ECON 8: Essay on the Impact, Advantages, and Disadvantages of Fat-Tax

VerifiedAdded on 2021/06/15

|9

|2150

|90

Essay

AI Summary

This economics essay delves into the concept of fat taxes, examining their implications, advantages, and disadvantages through the lens of a case study on Denmark's implementation and subsequent failure of such a tax. The essay begins by defining fat taxes as a government-imposed surcharge on unhealthy foods and explores the concept of externalities, specifically negative externalities related to the consumption of high-fat and high-sugar foods. It then presents a diagram illustrating the impact of the fat tax on supply, demand, and market equilibrium. The essay then analyzes the reasons behind the failure of the fat tax in Denmark, including cross-border trading, price inelasticity of certain foods, and job losses. Furthermore, it outlines the potential benefits, such as reduced social costs of obesity and healthier eating habits, and disadvantages, such as challenges in selecting taxable foods and the regressive nature of the tax. The essay concludes by summarizing the key findings and reiterating the complexities surrounding fat taxes as a policy instrument.

Running head: ECONOMICS

Impact of Fat-Tax

Name of the Student:

Name of the University:

Author note:

Impact of Fat-Tax

Name of the Student:

Name of the University:

Author note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMICS

Introduction

Fat-tax is a direct tax or surcharge that the government places upon the foods, considered

to be fattening and unhealthy. The aim of this tax is to discourage the consumption of unhealthy

and fattening diet and reduce the incidence of obesity among the people (Smed 2012). The junk

foods and sweets, containing high amount of saturated fat and sugar are the target for this tax. In

October 2011, Denmark introduced fat-tax, first time in the world on fattening milk, butter,

cheese, oil, meat, pizza and processed food items with more than 2.3% saturated food (BBC

News 2011). However, in November 2012, the tax was abolished as it was not a successful

measure to improve the health conditions of the citizens. The essay will highlight the

implications of fat-tax, in terms of externalities, advantages, disadvantages and the reasons for its

failure in Denmark.

Discussion

Externality of fat-tax

Taxes are imposed by governments to earn revenues and in some cases, to discourage

consumption of any product or service, if that is perceived to be harmful. Taxes reduce both the

demand and supply and results in a combination of a price and quantity, in which price is higher

than that without tax, and quantity is lower than without tax. Hence, taxes have impact on free

market equilibrium (Stiglitz and Rosengard 2015). An externality is a consequence of an

economic activity, which leads to inefficient market equilibrium as the equilibrium price does

not reflect the true benefits and costs of the product or service being produced (Farhi and Gabaix

2015). Externalities are of two types, positive and negative. Positive externality refers to the

Introduction

Fat-tax is a direct tax or surcharge that the government places upon the foods, considered

to be fattening and unhealthy. The aim of this tax is to discourage the consumption of unhealthy

and fattening diet and reduce the incidence of obesity among the people (Smed 2012). The junk

foods and sweets, containing high amount of saturated fat and sugar are the target for this tax. In

October 2011, Denmark introduced fat-tax, first time in the world on fattening milk, butter,

cheese, oil, meat, pizza and processed food items with more than 2.3% saturated food (BBC

News 2011). However, in November 2012, the tax was abolished as it was not a successful

measure to improve the health conditions of the citizens. The essay will highlight the

implications of fat-tax, in terms of externalities, advantages, disadvantages and the reasons for its

failure in Denmark.

Discussion

Externality of fat-tax

Taxes are imposed by governments to earn revenues and in some cases, to discourage

consumption of any product or service, if that is perceived to be harmful. Taxes reduce both the

demand and supply and results in a combination of a price and quantity, in which price is higher

than that without tax, and quantity is lower than without tax. Hence, taxes have impact on free

market equilibrium (Stiglitz and Rosengard 2015). An externality is a consequence of an

economic activity, which leads to inefficient market equilibrium as the equilibrium price does

not reflect the true benefits and costs of the product or service being produced (Farhi and Gabaix

2015). Externalities are of two types, positive and negative. Positive externality refers to the

2ECONOMICS

benefit enjoyed by the third party due to an economic transaction and negative externality is the

cost, borne by the third party from an economic transaction (Jarrow and Larsson 2012). To return

to the efficient market equilibrium, the government imposes tax on negative externalities.

The fat tax is a measure the curb the negative externality resulted from fattening food.

Foods with high level of saturated fat and sugar, such as, the junk food, desserts etc. and low in

nutritional value are harmful for the people. As they consume much of these foods, they grow a

tendency of obesity and unhealthy life. It has a social cost. The increasing incidence of obesity

and many more diseases, such as, heart diseases, diabetes, cancer and bone disorders are a matter

of concern for any society. It is found that, an obese person annually spends around $700 more

than that of a normal person for medical purpose in the USA (Economist.com, 2012). When

these costs are shared, it is a burden for everyone in the society including the government. It not

only affects the healthcare of the society, the economic productivity of the nation or the society

also gets hampered. Hence, to reduce the impact of the externalities from fattening foods and

sugary beverages, a fat-tax could be imposed by the government, which would raise the personal

and social marginal cost more than the benefit and discourage in production and consumption of

those food (Posner 2014).

benefit enjoyed by the third party due to an economic transaction and negative externality is the

cost, borne by the third party from an economic transaction (Jarrow and Larsson 2012). To return

to the efficient market equilibrium, the government imposes tax on negative externalities.

The fat tax is a measure the curb the negative externality resulted from fattening food.

Foods with high level of saturated fat and sugar, such as, the junk food, desserts etc. and low in

nutritional value are harmful for the people. As they consume much of these foods, they grow a

tendency of obesity and unhealthy life. It has a social cost. The increasing incidence of obesity

and many more diseases, such as, heart diseases, diabetes, cancer and bone disorders are a matter

of concern for any society. It is found that, an obese person annually spends around $700 more

than that of a normal person for medical purpose in the USA (Economist.com, 2012). When

these costs are shared, it is a burden for everyone in the society including the government. It not

only affects the healthcare of the society, the economic productivity of the nation or the society

also gets hampered. Hence, to reduce the impact of the externalities from fattening foods and

sugary beverages, a fat-tax could be imposed by the government, which would raise the personal

and social marginal cost more than the benefit and discourage in production and consumption of

those food (Posner 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMICS

S1=PMC (With no

fat–tax)

S2=SMC (With fat-tax)

D = PMB = SMB

E*

E’

Q*

P*

P’

Q’

P0 E0

T

Price

Quantity

Figure 1: Impact of Fat-tax

(Source: Author)

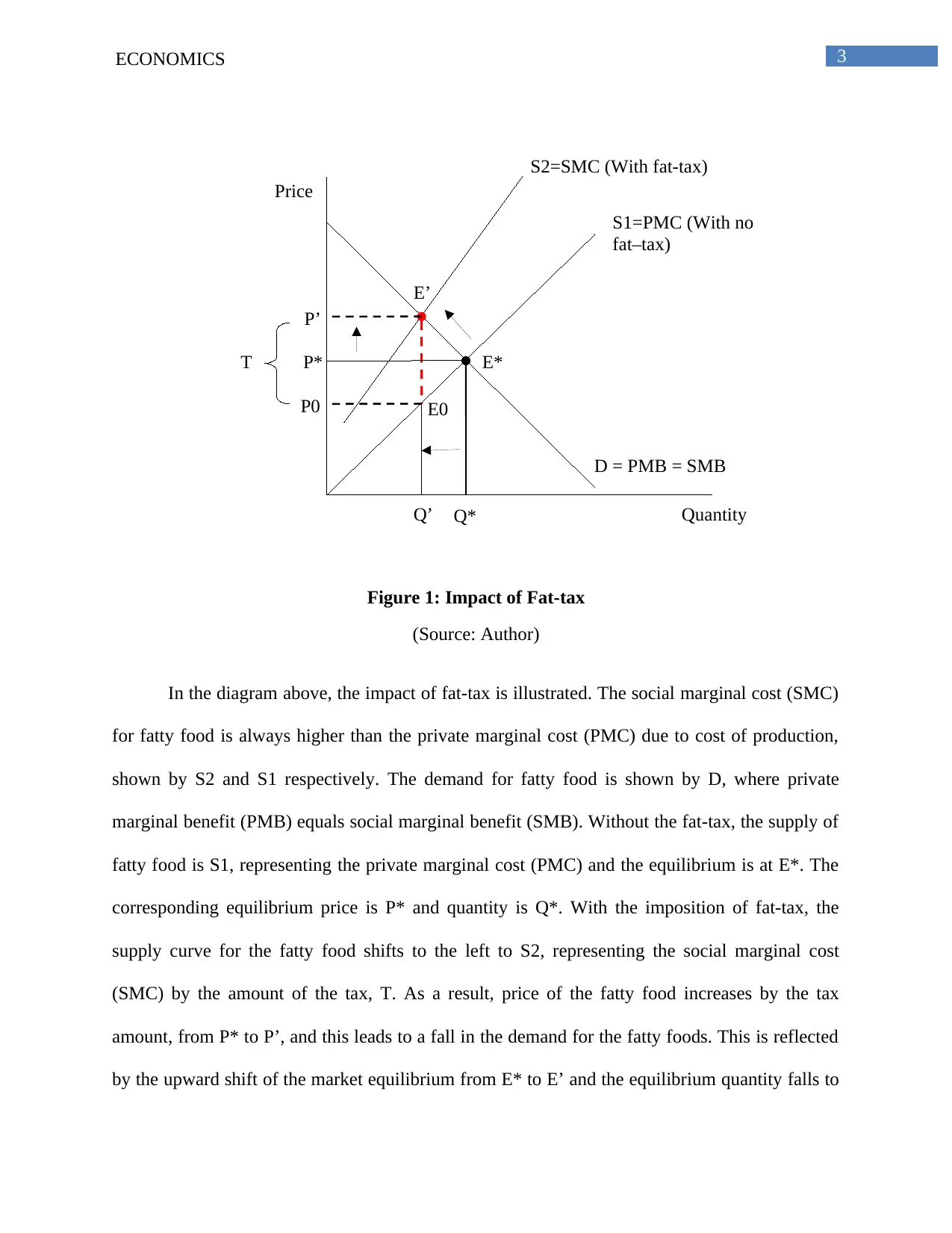

In the diagram above, the impact of fat-tax is illustrated. The social marginal cost (SMC)

for fatty food is always higher than the private marginal cost (PMC) due to cost of production,

shown by S2 and S1 respectively. The demand for fatty food is shown by D, where private

marginal benefit (PMB) equals social marginal benefit (SMB). Without the fat-tax, the supply of

fatty food is S1, representing the private marginal cost (PMC) and the equilibrium is at E*. The

corresponding equilibrium price is P* and quantity is Q*. With the imposition of fat-tax, the

supply curve for the fatty food shifts to the left to S2, representing the social marginal cost

(SMC) by the amount of the tax, T. As a result, price of the fatty food increases by the tax

amount, from P* to P’, and this leads to a fall in the demand for the fatty foods. This is reflected

by the upward shift of the market equilibrium from E* to E’ and the equilibrium quantity falls to

S1=PMC (With no

fat–tax)

S2=SMC (With fat-tax)

D = PMB = SMB

E*

E’

Q*

P*

P’

Q’

P0 E0

T

Price

Quantity

Figure 1: Impact of Fat-tax

(Source: Author)

In the diagram above, the impact of fat-tax is illustrated. The social marginal cost (SMC)

for fatty food is always higher than the private marginal cost (PMC) due to cost of production,

shown by S2 and S1 respectively. The demand for fatty food is shown by D, where private

marginal benefit (PMB) equals social marginal benefit (SMB). Without the fat-tax, the supply of

fatty food is S1, representing the private marginal cost (PMC) and the equilibrium is at E*. The

corresponding equilibrium price is P* and quantity is Q*. With the imposition of fat-tax, the

supply curve for the fatty food shifts to the left to S2, representing the social marginal cost

(SMC) by the amount of the tax, T. As a result, price of the fatty food increases by the tax

amount, from P* to P’, and this leads to a fall in the demand for the fatty foods. This is reflected

by the upward shift of the market equilibrium from E* to E’ and the equilibrium quantity falls to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMICS

Q’ from Q*. In this case, the consumers pay the price P’ and the producers get P0. The

difference between P’ and P0 is the tax amount, T, which is earned by the government. Hence,

the triangle E’E*E0 represents deadweight loss. Thus, a fat-tax is expected to reduce the

production and consumption of fatty food, which increases social benefits.

Reasons for fat-tax failure in Denmark

The government of Denmark introduced the fat-tax with an aim to reduce the production

and consumption of fattening food. It was imposed on food items containing more than 2.3%

saturated fat and high level of sucrose. The main purpose of the tax was to change the eating

habits of the Danes’ and encourage them to adopt a healthier and long life. The tax raised the

prices of unhealthy fattening foods more than the market equilibrium price and created an

inefficient equilibrium (Bødker et al. 2015). However, within a year, the Denmark government

abolished the tax and stated that they would try to improve the public health in other ways. There

are many reasons for the failure of this tax. Those are as follows.

The tax encouraged cross border trading. The Danes started buying lower cost

alternatives from other countries, such as, Sweden or Germany, where prices were 20%

less than that in Denmark. Majority of the Danes did not change their food habit; rather

they changed their shopping market. This had affected the domestic Danish market quite

negatively as their business fell as demand for domestic products fell due to availability

of cheaper imported substitutes (Kliff 2012).

Majority of the food items, such as, butter, bacon, etc are price inelastic. A mere tax

would not make much difference for staple food consumption.

Q’ from Q*. In this case, the consumers pay the price P’ and the producers get P0. The

difference between P’ and P0 is the tax amount, T, which is earned by the government. Hence,

the triangle E’E*E0 represents deadweight loss. Thus, a fat-tax is expected to reduce the

production and consumption of fatty food, which increases social benefits.

Reasons for fat-tax failure in Denmark

The government of Denmark introduced the fat-tax with an aim to reduce the production

and consumption of fattening food. It was imposed on food items containing more than 2.3%

saturated fat and high level of sucrose. The main purpose of the tax was to change the eating

habits of the Danes’ and encourage them to adopt a healthier and long life. The tax raised the

prices of unhealthy fattening foods more than the market equilibrium price and created an

inefficient equilibrium (Bødker et al. 2015). However, within a year, the Denmark government

abolished the tax and stated that they would try to improve the public health in other ways. There

are many reasons for the failure of this tax. Those are as follows.

The tax encouraged cross border trading. The Danes started buying lower cost

alternatives from other countries, such as, Sweden or Germany, where prices were 20%

less than that in Denmark. Majority of the Danes did not change their food habit; rather

they changed their shopping market. This had affected the domestic Danish market quite

negatively as their business fell as demand for domestic products fell due to availability

of cheaper imported substitutes (Kliff 2012).

Majority of the food items, such as, butter, bacon, etc are price inelastic. A mere tax

would not make much difference for staple food consumption.

5ECONOMICS

The fall in the revenue of the local producers created issues in the employment market as

many Danish lost their jobs (Stafford 2012). It also created bureaucratic problems in the

nation from the food producers.

Potential benefits and disadvantages of fat-tax

The fat-tax is aimed to achieve greater social benefits from healthier eating habits of the

population, thereby having healthy generations, greater productivity, and greater longevity and

reduced medical expenses. On the other hand, critics say that fat-tax is regressive in nature,

which will cost more to the lower income groups, who are more price sensitive than the higher

income groups (Moodie et al. 2013).

The potential advantages of fat-tax are:

It reduces the social cost of being unhealthy or obese. Obesity costs a significant amount

to the society in terms of diseases, like heart diseases, diabetes, angina, cardiac attacks

and premature deaths. It also leads to loss of productivity at work and loss of revenues for

the organizations. Hence, a tax on the unhealthy foods results in paying social cost and

achieving reduction in obesity and more efficient resource allocation (Moodie et al.

2013).

It encourages healthier diet among the population. This pushes the food producer to

innovate new foods with lower fat and sugar, promoting a healthy nation.

This tax raises revenues for the government.

The potential disadvantages are:

The fall in the revenue of the local producers created issues in the employment market as

many Danish lost their jobs (Stafford 2012). It also created bureaucratic problems in the

nation from the food producers.

Potential benefits and disadvantages of fat-tax

The fat-tax is aimed to achieve greater social benefits from healthier eating habits of the

population, thereby having healthy generations, greater productivity, and greater longevity and

reduced medical expenses. On the other hand, critics say that fat-tax is regressive in nature,

which will cost more to the lower income groups, who are more price sensitive than the higher

income groups (Moodie et al. 2013).

The potential advantages of fat-tax are:

It reduces the social cost of being unhealthy or obese. Obesity costs a significant amount

to the society in terms of diseases, like heart diseases, diabetes, angina, cardiac attacks

and premature deaths. It also leads to loss of productivity at work and loss of revenues for

the organizations. Hence, a tax on the unhealthy foods results in paying social cost and

achieving reduction in obesity and more efficient resource allocation (Moodie et al.

2013).

It encourages healthier diet among the population. This pushes the food producer to

innovate new foods with lower fat and sugar, promoting a healthy nation.

This tax raises revenues for the government.

The potential disadvantages are:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMICS

It becomes difficult to make a basket of selective fatty foods as there are many types of

food that contributes in obesity when consumed in excessive amount. Moreover, the food

consumption pattern of people is dynamic. Hence, selection of food items for taxation is

challenging.

Obesity is caused due to many factors other than food, such as, genetic factors, levels of

exercise, nature of job, and any disease like thyroid (Craven, Marlow and Shiers 2012)

Administration cost of collecting food tax is quite high.

This tax is likely to be regressive in nature as lower income group spend a higher

percentage of their income in the fatty foods like junk food, sugary beverages and in case

of staple food they are price insensitive even if those are healthy (Smed and Robertson

2012).

It results in fall in the aggregate demand for fatty foods in the economy, leading a fall in

profit for the food manufacturers. At the same time, people buy cheaper substitute

products from international market, as in the case of Denmark, which increases the

revenues for the other economies and reduces that of the domestic economy, resulting in

a setback for the country.

Conclusion

The fat-tax in Denmark was one of the most innovative measures to change the eating

habits of people for a healthier life. Fatty foods create negative externalities in terms of obesity,

diseases, loss of productivity and many more and hence, imposing a tax would increase the

government revenue and raise the market price, leading to a fall in demand and consumption.

However, the initiative failed in Denmark due to various economic and political reasons and it

did not reflect much change in the food habits of people.

It becomes difficult to make a basket of selective fatty foods as there are many types of

food that contributes in obesity when consumed in excessive amount. Moreover, the food

consumption pattern of people is dynamic. Hence, selection of food items for taxation is

challenging.

Obesity is caused due to many factors other than food, such as, genetic factors, levels of

exercise, nature of job, and any disease like thyroid (Craven, Marlow and Shiers 2012)

Administration cost of collecting food tax is quite high.

This tax is likely to be regressive in nature as lower income group spend a higher

percentage of their income in the fatty foods like junk food, sugary beverages and in case

of staple food they are price insensitive even if those are healthy (Smed and Robertson

2012).

It results in fall in the aggregate demand for fatty foods in the economy, leading a fall in

profit for the food manufacturers. At the same time, people buy cheaper substitute

products from international market, as in the case of Denmark, which increases the

revenues for the other economies and reduces that of the domestic economy, resulting in

a setback for the country.

Conclusion

The fat-tax in Denmark was one of the most innovative measures to change the eating

habits of people for a healthier life. Fatty foods create negative externalities in terms of obesity,

diseases, loss of productivity and many more and hence, imposing a tax would increase the

government revenue and raise the market price, leading to a fall in demand and consumption.

However, the initiative failed in Denmark due to various economic and political reasons and it

did not reflect much change in the food habits of people.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMICS

References

BBC News. "Denmark Introduces Food Fat Tax". BBC News. 2011.

http://www.bbc.com/news/world-europe-15137948.

Bødker, Malene, Charlotta Pisinger, Ulla Toft, and Torben Jørgensen. "The rise and fall of the

world's first fat tax." Health policy 119, no. 6 (2015): 737-742.

Craven, Barrie M., Michael L. Marlow, and Alden F. Shiers. "Fat taxes and other interventions

won't cure obesity." Economic Affairs 32, no. 2 (2012): 36-40.

Economist.com. "Waist Banned". The Economist. 2012.

https://www.economist.com/node/14120903.

Farhi, Emmanuel, and Xavier Gabaix. Optimal taxation with behavioral agents. No. w21524.

National Bureau of Economic Research, 2015.

Jarrow, Robert A., and Martin Larsson. "The meaning of market efficiency." Mathematical

Finance 22, no. 1 (2012): 1-30.

Kliff, Sarah. 2012. "Denmark Scraps World’S First Fat Tax". Washington Post. 2012.

https://www.washingtonpost.com/news/wonk/wp/2012/11/13/denmark-scraps-worlds-first-fat-

tax/?noredirect=on&utm_term=.a2b250f6585d.

Moodie, Marj, Lauren Sheppard, Gary Sacks, Catherine Keating, and Anna Flego. "Cost-

effectiveness of fiscal policies to prevent obesity." Current obesity reports 2, no. 3 (2013): 211-

224.

Posner, Richard A. Economic analysis of law. Wolters Kluwer Law & Business, 2014.

References

BBC News. "Denmark Introduces Food Fat Tax". BBC News. 2011.

http://www.bbc.com/news/world-europe-15137948.

Bødker, Malene, Charlotta Pisinger, Ulla Toft, and Torben Jørgensen. "The rise and fall of the

world's first fat tax." Health policy 119, no. 6 (2015): 737-742.

Craven, Barrie M., Michael L. Marlow, and Alden F. Shiers. "Fat taxes and other interventions

won't cure obesity." Economic Affairs 32, no. 2 (2012): 36-40.

Economist.com. "Waist Banned". The Economist. 2012.

https://www.economist.com/node/14120903.

Farhi, Emmanuel, and Xavier Gabaix. Optimal taxation with behavioral agents. No. w21524.

National Bureau of Economic Research, 2015.

Jarrow, Robert A., and Martin Larsson. "The meaning of market efficiency." Mathematical

Finance 22, no. 1 (2012): 1-30.

Kliff, Sarah. 2012. "Denmark Scraps World’S First Fat Tax". Washington Post. 2012.

https://www.washingtonpost.com/news/wonk/wp/2012/11/13/denmark-scraps-worlds-first-fat-

tax/?noredirect=on&utm_term=.a2b250f6585d.

Moodie, Marj, Lauren Sheppard, Gary Sacks, Catherine Keating, and Anna Flego. "Cost-

effectiveness of fiscal policies to prevent obesity." Current obesity reports 2, no. 3 (2013): 211-

224.

Posner, Richard A. Economic analysis of law. Wolters Kluwer Law & Business, 2014.

8ECONOMICS

Smed, Sinne, and Aileen Robertson. "Are taxes on fatty foods having their desired effects on

health?." BMJ-British Medical Journal 345, no. 7882 (2012): 9.

Smed, Sinne. "Financial penalties on foods: the fat tax in Denmark." Nutrition Bulletin 37, no. 2

(2012): 142-147.

Stafford, Ned. "Denmark cancels" fat tax" and shelves" sugar tax" because of threat of job

losses." BMJ: British Medical Journal (Online) 345 (2012).

Stiglitz, Joseph E., and Jay K. Rosengard. Economics of the Public Sector: Fourth International

Student Edition. WW Norton & Company, 2015.

Smed, Sinne, and Aileen Robertson. "Are taxes on fatty foods having their desired effects on

health?." BMJ-British Medical Journal 345, no. 7882 (2012): 9.

Smed, Sinne. "Financial penalties on foods: the fat tax in Denmark." Nutrition Bulletin 37, no. 2

(2012): 142-147.

Stafford, Ned. "Denmark cancels" fat tax" and shelves" sugar tax" because of threat of job

losses." BMJ: British Medical Journal (Online) 345 (2012).

Stiglitz, Joseph E., and Jay K. Rosengard. Economics of the Public Sector: Fourth International

Student Edition. WW Norton & Company, 2015.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.