DuoLever Limited: Financial Analysis of Recyclable Product Options

VerifiedAdded on 2023/03/17

|28

|2916

|34

Report

AI Summary

This report analyzes two options for DuoLever Limited, a personal care product company, to implement recyclable packaging. The first option involves investing in the production of recycled sachet plastic, while the second involves licensing the use of a patented option to an external company. The analysis includes calculating Net Present Value (NPV) for each option under base, best, and worst-case scenarios. The report considers sales revenue, variable costs, and other expenses to determine the financial viability of each option, including uncertainty analysis. The findings suggest that neither option presents a positive NPV, indicating potential financial challenges for DuoLever in adopting either strategy. The report concludes with recommendations based on the financial analysis, emphasizing the impact of sales fluctuations on profitability.

Running Head: FINANCE 0

Finance

(Student Name)

Finance

(Student Name)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 1

Table of Contents

Memo...............................................................................................................................................2

Introduction......................................................................................................................................2

Analysis...........................................................................................................................................2

1st Option......................................................................................................................................3

Uncertainty Analysis................................................................................................................4

2nd Option.....................................................................................................................................4

Uncertainty Condition..............................................................................................................6

Recommendations............................................................................................................................6

Conclusion.......................................................................................................................................6

References........................................................................................................................................8

Table of Contents

Memo...............................................................................................................................................2

Introduction......................................................................................................................................2

Analysis...........................................................................................................................................2

1st Option......................................................................................................................................3

Uncertainty Analysis................................................................................................................4

2nd Option.....................................................................................................................................4

Uncertainty Condition..............................................................................................................6

Recommendations............................................................................................................................6

Conclusion.......................................................................................................................................6

References........................................................................................................................................8

FINANCE 2

Memo

TO: DuoLever CEO

FROM- (Student Name)

DATE- May 16, 2018

Introduction

In recent scenario, most of the companies have adopted various means to achieve growth and

success in the market. They ignore its responsibilities towards the environment and society that

harm the environment at greater level. The number of plastic consumption by the companies is

increasing day by day that affected overall environment at greater level (Hayward et al., 2017).

One of the companies DuoLever Limited is one of the company that deal in the personal care

products. The company offer variety of personal products to their consumers that are related to

skin as well as hair products. The company uses plastic for packaging their products. However,

the company has decided to use recyclable products in their business to take initiatives towards

sustainable business.

In the following part there will be detailed analysis of the Option that the company can use to

produce recyclable products for their business

Memo

TO: DuoLever CEO

FROM- (Student Name)

DATE- May 16, 2018

Introduction

In recent scenario, most of the companies have adopted various means to achieve growth and

success in the market. They ignore its responsibilities towards the environment and society that

harm the environment at greater level. The number of plastic consumption by the companies is

increasing day by day that affected overall environment at greater level (Hayward et al., 2017).

One of the companies DuoLever Limited is one of the company that deal in the personal care

products. The company offer variety of personal products to their consumers that are related to

skin as well as hair products. The company uses plastic for packaging their products. However,

the company has decided to use recyclable products in their business to take initiatives towards

sustainable business.

In the following part there will be detailed analysis of the Option that the company can use to

produce recyclable products for their business

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 3

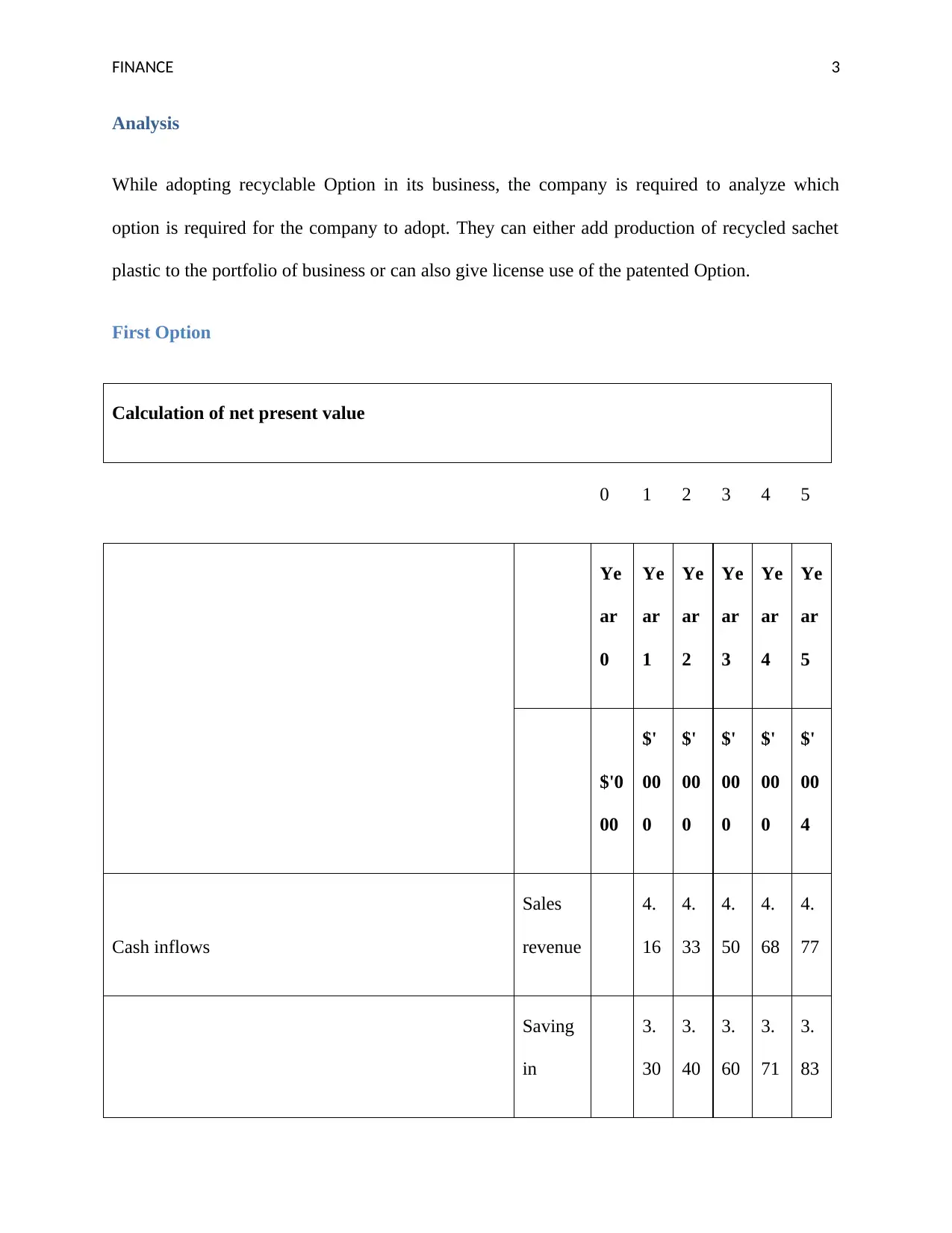

Analysis

While adopting recyclable Option in its business, the company is required to analyze which

option is required for the company to adopt. They can either add production of recycled sachet

plastic to the portfolio of business or can also give license use of the patented Option.

First Option

Calculation of net present value

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

4

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

3.

30

3.

40

3.

60

3.

71

3.

83

Analysis

While adopting recyclable Option in its business, the company is required to analyze which

option is required for the company to adopt. They can either add production of recycled sachet

plastic to the portfolio of business or can also give license use of the patented Option.

First Option

Calculation of net present value

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

4

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

3.

30

3.

40

3.

60

3.

71

3.

83

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

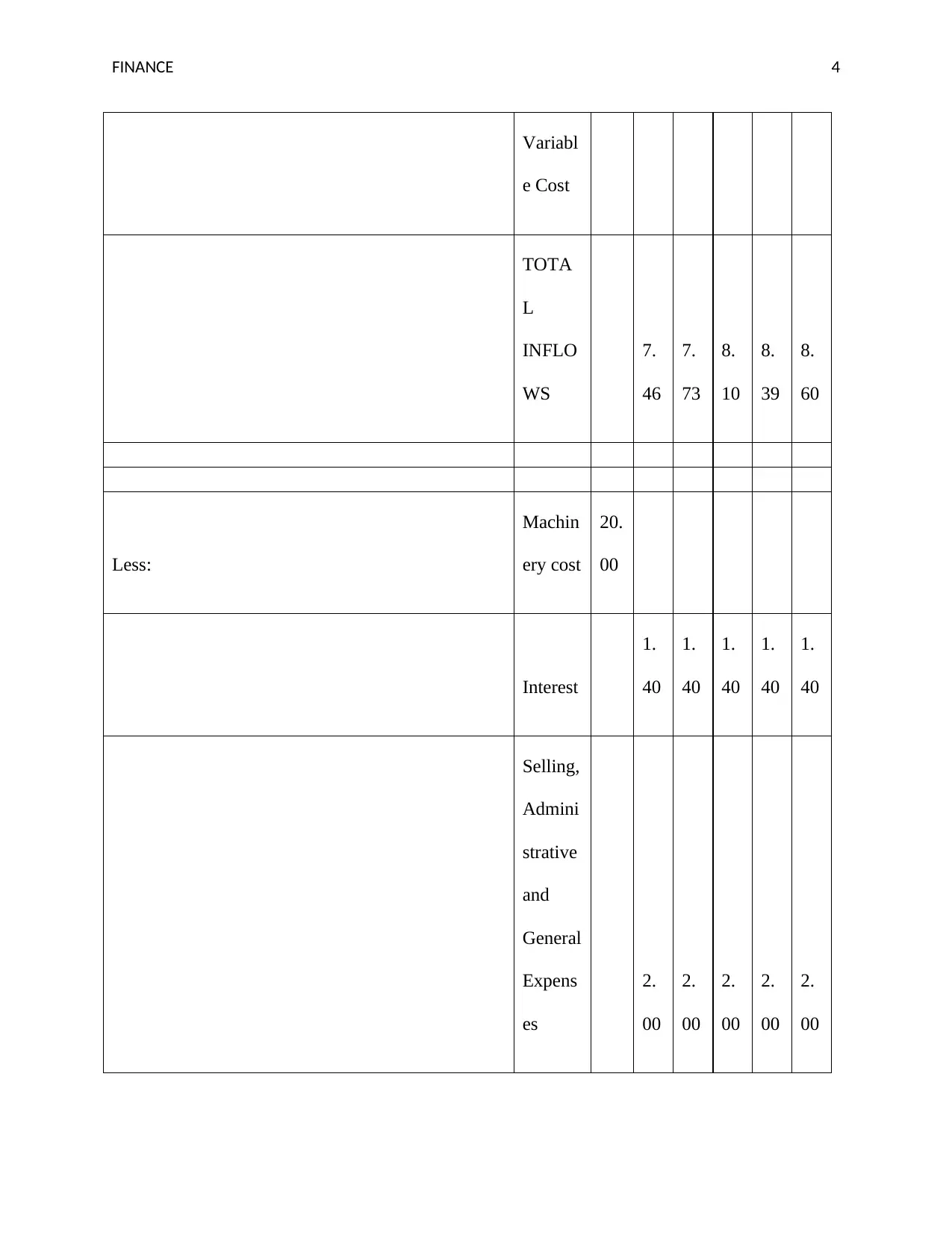

FINANCE 4

Variabl

e Cost

TOTA

L

INFLO

WS

7.

46

7.

73

8.

10

8.

39

8.

60

Less:

Machin

ery cost

20.

00

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

Variabl

e Cost

TOTA

L

INFLO

WS

7.

46

7.

73

8.

10

8.

39

8.

60

Less:

Machin

ery cost

20.

00

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

FINANCE 5

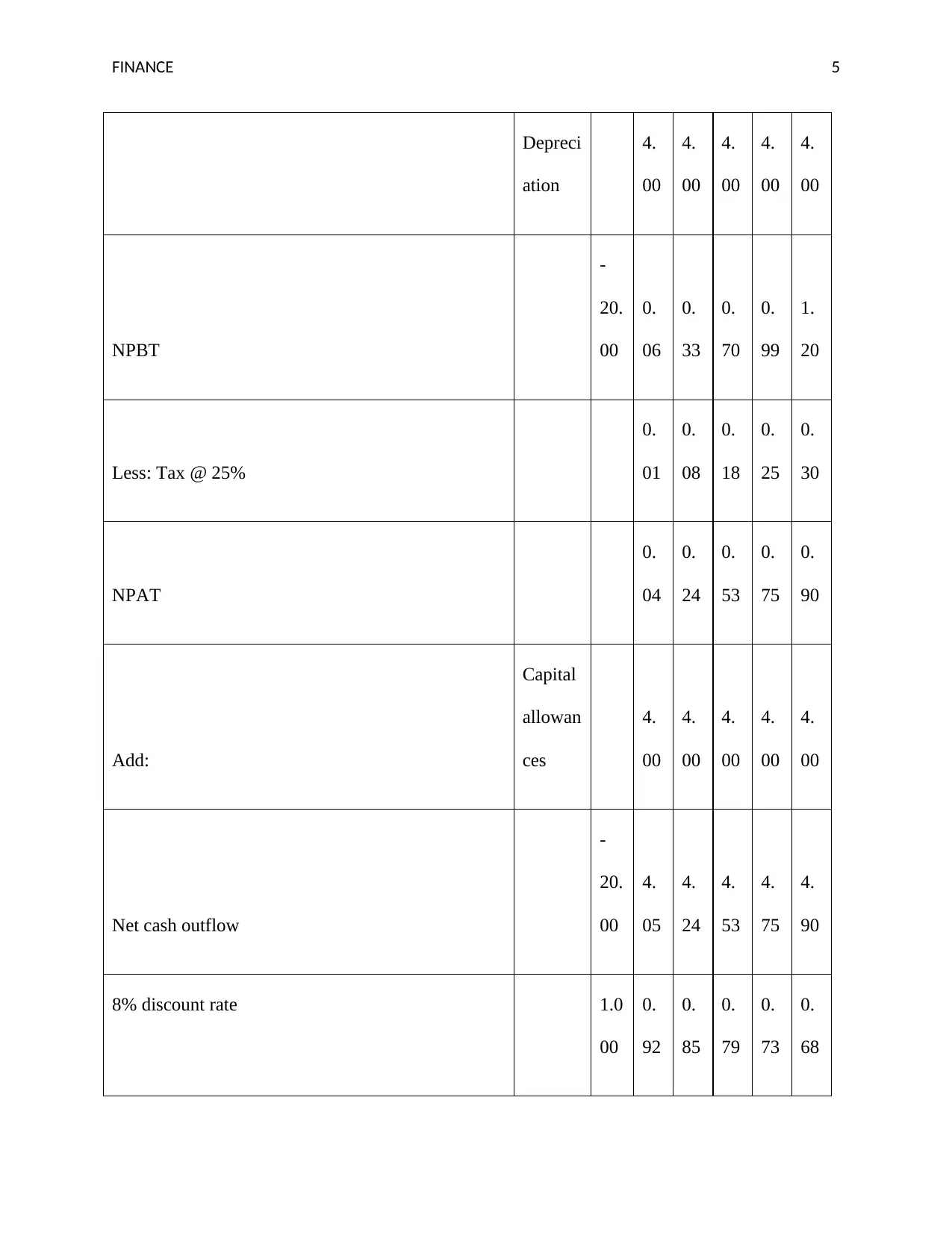

Depreci

ation

4.

00

4.

00

4.

00

4.

00

4.

00

NPBT

-

20.

00

0.

06

0.

33

0.

70

0.

99

1.

20

Less: Tax @ 25%

0.

01

0.

08

0.

18

0.

25

0.

30

NPAT

0.

04

0.

24

0.

53

0.

75

0.

90

Add:

Capital

allowan

ces

4.

00

4.

00

4.

00

4.

00

4.

00

Net cash outflow

-

20.

00

4.

05

4.

24

4.

53

4.

75

4.

90

8% discount rate 1.0

00

0.

92

0.

85

0.

79

0.

73

0.

68

Depreci

ation

4.

00

4.

00

4.

00

4.

00

4.

00

NPBT

-

20.

00

0.

06

0.

33

0.

70

0.

99

1.

20

Less: Tax @ 25%

0.

01

0.

08

0.

18

0.

25

0.

30

NPAT

0.

04

0.

24

0.

53

0.

75

0.

90

Add:

Capital

allowan

ces

4.

00

4.

00

4.

00

4.

00

4.

00

Net cash outflow

-

20.

00

4.

05

4.

24

4.

53

4.

75

4.

90

8% discount rate 1.0

00

0.

92

0.

85

0.

79

0.

73

0.

68

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 6

6 7 4 5 1

Present value

-

20.

00

3.

75

3.

64

3.

59

3.

49

3.

33

NPV

-

2.

20

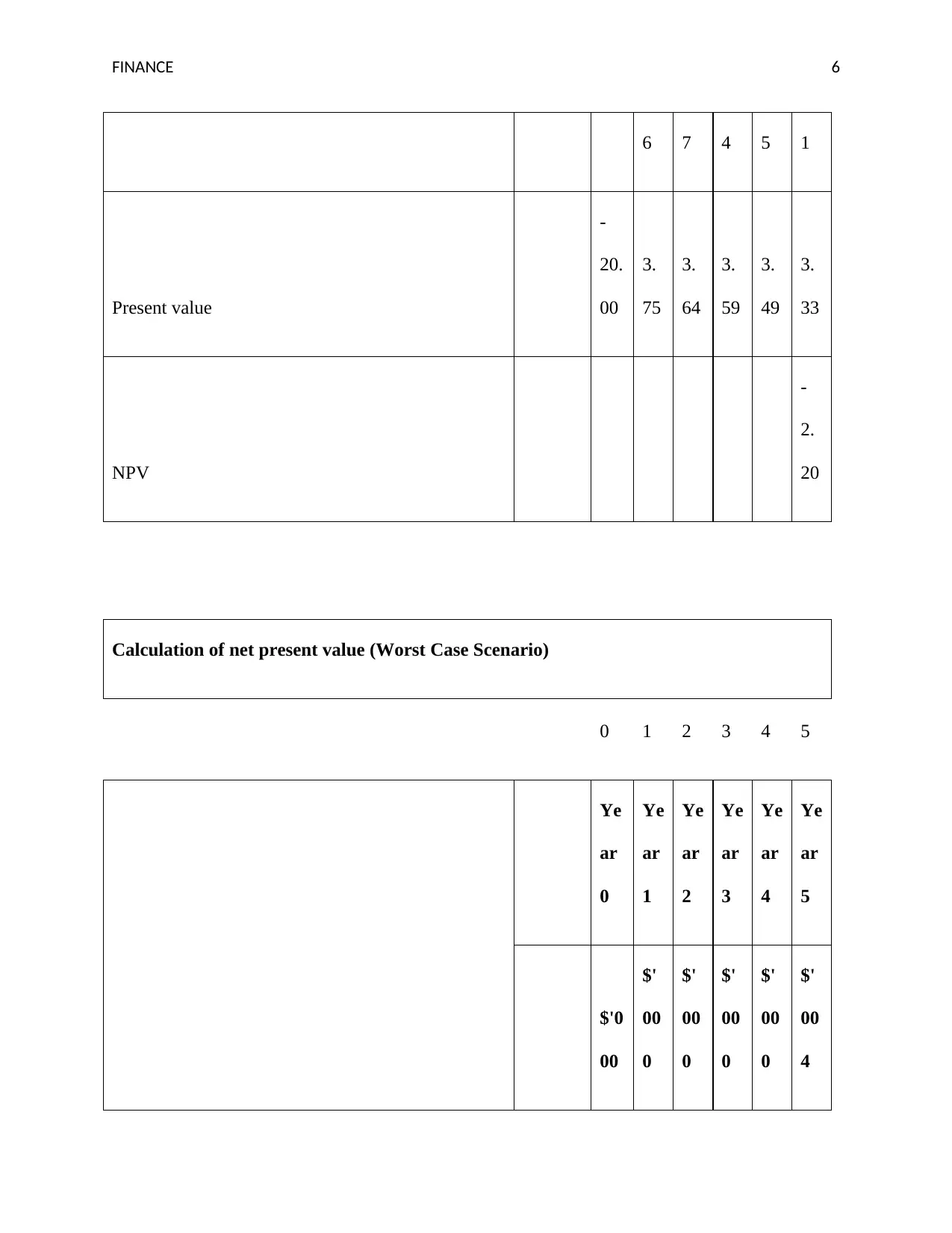

Calculation of net present value (Worst Case Scenario)

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

4

6 7 4 5 1

Present value

-

20.

00

3.

75

3.

64

3.

59

3.

49

3.

33

NPV

-

2.

20

Calculation of net present value (Worst Case Scenario)

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 7

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

Variabl

e Cost

3.

30

3.

40

3.

60

3.

71

3.

83

TOTA

L

INFLO

WS

7.

46

7.

73

8.

10

8.

39

8.

60

Total

Cash

Inflow

in

worst

case

6.

71

6.

95

7.

29

7.

55

7.

74

Less:

Machin

ery cost

20.

00

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

Variabl

e Cost

3.

30

3.

40

3.

60

3.

71

3.

83

TOTA

L

INFLO

WS

7.

46

7.

73

8.

10

8.

39

8.

60

Total

Cash

Inflow

in

worst

case

6.

71

6.

95

7.

29

7.

55

7.

74

Less:

Machin

ery cost

20.

00

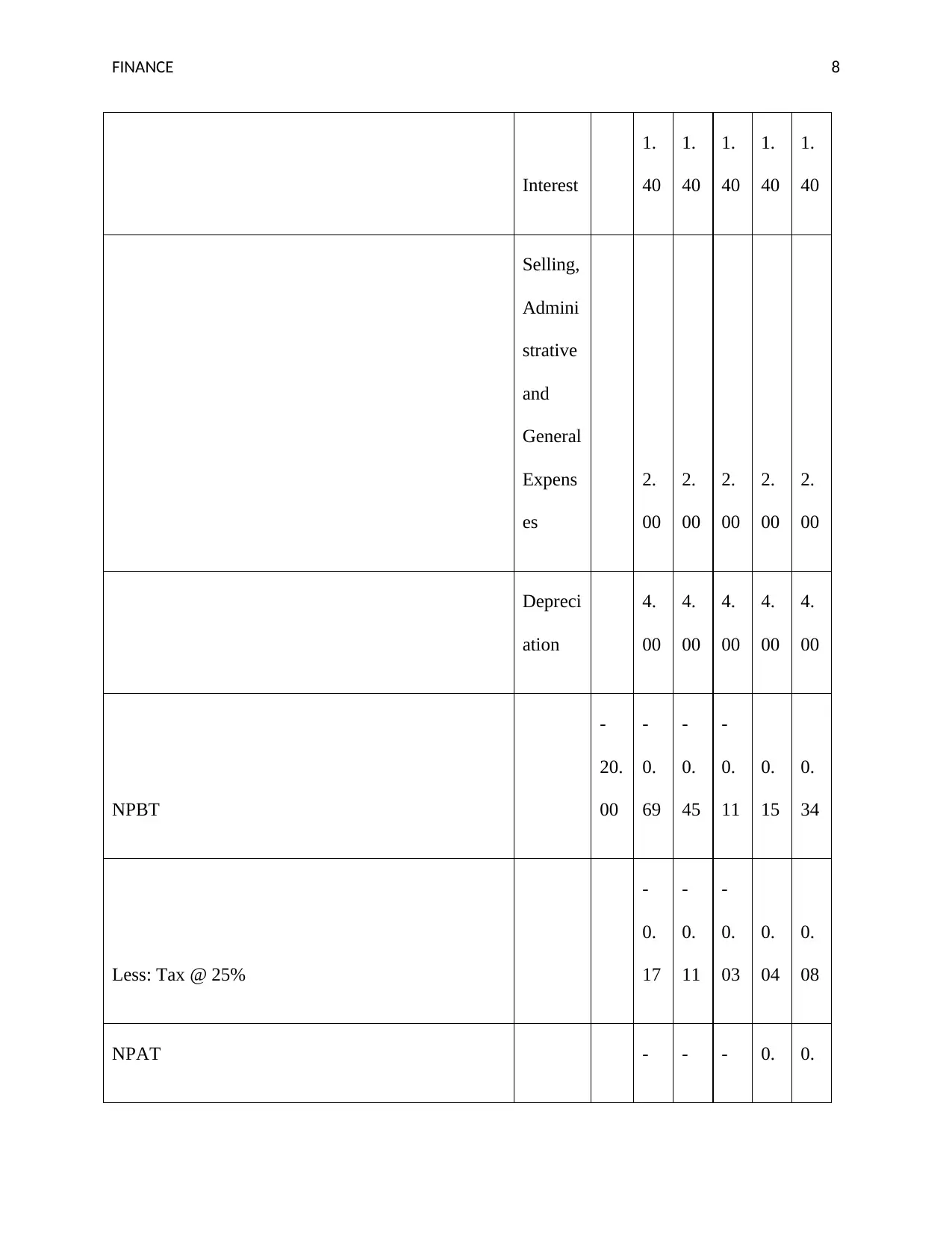

FINANCE 8

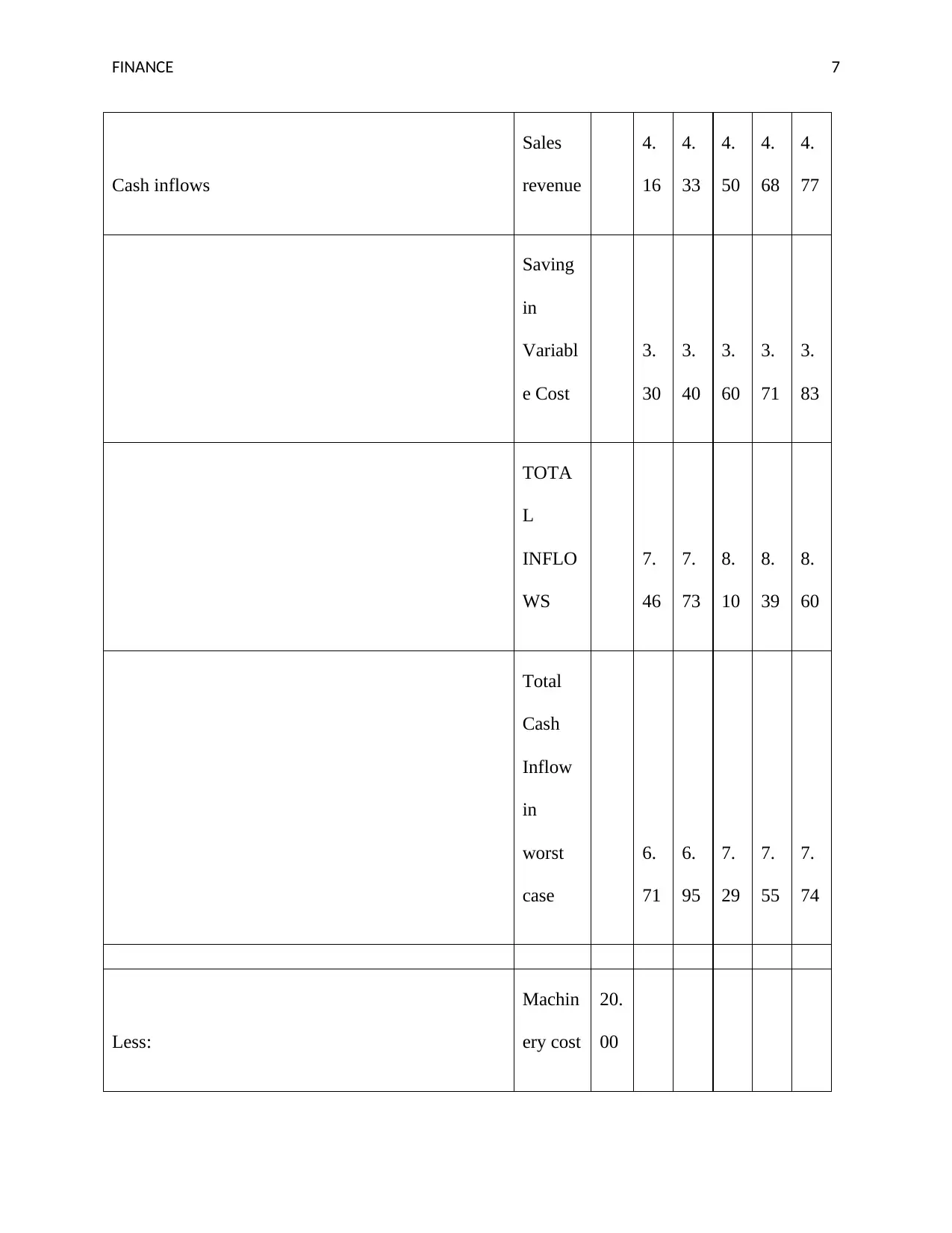

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

Depreci

ation

4.

00

4.

00

4.

00

4.

00

4.

00

NPBT

-

20.

00

-

0.

69

-

0.

45

-

0.

11

0.

15

0.

34

Less: Tax @ 25%

-

0.

17

-

0.

11

-

0.

03

0.

04

0.

08

NPAT - - - 0. 0.

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

Depreci

ation

4.

00

4.

00

4.

00

4.

00

4.

00

NPBT

-

20.

00

-

0.

69

-

0.

45

-

0.

11

0.

15

0.

34

Less: Tax @ 25%

-

0.

17

-

0.

11

-

0.

03

0.

04

0.

08

NPAT - - - 0. 0.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

FINANCE 9

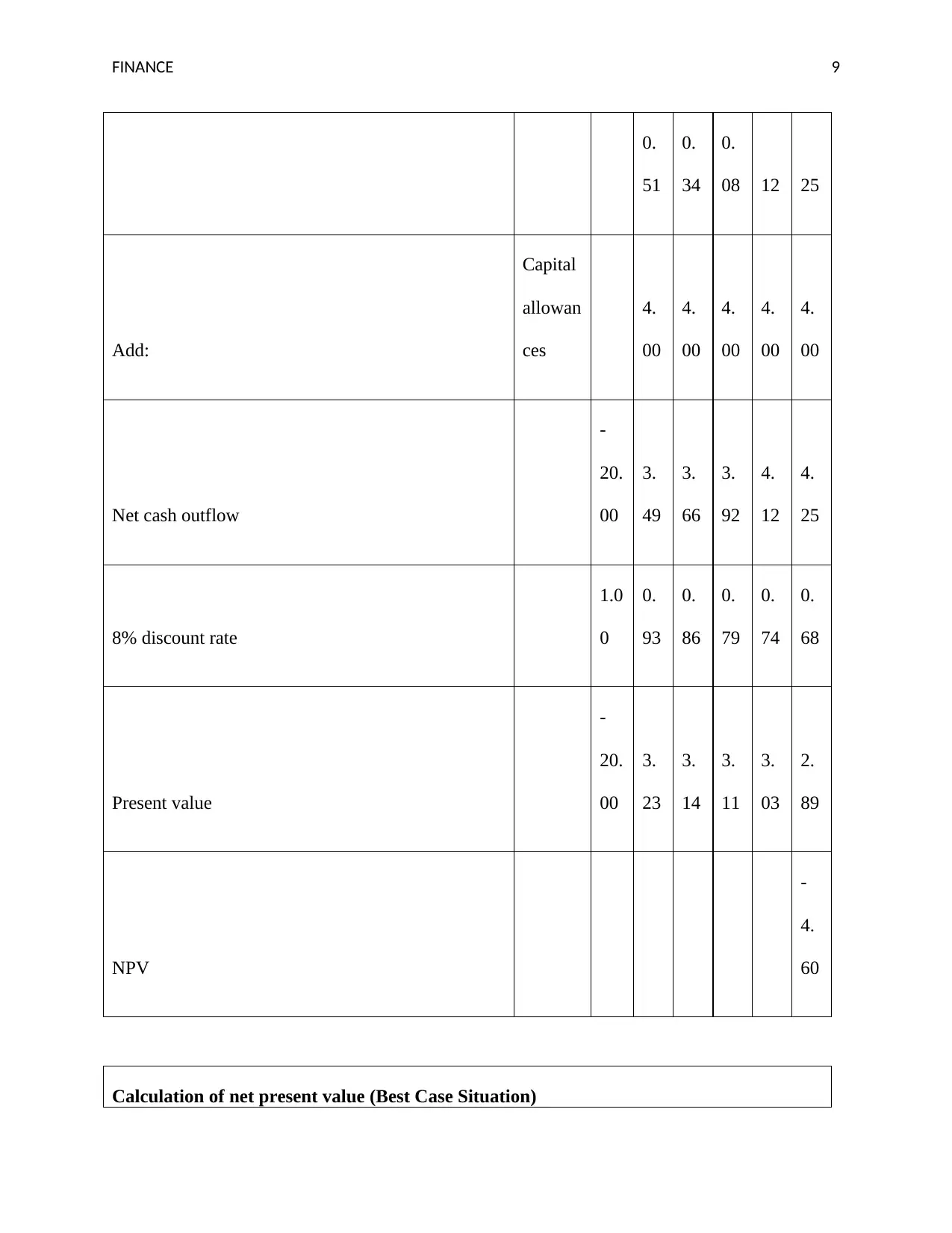

0.

51

0.

34

0.

08 12 25

Add:

Capital

allowan

ces

4.

00

4.

00

4.

00

4.

00

4.

00

Net cash outflow

-

20.

00

3.

49

3.

66

3.

92

4.

12

4.

25

8% discount rate

1.0

0

0.

93

0.

86

0.

79

0.

74

0.

68

Present value

-

20.

00

3.

23

3.

14

3.

11

3.

03

2.

89

NPV

-

4.

60

Calculation of net present value (Best Case Situation)

0.

51

0.

34

0.

08 12 25

Add:

Capital

allowan

ces

4.

00

4.

00

4.

00

4.

00

4.

00

Net cash outflow

-

20.

00

3.

49

3.

66

3.

92

4.

12

4.

25

8% discount rate

1.0

0

0.

93

0.

86

0.

79

0.

74

0.

68

Present value

-

20.

00

3.

23

3.

14

3.

11

3.

03

2.

89

NPV

-

4.

60

Calculation of net present value (Best Case Situation)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FINANCE 10

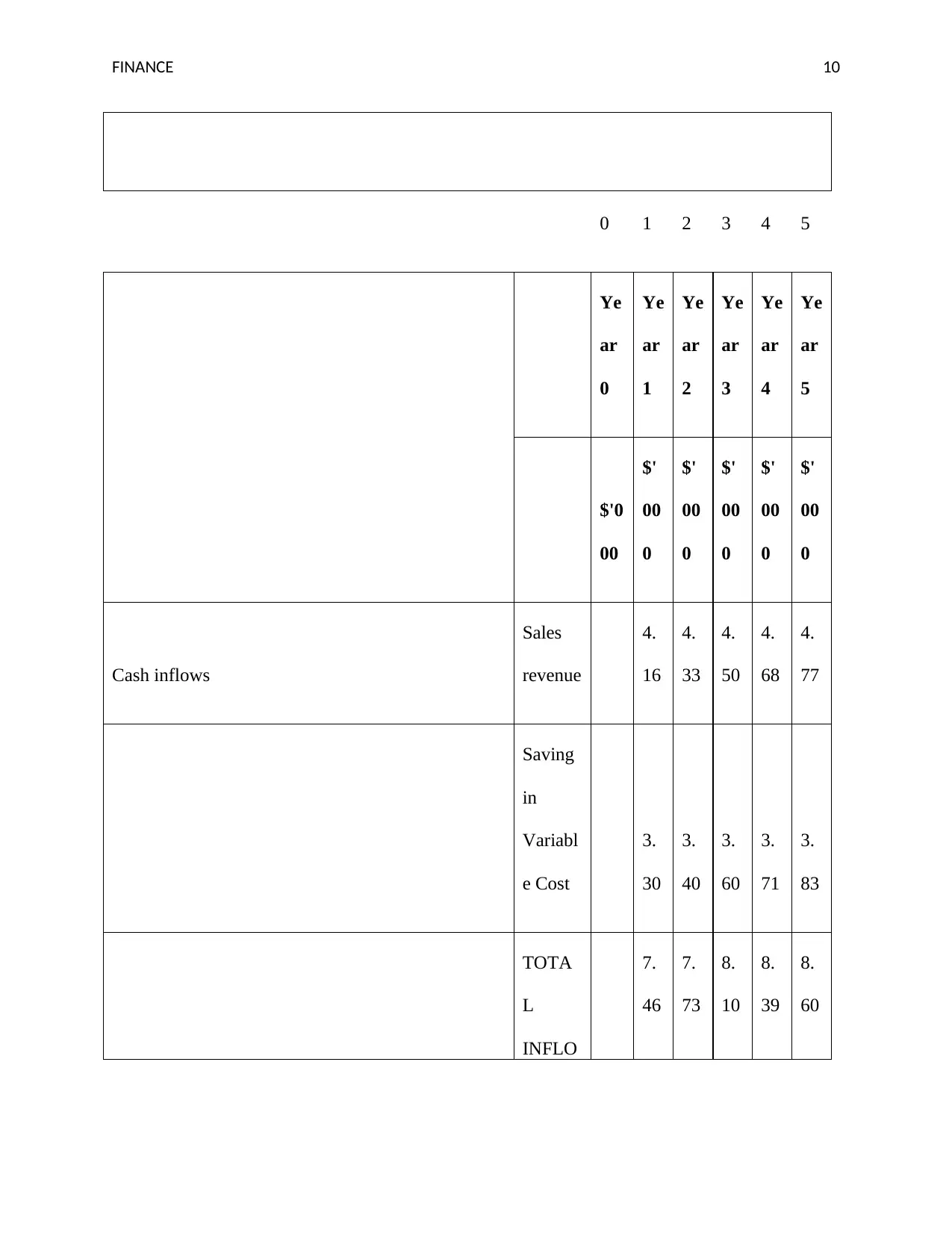

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

0

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

Variabl

e Cost

3.

30

3.

40

3.

60

3.

71

3.

83

TOTA

L

INFLO

7.

46

7.

73

8.

10

8.

39

8.

60

0 1 2 3 4 5

Ye

ar

0

Ye

ar

1

Ye

ar

2

Ye

ar

3

Ye

ar

4

Ye

ar

5

$'0

00

$'

00

0

$'

00

0

$'

00

0

$'

00

0

$'

00

0

Cash inflows

Sales

revenue

4.

16

4.

33

4.

50

4.

68

4.

77

Saving

in

Variabl

e Cost

3.

30

3.

40

3.

60

3.

71

3.

83

TOTA

L

INFLO

7.

46

7.

73

8.

10

8.

39

8.

60

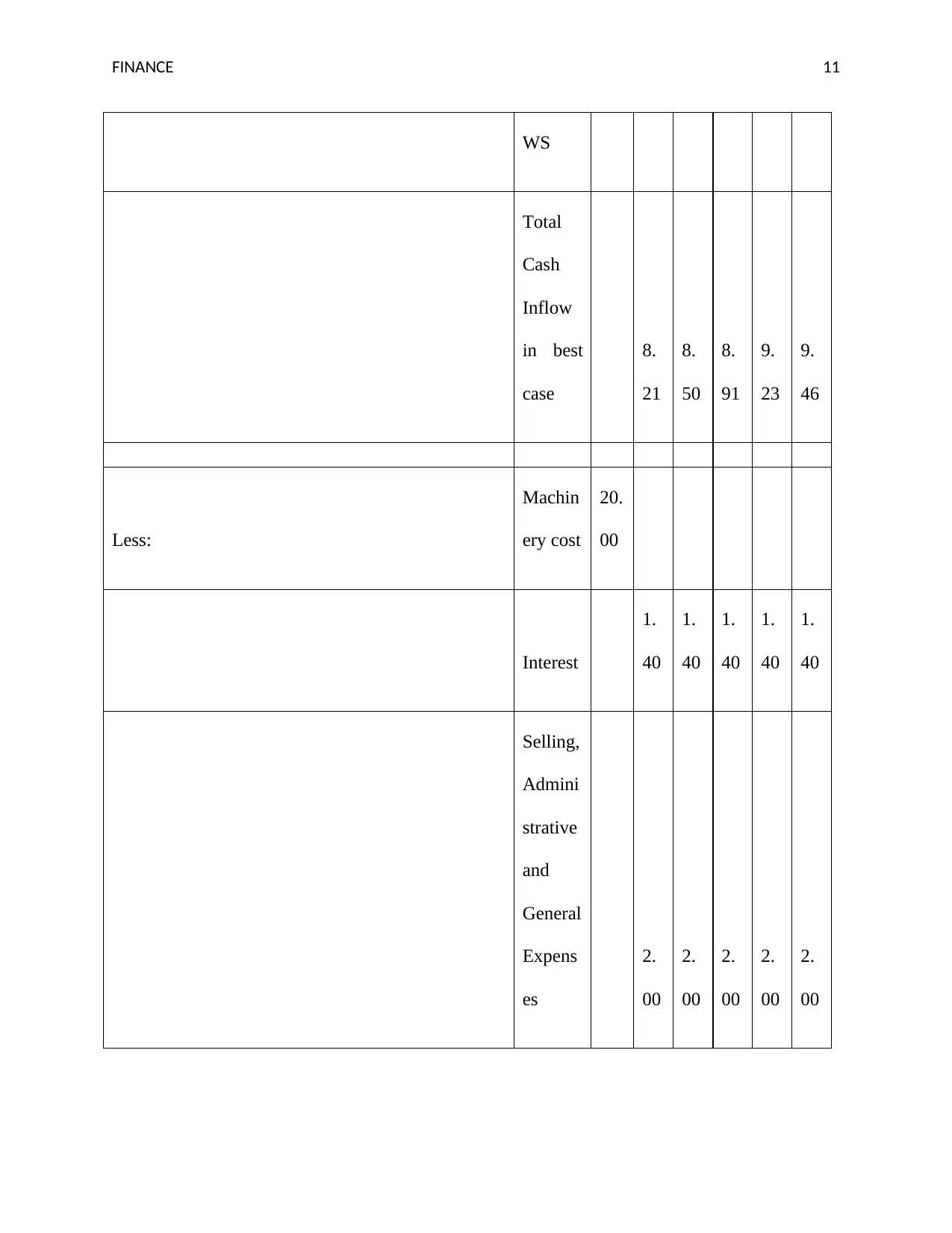

FINANCE 11

WS

Total

Cash

Inflow

in best

case

8.

21

8.

50

8.

91

9.

23

9.

46

Less:

Machin

ery cost

20.

00

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

WS

Total

Cash

Inflow

in best

case

8.

21

8.

50

8.

91

9.

23

9.

46

Less:

Machin

ery cost

20.

00

Interest

1.

40

1.

40

1.

40

1.

40

1.

40

Selling,

Admini

strative

and

General

Expens

es

2.

00

2.

00

2.

00

2.

00

2.

00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.