Econometrics Assignment: Regression Models and Hypothesis Testing

VerifiedAdded on 2020/04/07

|11

|705

|106

Homework Assignment

AI Summary

This econometrics assignment presents a regression analysis using Microsoft data, exploring concepts such as risk premium and beta values. The analysis includes the development and testing of hypotheses using Wald tests to determine the significance of coefficients. The assignment also calculates and interprets R-squared values, assesses confidence intervals for beta values, and predicts Microsoft's return based on market returns. Furthermore, it extends the analysis to include regression models for other companies like GE, GM, IBM, Disney, and Mobil-Exxon, providing a comparative view of their market behavior. The solution also includes several tables which provides detailed results of the analysis.

Running Header: ECONOMETRICS 1

ECONOMETRICS

Student's name:

Institution:

Professor's name:

Course code:

ECONOMETRICS

Student's name:

Institution:

Professor's name:

Course code:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Econometrics 2

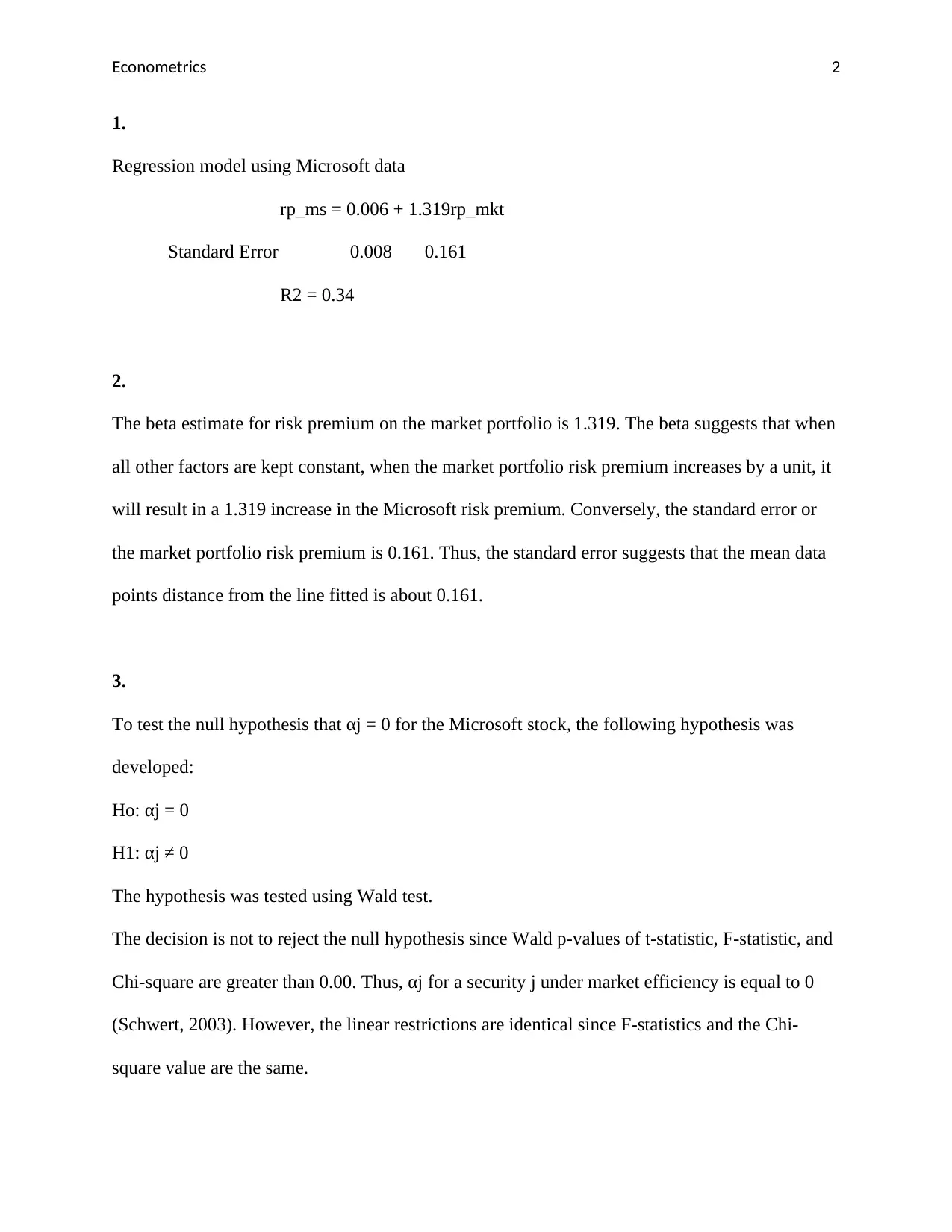

1.

Regression model using Microsoft data

rp_ms = 0.006 + 1.319rp_mkt

Standard Error 0.008 0.161

R2 = 0.34

2.

The beta estimate for risk premium on the market portfolio is 1.319. The beta suggests that when

all other factors are kept constant, when the market portfolio risk premium increases by a unit, it

will result in a 1.319 increase in the Microsoft risk premium. Conversely, the standard error or

the market portfolio risk premium is 0.161. Thus, the standard error suggests that the mean data

points distance from the line fitted is about 0.161.

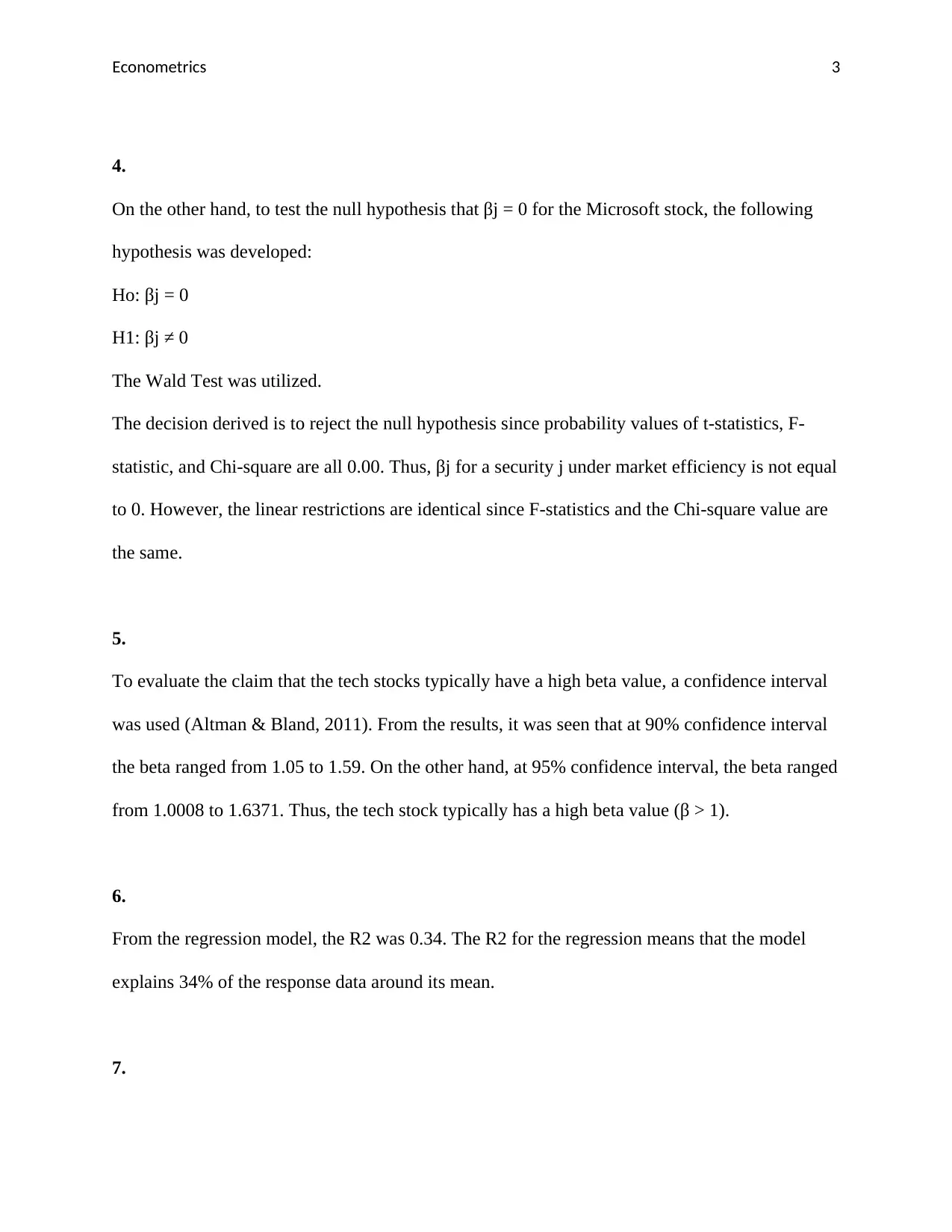

3.

To test the null hypothesis that αj = 0 for the Microsoft stock, the following hypothesis was

developed:

Ho: αj = 0

H1: αj ≠ 0

The hypothesis was tested using Wald test.

The decision is not to reject the null hypothesis since Wald p-values of t-statistic, F-statistic, and

Chi-square are greater than 0.00. Thus, αj for a security j under market efficiency is equal to 0

(Schwert, 2003). However, the linear restrictions are identical since F-statistics and the Chi-

square value are the same.

1.

Regression model using Microsoft data

rp_ms = 0.006 + 1.319rp_mkt

Standard Error 0.008 0.161

R2 = 0.34

2.

The beta estimate for risk premium on the market portfolio is 1.319. The beta suggests that when

all other factors are kept constant, when the market portfolio risk premium increases by a unit, it

will result in a 1.319 increase in the Microsoft risk premium. Conversely, the standard error or

the market portfolio risk premium is 0.161. Thus, the standard error suggests that the mean data

points distance from the line fitted is about 0.161.

3.

To test the null hypothesis that αj = 0 for the Microsoft stock, the following hypothesis was

developed:

Ho: αj = 0

H1: αj ≠ 0

The hypothesis was tested using Wald test.

The decision is not to reject the null hypothesis since Wald p-values of t-statistic, F-statistic, and

Chi-square are greater than 0.00. Thus, αj for a security j under market efficiency is equal to 0

(Schwert, 2003). However, the linear restrictions are identical since F-statistics and the Chi-

square value are the same.

Econometrics 3

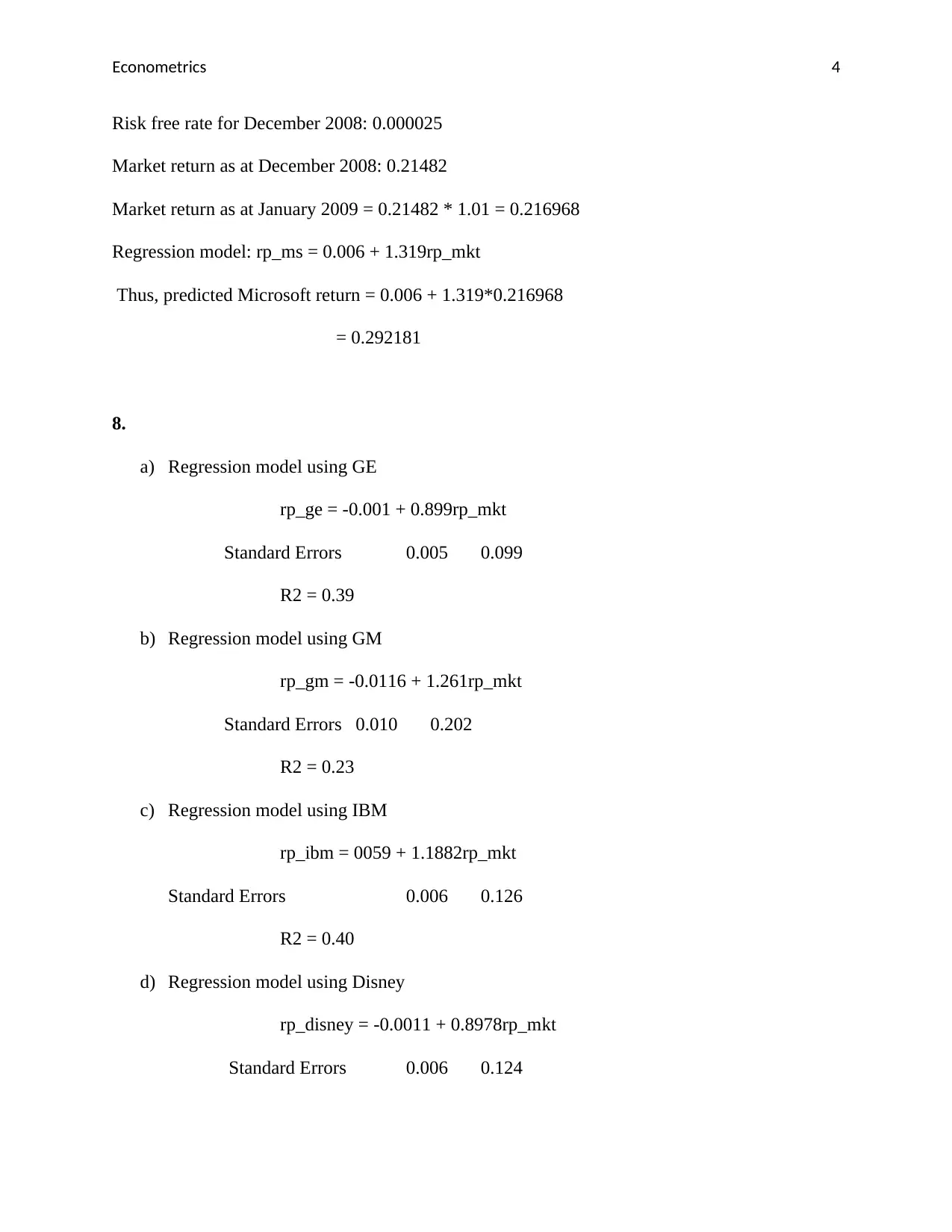

4.

On the other hand, to test the null hypothesis that βj = 0 for the Microsoft stock, the following

hypothesis was developed:

Ho: βj = 0

H1: βj ≠ 0

The Wald Test was utilized.

The decision derived is to reject the null hypothesis since probability values of t-statistics, F-

statistic, and Chi-square are all 0.00. Thus, βj for a security j under market efficiency is not equal

to 0. However, the linear restrictions are identical since F-statistics and the Chi-square value are

the same.

5.

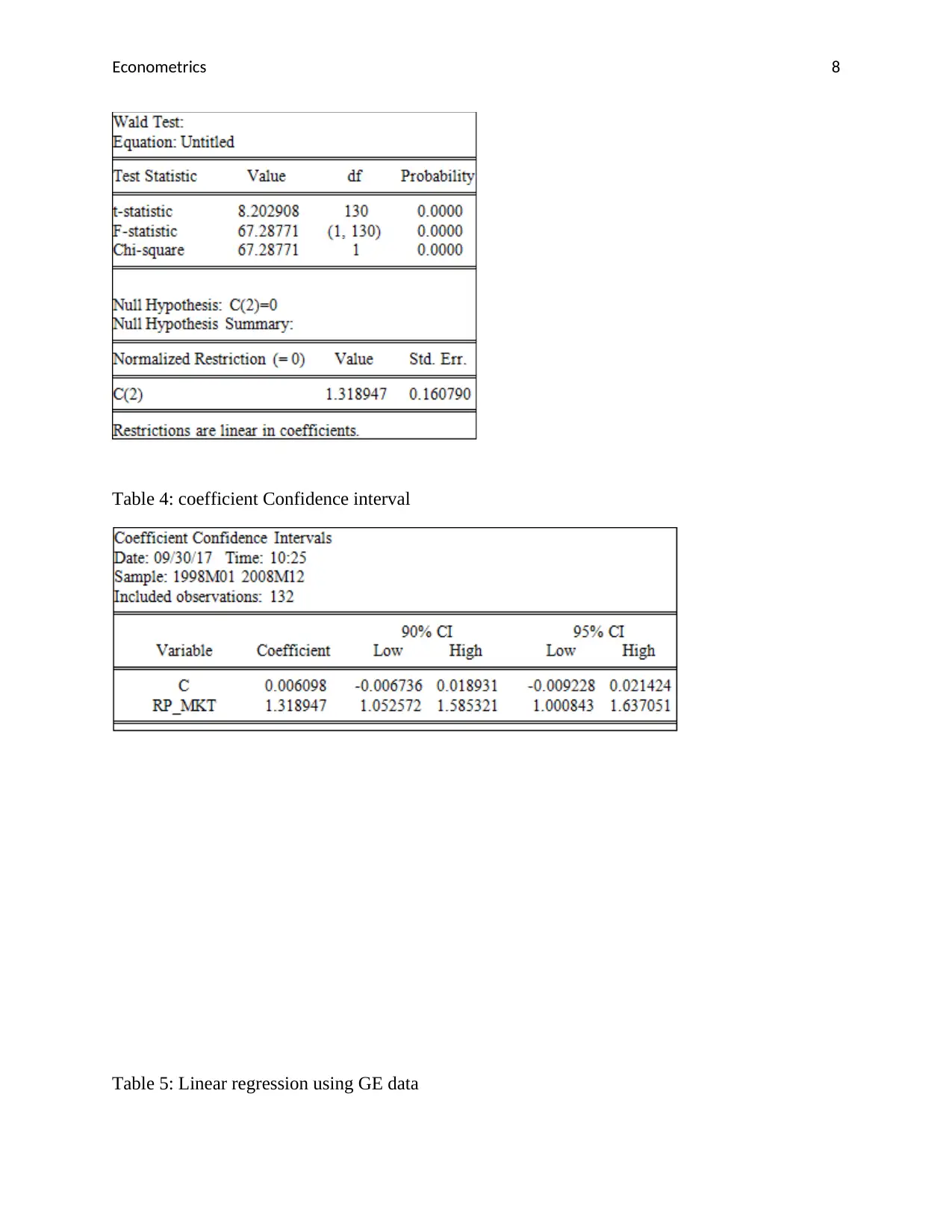

To evaluate the claim that the tech stocks typically have a high beta value, a confidence interval

was used (Altman & Bland, 2011). From the results, it was seen that at 90% confidence interval

the beta ranged from 1.05 to 1.59. On the other hand, at 95% confidence interval, the beta ranged

from 1.0008 to 1.6371. Thus, the tech stock typically has a high beta value (β > 1).

6.

From the regression model, the R2 was 0.34. The R2 for the regression means that the model

explains 34% of the response data around its mean.

7.

4.

On the other hand, to test the null hypothesis that βj = 0 for the Microsoft stock, the following

hypothesis was developed:

Ho: βj = 0

H1: βj ≠ 0

The Wald Test was utilized.

The decision derived is to reject the null hypothesis since probability values of t-statistics, F-

statistic, and Chi-square are all 0.00. Thus, βj for a security j under market efficiency is not equal

to 0. However, the linear restrictions are identical since F-statistics and the Chi-square value are

the same.

5.

To evaluate the claim that the tech stocks typically have a high beta value, a confidence interval

was used (Altman & Bland, 2011). From the results, it was seen that at 90% confidence interval

the beta ranged from 1.05 to 1.59. On the other hand, at 95% confidence interval, the beta ranged

from 1.0008 to 1.6371. Thus, the tech stock typically has a high beta value (β > 1).

6.

From the regression model, the R2 was 0.34. The R2 for the regression means that the model

explains 34% of the response data around its mean.

7.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Econometrics 4

Risk free rate for December 2008: 0.000025

Market return as at December 2008: 0.21482

Market return as at January 2009 = 0.21482 * 1.01 = 0.216968

Regression model: rp_ms = 0.006 + 1.319rp_mkt

Thus, predicted Microsoft return = 0.006 + 1.319*0.216968

= 0.292181

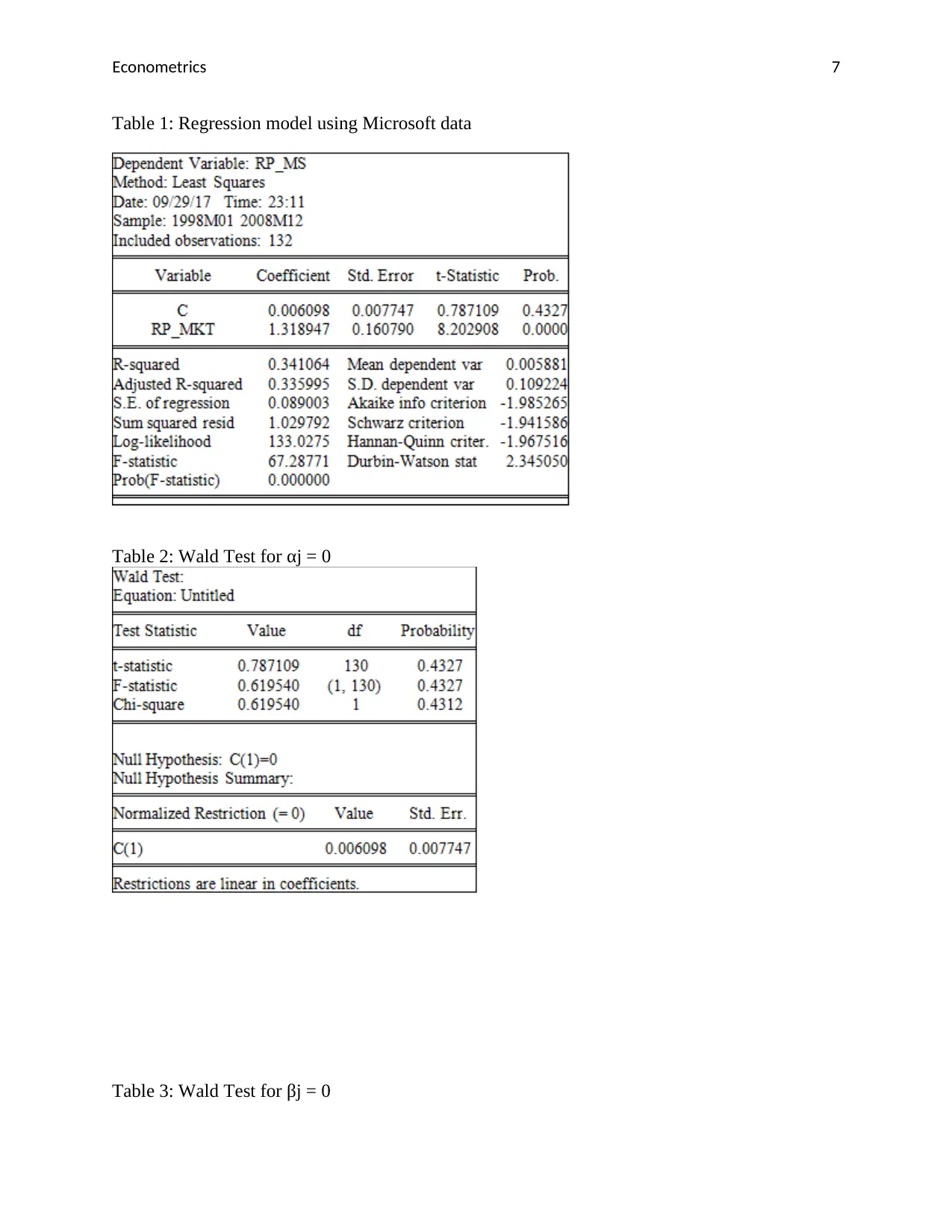

8.

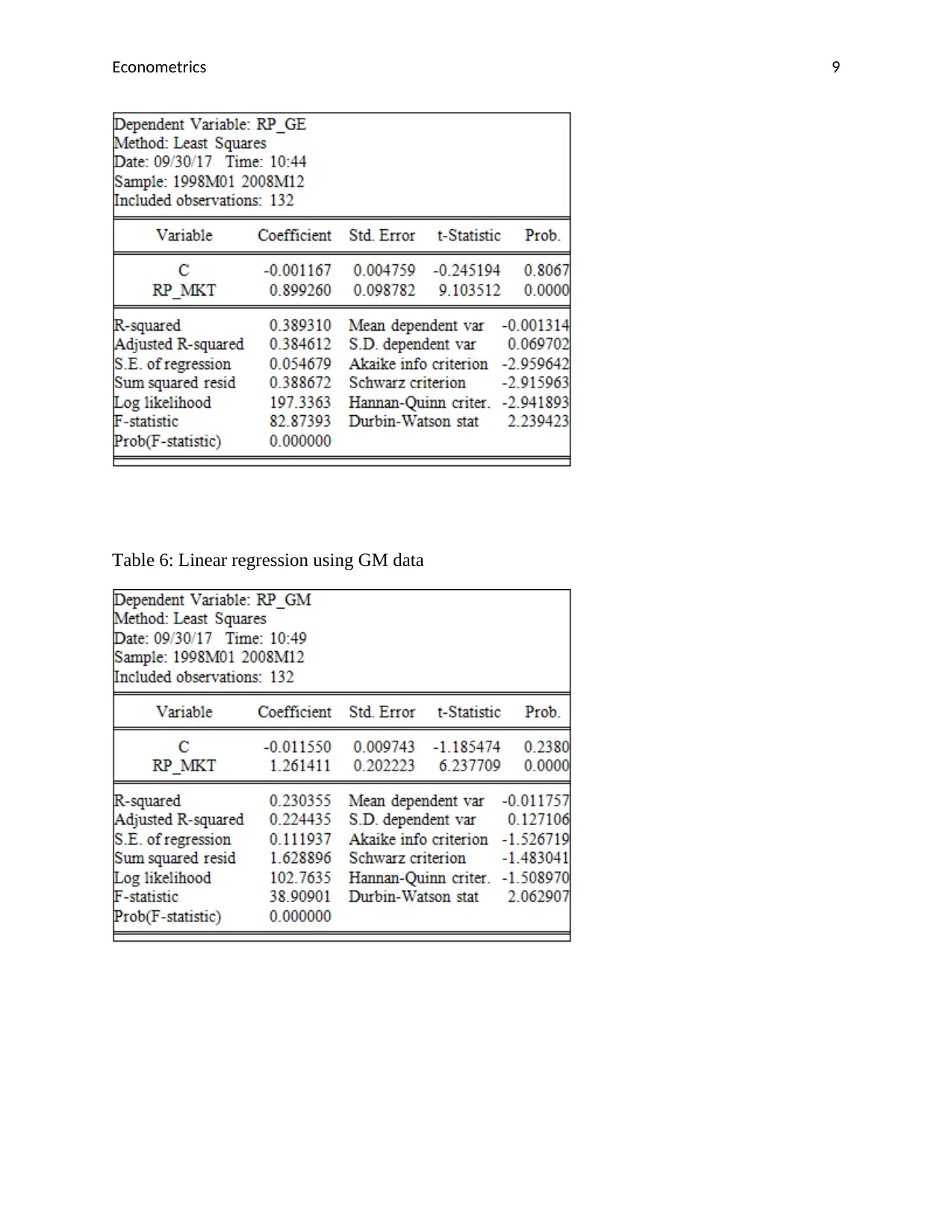

a) Regression model using GE

rp_ge = -0.001 + 0.899rp_mkt

Standard Errors 0.005 0.099

R2 = 0.39

b) Regression model using GM

rp_gm = -0.0116 + 1.261rp_mkt

Standard Errors 0.010 0.202

R2 = 0.23

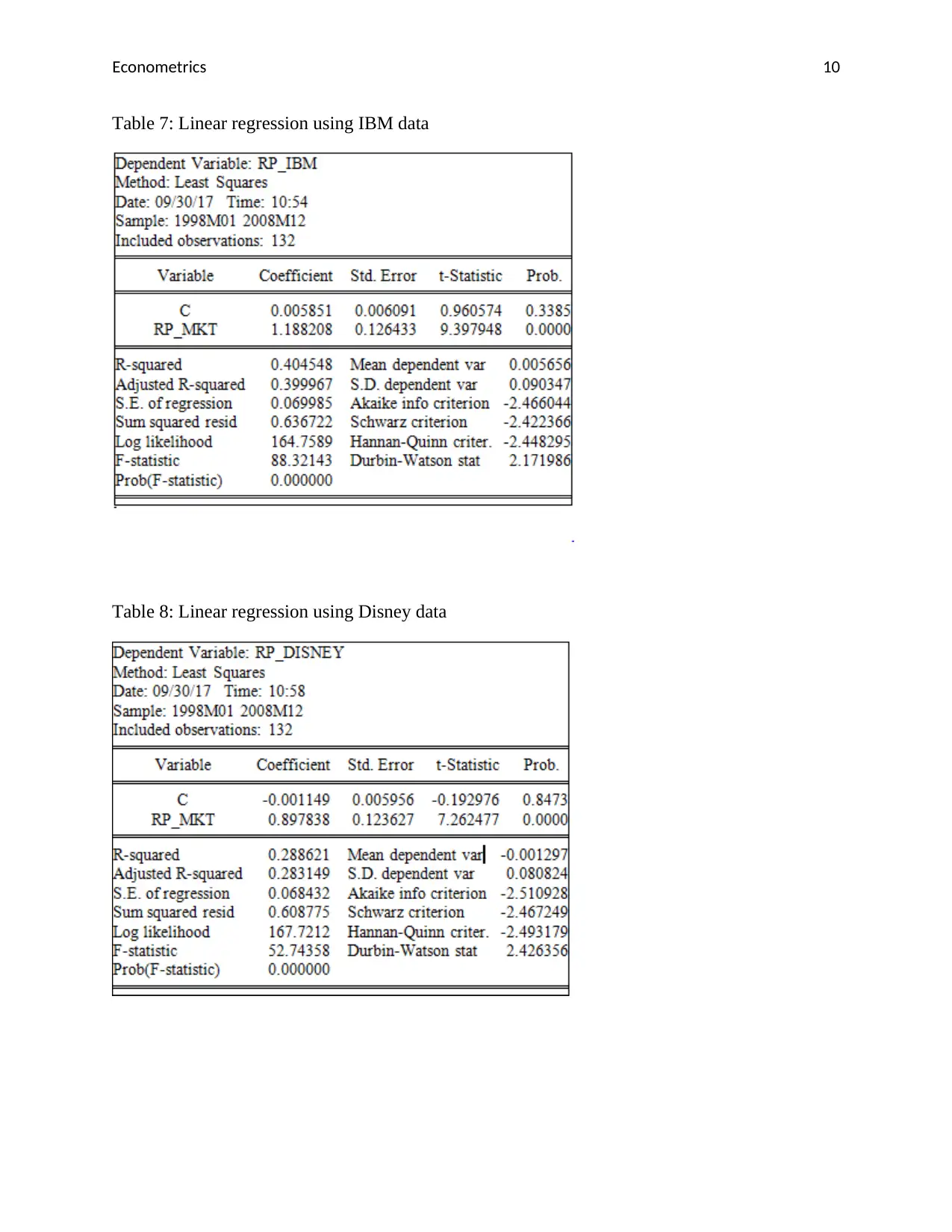

c) Regression model using IBM

rp_ibm = 0059 + 1.1882rp_mkt

Standard Errors 0.006 0.126

R2 = 0.40

d) Regression model using Disney

rp_disney = -0.0011 + 0.8978rp_mkt

Standard Errors 0.006 0.124

Risk free rate for December 2008: 0.000025

Market return as at December 2008: 0.21482

Market return as at January 2009 = 0.21482 * 1.01 = 0.216968

Regression model: rp_ms = 0.006 + 1.319rp_mkt

Thus, predicted Microsoft return = 0.006 + 1.319*0.216968

= 0.292181

8.

a) Regression model using GE

rp_ge = -0.001 + 0.899rp_mkt

Standard Errors 0.005 0.099

R2 = 0.39

b) Regression model using GM

rp_gm = -0.0116 + 1.261rp_mkt

Standard Errors 0.010 0.202

R2 = 0.23

c) Regression model using IBM

rp_ibm = 0059 + 1.1882rp_mkt

Standard Errors 0.006 0.126

R2 = 0.40

d) Regression model using Disney

rp_disney = -0.0011 + 0.8978rp_mkt

Standard Errors 0.006 0.124

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Econometrics 5

R2 = 0.29

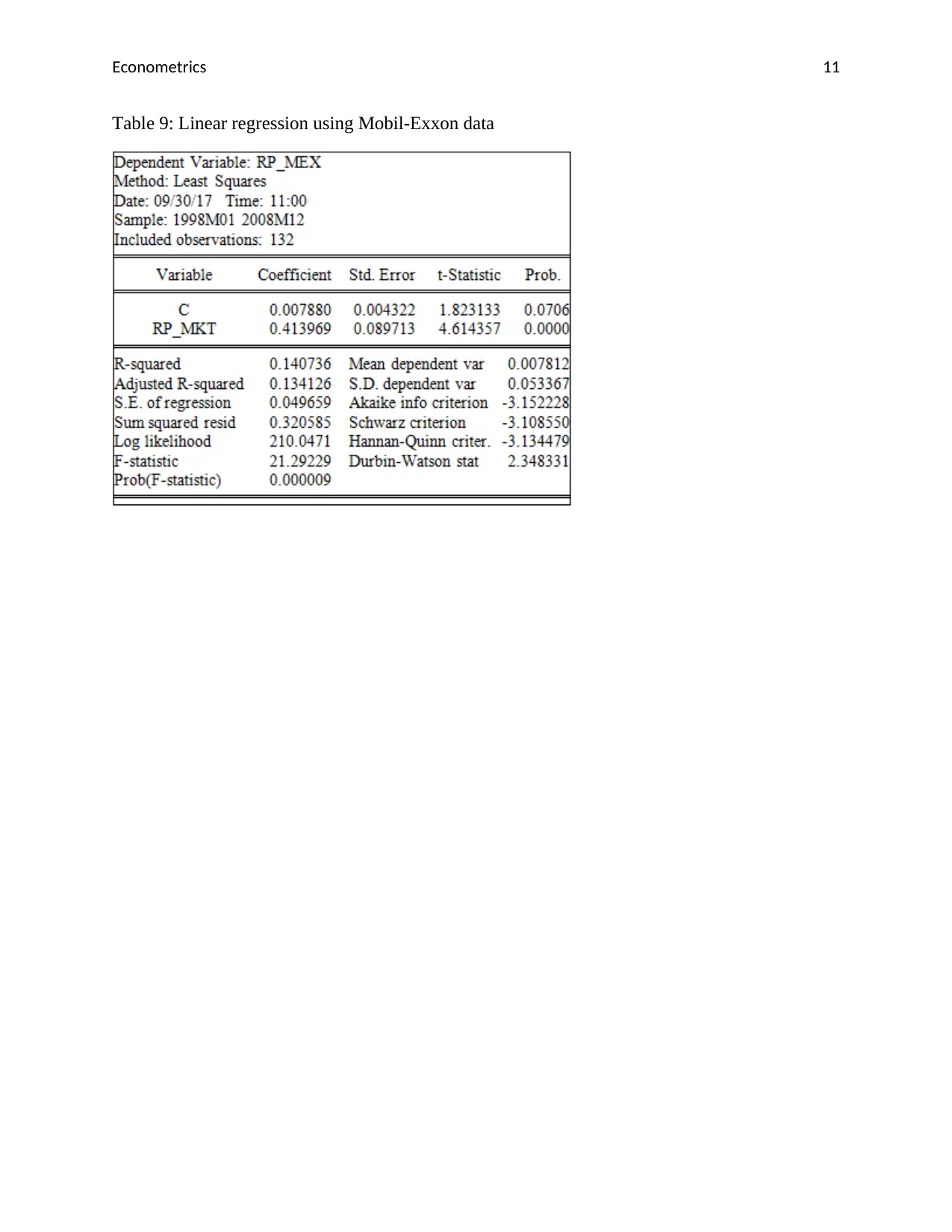

e) Regression model using Mobil-Exxon

rp_mex = 0.0078 + 0.4140rp_mkt

Standard Errors 0.004 0.090

R2 = 0.14

Reference:

R2 = 0.29

e) Regression model using Mobil-Exxon

rp_mex = 0.0078 + 0.4140rp_mkt

Standard Errors 0.004 0.090

R2 = 0.14

Reference:

Econometrics 6

Altman, D. G., & Bland, J. M. (2011). How to obtain the confidence interval from a P

value. BMJ, 343, d2090.

Schwert, G. W. (2003). Anomalies and market efficiency. Handbook of the Economics of

Finance, 1, 939-974.

Appendix

Altman, D. G., & Bland, J. M. (2011). How to obtain the confidence interval from a P

value. BMJ, 343, d2090.

Schwert, G. W. (2003). Anomalies and market efficiency. Handbook of the Economics of

Finance, 1, 939-974.

Appendix

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Econometrics 7

Table 1: Regression model using Microsoft data

Table 2: Wald Test for αj = 0

Table 3: Wald Test for βj = 0

Table 1: Regression model using Microsoft data

Table 2: Wald Test for αj = 0

Table 3: Wald Test for βj = 0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Econometrics 8

Table 4: coefficient Confidence interval

Table 5: Linear regression using GE data

Table 4: coefficient Confidence interval

Table 5: Linear regression using GE data

Econometrics 9

Table 6: Linear regression using GM data

Table 6: Linear regression using GM data

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Econometrics 10

Table 7: Linear regression using IBM data

Table 8: Linear regression using Disney data

Table 7: Linear regression using IBM data

Table 8: Linear regression using Disney data

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Econometrics 11

Table 9: Linear regression using Mobil-Exxon data

Table 9: Linear regression using Mobil-Exxon data

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.