Econometrics Homework: Analyzing School Lunch Program & Interest Rates

VerifiedAdded on 2023/06/11

|15

|2684

|375

Homework Assignment

AI Summary

This econometrics assignment solution comprises three questions. The first question analyzes the effect of the federally funded school lunch program on student performance using data from 408 high schools, employing a regression model to assess the impact of expenditures, lunch program participation, and enrollment on math scores. The second question explores the relationship between short-term interest rates, inflation, and the federal budget surplus/deficit using time series data from 1960 to 2016, including tests for serial correlation and heteroskedasticity. The third question investigates the relationship between per capita expenditure on education and per capita GDP across 34 countries in 1980, addressing potential heteroskedasticity issues and applying White's test. The assignment uses E-views for econometric analysis and hypothesis testing, providing detailed interpretations of the results. Desklib offers this solution along with a wide array of study resources, including past papers and solved assignments, for students seeking academic support.

Research on Physical Aggression

Name of Student:

Name of University:

Course ID:

Name of Student:

Name of University:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1:

Suppose we wish to estimate the effect of the federally funded school

lunch program on student performance. The file

MEAP93.xlscontainsdataon408highschools inAustraliafortheyear1993.

math10: percentage of tenth grade

rsatahighschoolreceivingapassingscoreonastandardizedmathemati

csexam.

expend: expenditures per student (in dollars).

lnchprg: percentage of students who are eligible for the

federal free lunch program.

enrol: number of student enrolment which measures school size

(a) Considered regression model:

math10=β0 +β1*log(expend i)+lnchprg i) * log(enrol i)

(b) Estimate the model using E-views and write down the fitted equation

(including the sample size, t-statistic and R-squared)

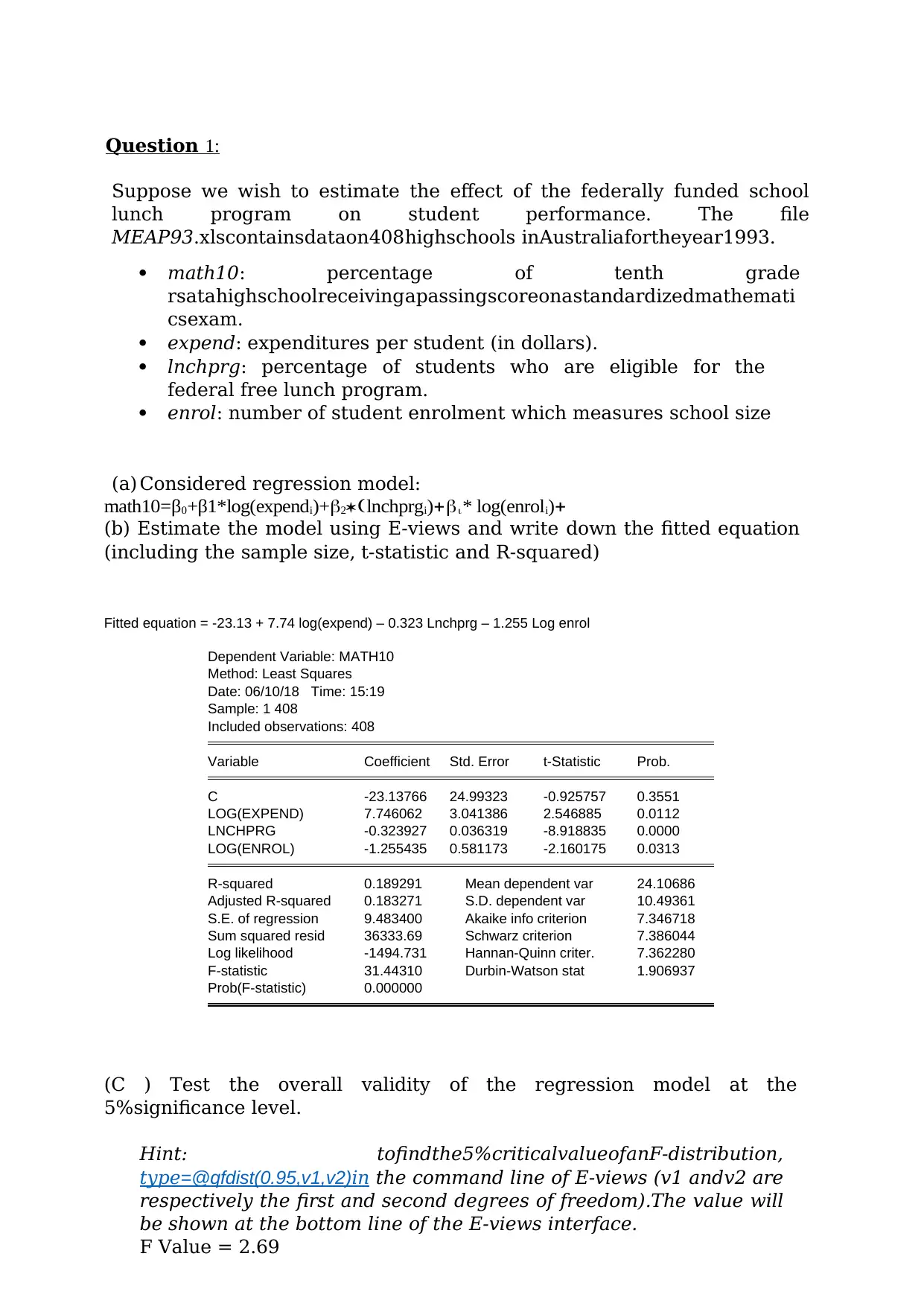

Fitted equation = -23.13 + 7.74 log(expend) – 0.323 Lnchprg – 1.255 Log enrol

Dependent Variable: MATH10

Method: Least Squares

Date: 06/10/18 Time: 15:19

Sample: 1 408

Included observations: 408

Variable Coefficient Std. Error t-Statistic Prob.

C -23.13766 24.99323 -0.925757 0.3551

LOG(EXPEND) 7.746062 3.041386 2.546885 0.0112

LNCHPRG -0.323927 0.036319 -8.918835 0.0000

LOG(ENROL) -1.255435 0.581173 -2.160175 0.0313

R-squared 0.189291 Mean dependent var 24.10686

Adjusted R-squared 0.183271 S.D. dependent var 10.49361

S.E. of regression 9.483400 Akaike info criterion 7.346718

Sum squared resid 36333.69 Schwarz criterion 7.386044

Log likelihood -1494.731 Hannan-Quinn criter. 7.362280

F-statistic 31.44310 Durbin-Watson stat 1.906937

Prob(F-statistic) 0.000000

(C ) Test the overall validity of the regression model at the

5%significance level.

Hint: tofindthe5%criticalvalueofanF-distribution,

type=@qfdist(0.95,v1,v2)in the command line of E-views (v1 andv2 are

respectively the first and second degrees of freedom).The value will

be shown at the bottom line of the E-views interface.

F Value = 2.69

Suppose we wish to estimate the effect of the federally funded school

lunch program on student performance. The file

MEAP93.xlscontainsdataon408highschools inAustraliafortheyear1993.

math10: percentage of tenth grade

rsatahighschoolreceivingapassingscoreonastandardizedmathemati

csexam.

expend: expenditures per student (in dollars).

lnchprg: percentage of students who are eligible for the

federal free lunch program.

enrol: number of student enrolment which measures school size

(a) Considered regression model:

math10=β0 +β1*log(expend i)+lnchprg i) * log(enrol i)

(b) Estimate the model using E-views and write down the fitted equation

(including the sample size, t-statistic and R-squared)

Fitted equation = -23.13 + 7.74 log(expend) – 0.323 Lnchprg – 1.255 Log enrol

Dependent Variable: MATH10

Method: Least Squares

Date: 06/10/18 Time: 15:19

Sample: 1 408

Included observations: 408

Variable Coefficient Std. Error t-Statistic Prob.

C -23.13766 24.99323 -0.925757 0.3551

LOG(EXPEND) 7.746062 3.041386 2.546885 0.0112

LNCHPRG -0.323927 0.036319 -8.918835 0.0000

LOG(ENROL) -1.255435 0.581173 -2.160175 0.0313

R-squared 0.189291 Mean dependent var 24.10686

Adjusted R-squared 0.183271 S.D. dependent var 10.49361

S.E. of regression 9.483400 Akaike info criterion 7.346718

Sum squared resid 36333.69 Schwarz criterion 7.386044

Log likelihood -1494.731 Hannan-Quinn criter. 7.362280

F-statistic 31.44310 Durbin-Watson stat 1.906937

Prob(F-statistic) 0.000000

(C ) Test the overall validity of the regression model at the

5%significance level.

Hint: tofindthe5%criticalvalueofanF-distribution,

type=@qfdist(0.95,v1,v2)in the command line of E-views (v1 andv2 are

respectively the first and second degrees of freedom).The value will

be shown at the bottom line of the E-views interface.

F Value = 2.69

H0 = The fit of intercept only model and the current model is same.

That is additional variables do not provide value taken together

H1 = The fit of intercept only model is significantly less compared

to our current model that is additional variables do make the model

significantly better.

F value is less than F statistic which means that we reject the null

hypothesis at 5% critical value. The additional variables make the

model significantly better.

(d) Does the lunch program increase student performance? Test the

hypothesis at the5%level.

H0 = The lunch model does not affect the student performance

H1 = The lunch model increases student performance

T statistic = -8.91

T value > 1

T statistic is lower than t value at 5% critical value, we therefore do

not reject the null hypothesis. The lunch program does not affect

student performance.

(e) Based on the regression output, if expend increase by 10% what is the

estimated percentage point change inmath10, holding lnchprg and enroll

constant.

math10 will change by 0.1expend units

(f) Now run the simple regression of math10onlnchprgsuchthat

math10=β 0+β 1lnchprg i

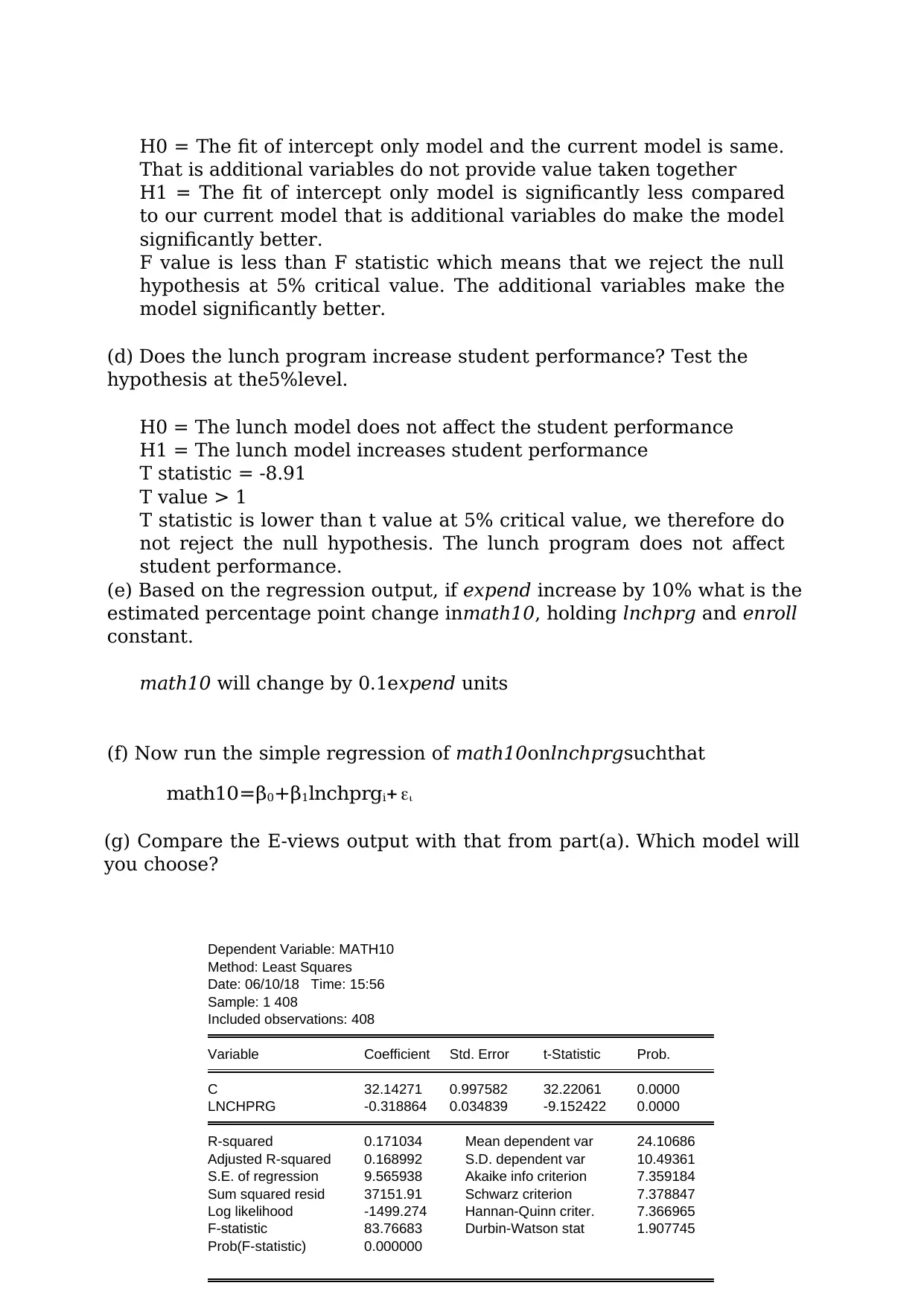

(g) Compare the E-views output with that from part(a). Which model will

you choose?

Dependent Variable: MATH10

Method: Least Squares

Date: 06/10/18 Time: 15:56

Sample: 1 408

Included observations: 408

Variable Coefficient Std. Error t-Statistic Prob.

C 32.14271 0.997582 32.22061 0.0000

LNCHPRG -0.318864 0.034839 -9.152422 0.0000

R-squared 0.171034 Mean dependent var 24.10686

Adjusted R-squared 0.168992 S.D. dependent var 10.49361

S.E. of regression 9.565938 Akaike info criterion 7.359184

Sum squared resid 37151.91 Schwarz criterion 7.378847

Log likelihood -1499.274 Hannan-Quinn criter. 7.366965

F-statistic 83.76683 Durbin-Watson stat 1.907745

Prob(F-statistic) 0.000000

That is additional variables do not provide value taken together

H1 = The fit of intercept only model is significantly less compared

to our current model that is additional variables do make the model

significantly better.

F value is less than F statistic which means that we reject the null

hypothesis at 5% critical value. The additional variables make the

model significantly better.

(d) Does the lunch program increase student performance? Test the

hypothesis at the5%level.

H0 = The lunch model does not affect the student performance

H1 = The lunch model increases student performance

T statistic = -8.91

T value > 1

T statistic is lower than t value at 5% critical value, we therefore do

not reject the null hypothesis. The lunch program does not affect

student performance.

(e) Based on the regression output, if expend increase by 10% what is the

estimated percentage point change inmath10, holding lnchprg and enroll

constant.

math10 will change by 0.1expend units

(f) Now run the simple regression of math10onlnchprgsuchthat

math10=β 0+β 1lnchprg i

(g) Compare the E-views output with that from part(a). Which model will

you choose?

Dependent Variable: MATH10

Method: Least Squares

Date: 06/10/18 Time: 15:56

Sample: 1 408

Included observations: 408

Variable Coefficient Std. Error t-Statistic Prob.

C 32.14271 0.997582 32.22061 0.0000

LNCHPRG -0.318864 0.034839 -9.152422 0.0000

R-squared 0.171034 Mean dependent var 24.10686

Adjusted R-squared 0.168992 S.D. dependent var 10.49361

S.E. of regression 9.565938 Akaike info criterion 7.359184

Sum squared resid 37151.91 Schwarz criterion 7.378847

Log likelihood -1499.274 Hannan-Quinn criter. 7.366965

F-statistic 83.76683 Durbin-Watson stat 1.907745

Prob(F-statistic) 0.000000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

We will choose the first model.

This is because the first model has a higher R squared than the second

model which explains that more variability is explained by the first model

compared to the second (Zou, Tuncali and Silverman 2003).

This is because the first model has a higher R squared than the second

model which explains that more variability is explained by the first model

compared to the second (Zou, Tuncali and Silverman 2003).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 2:

Suppose are searcher wants to analysis the short-term interest rate and

she develops a model given by

i 3 inf t def t

where 𝒊𝟑𝒕 is the three-month T-bill rate, 𝒊𝒏𝒇𝒕 is the annual inflation rate based on the consumer

price index (CPI), and 𝒅𝒆𝒇𝒕 is the federal budget surplus or deficit as a percentage of GDP. He

collects the yearly data for the period from 1960 to 2016 (57 observations) from the Federal Reserve

Economic Data. They are in the Excel file Interest_rate.xlsx.

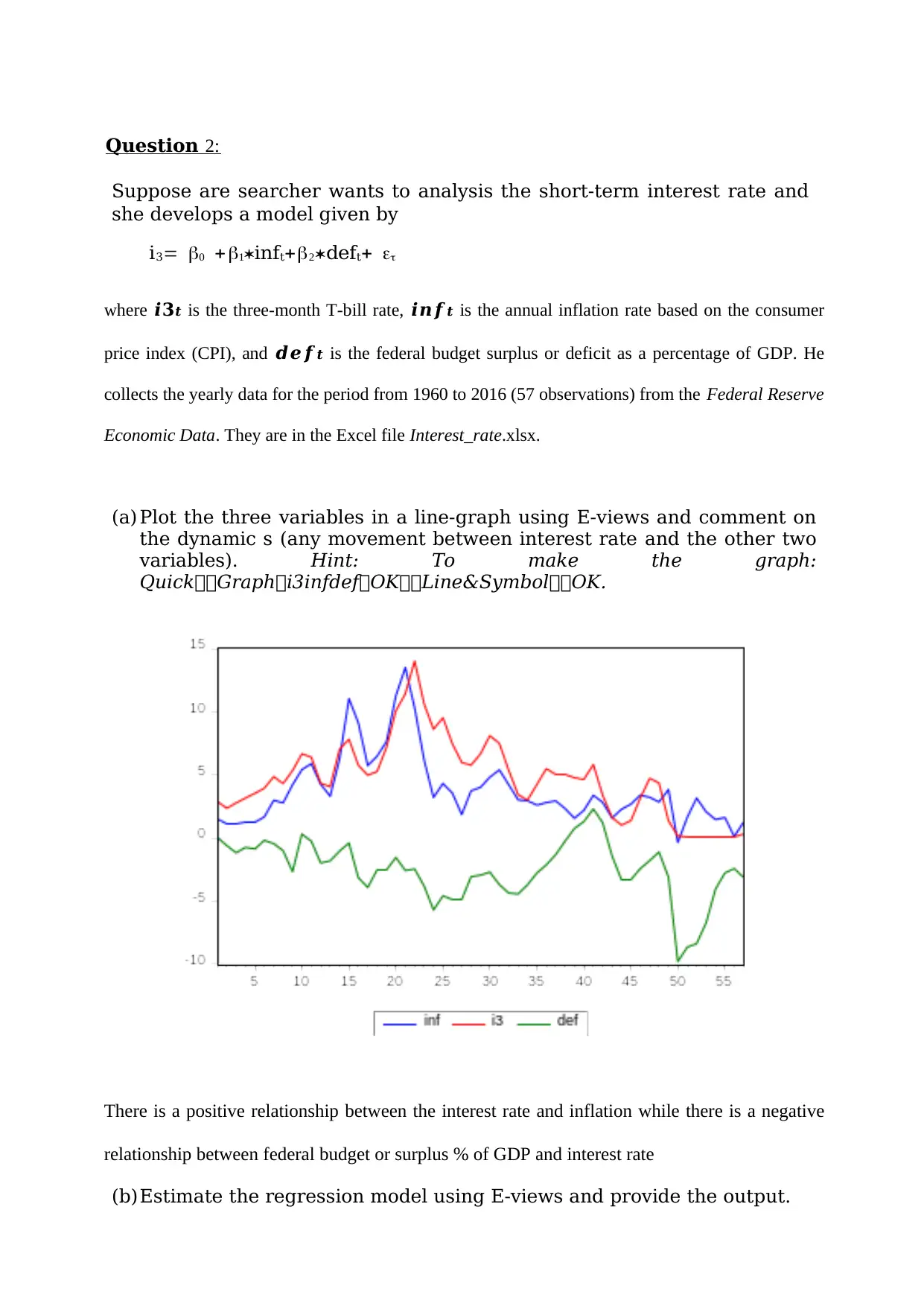

(a) Plot the three variables in a line-graph using E-views and comment on

the dynamic s (any movement between interest rate and the other two

variables). Hint: To make the graph:

QuickGraphi3infdefOKLine&SymbolOK.

There is a positive relationship between the interest rate and inflation while there is a negative

relationship between federal budget or surplus % of GDP and interest rate

(b)Estimate the regression model using E-views and provide the output.

Suppose are searcher wants to analysis the short-term interest rate and

she develops a model given by

i 3 inf t def t

where 𝒊𝟑𝒕 is the three-month T-bill rate, 𝒊𝒏𝒇𝒕 is the annual inflation rate based on the consumer

price index (CPI), and 𝒅𝒆𝒇𝒕 is the federal budget surplus or deficit as a percentage of GDP. He

collects the yearly data for the period from 1960 to 2016 (57 observations) from the Federal Reserve

Economic Data. They are in the Excel file Interest_rate.xlsx.

(a) Plot the three variables in a line-graph using E-views and comment on

the dynamic s (any movement between interest rate and the other two

variables). Hint: To make the graph:

QuickGraphi3infdefOKLine&SymbolOK.

There is a positive relationship between the interest rate and inflation while there is a negative

relationship between federal budget or surplus % of GDP and interest rate

(b)Estimate the regression model using E-views and provide the output.

2

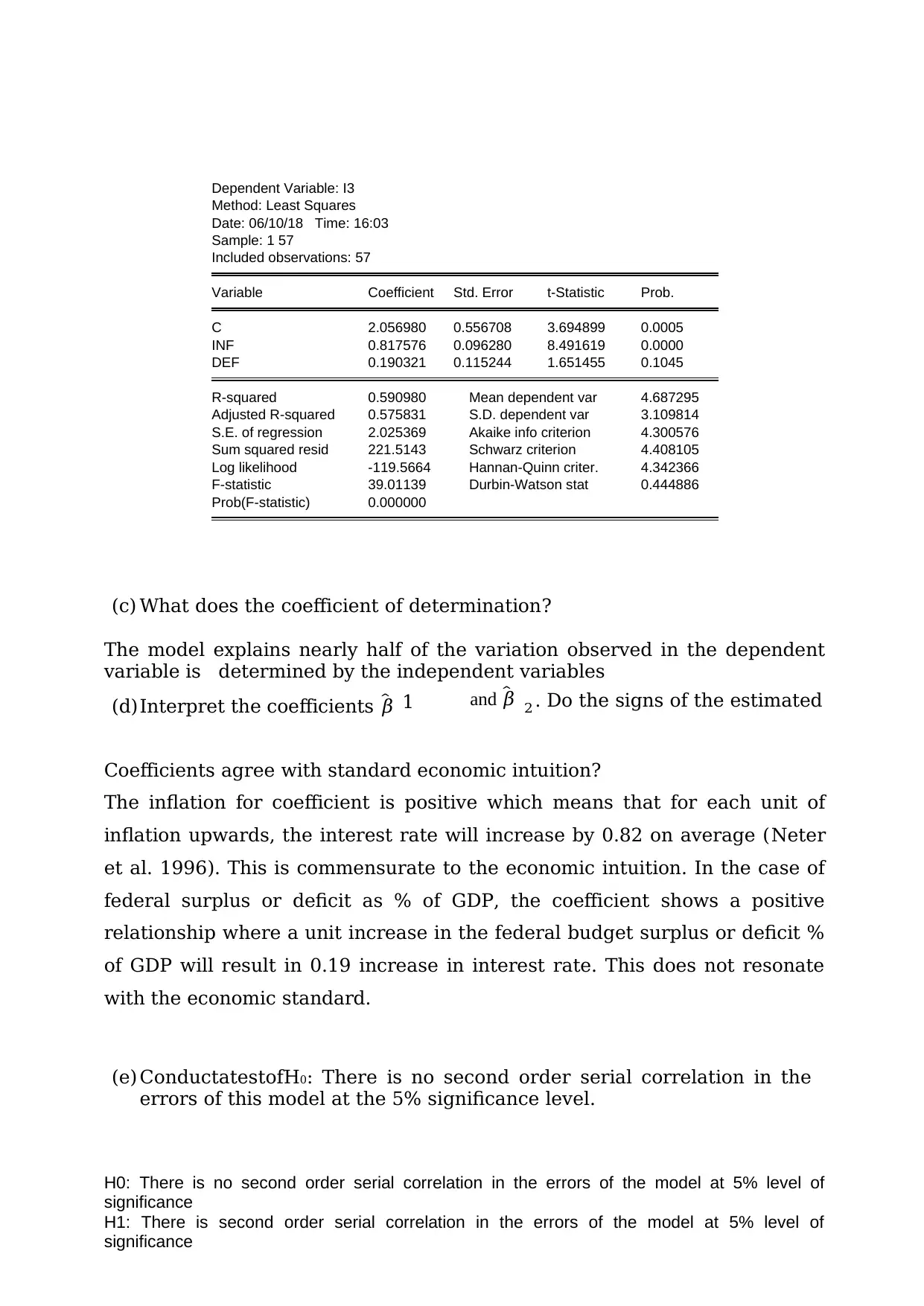

Dependent Variable: I3

Method: Least Squares

Date: 06/10/18 Time: 16:03

Sample: 1 57

Included observations: 57

Variable Coefficient Std. Error t-Statistic Prob.

C 2.056980 0.556708 3.694899 0.0005

INF 0.817576 0.096280 8.491619 0.0000

DEF 0.190321 0.115244 1.651455 0.1045

R-squared 0.590980 Mean dependent var 4.687295

Adjusted R-squared 0.575831 S.D. dependent var 3.109814

S.E. of regression 2.025369 Akaike info criterion 4.300576

Sum squared resid 221.5143 Schwarz criterion 4.408105

Log likelihood -119.5664 Hannan-Quinn criter. 4.342366

F-statistic 39.01139 Durbin-Watson stat 0.444886

Prob(F-statistic) 0.000000

(c) What does the coefficient of determination?

The model explains nearly half of the variation observed in the dependent

variable is determined by the independent variables

(d)Interpret the coefficients 𝛽̂ 1 and 𝛽̂ . Do the signs of the estimated

Coefficients agree with standard economic intuition?

The inflation for coefficient is positive which means that for each unit of

inflation upwards, the interest rate will increase by 0.82 on average (Neter

et al. 1996). This is commensurate to the economic intuition. In the case of

federal surplus or deficit as % of GDP, the coefficient shows a positive

relationship where a unit increase in the federal budget surplus or deficit %

of GDP will result in 0.19 increase in interest rate. This does not resonate

with the economic standard.

(e) ConductatestofH0: There is no second order serial correlation in the

errors of this model at the 5% significance level.

H0: There is no second order serial correlation in the errors of the model at 5% level of

significance

H1: There is second order serial correlation in the errors of the model at 5% level of

significance

Dependent Variable: I3

Method: Least Squares

Date: 06/10/18 Time: 16:03

Sample: 1 57

Included observations: 57

Variable Coefficient Std. Error t-Statistic Prob.

C 2.056980 0.556708 3.694899 0.0005

INF 0.817576 0.096280 8.491619 0.0000

DEF 0.190321 0.115244 1.651455 0.1045

R-squared 0.590980 Mean dependent var 4.687295

Adjusted R-squared 0.575831 S.D. dependent var 3.109814

S.E. of regression 2.025369 Akaike info criterion 4.300576

Sum squared resid 221.5143 Schwarz criterion 4.408105

Log likelihood -119.5664 Hannan-Quinn criter. 4.342366

F-statistic 39.01139 Durbin-Watson stat 0.444886

Prob(F-statistic) 0.000000

(c) What does the coefficient of determination?

The model explains nearly half of the variation observed in the dependent

variable is determined by the independent variables

(d)Interpret the coefficients 𝛽̂ 1 and 𝛽̂ . Do the signs of the estimated

Coefficients agree with standard economic intuition?

The inflation for coefficient is positive which means that for each unit of

inflation upwards, the interest rate will increase by 0.82 on average (Neter

et al. 1996). This is commensurate to the economic intuition. In the case of

federal surplus or deficit as % of GDP, the coefficient shows a positive

relationship where a unit increase in the federal budget surplus or deficit %

of GDP will result in 0.19 increase in interest rate. This does not resonate

with the economic standard.

(e) ConductatestofH0: There is no second order serial correlation in the

errors of this model at the 5% significance level.

H0: There is no second order serial correlation in the errors of the model at 5% level of

significance

H1: There is second order serial correlation in the errors of the model at 5% level of

significance

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

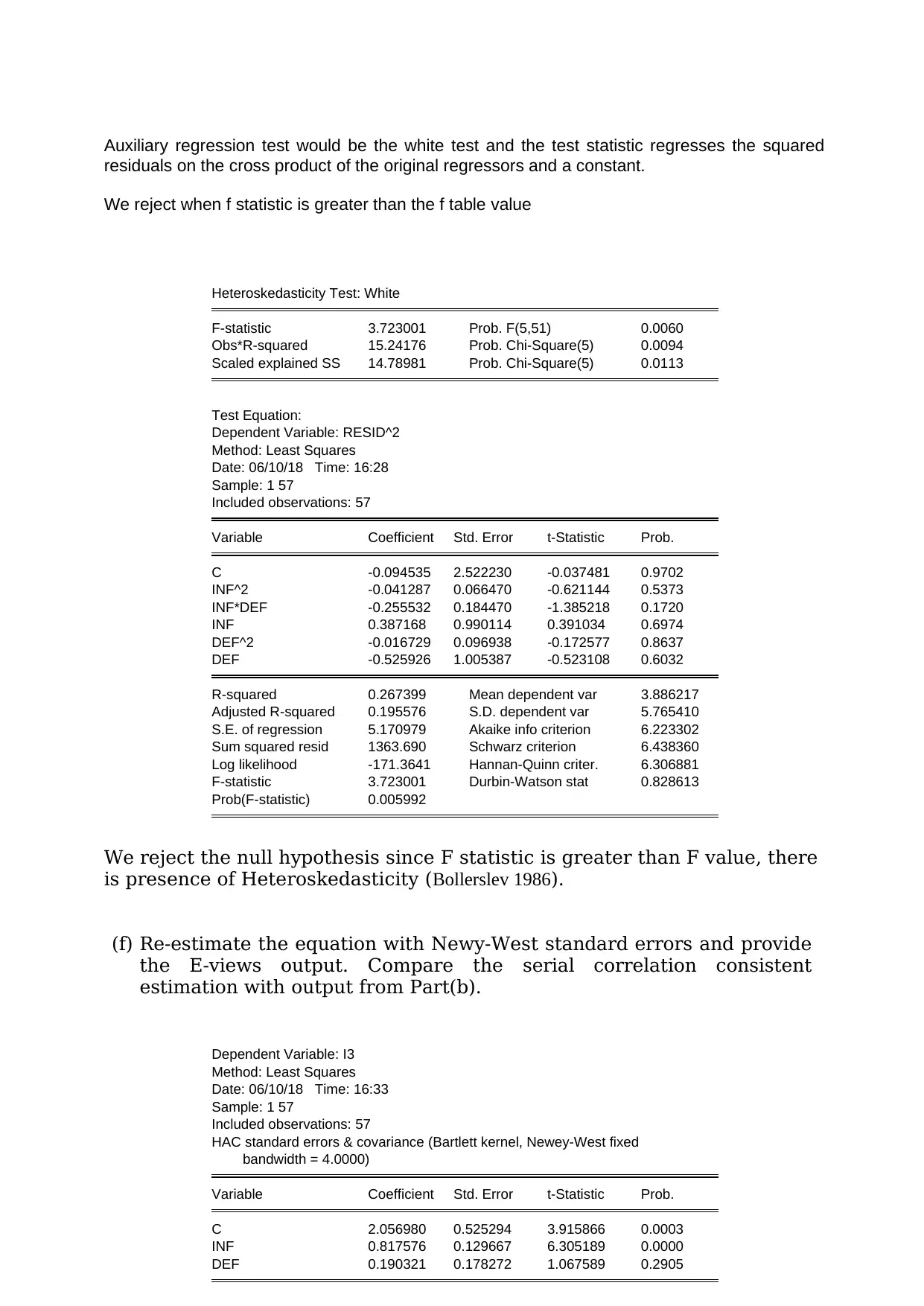

Auxiliary regression test would be the white test and the test statistic regresses the squared

residuals on the cross product of the original regressors and a constant.

We reject when f statistic is greater than the f table value

Heteroskedasticity Test: White

F-statistic 3.723001 Prob. F(5,51) 0.0060

Obs*R-squared 15.24176 Prob. Chi-Square(5) 0.0094

Scaled explained SS 14.78981 Prob. Chi-Square(5) 0.0113

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 06/10/18 Time: 16:28

Sample: 1 57

Included observations: 57

Variable Coefficient Std. Error t-Statistic Prob.

C -0.094535 2.522230 -0.037481 0.9702

INF^2 -0.041287 0.066470 -0.621144 0.5373

INF*DEF -0.255532 0.184470 -1.385218 0.1720

INF 0.387168 0.990114 0.391034 0.6974

DEF^2 -0.016729 0.096938 -0.172577 0.8637

DEF -0.525926 1.005387 -0.523108 0.6032

R-squared 0.267399 Mean dependent var 3.886217

Adjusted R-squared 0.195576 S.D. dependent var 5.765410

S.E. of regression 5.170979 Akaike info criterion 6.223302

Sum squared resid 1363.690 Schwarz criterion 6.438360

Log likelihood -171.3641 Hannan-Quinn criter. 6.306881

F-statistic 3.723001 Durbin-Watson stat 0.828613

Prob(F-statistic) 0.005992

We reject the null hypothesis since F statistic is greater than F value, there

is presence of Heteroskedasticity (Bollerslev 1986).

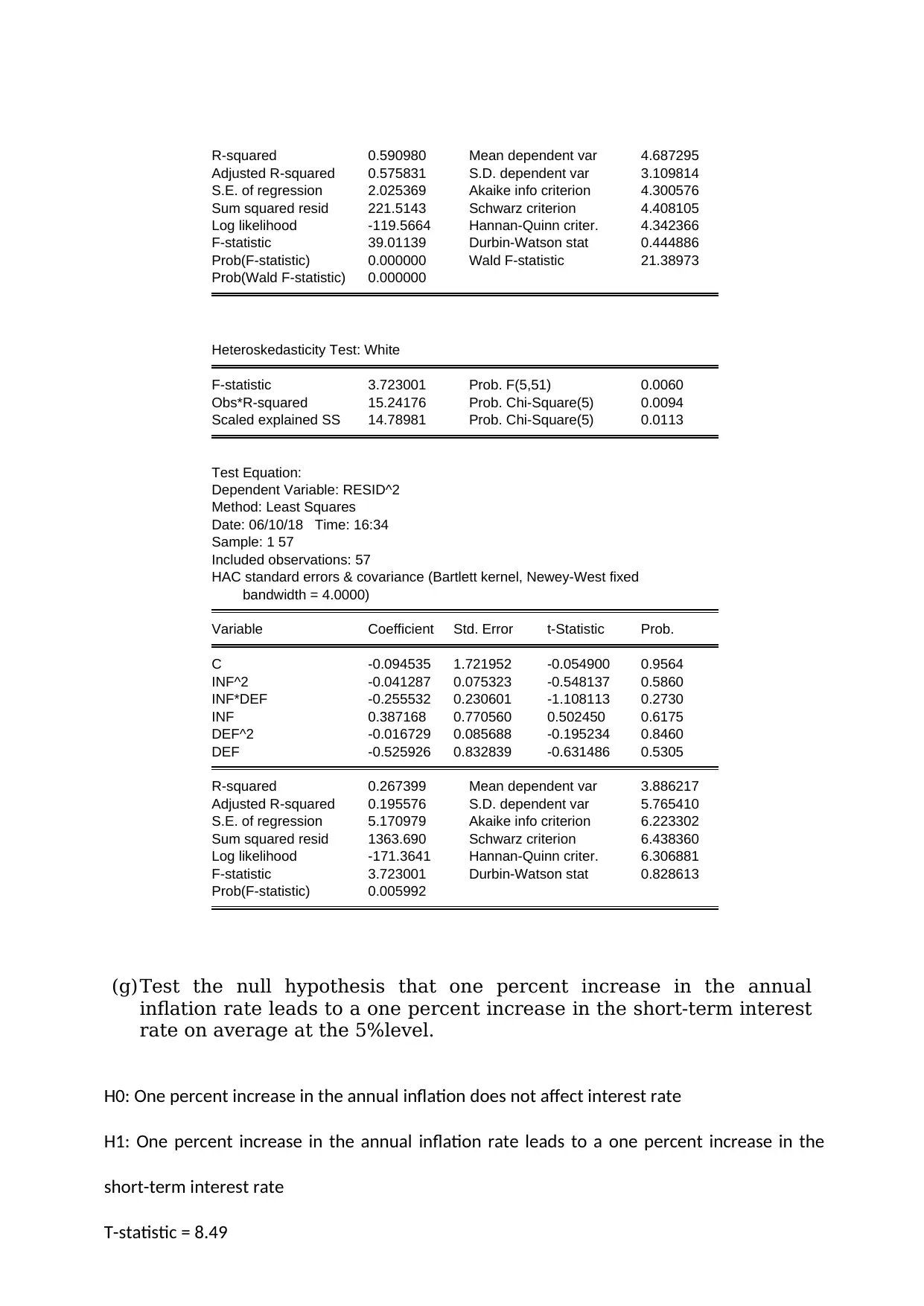

(f) Re-estimate the equation with Newy-West standard errors and provide

the E-views output. Compare the serial correlation consistent

estimation with output from Part(b).

Dependent Variable: I3

Method: Least Squares

Date: 06/10/18 Time: 16:33

Sample: 1 57

Included observations: 57

HAC standard errors & covariance (Bartlett kernel, Newey-West fixed

bandwidth = 4.0000)

Variable Coefficient Std. Error t-Statistic Prob.

C 2.056980 0.525294 3.915866 0.0003

INF 0.817576 0.129667 6.305189 0.0000

DEF 0.190321 0.178272 1.067589 0.2905

residuals on the cross product of the original regressors and a constant.

We reject when f statistic is greater than the f table value

Heteroskedasticity Test: White

F-statistic 3.723001 Prob. F(5,51) 0.0060

Obs*R-squared 15.24176 Prob. Chi-Square(5) 0.0094

Scaled explained SS 14.78981 Prob. Chi-Square(5) 0.0113

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 06/10/18 Time: 16:28

Sample: 1 57

Included observations: 57

Variable Coefficient Std. Error t-Statistic Prob.

C -0.094535 2.522230 -0.037481 0.9702

INF^2 -0.041287 0.066470 -0.621144 0.5373

INF*DEF -0.255532 0.184470 -1.385218 0.1720

INF 0.387168 0.990114 0.391034 0.6974

DEF^2 -0.016729 0.096938 -0.172577 0.8637

DEF -0.525926 1.005387 -0.523108 0.6032

R-squared 0.267399 Mean dependent var 3.886217

Adjusted R-squared 0.195576 S.D. dependent var 5.765410

S.E. of regression 5.170979 Akaike info criterion 6.223302

Sum squared resid 1363.690 Schwarz criterion 6.438360

Log likelihood -171.3641 Hannan-Quinn criter. 6.306881

F-statistic 3.723001 Durbin-Watson stat 0.828613

Prob(F-statistic) 0.005992

We reject the null hypothesis since F statistic is greater than F value, there

is presence of Heteroskedasticity (Bollerslev 1986).

(f) Re-estimate the equation with Newy-West standard errors and provide

the E-views output. Compare the serial correlation consistent

estimation with output from Part(b).

Dependent Variable: I3

Method: Least Squares

Date: 06/10/18 Time: 16:33

Sample: 1 57

Included observations: 57

HAC standard errors & covariance (Bartlett kernel, Newey-West fixed

bandwidth = 4.0000)

Variable Coefficient Std. Error t-Statistic Prob.

C 2.056980 0.525294 3.915866 0.0003

INF 0.817576 0.129667 6.305189 0.0000

DEF 0.190321 0.178272 1.067589 0.2905

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

R-squared 0.590980 Mean dependent var 4.687295

Adjusted R-squared 0.575831 S.D. dependent var 3.109814

S.E. of regression 2.025369 Akaike info criterion 4.300576

Sum squared resid 221.5143 Schwarz criterion 4.408105

Log likelihood -119.5664 Hannan-Quinn criter. 4.342366

F-statistic 39.01139 Durbin-Watson stat 0.444886

Prob(F-statistic) 0.000000 Wald F-statistic 21.38973

Prob(Wald F-statistic) 0.000000

Heteroskedasticity Test: White

F-statistic 3.723001 Prob. F(5,51) 0.0060

Obs*R-squared 15.24176 Prob. Chi-Square(5) 0.0094

Scaled explained SS 14.78981 Prob. Chi-Square(5) 0.0113

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 06/10/18 Time: 16:34

Sample: 1 57

Included observations: 57

HAC standard errors & covariance (Bartlett kernel, Newey-West fixed

bandwidth = 4.0000)

Variable Coefficient Std. Error t-Statistic Prob.

C -0.094535 1.721952 -0.054900 0.9564

INF^2 -0.041287 0.075323 -0.548137 0.5860

INF*DEF -0.255532 0.230601 -1.108113 0.2730

INF 0.387168 0.770560 0.502450 0.6175

DEF^2 -0.016729 0.085688 -0.195234 0.8460

DEF -0.525926 0.832839 -0.631486 0.5305

R-squared 0.267399 Mean dependent var 3.886217

Adjusted R-squared 0.195576 S.D. dependent var 5.765410

S.E. of regression 5.170979 Akaike info criterion 6.223302

Sum squared resid 1363.690 Schwarz criterion 6.438360

Log likelihood -171.3641 Hannan-Quinn criter. 6.306881

F-statistic 3.723001 Durbin-Watson stat 0.828613

Prob(F-statistic) 0.005992

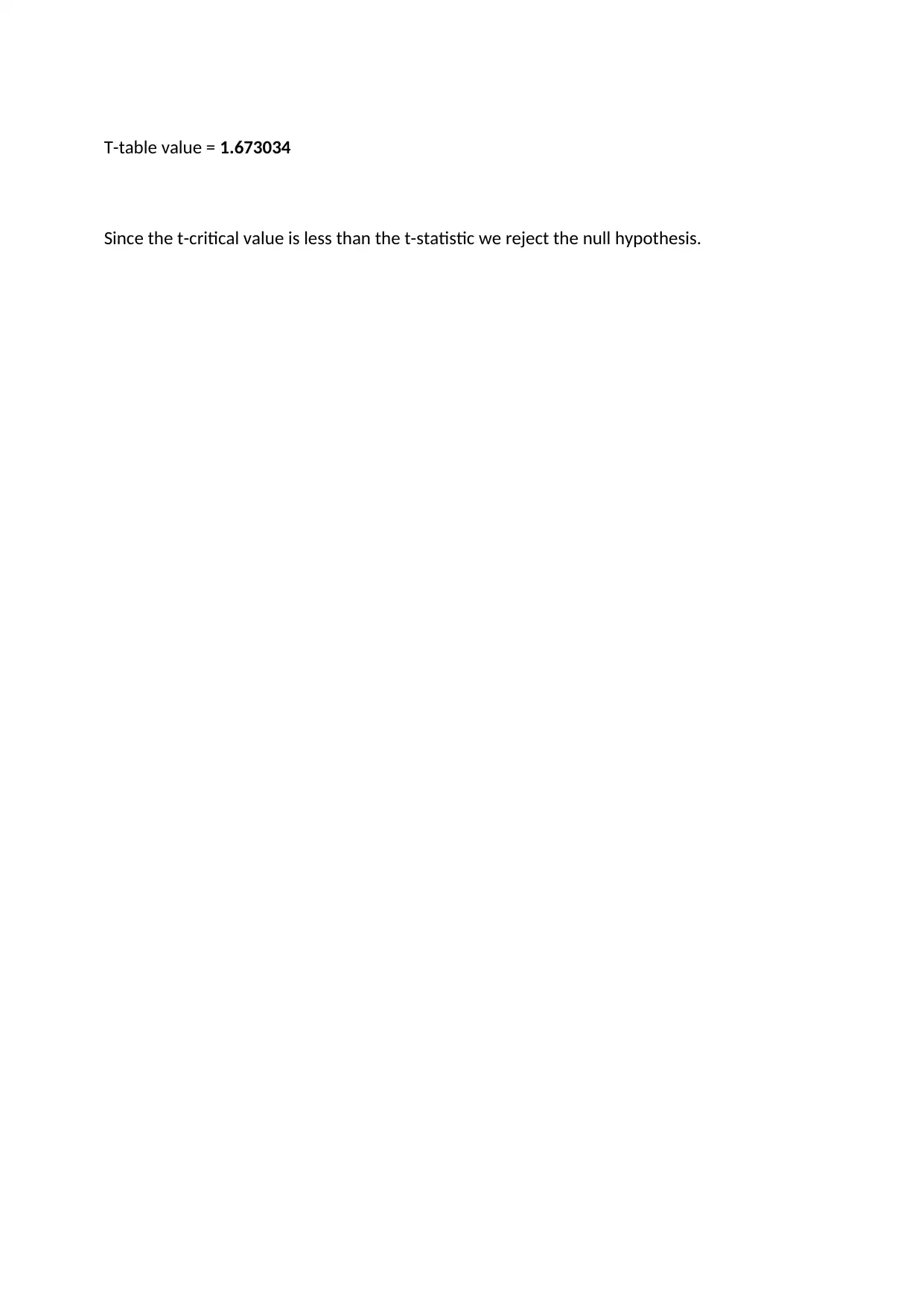

(g)Test the null hypothesis that one percent increase in the annual

inflation rate leads to a one percent increase in the short-term interest

rate on average at the 5%level.

H0: One percent increase in the annual inflation does not affect interest rate

H1: One percent increase in the annual inflation rate leads to a one percent increase in the

short-term interest rate

T-statistic = 8.49

Adjusted R-squared 0.575831 S.D. dependent var 3.109814

S.E. of regression 2.025369 Akaike info criterion 4.300576

Sum squared resid 221.5143 Schwarz criterion 4.408105

Log likelihood -119.5664 Hannan-Quinn criter. 4.342366

F-statistic 39.01139 Durbin-Watson stat 0.444886

Prob(F-statistic) 0.000000 Wald F-statistic 21.38973

Prob(Wald F-statistic) 0.000000

Heteroskedasticity Test: White

F-statistic 3.723001 Prob. F(5,51) 0.0060

Obs*R-squared 15.24176 Prob. Chi-Square(5) 0.0094

Scaled explained SS 14.78981 Prob. Chi-Square(5) 0.0113

Test Equation:

Dependent Variable: RESID^2

Method: Least Squares

Date: 06/10/18 Time: 16:34

Sample: 1 57

Included observations: 57

HAC standard errors & covariance (Bartlett kernel, Newey-West fixed

bandwidth = 4.0000)

Variable Coefficient Std. Error t-Statistic Prob.

C -0.094535 1.721952 -0.054900 0.9564

INF^2 -0.041287 0.075323 -0.548137 0.5860

INF*DEF -0.255532 0.230601 -1.108113 0.2730

INF 0.387168 0.770560 0.502450 0.6175

DEF^2 -0.016729 0.085688 -0.195234 0.8460

DEF -0.525926 0.832839 -0.631486 0.5305

R-squared 0.267399 Mean dependent var 3.886217

Adjusted R-squared 0.195576 S.D. dependent var 5.765410

S.E. of regression 5.170979 Akaike info criterion 6.223302

Sum squared resid 1363.690 Schwarz criterion 6.438360

Log likelihood -171.3641 Hannan-Quinn criter. 6.306881

F-statistic 3.723001 Durbin-Watson stat 0.828613

Prob(F-statistic) 0.005992

(g)Test the null hypothesis that one percent increase in the annual

inflation rate leads to a one percent increase in the short-term interest

rate on average at the 5%level.

H0: One percent increase in the annual inflation does not affect interest rate

H1: One percent increase in the annual inflation rate leads to a one percent increase in the

short-term interest rate

T-statistic = 8.49

T-table value = 1.673034

Since the t-critical value is less than the t-statistic we reject the null hypothesis.

Since the t-critical value is less than the t-statistic we reject the null hypothesis.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

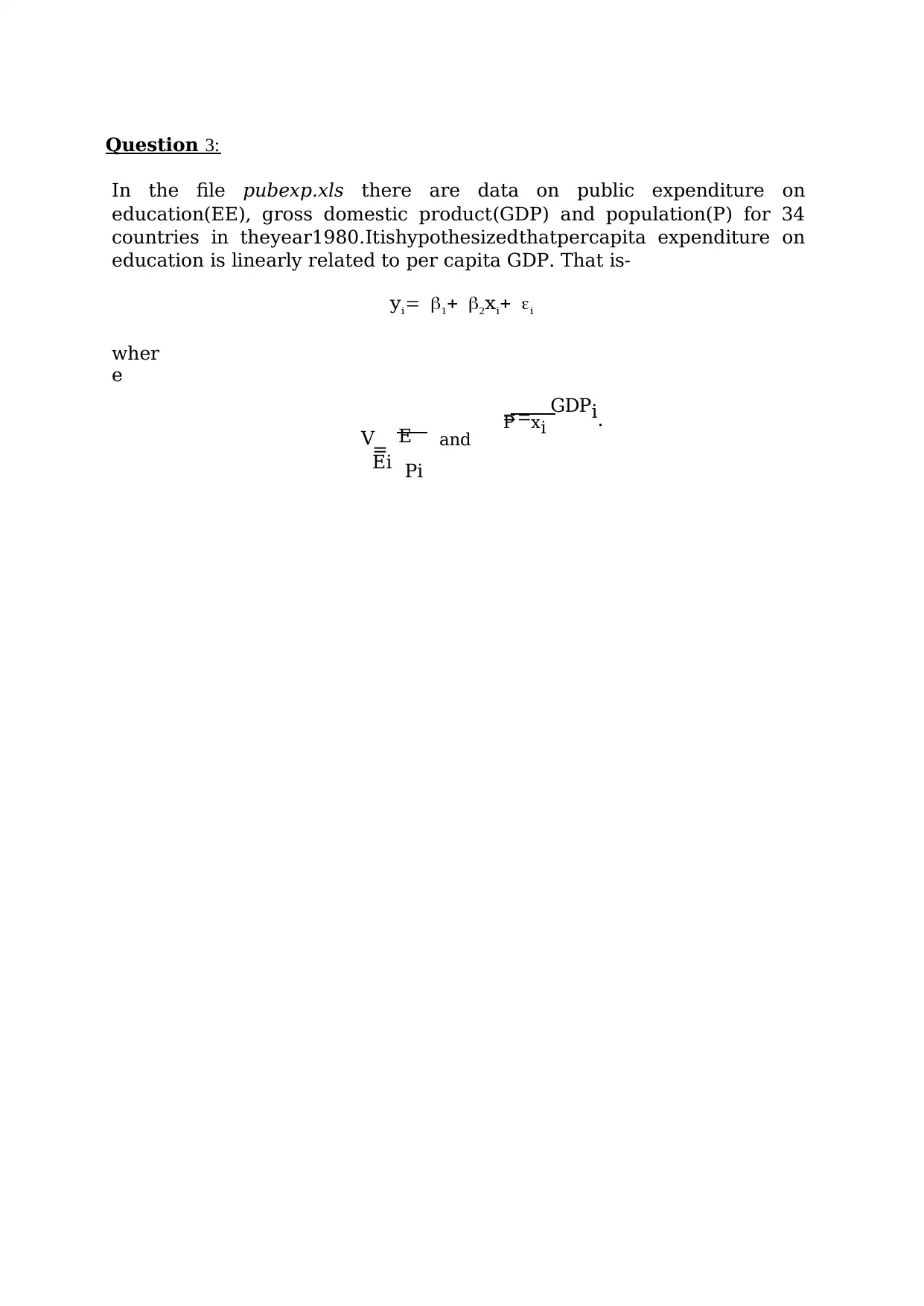

Question 3:

In the file pubexp.xls there are data on public expenditure on

education(EE), gross domestic product(GDP) and population(P) for 34

countries in theyear1980.Itishypothesizedthatpercapita expenditure on

education is linearly related to per capita GDP. That is-

yi12xii

wher

e

V=E

Ei Pi

and

GDPi.P xi

In the file pubexp.xls there are data on public expenditure on

education(EE), gross domestic product(GDP) and population(P) for 34

countries in theyear1980.Itishypothesizedthatpercapita expenditure on

education is linearly related to per capita GDP. That is-

yi12xii

wher

e

V=E

Ei Pi

and

GDPi.P xi

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

RESEARCH ON PHYSICAL AGGRESSION

i i

Import the data into E-views.

(a) Issues suspected that𝜀𝑖 may be heteroskedastic with a variance

related to𝑥.

(b)Why might the suspicion about heteroskedasticity be reasonable?

There is a positive relationship for the error term and the x variable.

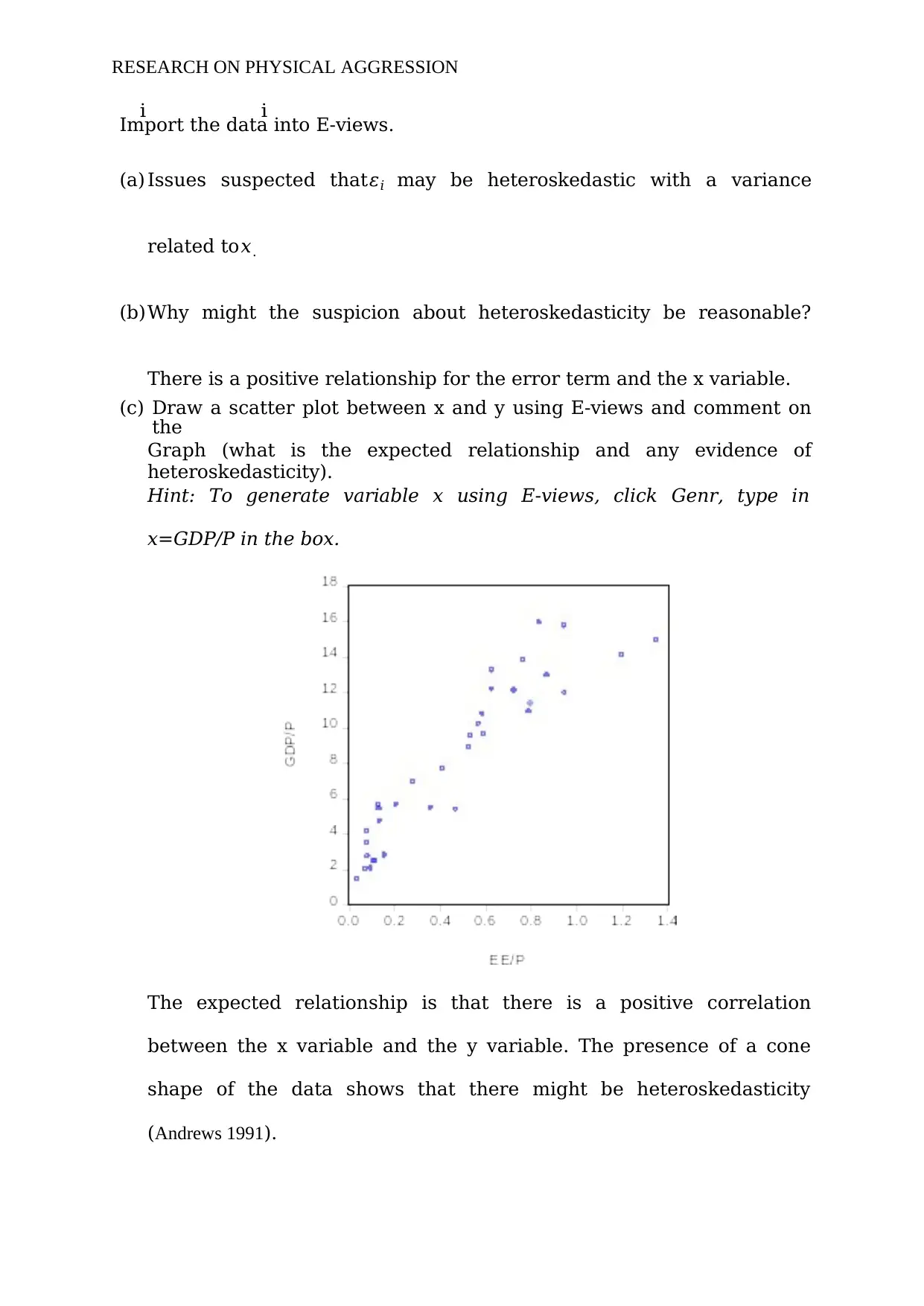

(c) Draw a scatter plot between x and y using E-views and comment on

the

Graph (what is the expected relationship and any evidence of

heteroskedasticity).

Hint: To generate variable x using E-views, click Genr, type in

x=GDP/P in the box.

The expected relationship is that there is a positive correlation

between the x variable and the y variable. The presence of a cone

shape of the data shows that there might be heteroskedasticity

(Andrews 1991).

i i

Import the data into E-views.

(a) Issues suspected that𝜀𝑖 may be heteroskedastic with a variance

related to𝑥.

(b)Why might the suspicion about heteroskedasticity be reasonable?

There is a positive relationship for the error term and the x variable.

(c) Draw a scatter plot between x and y using E-views and comment on

the

Graph (what is the expected relationship and any evidence of

heteroskedasticity).

Hint: To generate variable x using E-views, click Genr, type in

x=GDP/P in the box.

The expected relationship is that there is a positive correlation

between the x variable and the y variable. The presence of a cone

shape of the data shows that there might be heteroskedasticity

(Andrews 1991).

1RESEARCH ON PHYSICAL AGGRESSION

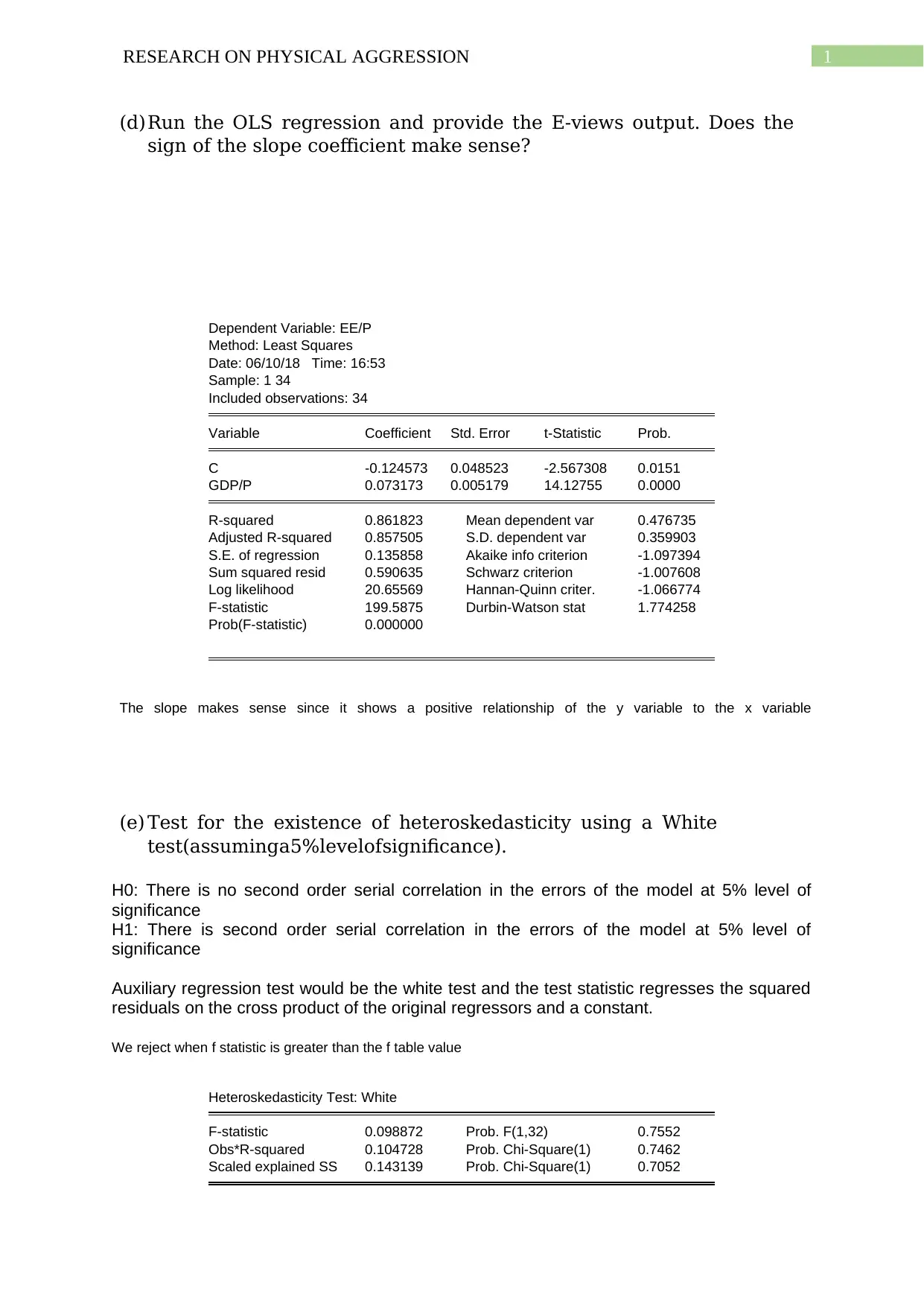

(d)Run the OLS regression and provide the E-views output. Does the

sign of the slope coefficient make sense?

Dependent Variable: EE/P

Method: Least Squares

Date: 06/10/18 Time: 16:53

Sample: 1 34

Included observations: 34

Variable Coefficient Std. Error t-Statistic Prob.

C -0.124573 0.048523 -2.567308 0.0151

GDP/P 0.073173 0.005179 14.12755 0.0000

R-squared 0.861823 Mean dependent var 0.476735

Adjusted R-squared 0.857505 S.D. dependent var 0.359903

S.E. of regression 0.135858 Akaike info criterion -1.097394

Sum squared resid 0.590635 Schwarz criterion -1.007608

Log likelihood 20.65569 Hannan-Quinn criter. -1.066774

F-statistic 199.5875 Durbin-Watson stat 1.774258

Prob(F-statistic) 0.000000

The slope makes sense since it shows a positive relationship of the y variable to the x variable

(e) Test for the existence of heteroskedasticity using a White

test(assuminga5%levelofsignificance).

H0: There is no second order serial correlation in the errors of the model at 5% level of

significance

H1: There is second order serial correlation in the errors of the model at 5% level of

significance

Auxiliary regression test would be the white test and the test statistic regresses the squared

residuals on the cross product of the original regressors and a constant.

We reject when f statistic is greater than the f table value

Heteroskedasticity Test: White

F-statistic 0.098872 Prob. F(1,32) 0.7552

Obs*R-squared 0.104728 Prob. Chi-Square(1) 0.7462

Scaled explained SS 0.143139 Prob. Chi-Square(1) 0.7052

(d)Run the OLS regression and provide the E-views output. Does the

sign of the slope coefficient make sense?

Dependent Variable: EE/P

Method: Least Squares

Date: 06/10/18 Time: 16:53

Sample: 1 34

Included observations: 34

Variable Coefficient Std. Error t-Statistic Prob.

C -0.124573 0.048523 -2.567308 0.0151

GDP/P 0.073173 0.005179 14.12755 0.0000

R-squared 0.861823 Mean dependent var 0.476735

Adjusted R-squared 0.857505 S.D. dependent var 0.359903

S.E. of regression 0.135858 Akaike info criterion -1.097394

Sum squared resid 0.590635 Schwarz criterion -1.007608

Log likelihood 20.65569 Hannan-Quinn criter. -1.066774

F-statistic 199.5875 Durbin-Watson stat 1.774258

Prob(F-statistic) 0.000000

The slope makes sense since it shows a positive relationship of the y variable to the x variable

(e) Test for the existence of heteroskedasticity using a White

test(assuminga5%levelofsignificance).

H0: There is no second order serial correlation in the errors of the model at 5% level of

significance

H1: There is second order serial correlation in the errors of the model at 5% level of

significance

Auxiliary regression test would be the white test and the test statistic regresses the squared

residuals on the cross product of the original regressors and a constant.

We reject when f statistic is greater than the f table value

Heteroskedasticity Test: White

F-statistic 0.098872 Prob. F(1,32) 0.7552

Obs*R-squared 0.104728 Prob. Chi-Square(1) 0.7462

Scaled explained SS 0.143139 Prob. Chi-Square(1) 0.7052

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.