Econometrics Data Analysis Report

VerifiedAdded on 2020/03/16

|35

|4832

|44

Report

AI Summary

This econometrics report analyzes Australian economic data across three key areas. The first section examines Australian House Price Indices, calculating compound annual growth rates for various cities, mortgage payments, and house price appreciation. The second section uses orthogonal least squares (OLS) regression to model the relationship between market value and stock value for three chosen securities (Adelaide Brighton, Webjet, and Ramsay Healthcare), analyzing betas, R-squared values, and portfolio diversification. The final section investigates the relationship between average hourly earnings (AHE) and factors like age, gender, and education level using multiple regression analysis, testing for statistical significance and omitted variable bias. The report utilizes MS Office, Minitab, and R for data analysis and interpretation, providing detailed calculations, tables, and figures to support its conclusions.

Running head: DATA ANALYSIS OF ECONOMETRICS

Data Analysis of Econometrics

Name of the University:

Name of the Student:

Author’s Note:

Data Analysis of Econometrics

Name of the University:

Name of the Student:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYSIS OF ECONOMETRICS 1

Executive Summary:

The report describes economic skills with the help of regression analysis. We answered three

questions and their subparts. We have provided the necessary calculations and tables. We

interpreted from the analysis with the help of MS Office, Minitab and R. We finally have

drawn the conclusions from each question.

Executive Summary:

The report describes economic skills with the help of regression analysis. We answered three

questions and their subparts. We have provided the necessary calculations and tables. We

interpreted from the analysis with the help of MS Office, Minitab and R. We finally have

drawn the conclusions from each question.

DATA ANALYSIS OF ECONOMETRICS 2

Table of Contents

Introduction:...............................................................................................................................3

Questions and Answers:.............................................................................................................3

Question A.............................................................................................................................3

Question B..............................................................................................................................6

Question C............................................................................................................................23

Conclusion:..............................................................................................................................29

Bibliography List:....................................................................................................................30

Table of Contents

Introduction:...............................................................................................................................3

Questions and Answers:.............................................................................................................3

Question A.............................................................................................................................3

Question B..............................................................................................................................6

Question C............................................................................................................................23

Conclusion:..............................................................................................................................29

Bibliography List:....................................................................................................................30

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYSIS OF ECONOMETRICS 3

Introduction:

We described here the group-survey of Australian data of different cities. The answers

of three questions are provided in the analysis. We derived the comparative study of different

Australian cities in the first part. In the second part, we calculated the analysis of economic

situation and relation of chosen three sectors. In the third part, we analyzed the data of age,

average hourly earnings and different factors.

We have elaborately analyzed the dataset with the help of MS Office, Minitab and R.

We installed add-ins in MS excel for advance analysis (Slazek et al. 2013). The report would

help the economic investigators of Australia.

Data analysis on econometrics in this report shows the overview of three different

segments of economics in this report.

Questions and Answers:

Question A (Australian House Price Index):

A1.

Introduction:

We described here the group-survey of Australian data of different cities. The answers

of three questions are provided in the analysis. We derived the comparative study of different

Australian cities in the first part. In the second part, we calculated the analysis of economic

situation and relation of chosen three sectors. In the third part, we analyzed the data of age,

average hourly earnings and different factors.

We have elaborately analyzed the dataset with the help of MS Office, Minitab and R.

We installed add-ins in MS excel for advance analysis (Slazek et al. 2013). The report would

help the economic investigators of Australia.

Data analysis on econometrics in this report shows the overview of three different

segments of economics in this report.

Questions and Answers:

Question A (Australian House Price Index):

A1.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYSIS OF ECONOMETRICS 4

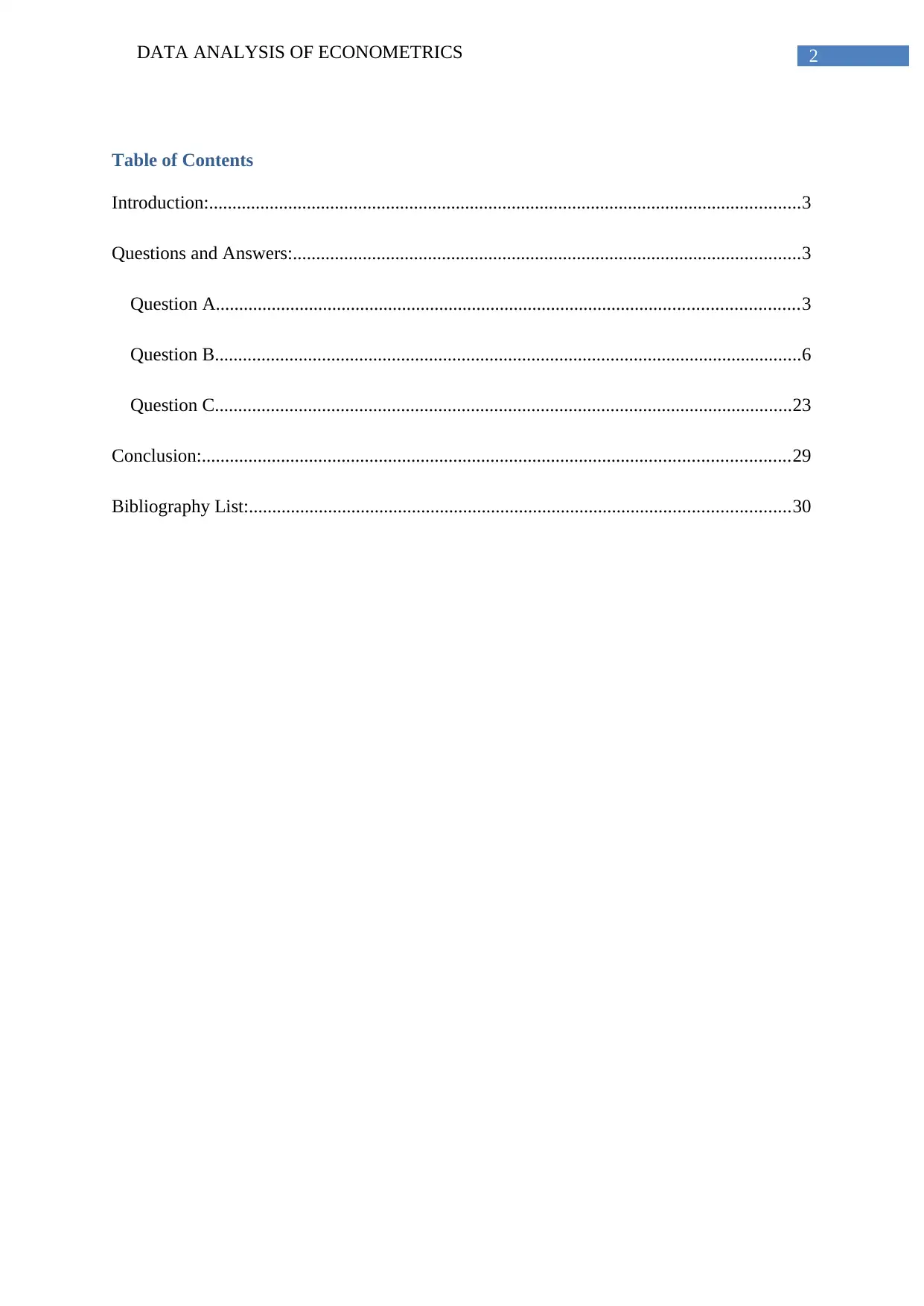

Table 1: Compound Annual Growth Rates of Various Australian Cities.

A2.

The city with the lowest growth is Perth at 0.89% in 2007-2016 and the city with the

highest growth is Sydney with 7.28% as shown in the 2013-2016.

A3.

SYDNEY:

The monthly payments are considered as PMT, as the loan is a collection of an annual

interest rate. The periodic payment where in this case the payments are paid monthly.

According to the assignment, the principal amount of Sydney is given as $608768.

To calculate PMT,

PMT = PV * [i / {1 - (1 + i)-n}]

Where, i = 0.5% (compounded monthly from 6%), t = 300 (300 months within 25

years since we are compounded monthly), PV = 608768(675000 – (20% * 675000))

PMT = $608768[0.5% / {1 – (1 + 0.5%)-300}] = $3922.300115

The amount needed to pay back is a total of $3922.3 per month.

A4.

Table 1: Compound Annual Growth Rates of Various Australian Cities.

A2.

The city with the lowest growth is Perth at 0.89% in 2007-2016 and the city with the

highest growth is Sydney with 7.28% as shown in the 2013-2016.

A3.

SYDNEY:

The monthly payments are considered as PMT, as the loan is a collection of an annual

interest rate. The periodic payment where in this case the payments are paid monthly.

According to the assignment, the principal amount of Sydney is given as $608768.

To calculate PMT,

PMT = PV * [i / {1 - (1 + i)-n}]

Where, i = 0.5% (compounded monthly from 6%), t = 300 (300 months within 25

years since we are compounded monthly), PV = 608768(675000 – (20% * 675000))

PMT = $608768[0.5% / {1 – (1 + 0.5%)-300}] = $3922.300115

The amount needed to pay back is a total of $3922.3 per month.

A4.

DATA ANALYSIS OF ECONOMETRICS 5

1

3

5

7

9

11

13

15

17

19

21

23

25

27

29

31

33

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Principal Amount

Interest Amount of SYDNEY

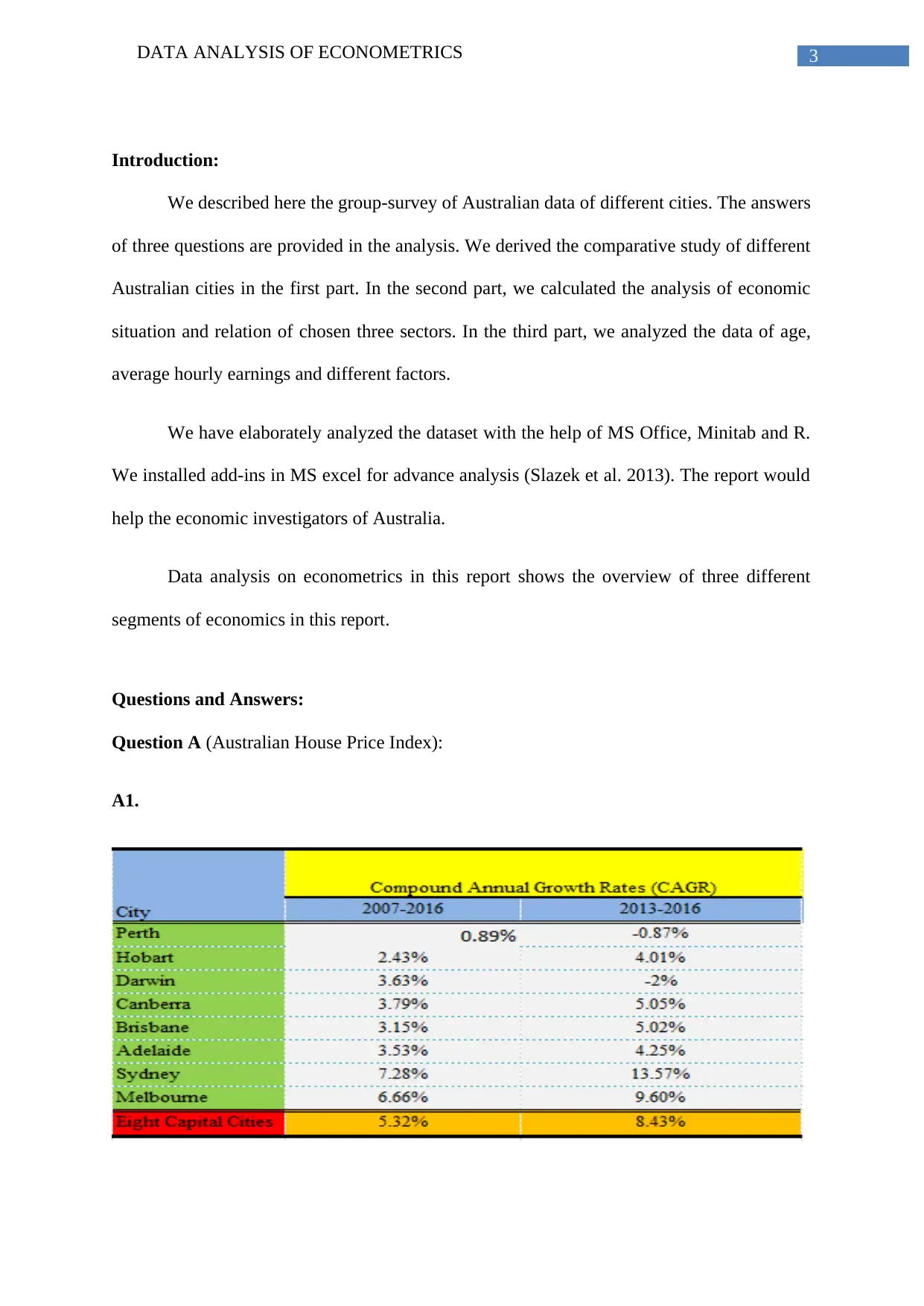

Figure 1: An Area Diagram shows the comparison between Principal Amount and

Percentage of Interest of Sydney.

The following figures are based off 24th month on data attached

Interest paid = $2937.057583

Principal Paid = $985.2346406

Total = $(2937.05+985.234) = $3922.3 = $3922.3

Percentage of payment paid to principal = 25.12%

A5.

The total amount of interest that will end up paying is = $567922.2263

The figure of total amount of interest is based on the appropriate calculation that also

includes all interest earning.

A6.

In the assignment,

1

3

5

7

9

11

13

15

17

19

21

23

25

27

29

31

33

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Principal Amount

Interest Amount of SYDNEY

Figure 1: An Area Diagram shows the comparison between Principal Amount and

Percentage of Interest of Sydney.

The following figures are based off 24th month on data attached

Interest paid = $2937.057583

Principal Paid = $985.2346406

Total = $(2937.05+985.234) = $3922.3 = $3922.3

Percentage of payment paid to principal = 25.12%

A5.

The total amount of interest that will end up paying is = $567922.2263

The figure of total amount of interest is based on the appropriate calculation that also

includes all interest earning.

A6.

In the assignment,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYSIS OF ECONOMETRICS 6

Sydney House Price: $675000

CAGR: 5.05%

Year 25: FV = Current Value*(1+r) n = 675000(1+5.05%) 25 = $2314128.793

House Appreciation = Future Value of House Price – Current Value of House Price

= 2314128.793 – 675000 = $1639128.793

As, $1639128.793 > $567922.2263; Therefore, we can say that, House Appreciation

> Total Interest Paid.

From our above calculation, we can conclude that the value of the house is greater

than the interest paid thus the value appreciation is sufficient to cover the total interest paid.

Question B.

The three chosen securities are industrial in Mix. And Fix., consumer services in

travel and tourism and healthcare providers. The value of ri in the industrial, consumer

services and Healthcare services are calculated separately.

B1.

A. Orthogonal Least Square (OLS) model of Adelaide Brighton (Market Value and

Stock Value):

Sydney House Price: $675000

CAGR: 5.05%

Year 25: FV = Current Value*(1+r) n = 675000(1+5.05%) 25 = $2314128.793

House Appreciation = Future Value of House Price – Current Value of House Price

= 2314128.793 – 675000 = $1639128.793

As, $1639128.793 > $567922.2263; Therefore, we can say that, House Appreciation

> Total Interest Paid.

From our above calculation, we can conclude that the value of the house is greater

than the interest paid thus the value appreciation is sufficient to cover the total interest paid.

Question B.

The three chosen securities are industrial in Mix. And Fix., consumer services in

travel and tourism and healthcare providers. The value of ri in the industrial, consumer

services and Healthcare services are calculated separately.

B1.

A. Orthogonal Least Square (OLS) model of Adelaide Brighton (Market Value and

Stock Value):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYSIS OF ECONOMETRICS 7

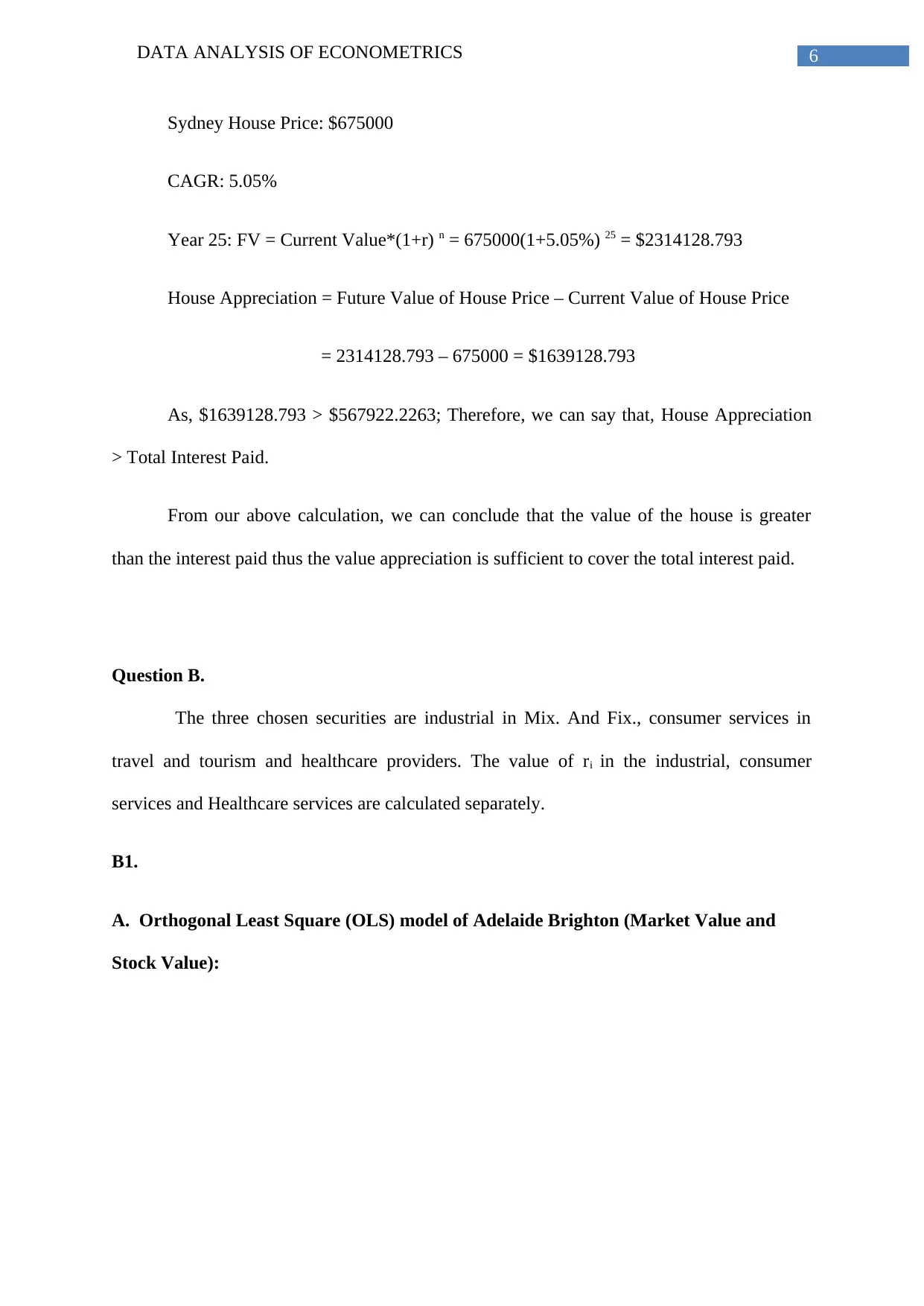

Table 2: Orthogonal Least Square regression model of Adelaide Brighton

-0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08 0.1

-2

-1.5

-1

-0.5

0

0.5

1

1.5

Adelaide Brighton Residual Plot

Residuals

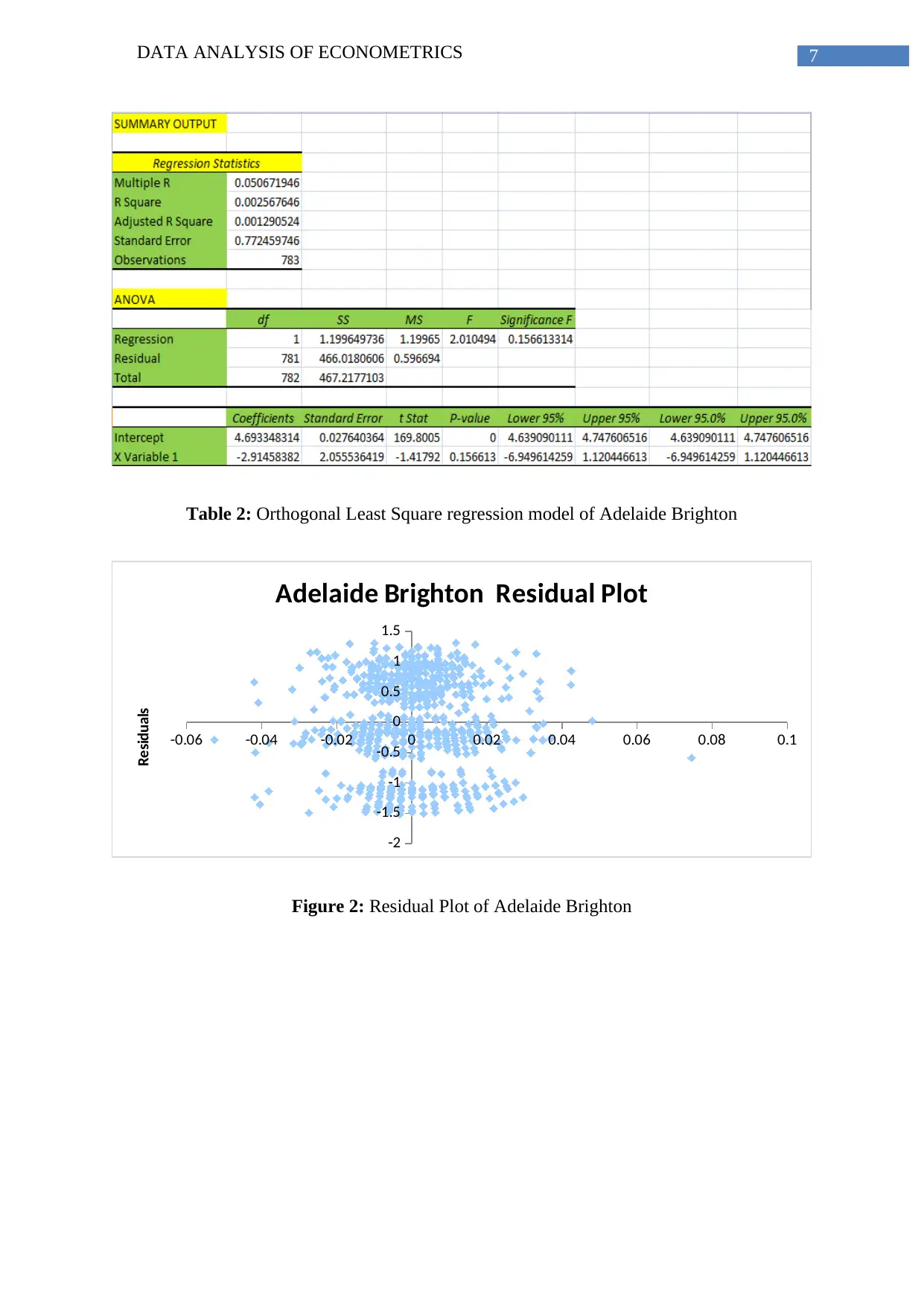

Figure 2: Residual Plot of Adelaide Brighton

Table 2: Orthogonal Least Square regression model of Adelaide Brighton

-0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08 0.1

-2

-1.5

-1

-0.5

0

0.5

1

1.5

Adelaide Brighton Residual Plot

Residuals

Figure 2: Residual Plot of Adelaide Brighton

DATA ANALYSIS OF ECONOMETRICS 8

0.005617978 0.024657534 0 0.005847953 0.033268102 0.014035088

0

1

2

3

4

5

6

7

Adelaide Brighton Line Fit Plot

Y

Predicted Y

Adelaide Brighton Prediction value

Y

Figure 3: Fitted residual line plot of Adelaide Brighton

B. Orthogonal Least Square (OLS) model of WEBJET (Market Value and Stock

Value):

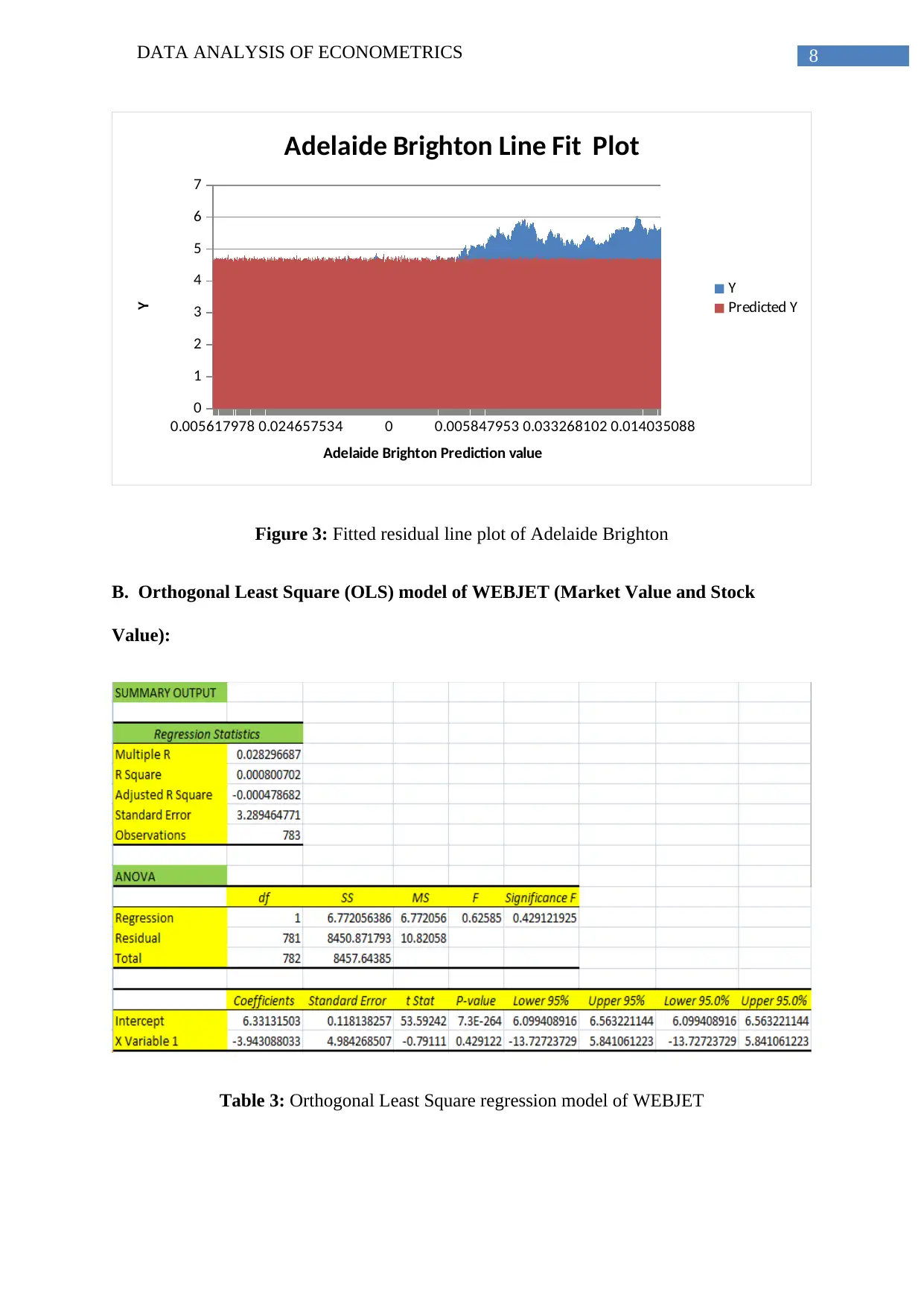

Table 3: Orthogonal Least Square regression model of WEBJET

0.005617978 0.024657534 0 0.005847953 0.033268102 0.014035088

0

1

2

3

4

5

6

7

Adelaide Brighton Line Fit Plot

Y

Predicted Y

Adelaide Brighton Prediction value

Y

Figure 3: Fitted residual line plot of Adelaide Brighton

B. Orthogonal Least Square (OLS) model of WEBJET (Market Value and Stock

Value):

Table 3: Orthogonal Least Square regression model of WEBJET

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYSIS OF ECONOMETRICS 9

-0.15 -0.1 -0.05 0 0.05 0.1 0.15 0.2 0.25

-6

-4

-2

0

2

4

6

8

WEBJET Residual Plot

WEBJET Value

Residuals

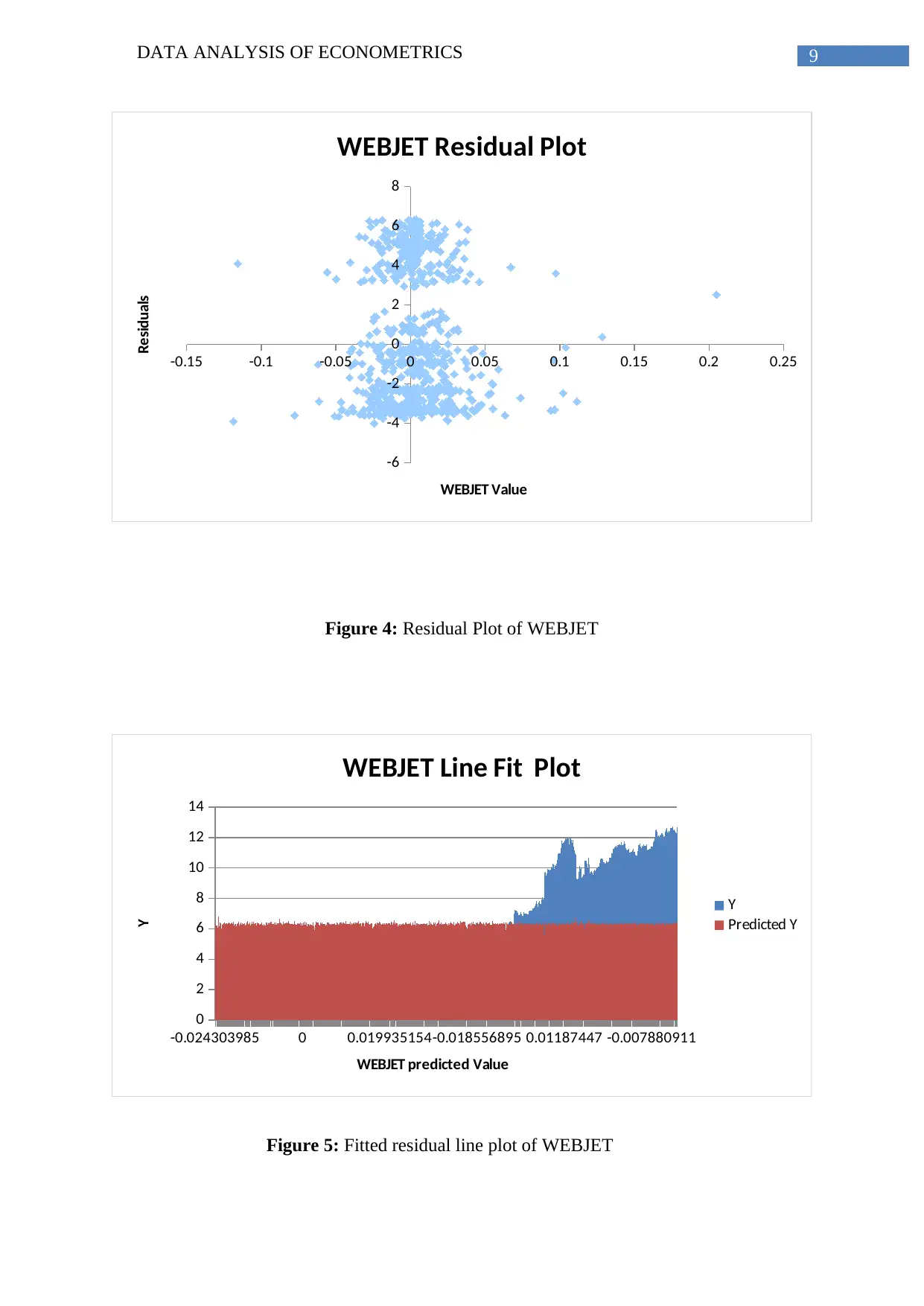

Figure 4: Residual Plot of WEBJET

-0.024303985 0 0.019935154-0.018556895 0.01187447 -0.007880911

0

2

4

6

8

10

12

14

WEBJET Line Fit Plot

Y

Predicted Y

WEBJET predicted Value

Y

Figure 5: Fitted residual line plot of WEBJET

-0.15 -0.1 -0.05 0 0.05 0.1 0.15 0.2 0.25

-6

-4

-2

0

2

4

6

8

WEBJET Residual Plot

WEBJET Value

Residuals

Figure 4: Residual Plot of WEBJET

-0.024303985 0 0.019935154-0.018556895 0.01187447 -0.007880911

0

2

4

6

8

10

12

14

WEBJET Line Fit Plot

Y

Predicted Y

WEBJET predicted Value

Y

Figure 5: Fitted residual line plot of WEBJET

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYSIS OF ECONOMETRICS 10

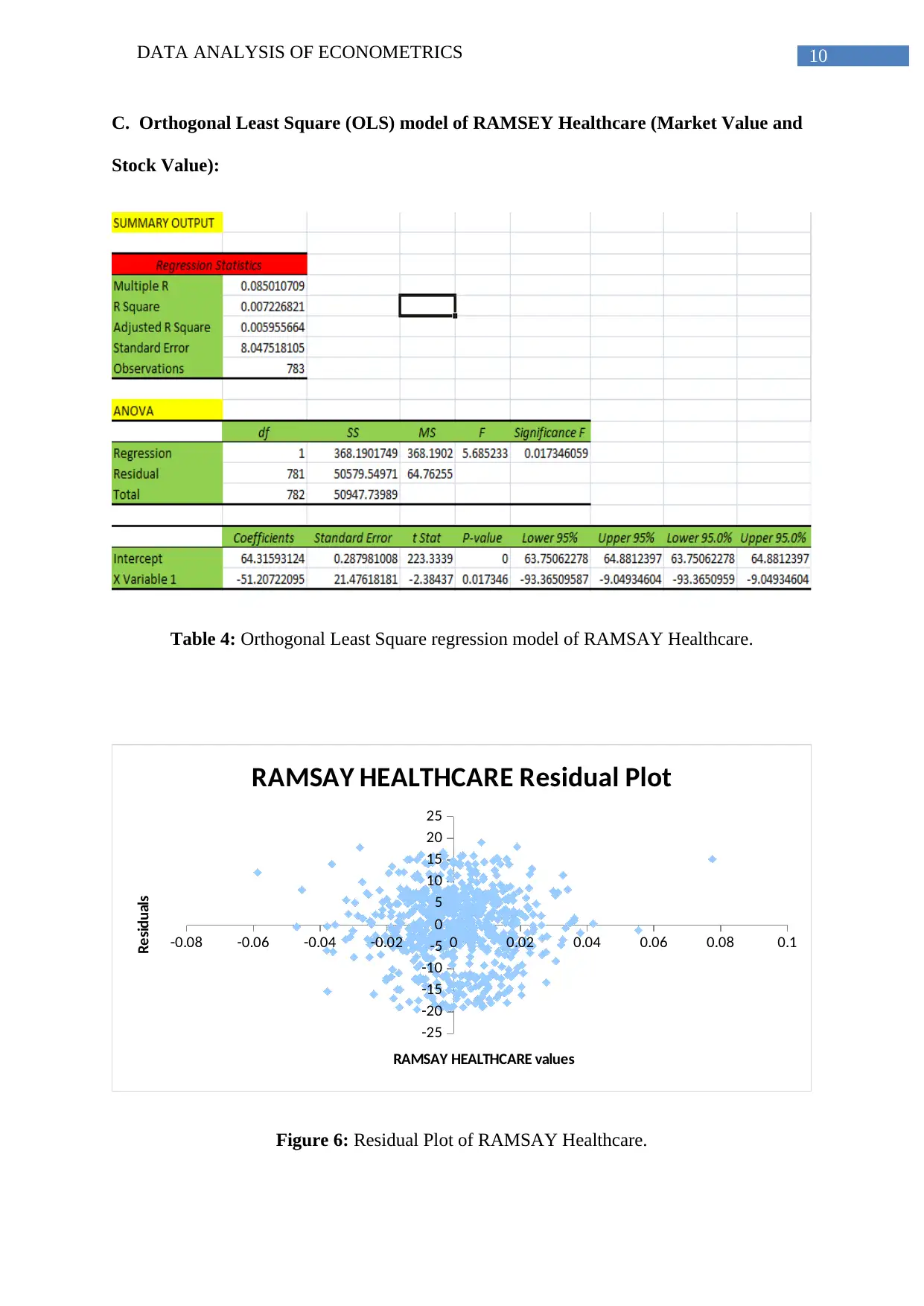

C. Orthogonal Least Square (OLS) model of RAMSEY Healthcare (Market Value and

Stock Value):

Table 4: Orthogonal Least Square regression model of RAMSAY Healthcare.

-0.08 -0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08 0.1

-25

-20

-15

-10

-5

0

5

10

15

20

25

RAMSAY HEALTHCARE Residual Plot

RAMSAY HEALTHCARE values

Residuals

Figure 6: Residual Plot of RAMSAY Healthcare.

C. Orthogonal Least Square (OLS) model of RAMSEY Healthcare (Market Value and

Stock Value):

Table 4: Orthogonal Least Square regression model of RAMSAY Healthcare.

-0.08 -0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08 0.1

-25

-20

-15

-10

-5

0

5

10

15

20

25

RAMSAY HEALTHCARE Residual Plot

RAMSAY HEALTHCARE values

Residuals

Figure 6: Residual Plot of RAMSAY Healthcare.

DATA ANALYSIS OF ECONOMETRICS 11

0.011123228 0.012152489 -0.012295772 0.015063168 0.016322404 0.008878128

0

10

20

30

40

50

60

70

80

90

RAMSAY HEALTHCARE Line Fit Plot

Y

Predicted Y

RAMSAY Healthcare predicted values

Y

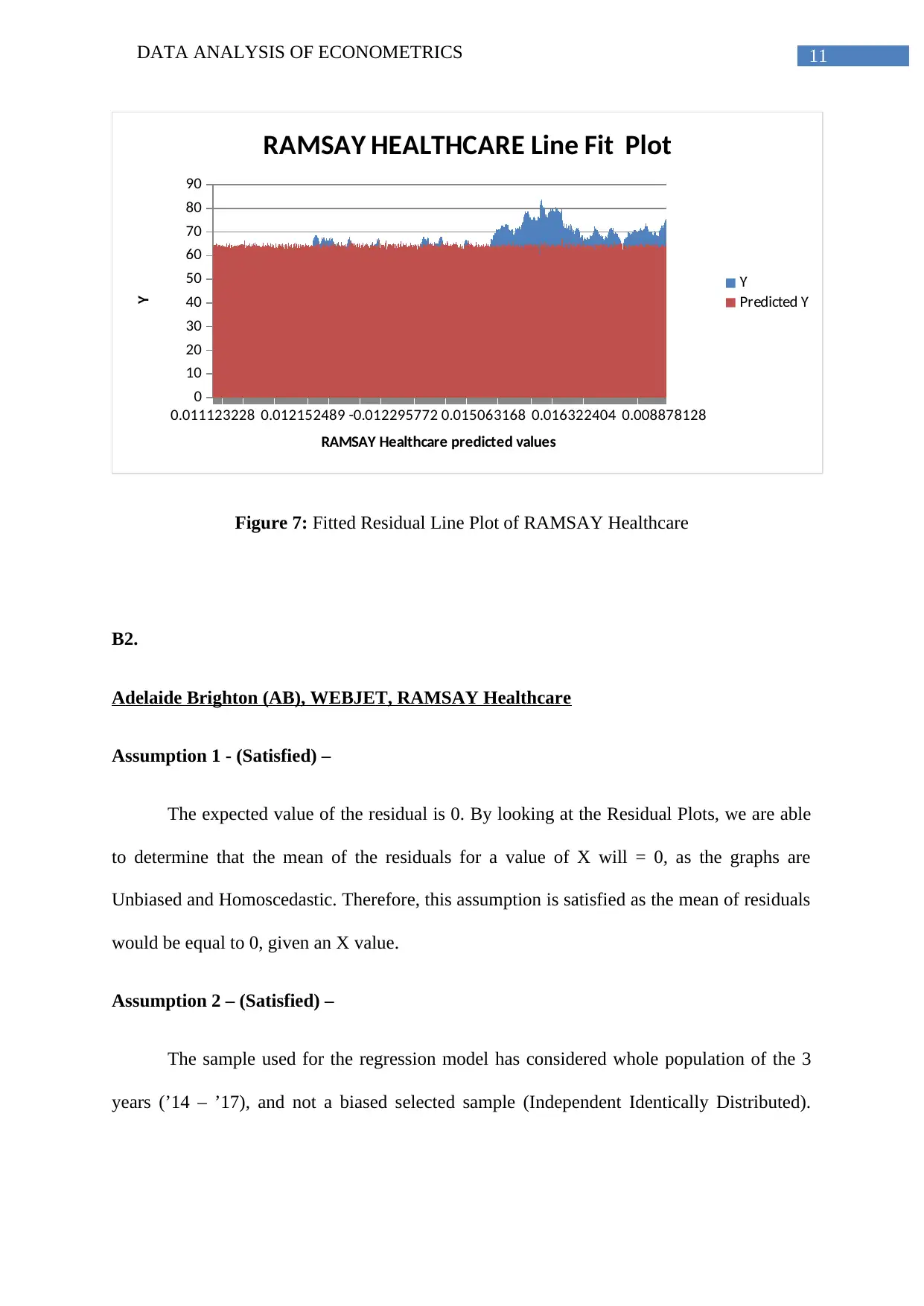

Figure 7: Fitted Residual Line Plot of RAMSAY Healthcare

B2.

Adelaide Brighton (AB), WEBJET, RAMSAY Healthcare

Assumption 1 - (Satisfied) –

The expected value of the residual is 0. By looking at the Residual Plots, we are able

to determine that the mean of the residuals for a value of X will = 0, as the graphs are

Unbiased and Homoscedastic. Therefore, this assumption is satisfied as the mean of residuals

would be equal to 0, given an X value.

Assumption 2 – (Satisfied) –

The sample used for the regression model has considered whole population of the 3

years (’14 – ’17), and not a biased selected sample (Independent Identically Distributed).

0.011123228 0.012152489 -0.012295772 0.015063168 0.016322404 0.008878128

0

10

20

30

40

50

60

70

80

90

RAMSAY HEALTHCARE Line Fit Plot

Y

Predicted Y

RAMSAY Healthcare predicted values

Y

Figure 7: Fitted Residual Line Plot of RAMSAY Healthcare

B2.

Adelaide Brighton (AB), WEBJET, RAMSAY Healthcare

Assumption 1 - (Satisfied) –

The expected value of the residual is 0. By looking at the Residual Plots, we are able

to determine that the mean of the residuals for a value of X will = 0, as the graphs are

Unbiased and Homoscedastic. Therefore, this assumption is satisfied as the mean of residuals

would be equal to 0, given an X value.

Assumption 2 – (Satisfied) –

The sample used for the regression model has considered whole population of the 3

years (’14 – ’17), and not a biased selected sample (Independent Identically Distributed).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 35

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.