ITC516: Data Mining and Visualization Business Case Analysis I

VerifiedAdded on 2020/03/23

|12

|1608

|142

Homework Assignment

AI Summary

This document provides a comprehensive solution to a data mining assignment, addressing key concepts in business intelligence. It begins with an analysis of Principal Component Analysis (PCA), detailing the principal component matrix, variance, and feature selection for US utilities data. The solution explores the advantages and disadvantages of PCA. Subsequently, the assignment delves into a loan acceptance case study using a dataset of 5000 observations. It includes pivot table analysis to determine probabilities related to loan acceptance based on online banking usage and credit card ownership. The solution also calculates probabilities using Naive Bayes and concludes with a strategy for customers to increase their chances of loan approval.

ITC516 – DATA MINING AND VISUALIZATION FOR BUSINESS INTELLIGENCE

BUSINESS CASE ANALYSIS I

STUDENT ID AND NAME

[Pick the date]

BUSINESS CASE ANALYSIS I

STUDENT ID AND NAME

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

Part A

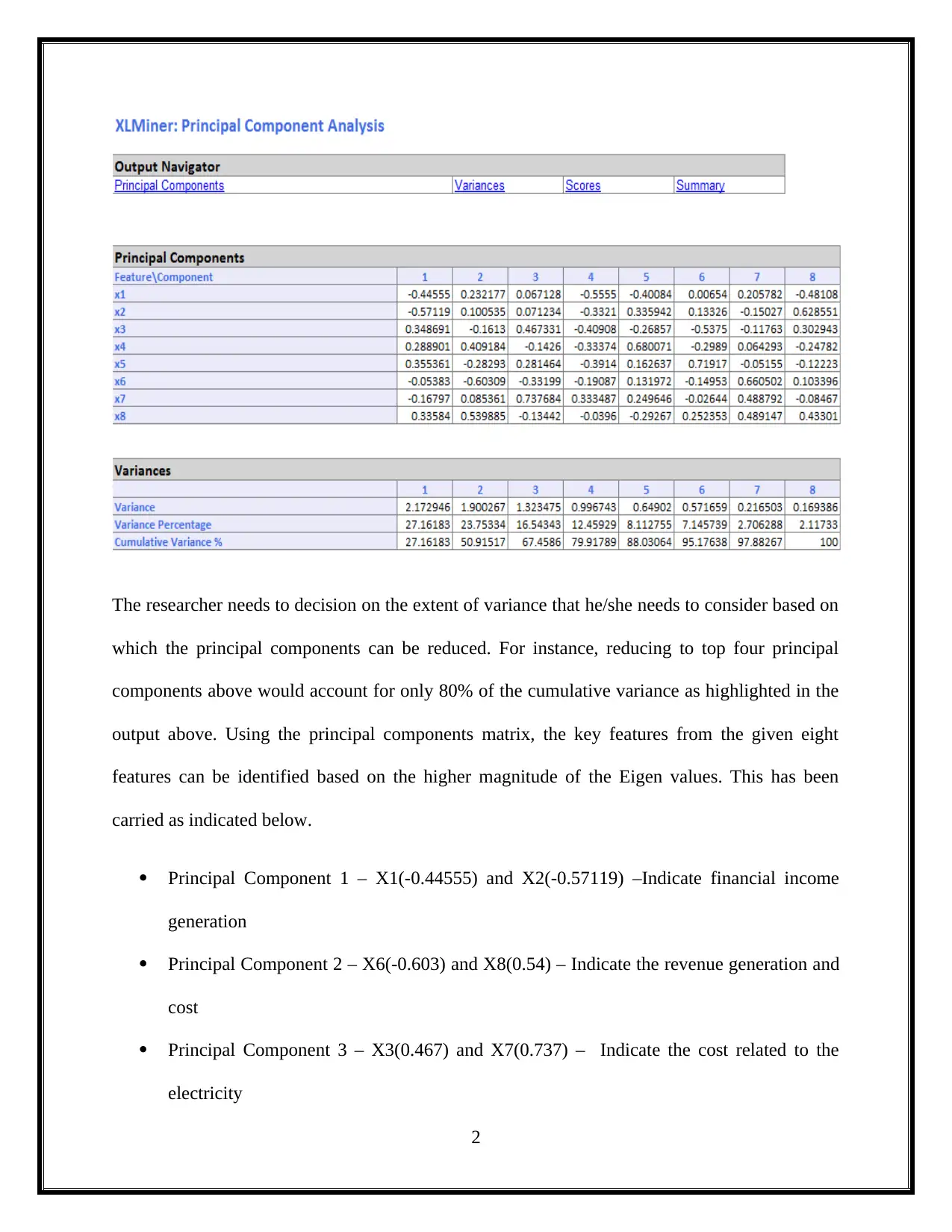

The most imperative component of Principal Component Analysis (PCA) is arguably the

principal component matrix. This essentially highlights the relevant eigen values which can be

used to derive the score through the coefficients in the matrix. Another key result obtained

through PCA is the total variance matrix which not only highlights the need for normalisation

but simultaneously also enables identification of critical principal components. In this regards,

preference would be given to those which tend to account for higher variance. On the other hand,

there are certain principal components where the variance contribution is quite limited which

leads to these being discarded and considered as noise. For the given data on 32 US utilities, the

PCA result as derived through the use of XL miner is indicated as follows.

1

Part A

The most imperative component of Principal Component Analysis (PCA) is arguably the

principal component matrix. This essentially highlights the relevant eigen values which can be

used to derive the score through the coefficients in the matrix. Another key result obtained

through PCA is the total variance matrix which not only highlights the need for normalisation

but simultaneously also enables identification of critical principal components. In this regards,

preference would be given to those which tend to account for higher variance. On the other hand,

there are certain principal components where the variance contribution is quite limited which

leads to these being discarded and considered as noise. For the given data on 32 US utilities, the

PCA result as derived through the use of XL miner is indicated as follows.

1

The researcher needs to decision on the extent of variance that he/she needs to consider based on

which the principal components can be reduced. For instance, reducing to top four principal

components above would account for only 80% of the cumulative variance as highlighted in the

output above. Using the principal components matrix, the key features from the given eight

features can be identified based on the higher magnitude of the Eigen values. This has been

carried as indicated below.

Principal Component 1 – X1(-0.44555) and X2(-0.57119) –Indicate financial income

generation

Principal Component 2 – X6(-0.603) and X8(0.54) – Indicate the revenue generation and

cost

Principal Component 3 – X3(0.467) and X7(0.737) – Indicate the cost related to the

electricity

2

which the principal components can be reduced. For instance, reducing to top four principal

components above would account for only 80% of the cumulative variance as highlighted in the

output above. Using the principal components matrix, the key features from the given eight

features can be identified based on the higher magnitude of the Eigen values. This has been

carried as indicated below.

Principal Component 1 – X1(-0.44555) and X2(-0.57119) –Indicate financial income

generation

Principal Component 2 – X6(-0.603) and X8(0.54) – Indicate the revenue generation and

cost

Principal Component 3 – X3(0.467) and X7(0.737) – Indicate the cost related to the

electricity

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Principal Component 4 – X1(-0.56) and X3(-0.41) – Indicate the cost structure with

emphasis on fixed costs

Further reduction of the above features may also be done considering the exact magnitude

corresponding to the various features and the respective significance of the principal components

obtained above.

Need for normalisation

A key drawback of PCA is that the variables on account of different scale of measurement may

require normalisation before PCA can be initiated. This is especially the case for the variables

when the scale of data of some variable tends to be very different from others. For instance

assume one variable varies between 0 and 1, while the other variable varies between 0 and 100.

Obviously, the variance of the variable having a larger range would be higher and hence it would

impact the PCA as the importance of this variable would be overwhelmingly high. For the data

on US utilities even though there are variables such as x3 and x6 for whom the variance would

be significantly higher in comparison to other variables such as x1 and x5 and hence it would be

advisable that normalisation would be done for better accuracy.

PART (B)

Advantages of principal component analysis

Low noise sensitivity technique

This covers the main factors i.e. standard deviation, eigenvectors and covariance of

original data into the new formed principal component.

3

emphasis on fixed costs

Further reduction of the above features may also be done considering the exact magnitude

corresponding to the various features and the respective significance of the principal components

obtained above.

Need for normalisation

A key drawback of PCA is that the variables on account of different scale of measurement may

require normalisation before PCA can be initiated. This is especially the case for the variables

when the scale of data of some variable tends to be very different from others. For instance

assume one variable varies between 0 and 1, while the other variable varies between 0 and 100.

Obviously, the variance of the variable having a larger range would be higher and hence it would

impact the PCA as the importance of this variable would be overwhelmingly high. For the data

on US utilities even though there are variables such as x3 and x6 for whom the variance would

be significantly higher in comparison to other variables such as x1 and x5 and hence it would be

advisable that normalisation would be done for better accuracy.

PART (B)

Advantages of principal component analysis

Low noise sensitivity technique

This covers the main factors i.e. standard deviation, eigenvectors and covariance of

original data into the new formed principal component.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It provides detailed information regarding the structural distribution of data

Lowers down the large number dimensions into smaller dimensions

Disadvantages of principal component analysis

Seems not appropriate technique to use for variable set while they are related by non-

linear relation. For example, PCA fails to analyze the “complex biological system”

When the principal components numbers are significant,then the evaluation of covariance

matrix is difficult.

It is considered as “Unsupervised technique” because it cannot be used for distribution

other than Gaussian distribution and for images which has no class labels.

Question 2

The aim is to compute the measurement for the personal loan acceptance based on the analysis

performed on the selected trainee set.

Total data set observation = 5000

Total number of variables = 14

Partition into training = 60%

Partition into validation = 40%

Standard partition of the XLMiner Analytical Tool has been used in excel add in to determine the

partition training data.

4

Lowers down the large number dimensions into smaller dimensions

Disadvantages of principal component analysis

Seems not appropriate technique to use for variable set while they are related by non-

linear relation. For example, PCA fails to analyze the “complex biological system”

When the principal components numbers are significant,then the evaluation of covariance

matrix is difficult.

It is considered as “Unsupervised technique” because it cannot be used for distribution

other than Gaussian distribution and for images which has no class labels.

Question 2

The aim is to compute the measurement for the personal loan acceptance based on the analysis

performed on the selected trainee set.

Total data set observation = 5000

Total number of variables = 14

Partition into training = 60%

Partition into validation = 40%

Standard partition of the XLMiner Analytical Tool has been used in excel add in to determine the

partition training data.

4

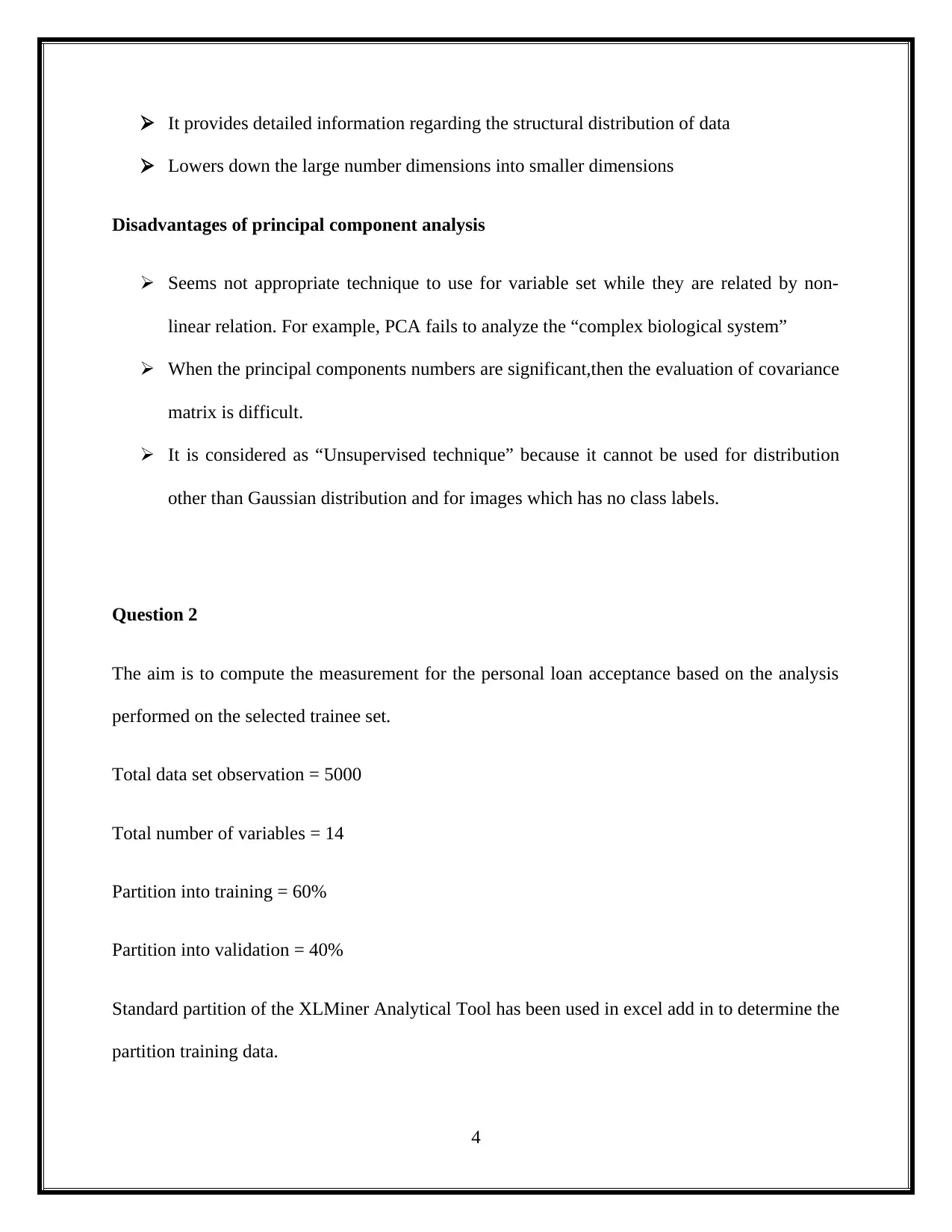

PART (A)

Description

Training data has been taken into account to create the pivot table which represents the relations

among the three variables.

Variable 1 - Online “Whether or not the customer is an active user of the online net banking

service of universal bank.” The value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 2 – Credit Card “Whether or not the customer holds credit card of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (First Row Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Second Row Label)

Pivot Table

PART (B)

Calculation of probability that this customer (who owns credit card and actively utilizing online

net banking service of universal bank) will accept the loan offer extended by universal bank is

show below:

5

Description

Training data has been taken into account to create the pivot table which represents the relations

among the three variables.

Variable 1 - Online “Whether or not the customer is an active user of the online net banking

service of universal bank.” The value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 2 – Credit Card “Whether or not the customer holds credit card of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (First Row Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Second Row Label)

Pivot Table

PART (B)

Calculation of probability that this customer (who owns credit card and actively utilizing online

net banking service of universal bank) will accept the loan offer extended by universal bank is

show below:

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

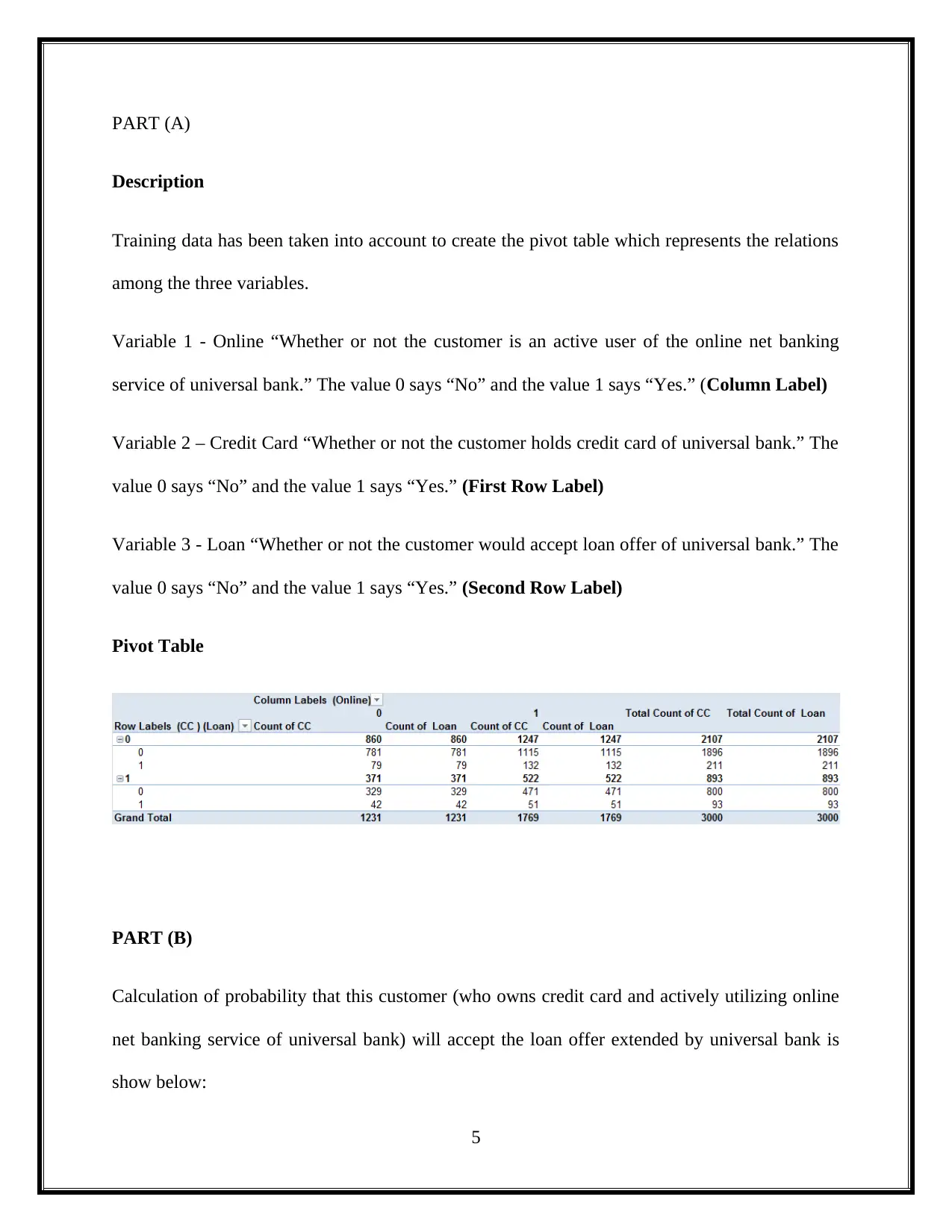

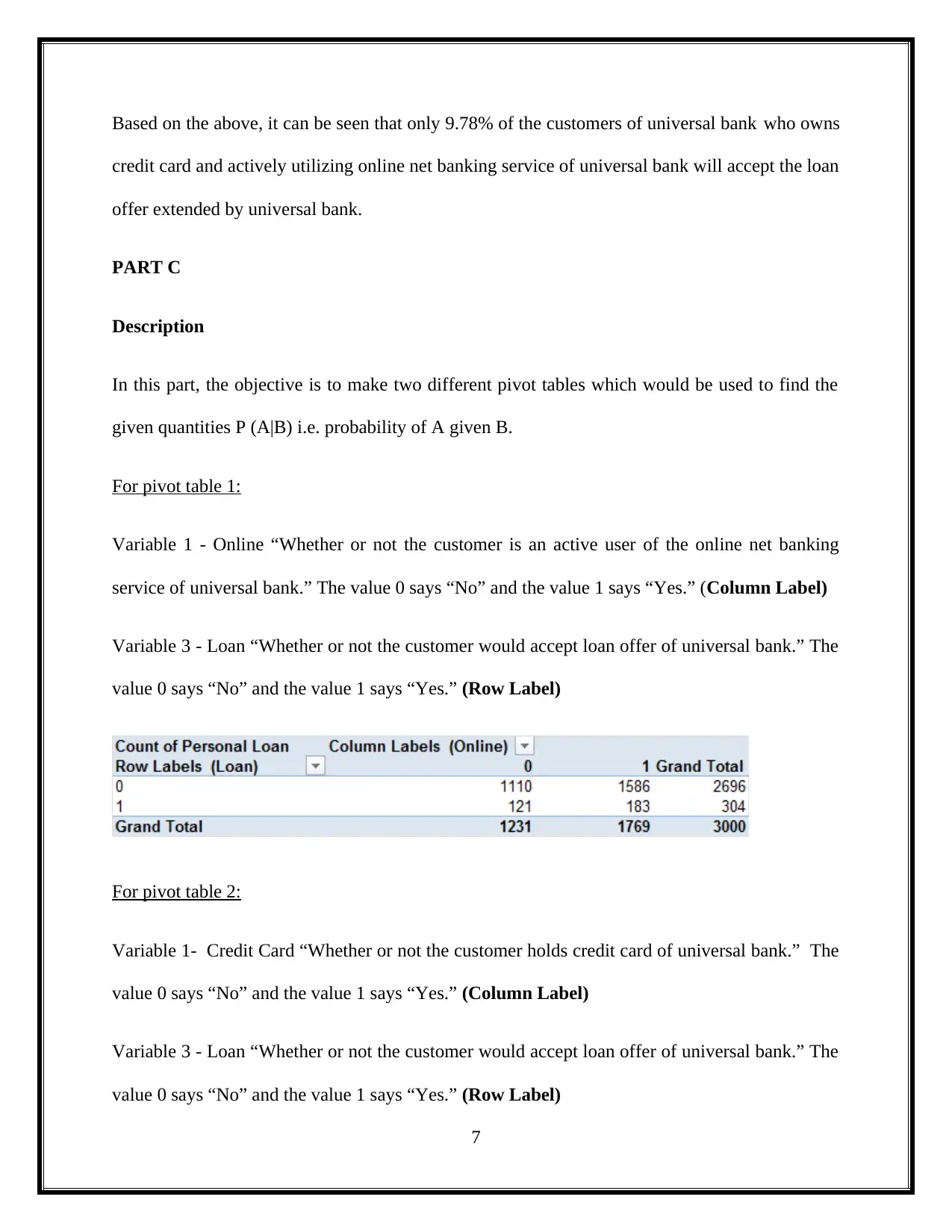

Favorable case:

Number of universal bank customers who owns credit card and actively utilizing online net

banking service of universal bank.

It can be determined by taking (CC =1∨Online=1) in the pivot table shown below = 51

Total possible cases:

Number of universal bank customers who owns credit card and actively utilizing online net

banking service of universal bank would also accepted loan offer extended by universal bank.

It can be determined by taking ( CC =1|Loan=1 ,Online=1 ¿ in the pivot table shown below =

522

Therefore, the probability = Favorable case / Total possible cases

¿ 51

522=0.0978∨9.78 %

6

Number of universal bank customers who owns credit card and actively utilizing online net

banking service of universal bank.

It can be determined by taking (CC =1∨Online=1) in the pivot table shown below = 51

Total possible cases:

Number of universal bank customers who owns credit card and actively utilizing online net

banking service of universal bank would also accepted loan offer extended by universal bank.

It can be determined by taking ( CC =1|Loan=1 ,Online=1 ¿ in the pivot table shown below =

522

Therefore, the probability = Favorable case / Total possible cases

¿ 51

522=0.0978∨9.78 %

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Based on the above, it can be seen that only 9.78% of the customers of universal bank who owns

credit card and actively utilizing online net banking service of universal bank will accept the loan

offer extended by universal bank.

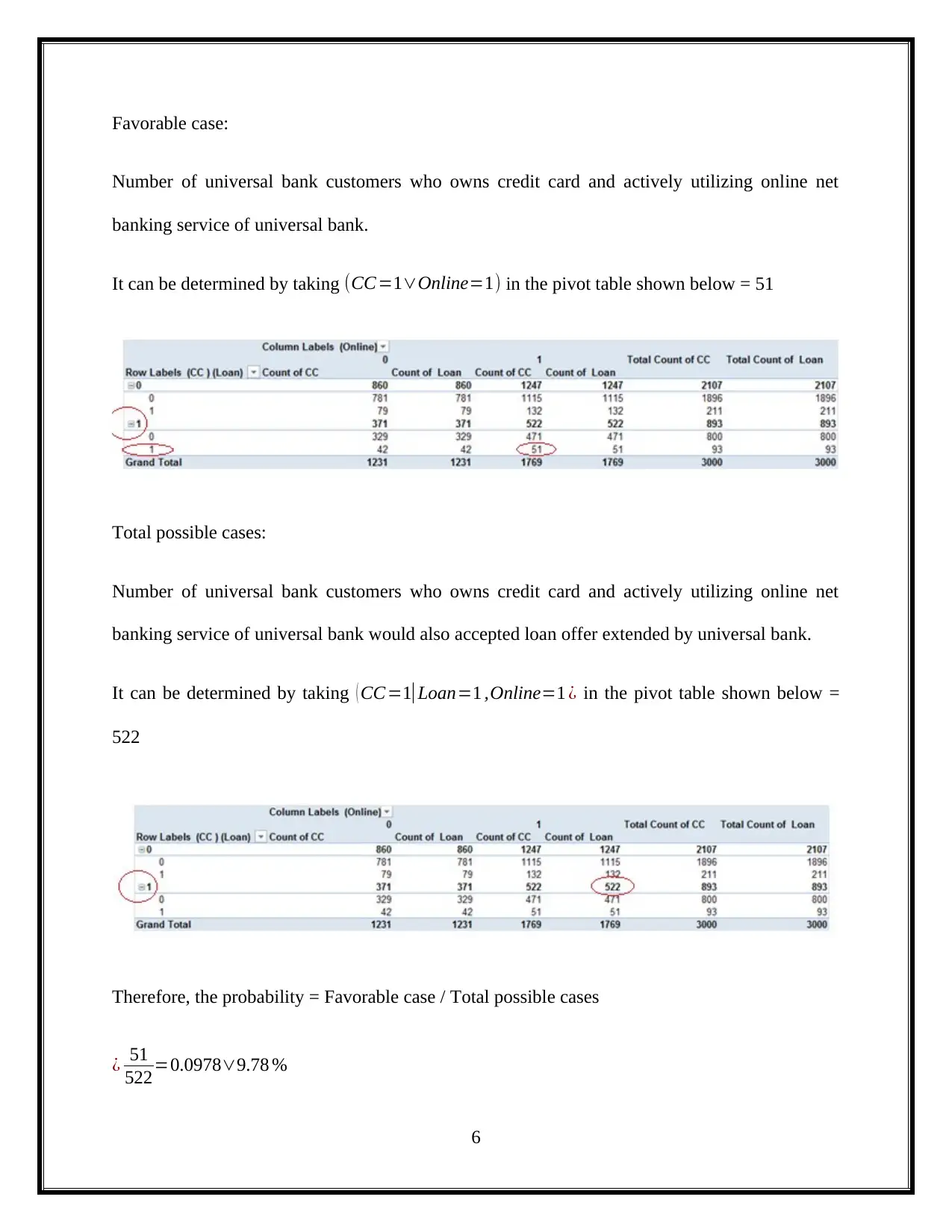

PART C

Description

In this part, the objective is to make two different pivot tables which would be used to find the

given quantities P (A|B) i.e. probability of A given B.

For pivot table 1:

Variable 1 - Online “Whether or not the customer is an active user of the online net banking

service of universal bank.” The value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Row Label)

For pivot table 2:

Variable 1- Credit Card “Whether or not the customer holds credit card of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Row Label)

7

credit card and actively utilizing online net banking service of universal bank will accept the loan

offer extended by universal bank.

PART C

Description

In this part, the objective is to make two different pivot tables which would be used to find the

given quantities P (A|B) i.e. probability of A given B.

For pivot table 1:

Variable 1 - Online “Whether or not the customer is an active user of the online net banking

service of universal bank.” The value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Row Label)

For pivot table 2:

Variable 1- Credit Card “Whether or not the customer holds credit card of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Column Label)

Variable 3 - Loan “Whether or not the customer would accept loan offer of universal bank.” The

value 0 says “No” and the value 1 says “Yes.” (Row Label)

7

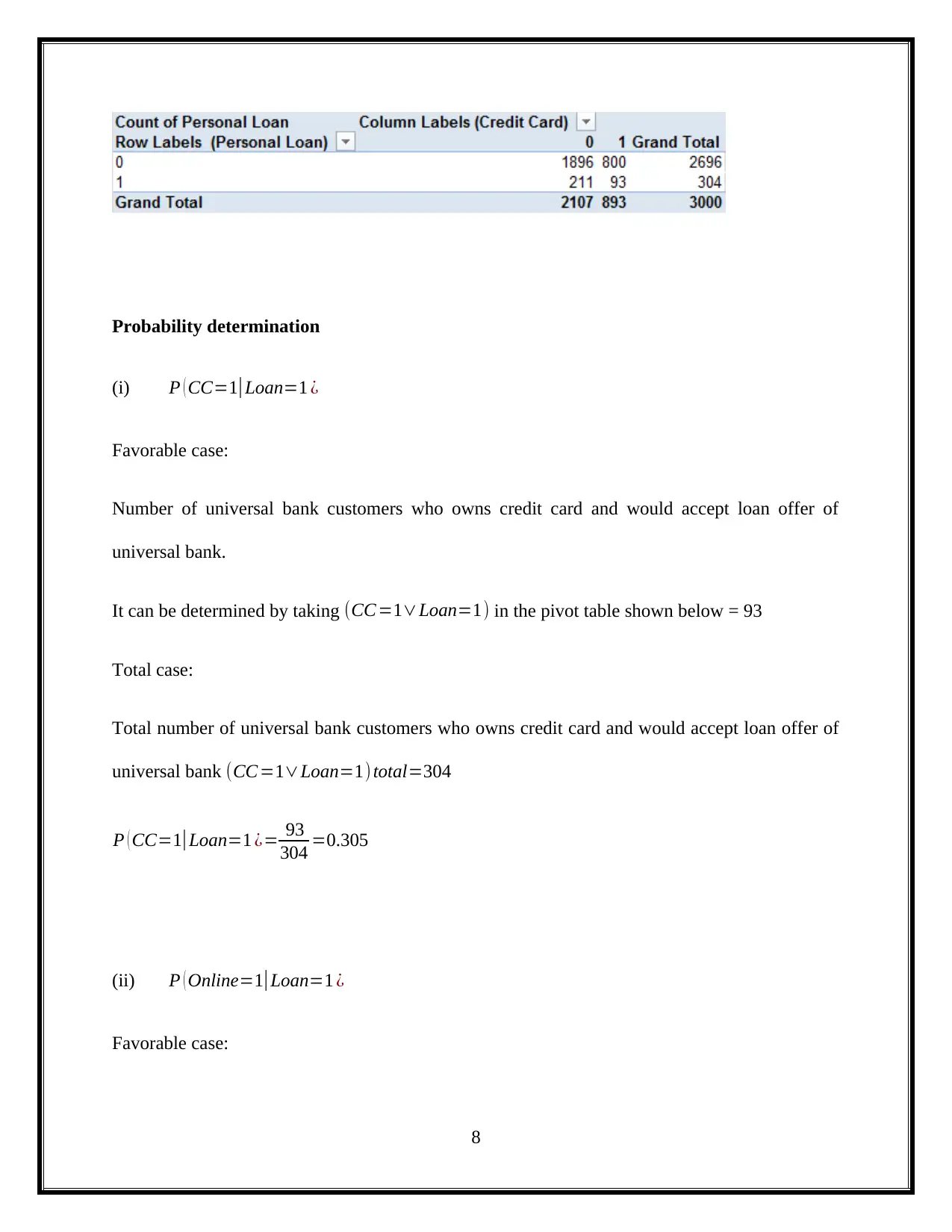

Probability determination

(i) P ( CC=1|Loan=1 ¿

Favorable case:

Number of universal bank customers who owns credit card and would accept loan offer of

universal bank.

It can be determined by taking (CC =1∨Loan=1) in the pivot table shown below = 93

Total case:

Total number of universal bank customers who owns credit card and would accept loan offer of

universal bank (CC=1∨Loan=1) total=304

P ( CC=1|Loan=1 ¿= 93

304 =0.305

(ii) P ( Online=1|Loan=1 ¿

Favorable case:

8

(i) P ( CC=1|Loan=1 ¿

Favorable case:

Number of universal bank customers who owns credit card and would accept loan offer of

universal bank.

It can be determined by taking (CC =1∨Loan=1) in the pivot table shown below = 93

Total case:

Total number of universal bank customers who owns credit card and would accept loan offer of

universal bank (CC=1∨Loan=1) total=304

P ( CC=1|Loan=1 ¿= 93

304 =0.305

(ii) P ( Online=1|Loan=1 ¿

Favorable case:

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

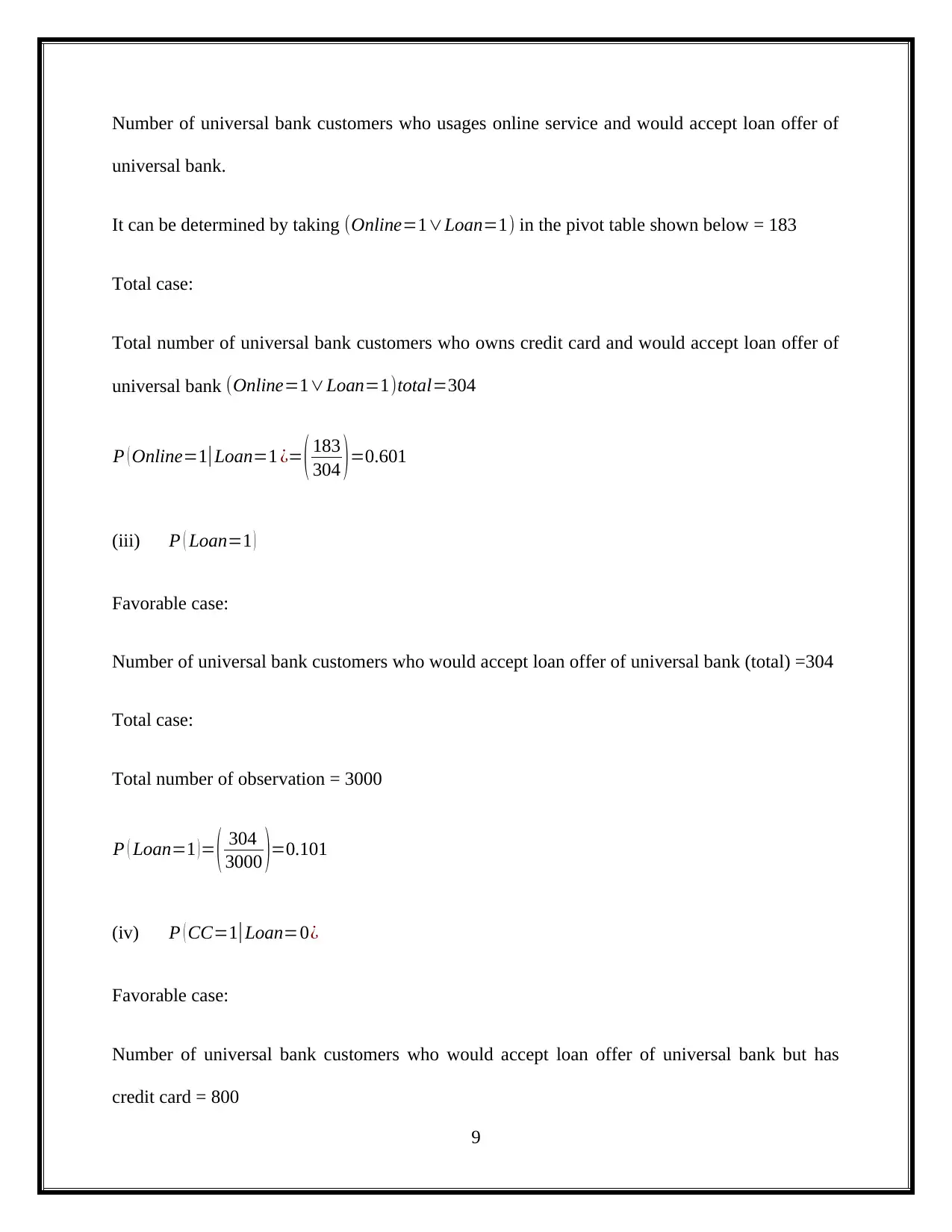

Number of universal bank customers who usages online service and would accept loan offer of

universal bank.

It can be determined by taking (Online=1∨Loan=1) in the pivot table shown below = 183

Total case:

Total number of universal bank customers who owns credit card and would accept loan offer of

universal bank (Online=1∨Loan=1)total=304

P ( Online=1|Loan=1 ¿= ( 183

304 )=0.601

(iii) P ( Loan=1 )

Favorable case:

Number of universal bank customers who would accept loan offer of universal bank (total) =304

Total case:

Total number of observation = 3000

P ( Loan=1 ) = ( 304

3000 )=0.101

(iv) P ( CC=1|Loan=0¿

Favorable case:

Number of universal bank customers who would accept loan offer of universal bank but has

credit card = 800

9

universal bank.

It can be determined by taking (Online=1∨Loan=1) in the pivot table shown below = 183

Total case:

Total number of universal bank customers who owns credit card and would accept loan offer of

universal bank (Online=1∨Loan=1)total=304

P ( Online=1|Loan=1 ¿= ( 183

304 )=0.601

(iii) P ( Loan=1 )

Favorable case:

Number of universal bank customers who would accept loan offer of universal bank (total) =304

Total case:

Total number of observation = 3000

P ( Loan=1 ) = ( 304

3000 )=0.101

(iv) P ( CC=1|Loan=0¿

Favorable case:

Number of universal bank customers who would accept loan offer of universal bank but has

credit card = 800

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

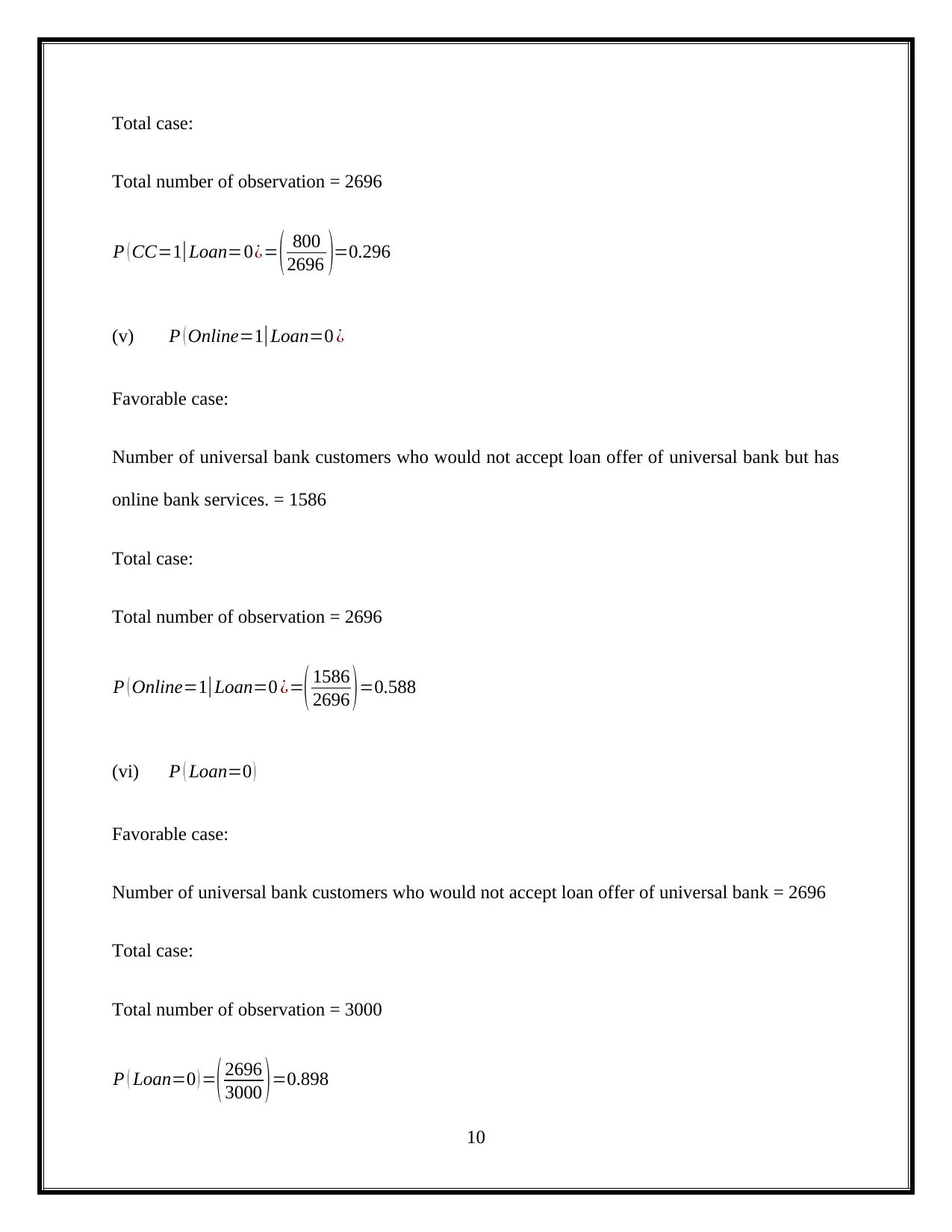

Total case:

Total number of observation = 2696

P ( CC=1|Loan=0¿= ( 800

2696 )=0.296

(v) P ( Online=1|Loan=0 ¿

Favorable case:

Number of universal bank customers who would not accept loan offer of universal bank but has

online bank services. = 1586

Total case:

Total number of observation = 2696

P ( Online=1|Loan=0 ¿=( 1586

2696 )=0.588

(vi) P ( Loan=0 )

Favorable case:

Number of universal bank customers who would not accept loan offer of universal bank = 2696

Total case:

Total number of observation = 3000

P ( Loan=0 ) =( 2696

3000 )=0.898

10

Total number of observation = 2696

P ( CC=1|Loan=0¿= ( 800

2696 )=0.296

(v) P ( Online=1|Loan=0 ¿

Favorable case:

Number of universal bank customers who would not accept loan offer of universal bank but has

online bank services. = 1586

Total case:

Total number of observation = 2696

P ( Online=1|Loan=0 ¿=( 1586

2696 )=0.588

(vi) P ( Loan=0 )

Favorable case:

Number of universal bank customers who would not accept loan offer of universal bank = 2696

Total case:

Total number of observation = 3000

P ( Loan=0 ) =( 2696

3000 )=0.898

10

PART (D)

Naive Bayes probability calculation

In the calculation of Naive Bayes probability, the numerator contains the multiplication of

proportion of (Loan = 1) = ( 0.305∗0.601∗0.101 )=0.0185

Numerator of conditional probability would be multiplication of proportion of (Loan =0) =

( 0.296∗0.588∗0.898 )=0.156

Finally, the denominator of Naive Bayes probability is the sum of these two conditional

probabilities = ( 0.305∗0.601∗0.101 )+ ( 0.296∗0.588∗0.898 )=0.174

Probability P( Loan=1∨CC =1 ,Online=1) = 0.0185/0.174 = 0.106

Therefore, the Naive Bayes probability is 0.106.

PART E

In order for the customer to increase chances of loan offering, they must be frequent users of the

online banking services and simultaneously must also hold bank’s credit card. This combination

would form the optimum or best strategy for the customer.

11

Naive Bayes probability calculation

In the calculation of Naive Bayes probability, the numerator contains the multiplication of

proportion of (Loan = 1) = ( 0.305∗0.601∗0.101 )=0.0185

Numerator of conditional probability would be multiplication of proportion of (Loan =0) =

( 0.296∗0.588∗0.898 )=0.156

Finally, the denominator of Naive Bayes probability is the sum of these two conditional

probabilities = ( 0.305∗0.601∗0.101 )+ ( 0.296∗0.588∗0.898 )=0.174

Probability P( Loan=1∨CC =1 ,Online=1) = 0.0185/0.174 = 0.106

Therefore, the Naive Bayes probability is 0.106.

PART E

In order for the customer to increase chances of loan offering, they must be frequent users of the

online banking services and simultaneously must also hold bank’s credit card. This combination

would form the optimum or best strategy for the customer.

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.