Analysis of Challenges Faced by Banks (CBA vs Westpac) During COVID-19

VerifiedAdded on 2022/09/14

|14

|1145

|12

Report

AI Summary

This report provides an in-depth analysis of the challenges faced by banking institutions, specifically the Commonwealth Bank and Westpac, during the COVID-19 pandemic. The study begins with an introduction to the global impact of the pandemic on financial systems, highlighting the economic losses and the need for banks to adapt. The research objectives include assessing the impact on business operations, the banking sector, and operational adjustments, as well as comparing the responses of the two banks. A review of literature discusses the risks to global financial stability, the impact on market liquidity, and the responses of central banks. The research employs a positivist philosophy and an analytical research design to examine secondary data. The discussion section details the measures taken by both Westpac and Commonwealth Bank in response to the crisis, with a comparison of their initiatives. The conclusion emphasizes the importance of adapting to new work standards and the crucial role of online banking and ATMs. The report concludes with recommendations for improving bank operations and includes a list of references.

ANALYSIS OF CHALLENGES

FACE BY BANKS DURING COVID

- 19

COMMON WEALTH BANK VS

WESTPAC

Name of the Student

FACE BY BANKS DURING COVID

- 19

COMMON WEALTH BANK VS

WESTPAC

Name of the Student

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction

• The global pandemic known as the Covid 19 has bought about

unprecedented loss to the human lives as well as the financial

systems

• With more than three months of crisis, the pandemic has

brought about consistent losses to the economy as a whole.

• The study is aimed at understanding these losses and thereby

outlining the manner in which the banking organizations such

as the Westpac and the Commonwealth have been planning

to deal with the losses

• The barriers faced by them will be discussed along with the

responses of the banking enterprises.

• The global pandemic known as the Covid 19 has bought about

unprecedented loss to the human lives as well as the financial

systems

• With more than three months of crisis, the pandemic has

brought about consistent losses to the economy as a whole.

• The study is aimed at understanding these losses and thereby

outlining the manner in which the banking organizations such

as the Westpac and the Commonwealth have been planning

to deal with the losses

• The barriers faced by them will be discussed along with the

responses of the banking enterprises.

Research Objectives

• To assess the impact that Covid 19 has on business operations

• To determine the specific impact that Covid 19 has had on the

banking sector

• To assess how banks have been conducting associated

operations in the light of the crisis brought on by Covid 19

• To compare the responses of the Commonwealth Bank to the

Covid 19 crisis with the responses by Westpac

• To generate a series of recommendations that can be taken

into consideration by the Commonwealth Bank and Westpac

for bringing about an improvement in their operations.

• To assess the impact that Covid 19 has on business operations

• To determine the specific impact that Covid 19 has had on the

banking sector

• To assess how banks have been conducting associated

operations in the light of the crisis brought on by Covid 19

• To compare the responses of the Commonwealth Bank to the

Covid 19 crisis with the responses by Westpac

• To generate a series of recommendations that can be taken

into consideration by the Commonwealth Bank and Westpac

for bringing about an improvement in their operations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Review of Literature

• The outbreak of the Covid 19 pandemic is posing a clear risk

and threat to global financial stability (King et al. 2020).

• As a consequence of the spike in volatility in the global

marketplace, market liquidity is something that has witnessed

a significant deterioration, and this is something that holds

true for markets that are traditionally perceived to be quite

deep, a good example in this respect being the American

treasury market (Latham 2020).

• Most central banks and financial institutions that are situated

in low income countries or in emerging economies have also

cut down their policy rates by a considerable extent (Maital

and Barzani 2020).

• The outbreak of the Covid 19 pandemic is posing a clear risk

and threat to global financial stability (King et al. 2020).

• As a consequence of the spike in volatility in the global

marketplace, market liquidity is something that has witnessed

a significant deterioration, and this is something that holds

true for markets that are traditionally perceived to be quite

deep, a good example in this respect being the American

treasury market (Latham 2020).

• Most central banks and financial institutions that are situated

in low income countries or in emerging economies have also

cut down their policy rates by a considerable extent (Maital

and Barzani 2020).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cont..

• One immediate aftermath that the banking sector is likely

faced with as a consequence of the Covid 19 crisis, is to

impose restrictions on access to a number of physical facilities,

so that employees and customers are protected from the virus

and do not have to worry about coming into direct contact

with the virus (Rameli and Wagner 2020).

Gaps in Literature Review

• The literature that has been reviewed above points to how

banks have responded to the impact of the Covid 19 pandemic

at the global level, with special reference being made to the

role that is played by central banks in ensuring the stability

and the efficiency of the international financial system

following the outbreak of the Covid 19 pandemic.

• One immediate aftermath that the banking sector is likely

faced with as a consequence of the Covid 19 crisis, is to

impose restrictions on access to a number of physical facilities,

so that employees and customers are protected from the virus

and do not have to worry about coming into direct contact

with the virus (Rameli and Wagner 2020).

Gaps in Literature Review

• The literature that has been reviewed above points to how

banks have responded to the impact of the Covid 19 pandemic

at the global level, with special reference being made to the

role that is played by central banks in ensuring the stability

and the efficiency of the international financial system

following the outbreak of the Covid 19 pandemic.

Research methods adopted

• Research Philosophy

• For this study, it is the positivist research philosophy that has

been chosen as it has helped the researcher to understand

how banks such as Westpac and the Commonwealth Bank

have responded to the crisis brought on by the Covid 19

pandemic in a detailed and accurate manner.

• Research Design

• The analytical research design is known also as the descriptive

research design and it is widely used by academics around the

world on grounds of the fact that it allows the investigator to

analyze and discuss the subject matter of the research in a

detailed way (Silverman 2016).

• Research Philosophy

• For this study, it is the positivist research philosophy that has

been chosen as it has helped the researcher to understand

how banks such as Westpac and the Commonwealth Bank

have responded to the crisis brought on by the Covid 19

pandemic in a detailed and accurate manner.

• Research Design

• The analytical research design is known also as the descriptive

research design and it is widely used by academics around the

world on grounds of the fact that it allows the investigator to

analyze and discuss the subject matter of the research in a

detailed way (Silverman 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research methods adopted

Data Collection and Analysis of Data

• The data that has been retrieved from the secondary sources

of information have then been analyzed in a thematic manner

Ethical Considerations

• This study has been carried out only after taking quite a few

ethical factors into consideration.

Limitations of the Study

• Some of the key limitations that are connected to this

research project are the fact that it had to be undertaken

in a limited span of time, and that there was not much in

terms of funding or financial resources that the

researcher could count on for writing this paper

Data Collection and Analysis of Data

• The data that has been retrieved from the secondary sources

of information have then been analyzed in a thematic manner

Ethical Considerations

• This study has been carried out only after taking quite a few

ethical factors into consideration.

Limitations of the Study

• Some of the key limitations that are connected to this

research project are the fact that it had to be undertaken

in a limited span of time, and that there was not much in

terms of funding or financial resources that the

researcher could count on for writing this paper

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Discussion and Analysis

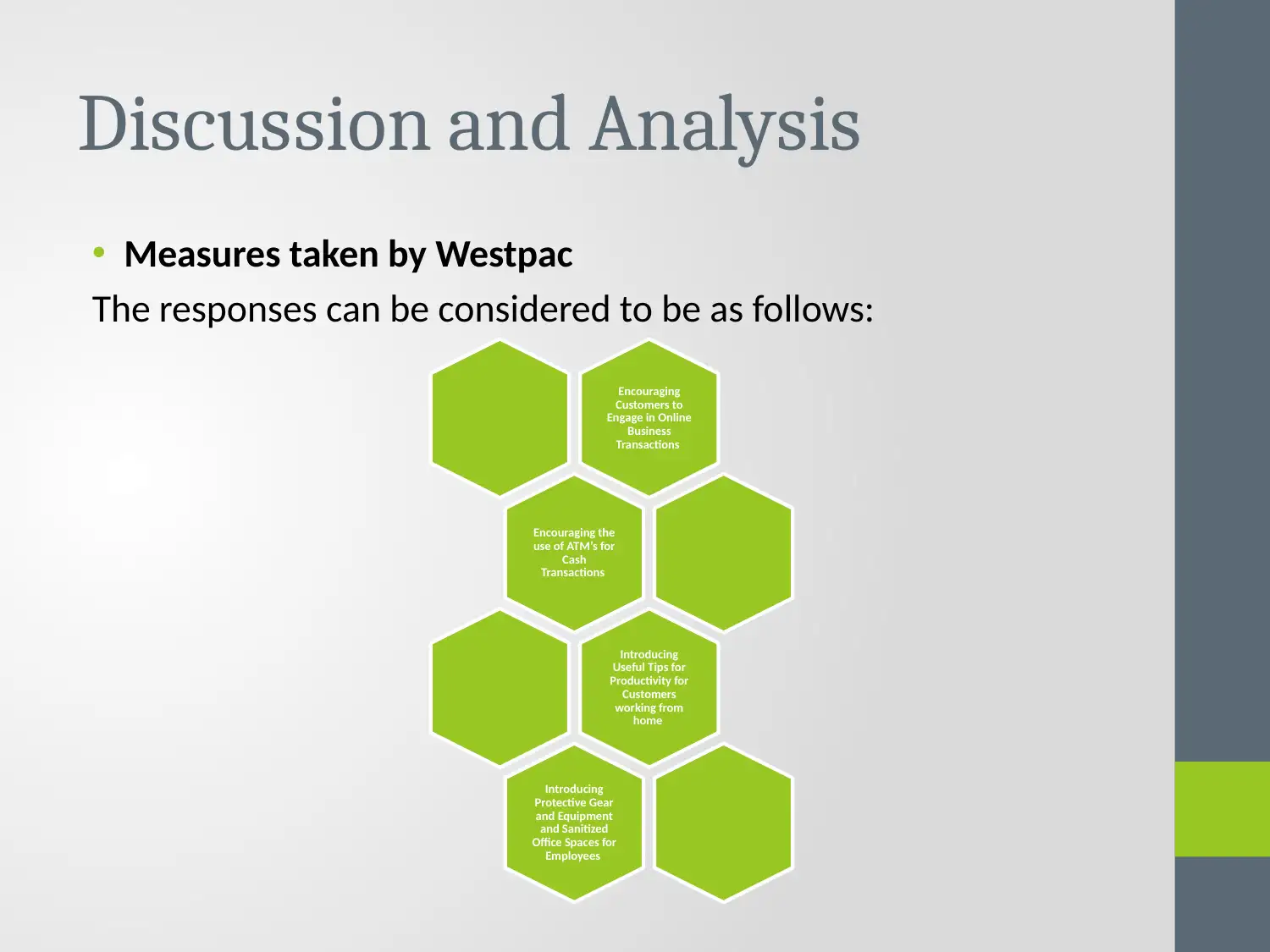

• Measures taken by Westpac

The responses can be considered to be as follows:

Encouraging

Customers to

Engage in Online

Business

Transactions

Encouraging the

use of ATM’s for

Cash

Transactions

Introducing

Useful Tips for

Productivity for

Customers

working from

home

Introducing

Protective Gear

and Equipment

and Sanitized

Office Spaces for

Employees

• Measures taken by Westpac

The responses can be considered to be as follows:

Encouraging

Customers to

Engage in Online

Business

Transactions

Encouraging the

use of ATM’s for

Cash

Transactions

Introducing

Useful Tips for

Productivity for

Customers

working from

home

Introducing

Protective Gear

and Equipment

and Sanitized

Office Spaces for

Employees

Measures taken by

Commonwealth

• The responses can be considered to be as follows:

Comparing the Initiatives Taken by Commonwealth Bank with the Initiatives of

Westpac

Both the Commonwealth Bank and Westpac Bank have responded in a similar manner

to the crisis that has been brought on by the Covid 19 pandemic. Both banks are

encouraging their customers to make extensive use of online banking facilities at this

period of time, and are providing them with all the help, care and assistance that they

need in order to be able to do so (De Vito and Gomez 2020).

Encouraging the

use of ATM and

Online Banking

Services for

Customers

Encouraging

Employees to

Work Remote and

Ensuring

Sanitized Offices

for Employees

who cannot work

remotely

Commonwealth

• The responses can be considered to be as follows:

Comparing the Initiatives Taken by Commonwealth Bank with the Initiatives of

Westpac

Both the Commonwealth Bank and Westpac Bank have responded in a similar manner

to the crisis that has been brought on by the Covid 19 pandemic. Both banks are

encouraging their customers to make extensive use of online banking facilities at this

period of time, and are providing them with all the help, care and assistance that they

need in order to be able to do so (De Vito and Gomez 2020).

Encouraging the

use of ATM and

Online Banking

Services for

Customers

Encouraging

Employees to

Work Remote and

Ensuring

Sanitized Offices

for Employees

who cannot work

remotely

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

• Employees around the world are having to change their work

standards, and are having to adjust to working from their

homes rather than from a professional setup like an office

space. With respect to the banking sector in particular, it is

seen that banks are not able to remain closed as monetary

transactions are vital during the crisis.

• Customers in particular are being encouraged to use online

banking facilities and ATMs in order to keep their financial

obligations from coming to a halt during this period of time in

human history.

• Employees around the world are having to change their work

standards, and are having to adjust to working from their

homes rather than from a professional setup like an office

space. With respect to the banking sector in particular, it is

seen that banks are not able to remain closed as monetary

transactions are vital during the crisis.

• Customers in particular are being encouraged to use online

banking facilities and ATMs in order to keep their financial

obligations from coming to a halt during this period of time in

human history.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recommendations

All employees of the banks should be

allowed to work from remote

locations for their physical safety and

wellbeing

The office spaces need to be

sanitized every single day to keep

these places safe from the risk of

infection

Customers of banks and employees

of the same should be confined to

online operations or transactions

only for reasons of personal safety

By working from a physical office

space, employees are risking their

lives and the lives of their family

members and a hike in salary is the

least that banks can ensure for

rewarding the commitment shown to

them by their employees during this

period of crisis.

All employees of the banks should be

allowed to work from remote

locations for their physical safety and

wellbeing

The office spaces need to be

sanitized every single day to keep

these places safe from the risk of

infection

Customers of banks and employees

of the same should be confined to

online operations or transactions

only for reasons of personal safety

By working from a physical office

space, employees are risking their

lives and the lives of their family

members and a hike in salary is the

least that banks can ensure for

rewarding the commitment shown to

them by their employees during this

period of crisis.

References

• De Vito, A. and Gomez, J.P., 2020. Estimating the COVID-19 Cash Crunch: Global

Evidence and Policy. Available at SSRN 3560612.

• Flick, U., 2018. Designing qualitative research. Sage

• Latham, L., 2020. COVID-19: Workers should not be made to mortgage our future. Green

Left Weekly, (1258), p.9.

• Maital, S. and BARZANI, E., 2020. The Global Economic Impact of COVID-19: A

Summary of Research. Samuel Neaman Institute for National Policy Research

• McKibbin, W. and Fernando, R., 2020. 3 The economic impact of COVID-19. Economics

in the Time of COVID-19, p.45

• Ramelli, S. and Wagner, A., 2020. 7 What the stock market tells us about the consequences

of COVID-19. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever, p.63.

• Silverman, D. ed., 2016. Qualitative research. Sage

• Wenham, C., Smith, J. and Morgan, R., 2020. COVID-19: the gendered impacts of the

outbreak. The Lancet, 395(10227), pp.846-848.

• Zhou, X., Snoswell, C.L., Harding, L.E., Bambling, M., Edirippulige, S., Bai, X. and Smith,

A.C., 2020. The role of telehealth in reducing the mental health burden from COVID-

19. Telemedicine and e-Health.

• De Vito, A. and Gomez, J.P., 2020. Estimating the COVID-19 Cash Crunch: Global

Evidence and Policy. Available at SSRN 3560612.

• Flick, U., 2018. Designing qualitative research. Sage

• Latham, L., 2020. COVID-19: Workers should not be made to mortgage our future. Green

Left Weekly, (1258), p.9.

• Maital, S. and BARZANI, E., 2020. The Global Economic Impact of COVID-19: A

Summary of Research. Samuel Neaman Institute for National Policy Research

• McKibbin, W. and Fernando, R., 2020. 3 The economic impact of COVID-19. Economics

in the Time of COVID-19, p.45

• Ramelli, S. and Wagner, A., 2020. 7 What the stock market tells us about the consequences

of COVID-19. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever, p.63.

• Silverman, D. ed., 2016. Qualitative research. Sage

• Wenham, C., Smith, J. and Morgan, R., 2020. COVID-19: the gendered impacts of the

outbreak. The Lancet, 395(10227), pp.846-848.

• Zhou, X., Snoswell, C.L., Harding, L.E., Bambling, M., Edirippulige, S., Bai, X. and Smith,

A.C., 2020. The role of telehealth in reducing the mental health burden from COVID-

19. Telemedicine and e-Health.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.