CQU ACCT20073: Term 2 2019 Company Accounting Consolidation Project

VerifiedAdded on 2022/11/10

|6

|1243

|218

Project

AI Summary

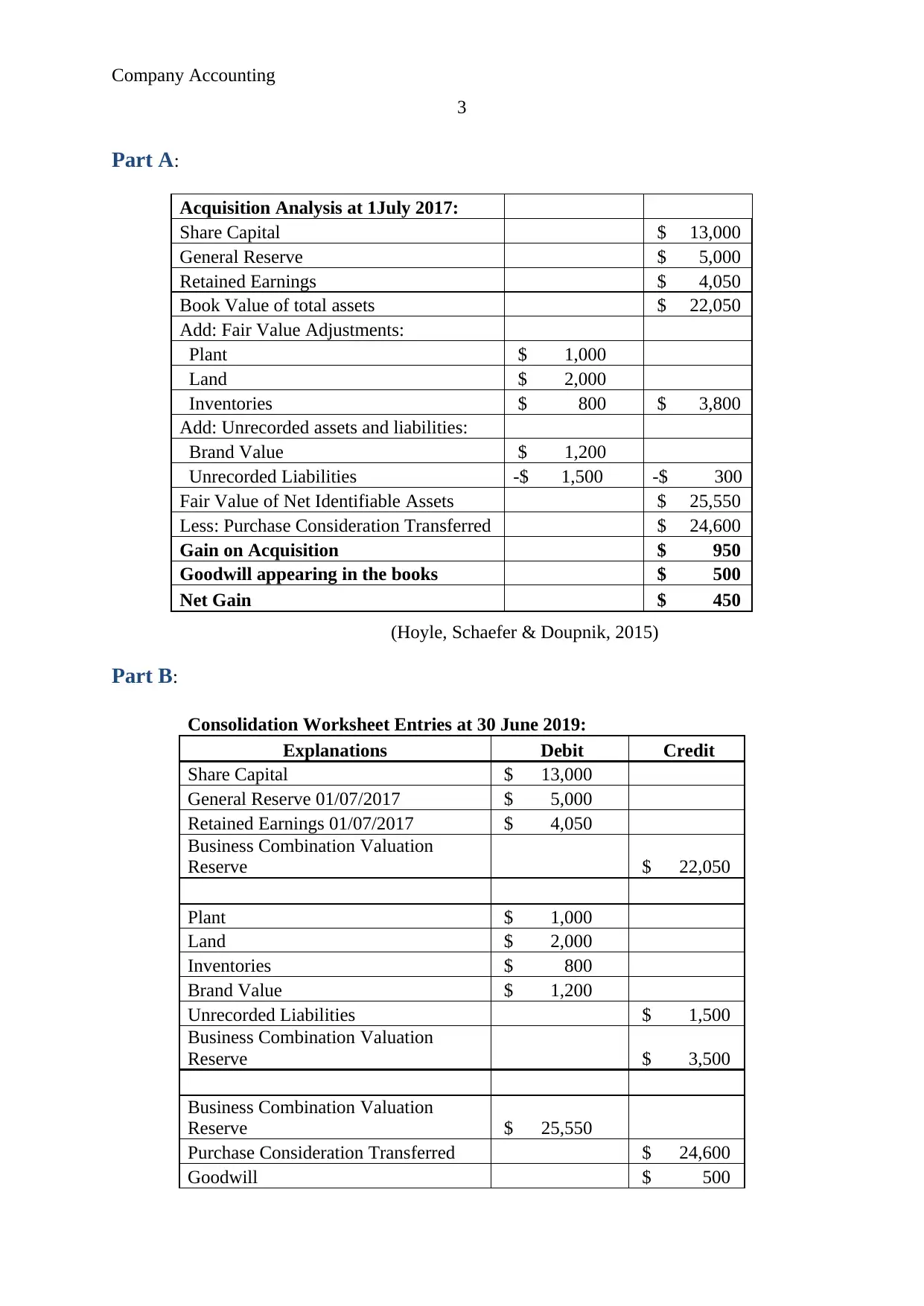

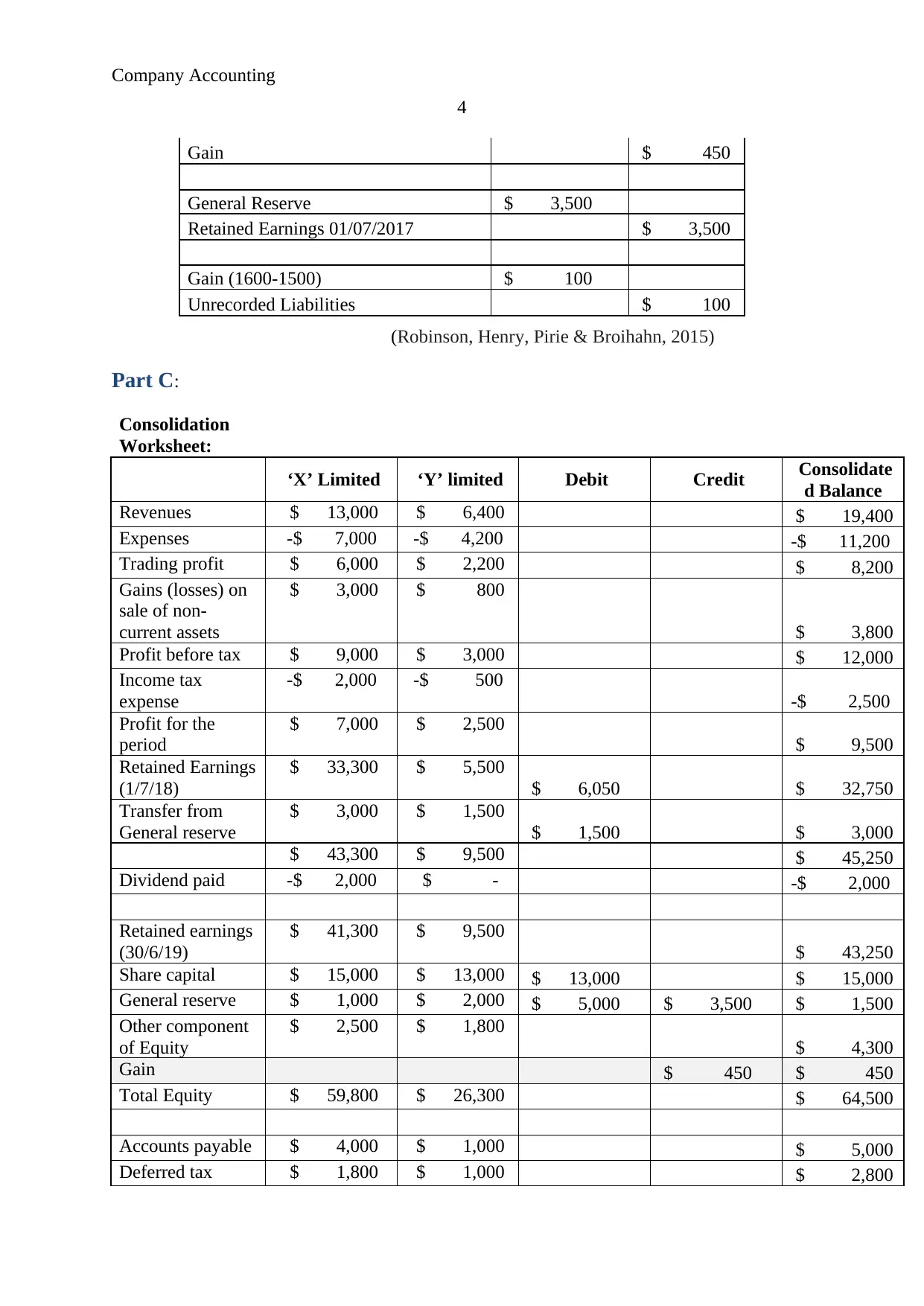

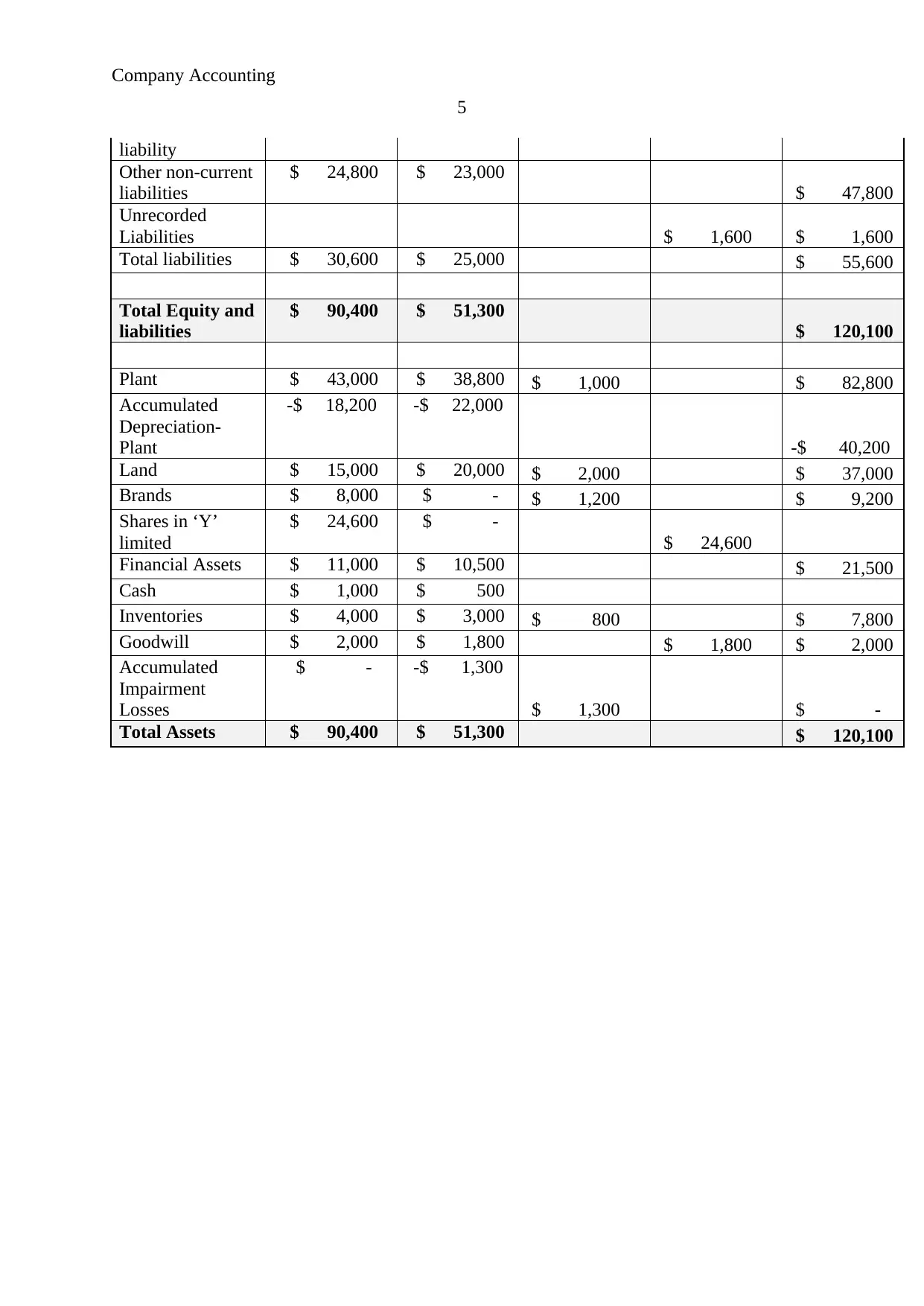

This project report delves into the intricacies of company accounting consolidation, focusing on the consolidation process for wholly owned entities. The report is structured into three parts: Part A analyzes the acquisition of a subsidiary, including fair value adjustments and the calculation of goodwill; Part B presents the consolidation worksheet entries at a specific date, detailing the adjustments required for business combination valuation and pre-acquisition entries; and Part C provides a consolidated worksheet, summarizing the financial performance and position of the combined entities. The report includes references to key accounting standards and textbooks, offering a comprehensive understanding of the consolidation process. The report covers topics from acquisition analysis to the preparation of consolidated financial statements.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)