Accounting and Financial Reporting Assignment for Dream Furniture

VerifiedAdded on 2021/06/17

|14

|2950

|60

Report

AI Summary

This report analyzes the accounting and financial reporting practices of Dream Furniture Pty Ltd, a furniture manufacturing and selling company in Australia. The report focuses on several key areas, including the acquisition and initial recognition of non-current assets (land, building, and machinery), calculating depreciation using straight-line and diminishing value methods, and accounting for revaluation of assets according to AASB 116. It also examines the presentation of non-current assets in the balance sheet and addresses the accounting treatment of revaluation and impairment losses. Furthermore, the report explores qualitative characteristics of financial reporting such as comparability, verifiability, timeliness, and understandability, and how they relate to Dream Furniture's financial statements. Finally, the report assesses the company's revenue recognition practices in accordance with AASB 15, outlining the five-step model for revenue recognition from contracts with customers. The report provides detailed journal entries and calculations to support its analysis, demonstrating the application of relevant accounting standards and principles.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

By student name

Professor

University

Date: 25 April 2018.

1 | P a g e

2

Contents

Introduction.................................................................................................................................................3

Acquisition of Non-Current Assets (question 1).......................................................................................... 3

Calculation of Depreciation (question 2)..................................................................................................... 5

Revaluation (questions 3)............................................................................................................................ 6

Balance Sheet Excerpt (question 4).............................................................................................................7

Revaluation and Impairment (question 5)................................................................................................... 7

Qualitative Characteristics (question 6).......................................................................................................9

Revenue Recognition (question 7)............................................................................................................. 10

References................................................................................................................................................. 12

2 | P a g e

Contents

Introduction.................................................................................................................................................3

Acquisition of Non-Current Assets (question 1).......................................................................................... 3

Calculation of Depreciation (question 2)..................................................................................................... 5

Revaluation (questions 3)............................................................................................................................ 6

Balance Sheet Excerpt (question 4).............................................................................................................7

Revaluation and Impairment (question 5)................................................................................................... 7

Qualitative Characteristics (question 6).......................................................................................................9

Revenue Recognition (question 7)............................................................................................................. 10

References................................................................................................................................................. 12

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Introduction

In the given case, one of the consulting and accounting firms Action accountants has been asked

to review the accounts of the new client, Dream Furniture Pty Limited in Australia. The major

areas of focus will be the non current assets reporting, recording and expensing of transactions,

revenue recognition and impairment of assets. The given company has a business of

manufacturing and selling furniture in Australia and has been set up in 2013. The business has 2

directors and is registered under the Goods and Service Tax scheme (Alexander, 2016). The

business commenced on 01st January 2013 and generally closes its annual books on 30th June

every year. A number of transaction that the company entered unto has been given including the

purchase of the fixed assets alongwith the details of valuationa and impairment. The company

has also mentioned its reveuue recognition transactions and the same has been assessed below in

terms of the AASB standards and the local GAAP.

Acquisition of Non-Current Assets (question 1)

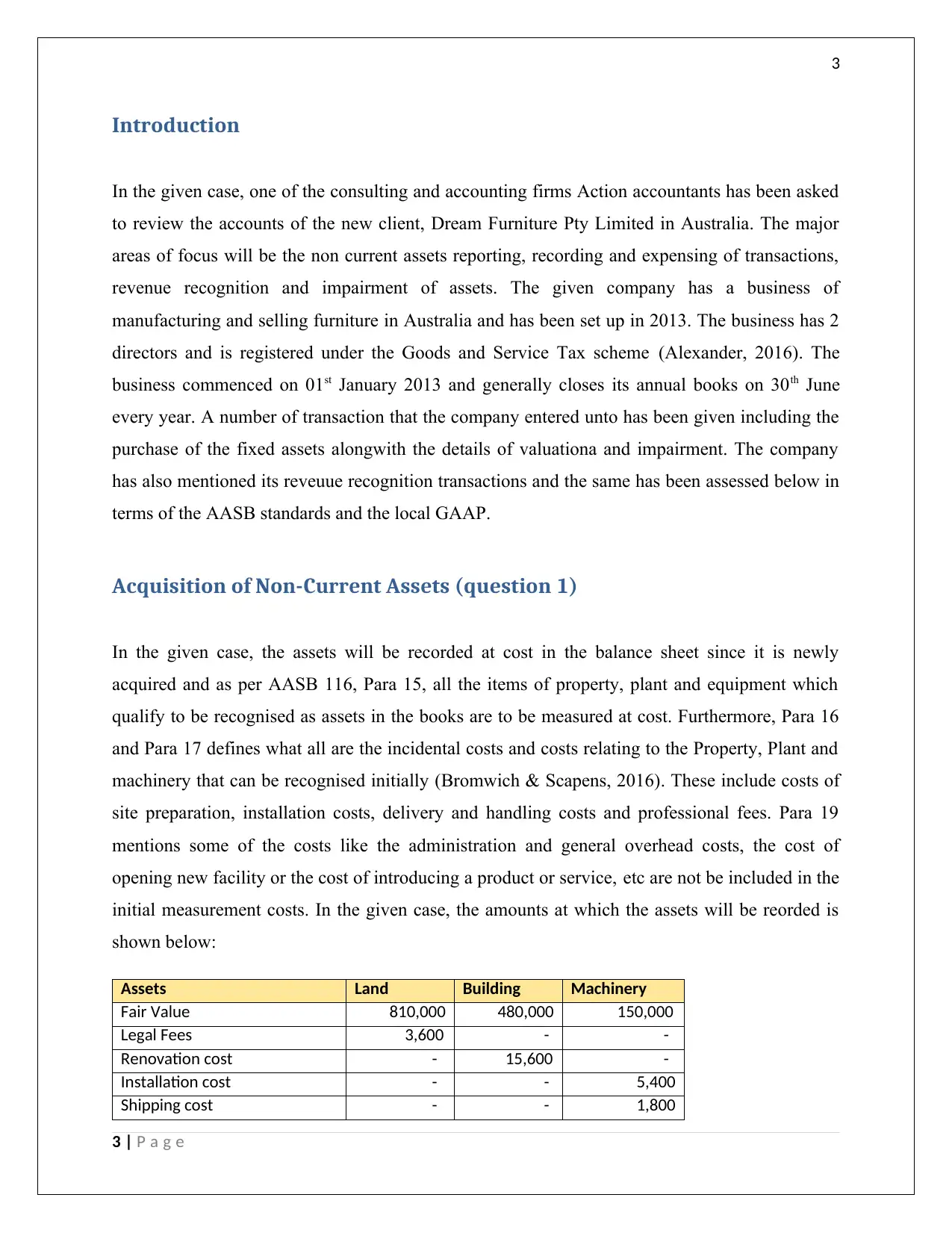

In the given case, the assets will be recorded at cost in the balance sheet since it is newly

acquired and as per AASB 116, Para 15, all the items of property, plant and equipment which

qualify to be recognised as assets in the books are to be measured at cost. Furthermore, Para 16

and Para 17 defines what all are the incidental costs and costs relating to the Property, Plant and

machinery that can be recognised initially (Bromwich & Scapens, 2016). These include costs of

site preparation, installation costs, delivery and handling costs and professional fees. Para 19

mentions some of the costs like the administration and general overhead costs, the cost of

opening new facility or the cost of introducing a product or service, etc are not be included in the

initial measurement costs. In the given case, the amounts at which the assets will be reorded is

shown below:

Assets Land Building Machinery

Fair Value 810,000 480,000 150,000

Legal Fees 3,600 - -

Renovation cost - 15,600 -

Installation cost - - 5,400

Shipping cost - - 1,800

3 | P a g e

Introduction

In the given case, one of the consulting and accounting firms Action accountants has been asked

to review the accounts of the new client, Dream Furniture Pty Limited in Australia. The major

areas of focus will be the non current assets reporting, recording and expensing of transactions,

revenue recognition and impairment of assets. The given company has a business of

manufacturing and selling furniture in Australia and has been set up in 2013. The business has 2

directors and is registered under the Goods and Service Tax scheme (Alexander, 2016). The

business commenced on 01st January 2013 and generally closes its annual books on 30th June

every year. A number of transaction that the company entered unto has been given including the

purchase of the fixed assets alongwith the details of valuationa and impairment. The company

has also mentioned its reveuue recognition transactions and the same has been assessed below in

terms of the AASB standards and the local GAAP.

Acquisition of Non-Current Assets (question 1)

In the given case, the assets will be recorded at cost in the balance sheet since it is newly

acquired and as per AASB 116, Para 15, all the items of property, plant and equipment which

qualify to be recognised as assets in the books are to be measured at cost. Furthermore, Para 16

and Para 17 defines what all are the incidental costs and costs relating to the Property, Plant and

machinery that can be recognised initially (Bromwich & Scapens, 2016). These include costs of

site preparation, installation costs, delivery and handling costs and professional fees. Para 19

mentions some of the costs like the administration and general overhead costs, the cost of

opening new facility or the cost of introducing a product or service, etc are not be included in the

initial measurement costs. In the given case, the amounts at which the assets will be reorded is

shown below:

Assets Land Building Machinery

Fair Value 810,000 480,000 150,000

Legal Fees 3,600 - -

Renovation cost - 15,600 -

Installation cost - - 5,400

Shipping cost - - 1,800

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

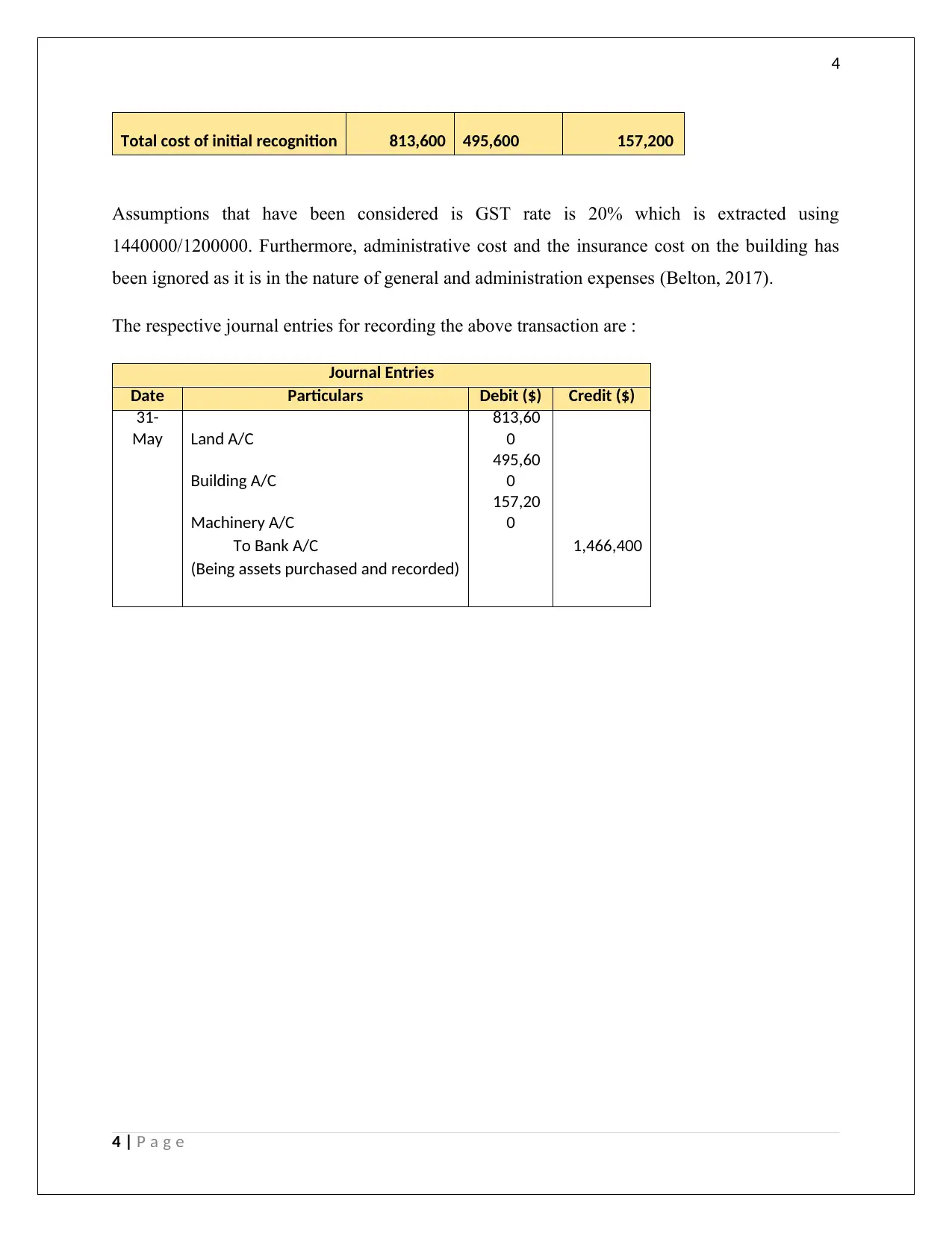

Total cost of initial recognition 813,600 495,600 157,200

Assumptions that have been considered is GST rate is 20% which is extracted using

1440000/1200000. Furthermore, administrative cost and the insurance cost on the building has

been ignored as it is in the nature of general and administration expenses (Belton, 2017).

The respective journal entries for recording the above transaction are :

Journal Entries

Date Particulars Debit ($) Credit ($)

31-

May Land A/C

813,60

0

Building A/C

495,60

0

Machinery A/C

157,20

0

To Bank A/C 1,466,400

(Being assets purchased and recorded)

4 | P a g e

Total cost of initial recognition 813,600 495,600 157,200

Assumptions that have been considered is GST rate is 20% which is extracted using

1440000/1200000. Furthermore, administrative cost and the insurance cost on the building has

been ignored as it is in the nature of general and administration expenses (Belton, 2017).

The respective journal entries for recording the above transaction are :

Journal Entries

Date Particulars Debit ($) Credit ($)

31-

May Land A/C

813,60

0

Building A/C

495,60

0

Machinery A/C

157,20

0

To Bank A/C 1,466,400

(Being assets purchased and recorded)

4 | P a g e

5

Calculation of Depreciation (question 2)

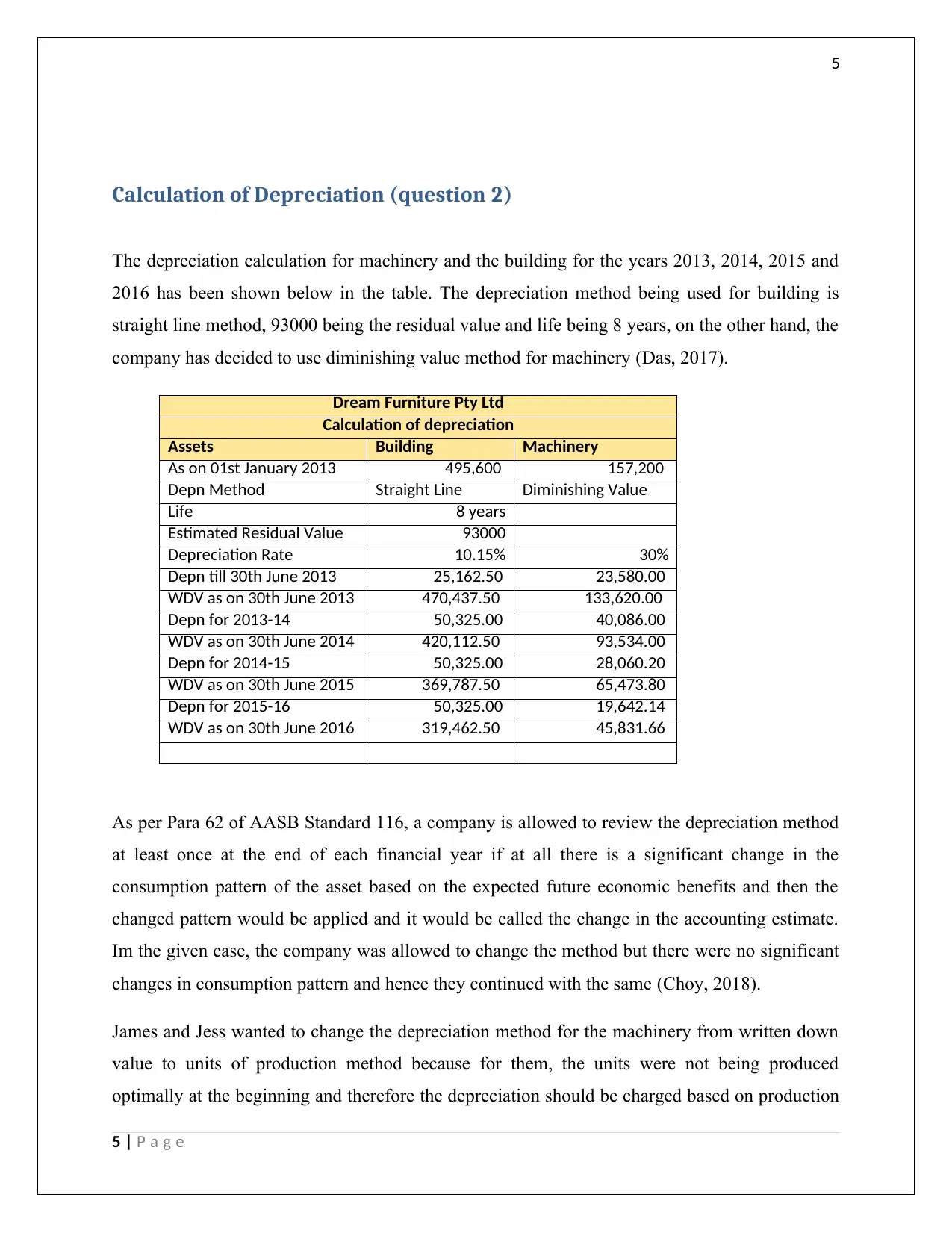

The depreciation calculation for machinery and the building for the years 2013, 2014, 2015 and

2016 has been shown below in the table. The depreciation method being used for building is

straight line method, 93000 being the residual value and life being 8 years, on the other hand, the

company has decided to use diminishing value method for machinery (Das, 2017).

Dream Furniture Pty Ltd

Calculation of depreciation

Assets Building Machinery

As on 01st January 2013 495,600 157,200

Depn Method Straight Line Diminishing Value

Life 8 years

Estimated Residual Value 93000

Depreciation Rate 10.15% 30%

Depn till 30th June 2013 25,162.50 23,580.00

WDV as on 30th June 2013 470,437.50 133,620.00

Depn for 2013-14 50,325.00 40,086.00

WDV as on 30th June 2014 420,112.50 93,534.00

Depn for 2014-15 50,325.00 28,060.20

WDV as on 30th June 2015 369,787.50 65,473.80

Depn for 2015-16 50,325.00 19,642.14

WDV as on 30th June 2016 319,462.50 45,831.66

As per Para 62 of AASB Standard 116, a company is allowed to review the depreciation method

at least once at the end of each financial year if at all there is a significant change in the

consumption pattern of the asset based on the expected future economic benefits and then the

changed pattern would be applied and it would be called the change in the accounting estimate.

Im the given case, the company was allowed to change the method but there were no significant

changes in consumption pattern and hence they continued with the same (Choy, 2018).

James and Jess wanted to change the depreciation method for the machinery from written down

value to units of production method because for them, the units were not being produced

optimally at the beginning and therefore the depreciation should be charged based on production

5 | P a g e

Calculation of Depreciation (question 2)

The depreciation calculation for machinery and the building for the years 2013, 2014, 2015 and

2016 has been shown below in the table. The depreciation method being used for building is

straight line method, 93000 being the residual value and life being 8 years, on the other hand, the

company has decided to use diminishing value method for machinery (Das, 2017).

Dream Furniture Pty Ltd

Calculation of depreciation

Assets Building Machinery

As on 01st January 2013 495,600 157,200

Depn Method Straight Line Diminishing Value

Life 8 years

Estimated Residual Value 93000

Depreciation Rate 10.15% 30%

Depn till 30th June 2013 25,162.50 23,580.00

WDV as on 30th June 2013 470,437.50 133,620.00

Depn for 2013-14 50,325.00 40,086.00

WDV as on 30th June 2014 420,112.50 93,534.00

Depn for 2014-15 50,325.00 28,060.20

WDV as on 30th June 2015 369,787.50 65,473.80

Depn for 2015-16 50,325.00 19,642.14

WDV as on 30th June 2016 319,462.50 45,831.66

As per Para 62 of AASB Standard 116, a company is allowed to review the depreciation method

at least once at the end of each financial year if at all there is a significant change in the

consumption pattern of the asset based on the expected future economic benefits and then the

changed pattern would be applied and it would be called the change in the accounting estimate.

Im the given case, the company was allowed to change the method but there were no significant

changes in consumption pattern and hence they continued with the same (Choy, 2018).

James and Jess wanted to change the depreciation method for the machinery from written down

value to units of production method because for them, the units were not being produced

optimally at the beginning and therefore the depreciation should be charged based on production

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

of units but on the other hand, diminishing value method being used shows that the maximum

utilisation of machine was being done in the beginning.

Revaluation (questions 3)

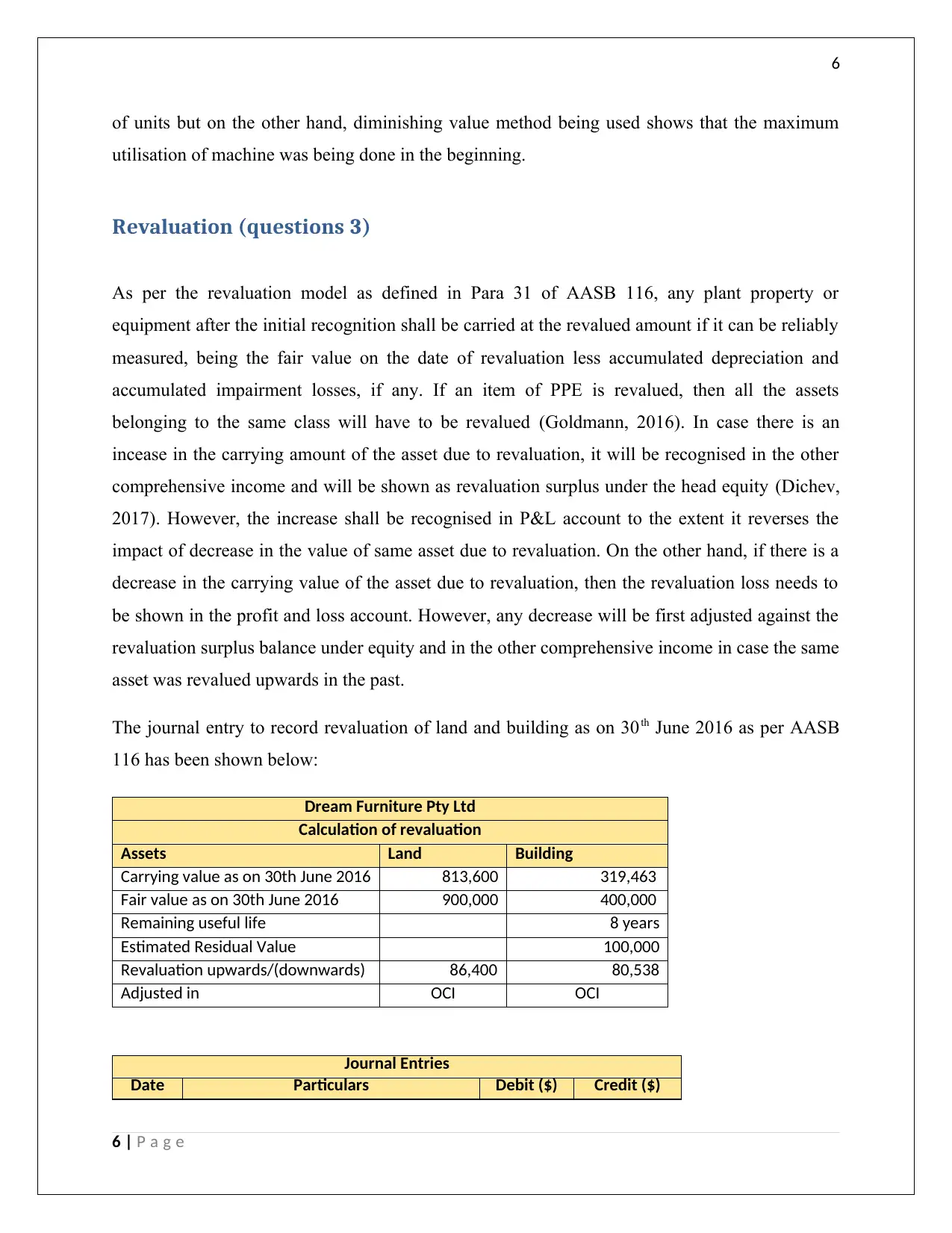

As per the revaluation model as defined in Para 31 of AASB 116, any plant property or

equipment after the initial recognition shall be carried at the revalued amount if it can be reliably

measured, being the fair value on the date of revaluation less accumulated depreciation and

accumulated impairment losses, if any. If an item of PPE is revalued, then all the assets

belonging to the same class will have to be revalued (Goldmann, 2016). In case there is an

incease in the carrying amount of the asset due to revaluation, it will be recognised in the other

comprehensive income and will be shown as revaluation surplus under the head equity (Dichev,

2017). However, the increase shall be recognised in P&L account to the extent it reverses the

impact of decrease in the value of same asset due to revaluation. On the other hand, if there is a

decrease in the carrying value of the asset due to revaluation, then the revaluation loss needs to

be shown in the profit and loss account. However, any decrease will be first adjusted against the

revaluation surplus balance under equity and in the other comprehensive income in case the same

asset was revalued upwards in the past.

The journal entry to record revaluation of land and building as on 30th June 2016 as per AASB

116 has been shown below:

Dream Furniture Pty Ltd

Calculation of revaluation

Assets Land Building

Carrying value as on 30th June 2016 813,600 319,463

Fair value as on 30th June 2016 900,000 400,000

Remaining useful life 8 years

Estimated Residual Value 100,000

Revaluation upwards/(downwards) 86,400 80,538

Adjusted in OCI OCI

Journal Entries

Date Particulars Debit ($) Credit ($)

6 | P a g e

of units but on the other hand, diminishing value method being used shows that the maximum

utilisation of machine was being done in the beginning.

Revaluation (questions 3)

As per the revaluation model as defined in Para 31 of AASB 116, any plant property or

equipment after the initial recognition shall be carried at the revalued amount if it can be reliably

measured, being the fair value on the date of revaluation less accumulated depreciation and

accumulated impairment losses, if any. If an item of PPE is revalued, then all the assets

belonging to the same class will have to be revalued (Goldmann, 2016). In case there is an

incease in the carrying amount of the asset due to revaluation, it will be recognised in the other

comprehensive income and will be shown as revaluation surplus under the head equity (Dichev,

2017). However, the increase shall be recognised in P&L account to the extent it reverses the

impact of decrease in the value of same asset due to revaluation. On the other hand, if there is a

decrease in the carrying value of the asset due to revaluation, then the revaluation loss needs to

be shown in the profit and loss account. However, any decrease will be first adjusted against the

revaluation surplus balance under equity and in the other comprehensive income in case the same

asset was revalued upwards in the past.

The journal entry to record revaluation of land and building as on 30th June 2016 as per AASB

116 has been shown below:

Dream Furniture Pty Ltd

Calculation of revaluation

Assets Land Building

Carrying value as on 30th June 2016 813,600 319,463

Fair value as on 30th June 2016 900,000 400,000

Remaining useful life 8 years

Estimated Residual Value 100,000

Revaluation upwards/(downwards) 86,400 80,538

Adjusted in OCI OCI

Journal Entries

Date Particulars Debit ($) Credit ($)

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

30-Jun Land A/C 86,400

Building A/C 80,538

To Revaluation Surplus A/C - 166,938

(Being assets revalued through OCI)

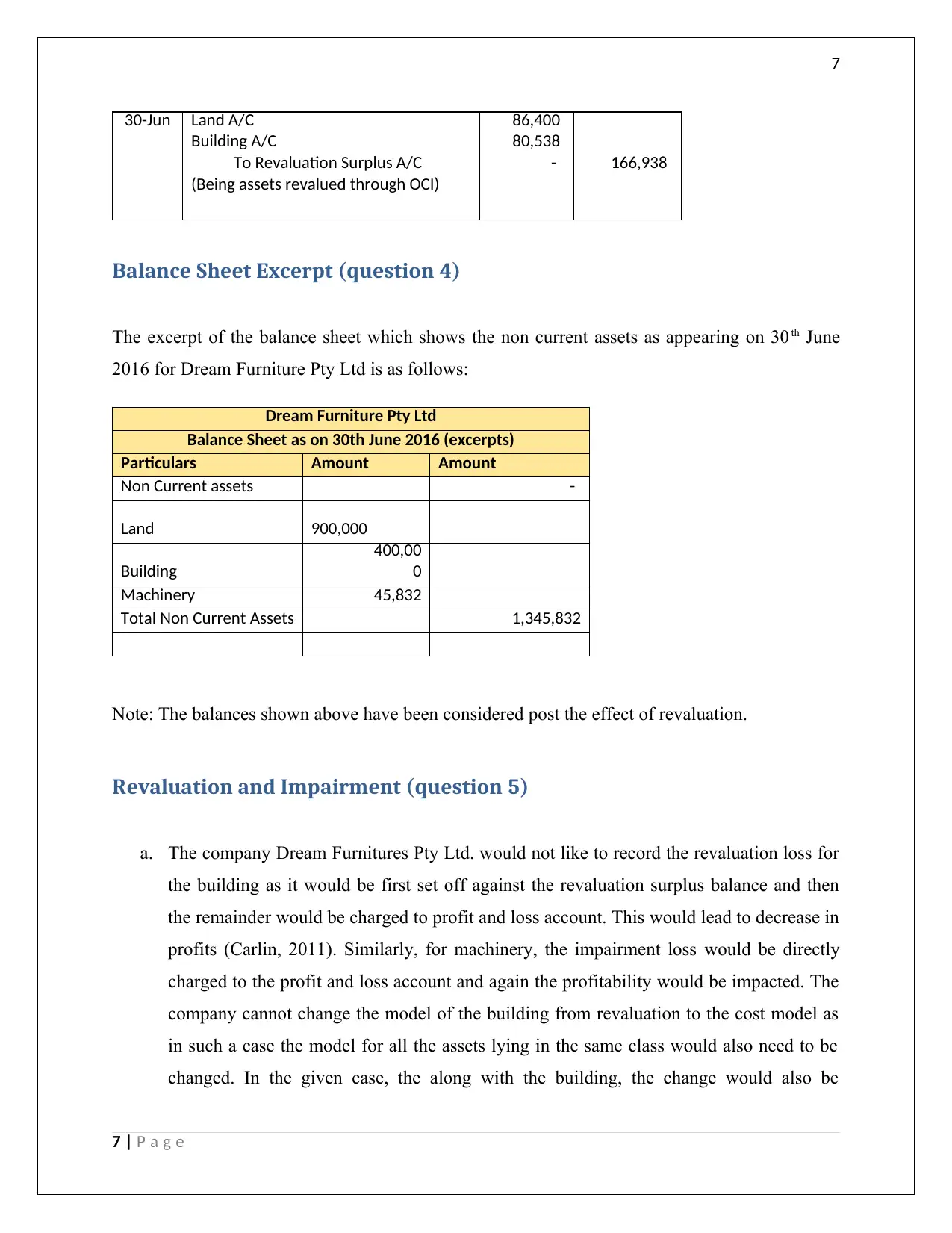

Balance Sheet Excerpt (question 4)

The excerpt of the balance sheet which shows the non current assets as appearing on 30th June

2016 for Dream Furniture Pty Ltd is as follows:

Dream Furniture Pty Ltd

Balance Sheet as on 30th June 2016 (excerpts)

Particulars Amount Amount

Non Current assets -

Land 900,000

Building

400,00

0

Machinery 45,832

Total Non Current Assets 1,345,832

Note: The balances shown above have been considered post the effect of revaluation.

Revaluation and Impairment (question 5)

a. The company Dream Furnitures Pty Ltd. would not like to record the revaluation loss for

the building as it would be first set off against the revaluation surplus balance and then

the remainder would be charged to profit and loss account. This would lead to decrease in

profits (Carlin, 2011). Similarly, for machinery, the impairment loss would be directly

charged to the profit and loss account and again the profitability would be impacted. The

company cannot change the model of the building from revaluation to the cost model as

in such a case the model for all the assets lying in the same class would also need to be

changed. In the given case, the along with the building, the change would also be

7 | P a g e

30-Jun Land A/C 86,400

Building A/C 80,538

To Revaluation Surplus A/C - 166,938

(Being assets revalued through OCI)

Balance Sheet Excerpt (question 4)

The excerpt of the balance sheet which shows the non current assets as appearing on 30th June

2016 for Dream Furniture Pty Ltd is as follows:

Dream Furniture Pty Ltd

Balance Sheet as on 30th June 2016 (excerpts)

Particulars Amount Amount

Non Current assets -

Land 900,000

Building

400,00

0

Machinery 45,832

Total Non Current Assets 1,345,832

Note: The balances shown above have been considered post the effect of revaluation.

Revaluation and Impairment (question 5)

a. The company Dream Furnitures Pty Ltd. would not like to record the revaluation loss for

the building as it would be first set off against the revaluation surplus balance and then

the remainder would be charged to profit and loss account. This would lead to decrease in

profits (Carlin, 2011). Similarly, for machinery, the impairment loss would be directly

charged to the profit and loss account and again the profitability would be impacted. The

company cannot change the model of the building from revaluation to the cost model as

in such a case the model for all the assets lying in the same class would also need to be

changed. In the given case, the along with the building, the change would also be

7 | P a g e

8

required for the land. In case the impairment loss and the revaluation are not being

recorded in the books of the company, two of the qualitative characteristics of the

financial reporting would be violated is comparability alongwith consistency. The ussers

of the financial statements would not be able to compare the last year’s working with the

current year. At the same time, it can also be said that the verifiability aspect of the

financial reporting is also being compromised.

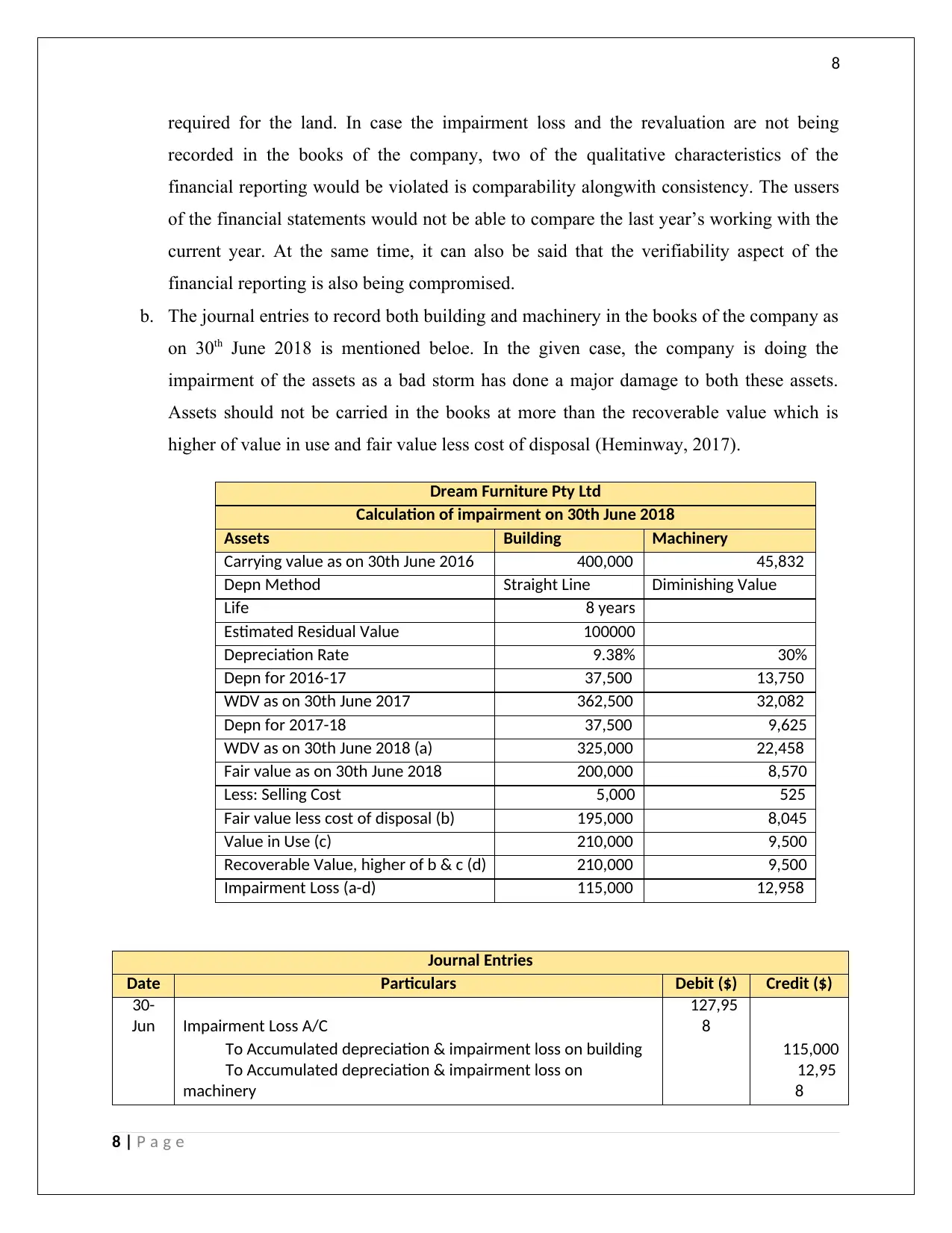

b. The journal entries to record both building and machinery in the books of the company as

on 30th June 2018 is mentioned beloe. In the given case, the company is doing the

impairment of the assets as a bad storm has done a major damage to both these assets.

Assets should not be carried in the books at more than the recoverable value which is

higher of value in use and fair value less cost of disposal (Heminway, 2017).

Dream Furniture Pty Ltd

Calculation of impairment on 30th June 2018

Assets Building Machinery

Carrying value as on 30th June 2016 400,000 45,832

Depn Method Straight Line Diminishing Value

Life 8 years

Estimated Residual Value 100000

Depreciation Rate 9.38% 30%

Depn for 2016-17 37,500 13,750

WDV as on 30th June 2017 362,500 32,082

Depn for 2017-18 37,500 9,625

WDV as on 30th June 2018 (a) 325,000 22,458

Fair value as on 30th June 2018 200,000 8,570

Less: Selling Cost 5,000 525

Fair value less cost of disposal (b) 195,000 8,045

Value in Use (c) 210,000 9,500

Recoverable Value, higher of b & c (d) 210,000 9,500

Impairment Loss (a-d) 115,000 12,958

Journal Entries

Date Particulars Debit ($) Credit ($)

30-

Jun Impairment Loss A/C

127,95

8

To Accumulated depreciation & impairment loss on building 115,000

To Accumulated depreciation & impairment loss on

machinery

12,95

8

8 | P a g e

required for the land. In case the impairment loss and the revaluation are not being

recorded in the books of the company, two of the qualitative characteristics of the

financial reporting would be violated is comparability alongwith consistency. The ussers

of the financial statements would not be able to compare the last year’s working with the

current year. At the same time, it can also be said that the verifiability aspect of the

financial reporting is also being compromised.

b. The journal entries to record both building and machinery in the books of the company as

on 30th June 2018 is mentioned beloe. In the given case, the company is doing the

impairment of the assets as a bad storm has done a major damage to both these assets.

Assets should not be carried in the books at more than the recoverable value which is

higher of value in use and fair value less cost of disposal (Heminway, 2017).

Dream Furniture Pty Ltd

Calculation of impairment on 30th June 2018

Assets Building Machinery

Carrying value as on 30th June 2016 400,000 45,832

Depn Method Straight Line Diminishing Value

Life 8 years

Estimated Residual Value 100000

Depreciation Rate 9.38% 30%

Depn for 2016-17 37,500 13,750

WDV as on 30th June 2017 362,500 32,082

Depn for 2017-18 37,500 9,625

WDV as on 30th June 2018 (a) 325,000 22,458

Fair value as on 30th June 2018 200,000 8,570

Less: Selling Cost 5,000 525

Fair value less cost of disposal (b) 195,000 8,045

Value in Use (c) 210,000 9,500

Recoverable Value, higher of b & c (d) 210,000 9,500

Impairment Loss (a-d) 115,000 12,958

Journal Entries

Date Particulars Debit ($) Credit ($)

30-

Jun Impairment Loss A/C

127,95

8

To Accumulated depreciation & impairment loss on building 115,000

To Accumulated depreciation & impairment loss on

machinery

12,95

8

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

(Being impairment of assets recorded)

Qualitative Characteristics (question 6)

While preparing the financial statements, the companies need to follow and ensure that the

qualitative charteristics of the financials are being followed while reporting. The enhancing

qualitative charteristics which Dream Furnitures Pty Ltd needs to follow are mentioned below.

These are required to ensure the reliability of the financial statements and that it becomes

relevant to the user and they get reasonable assurance to rely on the same and take their

investment decisions.

1. Comparability: This ensures the user to compare the current year data with the last year

and do the trend analysis and fin out what are the similarities and what are the

differences. This will be significantly affected if the methods of accounting are changed

every now and then (Knechel & Salterio, 2016).

2. Verifiability: This is one of the new concepts in reporting and any financial report is

verifiable when a group of knowledgeable person are able to reach to a consensus based

on the given information as to whether it gives the faithful representation of matters.

3. Timeliness: It is a very important aspect as the report needs to be delivered in time to the

users or else it renders them useless. If timely delivered, it can affect many investment

decisions.

4. Understandability: The information in the financial statements must be delivered in a way

that it can be clearly understood by the user, classified, characterised in a way that it can

give out some meaningful information (Raiborn, et al., 2016).

9 | P a g e

(Being impairment of assets recorded)

Qualitative Characteristics (question 6)

While preparing the financial statements, the companies need to follow and ensure that the

qualitative charteristics of the financials are being followed while reporting. The enhancing

qualitative charteristics which Dream Furnitures Pty Ltd needs to follow are mentioned below.

These are required to ensure the reliability of the financial statements and that it becomes

relevant to the user and they get reasonable assurance to rely on the same and take their

investment decisions.

1. Comparability: This ensures the user to compare the current year data with the last year

and do the trend analysis and fin out what are the similarities and what are the

differences. This will be significantly affected if the methods of accounting are changed

every now and then (Knechel & Salterio, 2016).

2. Verifiability: This is one of the new concepts in reporting and any financial report is

verifiable when a group of knowledgeable person are able to reach to a consensus based

on the given information as to whether it gives the faithful representation of matters.

3. Timeliness: It is a very important aspect as the report needs to be delivered in time to the

users or else it renders them useless. If timely delivered, it can affect many investment

decisions.

4. Understandability: The information in the financial statements must be delivered in a way

that it can be clearly understood by the user, classified, characterised in a way that it can

give out some meaningful information (Raiborn, et al., 2016).

9 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

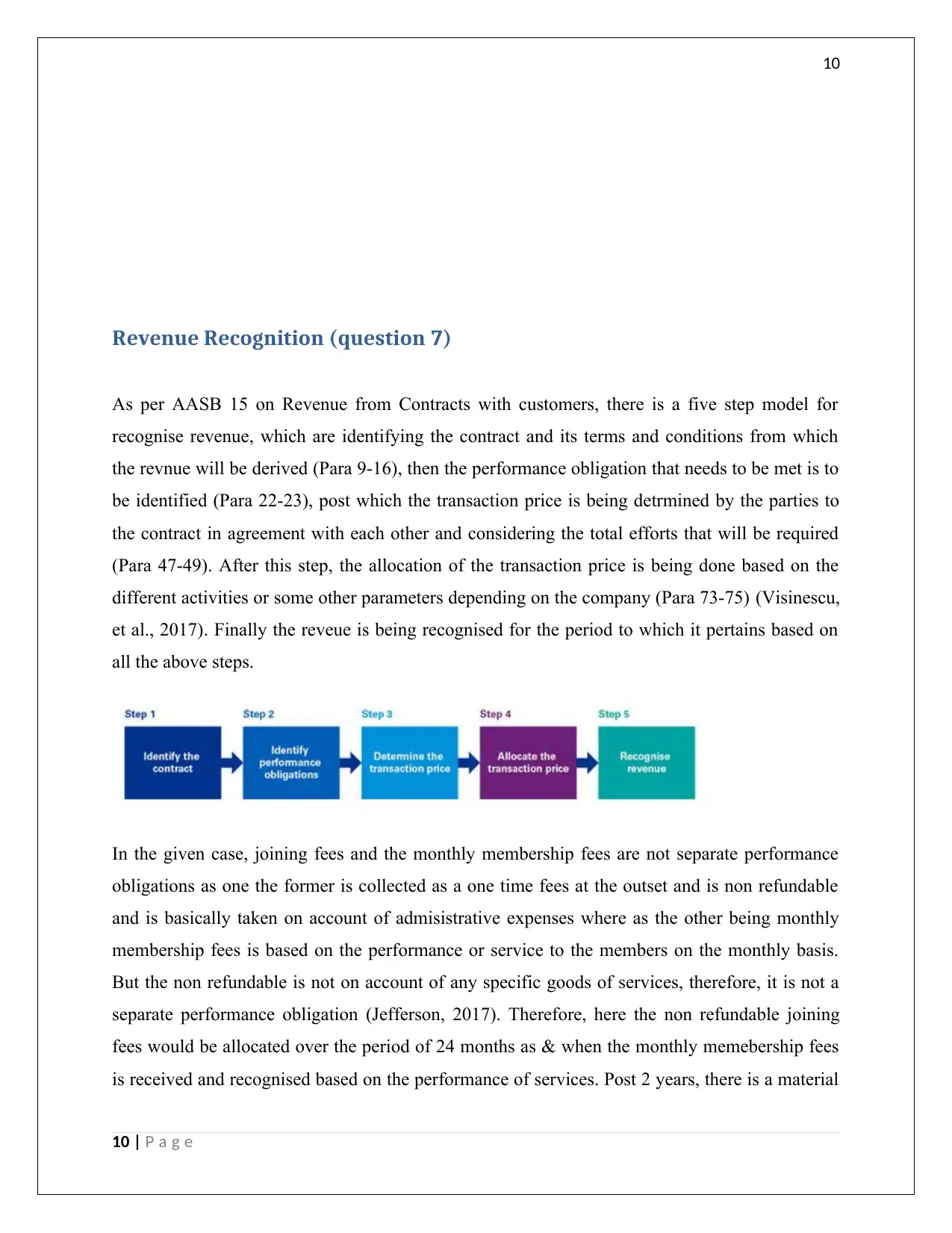

Revenue Recognition (question 7)

As per AASB 15 on Revenue from Contracts with customers, there is a five step model for

recognise revenue, which are identifying the contract and its terms and conditions from which

the revnue will be derived (Para 9-16), then the performance obligation that needs to be met is to

be identified (Para 22-23), post which the transaction price is being detrmined by the parties to

the contract in agreement with each other and considering the total efforts that will be required

(Para 47-49). After this step, the allocation of the transaction price is being done based on the

different activities or some other parameters depending on the company (Para 73-75) (Visinescu,

et al., 2017). Finally the reveue is being recognised for the period to which it pertains based on

all the above steps.

In the given case, joining fees and the monthly membership fees are not separate performance

obligations as one the former is collected as a one time fees at the outset and is non refundable

and is basically taken on account of admisistrative expenses where as the other being monthly

membership fees is based on the performance or service to the members on the monthly basis.

But the non refundable is not on account of any specific goods of services, therefore, it is not a

separate performance obligation (Jefferson, 2017). Therefore, here the non refundable joining

fees would be allocated over the period of 24 months as & when the monthly memebership fees

is received and recognised based on the performance of services. Post 2 years, there is a material

10 | P a g e

Revenue Recognition (question 7)

As per AASB 15 on Revenue from Contracts with customers, there is a five step model for

recognise revenue, which are identifying the contract and its terms and conditions from which

the revnue will be derived (Para 9-16), then the performance obligation that needs to be met is to

be identified (Para 22-23), post which the transaction price is being detrmined by the parties to

the contract in agreement with each other and considering the total efforts that will be required

(Para 47-49). After this step, the allocation of the transaction price is being done based on the

different activities or some other parameters depending on the company (Para 73-75) (Visinescu,

et al., 2017). Finally the reveue is being recognised for the period to which it pertains based on

all the above steps.

In the given case, joining fees and the monthly membership fees are not separate performance

obligations as one the former is collected as a one time fees at the outset and is non refundable

and is basically taken on account of admisistrative expenses where as the other being monthly

membership fees is based on the performance or service to the members on the monthly basis.

But the non refundable is not on account of any specific goods of services, therefore, it is not a

separate performance obligation (Jefferson, 2017). Therefore, here the non refundable joining

fees would be allocated over the period of 24 months as & when the monthly memebership fees

is received and recognised based on the performance of services. Post 2 years, there is a material

10 | P a g e

11

right with the customer and hence no joining fees is being taken and then only the monthly

membership fees is being recognised a revenue.

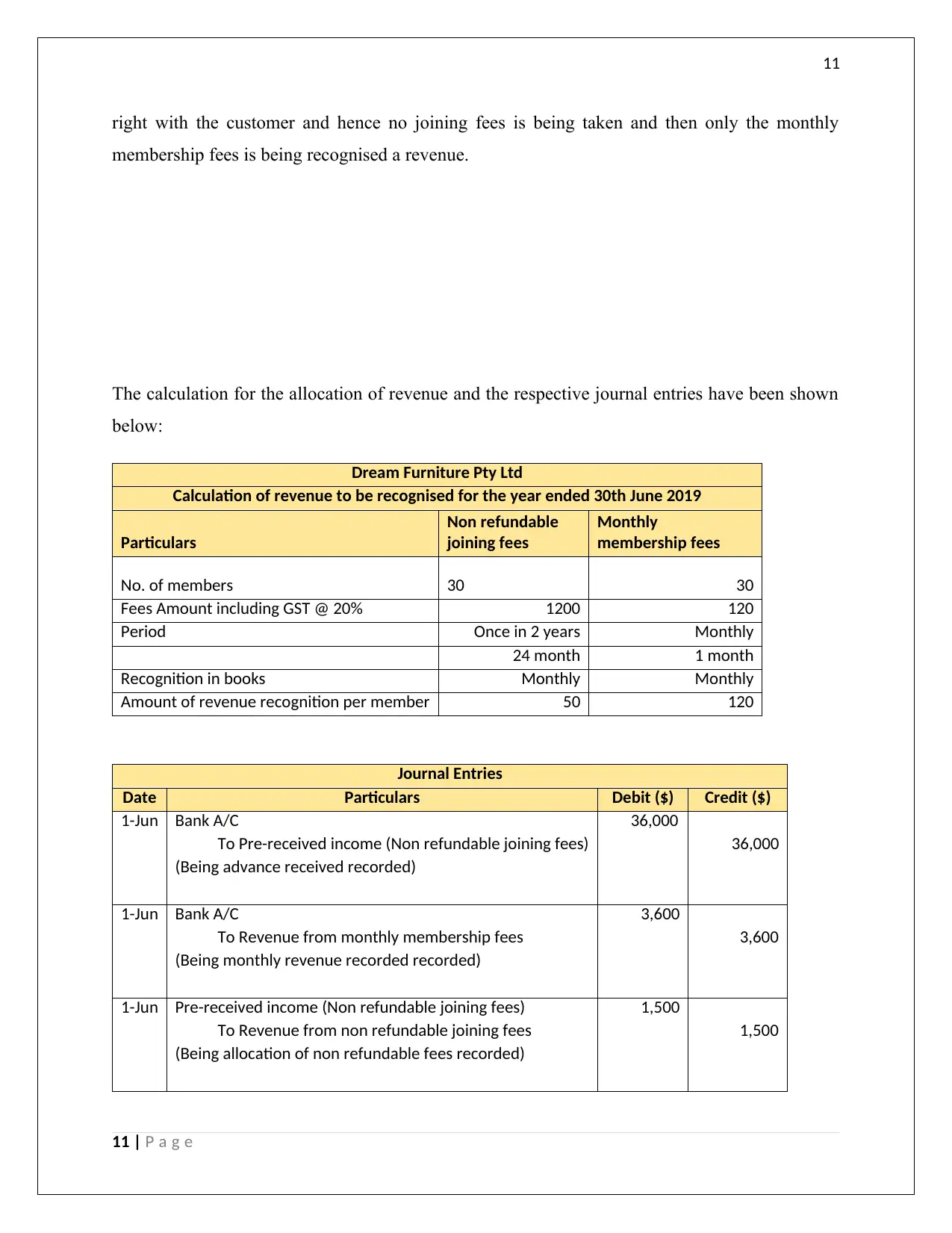

The calculation for the allocation of revenue and the respective journal entries have been shown

below:

Dream Furniture Pty Ltd

Calculation of revenue to be recognised for the year ended 30th June 2019

Particulars

Non refundable

joining fees

Monthly

membership fees

No. of members 30 30

Fees Amount including GST @ 20% 1200 120

Period Once in 2 years Monthly

24 month 1 month

Recognition in books Monthly Monthly

Amount of revenue recognition per member 50 120

Journal Entries

Date Particulars Debit ($) Credit ($)

1-Jun Bank A/C 36,000

To Pre-received income (Non refundable joining fees) 36,000

(Being advance received recorded)

1-Jun Bank A/C 3,600

To Revenue from monthly membership fees 3,600

(Being monthly revenue recorded recorded)

1-Jun Pre-received income (Non refundable joining fees) 1,500

To Revenue from non refundable joining fees 1,500

(Being allocation of non refundable fees recorded)

11 | P a g e

right with the customer and hence no joining fees is being taken and then only the monthly

membership fees is being recognised a revenue.

The calculation for the allocation of revenue and the respective journal entries have been shown

below:

Dream Furniture Pty Ltd

Calculation of revenue to be recognised for the year ended 30th June 2019

Particulars

Non refundable

joining fees

Monthly

membership fees

No. of members 30 30

Fees Amount including GST @ 20% 1200 120

Period Once in 2 years Monthly

24 month 1 month

Recognition in books Monthly Monthly

Amount of revenue recognition per member 50 120

Journal Entries

Date Particulars Debit ($) Credit ($)

1-Jun Bank A/C 36,000

To Pre-received income (Non refundable joining fees) 36,000

(Being advance received recorded)

1-Jun Bank A/C 3,600

To Revenue from monthly membership fees 3,600

(Being monthly revenue recorded recorded)

1-Jun Pre-received income (Non refundable joining fees) 1,500

To Revenue from non refundable joining fees 1,500

(Being allocation of non refundable fees recorded)

11 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.