FNS50215 Diploma of Accounting Module 4.1 Assignment Solution

VerifiedAdded on 2023/03/30

|33

|7361

|132

Homework Assignment

AI Summary

This assignment solution addresses the requirements of the FNS50215 Diploma of Accounting Module 4.1, focusing on preparing tax documentation for individuals. The assignment includes various assessment activities, such as calculating Medicare Levy liabilities for different taxpayers based on their taxable income and family status. It also involves tax calculations for individuals with diverse income sources, including employment income, fringe benefits, and dividend income, and determining the net tax payable or refundable, considering factors like PAYG installments, Medicare Levy Surcharge, and franking credits. The solution covers the application of tax regulations to various financial scenarios, including income from both Australian and foreign sources, and requires the use of the textbook 'Prepare Tax Documentation for Individuals' by Peter Baker, Geoff Cliff & Sonia Deaner, 14th Edition. The document provides detailed calculations and explanations for each question, demonstrating the application of relevant tax principles and legislation.

FNS50215 Diploma of Accounting

Module 4.1 Assignment

Instructions:

This assignment contains multiple Assessment Activities

Please complete the Declaration of Authenticity at the bottom of this page

Save this assignment (e.g. on your desktop)

To complete the assignment, read the instructions for each question carefully.

You may be required to refer to your learning materials or other sources to complete

this assessment.

You are required to type all your responses in the spaces provided

Once you have completed all parts of the assignment and saved it, login to the

Monarch Institute LMS to submit your assignment for grading

To submit your assignment click on the file “Submit Diploma of Accounting Module 4.1

Assignment” in the Module 4.1 section of your course and upload your assignment file.

Please be sure to click “Continue” after clicking “submit”. This ensures your assessor receives

notification of your submission – very important!

Declaration of Understanding and Authenticity *

I have read and understood the assessment instructions provided to me in the Learning Management System.

I certify that the attached material is my original work. No other person’s work has been used without due

acknowledgement. I understand that the work submitted may be reproduced and/or communicated for the purpose

of detecting plagiarism.

Student Name*: Date:

* I understand that by typing my name or inserting a digital signature into this box that I agree and am bound by the

above student declaration.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 1 of 33

Module 4.1 Assignment

Instructions:

This assignment contains multiple Assessment Activities

Please complete the Declaration of Authenticity at the bottom of this page

Save this assignment (e.g. on your desktop)

To complete the assignment, read the instructions for each question carefully.

You may be required to refer to your learning materials or other sources to complete

this assessment.

You are required to type all your responses in the spaces provided

Once you have completed all parts of the assignment and saved it, login to the

Monarch Institute LMS to submit your assignment for grading

To submit your assignment click on the file “Submit Diploma of Accounting Module 4.1

Assignment” in the Module 4.1 section of your course and upload your assignment file.

Please be sure to click “Continue” after clicking “submit”. This ensures your assessor receives

notification of your submission – very important!

Declaration of Understanding and Authenticity *

I have read and understood the assessment instructions provided to me in the Learning Management System.

I certify that the attached material is my original work. No other person’s work has been used without due

acknowledgement. I understand that the work submitted may be reproduced and/or communicated for the purpose

of detecting plagiarism.

Student Name*: Date:

* I understand that by typing my name or inserting a digital signature into this box that I agree and am bound by the

above student declaration.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 1 of 33

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC502

Important assessment information

Aims of this assessment

This assessment focuses on preparing tax documentation for individuals.

Marking and feedback

This assignment contains multiple Assessment Activities each containing specific instructions.

You are required to attempt all questions.

This particular assessment forms part of your overall assessment for the following unit(s) of

competency:

FNSACC502 Prepare tax documentation for individuals

Grading for this assessment will be deemed “competent” or “not-yet-competent” in line with

specified educational standards under the Australian Qualifications Framework.

What does “competent” mean?

These answers contain relevant and accurate information in response to the question/s with

limited serious errors in fact or application. If incorrect information is contained in an answer, it

must be fundamentally outweighed by the accurate information provided. This will be assessed

against a marking guide provided to assessors for their determination.

What does “not-yet-competent” mean?

This occurs when an assessment does not meet the marking guide standards provided to

assessors. These answers either do not address the question specifically, or are wrong from a

legislative perspective, or are incorrectly applied. Answers that omit to provide a response to any

significant issue (where multiple issues must be addressed in a question) may also be deemed

not-yet-competent. Answers that have faulty reasoning, a poor standard of expression or include

plagiarism may also be deemed not-yet-competent. Please note, additional information regarding

Monarch’s plagiarism policy is contained in the Student Information Guide which can be found

here: http://www.monarch.edu.au/student-info/

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 2 of 33

Important assessment information

Aims of this assessment

This assessment focuses on preparing tax documentation for individuals.

Marking and feedback

This assignment contains multiple Assessment Activities each containing specific instructions.

You are required to attempt all questions.

This particular assessment forms part of your overall assessment for the following unit(s) of

competency:

FNSACC502 Prepare tax documentation for individuals

Grading for this assessment will be deemed “competent” or “not-yet-competent” in line with

specified educational standards under the Australian Qualifications Framework.

What does “competent” mean?

These answers contain relevant and accurate information in response to the question/s with

limited serious errors in fact or application. If incorrect information is contained in an answer, it

must be fundamentally outweighed by the accurate information provided. This will be assessed

against a marking guide provided to assessors for their determination.

What does “not-yet-competent” mean?

This occurs when an assessment does not meet the marking guide standards provided to

assessors. These answers either do not address the question specifically, or are wrong from a

legislative perspective, or are incorrectly applied. Answers that omit to provide a response to any

significant issue (where multiple issues must be addressed in a question) may also be deemed

not-yet-competent. Answers that have faulty reasoning, a poor standard of expression or include

plagiarism may also be deemed not-yet-competent. Please note, additional information regarding

Monarch’s plagiarism policy is contained in the Student Information Guide which can be found

here: http://www.monarch.edu.au/student-info/

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 2 of 33

Units Covered: FNSACC502

What happens if you are deemed not-yet-competent?

In the event you do not achieve competency by your assessor on this assessment, you will be

given one more opportunity to re-submit the assessment after consultation with your Trainer/

Assessor. You will know your assessment is deemed ‘not-yet-competent’ if your grade book in the

Monarch LMS says “NYC” after you have received an email from your assessor advising your

assessment has been graded.

Important: It is your responsibility to ensure your assessment resubmission addresses all areas

deemed unsatisfactory by your assessor. Please note, if you are still unsuccessful in meeting

competency after resubmitting your assessment, you will be required to repeat those units.

In the event that you have concerns about the assessment decision then you can refer to our

Complaints & Appeals process also contained within the Student Information Guide.

Expectations from your assessor when answering different types of assessment questions:

Knowledge based questions:

A knowledge based question requires you to clearly identify and cover the key subject matter

areas raised in the question in full as part of the response.

Performance based questions:

A performance based question requires you to clearly demonstrate your ability to complete

certain tasks, that is, to perform these tasks.

Good luck

Finally, good luck with your learning and assessments and remember your trainers are here to

assist you

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 3 of 33

What happens if you are deemed not-yet-competent?

In the event you do not achieve competency by your assessor on this assessment, you will be

given one more opportunity to re-submit the assessment after consultation with your Trainer/

Assessor. You will know your assessment is deemed ‘not-yet-competent’ if your grade book in the

Monarch LMS says “NYC” after you have received an email from your assessor advising your

assessment has been graded.

Important: It is your responsibility to ensure your assessment resubmission addresses all areas

deemed unsatisfactory by your assessor. Please note, if you are still unsuccessful in meeting

competency after resubmitting your assessment, you will be required to repeat those units.

In the event that you have concerns about the assessment decision then you can refer to our

Complaints & Appeals process also contained within the Student Information Guide.

Expectations from your assessor when answering different types of assessment questions:

Knowledge based questions:

A knowledge based question requires you to clearly identify and cover the key subject matter

areas raised in the question in full as part of the response.

Performance based questions:

A performance based question requires you to clearly demonstrate your ability to complete

certain tasks, that is, to perform these tasks.

Good luck

Finally, good luck with your learning and assessments and remember your trainers are here to

assist you

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 3 of 33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC502

Assessment Activities

Short Answer and Worked Answer Questions

FNSACC502 – Prepare tax documentation for individuals

The following questions are based on the material in the textbook “Prepare Tax Documentation for

Individuals” by Peter Baker, Geoff Cliff & Sonia Deaner, 14th Edition (January 2017).

Activity instructions to candidates

This is an open book assessment activity.

You may use a financial calculator or computer application to help calculate values

You are required to read this assessment and answer all questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: approximately 3 hours

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 4 of 33

Assessment Activities

Short Answer and Worked Answer Questions

FNSACC502 – Prepare tax documentation for individuals

The following questions are based on the material in the textbook “Prepare Tax Documentation for

Individuals” by Peter Baker, Geoff Cliff & Sonia Deaner, 14th Edition (January 2017).

Activity instructions to candidates

This is an open book assessment activity.

You may use a financial calculator or computer application to help calculate values

You are required to read this assessment and answer all questions that follow.

Please type your answers in the spaces provided.

Please ensure you have read “Important assessment information” at the front of this assessment

Estimated time for completion of this assessment activity: approximately 3 hours

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 4 of 33

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC502

The following questions are based on the material in Chapter 1:

Q1.1.5.

(Application of Medicare Levy using family thresholds)

Required: For each taxpayer, calculate their liability for Medicare Levy.

The following persons are resident taxpayers who are not liable for the Medicare Levy Surcharge. The

information given relates to the 2015/16 tax year:

a. Glenn derived taxable income of $22,000 and his wife Rowena derived taxable income of $6,000. They

do not have any children.

It is not needed for Glen for bearing any medicine levy because of the fact that the taxable income is less than

the family threshold where $6000. Thus, it cannot be applied to medical levy.

b. Kath derived taxable income of $41,000 and her husband Fred derived taxable income of $18,000.

They have three dependent children.

Taxable income of Kath = $41,000

Taxable income of Fred = $18,000

3 Dependent Children

{(1500 × 3) – 1500} = $3000

Total = $62,000

= ($62,000 × 2%)

= $1240

c. Beck derived taxable income of $29,000 and her de facto partner Roy derived taxable income $40,000.

They have four dependent children.

Taxable income of Beck = $29,000

Taxable income of Roy = $40,000

3 Dependent Children

(1500 × 3) = $4500

Total = $73500

= ($73500 × 2%)

= $1,470

d. Will derived taxable income of $36,000 and his wife Tina derived taxable income of $22,000. They

have three dependent children.

Taxable income of Will = $36,000

Taxable income of Tina = $22,000

3 Dependent Children

(1500 × 2) = $3000

Total = $61,000

= ($61,000 × 2%)

= $1,220

Q2.1.19.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 5 of 33

The following questions are based on the material in Chapter 1:

Q1.1.5.

(Application of Medicare Levy using family thresholds)

Required: For each taxpayer, calculate their liability for Medicare Levy.

The following persons are resident taxpayers who are not liable for the Medicare Levy Surcharge. The

information given relates to the 2015/16 tax year:

a. Glenn derived taxable income of $22,000 and his wife Rowena derived taxable income of $6,000. They

do not have any children.

It is not needed for Glen for bearing any medicine levy because of the fact that the taxable income is less than

the family threshold where $6000. Thus, it cannot be applied to medical levy.

b. Kath derived taxable income of $41,000 and her husband Fred derived taxable income of $18,000.

They have three dependent children.

Taxable income of Kath = $41,000

Taxable income of Fred = $18,000

3 Dependent Children

{(1500 × 3) – 1500} = $3000

Total = $62,000

= ($62,000 × 2%)

= $1240

c. Beck derived taxable income of $29,000 and her de facto partner Roy derived taxable income $40,000.

They have four dependent children.

Taxable income of Beck = $29,000

Taxable income of Roy = $40,000

3 Dependent Children

(1500 × 3) = $4500

Total = $73500

= ($73500 × 2%)

= $1,470

d. Will derived taxable income of $36,000 and his wife Tina derived taxable income of $22,000. They

have three dependent children.

Taxable income of Will = $36,000

Taxable income of Tina = $22,000

3 Dependent Children

(1500 × 2) = $3000

Total = $61,000

= ($61,000 × 2%)

= $1,220

Q2.1.19.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 5 of 33

Units Covered: FNSACC502

(Tax calculation for family)

Fred, a resident taxpayer aged 47, has taxable income of $145,345 and reportable fringe benefits of $17,170.

During the year Fred has paid PAYG tax instalments totalling $13,480. His wife, Jani, has taxable income of

$27,000.

They have seven children and no private health insurance.

Required: Calculate Fred’s net tax payable for the 2016/17 tax year.

Tip: Check if Medicare Levy Surcharge will apply to Fred and, if applicable, include in your calculations.

The following questions are based on the material in Chapter 2:

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 6 of 33

Particulars Amount

Taxable Income of Fred 145345

Reportable Fringe Benefits 27000

Taxable income of Jani 27000

PAYG instalment -13480

Taxable Income 185865

Dependent children (3*1500) 4500

Less: Exemption of First Child 1500 3000

Taxable income for Medicare levy 188865

Medicare levy 3777.3

Medicare levy surcharge 1888.65

Net Medicare levy 5665.95

(Tax calculation for family)

Fred, a resident taxpayer aged 47, has taxable income of $145,345 and reportable fringe benefits of $17,170.

During the year Fred has paid PAYG tax instalments totalling $13,480. His wife, Jani, has taxable income of

$27,000.

They have seven children and no private health insurance.

Required: Calculate Fred’s net tax payable for the 2016/17 tax year.

Tip: Check if Medicare Levy Surcharge will apply to Fred and, if applicable, include in your calculations.

The following questions are based on the material in Chapter 2:

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 6 of 33

Particulars Amount

Taxable Income of Fred 145345

Reportable Fringe Benefits 27000

Taxable income of Jani 27000

PAYG instalment -13480

Taxable Income 185865

Dependent children (3*1500) 4500

Less: Exemption of First Child 1500 3000

Taxable income for Medicare levy 188865

Medicare levy 3777.3

Medicare levy surcharge 1888.65

Net Medicare levy 5665.95

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC502

Q3.2.3

(Income from personal exertion)

Ned Markson is a resident taxpayer employed by Acme Holdings Ltd. The following transactions were all as a

consequence of Ned’s employment:

Net weekly wages totalled $78,000 for the year.

Total PAYG tax withheld from Ned’s weekly wages from Acme and forwarded to the ATO amounted to

$19,000.

Additional wages paid to Ned as a Christmas bonus of $6,000 net (net of $4,200 PAYG tax withheld).

Reimbursement of out-of-pocket travel costs of $1,200 that Ned incurred during his employment.

A taxable travel allowance totalling $2,800. No PAYG was withheld from this amount.

Acme paid health insurance premiums for Ned and his wife to the value of $2,750.

Superannuation contributed $10,000 to Acme Holdings Superannuation Fund on behalf of Ned.

Required:

For each of these transactions indicate which amounts are to be included in Ned’s assessable income and

provide Ned’s total assessable income.

Particulars Amount ($) Amount ($)

Net weekly wages 78000

Additional wages paid 10200

Fringe Benefit for Travelling Cost 1200

Travel allowance 2800

Health insurance premium 2750

94950

Less: Deductions

Superannuation -10000

PAYG on weekly wages -19000

PAYG on Additional Wages -4200 -33200

Assessable Income 61750

Q4.2.13

(Calculation of tax payable from dividend income)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 7 of 33

Q3.2.3

(Income from personal exertion)

Ned Markson is a resident taxpayer employed by Acme Holdings Ltd. The following transactions were all as a

consequence of Ned’s employment:

Net weekly wages totalled $78,000 for the year.

Total PAYG tax withheld from Ned’s weekly wages from Acme and forwarded to the ATO amounted to

$19,000.

Additional wages paid to Ned as a Christmas bonus of $6,000 net (net of $4,200 PAYG tax withheld).

Reimbursement of out-of-pocket travel costs of $1,200 that Ned incurred during his employment.

A taxable travel allowance totalling $2,800. No PAYG was withheld from this amount.

Acme paid health insurance premiums for Ned and his wife to the value of $2,750.

Superannuation contributed $10,000 to Acme Holdings Superannuation Fund on behalf of Ned.

Required:

For each of these transactions indicate which amounts are to be included in Ned’s assessable income and

provide Ned’s total assessable income.

Particulars Amount ($) Amount ($)

Net weekly wages 78000

Additional wages paid 10200

Fringe Benefit for Travelling Cost 1200

Travel allowance 2800

Health insurance premium 2750

94950

Less: Deductions

Superannuation -10000

PAYG on weekly wages -19000

PAYG on Additional Wages -4200 -33200

Assessable Income 61750

Q4.2.13

(Calculation of tax payable from dividend income)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 7 of 33

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC502

Jim Dough, a single resident taxpayer, received the following amounts from investments during the 2016/17

tax year:

Fully Franked Dividends – Dynamic Ltd (franking credit $9,000) $ 21,000

Partly Franked Dividends – Static Ltd (franking credit $2,400) 15,000

Unfranked Dividends – Lost Ground Ltd 20,000

Jim had no other income or deductions during the year.

Required:

a. Calculate Dough’s taxable income for the 2016/17 tax year.

b. Calculate Dough’s net tax payable or refundable for the 2016/17 tax year.

a.

Assessable Income

Fully Franked Dividend Amount ($) Amount ($)

Fully Franked (Net) 12000

Franking Credits 9000 21000

Static Ltd

Fully Franked (Net) 12600

Franking Credits 2400 15000

Unfranked Dividend 20000

Total Taxable Income 56000

b.

Assessable Income

Fully Franked Dividend Amount ($) Amount ($)

Fully Franked (Net) 12000

Franking Credits 9000 21000

Static Ltd

Fully Franked (Net) 12600

Franking Credits 2400 15000

Unfranked Dividend 20000

Total Taxable Income 56000

Tax on Taxable Income 9647

Add: Medicare Levy 1120

Less: Franking offset 15000

Net Tax Refundable 4233

The following questions are based on the material in Chapter 3:

Q5.3.5

(Taxable income from Australian and foreign sources)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 8 of 33

Jim Dough, a single resident taxpayer, received the following amounts from investments during the 2016/17

tax year:

Fully Franked Dividends – Dynamic Ltd (franking credit $9,000) $ 21,000

Partly Franked Dividends – Static Ltd (franking credit $2,400) 15,000

Unfranked Dividends – Lost Ground Ltd 20,000

Jim had no other income or deductions during the year.

Required:

a. Calculate Dough’s taxable income for the 2016/17 tax year.

b. Calculate Dough’s net tax payable or refundable for the 2016/17 tax year.

a.

Assessable Income

Fully Franked Dividend Amount ($) Amount ($)

Fully Franked (Net) 12000

Franking Credits 9000 21000

Static Ltd

Fully Franked (Net) 12600

Franking Credits 2400 15000

Unfranked Dividend 20000

Total Taxable Income 56000

b.

Assessable Income

Fully Franked Dividend Amount ($) Amount ($)

Fully Franked (Net) 12000

Franking Credits 9000 21000

Static Ltd

Fully Franked (Net) 12600

Franking Credits 2400 15000

Unfranked Dividend 20000

Total Taxable Income 56000

Tax on Taxable Income 9647

Add: Medicare Levy 1120

Less: Franking offset 15000

Net Tax Refundable 4233

The following questions are based on the material in Chapter 3:

Q5.3.5

(Taxable income from Australian and foreign sources)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 8 of 33

Units Covered: FNSACC502

Yvette Jankic, a resident single taxpayer aged 31, worked in New Zealand from 1 July 2016 until 15 November

2016 and has provided the following information for the 2016/17 tax year:

Receipts $

Interest (net of TFN tax withheld $490) 510

Interest from United Kingdom (net of withholding tax $300) 2,700

Dividend from the U.S. state of Georgia (net of withholding tax $2,100) 3,900

Gross salary – Australian employment (PAYG tax $5,285 withheld) 21,000

Reportable fringe benefit as per PAYG Summary 6,252

Net salary – New Zealand employment (tax withheld $2,540) 12,650

Bonus from Australian Employer for exceptional performance 2,000

Payments $

Interest and Dividend deductions relating to United Kingdom and Georgia investments 250

Work-related deductions relating to Australian employment 300

Note – Yvette does not have private health insurance.

Required:

a. Calculate Yvette’s taxable income for the 2016/17 tax year.

b. Calculate Yvette’s net tax payable or refundable for the 2016/17 tax year.

a.

Calculation of Assessable income

Particulars Amount ($) Amount ($)

Interest (Net) 510

TFN tax withheld 490 1000

Interest from United Kingdom (net) 2700

Withholding tax 300 3000

Dividend from the U.S. state of Georgia 3900

Withholding tax 2100 6000

Gross salary – Australian employment 21000

PAYG tax 5285 26285

Reportable fringe benefit as per PAYG Summary 6252

Net salary – New Zealand employment (Net) 12650

Tax withheld 2540 15190

Bonus from Australian Employer for exceptional performance 2,000

Taxable Income 59727

b.

Calculation of Assessable income

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 9 of 33

Yvette Jankic, a resident single taxpayer aged 31, worked in New Zealand from 1 July 2016 until 15 November

2016 and has provided the following information for the 2016/17 tax year:

Receipts $

Interest (net of TFN tax withheld $490) 510

Interest from United Kingdom (net of withholding tax $300) 2,700

Dividend from the U.S. state of Georgia (net of withholding tax $2,100) 3,900

Gross salary – Australian employment (PAYG tax $5,285 withheld) 21,000

Reportable fringe benefit as per PAYG Summary 6,252

Net salary – New Zealand employment (tax withheld $2,540) 12,650

Bonus from Australian Employer for exceptional performance 2,000

Payments $

Interest and Dividend deductions relating to United Kingdom and Georgia investments 250

Work-related deductions relating to Australian employment 300

Note – Yvette does not have private health insurance.

Required:

a. Calculate Yvette’s taxable income for the 2016/17 tax year.

b. Calculate Yvette’s net tax payable or refundable for the 2016/17 tax year.

a.

Calculation of Assessable income

Particulars Amount ($) Amount ($)

Interest (Net) 510

TFN tax withheld 490 1000

Interest from United Kingdom (net) 2700

Withholding tax 300 3000

Dividend from the U.S. state of Georgia 3900

Withholding tax 2100 6000

Gross salary – Australian employment 21000

PAYG tax 5285 26285

Reportable fringe benefit as per PAYG Summary 6252

Net salary – New Zealand employment (Net) 12650

Tax withheld 2540 15190

Bonus from Australian Employer for exceptional performance 2,000

Taxable Income 59727

b.

Calculation of Assessable income

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 9 of 33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Units Covered: FNSACC502

Particulars

Amount

($)

Amount

($)

Interest (Net) 510

TFN tax withheld 490 1000

Interest from United Kingdom (net) 2700

Withholding tax 300 3000

Dividend from the U.S. state of Georgia 3900

Withholding tax 2100 6000

Gross salary – Australian employment 21000

PAYG tax 5285 26285

Reportable fringe benefit as per PAYG Summary 6252

Net salary – New Zealand employment (Net) 12650

Tax withheld 2540 15190

Bonus from Australian Employer for exceptional performance 2,000

59727

Deductions

Interest and Dividend deductions relating to United Kingdom and Georgia

investments 250

Work-related deductions relating to Australian employment 300

Total allowable deductions 550

Taxable Income 59177

Tax on Income 10760

Medicare levy 1183.54

Less: Tax offset 10715

Net Tax Payable 1228.54

The following questions are based on the material in Chapter 4:

Q6.4.3

(Disposal of two assets)

On 10 April 1988, Penny Pleb, an Australian resident, purchased a block of land for $74,000 as an

investment. On 19 February 2017, she sold the land for $125,000.

Penny also sold shares in Prosperous Ltd for $32,000 on 1 August 2016. The shares had cost Penny $8,000 on

17 July 2008. Penny did not dispose of any other assets during the year, nor did she have any capital losses

from previous years.

Required:

Calculate the minimum net capital gain to be included in Penny's assessable income or capital loss to be

carried forward from the 2016/17 tax year.

Calculate using the indexed cost base method and also using only the discount method (without indexing) to

determine the most favourable outcome for Penny. Show your workings for each method.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 10 of 33

Particulars

Amount

($)

Amount

($)

Interest (Net) 510

TFN tax withheld 490 1000

Interest from United Kingdom (net) 2700

Withholding tax 300 3000

Dividend from the U.S. state of Georgia 3900

Withholding tax 2100 6000

Gross salary – Australian employment 21000

PAYG tax 5285 26285

Reportable fringe benefit as per PAYG Summary 6252

Net salary – New Zealand employment (Net) 12650

Tax withheld 2540 15190

Bonus from Australian Employer for exceptional performance 2,000

59727

Deductions

Interest and Dividend deductions relating to United Kingdom and Georgia

investments 250

Work-related deductions relating to Australian employment 300

Total allowable deductions 550

Taxable Income 59177

Tax on Income 10760

Medicare levy 1183.54

Less: Tax offset 10715

Net Tax Payable 1228.54

The following questions are based on the material in Chapter 4:

Q6.4.3

(Disposal of two assets)

On 10 April 1988, Penny Pleb, an Australian resident, purchased a block of land for $74,000 as an

investment. On 19 February 2017, she sold the land for $125,000.

Penny also sold shares in Prosperous Ltd for $32,000 on 1 August 2016. The shares had cost Penny $8,000 on

17 July 2008. Penny did not dispose of any other assets during the year, nor did she have any capital losses

from previous years.

Required:

Calculate the minimum net capital gain to be included in Penny's assessable income or capital loss to be

carried forward from the 2016/17 tax year.

Calculate using the indexed cost base method and also using only the discount method (without indexing) to

determine the most favourable outcome for Penny. Show your workings for each method.

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 10 of 33

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Units Covered: FNSACC502

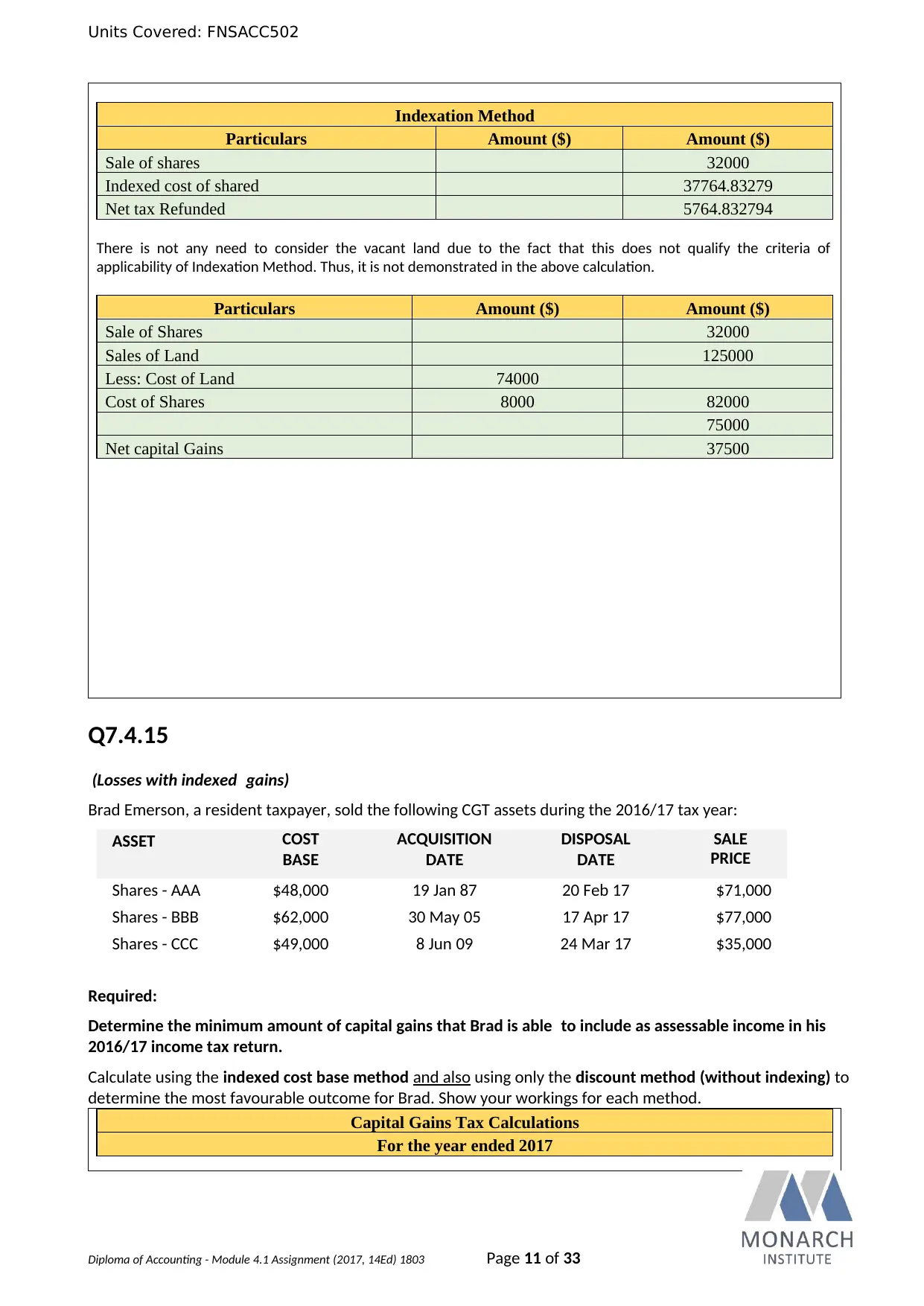

Indexation Method

Particulars Amount ($) Amount ($)

Sale of shares 32000

Indexed cost of shared 37764.83279

Net tax Refunded 5764.832794

There is not any need to consider the vacant land due to the fact that this does not qualify the criteria of

applicability of Indexation Method. Thus, it is not demonstrated in the above calculation.

Particulars Amount ($) Amount ($)

Sale of Shares 32000

Sales of Land 125000

Less: Cost of Land 74000

Cost of Shares 8000 82000

75000

Net capital Gains 37500

Q7.4.15

(Losses with indexed gains)

Brad Emerson, a resident taxpayer, sold the following CGT assets during the 2016/17 tax year:

ASSET COST

BASE

ACQUISITION

DATE

DISPOSAL

DATE

SALE

PRICE

Shares - AAA $48,000 19 Jan 87 20 Feb 17 $71,000

Shares - BBB $62,000 30 May 05 17 Apr 17 $77,000

Shares - CCC $49,000 8 Jun 09 24 Mar 17 $35,000

Required:

Determine the minimum amount of capital gains that Brad is able to include as assessable income in his

2016/17 income tax return.

Calculate using the indexed cost base method and also using only the discount method (without indexing) to

determine the most favourable outcome for Brad. Show your workings for each method.

Capital Gains Tax Calculations

For the year ended 2017

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 11 of 33

Indexation Method

Particulars Amount ($) Amount ($)

Sale of shares 32000

Indexed cost of shared 37764.83279

Net tax Refunded 5764.832794

There is not any need to consider the vacant land due to the fact that this does not qualify the criteria of

applicability of Indexation Method. Thus, it is not demonstrated in the above calculation.

Particulars Amount ($) Amount ($)

Sale of Shares 32000

Sales of Land 125000

Less: Cost of Land 74000

Cost of Shares 8000 82000

75000

Net capital Gains 37500

Q7.4.15

(Losses with indexed gains)

Brad Emerson, a resident taxpayer, sold the following CGT assets during the 2016/17 tax year:

ASSET COST

BASE

ACQUISITION

DATE

DISPOSAL

DATE

SALE

PRICE

Shares - AAA $48,000 19 Jan 87 20 Feb 17 $71,000

Shares - BBB $62,000 30 May 05 17 Apr 17 $77,000

Shares - CCC $49,000 8 Jun 09 24 Mar 17 $35,000

Required:

Determine the minimum amount of capital gains that Brad is able to include as assessable income in his

2016/17 income tax return.

Calculate using the indexed cost base method and also using only the discount method (without indexing) to

determine the most favourable outcome for Brad. Show your workings for each method.

Capital Gains Tax Calculations

For the year ended 2017

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 11 of 33

Units Covered: FNSACC502

Indexed Capital gains

Particulars Amount ($) Amount ($)

Shares in AAA

Sales Proceeds 71000

Cost Price 48000

Capital gains 23000

Indexed Capital gains 2917

Shares in BBB

Sales Proceeds 77000

Cost Price 62000

Capital gains 15000

Indexed Capital gains 1755

Shares - CCC

Sales Proceeds 35000

Cost Price 49000

Capital loss -14000

-9328

Capital Gains Tax Calculations

For the year ended 2017

50% CGT Discount

Particulars Amount ($) Amount ($)

Shares in AAA

Sales Proceeds 71000

Cost Price 48000

Capital gains 23000

50% CGT Discount 11500

Shares in BBB

Sales Proceeds 77000

Cost Price 62000

Capital gains 15000

50% CGT Discount 7500

Shares - CCC

Sales Proceeds 35000

Cost Price 49000

Capital loss -14000

Capital gains tax payable 5000

Q8.4.37

(Partial main residence exemption)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 12 of 33

Indexed Capital gains

Particulars Amount ($) Amount ($)

Shares in AAA

Sales Proceeds 71000

Cost Price 48000

Capital gains 23000

Indexed Capital gains 2917

Shares in BBB

Sales Proceeds 77000

Cost Price 62000

Capital gains 15000

Indexed Capital gains 1755

Shares - CCC

Sales Proceeds 35000

Cost Price 49000

Capital loss -14000

-9328

Capital Gains Tax Calculations

For the year ended 2017

50% CGT Discount

Particulars Amount ($) Amount ($)

Shares in AAA

Sales Proceeds 71000

Cost Price 48000

Capital gains 23000

50% CGT Discount 11500

Shares in BBB

Sales Proceeds 77000

Cost Price 62000

Capital gains 15000

50% CGT Discount 7500

Shares - CCC

Sales Proceeds 35000

Cost Price 49000

Capital loss -14000

Capital gains tax payable 5000

Q8.4.37

(Partial main residence exemption)

Diploma of Accounting - Module 4.1 Assignment (2017, 14Ed) 1803 Page 12 of 33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 33

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.