safety (Revenue) = (Planned sales revenue) - (Breakeven revenue)

= £689,000 –£469,768

= £219, 232

OR

Margin of safety (revenue) = (Margin of safety (volume/unit)) x (Selling price)

= 16,864 electric kettles x £13

= £219, 232

Answer to (c)

Estimating profit at 53,000 electric kettles at selling price of £13per electric kettle:

Sales (from question) = 53,000 electric kettles

Break even number of electric kettles (from calculation). = 36,136 electric kettles

Therefore, sales are above break-even point by 16,864 electric kettles (53, 000 – 36,136)

Contribution per electric kettles = £2.95

Additional contribution = 16, 864 x £2.95 = £49, 749

Answer to (d)

Estimating units of electric kettles to produce and sell for a profit of £90,000

point (sales): =£106,600

£2.95

= 36,136 electric kettles.

Therefore, Revenue at Break-even = 36,136 electric kettles x £13

= £469,768

Margin of Safety (Volumes/Units) = (Planned sales in unit) - (Breakeven sales in unit)

= (53, 000 electric kettles) – (36, 136 electric kettles)

= 16, 864 electric kettles

Margin of Safety (Revenue) = (Planned sales revenue) - (Breakeven revenue)

= £689,000 –£469,768

= £219, 232

OR

Margin of safety (revenue) = (Margin of safety (volume/unit)) x (Selling price)

= 16,864 electric kettles x £13

= £219, 232

Answer to (c)

Estimating profit at 53,000 electric kettles at selling price of £13per electric kettle:

Sales (from question) = 53,000 electric kettles

Break even number of electric kettles (from calculation). = 36,136 electric kettles

Therefore, sales are above break-even point by 16,864 electric kettles (53, 000 – 36,136)

Contribution per electric kettles = £2.95

Additional contribution = 16, 864 x £2.95 = £49, 749

Answer to (d)

Estimating units of electric kettles to produce and sell for a profit of £90,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

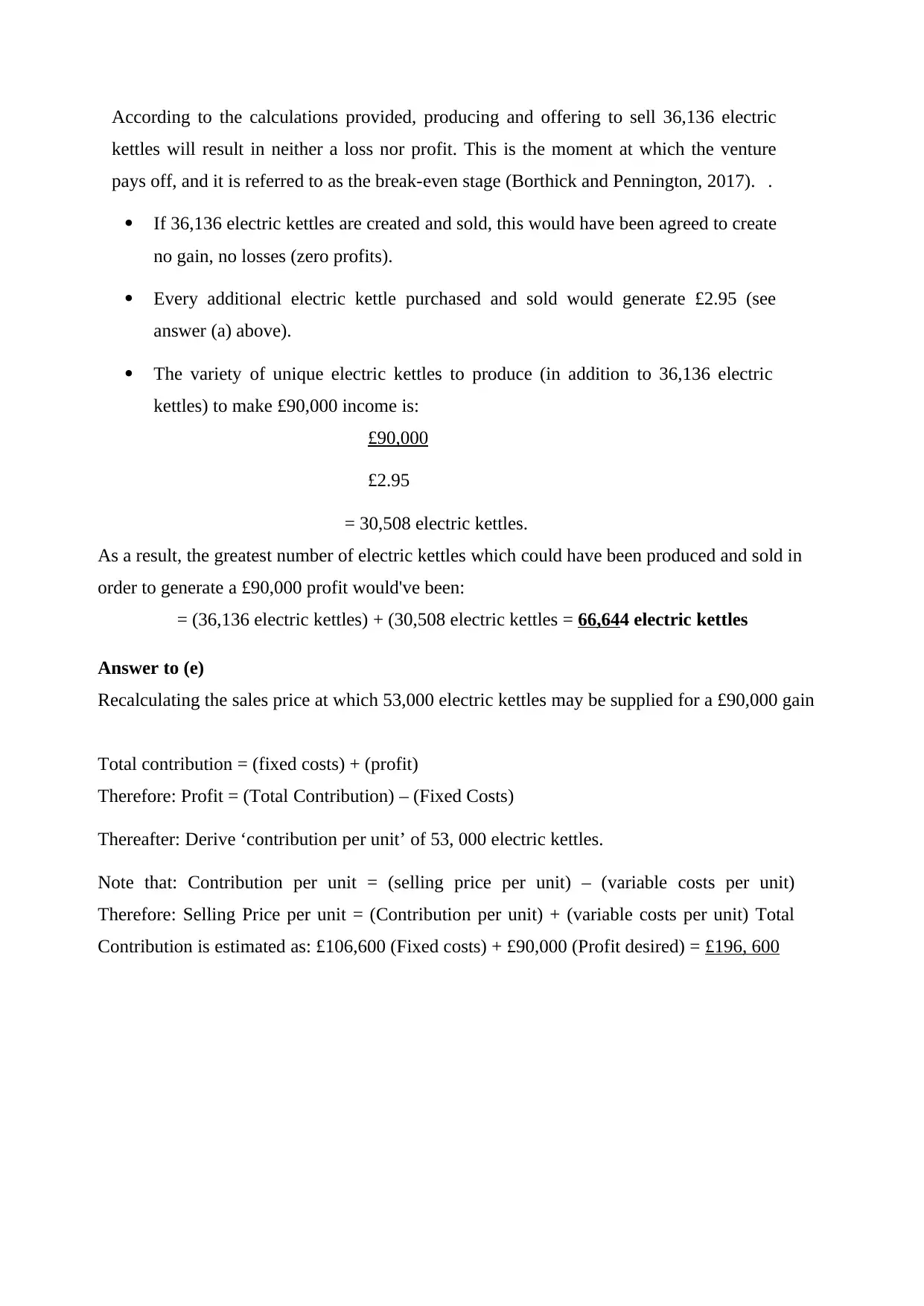

According to the calculations provided, producing and offering to sell 36,136 electric

kettles will result in neither a loss nor profit. This is the moment at which the venture

pays off, and it is referred to as the break-even stage (Borthick and Pennington, 2017). .

If 36,136 electric kettles are created and sold, this would have been agreed to create

no gain, no losses (zero profits).

Every additional electric kettle purchased and sold would generate £2.95 (see

answer (a) above).

The variety of unique electric kettles to produce (in addition to 36,136 electric

kettles) to make £90,000 income is:

£90,000

£2.95

= 30,508 electric kettles.

As a result, the greatest number of electric kettles which could have been produced and sold in

order to generate a £90,000 profit would've been:

= (36,136 electric kettles) + (30,508 electric kettles = 66,644 electric kettles

Answer to (e)

Recalculating the sales price at which 53,000 electric kettles may be supplied for a £90,000 gain

Total contribution = (fixed costs) + (profit)

Therefore: Profit = (Total Contribution) – (Fixed Costs)

Thereafter: Derive ‘contribution per unit’ of 53, 000 electric kettles.

Note that: Contribution per unit = (selling price per unit) – (variable costs per unit)

Therefore: Selling Price per unit = (Contribution per unit) + (variable costs per unit) Total

Contribution is estimated as: £106,600 (Fixed costs) + £90,000 (Profit desired) = £196, 600

kettles will result in neither a loss nor profit. This is the moment at which the venture

pays off, and it is referred to as the break-even stage (Borthick and Pennington, 2017). .

If 36,136 electric kettles are created and sold, this would have been agreed to create

no gain, no losses (zero profits).

Every additional electric kettle purchased and sold would generate £2.95 (see

answer (a) above).

The variety of unique electric kettles to produce (in addition to 36,136 electric

kettles) to make £90,000 income is:

£90,000

£2.95

= 30,508 electric kettles.

As a result, the greatest number of electric kettles which could have been produced and sold in

order to generate a £90,000 profit would've been:

= (36,136 electric kettles) + (30,508 electric kettles = 66,644 electric kettles

Answer to (e)

Recalculating the sales price at which 53,000 electric kettles may be supplied for a £90,000 gain

Total contribution = (fixed costs) + (profit)

Therefore: Profit = (Total Contribution) – (Fixed Costs)

Thereafter: Derive ‘contribution per unit’ of 53, 000 electric kettles.

Note that: Contribution per unit = (selling price per unit) – (variable costs per unit)

Therefore: Selling Price per unit = (Contribution per unit) + (variable costs per unit) Total

Contribution is estimated as: £106,600 (Fixed costs) + £90,000 (Profit desired) = £196, 600

If 53,000 electric kettles are sold, contribution needed per electric kettles is estimated as:

£196, 600

53, 000 (electric kettles)

= £3.71

Therefore, the estimated selling price = (Contribution per unit) + (variable costs per unit):

Contribution per unit £3.71

Materials £5.25

Labour £2.95

Variable Overheads £1.85

New Selling Price £13.76

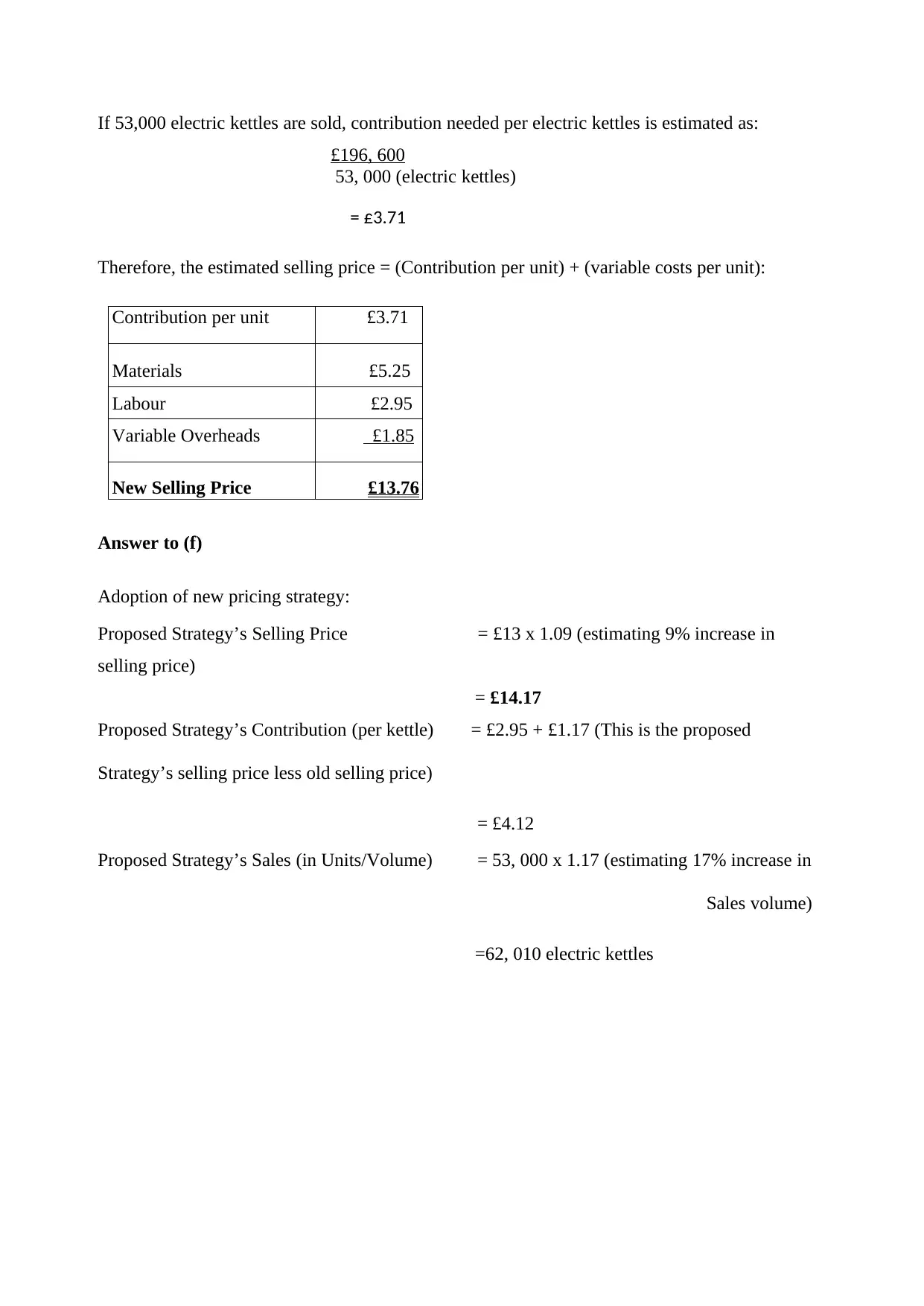

Answer to (f)

Adoption of new pricing strategy:

Proposed Strategy’s Selling Price = £13 x 1.09 (estimating 9% increase in

selling price)

= £14.17

Proposed Strategy’s Contribution (per kettle) = £2.95 + £1.17 (This is the proposed

Strategy’s selling price less old selling price)

= £4.12

Proposed Strategy’s Sales (in Units/Volume) = 53, 000 x 1.17 (estimating 17% increase in

Sales volume)

=62, 010 electric kettles

£196, 600

53, 000 (electric kettles)

= £3.71

Therefore, the estimated selling price = (Contribution per unit) + (variable costs per unit):

Contribution per unit £3.71

Materials £5.25

Labour £2.95

Variable Overheads £1.85

New Selling Price £13.76

Answer to (f)

Adoption of new pricing strategy:

Proposed Strategy’s Selling Price = £13 x 1.09 (estimating 9% increase in

selling price)

= £14.17

Proposed Strategy’s Contribution (per kettle) = £2.95 + £1.17 (This is the proposed

Strategy’s selling price less old selling price)

= £4.12

Proposed Strategy’s Sales (in Units/Volume) = 53, 000 x 1.17 (estimating 17% increase in

Sales volume)

=62, 010 electric kettles

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Proposed Strategy’s Total Contribution = £4.12 x 62, 010 electric kettles

= £255,481

Proposed Strategy’s Fixed Costs = £106,600 + £45,000

= £151, 600

Proposed Strategy’s Profit = New Total Contribution – New Fixed Costs

= £255, 481 - £151,600

= £103, 881

The proposed approach provides a profit of £103, 881, which is higher than the £49,749

beginning cash profit. As a consequence (as mentioned in answer (c) above), the proposed plan

is a critical step that Plaistead Plc must accept.

Answer to (g)

The break-even calculation is dependent on several factors, such as the following:

Production, shipping, and carrying cost are all subdivided into permanent and variable parts.

There will be a propensity if assessment information is recorded on a graph because the

structure of spending is ongoing (Bühler, Wallenburg and Wieland, 2016).

At every present generation, the overall amount of capital expenditures will remain constant,

whereas operating cost will fluctuate in relation to output.

The maker's sales costs would remain constant regardless of the number of sales, suggesting

that they would not alter in reaction to differences in end products.

The installation costs, workers, accommodation, marketing, and other purchased technology

will all remain same.

The public's perceptions, as well as the scientific capabilities and effectiveness of computer

networks, would stay constant.

Profits and expenses were also calculated utilizing a completely electronic assessment, such

as stock fair pricing or quantity demanded (Chung and Chen, 2016).

Only the productive capacity or advertising is considered a significant part of the cost.

= £255,481

Proposed Strategy’s Fixed Costs = £106,600 + £45,000

= £151, 600

Proposed Strategy’s Profit = New Total Contribution – New Fixed Costs

= £255, 481 - £151,600

= £103, 881

The proposed approach provides a profit of £103, 881, which is higher than the £49,749

beginning cash profit. As a consequence (as mentioned in answer (c) above), the proposed plan

is a critical step that Plaistead Plc must accept.

Answer to (g)

The break-even calculation is dependent on several factors, such as the following:

Production, shipping, and carrying cost are all subdivided into permanent and variable parts.

There will be a propensity if assessment information is recorded on a graph because the

structure of spending is ongoing (Bühler, Wallenburg and Wieland, 2016).

At every present generation, the overall amount of capital expenditures will remain constant,

whereas operating cost will fluctuate in relation to output.

The maker's sales costs would remain constant regardless of the number of sales, suggesting

that they would not alter in reaction to differences in end products.

The installation costs, workers, accommodation, marketing, and other purchased technology

will all remain same.

The public's perceptions, as well as the scientific capabilities and effectiveness of computer

networks, would stay constant.

Profits and expenses were also calculated utilizing a completely electronic assessment, such

as stock fair pricing or quantity demanded (Chung and Chen, 2016).

Only the productive capacity or advertising is considered a significant part of the cost.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

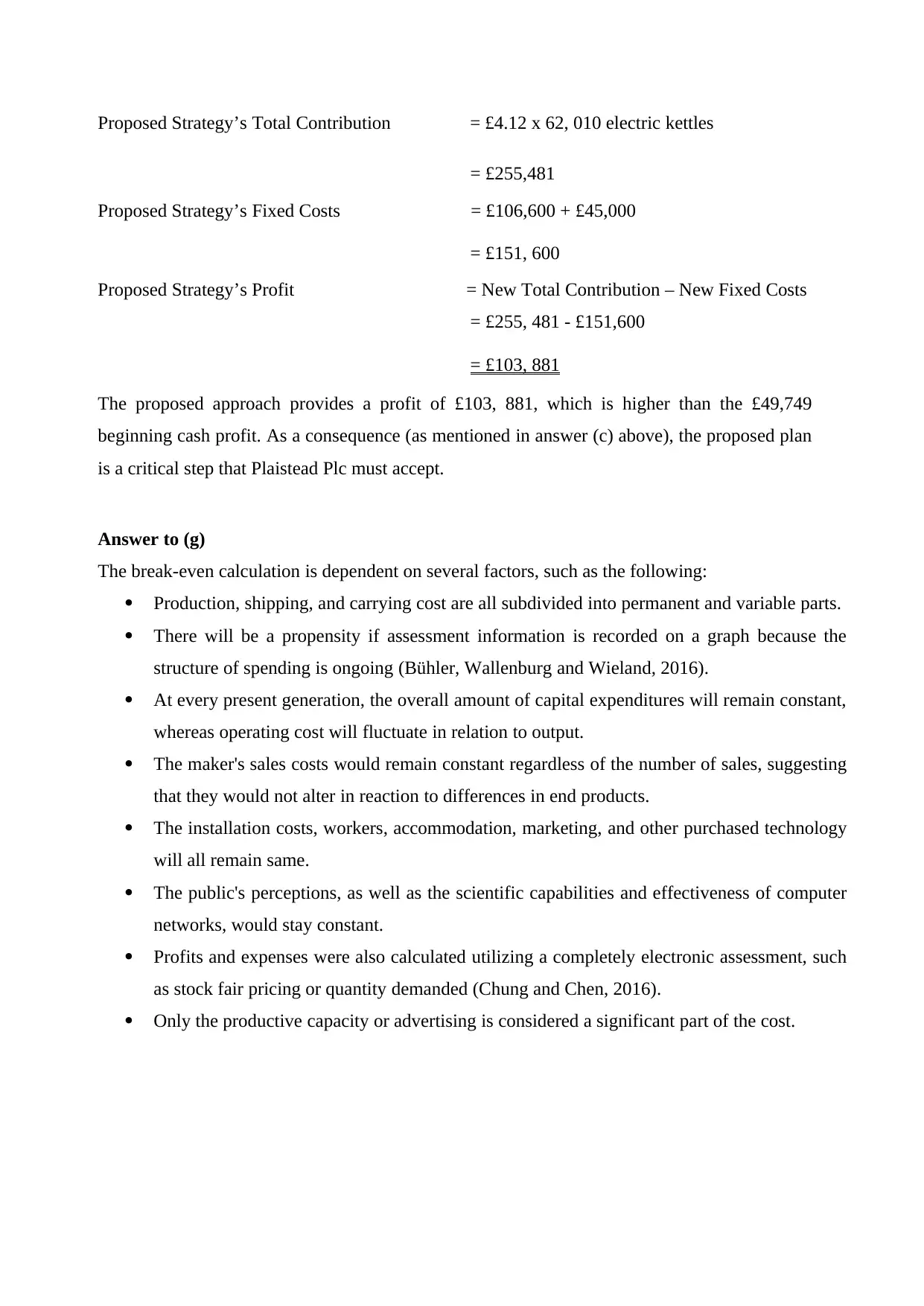

Part 2

Question 3: Crawford Plc

Answer to (a)

Allocating cost based on:

Number of employees 12:10:3.

Direct materials 17:8.

Floor space 3:4:1.

Floor space 3:4:1.

Machinery used in each department 50:40:3.

Number of employees 12:10:3.

Kilowatt hours 1.5:1.3:2.

STEP 1: Allocating costs to departments using a suitable method (ratio) for each

department:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Indirect labour–12:10:3 28 000 13,440 11,200 3,360

Indirect material – 17:8 22 000 14 960 7 040 -----

Heating & lighting – 3:4:1 13 000 4 875 6 500 1 625

Rent & rates – 3:4:1 14 000 5 250 7 000 1 750

Depreciation – 50:40:3 19 000 10 215 8 172 613

Supervision – 12:10:3 15 000 7 200 6 000 1 800

Power – 1.5:1.3:2 9 000 2 813 2 438 3 750

120 000 58 753 48 350 12 898

STEP 2: Allocating service department costs to production departments:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Balance from Step 1 above 120 000 58 753 48 350 12 898

Allocate Canteen to Assembly &

Joinery

7 035 5 863 [12 898]

120 000 65 788 54 213 ------

STEP 3: Calculating the overhead recovery rates for Assembly and Joinery Department:

The amount of "labour hours" determines the total spending capability. The agency's

overhead expenses are computed in both circumstances by dividing the number of actual

labour hours by the amount of suburbs. The excess recovering percentage is as follows:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦

𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 Di𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

Question 3: Crawford Plc

Answer to (a)

Allocating cost based on:

Number of employees 12:10:3.

Direct materials 17:8.

Floor space 3:4:1.

Floor space 3:4:1.

Machinery used in each department 50:40:3.

Number of employees 12:10:3.

Kilowatt hours 1.5:1.3:2.

STEP 1: Allocating costs to departments using a suitable method (ratio) for each

department:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Indirect labour–12:10:3 28 000 13,440 11,200 3,360

Indirect material – 17:8 22 000 14 960 7 040 -----

Heating & lighting – 3:4:1 13 000 4 875 6 500 1 625

Rent & rates – 3:4:1 14 000 5 250 7 000 1 750

Depreciation – 50:40:3 19 000 10 215 8 172 613

Supervision – 12:10:3 15 000 7 200 6 000 1 800

Power – 1.5:1.3:2 9 000 2 813 2 438 3 750

120 000 58 753 48 350 12 898

STEP 2: Allocating service department costs to production departments:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Balance from Step 1 above 120 000 58 753 48 350 12 898

Allocate Canteen to Assembly &

Joinery

7 035 5 863 [12 898]

120 000 65 788 54 213 ------

STEP 3: Calculating the overhead recovery rates for Assembly and Joinery Department:

The amount of "labour hours" determines the total spending capability. The agency's

overhead expenses are computed in both circumstances by dividing the number of actual

labour hours by the amount of suburbs. The excess recovering percentage is as follows:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦

𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 Di𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= 65,788 = £31.33 per labour hour

2 100 hours

𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡

𝐷𝑖𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= £54,202 =38.72 per labour hour

1 400 hours

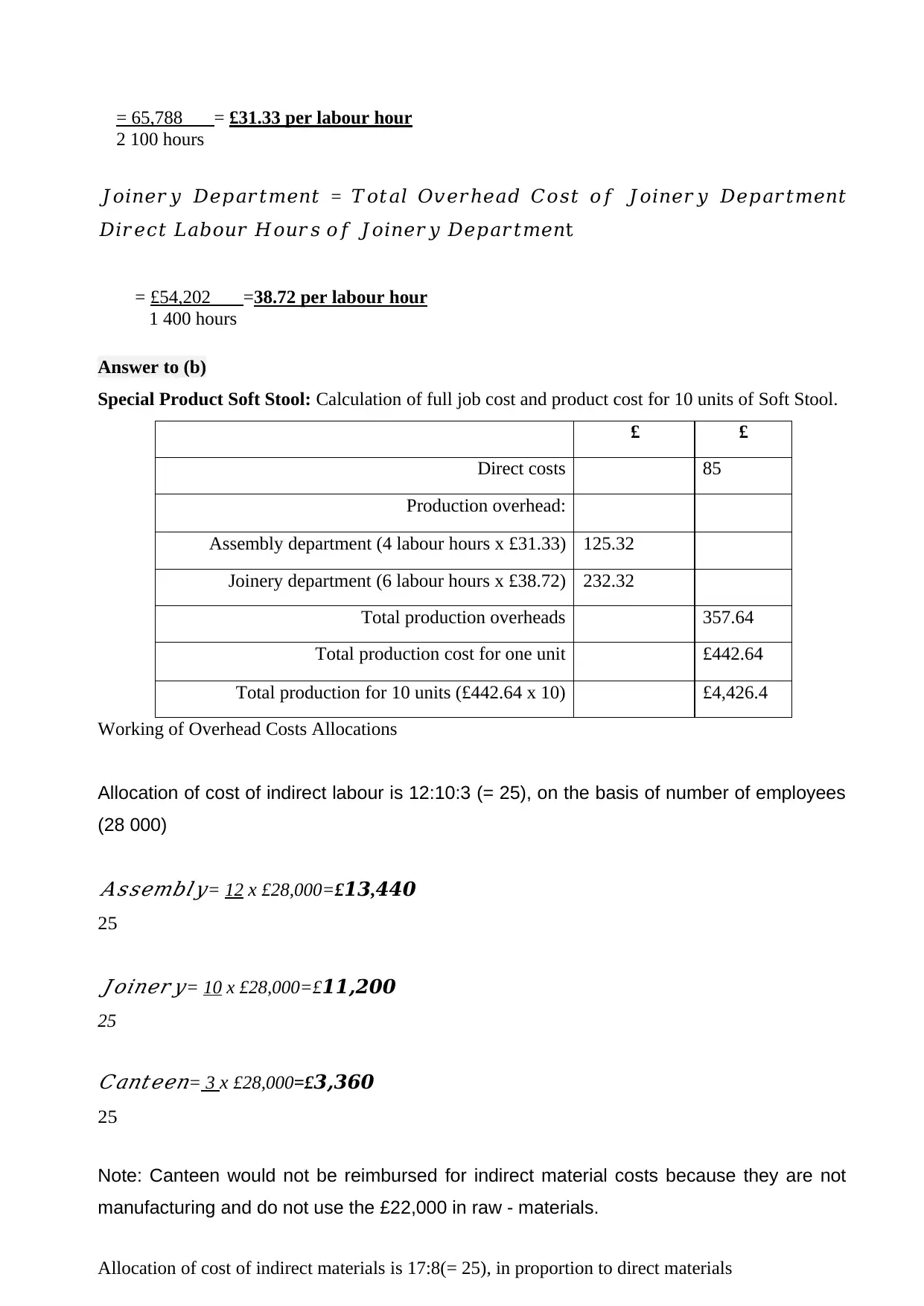

Answer to (b)

Special Product Soft Stool: Calculation of full job cost and product cost for 10 units of Soft Stool.

£ £

Direct costs 85

Production overhead:

Assembly department (4 labour hours x £31.33) 125.32

Joinery department (6 labour hours x £38.72) 232.32

Total production overheads 357.64

Total production cost for one unit £442.64

Total production for 10 units (£442.64 x 10) £4,426.4

Working of Overhead Costs Allocations

Allocation of cost of indirect labour is 12:10:3 (= 25), on the basis of number of employees

(28 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 12 x £28,000=£13,440

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 10 x £28,000=£11,200

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 3 x £28,000=£3,360

25

Note: Canteen would not be reimbursed for indirect material costs because they are not

manufacturing and do not use the £22,000 in raw - materials.

Allocation of cost of indirect materials is 17:8(= 25), in proportion to direct materials

2 100 hours

𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡

𝐷𝑖𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= £54,202 =38.72 per labour hour

1 400 hours

Answer to (b)

Special Product Soft Stool: Calculation of full job cost and product cost for 10 units of Soft Stool.

£ £

Direct costs 85

Production overhead:

Assembly department (4 labour hours x £31.33) 125.32

Joinery department (6 labour hours x £38.72) 232.32

Total production overheads 357.64

Total production cost for one unit £442.64

Total production for 10 units (£442.64 x 10) £4,426.4

Working of Overhead Costs Allocations

Allocation of cost of indirect labour is 12:10:3 (= 25), on the basis of number of employees

(28 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 12 x £28,000=£13,440

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 10 x £28,000=£11,200

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 3 x £28,000=£3,360

25

Note: Canteen would not be reimbursed for indirect material costs because they are not

manufacturing and do not use the £22,000 in raw - materials.

Allocation of cost of indirect materials is 17:8(= 25), in proportion to direct materials

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

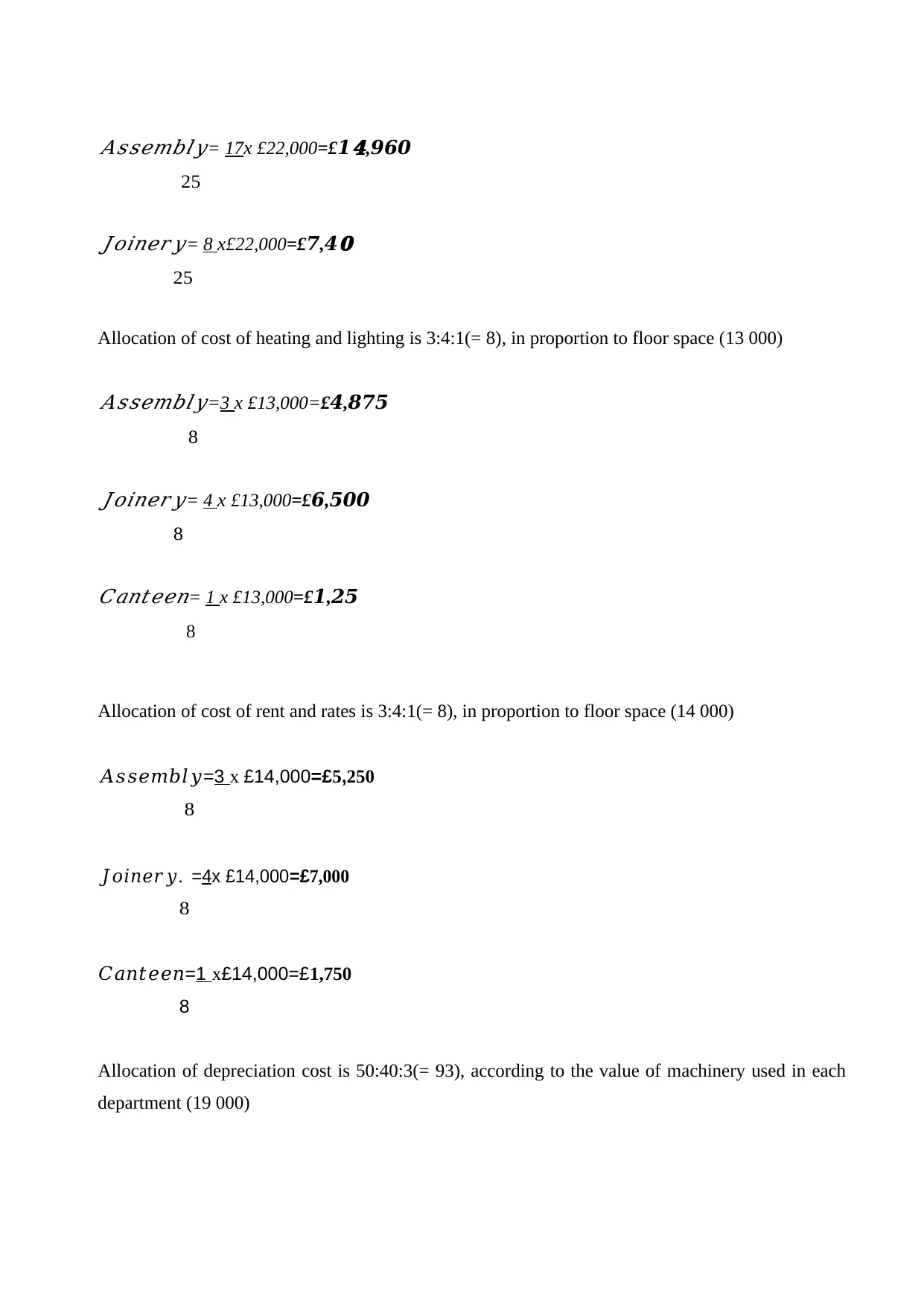

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 17x £22,000=£1

𝟒,960

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 8 x£22,000=£7,4

𝟎

25

Allocation of cost of heating and lighting is 3:4:1(= 8), in proportion to floor space (13 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £13,000=£4,875

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 4 x £13,000=£6,500

8𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 1 x £13,000=£1,25

8

Allocation of cost of rent and rates is 3:4:1(= 8), in proportion to floor space (14 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £14,000=£5,250

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦. =4x £14,000=£7,000

8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=1 x£14,000=£1,750

8

Allocation of depreciation cost is 50:40:3(= 93), according to the value of machinery used in each

department (19 000)

𝟒,960

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 8 x£22,000=£7,4

𝟎

25

Allocation of cost of heating and lighting is 3:4:1(= 8), in proportion to floor space (13 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £13,000=£4,875

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 4 x £13,000=£6,500

8𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 1 x £13,000=£1,25

8

Allocation of cost of rent and rates is 3:4:1(= 8), in proportion to floor space (14 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £14,000=£5,250

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦. =4x £14,000=£7,000

8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=1 x£14,000=£1,750

8

Allocation of depreciation cost is 50:40:3(= 93), according to the value of machinery used in each

department (19 000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

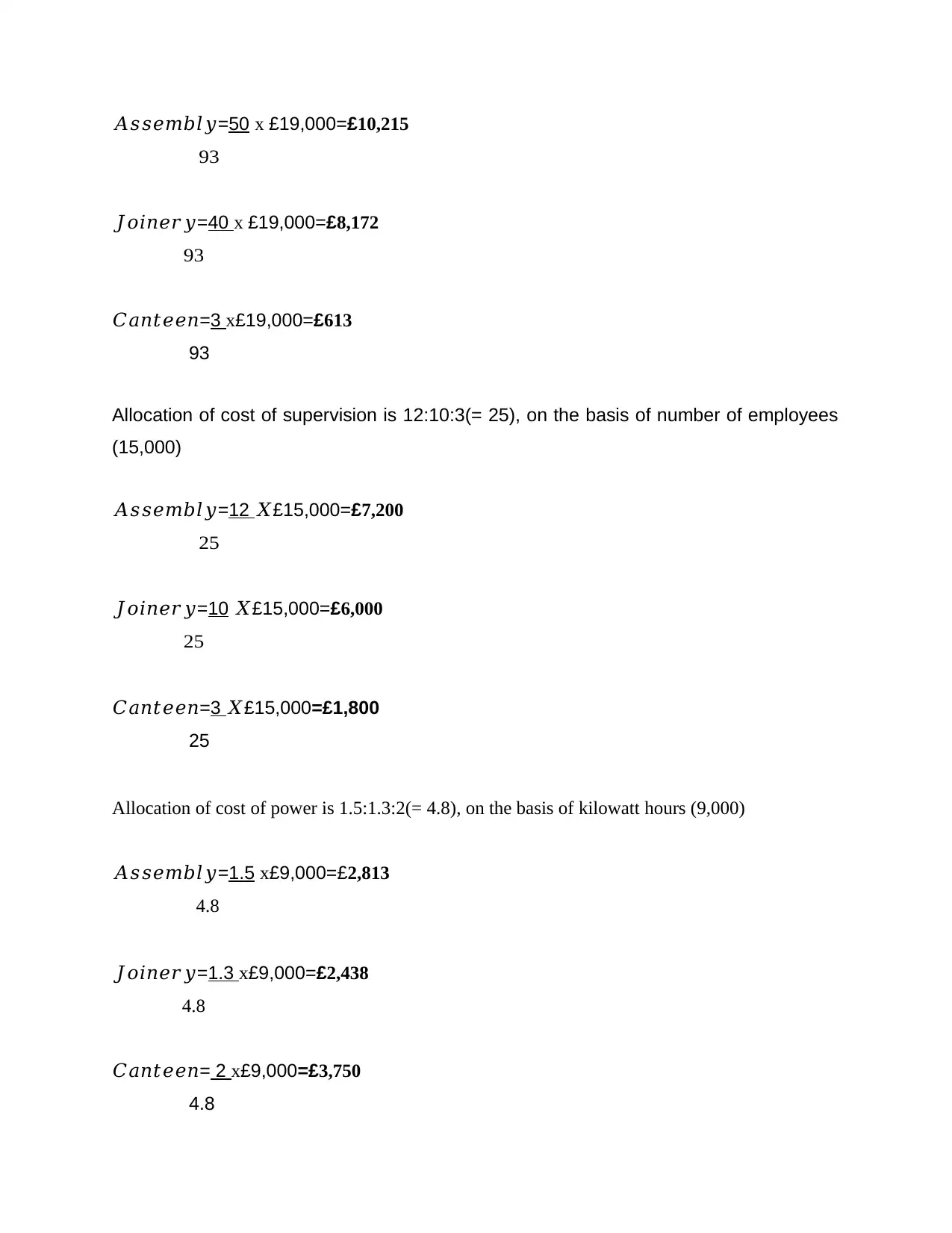

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=50 x £19,000=£10,215

93

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=40 x £19,000=£8,172

93

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 x£19,000=£613

93

Allocation of cost of supervision is 12:10:3(= 25), on the basis of number of employees

(15,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 𝑋£15,000=£7,200

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋£15,000=£6,000

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 𝑋£15,000=£1,800

25

Allocation of cost of power is 1.5:1.3:2(= 4.8), on the basis of kilowatt hours (9,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=1.5 x£9,000=£2,813

4.8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=1.3 x£9,000=£2,438

4.8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 2 x£9,000=£3,750

4.8

93

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=40 x £19,000=£8,172

93

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 x£19,000=£613

93

Allocation of cost of supervision is 12:10:3(= 25), on the basis of number of employees

(15,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 𝑋£15,000=£7,200

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋£15,000=£6,000

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 𝑋£15,000=£1,800

25

Allocation of cost of power is 1.5:1.3:2(= 4.8), on the basis of kilowatt hours (9,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=1.5 x£9,000=£2,813

4.8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=1.3 x£9,000=£2,438

4.8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 2 x£9,000=£3,750

4.8

Absorption of canteen cost is 12:10(=22), on the basis of kilowatt hours

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 x£12,898=£7,035

22

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋 £12,898 =£5,863

22

Answer to (c)

Working in a continuous induction phase is significantly more efficient and cost-effective

(plant-wide rate). However, if manufacturing techniques differ significantly between

sections (labor-intensive vs. machine-intensive), adopting a sufficient number is likely to

inflate overhead expenses. It may have been higher if the results had been different.

Absorption Costing's Benefits:

GAAP Conformance– It has the benefit of complying to Generally Accepted

Accounting Principles (GAAP) that is needed for filing tax returns with the IRS

(IRS).

Keeping track of all manufacturing expenses– Extendable exchange rates only

factor into the equation actual expenses, although this includes all manufacturing

costs. Adjusted operational expenses like as personnel, building rent rates, and

electricity prices are addressed via absorptive pricing. This offers workers a much

more entire facts of how much a company spends on each product, enabling them

to place orders to boost socioeconomic sales and profit opportunities (Daferighe,

2019).

Monitoring Revenues- When contrasted to extensible pricing, absorption price

provides a considerably more exact fiscal situation, especially if all products are not

delivered throughout that period. This becomes a serious issue if a company invests

in production under the expectation of steady overall sales.

Absorption Costing's Drawbacks:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 x£12,898=£7,035

22

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋 £12,898 =£5,863

22

Answer to (c)

Working in a continuous induction phase is significantly more efficient and cost-effective

(plant-wide rate). However, if manufacturing techniques differ significantly between

sections (labor-intensive vs. machine-intensive), adopting a sufficient number is likely to

inflate overhead expenses. It may have been higher if the results had been different.

Absorption Costing's Benefits:

GAAP Conformance– It has the benefit of complying to Generally Accepted

Accounting Principles (GAAP) that is needed for filing tax returns with the IRS

(IRS).

Keeping track of all manufacturing expenses– Extendable exchange rates only

factor into the equation actual expenses, although this includes all manufacturing

costs. Adjusted operational expenses like as personnel, building rent rates, and

electricity prices are addressed via absorptive pricing. This offers workers a much

more entire facts of how much a company spends on each product, enabling them

to place orders to boost socioeconomic sales and profit opportunities (Daferighe,

2019).

Monitoring Revenues- When contrasted to extensible pricing, absorption price

provides a considerably more exact fiscal situation, especially if all products are not

delivered throughout that period. This becomes a serious issue if a company invests

in production under the expectation of steady overall sales.

Absorption Costing's Drawbacks:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.