Summer 2017-2018 ECON 301: Industrial Business Analysis Assignment

VerifiedAdded on 2023/06/10

|8

|999

|249

Homework Assignment

AI Summary

This assignment analyzes industrial business economics, focusing on applying economic models to determine pricing and product policies in different market types. The solution begins by calculating the Cournot equilibrium for two firms, determining their response functions, quantities, price, and profit. It then examines a monopoly cartel scenario, calculating the profit-maximizing output and price. The assignment further explores the consequences of one firm cheating within the cartel. Finally, it presents a payoff matrix to illustrate the strategic interactions between firms, analyzing scenarios of collusion and competition, and identifying the Nash equilibrium. The assignment covers key concepts like profit maximization, market structures, and strategic decision-making in an industrial context.

Running head: INDUSTRIAL BUSINESS

Industrial Business

Name of the student:

Name of the University:

Author note

Industrial Business

Name of the student:

Name of the University:

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1INDUSTRIAL BUSINESS

Table of Contents

Answer 1:...................................................................................................................................2

Answer 2:...................................................................................................................................3

Answer 3:...................................................................................................................................4

Answer 4:...................................................................................................................................5

Reference:..................................................................................................................................7

Table of Contents

Answer 1:...................................................................................................................................2

Answer 2:...................................................................................................................................3

Answer 3:...................................................................................................................................4

Answer 4:...................................................................................................................................5

Reference:..................................................................................................................................7

2INDUSTRIAL BUSINESS

Answer 1:

As per the Cournot equilibrium:

Response function from SA will be:

Profit = Total Revenue (TRsa) – Total Cost (TCsa)

= (55 – Qsa - Qkpc) x Qsa – 10 x Qsa

First Order Condition of profit maximisation:

dProfit/dQsa = 55 – 2 x Qsa – Qkp – 10 ………… (i)

Second Order Condition of profit maximisation:

dProfit/dQsa = 0

From (i) we get,

Qkpc = 45 – 2 x Qsa ………. (ii)

Response function of KPC:

Profit = Total Revenue (TRkpc) – Total Cost (TCkpc)

= (55 – Qsa – Qkpc) x Qkpc – 10 x Qkpc

First Order Condition of profit maximisation:

dProfit/dQkpc = 55 – 2 x Qkpc – Qsa ………… (iii)

Second Order Condition of profit maximisation:

dProfit/dQkpc = 0

From (iii) we get

Qkpc = (55 – Qsa)/2 …………. (iv)

From (iii) and (iv) we get,

45 – 2 x Qsa = (55 – Qsa)/2

90 – 4 x Qsa = 55 – Qsa

- 3 x Qsa = - 35

Answer 1:

As per the Cournot equilibrium:

Response function from SA will be:

Profit = Total Revenue (TRsa) – Total Cost (TCsa)

= (55 – Qsa - Qkpc) x Qsa – 10 x Qsa

First Order Condition of profit maximisation:

dProfit/dQsa = 55 – 2 x Qsa – Qkp – 10 ………… (i)

Second Order Condition of profit maximisation:

dProfit/dQsa = 0

From (i) we get,

Qkpc = 45 – 2 x Qsa ………. (ii)

Response function of KPC:

Profit = Total Revenue (TRkpc) – Total Cost (TCkpc)

= (55 – Qsa – Qkpc) x Qkpc – 10 x Qkpc

First Order Condition of profit maximisation:

dProfit/dQkpc = 55 – 2 x Qkpc – Qsa ………… (iii)

Second Order Condition of profit maximisation:

dProfit/dQkpc = 0

From (iii) we get

Qkpc = (55 – Qsa)/2 …………. (iv)

From (iii) and (iv) we get,

45 – 2 x Qsa = (55 – Qsa)/2

90 – 4 x Qsa = 55 – Qsa

- 3 x Qsa = - 35

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3INDUSTRIAL BUSINESS

Qsa = 35/3

Therefore, Qsa = 11.66

Qkpc = (55 – 11.66)/2 ……… from (iv)

Therefore, Qkpc = 21.67

Price = (55 – 11.66 – 21.67)

Therefore, Price = 21.67

Profit SA = (21.67 x 11.66) – 10 x 11.66

Therefore, Profit SA = 136.07

Profit KPC = (21.67 x 11.66) – 10 x 11.66

Therefore, Profit SA = 136.07

From the above calculation, it can be seen that,

i) Nash equilibrium quantities are – (11.66 & 21.67)

ii) Equilibrium price – (21.67)

iii) Profit to each firm – (136.07)

Answer 2:

Being a monopoly cartel objective of the same will be to enhance the profit of the

same (Waldman & Jensen, 2016). As per the profit maximisation policy of the monopoly, the

price would be:

MR = MC (MR = Marginal Revenue & MC = Marginal Cost)

MR = dTR/Dq (TR = Total Revenue)

TR = P x Q

= (55 – Q) x Q

= 55Q – Q2

MR = 55 – 2Q

Qsa = 35/3

Therefore, Qsa = 11.66

Qkpc = (55 – 11.66)/2 ……… from (iv)

Therefore, Qkpc = 21.67

Price = (55 – 11.66 – 21.67)

Therefore, Price = 21.67

Profit SA = (21.67 x 11.66) – 10 x 11.66

Therefore, Profit SA = 136.07

Profit KPC = (21.67 x 11.66) – 10 x 11.66

Therefore, Profit SA = 136.07

From the above calculation, it can be seen that,

i) Nash equilibrium quantities are – (11.66 & 21.67)

ii) Equilibrium price – (21.67)

iii) Profit to each firm – (136.07)

Answer 2:

Being a monopoly cartel objective of the same will be to enhance the profit of the

same (Waldman & Jensen, 2016). As per the profit maximisation policy of the monopoly, the

price would be:

MR = MC (MR = Marginal Revenue & MC = Marginal Cost)

MR = dTR/Dq (TR = Total Revenue)

TR = P x Q

= (55 – Q) x Q

= 55Q – Q2

MR = 55 – 2Q

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4INDUSTRIAL BUSINESS

MC = 10

Therefore,

55 – 2Q = 10

- 2Q = -45

Q = 45/2

Therefore, Q = 22.5

Price = 55 – 22.5

Therefore, Price = 22.5

Profit = TR – TC

= Q x P – Q x C

= (22.5 * 22.5) – (22.5 * 10)

= 281.253

Profit to each firm = 281.253/2 = 140.626

Therefore, Profit = 281.253

i) quantity output = 22.5

ii) Price = 22.5

iii) Profit to each firm = 140.626

Considering the cartel scenario, it can be stated that, price has been enhanced whereas

quantity output has been decreased leading to rise in the profit of both the firm.

Answer 3:

If one firm produce at same quantity as previous and the other one cheats, then the

cartel will fail (Klein & Schinkel, 2018). There is often a tendency from the business firms

who enters into cartel to break the agreements in the last period. Thus, the cartel will last,

until one firm wants to opt out and produce at the mutually beneficial output (Bloch, 2018).

MC = 10

Therefore,

55 – 2Q = 10

- 2Q = -45

Q = 45/2

Therefore, Q = 22.5

Price = 55 – 22.5

Therefore, Price = 22.5

Profit = TR – TC

= Q x P – Q x C

= (22.5 * 22.5) – (22.5 * 10)

= 281.253

Profit to each firm = 281.253/2 = 140.626

Therefore, Profit = 281.253

i) quantity output = 22.5

ii) Price = 22.5

iii) Profit to each firm = 140.626

Considering the cartel scenario, it can be stated that, price has been enhanced whereas

quantity output has been decreased leading to rise in the profit of both the firm.

Answer 3:

If one firm produce at same quantity as previous and the other one cheats, then the

cartel will fail (Klein & Schinkel, 2018). There is often a tendency from the business firms

who enters into cartel to break the agreements in the last period. Thus, the cartel will last,

until one firm wants to opt out and produce at the mutually beneficial output (Bloch, 2018).

5INDUSTRIAL BUSINESS

If one firm produce at cartel decided level of output, then profit will be,

Profit = (55 – 22.5 – Qkpc) x Qkpc – 10 x Qkpc = 0

Therefore, (22.5 – Qkpc) x Qkpc = 10 x Qkpc

Therefore, 22.5 – Qkpc = 10

Therefore, Qkpc = 12.5

Price = 55- 22.5 – 12.5 = 20

Profit = (55 – 22.5 – 12.5) x 12.5 – 10 x 12.5

= (20 x 12.5) – 125

= 250 – 125

= 125

Total output by both the firm = 22.5 + 12.5 = 35

Price = 22.5 + 20 = 42.5

Profit in case of non-cooperation = 125

i) Quantity output is 12.5

ii) Price will be 20

iii) Profit to each firm will be 125

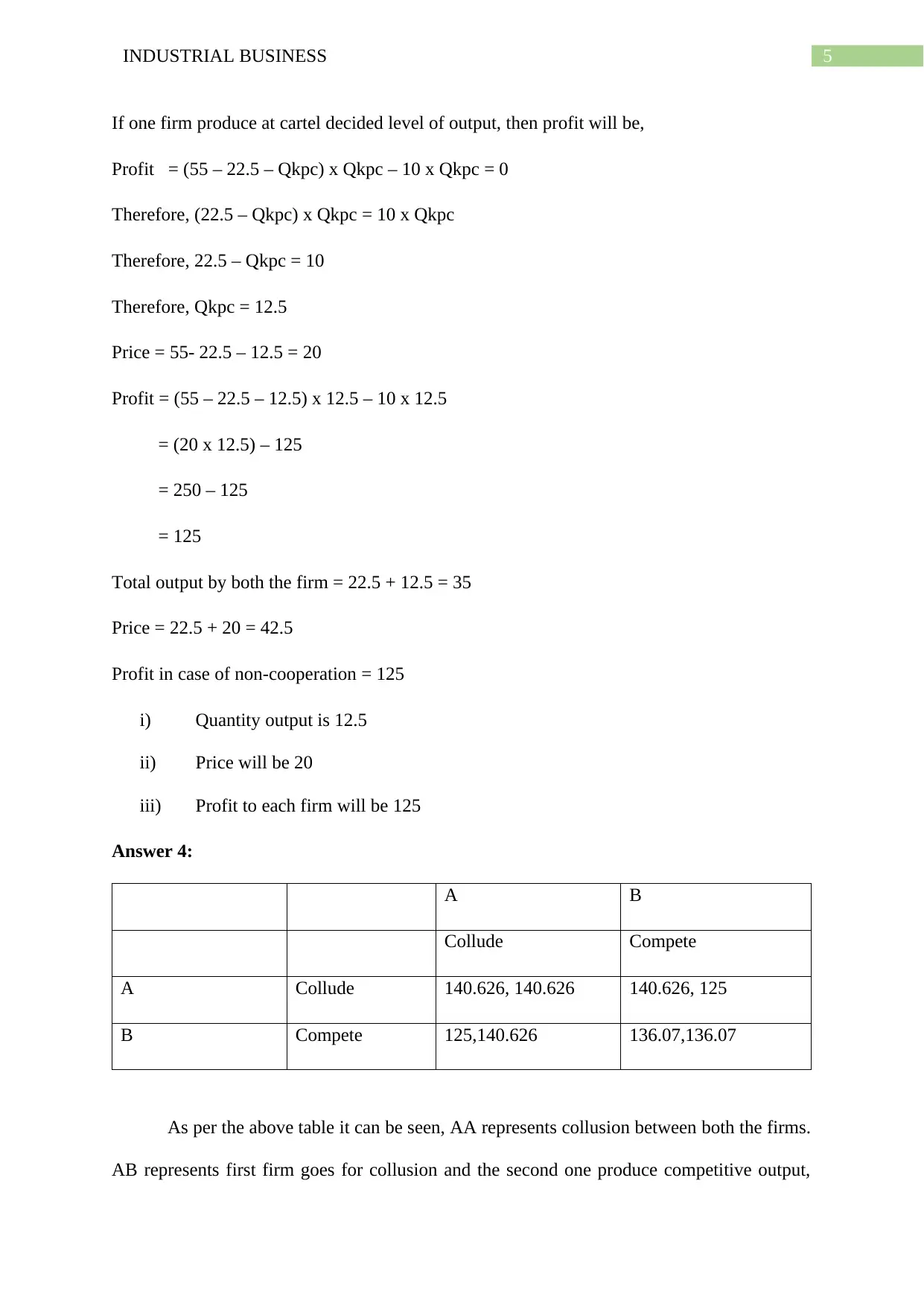

Answer 4:

A B

Collude Compete

A Collude 140.626, 140.626 140.626, 125

B Compete 125,140.626 136.07,136.07

As per the above table it can be seen, AA represents collusion between both the firms.

AB represents first firm goes for collusion and the second one produce competitive output,

If one firm produce at cartel decided level of output, then profit will be,

Profit = (55 – 22.5 – Qkpc) x Qkpc – 10 x Qkpc = 0

Therefore, (22.5 – Qkpc) x Qkpc = 10 x Qkpc

Therefore, 22.5 – Qkpc = 10

Therefore, Qkpc = 12.5

Price = 55- 22.5 – 12.5 = 20

Profit = (55 – 22.5 – 12.5) x 12.5 – 10 x 12.5

= (20 x 12.5) – 125

= 250 – 125

= 125

Total output by both the firm = 22.5 + 12.5 = 35

Price = 22.5 + 20 = 42.5

Profit in case of non-cooperation = 125

i) Quantity output is 12.5

ii) Price will be 20

iii) Profit to each firm will be 125

Answer 4:

A B

Collude Compete

A Collude 140.626, 140.626 140.626, 125

B Compete 125,140.626 136.07,136.07

As per the above table it can be seen, AA represents collusion between both the firms.

AB represents first firm goes for collusion and the second one produce competitive output,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6INDUSTRIAL BUSINESS

vis-à-vis in case of the BA. BB represents competitive pricing between both the options.

Thus, it can be seen that if the first firm goes for competitive pricing and second firm goes for

collusion, then Nash equilibrium will be achieved (Telser, 2017).

vis-à-vis in case of the BA. BB represents competitive pricing between both the options.

Thus, it can be seen that if the first firm goes for competitive pricing and second firm goes for

collusion, then Nash equilibrium will be achieved (Telser, 2017).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7INDUSTRIAL BUSINESS

Reference:

Bloch, F. (2018). Coalitions and networks in oligopolies.

Klein, T., & Schinkel, M. P. (2018). Cartel Stability by a Margin.

Telser, L. G. (2017). Competition, collusion, and game theory. Routledge.

Waldman, D., & Jensen, E. (2016). Industrial organization: theory and practice. Routledge.

Reference:

Bloch, F. (2018). Coalitions and networks in oligopolies.

Klein, T., & Schinkel, M. P. (2018). Cartel Stability by a Margin.

Telser, L. G. (2017). Competition, collusion, and game theory. Routledge.

Waldman, D., & Jensen, E. (2016). Industrial organization: theory and practice. Routledge.

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.