Financial Analysis: Management Accounting Systems at Creams Ltd

VerifiedAdded on 2023/01/11

|17

|4728

|85

Report

AI Summary

This report provides a detailed analysis of management accounting practices at Creams Ltd, a medium-sized UK company specializing in sweets. It covers various aspects of management accounting, including an explanation of management accounting and its essential system requirements, different methods used to report management accounting information, and an evaluation of the benefits of these systems. The report also includes calculations of costs using different costing techniques such as absorption and marginal costing, application of management accounting techniques to generate financial reporting documents, and an explanation of budgetary control along with the advantages and disadvantages of different planning tools. Furthermore, it compares different organizations based on their use of management accounting systems to respond to financial problems and assesses how companies use management accounting for sustainable success. The report concludes by evaluating the use of planning tools for responding to financial problems.

Management

accounting

accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Explanation of management accounting along with essential requirements of its systems...1

P2 Description of different methods which are used to report information of management

accounting....................................................................................................................................2

M1 Evaluation of benefits of all the systems which are used for in organisations.....................3

D1 Integration of management accounting reports and systems within organisational context

in critical manner.........................................................................................................................4

TASK 2............................................................................................................................................4

P3 Calculation of costs with the help of different costing techniques such as absorption and

marginal costing...........................................................................................................................4

M2 Application of range of management accounting techniques to generate financial reporting

documents..................................................................................................................................10

D2 Interpretation of data............................................................................................................11

TASK 3..........................................................................................................................................11

P4 Explanation of budgetary control along with advantages and disadvantages of different

planning tools which are used in it............................................................................................11

M3 Analysis of various planning tool’s use in preparing and forecasting budgets...................12

TASK 4..........................................................................................................................................13

P5 Comparison of different organisations on the basis of use of management accounting

systems to respond financial problems......................................................................................13

M4 Assessment of the way in which companies are using management accounting to respond

financial problems and the way in which it can lead entities o sustainable success..................14

D3 Evaluation of use of planning tools for responding financial problems..............................15

CONCLUSION..............................................................................................................................15

Table of Contents.............................................................................................................................2

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Explanation of management accounting along with essential requirements of its systems...1

P2 Description of different methods which are used to report information of management

accounting....................................................................................................................................2

M1 Evaluation of benefits of all the systems which are used for in organisations.....................3

D1 Integration of management accounting reports and systems within organisational context

in critical manner.........................................................................................................................4

TASK 2............................................................................................................................................4

P3 Calculation of costs with the help of different costing techniques such as absorption and

marginal costing...........................................................................................................................4

M2 Application of range of management accounting techniques to generate financial reporting

documents..................................................................................................................................10

D2 Interpretation of data............................................................................................................11

TASK 3..........................................................................................................................................11

P4 Explanation of budgetary control along with advantages and disadvantages of different

planning tools which are used in it............................................................................................11

M3 Analysis of various planning tool’s use in preparing and forecasting budgets...................12

TASK 4..........................................................................................................................................13

P5 Comparison of different organisations on the basis of use of management accounting

systems to respond financial problems......................................................................................13

M4 Assessment of the way in which companies are using management accounting to respond

financial problems and the way in which it can lead entities o sustainable success..................14

D3 Evaluation of use of planning tools for responding financial problems..............................15

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is one of the key factors which are focused by all the entities to

make sure that detailed internal records are formulated which can help to analyse the market

position of business. If the enterprises are not able to generate it then it may leave impact upon

mind set of insider parties such as employees, managers and stakeholders as they assess and

evaluate internal records to analyse actual position of company. It shows that for all the

companies it is very important that they should conduct it every year so that interest of

stakeholders could be improved (Abernethy and Wallis, 2018). Present report is based upon

Creams Ltd which is a medium sized company of UK. Currently it is selling different types of

sweets in the market which includes waffles, ice creams, doughnuts etc. Various topics that are

covered in this assignment are analysis of management accounting, its systems, their essential

requirements, reports to record its information, costing techniques such as marginal and

absorption costing etc. Additionally, planning tools along with their advantages and

disadvantages, comparison of companies on the basis of use of management accounting systems

to respond financial challenges etc. are also covered in this project.

TASK 1

P1 Explanation of management accounting along with essential requirements of its systems

Management accounting is the process of controlling, evaluating and analysing all the

steps which are taken by the managers for betterment of business so that progress of company

could be analysed. In Creams Ltd it is used by managers for the purpose of analysing actual

performance of business. While conducting it different types of systems are used which are

described below:

Price optimisation system: This management accounting system is used by all the

organisations so that they can set appropriate price for all the products and attract large number

of customers. In Creams Ltd it is used to analyse responses of clients on the prices that are set of

ice creams, doughnuts and waffles. It is essentially required for the entity as it helps the

managers to set best suitable price for the items that are sold by it which is beneficial to meet

business goals such as higher revenues and profits (Alawattage and Wickramasinghe, 2018).

Cost accounting system: Under this accounting systems managers keep detailed

information of all the costs that have taken place while operating business. In Creams Ltd it is

1

Management accounting is one of the key factors which are focused by all the entities to

make sure that detailed internal records are formulated which can help to analyse the market

position of business. If the enterprises are not able to generate it then it may leave impact upon

mind set of insider parties such as employees, managers and stakeholders as they assess and

evaluate internal records to analyse actual position of company. It shows that for all the

companies it is very important that they should conduct it every year so that interest of

stakeholders could be improved (Abernethy and Wallis, 2018). Present report is based upon

Creams Ltd which is a medium sized company of UK. Currently it is selling different types of

sweets in the market which includes waffles, ice creams, doughnuts etc. Various topics that are

covered in this assignment are analysis of management accounting, its systems, their essential

requirements, reports to record its information, costing techniques such as marginal and

absorption costing etc. Additionally, planning tools along with their advantages and

disadvantages, comparison of companies on the basis of use of management accounting systems

to respond financial challenges etc. are also covered in this project.

TASK 1

P1 Explanation of management accounting along with essential requirements of its systems

Management accounting is the process of controlling, evaluating and analysing all the

steps which are taken by the managers for betterment of business so that progress of company

could be analysed. In Creams Ltd it is used by managers for the purpose of analysing actual

performance of business. While conducting it different types of systems are used which are

described below:

Price optimisation system: This management accounting system is used by all the

organisations so that they can set appropriate price for all the products and attract large number

of customers. In Creams Ltd it is used to analyse responses of clients on the prices that are set of

ice creams, doughnuts and waffles. It is essentially required for the entity as it helps the

managers to set best suitable price for the items that are sold by it which is beneficial to meet

business goals such as higher revenues and profits (Alawattage and Wickramasinghe, 2018).

Cost accounting system: Under this accounting systems managers keep detailed

information of all the costs that have taken place while operating business. In Creams Ltd it is

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

being utilised by management so that accurate information regarding the activities that are

resulting in higher costs could be determined. Essential requirements of it for the business is to

formulate cost control strategies because it will guide to estimate all the expenses which may

take place in future while carrying out operations.

Job order costing system: The companies which are involved in multiple activities use

this system so that requirements of all the clients could be fulfilled according to their

specifications. Creams Ltd is using job order costing so that managers can keep record of all the

jobs that are performed by them to carry out operations. One of the key requirements of this

system to the organisation is that it guides all the members of company to make sure that they

perform all the jobs according to specification of customers to meet long-term goals (Bento,

Mertins and White, 2018).

Inventory management system: It is used by all the companies to analyse the stock

which is used for performing all the operations in systematic manner. Managers of Creams Ltd

are using it so that they can analyse that they are having sufficient goods to meet requirements of

clients. There are three different types of it which are as follows:

First in First Out (FIFO): This inventory management system is used by entities to use

previously purchased goods to manufacture products.

Average cost (AVCO): In this method of inventory management all the goods are used

on average basis for production activities.

Last in First Out (LIFO): This method of managing inventory is taken in to

consideration when enterprises use recently purchased stock to perform operations.

From all the above described management accounting systems Creams Ltd is using FIFO

as it helps to utilise all the resources properly. Its essential requirement for business it that it

guides managers to make sure that they use all the stocked items properly to perform all the

operations (Eldenburg, Krishnan and Krishnan, 2017).

P2 Description of different methods which are used to report information of management

accounting

In all the companies, specific procedure is followed for the purpose formulating records of

whole years so that internal stakeholders can analyse actual performance of business. This

process is known as management accounting reporting. In Creams Ltd it is used by managers so

2

resulting in higher costs could be determined. Essential requirements of it for the business is to

formulate cost control strategies because it will guide to estimate all the expenses which may

take place in future while carrying out operations.

Job order costing system: The companies which are involved in multiple activities use

this system so that requirements of all the clients could be fulfilled according to their

specifications. Creams Ltd is using job order costing so that managers can keep record of all the

jobs that are performed by them to carry out operations. One of the key requirements of this

system to the organisation is that it guides all the members of company to make sure that they

perform all the jobs according to specification of customers to meet long-term goals (Bento,

Mertins and White, 2018).

Inventory management system: It is used by all the companies to analyse the stock

which is used for performing all the operations in systematic manner. Managers of Creams Ltd

are using it so that they can analyse that they are having sufficient goods to meet requirements of

clients. There are three different types of it which are as follows:

First in First Out (FIFO): This inventory management system is used by entities to use

previously purchased goods to manufacture products.

Average cost (AVCO): In this method of inventory management all the goods are used

on average basis for production activities.

Last in First Out (LIFO): This method of managing inventory is taken in to

consideration when enterprises use recently purchased stock to perform operations.

From all the above described management accounting systems Creams Ltd is using FIFO

as it helps to utilise all the resources properly. Its essential requirement for business it that it

guides managers to make sure that they use all the stocked items properly to perform all the

operations (Eldenburg, Krishnan and Krishnan, 2017).

P2 Description of different methods which are used to report information of management

accounting

In all the companies, specific procedure is followed for the purpose formulating records of

whole years so that internal stakeholders can analyse actual performance of business. This

process is known as management accounting reporting. In Creams Ltd it is used by managers so

2

that they can record information of all the operations which are performed by them. Description

of all of them is as follows:

Inventory management report: This report is mainly used for the purpose of recording

details regarding the stock which is used to perform business activities. In Creams Ltd it

is used by managers to analyse that they are having appropriate amount of stock so that

they can meet requirements of clients who order ice creams, waffles and doughnuts. It is

beneficial for the business because it can help to ignore the situation of lack of stock to

perform operational activities (Englund and Gerdin, 2018).

Performance report: Most of the companies are generating this report to record actual

performance of business and the individuals who are working in it. In Creams Ltd it is

created by management so that they can analyse that the efforts that are made by them to

improve business have resulted positively or negatively. It is very beneficial for the entity

because it helps to motivate employees by providing them rewards according to their

performance.

Budget report: It is related with the allocation of funds to different departments so that

all of them can perform all their activities properly. In Creams Ltd financial division

generates it in order to assign budget to all the functional departments according to their

requirements. The key benefit of it to the enterprise is that it helps to perform all the

activities properly because it allocates sufficient funding to all the divisions.

Account receivable report: It is used in most of the large and some of the medium sized

companies who are allowing credit to the clients. Creams Ltd is generating it for the

purpose of analyse the actual receivables that are required to be collected by it from the

clients in future. It is beneficial for the organisation because with the help of it

management and other concerned parties get aware of actual owed amount of company

from different customers (Horton and de Araujo Wanderley, 2018).

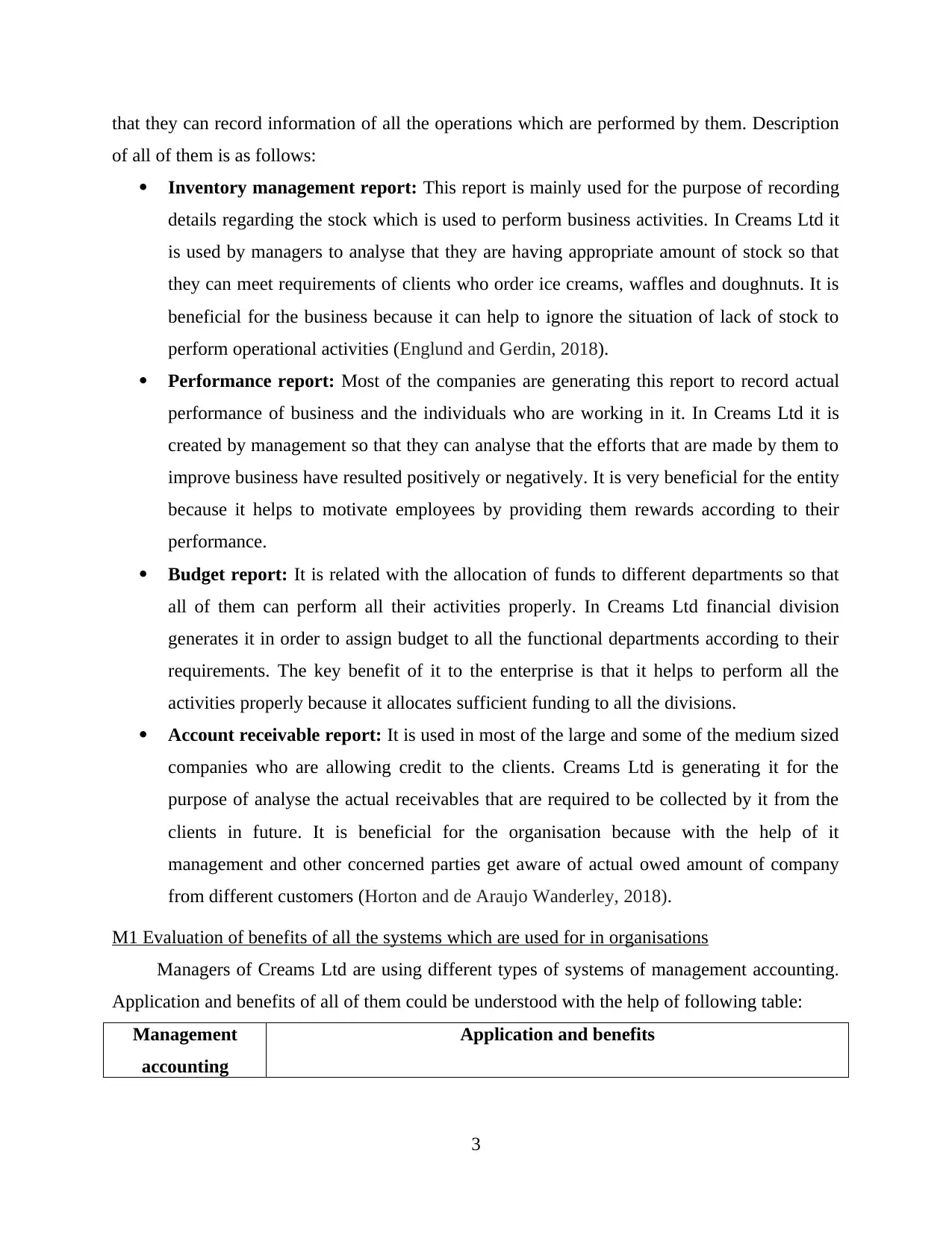

M1 Evaluation of benefits of all the systems which are used for in organisations

Managers of Creams Ltd are using different types of systems of management accounting.

Application and benefits of all of them could be understood with the help of following table:

Management

accounting

Application and benefits

3

of all of them is as follows:

Inventory management report: This report is mainly used for the purpose of recording

details regarding the stock which is used to perform business activities. In Creams Ltd it

is used by managers to analyse that they are having appropriate amount of stock so that

they can meet requirements of clients who order ice creams, waffles and doughnuts. It is

beneficial for the business because it can help to ignore the situation of lack of stock to

perform operational activities (Englund and Gerdin, 2018).

Performance report: Most of the companies are generating this report to record actual

performance of business and the individuals who are working in it. In Creams Ltd it is

created by management so that they can analyse that the efforts that are made by them to

improve business have resulted positively or negatively. It is very beneficial for the entity

because it helps to motivate employees by providing them rewards according to their

performance.

Budget report: It is related with the allocation of funds to different departments so that

all of them can perform all their activities properly. In Creams Ltd financial division

generates it in order to assign budget to all the functional departments according to their

requirements. The key benefit of it to the enterprise is that it helps to perform all the

activities properly because it allocates sufficient funding to all the divisions.

Account receivable report: It is used in most of the large and some of the medium sized

companies who are allowing credit to the clients. Creams Ltd is generating it for the

purpose of analyse the actual receivables that are required to be collected by it from the

clients in future. It is beneficial for the organisation because with the help of it

management and other concerned parties get aware of actual owed amount of company

from different customers (Horton and de Araujo Wanderley, 2018).

M1 Evaluation of benefits of all the systems which are used for in organisations

Managers of Creams Ltd are using different types of systems of management accounting.

Application and benefits of all of them could be understood with the help of following table:

Management

accounting

Application and benefits

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

systems

Price optimisation

system

It is applied in Creams Ltd because it is beneficial to set appropriate price

for all the products that best suits to the objectives of business.

Cost accounting

system

It is used by managers of Creams Ltd as it helps to analyse the costs that

may take place in future and formulate effective strategies to deal with

them.

Inventory

management

system

This system is applied in Creams Ltd because it benefits the company to

analyse the actual status of inventory and assure that it is having sufficient

goods to perform all the business activities.

Job order costing This management accounting system is used in Creams Ltd as it is

beneficial to meet all the requirements of customers according to their

requirements.

D1 Integration of management accounting reports and systems within organisational context in

critical manner

Managers of Creams Ltd are using various types of management accounting systems are

reports as all of them helps to attain success for business. For example, costing accounting

system helps to analyse costs so that strategies to control them could be formulated. Price

optimisation system is used by the managers as it helps them to set right price for all the items

that are sold by the entity in the market. On the other hand, different types of reports such as

performance report is generated by the company as it helps to analyse that all the efforts that are

made by them are resulting positively or negatively (Laing, 2018). Accounting receivable reports

are used to tighten the credit policies because it helps to analyse the arrear which is made by

clients in making payments of owed amount by them.

TASK 2

P3 Calculation of costs with the help of different costing techniques such as absorption and

marginal costing

In all the companies, different types of costing techniques are used for the purpose of

analysing net income for the year. Two of them which are used by Creams Ltd to assess the

actual profits are as follows:

4

Price optimisation

system

It is applied in Creams Ltd because it is beneficial to set appropriate price

for all the products that best suits to the objectives of business.

Cost accounting

system

It is used by managers of Creams Ltd as it helps to analyse the costs that

may take place in future and formulate effective strategies to deal with

them.

Inventory

management

system

This system is applied in Creams Ltd because it benefits the company to

analyse the actual status of inventory and assure that it is having sufficient

goods to perform all the business activities.

Job order costing This management accounting system is used in Creams Ltd as it is

beneficial to meet all the requirements of customers according to their

requirements.

D1 Integration of management accounting reports and systems within organisational context in

critical manner

Managers of Creams Ltd are using various types of management accounting systems are

reports as all of them helps to attain success for business. For example, costing accounting

system helps to analyse costs so that strategies to control them could be formulated. Price

optimisation system is used by the managers as it helps them to set right price for all the items

that are sold by the entity in the market. On the other hand, different types of reports such as

performance report is generated by the company as it helps to analyse that all the efforts that are

made by them are resulting positively or negatively (Laing, 2018). Accounting receivable reports

are used to tighten the credit policies because it helps to analyse the arrear which is made by

clients in making payments of owed amount by them.

TASK 2

P3 Calculation of costs with the help of different costing techniques such as absorption and

marginal costing

In all the companies, different types of costing techniques are used for the purpose of

analysing net income for the year. Two of them which are used by Creams Ltd to assess the

actual profits are as follows:

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

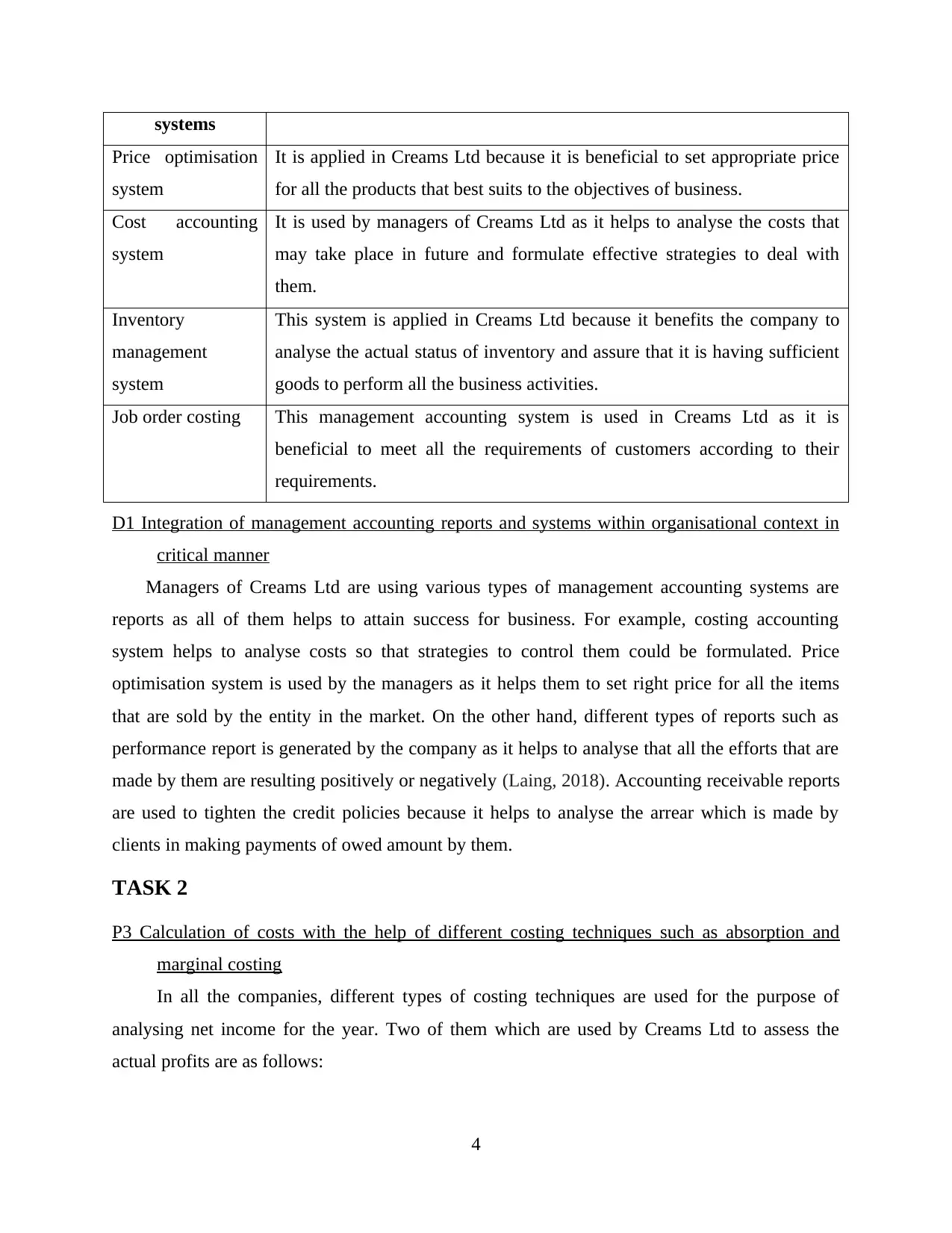

Marginal costing: This costing technique is used by all the companies to analyse the cost

of all the additional units that are manufactured during the year. In Creams Ltd the managers are

using it to analyse the expenses which have taken place due to production of additional items that

are sold to the customers to meet their demand (Nørreklit, 2017). It is also known as variable

costing because only variable costs are used in it while calculating profits with the help of it.

Detailed calculation of profits with the help of this technique is as follows:

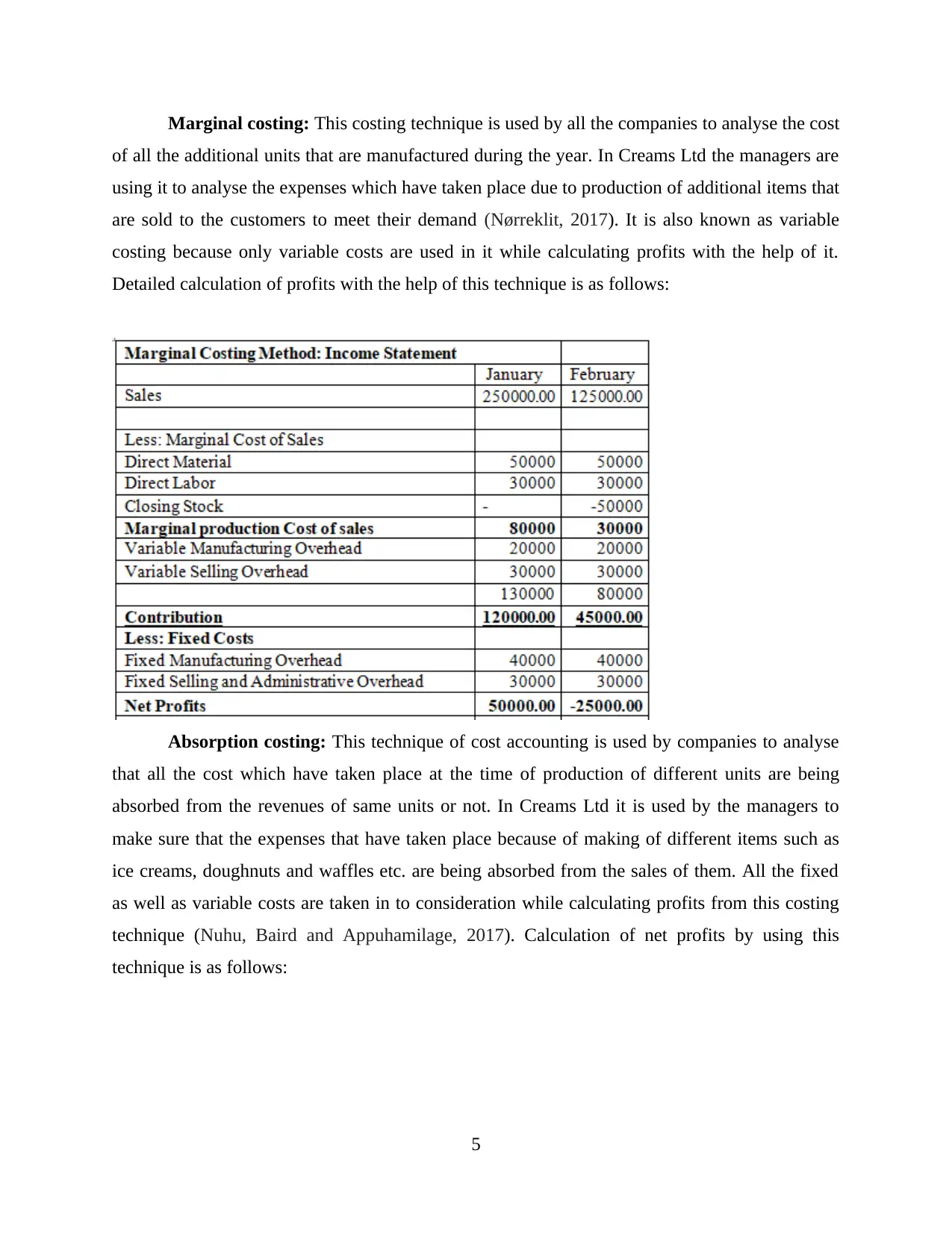

Absorption costing: This technique of cost accounting is used by companies to analyse

that all the cost which have taken place at the time of production of different units are being

absorbed from the revenues of same units or not. In Creams Ltd it is used by the managers to

make sure that the expenses that have taken place because of making of different items such as

ice creams, doughnuts and waffles etc. are being absorbed from the sales of them. All the fixed

as well as variable costs are taken in to consideration while calculating profits from this costing

technique (Nuhu, Baird and Appuhamilage, 2017). Calculation of net profits by using this

technique is as follows:

5

of all the additional units that are manufactured during the year. In Creams Ltd the managers are

using it to analyse the expenses which have taken place due to production of additional items that

are sold to the customers to meet their demand (Nørreklit, 2017). It is also known as variable

costing because only variable costs are used in it while calculating profits with the help of it.

Detailed calculation of profits with the help of this technique is as follows:

Absorption costing: This technique of cost accounting is used by companies to analyse

that all the cost which have taken place at the time of production of different units are being

absorbed from the revenues of same units or not. In Creams Ltd it is used by the managers to

make sure that the expenses that have taken place because of making of different items such as

ice creams, doughnuts and waffles etc. are being absorbed from the sales of them. All the fixed

as well as variable costs are taken in to consideration while calculating profits from this costing

technique (Nuhu, Baird and Appuhamilage, 2017). Calculation of net profits by using this

technique is as follows:

5

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

M2 Application of range of management accounting techniques to generate financial reporting

documents

There are various different types of management accounting that could be used by

companies for the purpose of formulating financial reporting documents. Description of some of

them is as follows:

Standard costing: This technique of management accounting could be used by Creams

Ltd to analyse the difference between actual and standard performance of business. With the help

of it, strategies for improvement in performance could be formulated.

Historical costing: Under this technique of management accounting all the assets and

liabilities are required to be recorded on the basis of actual value rather than market value. By

using it Creams Ltd will be able to record accurate information of all the figures of balance sheet

in books.

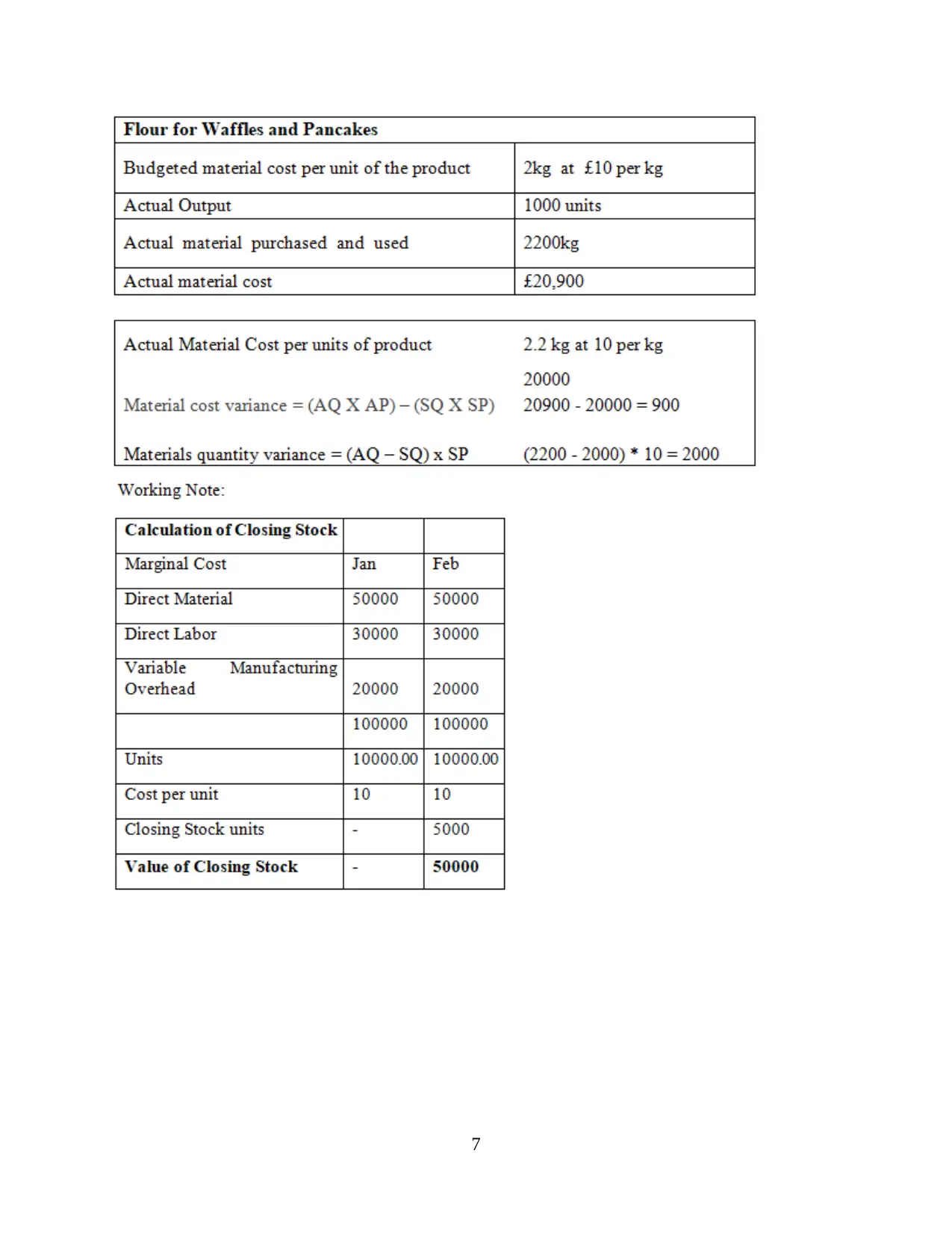

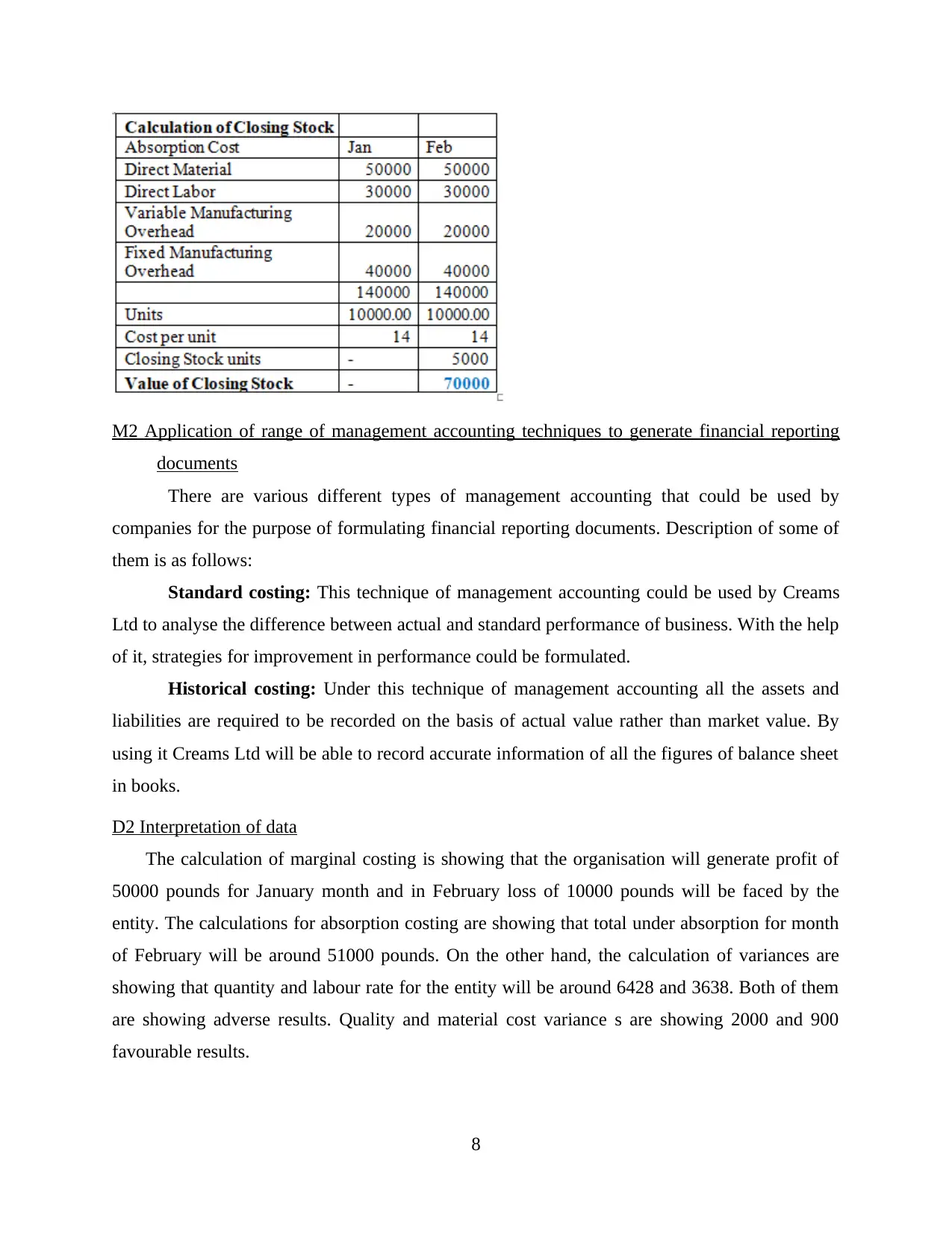

D2 Interpretation of data

The calculation of marginal costing is showing that the organisation will generate profit of

50000 pounds for January month and in February loss of 10000 pounds will be faced by the

entity. The calculations for absorption costing are showing that total under absorption for month

of February will be around 51000 pounds. On the other hand, the calculation of variances are

showing that quantity and labour rate for the entity will be around 6428 and 3638. Both of them

are showing adverse results. Quality and material cost variance s are showing 2000 and 900

favourable results.

8

documents

There are various different types of management accounting that could be used by

companies for the purpose of formulating financial reporting documents. Description of some of

them is as follows:

Standard costing: This technique of management accounting could be used by Creams

Ltd to analyse the difference between actual and standard performance of business. With the help

of it, strategies for improvement in performance could be formulated.

Historical costing: Under this technique of management accounting all the assets and

liabilities are required to be recorded on the basis of actual value rather than market value. By

using it Creams Ltd will be able to record accurate information of all the figures of balance sheet

in books.

D2 Interpretation of data

The calculation of marginal costing is showing that the organisation will generate profit of

50000 pounds for January month and in February loss of 10000 pounds will be faced by the

entity. The calculations for absorption costing are showing that total under absorption for month

of February will be around 51000 pounds. On the other hand, the calculation of variances are

showing that quantity and labour rate for the entity will be around 6428 and 3638. Both of them

are showing adverse results. Quality and material cost variance s are showing 2000 and 900

favourable results.

8

TASK 3

P4 Explanation of budgetary control along with advantages and disadvantages of different

planning tools which are used in it

Budget is characterised as general statement that involves estimated receipts and expenses

for an accounting year. In Creams Limited, managers prepare budget in order to create spending

plan for monetary resources and to ensure that all departments have resources to execute

operations effectively.

Budgetary control is termed as procedure to create spending plan addition to periodically

comparing real expenses against defined plan for controlling spending along with meeting

financial goals. With this, financial managers of Creams Ltd are able to manage all line items

that results in controlling business operations and expenses in order to gain maximum revenues.

It involves various number of planning tools that helps in controlling operational working and

some are as discussed in context to Creams Ltd:

Zero based budget: The budget type in which all expenses are justified for new period is

said to zero based budget. In Creams Ltd, managers prepare Zero based budget as per

requirements for upcoming period as well as to collect information related to expenses and costs

concerned with new product (Qian, Burritt and Monroe, 2018).

Advantages: With zero based budget, managers of Creams Ltd are benefitted in improving

operations for upcoming period and eliminates resource wastage through providing new

calculations of income and expenditure.

Disadvantages: To prepare zero based budget, finance department of Creams Ltd requires

huge time and also in-depth knowledge for each financial mechanisms which becomes

cumbersome difficult for the entity.

Flexible budget: The financial plan wherein modifications are done as per needs of

organisation. It calculates distinct level of expenditures for costs that depends on fluctuations in

actual revenue. With the help of flexible budget, finance team of Creams Ltd is able to make

relevant changes in budgets as per activity level.

Advantages: Flexible budget benefits Creams Ltd in predicting performances addition to

income level for changes in of sales and production. It also helps the company in recognising

irregular earnings so to use funds in much needed times.

9

P4 Explanation of budgetary control along with advantages and disadvantages of different

planning tools which are used in it

Budget is characterised as general statement that involves estimated receipts and expenses

for an accounting year. In Creams Limited, managers prepare budget in order to create spending

plan for monetary resources and to ensure that all departments have resources to execute

operations effectively.

Budgetary control is termed as procedure to create spending plan addition to periodically

comparing real expenses against defined plan for controlling spending along with meeting

financial goals. With this, financial managers of Creams Ltd are able to manage all line items

that results in controlling business operations and expenses in order to gain maximum revenues.

It involves various number of planning tools that helps in controlling operational working and

some are as discussed in context to Creams Ltd:

Zero based budget: The budget type in which all expenses are justified for new period is

said to zero based budget. In Creams Ltd, managers prepare Zero based budget as per

requirements for upcoming period as well as to collect information related to expenses and costs

concerned with new product (Qian, Burritt and Monroe, 2018).

Advantages: With zero based budget, managers of Creams Ltd are benefitted in improving

operations for upcoming period and eliminates resource wastage through providing new

calculations of income and expenditure.

Disadvantages: To prepare zero based budget, finance department of Creams Ltd requires

huge time and also in-depth knowledge for each financial mechanisms which becomes

cumbersome difficult for the entity.

Flexible budget: The financial plan wherein modifications are done as per needs of

organisation. It calculates distinct level of expenditures for costs that depends on fluctuations in

actual revenue. With the help of flexible budget, finance team of Creams Ltd is able to make

relevant changes in budgets as per activity level.

Advantages: Flexible budget benefits Creams Ltd in predicting performances addition to

income level for changes in of sales and production. It also helps the company in recognising

irregular earnings so to use funds in much needed times.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.