Debenhams: A Strategic Analysis of Innovation and Adaptation

VerifiedAdded on 2021/06/30

|18

|7279

|130

Report

AI Summary

This report provides a comprehensive analysis of Debenhams' strategic adaptation to the changing retail landscape, focusing on the impact of the digital economy. It begins with an executive summary, followed by an introduction covering the theoretical background of innovation and Debenhams' profile, including a SWOT analysis. The report then delves into Debenhams' internal factors, such as leadership, structure, and culture, examining the transition from previous leadership to Sergio Bucher's focus on online sales and customer experience. The analysis extends to external factors, including e-commerce trends and a Porter's Five Forces analysis, and evaluates Debenhams' new strategy. The report concludes with recommendations for Debenhams, addressing internal issues like communication channels and career progression, aiming to improve the company's innovation process and overall performance. The report draws upon the provided figures and tables to support its findings.

4

Executive summary

Section A of the report primarily focuses on theoretical background and driving forces of

innovation. The whole retailer sector is not a stranger to the waves of innovation because

digital economy is currently disrupting the retail industry. Debenhams Plc Share price

plummeted when online retailers penetrated the market in 2008. The downward trend in the

number of physical stores forces Debenhams to identify new online distribution channels in

order to continue generating revenues.

Section B analyses Debenhams internal factors. It is notable that both previous leaders Mr.

Sharp and Mr. Templeman did not adopt the Debenhams existing business model to the new

digital environment due to poor innovative climate within organisation and strong

organisational foundations that were formed more than 200 years ago. In 2016, Sergio

Bucher, used his knowledge, gained in Amazon, and announced new strategy with focus on

online selling and better customer experience by introducing social shopping within physical

stores. Debenhams, headed by Sergio Bucher started moving towards entrepreneurial culture

and organic structure. Nonetheless, interviews conducted with employees in Debenhams

Guildford department has showed that Debenhams did not introduce a fully organic

structure.

Section C analyses how Debenhams competitors adopted their business models to the new

environment. For example, Marks & Spencer as well as John Lewis almost doubled their online

sales, while Debenhams continued to focus on physical stores. Section D evaluates new

Debenhams strategy with focus on online sales and better customer experience. However, in

must be remembered that Debenhams introduced their new strategy only in 2016-2017,

therefore it is too early to expect positive changes in profitability and share price index.

The last section E of the report suggest recommendations for Debenhams. It is notable, that

Debenhams is moving into the right direction. However, there are some internal issues that

should be considered. For example, shared vision is not set among all employees.

Furthermore, there is no direct communication channel between regular employees senior

management. The following report suggests to implement the employee cross functional

suggestion program to improve communication channels and align all employees in

innovation process. Finally, Debenhams should better encourage career progression to make

employees motivated.

Executive summary

Section A of the report primarily focuses on theoretical background and driving forces of

innovation. The whole retailer sector is not a stranger to the waves of innovation because

digital economy is currently disrupting the retail industry. Debenhams Plc Share price

plummeted when online retailers penetrated the market in 2008. The downward trend in the

number of physical stores forces Debenhams to identify new online distribution channels in

order to continue generating revenues.

Section B analyses Debenhams internal factors. It is notable that both previous leaders Mr.

Sharp and Mr. Templeman did not adopt the Debenhams existing business model to the new

digital environment due to poor innovative climate within organisation and strong

organisational foundations that were formed more than 200 years ago. In 2016, Sergio

Bucher, used his knowledge, gained in Amazon, and announced new strategy with focus on

online selling and better customer experience by introducing social shopping within physical

stores. Debenhams, headed by Sergio Bucher started moving towards entrepreneurial culture

and organic structure. Nonetheless, interviews conducted with employees in Debenhams

Guildford department has showed that Debenhams did not introduce a fully organic

structure.

Section C analyses how Debenhams competitors adopted their business models to the new

environment. For example, Marks & Spencer as well as John Lewis almost doubled their online

sales, while Debenhams continued to focus on physical stores. Section D evaluates new

Debenhams strategy with focus on online sales and better customer experience. However, in

must be remembered that Debenhams introduced their new strategy only in 2016-2017,

therefore it is too early to expect positive changes in profitability and share price index.

The last section E of the report suggest recommendations for Debenhams. It is notable, that

Debenhams is moving into the right direction. However, there are some internal issues that

should be considered. For example, shared vision is not set among all employees.

Furthermore, there is no direct communication channel between regular employees senior

management. The following report suggests to implement the employee cross functional

suggestion program to improve communication channels and align all employees in

innovation process. Finally, Debenhams should better encourage career progression to make

employees motivated.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

Table of Contents

Executive Summary ....................................................................................... 4

Part A Introduction ....................................................................................... 6

1.1 Introduction .......................................................................................................................... 6

1.2 Debenhams Profile .............................................................................................................. 7

1.3 Debenhams SWOT Analysis ............................................................................................... 8

Part B Debenhams Internal Factors ................................................................ 9

2.1 Debenhams Leadership and Structure ................................................................................. 9

2.2 Debenhams Culture ............................................................................................................ 10

Part C Debenhams External Factors ............................................................. 12

3.1 E-commerce Trends ........................................................................................................... 12

3.2 Debenhams Porter’s 5 Forces Analysis ............................................................................. 13

3.3 Debenhams Other External Factors ................................................................................... 14

Part D Debenhams Strategy ......................................................................... 15

Part E Recommendations for Debenhams ................................................... 16

List of Figures

Figure 1.1 Organizational Architecture ..................................................................................... 6

Figure 1.2 Debenhams Plc Share Price ..................................................................................... 7

Figure 1.3 Debenhams Business Cycle ...................................................................................... 7

Figure 2.1 Debenhams Organizational Structure ....................................................................... 9

Figure 2.2 Three Levels of Culture ......................................................................................... 11

Figure 3.1 World E-commerce Growth .................................................................................. 12

List of Tables

Table 1.1 Debenhams SWOT Analysis .................................................................................... 8

Table 3.2 Debenhams Porter’s 5 Forcers Analysis .............................................................13-14

List of References………………………………………………………………………………………17

Appendices…………………………………………………………………………………21

Table of Contents

Executive Summary ....................................................................................... 4

Part A Introduction ....................................................................................... 6

1.1 Introduction .......................................................................................................................... 6

1.2 Debenhams Profile .............................................................................................................. 7

1.3 Debenhams SWOT Analysis ............................................................................................... 8

Part B Debenhams Internal Factors ................................................................ 9

2.1 Debenhams Leadership and Structure ................................................................................. 9

2.2 Debenhams Culture ............................................................................................................ 10

Part C Debenhams External Factors ............................................................. 12

3.1 E-commerce Trends ........................................................................................................... 12

3.2 Debenhams Porter’s 5 Forces Analysis ............................................................................. 13

3.3 Debenhams Other External Factors ................................................................................... 14

Part D Debenhams Strategy ......................................................................... 15

Part E Recommendations for Debenhams ................................................... 16

List of Figures

Figure 1.1 Organizational Architecture ..................................................................................... 6

Figure 1.2 Debenhams Plc Share Price ..................................................................................... 7

Figure 1.3 Debenhams Business Cycle ...................................................................................... 7

Figure 2.1 Debenhams Organizational Structure ....................................................................... 9

Figure 2.2 Three Levels of Culture ......................................................................................... 11

Figure 3.1 World E-commerce Growth .................................................................................. 12

List of Tables

Table 1.1 Debenhams SWOT Analysis .................................................................................... 8

Table 3.2 Debenhams Porter’s 5 Forcers Analysis .............................................................13-14

List of References………………………………………………………………………………………17

Appendices…………………………………………………………………………………21

6

Part A – Introduction

1.1 Introduction

In businesses, innovation often results when companies want to further satisfy the needs and

wants of their customers. When organizations set an innovation strategy, they face with a

dilemma whether they should choose incremental or radical innovation path. Incremental

innovation is a reduced risk approach that focuses on adding new features to the existing

product or service to make it more competitive, while radical innovation is about absolutely

new products that transform the market or even creates the new ones (Drucker; 2014).

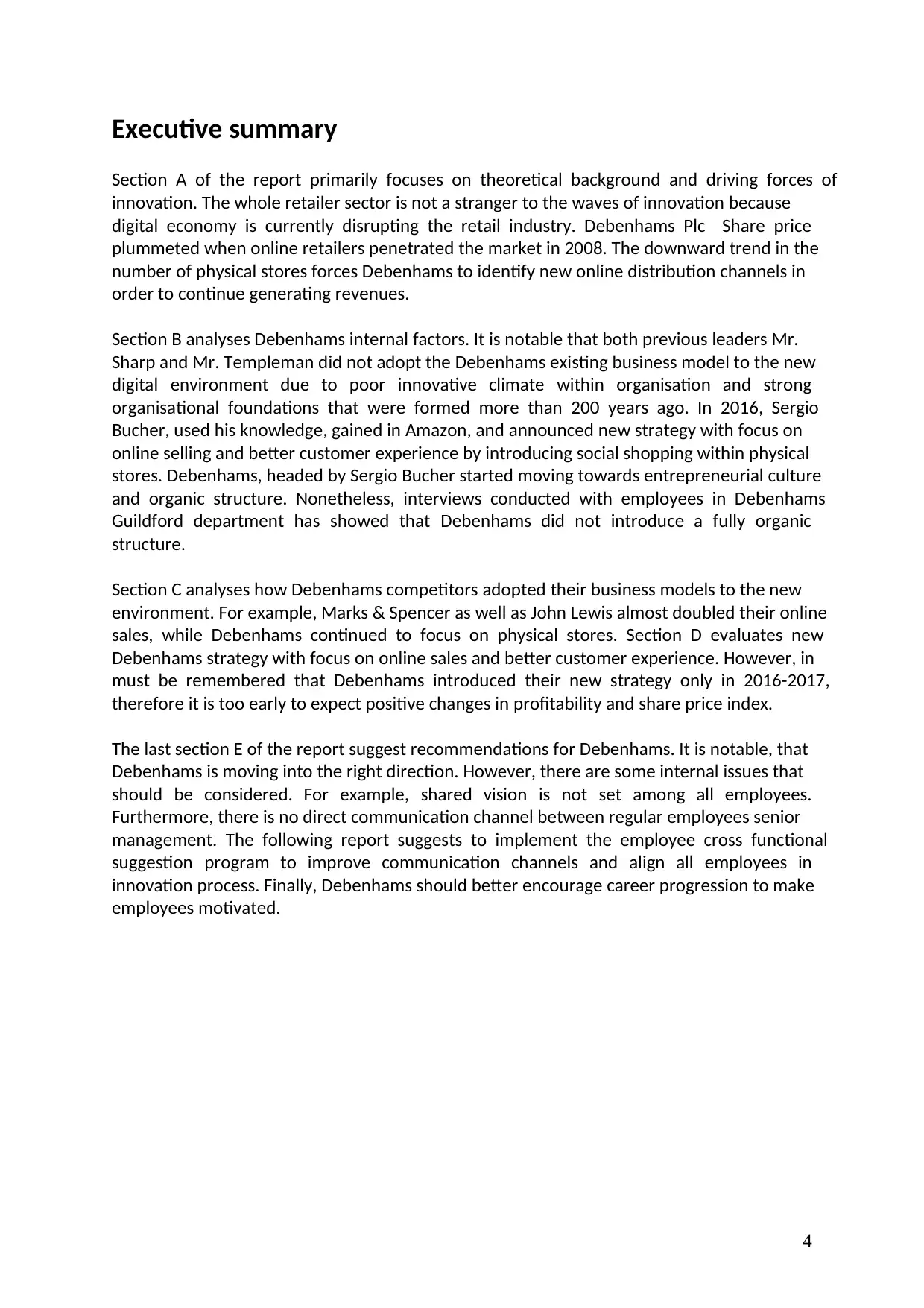

According to Schumpeter (1939) and Kizner (1976), every business is linked to the waves of

innovation, because when a product changes positively, other organizations must seek

innovations in order compete and continue making profits. In order to innovate successfully

and quicker respond to external factors, organizational architecture should be created based

on trust, openness and self-interest. Figure 1.1 shows that organizational architecture

consists of both internal and external components.

Figure 1.1 Organizational Architecture

Source: Burns; 2013

Internal architecture primarily focuses on employees generating a strong sense of collectivism

based on shared objectives and commonly accepted strategies. The leader is responsible for

creating a structure and culture within organization. External environment effect culture

constantly and the leader must be responsive to it and being able to adopt the strategy to the

new environment.

The whole retail sector is not a stranger to innovation. Digitalisation of economy and mobile

shopping are currently disrupting the retail industry (Hendrikzs; 2018). Retail firms that

operate online have much less operating expenses compared to firms with physical store.

Therefore, online retailers could afford spend more funds on promotion. The downward

trend in the number of physical stores forces existing retail firms to find innovative

Internal Architecture External Architecture

Part A – Introduction

1.1 Introduction

In businesses, innovation often results when companies want to further satisfy the needs and

wants of their customers. When organizations set an innovation strategy, they face with a

dilemma whether they should choose incremental or radical innovation path. Incremental

innovation is a reduced risk approach that focuses on adding new features to the existing

product or service to make it more competitive, while radical innovation is about absolutely

new products that transform the market or even creates the new ones (Drucker; 2014).

According to Schumpeter (1939) and Kizner (1976), every business is linked to the waves of

innovation, because when a product changes positively, other organizations must seek

innovations in order compete and continue making profits. In order to innovate successfully

and quicker respond to external factors, organizational architecture should be created based

on trust, openness and self-interest. Figure 1.1 shows that organizational architecture

consists of both internal and external components.

Figure 1.1 Organizational Architecture

Source: Burns; 2013

Internal architecture primarily focuses on employees generating a strong sense of collectivism

based on shared objectives and commonly accepted strategies. The leader is responsible for

creating a structure and culture within organization. External environment effect culture

constantly and the leader must be responsive to it and being able to adopt the strategy to the

new environment.

The whole retail sector is not a stranger to innovation. Digitalisation of economy and mobile

shopping are currently disrupting the retail industry (Hendrikzs; 2018). Retail firms that

operate online have much less operating expenses compared to firms with physical store.

Therefore, online retailers could afford spend more funds on promotion. The downward

trend in the number of physical stores forces existing retail firms to find innovative

Internal Architecture External Architecture

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

approaches towards reaching and selling products to customers (Rigby; 2017). Debenhams

Plc is one of the UK’s retail firms that is currently looking for solutions in order to adopt the

existing business model to the new environment.

1.2 Debenhams Profile

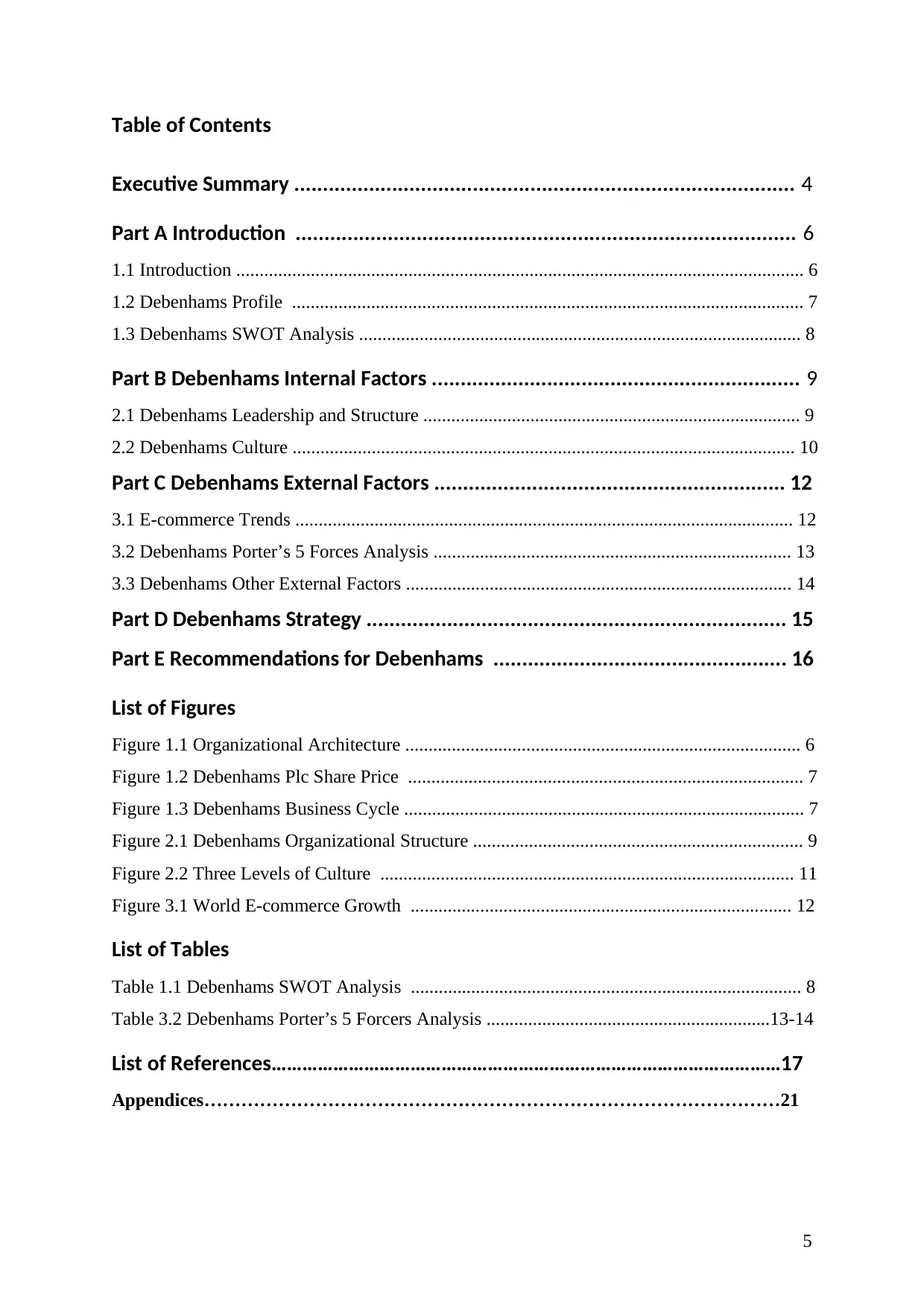

Debenhams plc is a United Kingdom-based company, which is engaged in multi-channel

business. Debenhams’s is operating in approximately 240 stores in 27 countries. There are

two main segments: UK and International. The UK segment consists of both physical stores

and online sales. Physical stores offer customers a great number of services such as

restaurants and cafes, personal shopping assistance, hairdressing, beauty treatments and nail

bars (Proactiveinvestors.com; 2018). The international segment consists mainly from

franchise stores. Nonetheless, Debenham’s own stores in Denmark in the Republic of Ireland.

Debenhams is currently promoting the online sales outside the UK, however due to high

competition and online retailers such as Amazon, Debenhams is facing challenges (Reuters;

2018). Figure 1.1 shows the downward trend of the Debenhams share price from 2006 to

2018.

Figure 1.1 Debenhams Plc Share Price

Source: Google Finance; 2018

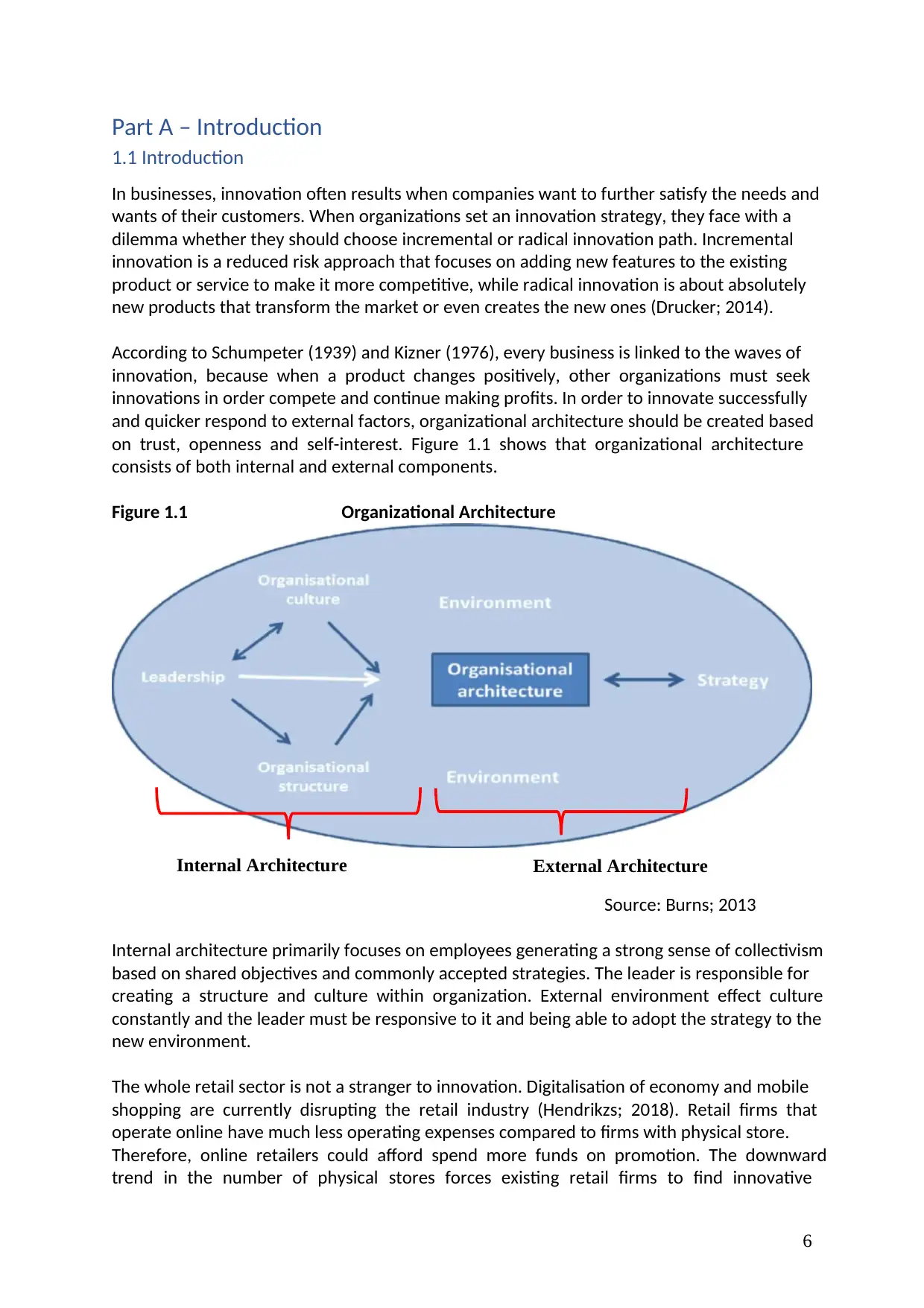

According to Figure 1.1, the share price dropped from 201 GBX in 2006 to 22.12 in 2018 and

this proves that Debenhams Plc is experiencing significant challenges both internal and

external. Debenhams was established in 1813 and according to the share prices dynamics,

currently is at the very end of its life cycle and entered phase “Decline”.

Figure 1.3 Debenhams Business Cycle

approaches towards reaching and selling products to customers (Rigby; 2017). Debenhams

Plc is one of the UK’s retail firms that is currently looking for solutions in order to adopt the

existing business model to the new environment.

1.2 Debenhams Profile

Debenhams plc is a United Kingdom-based company, which is engaged in multi-channel

business. Debenhams’s is operating in approximately 240 stores in 27 countries. There are

two main segments: UK and International. The UK segment consists of both physical stores

and online sales. Physical stores offer customers a great number of services such as

restaurants and cafes, personal shopping assistance, hairdressing, beauty treatments and nail

bars (Proactiveinvestors.com; 2018). The international segment consists mainly from

franchise stores. Nonetheless, Debenham’s own stores in Denmark in the Republic of Ireland.

Debenhams is currently promoting the online sales outside the UK, however due to high

competition and online retailers such as Amazon, Debenhams is facing challenges (Reuters;

2018). Figure 1.1 shows the downward trend of the Debenhams share price from 2006 to

2018.

Figure 1.1 Debenhams Plc Share Price

Source: Google Finance; 2018

According to Figure 1.1, the share price dropped from 201 GBX in 2006 to 22.12 in 2018 and

this proves that Debenhams Plc is experiencing significant challenges both internal and

external. Debenhams was established in 1813 and according to the share prices dynamics,

currently is at the very end of its life cycle and entered phase “Decline”.

Figure 1.3 Debenhams Business Cycle

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Therefore, Debenhams have to innovate in order to extend the business cycle and continue

generating profits.

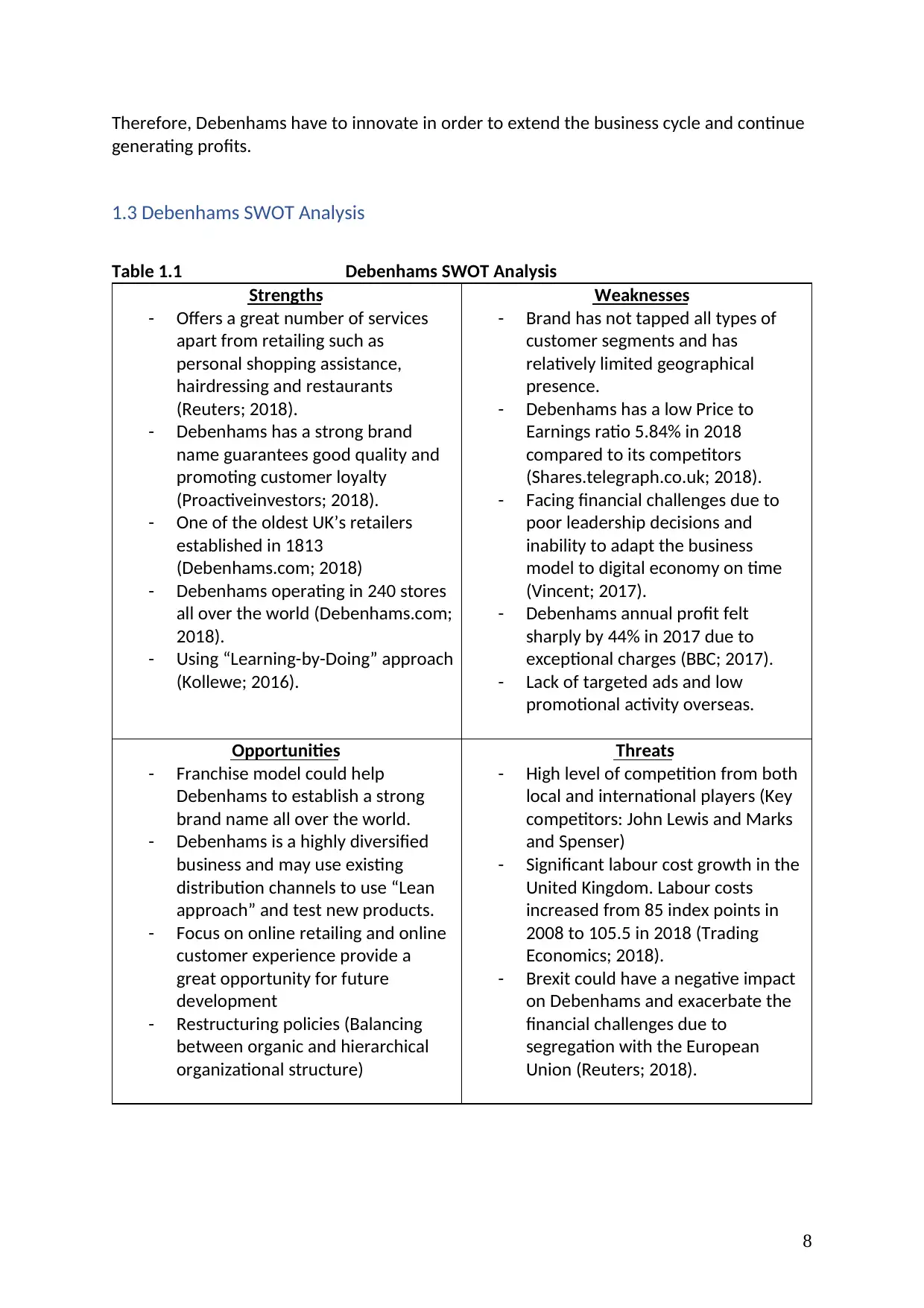

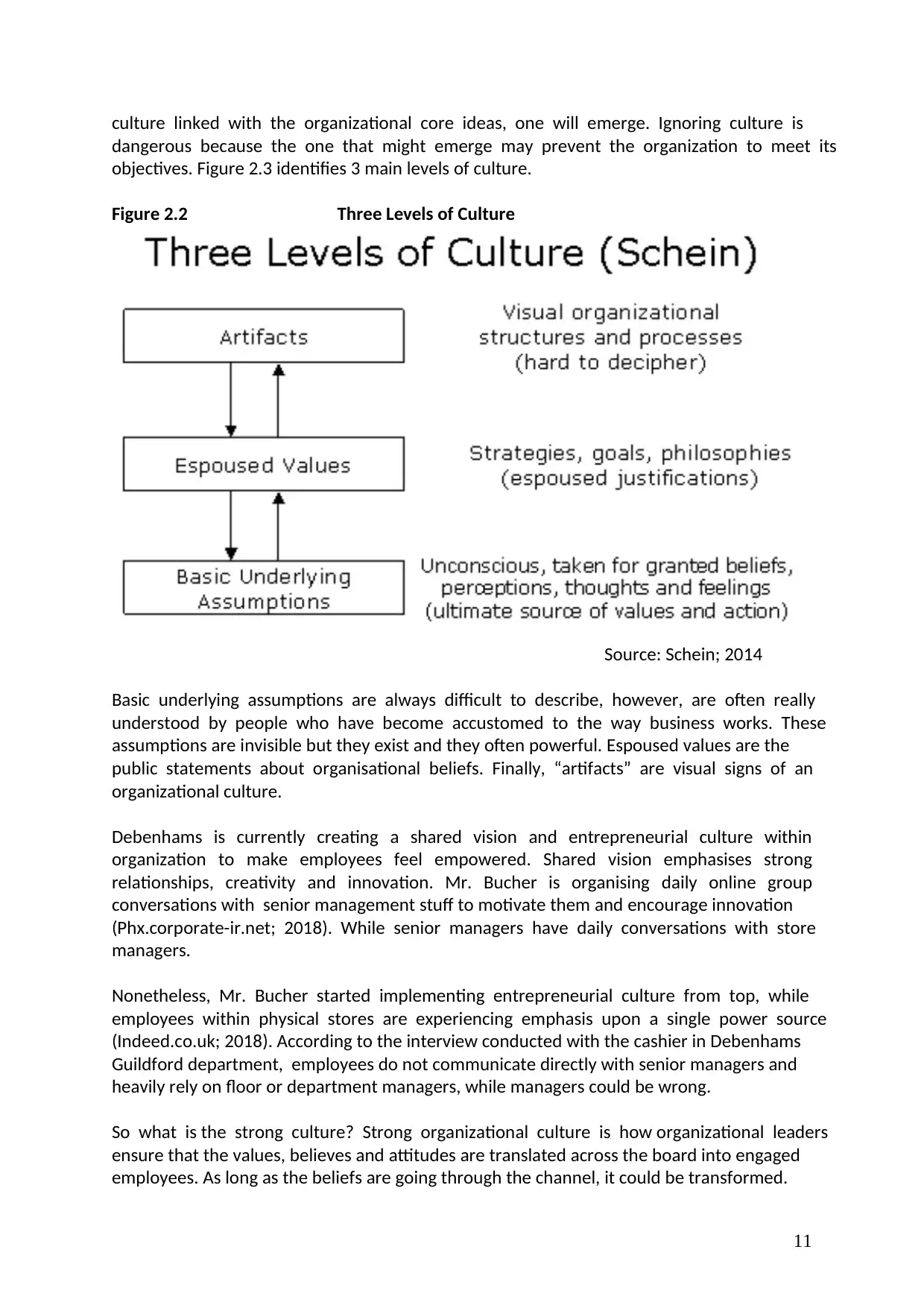

1.3 Debenhams SWOT Analysis

Table 1.1 Debenhams SWOT Analysis

Strengths

- Offers a great number of services

apart from retailing such as

personal shopping assistance,

hairdressing and restaurants

(Reuters; 2018).

- Debenhams has a strong brand

name guarantees good quality and

promoting customer loyalty

(Proactiveinvestors; 2018).

- One of the oldest UK’s retailers

established in 1813

(Debenhams.com; 2018)

- Debenhams operating in 240 stores

all over the world (Debenhams.com;

2018).

- Using “Learning-by-Doing” approach

(Kollewe; 2016).

Weaknesses

- Brand has not tapped all types of

customer segments and has

relatively limited geographical

presence.

- Debenhams has a low Price to

Earnings ratio 5.84% in 2018

compared to its competitors

(Shares.telegraph.co.uk; 2018).

- Facing financial challenges due to

poor leadership decisions and

inability to adapt the business

model to digital economy on time

(Vincent; 2017).

- Debenhams annual profit felt

sharply by 44% in 2017 due to

exceptional charges (BBC; 2017).

- Lack of targeted ads and low

promotional activity overseas.

Opportunities

- Franchise model could help

Debenhams to establish a strong

brand name all over the world.

- Debenhams is a highly diversified

business and may use existing

distribution channels to use “Lean

approach” and test new products.

- Focus on online retailing and online

customer experience provide a

great opportunity for future

development

- Restructuring policies (Balancing

between organic and hierarchical

organizational structure)

Threats

- High level of competition from both

local and international players (Key

competitors: John Lewis and Marks

and Spenser)

- Significant labour cost growth in the

United Kingdom. Labour costs

increased from 85 index points in

2008 to 105.5 in 2018 (Trading

Economics; 2018).

- Brexit could have a negative impact

on Debenhams and exacerbate the

financial challenges due to

segregation with the European

Union (Reuters; 2018).

Therefore, Debenhams have to innovate in order to extend the business cycle and continue

generating profits.

1.3 Debenhams SWOT Analysis

Table 1.1 Debenhams SWOT Analysis

Strengths

- Offers a great number of services

apart from retailing such as

personal shopping assistance,

hairdressing and restaurants

(Reuters; 2018).

- Debenhams has a strong brand

name guarantees good quality and

promoting customer loyalty

(Proactiveinvestors; 2018).

- One of the oldest UK’s retailers

established in 1813

(Debenhams.com; 2018)

- Debenhams operating in 240 stores

all over the world (Debenhams.com;

2018).

- Using “Learning-by-Doing” approach

(Kollewe; 2016).

Weaknesses

- Brand has not tapped all types of

customer segments and has

relatively limited geographical

presence.

- Debenhams has a low Price to

Earnings ratio 5.84% in 2018

compared to its competitors

(Shares.telegraph.co.uk; 2018).

- Facing financial challenges due to

poor leadership decisions and

inability to adapt the business

model to digital economy on time

(Vincent; 2017).

- Debenhams annual profit felt

sharply by 44% in 2017 due to

exceptional charges (BBC; 2017).

- Lack of targeted ads and low

promotional activity overseas.

Opportunities

- Franchise model could help

Debenhams to establish a strong

brand name all over the world.

- Debenhams is a highly diversified

business and may use existing

distribution channels to use “Lean

approach” and test new products.

- Focus on online retailing and online

customer experience provide a

great opportunity for future

development

- Restructuring policies (Balancing

between organic and hierarchical

organizational structure)

Threats

- High level of competition from both

local and international players (Key

competitors: John Lewis and Marks

and Spenser)

- Significant labour cost growth in the

United Kingdom. Labour costs

increased from 85 index points in

2008 to 105.5 in 2018 (Trading

Economics; 2018).

- Brexit could have a negative impact

on Debenhams and exacerbate the

financial challenges due to

segregation with the European

Union (Reuters; 2018).

9

Part B – Debenhams Internal Factors

2.1 Debenhams Leadership and Structure

It is notable that leading organization towards innovation process requires distinctive skills

and capabilities. Nonetheless, it is vital to distinguish between entrepreneurial and

management leadership. Management is more concerned about handling complexity in

organizational processes and efficiency, while entrepreneurial leadership is much more

concerned with setting strategic goals and general direction and less about detail.

When Debenhams faced with challenges in 2008, both previous leaders Templeman and

Sharp continued to promote their existing business model with little changes: Debenhams

purchased the Faith concessions trading within its stores and started focusing more on luxury

segment thus investing significant sums in refurbishment of the stores (BBC news; 2016).

In 2016, Sergio Bucher, former vice-president of Amazon’s European fashion business

replaced Mr. Sharp and brought participative leadership style to Debenhams. Mr. Bucher

announced new strategy with major focus on online selling and better customer experience.

The next sections will analyse how new Debenhams leader is setting a shared vision and

implementing the new strategy. It is notable that both Mr. Sharp and Mr Templeman did not

recognise the importance of digital strategy and online sales. In 2016 digital sales were only

15% compared to 35% at John Lewis (Kakar; 2018).

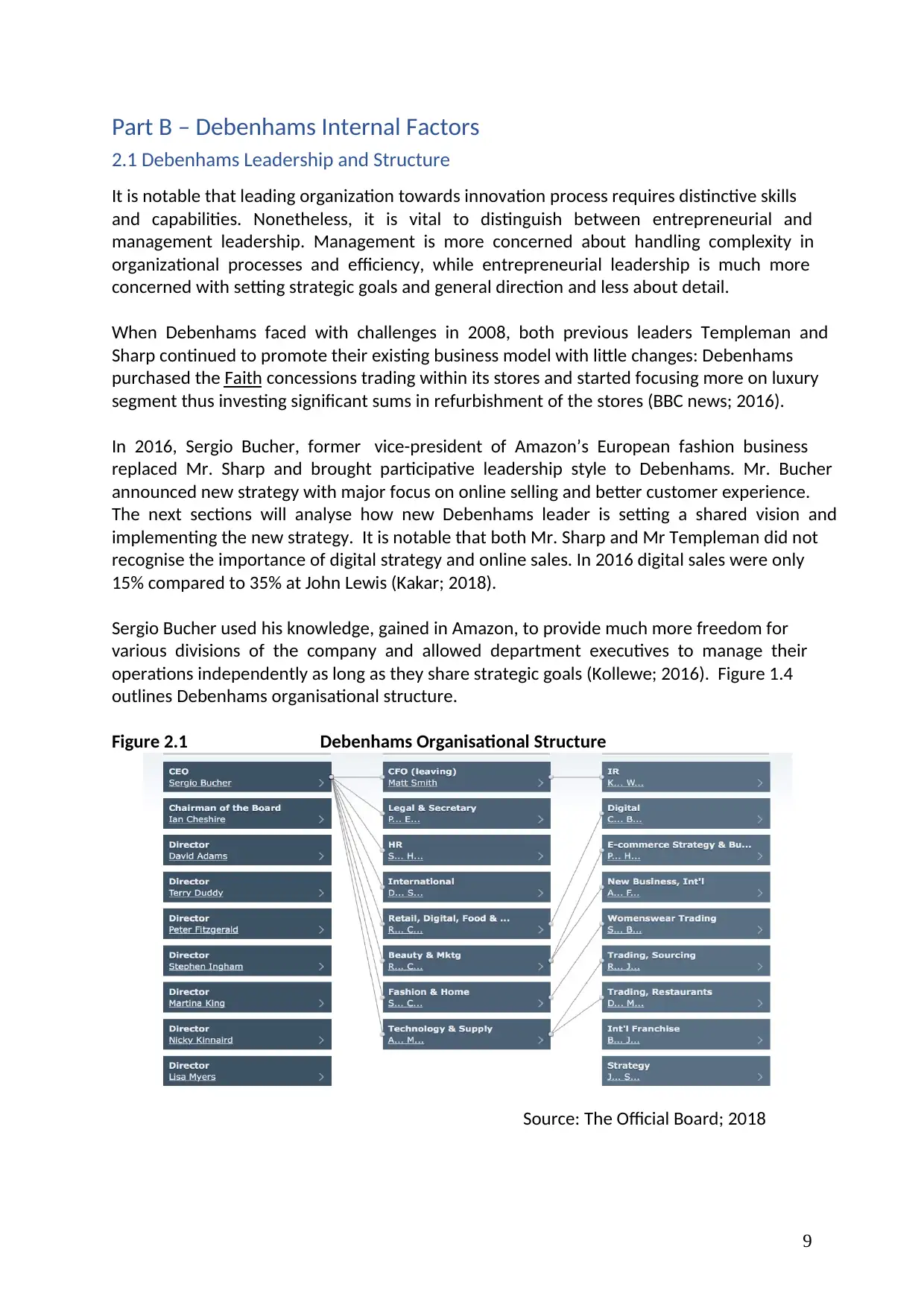

Sergio Bucher used his knowledge, gained in Amazon, to provide much more freedom for

various divisions of the company and allowed department executives to manage their

operations independently as long as they share strategic goals (Kollewe; 2016). Figure 1.4

outlines Debenhams organisational structure.

Figure 2.1 Debenhams Organisational Structure

Source: The Official Board; 2018

Part B – Debenhams Internal Factors

2.1 Debenhams Leadership and Structure

It is notable that leading organization towards innovation process requires distinctive skills

and capabilities. Nonetheless, it is vital to distinguish between entrepreneurial and

management leadership. Management is more concerned about handling complexity in

organizational processes and efficiency, while entrepreneurial leadership is much more

concerned with setting strategic goals and general direction and less about detail.

When Debenhams faced with challenges in 2008, both previous leaders Templeman and

Sharp continued to promote their existing business model with little changes: Debenhams

purchased the Faith concessions trading within its stores and started focusing more on luxury

segment thus investing significant sums in refurbishment of the stores (BBC news; 2016).

In 2016, Sergio Bucher, former vice-president of Amazon’s European fashion business

replaced Mr. Sharp and brought participative leadership style to Debenhams. Mr. Bucher

announced new strategy with major focus on online selling and better customer experience.

The next sections will analyse how new Debenhams leader is setting a shared vision and

implementing the new strategy. It is notable that both Mr. Sharp and Mr Templeman did not

recognise the importance of digital strategy and online sales. In 2016 digital sales were only

15% compared to 35% at John Lewis (Kakar; 2018).

Sergio Bucher used his knowledge, gained in Amazon, to provide much more freedom for

various divisions of the company and allowed department executives to manage their

operations independently as long as they share strategic goals (Kollewe; 2016). Figure 1.4

outlines Debenhams organisational structure.

Figure 2.1 Debenhams Organisational Structure

Source: The Official Board; 2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

Debenhams CEO headed for providing more autonomy to its divisions and headed to

gradually substitute the mechanistic structure on horizontal structure (organic). It is a

significant step in becoming a learning organisation and consequently, becoming more

responsive to factors and trends (Craven; 2017). As long as all employees are motivated and

have enough autonomy, they will generate ideas on how to increase efficiency and

productivity and their ideas will not pass through the long channel to reach senior managers.

Before 2016, Debenhams used centralized structure. The research conducted by Swamy

(2014) showed that 20-15% of European companies are still using centralized structure with

focus on specialization. Nonetheless, Swamy (2014) argued that in order to extend the

business cycle by identifying possible innovations, centralized structure is not useful.

Traditionally, retail companies do not have R&D departments and all innovations are initiated

by managers and executives of different departments. In this case, Debenhams’s divisions

should be extremely autonomous in order to innovate successfully. For example, the

“process” of selling goods in stores could be improved by store employees as long as they

may have better understanding of internal environment within stores.

Based on the interview, conducted with Debenhams senior consultant, management is

currently providing support rather than direction. Customer service employees are allowed

to design the store and suggest how to improve the efficiency. Nonetheless, the ideas

generated by employees are still “filtered” by managers and then only transmitted to senior

management. Consequently, there is no direct communication channel. However,

Debenhams is working on creating a direct communication channel. Therefore, Debenhams

still did not adopt completely organic structure.

However, the losses from previous innovative initiations and bold decisions were significant,

therefore Bucher is not aiming to create a fully organic structure. Bucher is concerned that

autonomously could also lead to anarchy within organization. For example, Oticon, producer

of hearing aids, reorganized its business into 100 self-directed project teams seeking

innovative approach to increase sales. However, within 6 years Oticon reintroduced more

hierarchical control (Jardine; 2013). It may be argued that Debenhams is currently balancing

between hierarchical and organic structure.

It is notable that all online retailers, including Amazon, have an independent R&D department

that focuses on new products and improving existing products because online retailing is

closely linked with computer technologies and digital marketing (Jolly; 2017). As long as

Debenhams is moving towards increasing in online sales volume, they should consider

creating a powerful R&D department that would maintain the existing sales channels and

identify the new ones. As long as Debenhams is a highly differentiated business with its nail

bars, cafes, online and physical stores and etcetera, R&D should connect all divisions and

create a direct link to Debenhams core ideas.

2.2 Debenhams Culture

One of the major components of Debenhams architecture that drives innovation is culture.

Burns (2013) describes organizational culture as the set of norms, basic beliefs and

assumptions regarding behaviour that underpin that group. If a leader does not impose a

Debenhams CEO headed for providing more autonomy to its divisions and headed to

gradually substitute the mechanistic structure on horizontal structure (organic). It is a

significant step in becoming a learning organisation and consequently, becoming more

responsive to factors and trends (Craven; 2017). As long as all employees are motivated and

have enough autonomy, they will generate ideas on how to increase efficiency and

productivity and their ideas will not pass through the long channel to reach senior managers.

Before 2016, Debenhams used centralized structure. The research conducted by Swamy

(2014) showed that 20-15% of European companies are still using centralized structure with

focus on specialization. Nonetheless, Swamy (2014) argued that in order to extend the

business cycle by identifying possible innovations, centralized structure is not useful.

Traditionally, retail companies do not have R&D departments and all innovations are initiated

by managers and executives of different departments. In this case, Debenhams’s divisions

should be extremely autonomous in order to innovate successfully. For example, the

“process” of selling goods in stores could be improved by store employees as long as they

may have better understanding of internal environment within stores.

Based on the interview, conducted with Debenhams senior consultant, management is

currently providing support rather than direction. Customer service employees are allowed

to design the store and suggest how to improve the efficiency. Nonetheless, the ideas

generated by employees are still “filtered” by managers and then only transmitted to senior

management. Consequently, there is no direct communication channel. However,

Debenhams is working on creating a direct communication channel. Therefore, Debenhams

still did not adopt completely organic structure.

However, the losses from previous innovative initiations and bold decisions were significant,

therefore Bucher is not aiming to create a fully organic structure. Bucher is concerned that

autonomously could also lead to anarchy within organization. For example, Oticon, producer

of hearing aids, reorganized its business into 100 self-directed project teams seeking

innovative approach to increase sales. However, within 6 years Oticon reintroduced more

hierarchical control (Jardine; 2013). It may be argued that Debenhams is currently balancing

between hierarchical and organic structure.

It is notable that all online retailers, including Amazon, have an independent R&D department

that focuses on new products and improving existing products because online retailing is

closely linked with computer technologies and digital marketing (Jolly; 2017). As long as

Debenhams is moving towards increasing in online sales volume, they should consider

creating a powerful R&D department that would maintain the existing sales channels and

identify the new ones. As long as Debenhams is a highly differentiated business with its nail

bars, cafes, online and physical stores and etcetera, R&D should connect all divisions and

create a direct link to Debenhams core ideas.

2.2 Debenhams Culture

One of the major components of Debenhams architecture that drives innovation is culture.

Burns (2013) describes organizational culture as the set of norms, basic beliefs and

assumptions regarding behaviour that underpin that group. If a leader does not impose a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

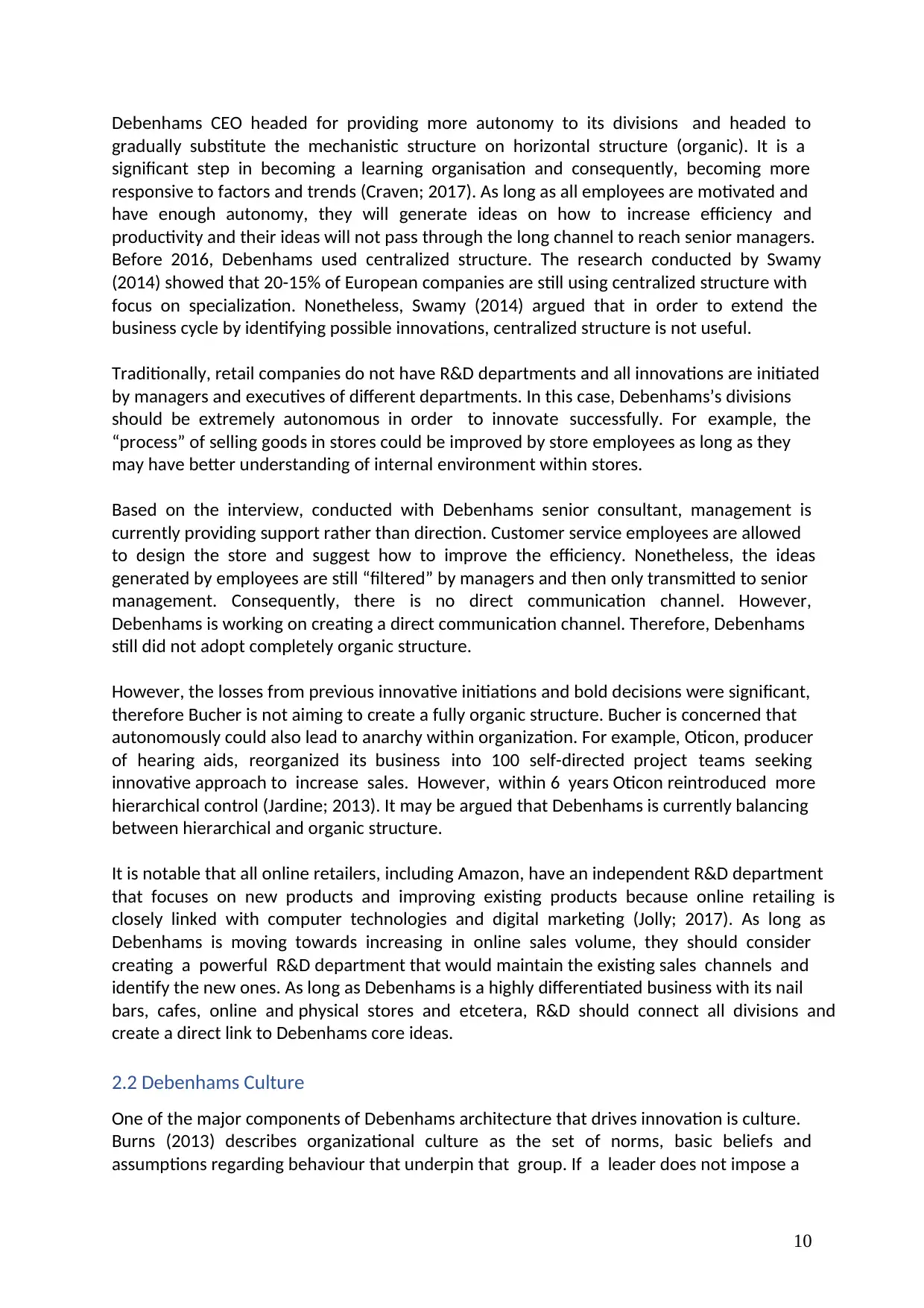

culture linked with the organizational core ideas, one will emerge. Ignoring culture is

dangerous because the one that might emerge may prevent the organization to meet its

objectives. Figure 2.3 identifies 3 main levels of culture.

Figure 2.2 Three Levels of Culture

Source: Schein; 2014

Basic underlying assumptions are always difficult to describe, however, are often really

understood by people who have become accustomed to the way business works. These

assumptions are invisible but they exist and they often powerful. Espoused values are the

public statements about organisational beliefs. Finally, “artifacts” are visual signs of an

organizational culture.

Debenhams is currently creating a shared vision and entrepreneurial culture within

organization to make employees feel empowered. Shared vision emphasises strong

relationships, creativity and innovation. Mr. Bucher is organising daily online group

conversations with senior management stuff to motivate them and encourage innovation

(Phx.corporate-ir.net; 2018). While senior managers have daily conversations with store

managers.

Nonetheless, Mr. Bucher started implementing entrepreneurial culture from top, while

employees within physical stores are experiencing emphasis upon a single power source

(Indeed.co.uk; 2018). According to the interview conducted with the cashier in Debenhams

Guildford department, employees do not communicate directly with senior managers and

heavily rely on floor or department managers, while managers could be wrong.

So what is the strong culture? Strong organizational culture is how organizational leaders

ensure that the values, believes and attitudes are translated across the board into engaged

employees. As long as the beliefs are going through the channel, it could be transformed.

culture linked with the organizational core ideas, one will emerge. Ignoring culture is

dangerous because the one that might emerge may prevent the organization to meet its

objectives. Figure 2.3 identifies 3 main levels of culture.

Figure 2.2 Three Levels of Culture

Source: Schein; 2014

Basic underlying assumptions are always difficult to describe, however, are often really

understood by people who have become accustomed to the way business works. These

assumptions are invisible but they exist and they often powerful. Espoused values are the

public statements about organisational beliefs. Finally, “artifacts” are visual signs of an

organizational culture.

Debenhams is currently creating a shared vision and entrepreneurial culture within

organization to make employees feel empowered. Shared vision emphasises strong

relationships, creativity and innovation. Mr. Bucher is organising daily online group

conversations with senior management stuff to motivate them and encourage innovation

(Phx.corporate-ir.net; 2018). While senior managers have daily conversations with store

managers.

Nonetheless, Mr. Bucher started implementing entrepreneurial culture from top, while

employees within physical stores are experiencing emphasis upon a single power source

(Indeed.co.uk; 2018). According to the interview conducted with the cashier in Debenhams

Guildford department, employees do not communicate directly with senior managers and

heavily rely on floor or department managers, while managers could be wrong.

So what is the strong culture? Strong organizational culture is how organizational leaders

ensure that the values, believes and attitudes are translated across the board into engaged

employees. As long as the beliefs are going through the channel, it could be transformed.

12

Amazon implemented the cross-functional employee suggestion program, where the

company only set the suggestion guidelines. It is highly likely that Mr. Bucher would

implement something similar.

“Artifacts” on the Debenhams website such as “Drive Our Growth” shows that Debenhams

considers its employees as partners (Debemhams.co.uk; 2018).

Furthermore, management stuff always ask what they could do to make the job better

(Indeed.co.uk; 2018). It may be argued that Mr Bucher did everything possible to introduce

the entrepreneurial culture with emphasis on future. Employees within stores are allowed to

make personal calls and leave the work earlier. Debenhams do not want employees who are

“clock watchers”.

However, employees are not satisfied with culture in Debenhams. Based on the employees’

reviews made from 2016 to 2018, culture has only 3.4 points out of 5 (Indeed.co.uk; 2018).

Nonetheless, due to financial challenges, many employees at Debenhams works at the rate

close to the minimum wage rate in the UK (£7.83 per hour in 2018) (Gov.vo.uk; 2018).

Therefore, financial challenges could slow down the new culture adoption process.

Part C – Debenhams External Factors

3.1 E-commerce Trends

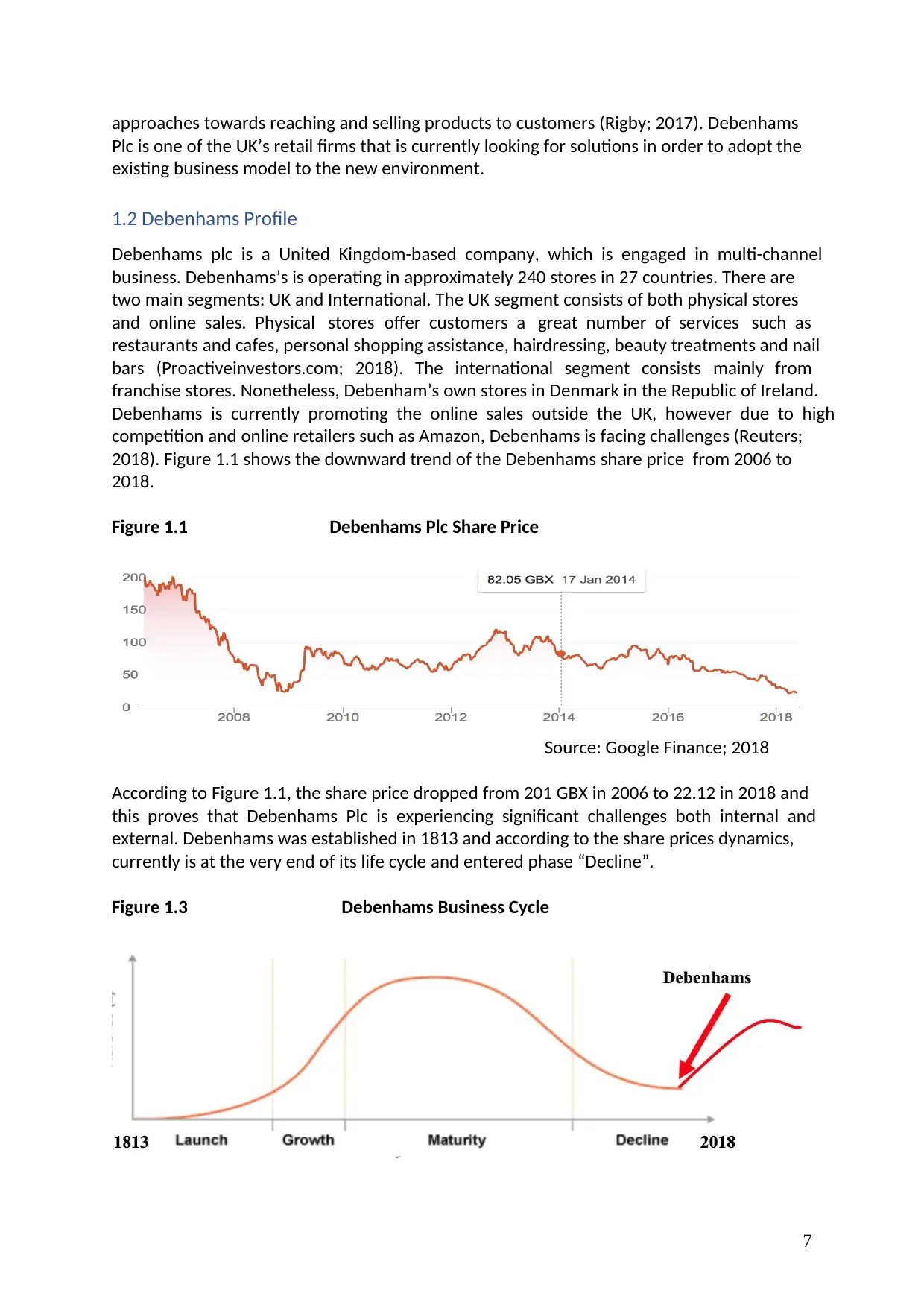

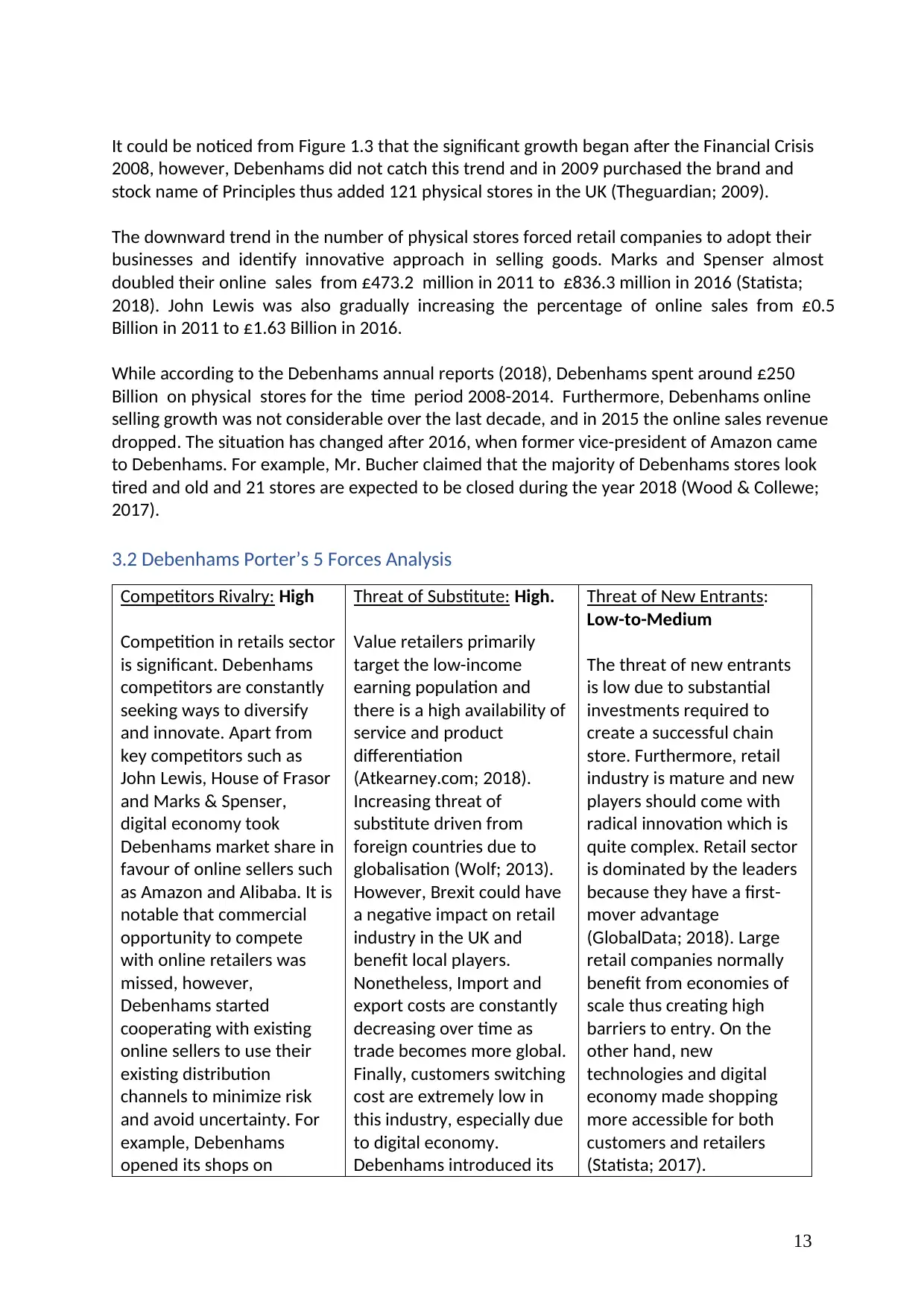

UK retails sector is growing fast and contributed £194 Billion to UK economic output in 2017.

This was an increase from £190 Billion in 2016. There are around 542,000 businesses

operating in UK’s retail sector in 2017 (Gov.uk; 2018). It is notable that the total proportion

of online sales have risen from 2.7 % in 2007 to 17.1% in 2017.

Debenhams started having financial problems in 2007, 2 years after the IPO. The challenges

faced by the organization forced the leaders to change the strategy and find alternative

solutions, however, it took almost 10 years to find the correct strategy (Cunliffe; 2008). Figure

1.3 shows the world e-commerce growth dynamics from 2000 to 2015.

Figure 3.1 World E-commerce Growth

Source: Statista; 2017

Amazon implemented the cross-functional employee suggestion program, where the

company only set the suggestion guidelines. It is highly likely that Mr. Bucher would

implement something similar.

“Artifacts” on the Debenhams website such as “Drive Our Growth” shows that Debenhams

considers its employees as partners (Debemhams.co.uk; 2018).

Furthermore, management stuff always ask what they could do to make the job better

(Indeed.co.uk; 2018). It may be argued that Mr Bucher did everything possible to introduce

the entrepreneurial culture with emphasis on future. Employees within stores are allowed to

make personal calls and leave the work earlier. Debenhams do not want employees who are

“clock watchers”.

However, employees are not satisfied with culture in Debenhams. Based on the employees’

reviews made from 2016 to 2018, culture has only 3.4 points out of 5 (Indeed.co.uk; 2018).

Nonetheless, due to financial challenges, many employees at Debenhams works at the rate

close to the minimum wage rate in the UK (£7.83 per hour in 2018) (Gov.vo.uk; 2018).

Therefore, financial challenges could slow down the new culture adoption process.

Part C – Debenhams External Factors

3.1 E-commerce Trends

UK retails sector is growing fast and contributed £194 Billion to UK economic output in 2017.

This was an increase from £190 Billion in 2016. There are around 542,000 businesses

operating in UK’s retail sector in 2017 (Gov.uk; 2018). It is notable that the total proportion

of online sales have risen from 2.7 % in 2007 to 17.1% in 2017.

Debenhams started having financial problems in 2007, 2 years after the IPO. The challenges

faced by the organization forced the leaders to change the strategy and find alternative

solutions, however, it took almost 10 years to find the correct strategy (Cunliffe; 2008). Figure

1.3 shows the world e-commerce growth dynamics from 2000 to 2015.

Figure 3.1 World E-commerce Growth

Source: Statista; 2017

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

13

It could be noticed from Figure 1.3 that the significant growth began after the Financial Crisis

2008, however, Debenhams did not catch this trend and in 2009 purchased the brand and

stock name of Principles thus added 121 physical stores in the UK (Theguardian; 2009).

The downward trend in the number of physical stores forced retail companies to adopt their

businesses and identify innovative approach in selling goods. Marks and Spenser almost

doubled their online sales from £473.2 million in 2011 to £836.3 million in 2016 (Statista;

2018). John Lewis was also gradually increasing the percentage of online sales from £0.5

Billion in 2011 to £1.63 Billion in 2016.

While according to the Debenhams annual reports (2018), Debenhams spent around £250

Billion on physical stores for the time period 2008-2014. Furthermore, Debenhams online

selling growth was not considerable over the last decade, and in 2015 the online sales revenue

dropped. The situation has changed after 2016, when former vice-president of Amazon came

to Debenhams. For example, Mr. Bucher claimed that the majority of Debenhams stores look

tired and old and 21 stores are expected to be closed during the year 2018 (Wood & Collewe;

2017).

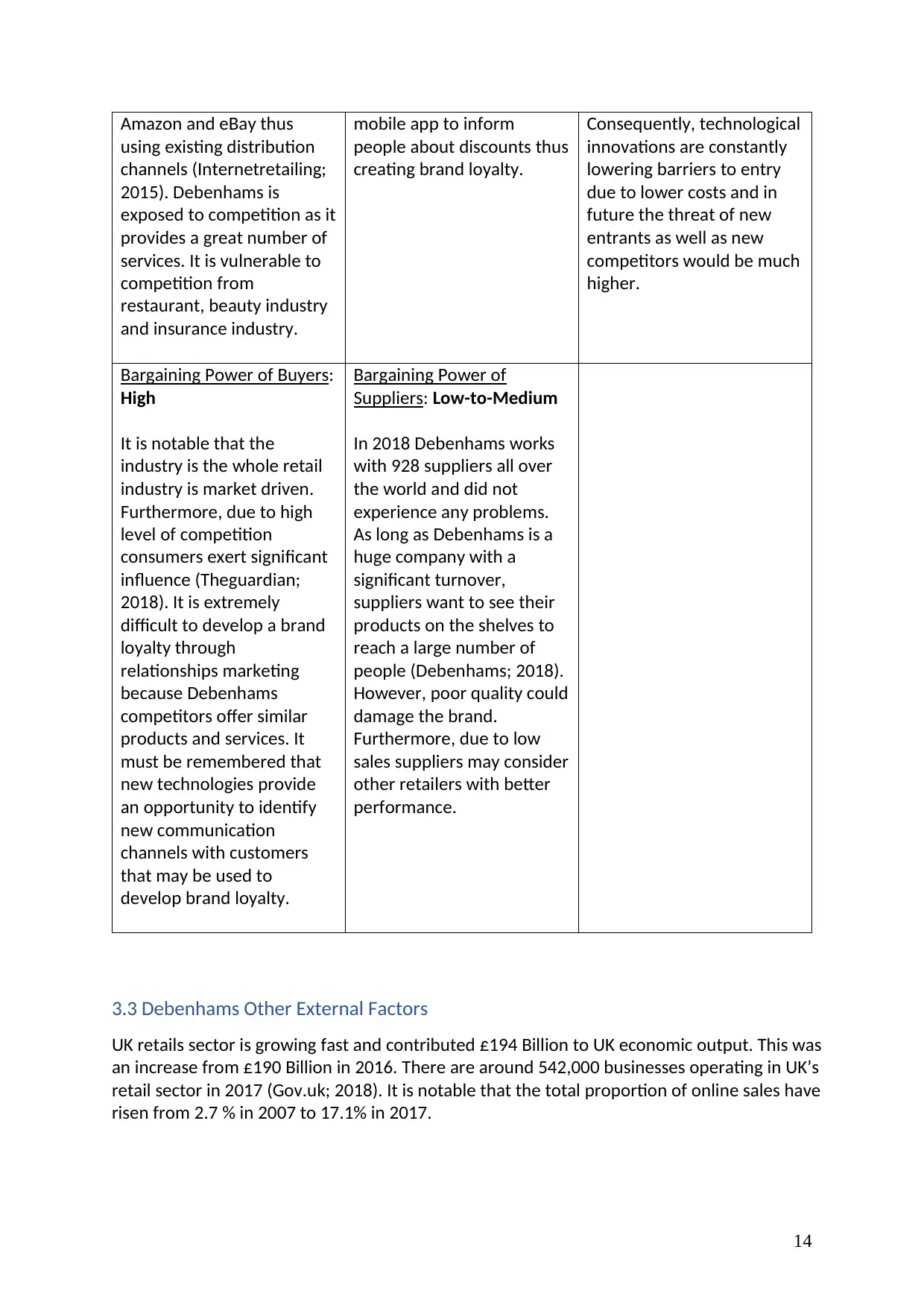

3.2 Debenhams Porter’s 5 Forces Analysis

Competitors Rivalry: High

Competition in retails sector

is significant. Debenhams

competitors are constantly

seeking ways to diversify

and innovate. Apart from

key competitors such as

John Lewis, House of Frasor

and Marks & Spenser,

digital economy took

Debenhams market share in

favour of online sellers such

as Amazon and Alibaba. It is

notable that commercial

opportunity to compete

with online retailers was

missed, however,

Debenhams started

cooperating with existing

online sellers to use their

existing distribution

channels to minimize risk

and avoid uncertainty. For

example, Debenhams

opened its shops on

Threat of Substitute: High.

Value retailers primarily

target the low-income

earning population and

there is a high availability of

service and product

differentiation

(Atkearney.com; 2018).

Increasing threat of

substitute driven from

foreign countries due to

globalisation (Wolf; 2013).

However, Brexit could have

a negative impact on retail

industry in the UK and

benefit local players.

Nonetheless, Import and

export costs are constantly

decreasing over time as

trade becomes more global.

Finally, customers switching

cost are extremely low in

this industry, especially due

to digital economy.

Debenhams introduced its

Threat of New Entrants:

Low-to-Medium

The threat of new entrants

is low due to substantial

investments required to

create a successful chain

store. Furthermore, retail

industry is mature and new

players should come with

radical innovation which is

quite complex. Retail sector

is dominated by the leaders

because they have a first-

mover advantage

(GlobalData; 2018). Large

retail companies normally

benefit from economies of

scale thus creating high

barriers to entry. On the

other hand, new

technologies and digital

economy made shopping

more accessible for both

customers and retailers

(Statista; 2017).

It could be noticed from Figure 1.3 that the significant growth began after the Financial Crisis

2008, however, Debenhams did not catch this trend and in 2009 purchased the brand and

stock name of Principles thus added 121 physical stores in the UK (Theguardian; 2009).

The downward trend in the number of physical stores forced retail companies to adopt their

businesses and identify innovative approach in selling goods. Marks and Spenser almost

doubled their online sales from £473.2 million in 2011 to £836.3 million in 2016 (Statista;

2018). John Lewis was also gradually increasing the percentage of online sales from £0.5

Billion in 2011 to £1.63 Billion in 2016.

While according to the Debenhams annual reports (2018), Debenhams spent around £250

Billion on physical stores for the time period 2008-2014. Furthermore, Debenhams online

selling growth was not considerable over the last decade, and in 2015 the online sales revenue

dropped. The situation has changed after 2016, when former vice-president of Amazon came

to Debenhams. For example, Mr. Bucher claimed that the majority of Debenhams stores look

tired and old and 21 stores are expected to be closed during the year 2018 (Wood & Collewe;

2017).

3.2 Debenhams Porter’s 5 Forces Analysis

Competitors Rivalry: High

Competition in retails sector

is significant. Debenhams

competitors are constantly

seeking ways to diversify

and innovate. Apart from

key competitors such as

John Lewis, House of Frasor

and Marks & Spenser,

digital economy took

Debenhams market share in

favour of online sellers such

as Amazon and Alibaba. It is

notable that commercial

opportunity to compete

with online retailers was

missed, however,

Debenhams started

cooperating with existing

online sellers to use their

existing distribution

channels to minimize risk

and avoid uncertainty. For

example, Debenhams

opened its shops on

Threat of Substitute: High.

Value retailers primarily

target the low-income

earning population and

there is a high availability of

service and product

differentiation

(Atkearney.com; 2018).

Increasing threat of

substitute driven from

foreign countries due to

globalisation (Wolf; 2013).

However, Brexit could have

a negative impact on retail

industry in the UK and

benefit local players.

Nonetheless, Import and

export costs are constantly

decreasing over time as

trade becomes more global.

Finally, customers switching

cost are extremely low in

this industry, especially due

to digital economy.

Debenhams introduced its

Threat of New Entrants:

Low-to-Medium

The threat of new entrants

is low due to substantial

investments required to

create a successful chain

store. Furthermore, retail

industry is mature and new

players should come with

radical innovation which is

quite complex. Retail sector

is dominated by the leaders

because they have a first-

mover advantage

(GlobalData; 2018). Large

retail companies normally

benefit from economies of

scale thus creating high

barriers to entry. On the

other hand, new

technologies and digital

economy made shopping

more accessible for both

customers and retailers

(Statista; 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

Amazon and eBay thus

using existing distribution

channels (Internetretailing;

2015). Debenhams is

exposed to competition as it

provides a great number of

services. It is vulnerable to

competition from

restaurant, beauty industry

and insurance industry.

mobile app to inform

people about discounts thus

creating brand loyalty.

Consequently, technological

innovations are constantly

lowering barriers to entry

due to lower costs and in

future the threat of new

entrants as well as new

competitors would be much

higher.

Bargaining Power of Buyers:

High

It is notable that the

industry is the whole retail

industry is market driven.

Furthermore, due to high

level of competition

consumers exert significant

influence (Theguardian;

2018). It is extremely

difficult to develop a brand

loyalty through

relationships marketing

because Debenhams

competitors offer similar

products and services. It

must be remembered that

new technologies provide

an opportunity to identify

new communication

channels with customers

that may be used to

develop brand loyalty.

Bargaining Power of

Suppliers: Low-to-Medium

In 2018 Debenhams works

with 928 suppliers all over

the world and did not

experience any problems.

As long as Debenhams is a

huge company with a

significant turnover,

suppliers want to see their

products on the shelves to

reach a large number of

people (Debenhams; 2018).

However, poor quality could

damage the brand.

Furthermore, due to low

sales suppliers may consider

other retailers with better

performance.

3.3 Debenhams Other External Factors

UK retails sector is growing fast and contributed £194 Billion to UK economic output. This was

an increase from £190 Billion in 2016. There are around 542,000 businesses operating in UK’s

retail sector in 2017 (Gov.uk; 2018). It is notable that the total proportion of online sales have

risen from 2.7 % in 2007 to 17.1% in 2017.

Amazon and eBay thus

using existing distribution

channels (Internetretailing;

2015). Debenhams is

exposed to competition as it

provides a great number of

services. It is vulnerable to

competition from

restaurant, beauty industry

and insurance industry.

mobile app to inform

people about discounts thus

creating brand loyalty.

Consequently, technological

innovations are constantly

lowering barriers to entry

due to lower costs and in

future the threat of new

entrants as well as new

competitors would be much

higher.

Bargaining Power of Buyers:

High

It is notable that the

industry is the whole retail

industry is market driven.

Furthermore, due to high

level of competition

consumers exert significant

influence (Theguardian;

2018). It is extremely

difficult to develop a brand

loyalty through

relationships marketing

because Debenhams

competitors offer similar

products and services. It

must be remembered that

new technologies provide

an opportunity to identify

new communication

channels with customers

that may be used to

develop brand loyalty.

Bargaining Power of

Suppliers: Low-to-Medium

In 2018 Debenhams works

with 928 suppliers all over

the world and did not

experience any problems.

As long as Debenhams is a

huge company with a

significant turnover,

suppliers want to see their

products on the shelves to

reach a large number of

people (Debenhams; 2018).

However, poor quality could

damage the brand.

Furthermore, due to low

sales suppliers may consider

other retailers with better

performance.

3.3 Debenhams Other External Factors

UK retails sector is growing fast and contributed £194 Billion to UK economic output. This was

an increase from £190 Billion in 2016. There are around 542,000 businesses operating in UK’s

retail sector in 2017 (Gov.uk; 2018). It is notable that the total proportion of online sales have

risen from 2.7 % in 2007 to 17.1% in 2017.

15

Marks and Spenser almost doubled their online sales from £473.2 million in 2011 to £836.3

million in 2016 (Statista; 2018). John Lewis was also gradually increasing the percentage of

online sales from £0.5 Billion in 2011 to £1.63 Billion in 2016.

According to the Debenhams annual reports (2018), Debenhams spent around £250 Billion

on physical stores for the time period 2008-2014. Furthermore, Debenhams online selling

growth was not considerable over the last decade, and in 2015 the online sales revenue

dropped. The situation has changed after 2016, when former vice-president of Amazon came

to Debenhams.

It may be argued that Debenhams completely ignored the external environment and trends

which ultimately led to very poor performance. The foundations that were formed in 1813,

205 years ago, when Debenhams was established, were preventing Debenhams to adopt the

new strategy and identify the importance of having totally different «paradigm».

Finally, the research has showed that UK customers prefer to combine shopping in physical

stores with other leisure activities. The UK leisure sector has 5% annual growth. Taking into

account the fact that customers often visit Debenhams stores with the family, it would be

reasonable for Debenhams to offer some leisure activities inside the stores (Wood & Collowe;

2017).

Part D – Debenhams Strategy

Debenhams existing strategy consists of two main components: focusing on online selling by

creating new online selling channels and integration of social shopping in exiting physical

departments.

The shift towards increase in online sales volumes by investing considerable amount of capital

(£55m) to improve online customer experience. Apart from collaborations with online selling

platforms such as Amazon and eBay, Debenhams launched its new mobile app. It is notable

that 55% of online shopping revenue is generated from mobile app. Debenhams also

established a direct communication channel with customers to respond immediately to

customers preferences (Rigby; 2017). Furthermore, targeted ads on social platforms allows

Debenhams to inform potential customers about new discounts and new goods. Debenhams

started benefiting from new technologies and in 2017, increased its online selling volumes by

17%.

The second strategic component is to focus on social shopping and making store visits a “fun

leisure activity” (Wood & Collewe; 2017). UK leisure sector has grown 5% annually since 2010

and in 2016 worth 4.7% of the UK GDP. Eating out is considered one of the most common

leisure activity as 85% of UK consumers spend money on this activity (Parret; 2016).

As a response to rapid growth of UK leisure activities, Debenhams will provide more space to

new restaurants as well as nail and blow-dry bars. Debenhams is expected to open around

110 new cafes and restaurants inside the physical stores to improve customer experience and

consequently make people visit the store more often.

Marks and Spenser almost doubled their online sales from £473.2 million in 2011 to £836.3

million in 2016 (Statista; 2018). John Lewis was also gradually increasing the percentage of

online sales from £0.5 Billion in 2011 to £1.63 Billion in 2016.

According to the Debenhams annual reports (2018), Debenhams spent around £250 Billion

on physical stores for the time period 2008-2014. Furthermore, Debenhams online selling

growth was not considerable over the last decade, and in 2015 the online sales revenue

dropped. The situation has changed after 2016, when former vice-president of Amazon came

to Debenhams.

It may be argued that Debenhams completely ignored the external environment and trends

which ultimately led to very poor performance. The foundations that were formed in 1813,

205 years ago, when Debenhams was established, were preventing Debenhams to adopt the

new strategy and identify the importance of having totally different «paradigm».

Finally, the research has showed that UK customers prefer to combine shopping in physical

stores with other leisure activities. The UK leisure sector has 5% annual growth. Taking into

account the fact that customers often visit Debenhams stores with the family, it would be

reasonable for Debenhams to offer some leisure activities inside the stores (Wood & Collowe;

2017).

Part D – Debenhams Strategy

Debenhams existing strategy consists of two main components: focusing on online selling by

creating new online selling channels and integration of social shopping in exiting physical

departments.

The shift towards increase in online sales volumes by investing considerable amount of capital

(£55m) to improve online customer experience. Apart from collaborations with online selling

platforms such as Amazon and eBay, Debenhams launched its new mobile app. It is notable

that 55% of online shopping revenue is generated from mobile app. Debenhams also

established a direct communication channel with customers to respond immediately to

customers preferences (Rigby; 2017). Furthermore, targeted ads on social platforms allows

Debenhams to inform potential customers about new discounts and new goods. Debenhams

started benefiting from new technologies and in 2017, increased its online selling volumes by

17%.

The second strategic component is to focus on social shopping and making store visits a “fun

leisure activity” (Wood & Collewe; 2017). UK leisure sector has grown 5% annually since 2010

and in 2016 worth 4.7% of the UK GDP. Eating out is considered one of the most common

leisure activity as 85% of UK consumers spend money on this activity (Parret; 2016).

As a response to rapid growth of UK leisure activities, Debenhams will provide more space to

new restaurants as well as nail and blow-dry bars. Debenhams is expected to open around

110 new cafes and restaurants inside the physical stores to improve customer experience and

consequently make people visit the store more often.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.