Comprehensive Statistical Analysis Report: Credit Card Data

VerifiedAdded on 2020/01/28

|28

|1931

|243

Report

AI Summary

This report presents a statistical analysis of credit card data, employing descriptive statistics and regression analysis to explore relationships between variables such as income, household size, and credit card charges. The analysis includes regression equations, predicted credit card charges, and model modifications. Task 2 focuses on exam and assignment scores, utilizing histograms, descriptive statistics, and correlation analysis to identify relationships between different assessments. Task 3 delves into depression levels across different cities, employing descriptive statistics and ANOVA to assess the impact of health status on depression. The report concludes with key findings and implications derived from the statistical analyses.

STATS

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION.......................................................................................................................................................................................3

TASK 1........................................................................................................................................................................................................3

1 Descriptive statistics.............................................................................................................................................................................3

2 Regression analysis...............................................................................................................................................................................4

3 Equation of regression..........................................................................................................................................................................8

4 Predicted credit card charge when family size is three.........................................................................................................................8

5 Modification of model..........................................................................................................................................................................9

TASK 2......................................................................................................................................................................................................10

Activity 01.............................................................................................................................................................................................10

Activity 02.............................................................................................................................................................................................10

Activity 03.............................................................................................................................................................................................22

TASK 3......................................................................................................................................................................................................25

1 Descriptive statistics...........................................................................................................................................................................25

2 ANNOVA...........................................................................................................................................................................................25

3 Appropriateness of treatment..............................................................................................................................................................27

CONCLUSION..........................................................................................................................................................................................27

INTRODUCTION.......................................................................................................................................................................................3

TASK 1........................................................................................................................................................................................................3

1 Descriptive statistics.............................................................................................................................................................................3

2 Regression analysis...............................................................................................................................................................................4

3 Equation of regression..........................................................................................................................................................................8

4 Predicted credit card charge when family size is three.........................................................................................................................8

5 Modification of model..........................................................................................................................................................................9

TASK 2......................................................................................................................................................................................................10

Activity 01.............................................................................................................................................................................................10

Activity 02.............................................................................................................................................................................................10

Activity 03.............................................................................................................................................................................................22

TASK 3......................................................................................................................................................................................................25

1 Descriptive statistics...........................................................................................................................................................................25

2 ANNOVA...........................................................................................................................................................................................25

3 Appropriateness of treatment..............................................................................................................................................................27

CONCLUSION..........................................................................................................................................................................................27

INTRODUCTION

In the current time period credit card business is running by the number of firms. In the current report data set related to credit

card is analyzed and in this regard descriptive statistical tool are used to analyze the data along with regression analysis tools. In

middle part of the report, correlation tool is applied to explore relationship among the variables. Apart from this, ANOVA tools is

used to identify whether there is relationship between geographic location and depression level. In this way, entire research is carried

out.

TASK 1

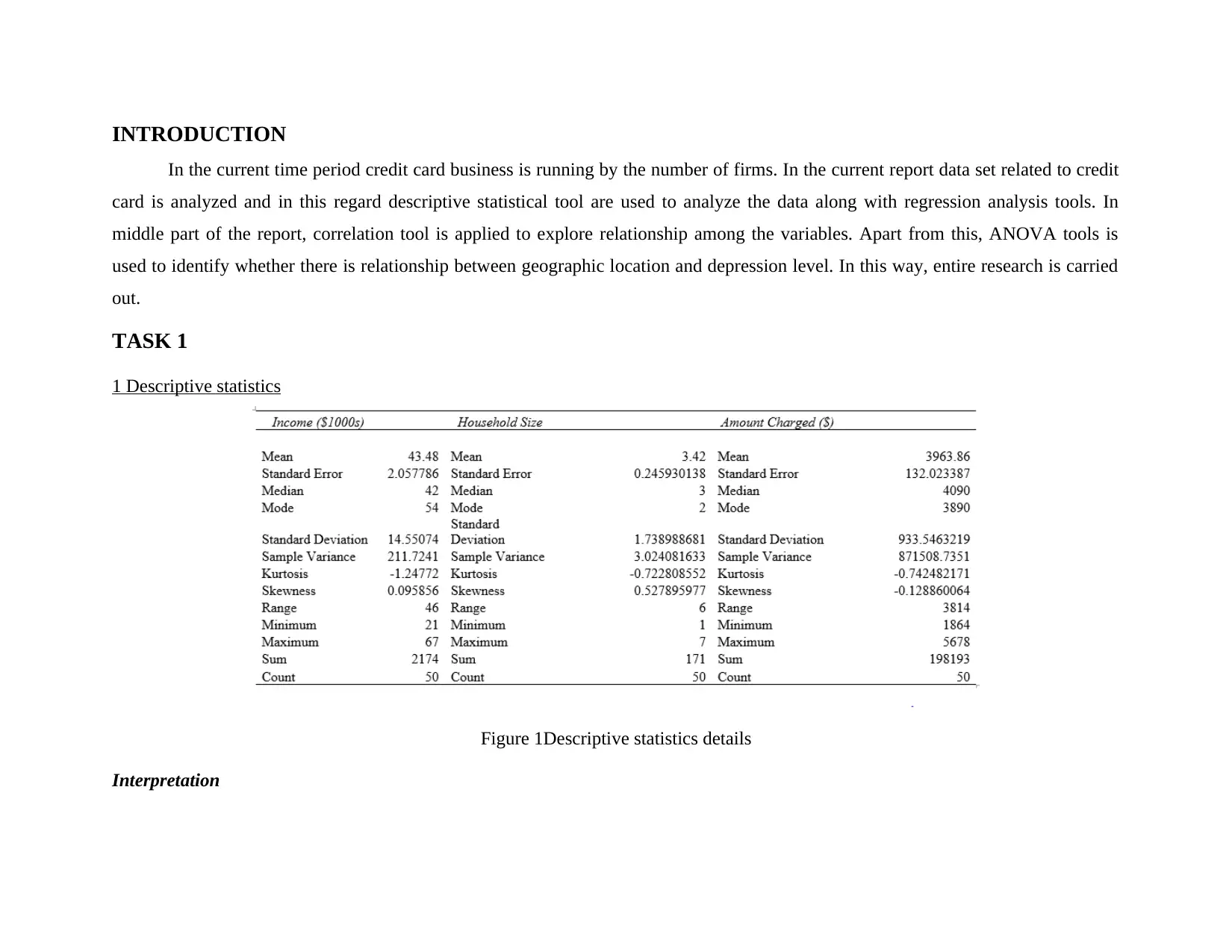

1 Descriptive statistics

Figure 1Descriptive statistics details

Interpretation

In the current time period credit card business is running by the number of firms. In the current report data set related to credit

card is analyzed and in this regard descriptive statistical tool are used to analyze the data along with regression analysis tools. In

middle part of the report, correlation tool is applied to explore relationship among the variables. Apart from this, ANOVA tools is

used to identify whether there is relationship between geographic location and depression level. In this way, entire research is carried

out.

TASK 1

1 Descriptive statistics

Figure 1Descriptive statistics details

Interpretation

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In case of variable income it is observed that on average basis people are earning $43000 followed by standard deviation which is

14.55. On other hand, in case of variable household on average basis size of the entire family is 3.42 which means that on average

basis there are 3 to 4 members in each family from whom data is gathered. Standard deviation is 1.73 which means that family size is

approx. same over time period and it does not change at rapid pace. Mean value of amount charged is 3963.86 which means that there

are large number of respondents which are making annual charge of mentioned value in respect to credit card. Results are clearly

reflecting that the difference between minimum and maximum amount charged is high if same is compared with relevant studied

variables which are given in the table. This is reflecting that people become more habitual of using credit card to meet their needs.

Even people are making overuse of credit card if we compare and take in to account their income level.

2 Regression analysis

H0: There is no significant mean difference between income level, household size and amount charged.

H1: There is significant mean difference between income level, household size and amount charged.

14.55. On other hand, in case of variable household on average basis size of the entire family is 3.42 which means that on average

basis there are 3 to 4 members in each family from whom data is gathered. Standard deviation is 1.73 which means that family size is

approx. same over time period and it does not change at rapid pace. Mean value of amount charged is 3963.86 which means that there

are large number of respondents which are making annual charge of mentioned value in respect to credit card. Results are clearly

reflecting that the difference between minimum and maximum amount charged is high if same is compared with relevant studied

variables which are given in the table. This is reflecting that people become more habitual of using credit card to meet their needs.

Even people are making overuse of credit card if we compare and take in to account their income level.

2 Regression analysis

H0: There is no significant mean difference between income level, household size and amount charged.

H1: There is significant mean difference between income level, household size and amount charged.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

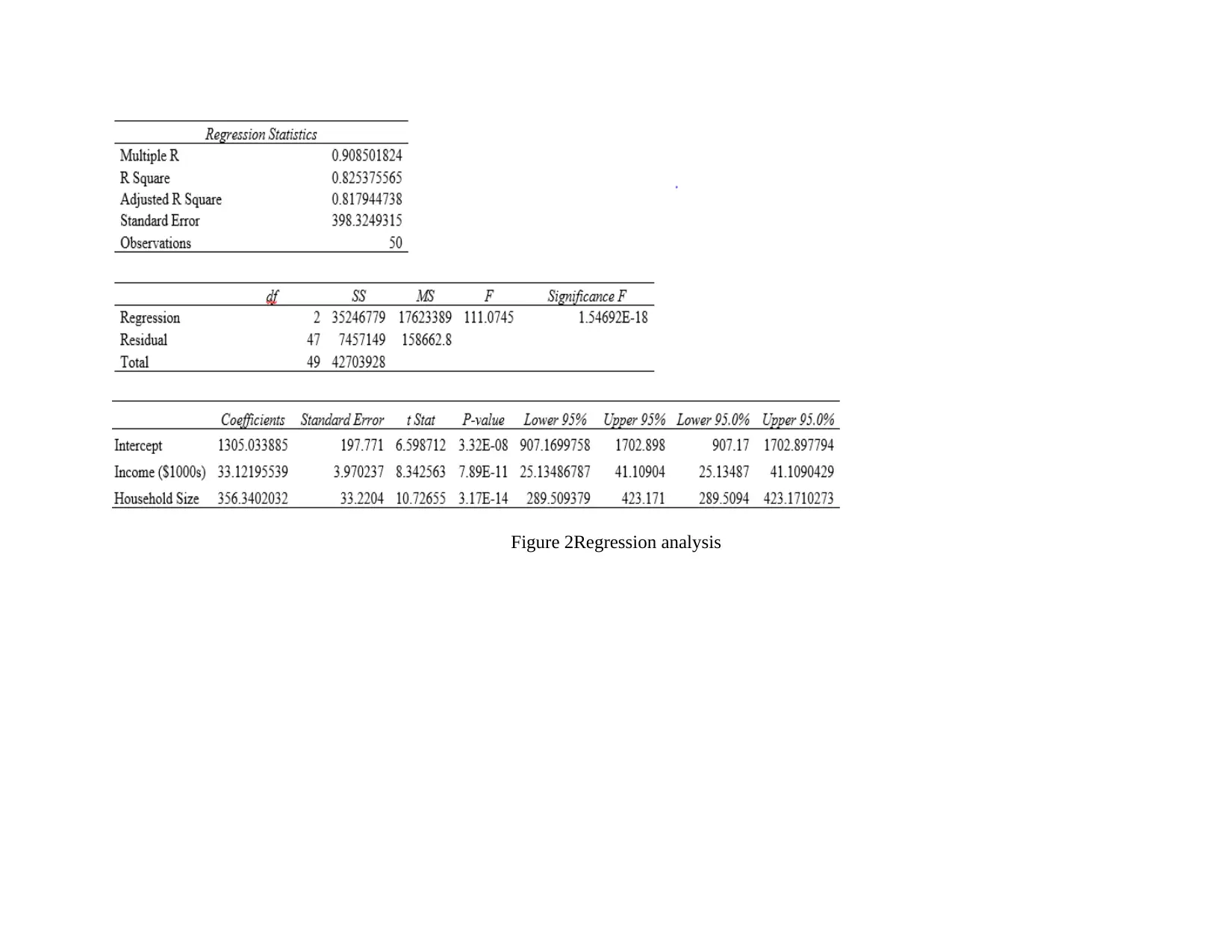

Figure 2Regression analysis

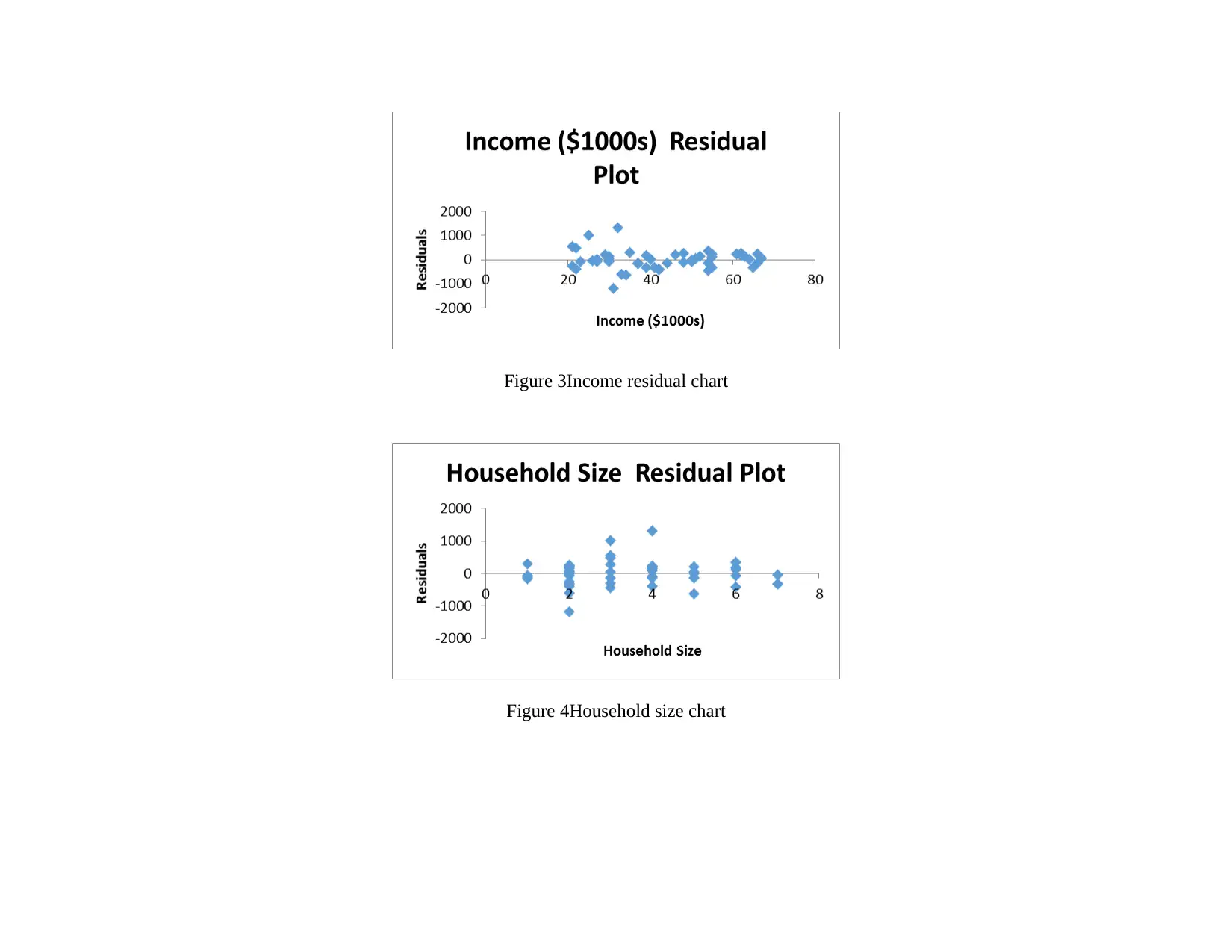

Figure 3Income residual chart

Figure 4Household size chart

Figure 4Household size chart

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

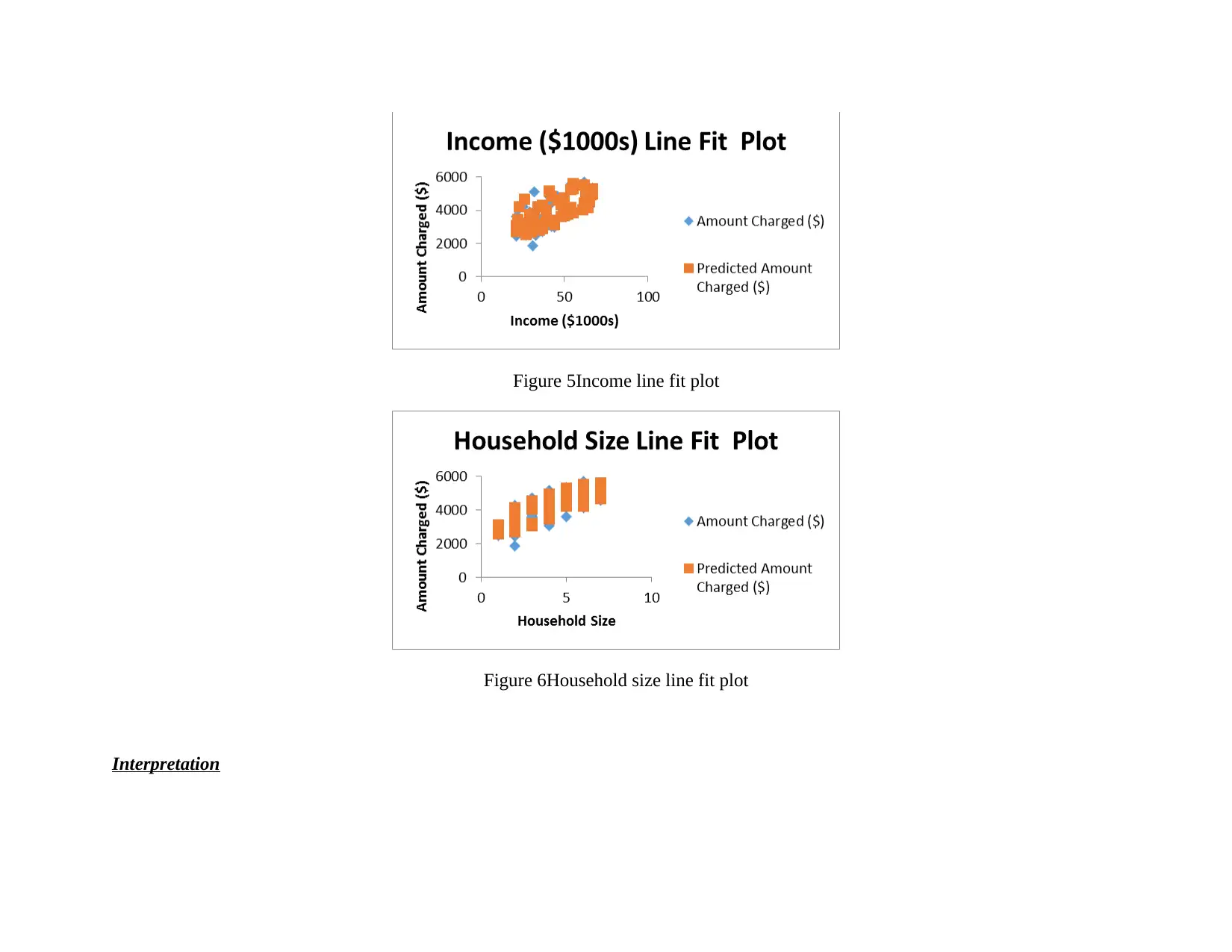

Figure 5Income line fit plot

Figure 6Household size line fit plot

Interpretation

Figure 6Household size line fit plot

Interpretation

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

There is high degree of correlation among the variables income level, household and amount charged. This is proved from the

fact the correlation value is 0.90 which is very high and is near to 1. Results are also indicating that big percentage change comes in

the amount spend with slight change that happened in the values of the variables namely income level and household. As per facts

82% variation comes in the amount spend with variation in the mentioned variables. Adjusted R square is 0.81 which strongly

indicating that 81% variation comes in the amount charged when any new variable will be added in the data set. Level of significance

is 1.54>0.05 and this is clear that in terms of impact both independent variables does not have significant impact on the dependent

variable. Results are reflecting that in case income of individual changed then amount charged may be impacted by 33 points. In same

way if household size altered then amount charged may change by 356 points.

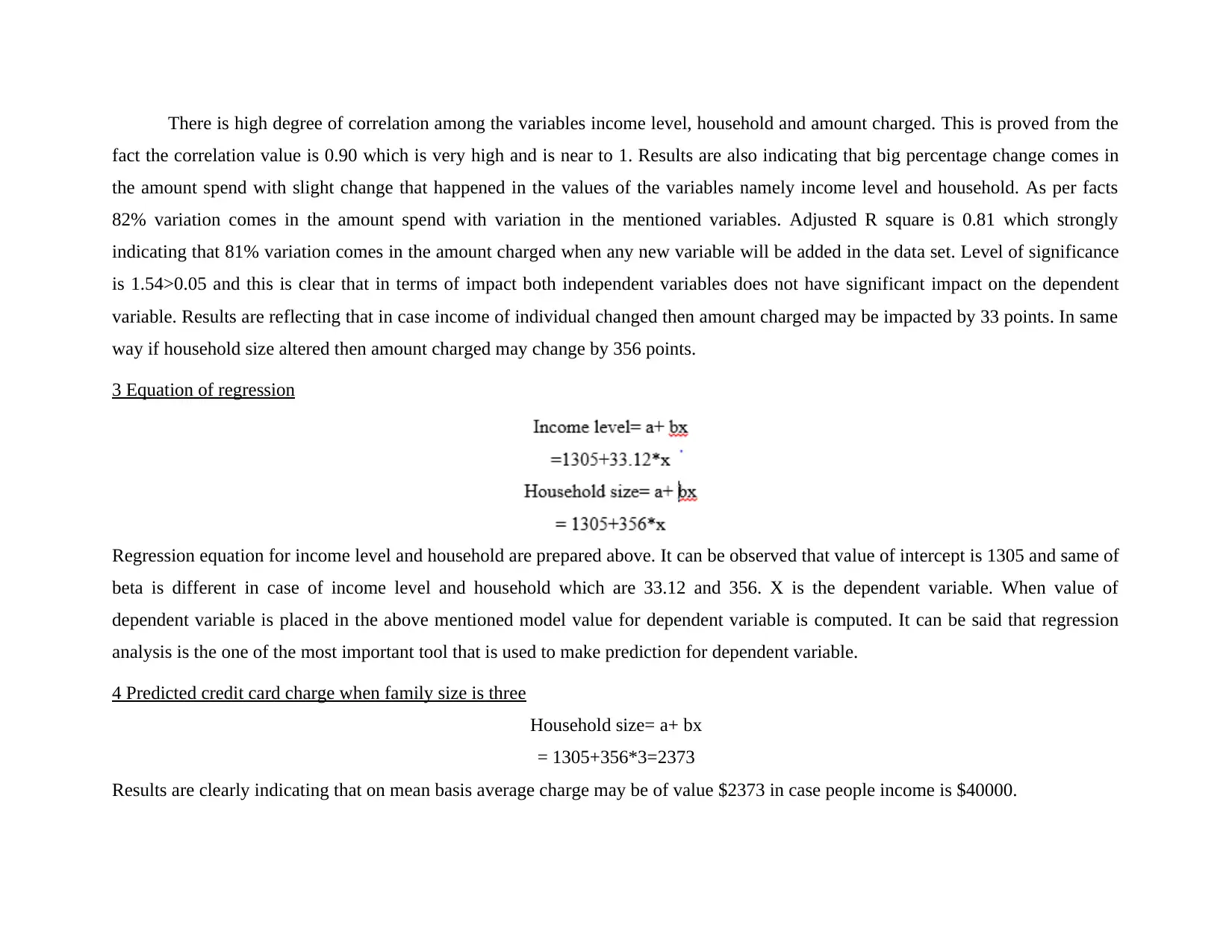

3 Equation of regression

Regression equation for income level and household are prepared above. It can be observed that value of intercept is 1305 and same of

beta is different in case of income level and household which are 33.12 and 356. X is the dependent variable. When value of

dependent variable is placed in the above mentioned model value for dependent variable is computed. It can be said that regression

analysis is the one of the most important tool that is used to make prediction for dependent variable.

4 Predicted credit card charge when family size is three

Household size= a+ bx

= 1305+356*3=2373

Results are clearly indicating that on mean basis average charge may be of value $2373 in case people income is $40000.

fact the correlation value is 0.90 which is very high and is near to 1. Results are also indicating that big percentage change comes in

the amount spend with slight change that happened in the values of the variables namely income level and household. As per facts

82% variation comes in the amount spend with variation in the mentioned variables. Adjusted R square is 0.81 which strongly

indicating that 81% variation comes in the amount charged when any new variable will be added in the data set. Level of significance

is 1.54>0.05 and this is clear that in terms of impact both independent variables does not have significant impact on the dependent

variable. Results are reflecting that in case income of individual changed then amount charged may be impacted by 33 points. In same

way if household size altered then amount charged may change by 356 points.

3 Equation of regression

Regression equation for income level and household are prepared above. It can be observed that value of intercept is 1305 and same of

beta is different in case of income level and household which are 33.12 and 356. X is the dependent variable. When value of

dependent variable is placed in the above mentioned model value for dependent variable is computed. It can be said that regression

analysis is the one of the most important tool that is used to make prediction for dependent variable.

4 Predicted credit card charge when family size is three

Household size= a+ bx

= 1305+356*3=2373

Results are clearly indicating that on mean basis average charge may be of value $2373 in case people income is $40000.

5 Modification of model

Model can be modified by adding new variable namely household saving rate and by using relationship that exist between the

saving rate and credit card charge can be identified.

Model can be modified by adding new variable namely household saving rate and by using relationship that exist between the

saving rate and credit card charge can be identified.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

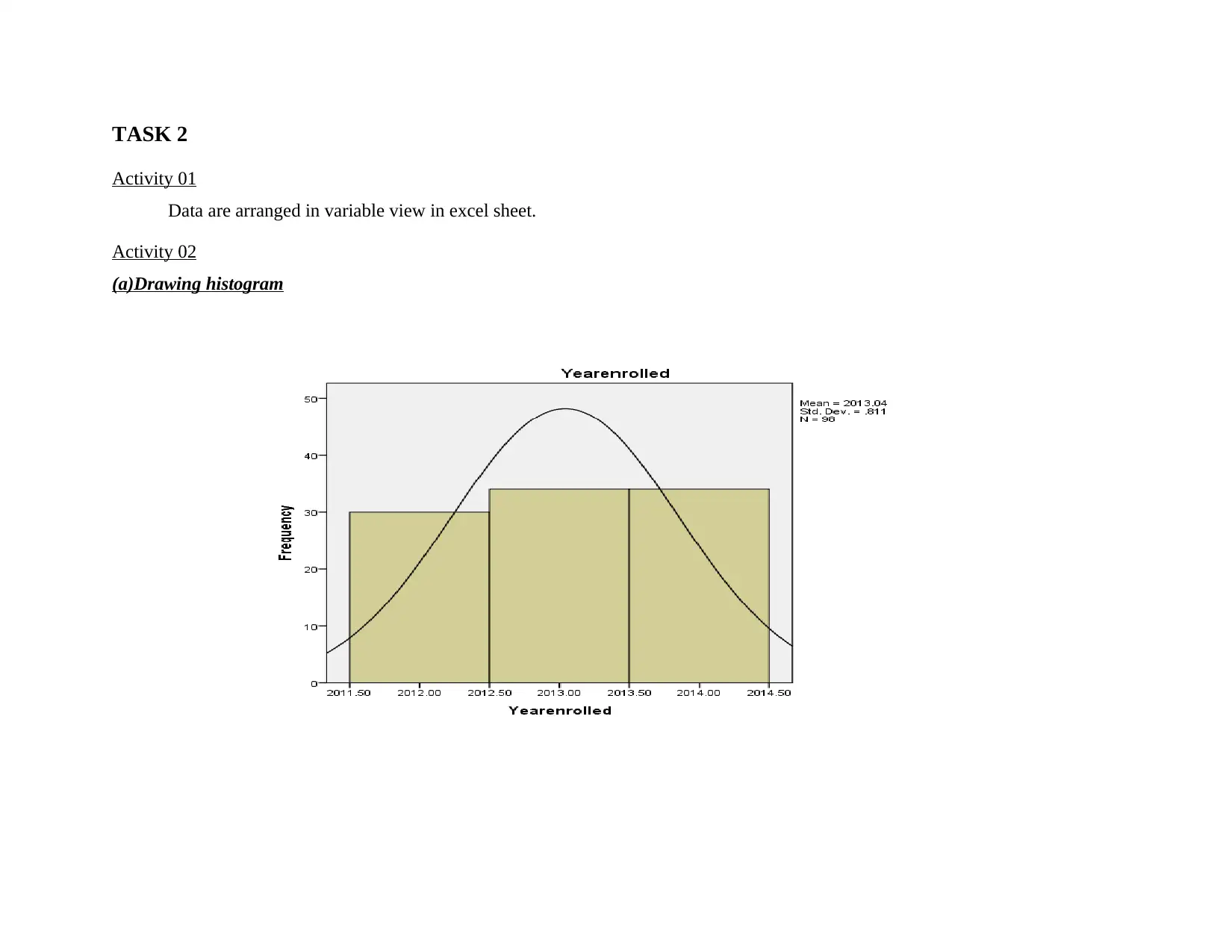

TASK 2

Activity 01

Data are arranged in variable view in excel sheet.

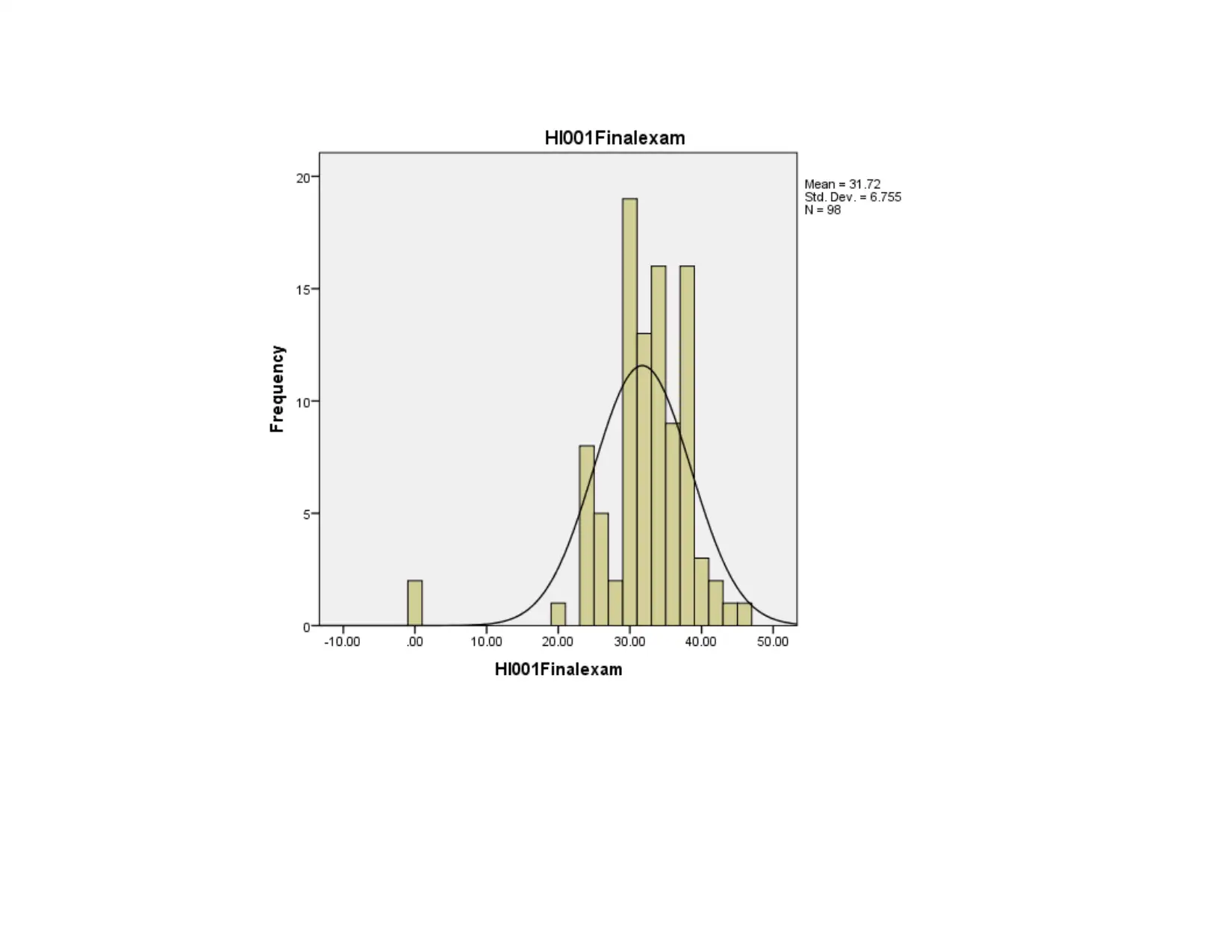

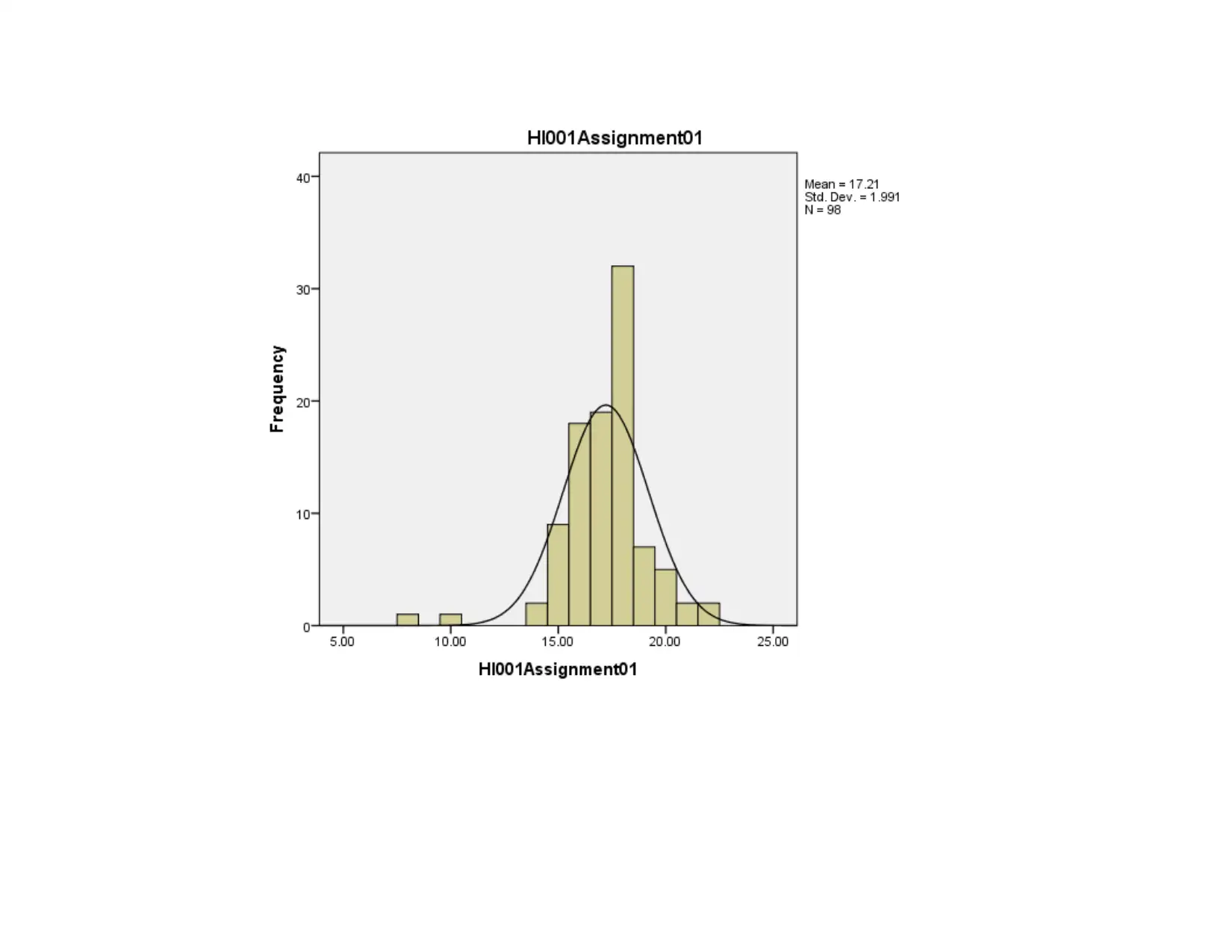

Activity 02

(a)Drawing histogram

Activity 01

Data are arranged in variable view in excel sheet.

Activity 02

(a)Drawing histogram

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.