DigiSav Business Plan: Digitizing Savings Groups (UU-MBA-714-ZM)

VerifiedAdded on 2022/08/18

|16

|3912

|15

Project

AI Summary

This business plan outlines the strategic direction of DigiSav, a Zambian fintech startup aiming to promote financial inclusion by digitizing savings groups. The plan details the company's mission, vision, core values, and goals, along with a SWOT analysis to assess its strengths, weaknesses, opportunities, and threats. It includes market research, industry analysis, competitor identification, and target market segmentation. The marketing plan covers advertising and promotion strategies, while the investment and profitability section addresses capital injection, breakeven analysis, and other financial needs. The plan also discusses the company's governance structure, action plan, and expected economic benefits, emphasizing the use of a mobile application and USSD code to reach the unbanked and underbanked population. DigiSav aims to partner with Mobile Network Operators (MNOs) to leverage their networks and provide access to financial services such as loans, savings, insurance, and micro pensions, creating transaction histories and credit scores for customers.

Page 1

Week 4: Assignment 1

Develop a Business Plan

You are assigned to prepare a business plan of a small / family

business of your choice

Business Function and Procedures (UU-MBA-714-ZM)

STUDENT NO: R1711D3986200

Tutor: Ramakrushna Mahapatra

August 14, 2019

Week 4: Assignment 1

Develop a Business Plan

You are assigned to prepare a business plan of a small / family

business of your choice

Business Function and Procedures (UU-MBA-714-ZM)

STUDENT NO: R1711D3986200

Tutor: Ramakrushna Mahapatra

August 14, 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 2

DigiSav

BUSINESS PLAN

DIGITIZING THE SAVINGS GROUPS

(2019-2023)

Note: This business plan is a hypothetical case for academic use only. The company DigiSav. and

names used in the profile are hypothetical even though reference has been made to some real

corporate entities. However, the cases remain hypothetical and all actual data used is referenced.

August 2019

DigiSav

BUSINESS PLAN

DIGITIZING THE SAVINGS GROUPS

(2019-2023)

Note: This business plan is a hypothetical case for academic use only. The company DigiSav. and

names used in the profile are hypothetical even though reference has been made to some real

corporate entities. However, the cases remain hypothetical and all actual data used is referenced.

August 2019

Page 3

Contents

1.0 BUSINESS RATIONALE...................................................................................................................................4

1.1 Introduction..............................................................................................................................................4

1.2 Vision and Mission....................................................................................................................................5

1.3 Core Values...............................................................................................................................................5

1.4 Goals and Objectives................................................................................................................................5

1.5 Governance..............................................................................................................................................6

2.0 Market Research..........................................................................................................................................7

2.1 Situation Analysis - SWOT.........................................................................................................................7

2.1.1 Strengths...........................................................................................................................................7

2.1.2 Opportunities....................................................................................................................................8

2.1.3 Weaknesses.......................................................................................................................................8

2.1.4 Threats...............................................................................................................................................8

3.0 Industry Analysis...........................................................................................................................................8

3.1 Competitors..............................................................................................................................................8

3.2 Target Market and Products.....................................................................................................................9

4.0 Marketing Plan...........................................................................................................................................10

4.1 Advertisement or Promotions................................................................................................................10

5.0 Investment and Profitability.......................................................................................................................12

5.1 Injection of Capital..................................................................................................................................12

5.2 Breakeven analysis.................................................................................................................................12

5.3 Other Financial needs.............................................................................................................................12

6.0 Inventors, Economic Benefits and Justification..........................................................................................13

7.0 Action Plan.................................................................................................................................................13

8.0 Conclusion..................................................................................................................................................14

References........................................................................................................................................................16

Contents

1.0 BUSINESS RATIONALE...................................................................................................................................4

1.1 Introduction..............................................................................................................................................4

1.2 Vision and Mission....................................................................................................................................5

1.3 Core Values...............................................................................................................................................5

1.4 Goals and Objectives................................................................................................................................5

1.5 Governance..............................................................................................................................................6

2.0 Market Research..........................................................................................................................................7

2.1 Situation Analysis - SWOT.........................................................................................................................7

2.1.1 Strengths...........................................................................................................................................7

2.1.2 Opportunities....................................................................................................................................8

2.1.3 Weaknesses.......................................................................................................................................8

2.1.4 Threats...............................................................................................................................................8

3.0 Industry Analysis...........................................................................................................................................8

3.1 Competitors..............................................................................................................................................8

3.2 Target Market and Products.....................................................................................................................9

4.0 Marketing Plan...........................................................................................................................................10

4.1 Advertisement or Promotions................................................................................................................10

5.0 Investment and Profitability.......................................................................................................................12

5.1 Injection of Capital..................................................................................................................................12

5.2 Breakeven analysis.................................................................................................................................12

5.3 Other Financial needs.............................................................................................................................12

6.0 Inventors, Economic Benefits and Justification..........................................................................................13

7.0 Action Plan.................................................................................................................................................13

8.0 Conclusion..................................................................................................................................................14

References........................................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 4

1.0 BUSINESS RATIONALE

1.1 Introduction

DigiSav is a Startup Fintech which is limited by shares and has its

operation in Lusaka, Zambia. DigiSav aims to partner with Mobile Network

Operators (MNOs) and leverage on their networks in order to promote

financial inclusion by banking the underbanked and unbanked population

through digitization of Savings Groups in rural areas.

DigiSav was a brainchild of two brothers after taking advantage of market

gaps that showed that there was linkage disconnect of Savings Groups

(SGs) to formal financial services; the SGs face the risk of security over

physical cash and difficult of maintaining a manual based record keeping

system; members are unable to access formal financial services due to lack

of transaction history or credit history for FSPs to determine customer

credit worthiness. Further, most of the rural adult population are

uneducated triggering slow uptake of financial services. It is from this

backdrop that DigiSav was credited to bank the unbanked and underbanked

population as well as meet the financial inclusion agenda for the country.

The product DigiSav offers is centered around onboarding of SGs on its

network that is accessed either through an android mobile application or

Unstructured Supplementary Service Data (USSD) code on a mobile phone.

The onboarding process requires registration of the SG on the DigiSav

mobile phone application savings group platform. The system requires

creation of a unique Personal Identification Number (PIN) for at least three

group leaders with basic Know-Your-Client (KYC) as required by the

Zambia Information and Communication Technology Authority (ZICTA)

for sim card registration.

The DigiSav platform accords the underbanked and unbanked population to

be able to access financial services such as loans, savings, insurance and

micro pension from formal Financial Service Providers (FSPs) and other

non-financial services due to the ability of the system to store and generate

credit scores. The system therefore creates a transaction history for

customers and acts as another source of revenue for the company when

FSPs search its database. In addition, the system is able to handle Big Data

1.0 BUSINESS RATIONALE

1.1 Introduction

DigiSav is a Startup Fintech which is limited by shares and has its

operation in Lusaka, Zambia. DigiSav aims to partner with Mobile Network

Operators (MNOs) and leverage on their networks in order to promote

financial inclusion by banking the underbanked and unbanked population

through digitization of Savings Groups in rural areas.

DigiSav was a brainchild of two brothers after taking advantage of market

gaps that showed that there was linkage disconnect of Savings Groups

(SGs) to formal financial services; the SGs face the risk of security over

physical cash and difficult of maintaining a manual based record keeping

system; members are unable to access formal financial services due to lack

of transaction history or credit history for FSPs to determine customer

credit worthiness. Further, most of the rural adult population are

uneducated triggering slow uptake of financial services. It is from this

backdrop that DigiSav was credited to bank the unbanked and underbanked

population as well as meet the financial inclusion agenda for the country.

The product DigiSav offers is centered around onboarding of SGs on its

network that is accessed either through an android mobile application or

Unstructured Supplementary Service Data (USSD) code on a mobile phone.

The onboarding process requires registration of the SG on the DigiSav

mobile phone application savings group platform. The system requires

creation of a unique Personal Identification Number (PIN) for at least three

group leaders with basic Know-Your-Client (KYC) as required by the

Zambia Information and Communication Technology Authority (ZICTA)

for sim card registration.

The DigiSav platform accords the underbanked and unbanked population to

be able to access financial services such as loans, savings, insurance and

micro pension from formal Financial Service Providers (FSPs) and other

non-financial services due to the ability of the system to store and generate

credit scores. The system therefore creates a transaction history for

customers and acts as another source of revenue for the company when

FSPs search its database. In addition, the system is able to handle Big Data

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 5

which is envisaged to be a potential revenue stream in the future through

data analytics.

This business plan is therefore formulated with the aim to provide the

strategic direction of DigiSav and maintain a competitive advantage and

attain long term organizational performance. This is important because a

business that does not plan has already planned to fail (Kotler, 2011)

1.2 Vision and Mission

Mission

Our mission is to bridge the gap in financial inclusion by being a beckon of

excellence in mobile based application platforms and offer customer centric

digital financial services for banking of the underbanked and unbanked

adult population.

Vision

Our vision is to collaborate with partners that have financial inclusion

penetration in rural areas and savings groups to provide savings, credit and

other value added services through a mobile phone based savings group

platform.

1.3 Core Values

The core values of DigiSav include quality, innovation, teamwork, honesty

and customer receptiveness. These are the values that support the vision

and define our values and culture.

1.4 Goals and Objectives

In the next one (1) to five (5) years the nonfinancial goals of DigiSav

include creation of an image as the company with a mobile platform of

choice for Savings Groups (SGs); Leverage on the network of existing

mobile network providers in Zambia by signing contract with all three (3)

mobile network providers to offer the DigiSav mobile service through their

networks; To phase our penetration and product launch province by

province to cover at least six (6) of the ten (10) provinces over the five (5)

year period, Lusaka, Eastern, Southern, Central, Copperbelt, and North

Western province.

which is envisaged to be a potential revenue stream in the future through

data analytics.

This business plan is therefore formulated with the aim to provide the

strategic direction of DigiSav and maintain a competitive advantage and

attain long term organizational performance. This is important because a

business that does not plan has already planned to fail (Kotler, 2011)

1.2 Vision and Mission

Mission

Our mission is to bridge the gap in financial inclusion by being a beckon of

excellence in mobile based application platforms and offer customer centric

digital financial services for banking of the underbanked and unbanked

adult population.

Vision

Our vision is to collaborate with partners that have financial inclusion

penetration in rural areas and savings groups to provide savings, credit and

other value added services through a mobile phone based savings group

platform.

1.3 Core Values

The core values of DigiSav include quality, innovation, teamwork, honesty

and customer receptiveness. These are the values that support the vision

and define our values and culture.

1.4 Goals and Objectives

In the next one (1) to five (5) years the nonfinancial goals of DigiSav

include creation of an image as the company with a mobile platform of

choice for Savings Groups (SGs); Leverage on the network of existing

mobile network providers in Zambia by signing contract with all three (3)

mobile network providers to offer the DigiSav mobile service through their

networks; To phase our penetration and product launch province by

province to cover at least six (6) of the ten (10) provinces over the five (5)

year period, Lusaka, Eastern, Southern, Central, Copperbelt, and North

Western province.

Page 6

Our financial goals over the five (5) years will be to record earnings per

share growth rate of at least four (4) percent per annum over time and

return on equity of at least twenty (20) percent.

1.5 Governance

DigiSav is incorporated in Zambia and is a family business limited by

shares and governed by the Companies Act Cap 388 of the laws of Zambia.

DigiSav has a firm policy to adhere to both local and applicable

international laws and regulations and so is registered with Patents and

Companies Registration Agency (PACRA), Zambia Revenue Authority

(ZRA) for Taxpayer Identification Number (TPIN), Value Added Tax

(VAT) and corporate Tax, Bank of Zambia (BoZ) for mobile payment

license. It also recognizes national and international regulations on

customer data protection such as the Cyber Security Act and the General

Data Protection Regulation (GDPR).

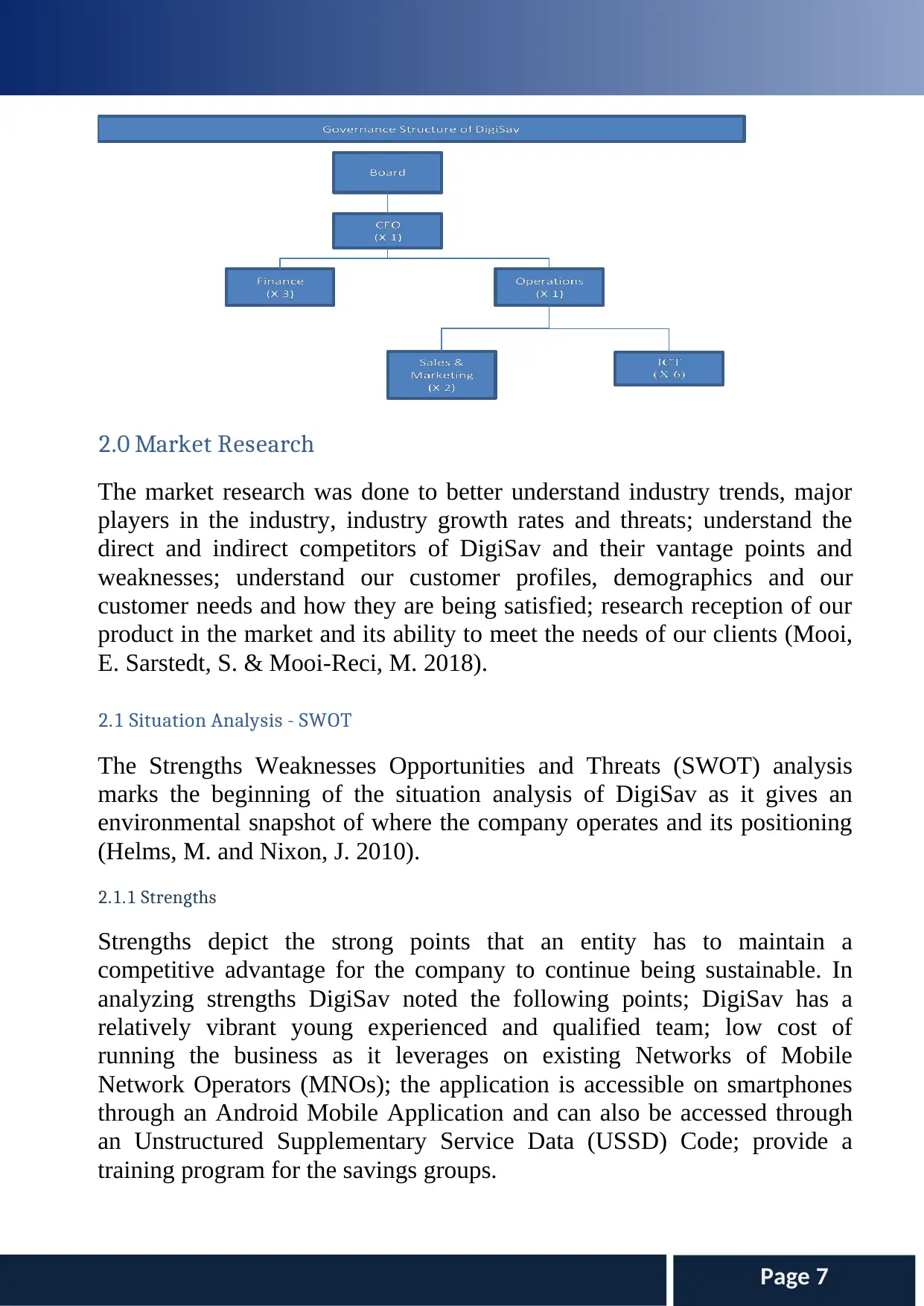

DigiSav has a board of directors (BoDs) that dictates the strategic direction

by formulating corporate strategies and policies. The BoDs delegate

functions to the executive senior management with mandate to ensure the

mission and vision of DigiSav is drawn into objectives attainable in the

medium to long term. Medium to long term objectives are further cascaded

to operational and line managers that interpret them to operational goals

achievable in the short term. These short term goals are what is aligned to

individual Key Performance Indicators (KPIs). KPIs ultimately meet

strategic objectives of DigiSav and its vision. DigiSav substantially adopts

the emergent strategy formulation technique because it enables for

convergent behavior and collective participation in strategy formulation

(Messori, 2016).

The shareholding percentage in the company is split 60:40 between the

CEO and the Operations Director.

Figure 1: Governance Structure

Our financial goals over the five (5) years will be to record earnings per

share growth rate of at least four (4) percent per annum over time and

return on equity of at least twenty (20) percent.

1.5 Governance

DigiSav is incorporated in Zambia and is a family business limited by

shares and governed by the Companies Act Cap 388 of the laws of Zambia.

DigiSav has a firm policy to adhere to both local and applicable

international laws and regulations and so is registered with Patents and

Companies Registration Agency (PACRA), Zambia Revenue Authority

(ZRA) for Taxpayer Identification Number (TPIN), Value Added Tax

(VAT) and corporate Tax, Bank of Zambia (BoZ) for mobile payment

license. It also recognizes national and international regulations on

customer data protection such as the Cyber Security Act and the General

Data Protection Regulation (GDPR).

DigiSav has a board of directors (BoDs) that dictates the strategic direction

by formulating corporate strategies and policies. The BoDs delegate

functions to the executive senior management with mandate to ensure the

mission and vision of DigiSav is drawn into objectives attainable in the

medium to long term. Medium to long term objectives are further cascaded

to operational and line managers that interpret them to operational goals

achievable in the short term. These short term goals are what is aligned to

individual Key Performance Indicators (KPIs). KPIs ultimately meet

strategic objectives of DigiSav and its vision. DigiSav substantially adopts

the emergent strategy formulation technique because it enables for

convergent behavior and collective participation in strategy formulation

(Messori, 2016).

The shareholding percentage in the company is split 60:40 between the

CEO and the Operations Director.

Figure 1: Governance Structure

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 7

2.0 Market Research

The market research was done to better understand industry trends, major

players in the industry, industry growth rates and threats; understand the

direct and indirect competitors of DigiSav and their vantage points and

weaknesses; understand our customer profiles, demographics and our

customer needs and how they are being satisfied; research reception of our

product in the market and its ability to meet the needs of our clients (Mooi,

E. Sarstedt, S. & Mooi-Reci, M. 2018).

2.1 Situation Analysis - SWOT

The Strengths Weaknesses Opportunities and Threats (SWOT) analysis

marks the beginning of the situation analysis of DigiSav as it gives an

environmental snapshot of where the company operates and its positioning

(Helms, M. and Nixon, J. 2010).

2.1.1 Strengths

Strengths depict the strong points that an entity has to maintain a

competitive advantage for the company to continue being sustainable. In

analyzing strengths DigiSav noted the following points; DigiSav has a

relatively vibrant young experienced and qualified team; low cost of

running the business as it leverages on existing Networks of Mobile

Network Operators (MNOs); the application is accessible on smartphones

through an Android Mobile Application and can also be accessed through

an Unstructured Supplementary Service Data (USSD) Code; provide a

training program for the savings groups.

2.0 Market Research

The market research was done to better understand industry trends, major

players in the industry, industry growth rates and threats; understand the

direct and indirect competitors of DigiSav and their vantage points and

weaknesses; understand our customer profiles, demographics and our

customer needs and how they are being satisfied; research reception of our

product in the market and its ability to meet the needs of our clients (Mooi,

E. Sarstedt, S. & Mooi-Reci, M. 2018).

2.1 Situation Analysis - SWOT

The Strengths Weaknesses Opportunities and Threats (SWOT) analysis

marks the beginning of the situation analysis of DigiSav as it gives an

environmental snapshot of where the company operates and its positioning

(Helms, M. and Nixon, J. 2010).

2.1.1 Strengths

Strengths depict the strong points that an entity has to maintain a

competitive advantage for the company to continue being sustainable. In

analyzing strengths DigiSav noted the following points; DigiSav has a

relatively vibrant young experienced and qualified team; low cost of

running the business as it leverages on existing Networks of Mobile

Network Operators (MNOs); the application is accessible on smartphones

through an Android Mobile Application and can also be accessed through

an Unstructured Supplementary Service Data (USSD) Code; provide a

training program for the savings groups.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 8

2.1.2 Opportunities

Opportunities represent prospects external to the company that can be

exploited to attain a competitive edge (Morden, 1993: p.29-30). The

opportunities of DigiSav include a favorable regulatory environment and

government’s will to support financial inclusion; wide spread mobile

network infrastructure throughout the country; increasing financial

inclusion rates over the years as measured by the Finscope Survey which

show increasing levels of inclusion to 59 percent in 2015 from 39 percent

in 2009 and the rate is expected to be higher in the next survey in 2020.

2.1.3 Weaknesses

The weaknesses represent internal pitfalls that have the potential to

negatively affect the company if not properly managed or alleviated. These

can potentially damage the reputation of DigiSav or adversely affect its

sustainability. The management of DigiSav note that the company lacks

experience in the market and is a family business therefore does not have a

strong financial backing to support rapid expansion; the company depends

on leveraging on network of MNOs and its small nature means that it does

not have much negotiating power over the large and powerful MNOs on

fixing the pricing structure.

2.1.4 Threats

Despite having a favorable regulatory environment, the financial sector is

overly regulated; MNOs have set up subsidiaries as per law in Zambia that

are mobile money service providers and can easily enter into the market.

They already have a proven mobile platform and the customer base.

Further, emergent of new substitute products or technologies such as block-

chain technology, artificial intelligence, big data and cryptocurrency pose a

threat of development new product or rendering existing products obsolete.

3.0 Industry Analysis

The industry analysis aims to speak in a detailed manner to the company’s

competitors and customers in the context of a detailed knowledge of the

environment in which a company operates (Anne-Maria, H. 2014).

2.1.2 Opportunities

Opportunities represent prospects external to the company that can be

exploited to attain a competitive edge (Morden, 1993: p.29-30). The

opportunities of DigiSav include a favorable regulatory environment and

government’s will to support financial inclusion; wide spread mobile

network infrastructure throughout the country; increasing financial

inclusion rates over the years as measured by the Finscope Survey which

show increasing levels of inclusion to 59 percent in 2015 from 39 percent

in 2009 and the rate is expected to be higher in the next survey in 2020.

2.1.3 Weaknesses

The weaknesses represent internal pitfalls that have the potential to

negatively affect the company if not properly managed or alleviated. These

can potentially damage the reputation of DigiSav or adversely affect its

sustainability. The management of DigiSav note that the company lacks

experience in the market and is a family business therefore does not have a

strong financial backing to support rapid expansion; the company depends

on leveraging on network of MNOs and its small nature means that it does

not have much negotiating power over the large and powerful MNOs on

fixing the pricing structure.

2.1.4 Threats

Despite having a favorable regulatory environment, the financial sector is

overly regulated; MNOs have set up subsidiaries as per law in Zambia that

are mobile money service providers and can easily enter into the market.

They already have a proven mobile platform and the customer base.

Further, emergent of new substitute products or technologies such as block-

chain technology, artificial intelligence, big data and cryptocurrency pose a

threat of development new product or rendering existing products obsolete.

3.0 Industry Analysis

The industry analysis aims to speak in a detailed manner to the company’s

competitors and customers in the context of a detailed knowledge of the

environment in which a company operates (Anne-Maria, H. 2014).

Page 9

3.1 Competitors

Understanding competitors and knowing them helps a company to develop

products that stand out from the competition.

https://www.infoentrepreneurs.org/en/guides/understand-your-competitors/

DigiSav will be operating in a market in which all the three MNOs in

Zambia have well established mobile payment platforms operated through

their subsidiaries therefore posing both an opportunity and a threat for

DigiSav. Our company will have the advantage of leveraging on the MNOs

who already have a customer base and customer confidence. Conversely,

the MNOs have the potential to enter our market though we note that it is

unlikely to happen because our service is not a core product offering for

them. However, contracting and partnering with them mitigates this risk.

There is no direct competitor in the market as there is no known bank or

fintech on the market offering a similar product. There was a fintech that

emerged with the promise of offering a similar product that would digitize

SGs but suddenly exited without a prototype of their product nor licensing

with relevant regulatory authorities. In this regard, DigiSav enjoys a

monopolistic market at the moment and has leeway to experiment on

pricing.

3.2 Target Market and Products

DigiSave recognizes that Zambia has about 4,700 Savings Groups (SGs)

with over hundred thousand members with cumulative savings amounting

K39 million which are outside the formal financial service and comprise the

target market for DigiSav which is largely digitizing the SGs thereby

formerly including them and providing them with products they are

otherwise unable to access such as secured savings, access to credit outside

the closed user group, micro insurance and investments products.

SGs represent a group of people, usually numbering ten (10) to fifteen (15)

that come together due to lack of access to funding and credit to form a

group that pools money together for the purpose of providing funding and

credit within the closed group. DigiSav notes that these groups keep

physical cash therefore face the risk of theft and issues around monitoring

of deposits made by group members. Therefore, DigiSav provides a

3.1 Competitors

Understanding competitors and knowing them helps a company to develop

products that stand out from the competition.

https://www.infoentrepreneurs.org/en/guides/understand-your-competitors/

DigiSav will be operating in a market in which all the three MNOs in

Zambia have well established mobile payment platforms operated through

their subsidiaries therefore posing both an opportunity and a threat for

DigiSav. Our company will have the advantage of leveraging on the MNOs

who already have a customer base and customer confidence. Conversely,

the MNOs have the potential to enter our market though we note that it is

unlikely to happen because our service is not a core product offering for

them. However, contracting and partnering with them mitigates this risk.

There is no direct competitor in the market as there is no known bank or

fintech on the market offering a similar product. There was a fintech that

emerged with the promise of offering a similar product that would digitize

SGs but suddenly exited without a prototype of their product nor licensing

with relevant regulatory authorities. In this regard, DigiSav enjoys a

monopolistic market at the moment and has leeway to experiment on

pricing.

3.2 Target Market and Products

DigiSave recognizes that Zambia has about 4,700 Savings Groups (SGs)

with over hundred thousand members with cumulative savings amounting

K39 million which are outside the formal financial service and comprise the

target market for DigiSav which is largely digitizing the SGs thereby

formerly including them and providing them with products they are

otherwise unable to access such as secured savings, access to credit outside

the closed user group, micro insurance and investments products.

SGs represent a group of people, usually numbering ten (10) to fifteen (15)

that come together due to lack of access to funding and credit to form a

group that pools money together for the purpose of providing funding and

credit within the closed group. DigiSav notes that these groups keep

physical cash therefore face the risk of theft and issues around monitoring

of deposits made by group members. Therefore, DigiSav provides a

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 10

platform that offers the SGs security to money and proper record of

transactions.

The SGs are segmented into three groups, rural and unbanked SGs with

mobile phone access, rural and unbanked SGs without mobile access and

urban and banked SGs. The marketing plan as shown below in 4.0 varies

for each segment by defining the market and showing the position of the

company in the market (Kotler, 2011).

In addition to the core product of serving SGs, DigiSav will also offer big

data and a credit scoring service. The credit scores will provide a data base

for other Financial Service Providers (FSPs) to use to identify the credit

worthiness of customers and for enabling customers access other financial

and non-financial products there were unable to access.

DigiSav will also provide capacity building to SGs in partnership with

partners such as SaveNet in order to create financial education awareness

amongst SG members.

These will therefore build a base upon which other revenue streams can be

generated in addition to our niche of digitizing savings groups – a product

which no one is offering on the market and strategically positions us as

being the only players on the market.

4.0 Marketing Plan

4.1 Advertisement or Promotions

DigiSav will follow the strategies which have been formed around its

competencies to take advantage of the opportunities in the environment and

mitigate its weaknesses and threats as it strives towards its objectives. The

strategies are an expression of how DigiSav plans to achieve its objectives

in the next one (1) to five (5) years. DigiSav currently follows a focus

strategy centered around market segment. In the long-run, DigiSav will

pursue a broader diversification strategy to attain both market penetration

so at to have greater dominance in the market and market development to

ensure that the products reaches all target geographic areas, six (6) of ten

(10) provinces in five (5) years. https://www.youtube.com/watch?v=FgwJbE1wIzk

platform that offers the SGs security to money and proper record of

transactions.

The SGs are segmented into three groups, rural and unbanked SGs with

mobile phone access, rural and unbanked SGs without mobile access and

urban and banked SGs. The marketing plan as shown below in 4.0 varies

for each segment by defining the market and showing the position of the

company in the market (Kotler, 2011).

In addition to the core product of serving SGs, DigiSav will also offer big

data and a credit scoring service. The credit scores will provide a data base

for other Financial Service Providers (FSPs) to use to identify the credit

worthiness of customers and for enabling customers access other financial

and non-financial products there were unable to access.

DigiSav will also provide capacity building to SGs in partnership with

partners such as SaveNet in order to create financial education awareness

amongst SG members.

These will therefore build a base upon which other revenue streams can be

generated in addition to our niche of digitizing savings groups – a product

which no one is offering on the market and strategically positions us as

being the only players on the market.

4.0 Marketing Plan

4.1 Advertisement or Promotions

DigiSav will follow the strategies which have been formed around its

competencies to take advantage of the opportunities in the environment and

mitigate its weaknesses and threats as it strives towards its objectives. The

strategies are an expression of how DigiSav plans to achieve its objectives

in the next one (1) to five (5) years. DigiSav currently follows a focus

strategy centered around market segment. In the long-run, DigiSav will

pursue a broader diversification strategy to attain both market penetration

so at to have greater dominance in the market and market development to

ensure that the products reaches all target geographic areas, six (6) of ten

(10) provinces in five (5) years. https://www.youtube.com/watch?v=FgwJbE1wIzk

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 11

The focus will be on building a strong competitive position in the first two

(2) years and thereafter shift attention towards diversifying operations in

the remaining three (3) years. it is believed that these steps will help us to

move towards the realization of our corporate vision. The three (3)

segmented products will therefore be advertised as follows:

a. The Urban and Banked SGs

The main channel of advertising for this segment will be advertisements

on Social media such as facebook, LinkedIn, Tweeter, and YouTude, TV

and radio, newspapers, magazines, and journals. This segment is

financially included, tech-savvy, financially sound and still want to

benefit from the advantage that comes with SGs. In this regard, this form

of advertisement is most appropriate for them. Social media is therefore

a great tool for advertising as the number of mobile phone owners

continues to grow (Okazaki, S. & Taylor, C. 2013). Occasional

advertising at trade exhibitions such as trade expos and minimal

sponsorship of events will be done.

b. The Rural and Unbanked SGs with Mobile Phone Access

This segment will be mainly targeted through sending of bulk messages

in local languages for a targeted demographic area. It’s noted that SGs

have an association in Zambia known as SaveNet that is an umbrella

body and requires that all SGs are registered with it. In this regard,

SaveNet does a lot of education and sensitization campaigns in rural

areas to bring unregistered groups under its ambit. We will therefore

leverage on SaveNet through a Memorandum of Understanding (MOU)

as a means to reach the rural based groups through these teachable

moments.

c. The Rural and Unbanked SGs without Mobile Phone Access

As highlighted above the main advertising channel for these groups will

be teachable moments from the MOU with SaveNet because it has a

greater rural penetration. Each registered group with SaveNet without a

mobile phone and subscribes to our product will qualify for our tier two

The focus will be on building a strong competitive position in the first two

(2) years and thereafter shift attention towards diversifying operations in

the remaining three (3) years. it is believed that these steps will help us to

move towards the realization of our corporate vision. The three (3)

segmented products will therefore be advertised as follows:

a. The Urban and Banked SGs

The main channel of advertising for this segment will be advertisements

on Social media such as facebook, LinkedIn, Tweeter, and YouTude, TV

and radio, newspapers, magazines, and journals. This segment is

financially included, tech-savvy, financially sound and still want to

benefit from the advantage that comes with SGs. In this regard, this form

of advertisement is most appropriate for them. Social media is therefore

a great tool for advertising as the number of mobile phone owners

continues to grow (Okazaki, S. & Taylor, C. 2013). Occasional

advertising at trade exhibitions such as trade expos and minimal

sponsorship of events will be done.

b. The Rural and Unbanked SGs with Mobile Phone Access

This segment will be mainly targeted through sending of bulk messages

in local languages for a targeted demographic area. It’s noted that SGs

have an association in Zambia known as SaveNet that is an umbrella

body and requires that all SGs are registered with it. In this regard,

SaveNet does a lot of education and sensitization campaigns in rural

areas to bring unregistered groups under its ambit. We will therefore

leverage on SaveNet through a Memorandum of Understanding (MOU)

as a means to reach the rural based groups through these teachable

moments.

c. The Rural and Unbanked SGs without Mobile Phone Access

As highlighted above the main advertising channel for these groups will

be teachable moments from the MOU with SaveNet because it has a

greater rural penetration. Each registered group with SaveNet without a

mobile phone and subscribes to our product will qualify for our tier two

Page 12

product that comes with three mobile phones for the group leaders.

However, the phones can be made available to all the members at a small

monthly fee. This will reduce costs for us as we do not need to

physically go into rural areas. We will also do exhibitions at annual

provisional shows with messages printed in local languages.

Performance to gauge effectiveness of the advertising or promotion plan

will be done through monitoring the levels of turnover as a result of

advertising, monitoring customer awareness through research, monitoring

the number of customer transactions on the platform and customer

registrations.

In order to ensure that the marketing plan is executed affectively, DigiSav

has employed a permanent sales and marketing specialist that oversees

market penetration, development and product development strategies and

diversification.

5.0 Investment and Profitability

5.1 Injection of Capital

DigiSav will require funding of $200,000 of which fifty (60) percent will

mainly cover advertisement cost due to the expected high advertisement

costs in the first three (3) years and printing of education material. forty

(40) percent will be used for the phased provisional expansion program in

the six (6) provinces over the five (5) years.

The directors do not draw a salary until the company breaks even and

begins to make a profit in year four (4) onwards.

5.2 Breakeven analysis

Financial projections indicate that DigiSav will have a breakeven point in

year four (4) and subsequently report net profits of $80,384 (US) in year

four with an increase of ten percent (10%) in year five (5). At breakeven

point, the mobile platform for SGs will have eighty percent utilization

(80%).

product that comes with three mobile phones for the group leaders.

However, the phones can be made available to all the members at a small

monthly fee. This will reduce costs for us as we do not need to

physically go into rural areas. We will also do exhibitions at annual

provisional shows with messages printed in local languages.

Performance to gauge effectiveness of the advertising or promotion plan

will be done through monitoring the levels of turnover as a result of

advertising, monitoring customer awareness through research, monitoring

the number of customer transactions on the platform and customer

registrations.

In order to ensure that the marketing plan is executed affectively, DigiSav

has employed a permanent sales and marketing specialist that oversees

market penetration, development and product development strategies and

diversification.

5.0 Investment and Profitability

5.1 Injection of Capital

DigiSav will require funding of $200,000 of which fifty (60) percent will

mainly cover advertisement cost due to the expected high advertisement

costs in the first three (3) years and printing of education material. forty

(40) percent will be used for the phased provisional expansion program in

the six (6) provinces over the five (5) years.

The directors do not draw a salary until the company breaks even and

begins to make a profit in year four (4) onwards.

5.2 Breakeven analysis

Financial projections indicate that DigiSav will have a breakeven point in

year four (4) and subsequently report net profits of $80,384 (US) in year

four with an increase of ten percent (10%) in year five (5). At breakeven

point, the mobile platform for SGs will have eighty percent utilization

(80%).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.