Price Theory: Analysis of a Proposed Merger in the Concrete Industry

VerifiedAdded on 2023/01/19

|12

|1522

|28

Report

AI Summary

This report analyzes the proposed merger of two firms (Big Industries and ConCorp) in the pre-mixed concrete industry, operating under an oligopoly market structure. The analysis, conducted from the perspective of an expert economist advising a regulatory authority, compares pre-merger and post-merger industry scenarios. Using the Cournot model, the report calculates output, price, profit, and consumer surplus for each scenario. The findings indicate that the merger, despite reducing overall industry output and increasing prices, leads to an increase in aggregate industry welfare due to significant profit gains that offset the loss in consumer surplus. The recommendation is to approve the merger, while also suggesting government monitoring of the merged firm's cost reduction claims. The financial implications of the merger, including potential tax revenue increases, are also considered. The analysis highlights the importance of considering both producer and consumer welfare when evaluating merger proposals.

Running head: PRICE THEORY

Price Theory

Name of the Student

Name of the University

Student ID

Course ID

Price Theory

Name of the Student

Name of the University

Student ID

Course ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRICE THEORY

Brief

Briefing for the permission of merger in per-mix concrete industry

Subject: Critical analysis of industry scenario as a consequence of proposed merger.

Prepared by: Name of the Student

Core message:

Executive summary

The brief critically discusses the industry scenario before and after merger to understand

the welfare consequence of merger on consumer, producer and total society as a whole. The

main intention is to give right advice to the regulatory authority regarding allowance or non-

allowance of the proposed merger between two (Big Industries and ConCorp) of the three

operating firms in the concrete industry. Evaluation of industry scenario suggests the regulatory

authority should accept the merger proposal.

Recommendation

Based on the conducted industry analysis it is recommended for the authority should

allow the merger between the two dominating firms in the industry. By allowing mergers, the

authority can help the industry to attain greater efficiency in terms of healthy competition

between the two remaining firms. Government however should closely monitor whether BigCon

is able to achieve successfully its claim of lowering the marginal cost of production.

Key information

Pre-mixed concrete is one of the major inputs in the concrete industry. Three firms –

Aggregate Inc, ConCorp and Big Industries, initially dominate the industry. The dominance of

three firms make the industry an oligopoly market. The market has considerable natural (huge

capital requirement) and regulatory barriers.

Now, two of these three firms Big Industries have attempted to merge with the

expectation that proposed merger would reduce unit cost of production. After merger, the

merged firm attains a greater efficiency because of the combined production as reflected from

Brief

Briefing for the permission of merger in per-mix concrete industry

Subject: Critical analysis of industry scenario as a consequence of proposed merger.

Prepared by: Name of the Student

Core message:

Executive summary

The brief critically discusses the industry scenario before and after merger to understand

the welfare consequence of merger on consumer, producer and total society as a whole. The

main intention is to give right advice to the regulatory authority regarding allowance or non-

allowance of the proposed merger between two (Big Industries and ConCorp) of the three

operating firms in the concrete industry. Evaluation of industry scenario suggests the regulatory

authority should accept the merger proposal.

Recommendation

Based on the conducted industry analysis it is recommended for the authority should

allow the merger between the two dominating firms in the industry. By allowing mergers, the

authority can help the industry to attain greater efficiency in terms of healthy competition

between the two remaining firms. Government however should closely monitor whether BigCon

is able to achieve successfully its claim of lowering the marginal cost of production.

Key information

Pre-mixed concrete is one of the major inputs in the concrete industry. Three firms –

Aggregate Inc, ConCorp and Big Industries, initially dominate the industry. The dominance of

three firms make the industry an oligopoly market. The market has considerable natural (huge

capital requirement) and regulatory barriers.

Now, two of these three firms Big Industries have attempted to merge with the

expectation that proposed merger would reduce unit cost of production. After merger, the

merged firm attains a greater efficiency because of the combined production as reflected from

2PRICE THEORY

the substantial reduction in marginal cost of the firm. Once the merger has been approved, the

market will be share between only two firms merged firm (BigCon) and Aggregate Inc.

Pre-merger industry outcome

Prior to mergers, independent firms face identical demand and cost results in an identical

output for each firm. Under this situation, each firm produces 2300 cubic metres of pre-mixed

concrete, charge a price of $255 and earns profit amounts to $64500. The total available quantity

in the market is 6900 cubic metres concrete. At market equilibrium, consumers earn a surplus of

1190250.

Post-merger industry outcome

After merger each of the two firm in the industry produces a larger output because of a

larger market share. The merged firm however produces a greater quantity (3400 cubic metre)

compared to the single operating firm (Aggregate Inc.). Total industry output reduces to 6300

cubic metres of concrete. Market price increases to $255. Profit earned by each of the firm

increases. The consumer surplus however reduces significantly. Increase in profit to each of the

firm is so large that it offsets the loss in consumer surplus because of a higher price and lower

industry output. As a result aggregate industry welfare increases after the merger indicating that

the regulatory authority should allow the proposed merger.

Financial implication

As suggested from the analysis, the proposed merger results in a higher profit for the

individual firm. Allowing merger government therefore can earn larger tax revenue with

substantial competition in the industry.

the substantial reduction in marginal cost of the firm. Once the merger has been approved, the

market will be share between only two firms merged firm (BigCon) and Aggregate Inc.

Pre-merger industry outcome

Prior to mergers, independent firms face identical demand and cost results in an identical

output for each firm. Under this situation, each firm produces 2300 cubic metres of pre-mixed

concrete, charge a price of $255 and earns profit amounts to $64500. The total available quantity

in the market is 6900 cubic metres concrete. At market equilibrium, consumers earn a surplus of

1190250.

Post-merger industry outcome

After merger each of the two firm in the industry produces a larger output because of a

larger market share. The merged firm however produces a greater quantity (3400 cubic metre)

compared to the single operating firm (Aggregate Inc.). Total industry output reduces to 6300

cubic metres of concrete. Market price increases to $255. Profit earned by each of the firm

increases. The consumer surplus however reduces significantly. Increase in profit to each of the

firm is so large that it offsets the loss in consumer surplus because of a higher price and lower

industry output. As a result aggregate industry welfare increases after the merger indicating that

the regulatory authority should allow the proposed merger.

Financial implication

As suggested from the analysis, the proposed merger results in a higher profit for the

individual firm. Allowing merger government therefore can earn larger tax revenue with

substantial competition in the industry.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRICE THEORY

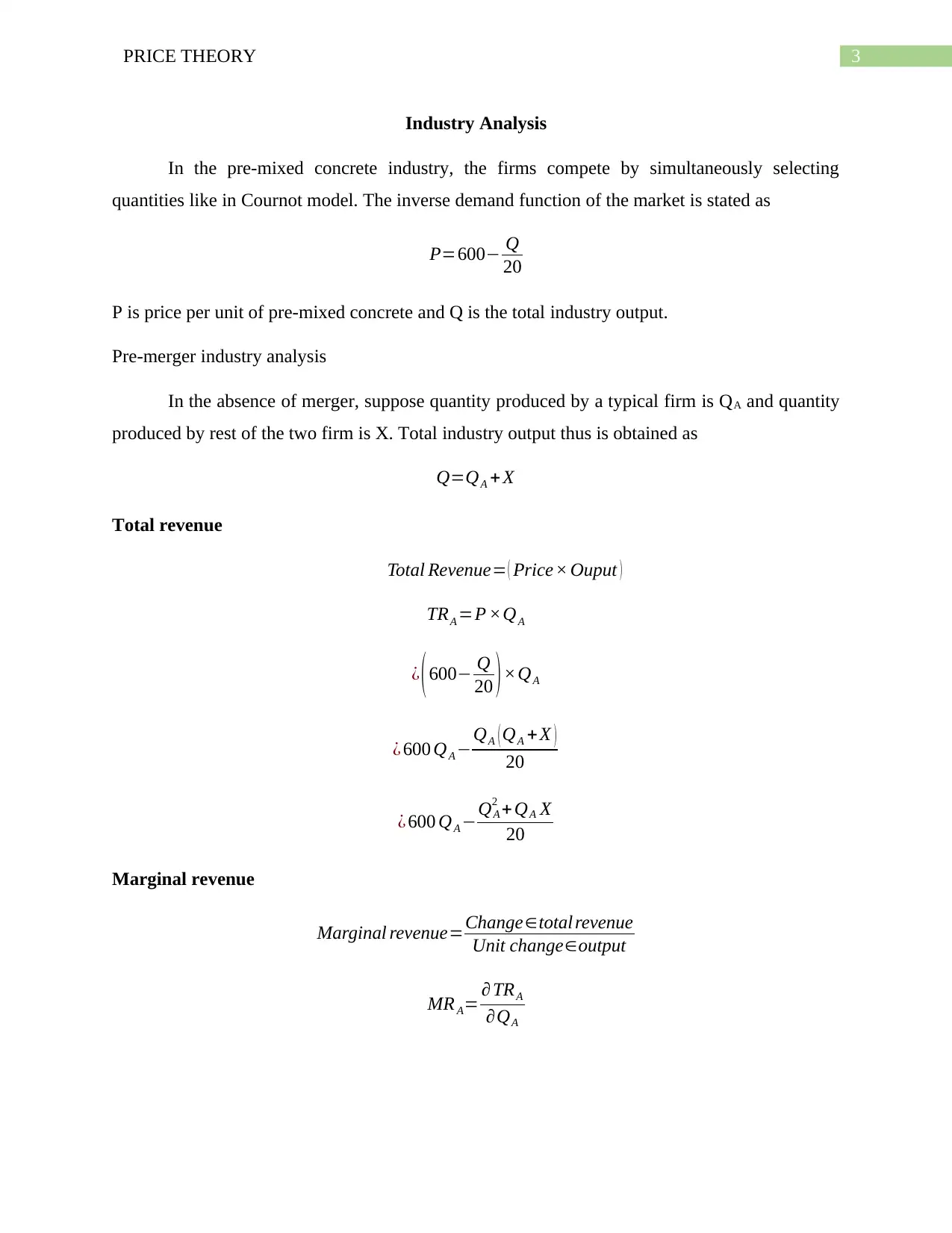

Industry Analysis

In the pre-mixed concrete industry, the firms compete by simultaneously selecting

quantities like in Cournot model. The inverse demand function of the market is stated as

P=600− Q

20

P is price per unit of pre-mixed concrete and Q is the total industry output.

Pre-merger industry analysis

In the absence of merger, suppose quantity produced by a typical firm is QA and quantity

produced by rest of the two firm is X. Total industry output thus is obtained as

Q=QA + X

Total revenue

Total Revenue= ( Price× Ouput )

TRA =P ×QA

¿ (600− Q

20 )×QA

¿ 600 QA −QA ( QA +X )

20

¿ 600 QA −QA

2 +QA X

20

Marginal revenue

Marginal revenue=Change∈total revenue

Unit change∈output

MR A= ∂ TRA

∂QA

Industry Analysis

In the pre-mixed concrete industry, the firms compete by simultaneously selecting

quantities like in Cournot model. The inverse demand function of the market is stated as

P=600− Q

20

P is price per unit of pre-mixed concrete and Q is the total industry output.

Pre-merger industry analysis

In the absence of merger, suppose quantity produced by a typical firm is QA and quantity

produced by rest of the two firm is X. Total industry output thus is obtained as

Q=QA + X

Total revenue

Total Revenue= ( Price× Ouput )

TRA =P ×QA

¿ (600− Q

20 )×QA

¿ 600 QA −QA ( QA +X )

20

¿ 600 QA −QA

2 +QA X

20

Marginal revenue

Marginal revenue=Change∈total revenue

Unit change∈output

MR A= ∂ TRA

∂QA

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRICE THEORY

¿

∂ (600 QA −QA

2 +QA X

20 )

∂QA

¿ 600−2 QA + X

20

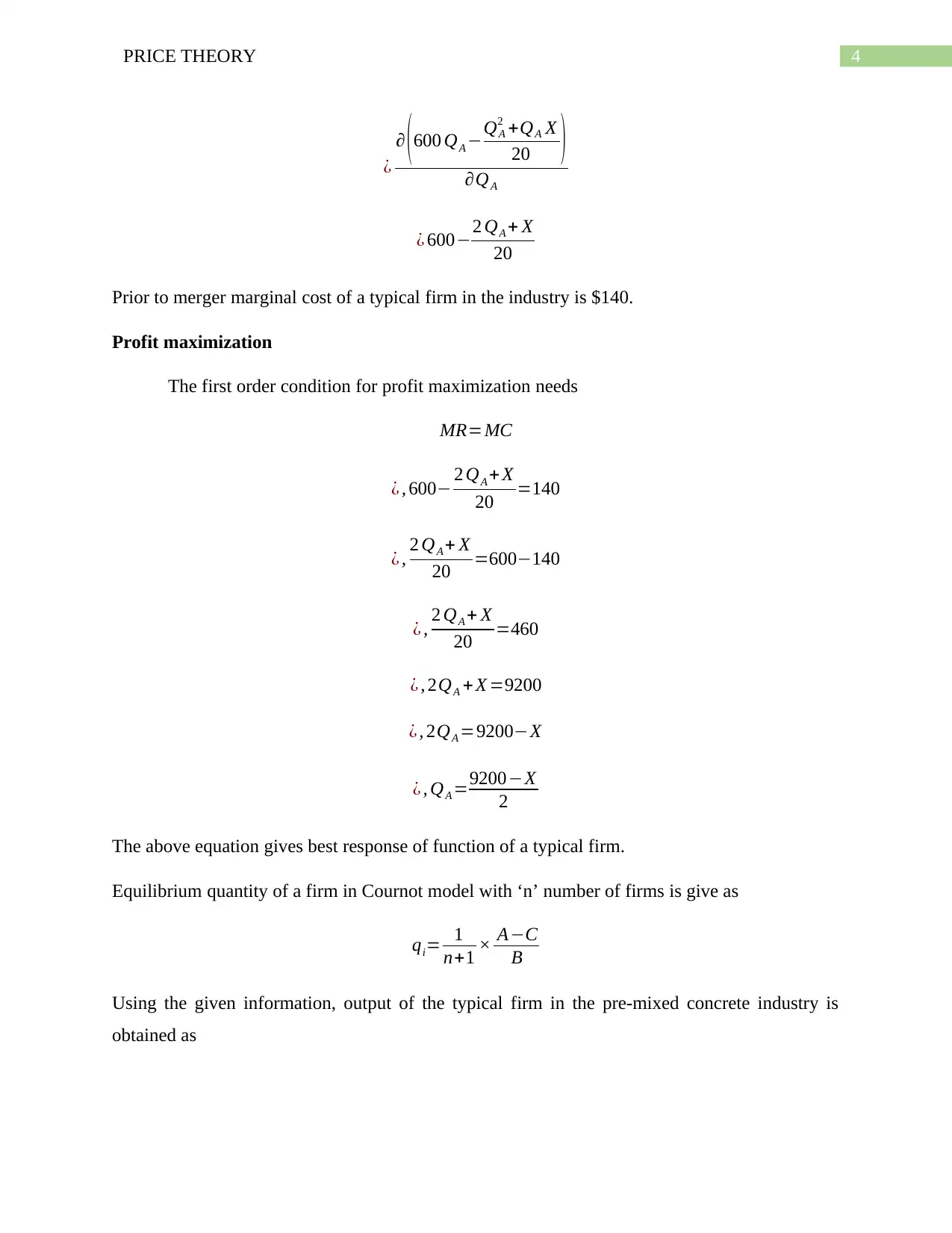

Prior to merger marginal cost of a typical firm in the industry is $140.

Profit maximization

The first order condition for profit maximization needs

MR=MC

¿ , 600− 2 QA + X

20 =140

¿ , 2 QA + X

20 =600−140

¿ , 2 QA + X

20 =460

¿ , 2QA + X =9200

¿ , 2QA =9200−X

¿ , QA =9200−X

2

The above equation gives best response of function of a typical firm.

Equilibrium quantity of a firm in Cournot model with ‘n’ number of firms is give as

qi= 1

n+1 × A−C

B

Using the given information, output of the typical firm in the pre-mixed concrete industry is

obtained as

¿

∂ (600 QA −QA

2 +QA X

20 )

∂QA

¿ 600−2 QA + X

20

Prior to merger marginal cost of a typical firm in the industry is $140.

Profit maximization

The first order condition for profit maximization needs

MR=MC

¿ , 600− 2 QA + X

20 =140

¿ , 2 QA + X

20 =600−140

¿ , 2 QA + X

20 =460

¿ , 2QA + X =9200

¿ , 2QA =9200−X

¿ , QA =9200−X

2

The above equation gives best response of function of a typical firm.

Equilibrium quantity of a firm in Cournot model with ‘n’ number of firms is give as

qi= 1

n+1 × A−C

B

Using the given information, output of the typical firm in the pre-mixed concrete industry is

obtained as

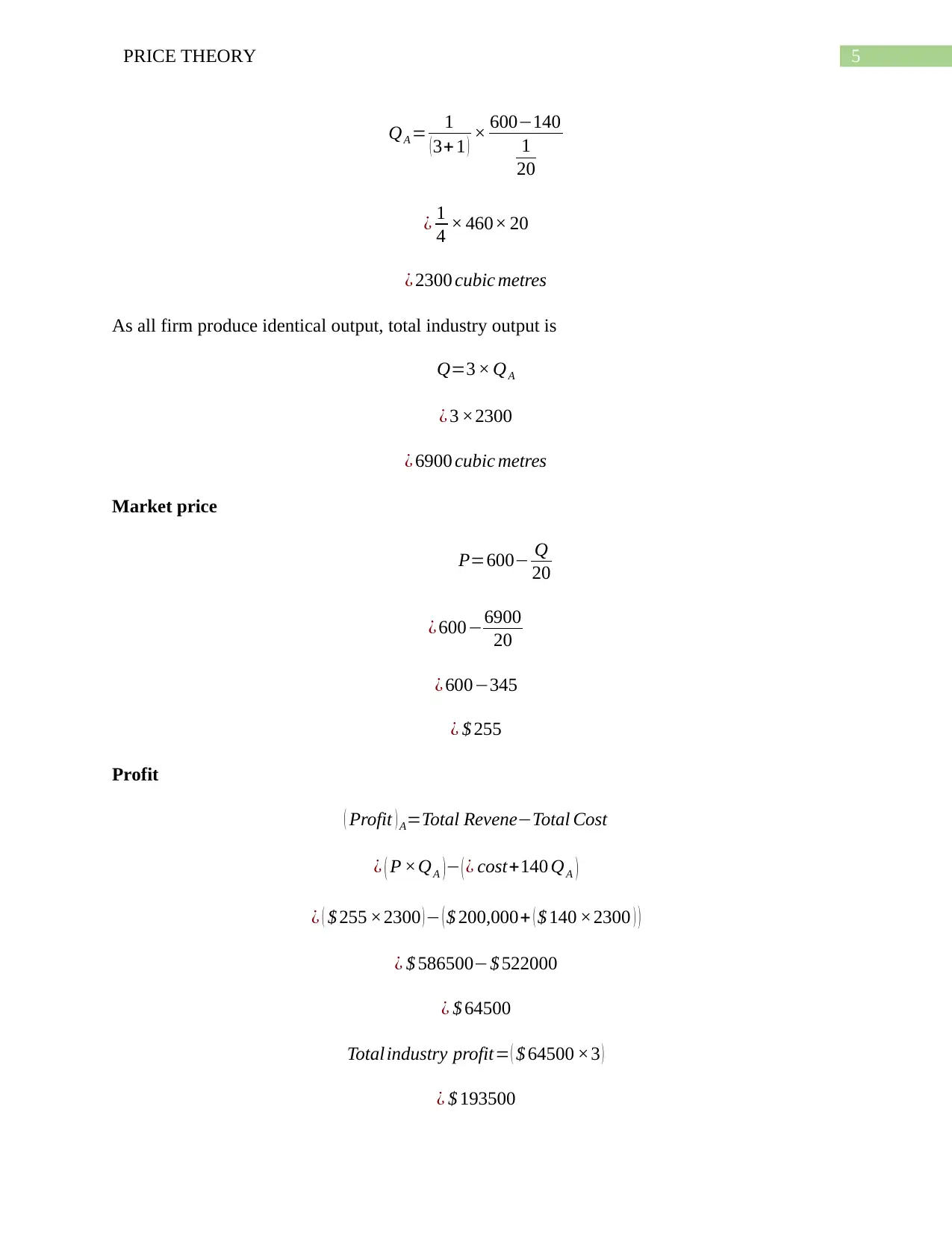

5PRICE THEORY

QA = 1

( 3+ 1 ) × 600−140

1

20

¿ 1

4 × 460× 20

¿ 2300 cubic metres

As all firm produce identical output, total industry output is

Q=3 × QA

¿ 3 ×2300

¿ 6900 cubic metres

Market price

P=600− Q

20

¿ 600−6900

20

¿ 600−345

¿ $ 255

Profit

( Profit ) A=Total Revene−Total Cost

¿ ( P ×QA )− ( ¿ cost+140 QA )

¿ ( $ 255 ×2300 ) − ( $ 200,000+ ( $ 140 ×2300 ) )

¿ $ 586500−$ 522000

¿ $ 64500

Total industry profit= ( $ 64500 ×3 )

¿ $ 193500

QA = 1

( 3+ 1 ) × 600−140

1

20

¿ 1

4 × 460× 20

¿ 2300 cubic metres

As all firm produce identical output, total industry output is

Q=3 × QA

¿ 3 ×2300

¿ 6900 cubic metres

Market price

P=600− Q

20

¿ 600−6900

20

¿ 600−345

¿ $ 255

Profit

( Profit ) A=Total Revene−Total Cost

¿ ( P ×QA )− ( ¿ cost+140 QA )

¿ ( $ 255 ×2300 ) − ( $ 200,000+ ( $ 140 ×2300 ) )

¿ $ 586500−$ 522000

¿ $ 64500

Total industry profit= ( $ 64500 ×3 )

¿ $ 193500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PRICE THEORY

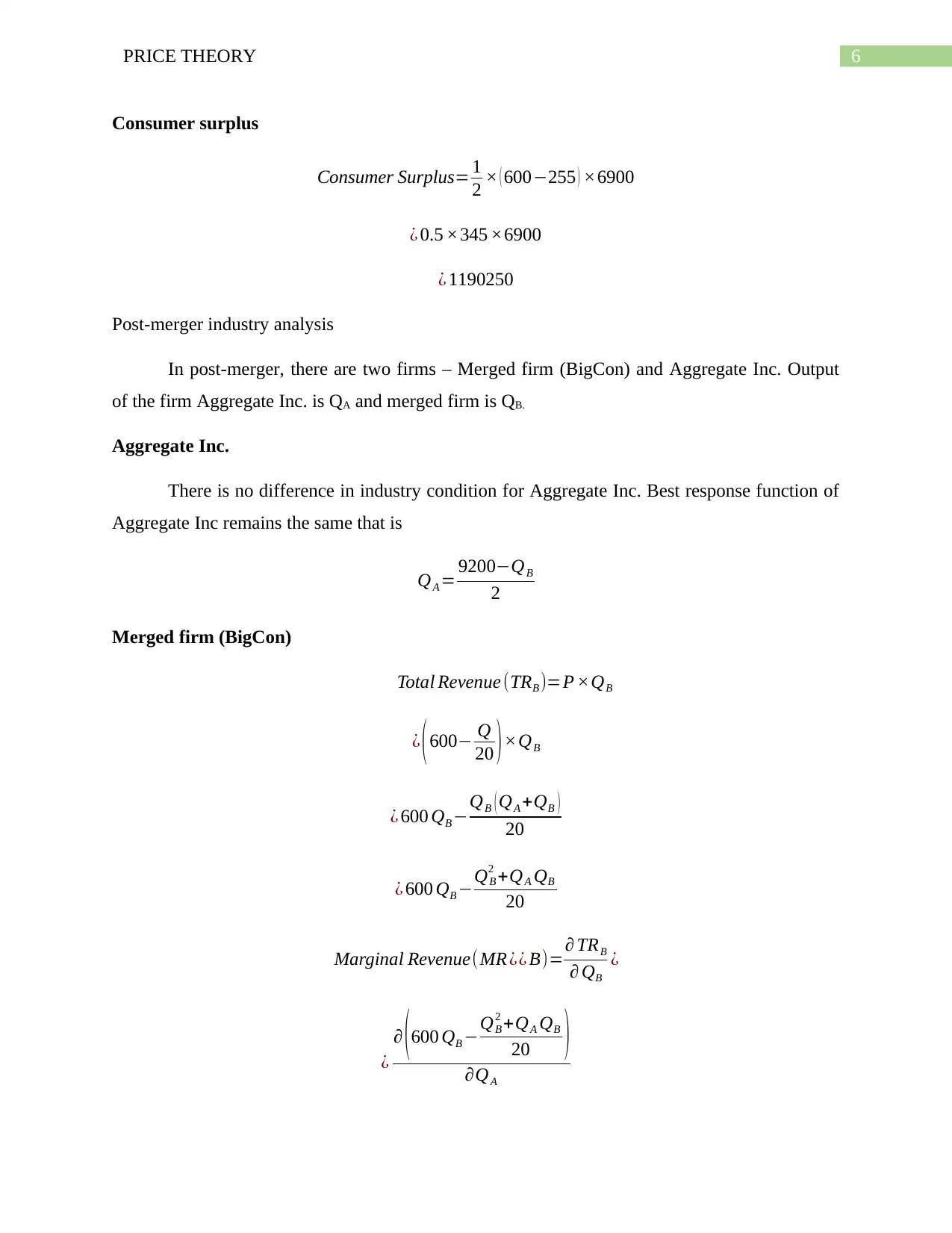

Consumer surplus

Consumer Surplus= 1

2 × ( 600−255 ) ×6900

¿ 0.5 ×345 ×6900

¿ 1190250

Post-merger industry analysis

In post-merger, there are two firms – Merged firm (BigCon) and Aggregate Inc. Output

of the firm Aggregate Inc. is QA and merged firm is QB.

Aggregate Inc.

There is no difference in industry condition for Aggregate Inc. Best response function of

Aggregate Inc remains the same that is

QA = 9200−QB

2

Merged firm (BigCon)

Total Revenue (TRB )=P ×QB

¿ (600− Q

20 )×QB

¿ 600 QB −QB ( QA +QB )

20

¿ 600 QB −QB

2 +QA QB

20

Marginal Revenue(MR ¿¿ B)=∂ TRB

∂ QB

¿

¿

∂ (600 QB −QB

2 +QA QB

20 )

∂QA

Consumer surplus

Consumer Surplus= 1

2 × ( 600−255 ) ×6900

¿ 0.5 ×345 ×6900

¿ 1190250

Post-merger industry analysis

In post-merger, there are two firms – Merged firm (BigCon) and Aggregate Inc. Output

of the firm Aggregate Inc. is QA and merged firm is QB.

Aggregate Inc.

There is no difference in industry condition for Aggregate Inc. Best response function of

Aggregate Inc remains the same that is

QA = 9200−QB

2

Merged firm (BigCon)

Total Revenue (TRB )=P ×QB

¿ (600− Q

20 )×QB

¿ 600 QB −QB ( QA +QB )

20

¿ 600 QB −QB

2 +QA QB

20

Marginal Revenue(MR ¿¿ B)=∂ TRB

∂ QB

¿

¿

∂ (600 QB −QB

2 +QA QB

20 )

∂QA

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

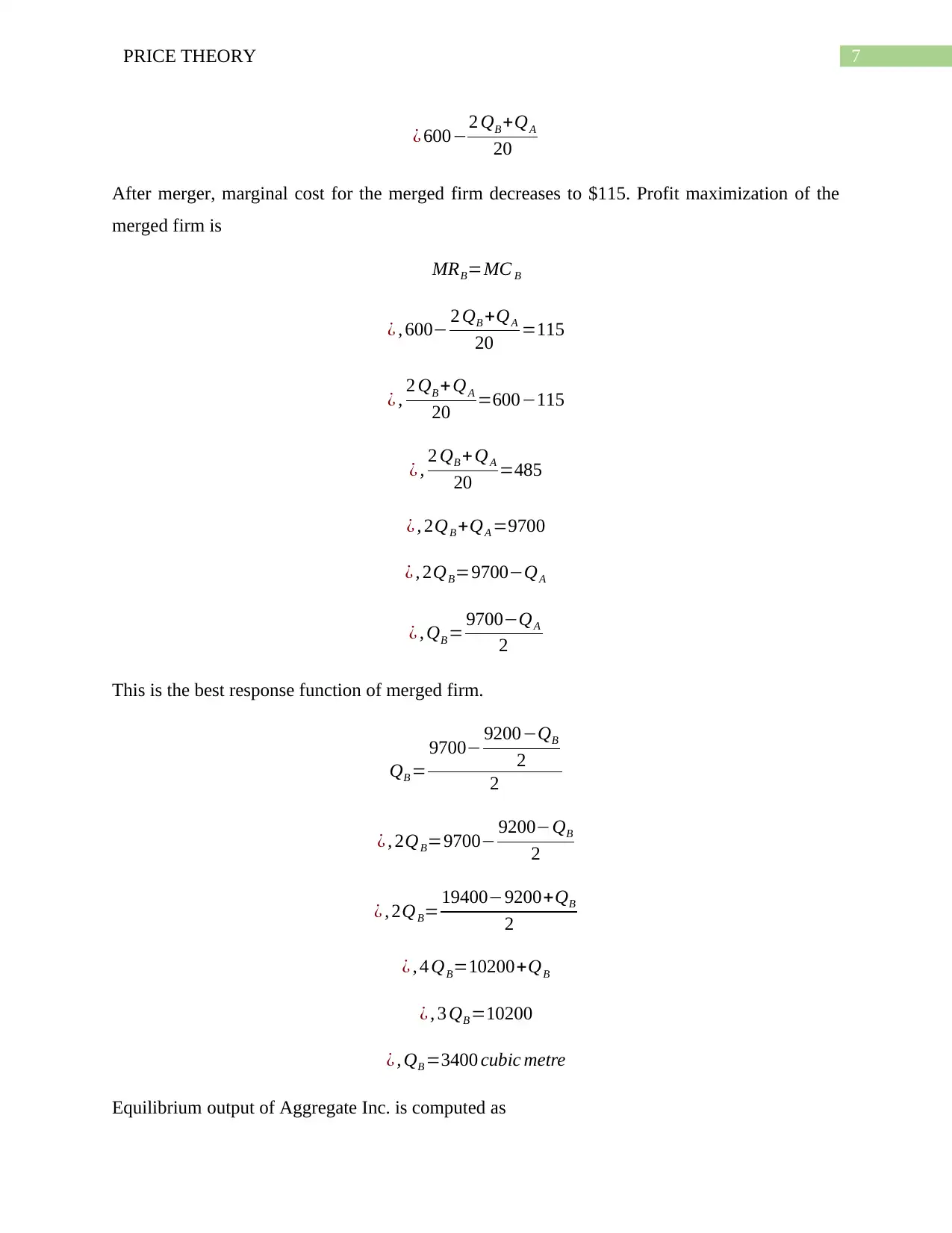

7PRICE THEORY

¿ 600−2 QB +QA

20

After merger, marginal cost for the merged firm decreases to $115. Profit maximization of the

merged firm is

MRB=MC B

¿ , 600− 2 QB +QA

20 =115

¿ , 2 QB +QA

20 =600−115

¿ , 2 QB +QA

20 =485

¿ , 2QB +QA =9700

¿ , 2QB=9700−QA

¿ , QB = 9700−QA

2

This is the best response function of merged firm.

QB =

9700− 9200−QB

2

2

¿ , 2QB=9700− 9200−QB

2

¿ , 2QB= 19400−9200+QB

2

¿ , 4 QB=10200+QB

¿ , 3 QB =10200

¿ , QB =3400 cubic metre

Equilibrium output of Aggregate Inc. is computed as

¿ 600−2 QB +QA

20

After merger, marginal cost for the merged firm decreases to $115. Profit maximization of the

merged firm is

MRB=MC B

¿ , 600− 2 QB +QA

20 =115

¿ , 2 QB +QA

20 =600−115

¿ , 2 QB +QA

20 =485

¿ , 2QB +QA =9700

¿ , 2QB=9700−QA

¿ , QB = 9700−QA

2

This is the best response function of merged firm.

QB =

9700− 9200−QB

2

2

¿ , 2QB=9700− 9200−QB

2

¿ , 2QB= 19400−9200+QB

2

¿ , 4 QB=10200+QB

¿ , 3 QB =10200

¿ , QB =3400 cubic metre

Equilibrium output of Aggregate Inc. is computed as

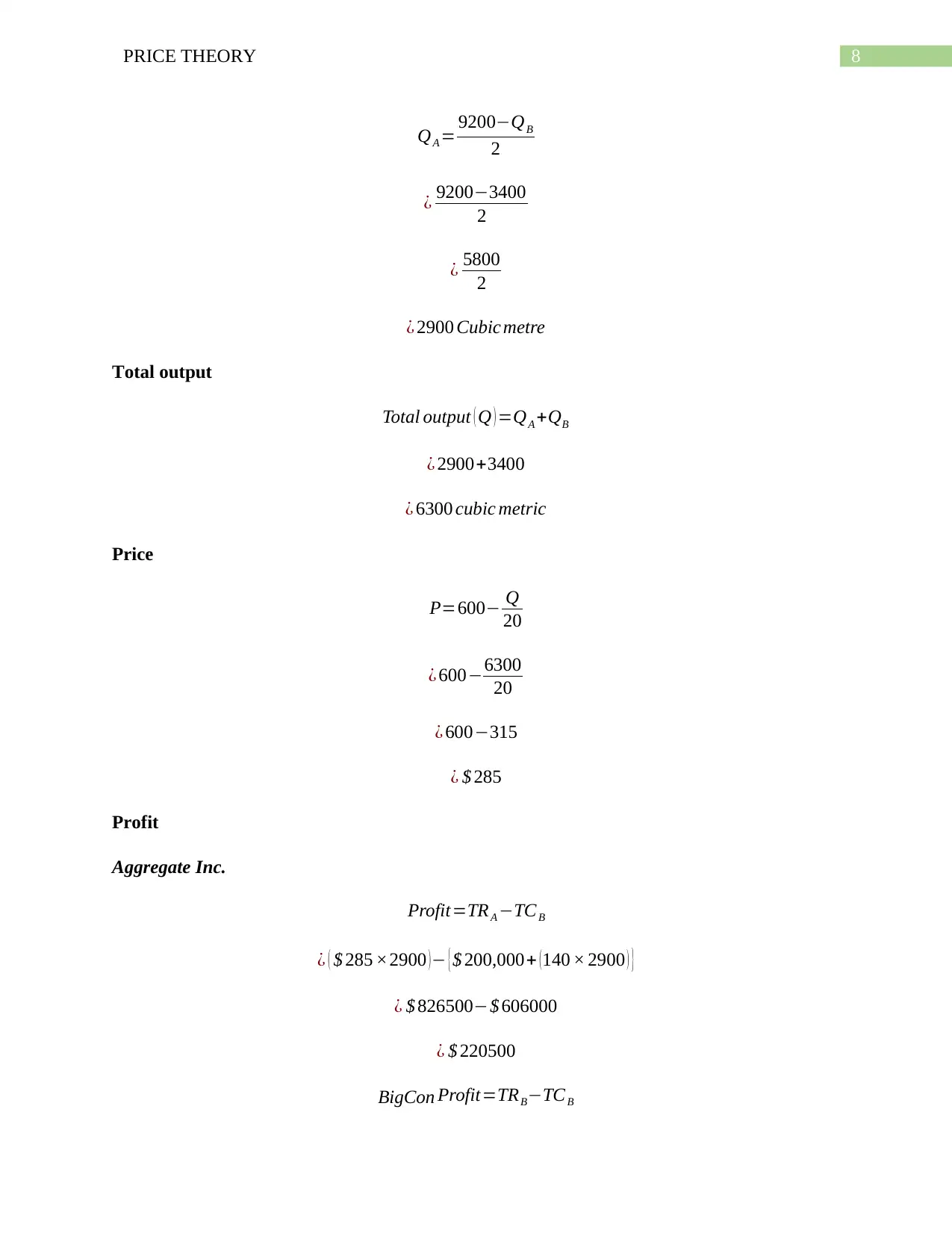

8PRICE THEORY

QA = 9200−QB

2

¿ 9200−3400

2

¿ 5800

2

¿ 2900 Cubic metre

Total output

Total output ( Q ) =QA +QB

¿ 2900+3400

¿ 6300 cubic metric

Price

P=600− Q

20

¿ 600−6300

20

¿ 600−315

¿ $ 285

Profit

Aggregate Inc.

Profit=TRA −TC B

¿ ( $ 285 ×2900 ) − { $ 200,000+ ( 140 × 2900 ) }

¿ $ 826500−$ 606000

¿ $ 220500

BigCon Profit=TRB−TCB

QA = 9200−QB

2

¿ 9200−3400

2

¿ 5800

2

¿ 2900 Cubic metre

Total output

Total output ( Q ) =QA +QB

¿ 2900+3400

¿ 6300 cubic metric

Price

P=600− Q

20

¿ 600−6300

20

¿ 600−315

¿ $ 285

Profit

Aggregate Inc.

Profit=TRA −TC B

¿ ( $ 285 ×2900 ) − { $ 200,000+ ( 140 × 2900 ) }

¿ $ 826500−$ 606000

¿ $ 220500

BigCon Profit=TRB−TCB

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

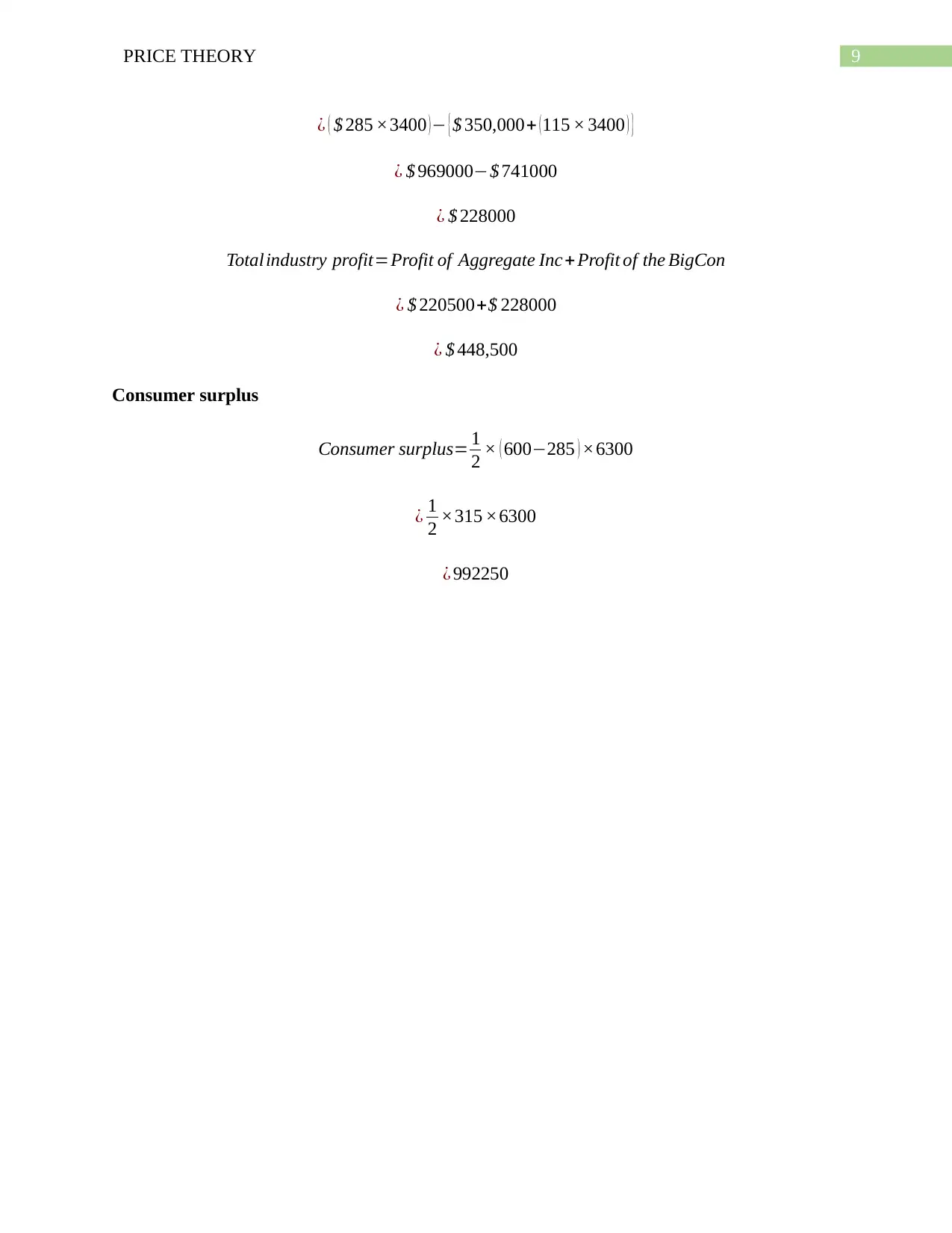

9PRICE THEORY

¿ ( $ 285 ×3400 ) − { $ 350,000+ ( 115 × 3400 ) }

¿ $ 969000−$ 741000

¿ $ 228000

Totalindustry profit=Profit of Aggregate Inc+ Profit of the BigCon

¿ $ 220500+$ 228000

¿ $ 448,500

Consumer surplus

Consumer surplus= 1

2 × ( 600−285 ) ×6300

¿ 1

2 ×315 ×6300

¿ 992250

¿ ( $ 285 ×3400 ) − { $ 350,000+ ( 115 × 3400 ) }

¿ $ 969000−$ 741000

¿ $ 228000

Totalindustry profit=Profit of Aggregate Inc+ Profit of the BigCon

¿ $ 220500+$ 228000

¿ $ 448,500

Consumer surplus

Consumer surplus= 1

2 × ( 600−285 ) ×6300

¿ 1

2 ×315 ×6300

¿ 992250

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PRICE THEORY

11PRICE THEORY

Bibliography

Baumol, W.J. and Blinder, A.S., 2015. Microeconomics: Principles and policy. Nelson

Education.

Friedman, L.S., 2017. The microeconomics of public policy analysis. Princeton University Press.

Kreps, D.M., 2019. Microeconomics for managers. Princeton University Press.

Mochrie, R., 2015. Intermediate microeconomics. Macmillan International Higher Education.

Bibliography

Baumol, W.J. and Blinder, A.S., 2015. Microeconomics: Principles and policy. Nelson

Education.

Friedman, L.S., 2017. The microeconomics of public policy analysis. Princeton University Press.

Kreps, D.M., 2019. Microeconomics for managers. Princeton University Press.

Mochrie, R., 2015. Intermediate microeconomics. Macmillan International Higher Education.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.