CSL Limited & AASB: Analysis of Contemporary Accounting Issues

VerifiedAdded on 2023/06/14

|18

|2255

|122

Report

AI Summary

This report provides an in-depth analysis of CSL Limited's compliance with the Australian Accounting Standards Board (AASB) conceptual framework. It examines the achievement of conceptual framework objectives through a review of CSL Limited's consolidated balance sheet, income statement, statement of changes in equity, and cash flow statement, demonstrating the company's commitment to providing relevant financial information to its target audience. The report also evaluates CSL Limited's adherence to recognition criteria for assets, liabilities, equity, revenue, and expenses, referencing specific AASB standards such as AASB 116, AASB 138, AASB 9, AASB 102, AASB 1004, and AASB 118. Furthermore, the analysis extends to the fundamental qualitative characteristics (relevance and faithful representation) and enhancing qualitative characteristics (comparability, verifiability, timeliness, and understandability) of the financial information presented by CSL Limited, concluding that the company effectively complies with AASB standards, minimizing potential accounting issues.

Running head: CONTEMPORARY ISSUES IN ACCOUNTING

Contemporary Issues in Accounting

Name of the Student

Name of the University

Author’s Note

Contemporary Issues in Accounting

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CONTEMPORARY ISSUES IN ACCOUNTING

Abstract

This report examines various requirements and standards of the conceptual framework with

respect of CSL Limited. The main aim of the first part of the report lies in the examination of the

conceptual framework objectives. The second part involves in the examination of recognition

criteria. The last part evaluates the characteristics of financial information.

Abstract

This report examines various requirements and standards of the conceptual framework with

respect of CSL Limited. The main aim of the first part of the report lies in the examination of the

conceptual framework objectives. The second part involves in the examination of recognition

criteria. The last part evaluates the characteristics of financial information.

2CONTEMPORARY ISSUES IN ACCOUNTING

Table of Contents

Introduction......................................................................................................................................3

Conceptual Framework Objectives..................................................................................................3

Target Audience...............................................................................................................................7

Recognition Criteria.........................................................................................................................8

Fundamental Qualitative Characteristics.......................................................................................13

Enhancing Qualitative Characteristics...........................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

Table of Contents

Introduction......................................................................................................................................3

Conceptual Framework Objectives..................................................................................................3

Target Audience...............................................................................................................................7

Recognition Criteria.........................................................................................................................8

Fundamental Qualitative Characteristics.......................................................................................13

Enhancing Qualitative Characteristics...........................................................................................14

Conclusion.....................................................................................................................................15

References......................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CONTEMPORARY ISSUES IN ACCOUNTING

Introduction

In today’s business world, the accounting profession is facing different kinds of issues in

the process of financial reporting of the business entities. All of these issues are crucial issues

and the financial regulatory authorities are required to take into consideration all of these issues.

In the recent years, it can be seen that the business entities are facing the compliance issues with

the required standards and principles of accounting conceptual framework. It is expected that the

business organizations will follow all the standards and regulations of financial reporting at the

time of the preparation and presentation of their financial statements (aasb.gov.au 2018). The

conceptual framework of AASB and IASB can be defined as a system that is responsible for the

development required regulations and principles for financial accounting. Thus, all the

Australian business entities need to follow the standards and principles of AASB conceptual

framework in order to avoid the accounting issues (aasb.gov.au 2018). Different parts of the

report examine different requirements of AASB conceptual framework in respect to an

Australian company, CSL Limited. CSL Limited involves in the research, development,

manufacturing and marketing of biological products and the company is listed among the top 100

companies of Australian Securities Exchange (ASX) (csl.com 2018).

Conceptual Framework Objectives

The conceptual framework of AASB has three major objectives that are required to be

achieved at the time of financial reporting. They are discussed below:

First Objective: Financial statements of the companies must be able to provide the users with

relevant financial information about the current financial position of the business entities and

Introduction

In today’s business world, the accounting profession is facing different kinds of issues in

the process of financial reporting of the business entities. All of these issues are crucial issues

and the financial regulatory authorities are required to take into consideration all of these issues.

In the recent years, it can be seen that the business entities are facing the compliance issues with

the required standards and principles of accounting conceptual framework. It is expected that the

business organizations will follow all the standards and regulations of financial reporting at the

time of the preparation and presentation of their financial statements (aasb.gov.au 2018). The

conceptual framework of AASB and IASB can be defined as a system that is responsible for the

development required regulations and principles for financial accounting. Thus, all the

Australian business entities need to follow the standards and principles of AASB conceptual

framework in order to avoid the accounting issues (aasb.gov.au 2018). Different parts of the

report examine different requirements of AASB conceptual framework in respect to an

Australian company, CSL Limited. CSL Limited involves in the research, development,

manufacturing and marketing of biological products and the company is listed among the top 100

companies of Australian Securities Exchange (ASX) (csl.com 2018).

Conceptual Framework Objectives

The conceptual framework of AASB has three major objectives that are required to be

achieved at the time of financial reporting. They are discussed below:

First Objective: Financial statements of the companies must be able to provide the users with

relevant financial information about the current financial position of the business entities and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CONTEMPORARY ISSUES IN ACCOUNTING

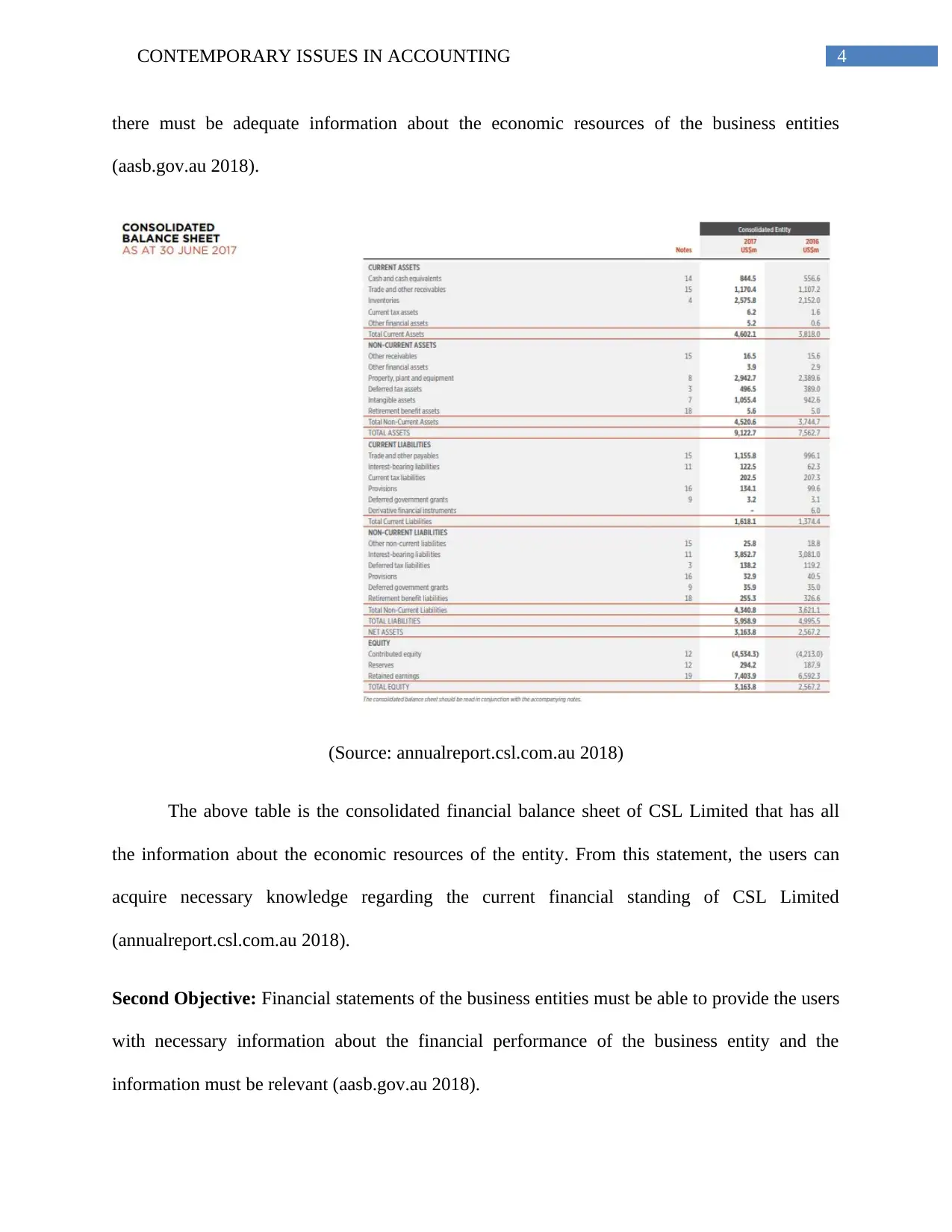

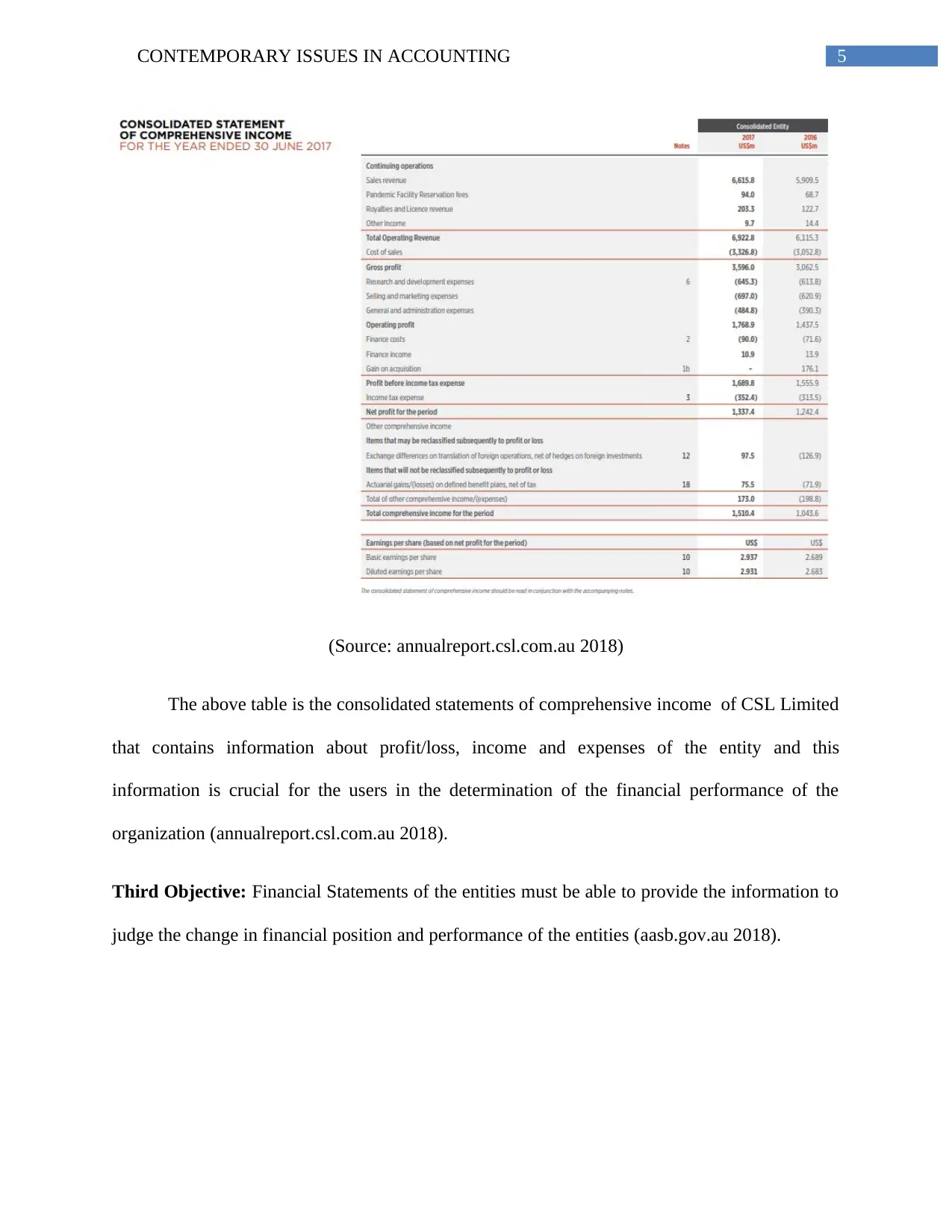

there must be adequate information about the economic resources of the business entities

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

The above table is the consolidated financial balance sheet of CSL Limited that has all

the information about the economic resources of the entity. From this statement, the users can

acquire necessary knowledge regarding the current financial standing of CSL Limited

(annualreport.csl.com.au 2018).

Second Objective: Financial statements of the business entities must be able to provide the users

with necessary information about the financial performance of the business entity and the

information must be relevant (aasb.gov.au 2018).

there must be adequate information about the economic resources of the business entities

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

The above table is the consolidated financial balance sheet of CSL Limited that has all

the information about the economic resources of the entity. From this statement, the users can

acquire necessary knowledge regarding the current financial standing of CSL Limited

(annualreport.csl.com.au 2018).

Second Objective: Financial statements of the business entities must be able to provide the users

with necessary information about the financial performance of the business entity and the

information must be relevant (aasb.gov.au 2018).

5CONTEMPORARY ISSUES IN ACCOUNTING

(Source: annualreport.csl.com.au 2018)

The above table is the consolidated statements of comprehensive income of CSL Limited

that contains information about profit/loss, income and expenses of the entity and this

information is crucial for the users in the determination of the financial performance of the

organization (annualreport.csl.com.au 2018).

Third Objective: Financial Statements of the entities must be able to provide the information to

judge the change in financial position and performance of the entities (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

The above table is the consolidated statements of comprehensive income of CSL Limited

that contains information about profit/loss, income and expenses of the entity and this

information is crucial for the users in the determination of the financial performance of the

organization (annualreport.csl.com.au 2018).

Third Objective: Financial Statements of the entities must be able to provide the information to

judge the change in financial position and performance of the entities (aasb.gov.au 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CONTEMPORARY ISSUES IN ACCOUNTING

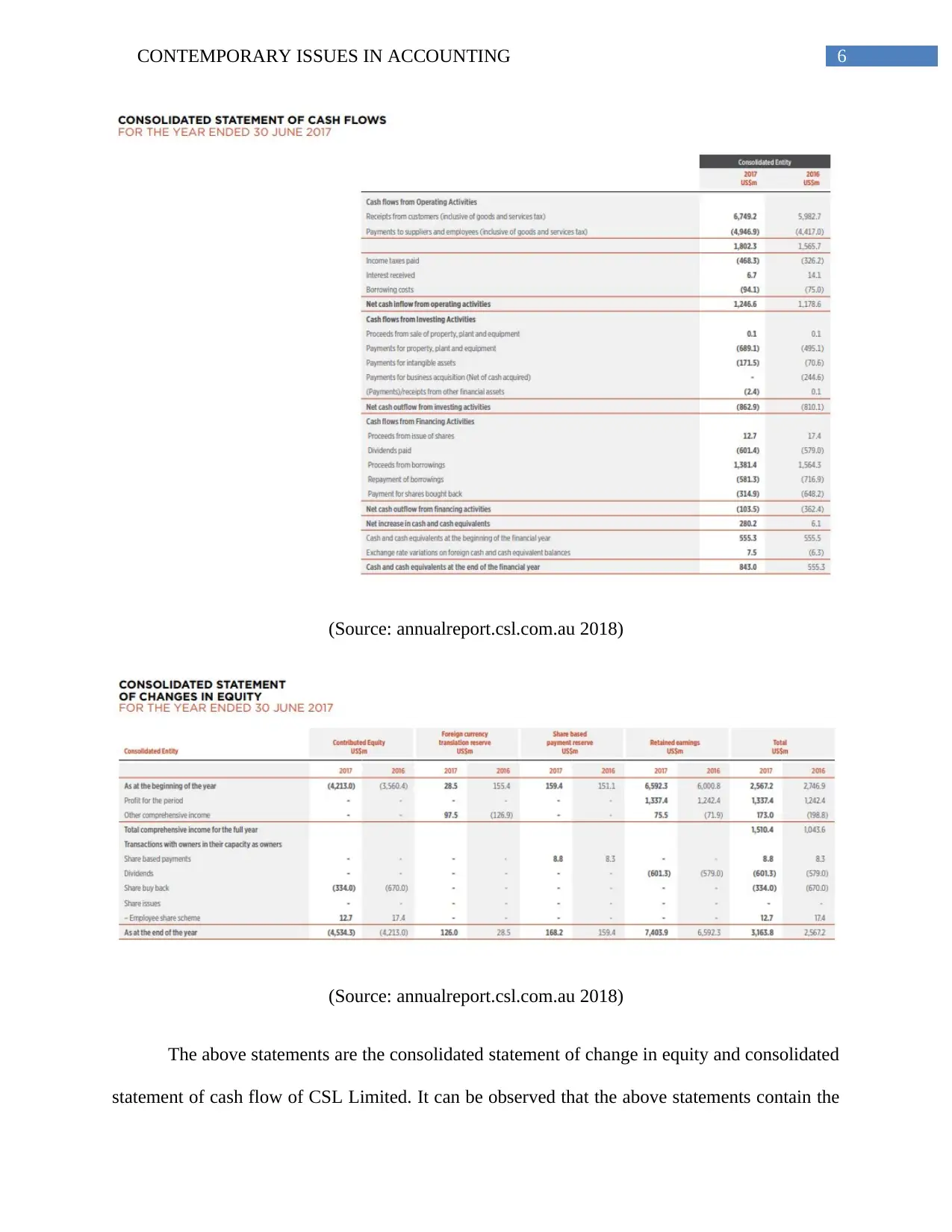

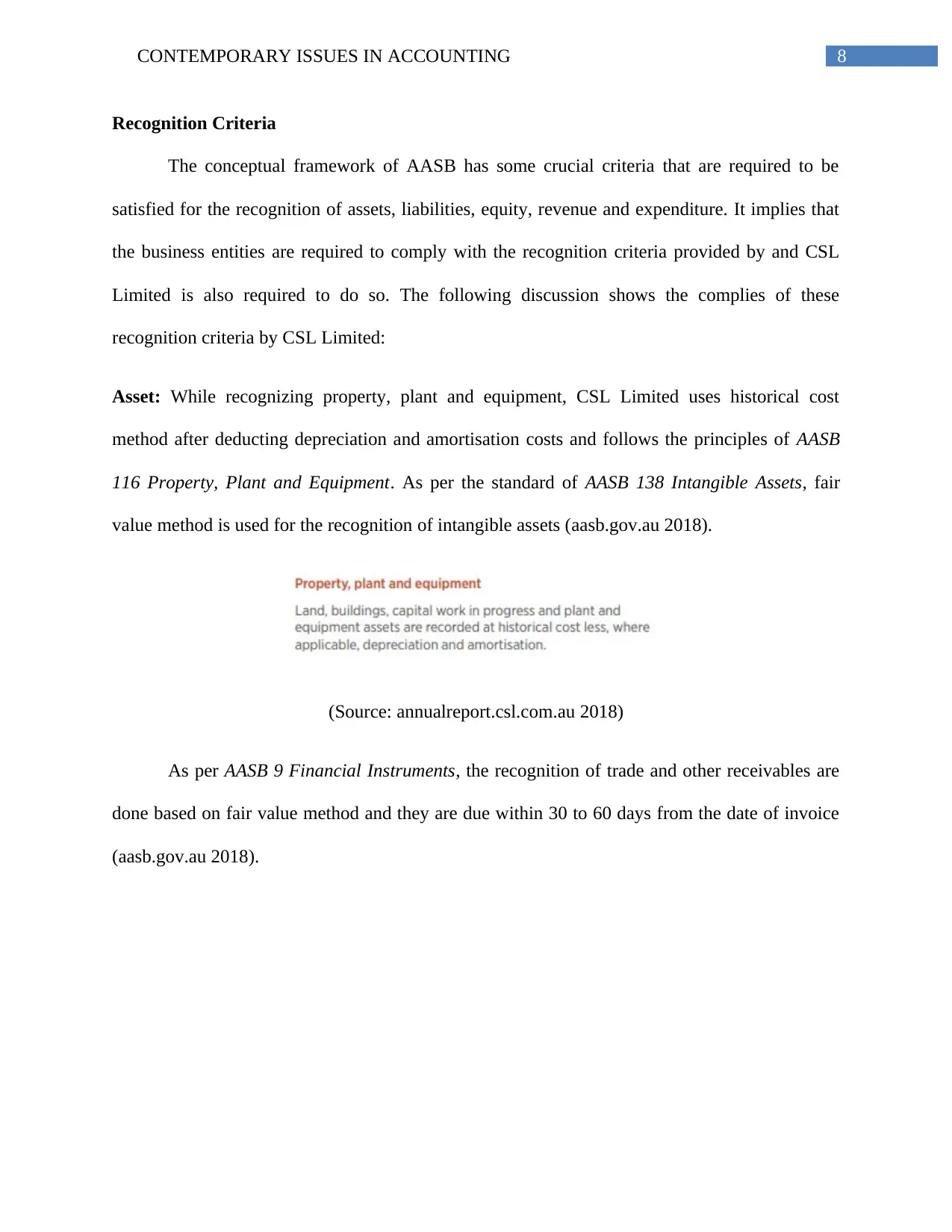

(Source: annualreport.csl.com.au 2018)

(Source: annualreport.csl.com.au 2018)

The above statements are the consolidated statement of change in equity and consolidated

statement of cash flow of CSL Limited. It can be observed that the above statements contain the

(Source: annualreport.csl.com.au 2018)

(Source: annualreport.csl.com.au 2018)

The above statements are the consolidated statement of change in equity and consolidated

statement of cash flow of CSL Limited. It can be observed that the above statements contain the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CONTEMPORARY ISSUES IN ACCOUNTING

financial information related to the change in profit, change in cash inflows, change in cash

outflows and others that helps the users in the determination of the change in performance of

CSL Limited (annualreport.csl.com.au 2018).

Apart from this, the analysis of the latest annual report of CSL Limited shows that the

company complies with the regulations of Australian Accounting Standards and the other

authoritative accounting pronouncements of AASB (annualreport.csl.com.au 2018). Moreover,

in order to bring uniformity, the company has adopted the standards of International Financial

Reporting Standards (IFRS) and IASB. Hence, all these aspects prove the fact that CSL Limited

has achieved the objective of conceptual framework (annualreport.csl.com.au 2018).

Target Audience

The above discussion shows that CSL Limited publishes different kinds of financial

statements containing information on different financial aspects of the entity. From the

consolidated balance sheet, the target audience can get the information about the financial

situation of the company (annualreport.csl.com.au 2018). From the income statement, the target

audience can obtain relevant financial information to judge the financial performance of the

company. After that, the statements of change in equity and cash flows provide information that

is required to ascertain the change in the financial position and performance of the company. It

implies that the users of financial statements can get all the relevant information for effective

decision-making process (annualreport.csl.com.au 2018). Thus, based on the above discussion, it

can be said that CSL Limited provides all the adequate information for the needs of users.

financial information related to the change in profit, change in cash inflows, change in cash

outflows and others that helps the users in the determination of the change in performance of

CSL Limited (annualreport.csl.com.au 2018).

Apart from this, the analysis of the latest annual report of CSL Limited shows that the

company complies with the regulations of Australian Accounting Standards and the other

authoritative accounting pronouncements of AASB (annualreport.csl.com.au 2018). Moreover,

in order to bring uniformity, the company has adopted the standards of International Financial

Reporting Standards (IFRS) and IASB. Hence, all these aspects prove the fact that CSL Limited

has achieved the objective of conceptual framework (annualreport.csl.com.au 2018).

Target Audience

The above discussion shows that CSL Limited publishes different kinds of financial

statements containing information on different financial aspects of the entity. From the

consolidated balance sheet, the target audience can get the information about the financial

situation of the company (annualreport.csl.com.au 2018). From the income statement, the target

audience can obtain relevant financial information to judge the financial performance of the

company. After that, the statements of change in equity and cash flows provide information that

is required to ascertain the change in the financial position and performance of the company. It

implies that the users of financial statements can get all the relevant information for effective

decision-making process (annualreport.csl.com.au 2018). Thus, based on the above discussion, it

can be said that CSL Limited provides all the adequate information for the needs of users.

8CONTEMPORARY ISSUES IN ACCOUNTING

Recognition Criteria

The conceptual framework of AASB has some crucial criteria that are required to be

satisfied for the recognition of assets, liabilities, equity, revenue and expenditure. It implies that

the business entities are required to comply with the recognition criteria provided by and CSL

Limited is also required to do so. The following discussion shows the complies of these

recognition criteria by CSL Limited:

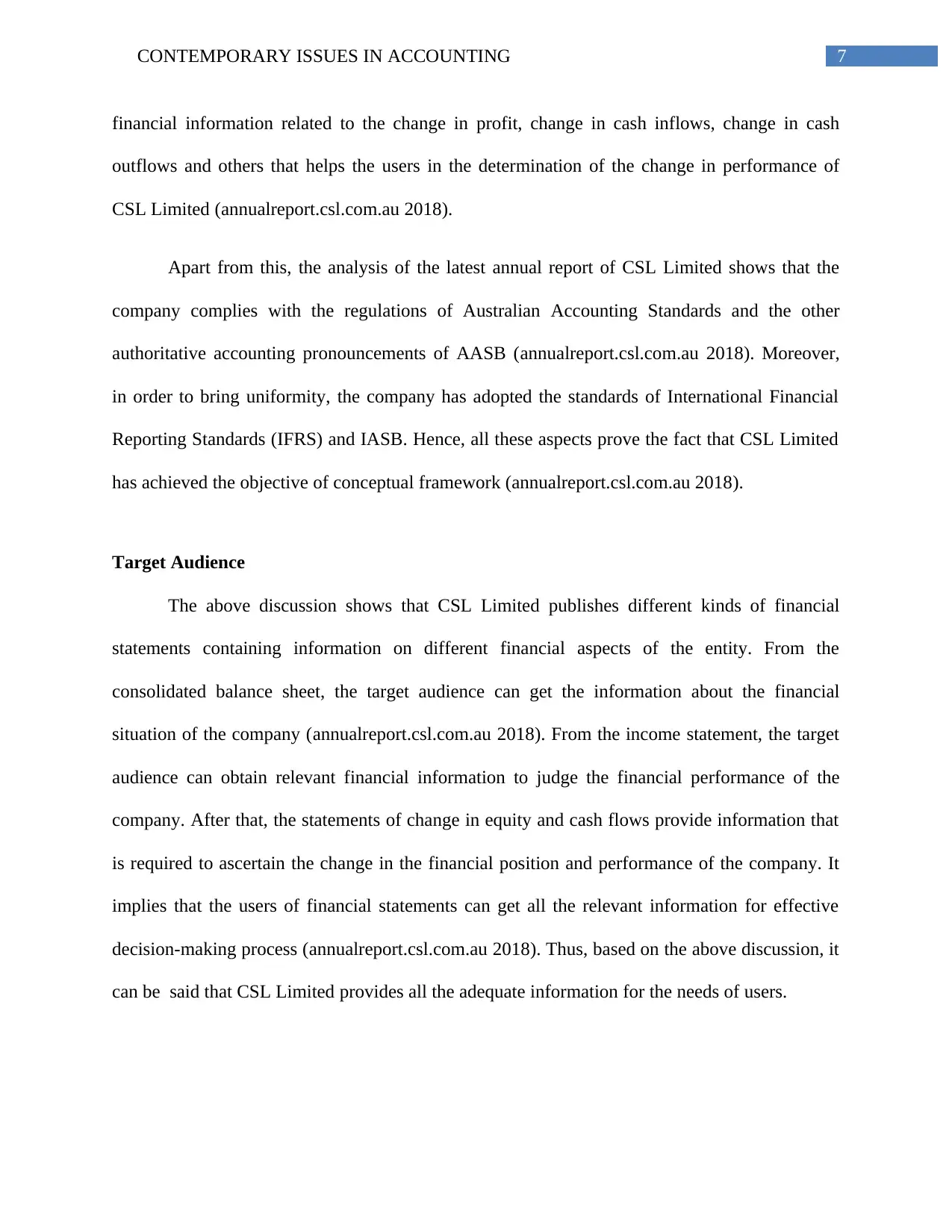

Asset: While recognizing property, plant and equipment, CSL Limited uses historical cost

method after deducting depreciation and amortisation costs and follows the principles of AASB

116 Property, Plant and Equipment. As per the standard of AASB 138 Intangible Assets, fair

value method is used for the recognition of intangible assets (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

As per AASB 9 Financial Instruments, the recognition of trade and other receivables are

done based on fair value method and they are due within 30 to 60 days from the date of invoice

(aasb.gov.au 2018).

Recognition Criteria

The conceptual framework of AASB has some crucial criteria that are required to be

satisfied for the recognition of assets, liabilities, equity, revenue and expenditure. It implies that

the business entities are required to comply with the recognition criteria provided by and CSL

Limited is also required to do so. The following discussion shows the complies of these

recognition criteria by CSL Limited:

Asset: While recognizing property, plant and equipment, CSL Limited uses historical cost

method after deducting depreciation and amortisation costs and follows the principles of AASB

116 Property, Plant and Equipment. As per the standard of AASB 138 Intangible Assets, fair

value method is used for the recognition of intangible assets (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

As per AASB 9 Financial Instruments, the recognition of trade and other receivables are

done based on fair value method and they are due within 30 to 60 days from the date of invoice

(aasb.gov.au 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CONTEMPORARY ISSUES IN ACCOUNTING

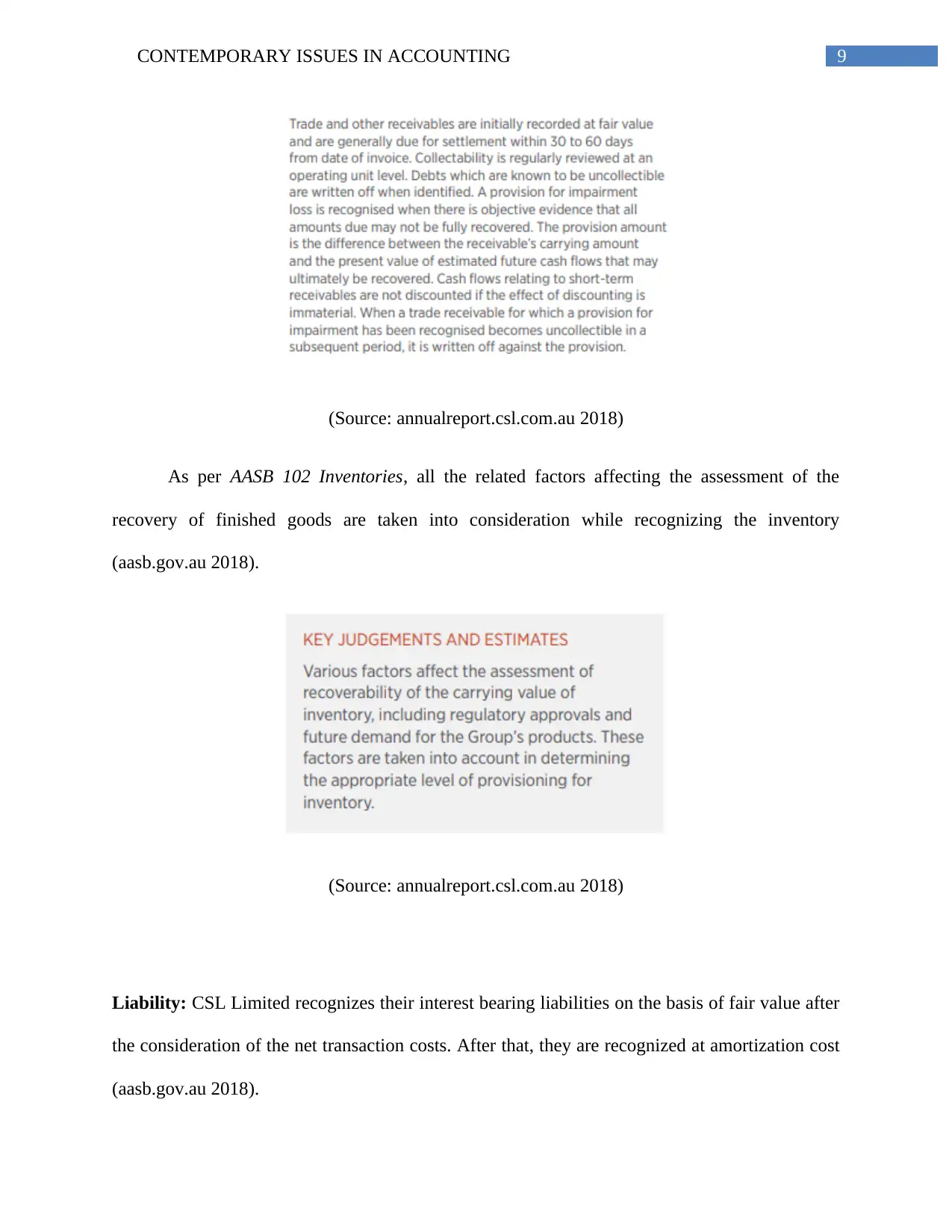

(Source: annualreport.csl.com.au 2018)

As per AASB 102 Inventories, all the related factors affecting the assessment of the

recovery of finished goods are taken into consideration while recognizing the inventory

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

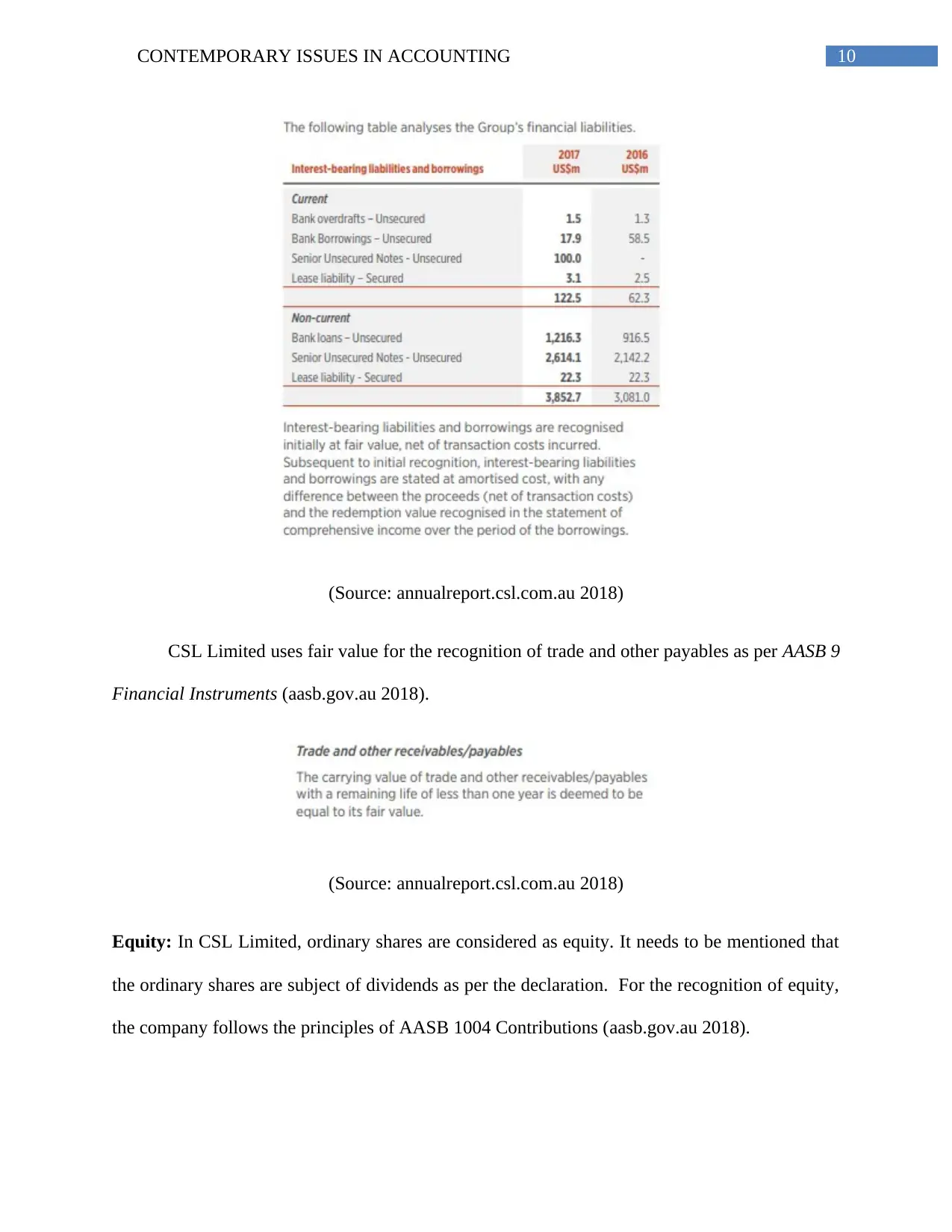

Liability: CSL Limited recognizes their interest bearing liabilities on the basis of fair value after

the consideration of the net transaction costs. After that, they are recognized at amortization cost

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

As per AASB 102 Inventories, all the related factors affecting the assessment of the

recovery of finished goods are taken into consideration while recognizing the inventory

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

Liability: CSL Limited recognizes their interest bearing liabilities on the basis of fair value after

the consideration of the net transaction costs. After that, they are recognized at amortization cost

(aasb.gov.au 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CONTEMPORARY ISSUES IN ACCOUNTING

(Source: annualreport.csl.com.au 2018)

CSL Limited uses fair value for the recognition of trade and other payables as per AASB 9

Financial Instruments (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

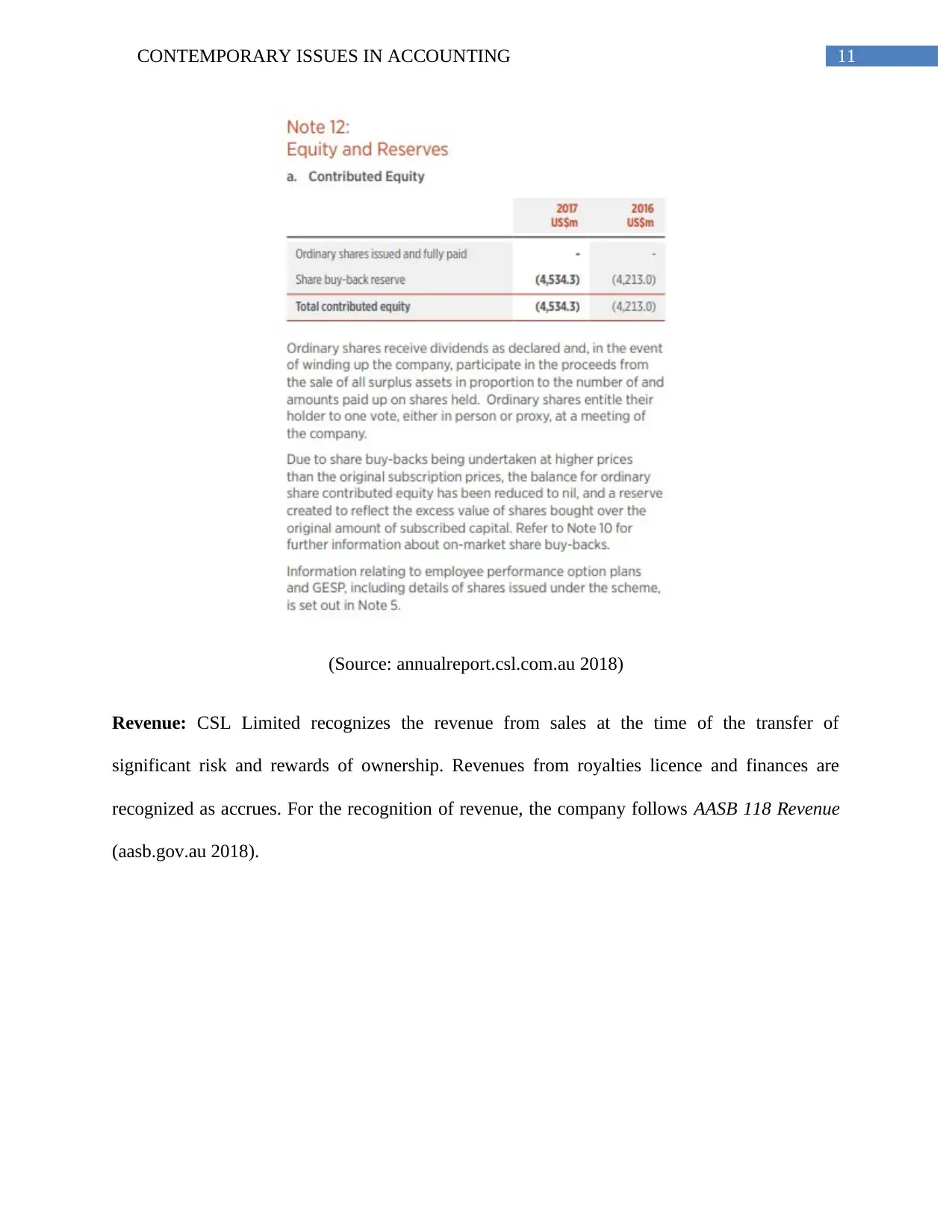

Equity: In CSL Limited, ordinary shares are considered as equity. It needs to be mentioned that

the ordinary shares are subject of dividends as per the declaration. For the recognition of equity,

the company follows the principles of AASB 1004 Contributions (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

CSL Limited uses fair value for the recognition of trade and other payables as per AASB 9

Financial Instruments (aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

Equity: In CSL Limited, ordinary shares are considered as equity. It needs to be mentioned that

the ordinary shares are subject of dividends as per the declaration. For the recognition of equity,

the company follows the principles of AASB 1004 Contributions (aasb.gov.au 2018).

11CONTEMPORARY ISSUES IN ACCOUNTING

(Source: annualreport.csl.com.au 2018)

Revenue: CSL Limited recognizes the revenue from sales at the time of the transfer of

significant risk and rewards of ownership. Revenues from royalties licence and finances are

recognized as accrues. For the recognition of revenue, the company follows AASB 118 Revenue

(aasb.gov.au 2018).

(Source: annualreport.csl.com.au 2018)

Revenue: CSL Limited recognizes the revenue from sales at the time of the transfer of

significant risk and rewards of ownership. Revenues from royalties licence and finances are

recognized as accrues. For the recognition of revenue, the company follows AASB 118 Revenue

(aasb.gov.au 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.