ECON6000: Demand Forecasting and Analysis for Schmeckt Gut Report

VerifiedAdded on 2023/05/28

|16

|3796

|493

Report

AI Summary

This report, directed to the board members of Schmeckt Gut, analyzes the demand for a new product using data from the company's research department. It employs regression analysis to understand the influence of variables such as consumer income, inflation, and tariff rates, projecting demand under four different scenarios. The analysis reveals that income growth is the most significant factor impacting demand, although the nature of the impact varies across scenarios. The report provides detailed regression outputs, discussing the relationships between variables like income, tariffs, inflation, and the number of stores. The findings highlight the importance of considering economic principles, such as the Laffer curve and Phillips curve, in forecasting demand. The report concludes with strategic recommendations for the board based on the different projected scenarios, emphasizing the need for a thorough understanding of economic factors to effectively launch the new product.

1

ECON6000 ECONOMIC PRINCIPLES & DECISION MAKING

ASSESSMENT 3

ECON6000 ECONOMIC PRINCIPLES & DECISION MAKING

ASSESSMENT 3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Executive summary

This is a report directed to the board member of Schmeckt Gut regarding the demand for the

new product of the company. The demand forecasting before the launch of the product is

important for the strategy formulation and decision making. The objective of this paper is to

analyse the data provided by the research department of the company to understand the

variables that influence the demand for the product. The study divides the projection into four

different scenarios and regression analysis is done based on the data. The study finds out that,

income growth of the consumer is the most important variable that impacts the demand for

the new product. However, the nature of the impact on the demand depends on the projection

of the variables. The study also recommends strategies to the board members based on the

different scenarios.

Executive summary

This is a report directed to the board member of Schmeckt Gut regarding the demand for the

new product of the company. The demand forecasting before the launch of the product is

important for the strategy formulation and decision making. The objective of this paper is to

analyse the data provided by the research department of the company to understand the

variables that influence the demand for the product. The study divides the projection into four

different scenarios and regression analysis is done based on the data. The study finds out that,

income growth of the consumer is the most important variable that impacts the demand for

the new product. However, the nature of the impact on the demand depends on the projection

of the variables. The study also recommends strategies to the board members based on the

different scenarios.

3

Table of contents

Introduction................................................................................................................................4

Methods......................................................................................................................................4

Discussion..................................................................................................................................4

Recommendation......................................................................................................................10

Conclusion................................................................................................................................11

Reference..................................................................................................................................13

Table of contents

Introduction................................................................................................................................4

Methods......................................................................................................................................4

Discussion..................................................................................................................................4

Recommendation......................................................................................................................10

Conclusion................................................................................................................................11

Reference..................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

4

Introduction

According to the principle of economics, the demand for a product depends on a lot of direct

and indirect factors. It is important for a company like Schmeckt Gut to understand and

forecast the demand for their new product. The income of the consumers, inflation and the

tariff rate has a crucial influence on the demand of the product. The objective of this report is

to understand the influence of the variables such as the change in the income, inflation and

the tariff rate.

Methods

The study uses the data of the research department of the company and uses regression

analysis to synthesise the data in order to get an insight regarding the demand for the new

product of the company.

Discussion

Different projections regarding the variable

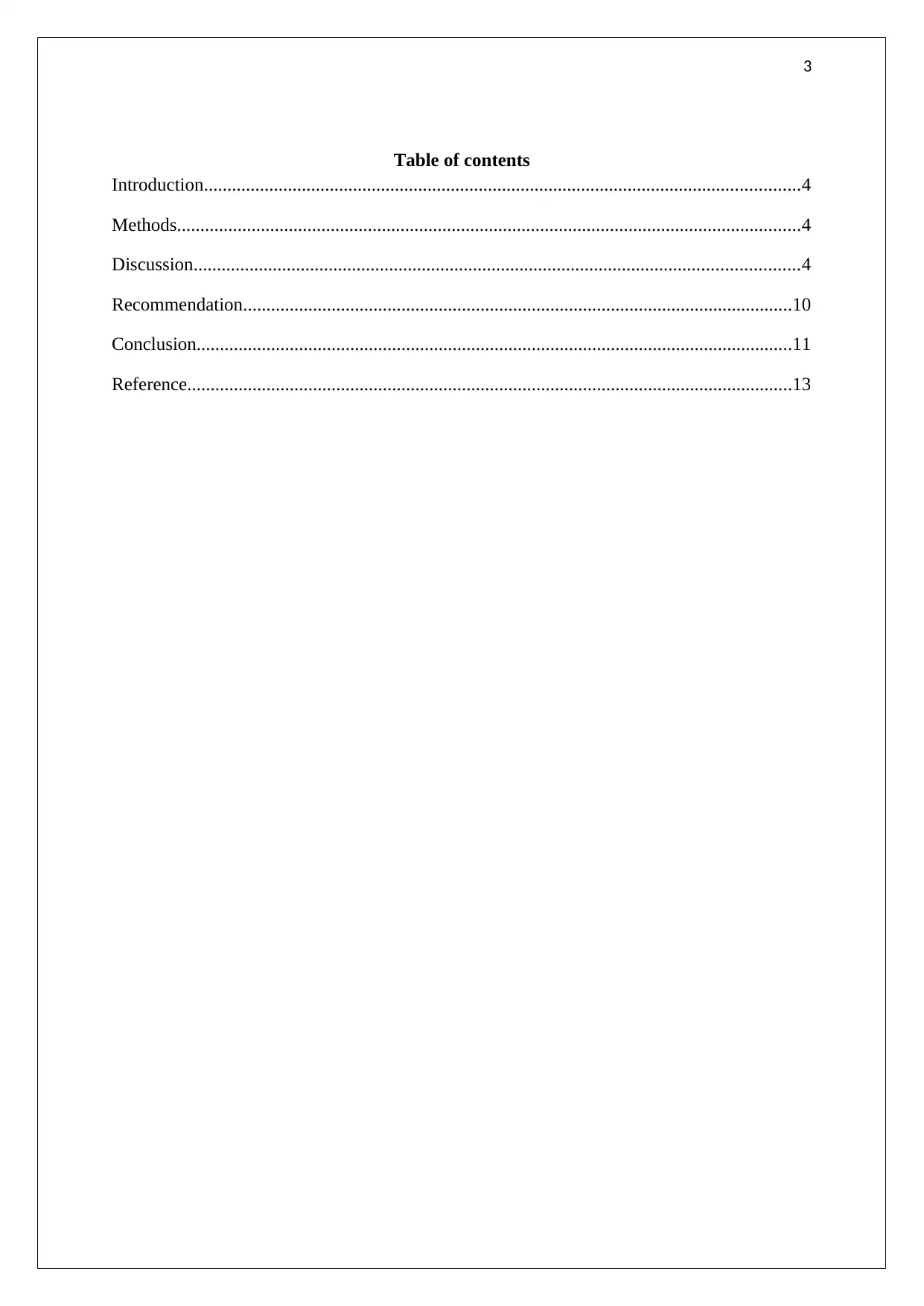

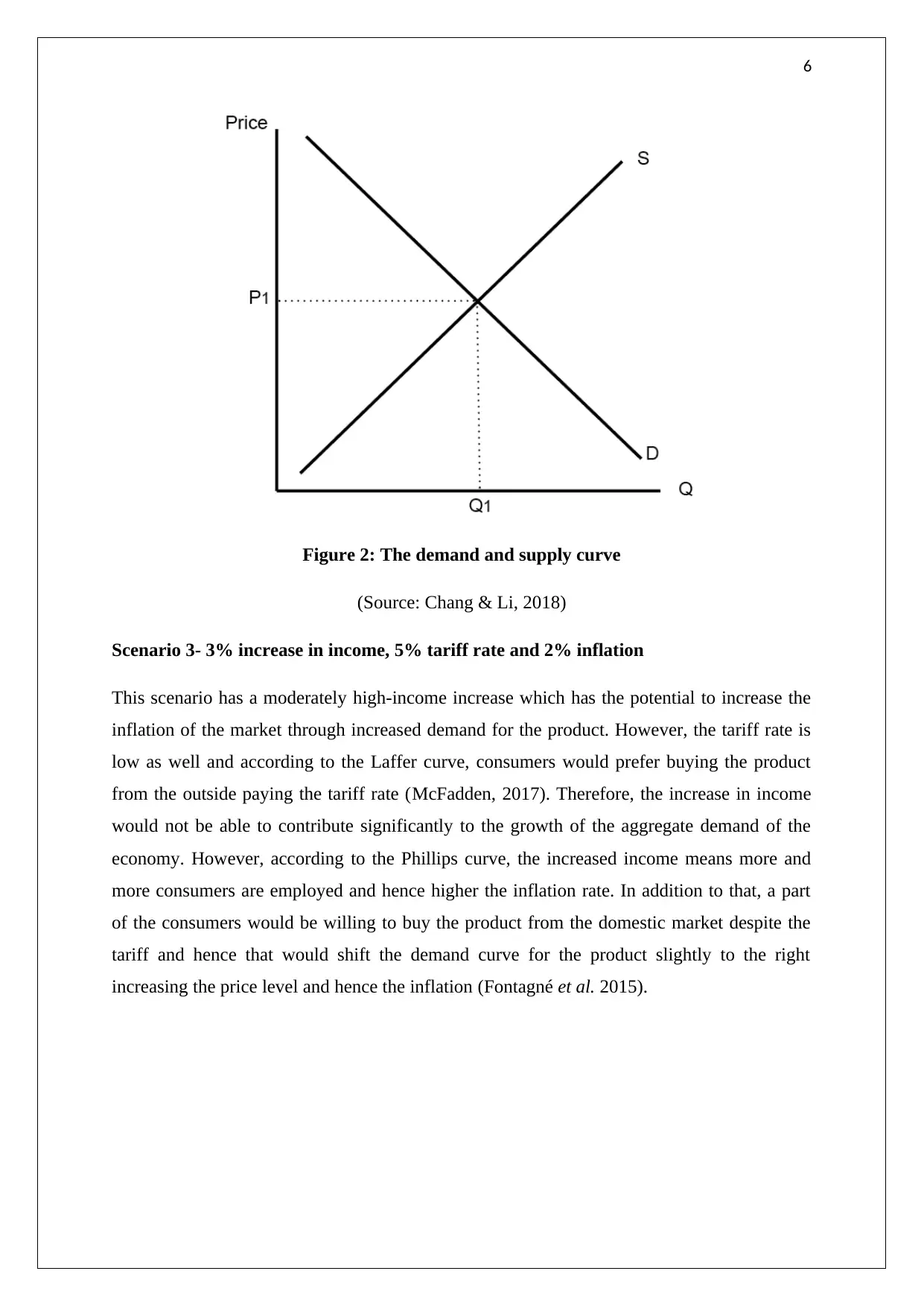

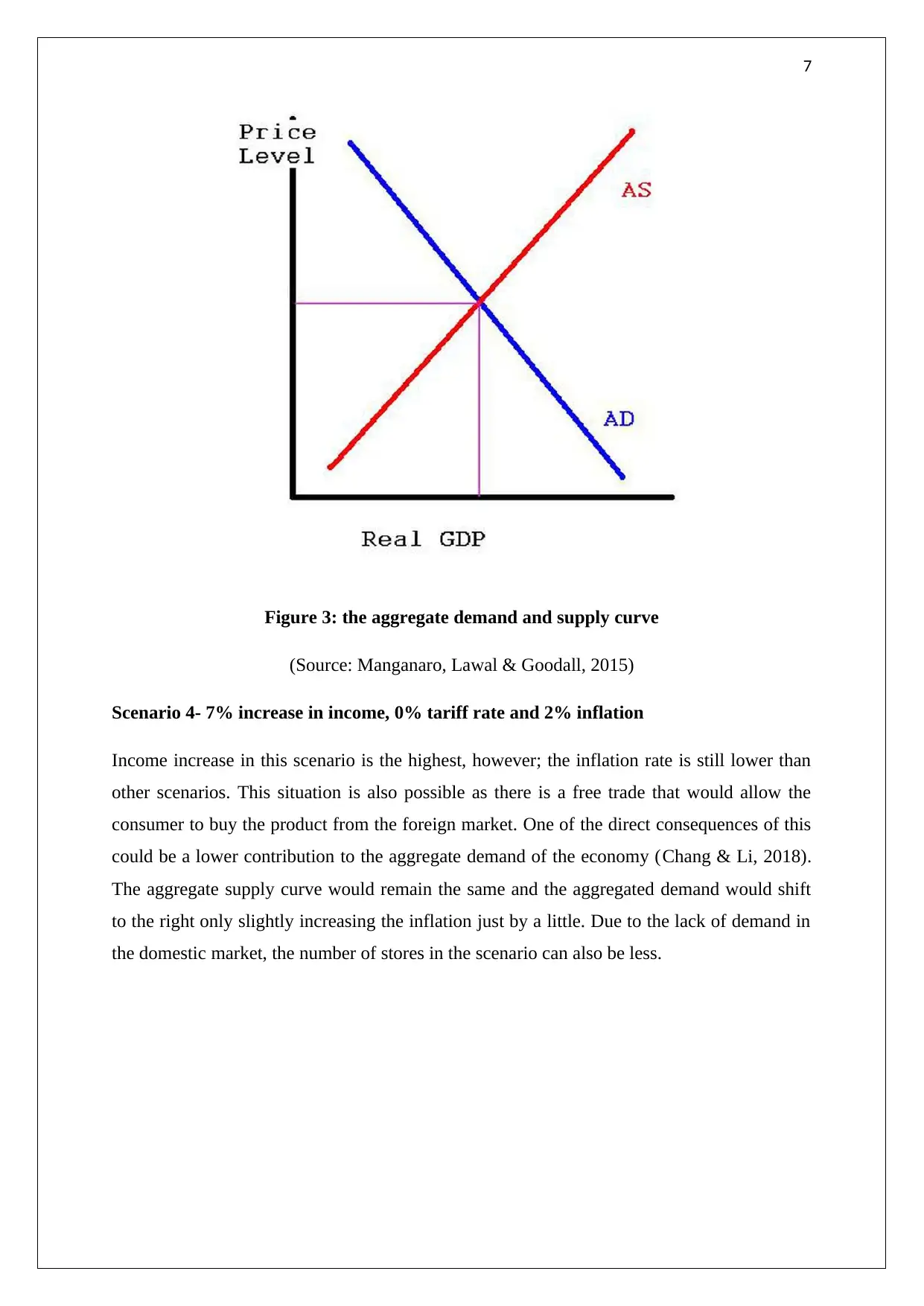

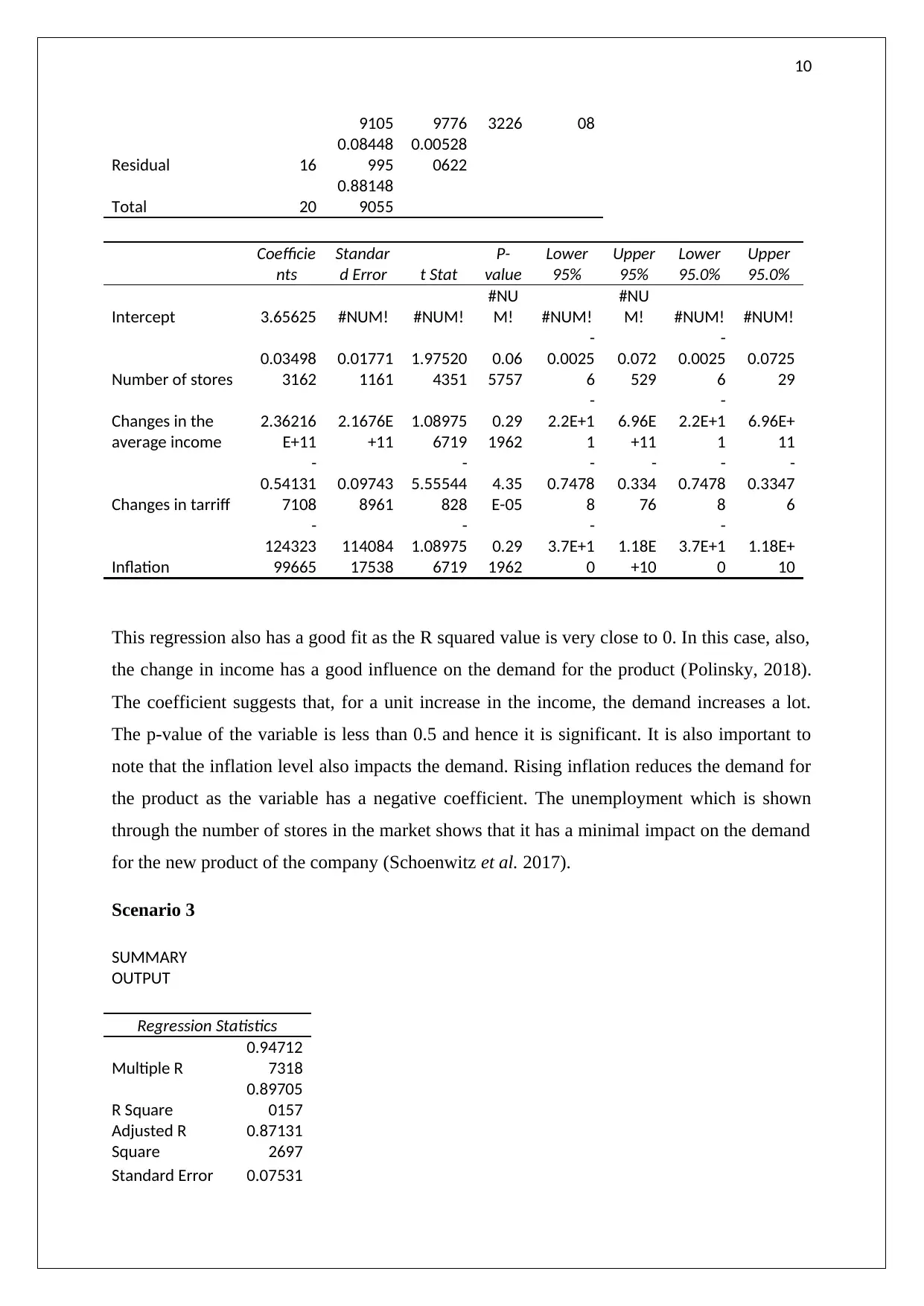

Scenario 1- 5% increase in income, 10% tariff rate and 5% inflation

This scenario is possible as high-income growth of 5% with the presence of a 10% tariff rate

can change the demand for the product in the domestic market. In this case, the demand curve

shifts to the right and increases the price of the product. This in turn, also increases the

inflation level in the economy. Boserup (2017) stated that this is a common phenomenon

under the boom phase of the business cycle to have a higher inflation level corresponding to a

higher income of the consumer. In addition to that, the increased consumption corresponding

to the increased income can also increase the overall output of the economy as per the theory

of aggregate demand. In both the ways, the price of the product has the opportunity to go up

pushing a lot of pressure on the inflation of the economy (Pigou, 2017). Furthermore, this

scenario also has a high tariff rate which can be considered as a tax for the importer. Laffer

curve shows that, with the increase in the tax rate, the revenue of the government increases as

people prefer to buy from outside with the tariff rate applied. However, after a certain point,

the consumers prefer to buy the products from the domestic market as the tariff rate increase

further. Lastly, as per the theory of Phillips as the income increases the number of

unemployed people decreases that impacts on the inflation rate and the number of stores in

the market.

Introduction

According to the principle of economics, the demand for a product depends on a lot of direct

and indirect factors. It is important for a company like Schmeckt Gut to understand and

forecast the demand for their new product. The income of the consumers, inflation and the

tariff rate has a crucial influence on the demand of the product. The objective of this report is

to understand the influence of the variables such as the change in the income, inflation and

the tariff rate.

Methods

The study uses the data of the research department of the company and uses regression

analysis to synthesise the data in order to get an insight regarding the demand for the new

product of the company.

Discussion

Different projections regarding the variable

Scenario 1- 5% increase in income, 10% tariff rate and 5% inflation

This scenario is possible as high-income growth of 5% with the presence of a 10% tariff rate

can change the demand for the product in the domestic market. In this case, the demand curve

shifts to the right and increases the price of the product. This in turn, also increases the

inflation level in the economy. Boserup (2017) stated that this is a common phenomenon

under the boom phase of the business cycle to have a higher inflation level corresponding to a

higher income of the consumer. In addition to that, the increased consumption corresponding

to the increased income can also increase the overall output of the economy as per the theory

of aggregate demand. In both the ways, the price of the product has the opportunity to go up

pushing a lot of pressure on the inflation of the economy (Pigou, 2017). Furthermore, this

scenario also has a high tariff rate which can be considered as a tax for the importer. Laffer

curve shows that, with the increase in the tax rate, the revenue of the government increases as

people prefer to buy from outside with the tariff rate applied. However, after a certain point,

the consumers prefer to buy the products from the domestic market as the tariff rate increase

further. Lastly, as per the theory of Phillips as the income increases the number of

unemployed people decreases that impacts on the inflation rate and the number of stores in

the market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

5

Figure 1: the Phillips curve

(Source: Leontief, 2016)

Scenario 2- 1% increase in income, 7.5% tariff rate and 3% inflation

This projection of this scenario is also matching as low-income growth, in this case, has

contributed to the increase in inflation (Brander & Spencer, 2015). Now the despite the low-

income increase, the inflation increase by 3% due to the fact that, tariff rate is moderately

high. Consumers of the market are discouraged to pay the tariff and bring the product from

outside. Thus, the domestic demand curve for the product shifts to the right and increases the

price and hence the inflation of the economy. In addition to that, higher inflation can lower

the unemployment rate leading to a further push in inflation. Therefore, 1% increase in

income can create a 3% inflation rate if the tariff or the tax rate is moderately high (Leontief,

2016). The increased aggregate demand of the domestic market due to the increase in income

and the tariff also increases the output that necessitates the number of stores to increase in the

market.

Figure 1: the Phillips curve

(Source: Leontief, 2016)

Scenario 2- 1% increase in income, 7.5% tariff rate and 3% inflation

This projection of this scenario is also matching as low-income growth, in this case, has

contributed to the increase in inflation (Brander & Spencer, 2015). Now the despite the low-

income increase, the inflation increase by 3% due to the fact that, tariff rate is moderately

high. Consumers of the market are discouraged to pay the tariff and bring the product from

outside. Thus, the domestic demand curve for the product shifts to the right and increases the

price and hence the inflation of the economy. In addition to that, higher inflation can lower

the unemployment rate leading to a further push in inflation. Therefore, 1% increase in

income can create a 3% inflation rate if the tariff or the tax rate is moderately high (Leontief,

2016). The increased aggregate demand of the domestic market due to the increase in income

and the tariff also increases the output that necessitates the number of stores to increase in the

market.

6

Figure 2: The demand and supply curve

(Source: Chang & Li, 2018)

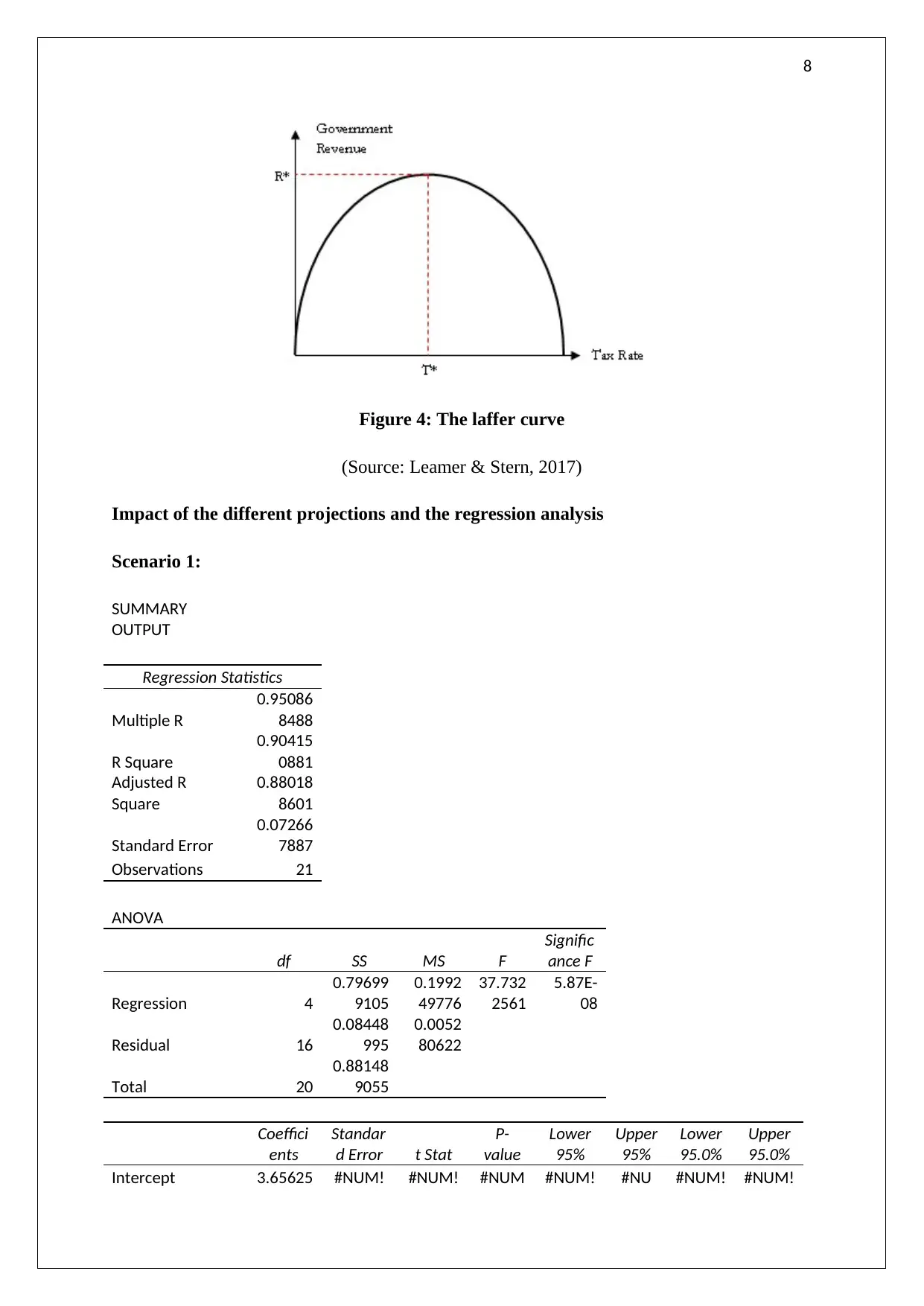

Scenario 3- 3% increase in income, 5% tariff rate and 2% inflation

This scenario has a moderately high-income increase which has the potential to increase the

inflation of the market through increased demand for the product. However, the tariff rate is

low as well and according to the Laffer curve, consumers would prefer buying the product

from the outside paying the tariff rate (McFadden, 2017). Therefore, the increase in income

would not be able to contribute significantly to the growth of the aggregate demand of the

economy. However, according to the Phillips curve, the increased income means more and

more consumers are employed and hence higher the inflation rate. In addition to that, a part

of the consumers would be willing to buy the product from the domestic market despite the

tariff and hence that would shift the demand curve for the product slightly to the right

increasing the price level and hence the inflation (Fontagné et al. 2015).

Figure 2: The demand and supply curve

(Source: Chang & Li, 2018)

Scenario 3- 3% increase in income, 5% tariff rate and 2% inflation

This scenario has a moderately high-income increase which has the potential to increase the

inflation of the market through increased demand for the product. However, the tariff rate is

low as well and according to the Laffer curve, consumers would prefer buying the product

from the outside paying the tariff rate (McFadden, 2017). Therefore, the increase in income

would not be able to contribute significantly to the growth of the aggregate demand of the

economy. However, according to the Phillips curve, the increased income means more and

more consumers are employed and hence higher the inflation rate. In addition to that, a part

of the consumers would be willing to buy the product from the domestic market despite the

tariff and hence that would shift the demand curve for the product slightly to the right

increasing the price level and hence the inflation (Fontagné et al. 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

7

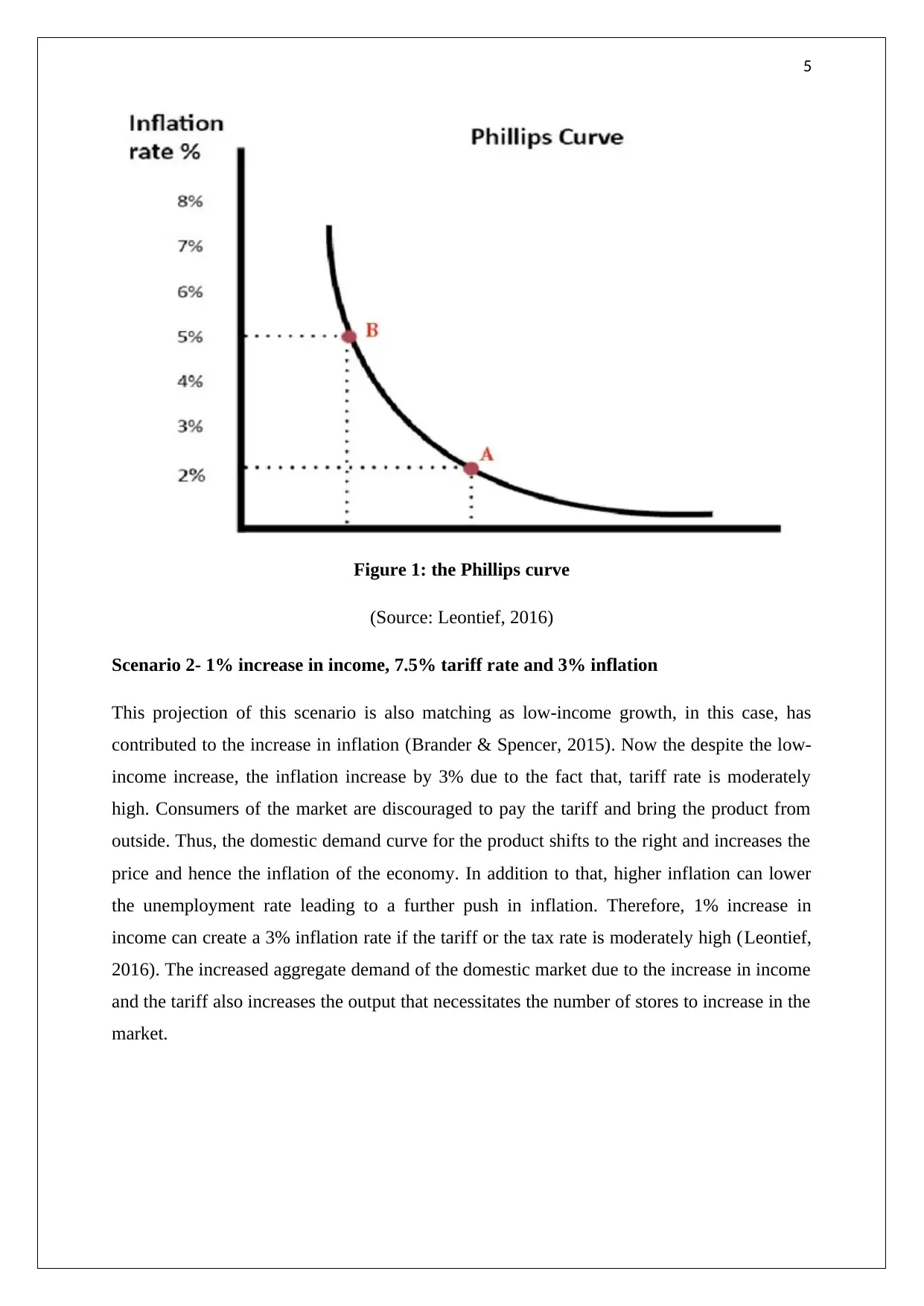

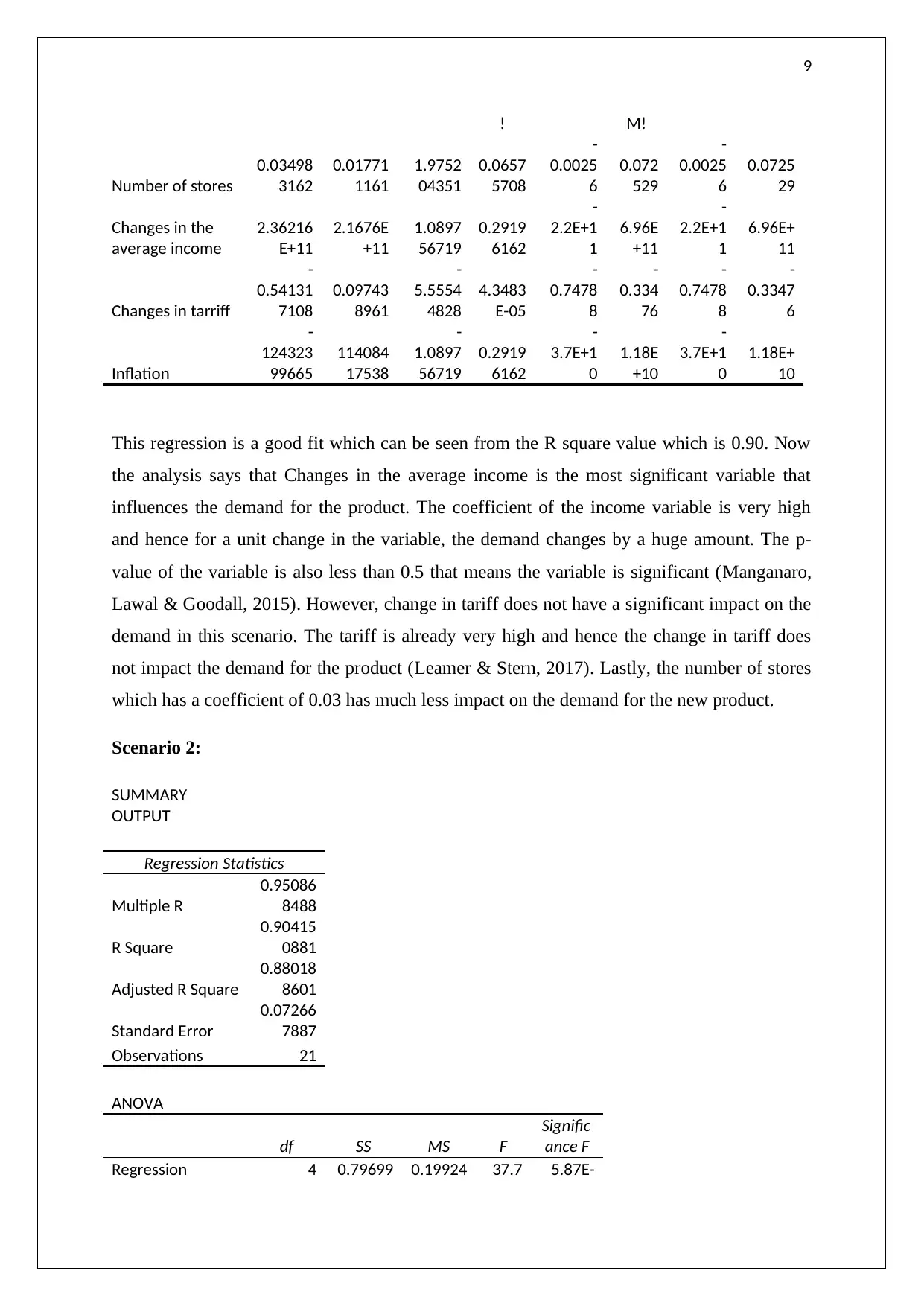

Figure 3: the aggregate demand and supply curve

(Source: Manganaro, Lawal & Goodall, 2015)

Scenario 4- 7% increase in income, 0% tariff rate and 2% inflation

Income increase in this scenario is the highest, however; the inflation rate is still lower than

other scenarios. This situation is also possible as there is a free trade that would allow the

consumer to buy the product from the foreign market. One of the direct consequences of this

could be a lower contribution to the aggregate demand of the economy (Chang & Li, 2018).

The aggregate supply curve would remain the same and the aggregated demand would shift

to the right only slightly increasing the inflation just by a little. Due to the lack of demand in

the domestic market, the number of stores in the scenario can also be less.

Figure 3: the aggregate demand and supply curve

(Source: Manganaro, Lawal & Goodall, 2015)

Scenario 4- 7% increase in income, 0% tariff rate and 2% inflation

Income increase in this scenario is the highest, however; the inflation rate is still lower than

other scenarios. This situation is also possible as there is a free trade that would allow the

consumer to buy the product from the foreign market. One of the direct consequences of this

could be a lower contribution to the aggregate demand of the economy (Chang & Li, 2018).

The aggregate supply curve would remain the same and the aggregated demand would shift

to the right only slightly increasing the inflation just by a little. Due to the lack of demand in

the domestic market, the number of stores in the scenario can also be less.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Figure 4: The laffer curve

(Source: Leamer & Stern, 2017)

Impact of the different projections and the regression analysis

Scenario 1:

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.95086

8488

R Square

0.90415

0881

Adjusted R

Square

0.88018

8601

Standard Error

0.07266

7887

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.79699

9105

0.1992

49776

37.732

2561

5.87E-

08

Residual 16

0.08448

995

0.0052

80622

Total 20

0.88148

9055

Coeffici

ents

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.65625 #NUM! #NUM! #NUM #NUM! #NU #NUM! #NUM!

Figure 4: The laffer curve

(Source: Leamer & Stern, 2017)

Impact of the different projections and the regression analysis

Scenario 1:

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.95086

8488

R Square

0.90415

0881

Adjusted R

Square

0.88018

8601

Standard Error

0.07266

7887

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.79699

9105

0.1992

49776

37.732

2561

5.87E-

08

Residual 16

0.08448

995

0.0052

80622

Total 20

0.88148

9055

Coeffici

ents

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.65625 #NUM! #NUM! #NUM #NUM! #NU #NUM! #NUM!

9

! M!

Number of stores

0.03498

3162

0.01771

1161

1.9752

04351

0.0657

5708

-

0.0025

6

0.072

529

-

0.0025

6

0.0725

29

Changes in the

average income

2.36216

E+11

2.1676E

+11

1.0897

56719

0.2919

6162

-

2.2E+1

1

6.96E

+11

-

2.2E+1

1

6.96E+

11

Changes in tarriff

-

0.54131

7108

0.09743

8961

-

5.5554

4828

4.3483

E-05

-

0.7478

8

-

0.334

76

-

0.7478

8

-

0.3347

6

Inflation

-

124323

99665

114084

17538

-

1.0897

56719

0.2919

6162

-

3.7E+1

0

1.18E

+10

-

3.7E+1

0

1.18E+

10

This regression is a good fit which can be seen from the R square value which is 0.90. Now

the analysis says that Changes in the average income is the most significant variable that

influences the demand for the product. The coefficient of the income variable is very high

and hence for a unit change in the variable, the demand changes by a huge amount. The p-

value of the variable is also less than 0.5 that means the variable is significant (Manganaro,

Lawal & Goodall, 2015). However, change in tariff does not have a significant impact on the

demand in this scenario. The tariff is already very high and hence the change in tariff does

not impact the demand for the product (Leamer & Stern, 2017). Lastly, the number of stores

which has a coefficient of 0.03 has much less impact on the demand for the new product.

Scenario 2:

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.95086

8488

R Square

0.90415

0881

Adjusted R Square

0.88018

8601

Standard Error

0.07266

7887

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4 0.79699 0.19924 37.7 5.87E-

! M!

Number of stores

0.03498

3162

0.01771

1161

1.9752

04351

0.0657

5708

-

0.0025

6

0.072

529

-

0.0025

6

0.0725

29

Changes in the

average income

2.36216

E+11

2.1676E

+11

1.0897

56719

0.2919

6162

-

2.2E+1

1

6.96E

+11

-

2.2E+1

1

6.96E+

11

Changes in tarriff

-

0.54131

7108

0.09743

8961

-

5.5554

4828

4.3483

E-05

-

0.7478

8

-

0.334

76

-

0.7478

8

-

0.3347

6

Inflation

-

124323

99665

114084

17538

-

1.0897

56719

0.2919

6162

-

3.7E+1

0

1.18E

+10

-

3.7E+1

0

1.18E+

10

This regression is a good fit which can be seen from the R square value which is 0.90. Now

the analysis says that Changes in the average income is the most significant variable that

influences the demand for the product. The coefficient of the income variable is very high

and hence for a unit change in the variable, the demand changes by a huge amount. The p-

value of the variable is also less than 0.5 that means the variable is significant (Manganaro,

Lawal & Goodall, 2015). However, change in tariff does not have a significant impact on the

demand in this scenario. The tariff is already very high and hence the change in tariff does

not impact the demand for the product (Leamer & Stern, 2017). Lastly, the number of stores

which has a coefficient of 0.03 has much less impact on the demand for the new product.

Scenario 2:

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.95086

8488

R Square

0.90415

0881

Adjusted R Square

0.88018

8601

Standard Error

0.07266

7887

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4 0.79699 0.19924 37.7 5.87E-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

10

9105 9776 3226 08

Residual 16

0.08448

995

0.00528

0622

Total 20

0.88148

9055

Coefficie

nts

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.65625 #NUM! #NUM!

#NU

M! #NUM!

#NU

M! #NUM! #NUM!

Number of stores

0.03498

3162

0.01771

1161

1.97520

4351

0.06

5757

-

0.0025

6

0.072

529

-

0.0025

6

0.0725

29

Changes in the

average income

2.36216

E+11

2.1676E

+11

1.08975

6719

0.29

1962

-

2.2E+1

1

6.96E

+11

-

2.2E+1

1

6.96E+

11

Changes in tarriff

-

0.54131

7108

0.09743

8961

-

5.55544

828

4.35

E-05

-

0.7478

8

-

0.334

76

-

0.7478

8

-

0.3347

6

Inflation

-

124323

99665

114084

17538

-

1.08975

6719

0.29

1962

-

3.7E+1

0

1.18E

+10

-

3.7E+1

0

1.18E+

10

This regression also has a good fit as the R squared value is very close to 0. In this case, also,

the change in income has a good influence on the demand for the product (Polinsky, 2018).

The coefficient suggests that, for a unit increase in the income, the demand increases a lot.

The p-value of the variable is less than 0.5 and hence it is significant. It is also important to

note that the inflation level also impacts the demand. Rising inflation reduces the demand for

the product as the variable has a negative coefficient. The unemployment which is shown

through the number of stores in the market shows that it has a minimal impact on the demand

for the new product of the company (Schoenwitz et al. 2017).

Scenario 3

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.94712

7318

R Square

0.89705

0157

Adjusted R

Square

0.87131

2697

Standard Error 0.07531

9105 9776 3226 08

Residual 16

0.08448

995

0.00528

0622

Total 20

0.88148

9055

Coefficie

nts

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.65625 #NUM! #NUM!

#NU

M! #NUM!

#NU

M! #NUM! #NUM!

Number of stores

0.03498

3162

0.01771

1161

1.97520

4351

0.06

5757

-

0.0025

6

0.072

529

-

0.0025

6

0.0725

29

Changes in the

average income

2.36216

E+11

2.1676E

+11

1.08975

6719

0.29

1962

-

2.2E+1

1

6.96E

+11

-

2.2E+1

1

6.96E+

11

Changes in tarriff

-

0.54131

7108

0.09743

8961

-

5.55544

828

4.35

E-05

-

0.7478

8

-

0.334

76

-

0.7478

8

-

0.3347

6

Inflation

-

124323

99665

114084

17538

-

1.08975

6719

0.29

1962

-

3.7E+1

0

1.18E

+10

-

3.7E+1

0

1.18E+

10

This regression also has a good fit as the R squared value is very close to 0. In this case, also,

the change in income has a good influence on the demand for the product (Polinsky, 2018).

The coefficient suggests that, for a unit increase in the income, the demand increases a lot.

The p-value of the variable is less than 0.5 and hence it is significant. It is also important to

note that the inflation level also impacts the demand. Rising inflation reduces the demand for

the product as the variable has a negative coefficient. The unemployment which is shown

through the number of stores in the market shows that it has a minimal impact on the demand

for the new product of the company (Schoenwitz et al. 2017).

Scenario 3

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.94712

7318

R Square

0.89705

0157

Adjusted R

Square

0.87131

2697

Standard Error 0.07531

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

11

1503

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.79073

9895

0.19768

4974

34.85

387

1.03E-

07

Residual 16

0.09074

916

0.00567

1822

Total 20

0.88148

9055

Coefficie

nts

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

3.65820

3125

3712577

.415

9.85354

E-07

0.999

999

-

787030

9

78703

16

-

787030

9

787031

6

Number of

stores

0.03666

3217

0.01836

1564

1.99673

7187

0.063

158

-

0.00226

0.075

588

-

0.0022

6

0.0755

88

Change in

average income

-

1803785

8586

3.93852

E+11

-

0.04579

856

0.964

038

-

8.5E+11

8.17E

+11

-

8.5E+1

1

8.17E+

11

Change in tariff

-

1.10780

9849

0.20174

5426

-

5.49112

7452

4.93E

-05

-

1.53549

-

0.680

13

-

1.5354

9

-

0.6801

3

Inflation

5521793

44.5

1205669

6583

0.04579

856

0.964

038

-

2.5E+10

2.61E

+10

-

2.5E+1

0

2.61E+

10

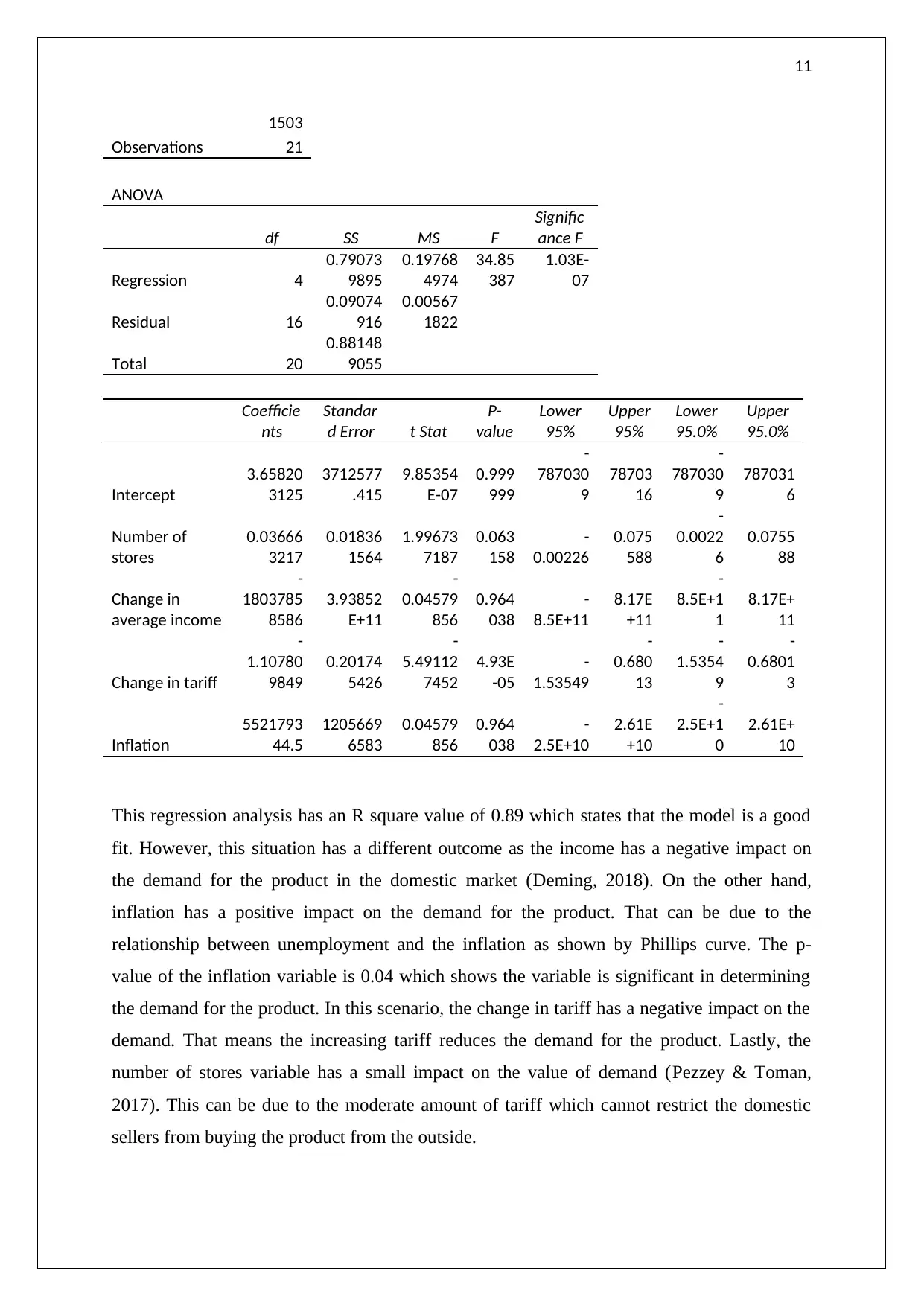

This regression analysis has an R square value of 0.89 which states that the model is a good

fit. However, this situation has a different outcome as the income has a negative impact on

the demand for the product in the domestic market (Deming, 2018). On the other hand,

inflation has a positive impact on the demand for the product. That can be due to the

relationship between unemployment and the inflation as shown by Phillips curve. The p-

value of the inflation variable is 0.04 which shows the variable is significant in determining

the demand for the product. In this scenario, the change in tariff has a negative impact on the

demand. That means the increasing tariff reduces the demand for the product. Lastly, the

number of stores variable has a small impact on the value of demand (Pezzey & Toman,

2017). This can be due to the moderate amount of tariff which cannot restrict the domestic

sellers from buying the product from the outside.

1503

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.79073

9895

0.19768

4974

34.85

387

1.03E-

07

Residual 16

0.09074

916

0.00567

1822

Total 20

0.88148

9055

Coefficie

nts

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept

3.65820

3125

3712577

.415

9.85354

E-07

0.999

999

-

787030

9

78703

16

-

787030

9

787031

6

Number of

stores

0.03666

3217

0.01836

1564

1.99673

7187

0.063

158

-

0.00226

0.075

588

-

0.0022

6

0.0755

88

Change in

average income

-

1803785

8586

3.93852

E+11

-

0.04579

856

0.964

038

-

8.5E+11

8.17E

+11

-

8.5E+1

1

8.17E+

11

Change in tariff

-

1.10780

9849

0.20174

5426

-

5.49112

7452

4.93E

-05

-

1.53549

-

0.680

13

-

1.5354

9

-

0.6801

3

Inflation

5521793

44.5

1205669

6583

0.04579

856

0.964

038

-

2.5E+10

2.61E

+10

-

2.5E+1

0

2.61E+

10

This regression analysis has an R square value of 0.89 which states that the model is a good

fit. However, this situation has a different outcome as the income has a negative impact on

the demand for the product in the domestic market (Deming, 2018). On the other hand,

inflation has a positive impact on the demand for the product. That can be due to the

relationship between unemployment and the inflation as shown by Phillips curve. The p-

value of the inflation variable is 0.04 which shows the variable is significant in determining

the demand for the product. In this scenario, the change in tariff has a negative impact on the

demand. That means the increasing tariff reduces the demand for the product. Lastly, the

number of stores variable has a small impact on the value of demand (Pezzey & Toman,

2017). This can be due to the moderate amount of tariff which cannot restrict the domestic

sellers from buying the product from the outside.

12

Scenario 4

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.8378

13612

R Square

0.7019

31649

Adjusted R

Square

0.5905

07822

Standard Error

0.1243

20267

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.61874

5066

0.15468

6266

13.34

463

5.72E-

05

Residual 17

0.26274

3989

0.01545

5529

Total 21

0.88148

9055

Coeffici

ents

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.625 #NUM! #NUM!

#NU

M! #NUM!

#NUM

! #NUM! #NUM!

Number of stores

0.0720

22271

0.02836

7823

2.53887

2013

0.021

189

0.01217

1

0.131

873

0.0121

71

0.1318

73

Change in the

average income

505065

2636

2545493

2641

0.19841

5478

0.845

073

-

4.9E+10

5.88E

+10

-

4.9E+1

0

5.88E+

10

Change in tariff 0 0 65535

#NU

M! 0 0 0 0

inflation

-

360760

9026

1818209

4744

-

0.19841

5478

0.845

073

-

4.2E+10

3.48E

+10

-

4.2E+1

0

3.48E+

10

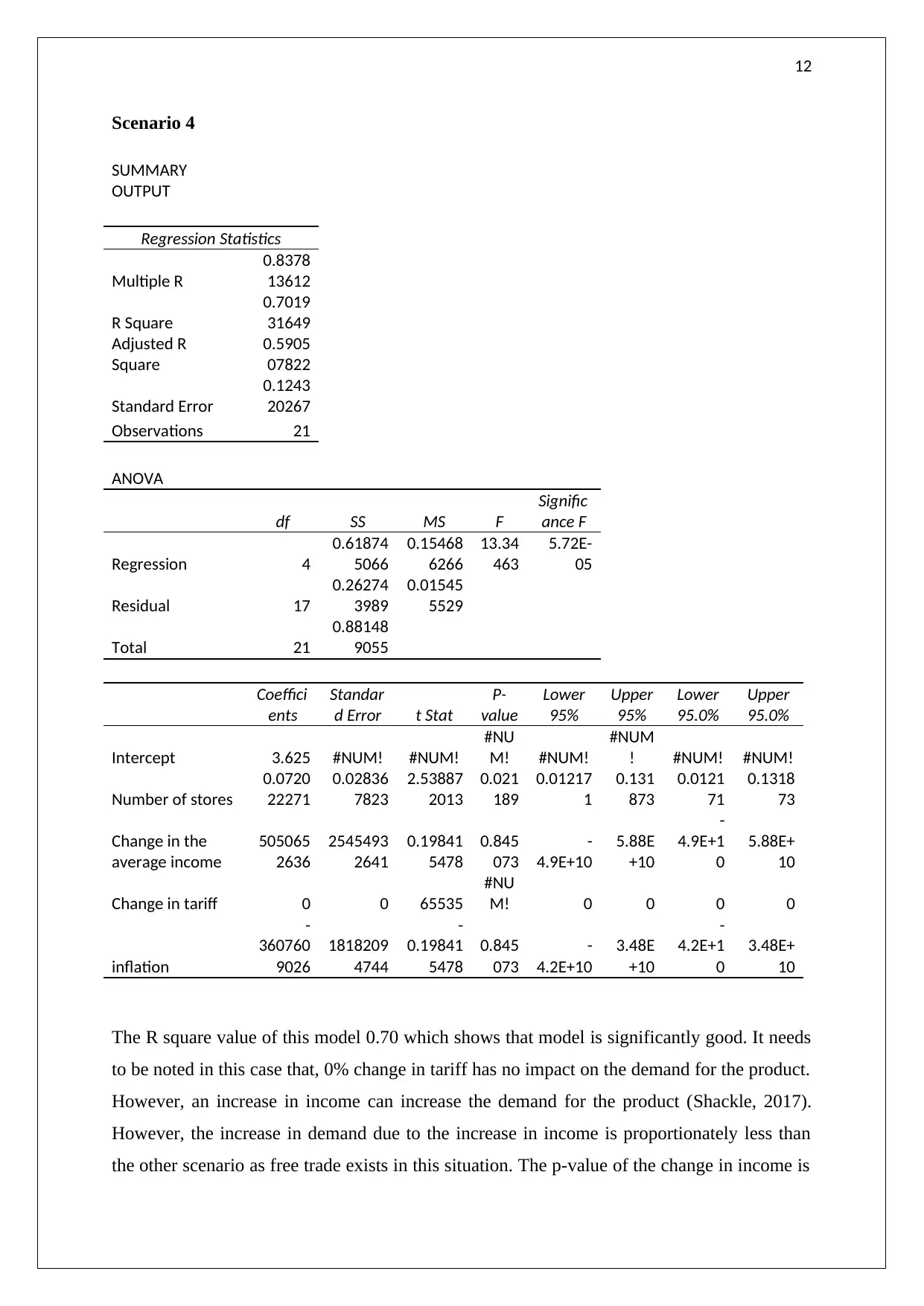

The R square value of this model 0.70 which shows that model is significantly good. It needs

to be noted in this case that, 0% change in tariff has no impact on the demand for the product.

However, an increase in income can increase the demand for the product (Shackle, 2017).

However, the increase in demand due to the increase in income is proportionately less than

the other scenario as free trade exists in this situation. The p-value of the change in income is

Scenario 4

SUMMARY

OUTPUT

Regression Statistics

Multiple R

0.8378

13612

R Square

0.7019

31649

Adjusted R

Square

0.5905

07822

Standard Error

0.1243

20267

Observations 21

ANOVA

df SS MS F

Signific

ance F

Regression 4

0.61874

5066

0.15468

6266

13.34

463

5.72E-

05

Residual 17

0.26274

3989

0.01545

5529

Total 21

0.88148

9055

Coeffici

ents

Standar

d Error t Stat

P-

value

Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 3.625 #NUM! #NUM!

#NU

M! #NUM!

#NUM

! #NUM! #NUM!

Number of stores

0.0720

22271

0.02836

7823

2.53887

2013

0.021

189

0.01217

1

0.131

873

0.0121

71

0.1318

73

Change in the

average income

505065

2636

2545493

2641

0.19841

5478

0.845

073

-

4.9E+10

5.88E

+10

-

4.9E+1

0

5.88E+

10

Change in tariff 0 0 65535

#NU

M! 0 0 0 0

inflation

-

360760

9026

1818209

4744

-

0.19841

5478

0.845

073

-

4.2E+10

3.48E

+10

-

4.2E+1

0

3.48E+

10

The R square value of this model 0.70 which shows that model is significantly good. It needs

to be noted in this case that, 0% change in tariff has no impact on the demand for the product.

However, an increase in income can increase the demand for the product (Shackle, 2017).

However, the increase in demand due to the increase in income is proportionately less than

the other scenario as free trade exists in this situation. The p-value of the change in income is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.