Kaplan DFP2 Oral Assignment: Insurance and Risk Protection Role-Play

VerifiedAdded on 2021/05/30

|18

|6664

|118

Practical Assignment

AI Summary

This oral assignment is part of the DFP2 Insurance and Risk Protection course, assessing the student's verbal communication skills in a role-play scenario. The assignment requires the student to act as a financial advisor and address six concerns Elspeth, a client, has regarding her life insurance recommendations. These concerns revolve around the cost of trauma policies, the availability of trauma insurance in super funds, the need for a personal income protection policy for John, methods to reduce income protection costs, the rationale behind different life/TPD cover amounts for Elspeth and John, and the possibility of John switching super funds for increased cover. The student must engage with the client, explain key issues, and manage the meeting professionally within a 20-minute time frame, which will be assessed through an audio recording. The assignment emphasizes the application of knowledge and skills developed in the DFP2 subject, including client relationship building and clear explanation of complex financial concepts. The student is expected to demonstrate competence in providing financial advice related to life insurance, as per the unit of competency FNSASICX503.

Oral Assignment

Audio

Insurance and Risk Protection

(DFP2_OR_Audio_v4)

Note: The oral assignment is based on the subject notes, which are current at the time of publishing.

Although legislation may have changed since the assignment or this marking guide were written,

the answers should be based on the information provided in the subject notes.

Student identification (student to complete)

Please complete the fields shaded grey.

Student number

Oral assignment result (assessor to complete)

Result — first submission (details for each activity are shown in the table below)

Parts that must be resubmitted

Result — resubmission (if applicable)

Result summary (assessor to complete)

Time First submission Resubmission (if required)

Preparation for

Oral Assignment Part 1 Instructions n.a. n.a.

Oral assessment Part 2 Role-play 20 minutes Not yet demonstrated Not yet demonstrated

Total time required 20 minutes

Feedback (assessor to complete)

[insert assessor feedback]

DFP2_OR_v4

Audio

Insurance and Risk Protection

(DFP2_OR_Audio_v4)

Note: The oral assignment is based on the subject notes, which are current at the time of publishing.

Although legislation may have changed since the assignment or this marking guide were written,

the answers should be based on the information provided in the subject notes.

Student identification (student to complete)

Please complete the fields shaded grey.

Student number

Oral assignment result (assessor to complete)

Result — first submission (details for each activity are shown in the table below)

Parts that must be resubmitted

Result — resubmission (if applicable)

Result summary (assessor to complete)

Time First submission Resubmission (if required)

Preparation for

Oral Assignment Part 1 Instructions n.a. n.a.

Oral assessment Part 2 Role-play 20 minutes Not yet demonstrated Not yet demonstrated

Total time required 20 minutes

Feedback (assessor to complete)

[insert assessor feedback]

DFP2_OR_v4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Before you begin

Read everything in this document before you start your oral assignment by audio recording.

About this document

This document is the oral assignment — half of the overall written and oral assignment.

This document includes the following parts:

• Part 1: Instructions for completing and submitting the Oral Assignment

• Part 2: Role-play – 20 minutes.

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to complete

the oral assignment within your enrolment period. Your study plan is in the DFP2 Insurance and Risk

Protection subject room.

You will need to start preparing for your oral assignment a few weeks before the written and oral

assignment is due.

Page 2 of 18

Read everything in this document before you start your oral assignment by audio recording.

About this document

This document is the oral assignment — half of the overall written and oral assignment.

This document includes the following parts:

• Part 1: Instructions for completing and submitting the Oral Assignment

• Part 2: Role-play – 20 minutes.

How to use the study plan

We recommend that you use the study plan for this subject to help you manage your time to complete

the oral assignment within your enrolment period. Your study plan is in the DFP2 Insurance and Risk

Protection subject room.

You will need to start preparing for your oral assignment a few weeks before the written and oral

assignment is due.

Page 2 of 18

Part 1: Instructions for completing and submitting

the Oral Assignment

Completing the oral assignment

The Insurance and Risk Protection subject will have introduced you to the concepts of personal risk

management as they apply to retail clients and considers the participants, products and regulation within

the insurance industry. The principles underpinning policy documentation, underwriting, risk appraisal and

pricing are also covered, as are approaches to designing client recommendations using insurance products.

This Oral Assignment is an assessment of your verbal communication skills — how you build a relationship

with a client, how you explain key issues to a client and respond to their questions, and how you manage a

meeting so that it runs professionally and on time. The assessment will confirm your ability to apply the

knowledge and skills developed in the DFP2 subject in an interaction with a client.

For this assignment you are required to complete a role-play of 20 minutes.

More information regarding requirements for the oral assignment are provided in the resources in your

subject in KapLearn.

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Oral_versionnumber_Submissionnumber

(e.g. 12345678_DFP2_OR_v4_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

Submitting the oral assignment

You have 12 weeks from the date of your enrolment in this subject to submit your completed Oral

Assignment and audio recording.

You must submit your completed oral assignment (Word document) in a compatible Microsoft Word

document. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed oral assignment as a PDF.

You will also need to upload an audio recording of your oral assessment.

The oral assignment (in Word) and the audio recording must all be completed before submitting it to Kaplan

Professional Education. Incomplete oral assignment documents and/or audio recordings will be returned to

you unmarked.

Page 3 of 18

the Oral Assignment

Completing the oral assignment

The Insurance and Risk Protection subject will have introduced you to the concepts of personal risk

management as they apply to retail clients and considers the participants, products and regulation within

the insurance industry. The principles underpinning policy documentation, underwriting, risk appraisal and

pricing are also covered, as are approaches to designing client recommendations using insurance products.

This Oral Assignment is an assessment of your verbal communication skills — how you build a relationship

with a client, how you explain key issues to a client and respond to their questions, and how you manage a

meeting so that it runs professionally and on time. The assessment will confirm your ability to apply the

knowledge and skills developed in the DFP2 subject in an interaction with a client.

For this assignment you are required to complete a role-play of 20 minutes.

More information regarding requirements for the oral assignment are provided in the resources in your

subject in KapLearn.

Saving your work

Download this document to your desktop, type your answers in the spaces provided and save your

work regularly.

• Use the template provided, as other formats will not be accepted for these assignments.

• Name your file as follows: Studentnumber_SubjectCode_Oral_versionnumber_Submissionnumber

(e.g. 12345678_DFP2_OR_v4_Submission1).

• Include your student ID on the first page of the assignment.

Before you submit your work, please do a spell check and proofread your work to ensure that everything is

clear and unambiguous.

Submitting the oral assignment

You have 12 weeks from the date of your enrolment in this subject to submit your completed Oral

Assignment and audio recording.

You must submit your completed oral assignment (Word document) in a compatible Microsoft Word

document. You need to save and submit this entire document.

Do not remove any sections of the document.

Do not save your completed oral assignment as a PDF.

You will also need to upload an audio recording of your oral assessment.

The oral assignment (in Word) and the audio recording must all be completed before submitting it to Kaplan

Professional Education. Incomplete oral assignment documents and/or audio recordings will be returned to

you unmarked.

Page 3 of 18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The maximum file size for the written assignment (word document), oral assignment (word document) and

audio recording is 20MB. Once you submit your oral assignment and audio recording for marking you will

be unable to make any further changes to it.

You are able to submit your written and oral assignment earlier than the deadline if you are confident you

have completed all parts and have prepared a quality submission.

Refer to your study guide so you can plan ahead to complete your audio recording before the written and

oral assignment is due.

For more information see the resources in your subject about how to organise and upload your audio

recording in KapLearn.

Note: The written assignment (in Word), oral assignment (in Word) and audio recording must all be

submitted together.

The oral assignment marking process

You have 12 weeks from the date of your enrolment in this subject to submit your completed oral

assignment and audio recording.

If you reach the end of your initial enrolment period and have been deemed ‘Not Yet Competent’ in one or

more assessment items, then an additional four (4) weeks will be granted, provided you attempted all

assessment tasks during the initial enrolment period.

Your assessor will mark your assignments and return them to you in the DFP2 Insurance and risk Protection

subject room in KapLearn under the ‘Written and Oral Assessment’ page.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to complete all the parts of your oral

assessment. Failure to do so will mean that your oral assignment will not be accepted for marking,

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed written and oral assessment.

How your oral assignment is graded

Oral assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent for

this oral assessment.

Your assessor will follow the below process when marking your oral assignment:

• Assess your responses in each part of the oral assessment, and then determine whether you have

demonstrated competence in each question or checklist.

• Determine if, on a holistic basis, your responses have demonstrated overall competence.

You must be deemed competent in all assessment items in order to be awarded your qualification,

including demonstrating competency in:

• all of the exam questions

• the written and oral assignment.

Page 4 of 18

audio recording is 20MB. Once you submit your oral assignment and audio recording for marking you will

be unable to make any further changes to it.

You are able to submit your written and oral assignment earlier than the deadline if you are confident you

have completed all parts and have prepared a quality submission.

Refer to your study guide so you can plan ahead to complete your audio recording before the written and

oral assignment is due.

For more information see the resources in your subject about how to organise and upload your audio

recording in KapLearn.

Note: The written assignment (in Word), oral assignment (in Word) and audio recording must all be

submitted together.

The oral assignment marking process

You have 12 weeks from the date of your enrolment in this subject to submit your completed oral

assignment and audio recording.

If you reach the end of your initial enrolment period and have been deemed ‘Not Yet Competent’ in one or

more assessment items, then an additional four (4) weeks will be granted, provided you attempted all

assessment tasks during the initial enrolment period.

Your assessor will mark your assignments and return them to you in the DFP2 Insurance and risk Protection

subject room in KapLearn under the ‘Written and Oral Assessment’ page.

Make a reasonable attempt

You must demonstrate that you have made a reasonable attempt to complete all the parts of your oral

assessment. Failure to do so will mean that your oral assignment will not be accepted for marking,

therefore you will not receive the benefit of feedback on your submission.

If you do not meet these requirements, you will be notified. You will then have until your submission

deadline to submit your completed written and oral assessment.

How your oral assignment is graded

Oral assignment tasks are used to determine your ‘competence’ in demonstrating the required knowledge

and/or skills for each subject. As a result, you will be graded as either competent or not yet competent for

this oral assessment.

Your assessor will follow the below process when marking your oral assignment:

• Assess your responses in each part of the oral assessment, and then determine whether you have

demonstrated competence in each question or checklist.

• Determine if, on a holistic basis, your responses have demonstrated overall competence.

You must be deemed competent in all assessment items in order to be awarded your qualification,

including demonstrating competency in:

• all of the exam questions

• the written and oral assignment.

Page 4 of 18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

‘Not yet competent’ and resubmissions

Should parts of your oral assignment be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need amend those sections

where the assessor has determined the assessment result is ‘not yet demonstrated’.

You may be asked to re-record a part of your audio recording or to answer some written questions in this

document. Use a different text colour for any written sections of your resubmission. Your assessor will be

in a better position to gauge the quality and nature of your changes. Ensure you leave your first assessor’s

comments in your oral assignment, so your second assessor can see the instructions that were originally

provided for you. Do not change any comments made by a Kaplan assessor.

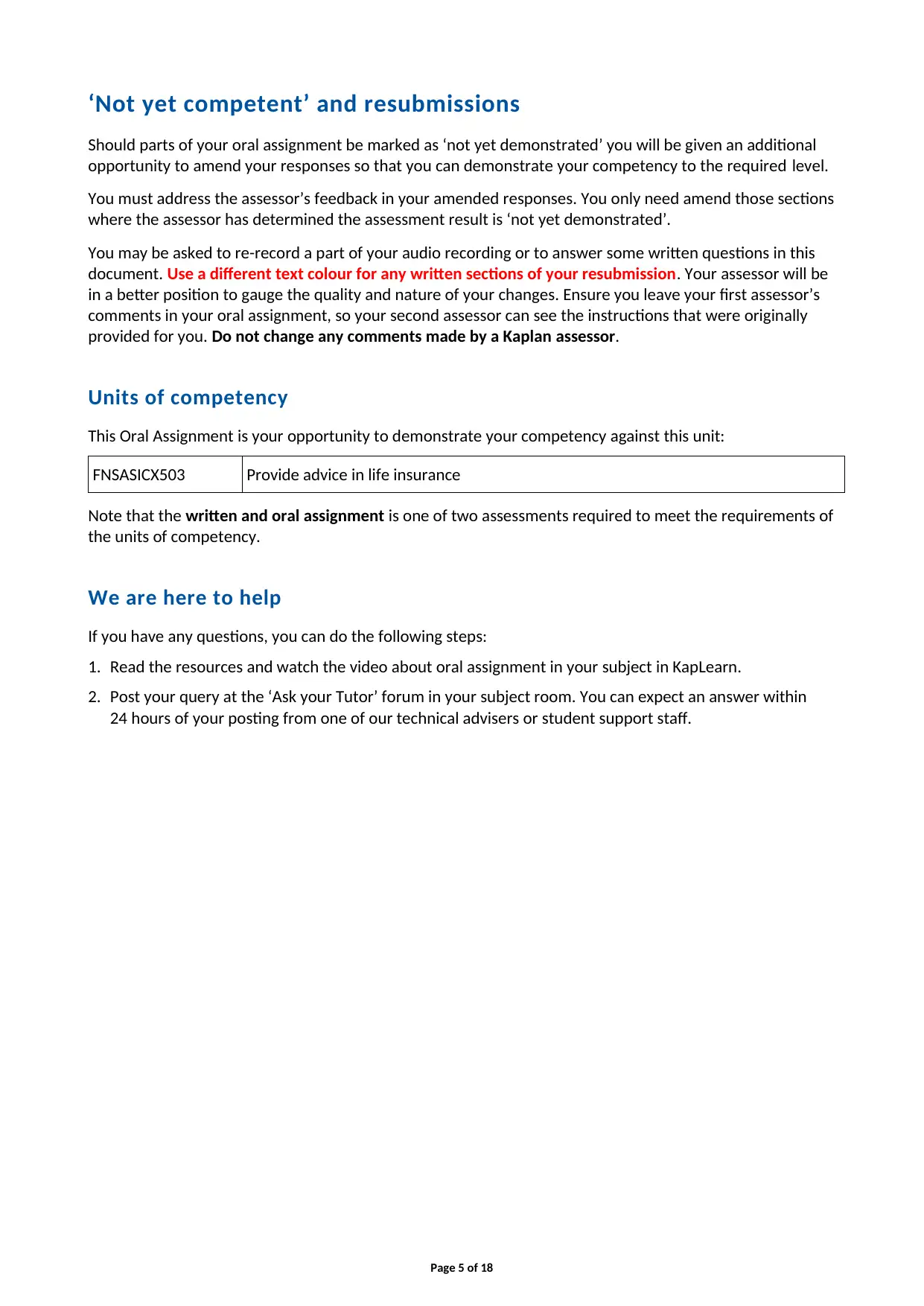

Units of competency

This Oral Assignment is your opportunity to demonstrate your competency against this unit:

FNSASICX503 Provide advice in life insurance

Note that the written and oral assignment is one of two assessments required to meet the requirements of

the units of competency.

We are here to help

If you have any questions, you can do the following steps:

1. Read the resources and watch the video about oral assignment in your subject in KapLearn.

2. Post your query at the ‘Ask your Tutor’ forum in your subject room. You can expect an answer within

24 hours of your posting from one of our technical advisers or student support staff.

Page 5 of 18

Should parts of your oral assignment be marked as ‘not yet demonstrated’ you will be given an additional

opportunity to amend your responses so that you can demonstrate your competency to the required level.

You must address the assessor’s feedback in your amended responses. You only need amend those sections

where the assessor has determined the assessment result is ‘not yet demonstrated’.

You may be asked to re-record a part of your audio recording or to answer some written questions in this

document. Use a different text colour for any written sections of your resubmission. Your assessor will be

in a better position to gauge the quality and nature of your changes. Ensure you leave your first assessor’s

comments in your oral assignment, so your second assessor can see the instructions that were originally

provided for you. Do not change any comments made by a Kaplan assessor.

Units of competency

This Oral Assignment is your opportunity to demonstrate your competency against this unit:

FNSASICX503 Provide advice in life insurance

Note that the written and oral assignment is one of two assessments required to meet the requirements of

the units of competency.

We are here to help

If you have any questions, you can do the following steps:

1. Read the resources and watch the video about oral assignment in your subject in KapLearn.

2. Post your query at the ‘Ask your Tutor’ forum in your subject room. You can expect an answer within

24 hours of your posting from one of our technical advisers or student support staff.

Page 5 of 18

Part 2: Role-play

You will participate in a role-play for a maximum of 20 minutes. The role-play will be conducted by audio

recording. You will need a volunteer to assist you in the role-play.

For your volunteer you need to select an appropriate person who is able to participate in the volunteer role

criteria below. The volunteer needs to understand that this is part of your assessment. Provide a copy of

the Instructions for Volunteers in your KapLearn subject to your volunteer so they understand what they

need to do in your assessment.

You will not be assessed on your acting ability. Rather, you will be assessed on the criteria listed below

under the student role.

When starting your role-play recording, ask your volunteer if they give permission to be included in the

audio recording. The volunteer needs to agree before the recording may continue.

See the resources in your subject in KapLearn to assist you in preparing for your role-play.

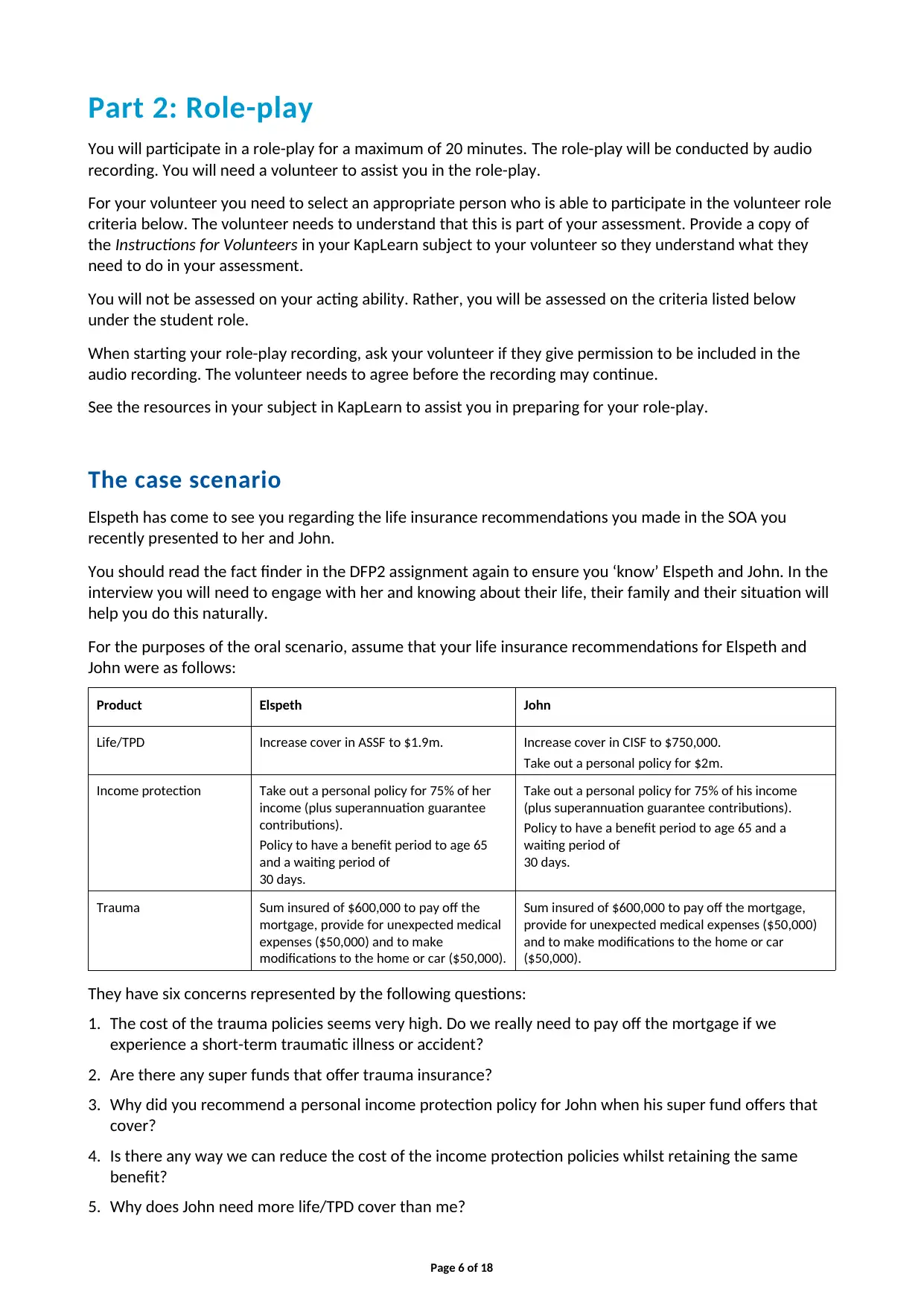

The case scenario

Elspeth has come to see you regarding the life insurance recommendations you made in the SOA you

recently presented to her and John.

You should read the fact finder in the DFP2 assignment again to ensure you ‘know’ Elspeth and John. In the

interview you will need to engage with her and knowing about their life, their family and their situation will

help you do this naturally.

For the purposes of the oral scenario, assume that your life insurance recommendations for Elspeth and

John were as follows:

Product Elspeth John

Life/TPD Increase cover in ASSF to $1.9m. Increase cover in CISF to $750,000.

Take out a personal policy for $2m.

Income protection Take out a personal policy for 75% of her

income (plus superannuation guarantee

contributions).

Policy to have a benefit period to age 65

and a waiting period of

30 days.

Take out a personal policy for 75% of his income

(plus superannuation guarantee contributions).

Policy to have a benefit period to age 65 and a

waiting period of

30 days.

Trauma Sum insured of $600,000 to pay off the

mortgage, provide for unexpected medical

expenses ($50,000) and to make

modifications to the home or car ($50,000).

Sum insured of $600,000 to pay off the mortgage,

provide for unexpected medical expenses ($50,000)

and to make modifications to the home or car

($50,000).

They have six concerns represented by the following questions:

1. The cost of the trauma policies seems very high. Do we really need to pay off the mortgage if we

experience a short-term traumatic illness or accident?

2. Are there any super funds that offer trauma insurance?

3. Why did you recommend a personal income protection policy for John when his super fund offers that

cover?

4. Is there any way we can reduce the cost of the income protection policies whilst retaining the same

benefit?

5. Why does John need more life/TPD cover than me?

Page 6 of 18

You will participate in a role-play for a maximum of 20 minutes. The role-play will be conducted by audio

recording. You will need a volunteer to assist you in the role-play.

For your volunteer you need to select an appropriate person who is able to participate in the volunteer role

criteria below. The volunteer needs to understand that this is part of your assessment. Provide a copy of

the Instructions for Volunteers in your KapLearn subject to your volunteer so they understand what they

need to do in your assessment.

You will not be assessed on your acting ability. Rather, you will be assessed on the criteria listed below

under the student role.

When starting your role-play recording, ask your volunteer if they give permission to be included in the

audio recording. The volunteer needs to agree before the recording may continue.

See the resources in your subject in KapLearn to assist you in preparing for your role-play.

The case scenario

Elspeth has come to see you regarding the life insurance recommendations you made in the SOA you

recently presented to her and John.

You should read the fact finder in the DFP2 assignment again to ensure you ‘know’ Elspeth and John. In the

interview you will need to engage with her and knowing about their life, their family and their situation will

help you do this naturally.

For the purposes of the oral scenario, assume that your life insurance recommendations for Elspeth and

John were as follows:

Product Elspeth John

Life/TPD Increase cover in ASSF to $1.9m. Increase cover in CISF to $750,000.

Take out a personal policy for $2m.

Income protection Take out a personal policy for 75% of her

income (plus superannuation guarantee

contributions).

Policy to have a benefit period to age 65

and a waiting period of

30 days.

Take out a personal policy for 75% of his income

(plus superannuation guarantee contributions).

Policy to have a benefit period to age 65 and a

waiting period of

30 days.

Trauma Sum insured of $600,000 to pay off the

mortgage, provide for unexpected medical

expenses ($50,000) and to make

modifications to the home or car ($50,000).

Sum insured of $600,000 to pay off the mortgage,

provide for unexpected medical expenses ($50,000)

and to make modifications to the home or car

($50,000).

They have six concerns represented by the following questions:

1. The cost of the trauma policies seems very high. Do we really need to pay off the mortgage if we

experience a short-term traumatic illness or accident?

2. Are there any super funds that offer trauma insurance?

3. Why did you recommend a personal income protection policy for John when his super fund offers that

cover?

4. Is there any way we can reduce the cost of the income protection policies whilst retaining the same

benefit?

5. Why does John need more life/TPD cover than me?

Page 6 of 18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6. Why can’t John switch to the same super fund as me and take out $2m life/TPD cover?

You should prepare your responses to these questions as either a speech (a one-way conversation) or as a

dialogue (a two-way conversation). The detailed requirements of your oral are addressed below.

Your situation

You should imagine yourself to be a qualified financial adviser. Even if you have no face-to-face experience

with clients seeking financial advice, you should present yourself in a professional and competent manner.

Be the adviser you would want to have if you were in Elspeth’s situation.

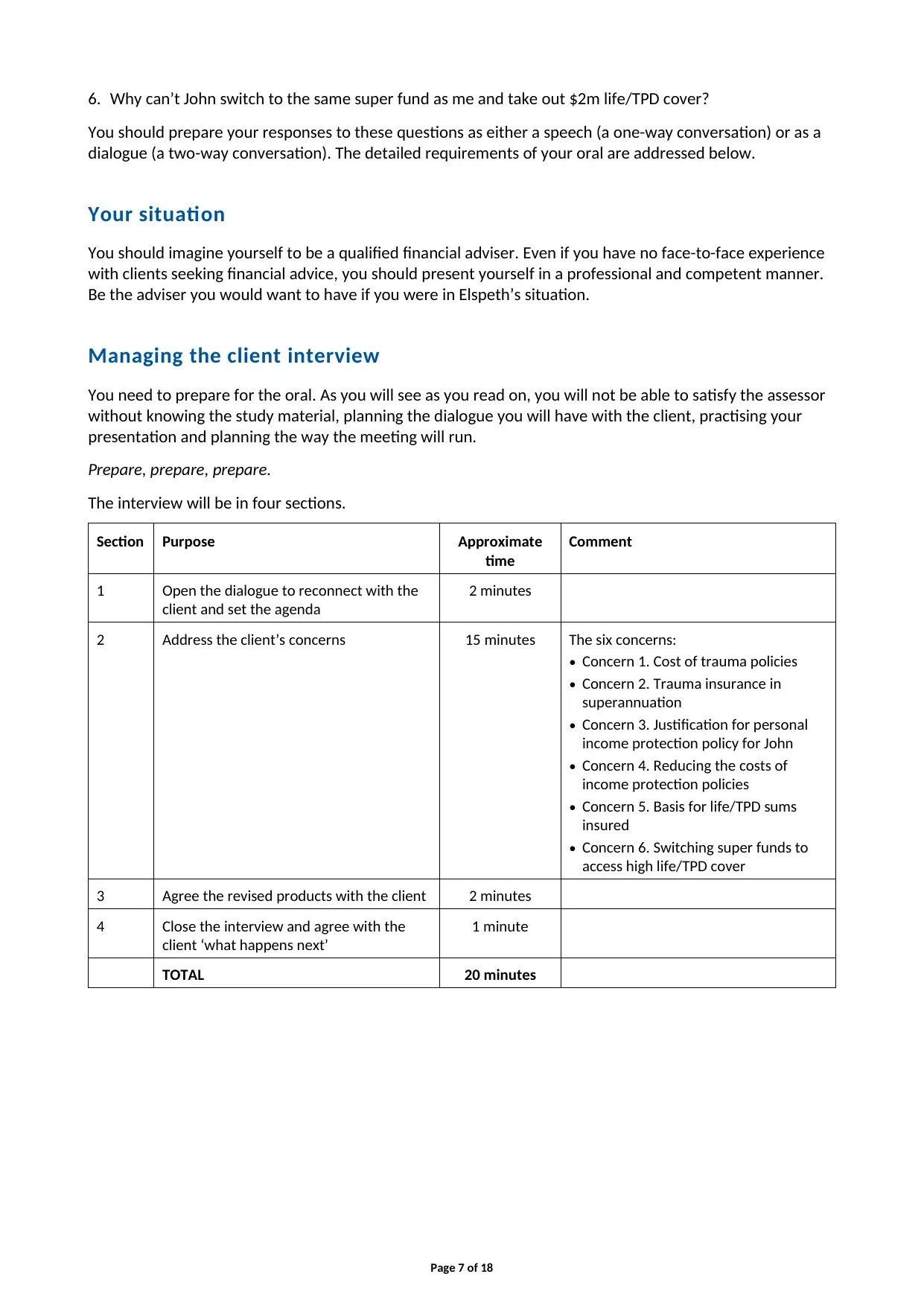

Managing the client interview

You need to prepare for the oral. As you will see as you read on, you will not be able to satisfy the assessor

without knowing the study material, planning the dialogue you will have with the client, practising your

presentation and planning the way the meeting will run.

Prepare, prepare, prepare.

The interview will be in four sections.

Section Purpose Approximate

time

Comment

1 Open the dialogue to reconnect with the

client and set the agenda

2 minutes

2 Address the client’s concerns 15 minutes The six concerns:

• Concern 1. Cost of trauma policies

• Concern 2. Trauma insurance in

superannuation

• Concern 3. Justification for personal

income protection policy for John

• Concern 4. Reducing the costs of

income protection policies

• Concern 5. Basis for life/TPD sums

insured

• Concern 6. Switching super funds to

access high life/TPD cover

3 Agree the revised products with the client 2 minutes

4 Close the interview and agree with the

client ‘what happens next’

1 minute

TOTAL 20 minutes

Page 7 of 18

You should prepare your responses to these questions as either a speech (a one-way conversation) or as a

dialogue (a two-way conversation). The detailed requirements of your oral are addressed below.

Your situation

You should imagine yourself to be a qualified financial adviser. Even if you have no face-to-face experience

with clients seeking financial advice, you should present yourself in a professional and competent manner.

Be the adviser you would want to have if you were in Elspeth’s situation.

Managing the client interview

You need to prepare for the oral. As you will see as you read on, you will not be able to satisfy the assessor

without knowing the study material, planning the dialogue you will have with the client, practising your

presentation and planning the way the meeting will run.

Prepare, prepare, prepare.

The interview will be in four sections.

Section Purpose Approximate

time

Comment

1 Open the dialogue to reconnect with the

client and set the agenda

2 minutes

2 Address the client’s concerns 15 minutes The six concerns:

• Concern 1. Cost of trauma policies

• Concern 2. Trauma insurance in

superannuation

• Concern 3. Justification for personal

income protection policy for John

• Concern 4. Reducing the costs of

income protection policies

• Concern 5. Basis for life/TPD sums

insured

• Concern 6. Switching super funds to

access high life/TPD cover

3 Agree the revised products with the client 2 minutes

4 Close the interview and agree with the

client ‘what happens next’

1 minute

TOTAL 20 minutes

Page 7 of 18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

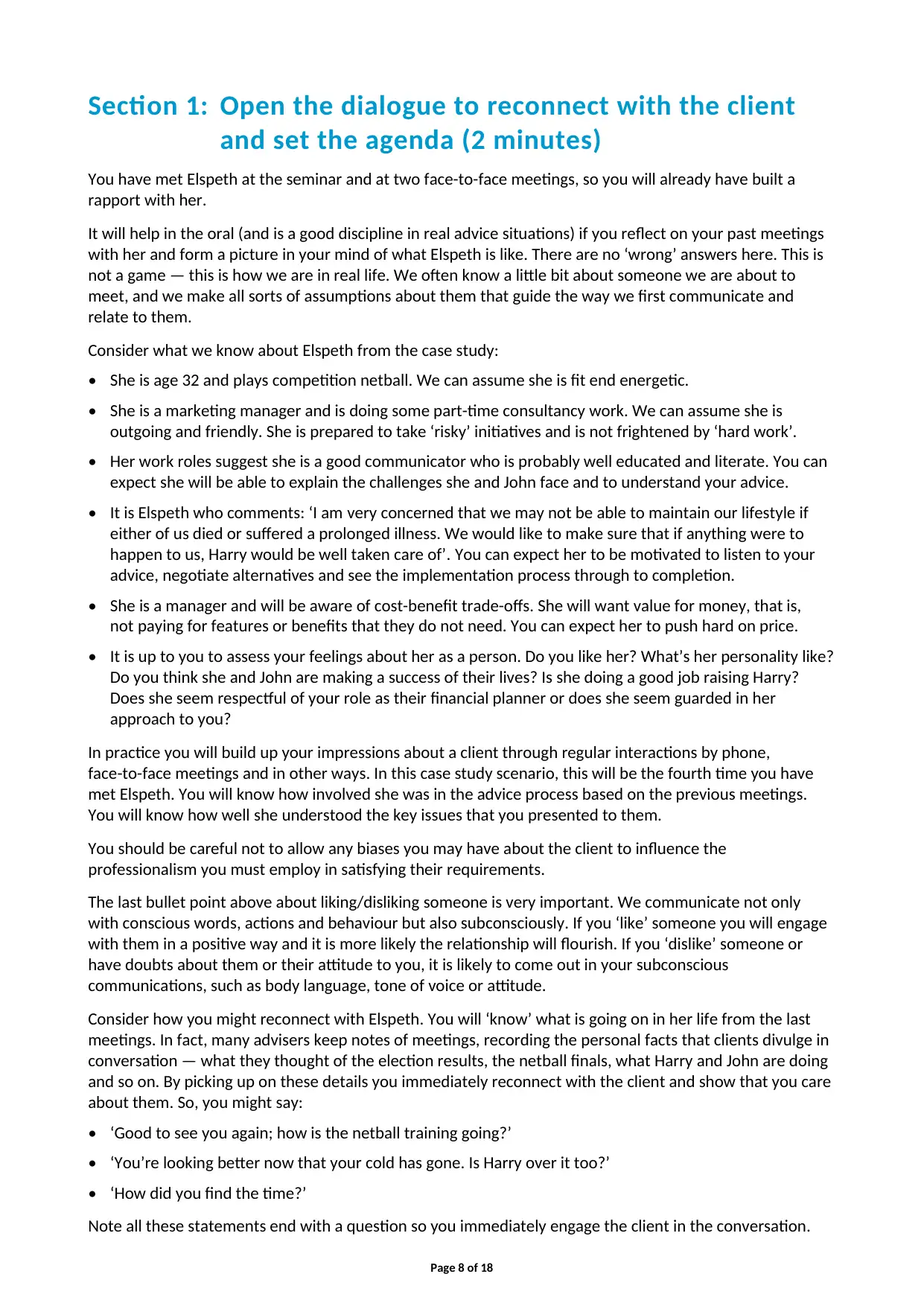

Section 1: Open the dialogue to reconnect with the client

and set the agenda (2 minutes)

You have met Elspeth at the seminar and at two face-to-face meetings, so you will already have built a

rapport with her.

It will help in the oral (and is a good discipline in real advice situations) if you reflect on your past meetings

with her and form a picture in your mind of what Elspeth is like. There are no ‘wrong’ answers here. This is

not a game — this is how we are in real life. We often know a little bit about someone we are about to

meet, and we make all sorts of assumptions about them that guide the way we first communicate and

relate to them.

Consider what we know about Elspeth from the case study:

• She is age 32 and plays competition netball. We can assume she is fit end energetic.

• She is a marketing manager and is doing some part-time consultancy work. We can assume she is

outgoing and friendly. She is prepared to take ‘risky’ initiatives and is not frightened by ‘hard work’.

• Her work roles suggest she is a good communicator who is probably well educated and literate. You can

expect she will be able to explain the challenges she and John face and to understand your advice.

• It is Elspeth who comments: ‘I am very concerned that we may not be able to maintain our lifestyle if

either of us died or suffered a prolonged illness. We would like to make sure that if anything were to

happen to us, Harry would be well taken care of’. You can expect her to be motivated to listen to your

advice, negotiate alternatives and see the implementation process through to completion.

• She is a manager and will be aware of cost-benefit trade-offs. She will want value for money, that is,

not paying for features or benefits that they do not need. You can expect her to push hard on price.

• It is up to you to assess your feelings about her as a person. Do you like her? What’s her personality like?

Do you think she and John are making a success of their lives? Is she doing a good job raising Harry?

Does she seem respectful of your role as their financial planner or does she seem guarded in her

approach to you?

In practice you will build up your impressions about a client through regular interactions by phone,

face-to-face meetings and in other ways. In this case study scenario, this will be the fourth time you have

met Elspeth. You will know how involved she was in the advice process based on the previous meetings.

You will know how well she understood the key issues that you presented to them.

You should be careful not to allow any biases you may have about the client to influence the

professionalism you must employ in satisfying their requirements.

The last bullet point above about liking/disliking someone is very important. We communicate not only

with conscious words, actions and behaviour but also subconsciously. If you ‘like’ someone you will engage

with them in a positive way and it is more likely the relationship will flourish. If you ‘dislike’ someone or

have doubts about them or their attitude to you, it is likely to come out in your subconscious

communications, such as body language, tone of voice or attitude.

Consider how you might reconnect with Elspeth. You will ‘know’ what is going on in her life from the last

meetings. In fact, many advisers keep notes of meetings, recording the personal facts that clients divulge in

conversation — what they thought of the election results, the netball finals, what Harry and John are doing

and so on. By picking up on these details you immediately reconnect with the client and show that you care

about them. So, you might say:

• ‘Good to see you again; how is the netball training going?’

• ‘You’re looking better now that your cold has gone. Is Harry over it too?’

• ‘How did you find the time?’

Note all these statements end with a question so you immediately engage the client in the conversation.

Page 8 of 18

and set the agenda (2 minutes)

You have met Elspeth at the seminar and at two face-to-face meetings, so you will already have built a

rapport with her.

It will help in the oral (and is a good discipline in real advice situations) if you reflect on your past meetings

with her and form a picture in your mind of what Elspeth is like. There are no ‘wrong’ answers here. This is

not a game — this is how we are in real life. We often know a little bit about someone we are about to

meet, and we make all sorts of assumptions about them that guide the way we first communicate and

relate to them.

Consider what we know about Elspeth from the case study:

• She is age 32 and plays competition netball. We can assume she is fit end energetic.

• She is a marketing manager and is doing some part-time consultancy work. We can assume she is

outgoing and friendly. She is prepared to take ‘risky’ initiatives and is not frightened by ‘hard work’.

• Her work roles suggest she is a good communicator who is probably well educated and literate. You can

expect she will be able to explain the challenges she and John face and to understand your advice.

• It is Elspeth who comments: ‘I am very concerned that we may not be able to maintain our lifestyle if

either of us died or suffered a prolonged illness. We would like to make sure that if anything were to

happen to us, Harry would be well taken care of’. You can expect her to be motivated to listen to your

advice, negotiate alternatives and see the implementation process through to completion.

• She is a manager and will be aware of cost-benefit trade-offs. She will want value for money, that is,

not paying for features or benefits that they do not need. You can expect her to push hard on price.

• It is up to you to assess your feelings about her as a person. Do you like her? What’s her personality like?

Do you think she and John are making a success of their lives? Is she doing a good job raising Harry?

Does she seem respectful of your role as their financial planner or does she seem guarded in her

approach to you?

In practice you will build up your impressions about a client through regular interactions by phone,

face-to-face meetings and in other ways. In this case study scenario, this will be the fourth time you have

met Elspeth. You will know how involved she was in the advice process based on the previous meetings.

You will know how well she understood the key issues that you presented to them.

You should be careful not to allow any biases you may have about the client to influence the

professionalism you must employ in satisfying their requirements.

The last bullet point above about liking/disliking someone is very important. We communicate not only

with conscious words, actions and behaviour but also subconsciously. If you ‘like’ someone you will engage

with them in a positive way and it is more likely the relationship will flourish. If you ‘dislike’ someone or

have doubts about them or their attitude to you, it is likely to come out in your subconscious

communications, such as body language, tone of voice or attitude.

Consider how you might reconnect with Elspeth. You will ‘know’ what is going on in her life from the last

meetings. In fact, many advisers keep notes of meetings, recording the personal facts that clients divulge in

conversation — what they thought of the election results, the netball finals, what Harry and John are doing

and so on. By picking up on these details you immediately reconnect with the client and show that you care

about them. So, you might say:

• ‘Good to see you again; how is the netball training going?’

• ‘You’re looking better now that your cold has gone. Is Harry over it too?’

• ‘How did you find the time?’

Note all these statements end with a question so you immediately engage the client in the conversation.

Page 8 of 18

You only need a short dialogue to reconnect with the client. Whilst it is important to be friendly and

engaging, you need to get ‘down to business’, so you need to transition to the second part of the meeting.

The transition from reconnecting to agreeing the agenda for the meeting may go as follows. You might say:

• ‘As you requested, what we’ll do today is to …’ (explain your agenda for the meeting).

• ‘I understand you are concerned about my life insurance recommendations, so I’d like to … (and then we

can…). Is that OK?’

• ‘I want to be sure you get what you want from this meeting. Am I right in saying …?’ (describe your

agenda).

Making this transition smoothly and professionally shows you are in control and know what you are doing.

It sends a message of confidence and capability.

Elspeth has told you their concerns about the life insurance recommendations before the meeting.

You should plan an agenda. This need not be complicated but should demonstrate your willingness to hear

their concerns, discuss alternatives and amend the life risk strategy if necessary. This could flow on to

different sums insured and product features, different premiums and even a change of superannuation

fund for John. A revised SOA would need to be prepared and signed off by the clients.

This part of the oral should take no more than two minutes.

Recording section 1 of the oral

Give your volunteer the assignment details describing Elspeth and John, your life risk recommendations and

the concerns she and John have expressed. Explain why she is coming to see you.

Agree with your volunteer how you will reaffirm your relationship with Elspeth and how you will set the

agenda for the meeting.

Page 9 of 18

engaging, you need to get ‘down to business’, so you need to transition to the second part of the meeting.

The transition from reconnecting to agreeing the agenda for the meeting may go as follows. You might say:

• ‘As you requested, what we’ll do today is to …’ (explain your agenda for the meeting).

• ‘I understand you are concerned about my life insurance recommendations, so I’d like to … (and then we

can…). Is that OK?’

• ‘I want to be sure you get what you want from this meeting. Am I right in saying …?’ (describe your

agenda).

Making this transition smoothly and professionally shows you are in control and know what you are doing.

It sends a message of confidence and capability.

Elspeth has told you their concerns about the life insurance recommendations before the meeting.

You should plan an agenda. This need not be complicated but should demonstrate your willingness to hear

their concerns, discuss alternatives and amend the life risk strategy if necessary. This could flow on to

different sums insured and product features, different premiums and even a change of superannuation

fund for John. A revised SOA would need to be prepared and signed off by the clients.

This part of the oral should take no more than two minutes.

Recording section 1 of the oral

Give your volunteer the assignment details describing Elspeth and John, your life risk recommendations and

the concerns she and John have expressed. Explain why she is coming to see you.

Agree with your volunteer how you will reaffirm your relationship with Elspeth and how you will set the

agenda for the meeting.

Page 9 of 18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Section 2: Address the client’s concerns (15 minutes)

In RG 146, ASIC describes a nine-stage financial planning process. These steps are as follows:

1. Establish and maintain a relationship with the client.

2. Identify client objectives, needs and financial situation.

3. Analyse client objectives, needs, financial situation and risk tolerance.

4. Develop appropriate strategies and solutions.

5. Present appropriate strategies and solutions to the client.

6. Negotiate financial plan/policy/transaction with the client.

7. Coordinate implementation of agreed financial plan/policy/transaction.

8. Complete and maintain necessary documentation.

9. Provide ongoing service.

After presenting the strategy and recommendations to the client (step 5), the next stage (step 6) is to

negotiate the details with the client. This is the essence of this part of the interview.

Dealing with a concern or problem

When a client expresses a concern, problem, or objection, you should handle the issue in three stages.

Firstly, acknowledge the problem, showing that you are interested and want to resolve it for the client.

You might say, ‘That’s a good point’ or ‘I can understand why you feel that way.’ Listen carefully.

Secondly, clarify what the client is saying to make sure you understand the true problem. You could say:

‘So the real problem is the cost of the policy?’ or ‘You are worried about the impact on your cash flow?’

Thirdly, respond to the client. This may mean explaining a misunderstanding, educating them on a technical

aspect of a recommendation and exploring assumptions that were made in the client’s needs and goals or

in your analysis.

You want to be open and honest. You can demonstrate that you are working for the client by using listening

skills, paraphrasing what the client says and giving the client time to understand and to absorb your

answers or suggestions.

You may find the client frustrating if they do not understand your answers the first time. Stay calm and be

prepared to restate or re-express your answers to ensure the client understands.

Practising your presentation

In an adviser role you will find you have to answer the same questions again and again to new and current

clients. For instance, ‘What does a financial planner do?’, ‘How much life insurance do I need?’ and

‘Should I hold life insurance in super or personally?’ Over time, with more knowledge and experience,

you will develop good answers to these questions in your own style. The detail of your answer may be

slightly different each time and will probably be different to answers by other advisers.

You should be able to answer common questions clearly and briefly. The length of your answer may vary

according to the topic and the client. For some clients you will keep it short and very simple, whereas other

clients may require a more in-depth answer. If you are not sure how much detail the client wants,

it’s probably better to start simple and ask if they want more information. For instance, you might say:

‘Well, broadly speaking … but in some cases, it may be … does that make sense?’ It is then up to the client

to acknowledge they have enough information or ask you for more information.

Page 10 of 18

In RG 146, ASIC describes a nine-stage financial planning process. These steps are as follows:

1. Establish and maintain a relationship with the client.

2. Identify client objectives, needs and financial situation.

3. Analyse client objectives, needs, financial situation and risk tolerance.

4. Develop appropriate strategies and solutions.

5. Present appropriate strategies and solutions to the client.

6. Negotiate financial plan/policy/transaction with the client.

7. Coordinate implementation of agreed financial plan/policy/transaction.

8. Complete and maintain necessary documentation.

9. Provide ongoing service.

After presenting the strategy and recommendations to the client (step 5), the next stage (step 6) is to

negotiate the details with the client. This is the essence of this part of the interview.

Dealing with a concern or problem

When a client expresses a concern, problem, or objection, you should handle the issue in three stages.

Firstly, acknowledge the problem, showing that you are interested and want to resolve it for the client.

You might say, ‘That’s a good point’ or ‘I can understand why you feel that way.’ Listen carefully.

Secondly, clarify what the client is saying to make sure you understand the true problem. You could say:

‘So the real problem is the cost of the policy?’ or ‘You are worried about the impact on your cash flow?’

Thirdly, respond to the client. This may mean explaining a misunderstanding, educating them on a technical

aspect of a recommendation and exploring assumptions that were made in the client’s needs and goals or

in your analysis.

You want to be open and honest. You can demonstrate that you are working for the client by using listening

skills, paraphrasing what the client says and giving the client time to understand and to absorb your

answers or suggestions.

You may find the client frustrating if they do not understand your answers the first time. Stay calm and be

prepared to restate or re-express your answers to ensure the client understands.

Practising your presentation

In an adviser role you will find you have to answer the same questions again and again to new and current

clients. For instance, ‘What does a financial planner do?’, ‘How much life insurance do I need?’ and

‘Should I hold life insurance in super or personally?’ Over time, with more knowledge and experience,

you will develop good answers to these questions in your own style. The detail of your answer may be

slightly different each time and will probably be different to answers by other advisers.

You should be able to answer common questions clearly and briefly. The length of your answer may vary

according to the topic and the client. For some clients you will keep it short and very simple, whereas other

clients may require a more in-depth answer. If you are not sure how much detail the client wants,

it’s probably better to start simple and ask if they want more information. For instance, you might say:

‘Well, broadly speaking … but in some cases, it may be … does that make sense?’ It is then up to the client

to acknowledge they have enough information or ask you for more information.

Page 10 of 18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In this oral, you should be able to respond to the client’s six questions without prompts or reminders —

just as you would do if you were face-to-face with them. This doesn’t mean you have to memorise your

words like an actor but that you should recall the key points and be able to cover them clearly.

Your answers must be tailored to the audience who is listening to your speech. In Elspeth’s case, she has

explained her six questions, so you can focus on the issues that interest her. Question 1 will be handled as a

short to-and-from dialogue, whereas Question 2 is simpler and will be made as a speech.

You should write and practise your answers to the questions with a friend or colleague or in front of a

mirror. You must say it out loud, so it will sound natural. Repeat until it feels comfortable. Make sure your

answers are clear and brief.

You should end every answer with a question, thus requiring feedback from the client to ensure they

understand and are satisfied with your response. In ‘real life’ you would look and listen for signs that what

the client says is not what they mean. The client may say ‘yes’ but their body language and mannerisms

may suggest they don’t understand and are too embarrassed to say ‘no’.

In some parts of these orals, you and the volunteer/client will have a structured dialogue with statements

and questions from you and answers from them.

Recording the oral

Section 2, concern 1: The cost of the trauma policies seems very high. Do we really need

to pay off the mortgage if we experience a short-term traumatic illness or accident?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Section 2, concern 2: Are there any super funds that offer trauma insurance?

In this part of the oral you will restate Elspeth’s concern and make a short statement rather than having a

to-and-fro dialogue. Your short speech to answer the client’s question should be about 100 words long

(this means you will use the speech for clients who want more detail).

This part of the oral should take about 1 minute.

Section 2, concern 3: Why did you recommend a personal income protection policy for

John when his super fund offers that cover?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Section 2, concern 4: Are there any other ways we can reduce the cost of the income

protection policies whilst retaining the same benefits?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Page 11 of 18

just as you would do if you were face-to-face with them. This doesn’t mean you have to memorise your

words like an actor but that you should recall the key points and be able to cover them clearly.

Your answers must be tailored to the audience who is listening to your speech. In Elspeth’s case, she has

explained her six questions, so you can focus on the issues that interest her. Question 1 will be handled as a

short to-and-from dialogue, whereas Question 2 is simpler and will be made as a speech.

You should write and practise your answers to the questions with a friend or colleague or in front of a

mirror. You must say it out loud, so it will sound natural. Repeat until it feels comfortable. Make sure your

answers are clear and brief.

You should end every answer with a question, thus requiring feedback from the client to ensure they

understand and are satisfied with your response. In ‘real life’ you would look and listen for signs that what

the client says is not what they mean. The client may say ‘yes’ but their body language and mannerisms

may suggest they don’t understand and are too embarrassed to say ‘no’.

In some parts of these orals, you and the volunteer/client will have a structured dialogue with statements

and questions from you and answers from them.

Recording the oral

Section 2, concern 1: The cost of the trauma policies seems very high. Do we really need

to pay off the mortgage if we experience a short-term traumatic illness or accident?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Section 2, concern 2: Are there any super funds that offer trauma insurance?

In this part of the oral you will restate Elspeth’s concern and make a short statement rather than having a

to-and-fro dialogue. Your short speech to answer the client’s question should be about 100 words long

(this means you will use the speech for clients who want more detail).

This part of the oral should take about 1 minute.

Section 2, concern 3: Why did you recommend a personal income protection policy for

John when his super fund offers that cover?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Section 2, concern 4: Are there any other ways we can reduce the cost of the income

protection policies whilst retaining the same benefits?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Page 11 of 18

Section 2, concern 5: Why does John need more life/TPD cover than me?

In this part of the oral you will restate Elspeth’s concern and make a short statement rather than having a

to-and-fro dialogue. Your short speech to answer the client’s question should be about 100 words long

(this means you will use the speech for clients who want more detail).

This part of the oral should take about 1 minute.

Section 2, concern 6: Why can’t John switch to the same super fund as me and take out

$2m life/TPD cover?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Note: You should not read your dialogue as if it were a script. You would not do that in a real-life client

situation. Your assessor will be able to tell from your voice if you are reading.

Section 3: Agree the revised products with the client

(2 minutes)

This statement should be between one and two minutes long.

Page 12 of 18

In this part of the oral you will restate Elspeth’s concern and make a short statement rather than having a

to-and-fro dialogue. Your short speech to answer the client’s question should be about 100 words long

(this means you will use the speech for clients who want more detail).

This part of the oral should take about 1 minute.

Section 2, concern 6: Why can’t John switch to the same super fund as me and take out

$2m life/TPD cover?

In this part of the oral you will restate Elspeth’s concern and make a statement about the concern.

You should involve the volunteer/client at least twice in the dialogue by giving them the opportunity to

respond to your suggestions or to ask a question.

This part of the oral should take about 2 minutes.

Note: You should not read your dialogue as if it were a script. You would not do that in a real-life client

situation. Your assessor will be able to tell from your voice if you are reading.

Section 3: Agree the revised products with the client

(2 minutes)

This statement should be between one and two minutes long.

Page 12 of 18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.