Report: Discount Rate and Inflation Rate Analysis in Treasury Bonds

VerifiedAdded on 2021/06/15

|6

|810

|119

Report

AI Summary

This report analyzes discount rates and inflation using data from U.S. and Australian Treasury bonds. It calculates the Yield to Maturity (YTM) for various maturity periods, demonstrating the relationship between maturity and return. The report compares the discount and inflation rates of the two countries, concluding that Australian Treasury bonds may offer better long-term returns due to potentially lower inflation. The analysis includes tables summarizing the price, coupon rates, and YTM for both U.S. and Australian bonds, providing a comprehensive overview of the financial instruments and their performance. The report also employs the "Approximate Approach" to estimate the discount rate and uses a formula to calculate the real rate of interest and inflation rate.

Principle of Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Analysis...........................................................................................................................................3

Discount Rate and Inflation Rate.................................................................................................3

U.S. Treasury bond......................................................................................................................3

Australia Treasury bond...............................................................................................................4

Conclusion.......................................................................................................................................5

References........................................................................................................................................6

1

Analysis...........................................................................................................................................3

Discount Rate and Inflation Rate.................................................................................................3

U.S. Treasury bond......................................................................................................................3

Australia Treasury bond...............................................................................................................4

Conclusion.......................................................................................................................................5

References........................................................................................................................................6

1

Analysis

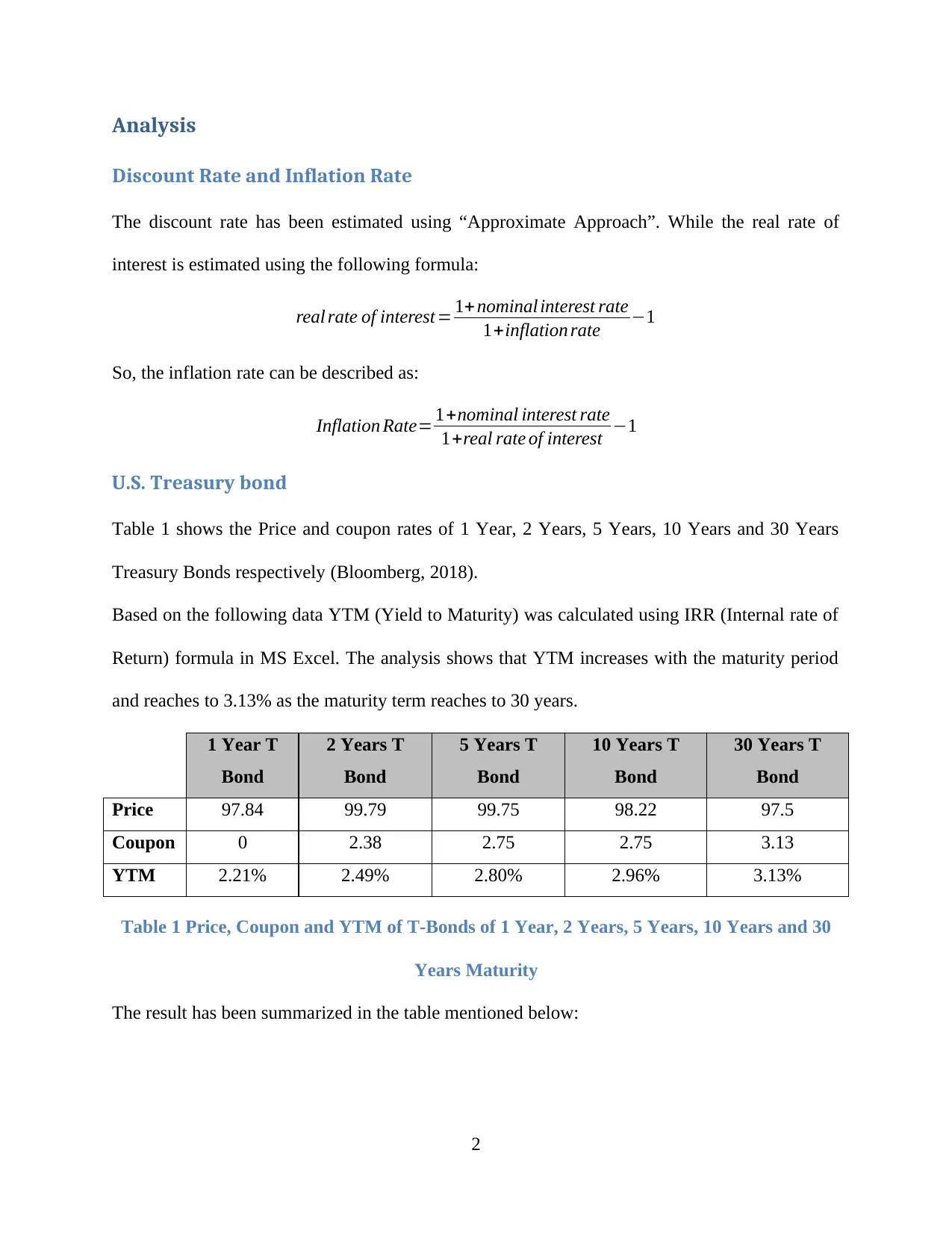

Discount Rate and Inflation Rate

The discount rate has been estimated using “Approximate Approach”. While the real rate of

interest is estimated using the following formula:

real rate of interest = 1+ nominal interest rate

1+inflation rate −1

So, the inflation rate can be described as:

Inflation Rate= 1+nominal interest rate

1+real rate of interest −1

U.S. Treasury bond

Table 1 shows the Price and coupon rates of 1 Year, 2 Years, 5 Years, 10 Years and 30 Years

Treasury Bonds respectively (Bloomberg, 2018).

Based on the following data YTM (Yield to Maturity) was calculated using IRR (Internal rate of

Return) formula in MS Excel. The analysis shows that YTM increases with the maturity period

and reaches to 3.13% as the maturity term reaches to 30 years.

1 Year T

Bond

2 Years T

Bond

5 Years T

Bond

10 Years T

Bond

30 Years T

Bond

Price 97.84 99.79 99.75 98.22 97.5

Coupon 0 2.38 2.75 2.75 3.13

YTM 2.21% 2.49% 2.80% 2.96% 3.13%

Table 1 Price, Coupon and YTM of T-Bonds of 1 Year, 2 Years, 5 Years, 10 Years and 30

Years Maturity

The result has been summarized in the table mentioned below:

2

Discount Rate and Inflation Rate

The discount rate has been estimated using “Approximate Approach”. While the real rate of

interest is estimated using the following formula:

real rate of interest = 1+ nominal interest rate

1+inflation rate −1

So, the inflation rate can be described as:

Inflation Rate= 1+nominal interest rate

1+real rate of interest −1

U.S. Treasury bond

Table 1 shows the Price and coupon rates of 1 Year, 2 Years, 5 Years, 10 Years and 30 Years

Treasury Bonds respectively (Bloomberg, 2018).

Based on the following data YTM (Yield to Maturity) was calculated using IRR (Internal rate of

Return) formula in MS Excel. The analysis shows that YTM increases with the maturity period

and reaches to 3.13% as the maturity term reaches to 30 years.

1 Year T

Bond

2 Years T

Bond

5 Years T

Bond

10 Years T

Bond

30 Years T

Bond

Price 97.84 99.79 99.75 98.22 97.5

Coupon 0 2.38 2.75 2.75 3.13

YTM 2.21% 2.49% 2.80% 2.96% 3.13%

Table 1 Price, Coupon and YTM of T-Bonds of 1 Year, 2 Years, 5 Years, 10 Years and 30

Years Maturity

The result has been summarized in the table mentioned below:

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

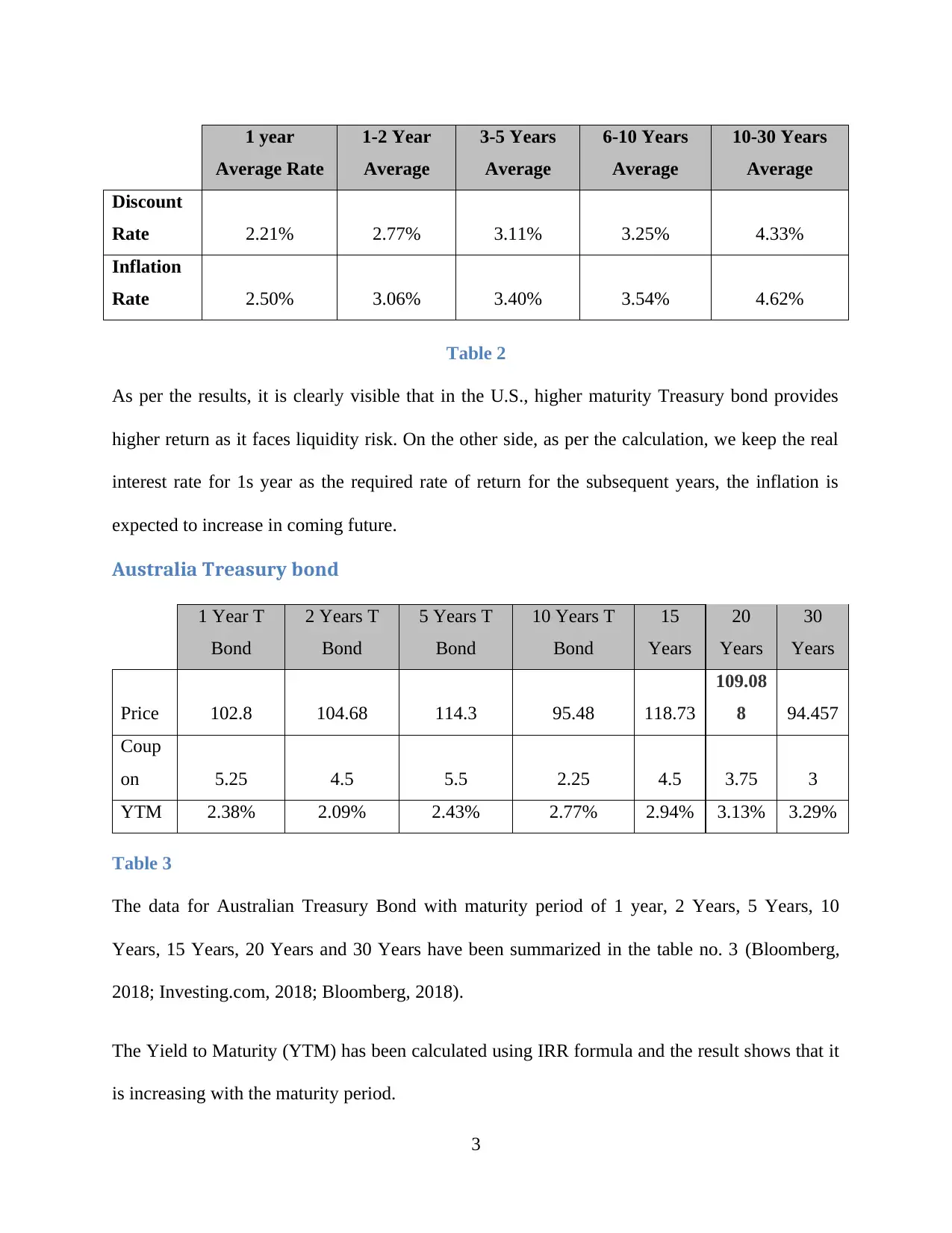

Table 2

As per the results, it is clearly visible that in the U.S., higher maturity Treasury bond provides

higher return as it faces liquidity risk. On the other side, as per the calculation, we keep the real

interest rate for 1s year as the required rate of return for the subsequent years, the inflation is

expected to increase in coming future.

Australia Treasury bond

1 Year T

Bond

2 Years T

Bond

5 Years T

Bond

10 Years T

Bond

15

Years

20

Years

30

Years

Price 102.8 104.68 114.3 95.48 118.73

109.08

8 94.457

Coup

on 5.25 4.5 5.5 2.25 4.5 3.75 3

YTM 2.38% 2.09% 2.43% 2.77% 2.94% 3.13% 3.29%

Table 3

The data for Australian Treasury Bond with maturity period of 1 year, 2 Years, 5 Years, 10

Years, 15 Years, 20 Years and 30 Years have been summarized in the table no. 3 (Bloomberg,

2018; Investing.com, 2018; Bloomberg, 2018).

The Yield to Maturity (YTM) has been calculated using IRR formula and the result shows that it

is increasing with the maturity period.

3

1 year

Average Rate

1-2 Year

Average

3-5 Years

Average

6-10 Years

Average

10-30 Years

Average

Discount

Rate 2.21% 2.77% 3.11% 3.25% 4.33%

Inflation

Rate 2.50% 3.06% 3.40% 3.54% 4.62%

As per the results, it is clearly visible that in the U.S., higher maturity Treasury bond provides

higher return as it faces liquidity risk. On the other side, as per the calculation, we keep the real

interest rate for 1s year as the required rate of return for the subsequent years, the inflation is

expected to increase in coming future.

Australia Treasury bond

1 Year T

Bond

2 Years T

Bond

5 Years T

Bond

10 Years T

Bond

15

Years

20

Years

30

Years

Price 102.8 104.68 114.3 95.48 118.73

109.08

8 94.457

Coup

on 5.25 4.5 5.5 2.25 4.5 3.75 3

YTM 2.38% 2.09% 2.43% 2.77% 2.94% 3.13% 3.29%

Table 3

The data for Australian Treasury Bond with maturity period of 1 year, 2 Years, 5 Years, 10

Years, 15 Years, 20 Years and 30 Years have been summarized in the table no. 3 (Bloomberg,

2018; Investing.com, 2018; Bloomberg, 2018).

The Yield to Maturity (YTM) has been calculated using IRR formula and the result shows that it

is increasing with the maturity period.

3

1 year

Average Rate

1-2 Year

Average

3-5 Years

Average

6-10 Years

Average

10-30 Years

Average

Discount

Rate 2.21% 2.77% 3.11% 3.25% 4.33%

Inflation

Rate 2.50% 3.06% 3.40% 3.54% 4.62%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 Year Average

Rate

1-2

Year

3-5

Years

6-10

Years

11-15

Years

16-20

Years

21-30

Years

Discount

Rate 2.38% 2.73% 3.26% 3.29% 4.33% 3.75% 4.09%

Inflation

Rate 1.90% 2.25% 2.78% 2.81% 4.62% 3.26% 3.59%

Table 4

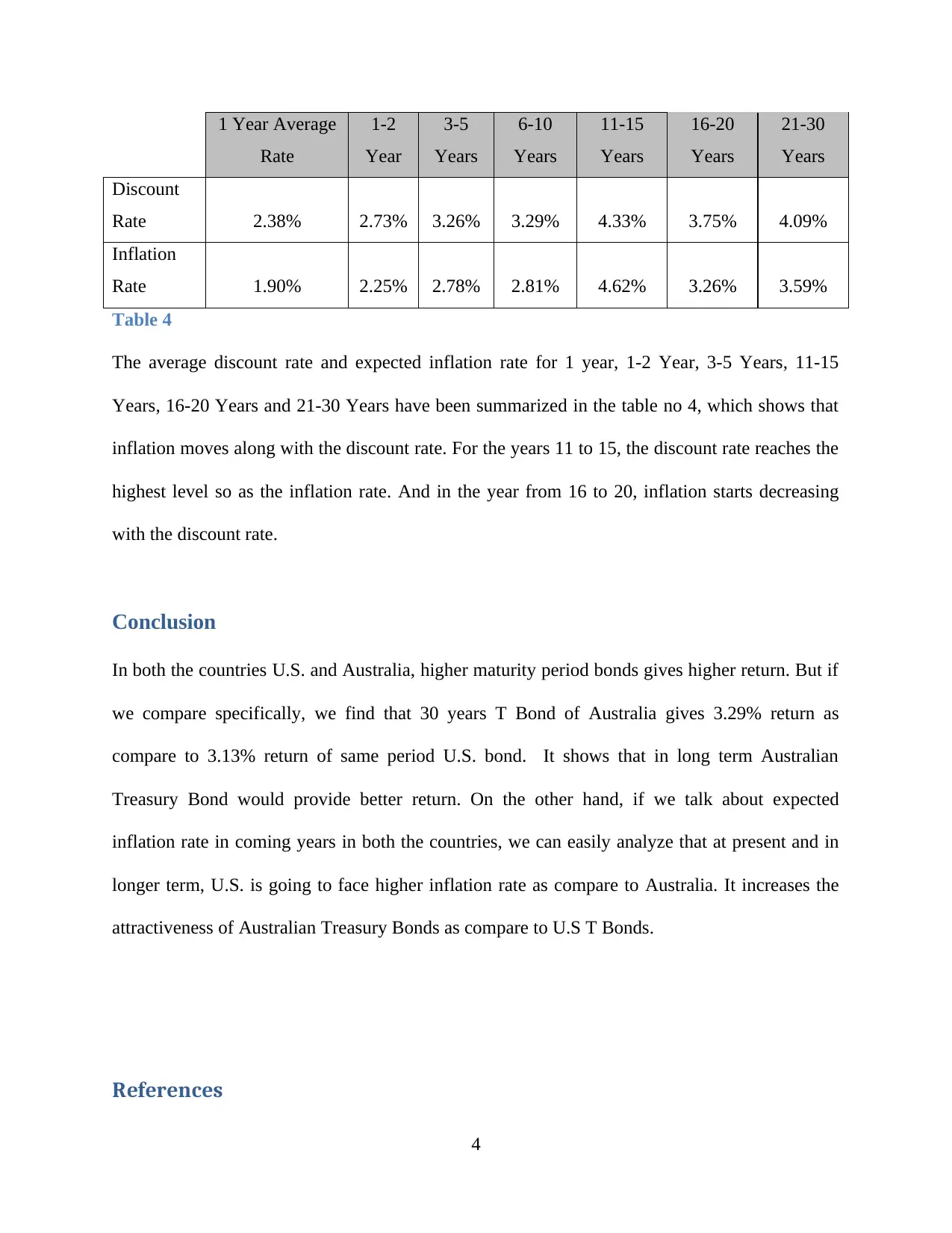

The average discount rate and expected inflation rate for 1 year, 1-2 Year, 3-5 Years, 11-15

Years, 16-20 Years and 21-30 Years have been summarized in the table no 4, which shows that

inflation moves along with the discount rate. For the years 11 to 15, the discount rate reaches the

highest level so as the inflation rate. And in the year from 16 to 20, inflation starts decreasing

with the discount rate.

Conclusion

In both the countries U.S. and Australia, higher maturity period bonds gives higher return. But if

we compare specifically, we find that 30 years T Bond of Australia gives 3.29% return as

compare to 3.13% return of same period U.S. bond. It shows that in long term Australian

Treasury Bond would provide better return. On the other hand, if we talk about expected

inflation rate in coming years in both the countries, we can easily analyze that at present and in

longer term, U.S. is going to face higher inflation rate as compare to Australia. It increases the

attractiveness of Australian Treasury Bonds as compare to U.S T Bonds.

References

4

Rate

1-2

Year

3-5

Years

6-10

Years

11-15

Years

16-20

Years

21-30

Years

Discount

Rate 2.38% 2.73% 3.26% 3.29% 4.33% 3.75% 4.09%

Inflation

Rate 1.90% 2.25% 2.78% 2.81% 4.62% 3.26% 3.59%

Table 4

The average discount rate and expected inflation rate for 1 year, 1-2 Year, 3-5 Years, 11-15

Years, 16-20 Years and 21-30 Years have been summarized in the table no 4, which shows that

inflation moves along with the discount rate. For the years 11 to 15, the discount rate reaches the

highest level so as the inflation rate. And in the year from 16 to 20, inflation starts decreasing

with the discount rate.

Conclusion

In both the countries U.S. and Australia, higher maturity period bonds gives higher return. But if

we compare specifically, we find that 30 years T Bond of Australia gives 3.29% return as

compare to 3.13% return of same period U.S. bond. It shows that in long term Australian

Treasury Bond would provide better return. On the other hand, if we talk about expected

inflation rate in coming years in both the countries, we can easily analyze that at present and in

longer term, U.S. is going to face higher inflation rate as compare to Australia. It increases the

attractiveness of Australian Treasury Bonds as compare to U.S T Bonds.

References

4

Bloomberg, 2018. Australian Rates & Bonds. [Online] Available at:

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia [Accessed 28

April 2018].

Bloomberg, 2018. United States Rates and Bonds. [Online] Available at:

https://www.bhttps://www.bloomberg.com/markets/rates-bonds/government-bonds/

usloomberg.com/markets/rates-bonds/government-bonds/us [Accessed 30 April 2018].

Investing.com, 2018. Australia 30-Year Bond Yield. [Online] Available at:

https://www.investing.com/rates-bonds/australia-30-year [Accessed 29 April 2018].

5

https://www.bloomberg.com/markets/rates-bonds/government-bonds/australia [Accessed 28

April 2018].

Bloomberg, 2018. United States Rates and Bonds. [Online] Available at:

https://www.bhttps://www.bloomberg.com/markets/rates-bonds/government-bonds/

usloomberg.com/markets/rates-bonds/government-bonds/us [Accessed 30 April 2018].

Investing.com, 2018. Australia 30-Year Bond Yield. [Online] Available at:

https://www.investing.com/rates-bonds/australia-30-year [Accessed 29 April 2018].

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 6

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.