MGT723 Research Project: Data Analysis, Hypothesis Testing & Insights

VerifiedAdded on 2023/06/11

|15

|3138

|304

Report

AI Summary

This research project report presents a comprehensive analysis of data collected from 60 firms across various countries, focusing on carbon disclosure and stakeholder theory. The report details the data collection process, including the use of secondary data and random sampling. It includes descriptive statistics, chi-square tests, correlation analysis, and regression analysis to examine the relationships between variables. The findings discuss the impact of independent variables on disclosure scores, limitations of the study, and opportunities for future research. The assignment is available on Desklib, a platform offering a wide range of study tools and solved assignments for students.

Research Project

Contents

Data Collection............................................................................................................................................1

Data analysis................................................................................................................................................2

Descriptive statistics................................................................................................................................2

Inferential analysis...................................................................................................................................9

Hypothesis testing.....................................................................................................................................13

Discussion..................................................................................................................................................14

Limitation..................................................................................................................................................14

Future Research........................................................................................................................................14

References.................................................................................................................................................15

Data Collection

Data collection is one of the most important part of every research. There are broadly two types

of data which are used for the research. The first one is the primary data, which is also known as

the first hand data. The primary data are those data which are collected by the researcher as per

the requirement of the research. The major techniques used for data collection are the primary

survey (which is used to collect the quantitative data), personal interview (which is used to

collect the qualitative data). To collect the quantitative data the close end questionnaire is used

whereas for the qualitative data collection the open ended questionnaire is used.

The second type of the data which is used for the research is the secondary data. This type of

data is collected by someone else for different purpose. The major sources of the secondary data

includes the published journals, books, government data center, company reports etc. The

secondary data is cheap as compared to the primary data(Cierniak and Reimann, 2011; Mangal

and Mangal, 2013; Rajasekar, Philominathan and Chinnathambi, 2013).

For the current research the secondary data has been used. The data has been collected for 60

different firms situated in different countries around the world. The companies has been selected

from the master data set and the selection of the companies from the master data was random.

The random sampling has been used, so the results from the analysis can be generalized. Once

the sample was selected the data cleaning process has been conducted which included identifying

the missing values and the also the identification of the outliers. The missing values were

recoded so that the results are not affected. Once the data cleaning process was completed the

data was exported to SPSS and the further analysis was conducted(Armstrong, 2012; George,

Seals and Aban, 2014; Monem A Mohammed, 2014).

Contents

Data Collection............................................................................................................................................1

Data analysis................................................................................................................................................2

Descriptive statistics................................................................................................................................2

Inferential analysis...................................................................................................................................9

Hypothesis testing.....................................................................................................................................13

Discussion..................................................................................................................................................14

Limitation..................................................................................................................................................14

Future Research........................................................................................................................................14

References.................................................................................................................................................15

Data Collection

Data collection is one of the most important part of every research. There are broadly two types

of data which are used for the research. The first one is the primary data, which is also known as

the first hand data. The primary data are those data which are collected by the researcher as per

the requirement of the research. The major techniques used for data collection are the primary

survey (which is used to collect the quantitative data), personal interview (which is used to

collect the qualitative data). To collect the quantitative data the close end questionnaire is used

whereas for the qualitative data collection the open ended questionnaire is used.

The second type of the data which is used for the research is the secondary data. This type of

data is collected by someone else for different purpose. The major sources of the secondary data

includes the published journals, books, government data center, company reports etc. The

secondary data is cheap as compared to the primary data(Cierniak and Reimann, 2011; Mangal

and Mangal, 2013; Rajasekar, Philominathan and Chinnathambi, 2013).

For the current research the secondary data has been used. The data has been collected for 60

different firms situated in different countries around the world. The companies has been selected

from the master data set and the selection of the companies from the master data was random.

The random sampling has been used, so the results from the analysis can be generalized. Once

the sample was selected the data cleaning process has been conducted which included identifying

the missing values and the also the identification of the outliers. The missing values were

recoded so that the results are not affected. Once the data cleaning process was completed the

data was exported to SPSS and the further analysis was conducted(Armstrong, 2012; George,

Seals and Aban, 2014; Monem A Mohammed, 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Data analysis

Data analysis has been conducted in two different ways. In the first section the results from the

descriptive analysis has been shown and in the next section the results from the inferential

analysis has been shown which includes the chi square test, correlation analysis and the

regression analysis.

Descriptive statistics

Descriptive results for the continuous variable are shown in the table below. Various measures of

the central tendencies and the skewness kurtosis of the variables have been included in the

descriptive analysis(M, no date; Hancock, 2009; Macdonald and Headlam, 2010).

Statistics

Disclosure

score

IV1 IV4 IV6

N Valid 59 59 59 59

Missing 0 0 0 0

Mean 88.8644 336.5706 6058634409.

1391

1.3407

Median 97.0000 5.6700 56400.0000 5.6500

Mode 100.00 -99.00 -99.00 -99.00

Std. Deviation 22.66051 1779.60974 44634118769

.61965

28.54073

Variance

513.499 3167010.833 19922045583

40513600000

.000

814.573

Skewness -3.274 6.564 7.671 -2.978

Std. Error of

Skewness

.311 .311 .311 .311

Kurtosis 10.556 45.942 58.895 8.649

Std. Error of Kurtosis .613 .613 .613 .613

Minimum .00 -99.00 -99.00 -99.00

Maximum 100.00 12986.40 34294700000

0.00

34.70

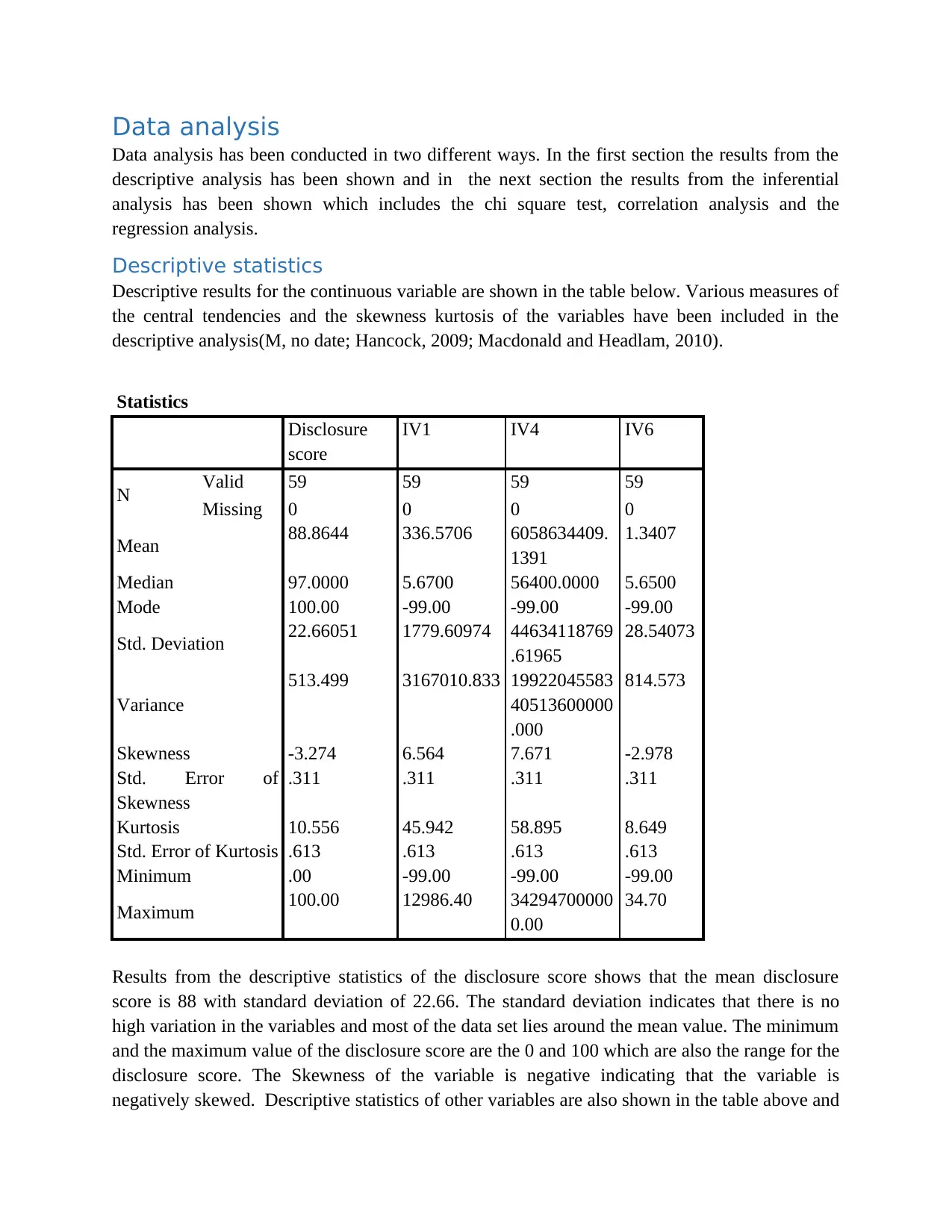

Results from the descriptive statistics of the disclosure score shows that the mean disclosure

score is 88 with standard deviation of 22.66. The standard deviation indicates that there is no

high variation in the variables and most of the data set lies around the mean value. The minimum

and the maximum value of the disclosure score are the 0 and 100 which are also the range for the

disclosure score. The Skewness of the variable is negative indicating that the variable is

negatively skewed. Descriptive statistics of other variables are also shown in the table above and

Data analysis has been conducted in two different ways. In the first section the results from the

descriptive analysis has been shown and in the next section the results from the inferential

analysis has been shown which includes the chi square test, correlation analysis and the

regression analysis.

Descriptive statistics

Descriptive results for the continuous variable are shown in the table below. Various measures of

the central tendencies and the skewness kurtosis of the variables have been included in the

descriptive analysis(M, no date; Hancock, 2009; Macdonald and Headlam, 2010).

Statistics

Disclosure

score

IV1 IV4 IV6

N Valid 59 59 59 59

Missing 0 0 0 0

Mean 88.8644 336.5706 6058634409.

1391

1.3407

Median 97.0000 5.6700 56400.0000 5.6500

Mode 100.00 -99.00 -99.00 -99.00

Std. Deviation 22.66051 1779.60974 44634118769

.61965

28.54073

Variance

513.499 3167010.833 19922045583

40513600000

.000

814.573

Skewness -3.274 6.564 7.671 -2.978

Std. Error of

Skewness

.311 .311 .311 .311

Kurtosis 10.556 45.942 58.895 8.649

Std. Error of Kurtosis .613 .613 .613 .613

Minimum .00 -99.00 -99.00 -99.00

Maximum 100.00 12986.40 34294700000

0.00

34.70

Results from the descriptive statistics of the disclosure score shows that the mean disclosure

score is 88 with standard deviation of 22.66. The standard deviation indicates that there is no

high variation in the variables and most of the data set lies around the mean value. The minimum

and the maximum value of the disclosure score are the 0 and 100 which are also the range for the

disclosure score. The Skewness of the variable is negative indicating that the variable is

negatively skewed. Descriptive statistics of other variables are also shown in the table above and

the results for those values can also be explained in similar way. Generally the median value is

considered as the more accurate measure of central tendency than the mean value. This is

because the extreme values in the series affect the mean value but do not affect the median value.

The skewness and kurtosis helps to explain the distribution of the series.

The histogram of the disclosure score shows that most of the values lies to the right of the mean

value and the value of skewness is also negative.

considered as the more accurate measure of central tendency than the mean value. This is

because the extreme values in the series affect the mean value but do not affect the median value.

The skewness and kurtosis helps to explain the distribution of the series.

The histogram of the disclosure score shows that most of the values lies to the right of the mean

value and the value of skewness is also negative.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

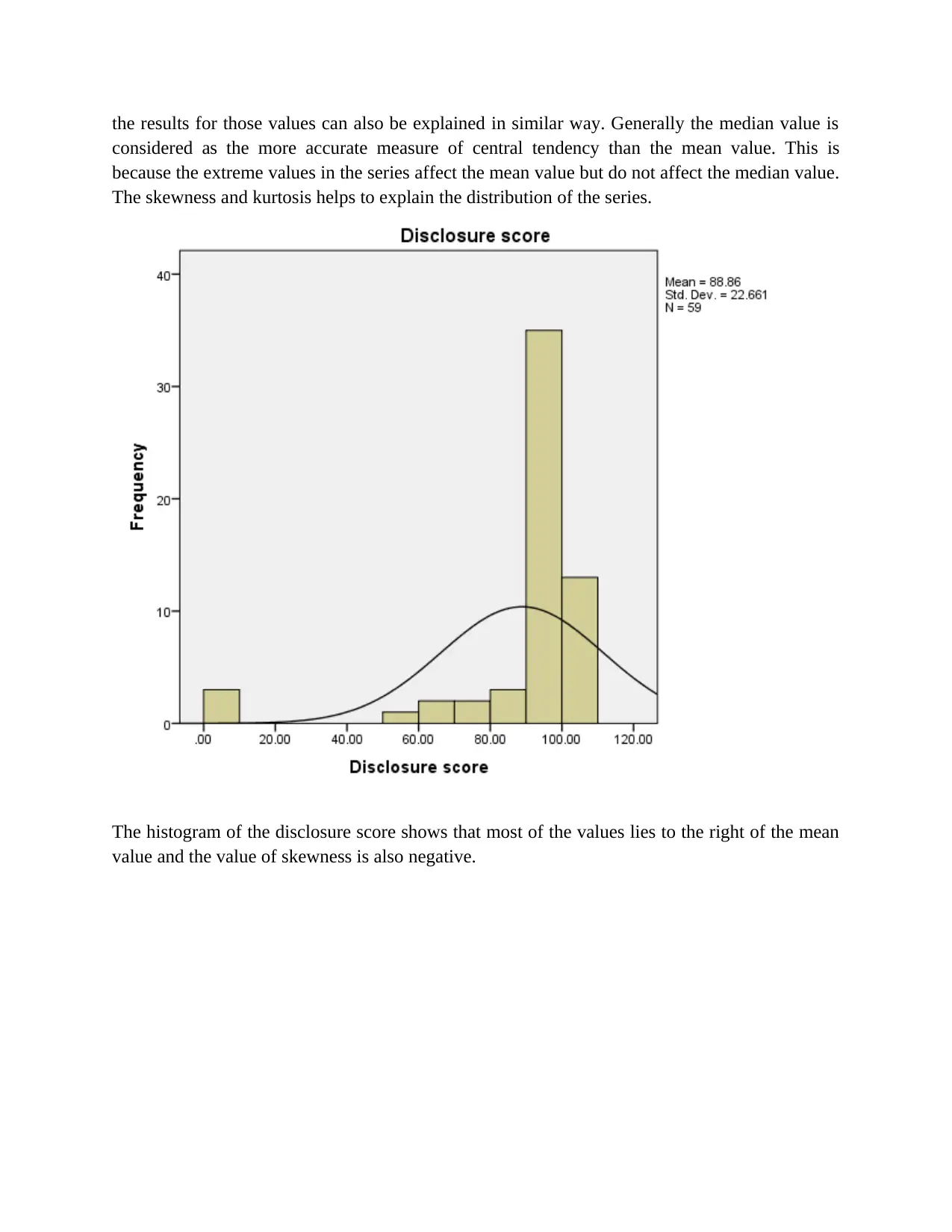

The histogram of IV1 indicates that the variable is normally distributed as most of the variable

lies near the mean value.

lies near the mean value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

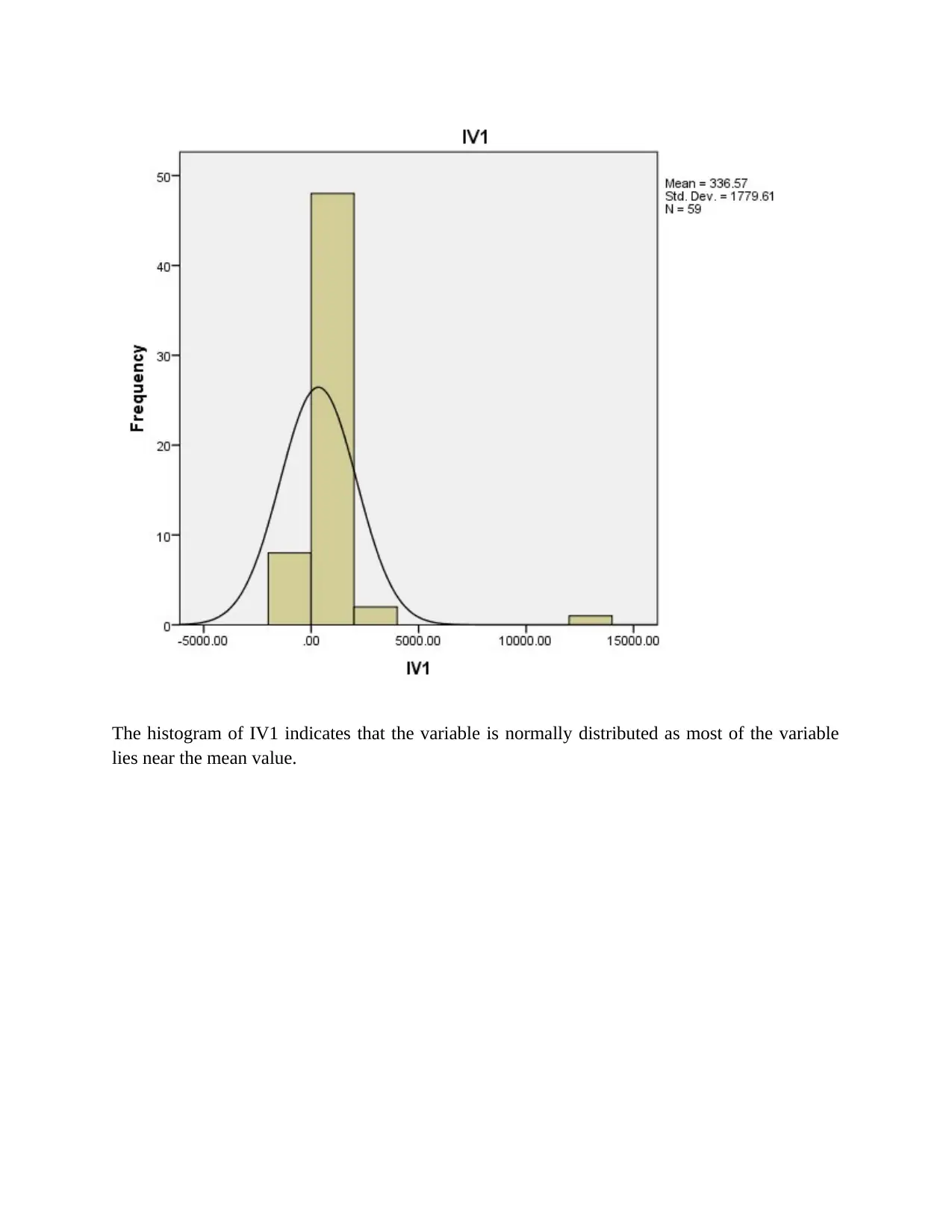

For the IV4 most of the values lies to the left of the mean value and the variable is not normally

distributed.

distributed.

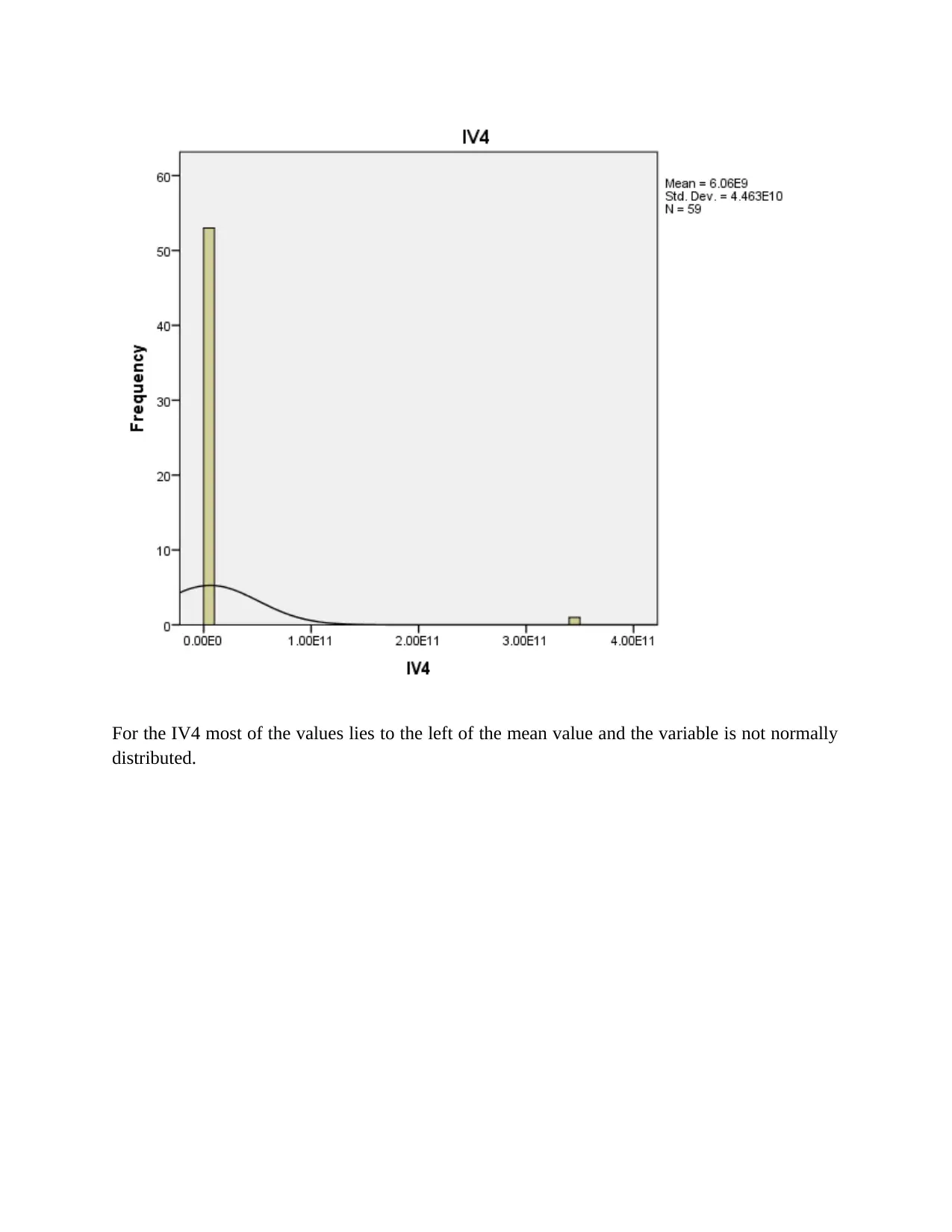

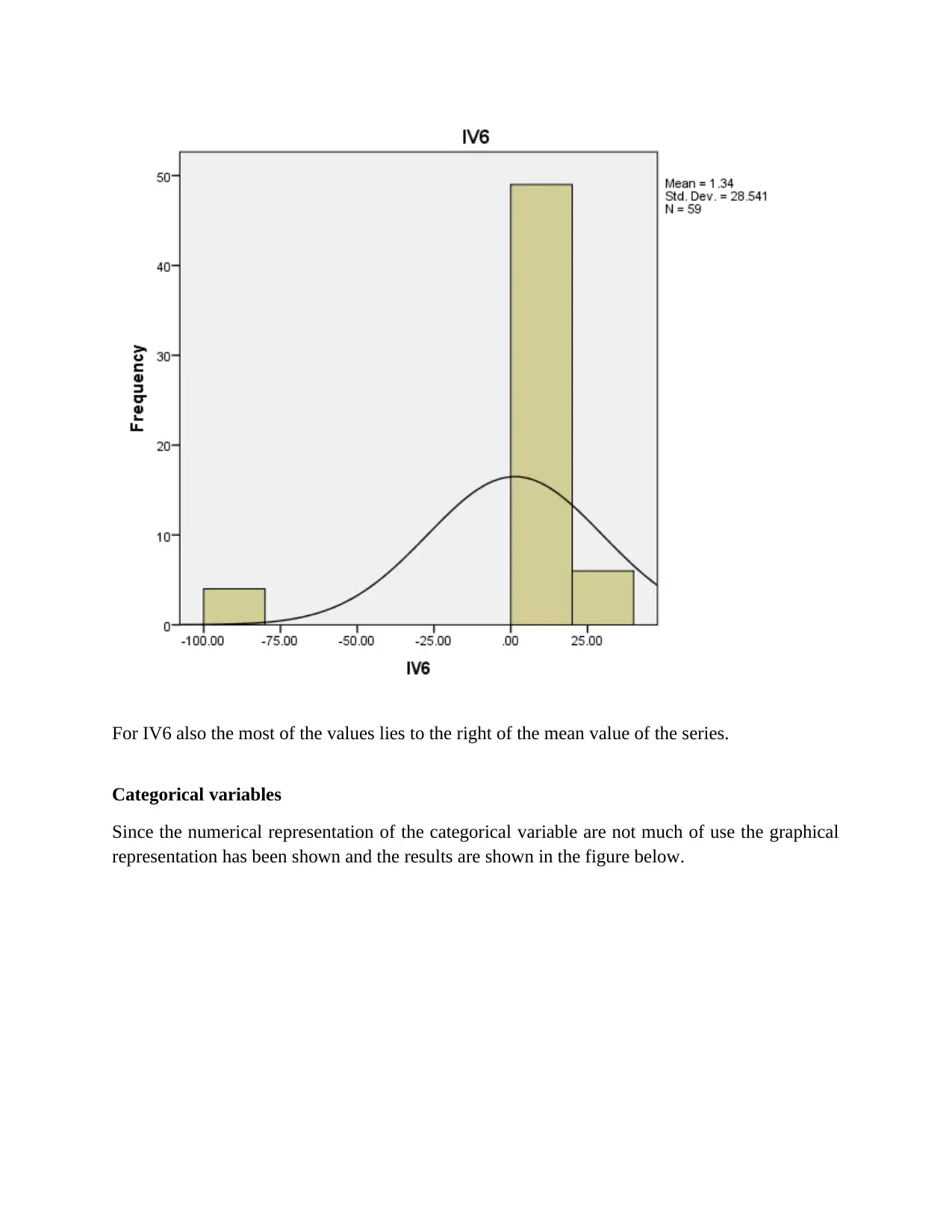

For IV6 also the most of the values lies to the right of the mean value of the series.

Categorical variables

Since the numerical representation of the categorical variable are not much of use the graphical

representation has been shown and the results are shown in the figure below.

Categorical variables

Since the numerical representation of the categorical variable are not much of use the graphical

representation has been shown and the results are shown in the figure below.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

12%

17%

22%14%

10%

10%

7% 8%

Industry

Financials

IT

industrials

Consumer Discretionary

materials

Consumer staples

Health care

others

Result shown in the figure above indicates that the most of the companies included in the sample

are in the industrial sector followed by the IT sector. The major sectors include the consumer

discretionary, financials and consumer staples(Winn et al., 2011; Guo, 2014).

s

20%

29%

10%

10%

10%

20%

Country

USA

United Kingdom

France

Germany

Canda

others

In terms of countries the higher number of firms are from United Kingdom, followed by the

firms in the United States. Furthermore other major countries includes France, Germany and

Canada.

17%

22%14%

10%

10%

7% 8%

Industry

Financials

IT

industrials

Consumer Discretionary

materials

Consumer staples

Health care

others

Result shown in the figure above indicates that the most of the companies included in the sample

are in the industrial sector followed by the IT sector. The major sectors include the consumer

discretionary, financials and consumer staples(Winn et al., 2011; Guo, 2014).

s

20%

29%

10%

10%

10%

20%

Country

USA

United Kingdom

France

Germany

Canda

others

In terms of countries the higher number of firms are from United Kingdom, followed by the

firms in the United States. Furthermore other major countries includes France, Germany and

Canada.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

49%51%

IV3

other

full time

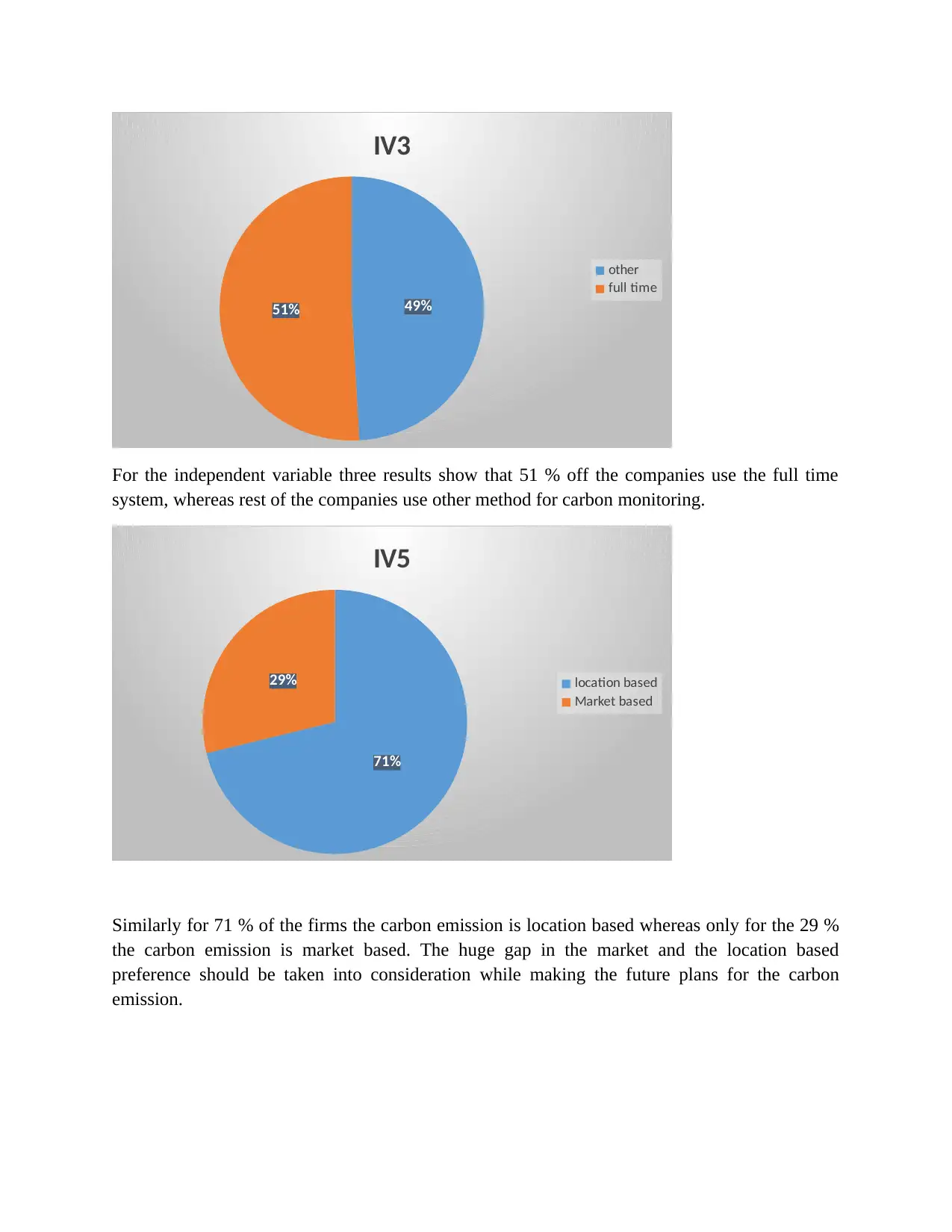

For the independent variable three results show that 51 % off the companies use the full time

system, whereas rest of the companies use other method for carbon monitoring.

71%

29%

IV5

location based

Market based

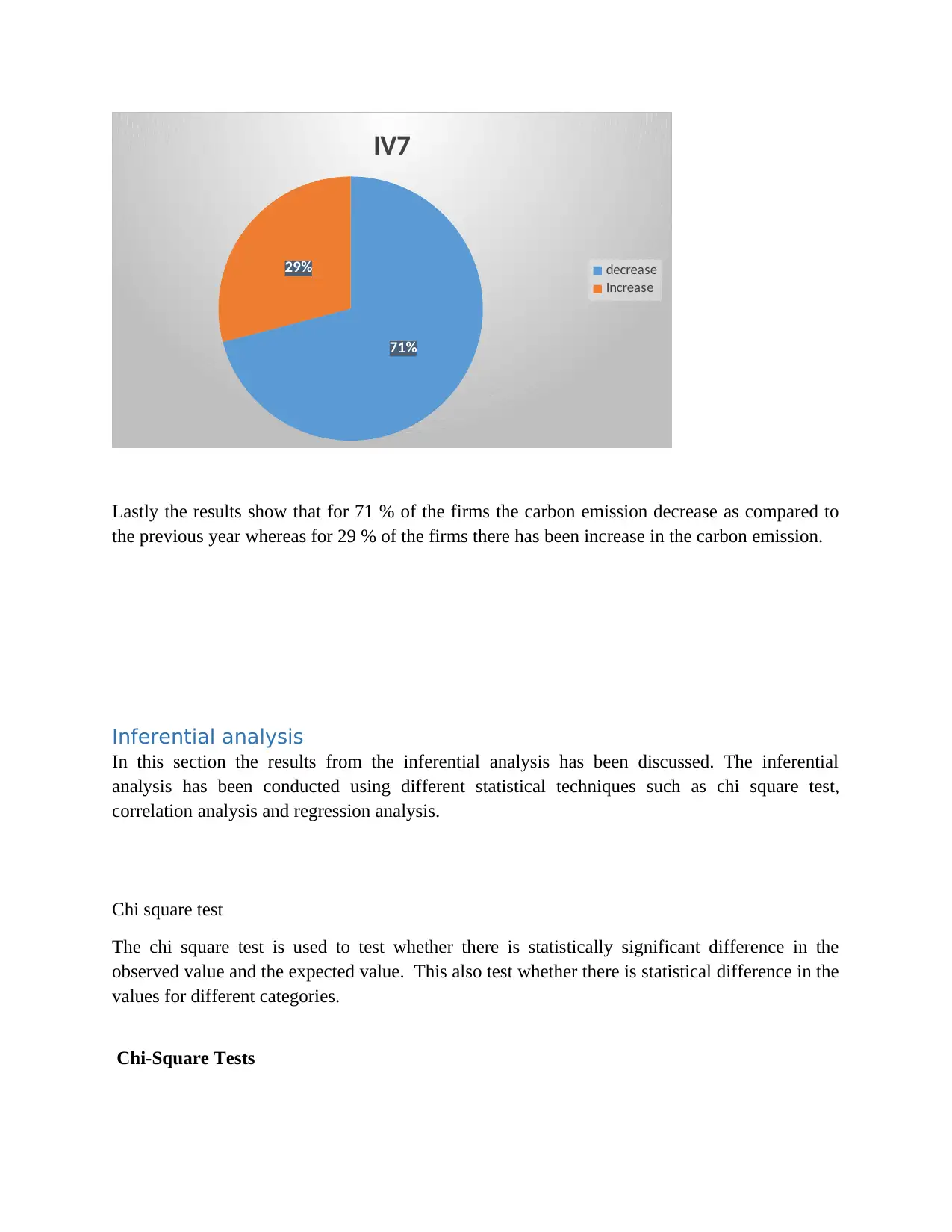

Similarly for 71 % of the firms the carbon emission is location based whereas only for the 29 %

the carbon emission is market based. The huge gap in the market and the location based

preference should be taken into consideration while making the future plans for the carbon

emission.

IV3

other

full time

For the independent variable three results show that 51 % off the companies use the full time

system, whereas rest of the companies use other method for carbon monitoring.

71%

29%

IV5

location based

Market based

Similarly for 71 % of the firms the carbon emission is location based whereas only for the 29 %

the carbon emission is market based. The huge gap in the market and the location based

preference should be taken into consideration while making the future plans for the carbon

emission.

71%

29%

IV7

decrease

Increase

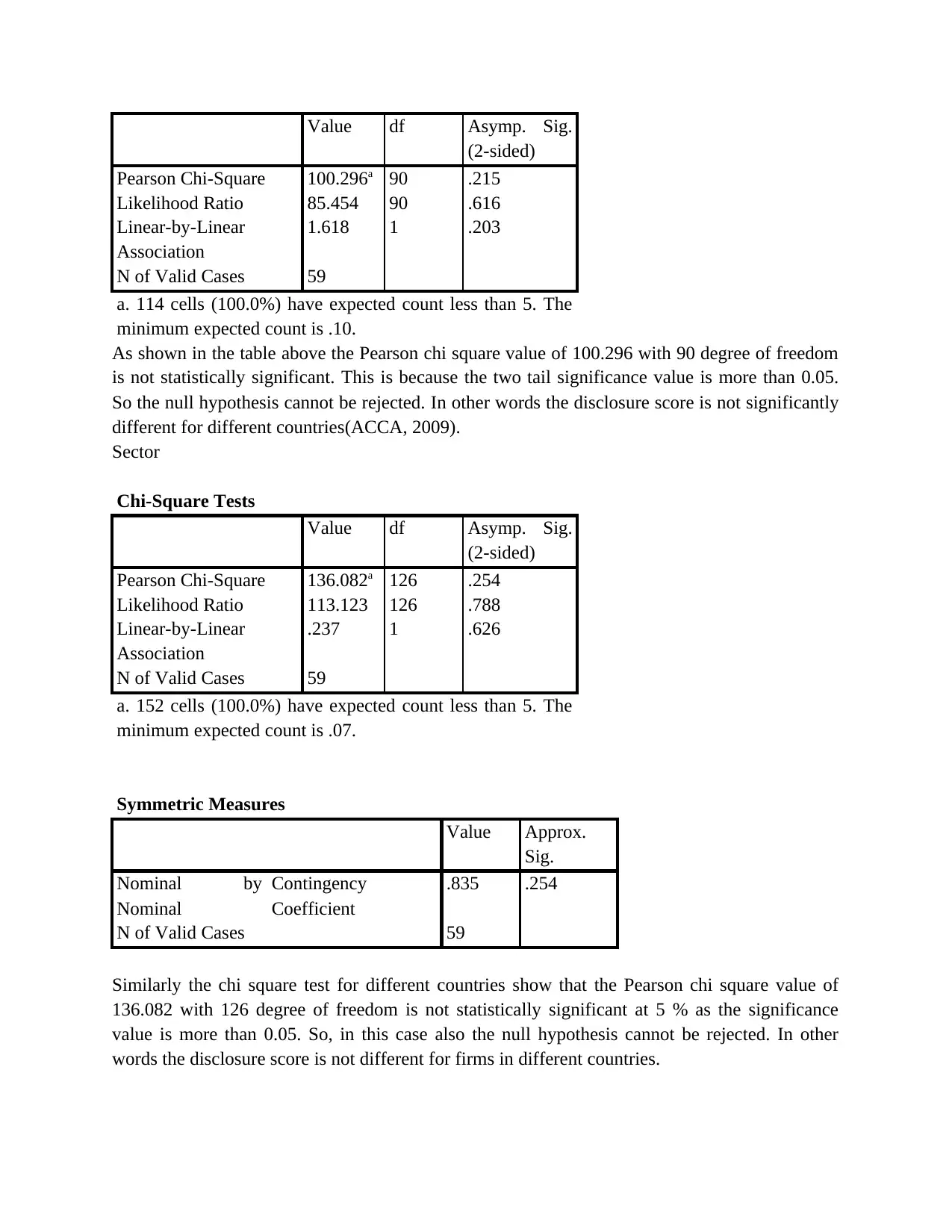

Lastly the results show that for 71 % of the firms the carbon emission decrease as compared to

the previous year whereas for 29 % of the firms there has been increase in the carbon emission.

Inferential analysis

In this section the results from the inferential analysis has been discussed. The inferential

analysis has been conducted using different statistical techniques such as chi square test,

correlation analysis and regression analysis.

Chi square test

The chi square test is used to test whether there is statistically significant difference in the

observed value and the expected value. This also test whether there is statistical difference in the

values for different categories.

Chi-Square Tests

29%

IV7

decrease

Increase

Lastly the results show that for 71 % of the firms the carbon emission decrease as compared to

the previous year whereas for 29 % of the firms there has been increase in the carbon emission.

Inferential analysis

In this section the results from the inferential analysis has been discussed. The inferential

analysis has been conducted using different statistical techniques such as chi square test,

correlation analysis and regression analysis.

Chi square test

The chi square test is used to test whether there is statistically significant difference in the

observed value and the expected value. This also test whether there is statistical difference in the

values for different categories.

Chi-Square Tests

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Value df Asymp. Sig.

(2-sided)

Pearson Chi-Square 100.296a 90 .215

Likelihood Ratio 85.454 90 .616

Linear-by-Linear

Association

1.618 1 .203

N of Valid Cases 59

a. 114 cells (100.0%) have expected count less than 5. The

minimum expected count is .10.

As shown in the table above the Pearson chi square value of 100.296 with 90 degree of freedom

is not statistically significant. This is because the two tail significance value is more than 0.05.

So the null hypothesis cannot be rejected. In other words the disclosure score is not significantly

different for different countries(ACCA, 2009).

Sector

Chi-Square Tests

Value df Asymp. Sig.

(2-sided)

Pearson Chi-Square 136.082a 126 .254

Likelihood Ratio 113.123 126 .788

Linear-by-Linear

Association

.237 1 .626

N of Valid Cases 59

a. 152 cells (100.0%) have expected count less than 5. The

minimum expected count is .07.

Symmetric Measures

Value Approx.

Sig.

Nominal by

Nominal

Contingency

Coefficient

.835 .254

N of Valid Cases 59

Similarly the chi square test for different countries show that the Pearson chi square value of

136.082 with 126 degree of freedom is not statistically significant at 5 % as the significance

value is more than 0.05. So, in this case also the null hypothesis cannot be rejected. In other

words the disclosure score is not different for firms in different countries.

(2-sided)

Pearson Chi-Square 100.296a 90 .215

Likelihood Ratio 85.454 90 .616

Linear-by-Linear

Association

1.618 1 .203

N of Valid Cases 59

a. 114 cells (100.0%) have expected count less than 5. The

minimum expected count is .10.

As shown in the table above the Pearson chi square value of 100.296 with 90 degree of freedom

is not statistically significant. This is because the two tail significance value is more than 0.05.

So the null hypothesis cannot be rejected. In other words the disclosure score is not significantly

different for different countries(ACCA, 2009).

Sector

Chi-Square Tests

Value df Asymp. Sig.

(2-sided)

Pearson Chi-Square 136.082a 126 .254

Likelihood Ratio 113.123 126 .788

Linear-by-Linear

Association

.237 1 .626

N of Valid Cases 59

a. 152 cells (100.0%) have expected count less than 5. The

minimum expected count is .07.

Symmetric Measures

Value Approx.

Sig.

Nominal by

Nominal

Contingency

Coefficient

.835 .254

N of Valid Cases 59

Similarly the chi square test for different countries show that the Pearson chi square value of

136.082 with 126 degree of freedom is not statistically significant at 5 % as the significance

value is more than 0.05. So, in this case also the null hypothesis cannot be rejected. In other

words the disclosure score is not different for firms in different countries.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

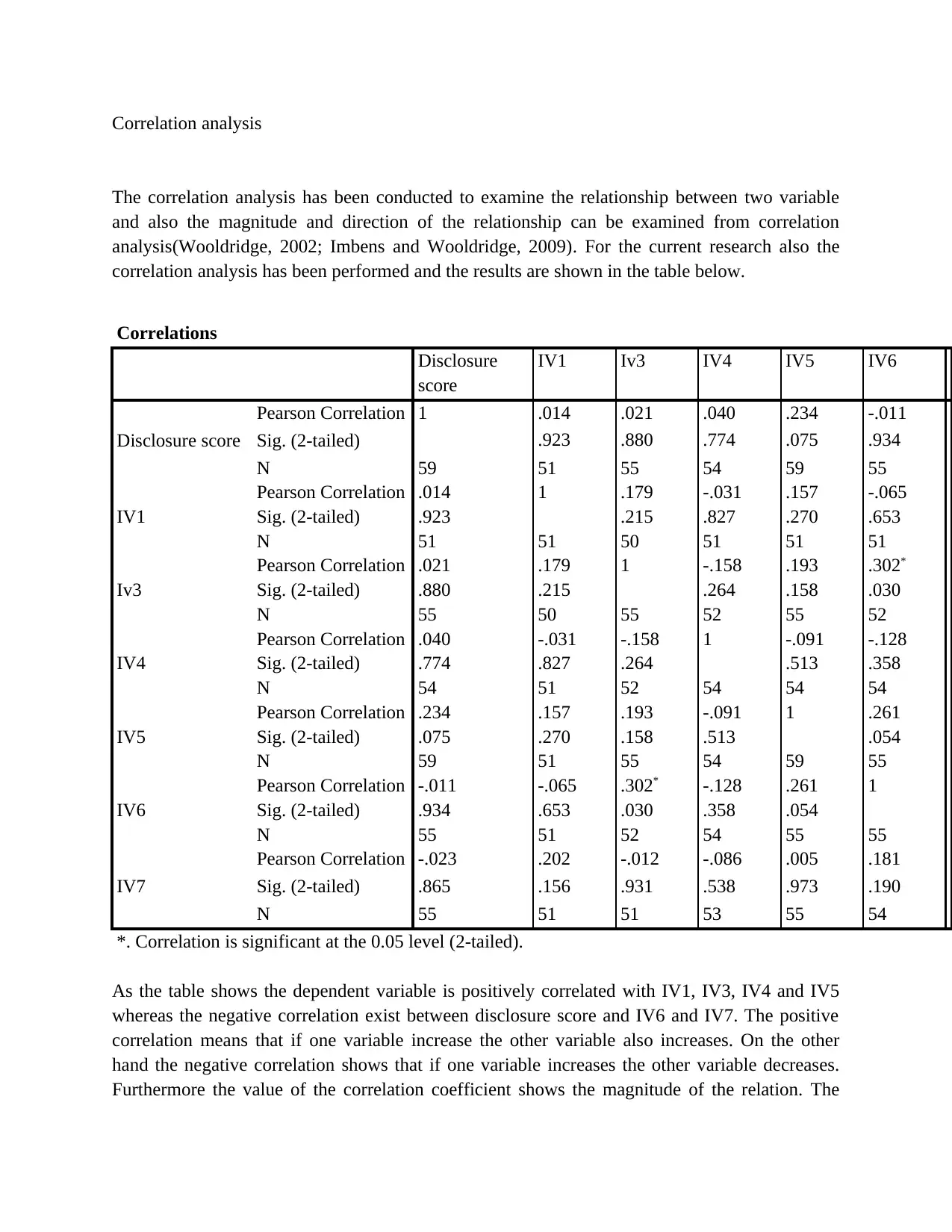

Correlation analysis

The correlation analysis has been conducted to examine the relationship between two variable

and also the magnitude and direction of the relationship can be examined from correlation

analysis(Wooldridge, 2002; Imbens and Wooldridge, 2009). For the current research also the

correlation analysis has been performed and the results are shown in the table below.

Correlations

Disclosure

score

IV1 Iv3 IV4 IV5 IV6 I

Disclosure score

Pearson Correlation 1 .014 .021 .040 .234 -.011 -

Sig. (2-tailed) .923 .880 .774 .075 .934 .

N 59 51 55 54 59 55 5

IV1

Pearson Correlation .014 1 .179 -.031 .157 -.065 .

Sig. (2-tailed) .923 .215 .827 .270 .653 .

N 51 51 50 51 51 51 5

Iv3

Pearson Correlation .021 .179 1 -.158 .193 .302* -

Sig. (2-tailed) .880 .215 .264 .158 .030 .

N 55 50 55 52 55 52 5

IV4

Pearson Correlation .040 -.031 -.158 1 -.091 -.128 -

Sig. (2-tailed) .774 .827 .264 .513 .358 .

N 54 51 52 54 54 54 5

IV5

Pearson Correlation .234 .157 .193 -.091 1 .261 .

Sig. (2-tailed) .075 .270 .158 .513 .054 .

N 59 51 55 54 59 55 5

IV6

Pearson Correlation -.011 -.065 .302* -.128 .261 1 .

Sig. (2-tailed) .934 .653 .030 .358 .054 .

N 55 51 52 54 55 55 5

IV7

Pearson Correlation -.023 .202 -.012 -.086 .005 .181 1

Sig. (2-tailed) .865 .156 .931 .538 .973 .190

N 55 51 51 53 55 54 5

*. Correlation is significant at the 0.05 level (2-tailed).

As the table shows the dependent variable is positively correlated with IV1, IV3, IV4 and IV5

whereas the negative correlation exist between disclosure score and IV6 and IV7. The positive

correlation means that if one variable increase the other variable also increases. On the other

hand the negative correlation shows that if one variable increases the other variable decreases.

Furthermore the value of the correlation coefficient shows the magnitude of the relation. The

The correlation analysis has been conducted to examine the relationship between two variable

and also the magnitude and direction of the relationship can be examined from correlation

analysis(Wooldridge, 2002; Imbens and Wooldridge, 2009). For the current research also the

correlation analysis has been performed and the results are shown in the table below.

Correlations

Disclosure

score

IV1 Iv3 IV4 IV5 IV6 I

Disclosure score

Pearson Correlation 1 .014 .021 .040 .234 -.011 -

Sig. (2-tailed) .923 .880 .774 .075 .934 .

N 59 51 55 54 59 55 5

IV1

Pearson Correlation .014 1 .179 -.031 .157 -.065 .

Sig. (2-tailed) .923 .215 .827 .270 .653 .

N 51 51 50 51 51 51 5

Iv3

Pearson Correlation .021 .179 1 -.158 .193 .302* -

Sig. (2-tailed) .880 .215 .264 .158 .030 .

N 55 50 55 52 55 52 5

IV4

Pearson Correlation .040 -.031 -.158 1 -.091 -.128 -

Sig. (2-tailed) .774 .827 .264 .513 .358 .

N 54 51 52 54 54 54 5

IV5

Pearson Correlation .234 .157 .193 -.091 1 .261 .

Sig. (2-tailed) .075 .270 .158 .513 .054 .

N 59 51 55 54 59 55 5

IV6

Pearson Correlation -.011 -.065 .302* -.128 .261 1 .

Sig. (2-tailed) .934 .653 .030 .358 .054 .

N 55 51 52 54 55 55 5

IV7

Pearson Correlation -.023 .202 -.012 -.086 .005 .181 1

Sig. (2-tailed) .865 .156 .931 .538 .973 .190

N 55 51 51 53 55 54 5

*. Correlation is significant at the 0.05 level (2-tailed).

As the table shows the dependent variable is positively correlated with IV1, IV3, IV4 and IV5

whereas the negative correlation exist between disclosure score and IV6 and IV7. The positive

correlation means that if one variable increase the other variable also increases. On the other

hand the negative correlation shows that if one variable increases the other variable decreases.

Furthermore the value of the correlation coefficient shows the magnitude of the relation. The

correlation coefficient close to -1 indicates strong negative relationship, whereas the correlation

value of close to +1 indicate positive strong positive correlation.

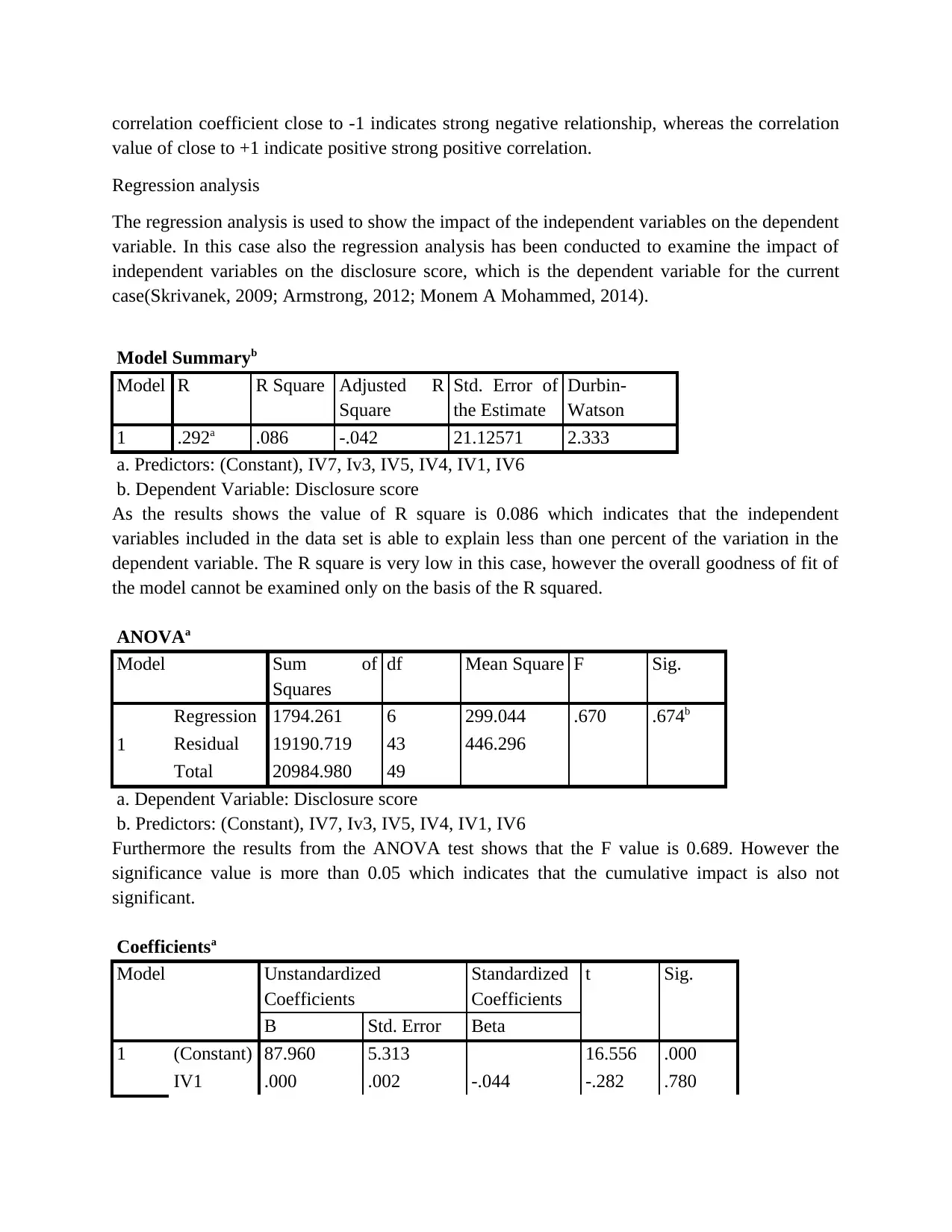

Regression analysis

The regression analysis is used to show the impact of the independent variables on the dependent

variable. In this case also the regression analysis has been conducted to examine the impact of

independent variables on the disclosure score, which is the dependent variable for the current

case(Skrivanek, 2009; Armstrong, 2012; Monem A Mohammed, 2014).

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

Durbin-

Watson

1 .292a .086 -.042 21.12571 2.333

a. Predictors: (Constant), IV7, Iv3, IV5, IV4, IV1, IV6

b. Dependent Variable: Disclosure score

As the results shows the value of R square is 0.086 which indicates that the independent

variables included in the data set is able to explain less than one percent of the variation in the

dependent variable. The R square is very low in this case, however the overall goodness of fit of

the model cannot be examined only on the basis of the R squared.

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 1794.261 6 299.044 .670 .674b

Residual 19190.719 43 446.296

Total 20984.980 49

a. Dependent Variable: Disclosure score

b. Predictors: (Constant), IV7, Iv3, IV5, IV4, IV1, IV6

Furthermore the results from the ANOVA test shows that the F value is 0.689. However the

significance value is more than 0.05 which indicates that the cumulative impact is also not

significant.

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 87.960 5.313 16.556 .000

IV1 .000 .002 -.044 -.282 .780

value of close to +1 indicate positive strong positive correlation.

Regression analysis

The regression analysis is used to show the impact of the independent variables on the dependent

variable. In this case also the regression analysis has been conducted to examine the impact of

independent variables on the disclosure score, which is the dependent variable for the current

case(Skrivanek, 2009; Armstrong, 2012; Monem A Mohammed, 2014).

Model Summaryb

Model R R Square Adjusted R

Square

Std. Error of

the Estimate

Durbin-

Watson

1 .292a .086 -.042 21.12571 2.333

a. Predictors: (Constant), IV7, Iv3, IV5, IV4, IV1, IV6

b. Dependent Variable: Disclosure score

As the results shows the value of R square is 0.086 which indicates that the independent

variables included in the data set is able to explain less than one percent of the variation in the

dependent variable. The R square is very low in this case, however the overall goodness of fit of

the model cannot be examined only on the basis of the R squared.

ANOVAa

Model Sum of

Squares

df Mean Square F Sig.

1

Regression 1794.261 6 299.044 .670 .674b

Residual 19190.719 43 446.296

Total 20984.980 49

a. Dependent Variable: Disclosure score

b. Predictors: (Constant), IV7, Iv3, IV5, IV4, IV1, IV6

Furthermore the results from the ANOVA test shows that the F value is 0.689. However the

significance value is more than 0.05 which indicates that the cumulative impact is also not

significant.

Coefficientsa

Model Unstandardized

Coefficients

Standardized

Coefficients

t Sig.

B Std. Error Beta

1 (Constant) 87.960 5.313 16.556 .000

IV1 .000 .002 -.044 -.282 .780

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.