Applying Management Accounting Techniques: Cost Analysis & Budgeting

VerifiedAdded on 2023/04/19

|8

|982

|148

Report

AI Summary

This management accounting assignment delves into cost-volume-profit analysis, flexible budgeting, and cost variances, using Lemon4U as a case study. It calculates break-even points, analyzes monthly profit, and assesses variances between budgeted and actual figures. The report also evaluates the cost-plus pricing method and explores absorption rates for dental treatments. Furthermore, it examines the impact of renting a machine on production costs and profitability, and assesses the viability of accepting a special order for candles. Finally, the assignment contrasts FIFO and CWA methods for inventory valuation, recommending the CWA method for its realism. Desklib offers a wealth of similar solved assignments and past papers for students.

Management Accounting 1

MANAGEMENT ACCOUNTING ASSIGNMENT 2

By (Name)

The Name of the Class

Professor

The Name of the School

The City and State

Date

MANAGEMENT ACCOUNTING ASSIGNMENT 2

By (Name)

The Name of the Class

Professor

The Name of the School

The City and State

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting 2

Question 1.1

Birthday is 20th

Profit Margin = 20%

Selling Price = Cost + Mark up

Cost per Unit = Total cost / Total units

Budget Actual

Cost per unit= 585 000/110 000 942 800/150 000

=5.32 = 6.29

Total Revenue = TC+ VC* margin Total revenue = TC+ VC*margin

= 35 000 + 550 000*1.2 = 695 000 = 42 800+900 000*1.2 = 1 122 800

Selling price = 695 000/110 000 Selling price = 1 122 800/150 000

= 6.32 per unit = 7.49 per unit

a. Break-even point = fixed cost/ (selling price – variable cost)

The Budget Actual

Fixed cost=35 800 Fixed cost=42 800

Variable cost=5 Variable cost=6

B E = 35 800/ (6.32-5) B E =42 800/ (7.49-6)

= 25 926 units = 28 725 units

Question 1.1

Birthday is 20th

Profit Margin = 20%

Selling Price = Cost + Mark up

Cost per Unit = Total cost / Total units

Budget Actual

Cost per unit= 585 000/110 000 942 800/150 000

=5.32 = 6.29

Total Revenue = TC+ VC* margin Total revenue = TC+ VC*margin

= 35 000 + 550 000*1.2 = 695 000 = 42 800+900 000*1.2 = 1 122 800

Selling price = 695 000/110 000 Selling price = 1 122 800/150 000

= 6.32 per unit = 7.49 per unit

a. Break-even point = fixed cost/ (selling price – variable cost)

The Budget Actual

Fixed cost=35 800 Fixed cost=42 800

Variable cost=5 Variable cost=6

B E = 35 800/ (6.32-5) B E =42 800/ (7.49-6)

= 25 926 units = 28 725 units

Management Accounting 3

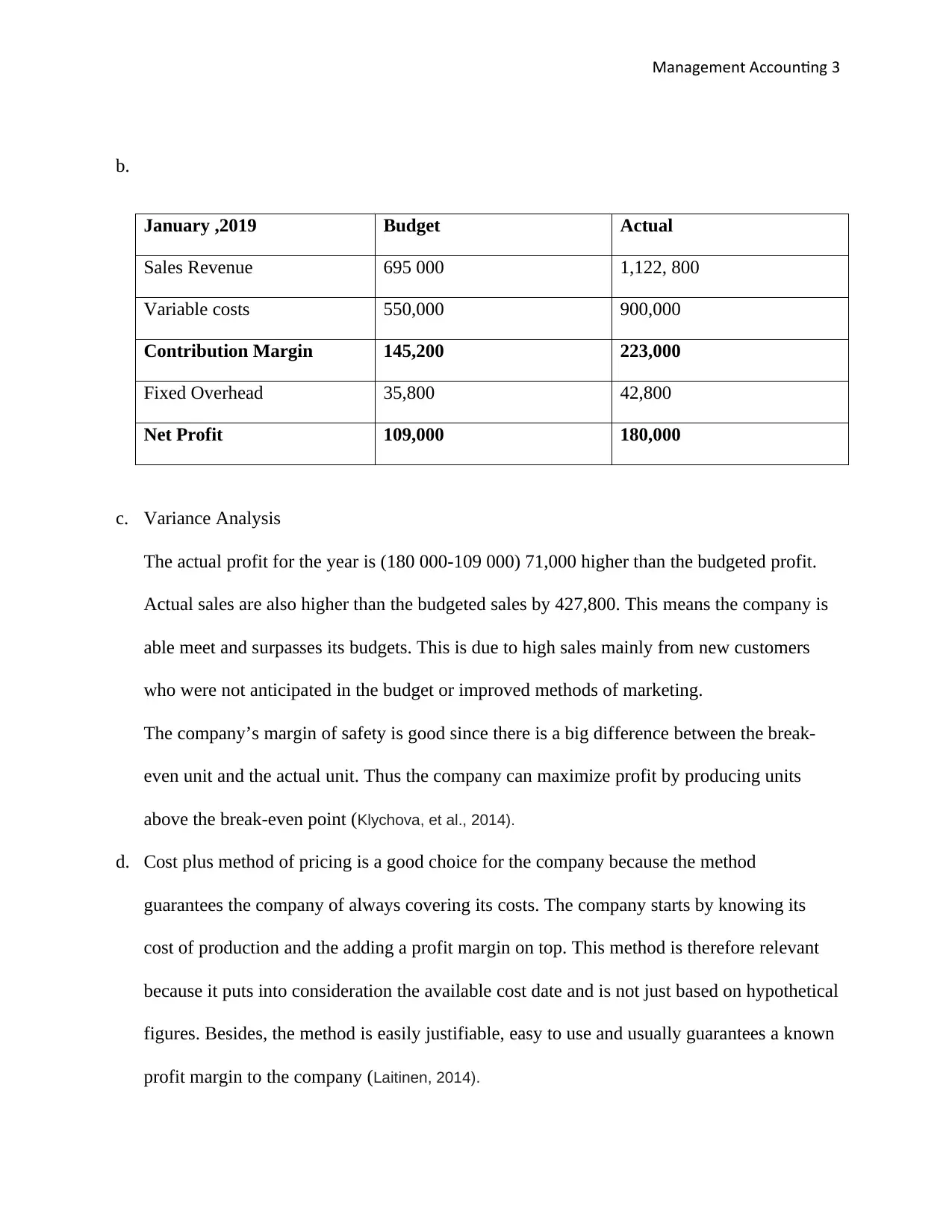

b.

January ,2019 Budget Actual

Sales Revenue 695 000 1,122, 800

Variable costs 550,000 900,000

Contribution Margin 145,200 223,000

Fixed Overhead 35,800 42,800

Net Profit 109,000 180,000

c. Variance Analysis

The actual profit for the year is (180 000-109 000) 71,000 higher than the budgeted profit.

Actual sales are also higher than the budgeted sales by 427,800. This means the company is

able meet and surpasses its budgets. This is due to high sales mainly from new customers

who were not anticipated in the budget or improved methods of marketing.

The company’s margin of safety is good since there is a big difference between the break-

even unit and the actual unit. Thus the company can maximize profit by producing units

above the break-even point (Klychova, et al., 2014).

d. Cost plus method of pricing is a good choice for the company because the method

guarantees the company of always covering its costs. The company starts by knowing its

cost of production and the adding a profit margin on top. This method is therefore relevant

because it puts into consideration the available cost date and is not just based on hypothetical

figures. Besides, the method is easily justifiable, easy to use and usually guarantees a known

profit margin to the company (Laitinen, 2014).

b.

January ,2019 Budget Actual

Sales Revenue 695 000 1,122, 800

Variable costs 550,000 900,000

Contribution Margin 145,200 223,000

Fixed Overhead 35,800 42,800

Net Profit 109,000 180,000

c. Variance Analysis

The actual profit for the year is (180 000-109 000) 71,000 higher than the budgeted profit.

Actual sales are also higher than the budgeted sales by 427,800. This means the company is

able meet and surpasses its budgets. This is due to high sales mainly from new customers

who were not anticipated in the budget or improved methods of marketing.

The company’s margin of safety is good since there is a big difference between the break-

even unit and the actual unit. Thus the company can maximize profit by producing units

above the break-even point (Klychova, et al., 2014).

d. Cost plus method of pricing is a good choice for the company because the method

guarantees the company of always covering its costs. The company starts by knowing its

cost of production and the adding a profit margin on top. This method is therefore relevant

because it puts into consideration the available cost date and is not just based on hypothetical

figures. Besides, the method is easily justifiable, easy to use and usually guarantees a known

profit margin to the company (Laitinen, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management Accounting 4

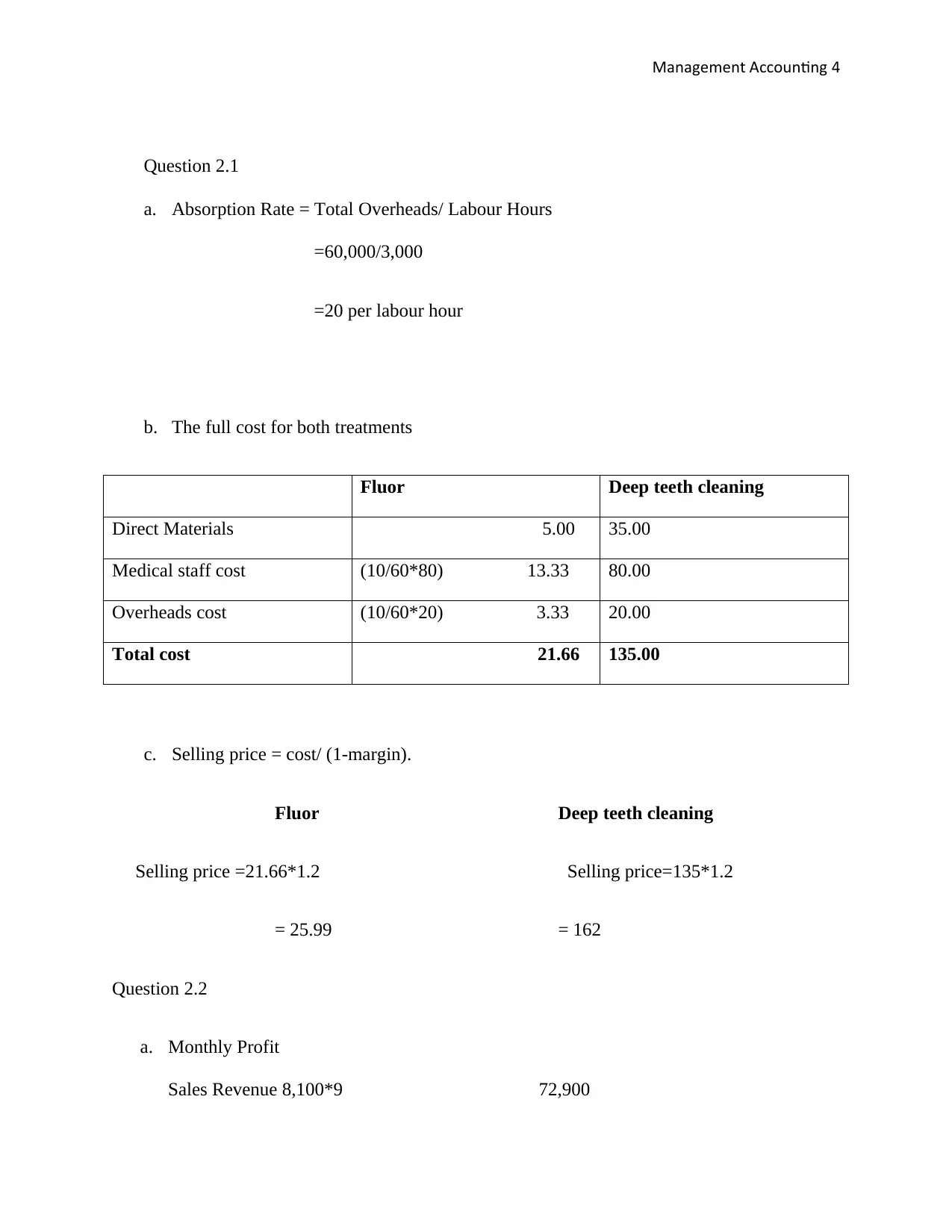

Question 2.1

a. Absorption Rate = Total Overheads/ Labour Hours

=60,000/3,000

=20 per labour hour

b. The full cost for both treatments

Fluor Deep teeth cleaning

Direct Materials 5.00 35.00

Medical staff cost (10/60*80) 13.33 80.00

Overheads cost (10/60*20) 3.33 20.00

Total cost 21.66 135.00

c. Selling price = cost/ (1-margin).

Fluor Deep teeth cleaning

Selling price =21.66*1.2 Selling price=135*1.2

= 25.99 = 162

Question 2.2

a. Monthly Profit

Sales Revenue 8,100*9 72,900

Question 2.1

a. Absorption Rate = Total Overheads/ Labour Hours

=60,000/3,000

=20 per labour hour

b. The full cost for both treatments

Fluor Deep teeth cleaning

Direct Materials 5.00 35.00

Medical staff cost (10/60*80) 13.33 80.00

Overheads cost (10/60*20) 3.33 20.00

Total cost 21.66 135.00

c. Selling price = cost/ (1-margin).

Fluor Deep teeth cleaning

Selling price =21.66*1.2 Selling price=135*1.2

= 25.99 = 162

Question 2.2

a. Monthly Profit

Sales Revenue 8,100*9 72,900

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

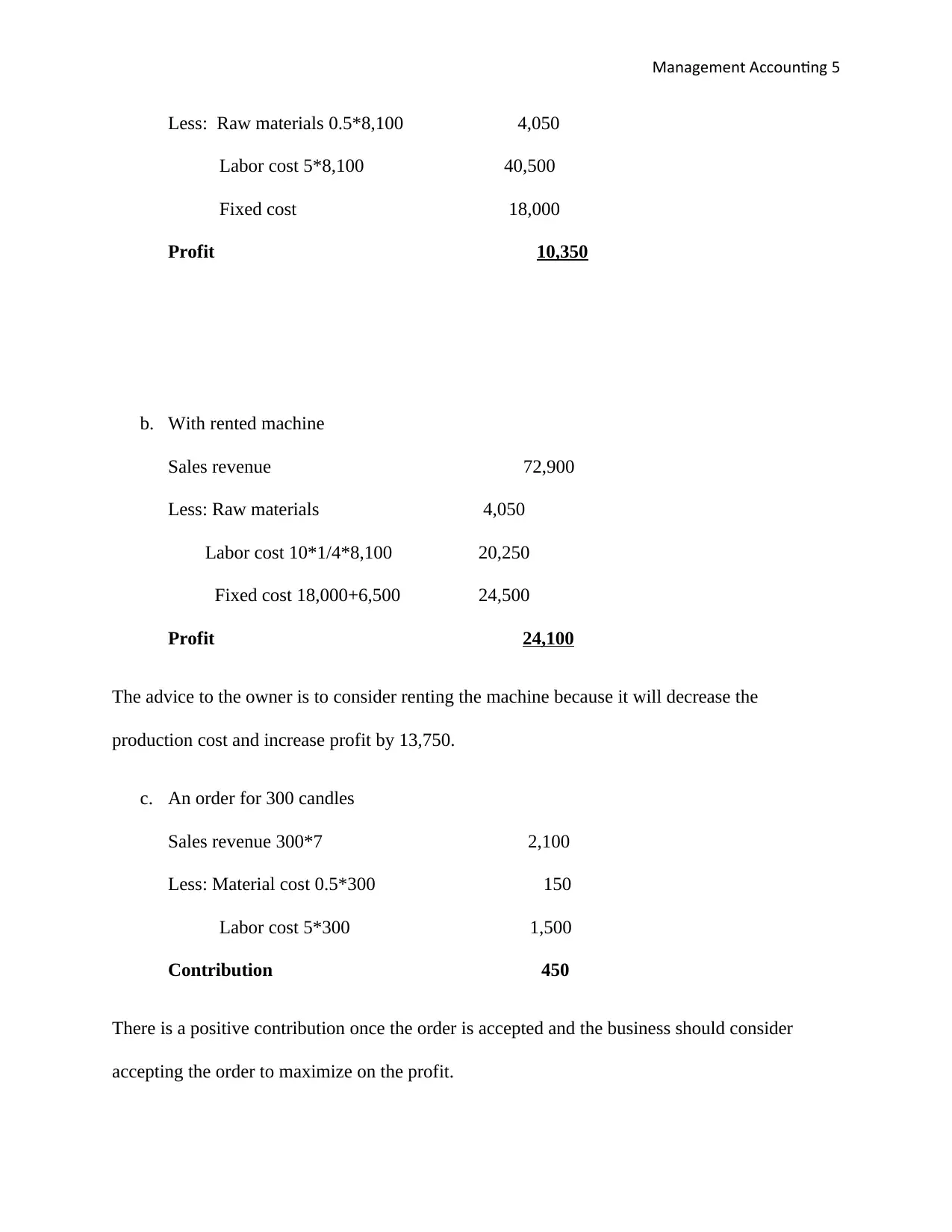

Management Accounting 5

Less: Raw materials 0.5*8,100 4,050

Labor cost 5*8,100 40,500

Fixed cost 18,000

Profit 10,350

b. With rented machine

Sales revenue 72,900

Less: Raw materials 4,050

Labor cost 10*1/4*8,100 20,250

Fixed cost 18,000+6,500 24,500

Profit 24,100

The advice to the owner is to consider renting the machine because it will decrease the

production cost and increase profit by 13,750.

c. An order for 300 candles

Sales revenue 300*7 2,100

Less: Material cost 0.5*300 150

Labor cost 5*300 1,500

Contribution 450

There is a positive contribution once the order is accepted and the business should consider

accepting the order to maximize on the profit.

Less: Raw materials 0.5*8,100 4,050

Labor cost 5*8,100 40,500

Fixed cost 18,000

Profit 10,350

b. With rented machine

Sales revenue 72,900

Less: Raw materials 4,050

Labor cost 10*1/4*8,100 20,250

Fixed cost 18,000+6,500 24,500

Profit 24,100

The advice to the owner is to consider renting the machine because it will decrease the

production cost and increase profit by 13,750.

c. An order for 300 candles

Sales revenue 300*7 2,100

Less: Material cost 0.5*300 150

Labor cost 5*300 1,500

Contribution 450

There is a positive contribution once the order is accepted and the business should consider

accepting the order to maximize on the profit.

Management Accounting 6

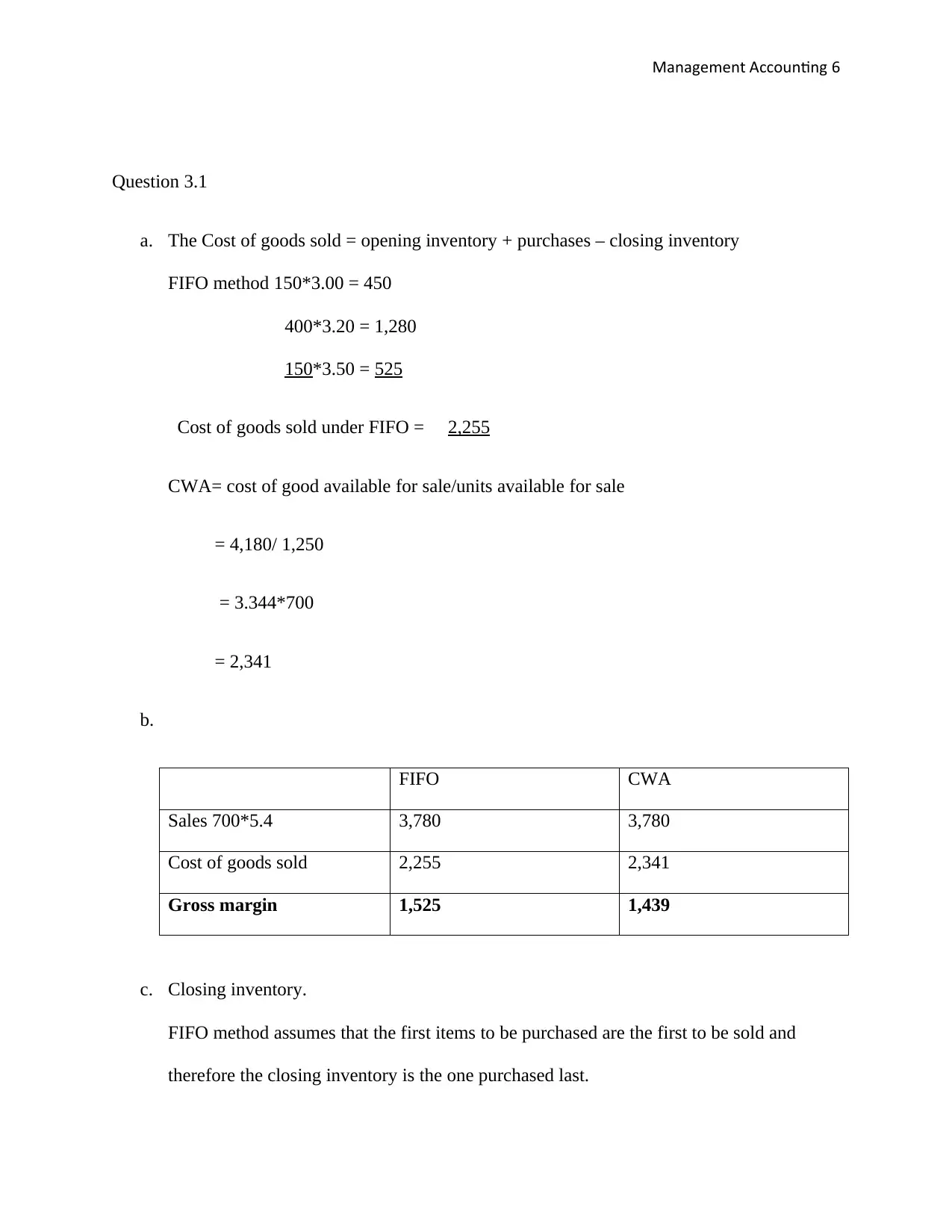

Question 3.1

a. The Cost of goods sold = opening inventory + purchases – closing inventory

FIFO method 150*3.00 = 450

400*3.20 = 1,280

150*3.50 = 525

Cost of goods sold under FIFO = 2,255

CWA= cost of good available for sale/units available for sale

= 4,180/ 1,250

= 3.344*700

= 2,341

b.

FIFO CWA

Sales 700*5.4 3,780 3,780

Cost of goods sold 2,255 2,341

Gross margin 1,525 1,439

c. Closing inventory.

FIFO method assumes that the first items to be purchased are the first to be sold and

therefore the closing inventory is the one purchased last.

Question 3.1

a. The Cost of goods sold = opening inventory + purchases – closing inventory

FIFO method 150*3.00 = 450

400*3.20 = 1,280

150*3.50 = 525

Cost of goods sold under FIFO = 2,255

CWA= cost of good available for sale/units available for sale

= 4,180/ 1,250

= 3.344*700

= 2,341

b.

FIFO CWA

Sales 700*5.4 3,780 3,780

Cost of goods sold 2,255 2,341

Gross margin 1,525 1,439

c. Closing inventory.

FIFO method assumes that the first items to be purchased are the first to be sold and

therefore the closing inventory is the one purchased last.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

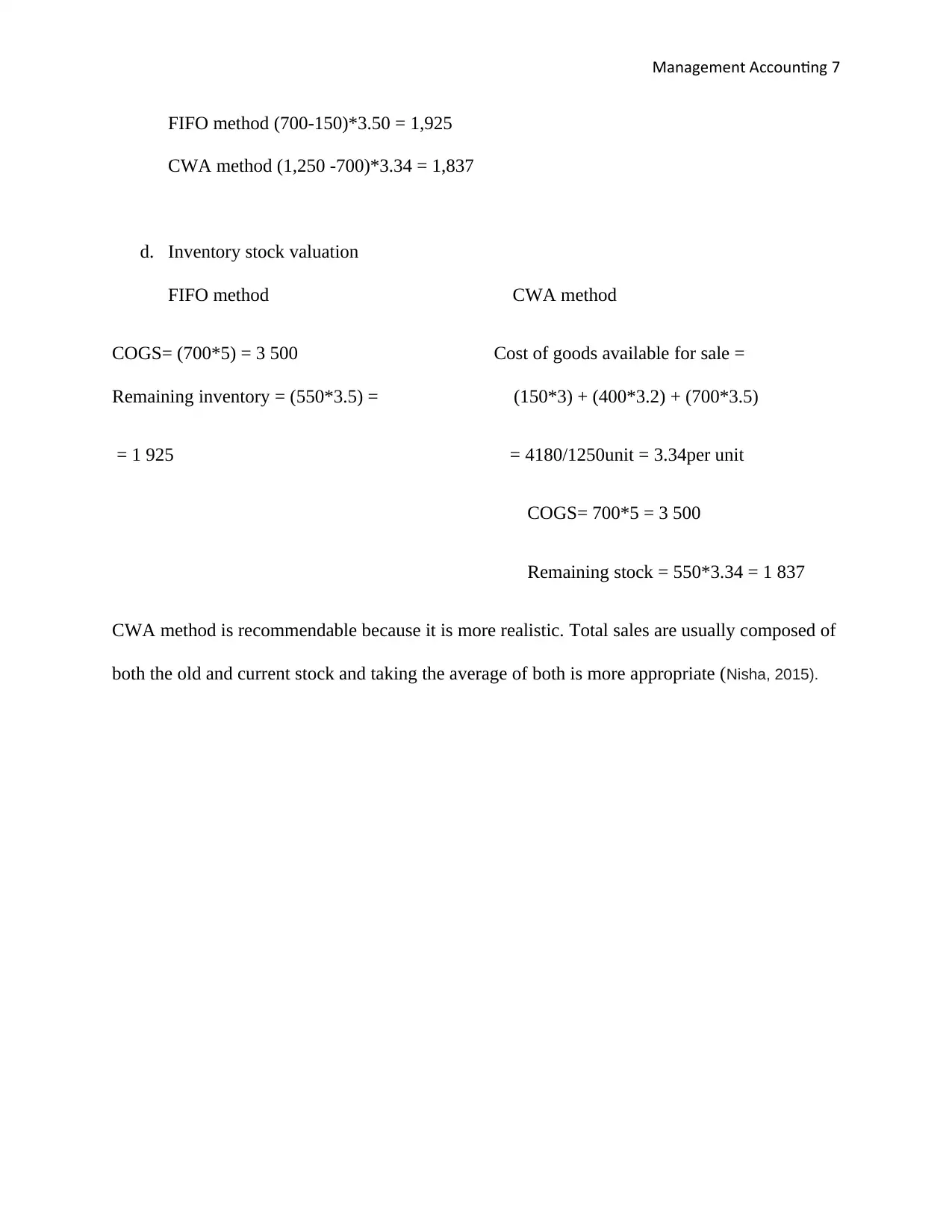

Management Accounting 7

FIFO method (700-150)*3.50 = 1,925

CWA method (1,250 -700)*3.34 = 1,837

d. Inventory stock valuation

FIFO method CWA method

COGS= (700*5) = 3 500 Cost of goods available for sale =

Remaining inventory = (550*3.5) = (150*3) + (400*3.2) + (700*3.5)

= 1 925 = 4180/1250unit = 3.34per unit

COGS= 700*5 = 3 500

Remaining stock = 550*3.34 = 1 837

CWA method is recommendable because it is more realistic. Total sales are usually composed of

both the old and current stock and taking the average of both is more appropriate (Nisha, 2015).

FIFO method (700-150)*3.50 = 1,925

CWA method (1,250 -700)*3.34 = 1,837

d. Inventory stock valuation

FIFO method CWA method

COGS= (700*5) = 3 500 Cost of goods available for sale =

Remaining inventory = (550*3.5) = (150*3) + (400*3.2) + (700*3.5)

= 1 925 = 4180/1250unit = 3.34per unit

COGS= 700*5 = 3 500

Remaining stock = 550*3.34 = 1 837

CWA method is recommendable because it is more realistic. Total sales are usually composed of

both the old and current stock and taking the average of both is more appropriate (Nisha, 2015).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management Accounting 8

References

Klychova, G.S., Faskhutdinova, М.S. and Sadrieva, E.R., 2014. Budget efficiency for cost control

purposes in management accounting system. Mediterranean journal of social sciences, 5(24), p.79.

Laitinen, E.K., 2014. Influence of cost accounting change on performance of manufacturing

firms. Advances in accounting, 30(1), pp.230-240.

Nisha, N., 2015. Inventory valuation practices: A developing country perspective. International Journal of

Information Research and Review, 2(7), pp.867-874.

References

Klychova, G.S., Faskhutdinova, М.S. and Sadrieva, E.R., 2014. Budget efficiency for cost control

purposes in management accounting system. Mediterranean journal of social sciences, 5(24), p.79.

Laitinen, E.K., 2014. Influence of cost accounting change on performance of manufacturing

firms. Advances in accounting, 30(1), pp.230-240.

Nisha, N., 2015. Inventory valuation practices: A developing country perspective. International Journal of

Information Research and Review, 2(7), pp.867-874.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.