ACC511 Managerial Finance: Dell Laptop Plant Project Report Analysis

VerifiedAdded on 2023/01/20

|16

|1953

|46

Report

AI Summary

This report evaluates Dell's decision to invest in a new laptop manufacturing plant, requiring an initial outlay of $500 million. The analysis employs Net Present Value (NPV), Internal Rate of Return (IRR), and payback period methods to assess the project's financial viability over a ten-year period. The report details annual depreciation, cash flows, and terminal values, culminating in a positive NPV and an IRR exceeding the required return, indicating a profitable investment. Furthermore, the report examines the implications of a new financial discipline requiring projects to cover their financing costs annually and calculates the maximum interest rate permissible under this constraint. The report concludes with recommendations based on the financial analysis and a discussion of the risks and benefits of the new financial discipline.

Running Head: Managerial Finance

Managerial Finance

Student Name

University Name

Managerial Finance

Student Name

University Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance

Contents

Executive Summary...................................................................................................................2

Introduction................................................................................................................................3

Capital budgeting decision regarding setting-up a new laptop manufacturing plant.................4

Annual depreciation expenses:...............................................................................................4

Annual cash flows associated with the plant:.........................................................................5

The cash-flows in year-0:.......................................................................................................7

The terminal or year-10 cash flows:.......................................................................................8

The NPV of the project:.........................................................................................................9

The IRR and payback period of the project:........................................................................10

Effect of application of same discount rate to all the projects without considering project

specific risks:........................................................................................................................11

Maximum interest rate on the loan which let the project meets the new financial discipline

requirement:.............................................................................................................................12

Analysis of the new financial discipline requirement:.............................................................13

Conclusions and Recommendations........................................................................................14

References................................................................................................................................15

Appendix A: Excel Spread sheet with detailed calculations....................................................16

1

Contents

Executive Summary...................................................................................................................2

Introduction................................................................................................................................3

Capital budgeting decision regarding setting-up a new laptop manufacturing plant.................4

Annual depreciation expenses:...............................................................................................4

Annual cash flows associated with the plant:.........................................................................5

The cash-flows in year-0:.......................................................................................................7

The terminal or year-10 cash flows:.......................................................................................8

The NPV of the project:.........................................................................................................9

The IRR and payback period of the project:........................................................................10

Effect of application of same discount rate to all the projects without considering project

specific risks:........................................................................................................................11

Maximum interest rate on the loan which let the project meets the new financial discipline

requirement:.............................................................................................................................12

Analysis of the new financial discipline requirement:.............................................................13

Conclusions and Recommendations........................................................................................14

References................................................................................................................................15

Appendix A: Excel Spread sheet with detailed calculations....................................................16

1

Managerial Finance

Executive Summary

This report evaluates Dell’s investment decision regarding setting up of a new laptop

manufacturing plant. This capital budgeting decision is based on the initial outlay and

subsequent cash flows related to this plant. This report uses various methods like NPV, IRR

and payback period to decide whether or not to set-up this plant. The NPV for this project is

positive and the IRR is higher than the required rate of return so it will be profitable for the

company to set up this plant. This report also analyses the new financial discipline which

requires the company to fund only those projects that generate sufficient cash-flows to pay its

financing cost every year.

2

Executive Summary

This report evaluates Dell’s investment decision regarding setting up of a new laptop

manufacturing plant. This capital budgeting decision is based on the initial outlay and

subsequent cash flows related to this plant. This report uses various methods like NPV, IRR

and payback period to decide whether or not to set-up this plant. The NPV for this project is

positive and the IRR is higher than the required rate of return so it will be profitable for the

company to set up this plant. This report also analyses the new financial discipline which

requires the company to fund only those projects that generate sufficient cash-flows to pay its

financing cost every year.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance

Introduction

Dell is a US-based multinational company. It is one of the largest providers of computer

technology and related products and services, employing approximately 157,000 peoples

around the world (Dell annual report, 2019).

Dell is considering setting up a new laptop manufacturing plant which requires an initial

investment of $500 million. This document uses various methods like NPV, IRR and payback

period to decide whether or not to set-up this plant.

This report includes a discussion about the pros and cons of a new financial requirement

which forces the company to fund only those projects that generate sufficient cash-flows to

pay the financing cost every year. This discussion also involves the calculation of the

maximum interest rate on the loan which let this project meets the financial discipline

requirement.

3

Introduction

Dell is a US-based multinational company. It is one of the largest providers of computer

technology and related products and services, employing approximately 157,000 peoples

around the world (Dell annual report, 2019).

Dell is considering setting up a new laptop manufacturing plant which requires an initial

investment of $500 million. This document uses various methods like NPV, IRR and payback

period to decide whether or not to set-up this plant.

This report includes a discussion about the pros and cons of a new financial requirement

which forces the company to fund only those projects that generate sufficient cash-flows to

pay the financing cost every year. This discussion also involves the calculation of the

maximum interest rate on the loan which let this project meets the financial discipline

requirement.

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance

Capital budgeting decision regarding setting-up a new laptop

manufacturing plant

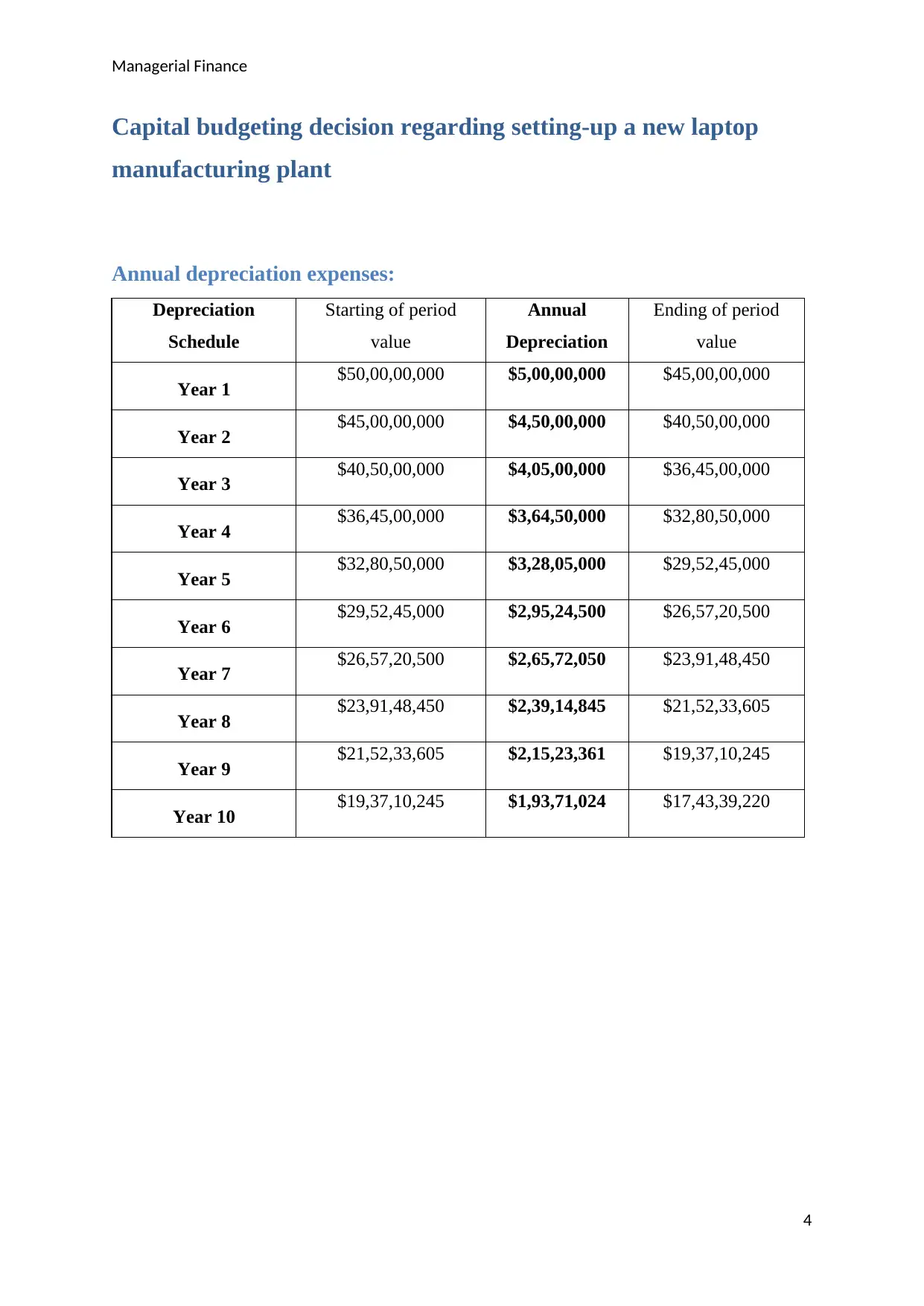

Annual depreciation expenses:

Depreciation

Schedule

Starting of period

value

Annual

Depreciation

Ending of period

value

Year 1 $50,00,00,000 $5,00,00,000 $45,00,00,000

Year 2 $45,00,00,000 $4,50,00,000 $40,50,00,000

Year 3 $40,50,00,000 $4,05,00,000 $36,45,00,000

Year 4 $36,45,00,000 $3,64,50,000 $32,80,50,000

Year 5 $32,80,50,000 $3,28,05,000 $29,52,45,000

Year 6 $29,52,45,000 $2,95,24,500 $26,57,20,500

Year 7 $26,57,20,500 $2,65,72,050 $23,91,48,450

Year 8 $23,91,48,450 $2,39,14,845 $21,52,33,605

Year 9 $21,52,33,605 $2,15,23,361 $19,37,10,245

Year 10 $19,37,10,245 $1,93,71,024 $17,43,39,220

4

Capital budgeting decision regarding setting-up a new laptop

manufacturing plant

Annual depreciation expenses:

Depreciation

Schedule

Starting of period

value

Annual

Depreciation

Ending of period

value

Year 1 $50,00,00,000 $5,00,00,000 $45,00,00,000

Year 2 $45,00,00,000 $4,50,00,000 $40,50,00,000

Year 3 $40,50,00,000 $4,05,00,000 $36,45,00,000

Year 4 $36,45,00,000 $3,64,50,000 $32,80,50,000

Year 5 $32,80,50,000 $3,28,05,000 $29,52,45,000

Year 6 $29,52,45,000 $2,95,24,500 $26,57,20,500

Year 7 $26,57,20,500 $2,65,72,050 $23,91,48,450

Year 8 $23,91,48,450 $2,39,14,845 $21,52,33,605

Year 9 $21,52,33,605 $2,15,23,361 $19,37,10,245

Year 10 $19,37,10,245 $1,93,71,024 $17,43,39,220

4

Managerial Finance

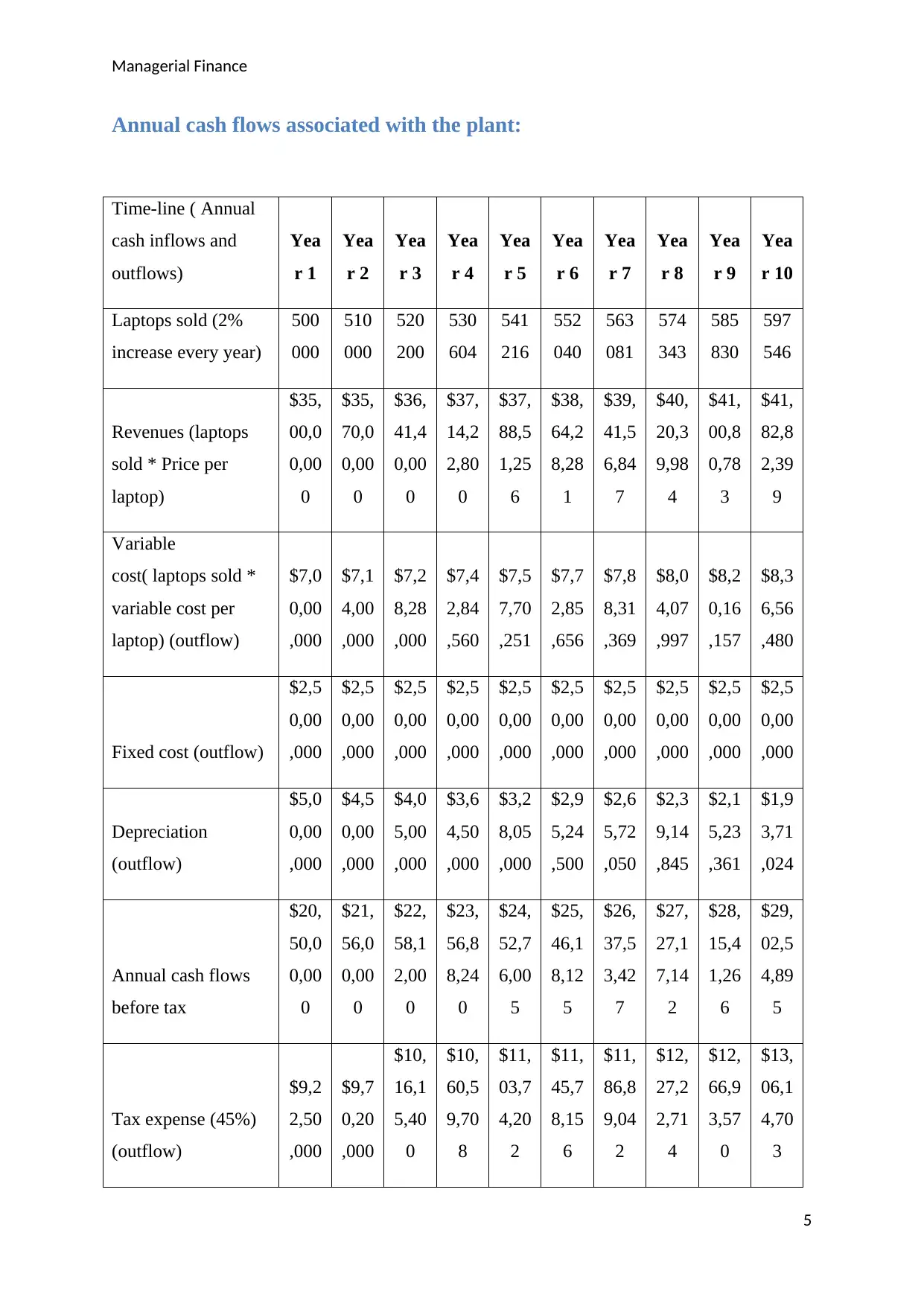

Annual cash flows associated with the plant:

Time-line ( Annual

cash inflows and

outflows)

Yea

r 1

Yea

r 2

Yea

r 3

Yea

r 4

Yea

r 5

Yea

r 6

Yea

r 7

Yea

r 8

Yea

r 9

Yea

r 10

Laptops sold (2%

increase every year)

500

000

510

000

520

200

530

604

541

216

552

040

563

081

574

343

585

830

597

546

Revenues (laptops

sold * Price per

laptop)

$35,

00,0

0,00

0

$35,

70,0

0,00

0

$36,

41,4

0,00

0

$37,

14,2

2,80

0

$37,

88,5

1,25

6

$38,

64,2

8,28

1

$39,

41,5

6,84

7

$40,

20,3

9,98

4

$41,

00,8

0,78

3

$41,

82,8

2,39

9

Variable

cost( laptops sold *

variable cost per

laptop) (outflow)

$7,0

0,00

,000

$7,1

4,00

,000

$7,2

8,28

,000

$7,4

2,84

,560

$7,5

7,70

,251

$7,7

2,85

,656

$7,8

8,31

,369

$8,0

4,07

,997

$8,2

0,16

,157

$8,3

6,56

,480

Fixed cost (outflow)

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

Depreciation

(outflow)

$5,0

0,00

,000

$4,5

0,00

,000

$4,0

5,00

,000

$3,6

4,50

,000

$3,2

8,05

,000

$2,9

5,24

,500

$2,6

5,72

,050

$2,3

9,14

,845

$2,1

5,23

,361

$1,9

3,71

,024

Annual cash flows

before tax

$20,

50,0

0,00

0

$21,

56,0

0,00

0

$22,

58,1

2,00

0

$23,

56,8

8,24

0

$24,

52,7

6,00

5

$25,

46,1

8,12

5

$26,

37,5

3,42

7

$27,

27,1

7,14

2

$28,

15,4

1,26

6

$29,

02,5

4,89

5

Tax expense (45%)

(outflow)

$9,2

2,50

,000

$9,7

0,20

,000

$10,

16,1

5,40

0

$10,

60,5

9,70

8

$11,

03,7

4,20

2

$11,

45,7

8,15

6

$11,

86,8

9,04

2

$12,

27,2

2,71

4

$12,

66,9

3,57

0

$13,

06,1

4,70

3

5

Annual cash flows associated with the plant:

Time-line ( Annual

cash inflows and

outflows)

Yea

r 1

Yea

r 2

Yea

r 3

Yea

r 4

Yea

r 5

Yea

r 6

Yea

r 7

Yea

r 8

Yea

r 9

Yea

r 10

Laptops sold (2%

increase every year)

500

000

510

000

520

200

530

604

541

216

552

040

563

081

574

343

585

830

597

546

Revenues (laptops

sold * Price per

laptop)

$35,

00,0

0,00

0

$35,

70,0

0,00

0

$36,

41,4

0,00

0

$37,

14,2

2,80

0

$37,

88,5

1,25

6

$38,

64,2

8,28

1

$39,

41,5

6,84

7

$40,

20,3

9,98

4

$41,

00,8

0,78

3

$41,

82,8

2,39

9

Variable

cost( laptops sold *

variable cost per

laptop) (outflow)

$7,0

0,00

,000

$7,1

4,00

,000

$7,2

8,28

,000

$7,4

2,84

,560

$7,5

7,70

,251

$7,7

2,85

,656

$7,8

8,31

,369

$8,0

4,07

,997

$8,2

0,16

,157

$8,3

6,56

,480

Fixed cost (outflow)

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

$2,5

0,00

,000

Depreciation

(outflow)

$5,0

0,00

,000

$4,5

0,00

,000

$4,0

5,00

,000

$3,6

4,50

,000

$3,2

8,05

,000

$2,9

5,24

,500

$2,6

5,72

,050

$2,3

9,14

,845

$2,1

5,23

,361

$1,9

3,71

,024

Annual cash flows

before tax

$20,

50,0

0,00

0

$21,

56,0

0,00

0

$22,

58,1

2,00

0

$23,

56,8

8,24

0

$24,

52,7

6,00

5

$25,

46,1

8,12

5

$26,

37,5

3,42

7

$27,

27,1

7,14

2

$28,

15,4

1,26

6

$29,

02,5

4,89

5

Tax expense (45%)

(outflow)

$9,2

2,50

,000

$9,7

0,20

,000

$10,

16,1

5,40

0

$10,

60,5

9,70

8

$11,

03,7

4,20

2

$11,

45,7

8,15

6

$11,

86,8

9,04

2

$12,

27,2

2,71

4

$12,

66,9

3,57

0

$13,

06,1

4,70

3

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance

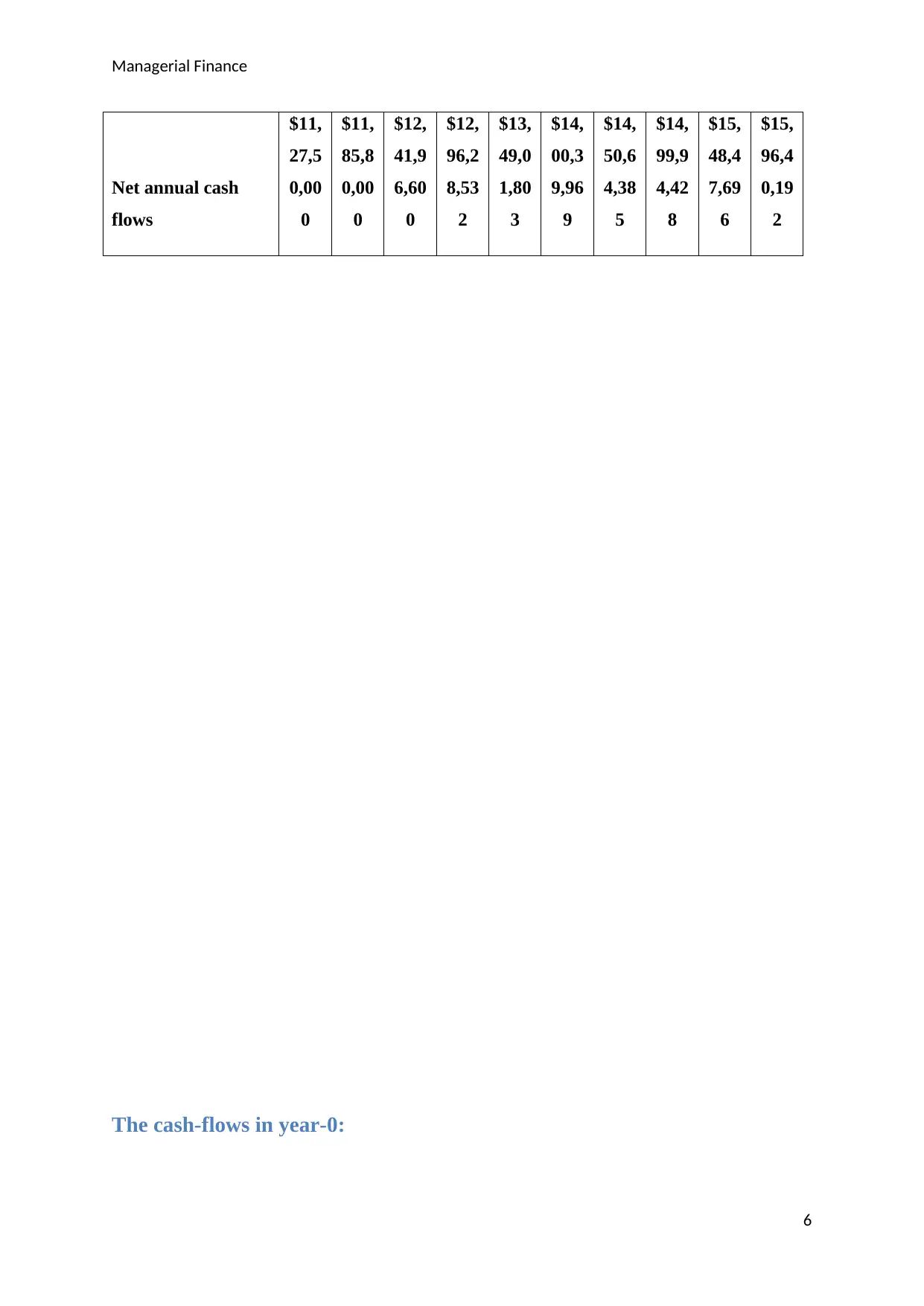

Net annual cash

flows

$11,

27,5

0,00

0

$11,

85,8

0,00

0

$12,

41,9

6,60

0

$12,

96,2

8,53

2

$13,

49,0

1,80

3

$14,

00,3

9,96

9

$14,

50,6

4,38

5

$14,

99,9

4,42

8

$15,

48,4

7,69

6

$15,

96,4

0,19

2

The cash-flows in year-0:

6

Net annual cash

flows

$11,

27,5

0,00

0

$11,

85,8

0,00

0

$12,

41,9

6,60

0

$12,

96,2

8,53

2

$13,

49,0

1,80

3

$14,

00,3

9,96

9

$14,

50,6

4,38

5

$14,

99,9

4,42

8

$15,

48,4

7,69

6

$15,

96,4

0,19

2

The cash-flows in year-0:

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance

Starting Investment (Plant investment + inventory

investment) (outflow) $60,00,00,000

The terminal or year-10 cash flows:

7

Starting Investment (Plant investment + inventory

investment) (outflow) $60,00,00,000

The terminal or year-10 cash flows:

7

Managerial Finance

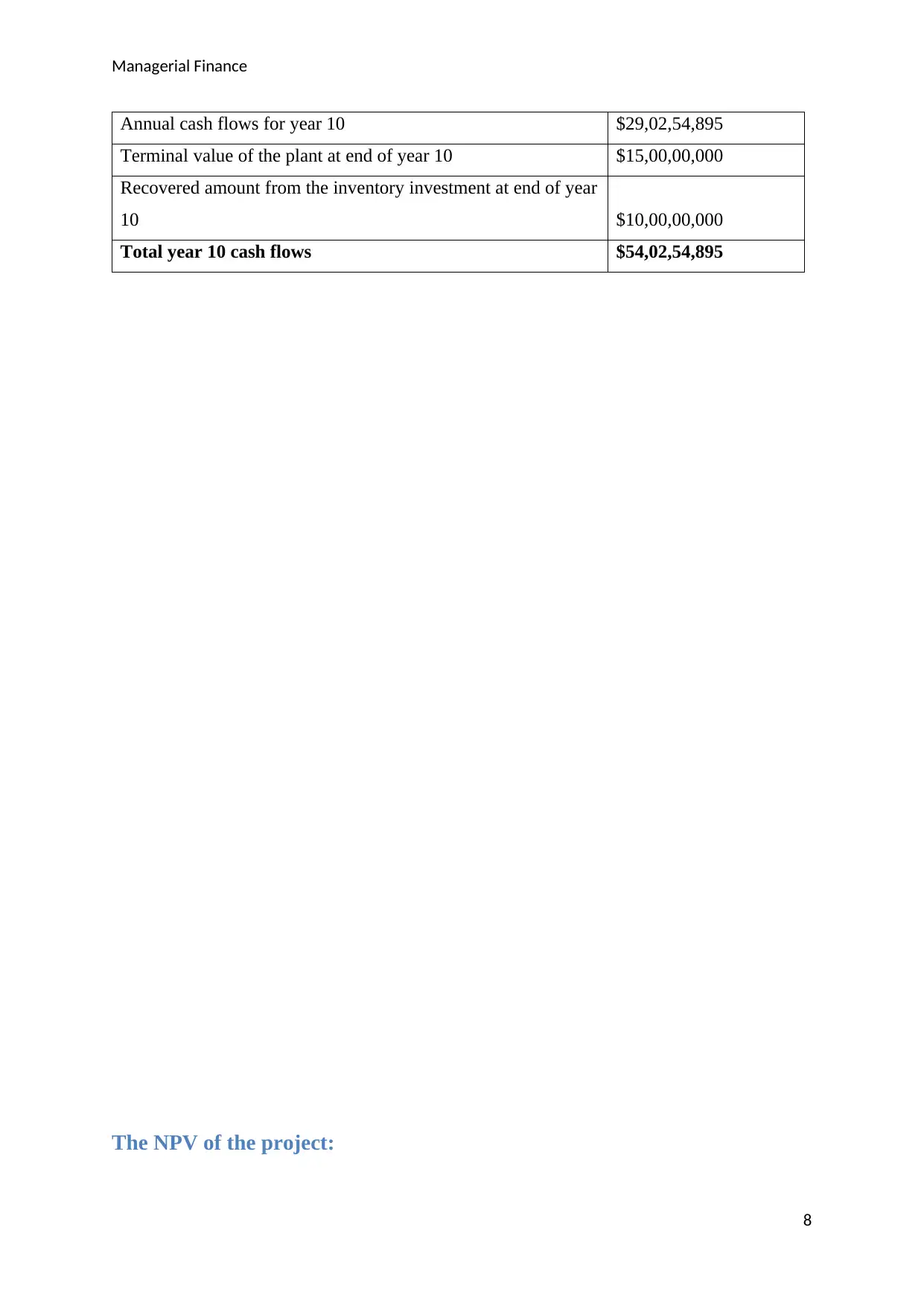

Annual cash flows for year 10 $29,02,54,895

Terminal value of the plant at end of year 10 $15,00,00,000

Recovered amount from the inventory investment at end of year

10 $10,00,00,000

Total year 10 cash flows $54,02,54,895

The NPV of the project:

8

Annual cash flows for year 10 $29,02,54,895

Terminal value of the plant at end of year 10 $15,00,00,000

Recovered amount from the inventory investment at end of year

10 $10,00,00,000

Total year 10 cash flows $54,02,54,895

The NPV of the project:

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Managerial Finance

Year

0

Year

1

Year

2

Year

3

Year

4

Year

5

Year

6

Year

7

Year

8

Year

9

Year

10

Cash

flows

-

$60,

00,0

0,00

0

$11,

27,5

0,00

0

$11,

85,8

0,00

0

$12,

41,9

6,60

0

$12,

96,2

8,53

2

$13,

49,0

1,80

3

$14,

00,3

9,96

9

$14,

50,6

4,38

5

$14,

99,9

4,42

8

$15,

48,4

7,69

6

$54,

02,5

4,89

5

NPV $10,21,15,791

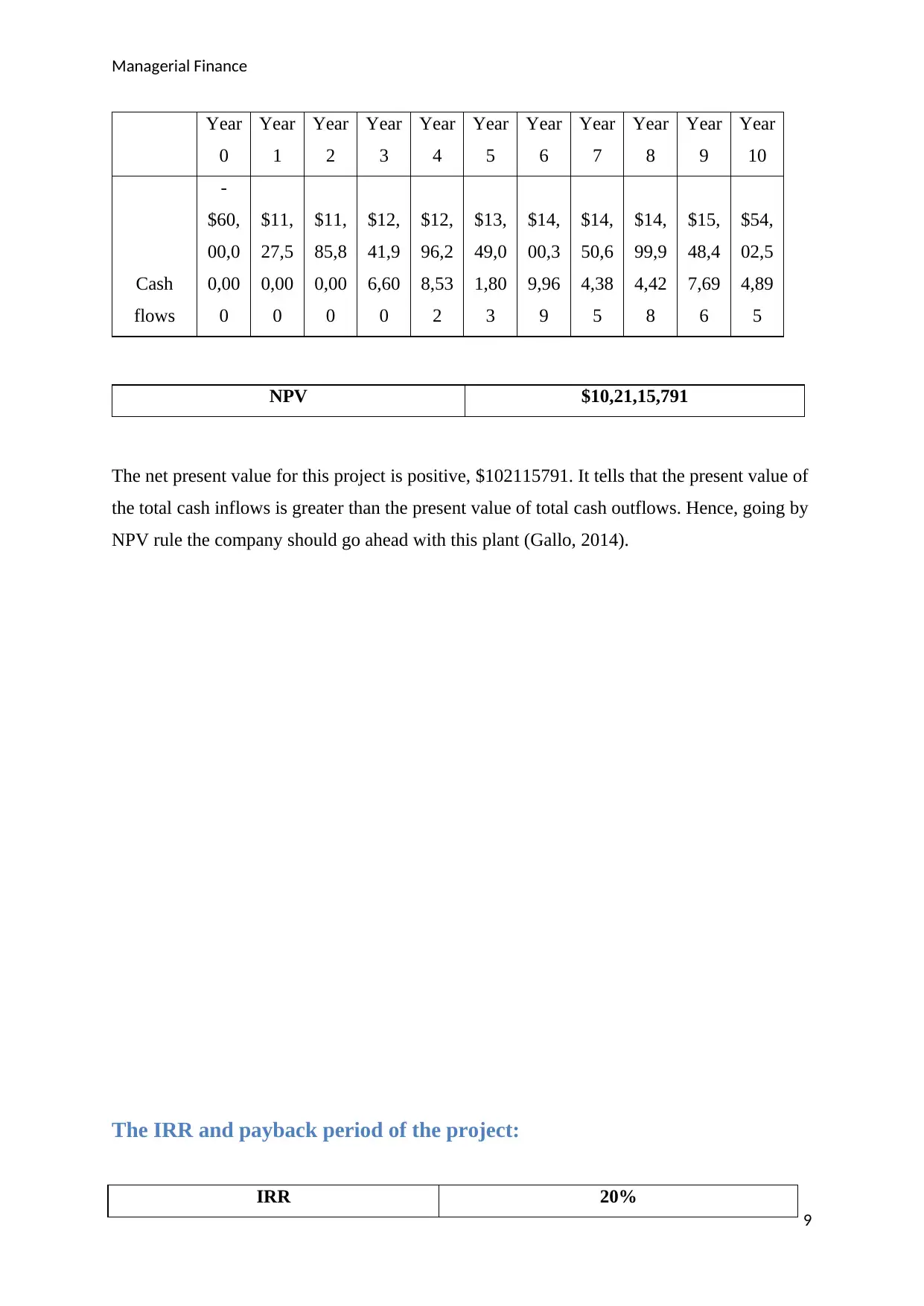

The net present value for this project is positive, $102115791. It tells that the present value of

the total cash inflows is greater than the present value of total cash outflows. Hence, going by

NPV rule the company should go ahead with this plant (Gallo, 2014).

The IRR and payback period of the project:

9

IRR 20%

Year

0

Year

1

Year

2

Year

3

Year

4

Year

5

Year

6

Year

7

Year

8

Year

9

Year

10

Cash

flows

-

$60,

00,0

0,00

0

$11,

27,5

0,00

0

$11,

85,8

0,00

0

$12,

41,9

6,60

0

$12,

96,2

8,53

2

$13,

49,0

1,80

3

$14,

00,3

9,96

9

$14,

50,6

4,38

5

$14,

99,9

4,42

8

$15,

48,4

7,69

6

$54,

02,5

4,89

5

NPV $10,21,15,791

The net present value for this project is positive, $102115791. It tells that the present value of

the total cash inflows is greater than the present value of total cash outflows. Hence, going by

NPV rule the company should go ahead with this plant (Gallo, 2014).

The IRR and payback period of the project:

9

IRR 20%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Managerial Finance

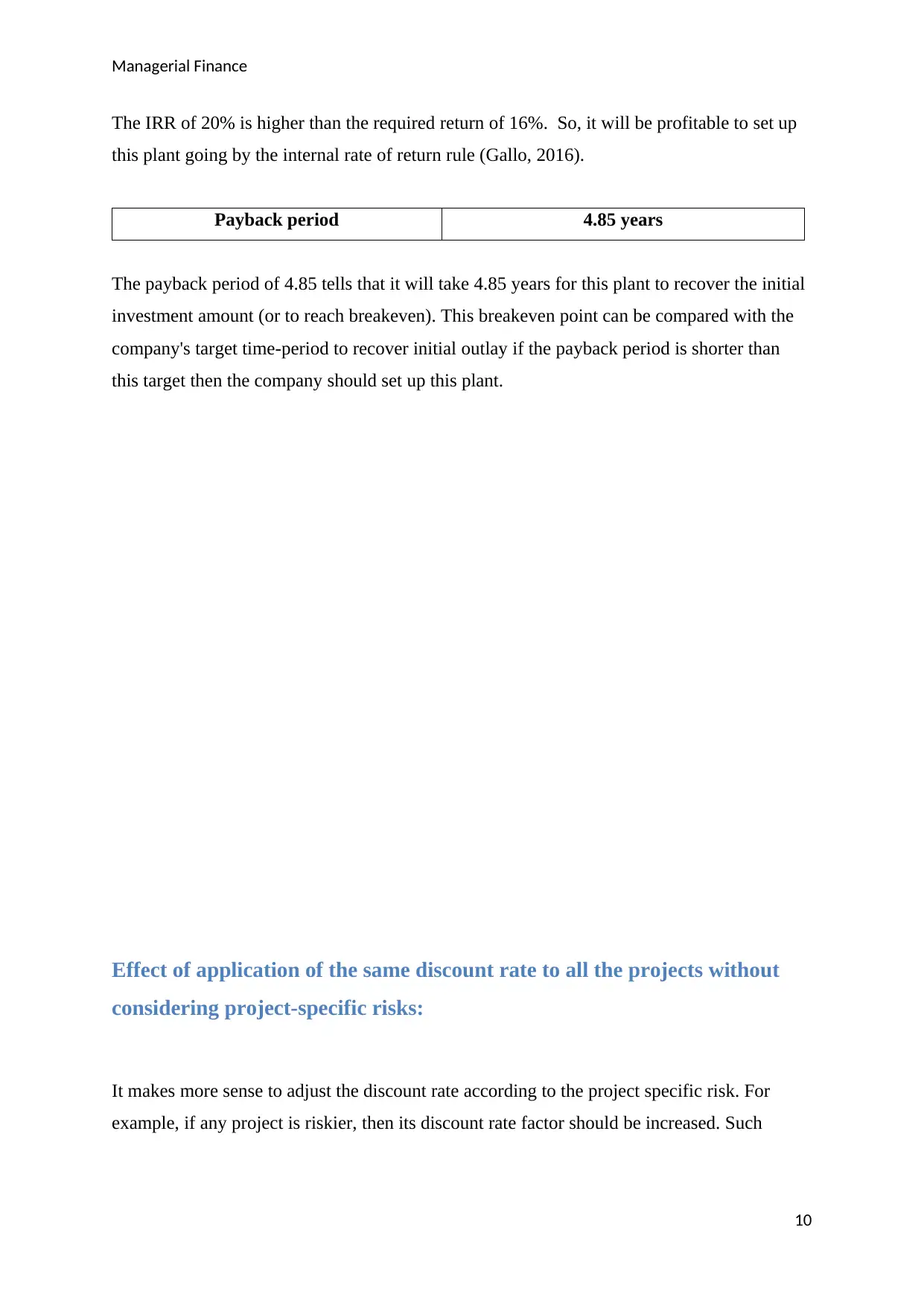

The IRR of 20% is higher than the required return of 16%. So, it will be profitable to set up

this plant going by the internal rate of return rule (Gallo, 2016).

Payback period 4.85 years

The payback period of 4.85 tells that it will take 4.85 years for this plant to recover the initial

investment amount (or to reach breakeven). This breakeven point can be compared with the

company's target time-period to recover initial outlay if the payback period is shorter than

this target then the company should set up this plant.

Effect of application of the same discount rate to all the projects without

considering project-specific risks:

It makes more sense to adjust the discount rate according to the project specific risk. For

example, if any project is riskier, then its discount rate factor should be increased. Such

10

The IRR of 20% is higher than the required return of 16%. So, it will be profitable to set up

this plant going by the internal rate of return rule (Gallo, 2016).

Payback period 4.85 years

The payback period of 4.85 tells that it will take 4.85 years for this plant to recover the initial

investment amount (or to reach breakeven). This breakeven point can be compared with the

company's target time-period to recover initial outlay if the payback period is shorter than

this target then the company should set up this plant.

Effect of application of the same discount rate to all the projects without

considering project-specific risks:

It makes more sense to adjust the discount rate according to the project specific risk. For

example, if any project is riskier, then its discount rate factor should be increased. Such

10

Managerial Finance

discount rate adjustment will result in the reduced present value of the project's future cash

flows indicating the increased uncertainty related to the project.

The maximum interest rate on the loan which let the project

meets the new financial discipline requirement

Cash flows:

11

discount rate adjustment will result in the reduced present value of the project's future cash

flows indicating the increased uncertainty related to the project.

The maximum interest rate on the loan which let the project

meets the new financial discipline requirement

Cash flows:

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.