Econometrics Assignment: Analysis of Economic Data and Models

VerifiedAdded on 2020/10/05

|16

|2449

|55

Homework Assignment

AI Summary

This econometrics assignment focuses on analyzing consumption expenditure using both simple and multiple regression models. The student utilizes hypothetical data and Excel to perform ordinary least squares (OLS) estimations, generate scatter diagrams illustrating relationships between variables like income and wealth, and conduct t-tests and F-tests at a 5% significance level. The assignment covers the interpretation of regression coefficients, the coefficient of determination, and the evaluation of hypotheses. The student explores the relationship between consumption expenditure and annual disposable income and level of wealth, providing interpretations of the regression results and conducting statistical tests to assess the significance of the findings. The analysis includes predicting total consumer expenditure using the generated regression equations and evaluating the overall results. The solution includes the use of Excel for calculations and statistical tests.

ECONOMETRIC

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

QUESTION......................................................................................................................................3

Hypothetical Data: Parts A and B..........................................................................................3

Part (A): Simple Linear Regression Model............................................................................3

(1)(b) Scatter diagram depicting Relationship between Total Consumption Expenditure and

Level of Wealth:.....................................................................................................................4

2.(a) Estimation and Interpretation of Regression by Ordinary Least Squares Method using

Excel:......................................................................................................................................5

2.(b) T-test conducted at 5% significance level.....................................................................5

3.(a)Determination of coefficient of determination and generating F-test output..................5

4.(a)Estimation and Interpretation of Regression by Ordinary Least Squares Method.........6

4.(b) T-test conducted at 5% significance level using Excel:................................................6

5.(a)generating F-test output using information in regression summary...............................7

6.Predicting total consumer expenditure using sample regression equation..........................7

Part (B): Multiple Regression Model:..............................................................................................8

7.Linear Regression Data under Multiple Regression Model................................................8

9.Calculation of Coefficient of multiple determination.........................................................8

10. Testing null hypotheses at 5% significance level.............................................................9

11.Testing joint hypotheses at 5% significance level...........................................................10

12: Findings..........................................................................................................................10

13: Evaluation of the results.................................................................................................10

APPENDIX:...................................................................................................................................12

QUESTION......................................................................................................................................3

Hypothetical Data: Parts A and B..........................................................................................3

Part (A): Simple Linear Regression Model............................................................................3

(1)(b) Scatter diagram depicting Relationship between Total Consumption Expenditure and

Level of Wealth:.....................................................................................................................4

2.(a) Estimation and Interpretation of Regression by Ordinary Least Squares Method using

Excel:......................................................................................................................................5

2.(b) T-test conducted at 5% significance level.....................................................................5

3.(a)Determination of coefficient of determination and generating F-test output..................5

4.(a)Estimation and Interpretation of Regression by Ordinary Least Squares Method.........6

4.(b) T-test conducted at 5% significance level using Excel:................................................6

5.(a)generating F-test output using information in regression summary...............................7

6.Predicting total consumer expenditure using sample regression equation..........................7

Part (B): Multiple Regression Model:..............................................................................................8

7.Linear Regression Data under Multiple Regression Model................................................8

9.Calculation of Coefficient of multiple determination.........................................................8

10. Testing null hypotheses at 5% significance level.............................................................9

11.Testing joint hypotheses at 5% significance level...........................................................10

12: Findings..........................................................................................................................10

13: Evaluation of the results.................................................................................................10

APPENDIX:...................................................................................................................................12

QUESTION

Hypothetical Data: Parts A and B

The table shown in Appendix provides data consisting of a dependent variable (Y), Total

consumption expenditure on non-durables and services and two independent variables, Annual

Disposable Income and Level of Wealth.

Part (A): Simple Linear Regression Model

Simple Linear Regression Model explains the relationship between two or more

variables, of which one is a dependent variable and other is independent variable. Independent

variables are denoted by letter X and dependent variables are denoted by letter Y. The relation

between these two can be explained with the help of the equation Y=a+bx+c where, Y is the

dependent variable; a is the intercept term; b denotes regression coefficient on independent

variable; x denotes independent variable and e denotes residual error. In order to draw

conclusions easily, researchers usually take help of graphs such as Scatter diagrams.

Scatter Diagrams:

Scatter Diagrams are graphical representation of two variables that show any correlation

between the variables. Generally, the first variable represents an independent variable (X) and a

dependent variable (Y), Total Consumption Expenditure in this case. The above sample takes

two independent variables for the value of X- Annual disposable income and Level of wealth.

The scatter diagrams depicting the relationship between these independent variables and

independent variables has been shown below:

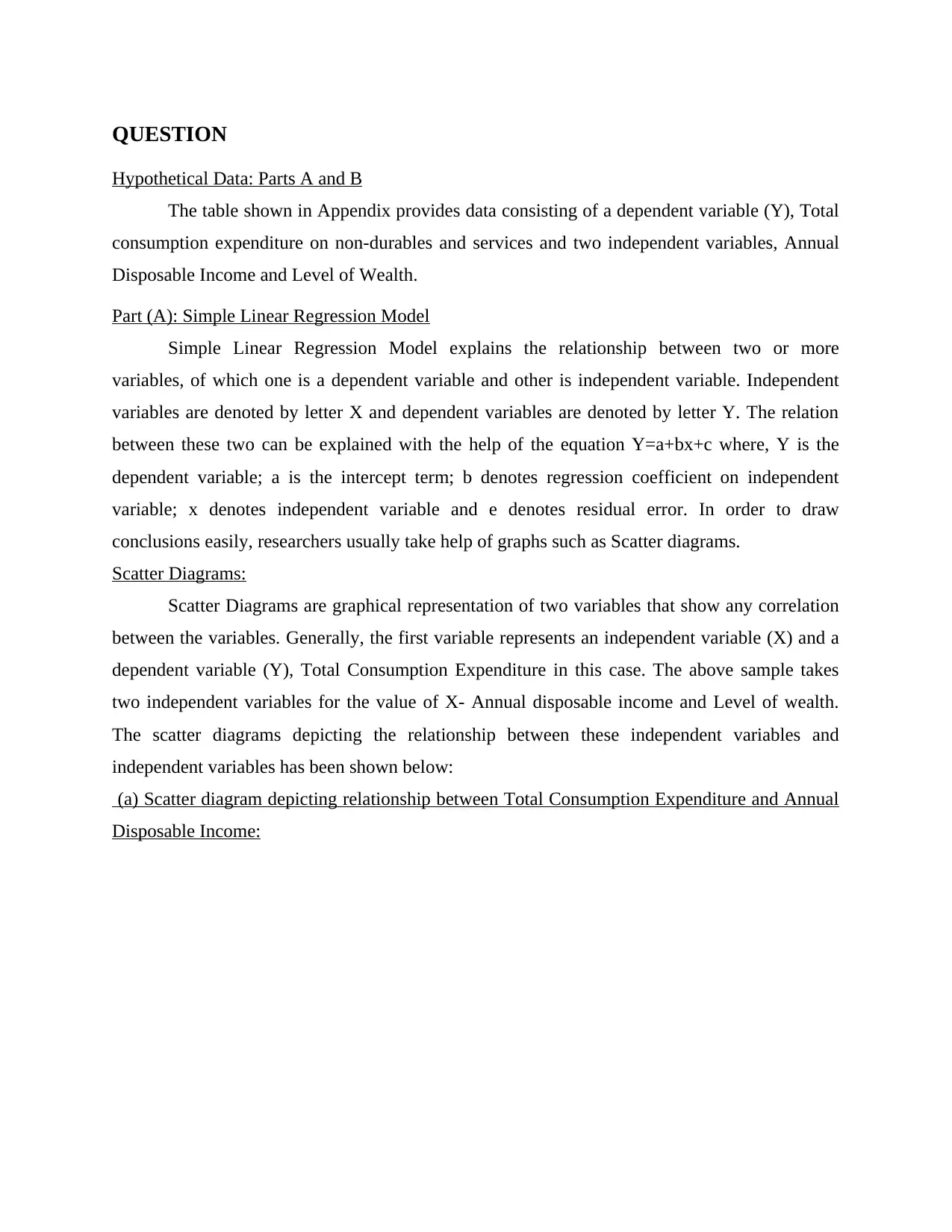

(a) Scatter diagram depicting relationship between Total Consumption Expenditure and Annual

Disposable Income:

Hypothetical Data: Parts A and B

The table shown in Appendix provides data consisting of a dependent variable (Y), Total

consumption expenditure on non-durables and services and two independent variables, Annual

Disposable Income and Level of Wealth.

Part (A): Simple Linear Regression Model

Simple Linear Regression Model explains the relationship between two or more

variables, of which one is a dependent variable and other is independent variable. Independent

variables are denoted by letter X and dependent variables are denoted by letter Y. The relation

between these two can be explained with the help of the equation Y=a+bx+c where, Y is the

dependent variable; a is the intercept term; b denotes regression coefficient on independent

variable; x denotes independent variable and e denotes residual error. In order to draw

conclusions easily, researchers usually take help of graphs such as Scatter diagrams.

Scatter Diagrams:

Scatter Diagrams are graphical representation of two variables that show any correlation

between the variables. Generally, the first variable represents an independent variable (X) and a

dependent variable (Y), Total Consumption Expenditure in this case. The above sample takes

two independent variables for the value of X- Annual disposable income and Level of wealth.

The scatter diagrams depicting the relationship between these independent variables and

independent variables has been shown below:

(a) Scatter diagram depicting relationship between Total Consumption Expenditure and Annual

Disposable Income:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

0 200 400 600 800 1000 1200

0

100

200

300

400

500

600

700

800

900

1000

Annual Disposable Income

Total Consumption Expenditure

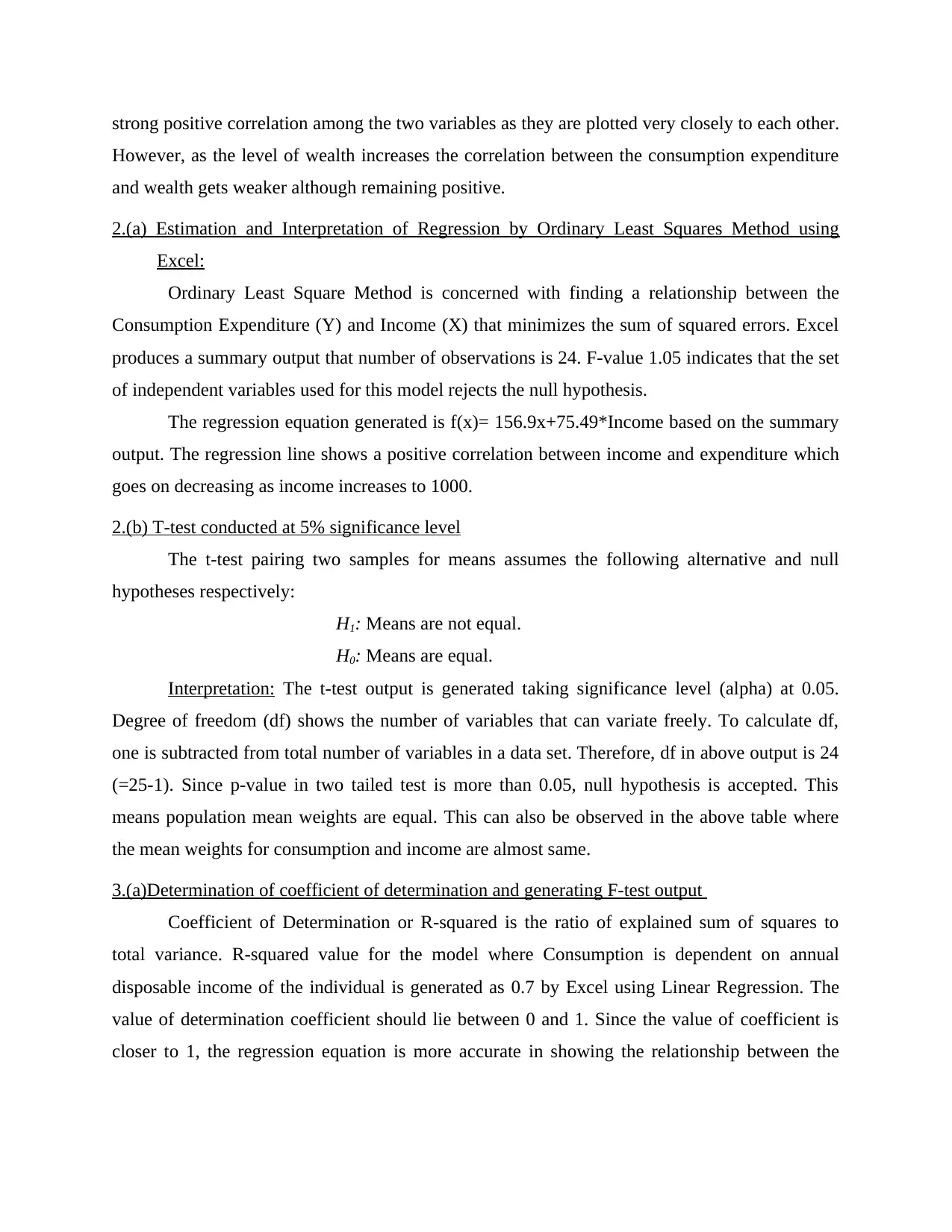

Interpretation: The X-axis plots Annual Disposable Income (independent variable) and

Y-axis plots Total Consumption Expenditure (dependent variable). The scatter diagram shows a

positive correlation among the two variables as they are not scattered very far away from each

other. This straight line is called Linear Regression Line. It is clear from the scatter plot that as

the annual disposable income of an individual increases the correlation between the consumption

expenditure and income gets weaker although remaining positive.

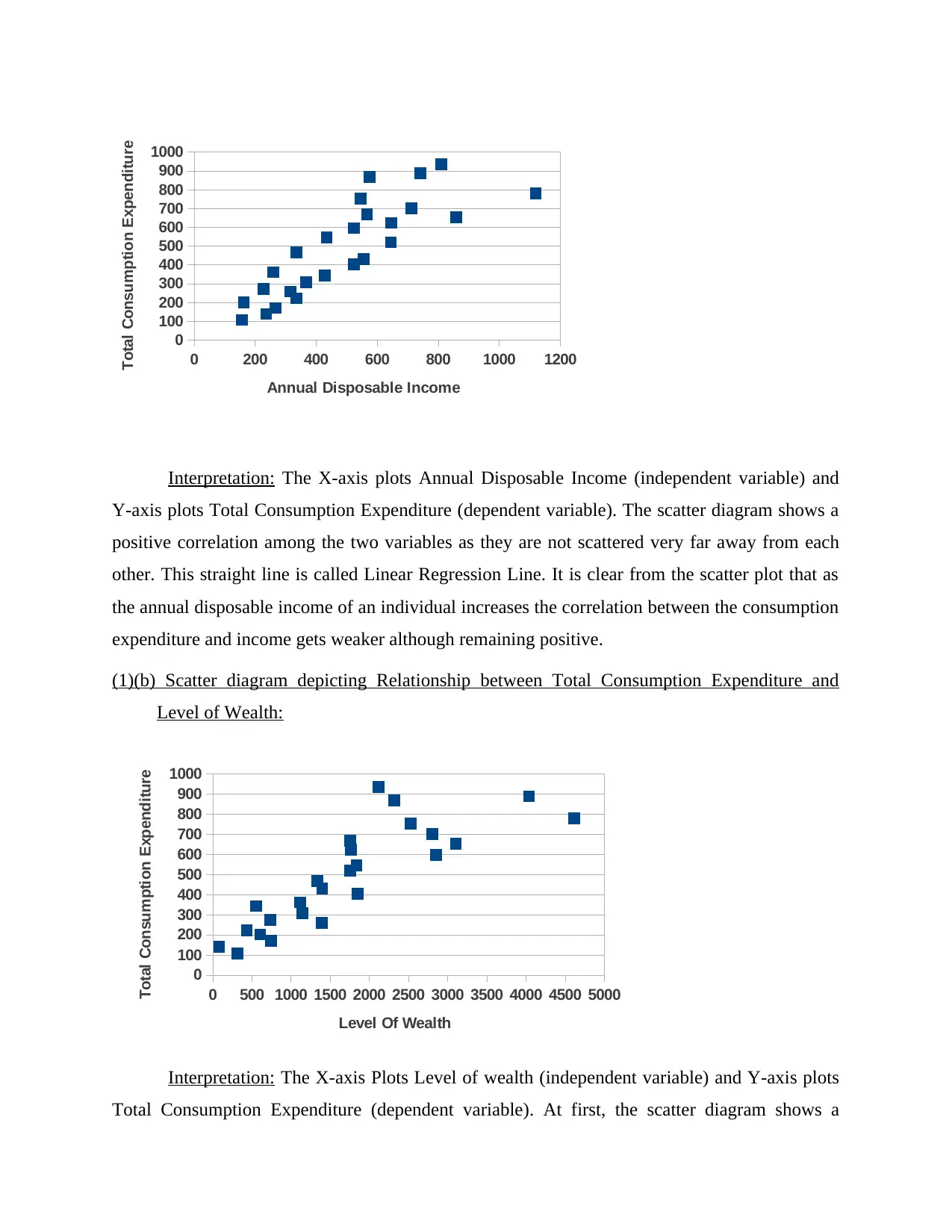

(1)(b) Scatter diagram depicting Relationship between Total Consumption Expenditure and

Level of Wealth:

0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000

0

100

200

300

400

500

600

700

800

900

1000

Level Of Wealth

Total Consumption Expenditure

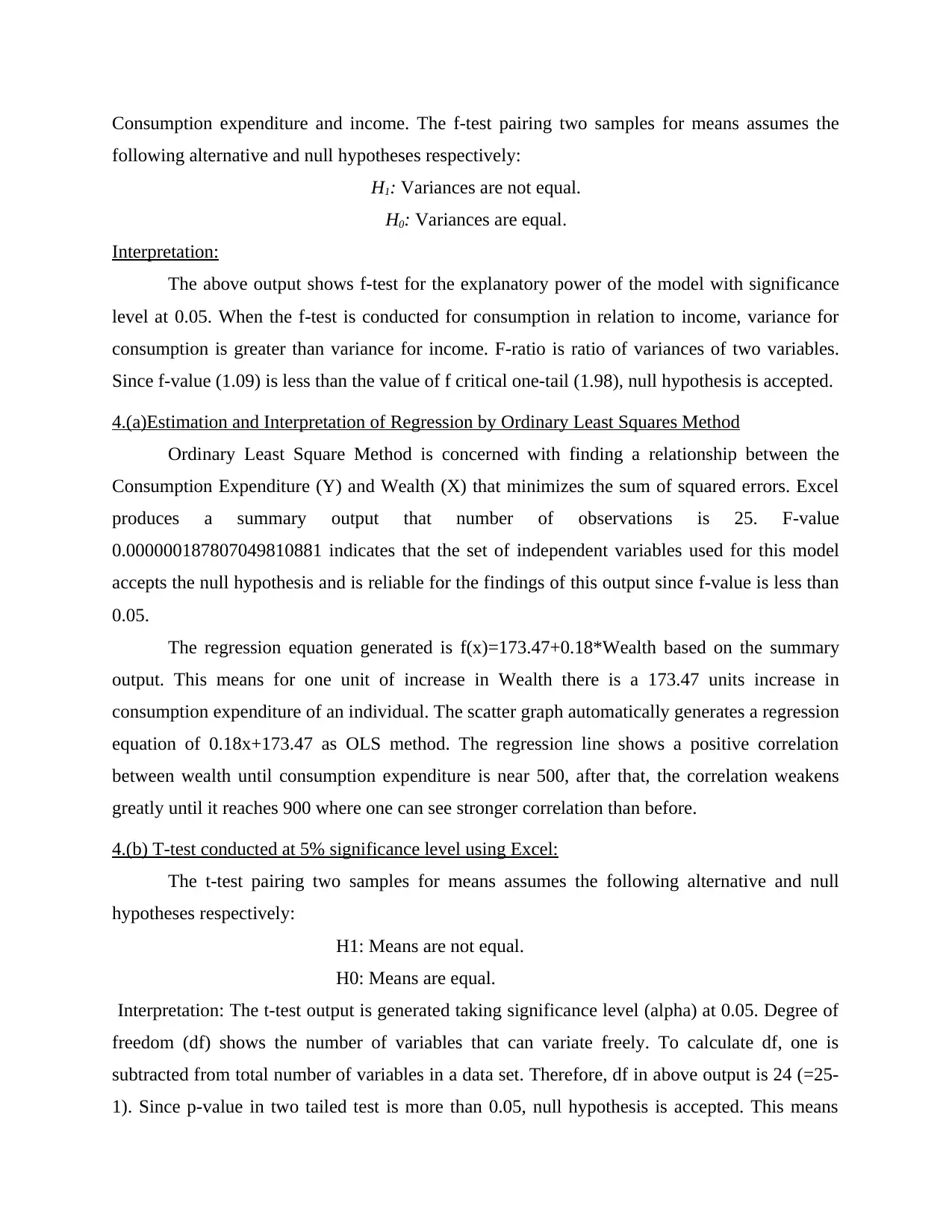

Interpretation: The X-axis Plots Level of wealth (independent variable) and Y-axis plots

Total Consumption Expenditure (dependent variable). At first, the scatter diagram shows a

0

100

200

300

400

500

600

700

800

900

1000

Annual Disposable Income

Total Consumption Expenditure

Interpretation: The X-axis plots Annual Disposable Income (independent variable) and

Y-axis plots Total Consumption Expenditure (dependent variable). The scatter diagram shows a

positive correlation among the two variables as they are not scattered very far away from each

other. This straight line is called Linear Regression Line. It is clear from the scatter plot that as

the annual disposable income of an individual increases the correlation between the consumption

expenditure and income gets weaker although remaining positive.

(1)(b) Scatter diagram depicting Relationship between Total Consumption Expenditure and

Level of Wealth:

0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000

0

100

200

300

400

500

600

700

800

900

1000

Level Of Wealth

Total Consumption Expenditure

Interpretation: The X-axis Plots Level of wealth (independent variable) and Y-axis plots

Total Consumption Expenditure (dependent variable). At first, the scatter diagram shows a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

strong positive correlation among the two variables as they are plotted very closely to each other.

However, as the level of wealth increases the correlation between the consumption expenditure

and wealth gets weaker although remaining positive.

2.(a) Estimation and Interpretation of Regression by Ordinary Least Squares Method using

Excel:

Ordinary Least Square Method is concerned with finding a relationship between the

Consumption Expenditure (Y) and Income (X) that minimizes the sum of squared errors. Excel

produces a summary output that number of observations is 24. F-value 1.05 indicates that the set

of independent variables used for this model rejects the null hypothesis.

The regression equation generated is f(x)= 156.9x+75.49*Income based on the summary

output. The regression line shows a positive correlation between income and expenditure which

goes on decreasing as income increases to 1000.

2.(b) T-test conducted at 5% significance level

The t-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Means are not equal.

H0: Means are equal.

Interpretation: The t-test output is generated taking significance level (alpha) at 0.05.

Degree of freedom (df) shows the number of variables that can variate freely. To calculate df,

one is subtracted from total number of variables in a data set. Therefore, df in above output is 24

(=25-1). Since p-value in two tailed test is more than 0.05, null hypothesis is accepted. This

means population mean weights are equal. This can also be observed in the above table where

the mean weights for consumption and income are almost same.

3.(a)Determination of coefficient of determination and generating F-test output

Coefficient of Determination or R-squared is the ratio of explained sum of squares to

total variance. R-squared value for the model where Consumption is dependent on annual

disposable income of the individual is generated as 0.7 by Excel using Linear Regression. The

value of determination coefficient should lie between 0 and 1. Since the value of coefficient is

closer to 1, the regression equation is more accurate in showing the relationship between the

However, as the level of wealth increases the correlation between the consumption expenditure

and wealth gets weaker although remaining positive.

2.(a) Estimation and Interpretation of Regression by Ordinary Least Squares Method using

Excel:

Ordinary Least Square Method is concerned with finding a relationship between the

Consumption Expenditure (Y) and Income (X) that minimizes the sum of squared errors. Excel

produces a summary output that number of observations is 24. F-value 1.05 indicates that the set

of independent variables used for this model rejects the null hypothesis.

The regression equation generated is f(x)= 156.9x+75.49*Income based on the summary

output. The regression line shows a positive correlation between income and expenditure which

goes on decreasing as income increases to 1000.

2.(b) T-test conducted at 5% significance level

The t-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Means are not equal.

H0: Means are equal.

Interpretation: The t-test output is generated taking significance level (alpha) at 0.05.

Degree of freedom (df) shows the number of variables that can variate freely. To calculate df,

one is subtracted from total number of variables in a data set. Therefore, df in above output is 24

(=25-1). Since p-value in two tailed test is more than 0.05, null hypothesis is accepted. This

means population mean weights are equal. This can also be observed in the above table where

the mean weights for consumption and income are almost same.

3.(a)Determination of coefficient of determination and generating F-test output

Coefficient of Determination or R-squared is the ratio of explained sum of squares to

total variance. R-squared value for the model where Consumption is dependent on annual

disposable income of the individual is generated as 0.7 by Excel using Linear Regression. The

value of determination coefficient should lie between 0 and 1. Since the value of coefficient is

closer to 1, the regression equation is more accurate in showing the relationship between the

Consumption expenditure and income. The f-test pairing two samples for means assumes the

following alternative and null hypotheses respectively:

H1: Variances are not equal.

H0: Variances are equal.

Interpretation:

The above output shows f-test for the explanatory power of the model with significance

level at 0.05. When the f-test is conducted for consumption in relation to income, variance for

consumption is greater than variance for income. F-ratio is ratio of variances of two variables.

Since f-value (1.09) is less than the value of f critical one-tail (1.98), null hypothesis is accepted.

4.(a)Estimation and Interpretation of Regression by Ordinary Least Squares Method

Ordinary Least Square Method is concerned with finding a relationship between the

Consumption Expenditure (Y) and Wealth (X) that minimizes the sum of squared errors. Excel

produces a summary output that number of observations is 25. F-value

0.000000187807049810881 indicates that the set of independent variables used for this model

accepts the null hypothesis and is reliable for the findings of this output since f-value is less than

0.05.

The regression equation generated is f(x)=173.47+0.18*Wealth based on the summary

output. This means for one unit of increase in Wealth there is a 173.47 units increase in

consumption expenditure of an individual. The scatter graph automatically generates a regression

equation of 0.18x+173.47 as OLS method. The regression line shows a positive correlation

between wealth until consumption expenditure is near 500, after that, the correlation weakens

greatly until it reaches 900 where one can see stronger correlation than before.

4.(b) T-test conducted at 5% significance level using Excel:

The t-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Means are not equal.

H0: Means are equal.

Interpretation: The t-test output is generated taking significance level (alpha) at 0.05. Degree of

freedom (df) shows the number of variables that can variate freely. To calculate df, one is

subtracted from total number of variables in a data set. Therefore, df in above output is 24 (=25-

1). Since p-value in two tailed test is more than 0.05, null hypothesis is accepted. This means

following alternative and null hypotheses respectively:

H1: Variances are not equal.

H0: Variances are equal.

Interpretation:

The above output shows f-test for the explanatory power of the model with significance

level at 0.05. When the f-test is conducted for consumption in relation to income, variance for

consumption is greater than variance for income. F-ratio is ratio of variances of two variables.

Since f-value (1.09) is less than the value of f critical one-tail (1.98), null hypothesis is accepted.

4.(a)Estimation and Interpretation of Regression by Ordinary Least Squares Method

Ordinary Least Square Method is concerned with finding a relationship between the

Consumption Expenditure (Y) and Wealth (X) that minimizes the sum of squared errors. Excel

produces a summary output that number of observations is 25. F-value

0.000000187807049810881 indicates that the set of independent variables used for this model

accepts the null hypothesis and is reliable for the findings of this output since f-value is less than

0.05.

The regression equation generated is f(x)=173.47+0.18*Wealth based on the summary

output. This means for one unit of increase in Wealth there is a 173.47 units increase in

consumption expenditure of an individual. The scatter graph automatically generates a regression

equation of 0.18x+173.47 as OLS method. The regression line shows a positive correlation

between wealth until consumption expenditure is near 500, after that, the correlation weakens

greatly until it reaches 900 where one can see stronger correlation than before.

4.(b) T-test conducted at 5% significance level using Excel:

The t-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Means are not equal.

H0: Means are equal.

Interpretation: The t-test output is generated taking significance level (alpha) at 0.05. Degree of

freedom (df) shows the number of variables that can variate freely. To calculate df, one is

subtracted from total number of variables in a data set. Therefore, df in above output is 24 (=25-

1). Since p-value in two tailed test is more than 0.05, null hypothesis is accepted. This means

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

population mean weights are equal. This can also be observed in the above table where the mean

weights for consumption and income are almost same.

5.(a)generating F-test output using information in regression summary

The f-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Variances are not equal.

H0: Variances are equal.

Interpretation:

The above output shows f-test for the explanatory power of the model with f-value at

0.047. When f-test is conducted for consumption in relation to wealth, variance for wealth is

greater than variance for consumption. This means with a small variation in consumption wealth

variates greatly. F-value (0.048) is less than the value of f critical one-tail (0.05), thus, null

hypothesis is accepted.

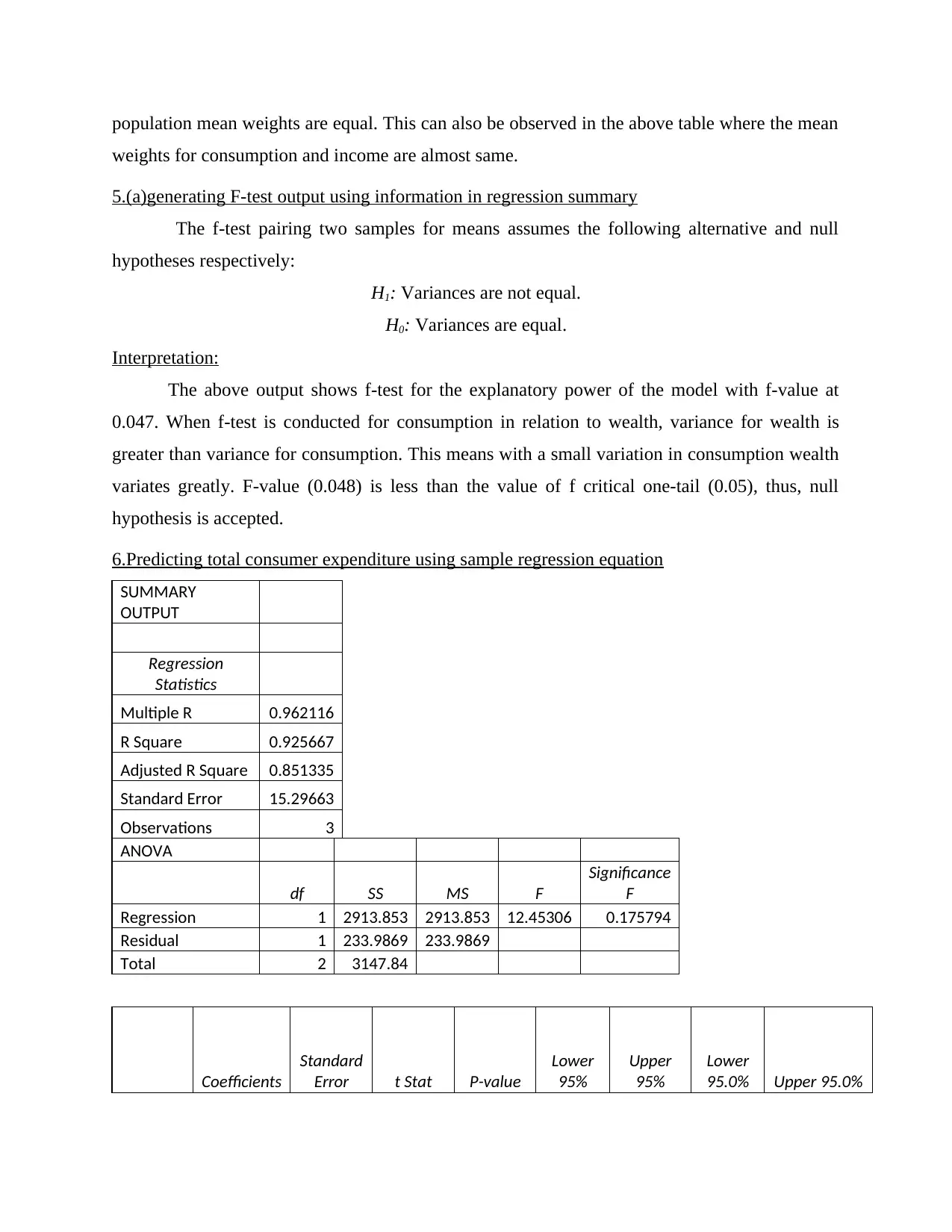

6.Predicting total consumer expenditure using sample regression equation

SUMMARY

OUTPUT

Regression

Statistics

Multiple R 0.962116

R Square 0.925667

Adjusted R Square 0.851335

Standard Error 15.29663

Observations 3

ANOVA

df SS MS F

Significance

F

Regression 1 2913.853 2913.853 12.45306 0.175794

Residual 1 233.9869 233.9869

Total 2 3147.84

Coefficients

Standard

Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0% Upper 95.0%

weights for consumption and income are almost same.

5.(a)generating F-test output using information in regression summary

The f-test pairing two samples for means assumes the following alternative and null

hypotheses respectively:

H1: Variances are not equal.

H0: Variances are equal.

Interpretation:

The above output shows f-test for the explanatory power of the model with f-value at

0.047. When f-test is conducted for consumption in relation to wealth, variance for wealth is

greater than variance for consumption. This means with a small variation in consumption wealth

variates greatly. F-value (0.048) is less than the value of f critical one-tail (0.05), thus, null

hypothesis is accepted.

6.Predicting total consumer expenditure using sample regression equation

SUMMARY

OUTPUT

Regression

Statistics

Multiple R 0.962116

R Square 0.925667

Adjusted R Square 0.851335

Standard Error 15.29663

Observations 3

ANOVA

df SS MS F

Significance

F

Regression 1 2913.853 2913.853 12.45306 0.175794

Residual 1 233.9869 233.9869

Total 2 3147.84

Coefficients

Standard

Error t Stat P-value

Lower

95%

Upper

95%

Lower

95.0% Upper 95.0%

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

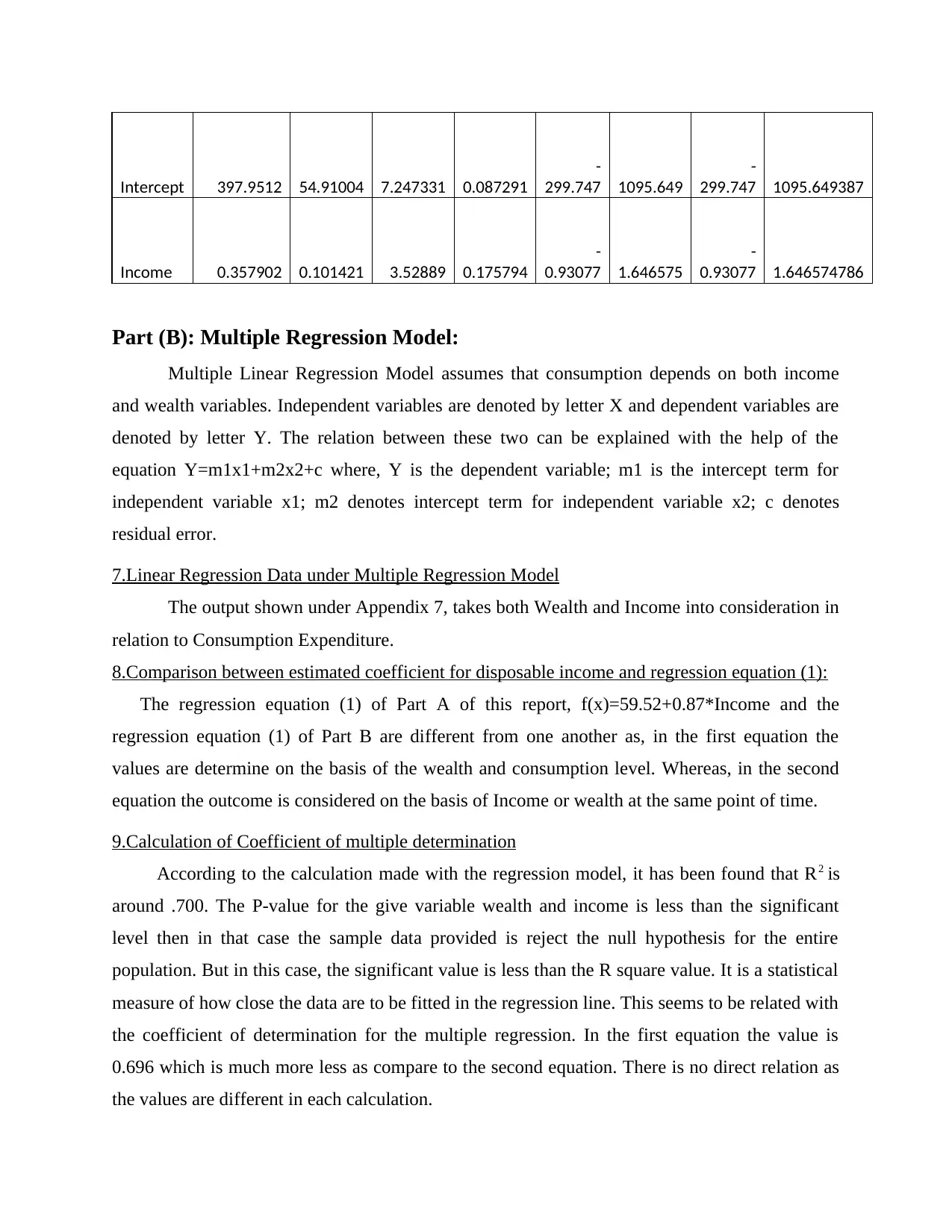

Intercept 397.9512 54.91004 7.247331 0.087291

-

299.747 1095.649

-

299.747 1095.649387

Income 0.357902 0.101421 3.52889 0.175794

-

0.93077 1.646575

-

0.93077 1.646574786

Part (B): Multiple Regression Model:

Multiple Linear Regression Model assumes that consumption depends on both income

and wealth variables. Independent variables are denoted by letter X and dependent variables are

denoted by letter Y. The relation between these two can be explained with the help of the

equation Y=m1x1+m2x2+c where, Y is the dependent variable; m1 is the intercept term for

independent variable x1; m2 denotes intercept term for independent variable x2; c denotes

residual error.

7.Linear Regression Data under Multiple Regression Model

The output shown under Appendix 7, takes both Wealth and Income into consideration in

relation to Consumption Expenditure.

8.Comparison between estimated coefficient for disposable income and regression equation (1):

The regression equation (1) of Part A of this report, f(x)=59.52+0.87*Income and the

regression equation (1) of Part B are different from one another as, in the first equation the

values are determine on the basis of the wealth and consumption level. Whereas, in the second

equation the outcome is considered on the basis of Income or wealth at the same point of time.

9.Calculation of Coefficient of multiple determination

According to the calculation made with the regression model, it has been found that R2 is

around .700. The P-value for the give variable wealth and income is less than the significant

level then in that case the sample data provided is reject the null hypothesis for the entire

population. But in this case, the significant value is less than the R square value. It is a statistical

measure of how close the data are to be fitted in the regression line. This seems to be related with

the coefficient of determination for the multiple regression. In the first equation the value is

0.696 which is much more less as compare to the second equation. There is no direct relation as

the values are different in each calculation.

-

299.747 1095.649

-

299.747 1095.649387

Income 0.357902 0.101421 3.52889 0.175794

-

0.93077 1.646575

-

0.93077 1.646574786

Part (B): Multiple Regression Model:

Multiple Linear Regression Model assumes that consumption depends on both income

and wealth variables. Independent variables are denoted by letter X and dependent variables are

denoted by letter Y. The relation between these two can be explained with the help of the

equation Y=m1x1+m2x2+c where, Y is the dependent variable; m1 is the intercept term for

independent variable x1; m2 denotes intercept term for independent variable x2; c denotes

residual error.

7.Linear Regression Data under Multiple Regression Model

The output shown under Appendix 7, takes both Wealth and Income into consideration in

relation to Consumption Expenditure.

8.Comparison between estimated coefficient for disposable income and regression equation (1):

The regression equation (1) of Part A of this report, f(x)=59.52+0.87*Income and the

regression equation (1) of Part B are different from one another as, in the first equation the

values are determine on the basis of the wealth and consumption level. Whereas, in the second

equation the outcome is considered on the basis of Income or wealth at the same point of time.

9.Calculation of Coefficient of multiple determination

According to the calculation made with the regression model, it has been found that R2 is

around .700. The P-value for the give variable wealth and income is less than the significant

level then in that case the sample data provided is reject the null hypothesis for the entire

population. But in this case, the significant value is less than the R square value. It is a statistical

measure of how close the data are to be fitted in the regression line. This seems to be related with

the coefficient of determination for the multiple regression. In the first equation the value is

0.696 which is much more less as compare to the second equation. There is no direct relation as

the values are different in each calculation.

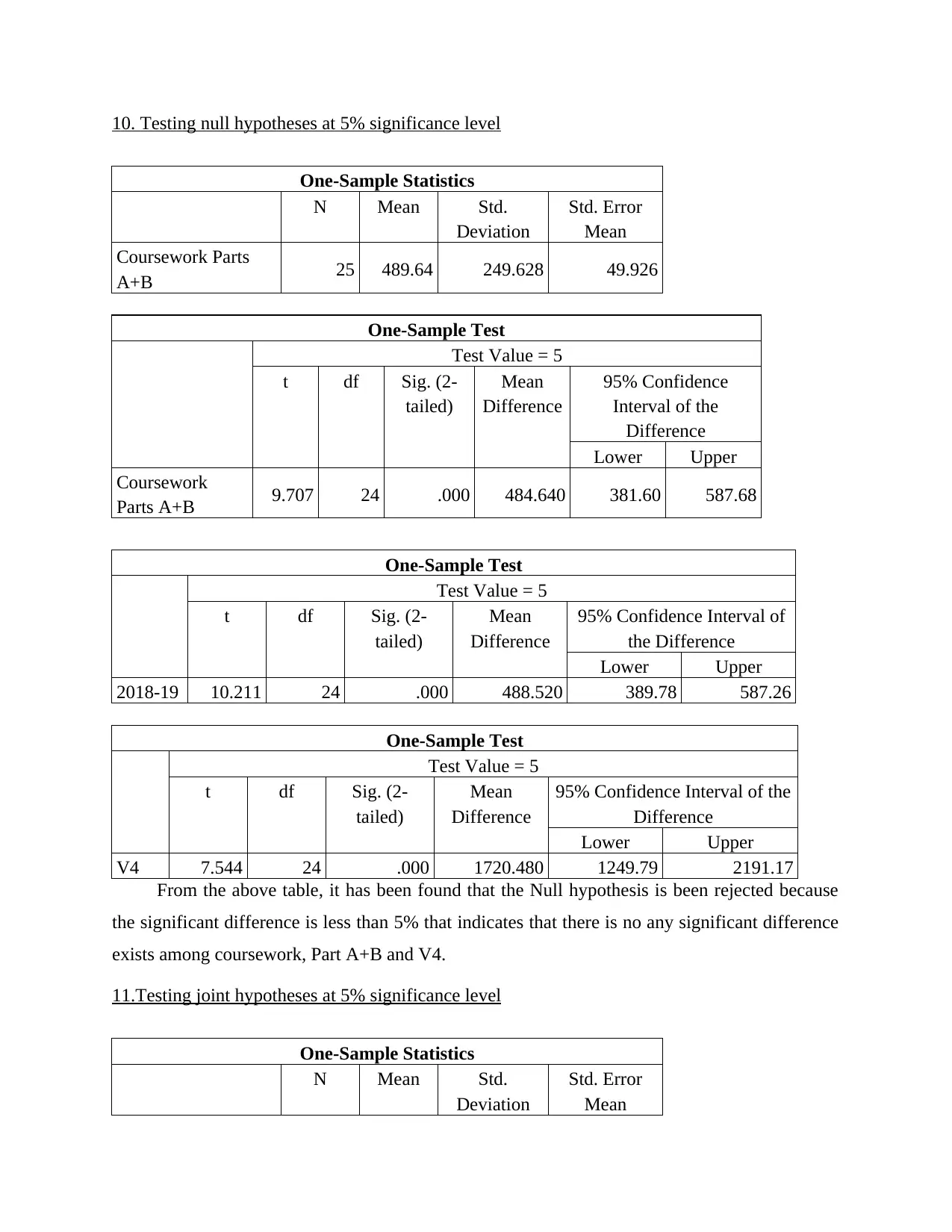

10. Testing null hypotheses at 5% significance level

One-Sample Statistics

N Mean Std.

Deviation

Std. Error

Mean

Coursework Parts

A+B 25 489.64 249.628 49.926

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Coursework

Parts A+B 9.707 24 .000 484.640 381.60 587.68

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval of

the Difference

Lower Upper

2018-19 10.211 24 .000 488.520 389.78 587.26

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval of the

Difference

Lower Upper

V4 7.544 24 .000 1720.480 1249.79 2191.17

From the above table, it has been found that the Null hypothesis is been rejected because

the significant difference is less than 5% that indicates that there is no any significant difference

exists among coursework, Part A+B and V4.

11.Testing joint hypotheses at 5% significance level

One-Sample Statistics

N Mean Std.

Deviation

Std. Error

Mean

One-Sample Statistics

N Mean Std.

Deviation

Std. Error

Mean

Coursework Parts

A+B 25 489.64 249.628 49.926

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence

Interval of the

Difference

Lower Upper

Coursework

Parts A+B 9.707 24 .000 484.640 381.60 587.68

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval of

the Difference

Lower Upper

2018-19 10.211 24 .000 488.520 389.78 587.26

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval of the

Difference

Lower Upper

V4 7.544 24 .000 1720.480 1249.79 2191.17

From the above table, it has been found that the Null hypothesis is been rejected because

the significant difference is less than 5% that indicates that there is no any significant difference

exists among coursework, Part A+B and V4.

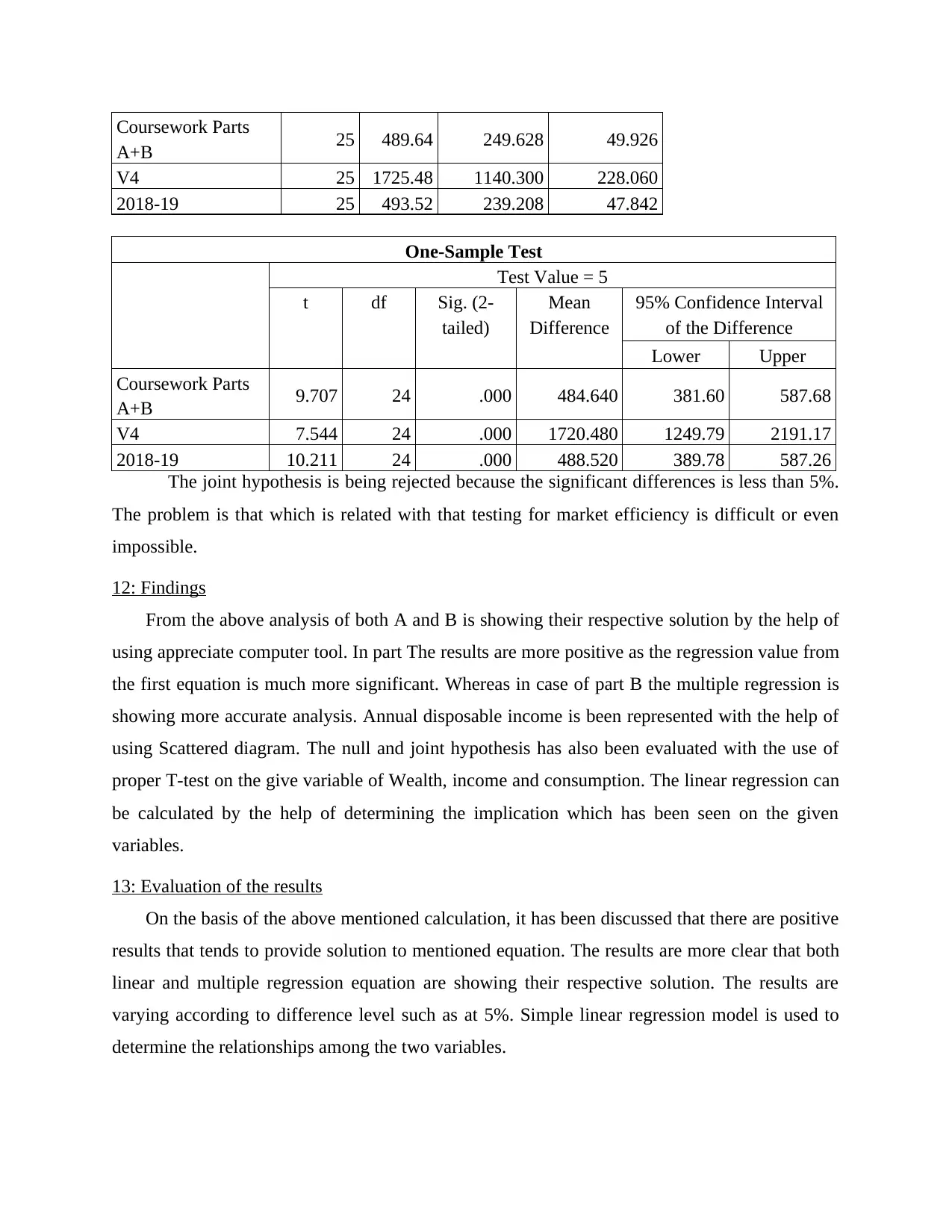

11.Testing joint hypotheses at 5% significance level

One-Sample Statistics

N Mean Std.

Deviation

Std. Error

Mean

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Coursework Parts

A+B 25 489.64 249.628 49.926

V4 25 1725.48 1140.300 228.060

2018-19 25 493.52 239.208 47.842

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval

of the Difference

Lower Upper

Coursework Parts

A+B 9.707 24 .000 484.640 381.60 587.68

V4 7.544 24 .000 1720.480 1249.79 2191.17

2018-19 10.211 24 .000 488.520 389.78 587.26

The joint hypothesis is being rejected because the significant differences is less than 5%.

The problem is that which is related with that testing for market efficiency is difficult or even

impossible.

12: Findings

From the above analysis of both A and B is showing their respective solution by the help of

using appreciate computer tool. In part The results are more positive as the regression value from

the first equation is much more significant. Whereas in case of part B the multiple regression is

showing more accurate analysis. Annual disposable income is been represented with the help of

using Scattered diagram. The null and joint hypothesis has also been evaluated with the use of

proper T-test on the give variable of Wealth, income and consumption. The linear regression can

be calculated by the help of determining the implication which has been seen on the given

variables.

13: Evaluation of the results

On the basis of the above mentioned calculation, it has been discussed that there are positive

results that tends to provide solution to mentioned equation. The results are more clear that both

linear and multiple regression equation are showing their respective solution. The results are

varying according to difference level such as at 5%. Simple linear regression model is used to

determine the relationships among the two variables.

A+B 25 489.64 249.628 49.926

V4 25 1725.48 1140.300 228.060

2018-19 25 493.52 239.208 47.842

One-Sample Test

Test Value = 5

t df Sig. (2-

tailed)

Mean

Difference

95% Confidence Interval

of the Difference

Lower Upper

Coursework Parts

A+B 9.707 24 .000 484.640 381.60 587.68

V4 7.544 24 .000 1720.480 1249.79 2191.17

2018-19 10.211 24 .000 488.520 389.78 587.26

The joint hypothesis is being rejected because the significant differences is less than 5%.

The problem is that which is related with that testing for market efficiency is difficult or even

impossible.

12: Findings

From the above analysis of both A and B is showing their respective solution by the help of

using appreciate computer tool. In part The results are more positive as the regression value from

the first equation is much more significant. Whereas in case of part B the multiple regression is

showing more accurate analysis. Annual disposable income is been represented with the help of

using Scattered diagram. The null and joint hypothesis has also been evaluated with the use of

proper T-test on the give variable of Wealth, income and consumption. The linear regression can

be calculated by the help of determining the implication which has been seen on the given

variables.

13: Evaluation of the results

On the basis of the above mentioned calculation, it has been discussed that there are positive

results that tends to provide solution to mentioned equation. The results are more clear that both

linear and multiple regression equation are showing their respective solution. The results are

varying according to difference level such as at 5%. Simple linear regression model is used to

determine the relationships among the two variables.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

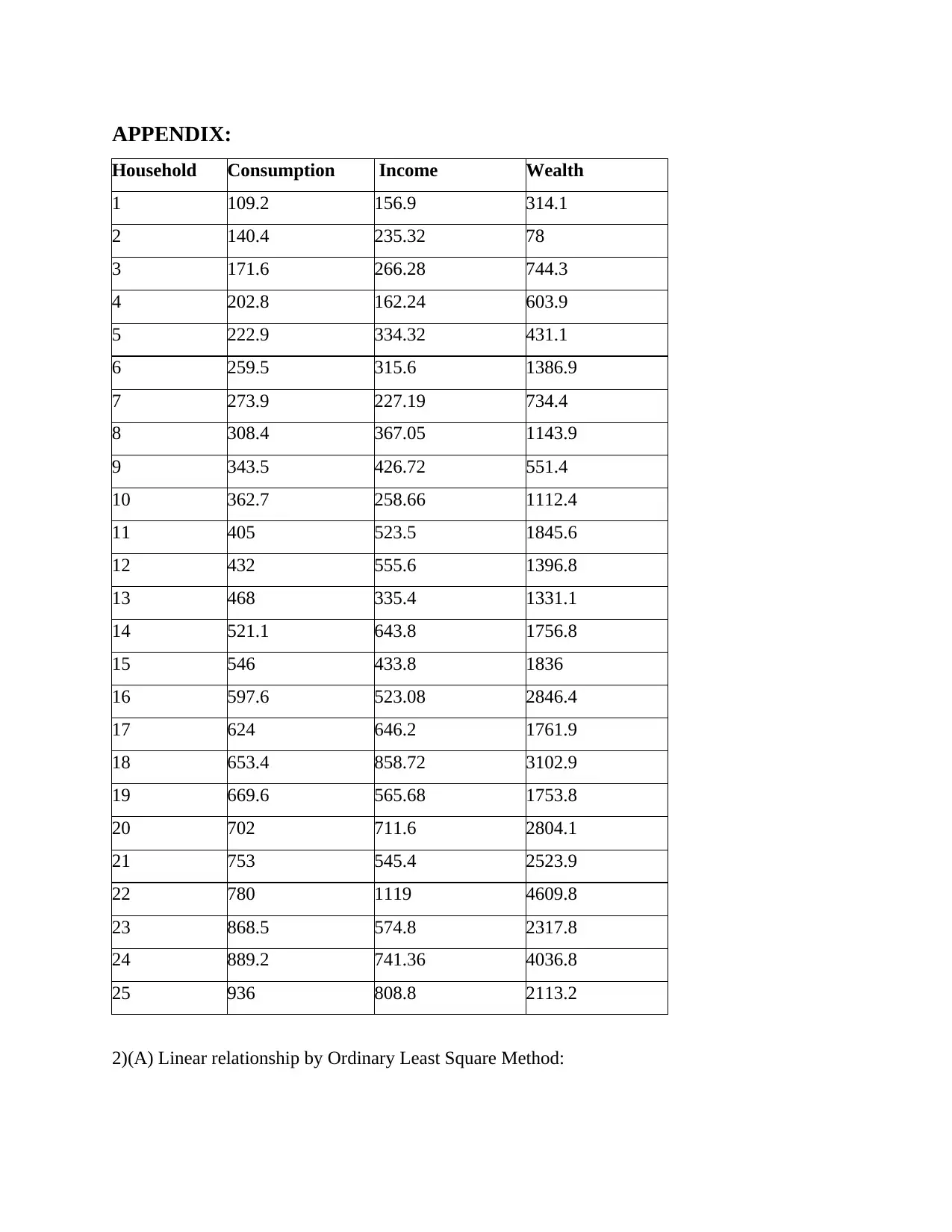

APPENDIX:

Household Consumption Income Wealth

1 109.2 156.9 314.1

2 140.4 235.32 78

3 171.6 266.28 744.3

4 202.8 162.24 603.9

5 222.9 334.32 431.1

6 259.5 315.6 1386.9

7 273.9 227.19 734.4

8 308.4 367.05 1143.9

9 343.5 426.72 551.4

10 362.7 258.66 1112.4

11 405 523.5 1845.6

12 432 555.6 1396.8

13 468 335.4 1331.1

14 521.1 643.8 1756.8

15 546 433.8 1836

16 597.6 523.08 2846.4

17 624 646.2 1761.9

18 653.4 858.72 3102.9

19 669.6 565.68 1753.8

20 702 711.6 2804.1

21 753 545.4 2523.9

22 780 1119 4609.8

23 868.5 574.8 2317.8

24 889.2 741.36 4036.8

25 936 808.8 2113.2

2)(A) Linear relationship by Ordinary Least Square Method:

Household Consumption Income Wealth

1 109.2 156.9 314.1

2 140.4 235.32 78

3 171.6 266.28 744.3

4 202.8 162.24 603.9

5 222.9 334.32 431.1

6 259.5 315.6 1386.9

7 273.9 227.19 734.4

8 308.4 367.05 1143.9

9 343.5 426.72 551.4

10 362.7 258.66 1112.4

11 405 523.5 1845.6

12 432 555.6 1396.8

13 468 335.4 1331.1

14 521.1 643.8 1756.8

15 546 433.8 1836

16 597.6 523.08 2846.4

17 624 646.2 1761.9

18 653.4 858.72 3102.9

19 669.6 565.68 1753.8

20 702 711.6 2804.1

21 753 545.4 2523.9

22 780 1119 4609.8

23 868.5 574.8 2317.8

24 889.2 741.36 4036.8

25 936 808.8 2113.2

2)(A) Linear relationship by Ordinary Least Square Method:

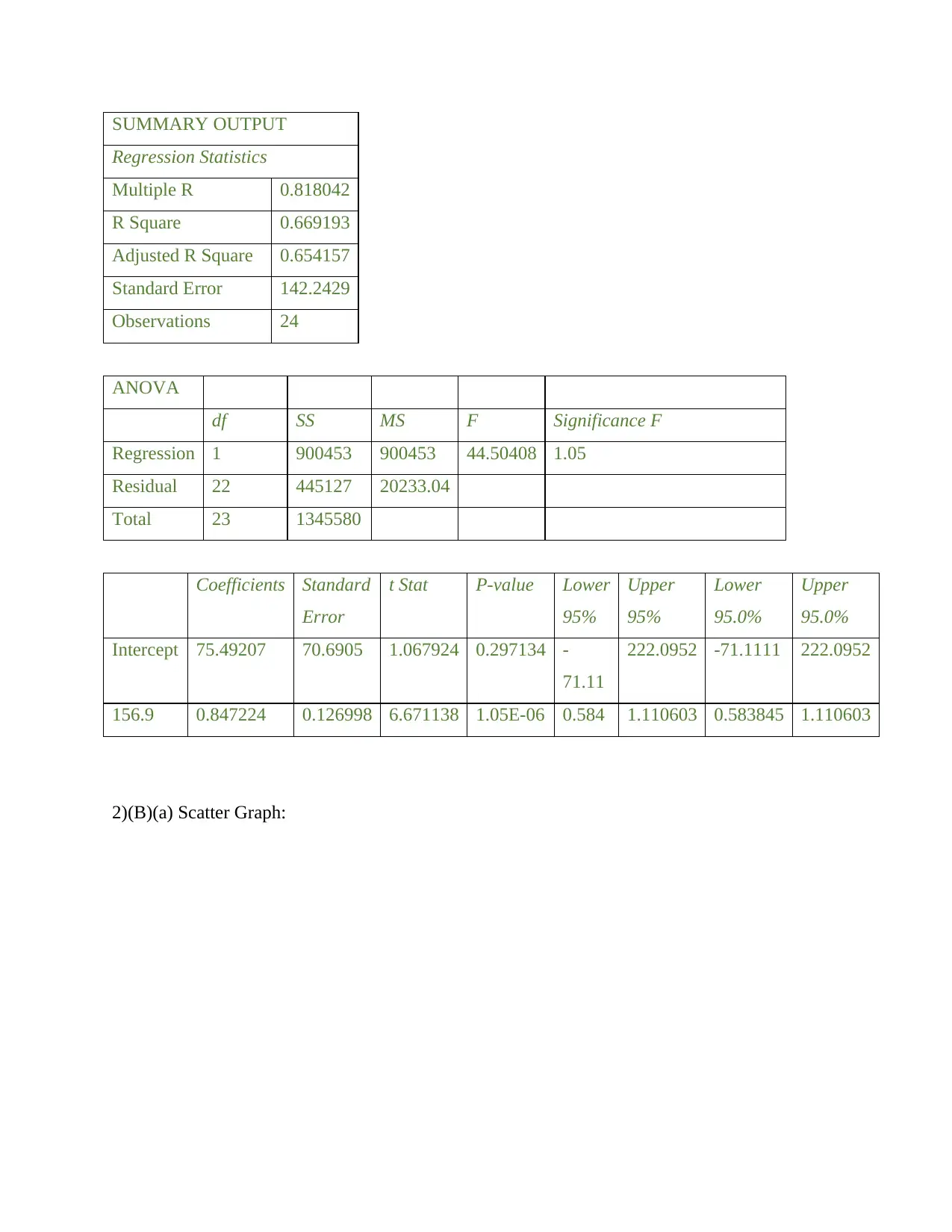

SUMMARY OUTPUT

Regression Statistics

Multiple R 0.818042

R Square 0.669193

Adjusted R Square 0.654157

Standard Error 142.2429

Observations 24

ANOVA

df SS MS F Significance F

Regression 1 900453 900453 44.50408 1.05

Residual 22 445127 20233.04

Total 23 1345580

Coefficients Standard

Error

t Stat P-value Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 75.49207 70.6905 1.067924 0.297134 -

71.11

222.0952 -71.1111 222.0952

156.9 0.847224 0.126998 6.671138 1.05E-06 0.584 1.110603 0.583845 1.110603

2)(B)(a) Scatter Graph:

Regression Statistics

Multiple R 0.818042

R Square 0.669193

Adjusted R Square 0.654157

Standard Error 142.2429

Observations 24

ANOVA

df SS MS F Significance F

Regression 1 900453 900453 44.50408 1.05

Residual 22 445127 20233.04

Total 23 1345580

Coefficients Standard

Error

t Stat P-value Lower

95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 75.49207 70.6905 1.067924 0.297134 -

71.11

222.0952 -71.1111 222.0952

156.9 0.847224 0.126998 6.671138 1.05E-06 0.584 1.110603 0.583845 1.110603

2)(B)(a) Scatter Graph:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.