Impact of Digital Banking on Customer Satisfaction: Research Proposal

VerifiedAdded on 2022/10/03

|20

|5180

|299

Report

AI Summary

This research proposal investigates the influence of digital banking on customer satisfaction, specifically focusing on Rokel Commercial Bank in Sierra Leone. The proposal includes an introduction outlining the research's purpose and background, detailing the shift from traditional to online banking. It explores the benefits of digital banking, such as increased customer convenience and cost reduction, while also acknowledging potential risks related to security and privacy. The research aims to understand the concept of digital banking, analyze its impact on customer satisfaction, and provide recommendations for Rokel Commercial Bank. The methodology includes the Research Onion Framework and various data collection and analysis methods. The proposal also covers ethical considerations, a time schedule, and resources needed for the study, concluding with a list of references. The study aims to offer insights into how digital banking can enhance customer satisfaction and provide Rokel Commercial Bank with strategies to improve its services.

Research proposal

8 / 1 7 / 2 0 1 9

8 / 1 7 / 2 0 1 9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research proposal 1

Contents

Title............................................................................................................................................2

Introduction................................................................................................................................2

Research Background.................................................................................................................2

Company background............................................................................................................5

Industry background...................................................................................................................5

Research aim and objectives..................................................................................................6

Research questions.................................................................................................................6

Research rational....................................................................................................................7

Research methodology...............................................................................................................7

Research Onion Framework...................................................................................................7

Research Philosophy..............................................................................................................8

Research Approach................................................................................................................9

Research design......................................................................................................................9

Research Strategy.................................................................................................................10

Data Collection Methods......................................................................................................11

Sampling Method.................................................................................................................11

Data Analysis Method..........................................................................................................12

Ethical Consideration...........................................................................................................12

Time schedule..........................................................................................................................13

Resources.................................................................................................................................13

Conclusion................................................................................................................................15

References................................................................................................................................16

Figure 1: Research Onion Framework 8

Contents

Title............................................................................................................................................2

Introduction................................................................................................................................2

Research Background.................................................................................................................2

Company background............................................................................................................5

Industry background...................................................................................................................5

Research aim and objectives..................................................................................................6

Research questions.................................................................................................................6

Research rational....................................................................................................................7

Research methodology...............................................................................................................7

Research Onion Framework...................................................................................................7

Research Philosophy..............................................................................................................8

Research Approach................................................................................................................9

Research design......................................................................................................................9

Research Strategy.................................................................................................................10

Data Collection Methods......................................................................................................11

Sampling Method.................................................................................................................11

Data Analysis Method..........................................................................................................12

Ethical Consideration...........................................................................................................12

Time schedule..........................................................................................................................13

Resources.................................................................................................................................13

Conclusion................................................................................................................................15

References................................................................................................................................16

Figure 1: Research Onion Framework 8

Research proposal 2

Table 1: Research plan for completing the project 13

Title

Impact of digital banking on customer satisfaction in commercial banks: a case of Rokel

Commercial Bank.

Introduction

The purpose of paper is to conduct the research proposal that assists in evaluating the

influence of digital banking on the client satisfaction related to Rokel commercial bank,

Sierra Leone. The impact of the digital banking on client satisfaction can be positive as well

as can be negative. Considering the same, the research proposal will involve the

recommendations to the Rokel commercial bank with the motive to recover their operations

in order to meet level of satisfaction to customers. The proposal of the research further

includes background of research rational for research with the justification. In addition to

this, the researcher will make use of the different methods in order to collect the information

due to which methodology is considered in proposal. The effective use of the research

methodology helps the company to determine the diverse techniques which are needed to

accomplish the task of research in the effective manner. In the end of the proposal the

timeline as well as resources are mentioned.

Research Background

The increasing progress as well as the development is the knowledgeable in information and

communication technology because it has carried many changes related to all the facts of the

life. The traditional banking practice has been replaced with the online banking which is

considered as benefit for the companies who are performing the operations in the market. The

Table 1: Research plan for completing the project 13

Title

Impact of digital banking on customer satisfaction in commercial banks: a case of Rokel

Commercial Bank.

Introduction

The purpose of paper is to conduct the research proposal that assists in evaluating the

influence of digital banking on the client satisfaction related to Rokel commercial bank,

Sierra Leone. The impact of the digital banking on client satisfaction can be positive as well

as can be negative. Considering the same, the research proposal will involve the

recommendations to the Rokel commercial bank with the motive to recover their operations

in order to meet level of satisfaction to customers. The proposal of the research further

includes background of research rational for research with the justification. In addition to

this, the researcher will make use of the different methods in order to collect the information

due to which methodology is considered in proposal. The effective use of the research

methodology helps the company to determine the diverse techniques which are needed to

accomplish the task of research in the effective manner. In the end of the proposal the

timeline as well as resources are mentioned.

Research Background

The increasing progress as well as the development is the knowledgeable in information and

communication technology because it has carried many changes related to all the facts of the

life. The traditional banking practice has been replaced with the online banking which is

considered as benefit for the companies who are performing the operations in the market. The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research proposal 3

online banking is one of the technologies that are used by the fastest rising exercise in terms

of banking (Alwan and Al-Zubi, 2016). The digital banking is not only provided by the

private banks in the market but commercial banks are also offering the services through the

digital banking because they are considering the requirements of the customers that are

changing in Sierra Leone market.

Digital banking system has allowed clients to access information with the help of the digital

system. In the research, this has been found that e-banking services first appeared in initial

1990s that credit card, ATM and telephone and many others (Ariff, Yun, Zakuan and Ismail,

2013). The digital banking allows the customer to conduct the activities like enquiry, e-

payments as well as e-transfer. The digital banking system leads to benefits as it adds value to

the satisfaction of the customers in relation to the better as well as improved service

offerings. It allows the banks to gain more competitive advantage in market over the diverse

range of other companies dealing in the same the industry. The developments also leads to

the opportunity of high associated risks that are witnessed in study as this risk can hinder the

achievement of e-banking services that constitute major concern for both customers as well

as the financial institutions (Kheng, Mahamad, and Ramayah, 2010).

The use of digital banking by customers has brought numerous benefits as it has reduced the

cost of the customers and service provider. The banks operate the business nationwide with

brick and mortar bank which means that fees are paying for the cost of personnel within the

different nation, handling and advertisement. The cost of commercial banks has been

declined because of emergence of digital banking because customers conduct the online

operations that help them to easy process and transaction.

The customers can connect to the services without any geographical barriers which lead to

the high performance in the banking business with assistance of digital banking through

online banking is one of the technologies that are used by the fastest rising exercise in terms

of banking (Alwan and Al-Zubi, 2016). The digital banking is not only provided by the

private banks in the market but commercial banks are also offering the services through the

digital banking because they are considering the requirements of the customers that are

changing in Sierra Leone market.

Digital banking system has allowed clients to access information with the help of the digital

system. In the research, this has been found that e-banking services first appeared in initial

1990s that credit card, ATM and telephone and many others (Ariff, Yun, Zakuan and Ismail,

2013). The digital banking allows the customer to conduct the activities like enquiry, e-

payments as well as e-transfer. The digital banking system leads to benefits as it adds value to

the satisfaction of the customers in relation to the better as well as improved service

offerings. It allows the banks to gain more competitive advantage in market over the diverse

range of other companies dealing in the same the industry. The developments also leads to

the opportunity of high associated risks that are witnessed in study as this risk can hinder the

achievement of e-banking services that constitute major concern for both customers as well

as the financial institutions (Kheng, Mahamad, and Ramayah, 2010).

The use of digital banking by customers has brought numerous benefits as it has reduced the

cost of the customers and service provider. The banks operate the business nationwide with

brick and mortar bank which means that fees are paying for the cost of personnel within the

different nation, handling and advertisement. The cost of commercial banks has been

declined because of emergence of digital banking because customers conduct the online

operations that help them to easy process and transaction.

The customers can connect to the services without any geographical barriers which lead to

the high performance in the banking business with assistance of digital banking through

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research proposal 4

faster delivery of information from customer as well as provider of service (Suleiman

Awwad, and Mohammad Agti, 2011). The digital banking is preferred by the customers as

this saves the time and encourages service quality which drives the customer satisfaction. The

most essential benefits to digital banking involves that consumers have a greater handle on

their amount since they only requires a connection of mobile to access their financial records.

The latest adoption of making use of technology that has supported the banks to spread their

purchaser base while electronic banking that has been showed to be main progression (Paul,

Mittal, and Srivastav, 2016).

The satisfaction of the customer is highly personal assessment that is highly influenced by the

expectation of the individual. It has been observed that satisfaction of the customer or

dissatisfaction is based on the achievement of the expectations of related to the service or

product. This can be understood that some of the customers who directly get engage in the

online shopping websites makes the payment for the products through only mode only rather

than the cash on delivery of the products (Srivastav and Mittal, 2016). The payment of the

product is done by company through online gateway which helps them to place the order

without any worries. However, banking online speed can influence the expectations of

customers as well as level of satisfaction. The good speed of the online transaction will lead

to good or positive customer satisfaction and vice versa. The full access to account

information related to the balances and transaction history, pay bills, transfers funds and

many other things. In addition, the mobile banking is a fast, easy and protected method to

contact the contact your books in few seconds. The customers can check history again and

again for checking their balances and they can also cross check the payment which is made

by them. This gives assurance that customers can make safe payment with the help of the

digital banking (Subashini, 2016).

faster delivery of information from customer as well as provider of service (Suleiman

Awwad, and Mohammad Agti, 2011). The digital banking is preferred by the customers as

this saves the time and encourages service quality which drives the customer satisfaction. The

most essential benefits to digital banking involves that consumers have a greater handle on

their amount since they only requires a connection of mobile to access their financial records.

The latest adoption of making use of technology that has supported the banks to spread their

purchaser base while electronic banking that has been showed to be main progression (Paul,

Mittal, and Srivastav, 2016).

The satisfaction of the customer is highly personal assessment that is highly influenced by the

expectation of the individual. It has been observed that satisfaction of the customer or

dissatisfaction is based on the achievement of the expectations of related to the service or

product. This can be understood that some of the customers who directly get engage in the

online shopping websites makes the payment for the products through only mode only rather

than the cash on delivery of the products (Srivastav and Mittal, 2016). The payment of the

product is done by company through online gateway which helps them to place the order

without any worries. However, banking online speed can influence the expectations of

customers as well as level of satisfaction. The good speed of the online transaction will lead

to good or positive customer satisfaction and vice versa. The full access to account

information related to the balances and transaction history, pay bills, transfers funds and

many other things. In addition, the mobile banking is a fast, easy and protected method to

contact the contact your books in few seconds. The customers can check history again and

again for checking their balances and they can also cross check the payment which is made

by them. This gives assurance that customers can make safe payment with the help of the

digital banking (Subashini, 2016).

Research proposal 5

It has been witnessed that the impact of the digital banking is not only positive it can be

negative related to the customer satisfaction. There are particular issues that are raised which

involved the fraudsters as well as criminals for stealing the details of the customers that are

dealing with those commercial banks. The digital banking emergence affects the customer

satisfaction with the rise in the issue of privacy as well as security related to details of

customers (Osei-Assibey and Augustine Bockarie, 2013). The aim of the paper is conduct the

research proposal with the topic impact of digital banking on customer’s satisfaction majorly

in commercial banks in relation to the case of Rokel Commercial Bank.

In addition to this, the major issue or challenge that has been witnessed that at most of places

include the rural area. Rokel commercial bank offers the services at every location where

they find the issue that at some areas they deal with the issue of the internet connectivity

which affects the customer satisfaction. This is one of the reasons due to which the customers

can switch the bank and this ultimately influences the customer loyalty within the market.

Company background

Rokel commercial bank came into existence in the year 1917 as Barclays Bank DCO with

100% shared that are owned by parent business. In the year 1917, the company was

incorporated locally with this it was retitled Barclays Bank of Sierra Leone Limited with

minimum of 25% shared that are majorly established by Sierra Leoneans along with 75%

Barclays Bank International (Rokel Commercial Bank, 2019). The major reason behind the

transfer was to motivate the Sierra Leoneans to take the participation as holders and to form

the confidence in bank. The basic banking facilities that are offered by bank in money

transfers, investment, call accounts, VISA debit card, checking, savings and others. Rokel

commercial bank has network of approx. 16 branches that helps them in offering the services

to their customers across the nation as this is the only way through which the bank can grab

It has been witnessed that the impact of the digital banking is not only positive it can be

negative related to the customer satisfaction. There are particular issues that are raised which

involved the fraudsters as well as criminals for stealing the details of the customers that are

dealing with those commercial banks. The digital banking emergence affects the customer

satisfaction with the rise in the issue of privacy as well as security related to details of

customers (Osei-Assibey and Augustine Bockarie, 2013). The aim of the paper is conduct the

research proposal with the topic impact of digital banking on customer’s satisfaction majorly

in commercial banks in relation to the case of Rokel Commercial Bank.

In addition to this, the major issue or challenge that has been witnessed that at most of places

include the rural area. Rokel commercial bank offers the services at every location where

they find the issue that at some areas they deal with the issue of the internet connectivity

which affects the customer satisfaction. This is one of the reasons due to which the customers

can switch the bank and this ultimately influences the customer loyalty within the market.

Company background

Rokel commercial bank came into existence in the year 1917 as Barclays Bank DCO with

100% shared that are owned by parent business. In the year 1917, the company was

incorporated locally with this it was retitled Barclays Bank of Sierra Leone Limited with

minimum of 25% shared that are majorly established by Sierra Leoneans along with 75%

Barclays Bank International (Rokel Commercial Bank, 2019). The major reason behind the

transfer was to motivate the Sierra Leoneans to take the participation as holders and to form

the confidence in bank. The basic banking facilities that are offered by bank in money

transfers, investment, call accounts, VISA debit card, checking, savings and others. Rokel

commercial bank has network of approx. 16 branches that helps them in offering the services

to their customers across the nation as this is the only way through which the bank can grab

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research proposal 6

the opportunity of serving their services to most of the customers in the nation (Rokel

Commercial Bank, 2019).

Rokel commercial bank offers digital banking

Rokel commercial bank provides facility of the digital banking to their customers which leads

to the high satisfaction. This helps in meeting the mission of company that is to provide the

banking as well as the related financial services with the motive to form the strong, lasting as

well as satisfying relationship with the employees, clients, shareholders and communities.

The company introduced the Rokel Simkorpor product which was a milestone in the bank as

it effort to promote inclusion of financial. The Rokel Simkorpor product is the one of the

mobile application that is designed in order to take banking to the doorsteps of clients as well

as it was designed by the bank after an initial survey in which they determine that low level

of education, coupled with the long queues in the bank as well as the bureaucratic nature of

the old banking process (Sesay, 2019). This application can be used by the people with the

motive to withdraw, making deposits, payment for the products as well as services, checking

of the balances, and transfer from one RC bank account to another.

Industry background

The industry that is majorly focused in the research proposal is commercial banking industry.

It has been witnessed that in late 1980s, the monetary scheme of Sierra Leone was consists of

the banking sector that majorly involves four commercial groups that majorly include

Standard charted bank (SL) limited, Sierra Leone Commercial Bank (SLCB), Barclays Bank

(SL) Limited (which is currently known as Rokel Commercial bank) and International Bank

for Trade and Industry (IBTI). Since then the banking industry of the country is evolving and

improving with the help of the new technologies that are helping in improving the operations

as well as in accomplished needs of clients. In end of the year 2017, it has been witnessed

the opportunity of serving their services to most of the customers in the nation (Rokel

Commercial Bank, 2019).

Rokel commercial bank offers digital banking

Rokel commercial bank provides facility of the digital banking to their customers which leads

to the high satisfaction. This helps in meeting the mission of company that is to provide the

banking as well as the related financial services with the motive to form the strong, lasting as

well as satisfying relationship with the employees, clients, shareholders and communities.

The company introduced the Rokel Simkorpor product which was a milestone in the bank as

it effort to promote inclusion of financial. The Rokel Simkorpor product is the one of the

mobile application that is designed in order to take banking to the doorsteps of clients as well

as it was designed by the bank after an initial survey in which they determine that low level

of education, coupled with the long queues in the bank as well as the bureaucratic nature of

the old banking process (Sesay, 2019). This application can be used by the people with the

motive to withdraw, making deposits, payment for the products as well as services, checking

of the balances, and transfer from one RC bank account to another.

Industry background

The industry that is majorly focused in the research proposal is commercial banking industry.

It has been witnessed that in late 1980s, the monetary scheme of Sierra Leone was consists of

the banking sector that majorly involves four commercial groups that majorly include

Standard charted bank (SL) limited, Sierra Leone Commercial Bank (SLCB), Barclays Bank

(SL) Limited (which is currently known as Rokel Commercial bank) and International Bank

for Trade and Industry (IBTI). Since then the banking industry of the country is evolving and

improving with the help of the new technologies that are helping in improving the operations

as well as in accomplished needs of clients. In end of the year 2017, it has been witnessed

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research proposal 7

that the country banking industry involves total number of 14 commercial banks. In addition,

some other financial institutions were formed which include Home Finance Company (SL)

Limited, First Discount House (SL) Limited and 5 foreign exchange bureaux. Along with

this, three additional banks with the six branches were majorly established in the year 2001

(Osei-Assibey and Augustine Bockarie, 2013).

Research aim and objectives

The aim of research is to determine influence of the digital banking on consumer satisfaction

in context of commercial banks majorly considering the Rokel Commercial Bank. The

motive of researcher is to accomplish the aim due to which the different objectives are

presented below: -

To comprehend the concept digital banking in terms of commercial banks.

To analyze influence of digital banking on consumer satisfaction for Rokel

Commercial Bank

To provide the recommendation to Rokel Commercial Bank for improving customer

satisfaction through digital banking.

Research questions

What is concept of digital banking in terms of commercial banks?

How digital banking influences consumer satisfaction for Rokel Commercial Bank?

What recommendations are provided to Rokel Commercial Bank for improving

customer satisfaction through digital banking?

Research rational

In the present environment, every companies being it banking or other are looking for the

meeting the expectation of the customers present in the market as this is the way through

which they can manage their business operations and leads to the success. It has been

that the country banking industry involves total number of 14 commercial banks. In addition,

some other financial institutions were formed which include Home Finance Company (SL)

Limited, First Discount House (SL) Limited and 5 foreign exchange bureaux. Along with

this, three additional banks with the six branches were majorly established in the year 2001

(Osei-Assibey and Augustine Bockarie, 2013).

Research aim and objectives

The aim of research is to determine influence of the digital banking on consumer satisfaction

in context of commercial banks majorly considering the Rokel Commercial Bank. The

motive of researcher is to accomplish the aim due to which the different objectives are

presented below: -

To comprehend the concept digital banking in terms of commercial banks.

To analyze influence of digital banking on consumer satisfaction for Rokel

Commercial Bank

To provide the recommendation to Rokel Commercial Bank for improving customer

satisfaction through digital banking.

Research questions

What is concept of digital banking in terms of commercial banks?

How digital banking influences consumer satisfaction for Rokel Commercial Bank?

What recommendations are provided to Rokel Commercial Bank for improving

customer satisfaction through digital banking?

Research rational

In the present environment, every companies being it banking or other are looking for the

meeting the expectation of the customers present in the market as this is the way through

which they can manage their business operations and leads to the success. It has been

Research proposal 8

determined that it is essential for companies to adopt new technologies which majorly

involve digital banking as this contributes in customer satisfaction (Alwan and Al-Zubi,

2016). The adaptation of technology makes work easy and simple for the customers as they

can easily access diverse facilities provided by commercial banks. In addition to this,

commercial banks adopt this technology with the motive to give the tough competition to

other banks available in the sector. The study is essential to be conducted by the researchers

as it will offer the better understanding about the digital banking and their used by the Rokel

Commercial Bank majorly for accomplishing the needs of customers. In addition, it is very

significant to conduct the research as this will bring recommendations related to digital

banking that leads to the satisfaction for the consumers.

Research methodology

The research methodology is the particular procedures or the techniques that are majorly used

to determine, select, process as well as evaluate the data linked to the research concern. The

researcher will consider the research mythology through which they allow the reader to

critically analyze the overall study validity as well as reliability (Bryman, 2006).

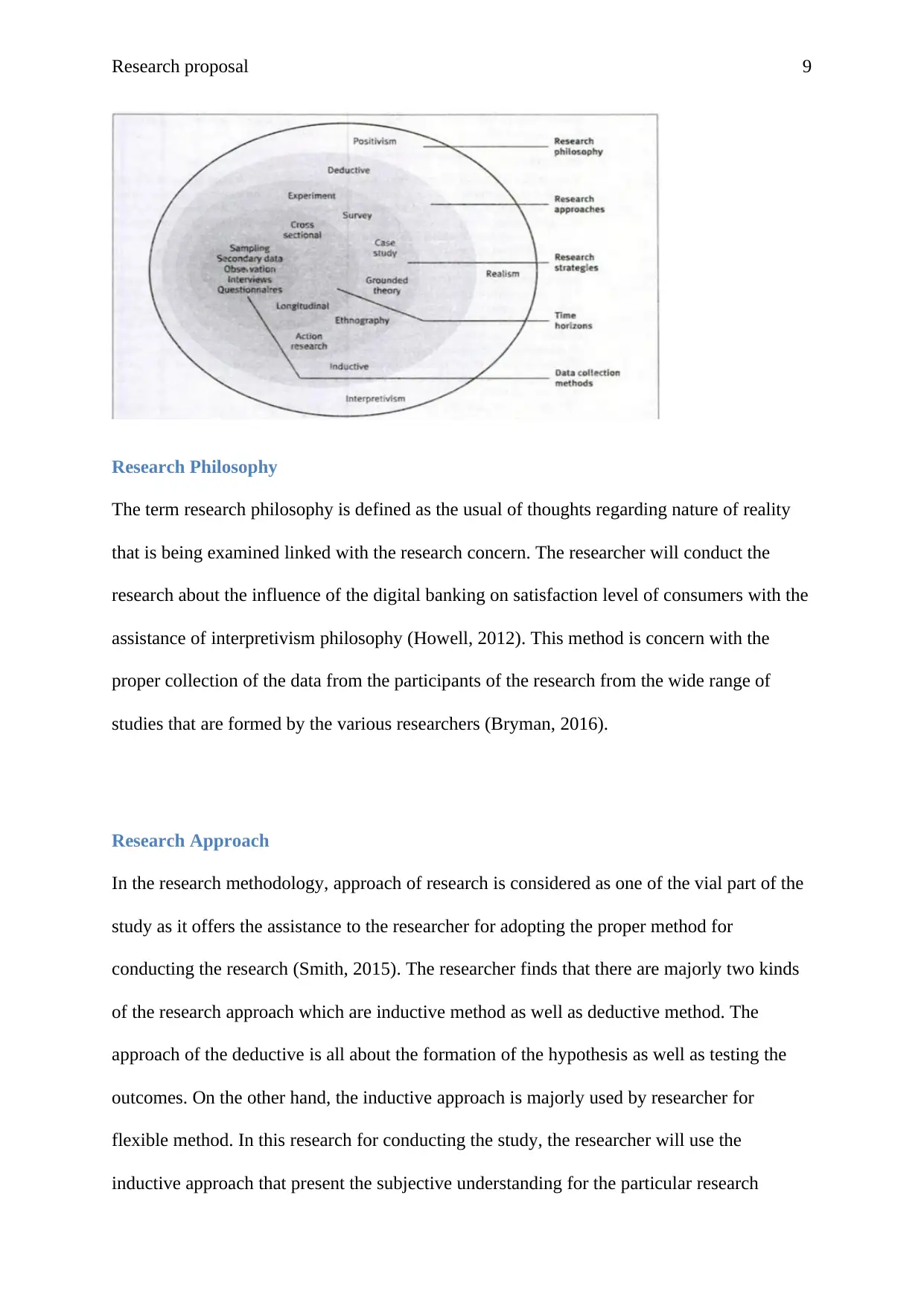

Research Onion Framework

The research methodology is a section that includes different research approaches, methods

as well as wide range of policies that will be majorly used by investigator with the motive to

gather precise as well as reliable information to meet the objectives of the research (Saunders,

2003). The onion framework is majorly used for in depth understanding related to tools as

well as techniques of the research. It has been determined that research onion framework has

been developed by the Saunders with the motive to form quality of research in effective

manner (Sekaran and Bougie, 016).

Figure 1: Research Onion Framework

determined that it is essential for companies to adopt new technologies which majorly

involve digital banking as this contributes in customer satisfaction (Alwan and Al-Zubi,

2016). The adaptation of technology makes work easy and simple for the customers as they

can easily access diverse facilities provided by commercial banks. In addition to this,

commercial banks adopt this technology with the motive to give the tough competition to

other banks available in the sector. The study is essential to be conducted by the researchers

as it will offer the better understanding about the digital banking and their used by the Rokel

Commercial Bank majorly for accomplishing the needs of customers. In addition, it is very

significant to conduct the research as this will bring recommendations related to digital

banking that leads to the satisfaction for the consumers.

Research methodology

The research methodology is the particular procedures or the techniques that are majorly used

to determine, select, process as well as evaluate the data linked to the research concern. The

researcher will consider the research mythology through which they allow the reader to

critically analyze the overall study validity as well as reliability (Bryman, 2006).

Research Onion Framework

The research methodology is a section that includes different research approaches, methods

as well as wide range of policies that will be majorly used by investigator with the motive to

gather precise as well as reliable information to meet the objectives of the research (Saunders,

2003). The onion framework is majorly used for in depth understanding related to tools as

well as techniques of the research. It has been determined that research onion framework has

been developed by the Saunders with the motive to form quality of research in effective

manner (Sekaran and Bougie, 016).

Figure 1: Research Onion Framework

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Research proposal 9

Research Philosophy

The term research philosophy is defined as the usual of thoughts regarding nature of reality

that is being examined linked with the research concern. The researcher will conduct the

research about the influence of the digital banking on satisfaction level of consumers with the

assistance of interpretivism philosophy (Howell, 2012). This method is concern with the

proper collection of the data from the participants of the research from the wide range of

studies that are formed by the various researchers (Bryman, 2016).

Research Approach

In the research methodology, approach of research is considered as one of the vial part of the

study as it offers the assistance to the researcher for adopting the proper method for

conducting the research (Smith, 2015). The researcher finds that there are majorly two kinds

of the research approach which are inductive method as well as deductive method. The

approach of the deductive is all about the formation of the hypothesis as well as testing the

outcomes. On the other hand, the inductive approach is majorly used by researcher for

flexible method. In this research for conducting the study, the researcher will use the

inductive approach that present the subjective understanding for the particular research

Research Philosophy

The term research philosophy is defined as the usual of thoughts regarding nature of reality

that is being examined linked with the research concern. The researcher will conduct the

research about the influence of the digital banking on satisfaction level of consumers with the

assistance of interpretivism philosophy (Howell, 2012). This method is concern with the

proper collection of the data from the participants of the research from the wide range of

studies that are formed by the various researchers (Bryman, 2016).

Research Approach

In the research methodology, approach of research is considered as one of the vial part of the

study as it offers the assistance to the researcher for adopting the proper method for

conducting the research (Smith, 2015). The researcher finds that there are majorly two kinds

of the research approach which are inductive method as well as deductive method. The

approach of the deductive is all about the formation of the hypothesis as well as testing the

outcomes. On the other hand, the inductive approach is majorly used by researcher for

flexible method. In this research for conducting the study, the researcher will use the

inductive approach that present the subjective understanding for the particular research

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Research proposal 10

concern which is linked to the positive influence of digital banking on customer satisfaction

within commercial bank of Rokel, situated in Sierra Leone.

Research design

The research design in investigation methodology is referred to as the framework of methods

as well as methods that are selected by investigator with the motive to align the dissimilar

sort of components of the research in the reasonably logical manner with the motive to

effectively acknowledge the research concern (Kumar, 2010). The research design benefits

the research to from an effective planning process composed as this helps to conduct the

appropriate research. The major two methods that can be used by the research involves is

quantitative and qualitative method that can be considered by study for getting details. In

addition, it has been found that quantitative research majorly relies on the data of numerical

data with the help of the statistical tools as well as techniques (Mitchell and Jolley, 2012). On

other hand, method of qualitiative research provide the way to the research in order to form

the new perception as well as ideas linked to the positive as well as negative impact of digital

banking on the satisfaction of customers.

The researcher will apply quantitative research as research topic is in subjective nature. It will

remain supportive in order to form the true image towards the concern of research and to

gather the relevant information aligned with the topic. In addition, this method offers the

support in identifying the behaviour of human towards with the factor that can influence the

behaviour (Eriksson and Kovalainen, 2015). The objective aligned with the research can get

fulfilled with the help of effective tool and techniques that is understood by the researcher

due to which they use the qualitative method of research.

concern which is linked to the positive influence of digital banking on customer satisfaction

within commercial bank of Rokel, situated in Sierra Leone.

Research design

The research design in investigation methodology is referred to as the framework of methods

as well as methods that are selected by investigator with the motive to align the dissimilar

sort of components of the research in the reasonably logical manner with the motive to

effectively acknowledge the research concern (Kumar, 2010). The research design benefits

the research to from an effective planning process composed as this helps to conduct the

appropriate research. The major two methods that can be used by the research involves is

quantitative and qualitative method that can be considered by study for getting details. In

addition, it has been found that quantitative research majorly relies on the data of numerical

data with the help of the statistical tools as well as techniques (Mitchell and Jolley, 2012). On

other hand, method of qualitiative research provide the way to the research in order to form

the new perception as well as ideas linked to the positive as well as negative impact of digital

banking on the satisfaction of customers.

The researcher will apply quantitative research as research topic is in subjective nature. It will

remain supportive in order to form the true image towards the concern of research and to

gather the relevant information aligned with the topic. In addition, this method offers the

support in identifying the behaviour of human towards with the factor that can influence the

behaviour (Eriksson and Kovalainen, 2015). The objective aligned with the research can get

fulfilled with the help of effective tool and techniques that is understood by the researcher

due to which they use the qualitative method of research.

Research proposal 11

Research Strategy

The research strategy is adopted by researcher for carrying out research that can help them to

encounter aim of research. The investigator finds wide range of the research strategy for their

research that includes literature review, questionnaire, experiment, case study and many

others. In this research, researcher will practice literature review as the research strategy in

which they gather the details related to the different opinions of the authors that are presented

by them in different sources which include books, journal articles, website and many others

(Mackey and Gass, 2015). The information related to the digital banking with their influence

on commercial bank is majorly gathered from the journals as well as the website of the

company which makes the information more specific.

In addition to this, the research will select the diverse type of research for conducting the

research. This research types includes exploratory, descriptive, and causal research design

that can be used by the research as per their research concern (Myers, 2013). Considering this

research, the researcher will use the descriptive research that will support for gathering the

reliable information about the digital banking impact on consumer satisfaction. This type is

further supported with the help of literature review that include the different views for the

studies.

Data Collection Methods

The data collection is linked to gather data from wide sources of information that can actually

contribute in achieving the aim of research. The entire study of research is either grounded on

secondary method or on the primary method (Gill, Stewart, and Chadwick, 2008).

Primary method of data collection is majorly referred for gathering the information with the

help of the first-hand data as well as the fresh information. It involves the wide range of

diverse sources which involves the questionnaire, survey data, observation as well as

Research Strategy

The research strategy is adopted by researcher for carrying out research that can help them to

encounter aim of research. The investigator finds wide range of the research strategy for their

research that includes literature review, questionnaire, experiment, case study and many

others. In this research, researcher will practice literature review as the research strategy in

which they gather the details related to the different opinions of the authors that are presented

by them in different sources which include books, journal articles, website and many others

(Mackey and Gass, 2015). The information related to the digital banking with their influence

on commercial bank is majorly gathered from the journals as well as the website of the

company which makes the information more specific.

In addition to this, the research will select the diverse type of research for conducting the

research. This research types includes exploratory, descriptive, and causal research design

that can be used by the research as per their research concern (Myers, 2013). Considering this

research, the researcher will use the descriptive research that will support for gathering the

reliable information about the digital banking impact on consumer satisfaction. This type is

further supported with the help of literature review that include the different views for the

studies.

Data Collection Methods

The data collection is linked to gather data from wide sources of information that can actually

contribute in achieving the aim of research. The entire study of research is either grounded on

secondary method or on the primary method (Gill, Stewart, and Chadwick, 2008).

Primary method of data collection is majorly referred for gathering the information with the

help of the first-hand data as well as the fresh information. It involves the wide range of

diverse sources which involves the questionnaire, survey data, observation as well as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.